University of South Australia: MATH 1053 Quber Case Study Report

VerifiedAdded on 2022/11/29

|16

|1853

|72

Report

AI Summary

This report provides a quantitative analysis of Quber's financial performance, including revenue, costs, and profitability. The analysis covers break-even points, driver cuts, and the impact of changes in petrol costs. The report utilizes various techniques such as break-even analysis and profitability testing, supported by financial data, clustered column charts, and sparklines. It examines the impact of a new driver cut on the company's revenue and profitability, calculates break-even rides for both the company and drivers, and explores the effect of reduced petrol costs on profitability. The report concludes with recommendations based on the findings and references relevant sources.

Error:

Refer

ence

source

not

found

UNIVERSITY OF SOUTH AUSTRALIA

Assignment Cover Sheet – Internal

An Assignment cover sheet needs to be included with each assignment. Please complete all details clearly.

When submitting the assignment online, please ensure this cover sheet is included at the start of your document. (Not as a separate attachment.)

Please check your Course Information Booklet or contact your School Office for assignment submission locations.

Name:

Student ID

Email:

Course code and title: MATH 1053 – Quantitative Methods for Business

School: Info. Tech. & Mathematical Sciences Program Code:

Course Coordinator: Dr Nick Fewster-Young Tutor:

Day, Time, Location of Tutorial:

Assignment number: 1 Due date: by 10 AM, Wednesday 11th September, 2019

Assignment topic as stated in Course Outline: Case Study Report

Further Information: (e.g. state if extension was granted and attach evidence of approval, Revised Submission Date)

I declare that the work contained in this assignment is my own, except where acknowledgement of sources is made.

I authorise the University to test any work submitted by me, using text comparison software, for instances of plagiarism. I understand this will involve the University

or its contractor copying my work and storing it on a database to be used in future to test work submitted by others.

I understand that I can obtain further information on this matter at http://www.unisanet.unisa.edu.au/learningconnection/student/studying/integrity.asp

Note: The attachment of this statement on any electronically submitted assignments will be deemed to have the same authority as a signed statement.

Signed: Date:

Date received from student Assessment/grade Assessed by:

Recorded: Dispatched (if applicable):

Refer

ence

source

not

found

UNIVERSITY OF SOUTH AUSTRALIA

Assignment Cover Sheet – Internal

An Assignment cover sheet needs to be included with each assignment. Please complete all details clearly.

When submitting the assignment online, please ensure this cover sheet is included at the start of your document. (Not as a separate attachment.)

Please check your Course Information Booklet or contact your School Office for assignment submission locations.

Name:

Student ID

Email:

Course code and title: MATH 1053 – Quantitative Methods for Business

School: Info. Tech. & Mathematical Sciences Program Code:

Course Coordinator: Dr Nick Fewster-Young Tutor:

Day, Time, Location of Tutorial:

Assignment number: 1 Due date: by 10 AM, Wednesday 11th September, 2019

Assignment topic as stated in Course Outline: Case Study Report

Further Information: (e.g. state if extension was granted and attach evidence of approval, Revised Submission Date)

I declare that the work contained in this assignment is my own, except where acknowledgement of sources is made.

I authorise the University to test any work submitted by me, using text comparison software, for instances of plagiarism. I understand this will involve the University

or its contractor copying my work and storing it on a database to be used in future to test work submitted by others.

I understand that I can obtain further information on this matter at http://www.unisanet.unisa.edu.au/learningconnection/student/studying/integrity.asp

Note: The attachment of this statement on any electronically submitted assignments will be deemed to have the same authority as a signed statement.

Signed: Date:

Date received from student Assessment/grade Assessed by:

Recorded: Dispatched (if applicable):

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

Quantitative Methods for Business- Quber

[Enter the date of submission]

Prepared by

[Enter your name]

3

[Enter the date of submission]

Prepared by

[Enter your name]

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Table of Contents

Introduction......................................................................................................................................1

Financial analysis.............................................................................................................................3

New cut for drivers...........................................................................................................................3

Break even rides...............................................................................................................................3

Conclusions and Recommendation..................................................................................................5

Appendix 1 – profitability analysis..................................................................................................7

Appendix 2 – Calculation of new drivers cut...................................................................................9

Appendix 3 – Breakeven rides.......................................................................................................12

4

Introduction......................................................................................................................................1

Financial analysis.............................................................................................................................3

New cut for drivers...........................................................................................................................3

Break even rides...............................................................................................................................3

Conclusions and Recommendation..................................................................................................5

Appendix 1 – profitability analysis..................................................................................................7

Appendix 2 – Calculation of new drivers cut...................................................................................9

Appendix 3 – Breakeven rides.......................................................................................................12

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Introduction

Quantitative analysis is performed to analyse the performance of the business and in that there is

the coverage of various aspects. The evaluation will be made with the help of several techniques

which are available. In the given analysis there will be use of the breakeven analysis and

profitability testing. Various other tools will be used by which the proper results will be obtained.

