Comparison of Absorption and Variable Costing Methods

VerifiedAdded on 2020/11/12

|20

|5143

|391

AI Summary

This assignment provides an in-depth analysis of the two cost accounting methods - absorption costing and variable costing. It explores their similarities and differences, along with their applications in management accounting. The document also delves into planning tools of budgetary control, highlighting their benefits and limitations. The study aims to understand how these methods contribute to effective management decision-making.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

UNIT 5 Management

Accounting

Accounting

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1. Management Accounting and types of management accounting systems that could be used

by Nisa....................................................................................................................................1

P 2. Different methods used by Nisa for management accounting reporting.........................3

TASK 2............................................................................................................................................5

P3. Production of income statements showing absorption costing and marginal costing

techniques...............................................................................................................................5

TASK 3............................................................................................................................................7

P4. Advantages and disadvantages of different types of planning tools................................7

TASK 4..........................................................................................................................................10

P5. Adapting management accounting systems to respond to financial problems...............10

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1. Management Accounting and types of management accounting systems that could be used

by Nisa....................................................................................................................................1

P 2. Different methods used by Nisa for management accounting reporting.........................3

TASK 2............................................................................................................................................5

P3. Production of income statements showing absorption costing and marginal costing

techniques...............................................................................................................................5

TASK 3............................................................................................................................................7

P4. Advantages and disadvantages of different types of planning tools................................7

TASK 4..........................................................................................................................................10

P5. Adapting management accounting systems to respond to financial problems...............10

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION

The performance of a business is reflected through accounting. There are two branches of

accountancy, fiscal and management. Financial division deals with fiscal data and transactions.

Management Accounting (MA) have wider scope, as it considers both monetary and

administrative information of business and aids the governance in significant decision making. In

presented report a detailed analysis is done of management accounting systems, its relevance and

applications in the organisation and it is carried out on the basis of Nisa is a leading retail chain

in economy of UK. With these various reporting methods which can be used in enterprise is

presented, income statements are prepared on marginal and absorption accounting technique.

Different planning tools considerable in governance of firm, their advantages and disadvantages

are reported as well.

TASK 1

P1. Management Accounting and types of management accounting systems that could be used by

Nisa

Management Accounting:

Management Accounting is also known as cost accounting or managerial accounting, it is

the process of analysing operations and business costs to prepare internal financial reports to aid

manager's decision making process in achieving business goals. This enables managers to look at

the events that happen in and around a business while considering the needs of the business.

Main aim of cost accounting is to translate estimates and data into knowledge that will ultimately

be used to guide decision making (Mårtensson and et.al., 2016). Outcome of the same are shown

in form of periodic reports. These reports are usually confidential and are for internal use only. In

management accounting, it is required to utilize qualified information and skills for preparing

accounting statements.

The main difference between financial and management accounting is that, FA provides

information which is required by stakeholders in order to assist decision and MA put emphasis

on providing data and information for aiding managers in decision making process.

Functions of management accounting system:

Analysis and interpretation of data: For effective planning and decision making data is

analysed in meaningful manner.

1

The performance of a business is reflected through accounting. There are two branches of

accountancy, fiscal and management. Financial division deals with fiscal data and transactions.

Management Accounting (MA) have wider scope, as it considers both monetary and

administrative information of business and aids the governance in significant decision making. In

presented report a detailed analysis is done of management accounting systems, its relevance and

applications in the organisation and it is carried out on the basis of Nisa is a leading retail chain

in economy of UK. With these various reporting methods which can be used in enterprise is

presented, income statements are prepared on marginal and absorption accounting technique.

Different planning tools considerable in governance of firm, their advantages and disadvantages

are reported as well.

TASK 1

P1. Management Accounting and types of management accounting systems that could be used by

Nisa

Management Accounting:

Management Accounting is also known as cost accounting or managerial accounting, it is

the process of analysing operations and business costs to prepare internal financial reports to aid

manager's decision making process in achieving business goals. This enables managers to look at

the events that happen in and around a business while considering the needs of the business.

Main aim of cost accounting is to translate estimates and data into knowledge that will ultimately

be used to guide decision making (Mårtensson and et.al., 2016). Outcome of the same are shown

in form of periodic reports. These reports are usually confidential and are for internal use only. In

management accounting, it is required to utilize qualified information and skills for preparing

accounting statements.

The main difference between financial and management accounting is that, FA provides

information which is required by stakeholders in order to assist decision and MA put emphasis

on providing data and information for aiding managers in decision making process.

Functions of management accounting system:

Analysis and interpretation of data: For effective planning and decision making data is

analysed in meaningful manner.

1

Facilitates control: It helps in translating given objectives into strategies and plans for

its effective achievement of goals.

Provides data: Management accounting provides relevant data for past progress and for

making future forecast. Means of communication: Forwarding plans upward, downwards and outwards through

organization.

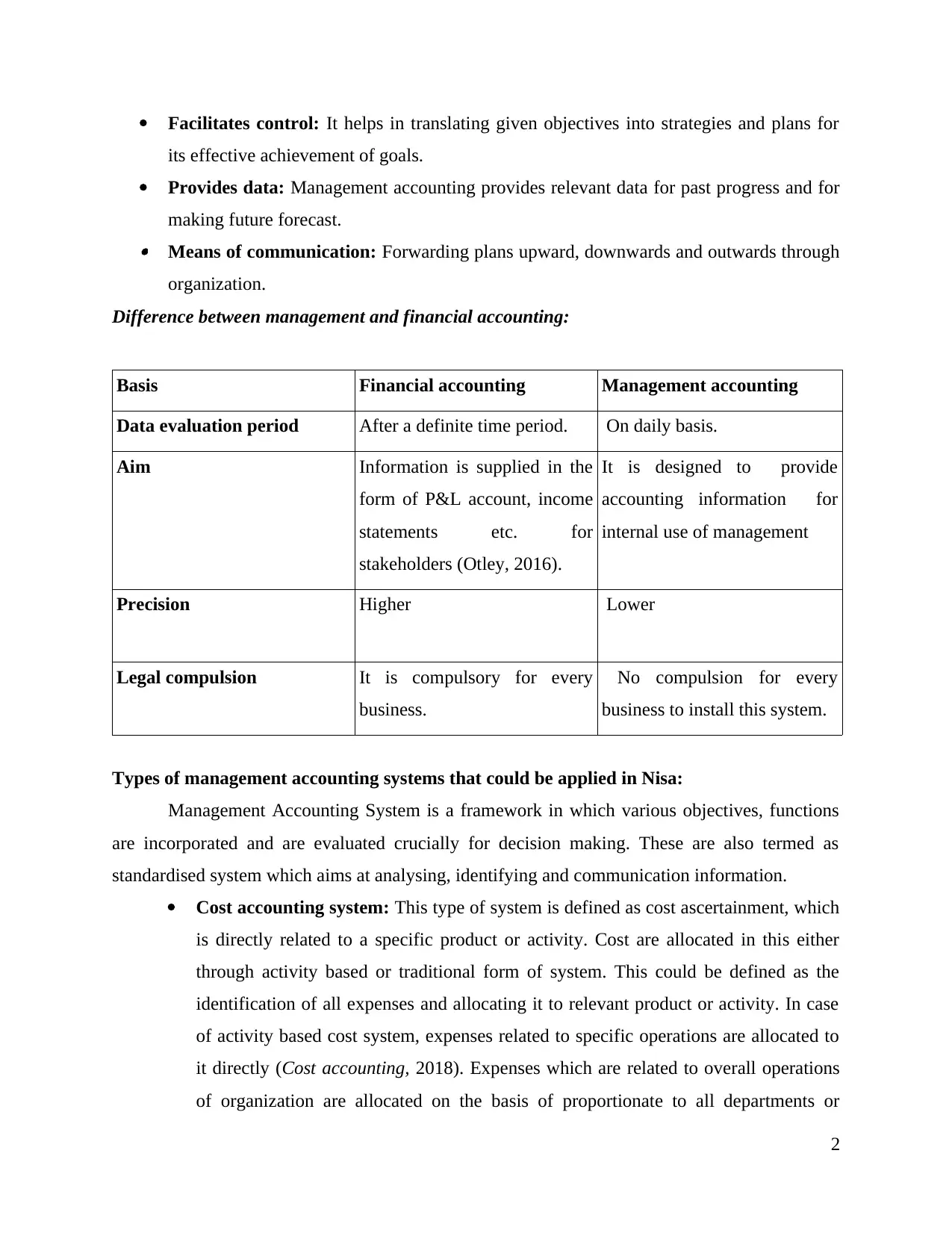

Difference between management and financial accounting:

Basis Financial accounting Management accounting

Data evaluation period After a definite time period. On daily basis.

Aim Information is supplied in the

form of P&L account, income

statements etc. for

stakeholders (Otley, 2016).

It is designed to provide

accounting information for

internal use of management

Precision Higher Lower

Legal compulsion It is compulsory for every

business.

No compulsion for every

business to install this system.

Types of management accounting systems that could be applied in Nisa:

Management Accounting System is a framework in which various objectives, functions

are incorporated and are evaluated crucially for decision making. These are also termed as

standardised system which aims at analysing, identifying and communication information.

Cost accounting system: This type of system is defined as cost ascertainment, which

is directly related to a specific product or activity. Cost are allocated in this either

through activity based or traditional form of system. This could be defined as the

identification of all expenses and allocating it to relevant product or activity. In case

of activity based cost system, expenses related to specific operations are allocated to

it directly (Cost accounting, 2018). Expenses which are related to overall operations

of organization are allocated on the basis of proportionate to all departments or

2

its effective achievement of goals.

Provides data: Management accounting provides relevant data for past progress and for

making future forecast. Means of communication: Forwarding plans upward, downwards and outwards through

organization.

Difference between management and financial accounting:

Basis Financial accounting Management accounting

Data evaluation period After a definite time period. On daily basis.

Aim Information is supplied in the

form of P&L account, income

statements etc. for

stakeholders (Otley, 2016).

It is designed to provide

accounting information for

internal use of management

Precision Higher Lower

Legal compulsion It is compulsory for every

business.

No compulsion for every

business to install this system.

Types of management accounting systems that could be applied in Nisa:

Management Accounting System is a framework in which various objectives, functions

are incorporated and are evaluated crucially for decision making. These are also termed as

standardised system which aims at analysing, identifying and communication information.

Cost accounting system: This type of system is defined as cost ascertainment, which

is directly related to a specific product or activity. Cost are allocated in this either

through activity based or traditional form of system. This could be defined as the

identification of all expenses and allocating it to relevant product or activity. In case

of activity based cost system, expenses related to specific operations are allocated to

it directly (Cost accounting, 2018). Expenses which are related to overall operations

of organization are allocated on the basis of proportionate to all departments or

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

activities. Cost is measured and recorded individually in order to assist management

in decisions which are related to inventory and control of expenses for any specific

area of business.

Job Costing System: In this system, main emphasis is given to allocation of

manufacturing cost of individual component produced in Nisa. This system is applied

in the cases where processes related with production of various goods, differ from

each other. Also, the determination of data and financial information related with cost

of particular product or job is done. This system would help Nisa in providing it with

information related to particular job performed for consumer under contract in which

costs are refundable (Renz, 2016). Organization is also assisted in executing cost per

unit of a product accurately and aids management in deciding the sales price that

could be quoted for specific products.

Inventory Management System: This system controls and oversees inventory

orders. In other words, it justifies that how and when order is to be placed for raw

materials to ensure smooth production activity. In this, components are stored and

used so that production and sales of goods could be kept in proper order. This system

enables keeping record of inventories that are sold in stores of Nisa. It also

determines units of various products that are required to maintain in stock so that

goods are readily available for sales in its stores (Cooper, Ezzamel and Qu, 2017).

The function that is performed in this system is; creation of purchase orders,

allocating, receiving, storing, disposing and adjusting the inventory which are

accompanied by functions related to sales orders, shipping and packaging from Nisa

outlet is performed.

Price optimisation system: This system makes use of mathematical analysis in Nisa,

which helps in determining how consumers will react to different prices for their

products and services distributed through various channels. Main objective of this

system in Nisa is to maximise operating profits and to determine prices.

P 2. Different methods used by Nisa for management accounting reporting

Accounting reports are methods of ensuring complete picture of business performance. A

comprehensive report is produced every quarter to give holistic view of business finances of

Nisa. This is especially crucial for Nisa to derive important strategic insights from these crucial

3

in decisions which are related to inventory and control of expenses for any specific

area of business.

