Management Accounting and Essential Requirements of Management Accounting Systems

VerifiedAdded on 2023/01/09

|22

|5742

|45

AI Summary

This study focuses on the concept of management accounting and the essential requirements of management accounting systems. It explores the different systems and reports used in management accounting and evaluates their benefits and integration within an organization's processes. The study also discusses the usage of cost analysis techniques to prepare income statements using marginal and absorption costing.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Unit 5 – Management

Accounting

Accounting

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Contents

INTRODUCTION.....................................................................................................................................3

MAIN BODY.............................................................................................................................................3

TASK 1.......................................................................................................................................................3

P1. Management accounting and essential requirements of management accounting systems................3

P2. Management Accounting Reports.....................................................................................................5

M1. Effective evaluation of vital benefits of explained MA-systems in case of Innocent Drinks:...........6

D1. Evaluate how systems and reporting of MA are effectively integrated within enterprise's processes:

.................................................................................................................................................................7

TASK 2.......................................................................................................................................................7

Usage of the techniques of cost analysis to prepare income statement by using marginal and absorption

costing.....................................................................................................................................................7

M2. Accounting techniques to prepare financial statements..................................................................11

D2. Interpretation of financial data........................................................................................................11

TASK 3.....................................................................................................................................................12

P4. Benefits and limitation of planning tools of budgetary control........................................................12

M3. Various planning tools and their application for projection of budgets..........................................15

TASK 4.....................................................................................................................................................16

P5 Adoption of management accounting systems to respond financial problems..................................16

M4 Contribution of management accounting in sustainable success of the organization while

responding financial problems...............................................................................................................19

D3 Application of planning tools to respond financial issue along with attainment of sustainable

success...................................................................................................................................................19

CONCLUSION........................................................................................................................................20

REFERENCES........................................................................................................................................21

INTRODUCTION.....................................................................................................................................3

MAIN BODY.............................................................................................................................................3

TASK 1.......................................................................................................................................................3

P1. Management accounting and essential requirements of management accounting systems................3

P2. Management Accounting Reports.....................................................................................................5

M1. Effective evaluation of vital benefits of explained MA-systems in case of Innocent Drinks:...........6

D1. Evaluate how systems and reporting of MA are effectively integrated within enterprise's processes:

.................................................................................................................................................................7

TASK 2.......................................................................................................................................................7

Usage of the techniques of cost analysis to prepare income statement by using marginal and absorption

costing.....................................................................................................................................................7

M2. Accounting techniques to prepare financial statements..................................................................11

D2. Interpretation of financial data........................................................................................................11

TASK 3.....................................................................................................................................................12

P4. Benefits and limitation of planning tools of budgetary control........................................................12

M3. Various planning tools and their application for projection of budgets..........................................15

TASK 4.....................................................................................................................................................16

P5 Adoption of management accounting systems to respond financial problems..................................16

M4 Contribution of management accounting in sustainable success of the organization while

responding financial problems...............................................................................................................19

D3 Application of planning tools to respond financial issue along with attainment of sustainable

success...................................................................................................................................................19

CONCLUSION........................................................................................................................................20

REFERENCES........................................................................................................................................21

INTRODUCTION

Management accounting term is often widely recognized as concept of management

accounting and may be clearly interpreted as a framework for delivering finance reports and

details to the managerial team mostly for supporting decision-making phase. Additionally,

strategic framework of management-accounting is employed by the organization 's internal staff,

and that's what makes it distinct from processes of financial accounting (March.Kure, Nørreklit

and Raffnsøe-Møller, 2017). The whole study-report is centered on Innocent Drinks Plc, a

corporate entity which is engaged in making smoothies, drinks and juice that are primarily sold

by company in cafes, malls, supermarkets and its different outlets. This study will address a

range of aspects like managerial-accounting and the basic criteria requisite of the distinct-distinct

management-accounting systems as well as the reporting methods/approaches. Moreover, study-

report includes an insight of the multiple budgetary planning tools along with an evaluation

about how all such planning tools and specific accounting-systems, are being used to respond

fiscal issues. It also provides 2 instances of how large multinational companies are

adopting management-accounting frameworks/systems to respond/resolve to financial problems.

MAIN BODY

TASK 1

P1. Management accounting and essential requirements of management accounting systems.

Management accounting can be demonstrated as framework model for conveying and

reporting financial information/data or essential facts to managing personnel to aid in decision-

taking tasks. Further this concept is being used by the enterprise's internal personnel with aim to

fulfill organizational goals and objects.

MA concept proposed systems which act like a assistance and guiding framework for

managers to accomplish critical organizational tasks as well as to generate key information for

managing and decision-taking tasks. MA Frameworks/systems are models that involves timely

monitoring and recording of financial losses on the related data used by business-people and key

stakeholders for the correct budgetary, decision-making procedures, which also provides

corporate performance reviews. The primary goal of MA-systems is to retain integrity and

oversight of expenses and to have a clear image of the profitability of the company (Monden,

Management accounting term is often widely recognized as concept of management

accounting and may be clearly interpreted as a framework for delivering finance reports and

details to the managerial team mostly for supporting decision-making phase. Additionally,

strategic framework of management-accounting is employed by the organization 's internal staff,

and that's what makes it distinct from processes of financial accounting (March.Kure, Nørreklit

and Raffnsøe-Møller, 2017). The whole study-report is centered on Innocent Drinks Plc, a

corporate entity which is engaged in making smoothies, drinks and juice that are primarily sold

by company in cafes, malls, supermarkets and its different outlets. This study will address a

range of aspects like managerial-accounting and the basic criteria requisite of the distinct-distinct

management-accounting systems as well as the reporting methods/approaches. Moreover, study-

report includes an insight of the multiple budgetary planning tools along with an evaluation

about how all such planning tools and specific accounting-systems, are being used to respond

fiscal issues. It also provides 2 instances of how large multinational companies are

adopting management-accounting frameworks/systems to respond/resolve to financial problems.

MAIN BODY

TASK 1

P1. Management accounting and essential requirements of management accounting systems.

Management accounting can be demonstrated as framework model for conveying and

reporting financial information/data or essential facts to managing personnel to aid in decision-

taking tasks. Further this concept is being used by the enterprise's internal personnel with aim to

fulfill organizational goals and objects.

MA concept proposed systems which act like a assistance and guiding framework for

managers to accomplish critical organizational tasks as well as to generate key information for

managing and decision-taking tasks. MA Frameworks/systems are models that involves timely

monitoring and recording of financial losses on the related data used by business-people and key

stakeholders for the correct budgetary, decision-making procedures, which also provides

corporate performance reviews. The primary goal of MA-systems is to retain integrity and

oversight of expenses and to have a clear image of the profitability of the company (Monden,

2019). In this regard below explained are certain MA systems that must be adopted by Innocent

Drinks Plc:

Cost Accounting system: This system relates to costs and could serve to control costs and

increase productivity. From using this framework, administrators can determine the costs of each

single product that can help to support their operations. Such a framework is used by companies

to measure cost of their all products in order to assess their efficiency. This is important to the

organization's cost estimation and planning of all tasks. In Innocent Drinks such a system

facilitates effective controlling of costs and keep track of allocation of costs. This also assist to

asses the main factors which are leading increase in overall costs of making smoothing and

drinks. It's essential requirements involves proper recording, reporting and allocation of different

costs along with appropriate description about classification of multiple costs (Aifuwa, Embele

and Saidu, 2018).

Price-optimization system: Such a framework relates to establishing the effective rates and

costs of items produced by organization with aim to enhance demand of its products. It's also

vitally important for corporation to determine right prices while maintaining profitability level.

This system can facilitate Innocent Drinks with processes which are focused towards analyzing

the minor as well as major impact on product's demand because of shift/change in its products'

prices. This system requires use of interpretation tools and analytical methods to identify key

factors and changes occurred due to change in prices of its different products along with setting

prices to gain competitive advantages.

Job-costing system: This is unique but essential system which all corporation like Innocent

Drinks to allocate costs to their major job-process with aim to enhance the accountability. In

corporate entities like Innocent Drinks, this is system is effective in recognizing how much costs

are incurred towards a particular job-process. Essential requirement of this system is to adequate

categorization of all the business job-processes and assignation of multiple costs to such

recognized job-processes (Kumarasiri, 2017).

Inventory management system: This system primarily proposes effective management of

inventories and related items. This system facilitates effective controlling over all the processes

Drinks Plc:

Cost Accounting system: This system relates to costs and could serve to control costs and

increase productivity. From using this framework, administrators can determine the costs of each

single product that can help to support their operations. Such a framework is used by companies

to measure cost of their all products in order to assess their efficiency. This is important to the

organization's cost estimation and planning of all tasks. In Innocent Drinks such a system

facilitates effective controlling of costs and keep track of allocation of costs. This also assist to

asses the main factors which are leading increase in overall costs of making smoothing and

drinks. It's essential requirements involves proper recording, reporting and allocation of different

costs along with appropriate description about classification of multiple costs (Aifuwa, Embele

and Saidu, 2018).

Price-optimization system: Such a framework relates to establishing the effective rates and

costs of items produced by organization with aim to enhance demand of its products. It's also

vitally important for corporation to determine right prices while maintaining profitability level.

This system can facilitate Innocent Drinks with processes which are focused towards analyzing

the minor as well as major impact on product's demand because of shift/change in its products'

prices. This system requires use of interpretation tools and analytical methods to identify key

factors and changes occurred due to change in prices of its different products along with setting

prices to gain competitive advantages.

Job-costing system: This is unique but essential system which all corporation like Innocent

Drinks to allocate costs to their major job-process with aim to enhance the accountability. In

corporate entities like Innocent Drinks, this is system is effective in recognizing how much costs

are incurred towards a particular job-process. Essential requirement of this system is to adequate

categorization of all the business job-processes and assignation of multiple costs to such

recognized job-processes (Kumarasiri, 2017).

Inventory management system: This system primarily proposes effective management of

inventories and related items. This system facilitates effective controlling over all the processes

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

which are directly or indirectly concerned with managing and utilizing inventories in business

purposes. This is a means that lets corporations like Innocent drinks to track it’s all inventories

like items to make smoothies, packing materials, finished goods etc. through supply chain within

enterprise. It develops the entire series from making requests with different wholesaler to ensure

the fulfillment of its customer demand, displaying 's entire path of making of finished goods.

Organizations can minimize repetition by carefully reviewing products, separating cases and

agreeing on more genius key choices. This system vitally require recording of each movement of

stock/inventories in or out at different level and also reasonable classification of inventories

within an organization context (Harrison and Lock, 2017).

