Unit 9 Management Accounting

VerifiedAdded on 2019/12/03

|21

|5977

|134

Report

AI Summary

This report focuses on management accounting techniques applied to Jeffrey & Son's, a manufacturing company producing 'Exquisite.' It covers cost classification, job cost sheet preparation, cost calculation using different absorption rates (direct labor hours and machine hours), variance analysis (comparing budgeted and actual costs for 1900 units), performance indicators for improvement, cost reduction strategies, and budgeting processes (including production, material purchase, and cash budgets). The report details the purpose and nature of budgeting, compares incremental and zero-based budgeting, and analyzes variances, their causes, and corrective actions. Finally, it discusses responsibility centers within the company and how different departments can use variance information for decision-making.

Unit 9 Management Accounting

Costing and Budgeting

Costing and Budgeting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

Introduction................................................................................................................................1

TASK 1......................................................................................................................................1

AC 1.1 Classification of cost............................................................................................1

AC 1.2 Preparation of job cost sheet................................................................................2

AC 1.3 Calculation of cost of Exquisite...........................................................................3

AC 1.4 Calculation of overhead absorption rate using direct labour hours......................5

AC 2.1 Preparation of cost sheet for 1900 units for variance analysis.............................5

AC 2.2 performance indicators used to identify the potential improvements..................7

AC 2.3 Ways to reduce cost, enhance value and quality..................................................8

TASK 2......................................................................................................................................8

AC 3.1 Purpose and nature of budgeting process.............................................................8

AC 3.2 Appropriate Budgeting method for the organization and its need.......................9

AC 3.3 Production and material purchase budget of Jeffrey & Son's Ltd........................9

AC 3.4 Cash budget of Jeffrey & Son's Ltd...................................................................10

AC 4.1 Calculation of variances, possible causes and corrective actions......................11

AC 4.2 Operating statement reconciling budgeted and actual results............................12

AC 4.3 Responsibility centres.........................................................................................12

CONCLUSION........................................................................................................................13

REFERENCES.........................................................................................................................14

Introduction................................................................................................................................1

TASK 1......................................................................................................................................1

AC 1.1 Classification of cost............................................................................................1

AC 1.2 Preparation of job cost sheet................................................................................2

AC 1.3 Calculation of cost of Exquisite...........................................................................3

AC 1.4 Calculation of overhead absorption rate using direct labour hours......................5

AC 2.1 Preparation of cost sheet for 1900 units for variance analysis.............................5

AC 2.2 performance indicators used to identify the potential improvements..................7

AC 2.3 Ways to reduce cost, enhance value and quality..................................................8

TASK 2......................................................................................................................................8

AC 3.1 Purpose and nature of budgeting process.............................................................8

AC 3.2 Appropriate Budgeting method for the organization and its need.......................9

AC 3.3 Production and material purchase budget of Jeffrey & Son's Ltd........................9

AC 3.4 Cash budget of Jeffrey & Son's Ltd...................................................................10

AC 4.1 Calculation of variances, possible causes and corrective actions......................11

AC 4.2 Operating statement reconciling budgeted and actual results............................12

AC 4.3 Responsibility centres.........................................................................................12

CONCLUSION........................................................................................................................13

REFERENCES.........................................................................................................................14

INTRODUCTION

Management accounting plays a very important role in the organization success and

growth. It helps to manage the business operation in an effective manner. It is the financial

data analysis technique that helps to take necessary decisions in order to control the cost for

business development purpose. This report will help us in identifying the importance and

significance of management accounting for Jeffrey and Son's.

Jeffrey & Son's is a manufacturing concern that produces many products called

Exquisite. Further, the report will discuss that how the company can get benefited through

applying different management tools such as budgeting process, cost sheets and variance

analysis.

The present report mainly aims at determining the importance of management and

cost accounting techniques for the business. It aims at identifying that how techniques help to

reduce the cost, enhance business incomes and take good business decisions. In this report,

various techniques such as budgeting, variance analysis and cost allocation will be discussed

for the given scenario.

1

Management accounting plays a very important role in the organization success and

growth. It helps to manage the business operation in an effective manner. It is the financial

data analysis technique that helps to take necessary decisions in order to control the cost for

business development purpose. This report will help us in identifying the importance and

significance of management accounting for Jeffrey and Son's.

Jeffrey & Son's is a manufacturing concern that produces many products called

Exquisite. Further, the report will discuss that how the company can get benefited through

applying different management tools such as budgeting process, cost sheets and variance

analysis.

The present report mainly aims at determining the importance of management and

cost accounting techniques for the business. It aims at identifying that how techniques help to

reduce the cost, enhance business incomes and take good business decisions. In this report,

various techniques such as budgeting, variance analysis and cost allocation will be discussed