The graphs will also be made so that proper understanding is developed and all of this will be

covered in report below.

i

Quantitative analysis is performed to analyse the performance of the business and in that there is

the coverage of various aspects. The evaluation will be made with the help of several techniques

which are available. In the given analysis there will be use of the breakeven analysis and

profitability testing. Various other tools will be used by which the proper results will be obtained.

The graphs will also be made so that proper understanding is developed and all of this will be

covered in report below.

i

Info graphics

Clustered column chart:

Clustered bar chart

representing cash flows from the

system:

2015 2016 2017 2018

0

200000

400000

600000

800000

1000000

1200000

1400000

1600000

1200000

1100000

1250000

1356000

950000900000

1000000

1100000

Total revenue and cost

Revenue

cost

1

2

3

4

5

6

7

8

9

10

11

12

13

-1000000 -500000 0 500000

Clustered bar chart

Cash flow

Month

Break even chart of Quber: Profitability of drivers:

0

20000

40000

-100000

-50000

0

50000

100000

150000

200000

Break even chart

Total cost

Total revenue

Total profits

Number of rides

Revenue in dollars

0

100

200

300

400

500

-1000

0

1000

2000

3000

4000

5000

6000

7000

Net profit of drivers

Total profit

Total profit new

Number of rides

Profit in dollar

ii

Clustered column chart:

Clustered bar chart

representing cash flows from the

system:

2015 2016 2017 2018

0

200000

400000

600000

800000

1000000

1200000

1400000

1600000

1200000

1100000

1250000

1356000

950000900000

1000000

1100000

Total revenue and cost

Revenue

cost

1

2

3

4

5

6

7

8

9

10

11

12

13

-1000000 -500000 0 500000

Clustered bar chart

Cash flow

Month

Break even chart of Quber: Profitability of drivers:

