Pros and Cons of USA-China Trade War and Protectionist Policy

VerifiedAdded on 2023/06/03

|11

|3273

|371

AI Summary

This report investigates the pros and cons of such a policy in the context of a globalized world as well as the comparative advantages that both the countries have currently. It also assess the impact on businesses in USA and China.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Cover Page

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Cover Page

Executive Summary................................................................................................................ 1

Introduction............................................................................................................................. 2

Protectionism.......................................................................................................................... 2

USA- China: Trade Deficit and Trade War..............................................................................2

In support of Protectionist Policy........................................................................................3

The Flip Side of a Protectionist Policy................................................................................3

Theory of Comparative Advantage.........................................................................................5

Knowledge Economy versus Manufacturing Economy.......................................................6

USA- China Trade War: The Impact on the rest of the World.................................................7

US China Trade War : the Impact on Domestic Consumers and Firms..................................7

Impact of US Firms............................................................................................................ 8

Disturbance of Complex Supply Chains ............................................................................8

Uncertainty in Business.....................................................................................................8

Conclusion.............................................................................................................................. 9

Executive Summary

USA administration has been introducing trade barriers in the form of tariffs against Chinese

imports, in order to make it possible to reduce the wide trade deficit against China. This has

led to a series economic actions which are now being described as a “Trade War”. The

implications of this trade was shall be seen all over the world. This report investigates the

pros and cons of such a policy in the context of a globalized world as well as the

comparative advantages that both the countries have currently. It also assess the impact on

businesses in USA and China.

Executive Summary................................................................................................................ 1

Introduction............................................................................................................................. 2

Protectionism.......................................................................................................................... 2

USA- China: Trade Deficit and Trade War..............................................................................2

In support of Protectionist Policy........................................................................................3

The Flip Side of a Protectionist Policy................................................................................3

Theory of Comparative Advantage.........................................................................................5

Knowledge Economy versus Manufacturing Economy.......................................................6

USA- China Trade War: The Impact on the rest of the World.................................................7

US China Trade War : the Impact on Domestic Consumers and Firms..................................7

Impact of US Firms............................................................................................................ 8

Disturbance of Complex Supply Chains ............................................................................8

Uncertainty in Business.....................................................................................................8

Conclusion.............................................................................................................................. 9

Executive Summary

USA administration has been introducing trade barriers in the form of tariffs against Chinese

imports, in order to make it possible to reduce the wide trade deficit against China. This has

led to a series economic actions which are now being described as a “Trade War”. The

implications of this trade was shall be seen all over the world. This report investigates the

pros and cons of such a policy in the context of a globalized world as well as the

comparative advantages that both the countries have currently. It also assess the impact on

businesses in USA and China.

Cover Page

Introduction

US President Donald Trump won the national election, largely based on the promise to

improve the US economy by reducing Free Trade, in general. Over the past year, USA has

been imposing higher trade barriers in the form of tariffs on several Chinese imports. In

retaliation, to the US policy against Chinese goods, China has introduced retaliatory tariffs,

resulting in a series of actions which are now being categorised as a trade war. (Tan, 2018)

Protectionism

The Trump administration has not only been arguing against more trade barriers against

China but has also, initiated actions against Free Trade Agreements, in general. The USA, in

2017, abstained from participating in the Trans Pacific Partnership, a Free trade Agreement

between over 11 countries ( Sherwood & Iturrieta, 2018). The overall policy of the Trump

administration also includes introducing more regulations to discourage the flow of skilled

and unskilled migrant workers, especially from countries like India and Mexico. This policy

of introducing higher trade barriers and barriers to labour inflow, in order to protect domestic

industry and labour is known as “protectionism” and is contrarian to US trade policy in the

The protectionist policy of USA does not operate in a vacuum. International Trade, in modern

times, has become complex intertwined structure or more “globalized” and the ripple effects

of the US policies will be seen all over the world.

USA- China: Trade Deficit and Trade War

Chinese exports to the USA tend to be lower on account of cheap labour available in China.

Import demand from USA has, in part, led to a phenomenal economic growth in China,

especially, in the past few decades.(Moes, 2018). On the flip side, the United States of

America has had trade deficits against China, every year in the last decade, with the

exception of the period during the Global Financial Crisis during the year 2008-09.(Federal

Reserve Bank of St. Louis, 2017) Since early 2018, the USA has been in the process of

Introduction

US President Donald Trump won the national election, largely based on the promise to

improve the US economy by reducing Free Trade, in general. Over the past year, USA has

been imposing higher trade barriers in the form of tariffs on several Chinese imports. In

retaliation, to the US policy against Chinese goods, China has introduced retaliatory tariffs,

resulting in a series of actions which are now being categorised as a trade war. (Tan, 2018)

Protectionism

The Trump administration has not only been arguing against more trade barriers against

China but has also, initiated actions against Free Trade Agreements, in general. The USA, in

2017, abstained from participating in the Trans Pacific Partnership, a Free trade Agreement

between over 11 countries ( Sherwood & Iturrieta, 2018). The overall policy of the Trump

administration also includes introducing more regulations to discourage the flow of skilled

and unskilled migrant workers, especially from countries like India and Mexico. This policy

of introducing higher trade barriers and barriers to labour inflow, in order to protect domestic

industry and labour is known as “protectionism” and is contrarian to US trade policy in the

The protectionist policy of USA does not operate in a vacuum. International Trade, in modern

times, has become complex intertwined structure or more “globalized” and the ripple effects

of the US policies will be seen all over the world.

USA- China: Trade Deficit and Trade War

Chinese exports to the USA tend to be lower on account of cheap labour available in China.

