MNG93002: U.S. Airline Industry - A Strategic Case Analysis Report

VerifiedAdded on 2023/06/14

|16

|3478

|84

Case Study

AI Summary

This report provides a comprehensive analysis of the U.S. Airline Industry, utilizing Porter's Five Forces framework to assess the competitive landscape and identify factors contributing to the industry's low profitability and cyclical economic performance. The analysis covers the bargaining power of suppliers and customers, the threat of substitutes and new entrants, and the intensity of competitive rivalry. It also discusses the advantages and disadvantages of the Five Forces model. Furthermore, the report explores the economic challenges faced by airlines, including fluctuating fuel costs and labor expenses. Finally, it suggests potential strategies that airlines could adopt to enhance their profitability and achieve sustained success in this challenging industry. Desklib offers a wealth of similar resources, including past papers and solved assignments, for students seeking academic support.

Strategy and case analysis

4/12/2018

U.S. Airline

4/12/2018

U.S. Airline

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Case and Strategy analysis 1

Contents

Introduction......................................................................................................................................2

Overview of the US airline industry................................................................................................3

Five forces analysis of US airline industry......................................................................................3

Bargaining power of suppliers.....................................................................................................4

Bargaining power of customers...................................................................................................5

Threat of Substitutes....................................................................................................................5

The intensity of competitive rivalry............................................................................................6

The threat of new entrants...........................................................................................................6

Advantages and disadvantages of the model...............................................................................7

Economic performance....................................................................................................................9

Identifying strategies for airline profitability................................................................................10

Discussion......................................................................................................................................10

Conclusion.....................................................................................................................................12

References......................................................................................................................................13

Contents

Introduction......................................................................................................................................2

Overview of the US airline industry................................................................................................3

Five forces analysis of US airline industry......................................................................................3

Bargaining power of suppliers.....................................................................................................4

Bargaining power of customers...................................................................................................5

Threat of Substitutes....................................................................................................................5

The intensity of competitive rivalry............................................................................................6

The threat of new entrants...........................................................................................................6

Advantages and disadvantages of the model...............................................................................7

Economic performance....................................................................................................................9

Identifying strategies for airline profitability................................................................................10

Discussion......................................................................................................................................10

Conclusion.....................................................................................................................................12

References......................................................................................................................................13

Case and Strategy analysis 2

Introduction

Strategic positioning defined as the positioning of an organization in the future which includes

the fluctuating environment along with the organized realization of the positioning. The strategy

identifies the contents and characters of the activities of the organizations (Hollensen, 2010). The

report is based on the case study of the United States Airline Industry. It focuses on the strategic

position of the Airline Industry of US. The report includes the five forces analysis of the US

airline industry and their components from the perspective of the US Airline. Along with this, it

includes the economic performance of the company. In the end, the paper will reflect the

strategies that contribute to the improvement of profitability of the US airline.

Introduction

Strategic positioning defined as the positioning of an organization in the future which includes

the fluctuating environment along with the organized realization of the positioning. The strategy

identifies the contents and characters of the activities of the organizations (Hollensen, 2010). The

report is based on the case study of the United States Airline Industry. It focuses on the strategic

position of the Airline Industry of US. The report includes the five forces analysis of the US

airline industry and their components from the perspective of the US Airline. Along with this, it

includes the economic performance of the company. In the end, the paper will reflect the

strategies that contribute to the improvement of profitability of the US airline.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Case and Strategy analysis 3

Overview of the US airline industry

The air transportation network of US was is very extensive. In the year 2013, there were

approximately 86 airports in the U.S who per annum handled more than 1,000,000 passengers

(CAPA, 2018). The passenger of air transportation market is a thriving industry which is taking

individuals across the world. US airports were included in the list of the world busiest airports

considering the passenger volume in the year 2014 (Belobaba, Odoni, and Barnhart, 2015).

Considering the geography of the United States which reflects that places or major cities were

available at large distance due to which most of the visitors started using air transportation for

the trips. After the Great Recession in the year 2013, the air traffic in the US was a decline as

reported by the government of US.

At the same time, the airline of US has faced the rapid association of all the nation's largest

carriers experiencing mergers (Morrison and Winston, 2010). After all this, the average fare of

domestic airline started increasing as the demand of the airline was increasing. The analysis of

the US domestic Airline industry reflect the top costs and drivers of the airline which include

Labour cost (31.3%), Fuel cost (17.3%) and the Aircraft Leasing cost (2.9%)(Lim, Sharma,

Wang and Zhang, 2018). The rise in the cost of the domestic airline was one of the reason due to

which there was a rise in the prices of the fare.

Five forces analysis of US airline industry

Porter’s five forces framework is a tool that is used by the companies for analyzing the

competitors of the business (Kotler, 2015). This tool is helpful for the company to adjust the

strategy that can suit the competitive environment and this will also contribute to improving the

Overview of the US airline industry

The air transportation network of US was is very extensive. In the year 2013, there were

approximately 86 airports in the U.S who per annum handled more than 1,000,000 passengers

(CAPA, 2018). The passenger of air transportation market is a thriving industry which is taking

individuals across the world. US airports were included in the list of the world busiest airports

considering the passenger volume in the year 2014 (Belobaba, Odoni, and Barnhart, 2015).

Considering the geography of the United States which reflects that places or major cities were

available at large distance due to which most of the visitors started using air transportation for

the trips. After the Great Recession in the year 2013, the air traffic in the US was a decline as

reported by the government of US.