Job Costing System: In this system, main emphasis is given to allocation of

manufacturing cost of individual component produced in Nisa. This system is applied

in the cases where processes related with production of various goods, differ from

each other. Also, the determination of data and financial information related with cost

of particular product or job is done. This system would help Nisa in providing it with

information related to particular job performed for consumer under contract in which

costs are refundable (Renz, 2016). Organization is also assisted in executing cost per

unit of a product accurately and aids management in deciding the sales price that

could be quoted for specific products.

Inventory Management System: This system controls and oversees inventory

orders. In other words, it justifies that how and when order is to be placed for raw

materials to ensure smooth production activity. In this, components are stored and

used so that production and sales of goods could be kept in proper order. This system

enables keeping record of inventories that are sold in stores of Nisa. It also

determines units of various products that are required to maintain in stock so that

goods are readily available for sales in its stores (Cooper, Ezzamel and Qu, 2017).

The function that is performed in this system is; creation of purchase orders,

allocating, receiving, storing, disposing and adjusting the inventory which are

accompanied by functions related to sales orders, shipping and packaging from Nisa

outlet is performed.

Price optimisation system: This system makes use of mathematical analysis in Nisa,

which helps in determining how consumers will react to different prices for their

products and services distributed through various channels. Main objective of this

system in Nisa is to maximise operating profits and to determine prices.

P 2. Different methods used by Nisa for management accounting reporting

Accounting reports are methods of ensuring complete picture of business performance. A

comprehensive report is produced every quarter to give holistic view of business finances of

Nisa. This is especially crucial for Nisa to derive important strategic insights from these crucial

3

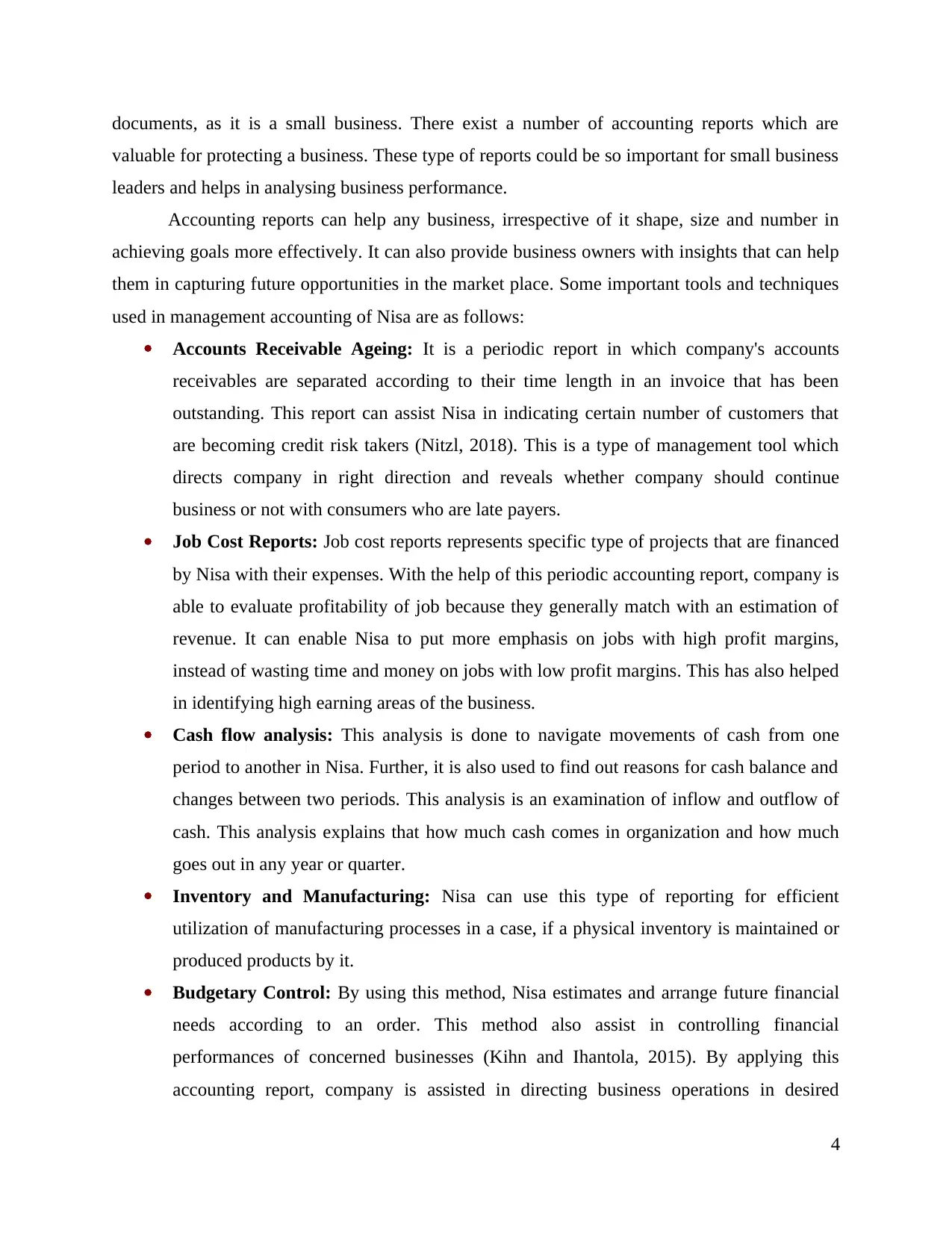

documents, as it is a small business. There exist a number of accounting reports which are

valuable for protecting a business. These type of reports could be so important for small business

leaders and helps in analysing business performance.

Accounting reports can help any business, irrespective of it shape, size and number in

achieving goals more effectively. It can also provide business owners with insights that can help

them in capturing future opportunities in the market place. Some important tools and techniques

used in management accounting of Nisa are as follows:

Accounts Receivable Ageing: It is a periodic report in which company's accounts

receivables are separated according to their time length in an invoice that has been

outstanding. This report can assist Nisa in indicating certain number of customers that

are becoming credit risk takers (Nitzl, 2018). This is a type of management tool which

directs company in right direction and reveals whether company should continue

business or not with consumers who are late payers.

Job Cost Reports: Job cost reports represents specific type of projects that are financed

by Nisa with their expenses. With the help of this periodic accounting report, company is

able to evaluate profitability of job because they generally match with an estimation of

revenue. It can enable Nisa to put more emphasis on jobs with high profit margins,

instead of wasting time and money on jobs with low profit margins. This has also helped

in identifying high earning areas of the business.

Cash flow analysis: This analysis is done to navigate movements of cash from one

period to another in Nisa. Further, it is also used to find out reasons for cash balance and

changes between two periods. This analysis is an examination of inflow and outflow of

cash. This analysis explains that how much cash comes in organization and how much

goes out in any year or quarter.

Inventory and Manufacturing: Nisa can use this type of reporting for efficient

utilization of manufacturing processes in a case, if a physical inventory is maintained or

produced products by it.

Budgetary Control: By using this method, Nisa estimates and arrange future financial

needs according to an order. This method also assist in controlling financial

performances of concerned businesses (Kihn and Ihantola, 2015). By applying this

accounting report, company is assisted in directing business operations in desired

4

valuable for protecting a business. These type of reports could be so important for small business

leaders and helps in analysing business performance.

Accounting reports can help any business, irrespective of it shape, size and number in

achieving goals more effectively. It can also provide business owners with insights that can help

them in capturing future opportunities in the market place. Some important tools and techniques

used in management accounting of Nisa are as follows:

Accounts Receivable Ageing: It is a periodic report in which company's accounts

receivables are separated according to their time length in an invoice that has been

outstanding. This report can assist Nisa in indicating certain number of customers that

are becoming credit risk takers (Nitzl, 2018). This is a type of management tool which

directs company in right direction and reveals whether company should continue

business or not with consumers who are late payers.

Job Cost Reports: Job cost reports represents specific type of projects that are financed

by Nisa with their expenses. With the help of this periodic accounting report, company is

able to evaluate profitability of job because they generally match with an estimation of

revenue. It can enable Nisa to put more emphasis on jobs with high profit margins,

instead of wasting time and money on jobs with low profit margins. This has also helped

in identifying high earning areas of the business.

Cash flow analysis: This analysis is done to navigate movements of cash from one

period to another in Nisa. Further, it is also used to find out reasons for cash balance and

changes between two periods. This analysis is an examination of inflow and outflow of

cash. This analysis explains that how much cash comes in organization and how much

goes out in any year or quarter.

Inventory and Manufacturing: Nisa can use this type of reporting for efficient

utilization of manufacturing processes in a case, if a physical inventory is maintained or

produced products by it.

Budgetary Control: By using this method, Nisa estimates and arrange future financial

needs according to an order. This method also assist in controlling financial

performances of concerned businesses (Kihn and Ihantola, 2015). By applying this

accounting report, company is assisted in directing business operations in desired

4

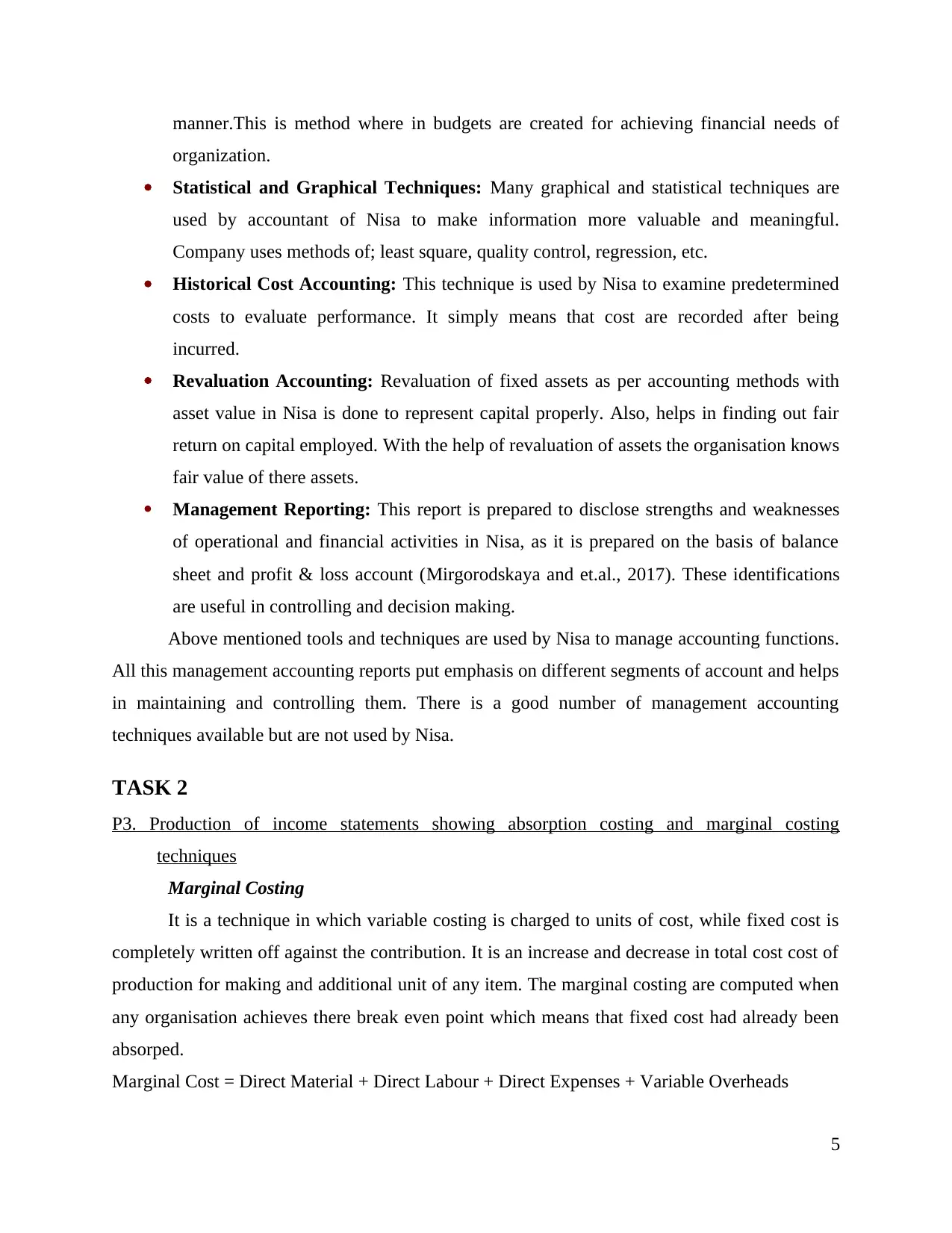

manner.This is method where in budgets are created for achieving financial needs of

organization.

Statistical and Graphical Techniques: Many graphical and statistical techniques are

used by accountant of Nisa to make information more valuable and meaningful.

Company uses methods of; least square, quality control, regression, etc.