for the given scenario.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

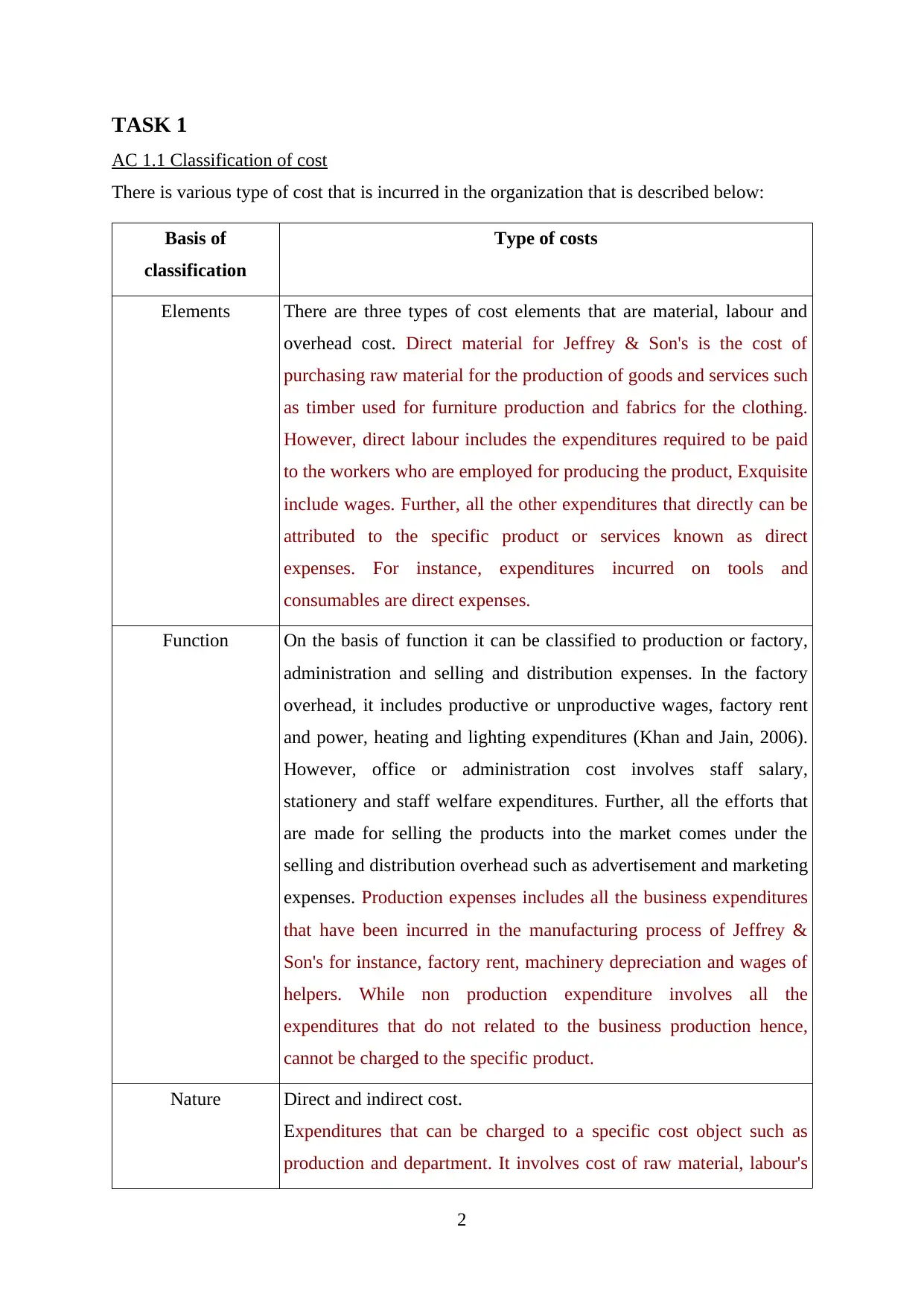

TASK 1

AC 1.1 Classification of cost

There is various type of cost that is incurred in the organization that is described below:

Basis of

classification

Type of costs

Elements There are three types of cost elements that are material, labour and

overhead cost. Direct material for Jeffrey & Son's is the cost of

purchasing raw material for the production of goods and services such

as timber used for furniture production and fabrics for the clothing.

However, direct labour includes the expenditures required to be paid

to the workers who are employed for producing the product, Exquisite

include wages. Further, all the other expenditures that directly can be

attributed to the specific product or services known as direct

expenses. For instance, expenditures incurred on tools and

consumables are direct expenses.

Function On the basis of function it can be classified to production or factory,

administration and selling and distribution expenses. In the factory

overhead, it includes productive or unproductive wages, factory rent

and power, heating and lighting expenditures (Khan and Jain, 2006).

However, office or administration cost involves staff salary,

stationery and staff welfare expenditures. Further, all the efforts that

are made for selling the products into the market comes under the

selling and distribution overhead such as advertisement and marketing

expenses. Production expenses includes all the business expenditures

that have been incurred in the manufacturing process of Jeffrey &

Son's for instance, factory rent, machinery depreciation and wages of

helpers. While non production expenditure involves all the

expenditures that do not related to the business production hence,

cannot be charged to the specific product.

Nature Direct and indirect cost.

Expenditures that can be charged to a specific cost object such as

production and department. It involves cost of raw material, labour's

2

AC 1.1 Classification of cost

There is various type of cost that is incurred in the organization that is described below:

Basis of

classification

Type of costs

Elements There are three types of cost elements that are material, labour and

overhead cost. Direct material for Jeffrey & Son's is the cost of

purchasing raw material for the production of goods and services such

as timber used for furniture production and fabrics for the clothing.

However, direct labour includes the expenditures required to be paid

to the workers who are employed for producing the product, Exquisite

include wages. Further, all the other expenditures that directly can be

attributed to the specific product or services known as direct

expenses. For instance, expenditures incurred on tools and

consumables are direct expenses.

Function On the basis of function it can be classified to production or factory,

administration and selling and distribution expenses. In the factory

overhead, it includes productive or unproductive wages, factory rent

and power, heating and lighting expenditures (Khan and Jain, 2006).

However, office or administration cost involves staff salary,

stationery and staff welfare expenditures. Further, all the efforts that

are made for selling the products into the market comes under the

selling and distribution overhead such as advertisement and marketing

expenses. Production expenses includes all the business expenditures

that have been incurred in the manufacturing process of Jeffrey &

Son's for instance, factory rent, machinery depreciation and wages of

helpers. While non production expenditure involves all the

expenditures that do not related to the business production hence,

cannot be charged to the specific product.

Nature Direct and indirect cost.

Expenditures that can be charged to a specific cost object such as

production and department. It involves cost of raw material, labour's

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

wages and cost of purchasing other equipment such as moulds.

However indirect cost cannot be attributes to a specific cost object.

(Dechow and Skinner, 2000). It is appropriate on the basis of some

costs such as direct machine hours and direct labour hours. It includes

postage, printing, advertisement, lighting and marketing expenses.

Behaviour Fixed, variable and semi variable cost are prevails under this basis.

The expenditures which do not get changes with the production

changes are known as fixed cost includes building rent, insurance, and

depreciation and watchmen salaries. However, variable cost is

directly related to the production and gets changed according to it

(Adler, 2013). For example, raw material and labour's wages. On

contrary, semi variable cost is remaining constant up to a certain

quantity of production and gets changed after this point with the

production changes such as electricity bill. Stepped fixed cost remains

fixed up to a fixed level of activity. Once, the upper level of activity

reached then fixed cost tends to reach at a higher level such as

warehousing cost and wages of supervisors.