Import demand from USA has, in part, led to a phenomenal economic growth in China,

especially, in the past few decades.(Moes, 2018). On the flip side, the United States of

America has had trade deficits against China, every year in the last decade, with the

exception of the period during the Global Financial Crisis during the year 2008-09.(Federal

Reserve Bank of St. Louis, 2017) Since early 2018, the USA has been in the process of

Cover Page

imposition of tariffs on a comprehensive list of items imported from China. (Federal Reserve

Bank of St. Louis, 2017).Among these items, metals and metal ores are the primary items of

concern along with meat items such as bovine meat. (Department of Foreign Affairs and

Trade, 2018). Trade barriers would be expected to lead to Chinese imports becoming more

expensive to consumers in the USA. this would ideally reduce the quantity of import in USA,

which may help the trade deficit become narrower than its current standing. (Mankiw 2018)

In support of Protectionist Policy

China has been able to make a trade surplus by executing currency devaluation, which helps

the Chinese imports become cheaper. This makes it very difficult for US products to compete

with the Chinese products. (Federal Reserve Bank of St. Louis, 2017)

The Chinese trade deficit reduced during the Global Financial Crisis as the Federal Reserve

Bank of USA had to manipulate interest rates to provide a boost to the US economy. A by-

product of this manipulation was a devalued US dollar which made Chinese imports

relatively more expensive. Trade deficit in USA during this time narrowed down. Hence,

there is empirical support for such a protectionist measure. ( Federal Reserve Bank of New

York, 2011)

The Flip Side of a Protectionist Policy

There can be several counter arguments against the policy. Such a protectionist policy is

against the larger goal of “globalization” and can raise other concerns. Trade is a narrow part

of international co-operation and does not exist in a vacuum, The financial markets, currency

markets, asset markets in the two country are also intertwined. There are several areas of the

US economy that benefit from a more globalized world. For example, it is easier for Chinese

investors to invest in USA due to fewer barriers in investment. As a result, Chinese investors

have been investing in assets in USA such as housing, in large numbers.(Richter, 2018)

Chinese tourists visit USA in very large number. (Sisson, 2018)

The gains from other sectors of the economy could be eroded as China may introduce barriers

to curb activities in other sectors of the economy.

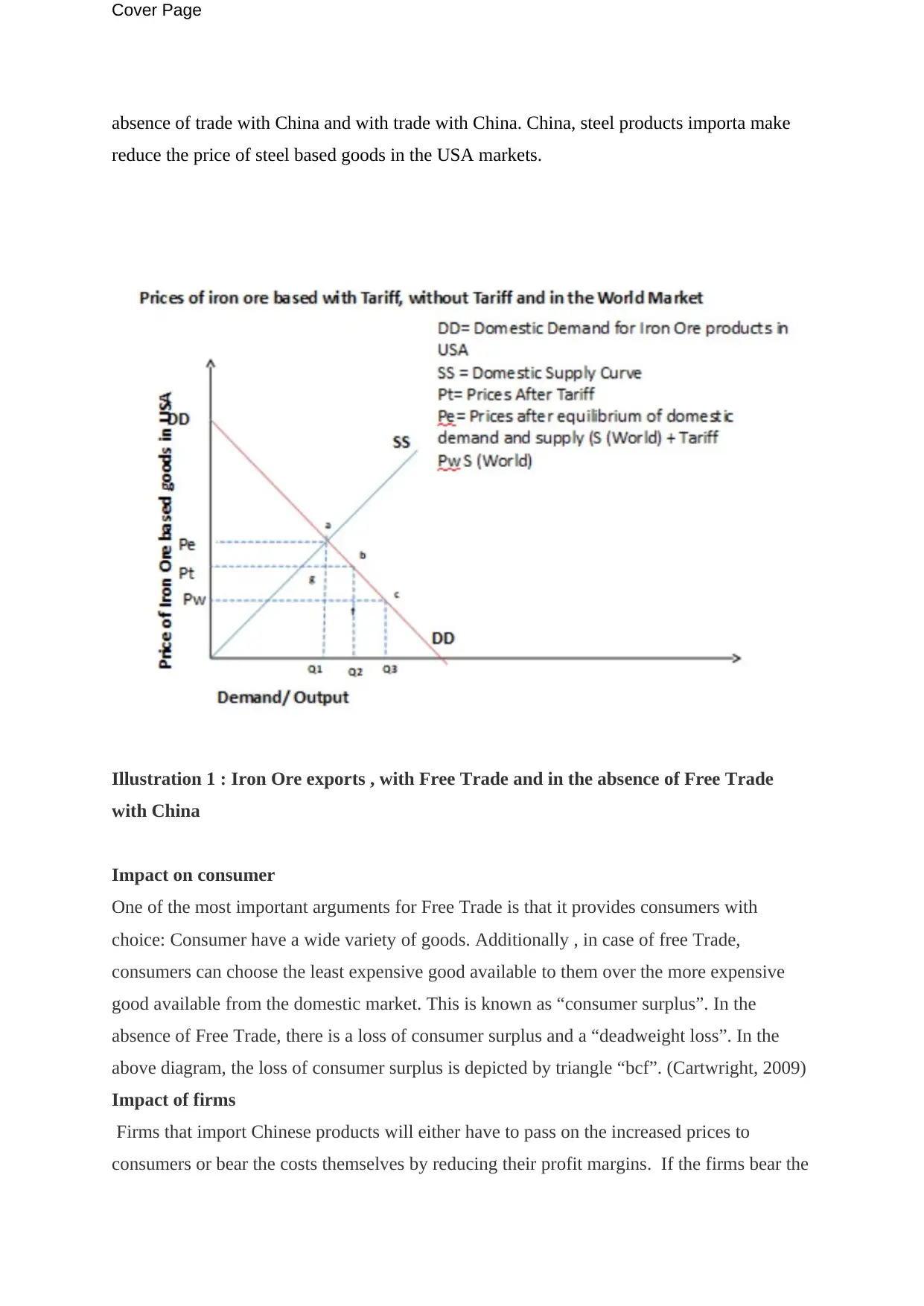

There are several important consequences of globalization in consumers . In the illustration

given below, the price of iron ore based products or steel based products are given , in the

imposition of tariffs on a comprehensive list of items imported from China. (Federal Reserve