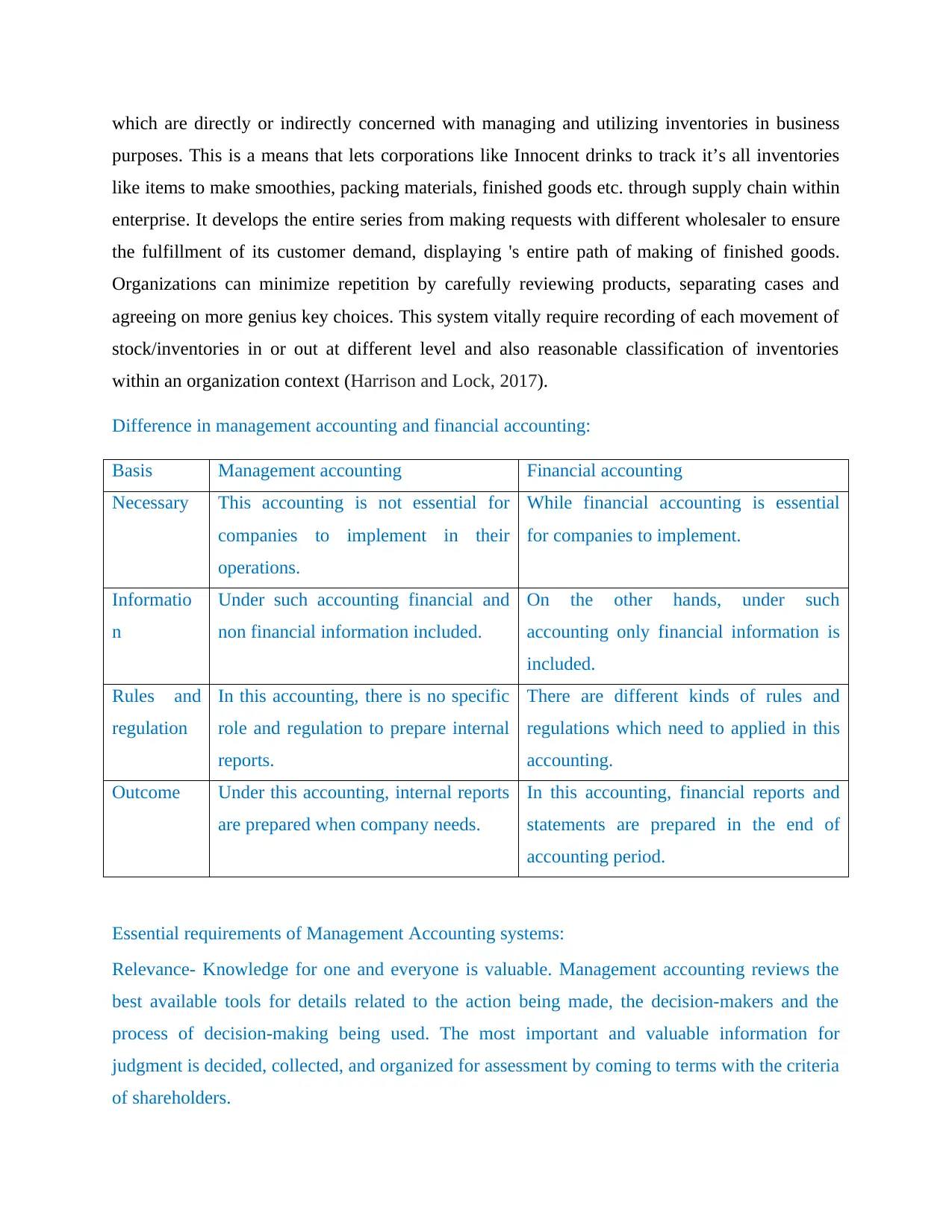

Difference in management accounting and financial accounting:

Basis Management accounting Financial accounting

Necessary This accounting is not essential for

companies to implement in their

operations.

While financial accounting is essential

for companies to implement.

Informatio

n

Under such accounting financial and

non financial information included.

On the other hands, under such

accounting only financial information is

included.

Rules and

regulation

In this accounting, there is no specific

role and regulation to prepare internal

reports.

There are different kinds of rules and

regulations which need to applied in this

accounting.

Outcome Under this accounting, internal reports

are prepared when company needs.

In this accounting, financial reports and

statements are prepared in the end of

accounting period.

Essential requirements of Management Accounting systems:

Relevance- Knowledge for one and everyone is valuable. Management accounting reviews the

best available tools for details related to the action being made, the decision-makers and the

process of decision-making being used. The most important and valuable information for

judgment is decided, collected, and organized for assessment by coming to terms with the criteria

of shareholders.

purposes. This is a means that lets corporations like Innocent drinks to track it’s all inventories

like items to make smoothies, packing materials, finished goods etc. through supply chain within

enterprise. It develops the entire series from making requests with different wholesaler to ensure

the fulfillment of its customer demand, displaying 's entire path of making of finished goods.

Organizations can minimize repetition by carefully reviewing products, separating cases and

agreeing on more genius key choices. This system vitally require recording of each movement of

stock/inventories in or out at different level and also reasonable classification of inventories

within an organization context (Harrison and Lock, 2017).

Difference in management accounting and financial accounting:

Basis Management accounting Financial accounting

Necessary This accounting is not essential for

companies to implement in their

operations.

While financial accounting is essential

for companies to implement.

Informatio

n

Under such accounting financial and

non financial information included.

On the other hands, under such

accounting only financial information is

included.

Rules and

regulation

In this accounting, there is no specific

role and regulation to prepare internal

reports.

There are different kinds of rules and

regulations which need to applied in this

accounting.

Outcome Under this accounting, internal reports

are prepared when company needs.

In this accounting, financial reports and

statements are prepared in the end of

accounting period.

Essential requirements of Management Accounting systems:

Relevance- Knowledge for one and everyone is valuable. Management accounting reviews the

best available tools for details related to the action being made, the decision-makers and the

process of decision-making being used. The most important and valuable information for

judgment is decided, collected, and organized for assessment by coming to terms with the criteria

of shareholders.

Value- It forecasts the effect on valuation. Management accounting ties the operations of the

enterprise to its fundamental business model which involves an in-depth view of the larger

macroeconomic climate. It includes analyzing knowledge along the road of value creation,

calculating future prospects, and focusing on costs, expenditures, and the probability of value

generation opportunities.

Credibility- Stewardship shapes authority. In making the judgment process even more

purposeful, transparency and oversight support. Trust and stability are enhanced by balancing

near-term market interests toward lengthy value for shareholders. Specialists of strategic

management are considered to be ethical, accountable, and mindful of the values, necessities of

government, and relational responsibilities of the company.

P2. Management Accounting Reports.

Management Accounting Reports: MA is a comprehensive concept which emphasizes on

reporting of information thus reports are essential aspects of it. It proposes multiple kind of key

reports which are also linked with above explained systems. Innocent Drinks should also apply

these reports to properly adapting such systems. Here below are several crucial reports linked

with MA, as follows:

Inventory management report: In order to effectively manage a corporation, it's really

critical to control and manage inventory as carefully and efficiently as practicable. One means to

do so is to use and prepare inventory management report. Reliable, up-to - date as well as

appropriate inventory management report can help managers to uncover trends, recognize

deficiencies and capabilities, and patch gaps and inventory wastage. With these insights,

manager can take action to increase profitably while reducing unnecessary costs. This in case

Innocent Drinks, allow managing team to track movement of stocks and to minimize inventories

costs and wastage.

Cost Report: This report is also act as fundamental requirement for manufacturing

enterprise like Innocent Drinks to manager their production costs. This report basically records

enterprise to its fundamental business model which involves an in-depth view of the larger

macroeconomic climate. It includes analyzing knowledge along the road of value creation,

calculating future prospects, and focusing on costs, expenditures, and the probability of value

generation opportunities.

Credibility- Stewardship shapes authority. In making the judgment process even more

purposeful, transparency and oversight support. Trust and stability are enhanced by balancing

near-term market interests toward lengthy value for shareholders. Specialists of strategic

management are considered to be ethical, accountable, and mindful of the values, necessities of

government, and relational responsibilities of the company.

P2. Management Accounting Reports.

Management Accounting Reports: MA is a comprehensive concept which emphasizes on

reporting of information thus reports are essential aspects of it. It proposes multiple kind of key

reports which are also linked with above explained systems. Innocent Drinks should also apply

these reports to properly adapting such systems. Here below are several crucial reports linked

with MA, as follows:

Inventory management report: In order to effectively manage a corporation, it's really

critical to control and manage inventory as carefully and efficiently as practicable. One means to

do so is to use and prepare inventory management report. Reliable, up-to - date as well as

appropriate inventory management report can help managers to uncover trends, recognize

deficiencies and capabilities, and patch gaps and inventory wastage. With these insights,

manager can take action to increase profitably while reducing unnecessary costs. This in case

Innocent Drinks, allow managing team to track movement of stocks and to minimize inventories

costs and wastage.

Cost Report: This report is also act as fundamental requirement for manufacturing

enterprise like Innocent Drinks to manager their production costs. This report basically records

systematic sub categorization of different-different costs along with different columns like

department wise costs, process wise cost, activity wiser costs etc. in Innocent Drinks this report

can be used to find out costs incurred in preparing a single drink or smoothie. This report's data

can be used by managing personnel to optimize costs and enhance profit margin (Smith, 2015).

Accounts-receivables report: Accounts receivables are the sum owed by businesses to the

organization for the selling of goods on credit-basis. In most corporate entities, accounts

receivables are usually executed by producing invoices, either by sending or digitally delivering

this to the clients. In exchange, the buyer must settle within a defined timeline termed credit

lines. An accounts receivable aging report genera lists accounts receivables depending on their

credit terms, aging — such that, how lengthy they are being unpaid. An accounts-

receivable aging report, also recognized as Debtors Book. In Innocent Drinks, such report will

help company to detect concerns soon afterwards they emerge and avoid significant issues from

happening later related to account receivables' collection.

