Comprehensive Financial Analysis and Performance of Virgin Atlantic

VerifiedAdded on 2023/02/07

|15

|3811

|47

Report

AI Summary

This report provides a comprehensive financial analysis of Virgin Atlantic, examining its performance from 2018 to 2022. It includes an executive summary, financial ratio analysis (liquidity, efficiency, profitability, and long-term stability), an evaluation of the airline industry sector, a SWOT analysis of Virgin Atlantic, and share valuation considerations. The report also explores financial and non-financial factors impacting valuation, suitable governance structures, and concludes with key findings. The analysis compares Virgin Atlantic's performance with competitors like Ryan Air, British Airways, and Jet 2 PLC, providing a detailed assessment of its strengths, weaknesses, opportunities, and threats. The financial ratios are analyzed across the five-year period, and industry benchmarks are included for comparison. The report further investigates the implications of the company's financial health, including its current and future obligations and stability, offering a detailed understanding of the airline's financial position and strategic considerations.

Virgin Atlantic

Name of Student

Name of Instructor

Date

Name of Student

Name of Instructor

Date

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Content

Executive Summary.........................................................................................................................3

Financial Analysis...........................................................................................................................4

Liquidity Ratio & Efficiency.......................................................................................................4

Current ratio.............................................................................................................................5

Quick ratio................................................................................................................................5

Cash ratio..................................................................................................................................5

Profitability ratios........................................................................................................................6

Gross margin profit..................................................................................................................6

Operating profit margin............................................................................................................6

Net profit margin......................................................................................................................6

Return on equity.......................................................................................................................7

Return on assets........................................................................................................................7

Long-term and Financial Stability...............................................................................................7

Debt to equity ratio...................................................................................................................7

Evaluation of Industry Sector..........................................................................................................7

SWOT Analysis...............................................................................................................................9

Virgin Atlantic Strengths.............................................................................................................9

Virgin Atlantic Weaknesses.........................................................................................................9

Virgin Atlantic Opportunities......................................................................................................9

Virgin Atlantic Threats..............................................................................................................10

Share Valuation.............................................................................................................................10

Financial and Non-Financial Factors.............................................................................................11

Asset based.................................................................................................................................11

Earnings based (including multiple of EBITDA method).........................................................11

Cash flow based.........................................................................................................................11

Dividend based...........................................................................................................................11

Suitable Governance Structure with referring to external auditor role..........................................12

Summary & Conclusion................................................................................................................12

References......................................................................................................................................13

Executive Summary.........................................................................................................................3

Financial Analysis...........................................................................................................................4

Liquidity Ratio & Efficiency.......................................................................................................4

Current ratio.............................................................................................................................5

Quick ratio................................................................................................................................5

Cash ratio..................................................................................................................................5

Profitability ratios........................................................................................................................6

Gross margin profit..................................................................................................................6

Operating profit margin............................................................................................................6

Net profit margin......................................................................................................................6

Return on equity.......................................................................................................................7

Return on assets........................................................................................................................7

Long-term and Financial Stability...............................................................................................7

Debt to equity ratio...................................................................................................................7

Evaluation of Industry Sector..........................................................................................................7

SWOT Analysis...............................................................................................................................9

Virgin Atlantic Strengths.............................................................................................................9

Virgin Atlantic Weaknesses.........................................................................................................9

Virgin Atlantic Opportunities......................................................................................................9

Virgin Atlantic Threats..............................................................................................................10

Share Valuation.............................................................................................................................10

Financial and Non-Financial Factors.............................................................................................11

Asset based.................................................................................................................................11

Earnings based (including multiple of EBITDA method).........................................................11

Cash flow based.........................................................................................................................11

Dividend based...........................................................................................................................11

Suitable Governance Structure with referring to external auditor role..........................................12

Summary & Conclusion................................................................................................................12

References......................................................................................................................................13

Executive Summary

The objective of this report is to examine the financial performance of Virgin Atlantic which is

operating as the private airline company in Australia for the period of 5 years ranges from 2018

to 2022. This report also examines the industry sector in which Virgin Atlantic is operating along

with the performance of three listed companies which are Ryan Air, British Airways and Jet 2

PLC. This report also examines the internal analysis of the company by implementing the SWOT

analysis of the company in which the relative strengths, weaknesses, opportunities and threats of

the company has been examined along with the pre and post share valuation for IPO.

In this report, the financial and non-financial factors are also examined that could have potential

impact on the valuation of the company along with Suitable Governance Structure with referring

to external auditor role. Lastly, this report ends with the conclusion which highlights the

important findings of this report

The objective of this report is to examine the financial performance of Virgin Atlantic which is

operating as the private airline company in Australia for the period of 5 years ranges from 2018

to 2022. This report also examines the industry sector in which Virgin Atlantic is operating along

with the performance of three listed companies which are Ryan Air, British Airways and Jet 2

PLC. This report also examines the internal analysis of the company by implementing the SWOT

analysis of the company in which the relative strengths, weaknesses, opportunities and threats of

the company has been examined along with the pre and post share valuation for IPO.

In this report, the financial and non-financial factors are also examined that could have potential

impact on the valuation of the company along with Suitable Governance Structure with referring

to external auditor role. Lastly, this report ends with the conclusion which highlights the