Bank of St. Louis, 2017).Among these items, metals and metal ores are the primary items of

concern along with meat items such as bovine meat. (Department of Foreign Affairs and

Trade, 2018). Trade barriers would be expected to lead to Chinese imports becoming more

expensive to consumers in the USA. this would ideally reduce the quantity of import in USA,

which may help the trade deficit become narrower than its current standing. (Mankiw 2018)

In support of Protectionist Policy

China has been able to make a trade surplus by executing currency devaluation, which helps

the Chinese imports become cheaper. This makes it very difficult for US products to compete

with the Chinese products. (Federal Reserve Bank of St. Louis, 2017)

The Chinese trade deficit reduced during the Global Financial Crisis as the Federal Reserve

Bank of USA had to manipulate interest rates to provide a boost to the US economy. A by-

product of this manipulation was a devalued US dollar which made Chinese imports

relatively more expensive. Trade deficit in USA during this time narrowed down. Hence,

there is empirical support for such a protectionist measure. ( Federal Reserve Bank of New

York, 2011)

The Flip Side of a Protectionist Policy

There can be several counter arguments against the policy. Such a protectionist policy is

against the larger goal of “globalization” and can raise other concerns. Trade is a narrow part

of international co-operation and does not exist in a vacuum, The financial markets, currency

markets, asset markets in the two country are also intertwined. There are several areas of the

US economy that benefit from a more globalized world. For example, it is easier for Chinese

investors to invest in USA due to fewer barriers in investment. As a result, Chinese investors

have been investing in assets in USA such as housing, in large numbers.(Richter, 2018)

Chinese tourists visit USA in very large number. (Sisson, 2018)

The gains from other sectors of the economy could be eroded as China may introduce barriers

to curb activities in other sectors of the economy.

There are several important consequences of globalization in consumers . In the illustration

given below, the price of iron ore based products or steel based products are given , in the

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Cover Page

absence of trade with China and with trade with China. China, steel products importa make

reduce the price of steel based goods in the USA markets.

Illustration 1 : Iron Ore exports , with Free Trade and in the absence of Free Trade

with China

Impact on consumer

One of the most important arguments for Free Trade is that it provides consumers with

choice: Consumer have a wide variety of goods. Additionally , in case of free Trade,

consumers can choose the least expensive good available to them over the more expensive

good available from the domestic market. This is known as “consumer surplus”. In the

absence of Free Trade, there is a loss of consumer surplus and a “deadweight loss”. In the

above diagram, the loss of consumer surplus is depicted by triangle “bcf”. (Cartwright, 2009)

Impact of firms

Firms that import Chinese products will either have to pass on the increased prices to

consumers or bear the costs themselves by reducing their profit margins. If the firms bear the

absence of trade with China and with trade with China. China, steel products importa make

reduce the price of steel based goods in the USA markets.

Illustration 1 : Iron Ore exports , with Free Trade and in the absence of Free Trade

with China

Impact on consumer

One of the most important arguments for Free Trade is that it provides consumers with

choice: Consumer have a wide variety of goods. Additionally , in case of free Trade,

consumers can choose the least expensive good available to them over the more expensive

good available from the domestic market. This is known as “consumer surplus”. In the

absence of Free Trade, there is a loss of consumer surplus and a “deadweight loss”. In the

above diagram, the loss of consumer surplus is depicted by triangle “bcf”. (Cartwright, 2009)

Impact of firms

Firms that import Chinese products will either have to pass on the increased prices to

consumers or bear the costs themselves by reducing their profit margins. If the firms bear the

Cover Page

costs, then there is a loss of profit for firms. Hence, firms will have to make a variety of

changes such as importing goods from other countries or changing theor operations to absorb

the costs. In any case, firms face plenty of uncertainty in such an environment and this may

affect their business decisions. (Richter, 2018)