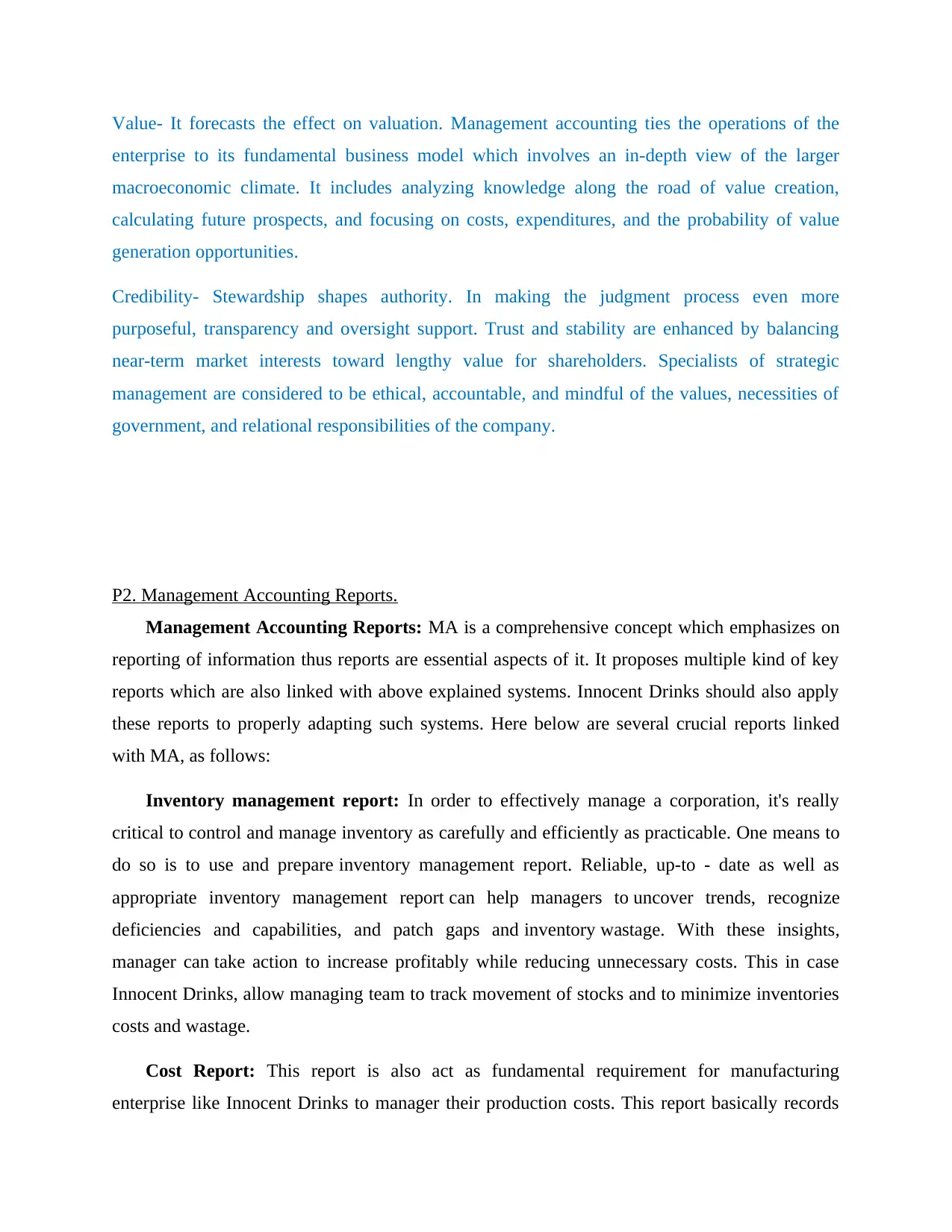

M1. Effective evaluation of vital benefits of explained MA-systems in case of Innocent Drinks:

MA systems Evaluation of Benefits/advantages

Cost Accounting System It is beneficial for Innocent as this enable mangers to minimise

their overall production costs and act as allocator causes that

increases costs.

Inventories Management

System

This offer advantage to company by optimising inventories

wastes, losses, theft and thereby optimising inventories costs.

This allow allocate factors leading to increasing stock handling

and storage costs.

Price-optimisation System It is advantageous for company to find out appropriate price rates

for its different range of items as well as to increase overall

demand to achieve competitive profit goals.

Job Costing System This enable Innocent to establish accountability within job

department wise costs, process wise cost, activity wiser costs etc. in Innocent Drinks this report

can be used to find out costs incurred in preparing a single drink or smoothie. This report's data

can be used by managing personnel to optimize costs and enhance profit margin (Smith, 2015).

Accounts-receivables report: Accounts receivables are the sum owed by businesses to the

organization for the selling of goods on credit-basis. In most corporate entities, accounts

receivables are usually executed by producing invoices, either by sending or digitally delivering

this to the clients. In exchange, the buyer must settle within a defined timeline termed credit

lines. An accounts receivable aging report genera lists accounts receivables depending on their

credit terms, aging — such that, how lengthy they are being unpaid. An accounts-

receivable aging report, also recognized as Debtors Book. In Innocent Drinks, such report will

help company to detect concerns soon afterwards they emerge and avoid significant issues from

happening later related to account receivables' collection.

M1. Effective evaluation of vital benefits of explained MA-systems in case of Innocent Drinks:

MA systems Evaluation of Benefits/advantages

Cost Accounting System It is beneficial for Innocent as this enable mangers to minimise

their overall production costs and act as allocator causes that

increases costs.

Inventories Management

System

This offer advantage to company by optimising inventories

wastes, losses, theft and thereby optimising inventories costs.

This allow allocate factors leading to increasing stock handling

and storage costs.

Price-optimisation System It is advantageous for company to find out appropriate price rates

for its different range of items as well as to increase overall

demand to achieve competitive profit goals.

Job Costing System This enable Innocent to establish accountability within job

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

processes by effective allocation of costs together with proper

justification (Routledge.Kenyon and Kenyon, 2016).

D1. Evaluate how systems and reporting of MA are effectively integrated within enterprise's

processes:

Here in organizational context an integration relates to combining two or more aspects of

business with each other to facilitates a cumulative framework. As discussed above all systems

and reports are integral part of management-accounting which supports overall managerial

framework as a whole. But here notable thing is that each system and report are designed to

overcame the issues involved in organizational processes like to manage inventories processes,

inventory MAS and report are proposed in MA mechanism thus it can be regarded as

fundamental integration. Further different accounting processes offers wide range of information

which are subsequently used by managers in cost accounting system, inventory MAS and other

systems as well as to prepare managerial reports. So integration herein between organization's

processes, systems and reports is significant to for achieving business targets and adapting MA

mechanism (Routledge and Kaarbøe, 2017).

TASK 2

Usage of the techniques of cost analysis to prepare income statement by using marginal and

absorption costing.

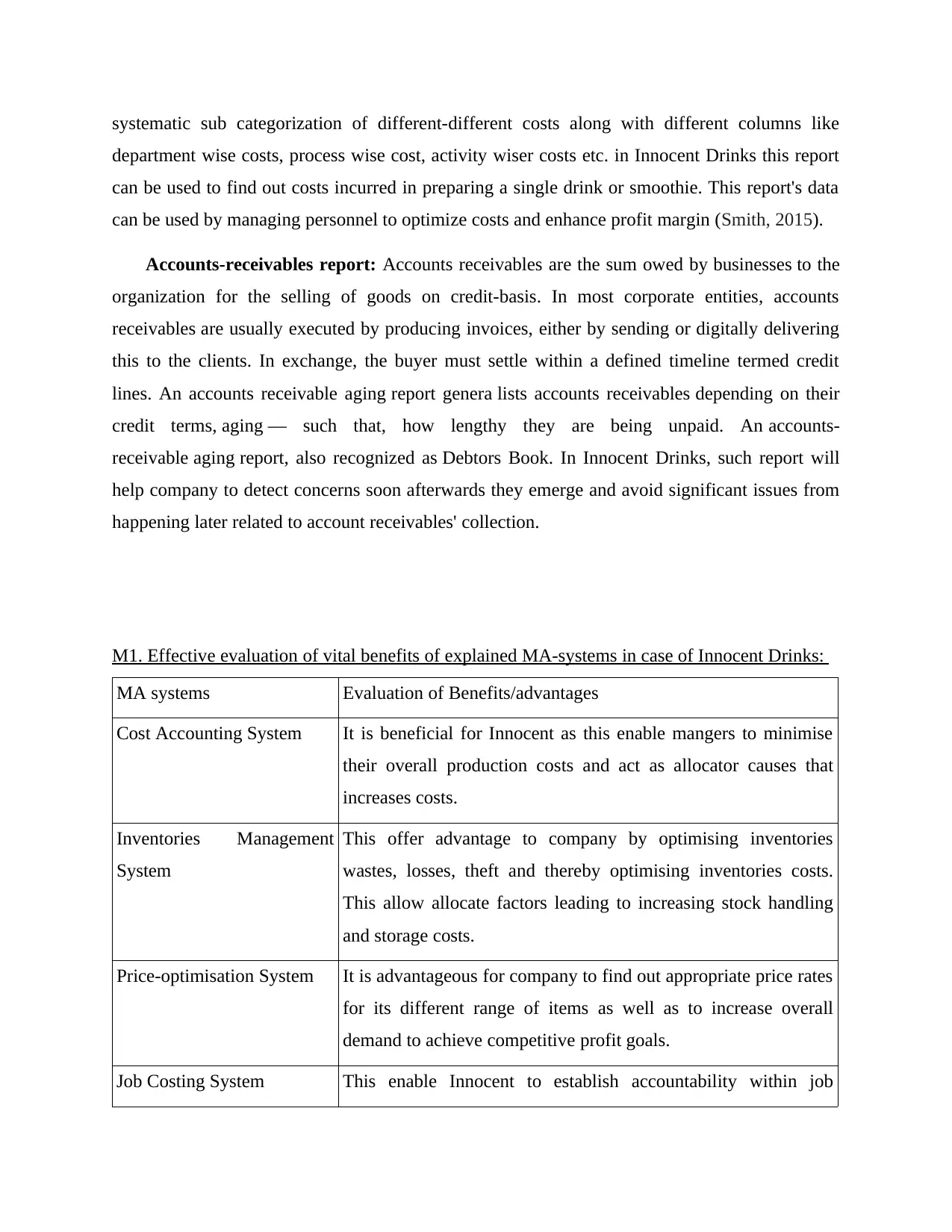

Marginal costing- It classifies costs as marginal or variable and fixed. All the variable costs are

aggregated to find out contribution per unit in this method.

Cost per unit:

April May

Variable Manufacturing cost

per unit

5 5

Closing stock £10000 £15000

justification (Routledge.Kenyon and Kenyon, 2016).

D1. Evaluate how systems and reporting of MA are effectively integrated within enterprise's

processes:

Here in organizational context an integration relates to combining two or more aspects of

business with each other to facilitates a cumulative framework. As discussed above all systems

and reports are integral part of management-accounting which supports overall managerial

framework as a whole. But here notable thing is that each system and report are designed to

overcame the issues involved in organizational processes like to manage inventories processes,

inventory MAS and report are proposed in MA mechanism thus it can be regarded as

fundamental integration. Further different accounting processes offers wide range of information

which are subsequently used by managers in cost accounting system, inventory MAS and other

systems as well as to prepare managerial reports. So integration herein between organization's

processes, systems and reports is significant to for achieving business targets and adapting MA

mechanism (Routledge and Kaarbøe, 2017).

TASK 2

Usage of the techniques of cost analysis to prepare income statement by using marginal and

absorption costing.

Marginal costing- It classifies costs as marginal or variable and fixed. All the variable costs are

aggregated to find out contribution per unit in this method.