Historical Cost Accounting: This technique is used by Nisa to examine predetermined

costs to evaluate performance. It simply means that cost are recorded after being

incurred.

Revaluation Accounting: Revaluation of fixed assets as per accounting methods with

asset value in Nisa is done to represent capital properly. Also, helps in finding out fair

return on capital employed. With the help of revaluation of assets the organisation knows

fair value of there assets.

Management Reporting: This report is prepared to disclose strengths and weaknesses

of operational and financial activities in Nisa, as it is prepared on the basis of balance

sheet and profit & loss account (Mirgorodskaya and et.al., 2017). These identifications

are useful in controlling and decision making.

Above mentioned tools and techniques are used by Nisa to manage accounting functions.

All this management accounting reports put emphasis on different segments of account and helps

in maintaining and controlling them. There is a good number of management accounting

techniques available but are not used by Nisa.

TASK 2

P3. Production of income statements showing absorption costing and marginal costing

techniques

Marginal Costing

It is a technique in which variable costing is charged to units of cost, while fixed cost is

completely written off against the contribution. It is an increase and decrease in total cost cost of

production for making and additional unit of any item. The marginal costing are computed when

any organisation achieves there break even point which means that fixed cost had already been

absorped.

Marginal Cost = Direct Material + Direct Labour + Direct Expenses + Variable Overheads

5

organization.

Statistical and Graphical Techniques: Many graphical and statistical techniques are

used by accountant of Nisa to make information more valuable and meaningful.

Company uses methods of; least square, quality control, regression, etc.

Historical Cost Accounting: This technique is used by Nisa to examine predetermined

costs to evaluate performance. It simply means that cost are recorded after being

incurred.

Revaluation Accounting: Revaluation of fixed assets as per accounting methods with

asset value in Nisa is done to represent capital properly. Also, helps in finding out fair

return on capital employed. With the help of revaluation of assets the organisation knows

fair value of there assets.

Management Reporting: This report is prepared to disclose strengths and weaknesses

of operational and financial activities in Nisa, as it is prepared on the basis of balance

sheet and profit & loss account (Mirgorodskaya and et.al., 2017). These identifications

are useful in controlling and decision making.

Above mentioned tools and techniques are used by Nisa to manage accounting functions.

All this management accounting reports put emphasis on different segments of account and helps

in maintaining and controlling them. There is a good number of management accounting

techniques available but are not used by Nisa.

TASK 2

P3. Production of income statements showing absorption costing and marginal costing

techniques

Marginal Costing

It is a technique in which variable costing is charged to units of cost, while fixed cost is

completely written off against the contribution. It is an increase and decrease in total cost cost of

production for making and additional unit of any item. The marginal costing are computed when

any organisation achieves there break even point which means that fixed cost had already been

absorped.

Marginal Cost = Direct Material + Direct Labour + Direct Expenses + Variable Overheads

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

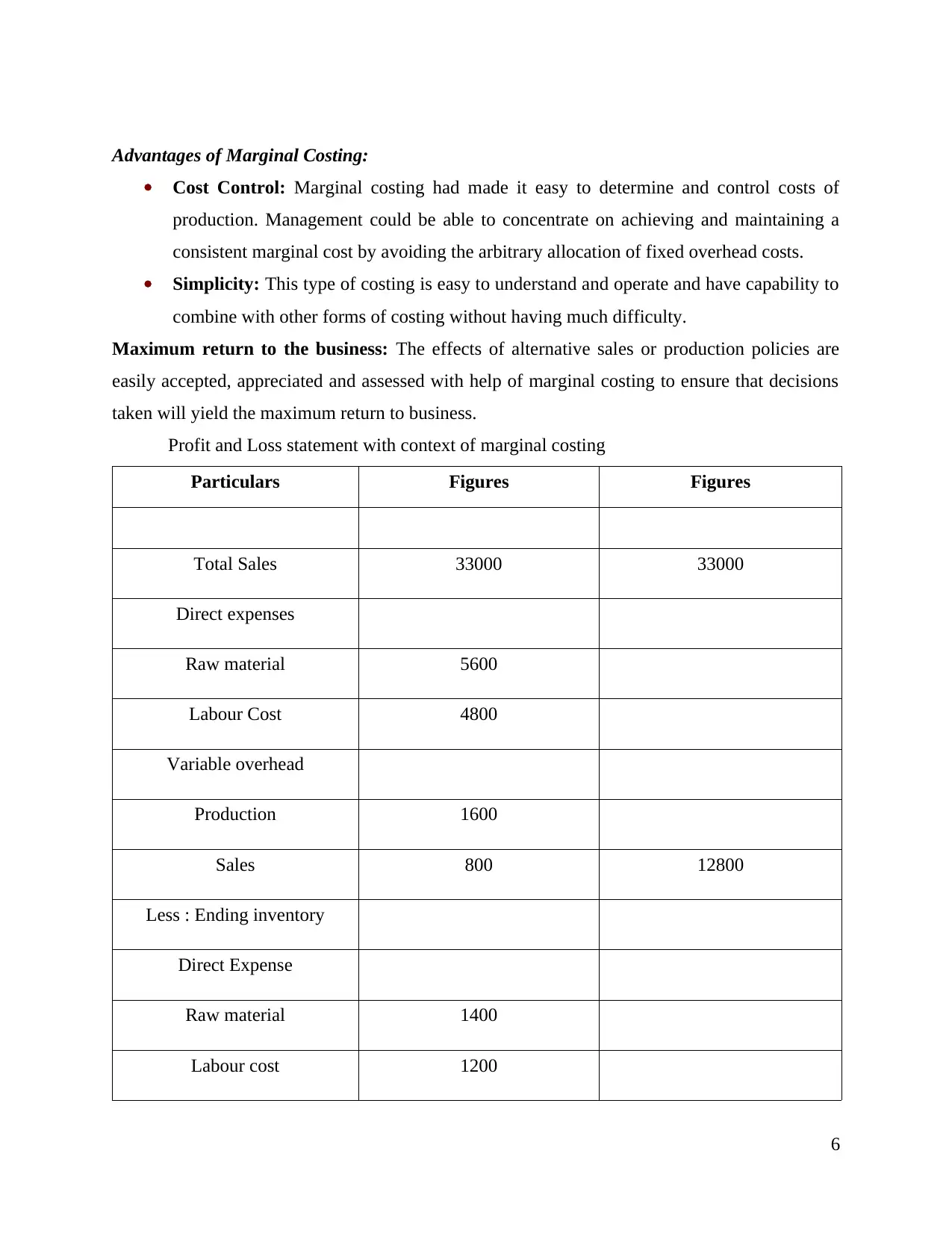

Advantages of Marginal Costing:

Cost Control: Marginal costing had made it easy to determine and control costs of

production. Management could be able to concentrate on achieving and maintaining a

consistent marginal cost by avoiding the arbitrary allocation of fixed overhead costs.

Simplicity: This type of costing is easy to understand and operate and have capability to

combine with other forms of costing without having much difficulty.

Maximum return to the business: The effects of alternative sales or production policies are

easily accepted, appreciated and assessed with help of marginal costing to ensure that decisions

taken will yield the maximum return to business.

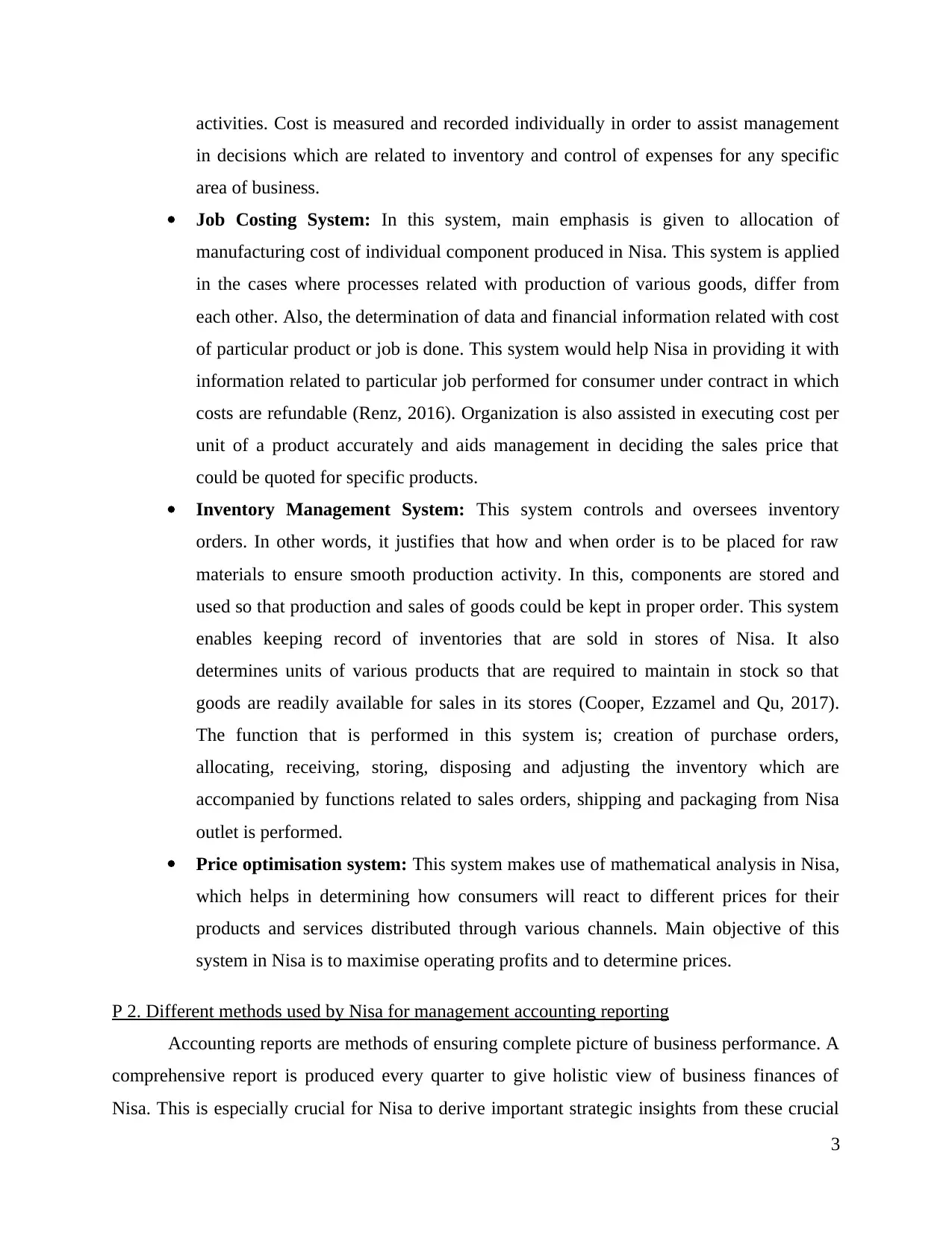

Profit and Loss statement with context of marginal costing

Particulars Figures Figures

Total Sales 33000 33000

Direct expenses

Raw material 5600

Labour Cost 4800

Variable overhead

Production 1600

Sales 800 12800

Less : Ending inventory

Direct Expense

Raw material 1400

Labour cost 1200

6

Cost Control: Marginal costing had made it easy to determine and control costs of

production. Management could be able to concentrate on achieving and maintaining a

consistent marginal cost by avoiding the arbitrary allocation of fixed overhead costs.

Simplicity: This type of costing is easy to understand and operate and have capability to

combine with other forms of costing without having much difficulty.

Maximum return to the business: The effects of alternative sales or production policies are

easily accepted, appreciated and assessed with help of marginal costing to ensure that decisions

taken will yield the maximum return to business.