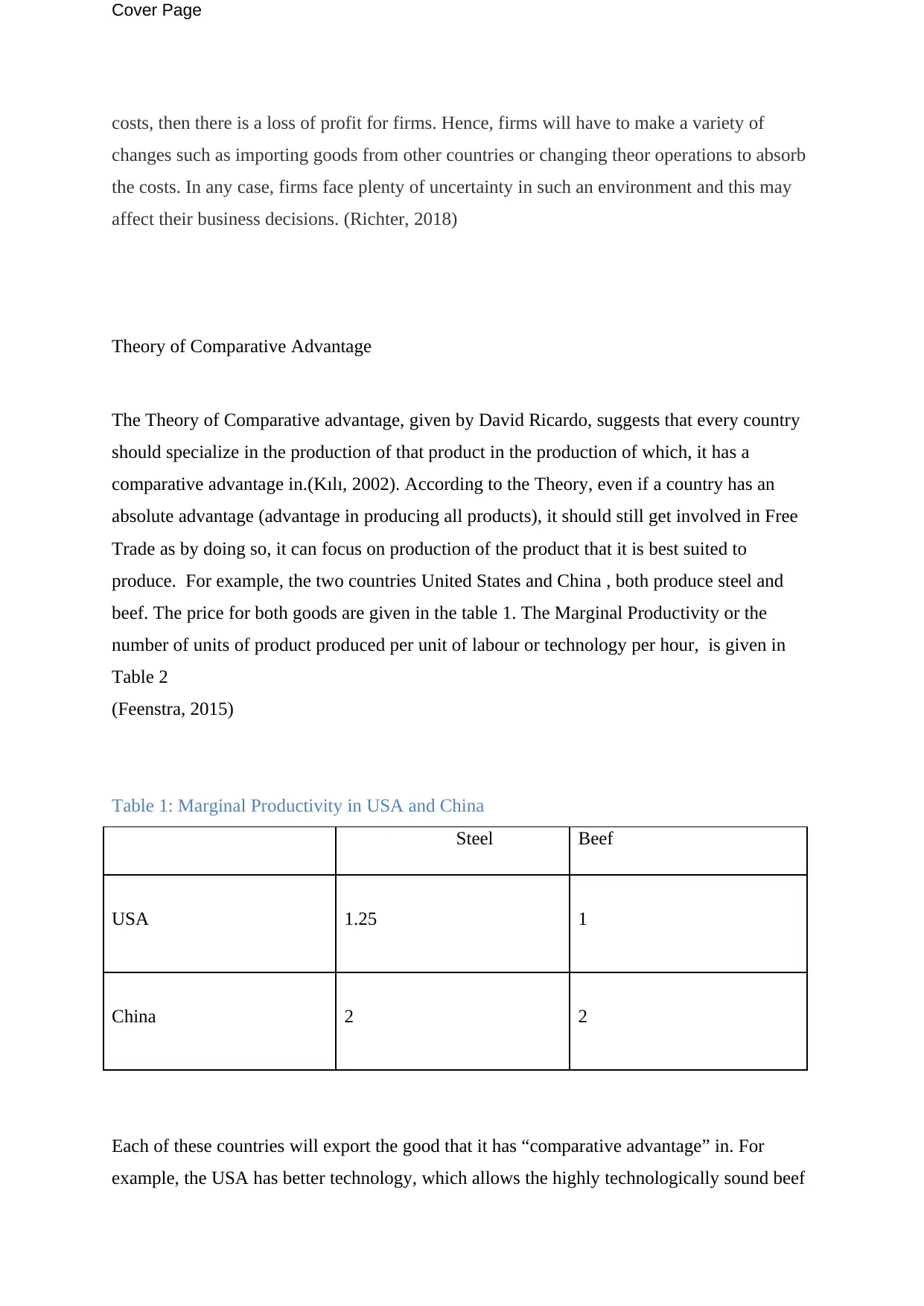

Theory of Comparative Advantage

The Theory of Comparative advantage, given by David Ricardo, suggests that every country

should specialize in the production of that product in the production of which, it has a

comparative advantage in.(Kılı, 2002). According to the Theory, even if a country has an

absolute advantage (advantage in producing all products), it should still get involved in Free

Trade as by doing so, it can focus on production of the product that it is best suited to

produce. For example, the two countries United States and China , both produce steel and

beef. The price for both goods are given in the table 1. The Marginal Productivity or the

number of units of product produced per unit of labour or technology per hour, is given in

Table 2

(Feenstra, 2015)

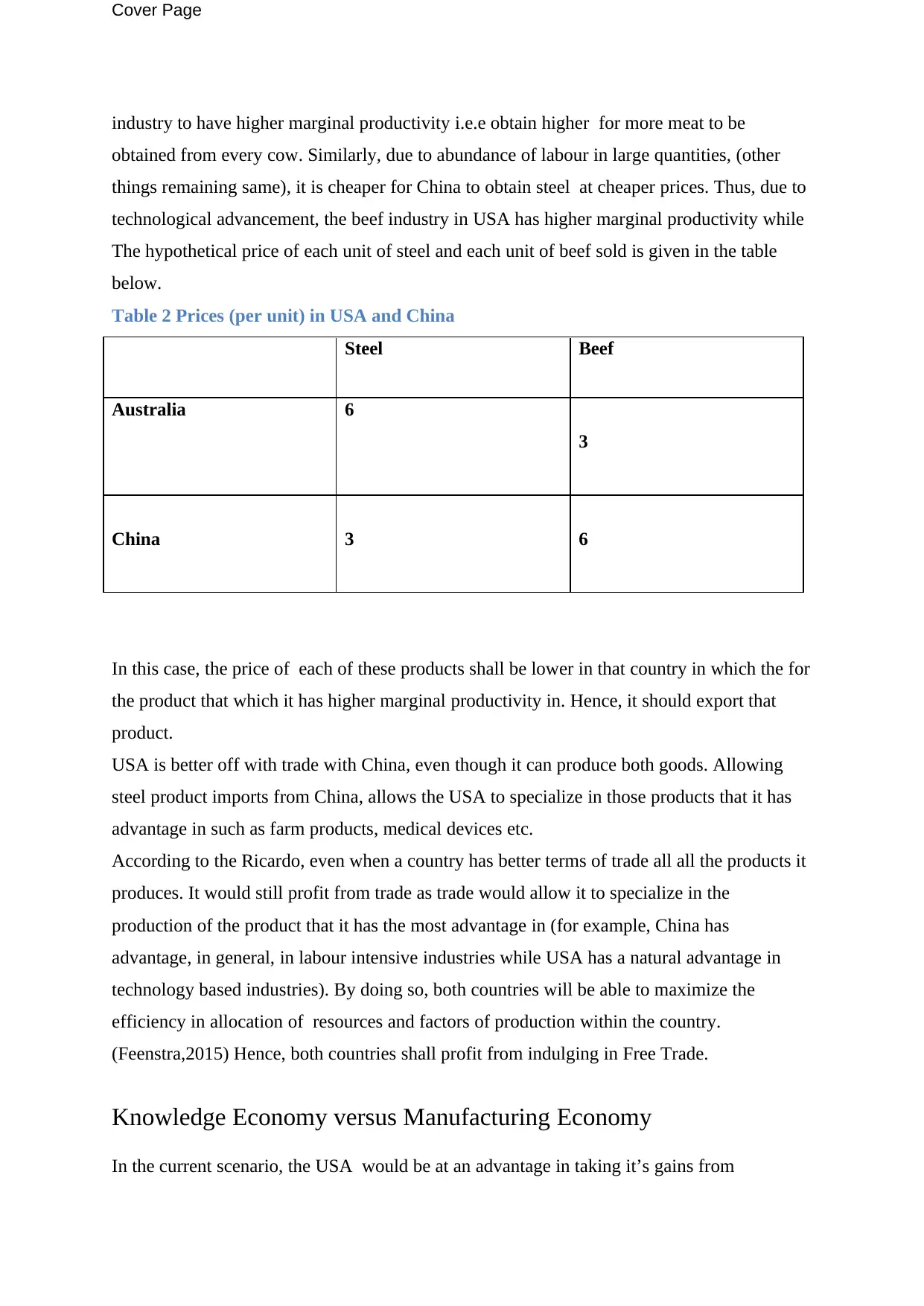

Table 1: Marginal Productivity in USA and China

Steel Beef

USA 1.25 1

China 2 2

Each of these countries will export the good that it has “comparative advantage” in. For