Cost per unit:

April May

Variable Manufacturing cost

per unit

5 5

Closing stock £10000 £15000

April May

Sales 56000 70000

Less: Marginal cost of sales 20000 25000

Variable Manufacturing cost 30000 30000

Opening stock 0 10000

Closing stock 10000 15000

Contribution 36000 45000

Less: Fixed Non-Manufacturing Cost 5000 5000

Less: Fixed Manufacturing Overhead 18000 18000

Net profit 13000 22000

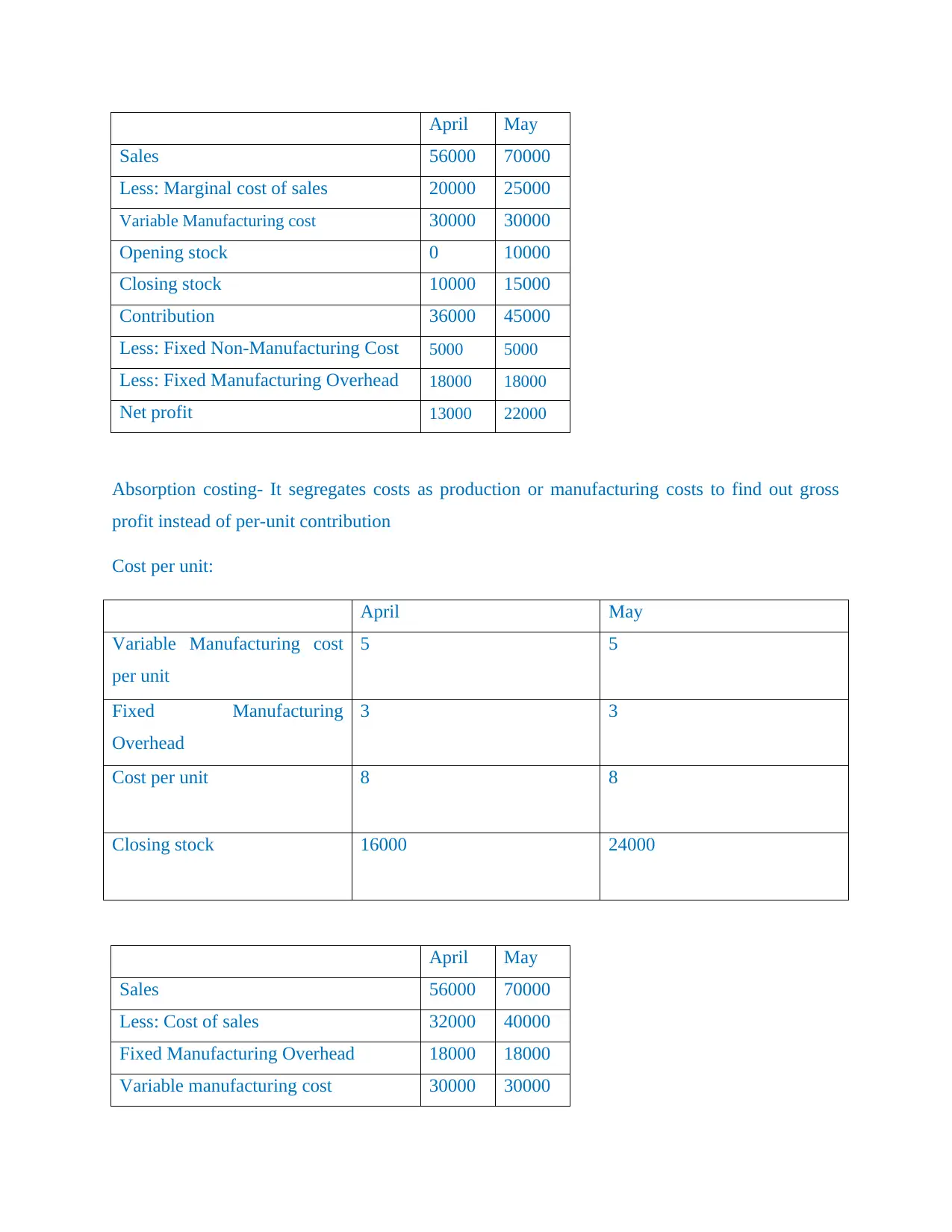

Absorption costing- It segregates costs as production or manufacturing costs to find out gross

profit instead of per-unit contribution

Cost per unit:

April May

Variable Manufacturing cost

per unit

5 5

Fixed Manufacturing

Overhead

3 3

Cost per unit 8 8

Closing stock 16000 24000

April May

Sales 56000 70000

Less: Cost of sales 32000 40000

Fixed Manufacturing Overhead 18000 18000

Variable manufacturing cost 30000 30000

Sales 56000 70000

Less: Marginal cost of sales 20000 25000

Variable Manufacturing cost 30000 30000

Opening stock 0 10000

Closing stock 10000 15000

Contribution 36000 45000

Less: Fixed Non-Manufacturing Cost 5000 5000

Less: Fixed Manufacturing Overhead 18000 18000

Net profit 13000 22000

Absorption costing- It segregates costs as production or manufacturing costs to find out gross

profit instead of per-unit contribution

Cost per unit:

April May

Variable Manufacturing cost

per unit

5 5

Fixed Manufacturing

Overhead

3 3

Cost per unit 8 8

Closing stock 16000 24000

April May

Sales 56000 70000

Less: Cost of sales 32000 40000

Fixed Manufacturing Overhead 18000 18000

Variable manufacturing cost 30000 30000

Opening stock 0 16000

Closing stock 16000 24000

Gross profit 24000 30000

Less: Fixed non manufacturing cost 5000 5000

Net profit 19000 25000

Reconciliation statement April May

Net profit under marginal cost 13000 22000

Add: Closing stock 6000 3000

Net profit under absorption cost 19000 25000

Variable cost per unit 49

Total fixed cost 140000

Selling price 60

Contribution (Selling price-variable

cost per unit) 11

PV ratio (Contribution per unit/selling

price*100 18.33

BEP in units (Fixed cost/contribution

per unit)

12727.2

7

BEP in sales (Fixed cost/PV ratio) 763636.

4

Margin of safety in units (Selling

units-BEP in units)

7272.72

7

Margin of safety in sales (Sales

revenue-BEP in sales)

436363.

6

Closing stock 16000 24000

Gross profit 24000 30000

Less: Fixed non manufacturing cost 5000 5000

Net profit 19000 25000

Reconciliation statement April May

Net profit under marginal cost 13000 22000

Add: Closing stock 6000 3000

Net profit under absorption cost 19000 25000

Variable cost per unit 49

Total fixed cost 140000

Selling price 60

Contribution (Selling price-variable

cost per unit) 11

PV ratio (Contribution per unit/selling

price*100 18.33

BEP in units (Fixed cost/contribution

per unit)

12727.2

7

BEP in sales (Fixed cost/PV ratio) 763636.

4

Margin of safety in units (Selling

units-BEP in units)

7272.72

7

Margin of safety in sales (Sales

revenue-BEP in sales)

436363.

6

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

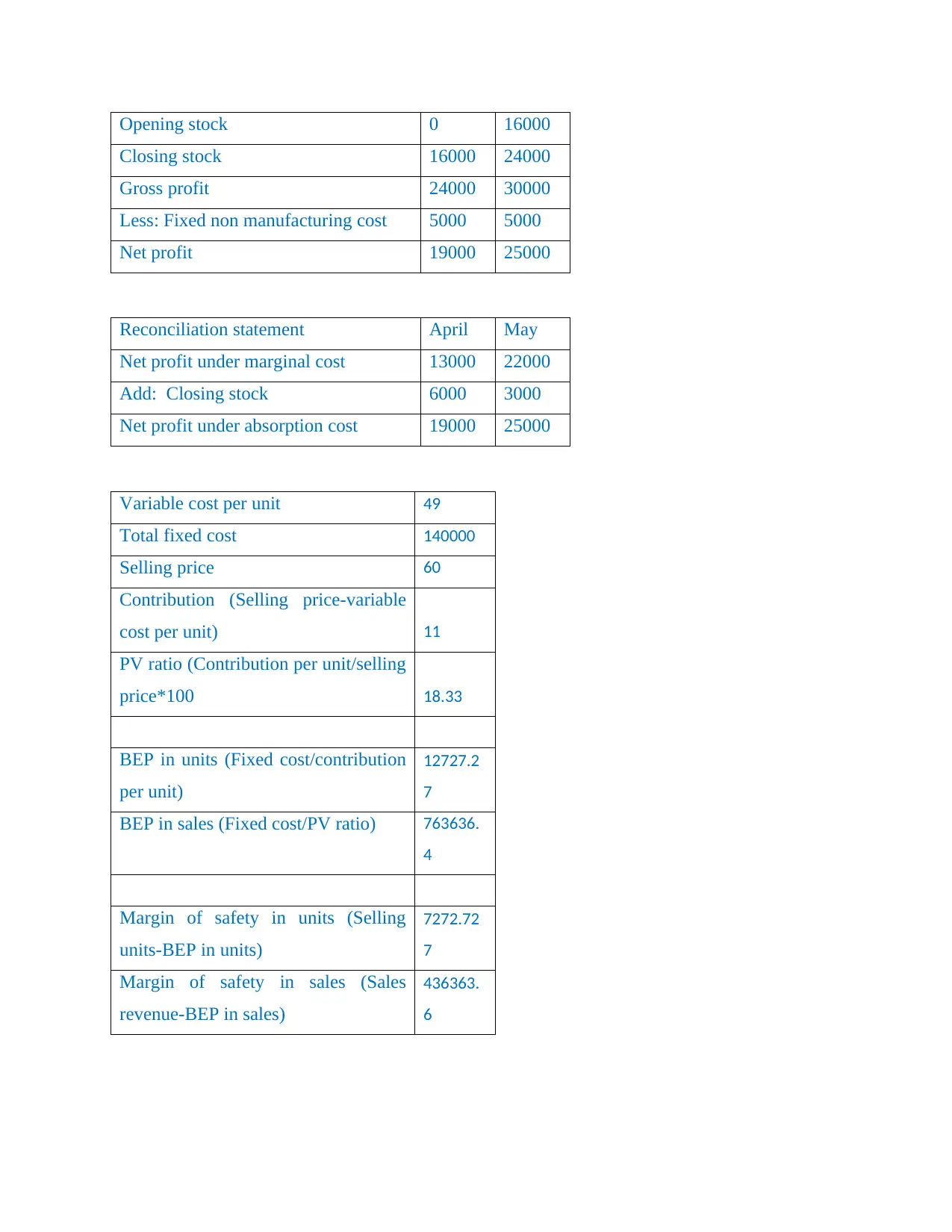

M2. Accounting techniques to prepare financial statements.

There are a range of accounting methods and each of them provides a systematic

framework to prepare financial statement (Taschner and Charifzadeh, 2020). Such as in above

part, income statements have been prepared by using absorption and marginal costing. As well as

breakeven point is also computed in order to know about level on which company will gain no

profit and no loss.

D2. Interpretation of financial data.