At the same time, the airline of US has faced the rapid association of all the nation's largest

carriers experiencing mergers (Morrison and Winston, 2010). After all this, the average fare of

domestic airline started increasing as the demand of the airline was increasing. The analysis of

the US domestic Airline industry reflect the top costs and drivers of the airline which include

Labour cost (31.3%), Fuel cost (17.3%) and the Aircraft Leasing cost (2.9%)(Lim, Sharma,

Wang and Zhang, 2018). The rise in the cost of the domestic airline was one of the reason due to

which there was a rise in the prices of the fare.

Five forces analysis of US airline industry

Porter’s five forces framework is a tool that is used by the companies for analyzing the

competitors of the business (Kotler, 2015). This tool is helpful for the company to adjust the

strategy that can suit the competitive environment and this will also contribute to improving the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

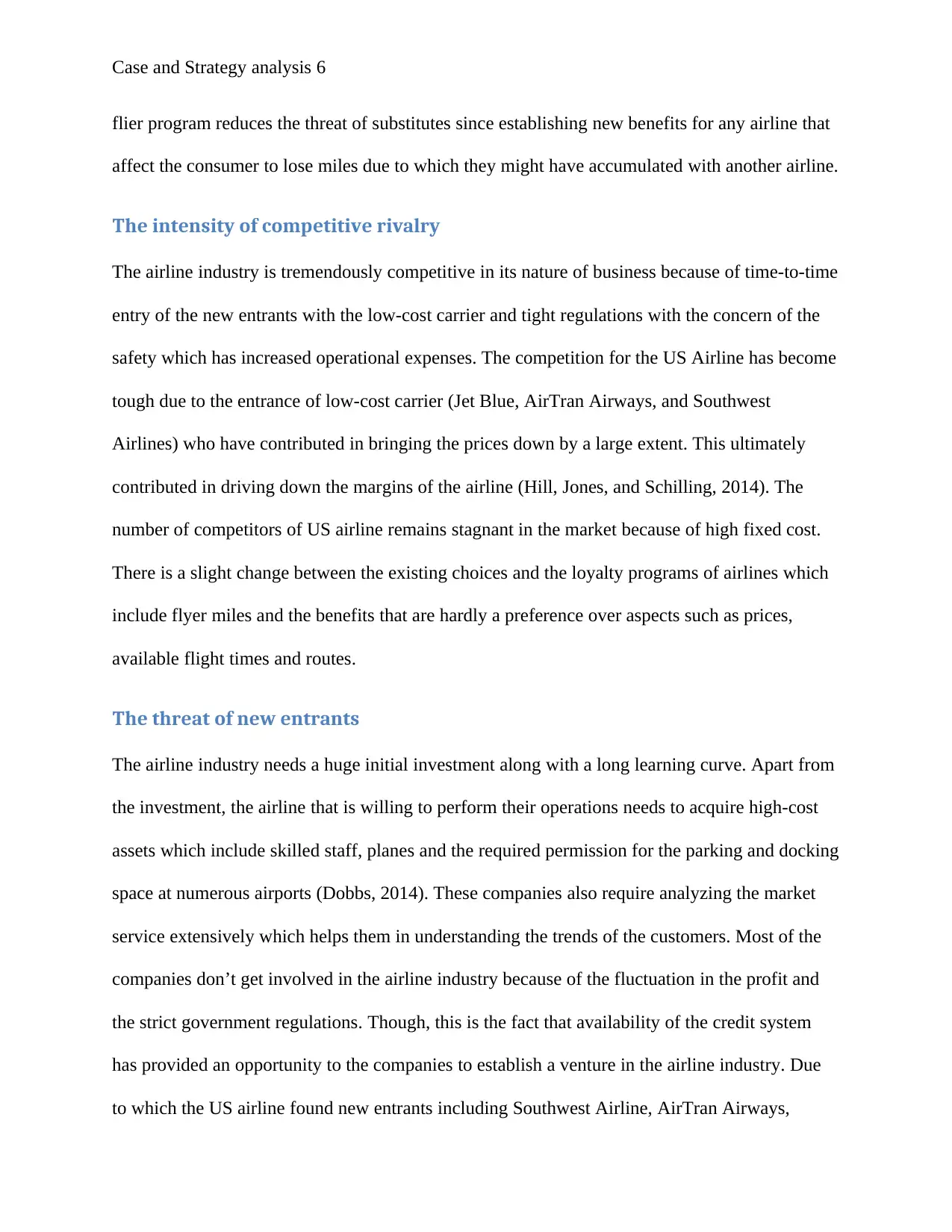

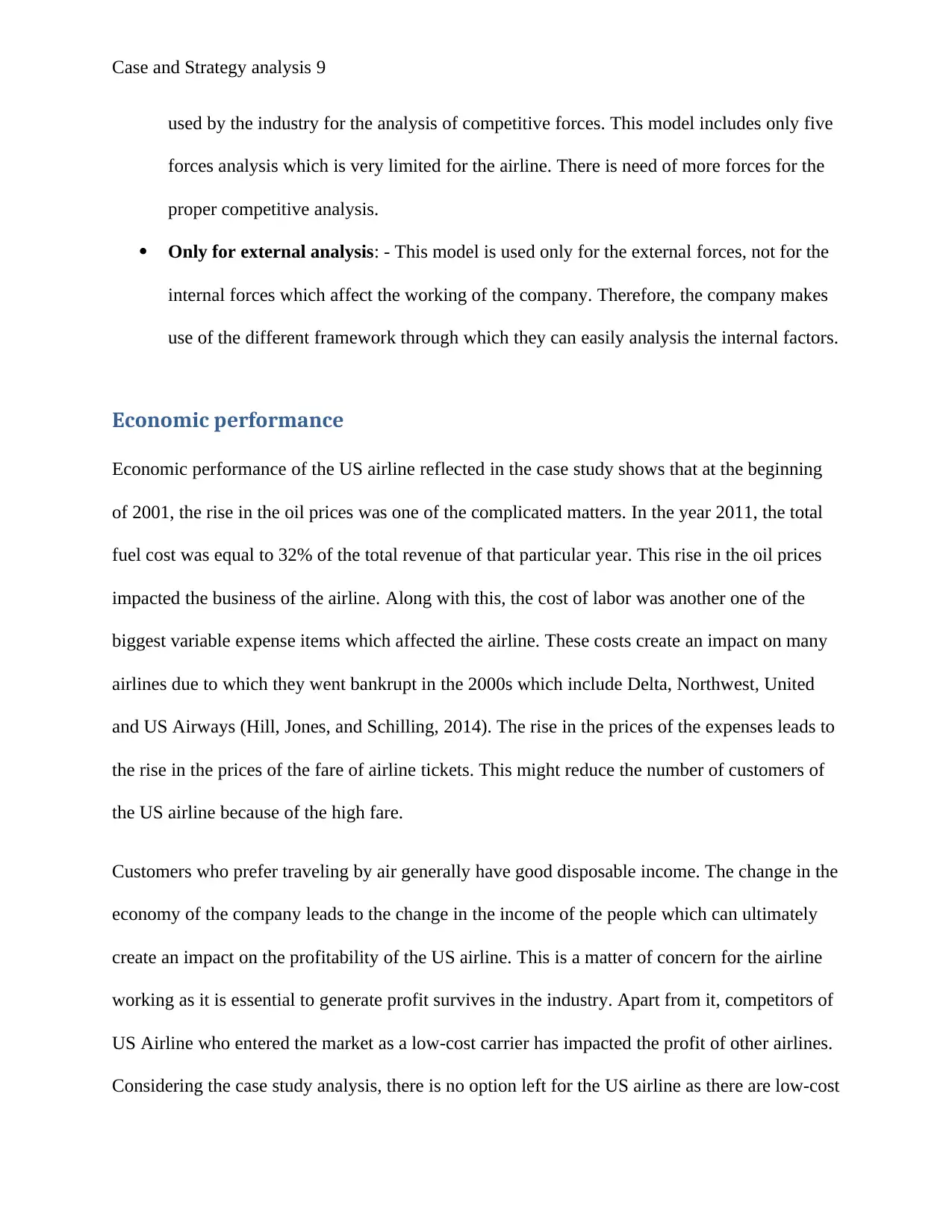

Case and Strategy analysis 4

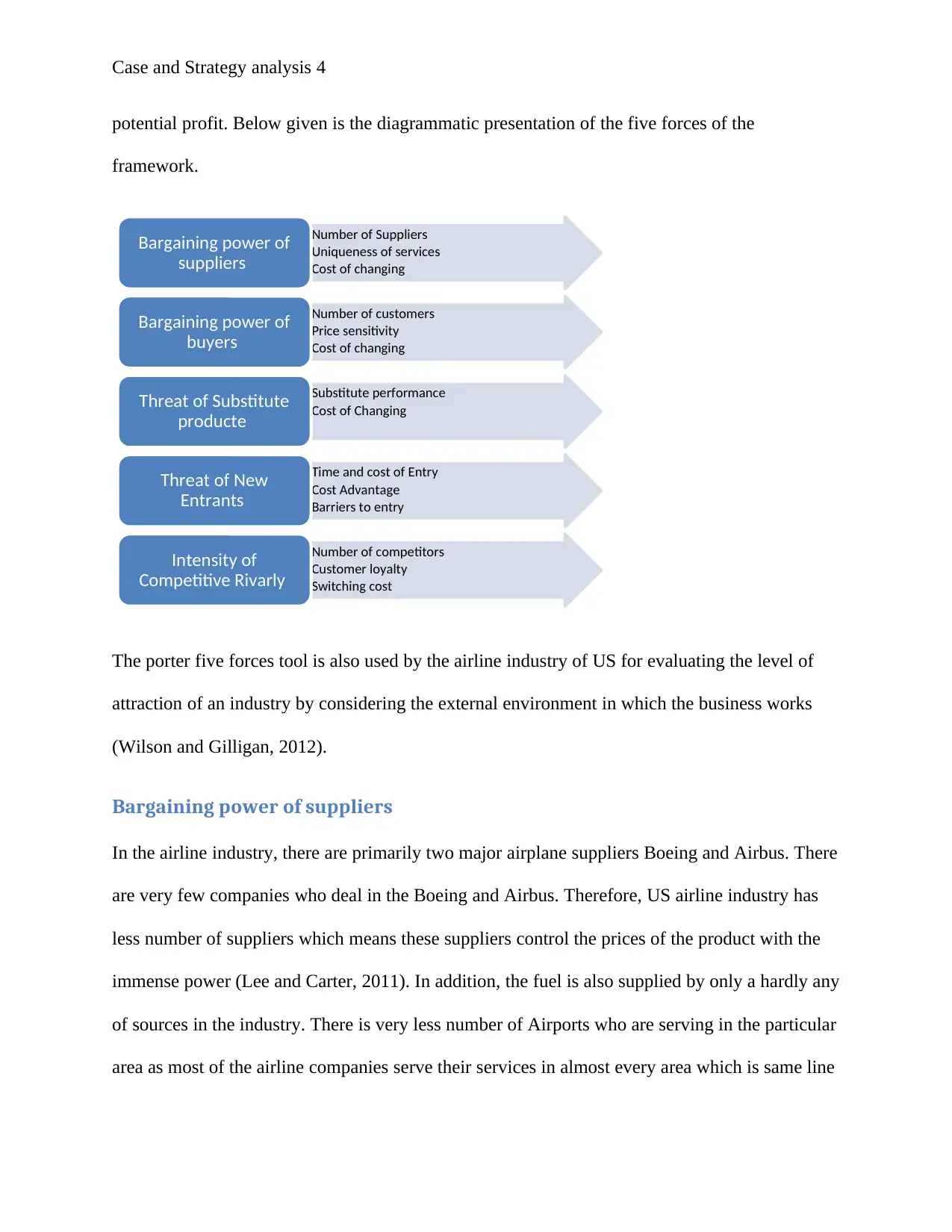

potential profit. Below given is the diagrammatic presentation of the five forces of the

framework.

The porter five forces tool is also used by the airline industry of US for evaluating the level of

attraction of an industry by considering the external environment in which the business works

(Wilson and Gilligan, 2012).

Bargaining power of suppliers

In the airline industry, there are primarily two major airplane suppliers Boeing and Airbus. There

are very few companies who deal in the Boeing and Airbus. Therefore, US airline industry has

less number of suppliers which means these suppliers control the prices of the product with the

immense power (Lee and Carter, 2011). In addition, the fuel is also supplied by only a hardly any

of sources in the industry. There is very less number of Airports who are serving in the particular

area as most of the airline companies serve their services in almost every area which is same line

Number of Suppliers

Uniqueness of services

Cost of changing

Bargaining power of

suppliers