example, the USA has better technology, which allows the highly technologically sound beef

costs, then there is a loss of profit for firms. Hence, firms will have to make a variety of

changes such as importing goods from other countries or changing theor operations to absorb

the costs. In any case, firms face plenty of uncertainty in such an environment and this may

affect their business decisions. (Richter, 2018)

Theory of Comparative Advantage

The Theory of Comparative advantage, given by David Ricardo, suggests that every country

should specialize in the production of that product in the production of which, it has a

comparative advantage in.(Kılı, 2002). According to the Theory, even if a country has an

absolute advantage (advantage in producing all products), it should still get involved in Free

Trade as by doing so, it can focus on production of the product that it is best suited to

produce. For example, the two countries United States and China , both produce steel and

beef. The price for both goods are given in the table 1. The Marginal Productivity or the

number of units of product produced per unit of labour or technology per hour, is given in

Table 2

(Feenstra, 2015)

Table 1: Marginal Productivity in USA and China

Steel Beef

USA 1.25 1

China 2 2

Each of these countries will export the good that it has “comparative advantage” in. For

example, the USA has better technology, which allows the highly technologically sound beef

Cover Page

industry to have higher marginal productivity i.e.e obtain higher for more meat to be

obtained from every cow. Similarly, due to abundance of labour in large quantities, (other

things remaining same), it is cheaper for China to obtain steel at cheaper prices. Thus, due to

technological advancement, the beef industry in USA has higher marginal productivity while

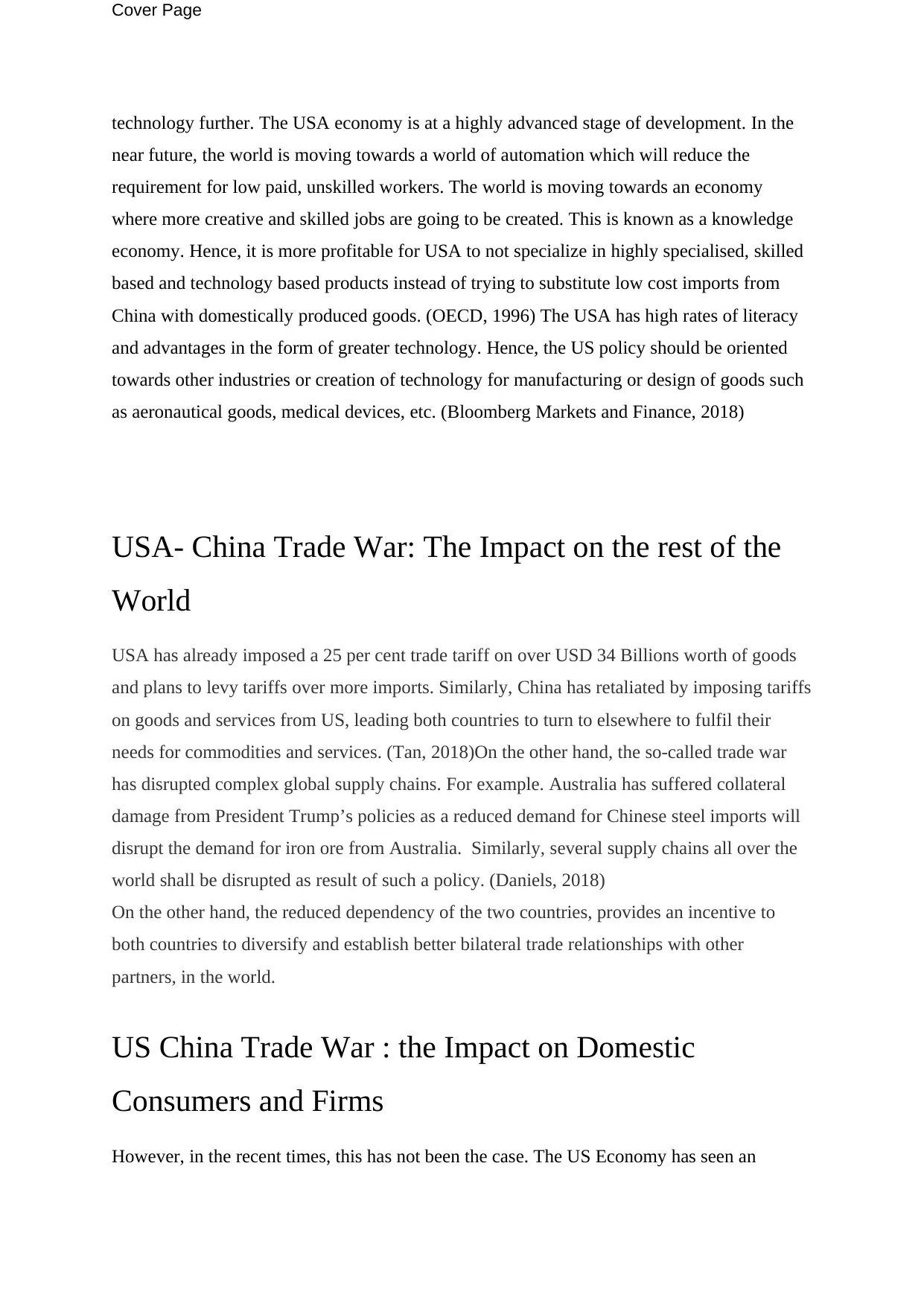

The hypothetical price of each unit of steel and each unit of beef sold is given in the table

below.