important findings of this report

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

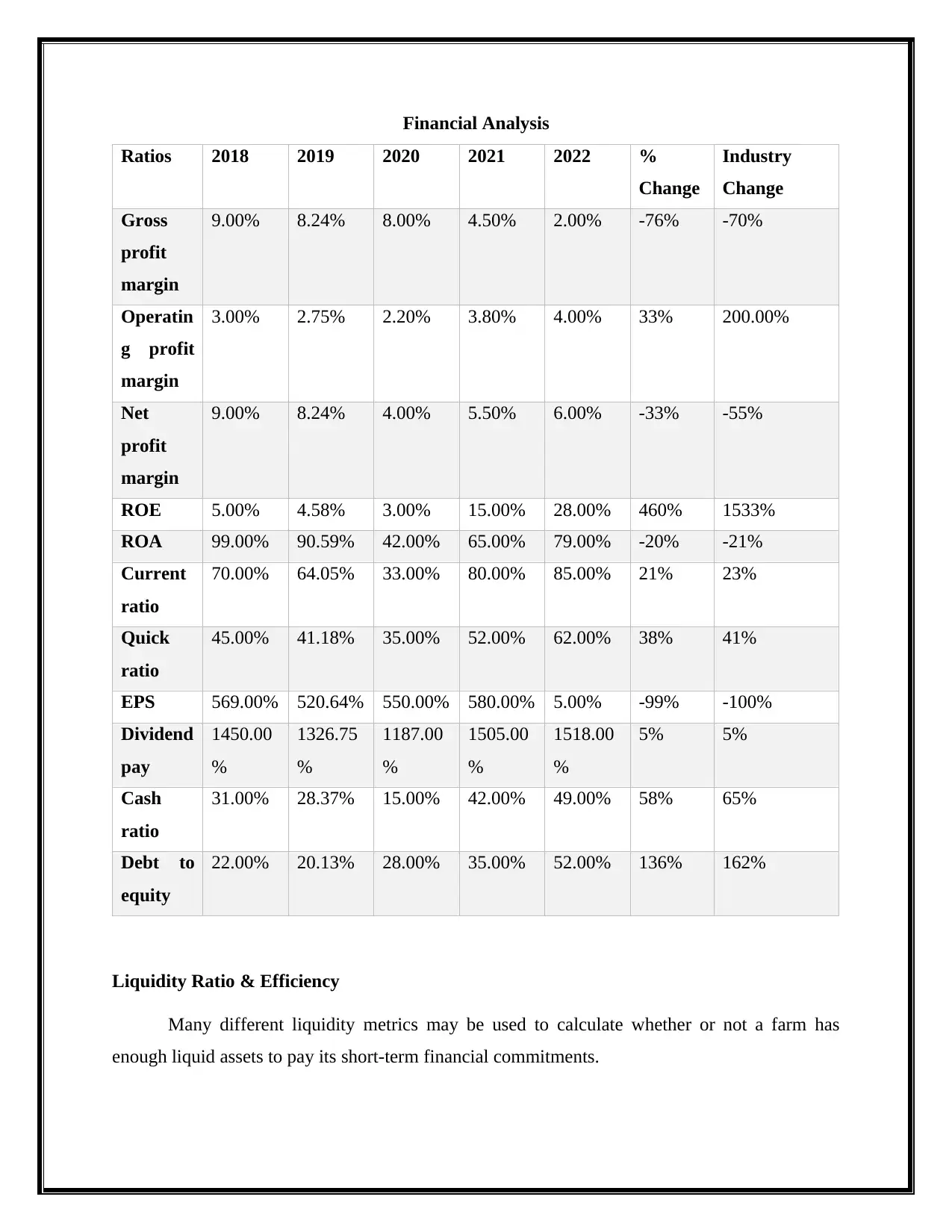

Financial Analysis

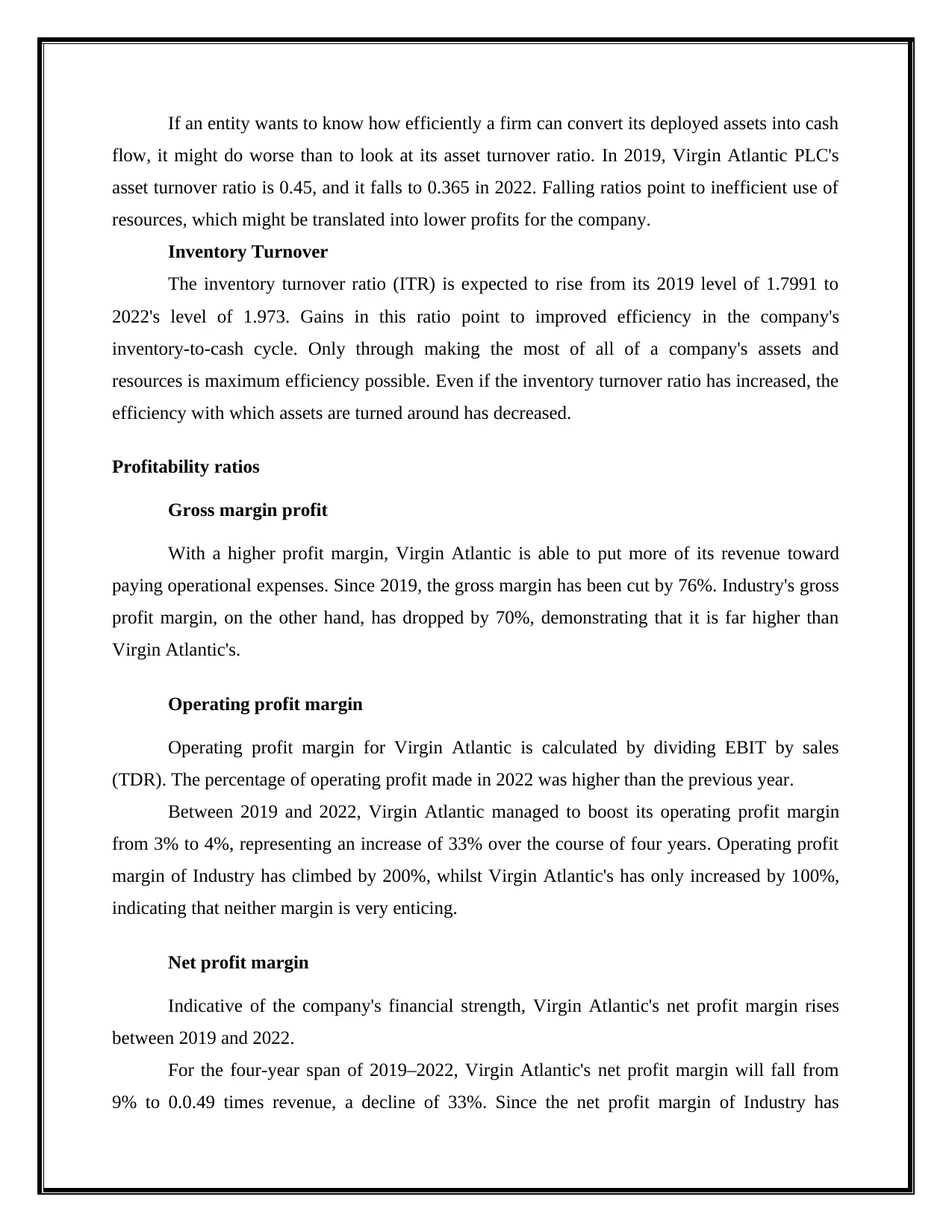

Ratios 2018 2019 2020 2021 2022 %

Change

Industry

Change

Gross

profit

margin

9.00% 8.24% 8.00% 4.50% 2.00% -76% -70%

Operatin

g profit

margin

3.00% 2.75% 2.20% 3.80% 4.00% 33% 200.00%

Net

profit

margin

9.00% 8.24% 4.00% 5.50% 6.00% -33% -55%

ROE 5.00% 4.58% 3.00% 15.00% 28.00% 460% 1533%

ROA 99.00% 90.59% 42.00% 65.00% 79.00% -20% -21%

Current

ratio

70.00% 64.05% 33.00% 80.00% 85.00% 21% 23%

Quick

ratio

45.00% 41.18% 35.00% 52.00% 62.00% 38% 41%

EPS 569.00% 520.64% 550.00% 580.00% 5.00% -99% -100%

Dividend

pay

1450.00

%

1326.75

%

1187.00

%

1505.00

%

1518.00

%

5% 5%

Cash

ratio

31.00% 28.37% 15.00% 42.00% 49.00% 58% 65%

Debt to

equity

22.00% 20.13% 28.00% 35.00% 52.00% 136% 162%

Liquidity Ratio & Efficiency

Many different liquidity metrics may be used to calculate whether or not a farm has

enough liquid assets to pay its short-term financial commitments.