Number of customers

Price sensitivity

Cost of changing

Bargaining power of

buyers

Substitute performance

Cost of Changing

Threat of Substitute

producte

Time and cost of Entry

Cost Advantage

Barriers to entry

Threat of New

Entrants

Number of competitors

Customer loyalty

Switching cost

Intensity of

Competitive Rivarly

potential profit. Below given is the diagrammatic presentation of the five forces of the

framework.

The porter five forces tool is also used by the airline industry of US for evaluating the level of

attraction of an industry by considering the external environment in which the business works

(Wilson and Gilligan, 2012).

Bargaining power of suppliers

In the airline industry, there are primarily two major airplane suppliers Boeing and Airbus. There

are very few companies who deal in the Boeing and Airbus. Therefore, US airline industry has

less number of suppliers which means these suppliers control the prices of the product with the

immense power (Lee and Carter, 2011). In addition, the fuel is also supplied by only a hardly any

of sources in the industry. There is very less number of Airports who are serving in the particular

area as most of the airline companies serve their services in almost every area which is same line

Number of Suppliers

Uniqueness of services

Cost of changing

Bargaining power of

suppliers

Number of customers

Price sensitivity

Cost of changing

Bargaining power of

buyers

Substitute performance

Cost of Changing

Threat of Substitute

producte

Time and cost of Entry

Cost Advantage

Barriers to entry

Threat of New

Entrants

Number of competitors

Customer loyalty

Switching cost

Intensity of

Competitive Rivarly

Case and Strategy analysis 5

US. US airline offers its services in domestic as well as in international areas. Another high-cost

input in the airline industry is labor which is powered by the labor union.

Bargaining power of customers

In the present market, the customer finds low switching cost in the airline industry. Most of the

customer decides the airline on the basis of availability and fare of the airline. Every customer

has a niche that attracts the customers who prefer airline. The emergence of the online portals