Table 2 Prices (per unit) in USA and China

Steel Beef

Australia 6

3

China 3 6

In this case, the price of each of these products shall be lower in that country in which the for

the product that which it has higher marginal productivity in. Hence, it should export that

product.

USA is better off with trade with China, even though it can produce both goods. Allowing

steel product imports from China, allows the USA to specialize in those products that it has

advantage in such as farm products, medical devices etc.

According to the Ricardo, even when a country has better terms of trade all all the products it

produces. It would still profit from trade as trade would allow it to specialize in the

production of the product that it has the most advantage in (for example, China has

advantage, in general, in labour intensive industries while USA has a natural advantage in

technology based industries). By doing so, both countries will be able to maximize the

efficiency in allocation of resources and factors of production within the country.

(Feenstra,2015) Hence, both countries shall profit from indulging in Free Trade.

Knowledge Economy versus Manufacturing Economy

In the current scenario, the USA would be at an advantage in taking it’s gains from

industry to have higher marginal productivity i.e.e obtain higher for more meat to be

obtained from every cow. Similarly, due to abundance of labour in large quantities, (other

things remaining same), it is cheaper for China to obtain steel at cheaper prices. Thus, due to

technological advancement, the beef industry in USA has higher marginal productivity while

The hypothetical price of each unit of steel and each unit of beef sold is given in the table

below.

Table 2 Prices (per unit) in USA and China

Steel Beef

Australia 6

3

China 3 6

In this case, the price of each of these products shall be lower in that country in which the for

the product that which it has higher marginal productivity in. Hence, it should export that

product.

USA is better off with trade with China, even though it can produce both goods. Allowing

steel product imports from China, allows the USA to specialize in those products that it has

advantage in such as farm products, medical devices etc.

According to the Ricardo, even when a country has better terms of trade all all the products it

produces. It would still profit from trade as trade would allow it to specialize in the

production of the product that it has the most advantage in (for example, China has

advantage, in general, in labour intensive industries while USA has a natural advantage in

technology based industries). By doing so, both countries will be able to maximize the

efficiency in allocation of resources and factors of production within the country.

(Feenstra,2015) Hence, both countries shall profit from indulging in Free Trade.

Knowledge Economy versus Manufacturing Economy

In the current scenario, the USA would be at an advantage in taking it’s gains from

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Cover Page

technology further. The USA economy is at a highly advanced stage of development. In the

near future, the world is moving towards a world of automation which will reduce the

requirement for low paid, unskilled workers. The world is moving towards an economy

where more creative and skilled jobs are going to be created. This is known as a knowledge

economy. Hence, it is more profitable for USA to not specialize in highly specialised, skilled

based and technology based products instead of trying to substitute low cost imports from

China with domestically produced goods. (OECD, 1996) The USA has high rates of literacy

and advantages in the form of greater technology. Hence, the US policy should be oriented

towards other industries or creation of technology for manufacturing or design of goods such

as aeronautical goods, medical devices, etc. (Bloomberg Markets and Finance, 2018)

USA- China Trade War: The Impact on the rest of the

World

USA has already imposed a 25 per cent trade tariff on over USD 34 Billions worth of goods

and plans to levy tariffs over more imports. Similarly, China has retaliated by imposing tariffs

on goods and services from US, leading both countries to turn to elsewhere to fulfil their

needs for commodities and services. (Tan, 2018)On the other hand, the so-called trade war

has disrupted complex global supply chains. For example. Australia has suffered collateral

damage from President Trump’s policies as a reduced demand for Chinese steel imports will

disrupt the demand for iron ore from Australia. Similarly, several supply chains all over the

world shall be disrupted as result of such a policy. (Daniels, 2018)

On the other hand, the reduced dependency of the two countries, provides an incentive to

both countries to diversify and establish better bilateral trade relationships with other

partners, in the world.

US China Trade War : the Impact on Domestic

Consumers and Firms

However, in the recent times, this has not been the case. The US Economy has seen an

technology further. The USA economy is at a highly advanced stage of development. In the

near future, the world is moving towards a world of automation which will reduce the

requirement for low paid, unskilled workers. The world is moving towards an economy

where more creative and skilled jobs are going to be created. This is known as a knowledge

economy. Hence, it is more profitable for USA to not specialize in highly specialised, skilled

based and technology based products instead of trying to substitute low cost imports from

China with domestically produced goods. (OECD, 1996) The USA has high rates of literacy

and advantages in the form of greater technology. Hence, the US policy should be oriented

towards other industries or creation of technology for manufacturing or design of goods such

as aeronautical goods, medical devices, etc. (Bloomberg Markets and Finance, 2018)

USA- China Trade War: The Impact on the rest of the

World

USA has already imposed a 25 per cent trade tariff on over USD 34 Billions worth of goods

and plans to levy tariffs over more imports. Similarly, China has retaliated by imposing tariffs

on goods and services from US, leading both countries to turn to elsewhere to fulfil their

needs for commodities and services. (Tan, 2018)On the other hand, the so-called trade war

has disrupted complex global supply chains. For example. Australia has suffered collateral

damage from President Trump’s policies as a reduced demand for Chinese steel imports will

disrupt the demand for iron ore from Australia. Similarly, several supply chains all over the

world shall be disrupted as result of such a policy. (Daniels, 2018)

On the other hand, the reduced dependency of the two countries, provides an incentive to

both countries to diversify and establish better bilateral trade relationships with other

partners, in the world.