0

20000

40000

-100000

-50000

0

50000

100000

150000

200000

Break even chart

Total cost

Total revenue

Total profits

Number of rides

Revenue in dollars

0

100

200

300

400

500

-1000

0

1000

2000

3000

4000

5000

6000

7000

Net profit of drivers

Total profit

Total profit new

Number of rides

Profit in dollar

ii

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

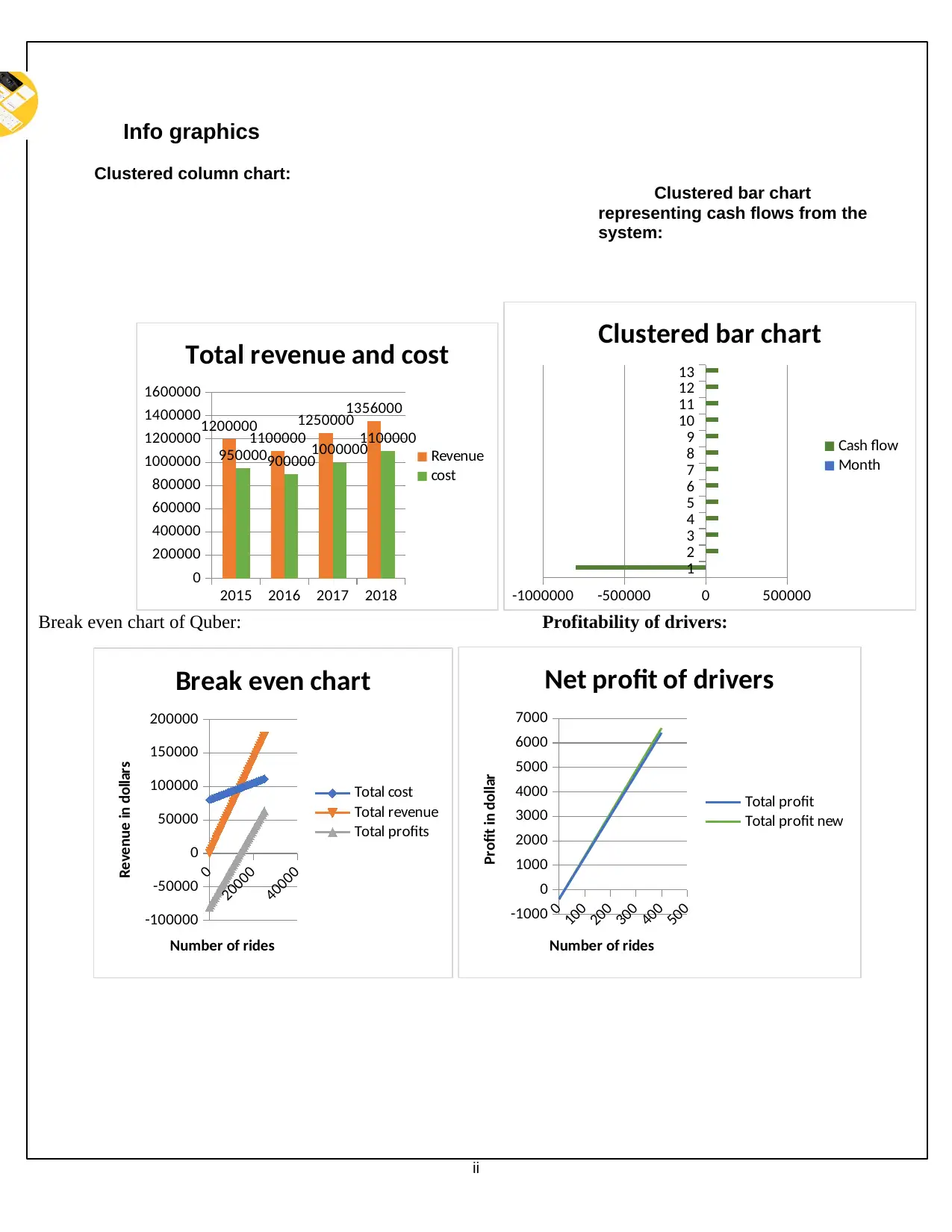

Financial analysis

The appendix 1 has provided data in relation to the cost and revenue and in that clustered graph is

presented. In 2018 the cost of $1100000 is incurred with which the revenue of $1356000 is

attained. The highest cost if incurred in 2016 and this is identified with the help of the expense to

revenue ratio.

The rides are changing in all years with maximum in 2017 and minimum in 2016 at 75000 and

55000 respectively. The changes are ascertained with spark lines and profit of $256000 is made

at highest level. The rides reduced in 2016 and so negative spark line is made in that year.

Quber will be able to maintain the profitability in the coming years and with that further

development will be made (Aparicio et al., 2015).

New cut for drivers

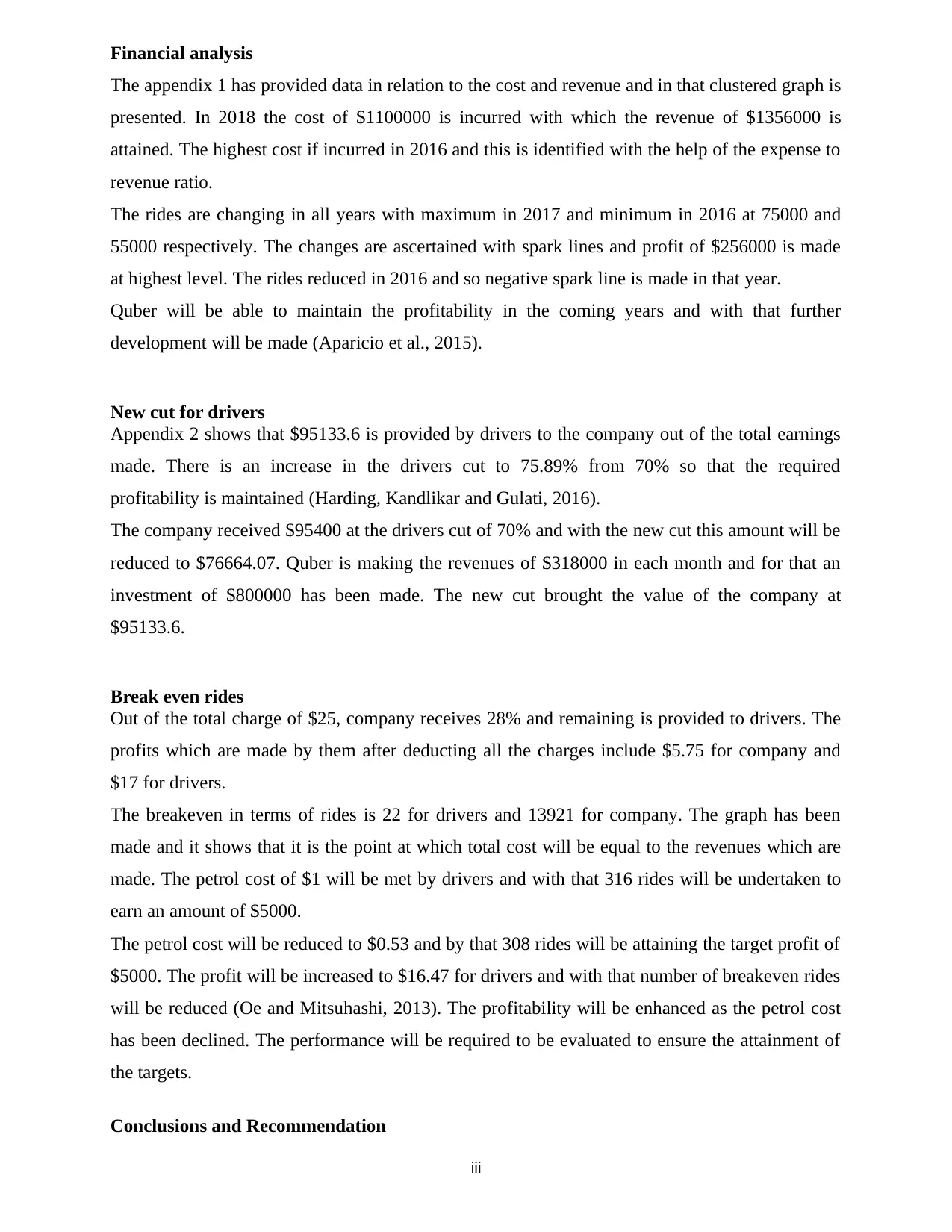

Appendix 2 shows that $95133.6 is provided by drivers to the company out of the total earnings