Profit and Loss statement with context of marginal costing

Particulars Figures Figures

Total Sales 33000 33000

Direct expenses

Raw material 5600

Labour Cost 4800

Variable overhead

Production 1600

Sales 800 12800

Less : Ending inventory

Direct Expense

Raw material 1400

Labour cost 1200

6

Variable Overhead

Production 400

Sales 200 3200

Production expense of per unit 9600

23400

Less: Fixed expense

Production O/H 3200

Fixed cost

Administrative expense 1200

Selling cost 1500

5900

Net Profit margin 17500

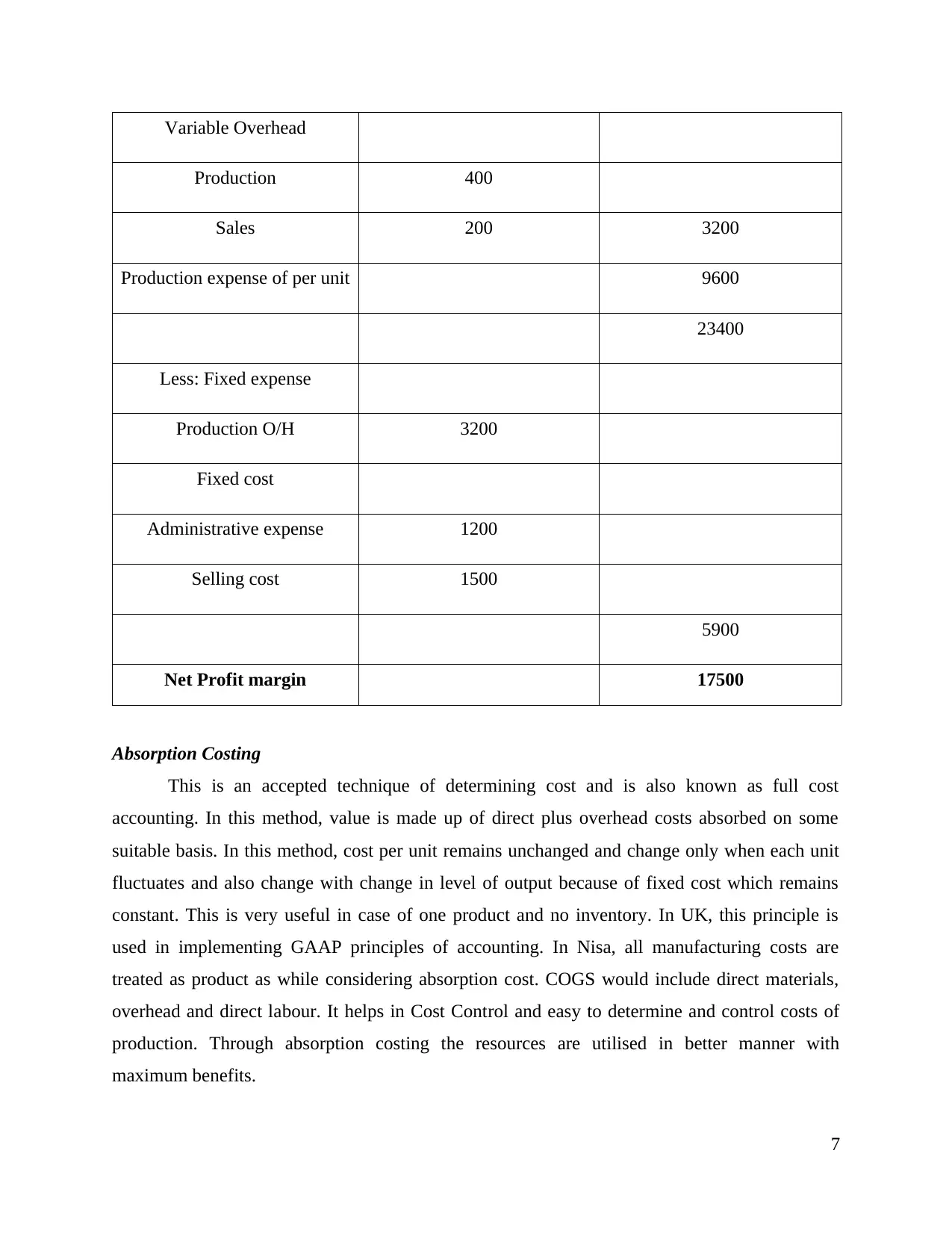

Absorption Costing

This is an accepted technique of determining cost and is also known as full cost

accounting. In this method, value is made up of direct plus overhead costs absorbed on some

suitable basis. In this method, cost per unit remains unchanged and change only when each unit

fluctuates and also change with change in level of output because of fixed cost which remains

constant. This is very useful in case of one product and no inventory. In UK, this principle is

used in implementing GAAP principles of accounting. In Nisa, all manufacturing costs are

treated as product as while considering absorption cost. COGS would include direct materials,

overhead and direct labour. It helps in Cost Control and easy to determine and control costs of

production. Through absorption costing the resources are utilised in better manner with

maximum benefits.

7

Production 400

Sales 200 3200

Production expense of per unit 9600

23400

Less: Fixed expense

Production O/H 3200

Fixed cost

Administrative expense 1200

Selling cost 1500

5900

Net Profit margin 17500

Absorption Costing

This is an accepted technique of determining cost and is also known as full cost

accounting. In this method, value is made up of direct plus overhead costs absorbed on some

suitable basis. In this method, cost per unit remains unchanged and change only when each unit

fluctuates and also change with change in level of output because of fixed cost which remains

constant. This is very useful in case of one product and no inventory. In UK, this principle is

used in implementing GAAP principles of accounting. In Nisa, all manufacturing costs are

treated as product as while considering absorption cost. COGS would include direct materials,

overhead and direct labour. It helps in Cost Control and easy to determine and control costs of

production. Through absorption costing the resources are utilised in better manner with

maximum benefits.

7

Management could be able to concentrate on achieving and maintaining a consistent

marginal cost by avoiding the arbitrary allocation of fixed overhead costs. This type of costing is

easy to understand and operate and have capability to combine with other forms of costing

without having much difficulty.

Maximum return to the business: The effects of alternative sales or production policies are

easily accepted, appreciated and assessed with help of marginal costing to ensure that decisions

taken will yield the maximum return to business. They help in maximising return of any

organisation through effective utilization of resources.

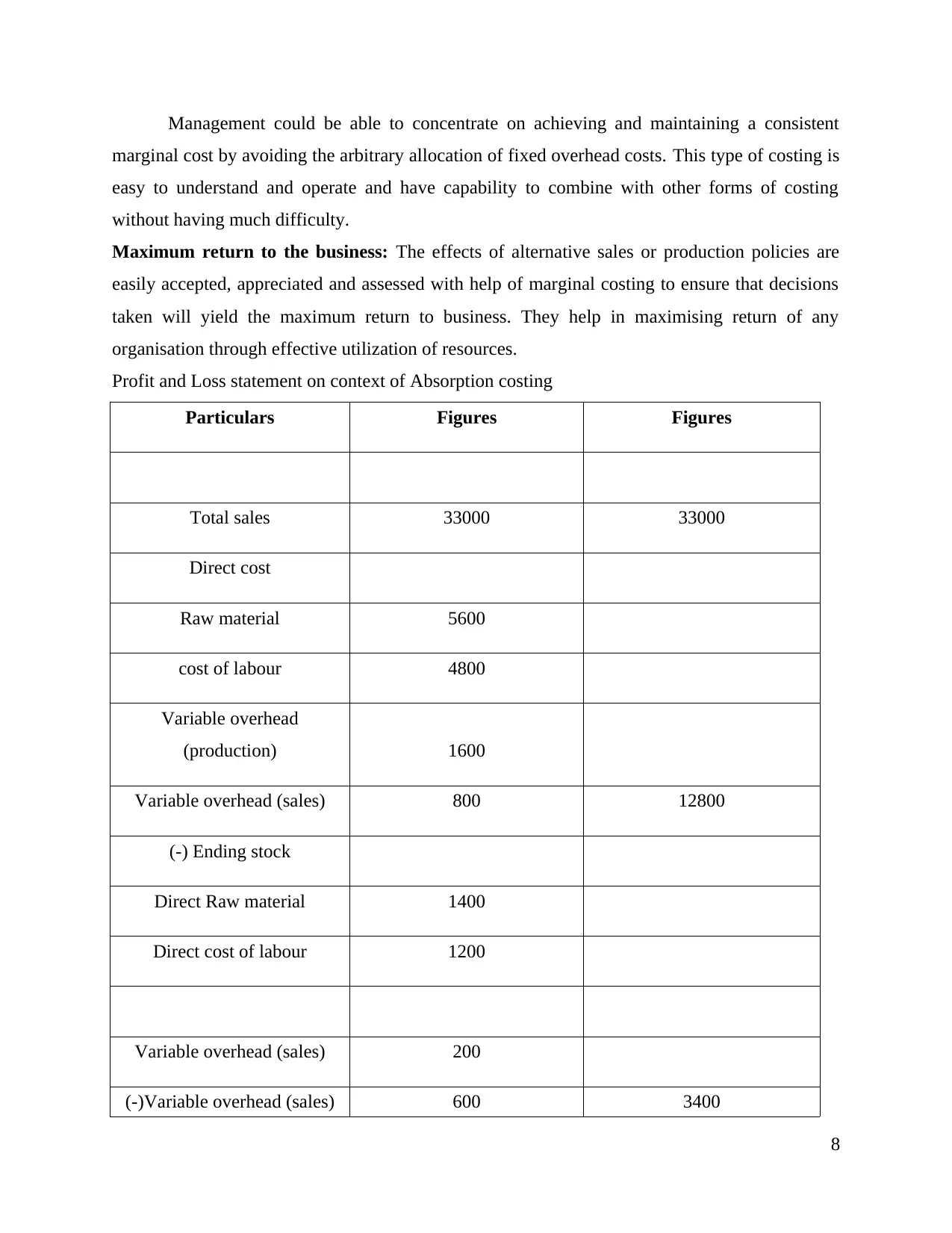

Profit and Loss statement on context of Absorption costing

Particulars Figures Figures

Total sales 33000 33000

Direct cost

Raw material 5600

cost of labour 4800

Variable overhead

(production) 1600

Variable overhead (sales) 800 12800

(-) Ending stock

Direct Raw material 1400

Direct cost of labour 1200

Variable overhead (sales) 200

(-)Variable overhead (sales) 600 3400

8

marginal cost by avoiding the arbitrary allocation of fixed overhead costs. This type of costing is

easy to understand and operate and have capability to combine with other forms of costing

without having much difficulty.

Maximum return to the business: The effects of alternative sales or production policies are

easily accepted, appreciated and assessed with help of marginal costing to ensure that decisions

taken will yield the maximum return to business. They help in maximising return of any

organisation through effective utilization of resources.

Profit and Loss statement on context of Absorption costing

Particulars Figures Figures

Total sales 33000 33000

Direct cost

Raw material 5600

cost of labour 4800

Variable overhead

(production) 1600

Variable overhead (sales) 800 12800

(-) Ending stock

Direct Raw material 1400

Direct cost of labour 1200

Variable overhead (sales) 200

(-)Variable overhead (sales) 600 3400

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

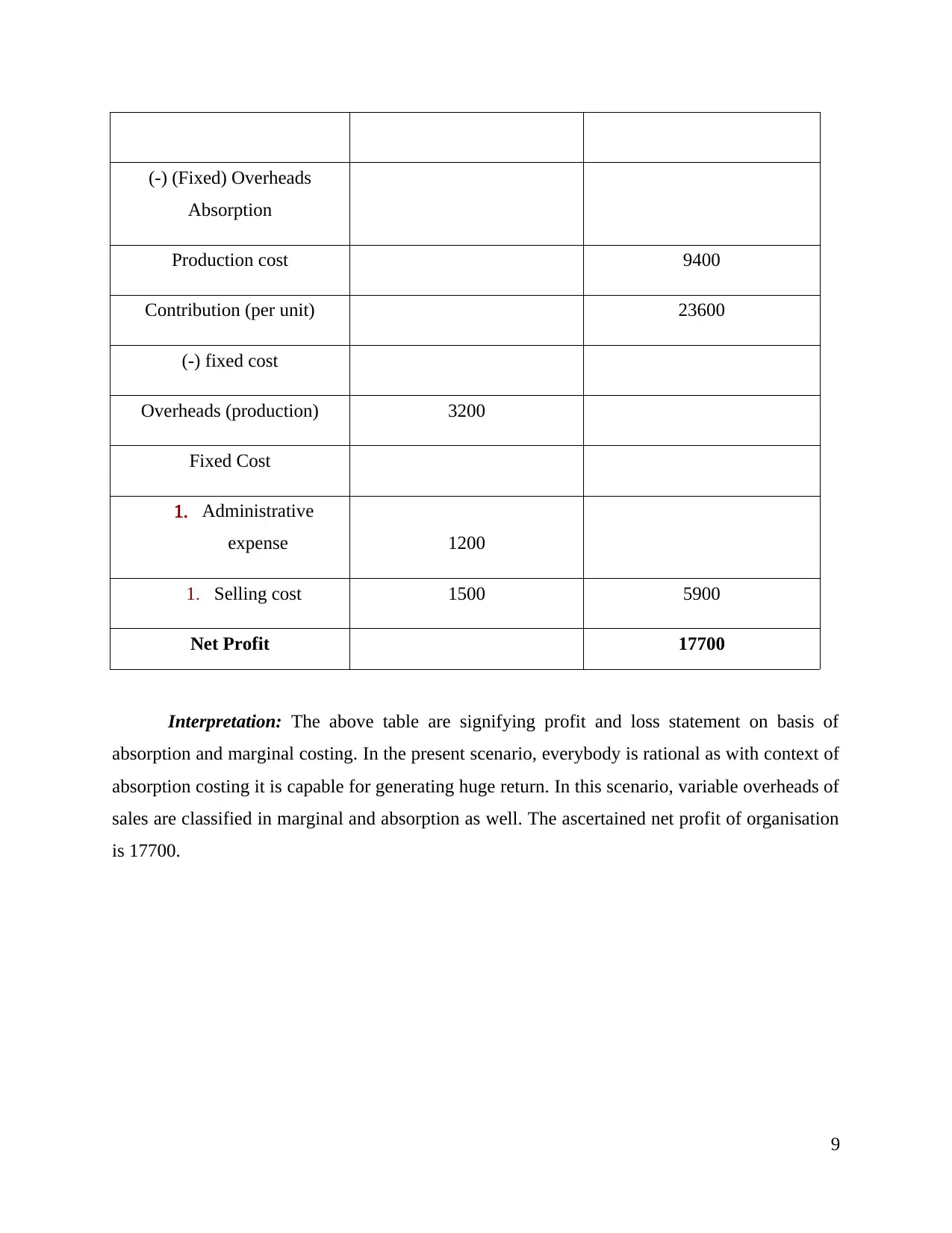

(-) (Fixed) Overheads

Absorption

Production cost 9400

Contribution (per unit) 23600

(-) fixed cost

Overheads (production) 3200

Fixed Cost

1. Administrative

expense 1200

1. Selling cost 1500 5900

Net Profit 17700

Interpretation: The above table are signifying profit and loss statement on basis of

absorption and marginal costing. In the present scenario, everybody is rational as with context of

absorption costing it is capable for generating huge return. In this scenario, variable overheads of

sales are classified in marginal and absorption as well. The ascertained net profit of organisation

is 17700.