Ratios 2018 2019 2020 2021 2022 %

Change

Industry

Change

Gross

profit

margin

9.00% 8.24% 8.00% 4.50% 2.00% -76% -70%

Operatin

g profit

margin

3.00% 2.75% 2.20% 3.80% 4.00% 33% 200.00%

Net

profit

margin

9.00% 8.24% 4.00% 5.50% 6.00% -33% -55%

ROE 5.00% 4.58% 3.00% 15.00% 28.00% 460% 1533%

ROA 99.00% 90.59% 42.00% 65.00% 79.00% -20% -21%

Current

ratio

70.00% 64.05% 33.00% 80.00% 85.00% 21% 23%

Quick

ratio

45.00% 41.18% 35.00% 52.00% 62.00% 38% 41%

EPS 569.00% 520.64% 550.00% 580.00% 5.00% -99% -100%

Dividend

pay

1450.00

%

1326.75

%

1187.00

%

1505.00

%

1518.00

%

5% 5%

Cash

ratio

31.00% 28.37% 15.00% 42.00% 49.00% 58% 65%

Debt to

equity

22.00% 20.13% 28.00% 35.00% 52.00% 136% 162%

Liquidity Ratio & Efficiency

Many different liquidity metrics may be used to calculate whether or not a farm has

enough liquid assets to pay its short-term financial commitments.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Current ratio

The current ratio is a measure of an organization's short-term liquidity and shows how

likely it is that it can pay its liabilities as they come due. To get the ratio, divide the total cash

and short-term investments of a corporation by the sum of the ratio's values. Current

Commitments of Virgin Atlantic: A Case Study The company's current ratio will not be able to

support claims that it can meet short-term obligations after 2022, since it will have declined

dramatically from 2019.

Over the course of the next four years, from 2018 to 2022, Virgin Atlantic's current ratio

will rise from 0.7 times to 0.85 times, an increase of 21%. Alternatively, the Current Ratio of

Industry has improved by 23% since January, surpassing Virgin Atlantic's Current Ratio by a

wide margin (Mika, 2021).

Quick ratio

How quickly a corporation can pay off its short-term debts is shown by the fast ratio.

Only readily available assets, such as cash and short-term marketable investments, are included,

together with receivables and current liabilities. The corporation will be unable to satisfy its

short-term commitments since the quick ratio is projected to fall between 2019 and 2022.

During the four-year span of 2019–2022, Virgin Atlantic's quick ratio will improve from

0.45 times to 0.62 times, an increase of 38%. However, Industry's fast ratio has improved by

41% since January, surpassing Virgin Atlantic's quick ratio in that time.

Cash ratio

The cash ratio may be used as an indication of the Virgin Atlantic Company's financial

stability. It is calculated by dividing a company's current obligations by its liquid assets (cash

and marketable securities). In 2019, the cash ratio improved, but it will go worse in 2020 and

2022, leaving insufficient funds to meet current obligations.

From 2018 to 2022, Virgin Atlantic's cash ratio will improve from 0.31 times to 0.0.49

times, an increase of 58%. But Industry's cash ratio has improved by 65%, making it more

alluring than Virgin Atlantic's cash ratio.

Asset Turnover Ratio

The current ratio is a measure of an organization's short-term liquidity and shows how

likely it is that it can pay its liabilities as they come due. To get the ratio, divide the total cash

and short-term investments of a corporation by the sum of the ratio's values. Current

Commitments of Virgin Atlantic: A Case Study The company's current ratio will not be able to

support claims that it can meet short-term obligations after 2022, since it will have declined

dramatically from 2019.

Over the course of the next four years, from 2018 to 2022, Virgin Atlantic's current ratio

will rise from 0.7 times to 0.85 times, an increase of 21%. Alternatively, the Current Ratio of

Industry has improved by 23% since January, surpassing Virgin Atlantic's Current Ratio by a

wide margin (Mika, 2021).

Quick ratio

How quickly a corporation can pay off its short-term debts is shown by the fast ratio.

Only readily available assets, such as cash and short-term marketable investments, are included,

together with receivables and current liabilities. The corporation will be unable to satisfy its

short-term commitments since the quick ratio is projected to fall between 2019 and 2022.

During the four-year span of 2019–2022, Virgin Atlantic's quick ratio will improve from

0.45 times to 0.62 times, an increase of 38%. However, Industry's fast ratio has improved by

41% since January, surpassing Virgin Atlantic's quick ratio in that time.

Cash ratio

The cash ratio may be used as an indication of the Virgin Atlantic Company's financial

stability. It is calculated by dividing a company's current obligations by its liquid assets (cash

and marketable securities). In 2019, the cash ratio improved, but it will go worse in 2020 and

2022, leaving insufficient funds to meet current obligations.

From 2018 to 2022, Virgin Atlantic's cash ratio will improve from 0.31 times to 0.0.49

times, an increase of 58%. But Industry's cash ratio has improved by 65%, making it more

alluring than Virgin Atlantic's cash ratio.

Asset Turnover Ratio

If an entity wants to know how efficiently a firm can convert its deployed assets into cash

flow, it might do worse than to look at its asset turnover ratio. In 2019, Virgin Atlantic PLC's

asset turnover ratio is 0.45, and it falls to 0.365 in 2022. Falling ratios point to inefficient use of

resources, which might be translated into lower profits for the company.

Inventory Turnover

The inventory turnover ratio (ITR) is expected to rise from its 2019 level of 1.7991 to

2022's level of 1.973. Gains in this ratio point to improved efficiency in the company's

inventory-to-cash cycle. Only through making the most of all of a company's assets and

resources is maximum efficiency possible. Even if the inventory turnover ratio has increased, the

efficiency with which assets are turned around has decreased.