made. There is an increase in the drivers cut to 75.89% from 70% so that the required

profitability is maintained (Harding, Kandlikar and Gulati, 2016).

The company received $95400 at the drivers cut of 70% and with the new cut this amount will be

reduced to $76664.07. Quber is making the revenues of $318000 in each month and for that an

investment of $800000 has been made. The new cut brought the value of the company at

$95133.6.

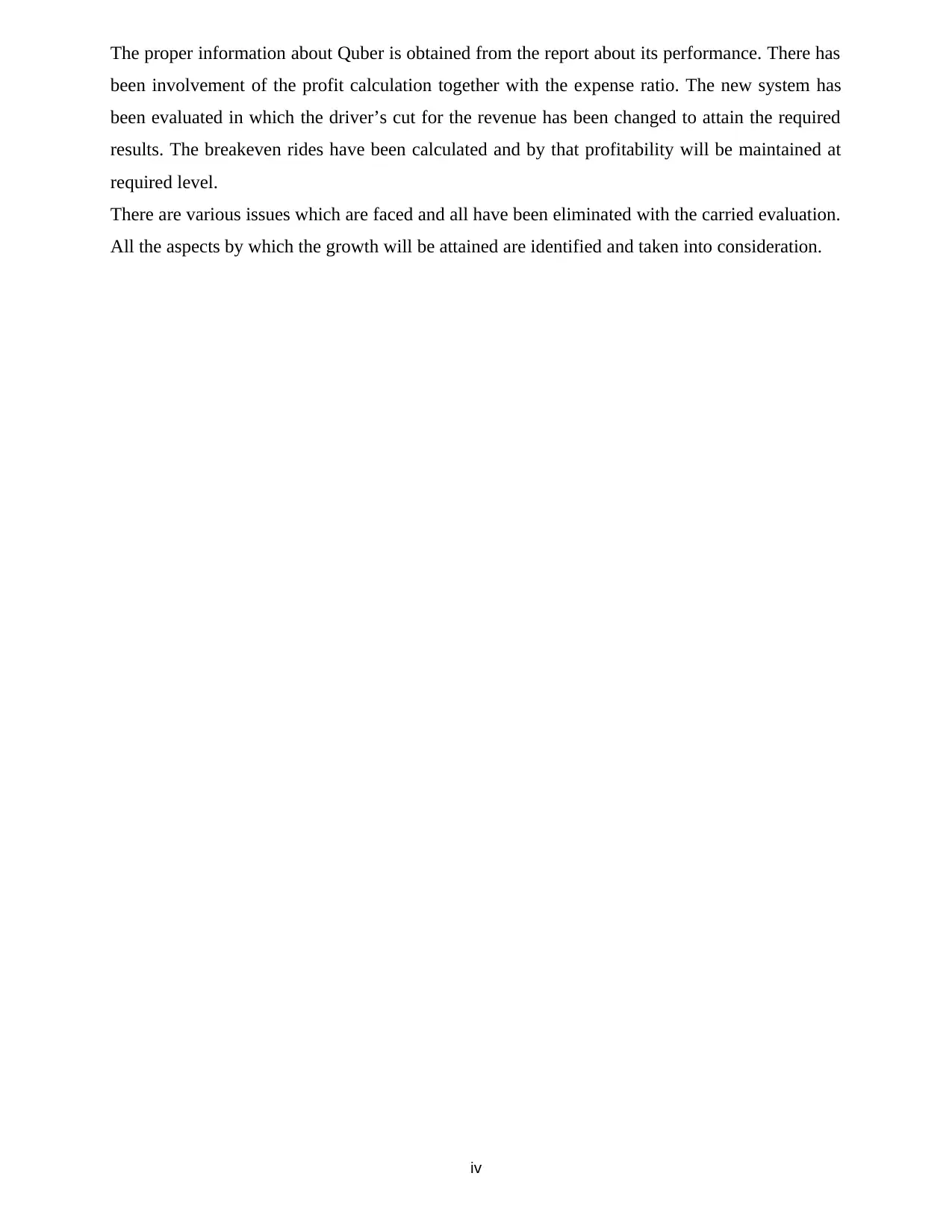

Break even rides

Out of the total charge of $25, company receives 28% and remaining is provided to drivers. The

profits which are made by them after deducting all the charges include $5.75 for company and

$17 for drivers.