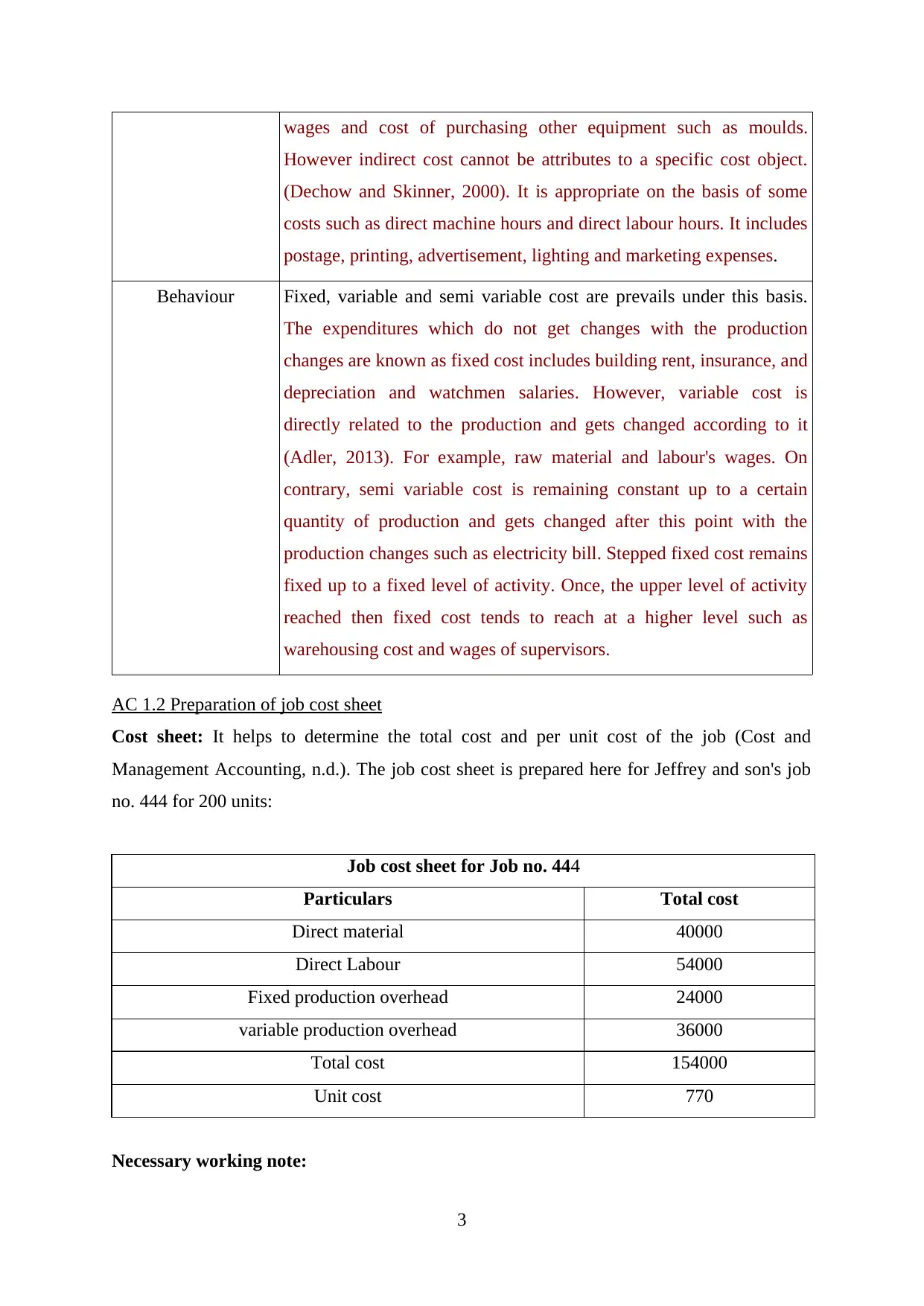

AC 1.2 Preparation of job cost sheet

Cost sheet: It helps to determine the total cost and per unit cost of the job (Cost and

Management Accounting, n.d.). The job cost sheet is prepared here for Jeffrey and son's job

no. 444 for 200 units:

Job cost sheet for Job no. 444

Particulars Total cost

Direct material 40000

Direct Labour 54000

Fixed production overhead 24000

variable production overhead 36000

Total cost 154000

Unit cost 770

Necessary working note:

3

However indirect cost cannot be attributes to a specific cost object.

(Dechow and Skinner, 2000). It is appropriate on the basis of some

costs such as direct machine hours and direct labour hours. It includes

postage, printing, advertisement, lighting and marketing expenses.

Behaviour Fixed, variable and semi variable cost are prevails under this basis.

The expenditures which do not get changes with the production

changes are known as fixed cost includes building rent, insurance, and

depreciation and watchmen salaries. However, variable cost is

directly related to the production and gets changed according to it

(Adler, 2013). For example, raw material and labour's wages. On

contrary, semi variable cost is remaining constant up to a certain

quantity of production and gets changed after this point with the

production changes such as electricity bill. Stepped fixed cost remains

fixed up to a fixed level of activity. Once, the upper level of activity

reached then fixed cost tends to reach at a higher level such as

warehousing cost and wages of supervisors.

AC 1.2 Preparation of job cost sheet

Cost sheet: It helps to determine the total cost and per unit cost of the job (Cost and

Management Accounting, n.d.). The job cost sheet is prepared here for Jeffrey and son's job

no. 444 for 200 units:

Job cost sheet for Job no. 444

Particulars Total cost

Direct material 40000

Direct Labour 54000

Fixed production overhead 24000

variable production overhead 36000

Total cost 154000

Unit cost 770

Necessary working note:

3

Direct material = 50kg* 4£ per kg.*200 units= 400000£

Direct labour cost

Labour hours = 30 hours per unit*200 Units = 6000 Hours

6000 hours * 9£ per hour = 54000£

Calculation of fixed overhead

= Total fixed production overhead/Total budgeted labour hours*Labour hours for job