Profitability ratios

Gross margin profit

With a higher profit margin, Virgin Atlantic is able to put more of its revenue toward

paying operational expenses. Since 2019, the gross margin has been cut by 76%. Industry's gross

profit margin, on the other hand, has dropped by 70%, demonstrating that it is far higher than

Virgin Atlantic's.

Operating profit margin

Operating profit margin for Virgin Atlantic is calculated by dividing EBIT by sales

(TDR). The percentage of operating profit made in 2022 was higher than the previous year.

Between 2019 and 2022, Virgin Atlantic managed to boost its operating profit margin

from 3% to 4%, representing an increase of 33% over the course of four years. Operating profit

margin of Industry has climbed by 200%, whilst Virgin Atlantic's has only increased by 100%,

indicating that neither margin is very enticing.

Net profit margin

Indicative of the company's financial strength, Virgin Atlantic's net profit margin rises

between 2019 and 2022.

For the four-year span of 2019–2022, Virgin Atlantic's net profit margin will fall from

9% to 0.0.49 times revenue, a decline of 33%. Since the net profit margin of Industry has

flow, it might do worse than to look at its asset turnover ratio. In 2019, Virgin Atlantic PLC's

asset turnover ratio is 0.45, and it falls to 0.365 in 2022. Falling ratios point to inefficient use of

resources, which might be translated into lower profits for the company.

Inventory Turnover

The inventory turnover ratio (ITR) is expected to rise from its 2019 level of 1.7991 to

2022's level of 1.973. Gains in this ratio point to improved efficiency in the company's

inventory-to-cash cycle. Only through making the most of all of a company's assets and

resources is maximum efficiency possible. Even if the inventory turnover ratio has increased, the

efficiency with which assets are turned around has decreased.

Profitability ratios

Gross margin profit

With a higher profit margin, Virgin Atlantic is able to put more of its revenue toward

paying operational expenses. Since 2019, the gross margin has been cut by 76%. Industry's gross

profit margin, on the other hand, has dropped by 70%, demonstrating that it is far higher than

Virgin Atlantic's.

Operating profit margin

Operating profit margin for Virgin Atlantic is calculated by dividing EBIT by sales

(TDR). The percentage of operating profit made in 2022 was higher than the previous year.

Between 2019 and 2022, Virgin Atlantic managed to boost its operating profit margin

from 3% to 4%, representing an increase of 33% over the course of four years. Operating profit

margin of Industry has climbed by 200%, whilst Virgin Atlantic's has only increased by 100%,

indicating that neither margin is very enticing.

Net profit margin

Indicative of the company's financial strength, Virgin Atlantic's net profit margin rises

between 2019 and 2022.

For the four-year span of 2019–2022, Virgin Atlantic's net profit margin will fall from

9% to 0.0.49 times revenue, a decline of 33%. Since the net profit margin of Industry has

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

likewise dropped by 55%, it is clear that neither the net profit margin of Virgin Atlantic nor the

net profit margin of Industry are very appealing.

Return on equity

This ratio, which is derived by dividing net income by shareholder's income, indicates the

rate of return on the investment in the company's shares and has improved for Virgin Atlantic

from 2018 to 2022.

The four-year span from 2018 to 2022 has seen a 460% growth in Virgin Atlantic's

Return on Equity (ROE), from 5% to 28%. While Virgin Atlantic's ROE is low, Industry's ROE

has improved by 1533 percent, making it a more appealing investment than Virgin Atlantic's

ROE.

Return on assets

Considering that return on assets is derived by dividing net income by total assets, a

higher return on assets for Virgin Atlantic from 2018 to 2022 indicates a more successful firm.

By most measures of liquidity, the company's financial health was better in 2019 than it is now

(2022), when it lacks the cash and current assets required to meet its immediate needs. On the

other hand, year-over-year growth in both return on assets and return on equity may be observed

in the profitability ratios, indicating that the business is growing more profitable. Increases in the

company's rate of return on equity are more evidence of this.

From 2018 to 2022, Virgin Atlantic's return on assets will fall from 99% to 79%, a

decline of 20%. Although the Return on Assets for Industry has declined by -21%, Virgin

Atlantic's ROA is more appealing.

Long-term and Financial Stability

Debt to equity ratio

By 2022, Virgin Atlantic's debt to equity ratio will have climbed by 136% from its

current level of 42%. By contrast, the debt-to-equity ratio for the industry as a whole has risen by

162%, indicating that Virgin Atlantic's ratio is more appealing.

Evaluation of Industry Sector

net profit margin of Industry are very appealing.

Return on equity

This ratio, which is derived by dividing net income by shareholder's income, indicates the

rate of return on the investment in the company's shares and has improved for Virgin Atlantic

from 2018 to 2022.

The four-year span from 2018 to 2022 has seen a 460% growth in Virgin Atlantic's

Return on Equity (ROE), from 5% to 28%. While Virgin Atlantic's ROE is low, Industry's ROE

has improved by 1533 percent, making it a more appealing investment than Virgin Atlantic's

ROE.

Return on assets

Considering that return on assets is derived by dividing net income by total assets, a

higher return on assets for Virgin Atlantic from 2018 to 2022 indicates a more successful firm.

By most measures of liquidity, the company's financial health was better in 2019 than it is now

(2022), when it lacks the cash and current assets required to meet its immediate needs. On the

other hand, year-over-year growth in both return on assets and return on equity may be observed

in the profitability ratios, indicating that the business is growing more profitable. Increases in the

company's rate of return on equity are more evidence of this.

From 2018 to 2022, Virgin Atlantic's return on assets will fall from 99% to 79%, a

decline of 20%. Although the Return on Assets for Industry has declined by -21%, Virgin

Atlantic's ROA is more appealing.

Long-term and Financial Stability

Debt to equity ratio

By 2022, Virgin Atlantic's debt to equity ratio will have climbed by 136% from its

current level of 42%. By contrast, the debt-to-equity ratio for the industry as a whole has risen by

162%, indicating that Virgin Atlantic's ratio is more appealing.

Evaluation of Industry Sector

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The United Kingdom is home to the world's second-largest aircraft manufacturing hub

and has the world's third-largest avionics network. Nearly 1,000,000 UK jobs, either directly or

indirectly, are supported by the aviation industry, which has a turnover of over £60 billion and

contributes over £22 billion to UK GDP (Rendahl, 2012). To that end, the aircraft manufacturing

sector in the United Kingdom generates £26 billion in goods per year and £3.5 trillion in global

market potential over the next two decades. The sector employs over 100,000 highly skilled

native English speakers and provides innovation and research with significant downstream

benefits for the wider UK economy (Dempsey, 2021).