US China Trade War : the Impact on Domestic

Consumers and Firms

However, in the recent times, this has not been the case. The US Economy has seen an

Cover Page

economic boom for 8 years in a row and hence, consumer spending remains high. As a result,

the USA has been high. . Hence, it is less likely, that consumers may be willing to spend less

money on Chinese imports. Some of the items that are expected to become more expensive

are apparel, footwear, toys etc. (Kearns, 2018)

Impact of US Firms

Impact on farmers: US farmers are demographic group that may suffer the greatest from

such a policy. Among the items that China has levied retaliatory tariffs are farm products and

food based products. Items of exports such as pork, soyabean, fruits etc. are some of the

products that will see a reduction in demand. Additionally, agro-based industries such as

frozen fruits such as vegetables are the some of the key exports that may suffer in the process.

(Daniels, 2018). The cost of production of farm products such as pork is already high in the

USA.

Disturbance of Complex Supply Chains

The world supply chain is a complex entity , that is fragmented over several nations. (KPMG,

2016) For example, the steel used in cars for the auto industry in the USA, import steel from

China which produces steel from Australia. Similarly, the iphones sold by US company

Apple are manufactured in China, that sources the earphones from another firm. In the wake

of additional taxes, profit margins of some companies could get eroded. This may result in

firms requiring to either sacrifice their profit margins or source materials from other

countries. For example, apparel firms could shift their production from China to other

neighbouring countries like Bangkok. Electronic firms could shift their production from

China to other countries like Vietnam. (Gillespie, 2018) (Daniels, 2018)

Uncertainty in Business

The effects of such a policy are felt for business firms all over the world, right from a mining firm in

Australia to a consumer product business like whirlpool. One of the direct effects of such a policy is

the uncertainty it brings , in terms of uncertainty regarding policies. In some extreme cases, firms

could shift production in other countries. Another direct uncertainty is uncertainty that comes from

uncertain foreign exchange.(Mu, 2018) It is expected that China may devalue its currency to keep

prices the same. This may affect earnings directly. For example, this would directly imports for China

economic boom for 8 years in a row and hence, consumer spending remains high. As a result,

the USA has been high. . Hence, it is less likely, that consumers may be willing to spend less

money on Chinese imports. Some of the items that are expected to become more expensive

are apparel, footwear, toys etc. (Kearns, 2018)

Impact of US Firms

Impact on farmers: US farmers are demographic group that may suffer the greatest from

such a policy. Among the items that China has levied retaliatory tariffs are farm products and

food based products. Items of exports such as pork, soyabean, fruits etc. are some of the

products that will see a reduction in demand. Additionally, agro-based industries such as

frozen fruits such as vegetables are the some of the key exports that may suffer in the process.

(Daniels, 2018). The cost of production of farm products such as pork is already high in the

USA.

Disturbance of Complex Supply Chains

The world supply chain is a complex entity , that is fragmented over several nations. (KPMG,

2016) For example, the steel used in cars for the auto industry in the USA, import steel from

China which produces steel from Australia. Similarly, the iphones sold by US company

Apple are manufactured in China, that sources the earphones from another firm. In the wake

of additional taxes, profit margins of some companies could get eroded. This may result in

firms requiring to either sacrifice their profit margins or source materials from other

countries. For example, apparel firms could shift their production from China to other

neighbouring countries like Bangkok. Electronic firms could shift their production from

China to other countries like Vietnam. (Gillespie, 2018) (Daniels, 2018)

Uncertainty in Business

The effects of such a policy are felt for business firms all over the world, right from a mining firm in

Australia to a consumer product business like whirlpool. One of the direct effects of such a policy is

the uncertainty it brings , in terms of uncertainty regarding policies. In some extreme cases, firms

could shift production in other countries. Another direct uncertainty is uncertainty that comes from

uncertain foreign exchange.(Mu, 2018) It is expected that China may devalue its currency to keep

prices the same. This may affect earnings directly. For example, this would directly imports for China

Cover Page

expensive, therefore, affecting demand from China. Uncertainty in equities and financial markets in

both countries is also expected, which may have a contagion effect all over the world.

Conclusion

The US- China Trade war is a part of a larger theme of protectionism that the Trump administration of

US government is oriented towards and may not just bring macroeconomic uncertainty in both

countries but all over the world. It may affect businesses by creating uncertainty and disturbing supply

chains that span all over the world. Additionally, the trade war may create problems in the financial

markets. More importantly, international trade is just one of the concerns in the larger picture of

globalisation and no policy should be made without keeping in mind the larger context of politics and

economics,

References

Bloomberg Markets and Finance(2018, May 06). Former RBI Governor Rajan on China's Debt,

Economy. Retrieved from https://www.youtube.com/watch?v=LglCBFmaOc4

Cartwright, B. (2016, February 4). “Free Trade and Protectionism Unit: Protectionist Quota

Diagram.” . Retrieved from You Tube: www.youtube.com/watch?v=GgqG1ZzoJS4

Daniels, S., (2018, August 21). “US-China Trade War: Australian Economy Risks Getting

Caught in Crossfire.” . Retrieved from CNN Money:

Daniels, J. (2018, September 19). Rising US-China trade tensions 'couldn't come at a worse time': Iowa

agriculture secretary. Retrieved from https://www.cnbc.com/2018/09/19/escalation-in-trade-war-comes-at-

worse-time-says-iowa-ag-official.html

Federal Reserve Bank of St. Louis. (2018) Currency Devaluation and Revaluation. Retrieved from

https://www.newyorkfed.org/aboutthefed/fedpoint/fed38.htmlCurrency Devaluation and Revaluation. (n.d.).

Retrieved from https://www.newyorkfed.org/aboutthefed/fedpoint/fed38.html

Federal Reserve Bank of St. Louis. (2017). “Deficits, Trading Companies for United

States.” . Retrieved from Federal Reserve Bank of St. Louis:

fred.stlouisfed.org/series/A09021USA174NNBR.

expensive, therefore, affecting demand from China. Uncertainty in equities and financial markets in

both countries is also expected, which may have a contagion effect all over the world.