= 80000£/20000 hours* 6000 hours

= 24000£

Calculation of variable production overhead

= 6£ per hour * 6000 hours

= 36000£

Cost per unit = Total cost/ number of units

= 154000£/200 Units = 770£ cost per unit

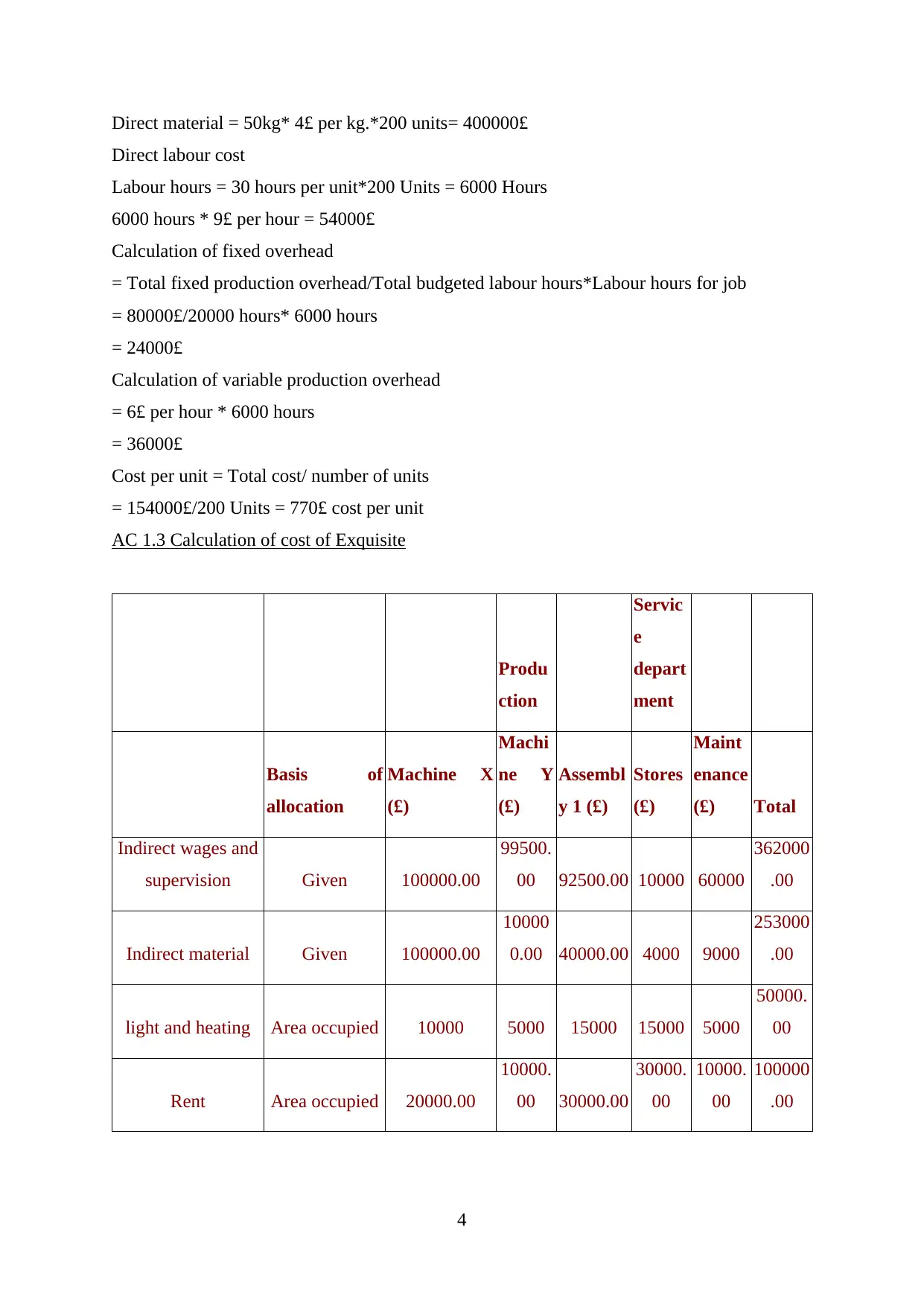

AC 1.3 Calculation of cost of Exquisite

Produ

ction

Servic

e

depart

ment

Basis of

allocation

Machine X

(£)

Machi

ne Y

(£)

Assembl

y 1 (£)

Stores

(£)

Maint

enance

(£) Total

Indirect wages and

supervision Given 100000.00

99500.

00 92500.00 10000 60000

362000

.00

Indirect material Given 100000.00

10000

0.00 40000.00 4000 9000

253000

.00

light and heating Area occupied 10000 5000 15000 15000 5000

50000.

00

Rent Area occupied 20000.00

10000.

00 30000.00

30000.

00

10000.

00

100000

.00

4

Direct labour cost

Labour hours = 30 hours per unit*200 Units = 6000 Hours

6000 hours * 9£ per hour = 54000£

Calculation of fixed overhead

= Total fixed production overhead/Total budgeted labour hours*Labour hours for job

= 80000£/20000 hours* 6000 hours

= 24000£

Calculation of variable production overhead

= 6£ per hour * 6000 hours

= 36000£

Cost per unit = Total cost/ number of units

= 154000£/200 Units = 770£ cost per unit

AC 1.3 Calculation of cost of Exquisite

Produ

ction

Servic

e

depart

ment

Basis of

allocation

Machine X

(£)

Machi

ne Y

(£)

Assembl

y 1 (£)

Stores

(£)

Maint

enance

(£) Total

Indirect wages and

supervision Given 100000.00

99500.

00 92500.00 10000 60000

362000

.00

Indirect material Given 100000.00

10000

0.00 40000.00 4000 9000

253000

.00

light and heating Area occupied 10000 5000 15000 15000 5000

50000.

00

Rent Area occupied 20000.00

10000.

00 30000.00

30000.

00

10000.

00

100000

.00

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

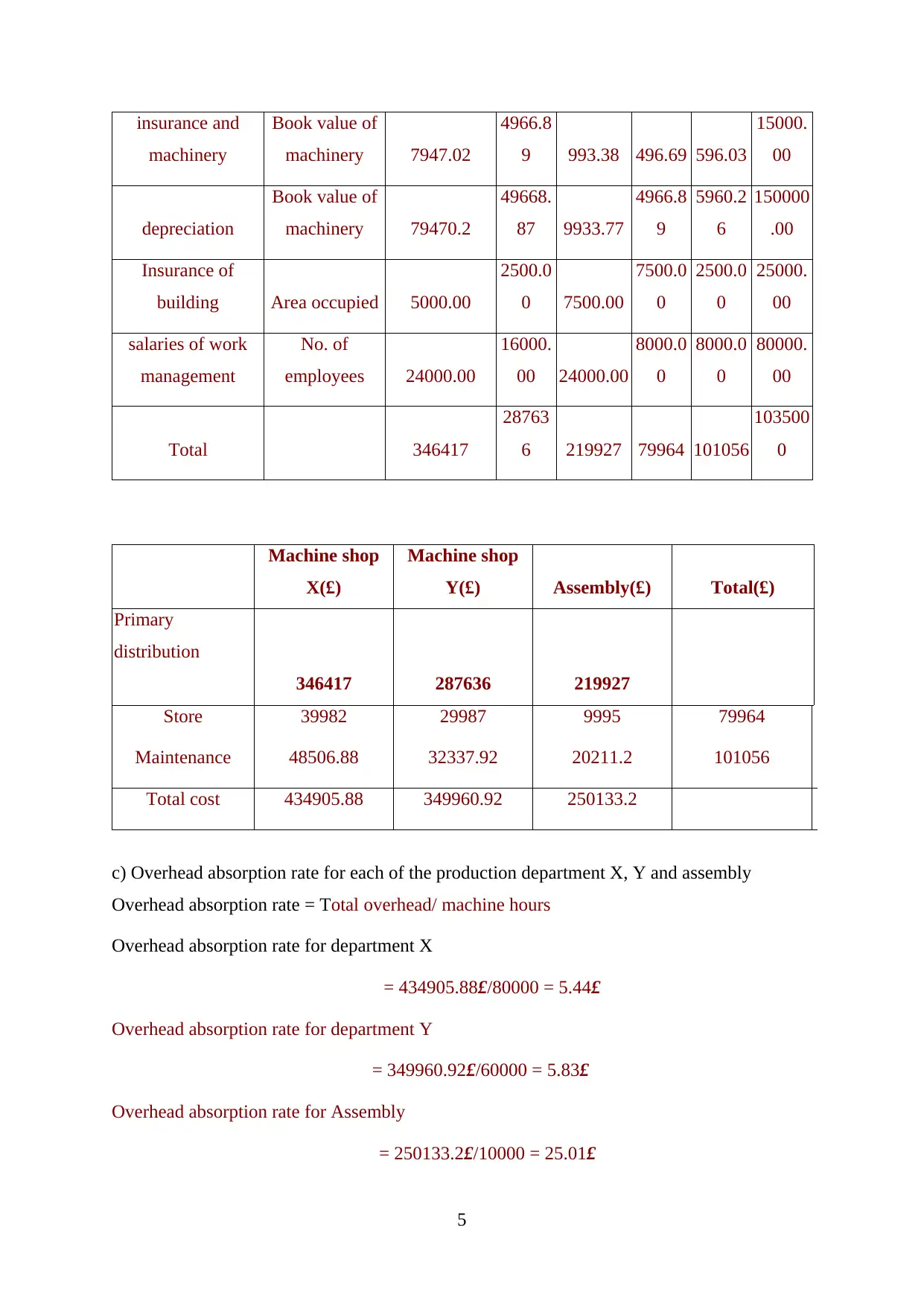

insurance and

machinery

Book value of

machinery 7947.02

4966.8

9 993.38 496.69 596.03

15000.

00

depreciation

Book value of

machinery 79470.2

49668.

87 9933.77

4966.8

9

5960.2

6

150000

.00

Insurance of

building Area occupied 5000.00

2500.0

0 7500.00

7500.0

0

2500.0

0

25000.

00

salaries of work

management

No. of

employees 24000.00

16000.

00 24000.00

8000.0

0

8000.0

0

80000.