In this analysis, we focused on three of Virgin Atlantic's main competitors: Stream 2

PLC, Ryan Air, and English Aviation Routes. The aircraft is second only to easyJet in terms of

fleet size and passenger volume among UK-based transporters. In January of 2011, British

Airways and Iberia merged to become the International Airlines Group (IAG), a holding

company with its headquarters in Madrid, Spain. When looking at annual revenue, IAG is the

second largest airline alliance in Europe and the third largest in the world. It is traded on the

London Stock Exchange and is included in the FTSE 100 File. English Aviation Routes is the

largest travel company, earning $1 billion in a single aircraft route in a single year (Anna, 2014).

After a series of nationalizations in the early 1970s, the English government established the

English Aviation Routes Board in 1974 to coordinate the efforts of the English Abroad Aviation

Routes Partnership, the English European Aviation Routes, and the Cambrian Aviation Routes

and Upper East Carriers (BA). On March 31st, 1974, four different airlines merged to become

English Aviation, establishing a standard for the company's route structure. It celebrated its

centenary in 2019 and has several forerunner companies to thank for that. When the Moderate

Party privatized BA in February 1987, the company had been in state hands for over 14 years

(Racculia, 2014).

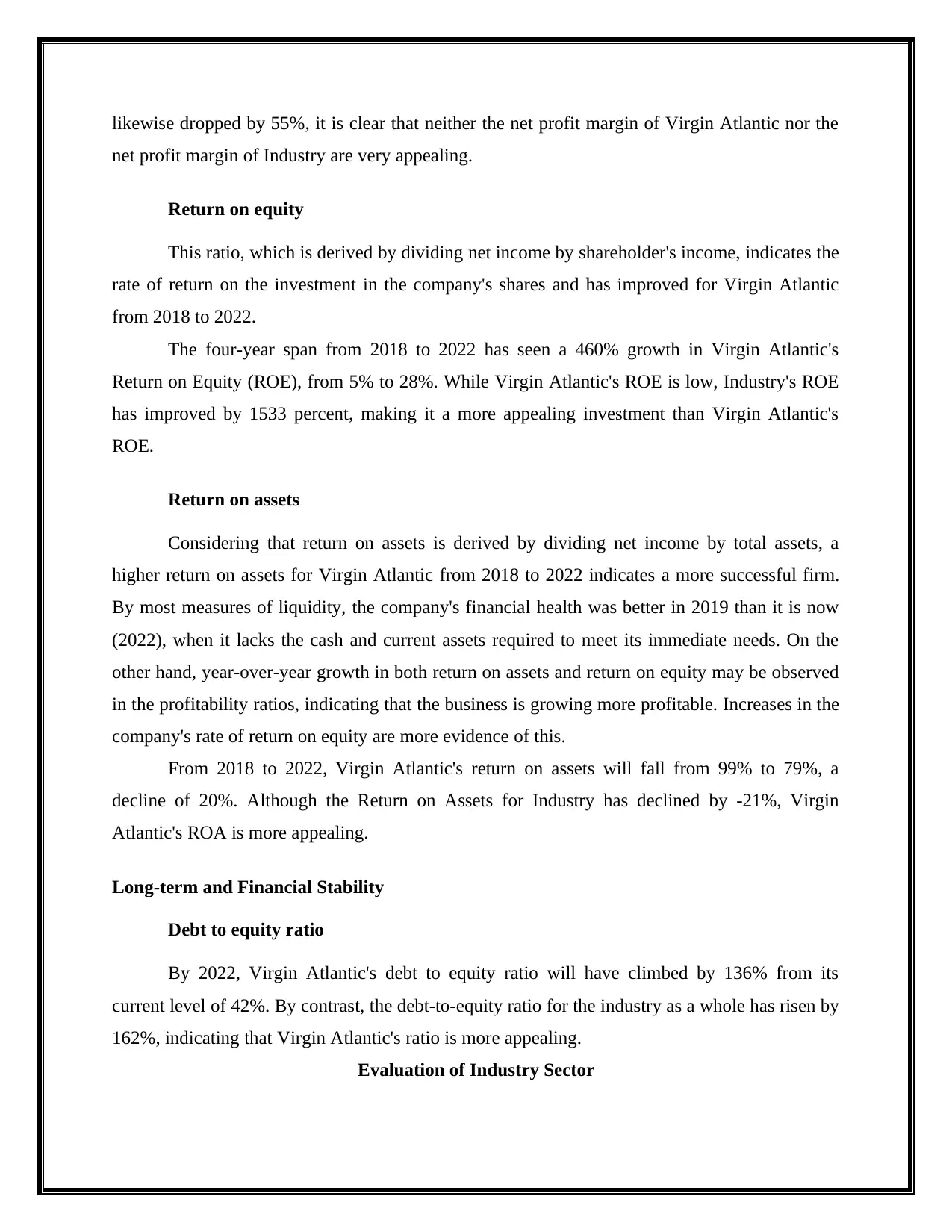

Ryan Air BRITISH AIRWAYS Jet 2 PLC

REVENUE 2,382.08 10,618.99 3,852.20

Profit Before Tax 253.38 1,198.71 848.308

and has the world's third-largest avionics network. Nearly 1,000,000 UK jobs, either directly or

indirectly, are supported by the aviation industry, which has a turnover of over £60 billion and

contributes over £22 billion to UK GDP (Rendahl, 2012). To that end, the aircraft manufacturing

sector in the United Kingdom generates £26 billion in goods per year and £3.5 trillion in global

market potential over the next two decades. The sector employs over 100,000 highly skilled

native English speakers and provides innovation and research with significant downstream

benefits for the wider UK economy (Dempsey, 2021).

In this analysis, we focused on three of Virgin Atlantic's main competitors: Stream 2

PLC, Ryan Air, and English Aviation Routes. The aircraft is second only to easyJet in terms of

fleet size and passenger volume among UK-based transporters. In January of 2011, British

Airways and Iberia merged to become the International Airlines Group (IAG), a holding

company with its headquarters in Madrid, Spain. When looking at annual revenue, IAG is the

second largest airline alliance in Europe and the third largest in the world. It is traded on the

London Stock Exchange and is included in the FTSE 100 File. English Aviation Routes is the

largest travel company, earning $1 billion in a single aircraft route in a single year (Anna, 2014).

After a series of nationalizations in the early 1970s, the English government established the

English Aviation Routes Board in 1974 to coordinate the efforts of the English Abroad Aviation

Routes Partnership, the English European Aviation Routes, and the Cambrian Aviation Routes

and Upper East Carriers (BA). On March 31st, 1974, four different airlines merged to become

English Aviation, establishing a standard for the company's route structure. It celebrated its

centenary in 2019 and has several forerunner companies to thank for that. When the Moderate

Party privatized BA in February 1987, the company had been in state hands for over 14 years

(Racculia, 2014).