9

Absorption

Production cost 9400

Contribution (per unit) 23600

(-) fixed cost

Overheads (production) 3200

Fixed Cost

1. Administrative

expense 1200

1. Selling cost 1500 5900

Net Profit 17700

Interpretation: The above table are signifying profit and loss statement on basis of

absorption and marginal costing. In the present scenario, everybody is rational as with context of

absorption costing it is capable for generating huge return. In this scenario, variable overheads of

sales are classified in marginal and absorption as well. The ascertained net profit of organisation

is 17700.

9

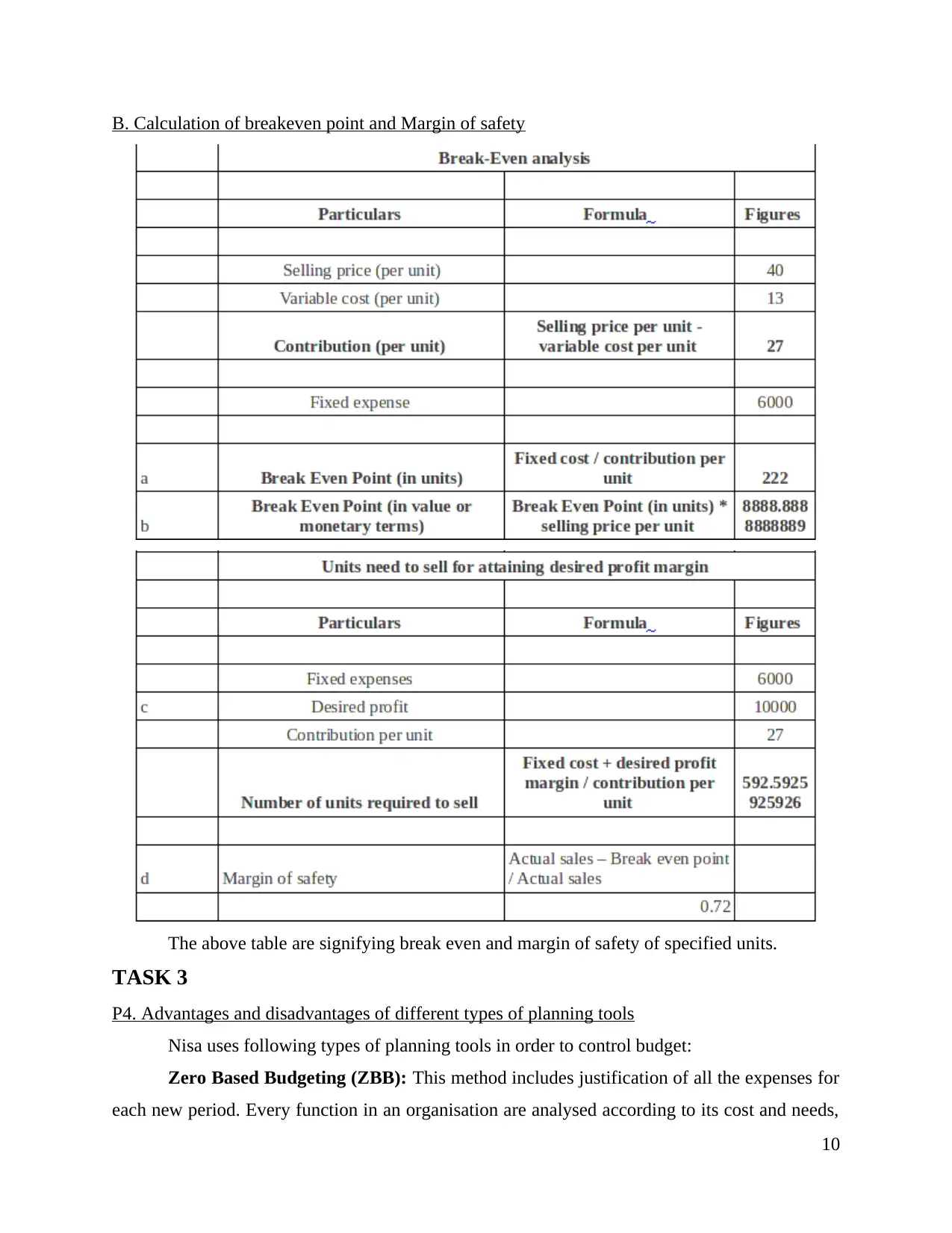

B. Calculation of breakeven point and Margin of safety

The above table are signifying break even and margin of safety of specified units.

TASK 3

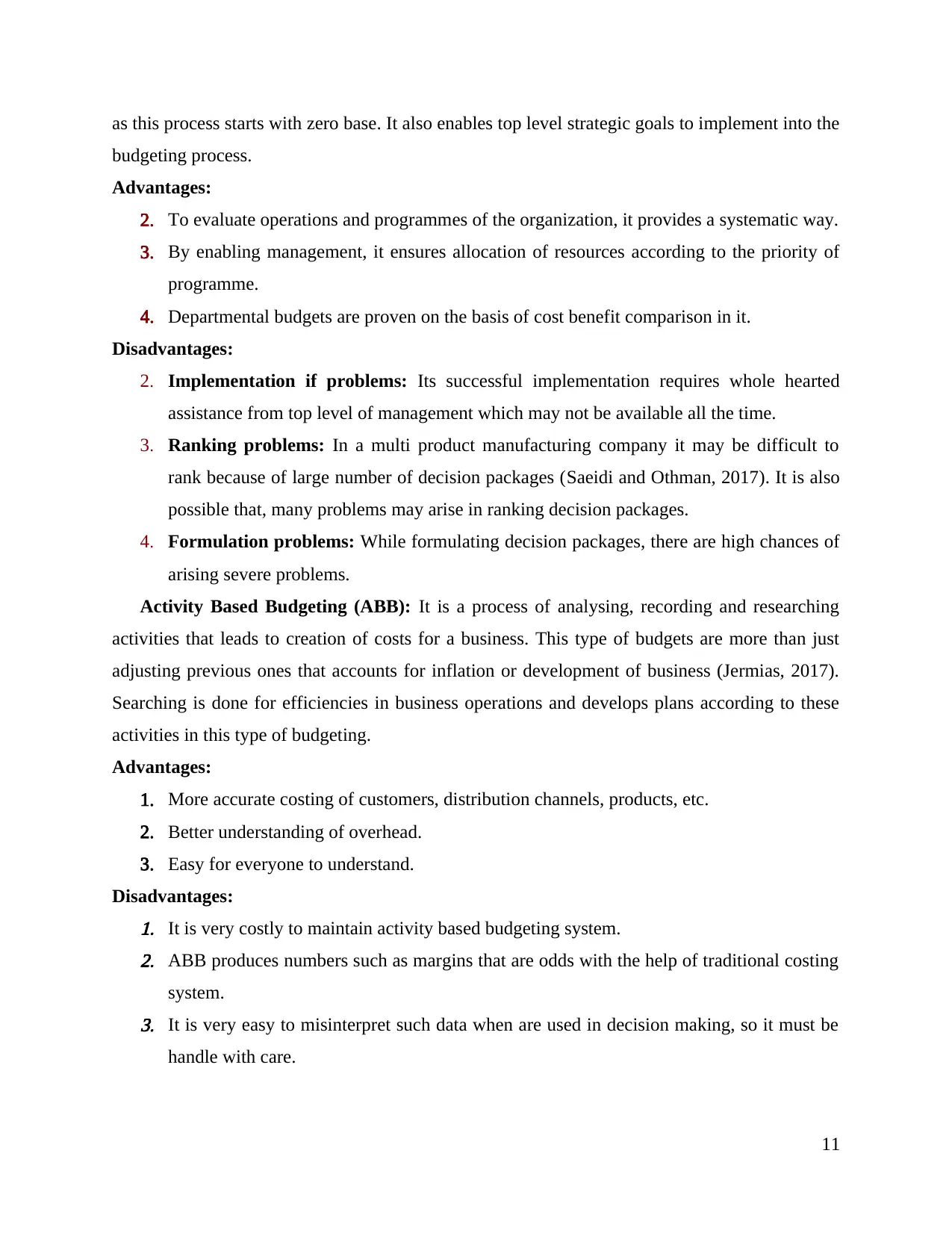

P4. Advantages and disadvantages of different types of planning tools

Nisa uses following types of planning tools in order to control budget:

Zero Based Budgeting (ZBB): This method includes justification of all the expenses for

each new period. Every function in an organisation are analysed according to its cost and needs,

10

The above table are signifying break even and margin of safety of specified units.

TASK 3

P4. Advantages and disadvantages of different types of planning tools

Nisa uses following types of planning tools in order to control budget:

Zero Based Budgeting (ZBB): This method includes justification of all the expenses for

each new period. Every function in an organisation are analysed according to its cost and needs,

10

as this process starts with zero base. It also enables top level strategic goals to implement into the

budgeting process.

Advantages:

2. To evaluate operations and programmes of the organization, it provides a systematic way.

3. By enabling management, it ensures allocation of resources according to the priority of

programme.

4. Departmental budgets are proven on the basis of cost benefit comparison in it.

Disadvantages:

2. Implementation if problems: Its successful implementation requires whole hearted

assistance from top level of management which may not be available all the time.

3. Ranking problems: In a multi product manufacturing company it may be difficult to

rank because of large number of decision packages (Saeidi and Othman, 2017). It is also

possible that, many problems may arise in ranking decision packages.

4. Formulation problems: While formulating decision packages, there are high chances of

arising severe problems.

Activity Based Budgeting (ABB): It is a process of analysing, recording and researching

activities that leads to creation of costs for a business. This type of budgets are more than just

adjusting previous ones that accounts for inflation or development of business (Jermias, 2017).

Searching is done for efficiencies in business operations and develops plans according to these

activities in this type of budgeting.

Advantages:

1. More accurate costing of customers, distribution channels, products, etc.

2. Better understanding of overhead.

3. Easy for everyone to understand.

Disadvantages:1. It is very costly to maintain activity based budgeting system.2. ABB produces numbers such as margins that are odds with the help of traditional costing

system.3. It is very easy to misinterpret such data when are used in decision making, so it must be

handle with care.

11

budgeting process.

Advantages:

2. To evaluate operations and programmes of the organization, it provides a systematic way.

3. By enabling management, it ensures allocation of resources according to the priority of

programme.

4. Departmental budgets are proven on the basis of cost benefit comparison in it.

Disadvantages:

2. Implementation if problems: Its successful implementation requires whole hearted

assistance from top level of management which may not be available all the time.

3. Ranking problems: In a multi product manufacturing company it may be difficult to

rank because of large number of decision packages (Saeidi and Othman, 2017). It is also

possible that, many problems may arise in ranking decision packages.

4. Formulation problems: While formulating decision packages, there are high chances of

arising severe problems.

Activity Based Budgeting (ABB): It is a process of analysing, recording and researching

activities that leads to creation of costs for a business. This type of budgets are more than just

adjusting previous ones that accounts for inflation or development of business (Jermias, 2017).