The breakeven in terms of rides is 22 for drivers and 13921 for company. The graph has been

made and it shows that it is the point at which total cost will be equal to the revenues which are

made. The petrol cost of $1 will be met by drivers and with that 316 rides will be undertaken to

earn an amount of $5000.

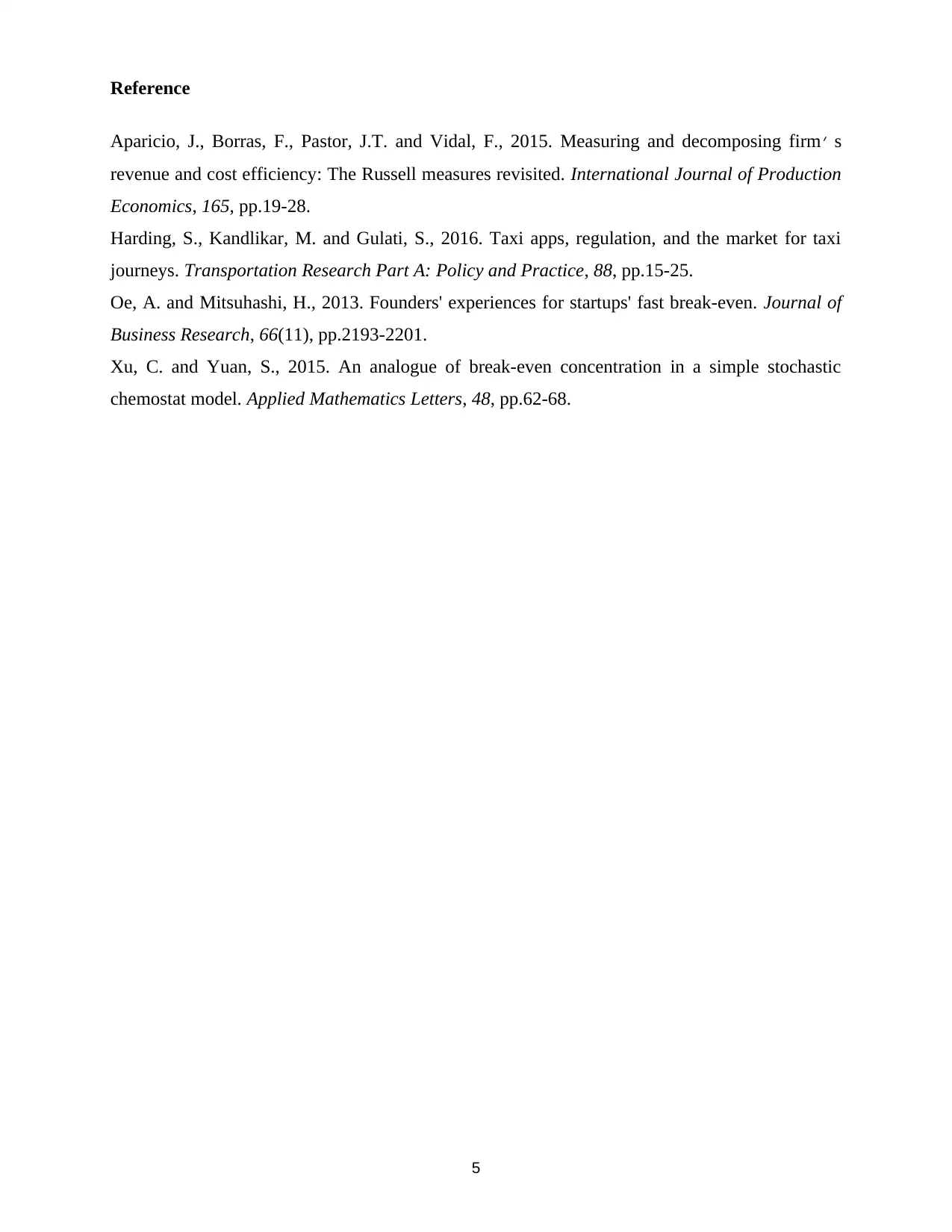

The petrol cost will be reduced to $0.53 and by that 308 rides will be attaining the target profit of

$5000. The profit will be increased to $16.47 for drivers and with that number of breakeven rides

will be reduced (Oe and Mitsuhashi, 2013). The profitability will be enhanced as the petrol cost

has been declined. The performance will be required to be evaluated to ensure the attainment of

the targets.

Conclusions and Recommendation

iii

The appendix 1 has provided data in relation to the cost and revenue and in that clustered graph is

presented. In 2018 the cost of $1100000 is incurred with which the revenue of $1356000 is

attained. The highest cost if incurred in 2016 and this is identified with the help of the expense to

revenue ratio.

