Financial Management Analysis: Vodafone Performance - SBLC5005

VerifiedAdded on 2023/06/11

|13

|3194

|454

Report

AI Summary

This report presents a financial analysis of Vodafone's performance over the latest five years, utilizing financial ratio analysis to assess the company's strengths and weaknesses. The analysis includes liquidity ratios (current and quick ratios), profitability ratios (gross profit margin, net profit margin, ROE, and ROA), efficiency ratios (receivable turnover, fixed asset turnover, inventory turnover, and asset turnover), and solvency ratios (debt/equity, leverage, and interest coverage). The report identifies trends in Vodafone's financial health, such as decreasing profitability and challenges in managing short-term debts. The analysis concludes with a summary of Vodafone’s financial standing and offers recommendations for future improvements. Desklib provides access to similar solved assignments and past papers for students.

ANALYSIS OF FINANCIAL PERFORMANCE OF VODAFONE 1

ANALYSIS OF FINANCIAL PERFORMANCE OF VODAFONE

Author

Course Title

Professor

City

Date

1

ANALYSIS OF FINANCIAL PERFORMANCE OF VODAFONE

Author

Course Title

Professor

City

Date

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Introduction

The report aims to present financial analysis of one of the organization listed on London

Stock Exchange. It will present financial performance analysis of Vodafone over the latest

five years. This would entails analysis of Vodafone financial outlook in the latest five years,

its financial ratio analysis which is aimed at estimating its weaknesses and financial strength

over this period. The report is concluded with company’s financial standings and

recommendations for future improvements.

Overview of Vodafone

Vodafone is one of the international mobile operators in Britain with its headquarters being in

Newbury (Vodafone Group Plc 2017). In essence, it is the world’s leading

telecommunication firms by revenue. In other words, Vodafone is the largest and most

popular multinational firm in UK and the leading form in the telecommunication industry all

across the globe. The company manoeuvres across the world where it provides a broad array

of the telecommunication services dealing directly with the clients and providing services for

the businesses. Some of its services and products include voice, messaging, devices to assist

client in meeting the total communications, fixed line as well as data solutions. The

organization or entity vision is to be the global leader in the telecommunication sector. It has

made significant growth all across the globe since its inception (Vodafone Group Plc 2016).

The company has been broadening its presence within enterprise communication marketplace

both locally and across different countries. It prioritises free cash flow creation and

concentrates on emerging marketplace instead of expansions which is fundamental.

Financial Ratio Analysis

2

The report aims to present financial analysis of one of the organization listed on London

Stock Exchange. It will present financial performance analysis of Vodafone over the latest

five years. This would entails analysis of Vodafone financial outlook in the latest five years,

its financial ratio analysis which is aimed at estimating its weaknesses and financial strength

over this period. The report is concluded with company’s financial standings and

recommendations for future improvements.

Overview of Vodafone

Vodafone is one of the international mobile operators in Britain with its headquarters being in

Newbury (Vodafone Group Plc 2017). In essence, it is the world’s leading

telecommunication firms by revenue. In other words, Vodafone is the largest and most

popular multinational firm in UK and the leading form in the telecommunication industry all

across the globe. The company manoeuvres across the world where it provides a broad array

of the telecommunication services dealing directly with the clients and providing services for

the businesses. Some of its services and products include voice, messaging, devices to assist

client in meeting the total communications, fixed line as well as data solutions. The

organization or entity vision is to be the global leader in the telecommunication sector. It has

made significant growth all across the globe since its inception (Vodafone Group Plc 2016).

The company has been broadening its presence within enterprise communication marketplace

both locally and across different countries. It prioritises free cash flow creation and

concentrates on emerging marketplace instead of expansions which is fundamental.

Financial Ratio Analysis

2

This is a technique utilized in assessing account of a specific organization (Grzegorz 2011). It

is a significant aspect in analysis since it offers easy and quick outcome to an organization. In

essence, ratio analysis is the easiest means in evaluating an organization’s financial

performance compared to the income statement and balance sheet (Cox 2007). The analysis is

also of greater importance to an organization in determining whether it is accomplishing all

the desired objectives as well as assist in assessing how its rivals are doing. In essence, ratio

analysis offers valuable information regarding an organization’s financial standing and

position (Gibson 2011). Besides, ratio analysis is utilized for analysing financial statements

of a specific firm in comparing itself with its competitors and comparing its performance over

a specified period. It offers relationship between different items within the financial

statements (Schroeder, Clark & Cathey 2009).