00

Total 346417

28763

6 219927 79964 101056

103500

0

Machine shop

X(£)

Machine shop

Y(£) Assembly(£) Total(£)

Primary

distribution

346417 287636 219927

Store 39982 29987 9995 79964

Maintenance 48506.88 32337.92 20211.2 101056

Total cost 434905.88 349960.92 250133.2

c) Overhead absorption rate for each of the production department X, Y and assembly

Overhead absorption rate = Total overhead/ machine hours

Overhead absorption rate for department X

= 434905.88£/80000 = 5.44£

Overhead absorption rate for department Y

= 349960.92£/60000 = 5.83£

Overhead absorption rate for Assembly

= 250133.2£/10000 = 25.01£

5

machinery

Book value of

machinery 7947.02

4966.8

9 993.38 496.69 596.03

15000.

00

depreciation

Book value of

machinery 79470.2

49668.

87 9933.77

4966.8

9

5960.2

6

150000

.00

Insurance of

building Area occupied 5000.00

2500.0

0 7500.00

7500.0

0

2500.0

0

25000.

00

salaries of work

management

No. of

employees 24000.00

16000.

00 24000.00

8000.0

0

8000.0

0

80000.

00

Total 346417

28763

6 219927 79964 101056

103500

0

Machine shop

X(£)

Machine shop

Y(£) Assembly(£) Total(£)

Primary

distribution

346417 287636 219927

Store 39982 29987 9995 79964

Maintenance 48506.88 32337.92 20211.2 101056

Total cost 434905.88 349960.92 250133.2

c) Overhead absorption rate for each of the production department X, Y and assembly

Overhead absorption rate = Total overhead/ machine hours

Overhead absorption rate for department X

= 434905.88£/80000 = 5.44£

Overhead absorption rate for department Y

= 349960.92£/60000 = 5.83£

Overhead absorption rate for Assembly

= 250133.2£/10000 = 25.01£

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

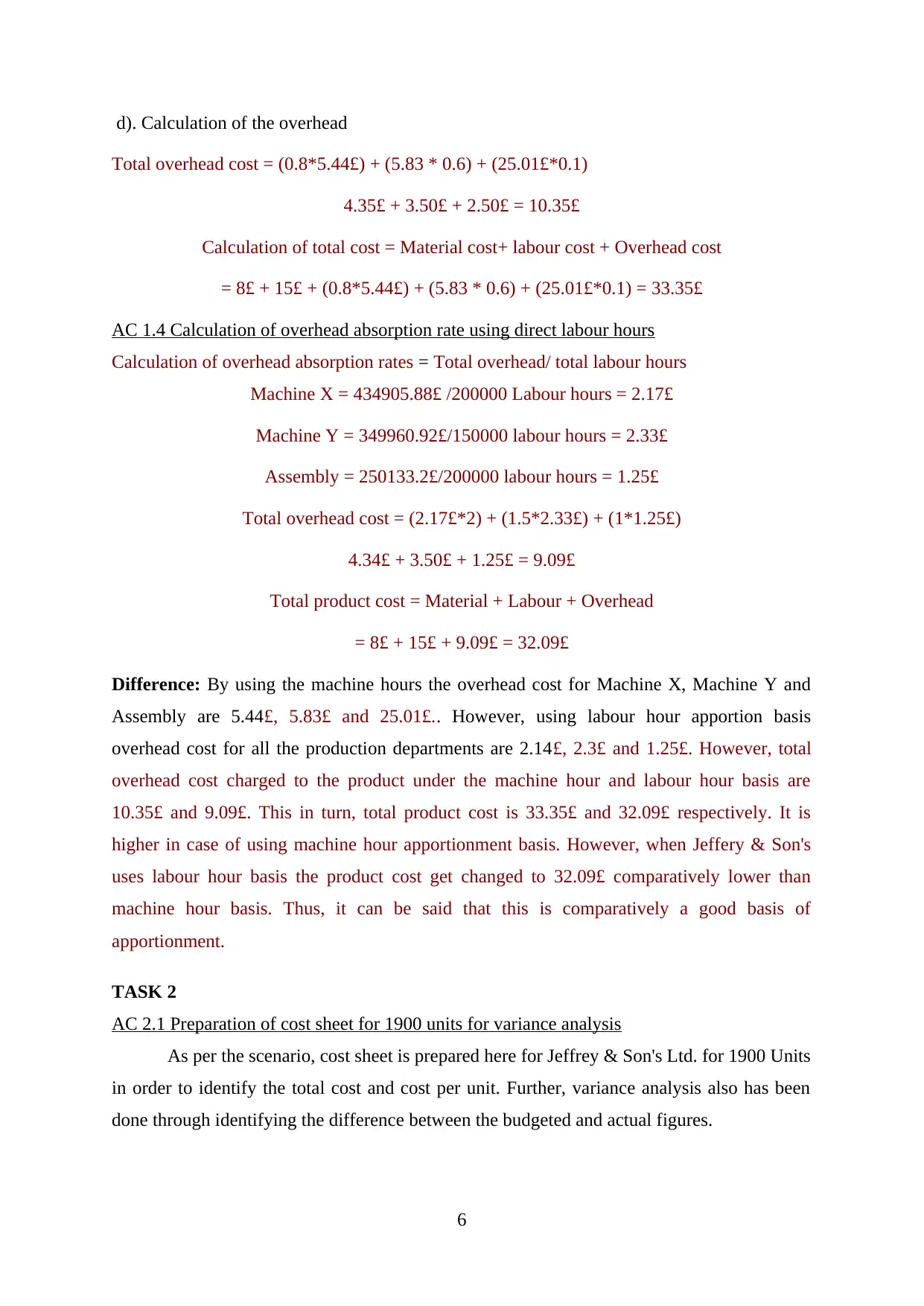

d). Calculation of the overhead

Total overhead cost = (0.8*5.44£) + (5.83 * 0.6) + (25.01£*0.1)

4.35£ + 3.50£ + 2.50£ = 10.35£

Calculation of total cost = Material cost+ labour cost + Overhead cost

= 8£ + 15£ + (0.8*5.44£) + (5.83 * 0.6) + (25.01£*0.1) = 33.35£

AC 1.4 Calculation of overhead absorption rate using direct labour hours

Calculation of overhead absorption rates = Total overhead/ total labour hours

Machine X = 434905.88£ /200000 Labour hours = 2.17£

Machine Y = 349960.92£/150000 labour hours = 2.33£

Assembly = 250133.2£/200000 labour hours = 1.25£

Total overhead cost = (2.17£*2) + (1.5*2.33£) + (1*1.25£)

4.34£ + 3.50£ + 1.25£ = 9.09£

Total product cost = Material + Labour + Overhead

= 8£ + 15£ + 9.09£ = 32.09£

Difference: By using the machine hours the overhead cost for Machine X, Machine Y and

Assembly are 5.44£, 5.83£ and 25.01£.. However, using labour hour apportion basis

overhead cost for all the production departments are 2.14£, 2.3£ and 1.25£. However, total

overhead cost charged to the product under the machine hour and labour hour basis are

10.35£ and 9.09£. This in turn, total product cost is 33.35£ and 32.09£ respectively. It is

higher in case of using machine hour apportionment basis. However, when Jeffery & Son's

uses labour hour basis the product cost get changed to 32.09£ comparatively lower than

machine hour basis. Thus, it can be said that this is comparatively a good basis of

apportionment.