The rides are changing in all years with maximum in 2017 and minimum in 2016 at 75000 and

55000 respectively. The changes are ascertained with spark lines and profit of $256000 is made

at highest level. The rides reduced in 2016 and so negative spark line is made in that year.

Quber will be able to maintain the profitability in the coming years and with that further

development will be made (Aparicio et al., 2015).

New cut for drivers

Appendix 2 shows that $95133.6 is provided by drivers to the company out of the total earnings

made. There is an increase in the drivers cut to 75.89% from 70% so that the required

profitability is maintained (Harding, Kandlikar and Gulati, 2016).

The company received $95400 at the drivers cut of 70% and with the new cut this amount will be

reduced to $76664.07. Quber is making the revenues of $318000 in each month and for that an

investment of $800000 has been made. The new cut brought the value of the company at

$95133.6.

Break even rides

Out of the total charge of $25, company receives 28% and remaining is provided to drivers. The

profits which are made by them after deducting all the charges include $5.75 for company and

$17 for drivers.

The breakeven in terms of rides is 22 for drivers and 13921 for company. The graph has been

made and it shows that it is the point at which total cost will be equal to the revenues which are

made. The petrol cost of $1 will be met by drivers and with that 316 rides will be undertaken to

earn an amount of $5000.

The petrol cost will be reduced to $0.53 and by that 308 rides will be attaining the target profit of

$5000. The profit will be increased to $16.47 for drivers and with that number of breakeven rides

will be reduced (Oe and Mitsuhashi, 2013). The profitability will be enhanced as the petrol cost

has been declined. The performance will be required to be evaluated to ensure the attainment of

the targets.

Conclusions and Recommendation

iii

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The proper information about Quber is obtained from the report about its performance. There has

been involvement of the profit calculation together with the expense ratio. The new system has

been evaluated in which the driver’s cut for the revenue has been changed to attain the required

results. The breakeven rides have been calculated and by that profitability will be maintained at

required level.

There are various issues which are faced and all have been eliminated with the carried evaluation.

All the aspects by which the growth will be attained are identified and taken into consideration.

(2 marks)

iv

been involvement of the profit calculation together with the expense ratio. The new system has

been evaluated in which the driver’s cut for the revenue has been changed to attain the required

results. The breakeven rides have been calculated and by that profitability will be maintained at

required level.

There are various issues which are faced and all have been eliminated with the carried evaluation.

All the aspects by which the growth will be attained are identified and taken into consideration.

(2 marks)

iv

Reference

Aparicio, J., Borras, F., Pastor, J.T. and Vidal, F., 2015. Measuring and decomposing firm׳ s

revenue and cost efficiency: The Russell measures revisited. International Journal of Production

Economics, 165, pp.19-28.

Harding, S., Kandlikar, M. and Gulati, S., 2016. Taxi apps, regulation, and the market for taxi

journeys. Transportation Research Part A: Policy and Practice, 88, pp.15-25.

Oe, A. and Mitsuhashi, H., 2013. Founders' experiences for startups' fast break-even. Journal of

Business Research, 66(11), pp.2193-2201.

Xu, C. and Yuan, S., 2015. An analogue of break-even concentration in a simple stochastic

chemostat model. Applied Mathematics Letters, 48, pp.62-68.

5

Aparicio, J., Borras, F., Pastor, J.T. and Vidal, F., 2015. Measuring and decomposing firm׳ s

revenue and cost efficiency: The Russell measures revisited. International Journal of Production

Economics, 165, pp.19-28.

Harding, S., Kandlikar, M. and Gulati, S., 2016. Taxi apps, regulation, and the market for taxi

journeys. Transportation Research Part A: Policy and Practice, 88, pp.15-25.

Oe, A. and Mitsuhashi, H., 2013. Founders' experiences for startups' fast break-even. Journal of

Business Research, 66(11), pp.2193-2201.

Xu, C. and Yuan, S., 2015. An analogue of break-even concentration in a simple stochastic

chemostat model. Applied Mathematics Letters, 48, pp.62-68.

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Appendix 1 – profitability analysis

(a)

Year 2014 2015 2016 2017 2018

Revenue 1200000 1100000 1250000 1356000

cost 950000 900000 1000000 1100000

Ratios 79.17% 81.82% 80.00% 81.12%

Rides 60000 55000 75000 74000

2015 2016 2017 2018

0

200000

400000

600000

800000

1000000

1200000

1400000

1600000

1200000

1100000

1250000

1356000

950000 900000

1000000

1100000

Total revenue and cost

Revenue

cost

(b)

2014 2015 2016 2017 2018

Net Profit ($ 000’) 208.33 250 200 250 256

Relative Percentage

Change N/A 20.0% -20.0% 25.00% 2.40%

Calculations:

Percentage change in profit = (Profit in current year- last year profit)/Last year profit*100

2016 = (200-250)250*100 = -20%

6

(a)

