Financial Case Study: Analyzing the Venture Capital Landscape

VerifiedAdded on 2023/06/04

|9

|1558

|115

Case Study

AI Summary

This financial case study provides an overview of venture capital, defining it as a form of financing for privately held businesses in exchange for partial ownership. It highlights the importance of venture capital in promoting new products, fostering ownership, encouraging customers, and driving economic growth. The study also examines the growth trends of venture capital, noting its increasing popularity and the significant investments made in various sectors such as e-commerce and marketplace. It emphasizes that venture capital has become a major source of finance for successful businesses and continues to dominate the global market.

Running head: FINANCIAL CASE STUDY

Financial case study

Name of the study

Name of the university

Student ID

Author note

Financial case study

Name of the study

Name of the university

Student ID

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL CASE STUDY

Table of Contents

Answer (i)...................................................................................................................................2

Answer (ii).................................................................................................................................3

Answer (iii)................................................................................................................................4

Reference....................................................................................................................................7

Table of Contents

Answer (i)...................................................................................................................................2

Answer (ii).................................................................................................................................3

Answer (iii)................................................................................................................................4

Reference....................................................................................................................................7

2FINANCIAL CASE STUDY

Answer (i)

Venture capital

It is the form of financing provided to the privately held businesses through investors

in return of entity’s partial ownership. The venture capitalists (VCs) recognizes the promising

products, new technologies, concepts and offer the require funds for moving forward the

project. In return as payments the VCs generally accepts stake, ownership or equities. The

general impression regarding venture capital is that it is quite typical, however, as per the past

records lower than 1% companies opted for VC money (Hsu et al., 2014). Canadian

policymakers and stakeholders strengthened VC sector on priority basis with regard to the

understanding that strong VC industry is crucial for developing vibrant tech ecosystem. As

per the recent trend Canada has made significant progress in VC.

Investment in venture capital capital is considered as risk capital or as the patient risk

capital owing to the fact that it includes risk regarding losing of money if VC does not

succeed which in turn will take medium to long run period for the investment for fructifying.

Generally the VC comes from the individuals with high net worth and institutional investors

and it is pooled together through dedicated firms for investments. Venture capital is the

amount provided by the outside investors for financing growing, new or the business with

troubles. While VCs offer funding they are well known regarding the fact that it involves

significant risk regarding the future cash flow and profits of the company. VC is regarded as

most appropriate option to fund the the costly source of capital for the entities (Bernstein,

Giroud & Townsend, 2016). As most of the businesses require large amount of up-front

capital they opt for VC as no better alternative is available. Main characteristics of VC

investment are as follows –

Answer (i)

Venture capital

It is the form of financing provided to the privately held businesses through investors

in return of entity’s partial ownership. The venture capitalists (VCs) recognizes the promising

products, new technologies, concepts and offer the require funds for moving forward the

project. In return as payments the VCs generally accepts stake, ownership or equities. The

general impression regarding venture capital is that it is quite typical, however, as per the past

records lower than 1% companies opted for VC money (Hsu et al., 2014). Canadian

policymakers and stakeholders strengthened VC sector on priority basis with regard to the

understanding that strong VC industry is crucial for developing vibrant tech ecosystem. As

per the recent trend Canada has made significant progress in VC.

Investment in venture capital capital is considered as risk capital or as the patient risk

capital owing to the fact that it includes risk regarding losing of money if VC does not

succeed which in turn will take medium to long run period for the investment for fructifying.

Generally the VC comes from the individuals with high net worth and institutional investors

and it is pooled together through dedicated firms for investments. Venture capital is the

amount provided by the outside investors for financing growing, new or the business with

troubles. While VCs offer funding they are well known regarding the fact that it involves

significant risk regarding the future cash flow and profits of the company. VC is regarded as

most appropriate option to fund the the costly source of capital for the entities (Bernstein,

Giroud & Townsend, 2016). As most of the businesses require large amount of up-front

capital they opt for VC as no better alternative is available. Main characteristics of VC

investment are as follows –

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCIAL CASE STUDY

High risk

Lon-term horizon

Lacking in liquidity

Capital gains and equity participation

VC investments are made towards innovative projects

Suppliers of VC participates in company management

Answer (ii)

Importance of venture capital

Importance of the venture capital is as follows –

Promotes products – any new product with the modern technology becomes feasible

commercially mainly owing to financial assistance from the VC institutions

Promotes ownership – as the scientists bring the laboratory findings to the reality and

makes that commercially successful, in the same way the entrepreneur transforms the

technical know-how into commercially viable project with the help of the VC

institutions (Drover et al., 2017).

Encourages the customers – financial institutions offers assistance as a package deal

that also includes marketing, management, technical assistance and others.