Conclusion

The US- China Trade war is a part of a larger theme of protectionism that the Trump administration of

US government is oriented towards and may not just bring macroeconomic uncertainty in both

countries but all over the world. It may affect businesses by creating uncertainty and disturbing supply

chains that span all over the world. Additionally, the trade war may create problems in the financial

markets. More importantly, international trade is just one of the concerns in the larger picture of

globalisation and no policy should be made without keeping in mind the larger context of politics and

economics,

References

Bloomberg Markets and Finance(2018, May 06). Former RBI Governor Rajan on China's Debt,

Economy. Retrieved from https://www.youtube.com/watch?v=LglCBFmaOc4

Cartwright, B. (2016, February 4). “Free Trade and Protectionism Unit: Protectionist Quota

Diagram.” . Retrieved from You Tube: www.youtube.com/watch?v=GgqG1ZzoJS4

Daniels, S., (2018, August 21). “US-China Trade War: Australian Economy Risks Getting

Caught in Crossfire.” . Retrieved from CNN Money:

Daniels, J. (2018, September 19). Rising US-China trade tensions 'couldn't come at a worse time': Iowa

agriculture secretary. Retrieved from https://www.cnbc.com/2018/09/19/escalation-in-trade-war-comes-at-

worse-time-says-iowa-ag-official.html

Federal Reserve Bank of St. Louis. (2018) Currency Devaluation and Revaluation. Retrieved from

https://www.newyorkfed.org/aboutthefed/fedpoint/fed38.htmlCurrency Devaluation and Revaluation. (n.d.).

Retrieved from https://www.newyorkfed.org/aboutthefed/fedpoint/fed38.html

Federal Reserve Bank of St. Louis. (2017). “Deficits, Trading Companies for United

States.” . Retrieved from Federal Reserve Bank of St. Louis:

fred.stlouisfed.org/series/A09021USA174NNBR.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Cover Page

Feenstra, R. C. (2015). Advanced International Traden Theory and Evidence: Second

Edition. Princeton, New Jersey: Princeton University Press.

Gillespie, P., (2018, March 05) A Trump trade war would hit red states hard. Retrieved from

https://money.cnn.com/2018/03/05/news/economy/trade-war-red-states/index.html

Mu, R. (2018, June 20). US-China Trade War: An Inevitable Conflict and The Impact on Equities, FX.

Retrieved from https://www.dailyfx.com/forex/fundamental/article/special_report/2018/06/20/US-China-Trade-

War-An-Inevitable-Conflict-and-The-Impact-on-Equities-FX-.html

Kili¸c, R. (2002). University of Michigan. Retrieved August 23, 2018, from Absolute and Comparative

Advantage: Ricardian Model: www.msu.edu

Mankiw, N. G. (2009). Study Guide, Brief Principles of Macroeconomics, Third Edition. Canberra: Cengage

Learning.

OECD. (1996). Science and technology policy. Retrieved October 18, 2018, from

http://www.oecd.org/sti/sci-tech/1913021.pdf

Sherwood, D., & Iturrieta, F. (2018, March 09). 11 countries have signed up to the Trans-

Pacific Partnership. Retrieved from World economic Forum:

https://www.weforum.org/agenda/2018/03/11-countries-have-signed-trans-pacific-

partnership

Sisson, P. (2018, February 02). Soaring Chinese tourism means big money for U.S. cities.

Retrieved from Curbed: https://www.curbed.com/2018/2/2/16964908/travel-cities-tourism-

china-chinese-los-angeles

Tan, H. (2018, August 22). Beijing retaliates as new US tariffs kick in on $16 billion of

Chinese goods. Retrieved from CNBC: https://www.cnbc.com/2018/08/23/us-china-trade-

war-new-round-of-american-tariffs-on-chinese-imports.html

KPMG., (2016, September) Taxing complex global supply chain in a post-BEPS world. Retrieved from

https://home.kpmg.com/be/en/home/insights/2016/09/taxing-complex-global-supply-chains-post-beps-

world.html

Feenstra, R. C. (2015). Advanced International Traden Theory and Evidence: Second

Edition. Princeton, New Jersey: Princeton University Press.

Gillespie, P., (2018, March 05) A Trump trade war would hit red states hard. Retrieved from

https://money.cnn.com/2018/03/05/news/economy/trade-war-red-states/index.html

Mu, R. (2018, June 20). US-China Trade War: An Inevitable Conflict and The Impact on Equities, FX.

Retrieved from https://www.dailyfx.com/forex/fundamental/article/special_report/2018/06/20/US-China-Trade-

War-An-Inevitable-Conflict-and-The-Impact-on-Equities-FX-.html

Kili¸c, R. (2002). University of Michigan. Retrieved August 23, 2018, from Absolute and Comparative

Advantage: Ricardian Model: www.msu.edu

Mankiw, N. G. (2009). Study Guide, Brief Principles of Macroeconomics, Third Edition. Canberra: Cengage

Learning.

OECD. (1996). Science and technology policy. Retrieved October 18, 2018, from

http://www.oecd.org/sti/sci-tech/1913021.pdf

Sherwood, D., & Iturrieta, F. (2018, March 09). 11 countries have signed up to the Trans-

Pacific Partnership. Retrieved from World economic Forum:

https://www.weforum.org/agenda/2018/03/11-countries-have-signed-trans-pacific-

partnership

Sisson, P. (2018, February 02). Soaring Chinese tourism means big money for U.S. cities.

Retrieved from Curbed: https://www.curbed.com/2018/2/2/16964908/travel-cities-tourism-

china-chinese-los-angeles

Tan, H. (2018, August 22). Beijing retaliates as new US tariffs kick in on $16 billion of

Chinese goods. Retrieved from CNBC: https://www.cnbc.com/2018/08/23/us-china-trade-

war-new-round-of-american-tariffs-on-chinese-imports.html

KPMG., (2016, September) Taxing complex global supply chain in a post-BEPS world. Retrieved from

https://home.kpmg.com/be/en/home/insights/2016/09/taxing-complex-global-supply-chains-post-beps-

world.html

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.