Year 2014 2015 2016 2017 2018

Revenue 1200000 1100000 1250000 1356000

cost 950000 900000 1000000 1100000

Ratios 79.17% 81.82% 80.00% 81.12%

Rides 60000 55000 75000 74000

2015 2016 2017 2018

0

200000

400000

600000

800000

1000000

1200000

1400000

1600000

1200000

1100000

1250000

1356000

950000 900000

1000000

1100000

Total revenue and cost

Revenue

cost

(b)

2014 2015 2016 2017 2018

Net Profit ($ 000’) 208.33 250 200 250 256

Relative Percentage

Change N/A 20.0% -20.0% 25.00% 2.40%

Calculations:

Percentage change in profit = (Profit in current year- last year profit)/Last year profit*100

2016 = (200-250)250*100 = -20%

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2017 = (250-200)200*100 = -20%

2018 = (256-250)250*100 = -20%

Calculation of net profit for 2014

Profit = 250/1.2 = 208.33

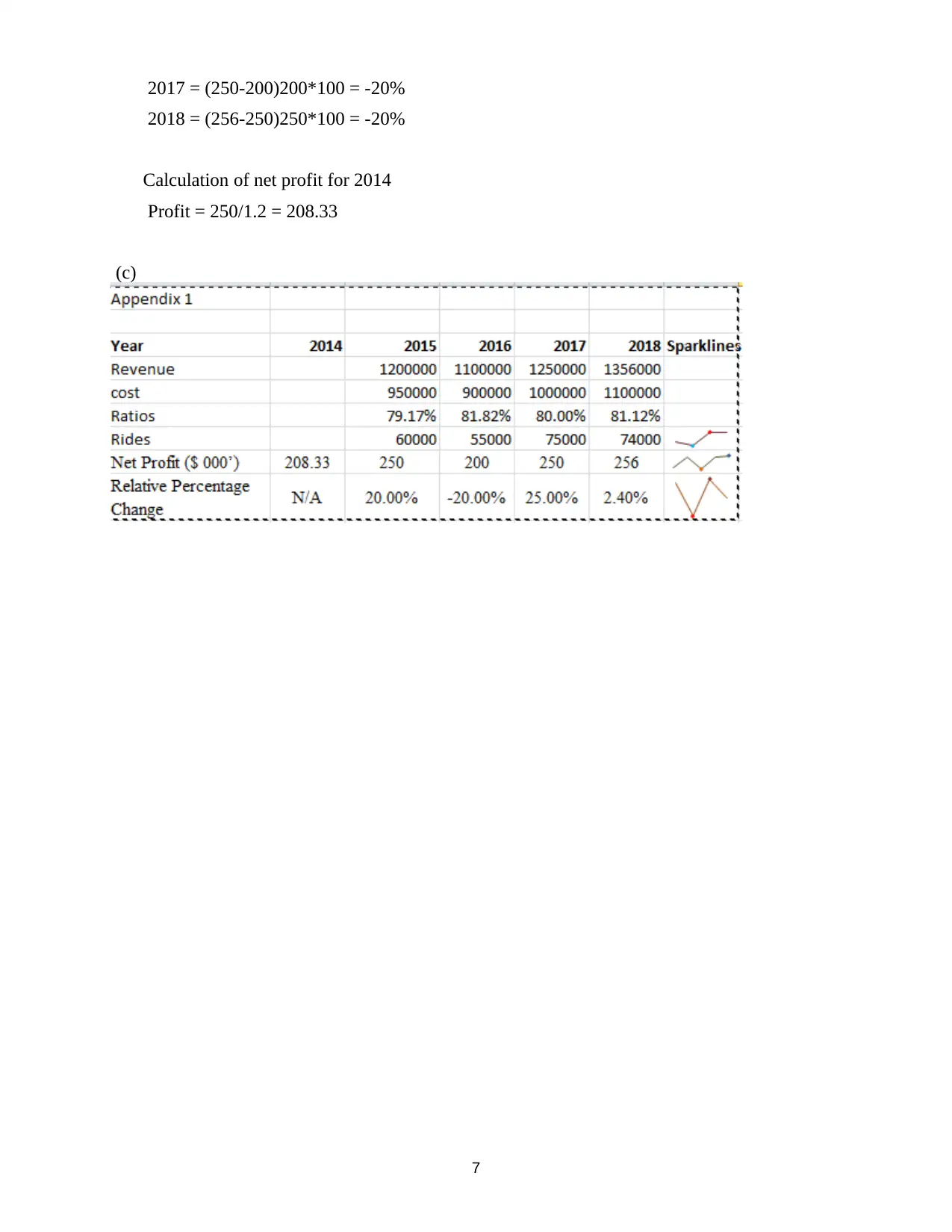

(c)

7

2018 = (256-250)250*100 = -20%

Calculation of net profit for 2014

Profit = 250/1.2 = 208.33

(c)