In the above part two income statements have been prepared which presents different

outcomes. Such as in the absorption costing net loss of 13000 pounds and net profit of 15000

pounds for month of April and May. While in marginal costing, the net loss is of 7000 pounds

for month of April and net profit of 17000 pounds for May. This is so because of consideration

of expenses in different under both methods.

TASK 3

P4. Benefits and limitation of planning tools of budgetary control.

In different types of business entities, a range of financial practices and methods are

implemented with an aim of successful operation of various kinds of operations. The budgetary

control is one of the key approach which is applied in the context of projecting further financial

activities.

Budgetary control is a strategy which ensures that the budget is structured in such a way as to

allow for the most detailed financial plans (Nyamwanza, Madzivire and Madzivire, 2020). It's an

approach that compares predictions with real outcomes to assess variations. Eventually, under it

a wide range of planning tools are included and each of them has own significance and some

drawbacks. In regards to innocent drinks limited, these planning tools are defined in a such

manner that are as:

1. Production budget- A production budget provides sets of units produced over a time

period for an adequate accounting tactic. This is a significant financial plan that can help

There are a range of accounting methods and each of them provides a systematic

framework to prepare financial statement (Taschner and Charifzadeh, 2020). Such as in above

part, income statements have been prepared by using absorption and marginal costing. As well as

breakeven point is also computed in order to know about level on which company will gain no

profit and no loss.

D2. Interpretation of financial data.

In the above part two income statements have been prepared which presents different

outcomes. Such as in the absorption costing net loss of 13000 pounds and net profit of 15000

pounds for month of April and May. While in marginal costing, the net loss is of 7000 pounds

for month of April and net profit of 17000 pounds for May. This is so because of consideration

of expenses in different under both methods.

TASK 3

P4. Benefits and limitation of planning tools of budgetary control.

In different types of business entities, a range of financial practices and methods are

implemented with an aim of successful operation of various kinds of operations. The budgetary

control is one of the key approach which is applied in the context of projecting further financial

activities.

Budgetary control is a strategy which ensures that the budget is structured in such a way as to

allow for the most detailed financial plans (Nyamwanza, Madzivire and Madzivire, 2020). It's an

approach that compares predictions with real outcomes to assess variations. Eventually, under it

a wide range of planning tools are included and each of them has own significance and some

drawbacks. In regards to innocent drinks limited, these planning tools are defined in a such

manner that are as:

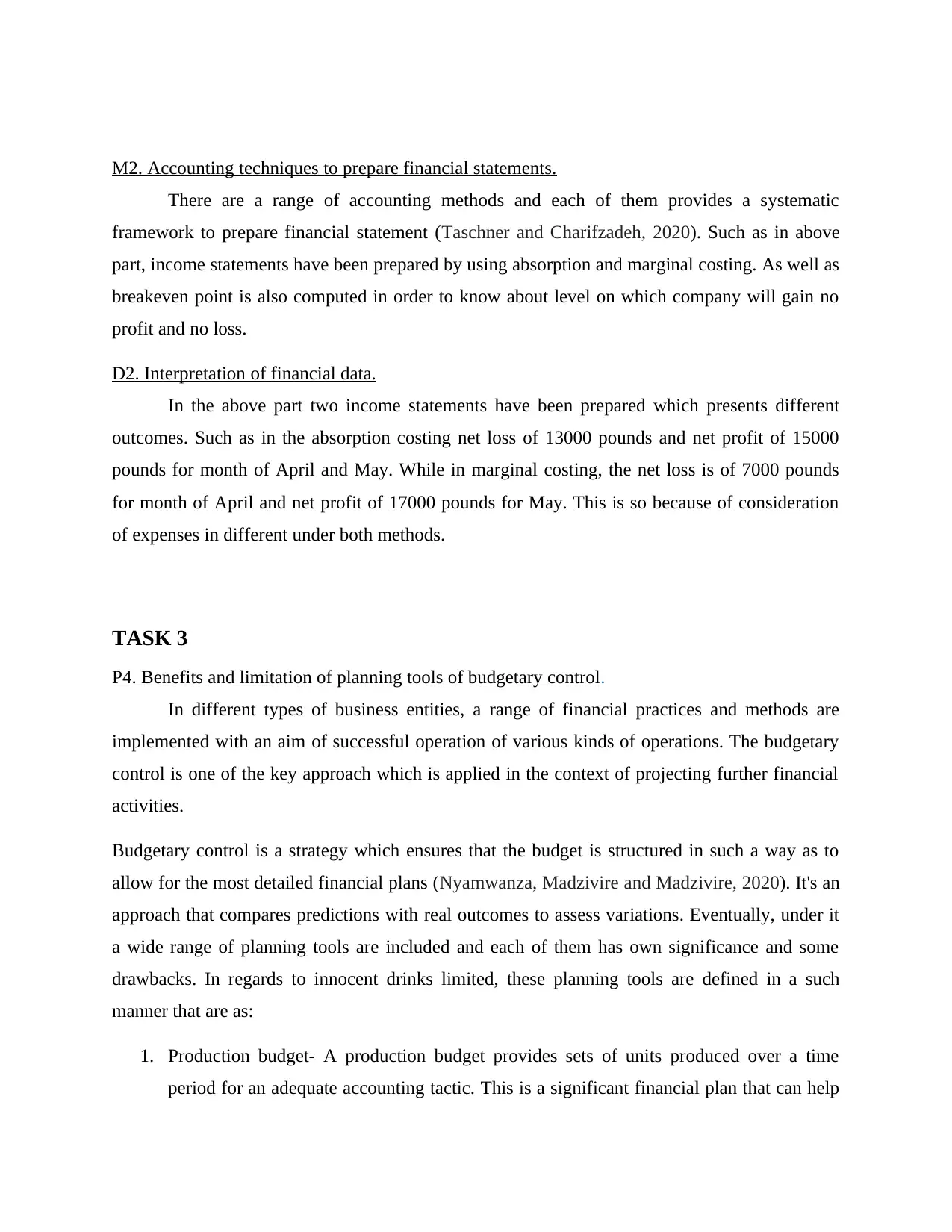

1. Production budget- A production budget provides sets of units produced over a time

period for an adequate accounting tactic. This is a significant financial plan that can help

a firm by providing accurate figures on raw resources. Without an appropriate production

budget, it will become difficult for businesses to provide sufficient knowledge on how

much products are to be delivered and the services available. As in Innocent Drinks

Limited, their accountant draws up an estimate so that their management department may

take appropriate steps and make reasonable decisions on the procurement of raw

materials and the development of new products. This budget has certain advantages and

disadvantages such as:

Advantages Disadvantages

This promotes the lowering of production

costs because it standardizes processing.

Actual stock of products is becoming

sufficient to handle. This is because

underneath it, evaluation of the required

raw material is given that leads to the better

decision-making by supervisors. For

example, their management take corrective

measures in Innocent Drinks limited to

purchasing sum of new raw material for

production.

One of the primary drawbacks of a

production budget for a company is that it

takes more time and resources. Like the

business above, they are also facing this

problem of higher time usage as well as

expense for planning this budget. Due to

this issue, small companies cannot

implement it in their financial planning.

Below an example of production budget is mentioned which encompasses all necessary

details that are included under it:

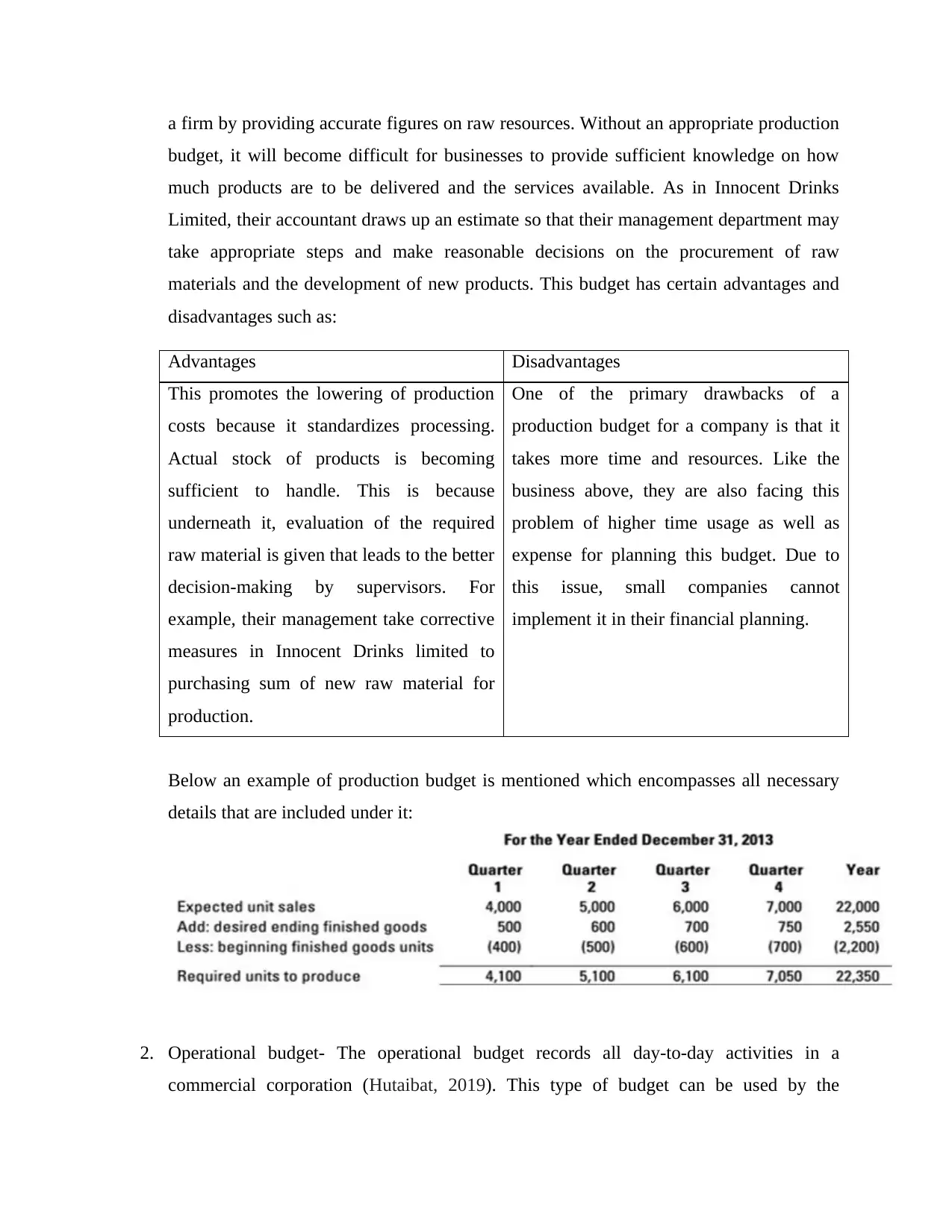

2. Operational budget- The operational budget records all day-to-day activities in a

commercial corporation (Hutaibat, 2019). This type of budget can be used by the

budget, it will become difficult for businesses to provide sufficient knowledge on how

much products are to be delivered and the services available. As in Innocent Drinks

Limited, their accountant draws up an estimate so that their management department may

take appropriate steps and make reasonable decisions on the procurement of raw

materials and the development of new products. This budget has certain advantages and

disadvantages such as:

Advantages Disadvantages

This promotes the lowering of production

costs because it standardizes processing.