Searching is done for efficiencies in business operations and develops plans according to these

activities in this type of budgeting.

Advantages:

1. More accurate costing of customers, distribution channels, products, etc.

2. Better understanding of overhead.

3. Easy for everyone to understand.

Disadvantages:1. It is very costly to maintain activity based budgeting system.2. ABB produces numbers such as margins that are odds with the help of traditional costing

system.3. It is very easy to misinterpret such data when are used in decision making, so it must be

handle with care.

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

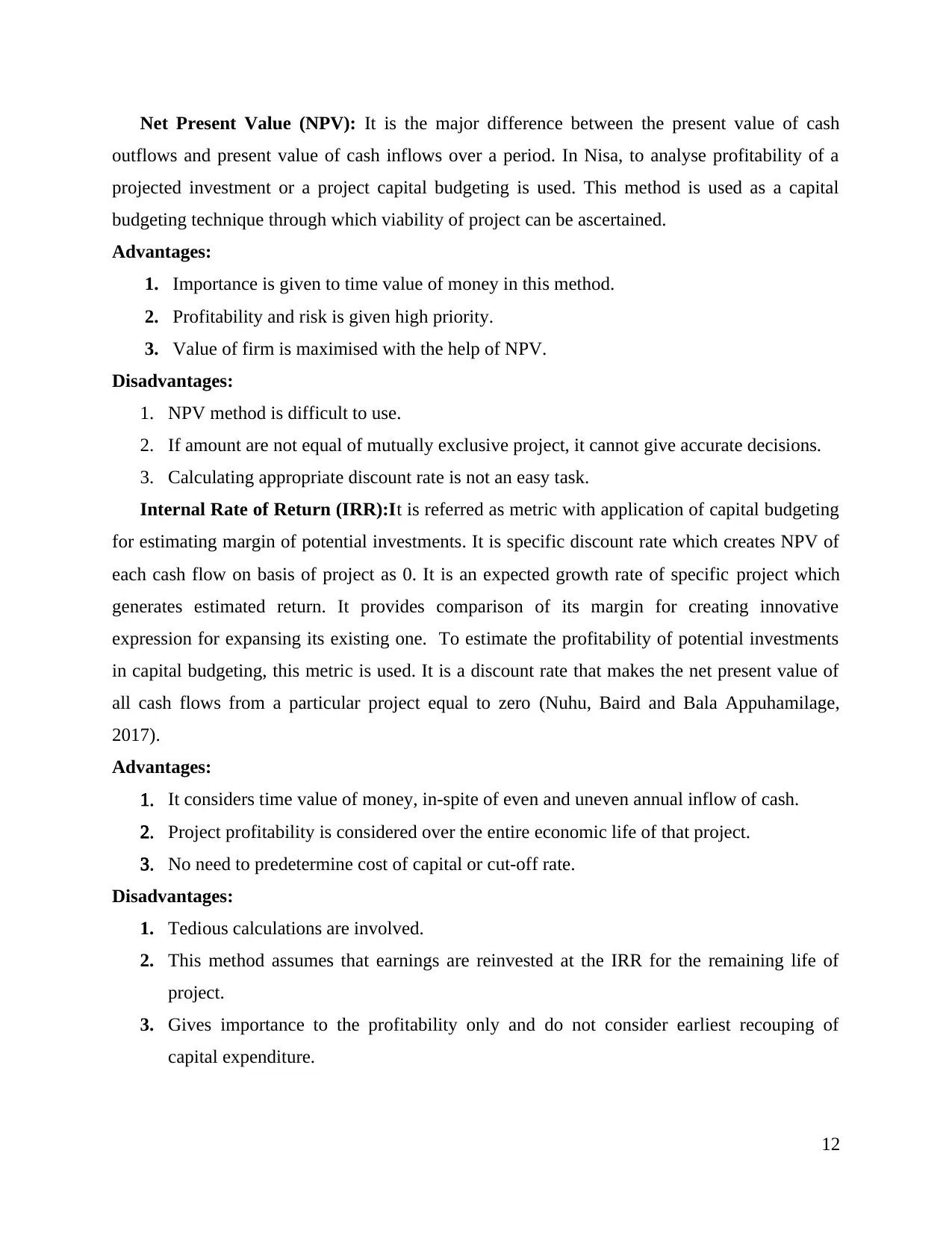

Net Present Value (NPV): It is the major difference between the present value of cash

outflows and present value of cash inflows over a period. In Nisa, to analyse profitability of a

projected investment or a project capital budgeting is used. This method is used as a capital

budgeting technique through which viability of project can be ascertained.

Advantages:

1. Importance is given to time value of money in this method.

2. Profitability and risk is given high priority.

3. Value of firm is maximised with the help of NPV.

Disadvantages:

1. NPV method is difficult to use.

2. If amount are not equal of mutually exclusive project, it cannot give accurate decisions.

3. Calculating appropriate discount rate is not an easy task.

Internal Rate of Return (IRR):It is referred as metric with application of capital budgeting

for estimating margin of potential investments. It is specific discount rate which creates NPV of

each cash flow on basis of project as 0. It is an expected growth rate of specific project which

generates estimated return. It provides comparison of its margin for creating innovative

expression for expansing its existing one. To estimate the profitability of potential investments

in capital budgeting, this metric is used. It is a discount rate that makes the net present value of

all cash flows from a particular project equal to zero (Nuhu, Baird and Bala Appuhamilage,

2017).

Advantages:

1. It considers time value of money, in-spite of even and uneven annual inflow of cash.

2. Project profitability is considered over the entire economic life of that project.

3. No need to predetermine cost of capital or cut-off rate.

Disadvantages:

1. Tedious calculations are involved.

2. This method assumes that earnings are reinvested at the IRR for the remaining life of

project.

3. Gives importance to the profitability only and do not consider earliest recouping of

capital expenditure.

12

outflows and present value of cash inflows over a period. In Nisa, to analyse profitability of a

projected investment or a project capital budgeting is used. This method is used as a capital

budgeting technique through which viability of project can be ascertained.

Advantages:

1. Importance is given to time value of money in this method.

2. Profitability and risk is given high priority.

3. Value of firm is maximised with the help of NPV.

Disadvantages:

1. NPV method is difficult to use.

2. If amount are not equal of mutually exclusive project, it cannot give accurate decisions.

3. Calculating appropriate discount rate is not an easy task.

Internal Rate of Return (IRR):It is referred as metric with application of capital budgeting

for estimating margin of potential investments. It is specific discount rate which creates NPV of

each cash flow on basis of project as 0. It is an expected growth rate of specific project which

generates estimated return. It provides comparison of its margin for creating innovative

expression for expansing its existing one. To estimate the profitability of potential investments

in capital budgeting, this metric is used. It is a discount rate that makes the net present value of

all cash flows from a particular project equal to zero (Nuhu, Baird and Bala Appuhamilage,

2017).

Advantages:

1. It considers time value of money, in-spite of even and uneven annual inflow of cash.

2. Project profitability is considered over the entire economic life of that project.

3. No need to predetermine cost of capital or cut-off rate.

Disadvantages:

1. Tedious calculations are involved.

2. This method assumes that earnings are reinvested at the IRR for the remaining life of

project.

3. Gives importance to the profitability only and do not consider earliest recouping of

capital expenditure.

12

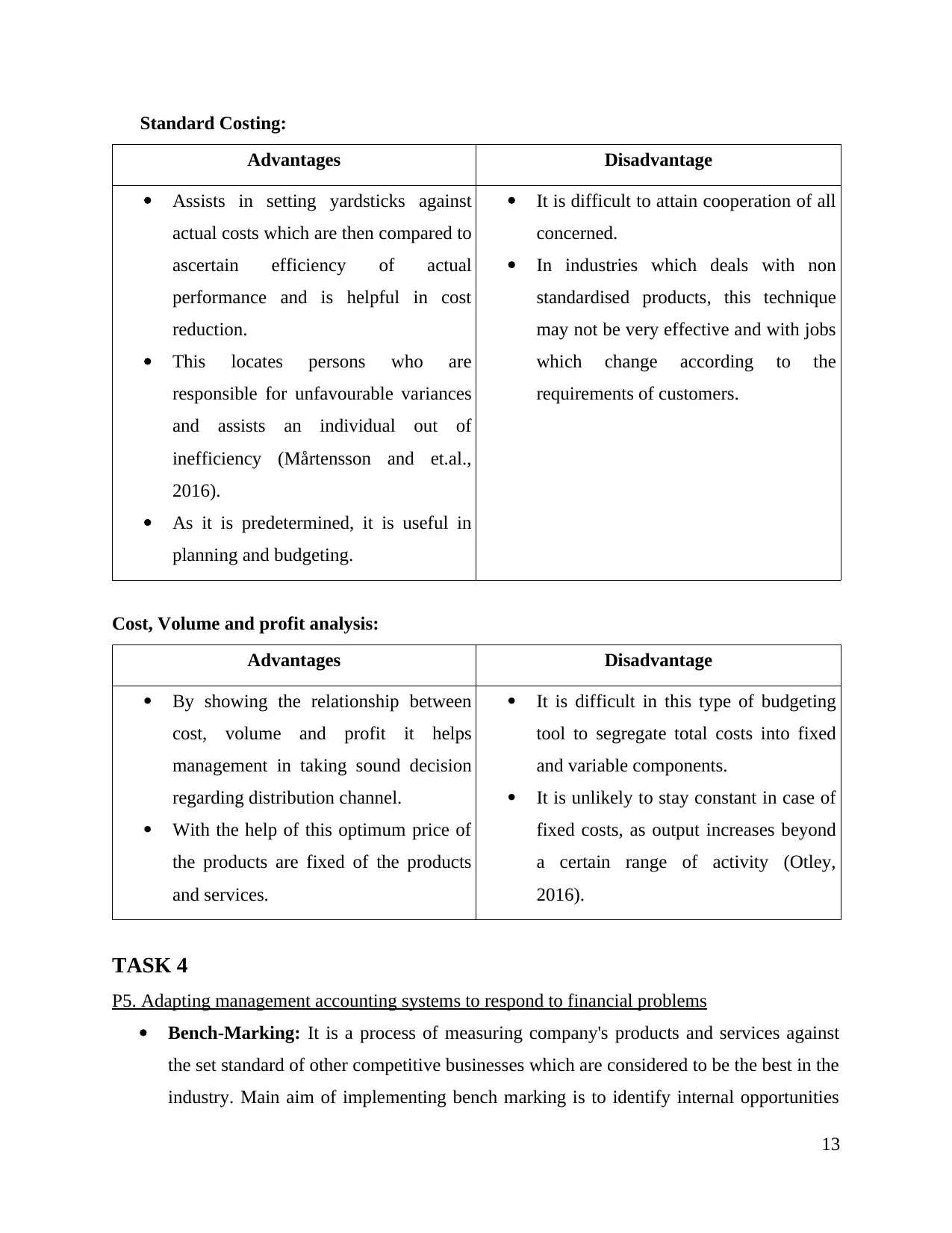

Standard Costing:

Advantages Disadvantage

Assists in setting yardsticks against

actual costs which are then compared to

ascertain efficiency of actual

performance and is helpful in cost

reduction.

This locates persons who are

responsible for unfavourable variances

and assists an individual out of

inefficiency (Mårtensson and et.al.,

2016).

As it is predetermined, it is useful in

planning and budgeting.

It is difficult to attain cooperation of all

concerned.

In industries which deals with non

standardised products, this technique

may not be very effective and with jobs

which change according to the

requirements of customers.

Cost, Volume and profit analysis:

Advantages Disadvantage

By showing the relationship between

cost, volume and profit it helps

management in taking sound decision

regarding distribution channel.

With the help of this optimum price of

the products are fixed of the products

and services.

It is difficult in this type of budgeting

tool to segregate total costs into fixed

and variable components.

It is unlikely to stay constant in case of

fixed costs, as output increases beyond

a certain range of activity (Otley,

2016).