Brings out the hidden talent – while funding the entrepreneurs, VC institutions

influences more thrust to the potential talent of borrower that helps in growing

borrowing concerns.

Promotes exports – VC institution influences the export oriented units that leads to

earning of more foreign exchange to the country.

As catalyst – VC institution acts more as the catalyst towards improving managerial

and financial talents of borrowing concerns. Further, the borrowing concerns will be

High risk

Lon-term horizon

Lacking in liquidity

Capital gains and equity participation

VC investments are made towards innovative projects

Suppliers of VC participates in company management

Answer (ii)

Importance of venture capital

Importance of the venture capital is as follows –

Promotes products – any new product with the modern technology becomes feasible

commercially mainly owing to financial assistance from the VC institutions

Promotes ownership – as the scientists bring the laboratory findings to the reality and

makes that commercially successful, in the same way the entrepreneur transforms the

technical know-how into commercially viable project with the help of the VC

institutions (Drover et al., 2017).

Encourages the customers – financial institutions offers assistance as a package deal

that also includes marketing, management, technical assistance and others.

Brings out the hidden talent – while funding the entrepreneurs, VC institutions

influences more thrust to the potential talent of borrower that helps in growing

borrowing concerns.

Promotes exports – VC institution influences the export oriented units that leads to

earning of more foreign exchange to the country.

As catalyst – VC institution acts more as the catalyst towards improving managerial

and financial talents of borrowing concerns. Further, the borrowing concerns will be

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCIAL CASE STUDY

more concerned in becoming self dependent and thereby they will take required

measures for repaying the loan (Burchard et al., 2016).

Creates more opportunities for the employees – through promoting the

entrepreneurship VC institutions encourage self-employment which in turn will

motivate educated unemployed for taking up new ventures that are not attempted

otherwise.

Helps the sick entities – various sick entities are able for turning around after getting

appropriate assistance from VC institutions.

Helps in technological growth – as the country grows with the improvements in the

modern technology. It can be achieved through strong financial back-ups that are

obtained through VC institutions.

Helps in economic growth – through promoting the new entrepreneurs and through

revising the sick units it leads to economic growth of the country. It will further lead

to increase in production of the consumers goods that improve the living standard of

people (Da Gbadji, Gailly & Schwienbacher, 2015).

Development of the backward areas – through promotion of industries in the

backward areas, VC institutions are answerable for developing the human resources

and backward regions.