offers the customer diverse facility related to the airline tickets, competing on price and flight

timings. There are different portals such as Expedia.com, SkyScanner.com and many others who

offer the different facility to the customers related to the availability and prices of the flight

(Grant, 2016).

Threat of Substitutes

The threat of substitutes takes place when similar products are offered in the industry (Chernev,

2018). Potential travelers have the capability to select the over diverse modes of the

transportation like buses, cars, trains, and boats. In substitution of the product, there is

involvement of the switching cost which is associated with the shifting of modes of

transportation. There are many customers who prefer US airlines for traveling places which are

at distance. The customer might choose other methods of transportation for the shorter distances.

In addition, technology is also contributing in substituting of customers from airline travel.

Technological communication such as WebEx, Skype, and other video-conferencing tools are

offering the facilities to the business travelers in conducting meetings due to which the volume

of a passenger at US airlines is declining (Management Study Guide, 2018). Though, there are

still numerous business meetings due to which the business operators travel. Moreover, frequent

US. US airline offers its services in domestic as well as in international areas. Another high-cost

input in the airline industry is labor which is powered by the labor union.

Bargaining power of customers

In the present market, the customer finds low switching cost in the airline industry. Most of the

customer decides the airline on the basis of availability and fare of the airline. Every customer

has a niche that attracts the customers who prefer airline. The emergence of the online portals

offers the customer diverse facility related to the airline tickets, competing on price and flight

timings. There are different portals such as Expedia.com, SkyScanner.com and many others who

offer the different facility to the customers related to the availability and prices of the flight

(Grant, 2016).