Liquidity Ratios

Such ratios are usually obtained from the organization’s balance sheet and help in assessing

the capacity of an entity or company in settling its debts (Costae 2008). The ratios include;

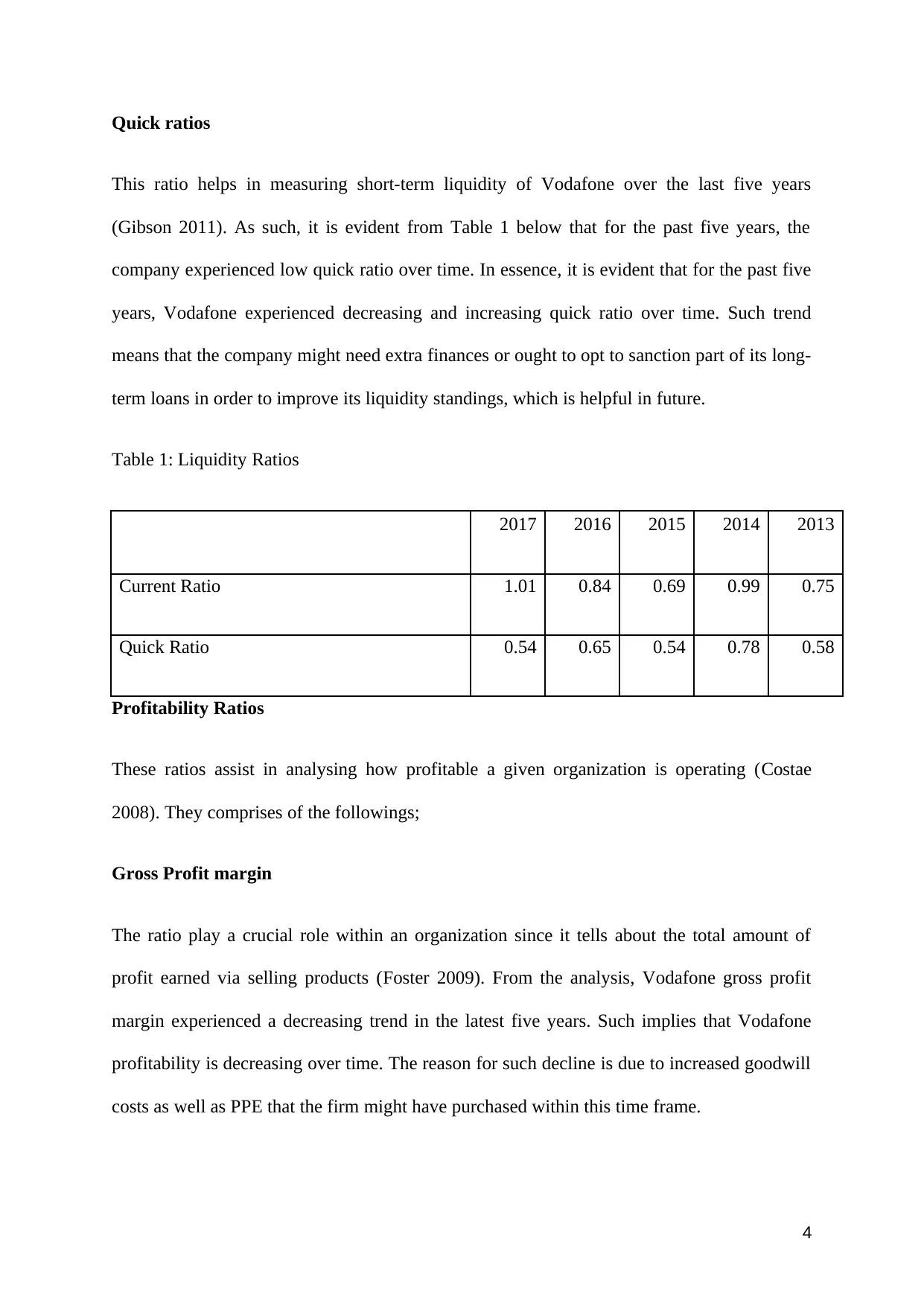

Current ratios

The ratio is said to display whether the short-term assets of Vodafone could cover its short-

term or current liabilities (Gibson 2011). As from Table 1 below, it can be stated that