TASK 2

AC 2.1 Preparation of cost sheet for 1900 units for variance analysis

As per the scenario, cost sheet is prepared here for Jeffrey & Son's Ltd. for 1900 Units

in order to identify the total cost and cost per unit. Further, variance analysis also has been

done through identifying the difference between the budgeted and actual figures.

6

Total overhead cost = (0.8*5.44£) + (5.83 * 0.6) + (25.01£*0.1)

4.35£ + 3.50£ + 2.50£ = 10.35£

Calculation of total cost = Material cost+ labour cost + Overhead cost

= 8£ + 15£ + (0.8*5.44£) + (5.83 * 0.6) + (25.01£*0.1) = 33.35£

AC 1.4 Calculation of overhead absorption rate using direct labour hours

Calculation of overhead absorption rates = Total overhead/ total labour hours

Machine X = 434905.88£ /200000 Labour hours = 2.17£

Machine Y = 349960.92£/150000 labour hours = 2.33£

Assembly = 250133.2£/200000 labour hours = 1.25£

Total overhead cost = (2.17£*2) + (1.5*2.33£) + (1*1.25£)

4.34£ + 3.50£ + 1.25£ = 9.09£

Total product cost = Material + Labour + Overhead

= 8£ + 15£ + 9.09£ = 32.09£

Difference: By using the machine hours the overhead cost for Machine X, Machine Y and

Assembly are 5.44£, 5.83£ and 25.01£.. However, using labour hour apportion basis

overhead cost for all the production departments are 2.14£, 2.3£ and 1.25£. However, total

overhead cost charged to the product under the machine hour and labour hour basis are

10.35£ and 9.09£. This in turn, total product cost is 33.35£ and 32.09£ respectively. It is

higher in case of using machine hour apportionment basis. However, when Jeffery & Son's

uses labour hour basis the product cost get changed to 32.09£ comparatively lower than

machine hour basis. Thus, it can be said that this is comparatively a good basis of

apportionment.

TASK 2

AC 2.1 Preparation of cost sheet for 1900 units for variance analysis

As per the scenario, cost sheet is prepared here for Jeffrey & Son's Ltd. for 1900 Units

in order to identify the total cost and cost per unit. Further, variance analysis also has been

done through identifying the difference between the budgeted and actual figures.

6

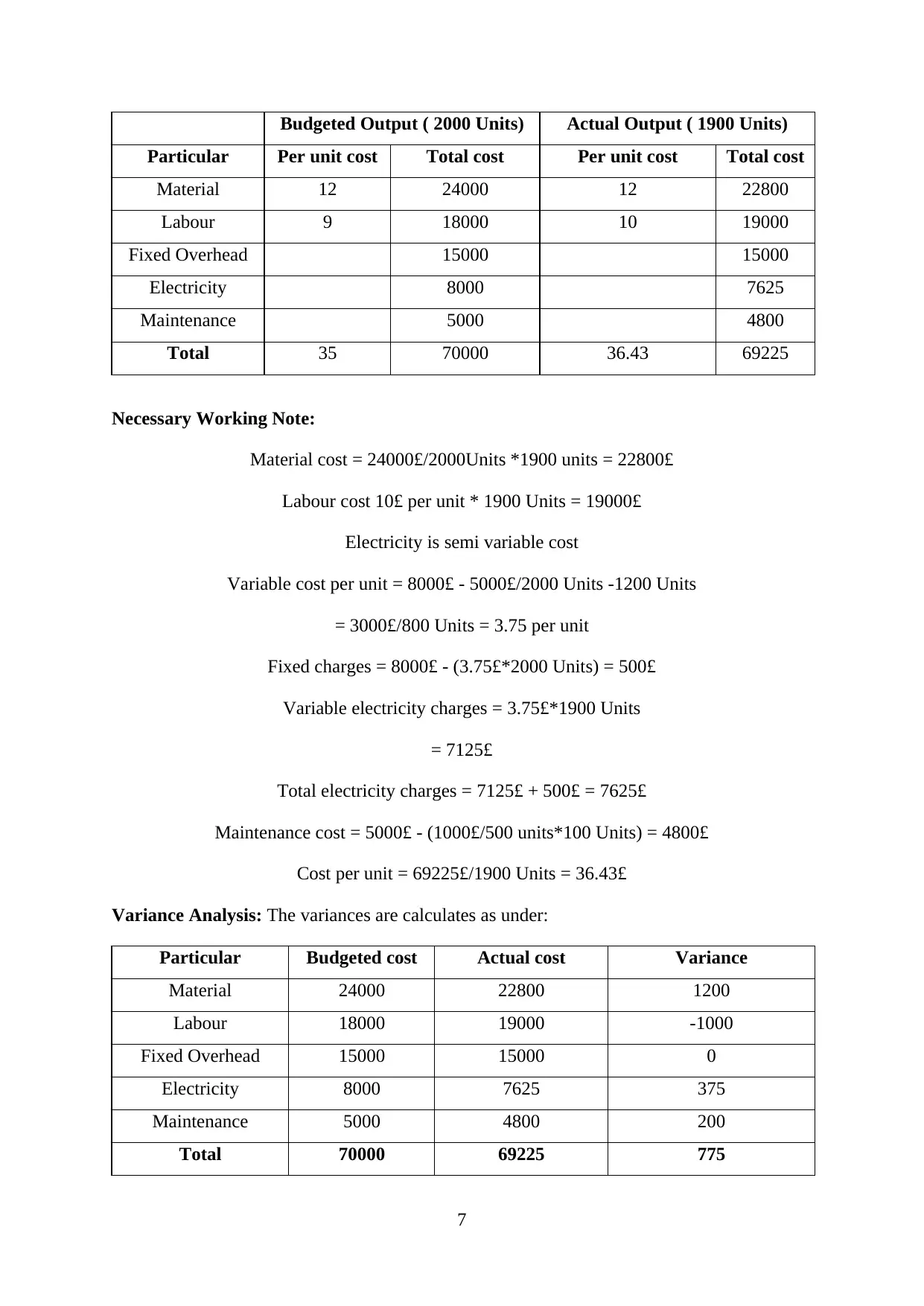

Budgeted Output ( 2000 Units) Actual Output ( 1900 Units)

Particular Per unit cost Total cost Per unit cost Total cost

Material 12 24000 12 22800

Labour 9 18000 10 19000

Fixed Overhead 15000 15000

Electricity 8000 7625

Maintenance 5000 4800

Total 35 70000 36.43 69225

Necessary Working Note:

Material cost = 24000£/2000Units *1900 units = 22800£

Labour cost 10£ per unit * 1900 Units = 19000£

Electricity is semi variable cost

Variable cost per unit = 8000£ - 5000£/2000 Units -1200 Units

= 3000£/800 Units = 3.75 per unit

Fixed charges = 8000£ - (3.75£*2000 Units) = 500£

Variable electricity charges = 3.75£*1900 Units

= 7125£

Total electricity charges = 7125£ + 500£ = 7625£

Maintenance cost = 5000£ - (1000£/500 units*100 Units) = 4800£

Cost per unit = 69225£/1900 Units = 36.43£

Variance Analysis: The variances are calculates as under:

Particular Budgeted cost Actual cost Variance

Material 24000 22800 1200

Labour 18000 19000 -1000

Fixed Overhead 15000 15000 0

Electricity 8000 7625 375

Maintenance 5000 4800 200

Total 70000 69225 775

7

Particular Per unit cost Total cost Per unit cost Total cost

Material 12 24000 12 22800

Labour 9 18000 10 19000

Fixed Overhead 15000 15000

Electricity 8000 7625

Maintenance 5000 4800

Total 35 70000 36.43 69225

Necessary Working Note:

Material cost = 24000£/2000Units *1900 units = 22800£

Labour cost 10£ per unit * 1900 Units = 19000£

Electricity is semi variable cost

Variable cost per unit = 8000£ - 5000£/2000 Units -1200 Units

= 3000£/800 Units = 3.75 per unit

Fixed charges = 8000£ - (3.75£*2000 Units) = 500£

Variable electricity charges = 3.75£*1900 Units

= 7125£

Total electricity charges = 7125£ + 500£ = 7625£

Maintenance cost = 5000£ - (1000£/500 units*100 Units) = 4800£

Cost per unit = 69225£/1900 Units = 36.43£

Variance Analysis: The variances are calculates as under:

Particular Budgeted cost Actual cost Variance

Material 24000 22800 1200

Labour 18000 19000 -1000

Fixed Overhead 15000 15000 0

Electricity 8000 7625 375

Maintenance 5000 4800 200

Total 70000 69225 775

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Interpretation: Material Variance indicates that company is decided the company bear lower

the cost as compared to then the budgeted. However, material price variance is zero because

the price of material remain same to 12£ per unit. However, total labour cost variance arised

to 1000£ due to higher the actual cost. The labour cost is get increased due to higher the

labour rate to 10£ per unit. Further, the electricity cost is getting declined to 7625£. However,

the budgeted cost is 8000£. Therefore, positive variance is raised to 375£. Maintenance cost

is getting affected due to lower the total production arised variance to 200£. As earlier

discussed, fixed cost remain same and get changed with the production. Therefore, fixed cost

variance do not changed under the output of 2000 Units and 1900 Units. Thus, it can be

concluded that labour cost variance, labour rate variance and material cost variance impacts

the company in negative direction (Burns and Scapens, 2000). It affects the business

profitability to a great extent. Therefore, the management has to search any alternatives to the

business that helps to reduce these negative impacts.

AC 2.2 performance indicators used to identify the potential improvements

Different type’s performance indicators are used by the Jeffrey & Son’s in order to

identify the business performances. One of the important tools is business sales higher the

business sales indicate improved performance and vice versa. By increasing the business

sales or turnover organization can make improvement to a great extent. For this purpose

business has to provide better and qualified customer products at justified rates. Moreover

effective advertising, sales promotion, before and after sales service can also be provided to

the consumers. Further, the product quality may be improved using new and innovative

technology for production. Another important tool is that business profitability higher the

business profits shows increased performance and vice versa (Needles and Crosson, 2013).

Every organization prepares financial statements so as to determine the business operational

results. They can identify the important areas through which sales can be improved and cost

can be minimized for profit maximization. On contrary, the business position through making

comparison with their competitor can be done. It can be done through comparing the total

sales and profits in their respective industry. High contribution of the company implies good

business performance and vice versa. Further, the customer satisfaction level can be analysed

through getting customer feedbacks (Kaplan and Atkinson, 2015).

In addition to it, customer waiting time for receiving the products and services

offered by Jeffrey & Son's is also an important tool. Reducing the waiting time will indicate

8

the cost as compared to then the budgeted. However, material price variance is zero because

the price of material remain same to 12£ per unit. However, total labour cost variance arised

to 1000£ due to higher the actual cost. The labour cost is get increased due to higher the

labour rate to 10£ per unit. Further, the electricity cost is getting declined to 7625£. However,

the budgeted cost is 8000£. Therefore, positive variance is raised to 375£. Maintenance cost

is getting affected due to lower the total production arised variance to 200£. As earlier

discussed, fixed cost remain same and get changed with the production. Therefore, fixed cost

variance do not changed under the output of 2000 Units and 1900 Units. Thus, it can be

concluded that labour cost variance, labour rate variance and material cost variance impacts

the company in negative direction (Burns and Scapens, 2000). It affects the business

profitability to a great extent. Therefore, the management has to search any alternatives to the

business that helps to reduce these negative impacts.

AC 2.2 performance indicators used to identify the potential improvements

Different type’s performance indicators are used by the Jeffrey & Son’s in order to

identify the business performances. One of the important tools is business sales higher the

business sales indicate improved performance and vice versa. By increasing the business

sales or turnover organization can make improvement to a great extent. For this purpose

business has to provide better and qualified customer products at justified rates. Moreover

effective advertising, sales promotion, before and after sales service can also be provided to

the consumers. Further, the product quality may be improved using new and innovative

technology for production. Another important tool is that business profitability higher the

business profits shows increased performance and vice versa (Needles and Crosson, 2013).

Every organization prepares financial statements so as to determine the business operational

results. They can identify the important areas through which sales can be improved and cost

can be minimized for profit maximization. On contrary, the business position through making

comparison with their competitor can be done. It can be done through comparing the total

sales and profits in their respective industry. High contribution of the company implies good

business performance and vice versa. Further, the customer satisfaction level can be analysed

through getting customer feedbacks (Kaplan and Atkinson, 2015).

In addition to it, customer waiting time for receiving the products and services

offered by Jeffrey & Son's is also an important tool. Reducing the waiting time will indicate

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

better business performance and vice versa. Another, the corporate image and market share of

the Jeffrey & Son’s helps to determine the business performance. Increasing the sales in

different markets tends to increase the business market share and implies good business

performance and vice versa. Improving the business value of Jeffrey & Son's also tends to

increase business performance. Utilization of business resources in an effective manner also

will indicate good business performance of Jeffrey & Son's and vice versa. Therefore, it can

be concluded that Jeffrey & Son’s can improve its performance by maximum utilization of its

resources, maximizing its sales and profitability and customer satisfactions.

AC 2.3 Ways to reduce cost, enhance value and quality

Every business requires reducing its cost, enhancing value and the quality for

achieving its objectives. It is also very important for Jeffrey & Son's to get higher the yield.

To reduce the cost business has to use better and upgraded technology, cutting off the

expenses and maximum utilizing the resources and recycling its waste and scrap. Further,

cost per unit can be decreased through large scale of production. Jeffrey & Son's need to

identify the sources at which material is available at cheaper the rates but quality should not

be affected. Moreover, employing skilled and qualified labour at reasonable wages rate

labour payments can be reduced. Value can be enhanced through increasing the sales and the

profitability. Shareholders are the business owners. Therefore, to enhance the value Jeffrey &

Son’s require paying good return to them (Zimmerman and Yahya-Zadeh, 2011).