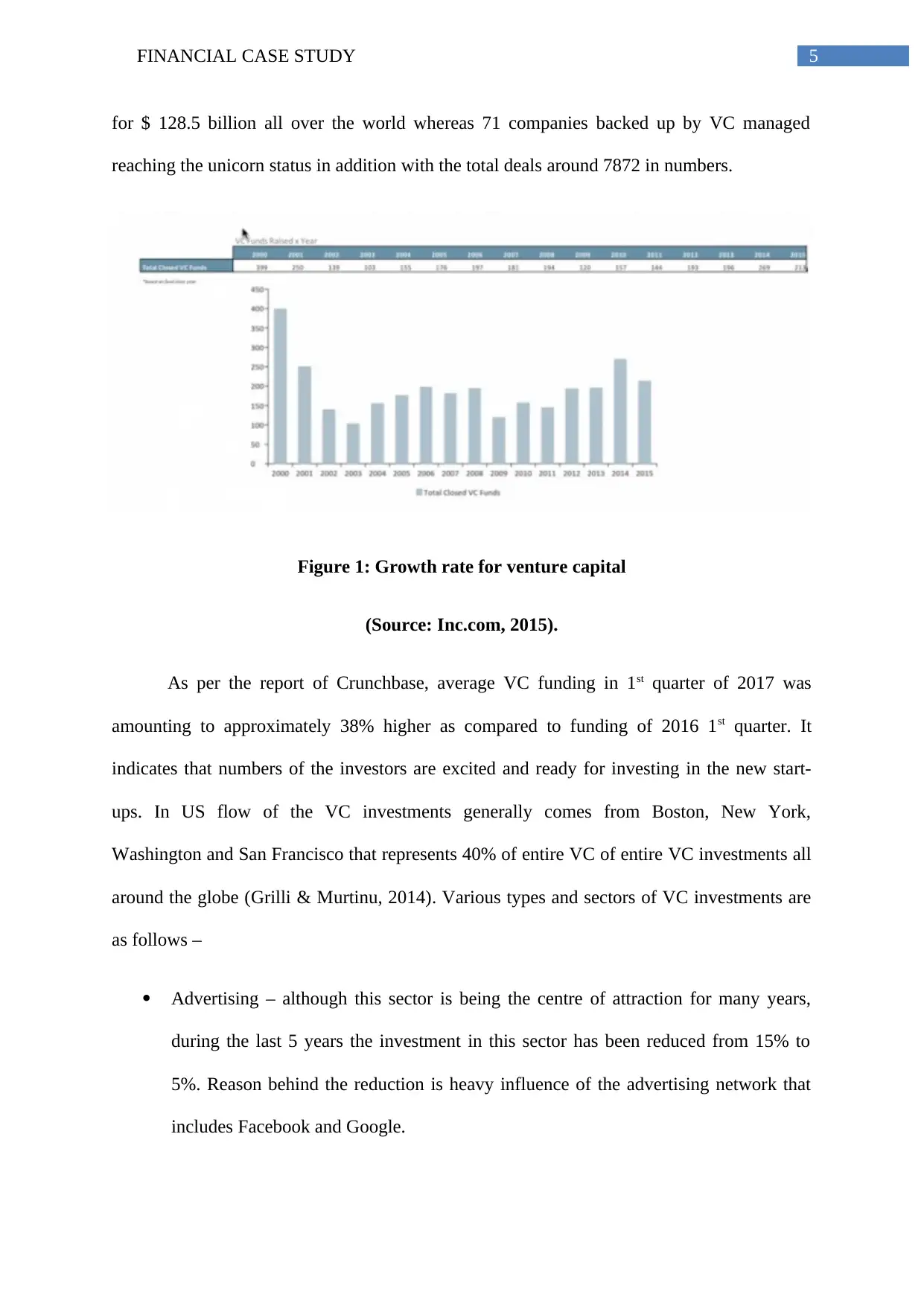

Answer (iii)

Growth trends of Venture capital

Various successful companies like Xiaomi, Uber, Snapchat are funded through

different VC investors. The pattern of VC funding has been changed and has gained

popularity in various countries over the last few years. During 2015, market for VC consisted

more concerned in becoming self dependent and thereby they will take required

measures for repaying the loan (Burchard et al., 2016).

Creates more opportunities for the employees – through promoting the

entrepreneurship VC institutions encourage self-employment which in turn will

motivate educated unemployed for taking up new ventures that are not attempted

otherwise.

Helps the sick entities – various sick entities are able for turning around after getting

appropriate assistance from VC institutions.

Helps in technological growth – as the country grows with the improvements in the

modern technology. It can be achieved through strong financial back-ups that are

obtained through VC institutions.

Helps in economic growth – through promoting the new entrepreneurs and through

revising the sick units it leads to economic growth of the country. It will further lead

to increase in production of the consumers goods that improve the living standard of

people (Da Gbadji, Gailly & Schwienbacher, 2015).

Development of the backward areas – through promotion of industries in the

backward areas, VC institutions are answerable for developing the human resources

and backward regions.

Answer (iii)

Growth trends of Venture capital

Various successful companies like Xiaomi, Uber, Snapchat are funded through

different VC investors. The pattern of VC funding has been changed and has gained

popularity in various countries over the last few years. During 2015, market for VC consisted

5FINANCIAL CASE STUDY

for $ 128.5 billion all over the world whereas 71 companies backed up by VC managed

reaching the unicorn status in addition with the total deals around 7872 in numbers.

Figure 1: Growth rate for venture capital

(Source: Inc.com, 2015).

As per the report of Crunchbase, average VC funding in 1st quarter of 2017 was

amounting to approximately 38% higher as compared to funding of 2016 1st quarter. It

indicates that numbers of the investors are excited and ready for investing in the new start-

ups. In US flow of the VC investments generally comes from Boston, New York,

Washington and San Francisco that represents 40% of entire VC of entire VC investments all

around the globe (Grilli & Murtinu, 2014). Various types and sectors of VC investments are

as follows –

Advertising – although this sector is being the centre of attraction for many years,

during the last 5 years the investment in this sector has been reduced from 15% to

5%. Reason behind the reduction is heavy influence of the advertising network that

includes Facebook and Google.

for $ 128.5 billion all over the world whereas 71 companies backed up by VC managed

reaching the unicorn status in addition with the total deals around 7872 in numbers.

Figure 1: Growth rate for venture capital

(Source: Inc.com, 2015).

As per the report of Crunchbase, average VC funding in 1st quarter of 2017 was

amounting to approximately 38% higher as compared to funding of 2016 1st quarter. It

indicates that numbers of the investors are excited and ready for investing in the new start-

ups. In US flow of the VC investments generally comes from Boston, New York,

Washington and San Francisco that represents 40% of entire VC of entire VC investments all

around the globe (Grilli & Murtinu, 2014). Various types and sectors of VC investments are

as follows –

Advertising – although this sector is being the centre of attraction for many years,

during the last 5 years the investment in this sector has been reduced from 15% to

5%. Reason behind the reduction is heavy influence of the advertising network that

includes Facebook and Google.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCIAL CASE STUDY

E-commerce – through the e-commerce is one of the most known business models

with regard to VC investments, it faced 5% reduction and became 10% from 15%

with series A being the the same level.