Vodafone has some challenges in settling its short or current debts in most part of its latest

five years. This is due to the notion that the company experienced relatively lower current

ratio below 1 between 2013 and 2016 except in 2017 where the company experienced

relatively higher current ratio mostly above one. Such trend is a clear sign that for most part

of its operations, the company was struggling with its current or short-term debts whenever

they came due.

3

is a significant aspect in analysis since it offers easy and quick outcome to an organization. In

essence, ratio analysis is the easiest means in evaluating an organization’s financial

performance compared to the income statement and balance sheet (Cox 2007). The analysis is

also of greater importance to an organization in determining whether it is accomplishing all

the desired objectives as well as assist in assessing how its rivals are doing. In essence, ratio

analysis offers valuable information regarding an organization’s financial standing and

position (Gibson 2011). Besides, ratio analysis is utilized for analysing financial statements

of a specific firm in comparing itself with its competitors and comparing its performance over

a specified period. It offers relationship between different items within the financial

statements (Schroeder, Clark & Cathey 2009).

Liquidity Ratios

Such ratios are usually obtained from the organization’s balance sheet and help in assessing

the capacity of an entity or company in settling its debts (Costae 2008). The ratios include;

Current ratios

The ratio is said to display whether the short-term assets of Vodafone could cover its short-

term or current liabilities (Gibson 2011). As from Table 1 below, it can be stated that

Vodafone has some challenges in settling its short or current debts in most part of its latest

five years. This is due to the notion that the company experienced relatively lower current

ratio below 1 between 2013 and 2016 except in 2017 where the company experienced

relatively higher current ratio mostly above one. Such trend is a clear sign that for most part

of its operations, the company was struggling with its current or short-term debts whenever

they came due.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Quick ratios

This ratio helps in measuring short-term liquidity of Vodafone over the last five years

(Gibson 2011). As such, it is evident from Table 1 below that for the past five years, the

company experienced low quick ratio over time. In essence, it is evident that for the past five

years, Vodafone experienced decreasing and increasing quick ratio over time. Such trend

means that the company might need extra finances or ought to opt to sanction part of its long-

term loans in order to improve its liquidity standings, which is helpful in future.

Table 1: Liquidity Ratios

2017 2016 2015 2014 2013

Current Ratio 1.01 0.84 0.69 0.99 0.75

Quick Ratio 0.54 0.65 0.54 0.78 0.58

Profitability Ratios

These ratios assist in analysing how profitable a given organization is operating (Costae

2008). They comprises of the followings;