Actual stock of products is becoming

sufficient to handle. This is because

underneath it, evaluation of the required

raw material is given that leads to the better

decision-making by supervisors. For

example, their management take corrective

measures in Innocent Drinks limited to

purchasing sum of new raw material for

production.

One of the primary drawbacks of a

production budget for a company is that it

takes more time and resources. Like the

business above, they are also facing this

problem of higher time usage as well as

expense for planning this budget. Due to

this issue, small companies cannot

implement it in their financial planning.

Below an example of production budget is mentioned which encompasses all necessary

details that are included under it:

2. Operational budget- The operational budget records all day-to-day activities in a

commercial corporation (Hutaibat, 2019). This type of budget can be used by the

corporation chosen above to handle its operating expenses and enhancing its working

capital. It can become feasible as all sorts of functions and processes are projected under

this which allow managers to plan strategies such as which practices are complicated and

which are simpler to carry out. Unlike the above functions, it still has other drawbacks

and advantages that are:

Advantages Disadvantages

The budget allows businesses to have an

eye on all expenses and manage costs

effectively to generate financial benefits.

Like in Innocent drinks limited above, this

budget is applied on all form of activities

which makes easier to managers to

determine a guideline to achieve desired

outcomes.

The key issue of this budget is that it does

not consider capital expenses which leads

to unreliable projection of income and

expenses. As well as it is not suitable for

those operations and activities which are

for long time period.

Below an example of this type of budget is mentioned which is as:

capital. It can become feasible as all sorts of functions and processes are projected under

this which allow managers to plan strategies such as which practices are complicated and

which are simpler to carry out. Unlike the above functions, it still has other drawbacks

and advantages that are:

Advantages Disadvantages

The budget allows businesses to have an

eye on all expenses and manage costs

effectively to generate financial benefits.

Like in Innocent drinks limited above, this

budget is applied on all form of activities

which makes easier to managers to

determine a guideline to achieve desired

outcomes.

The key issue of this budget is that it does

not consider capital expenses which leads

to unreliable projection of income and

expenses. As well as it is not suitable for

those operations and activities which are

for long time period.

Below an example of this type of budget is mentioned which is as:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

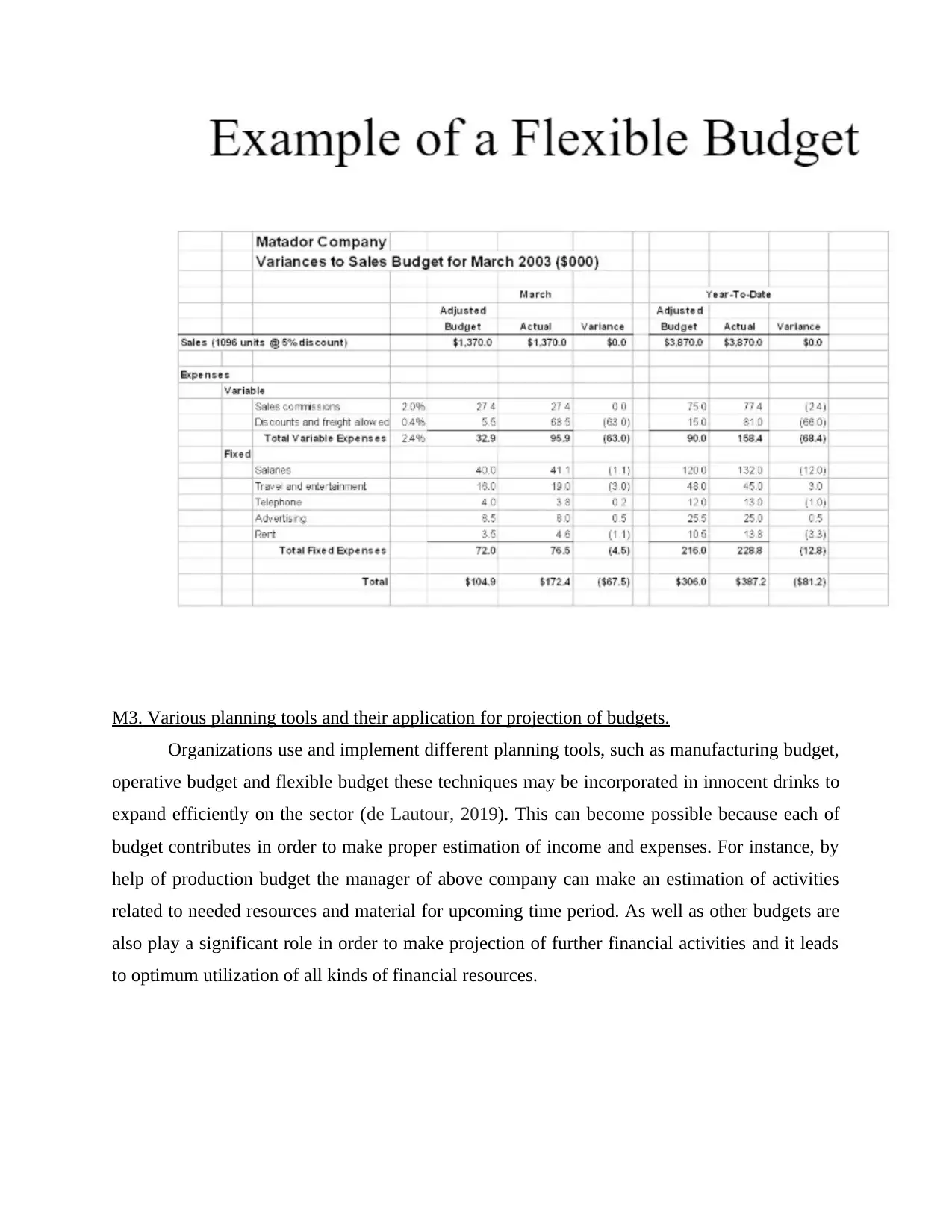

3. Flexible budget- A flexible budget, also known as a contingent budget, is a budgetary

schedule with projected revenues and expenditures depending on the real performance. In

other terms, a versatile budget uses the income and expenses generated in initial output as

a benchmark and forecasts how revenue and expenditure would adjust depending on

variation in output. Basically, this type of budget is used only for those types of activities

and operations which are variable such as wages, electricity bills etc. The managers of

Innocent drinks limited applies this budget in their operations such as for those activities

which can fluctuate in a particular accounting period. This budget has some benefits and

drawbacks that are as follows:

Advantages Disadvantages

The most important value of this financial

plan is that it allows the management of the

company to assess the volume of output

under various demand and industry

environments (Le, Nguyen and Phan,

2019). This is so because it allows

managers to make adjustment in planned

activities as per the business needs.

The budget needs professional workers to

operate on it. Shortage of trained labor is a

specific problem. Therefore, many

businesses and corporations are unable to

utilize this financial plan. Along with due

to more adjustments, this becomes difficult

to understand for users.

Below an example of flexible budget is presented that is as follows:

schedule with projected revenues and expenditures depending on the real performance. In

other terms, a versatile budget uses the income and expenses generated in initial output as

a benchmark and forecasts how revenue and expenditure would adjust depending on

variation in output. Basically, this type of budget is used only for those types of activities

and operations which are variable such as wages, electricity bills etc. The managers of

Innocent drinks limited applies this budget in their operations such as for those activities

which can fluctuate in a particular accounting period. This budget has some benefits and

drawbacks that are as follows:

Advantages Disadvantages

The most important value of this financial

plan is that it allows the management of the

company to assess the volume of output

under various demand and industry

environments (Le, Nguyen and Phan,

2019). This is so because it allows

managers to make adjustment in planned

activities as per the business needs.

The budget needs professional workers to

operate on it. Shortage of trained labor is a

specific problem. Therefore, many

businesses and corporations are unable to

utilize this financial plan. Along with due

to more adjustments, this becomes difficult

to understand for users.

Below an example of flexible budget is presented that is as follows:

M3. Various planning tools and their application for projection of budgets.

Organizations use and implement different planning tools, such as manufacturing budget,

operative budget and flexible budget these techniques may be incorporated in innocent drinks to

expand efficiently on the sector (de Lautour, 2019). This can become possible because each of

budget contributes in order to make proper estimation of income and expenses. For instance, by

help of production budget the manager of above company can make an estimation of activities

related to needed resources and material for upcoming time period. As well as other budgets are

also play a significant role in order to make projection of further financial activities and it leads

to optimum utilization of all kinds of financial resources.

Organizations use and implement different planning tools, such as manufacturing budget,

operative budget and flexible budget these techniques may be incorporated in innocent drinks to

expand efficiently on the sector (de Lautour, 2019). This can become possible because each of

budget contributes in order to make proper estimation of income and expenses. For instance, by

help of production budget the manager of above company can make an estimation of activities

related to needed resources and material for upcoming time period. As well as other budgets are

also play a significant role in order to make projection of further financial activities and it leads

to optimum utilization of all kinds of financial resources.