Marketplace – this sector experienced increase in the funding from 2.5% to 10% in

last 4 years. Current rate of growth has influenced the investors for considering this

sector as potential investment sector (Ewens, Nanda & Rhodes-Kropf, 2018).

All in all, it is quite evidential that the VC investment has become one of the major

sources of the finance for different successful businesses and at present it is dominating the

global market at rapid pace.

E-commerce – through the e-commerce is one of the most known business models

with regard to VC investments, it faced 5% reduction and became 10% from 15%

with series A being the the same level.

Marketplace – this sector experienced increase in the funding from 2.5% to 10% in

last 4 years. Current rate of growth has influenced the investors for considering this

sector as potential investment sector (Ewens, Nanda & Rhodes-Kropf, 2018).

All in all, it is quite evidential that the VC investment has become one of the major

sources of the finance for different successful businesses and at present it is dominating the

global market at rapid pace.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL CASE STUDY

Reference

Bernstein, S., Giroud, X., & Townsend, R. R. (2016). The impact of venture capital

monitoring. The Journal of Finance, 71(4), 1591-1622.

Burchardt, J., Hommel, U., Kamuriwo, D. S., & Billitteri, C. (2016). Venture capital

contracting in theory and practice: implications for entrepreneurship

research. Entrepreneurship Theory and Practice, 40(1), 25-48.

Da Gbadji, L. A. G., Gailly, B., & Schwienbacher, A. (2015). International analysis of

venture capital programs of large corporations and financial

institutions. Entrepreneurship Theory and Practice, 39(5), 1213-1245.

Drover, W., Busenitz, L., Matusik, S., Townsend, D., Anglin, A., & Dushnitsky, G. (2017). A

review and road map of entrepreneurial equity financing research: venture capital,

corporate venture capital, angel investment, crowdfunding, and accelerators. Journal

of Management, 43(6), 1820-1853.

Ewens, M., Nanda, R., & Rhodes-Kropf, M. (2018). Cost of experimentation and the

evolution of venture capital. Journal of Financial Economics, 128(3), 422-442.

Grilli, L., & Murtinu, S. (2014). Government, venture capital and the growth of European

high-tech entrepreneurial firms. Research Policy, 43(9), 1523-1543.

Hsu, D. K., Haynie, J. M., Simmons, S. A., & McKelvie, A. (2014). What matters, matters

differently: a conjoint analysis of the decision policies of angel and venture capital

investors. Venture Capital, 16(1), 1-25.

Reference

Bernstein, S., Giroud, X., & Townsend, R. R. (2016). The impact of venture capital

monitoring. The Journal of Finance, 71(4), 1591-1622.

Burchardt, J., Hommel, U., Kamuriwo, D. S., & Billitteri, C. (2016). Venture capital

contracting in theory and practice: implications for entrepreneurship

research. Entrepreneurship Theory and Practice, 40(1), 25-48.

Da Gbadji, L. A. G., Gailly, B., & Schwienbacher, A. (2015). International analysis of

venture capital programs of large corporations and financial

institutions. Entrepreneurship Theory and Practice, 39(5), 1213-1245.

Drover, W., Busenitz, L., Matusik, S., Townsend, D., Anglin, A., & Dushnitsky, G. (2017). A

review and road map of entrepreneurial equity financing research: venture capital,

corporate venture capital, angel investment, crowdfunding, and accelerators. Journal

of Management, 43(6), 1820-1853.

Ewens, M., Nanda, R., & Rhodes-Kropf, M. (2018). Cost of experimentation and the

evolution of venture capital. Journal of Financial Economics, 128(3), 422-442.

Grilli, L., & Murtinu, S. (2014). Government, venture capital and the growth of European

high-tech entrepreneurial firms. Research Policy, 43(9), 1523-1543.

Hsu, D. K., Haynie, J. M., Simmons, S. A., & McKelvie, A. (2014). What matters, matters

differently: a conjoint analysis of the decision policies of angel and venture capital

investors. Venture Capital, 16(1), 1-25.

8FINANCIAL CASE STUDY

Inc.com. (2015). 10 Growing Trends In Venture Capital for 2016. Retrieved 25 October

2018, from https://www.inc.com/lisa-calhoun/10-big-venture-capital-trends-to-watch-

in-2016.html

Inc.com. (2015). 10 Growing Trends In Venture Capital for 2016. Retrieved 25 October

2018, from https://www.inc.com/lisa-calhoun/10-big-venture-capital-trends-to-watch-

in-2016.html

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.