Ryan Air BRITISH AIRWAYS Jet 2 PLC

REVENUE 2,382.08 10,618.99 3,852.20

Profit Before Tax 253.38 1,198.71 848.308

Return on Capital

Employed

9.58% 12.98% 57.17%

Net Profit Ratio 4.74% 5.77% 19.16%

Gross Profit Ratio 12.46% 38.63% 34.20%

Operating Profit

Ratio

5.77% 6.90% 19.88%

British Airways invests in physical infrastructure whereas Jet 2 PLC depends on a

"predominantly leased airline fleet," thus their asset bases couldn't be more different. Given that

Ryan Air has an 8.6 percent operational margin and Jet 2 PLC has a 6.7 percent operational

margin, it's possible that Ryan Air's much lower gross profit margin (9.58 percent) compared to

BRITISH AIRWAYS' (12.97 percent) and Jet 2 PLC's (57.17 percent) indicates a different

categorization of expenses (Amit, 2021).

SWOT Analysis

Virgin Atlantic Strengths

1. One possible way to determine if Virgin Atlantic has the upper hand is to examine the

company's core competencies. Real assets, such as money and shares, and intangible

ones, such as brand recognition and trustworthiness, might be considered when valuing a

brand's assets.

2. Virgin Atlantic's infrastructure and management are reliable and sturdy.

3. When it comes to luxury travel, many affluent passengers consider Virgin Atlantic to be

their best choice because of the excellent service they have received.

4. More than 5 million people were transported in a single year.

5. One of the largest English airlines, Virgin Atlantic, serves more than 35 countries all over

the globe.

6. Richard Branson has put in a lot of time and effort to develop a leading business and

create a remarkable brand.

7. Widespread recognition as the ultimate luxury plane

Virgin Atlantic Weaknesses

Employed

9.58% 12.98% 57.17%

Net Profit Ratio 4.74% 5.77% 19.16%

Gross Profit Ratio 12.46% 38.63% 34.20%

Operating Profit

Ratio

5.77% 6.90% 19.88%

British Airways invests in physical infrastructure whereas Jet 2 PLC depends on a

"predominantly leased airline fleet," thus their asset bases couldn't be more different. Given that

Ryan Air has an 8.6 percent operational margin and Jet 2 PLC has a 6.7 percent operational

margin, it's possible that Ryan Air's much lower gross profit margin (9.58 percent) compared to

BRITISH AIRWAYS' (12.97 percent) and Jet 2 PLC's (57.17 percent) indicates a different

categorization of expenses (Amit, 2021).

SWOT Analysis

Virgin Atlantic Strengths

1. One possible way to determine if Virgin Atlantic has the upper hand is to examine the

company's core competencies. Real assets, such as money and shares, and intangible

ones, such as brand recognition and trustworthiness, might be considered when valuing a

brand's assets.

2. Virgin Atlantic's infrastructure and management are reliable and sturdy.

3. When it comes to luxury travel, many affluent passengers consider Virgin Atlantic to be

their best choice because of the excellent service they have received.

4. More than 5 million people were transported in a single year.

5. One of the largest English airlines, Virgin Atlantic, serves more than 35 countries all over

the globe.

6. Richard Branson has put in a lot of time and effort to develop a leading business and

create a remarkable brand.

7. Widespread recognition as the ultimate luxury plane

Virgin Atlantic Weaknesses

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1. A company's vulnerabilities are the parts of its operations that could need the most work.

Where the company fails or where it faces strong competition, it faces challenges

(Reuters, 2021).

2. As a result of intense competition, Virgin Atlantic is unable to increase its market share.

3. Not enough of an overall impact is made, especially when it comes to the development of

economies.

Virgin Atlantic Opportunities

1. Any company may improve its public profile in order to attract a wider audience and

focus more resources on its core mission. It is possible to find potential brand openings in

a variety of forms, such as new markets, enhanced products, refined communication, etc.

2. When it comes to international and local significance, Heathrow Terminal stands at the

top of the list.

3. Use its prominence for expansion across the world.

4. There is room for expansion of the plane's worldwide reach between the two paths and

the concerns (Reuters, 2021).

Virgin Atlantic Threats

The risks an organisation confronts are the things that might have an undesirable effect

on the company's core mission. A rise in competition, a shift in government direction, the

introduction of a new product or administration, and so on are all examples of things that might

undermine an initiative.

1. Increases in the price of gasoline and revisions to aviation regulations and standards.

2. Work expenses for Virgin Atlantic might affect the company's bottom line.

3. Competition on the European market is heating up.

Share Valuation

Price Band for Virgin Atlantic plc Shares

Where the company fails or where it faces strong competition, it faces challenges

(Reuters, 2021).

2. As a result of intense competition, Virgin Atlantic is unable to increase its market share.

3. Not enough of an overall impact is made, especially when it comes to the development of

economies.

Virgin Atlantic Opportunities

1. Any company may improve its public profile in order to attract a wider audience and

focus more resources on its core mission. It is possible to find potential brand openings in

a variety of forms, such as new markets, enhanced products, refined communication, etc.

2. When it comes to international and local significance, Heathrow Terminal stands at the

top of the list.

3. Use its prominence for expansion across the world.

4. There is room for expansion of the plane's worldwide reach between the two paths and

the concerns (Reuters, 2021).

Virgin Atlantic Threats

The risks an organisation confronts are the things that might have an undesirable effect

on the company's core mission. A rise in competition, a shift in government direction, the

introduction of a new product or administration, and so on are all examples of things that might

undermine an initiative.