TASK 4

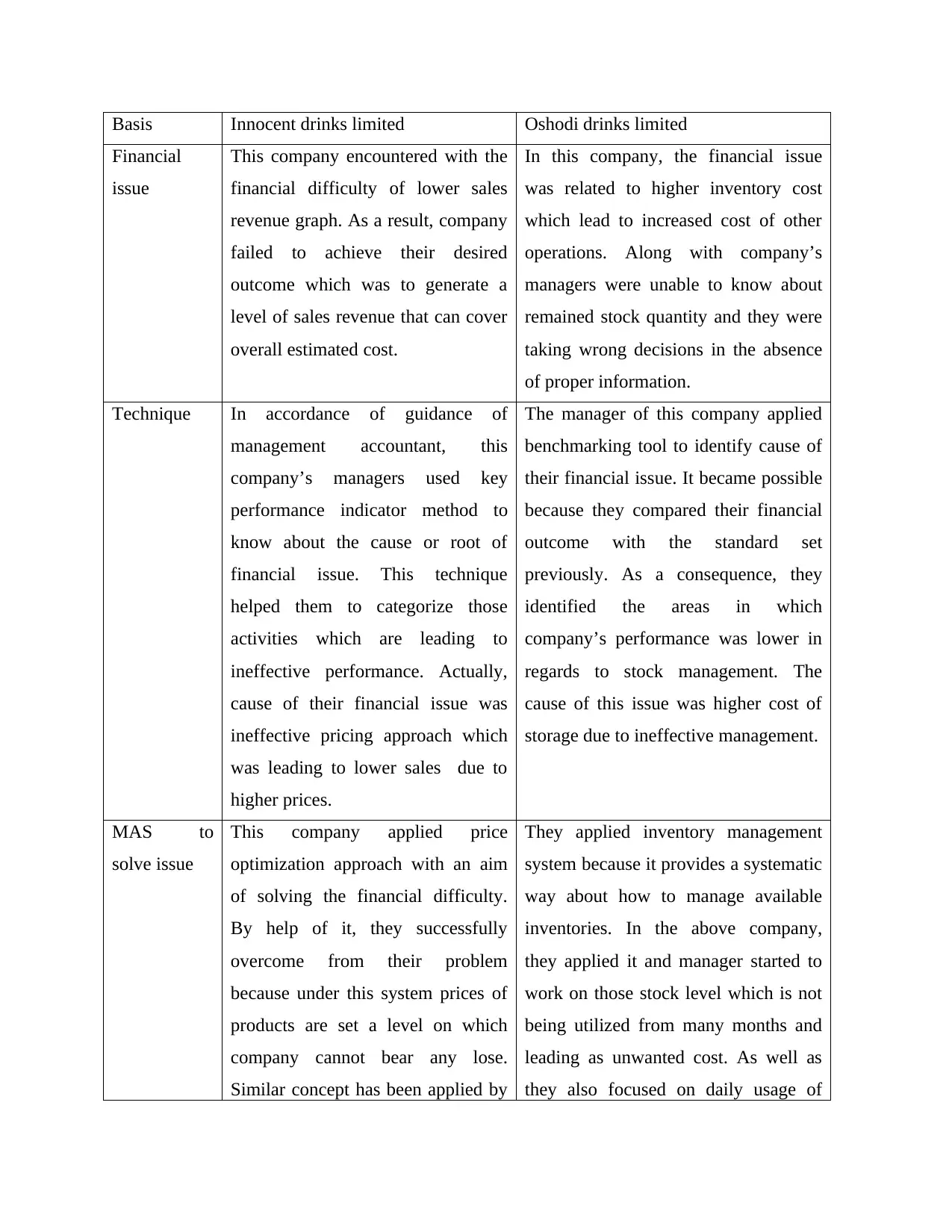

P5 Adoption of management accounting systems to respond financial problems.

Management accounting methods help to evaluate the problems and solve them by

introducing appropriate approaches and strategies. Each section includes the usage of various

accounting approach or frameworks to solve the organization's financial difficulties (Michiyasu

and Kojiro, 2019). There are a range of financial issues which are occurred in business entities

and need to be resolved in quick time. As above discussed that Innocent drinks limited is

involved in process of manufacturing various kinds of soft drinks and due to which they operate

a systematic procedure to complete different activities. This is obvious that, there can be some

financial issue due to lack or poor implementation of accounting systems. The financial

challenge is that encountered by the company since less cash is available. The corporation

encounters this condition because it is unwilling to execute tasks correctly, which contributes to

company losses. Below some type of financial issues are mentioned that are faced by innocent

drinks limited and by its competitive company:

Lower sales revenue- It can be understood as a financial difficulty that mainly raise due

to decreased graph of sales revenue day by day. The reason of this problem can be any

like poor management, higher cost or ineffective pricing approach etc. This is essential

for companies to recognize the cause of this issue as soon as possible otherwise it may

lead to shutdown of a business. The first step to deal with this problem is to identify

reason of issue and after that implement remedial actions to solve. Under innocent drinks

limited, they face this problem because of internal weaknesses.

Poor stock management- This type of issue can be occur in those businesses which deals

at large scale or manufacture huge quantity. It can be understood as a form of issue under

which a company’s stock management cost start to increase due to lack of information

about quantity of stored material. Being a manager, this is essential to know about how

much stock is remained at the end of a month and in the absence of this information a

financial difficulty may raise because manager can take wrong financial decisions. In the

competitive company of Innocent drinks limited, this issue has been occurred.

P5 Adoption of management accounting systems to respond financial problems.

Management accounting methods help to evaluate the problems and solve them by

introducing appropriate approaches and strategies. Each section includes the usage of various

accounting approach or frameworks to solve the organization's financial difficulties (Michiyasu

and Kojiro, 2019). There are a range of financial issues which are occurred in business entities

and need to be resolved in quick time. As above discussed that Innocent drinks limited is

involved in process of manufacturing various kinds of soft drinks and due to which they operate

a systematic procedure to complete different activities. This is obvious that, there can be some

financial issue due to lack or poor implementation of accounting systems. The financial

challenge is that encountered by the company since less cash is available. The corporation

encounters this condition because it is unwilling to execute tasks correctly, which contributes to

company losses. Below some type of financial issues are mentioned that are faced by innocent

drinks limited and by its competitive company:

Lower sales revenue- It can be understood as a financial difficulty that mainly raise due

to decreased graph of sales revenue day by day. The reason of this problem can be any

like poor management, higher cost or ineffective pricing approach etc. This is essential

for companies to recognize the cause of this issue as soon as possible otherwise it may

lead to shutdown of a business. The first step to deal with this problem is to identify

reason of issue and after that implement remedial actions to solve. Under innocent drinks

limited, they face this problem because of internal weaknesses.

Poor stock management- This type of issue can be occur in those businesses which deals

at large scale or manufacture huge quantity. It can be understood as a form of issue under

which a company’s stock management cost start to increase due to lack of information

about quantity of stored material. Being a manager, this is essential to know about how

much stock is remained at the end of a month and in the absence of this information a

financial difficulty may raise because manager can take wrong financial decisions. In the

competitive company of Innocent drinks limited, this issue has been occurred.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Techniques:

There are a range of techniques which can be used in companies in order to know about

actual cause of financial problem (Berry, Broadbent and Otley, 2019). In above mentioned

companies, these techniques have been adopted to solve their issues. Below overview of these

approaches is done in such manner:

Key performance indicator- It is also regarded as KPI. It is in both financial and non-financial

forms. Financial aspect can seek better explain the challenges identified in the organization's

current financial situation and non-financial elements help to recognize the problems found in

individual relationships. The accountant of innocent drinks limited have used strategic KPI to

evaluate financial problems. This will require careful review of the organization’s annual

accounts and a connection of previous documents.

Benchmarking- This involves the method of establishing criteria and matching the actual results

with the same. With the help of this method, the competitive company of innocent drinks limited

identifies cause of issue by comparing with set standards. It is a useful approach for those

companies that are unable to find out actual cause of their issue. In the above company, their

managers have applied in order to compare with standard outcome and by help of this they

identified actual cause of their issue.

Financial governance- It is the critical method of collecting, handling and monitoring financial

knowledge. Usage of this approach for the corporation's accountant to learn the sum of cash

remaining and to collect in the future (Tanui, 2020). This information is used to carry out more

cash purchases in order to prevent the usage of credit facilities resulting in a decrease in

unnecessary expenditure and to further increase the profitability. In addition to this, it can be

used for keeping supervision of financial activities of companies which lead as a framework to

solve different types of issues.

Comparison of companies to find out ways in which they use different accounting systems to

solve financial difficulties:

There are a range of techniques which can be used in companies in order to know about

actual cause of financial problem (Berry, Broadbent and Otley, 2019). In above mentioned

companies, these techniques have been adopted to solve their issues. Below overview of these

approaches is done in such manner:

Key performance indicator- It is also regarded as KPI. It is in both financial and non-financial

forms. Financial aspect can seek better explain the challenges identified in the organization's

current financial situation and non-financial elements help to recognize the problems found in

individual relationships. The accountant of innocent drinks limited have used strategic KPI to

evaluate financial problems. This will require careful review of the organization’s annual

accounts and a connection of previous documents.

Benchmarking- This involves the method of establishing criteria and matching the actual results

with the same. With the help of this method, the competitive company of innocent drinks limited

identifies cause of issue by comparing with set standards. It is a useful approach for those

companies that are unable to find out actual cause of their issue. In the above company, their

managers have applied in order to compare with standard outcome and by help of this they

identified actual cause of their issue.

Financial governance- It is the critical method of collecting, handling and monitoring financial

knowledge. Usage of this approach for the corporation's accountant to learn the sum of cash

remaining and to collect in the future (Tanui, 2020). This information is used to carry out more

cash purchases in order to prevent the usage of credit facilities resulting in a decrease in

unnecessary expenditure and to further increase the profitability. In addition to this, it can be

used for keeping supervision of financial activities of companies which lead as a framework to

solve different types of issues.

Comparison of companies to find out ways in which they use different accounting systems to

solve financial difficulties:

Basis Innocent drinks limited Oshodi drinks limited

Financial

issue

This company encountered with the

financial difficulty of lower sales

revenue graph. As a result, company

failed to achieve their desired

outcome which was to generate a

level of sales revenue that can cover

overall estimated cost.

In this company, the financial issue

was related to higher inventory cost

which lead to increased cost of other

operations. Along with company’s

managers were unable to know about

remained stock quantity and they were

taking wrong decisions in the absence

of proper information.

Technique In accordance of guidance of

management accountant, this

company’s managers used key

performance indicator method to

know about the cause or root of

financial issue. This technique

helped them to categorize those

activities which are leading to

ineffective performance. Actually,

cause of their financial issue was

ineffective pricing approach which

was leading to lower sales due to

higher prices.

The manager of this company applied

benchmarking tool to identify cause of

their financial issue. It became possible

because they compared their financial

outcome with the standard set

previously. As a consequence, they

identified the areas in which

company’s performance was lower in

regards to stock management. The

cause of this issue was higher cost of

storage due to ineffective management.

MAS to

solve issue

This company applied price

optimization approach with an aim

of solving the financial difficulty.

By help of it, they successfully

overcome from their problem

because under this system prices of

products are set a level on which

company cannot bear any lose.

Similar concept has been applied by

They applied inventory management

system because it provides a systematic

way about how to manage available

inventories. In the above company,

they applied it and manager started to

work on those stock level which is not

being utilized from many months and

leading as unwanted cost. As well as

they also focused on daily usage of

Financial

issue

This company encountered with the

financial difficulty of lower sales

revenue graph. As a result, company

failed to achieve their desired

outcome which was to generate a

level of sales revenue that can cover

overall estimated cost.

In this company, the financial issue

was related to higher inventory cost

which lead to increased cost of other

operations. Along with company’s

managers were unable to know about

remained stock quantity and they were

taking wrong decisions in the absence

of proper information.

Technique In accordance of guidance of

management accountant, this

company’s managers used key

performance indicator method to

know about the cause or root of

financial issue. This technique

helped them to categorize those

activities which are leading to

ineffective performance. Actually,

cause of their financial issue was

ineffective pricing approach which

was leading to lower sales due to

higher prices.