Threat of Substitutes

The threat of substitutes takes place when similar products are offered in the industry (Chernev,

2018). Potential travelers have the capability to select the over diverse modes of the

transportation like buses, cars, trains, and boats. In substitution of the product, there is

involvement of the switching cost which is associated with the shifting of modes of

transportation. There are many customers who prefer US airlines for traveling places which are

at distance. The customer might choose other methods of transportation for the shorter distances.

In addition, technology is also contributing in substituting of customers from airline travel.

Technological communication such as WebEx, Skype, and other video-conferencing tools are

offering the facilities to the business travelers in conducting meetings due to which the volume

of a passenger at US airlines is declining (Management Study Guide, 2018). Though, there are

still numerous business meetings due to which the business operators travel. Moreover, frequent

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Case and Strategy analysis 6

flier program reduces the threat of substitutes since establishing new benefits for any airline that

affect the consumer to lose miles due to which they might have accumulated with another airline.

The intensity of competitive rivalry

The airline industry is tremendously competitive in its nature of business because of time-to-time

entry of the new entrants with the low-cost carrier and tight regulations with the concern of the

safety which has increased operational expenses. The competition for the US Airline has become

tough due to the entrance of low-cost carrier (Jet Blue, AirTran Airways, and Southwest

Airlines) who have contributed in bringing the prices down by a large extent. This ultimately

contributed in driving down the margins of the airline (Hill, Jones, and Schilling, 2014). The

number of competitors of US airline remains stagnant in the market because of high fixed cost.

There is a slight change between the existing choices and the loyalty programs of airlines which

include flyer miles and the benefits that are hardly a preference over aspects such as prices,

available flight times and routes.

The threat of new entrants

The airline industry needs a huge initial investment along with a long learning curve. Apart from

the investment, the airline that is willing to perform their operations needs to acquire high-cost

assets which include skilled staff, planes and the required permission for the parking and docking

space at numerous airports (Dobbs, 2014). These companies also require analyzing the market

service extensively which helps them in understanding the trends of the customers. Most of the

companies don’t get involved in the airline industry because of the fluctuation in the profit and

the strict government regulations. Though, this is the fact that availability of the credit system

has provided an opportunity to the companies to establish a venture in the airline industry. Due

to which the US airline found new entrants including Southwest Airline, AirTran Airways,

flier program reduces the threat of substitutes since establishing new benefits for any airline that

affect the consumer to lose miles due to which they might have accumulated with another airline.

The intensity of competitive rivalry

The airline industry is tremendously competitive in its nature of business because of time-to-time

entry of the new entrants with the low-cost carrier and tight regulations with the concern of the

safety which has increased operational expenses. The competition for the US Airline has become

tough due to the entrance of low-cost carrier (Jet Blue, AirTran Airways, and Southwest

Airlines) who have contributed in bringing the prices down by a large extent. This ultimately

contributed in driving down the margins of the airline (Hill, Jones, and Schilling, 2014). The

number of competitors of US airline remains stagnant in the market because of high fixed cost.

There is a slight change between the existing choices and the loyalty programs of airlines which

include flyer miles and the benefits that are hardly a preference over aspects such as prices,

available flight times and routes.

The threat of new entrants

The airline industry needs a huge initial investment along with a long learning curve. Apart from

the investment, the airline that is willing to perform their operations needs to acquire high-cost

assets which include skilled staff, planes and the required permission for the parking and docking

space at numerous airports (Dobbs, 2014). These companies also require analyzing the market

service extensively which helps them in understanding the trends of the customers. Most of the

companies don’t get involved in the airline industry because of the fluctuation in the profit and

the strict government regulations. Though, this is the fact that availability of the credit system

has provided an opportunity to the companies to establish a venture in the airline industry. Due

to which the US airline found new entrants including Southwest Airline, AirTran Airways,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Case and Strategy analysis 7

Virgin America and Jet Blue. These new entrants make use of the non-union labor often to fly

just one type of the aircraft. Moreover, these airline companies are focused towards the lucrative

routes which mean they fly point-to-point (Hill, Jones, and Schilling, 2014). These new entrants

have contributed in creating a situation of the excess capacity in the industry. Generally, the

threat of the new entrants in the airline industry is low but US airline industry has found many

companies who entered the market of Airline.