TASK 4

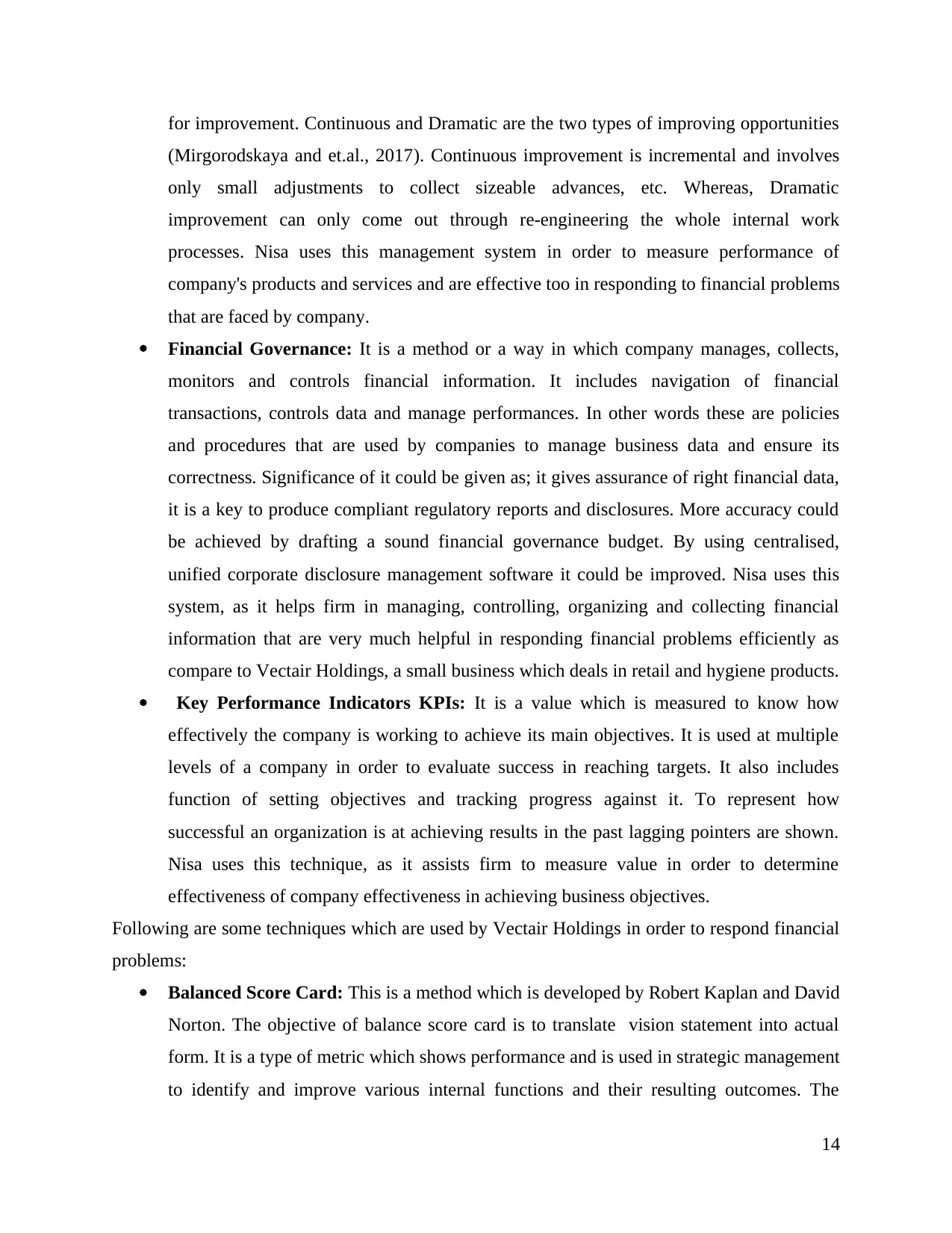

P5. Adapting management accounting systems to respond to financial problems

Bench-Marking: It is a process of measuring company's products and services against

the set standard of other competitive businesses which are considered to be the best in the

industry. Main aim of implementing bench marking is to identify internal opportunities

13

Advantages Disadvantage

Assists in setting yardsticks against

actual costs which are then compared to

ascertain efficiency of actual

performance and is helpful in cost

reduction.

This locates persons who are

responsible for unfavourable variances

and assists an individual out of

inefficiency (Mårtensson and et.al.,

2016).

As it is predetermined, it is useful in

planning and budgeting.

It is difficult to attain cooperation of all

concerned.

In industries which deals with non

standardised products, this technique

may not be very effective and with jobs

which change according to the

requirements of customers.

Cost, Volume and profit analysis:

Advantages Disadvantage

By showing the relationship between

cost, volume and profit it helps

management in taking sound decision

regarding distribution channel.

With the help of this optimum price of

the products are fixed of the products

and services.

It is difficult in this type of budgeting

tool to segregate total costs into fixed

and variable components.

It is unlikely to stay constant in case of

fixed costs, as output increases beyond

a certain range of activity (Otley,

2016).

TASK 4

P5. Adapting management accounting systems to respond to financial problems

Bench-Marking: It is a process of measuring company's products and services against

the set standard of other competitive businesses which are considered to be the best in the

industry. Main aim of implementing bench marking is to identify internal opportunities

13

for improvement. Continuous and Dramatic are the two types of improving opportunities

(Mirgorodskaya and et.al., 2017). Continuous improvement is incremental and involves

only small adjustments to collect sizeable advances, etc. Whereas, Dramatic

improvement can only come out through re-engineering the whole internal work

processes. Nisa uses this management system in order to measure performance of

company's products and services and are effective too in responding to financial problems

that are faced by company.

Financial Governance: It is a method or a way in which company manages, collects,

monitors and controls financial information. It includes navigation of financial

transactions, controls data and manage performances. In other words these are policies

and procedures that are used by companies to manage business data and ensure its

correctness. Significance of it could be given as; it gives assurance of right financial data,

it is a key to produce compliant regulatory reports and disclosures. More accuracy could

be achieved by drafting a sound financial governance budget. By using centralised,

unified corporate disclosure management software it could be improved. Nisa uses this

system, as it helps firm in managing, controlling, organizing and collecting financial

information that are very much helpful in responding financial problems efficiently as

compare to Vectair Holdings, a small business which deals in retail and hygiene products.

Key Performance Indicators KPIs: It is a value which is measured to know how

effectively the company is working to achieve its main objectives. It is used at multiple

levels of a company in order to evaluate success in reaching targets. It also includes

function of setting objectives and tracking progress against it. To represent how

successful an organization is at achieving results in the past lagging pointers are shown.

Nisa uses this technique, as it assists firm to measure value in order to determine

effectiveness of company effectiveness in achieving business objectives.

Following are some techniques which are used by Vectair Holdings in order to respond financial

problems:

Balanced Score Card: This is a method which is developed by Robert Kaplan and David

Norton. The objective of balance score card is to translate vision statement into actual

form. It is a type of metric which shows performance and is used in strategic management

to identify and improve various internal functions and their resulting outcomes. The

14

(Mirgorodskaya and et.al., 2017). Continuous improvement is incremental and involves

only small adjustments to collect sizeable advances, etc. Whereas, Dramatic

improvement can only come out through re-engineering the whole internal work

processes. Nisa uses this management system in order to measure performance of

company's products and services and are effective too in responding to financial problems

that are faced by company.

Financial Governance: It is a method or a way in which company manages, collects,

monitors and controls financial information. It includes navigation of financial

transactions, controls data and manage performances. In other words these are policies

and procedures that are used by companies to manage business data and ensure its

correctness. Significance of it could be given as; it gives assurance of right financial data,

it is a key to produce compliant regulatory reports and disclosures. More accuracy could

be achieved by drafting a sound financial governance budget. By using centralised,

unified corporate disclosure management software it could be improved. Nisa uses this

system, as it helps firm in managing, controlling, organizing and collecting financial

information that are very much helpful in responding financial problems efficiently as

compare to Vectair Holdings, a small business which deals in retail and hygiene products.

Key Performance Indicators KPIs: It is a value which is measured to know how

effectively the company is working to achieve its main objectives. It is used at multiple

levels of a company in order to evaluate success in reaching targets. It also includes

function of setting objectives and tracking progress against it. To represent how

successful an organization is at achieving results in the past lagging pointers are shown.

Nisa uses this technique, as it assists firm to measure value in order to determine

effectiveness of company effectiveness in achieving business objectives.

Following are some techniques which are used by Vectair Holdings in order to respond financial

problems:

Balanced Score Card: This is a method which is developed by Robert Kaplan and David

Norton. The objective of balance score card is to translate vision statement into actual

form. It is a type of metric which shows performance and is used in strategic management

to identify and improve various internal functions and their resulting outcomes. The

14

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

information which is gathered is interpreted by managers and executives and is also used

to make better decisions for organization (Balanced Scorecard, 2018). The purpose of it

is to implement good behaviour in the organization by isolating four separate areas which

are needed to be analysed. This technique is used by Vectair Holdings to improve their

internal management function and resulting outcomes.

Budgetary Target: The basic motive is to derive cost targets in a goal oriented manner.

Relationship of target budgeting and target costing is obvious and complement each other

but it also differs in their significance. By using this technique Vectair Holdings derive

cost targets in a goal oriented manner which can help company effectively according to

their business environment as compared to Nisa.

Above mentioned tools and methods are used by Vectair holding and Nisa in order to

respond to their financial problems. Techniques used by both of them differs a lot and has

diversified impacts on companies. Nisa uses; KPIs, benchmarking and financial governance

whereas, Vectair Holdings; Budgetary control and balanced score card. It was also concluded

that Nisa is using better techniques to respond financial problems.