Moreover, larger the market share, competitive advantages and business expansion

also contributes to improve the business value. Competitive advantageous can be taken by

providing wide range of products and services to the customers at affordable prices. Further,

creating good market image through satisfying the customers helps to enhance value of the

Jeffrey & Son's. Good business profitability and strong financial position helps to increase

Jeffrey & Son's business value. On contrary, quality can be improved through using better

quality of raw material and using good technology (Whitecotton, Libby and Phillips, 2013).

Therefore, Jeffrey & Son's requires making upgrade its technology according to the market

requirement. Moreover, technological improvement can be done in existing production

techniques. All this factors affect the Jeffrey & Son's in a positive manner that helps to

occupy larger the market share. This in turn, results in increasing the business growth and

sustainability for the future period.

9

the Jeffrey & Son’s helps to determine the business performance. Increasing the sales in

different markets tends to increase the business market share and implies good business

performance and vice versa. Improving the business value of Jeffrey & Son's also tends to

increase business performance. Utilization of business resources in an effective manner also

will indicate good business performance of Jeffrey & Son's and vice versa. Therefore, it can

be concluded that Jeffrey & Son’s can improve its performance by maximum utilization of its

resources, maximizing its sales and profitability and customer satisfactions.

AC 2.3 Ways to reduce cost, enhance value and quality

Every business requires reducing its cost, enhancing value and the quality for

achieving its objectives. It is also very important for Jeffrey & Son's to get higher the yield.

To reduce the cost business has to use better and upgraded technology, cutting off the

expenses and maximum utilizing the resources and recycling its waste and scrap. Further,

cost per unit can be decreased through large scale of production. Jeffrey & Son's need to

identify the sources at which material is available at cheaper the rates but quality should not

be affected. Moreover, employing skilled and qualified labour at reasonable wages rate

labour payments can be reduced. Value can be enhanced through increasing the sales and the

profitability. Shareholders are the business owners. Therefore, to enhance the value Jeffrey &

Son’s require paying good return to them (Zimmerman and Yahya-Zadeh, 2011).

Moreover, larger the market share, competitive advantages and business expansion

also contributes to improve the business value. Competitive advantageous can be taken by

providing wide range of products and services to the customers at affordable prices. Further,

creating good market image through satisfying the customers helps to enhance value of the

Jeffrey & Son's. Good business profitability and strong financial position helps to increase

Jeffrey & Son's business value. On contrary, quality can be improved through using better

quality of raw material and using good technology (Whitecotton, Libby and Phillips, 2013).

Therefore, Jeffrey & Son's requires making upgrade its technology according to the market

requirement. Moreover, technological improvement can be done in existing production

techniques. All this factors affect the Jeffrey & Son's in a positive manner that helps to

occupy larger the market share. This in turn, results in increasing the business growth and

sustainability for the future period.

9

TASK 2

AC 3.1 Purpose and nature of budgeting process

Budgeting process: It is the process of estimating the business expenditures and incomes for

the future period. In context to Jeffrey & Son's, the managers determine the future business

revenues and expenses for the business to determine the cash balance. The purpose of

preparing the budget by Jeffrey & Son's is to identify the difference between budgeted and

actual figures. It mainly aims at determine business variances and eliminate adverse variance

which create negative impact to the Jeffrey & Son's. It assists managers to take qualified

business decisions and remove negative business variances. Further, it aims at getting

appropriate incomes and allocates it in different operating functions in an effective manner.

However, cost control is another purpose of preparing budget by Jeffrey & Son's in which

expenditures are controlled through monitoring them. There are different kind of budgets

prepared by the organization includes sales budget, purchase budget, production budget and

cash budget. The purpose of this process is to take effective decisions and controlling the cost

(Ahrens and Chapman, 2007). Further, it is structured to eliminate the negative variances and

identify the cash availability at the end of the period.

Nature of budgeting Process: Initially, the holders require estimating the cash inflows and

cashing outflows. Under the cash inflow, Jeffrey & Son's requires to forecast the business

sales and other operation incomes. However, cash outflows can be forecasted through

considering the Jeffrey & Son's expenditures on purchase and its operational expenditures

such as labour's wages, staff salary and other capital expenditure requirements. Thereafter,

Jeffrey & Son's managers identify the cash balance by subtracting total cash payments from

the total cash inflows. It may be of two kinds that are surplus and deficit. Higher the incomes

of Jeffrey & Son are than expenses results in surplus and vice versa. (Datar and et. al., 2013).

Thereafter, cash balance should be added into initial cash balance to determine the cash

balance at the end of the period.

As per the given scenario, Jeffrey & Son's Ltd. can prepare budgets by considering all

the factors that affect the organization. The budget holders of the company are analysing the

market trend in order to determine the volatility. Jeffrey & Son's prepares its budgets through

adopting incremental budgeting system. The key factor in the budget is sales the company is

regularly increased its sales volume. It indicates the management's attitude is to increase the

number of units that are selling by the company (Mongiello, 2015). It helps to increase the

total business sales on a regular basis. The units may get increased by a specific percentage or

10

AC 3.1 Purpose and nature of budgeting process

Budgeting process: It is the process of estimating the business expenditures and incomes for

the future period. In context to Jeffrey & Son's, the managers determine the future business

revenues and expenses for the business to determine the cash balance. The purpose of

preparing the budget by Jeffrey & Son's is to identify the difference between budgeted and

actual figures. It mainly aims at determine business variances and eliminate adverse variance

which create negative impact to the Jeffrey & Son's. It assists managers to take qualified

business decisions and remove negative business variances. Further, it aims at getting

appropriate incomes and allocates it in different operating functions in an effective manner.

However, cost control is another purpose of preparing budget by Jeffrey & Son's in which

expenditures are controlled through monitoring them. There are different kind of budgets

prepared by the organization includes sales budget, purchase budget, production budget and

cash budget. The purpose of this process is to take effective decisions and controlling the cost

(Ahrens and Chapman, 2007). Further, it is structured to eliminate the negative variances and

identify the cash availability at the end of the period.

Nature of budgeting Process: Initially, the holders require estimating the cash inflows and

cashing outflows. Under the cash inflow, Jeffrey & Son's requires to forecast the business

sales and other operation incomes. However, cash outflows can be forecasted through

considering the Jeffrey & Son's expenditures on purchase and its operational expenditures

such as labour's wages, staff salary and other capital expenditure requirements. Thereafter,

Jeffrey & Son's managers identify the cash balance by subtracting total cash payments from

the total cash inflows. It may be of two kinds that are surplus and deficit. Higher the incomes

of Jeffrey & Son are than expenses results in surplus and vice versa. (Datar and et. al., 2013).

Thereafter, cash balance should be added into initial cash balance to determine the cash

balance at the end of the period.

As per the given scenario, Jeffrey & Son's Ltd. can prepare budgets by considering all

the factors that affect the organization. The budget holders of the company are analysing the

market trend in order to determine the volatility. Jeffrey & Son's prepares its budgets through

adopting incremental budgeting system. The key factor in the budget is sales the company is

regularly increased its sales volume. It indicates the management's attitude is to increase the

number of units that are selling by the company (Mongiello, 2015). It helps to increase the

total business sales on a regular basis. The units may get increased by a specific percentage or

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.