1. Increases in the price of gasoline and revisions to aviation regulations and standards.

2. Work expenses for Virgin Atlantic might affect the company's bottom line.

3. Competition on the European market is heating up.

Share Valuation

Price Band for Virgin Atlantic plc Shares

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

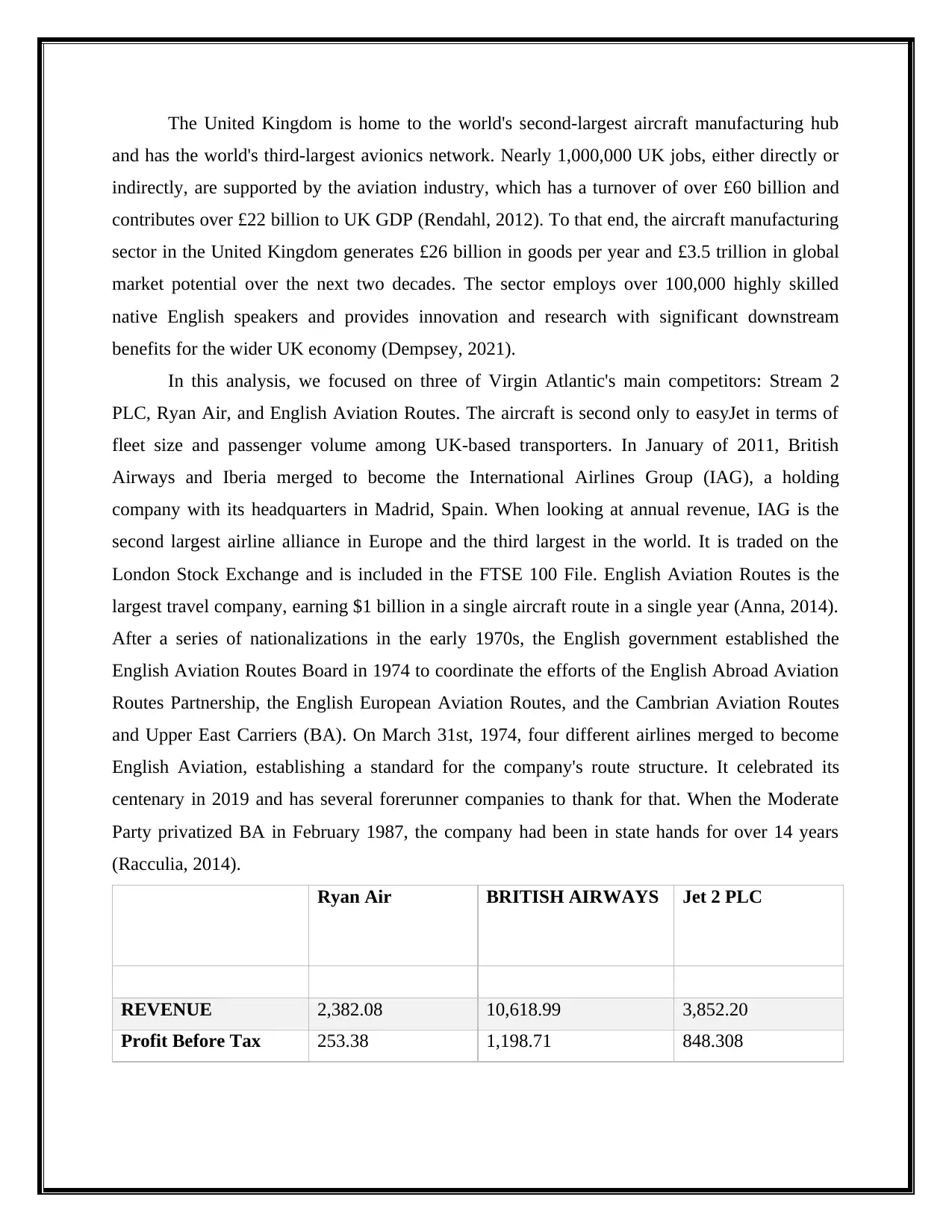

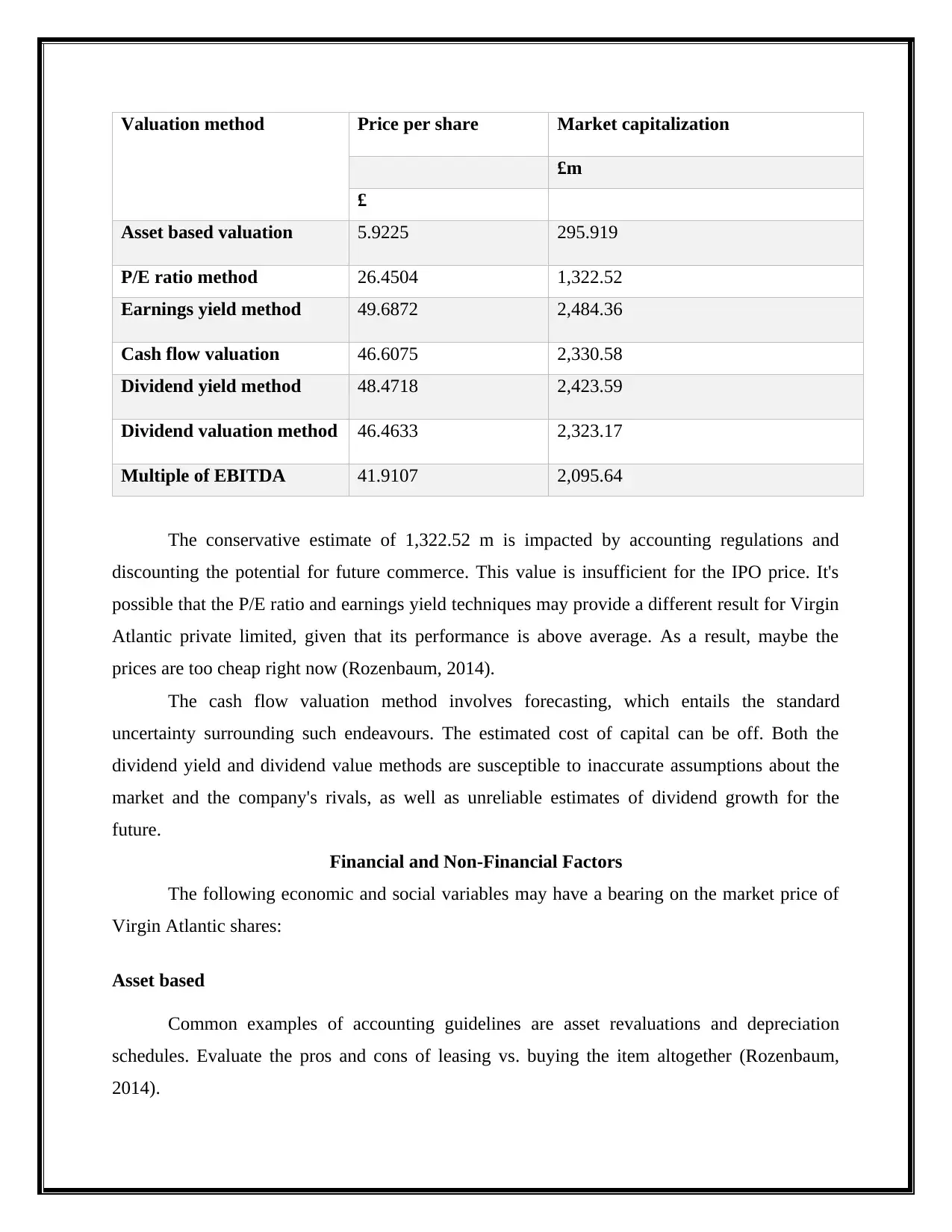

Valuation method Price per share Market capitalization

£m

£

Asset based valuation 5.9225 295.919

P/E ratio method 26.4504 1,322.52

Earnings yield method 49.6872 2,484.36

Cash flow valuation 46.6075 2,330.58

Dividend yield method 48.4718 2,423.59

Dividend valuation method 46.4633 2,323.17

Multiple of EBITDA 41.9107 2,095.64

The conservative estimate of 1,322.52 m is impacted by accounting regulations and

discounting the potential for future commerce. This value is insufficient for the IPO price. It's

possible that the P/E ratio and earnings yield techniques may provide a different result for Virgin