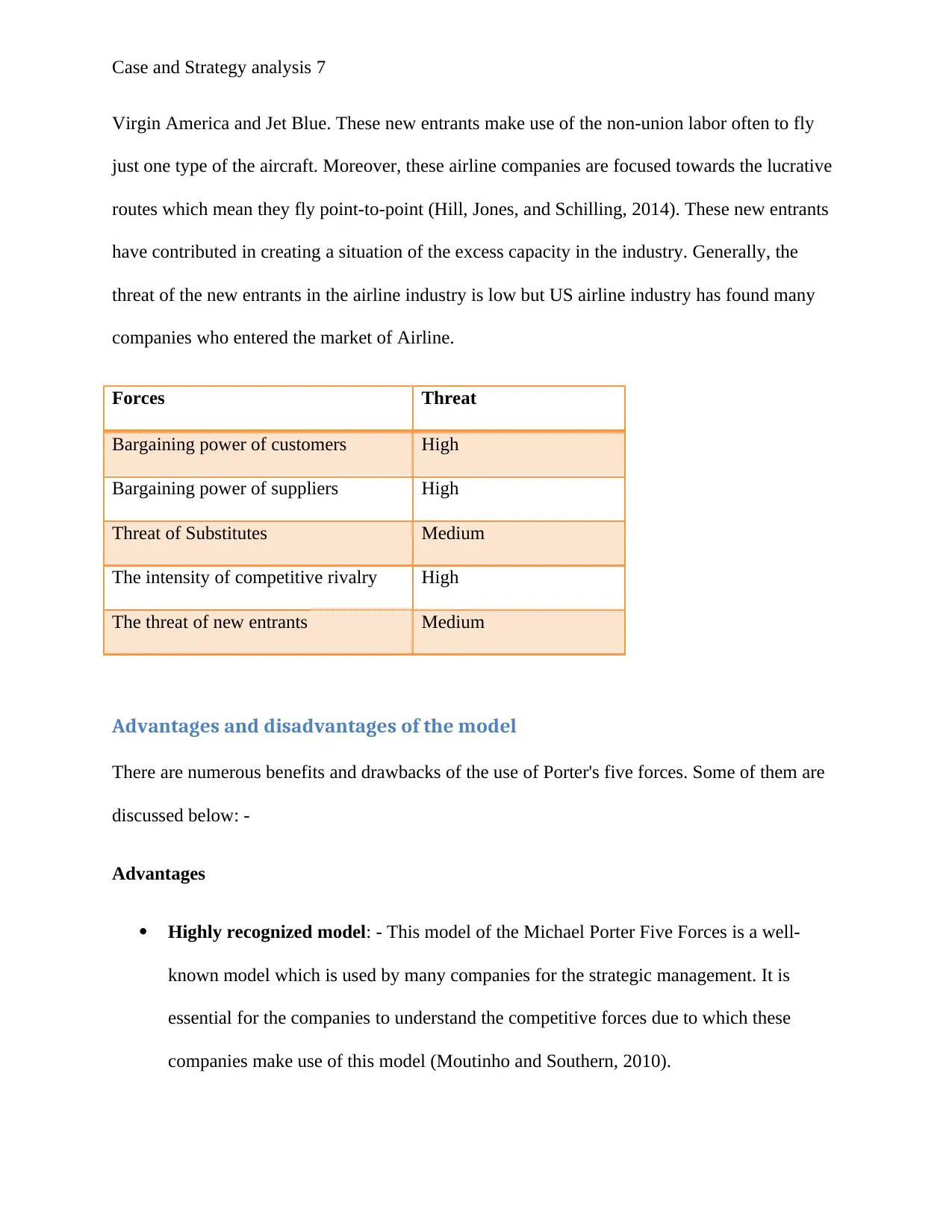

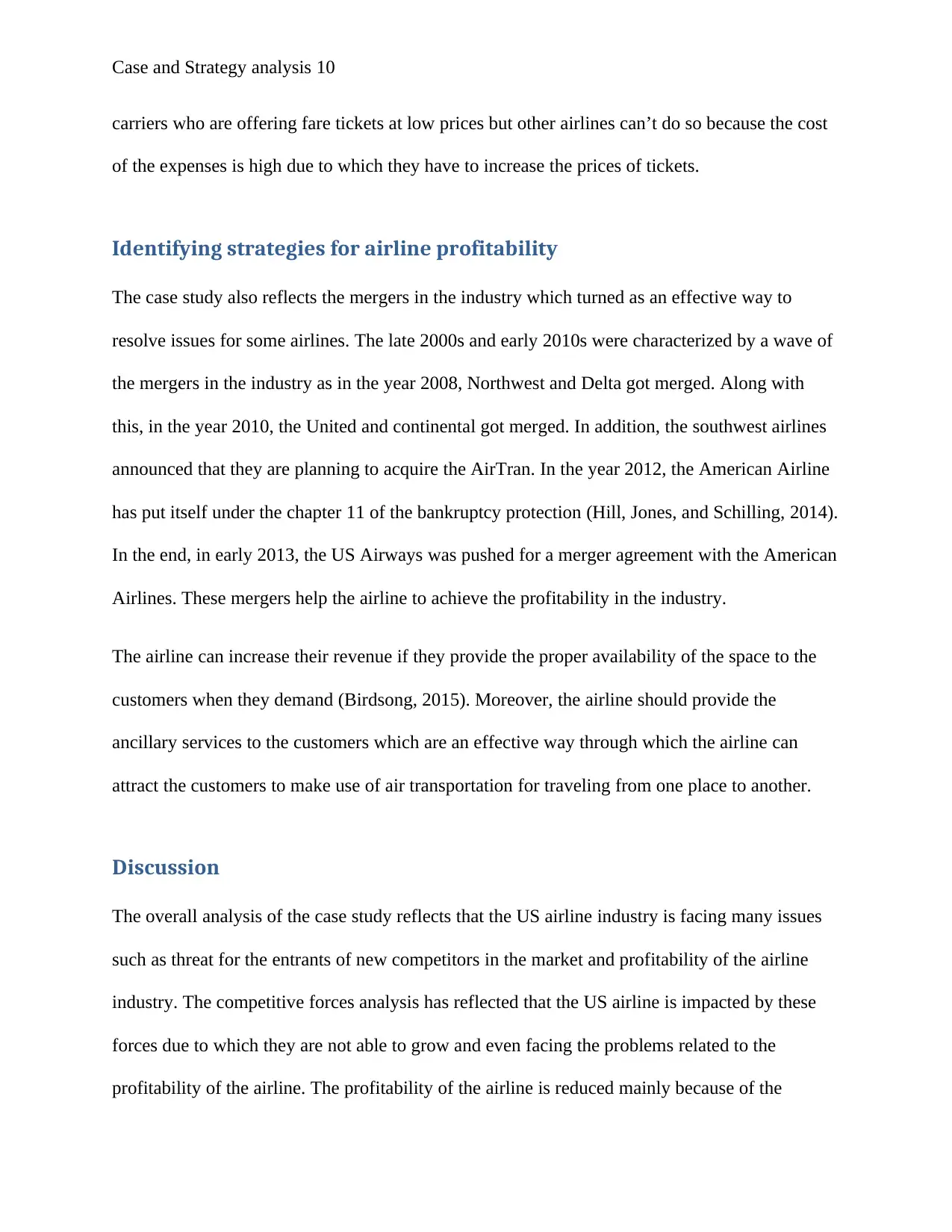

Forces Threat

Bargaining power of customers High

Bargaining power of suppliers High

Threat of Substitutes Medium

The intensity of competitive rivalry High

The threat of new entrants Medium

Advantages and disadvantages of the model

There are numerous benefits and drawbacks of the use of Porter's five forces. Some of them are

discussed below: -

Advantages

Highly recognized model: - This model of the Michael Porter Five Forces is a well-

known model which is used by many companies for the strategic management. It is

essential for the companies to understand the competitive forces due to which these

companies make use of this model (Moutinho and Southern, 2010).

Virgin America and Jet Blue. These new entrants make use of the non-union labor often to fly

just one type of the aircraft. Moreover, these airline companies are focused towards the lucrative

routes which mean they fly point-to-point (Hill, Jones, and Schilling, 2014). These new entrants

have contributed in creating a situation of the excess capacity in the industry. Generally, the

threat of the new entrants in the airline industry is low but US airline industry has found many

companies who entered the market of Airline.

Forces Threat

Bargaining power of customers High

Bargaining power of suppliers High

Threat of Substitutes Medium

The intensity of competitive rivalry High

The threat of new entrants Medium

Advantages and disadvantages of the model

There are numerous benefits and drawbacks of the use of Porter's five forces. Some of them are

discussed below: -

Advantages

Highly recognized model: - This model of the Michael Porter Five Forces is a well-

known model which is used by many companies for the strategic management. It is

essential for the companies to understand the competitive forces due to which these

companies make use of this model (Moutinho and Southern, 2010).

Case and Strategy analysis 8

Simplicity: - Simplicity of the model is the strong point of the model as it is very stress-

free to use and offers a comprehensible way of the market forces analysis. Therefore, the

managers of the business can make use of this analysis in numerous numbers of markets

where the business is operating its working.

The scope of business strategy: - This model is effective in the organization as well as

in the education field. It residues to affect the scope of the business strategy in both the

fields (Freeman, 2010).

Track the movements of suppliers: - The model talks about the activities from the

suppliers of the resources through the company to the consumer. The role of the business

is worried as it is the unit where the value is created. Moreover, the analysis of the

suppliers and customers is explained because these are the most important element of the

supply chain of the business (De Wit and Meyer, 2010).

Disadvantages

Development of model: - The model of Porter five forces was developed in the eighties

and it was designed to extract the details at that point in time. The change in the time has

brought many changes because of rapid development. Rapid development leads to the

cyclical developments, steady market structures and solid competition which are

changing with time. The emergence of the technology has also contributed to the changes

in the structure (Pringle and Huisman, 2011). This reflects that this model can’t be used