7

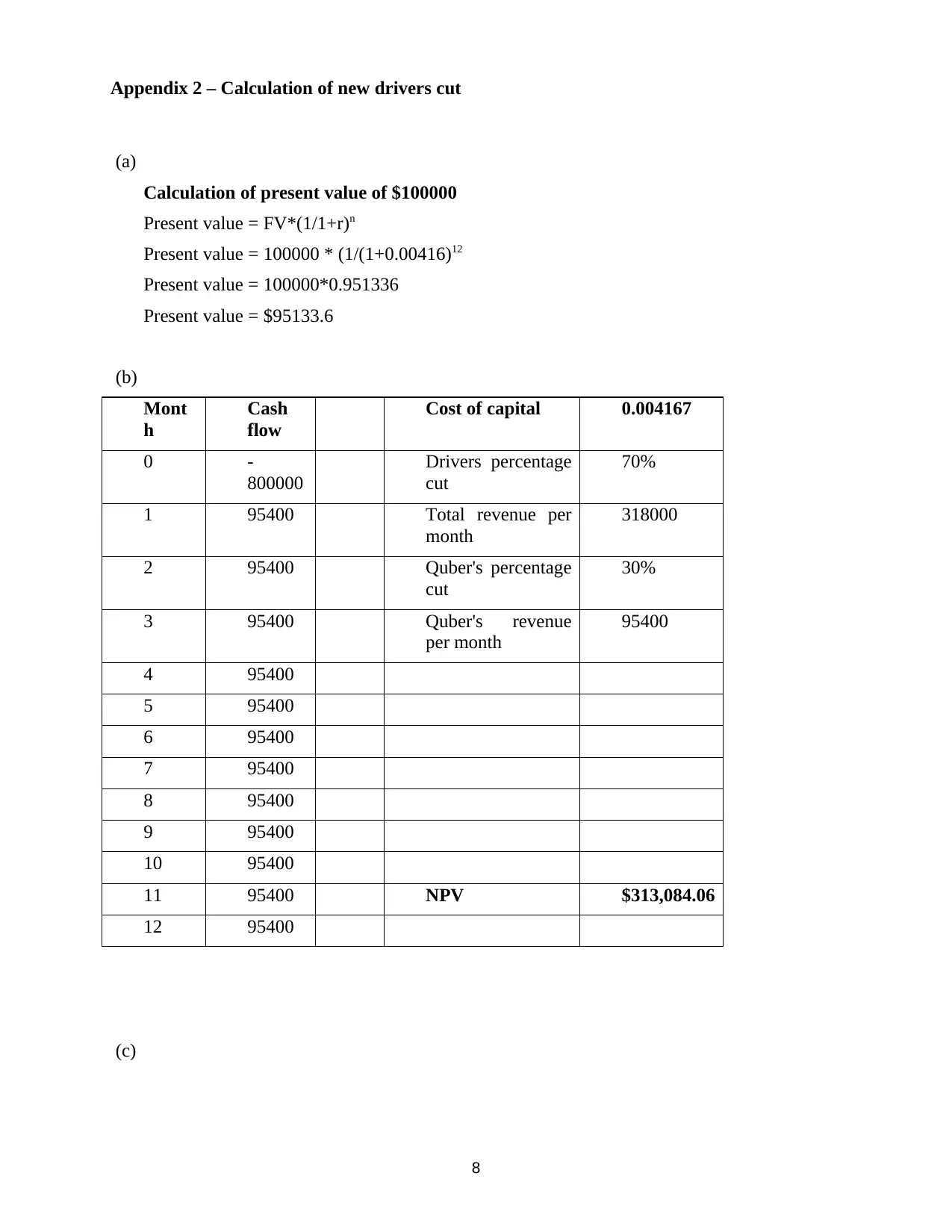

Appendix 2 – Calculation of new drivers cut

(a)

Calculation of present value of $100000

Present value = FV*(1/1+r)n

Present value = 100000 * (1/(1+0.00416)12

Present value = 100000*0.951336

Present value = $95133.6

(b)

Mont

h

Cash

flow

Cost of capital 0.004167

0 -

800000

Drivers percentage

cut

70%

1 95400 Total revenue per

month

318000

2 95400 Quber's percentage

cut

30%

3 95400 Quber's revenue

per month

95400

4 95400

5 95400

6 95400

7 95400

8 95400

9 95400

10 95400

11 95400 NPV $313,084.06

12 95400

(c)

8

(a)

Calculation of present value of $100000

Present value = FV*(1/1+r)n

Present value = 100000 * (1/(1+0.00416)12

Present value = 100000*0.951336

Present value = $95133.6

(b)

Mont

h

Cash

flow

Cost of capital 0.004167

0 -

800000

Drivers percentage

cut

70%

1 95400 Total revenue per

month

318000

2 95400 Quber's percentage

cut

30%

3 95400 Quber's revenue

per month

95400

4 95400

5 95400

6 95400

7 95400

8 95400

9 95400

10 95400

11 95400 NPV $313,084.06

12 95400

(c)

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.