Atlantic private limited, given that its performance is above average. As a result, maybe the

prices are too cheap right now (Rozenbaum, 2014).

The cash flow valuation method involves forecasting, which entails the standard

uncertainty surrounding such endeavours. The estimated cost of capital can be off. Both the

dividend yield and dividend value methods are susceptible to inaccurate assumptions about the

market and the company's rivals, as well as unreliable estimates of dividend growth for the

future.

Financial and Non-Financial Factors

The following economic and social variables may have a bearing on the market price of

Virgin Atlantic shares:

Asset based

Common examples of accounting guidelines are asset revaluations and depreciation

schedules. Evaluate the pros and cons of leasing vs. buying the item altogether (Rozenbaum,

2014).

£m

£

Asset based valuation 5.9225 295.919

P/E ratio method 26.4504 1,322.52

Earnings yield method 49.6872 2,484.36

Cash flow valuation 46.6075 2,330.58

Dividend yield method 48.4718 2,423.59

Dividend valuation method 46.4633 2,323.17

Multiple of EBITDA 41.9107 2,095.64

The conservative estimate of 1,322.52 m is impacted by accounting regulations and

discounting the potential for future commerce. This value is insufficient for the IPO price. It's

possible that the P/E ratio and earnings yield techniques may provide a different result for Virgin

Atlantic private limited, given that its performance is above average. As a result, maybe the

prices are too cheap right now (Rozenbaum, 2014).

The cash flow valuation method involves forecasting, which entails the standard

uncertainty surrounding such endeavours. The estimated cost of capital can be off. Both the

dividend yield and dividend value methods are susceptible to inaccurate assumptions about the

market and the company's rivals, as well as unreliable estimates of dividend growth for the

future.

Financial and Non-Financial Factors

The following economic and social variables may have a bearing on the market price of

Virgin Atlantic shares:

Asset based

Common examples of accounting guidelines are asset revaluations and depreciation

schedules. Evaluate the pros and cons of leasing vs. buying the item altogether (Rozenbaum,

2014).

Earnings based (including multiple of EBITDA method)

Distinguish between asset lease and outright purchase, and think about depreciation and

other accounting alternatives. Taxes, especially tax losses and deferred tax provisions, and their

effect on finances and the law

Cash flow based

Evaluate the pros and cons of asset leasing vs buying an asset outright from the

perspective of cash flow. Capital structure, gearing, and inflationary interest rates and

Involvement of other members of the group in noncommercial activities and expenses

Dividend based

The dividend policy as it is now; the aforementioned variables influencing profitability

that might reduce dividend payments Shares Issued and Outstanding Going Forward and

Historically (Arcelia, 2014). Value will be affected by the risk profiles and capital structures of

comparable enterprises used to calculate the cost of capital. Dividend-based valuation takes into

account the potential impact of the same factors that affect earnings-based valuation: the

economy, competition, and regulation. It will also depend on the dividend policy and the number

of shares that might be issued in the future, such as uncancelled treasury shares (Rozenbaum,

2014).

Suitable Governance Structure with referring to external auditor role

Corporate governance is the "system by which companies are led and governed," as

defined by the Financial Reporting Council (FRC), with implementation standards varying per

listing type. (Bloomberg, 2022). The airline and Virgin Occasions are owned by Virgin Atlantic

Restricted, a holding company that is 51% owned by the Virgin Group and 49% owned by Delta

Air Lines. On a management level, it is independent from the other Virgin-branded airlines. The

Civil Aviation Authority (CAA) has issued CAA Type a Working Licenses to both Virgin

Atlantic Aviation Routes Restricted and Virgin Atlantic Worldwide Restricted, allowing them to

transport passengers, cargo, and mail using aircraft with at least 20 seats under the name Virgin

Atlantic Aviation Routes Restricted (Andrea, 2022). Given that Virgin Atlantic secret restricted

is predicted to have a market valuation of more than £700k, the company will likely become

Distinguish between asset lease and outright purchase, and think about depreciation and

other accounting alternatives. Taxes, especially tax losses and deferred tax provisions, and their

effect on finances and the law

Cash flow based

Evaluate the pros and cons of asset leasing vs buying an asset outright from the

perspective of cash flow. Capital structure, gearing, and inflationary interest rates and

Involvement of other members of the group in noncommercial activities and expenses

Dividend based

The dividend policy as it is now; the aforementioned variables influencing profitability

that might reduce dividend payments Shares Issued and Outstanding Going Forward and

Historically (Arcelia, 2014). Value will be affected by the risk profiles and capital structures of

comparable enterprises used to calculate the cost of capital. Dividend-based valuation takes into

account the potential impact of the same factors that affect earnings-based valuation: the

economy, competition, and regulation. It will also depend on the dividend policy and the number

of shares that might be issued in the future, such as uncancelled treasury shares (Rozenbaum,

2014).

Suitable Governance Structure with referring to external auditor role

Corporate governance is the "system by which companies are led and governed," as

defined by the Financial Reporting Council (FRC), with implementation standards varying per

listing type. (Bloomberg, 2022). The airline and Virgin Occasions are owned by Virgin Atlantic

Restricted, a holding company that is 51% owned by the Virgin Group and 49% owned by Delta

Air Lines. On a management level, it is independent from the other Virgin-branded airlines. The

Civil Aviation Authority (CAA) has issued CAA Type a Working Licenses to both Virgin

Atlantic Aviation Routes Restricted and Virgin Atlantic Worldwide Restricted, allowing them to

transport passengers, cargo, and mail using aircraft with at least 20 seats under the name Virgin

Atlantic Aviation Routes Restricted (Andrea, 2022). Given that Virgin Atlantic secret restricted

is predicted to have a market valuation of more than £700k, the company will likely become

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.