to explicate today dynamic changes. Therefore, there is a need for the changes or

development of the model.

Limited to five forces: - The change in the industry working has brought many new

factors that create the impact on the working of the company. The five forces model is

Simplicity: - Simplicity of the model is the strong point of the model as it is very stress-

free to use and offers a comprehensible way of the market forces analysis. Therefore, the

managers of the business can make use of this analysis in numerous numbers of markets

where the business is operating its working.

The scope of business strategy: - This model is effective in the organization as well as

in the education field. It residues to affect the scope of the business strategy in both the

fields (Freeman, 2010).

Track the movements of suppliers: - The model talks about the activities from the

suppliers of the resources through the company to the consumer. The role of the business

is worried as it is the unit where the value is created. Moreover, the analysis of the

suppliers and customers is explained because these are the most important element of the

supply chain of the business (De Wit and Meyer, 2010).

Disadvantages

Development of model: - The model of Porter five forces was developed in the eighties

and it was designed to extract the details at that point in time. The change in the time has

brought many changes because of rapid development. Rapid development leads to the

cyclical developments, steady market structures and solid competition which are

changing with time. The emergence of the technology has also contributed to the changes

in the structure (Pringle and Huisman, 2011). This reflects that this model can’t be used

to explicate today dynamic changes. Therefore, there is a need for the changes or

development of the model.

Limited to five forces: - The change in the industry working has brought many new

factors that create the impact on the working of the company. The five forces model is

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Case and Strategy analysis 9

used by the industry for the analysis of competitive forces. This model includes only five

forces analysis which is very limited for the airline. There is need of more forces for the

proper competitive analysis.

Only for external analysis: - This model is used only for the external forces, not for the

internal forces which affect the working of the company. Therefore, the company makes

use of the different framework through which they can easily analysis the internal factors.

Economic performance

Economic performance of the US airline reflected in the case study shows that at the beginning

of 2001, the rise in the oil prices was one of the complicated matters. In the year 2011, the total

fuel cost was equal to 32% of the total revenue of that particular year. This rise in the oil prices

impacted the business of the airline. Along with this, the cost of labor was another one of the

biggest variable expense items which affected the airline. These costs create an impact on many

airlines due to which they went bankrupt in the 2000s which include Delta, Northwest, United

and US Airways (Hill, Jones, and Schilling, 2014). The rise in the prices of the expenses leads to

the rise in the prices of the fare of airline tickets. This might reduce the number of customers of

the US airline because of the high fare.