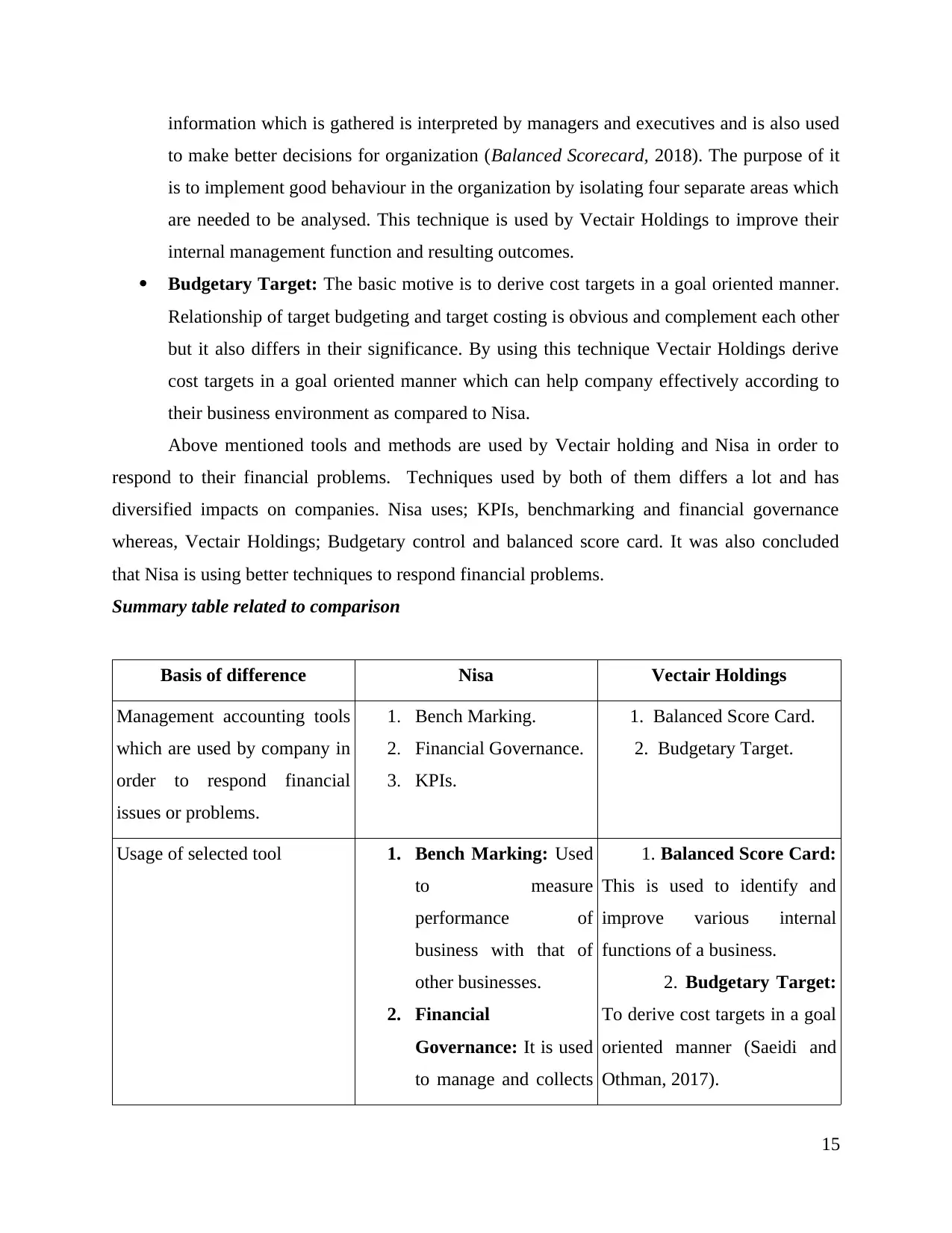

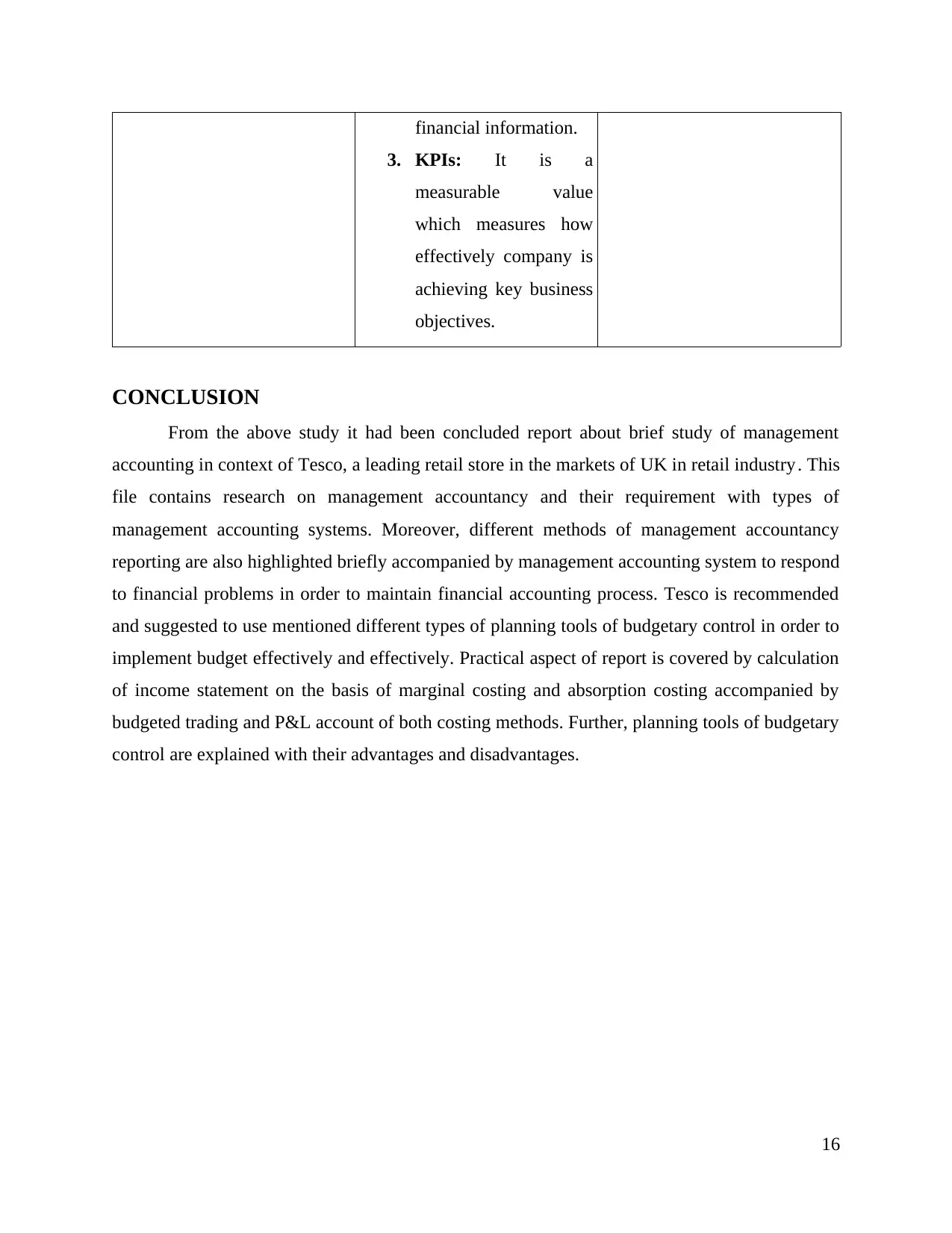

Summary table related to comparison

Basis of difference Nisa Vectair Holdings

Management accounting tools

which are used by company in

order to respond financial

issues or problems.

1. Bench Marking.

2. Financial Governance.

3. KPIs.

1. Balanced Score Card.

2. Budgetary Target.

Usage of selected tool 1. Bench Marking: Used

to measure

performance of

business with that of

other businesses.

2. Financial

Governance: It is used

to manage and collects

1. Balanced Score Card:

This is used to identify and

improve various internal

functions of a business.

2. Budgetary Target:

To derive cost targets in a goal

oriented manner (Saeidi and

Othman, 2017).

15

to make better decisions for organization (Balanced Scorecard, 2018). The purpose of it

is to implement good behaviour in the organization by isolating four separate areas which

are needed to be analysed. This technique is used by Vectair Holdings to improve their

internal management function and resulting outcomes.

Budgetary Target: The basic motive is to derive cost targets in a goal oriented manner.

Relationship of target budgeting and target costing is obvious and complement each other

but it also differs in their significance. By using this technique Vectair Holdings derive

cost targets in a goal oriented manner which can help company effectively according to

their business environment as compared to Nisa.

Above mentioned tools and methods are used by Vectair holding and Nisa in order to

respond to their financial problems. Techniques used by both of them differs a lot and has

diversified impacts on companies. Nisa uses; KPIs, benchmarking and financial governance

whereas, Vectair Holdings; Budgetary control and balanced score card. It was also concluded

that Nisa is using better techniques to respond financial problems.

Summary table related to comparison

Basis of difference Nisa Vectair Holdings

Management accounting tools

which are used by company in

order to respond financial

issues or problems.

1. Bench Marking.

2. Financial Governance.

3. KPIs.

1. Balanced Score Card.

2. Budgetary Target.

Usage of selected tool 1. Bench Marking: Used

to measure

performance of

business with that of

other businesses.

2. Financial

Governance: It is used

to manage and collects

1. Balanced Score Card:

This is used to identify and

improve various internal

functions of a business.

2. Budgetary Target:

To derive cost targets in a goal

oriented manner (Saeidi and

Othman, 2017).

15

financial information.

3. KPIs: It is a

measurable value

which measures how

effectively company is

achieving key business

objectives.

CONCLUSION

From the above study it had been concluded report about brief study of management

accounting in context of Tesco, a leading retail store in the markets of UK in retail industry. This

file contains research on management accountancy and their requirement with types of

management accounting systems. Moreover, different methods of management accountancy

reporting are also highlighted briefly accompanied by management accounting system to respond

to financial problems in order to maintain financial accounting process. Tesco is recommended

and suggested to use mentioned different types of planning tools of budgetary control in order to

implement budget effectively and effectively. Practical aspect of report is covered by calculation

of income statement on the basis of marginal costing and absorption costing accompanied by

budgeted trading and P&L account of both costing methods. Further, planning tools of budgetary

control are explained with their advantages and disadvantages.

16

3. KPIs: It is a

measurable value

which measures how

effectively company is

achieving key business

objectives.

CONCLUSION

From the above study it had been concluded report about brief study of management

accounting in context of Tesco, a leading retail store in the markets of UK in retail industry. This

file contains research on management accountancy and their requirement with types of

management accounting systems. Moreover, different methods of management accountancy

reporting are also highlighted briefly accompanied by management accounting system to respond

to financial problems in order to maintain financial accounting process. Tesco is recommended

and suggested to use mentioned different types of planning tools of budgetary control in order to

implement budget effectively and effectively. Practical aspect of report is covered by calculation

of income statement on the basis of marginal costing and absorption costing accompanied by

budgeted trading and P&L account of both costing methods. Further, planning tools of budgetary

control are explained with their advantages and disadvantages.

16

REFERENCES

Books and Journals

Cooper, D. J., Ezzamel, M. and Qu, S. Q., 2017. Popularizing a management accounting idea:

The case of the balanced scorecard. Contemporary Accounting Research. 34(2). pp.991-

1025.

Jermias, J., 2017. Development of management accounting practices in Indonesia. The Routledge

Handbook of Accounting in Asia, p.104.

Kihn, L. A. and Ihantola, E. M., 2015. Approaches to validation and evaluation in qualitative

studies of management accounting. Qualitative Research in Accounting & Management.

12(3). pp.230-255.

Mårtensson, M. and et.al., 2016. Management accounting of control practices: a matter of and for

strategy. In the 9TH INTERNATIONAL EIASM PUBLIC SECTOR CONFERENCE, held

in LISBON, PORTUGAL, SEPTEMBER 6-8, 2016..

Mirgorodskaya, E. O. and et.al., 2017. Balanced Budget System: Organizational and Financial

Tools. European Research Studies. 20(3B). p.300.

Nitzl, C., 2018. Management Accounting and Partial Least Squares-Structural Equation

Modelling (PLS-SEM): Some Illustrative Examples. In Partial Least Squares Structural

Equation Modeling (pp. 211-229). Springer, Cham.

Nitzl, C., 2018. Management Accounting and Partial Least Squares-Structural Equation

Modelling (PLS-SEM): Some Illustrative Examples. In Partial Least Squares Structural

Equation Modeling (pp. 211-229). Springer, Cham.

Nuhu, N. A., Baird, K. and Bala Appuhamilage, A., 2017. The adoption and success of

contemporary management accounting practices in the public sector. Asian Review of

Accounting. 25(1). pp.106-126.

Otley, D., 2016. The contingency theory of management accounting and control: 1980–2014.

Management accounting research. 31. pp.45-62.

Renz, D. O., 2016. The Jossey-Bass handbook of nonprofit leadership and management. John

Wiley & Sons.

Saeidi, S. P. and Othman, M. S. H., 2017. The mediating role of process and product innovation

in the relationship between environmental management accounting and firm's financial

performance. International Journal of Business Innovation and Research. 14(4). pp.421-438.

17

Books and Journals

Cooper, D. J., Ezzamel, M. and Qu, S. Q., 2017. Popularizing a management accounting idea:

The case of the balanced scorecard. Contemporary Accounting Research. 34(2). pp.991-

1025.

Jermias, J., 2017. Development of management accounting practices in Indonesia. The Routledge

Handbook of Accounting in Asia, p.104.

Kihn, L. A. and Ihantola, E. M., 2015. Approaches to validation and evaluation in qualitative

studies of management accounting. Qualitative Research in Accounting & Management.

12(3). pp.230-255.

Mårtensson, M. and et.al., 2016. Management accounting of control practices: a matter of and for

strategy. In the 9TH INTERNATIONAL EIASM PUBLIC SECTOR CONFERENCE, held

in LISBON, PORTUGAL, SEPTEMBER 6-8, 2016..

Mirgorodskaya, E. O. and et.al., 2017. Balanced Budget System: Organizational and Financial

Tools. European Research Studies. 20(3B). p.300.

Nitzl, C., 2018. Management Accounting and Partial Least Squares-Structural Equation

Modelling (PLS-SEM): Some Illustrative Examples. In Partial Least Squares Structural

Equation Modeling (pp. 211-229). Springer, Cham.

Nitzl, C., 2018. Management Accounting and Partial Least Squares-Structural Equation

Modelling (PLS-SEM): Some Illustrative Examples. In Partial Least Squares Structural

Equation Modeling (pp. 211-229). Springer, Cham.

Nuhu, N. A., Baird, K. and Bala Appuhamilage, A., 2017. The adoption and success of

contemporary management accounting practices in the public sector. Asian Review of

Accounting. 25(1). pp.106-126.

Otley, D., 2016. The contingency theory of management accounting and control: 1980–2014.

Management accounting research. 31. pp.45-62.

Renz, D. O., 2016. The Jossey-Bass handbook of nonprofit leadership and management. John

Wiley & Sons.

Saeidi, S. P. and Othman, M. S. H., 2017. The mediating role of process and product innovation

in the relationship between environmental management accounting and firm's financial

performance. International Journal of Business Innovation and Research. 14(4). pp.421-438.

17

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Online

Absorption costing. 2018. [Online]. Available through: <

https://www.accountingcoach.com/blog/absorption-costing>.

Balanced Scorecard. 2018. [Online]. Available through: <

http://www.balancedscorecard.org/BSC-Basics/About-the-Balanced-Scorecard>.

Cost accounting. 2018. [Online]. Available through: <

http://onlineaccountreading.blogspot.in/2014/12/cost-accounting.html#.WtwyHtTwbIU >.

18

Absorption costing. 2018. [Online]. Available through: <

https://www.accountingcoach.com/blog/absorption-costing>.

Balanced Scorecard. 2018. [Online]. Available through: <

http://www.balancedscorecard.org/BSC-Basics/About-the-Balanced-Scorecard>.

Cost accounting. 2018. [Online]. Available through: <

http://onlineaccountreading.blogspot.in/2014/12/cost-accounting.html#.WtwyHtTwbIU >.

18

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.