The manager of this company applied

benchmarking tool to identify cause of

their financial issue. It became possible

because they compared their financial

outcome with the standard set

previously. As a consequence, they

identified the areas in which

company’s performance was lower in

regards to stock management. The

cause of this issue was higher cost of

storage due to ineffective management.

MAS to

solve issue

This company applied price

optimization approach with an aim

of solving the financial difficulty.

By help of it, they successfully

overcome from their problem

because under this system prices of

products are set a level on which

company cannot bear any lose.

Similar concept has been applied by

They applied inventory management

system because it provides a systematic

way about how to manage available

inventories. In the above company,

they applied it and manager started to

work on those stock level which is not

being utilized from many months and

leading as unwanted cost. As well as

they also focused on daily usage of

above company and they changed

their prices. As a result, customer

started to buy their drinks at an

effective prices and their issue has

been solved.

material. By applying these aspects,

they became able to overcome from

their financial issues in less time at

lower expense.

M4 Contribution of management accounting in sustainable success of the organization while

responding financial problems.

As above discussed that how both companies applied MAS to solve their financial

problem. Under innocent drinks limited, their manager has adopted price optimization system

which helped them in overcoming issue of lower sales in less time (Hanif, Rakhman and

Nurkholis, 2019). Similarly, in Oshodi plc they also applied stock management system to deal

with financial problem. This is showing that these MAS are essential to solve financial issues

that leads in sustainable success.

D3 Application of planning tools to respond financial issue along with attainment of sustainable

success.

The Innocent drinks limited utilizes different forms of forecasting methods which are

called production budget, operating budget, and flexible budget. All of these methods have a

major part to play in the fiscal management phase (Jiang, 2019). These preparation methods also

help address financial problems. By help of these financial plans, managers can gather key

information about estimated income and expenses. This information can be used by above

company’s managers at the time of solving financial difficulties. It is indicating that planning

tools are useful to solve financial issues which leads to sustainable success.

their prices. As a result, customer

started to buy their drinks at an

effective prices and their issue has

been solved.

material. By applying these aspects,

they became able to overcome from

their financial issues in less time at

lower expense.

M4 Contribution of management accounting in sustainable success of the organization while

responding financial problems.

As above discussed that how both companies applied MAS to solve their financial

problem. Under innocent drinks limited, their manager has adopted price optimization system

which helped them in overcoming issue of lower sales in less time (Hanif, Rakhman and

Nurkholis, 2019). Similarly, in Oshodi plc they also applied stock management system to deal

with financial problem. This is showing that these MAS are essential to solve financial issues

that leads in sustainable success.

D3 Application of planning tools to respond financial issue along with attainment of sustainable

success.

The Innocent drinks limited utilizes different forms of forecasting methods which are

called production budget, operating budget, and flexible budget. All of these methods have a

major part to play in the fiscal management phase (Jiang, 2019). These preparation methods also

help address financial problems. By help of these financial plans, managers can gather key

information about estimated income and expenses. This information can be used by above

company’s managers at the time of solving financial difficulties. It is indicating that planning

tools are useful to solve financial issues which leads to sustainable success.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CONCLUSION

From the aforementioned study it was inferred that there is a significant role of

management accounting in the organization's performance because this strengthens the

interrelationship with the organization's internal divisions. This is possible since the planning of

various systems helps to obtain the diversified knowledge which improves comprehension and

ultimately improves the functionality of the systems. Preparing various forms of documentation

helps disperse knowledge to internal partners and administrators, enhancing decision-making and

helping to produce optimal outcomes. There are numerous strategy resources, such as the

production budget, flexible budget etc. These tools have its own role in managing the budget

which helps the organization to adapt to the financial problems and increase efficiency. Different

kinds of performance techniques and processes such as KPI and Benchmarking are used to solve

financial issues of above mentioned companies.

From the aforementioned study it was inferred that there is a significant role of

management accounting in the organization's performance because this strengthens the

interrelationship with the organization's internal divisions. This is possible since the planning of

various systems helps to obtain the diversified knowledge which improves comprehension and

ultimately improves the functionality of the systems. Preparing various forms of documentation

helps disperse knowledge to internal partners and administrators, enhancing decision-making and

helping to produce optimal outcomes. There are numerous strategy resources, such as the

production budget, flexible budget etc. These tools have its own role in managing the budget

which helps the organization to adapt to the financial problems and increase efficiency. Different

kinds of performance techniques and processes such as KPI and Benchmarking are used to solve

financial issues of above mentioned companies.

REFERENCES

Books and Journals:

March.Kure, N., Nørreklit, H. and Raffnsøe-Møller, M., 2017. Language Games of Management

Accounting—Constructing Illusions or Realities?. In A Philosophy of Management Accounting.

(pp. 211-224).

Monden, Y., 2019. Toyota management system: Linking the seven key functional areas. Routledge.

Aifuwa, H. O., Embele, K. and Saidu, M., 2018. Ethical accounting practices and financial reporting

quality. EPRA Journal of Multidisciplinary Research. 4(12). pp.31-44.

Kumarasiri, J., 2017. Stakeholder pressure on carbon emissions: strategies and the use of management

accounting. Australasian Journal of Environmental Management. 24(4). pp.339-354.

Harrison, F. and Lock, D., 2017. Advanced project management: a structured approach.

Routledge.Kenyon, R. and Kenyon, C., 2016. Accounting for KVA under IFRS 13. Risk,

Routledge.Meidell, A. and Kaarbøe, K., 2017. How the enterprise risk management function influences

decision-making in the organization–A field study of a large, global oil and gas company. The

British Accounting Review. 49(1). pp.39-55.

Smith, S. S., 2015. Accounting: Evolving for an integrated future. Journal of Accounting, Finance

& Management Strategy. 10(1). p.1.

Taschner, A. and Charifzadeh, M., 2020. Supply Chains, Supply Chain Management and Management

Accounting. In Management Accounting in Supply Chains (pp. 1-14). Springer Gabler,

Wiesbaden.

Nyamwanza, L., Madzivire, E. and Madzivire, E., 2020. Impact of Management Accounting on

Decision Making: A Zimbabwean Perspective. Journal of Accounting, Business and Finance

Research, 8(3), pp.133-145.

Hutaibat, K., 2019. Accounting for strategic management, strategising and power structures in the

Jordanian higher education sector. Journal of Accounting & Organizational Change.

Le, T.T., Nguyen, T.M.A. and Phan, T.T.H., 2019. Environmental Management Accounting and

Performance Efficiency in the Vietnamese Construction Material Industry—A Managerial

Implication for Sustainable Development. Sustainability, 11(19), p.5152.

de Lautour, V.J., 2019. Ethical and Accountable Management Accounting: Mission Impossible?.

In Strategic Management Accounting, Volume III (pp. 185-225). Palgrave Macmillan, Cham.

Michiyasu, N. and Kojiro, T., 2019. Reconstruction of the Management Accounting System based on

Material Flow Cost Accounting (MFCA) and Throughput Accounting (TA): Expansion of the

Concept of Opportunity Cost. Reconstruction, (18), pp.35-49.

Berry, A.J., Broadbent, J. and Otley, D.T. eds., 2019. Management control theory. Routledge.

Tanui, P.J., 2020. Relationship between Contemporary Management Accounting Practices and

Entrepreneurial Strategies of Large Enterprises in Eldoret Town, Kenya. Hybrid Journal of

Business and Finance, 1(1).

Hanif, H., Rakhman, A. and Nurkholis, M., 2019. The Construction of Entrepreneurial Accounting:

Evidence from Indonesia. Reference to this paper should be made as follows: Hanif, H, pp.104-

117.

Books and Journals:

March.Kure, N., Nørreklit, H. and Raffnsøe-Møller, M., 2017. Language Games of Management

Accounting—Constructing Illusions or Realities?. In A Philosophy of Management Accounting.

(pp. 211-224).

Monden, Y., 2019. Toyota management system: Linking the seven key functional areas. Routledge.

Aifuwa, H. O., Embele, K. and Saidu, M., 2018. Ethical accounting practices and financial reporting

quality. EPRA Journal of Multidisciplinary Research. 4(12). pp.31-44.

Kumarasiri, J., 2017. Stakeholder pressure on carbon emissions: strategies and the use of management

accounting. Australasian Journal of Environmental Management. 24(4). pp.339-354.

Harrison, F. and Lock, D., 2017. Advanced project management: a structured approach.

Routledge.Kenyon, R. and Kenyon, C., 2016. Accounting for KVA under IFRS 13. Risk,

Routledge.Meidell, A. and Kaarbøe, K., 2017. How the enterprise risk management function influences

decision-making in the organization–A field study of a large, global oil and gas company. The

British Accounting Review. 49(1). pp.39-55.

Smith, S. S., 2015. Accounting: Evolving for an integrated future. Journal of Accounting, Finance

& Management Strategy. 10(1). p.1.

Taschner, A. and Charifzadeh, M., 2020. Supply Chains, Supply Chain Management and Management

Accounting. In Management Accounting in Supply Chains (pp. 1-14). Springer Gabler,

Wiesbaden.

Nyamwanza, L., Madzivire, E. and Madzivire, E., 2020. Impact of Management Accounting on

Decision Making: A Zimbabwean Perspective. Journal of Accounting, Business and Finance

Research, 8(3), pp.133-145.

Hutaibat, K., 2019. Accounting for strategic management, strategising and power structures in the

Jordanian higher education sector. Journal of Accounting & Organizational Change.

Le, T.T., Nguyen, T.M.A. and Phan, T.T.H., 2019. Environmental Management Accounting and

Performance Efficiency in the Vietnamese Construction Material Industry—A Managerial

Implication for Sustainable Development. Sustainability, 11(19), p.5152.

de Lautour, V.J., 2019. Ethical and Accountable Management Accounting: Mission Impossible?.

In Strategic Management Accounting, Volume III (pp. 185-225). Palgrave Macmillan, Cham.

Michiyasu, N. and Kojiro, T., 2019. Reconstruction of the Management Accounting System based on

Material Flow Cost Accounting (MFCA) and Throughput Accounting (TA): Expansion of the

Concept of Opportunity Cost. Reconstruction, (18), pp.35-49.

Berry, A.J., Broadbent, J. and Otley, D.T. eds., 2019. Management control theory. Routledge.

Tanui, P.J., 2020. Relationship between Contemporary Management Accounting Practices and

Entrepreneurial Strategies of Large Enterprises in Eldoret Town, Kenya. Hybrid Journal of

Business and Finance, 1(1).

Hanif, H., Rakhman, A. and Nurkholis, M., 2019. The Construction of Entrepreneurial Accounting:

Evidence from Indonesia. Reference to this paper should be made as follows: Hanif, H, pp.104-

117.

Jiang, D., 2019. Management Accounting Literature Review—Based on the Development of

Management Accounting Research in 2015-2017. Modern Economy, 10(12), pp.2315-2334.

Management Accounting Research in 2015-2017. Modern Economy, 10(12), pp.2315-2334.

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.