Customers who prefer traveling by air generally have good disposable income. The change in the

economy of the company leads to the change in the income of the people which can ultimately

create an impact on the profitability of the US airline. This is a matter of concern for the airline

working as it is essential to generate profit survives in the industry. Apart from it, competitors of

US Airline who entered the market as a low-cost carrier has impacted the profit of other airlines.

Considering the case study analysis, there is no option left for the US airline as there are low-cost

used by the industry for the analysis of competitive forces. This model includes only five

forces analysis which is very limited for the airline. There is need of more forces for the

proper competitive analysis.

Only for external analysis: - This model is used only for the external forces, not for the

internal forces which affect the working of the company. Therefore, the company makes

use of the different framework through which they can easily analysis the internal factors.

Economic performance

Economic performance of the US airline reflected in the case study shows that at the beginning

of 2001, the rise in the oil prices was one of the complicated matters. In the year 2011, the total

fuel cost was equal to 32% of the total revenue of that particular year. This rise in the oil prices

impacted the business of the airline. Along with this, the cost of labor was another one of the

biggest variable expense items which affected the airline. These costs create an impact on many

airlines due to which they went bankrupt in the 2000s which include Delta, Northwest, United

and US Airways (Hill, Jones, and Schilling, 2014). The rise in the prices of the expenses leads to

the rise in the prices of the fare of airline tickets. This might reduce the number of customers of

the US airline because of the high fare.

Customers who prefer traveling by air generally have good disposable income. The change in the

economy of the company leads to the change in the income of the people which can ultimately

create an impact on the profitability of the US airline. This is a matter of concern for the airline

working as it is essential to generate profit survives in the industry. Apart from it, competitors of

US Airline who entered the market as a low-cost carrier has impacted the profit of other airlines.

Considering the case study analysis, there is no option left for the US airline as there are low-cost

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Case and Strategy analysis 10

carriers who are offering fare tickets at low prices but other airlines can’t do so because the cost

of the expenses is high due to which they have to increase the prices of tickets.

Identifying strategies for airline profitability

The case study also reflects the mergers in the industry which turned as an effective way to

resolve issues for some airlines. The late 2000s and early 2010s were characterized by a wave of

the mergers in the industry as in the year 2008, Northwest and Delta got merged. Along with

this, in the year 2010, the United and continental got merged. In addition, the southwest airlines

announced that they are planning to acquire the AirTran. In the year 2012, the American Airline

has put itself under the chapter 11 of the bankruptcy protection (Hill, Jones, and Schilling, 2014).

In the end, in early 2013, the US Airways was pushed for a merger agreement with the American

Airlines. These mergers help the airline to achieve the profitability in the industry.

The airline can increase their revenue if they provide the proper availability of the space to the

customers when they demand (Birdsong, 2015). Moreover, the airline should provide the

ancillary services to the customers which are an effective way through which the airline can

attract the customers to make use of air transportation for traveling from one place to another.

Discussion

The overall analysis of the case study reflects that the US airline industry is facing many issues

such as threat for the entrants of new competitors in the market and profitability of the airline

industry. The competitive forces analysis has reflected that the US airline is impacted by these

forces due to which they are not able to grow and even facing the problems related to the

profitability of the airline. The profitability of the airline is reduced mainly because of the

carriers who are offering fare tickets at low prices but other airlines can’t do so because the cost

of the expenses is high due to which they have to increase the prices of tickets.

Identifying strategies for airline profitability

The case study also reflects the mergers in the industry which turned as an effective way to

resolve issues for some airlines. The late 2000s and early 2010s were characterized by a wave of

the mergers in the industry as in the year 2008, Northwest and Delta got merged. Along with

this, in the year 2010, the United and continental got merged. In addition, the southwest airlines

announced that they are planning to acquire the AirTran. In the year 2012, the American Airline

has put itself under the chapter 11 of the bankruptcy protection (Hill, Jones, and Schilling, 2014).

In the end, in early 2013, the US Airways was pushed for a merger agreement with the American

Airlines. These mergers help the airline to achieve the profitability in the industry.

The airline can increase their revenue if they provide the proper availability of the space to the

customers when they demand (Birdsong, 2015). Moreover, the airline should provide the

ancillary services to the customers which are an effective way through which the airline can

attract the customers to make use of air transportation for traveling from one place to another.

Discussion

The overall analysis of the case study reflects that the US airline industry is facing many issues

such as threat for the entrants of new competitors in the market and profitability of the airline

industry. The competitive forces analysis has reflected that the US airline is impacted by these

forces due to which they are not able to grow and even facing the problems related to the

profitability of the airline. The profitability of the airline is reduced mainly because of the

Case and Strategy analysis 11

entrance of the low-cost carriers in the market along with the rise in the prices of the expenses.

The airline should make use of the different strategies through which they can try to increase the

profit. It is advisable for airlines to offer additional services to their customers which are an

effective way to make the space in the market and to attract the maximum number of customers.

entrance of the low-cost carriers in the market along with the rise in the prices of the expenses.

The airline should make use of the different strategies through which they can try to increase the

profit. It is advisable for airlines to offer additional services to their customers which are an

effective way to make the space in the market and to attract the maximum number of customers.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.