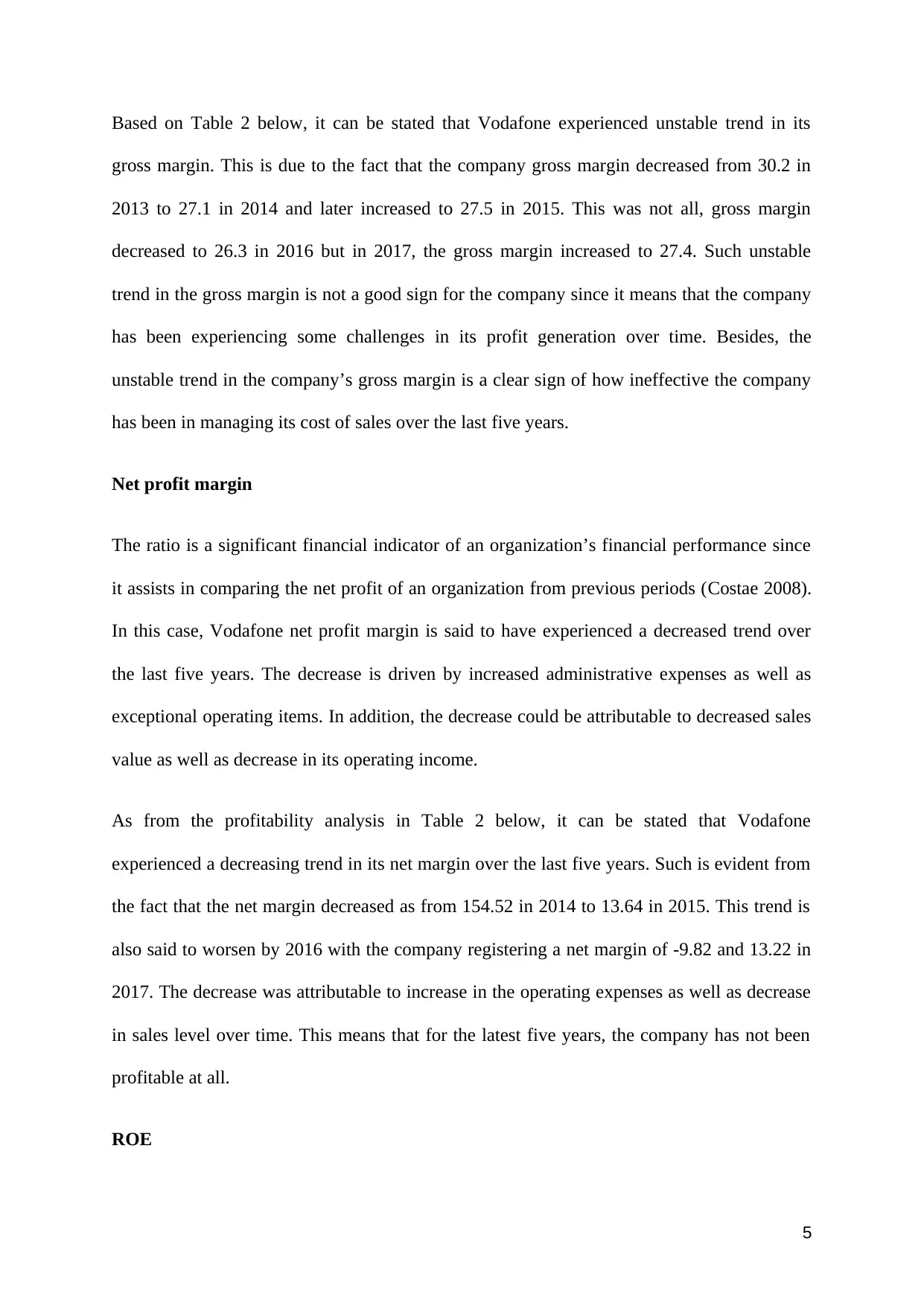

Gross Profit margin

The ratio play a crucial role within an organization since it tells about the total amount of

profit earned via selling products (Foster 2009). From the analysis, Vodafone gross profit

margin experienced a decreasing trend in the latest five years. Such implies that Vodafone

profitability is decreasing over time. The reason for such decline is due to increased goodwill

costs as well as PPE that the firm might have purchased within this time frame.

4

This ratio helps in measuring short-term liquidity of Vodafone over the last five years

(Gibson 2011). As such, it is evident from Table 1 below that for the past five years, the

company experienced low quick ratio over time. In essence, it is evident that for the past five

years, Vodafone experienced decreasing and increasing quick ratio over time. Such trend

means that the company might need extra finances or ought to opt to sanction part of its long-

term loans in order to improve its liquidity standings, which is helpful in future.

Table 1: Liquidity Ratios

2017 2016 2015 2014 2013

Current Ratio 1.01 0.84 0.69 0.99 0.75

Quick Ratio 0.54 0.65 0.54 0.78 0.58

Profitability Ratios

These ratios assist in analysing how profitable a given organization is operating (Costae

2008). They comprises of the followings;

Gross Profit margin

The ratio play a crucial role within an organization since it tells about the total amount of

profit earned via selling products (Foster 2009). From the analysis, Vodafone gross profit

margin experienced a decreasing trend in the latest five years. Such implies that Vodafone

profitability is decreasing over time. The reason for such decline is due to increased goodwill

costs as well as PPE that the firm might have purchased within this time frame.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

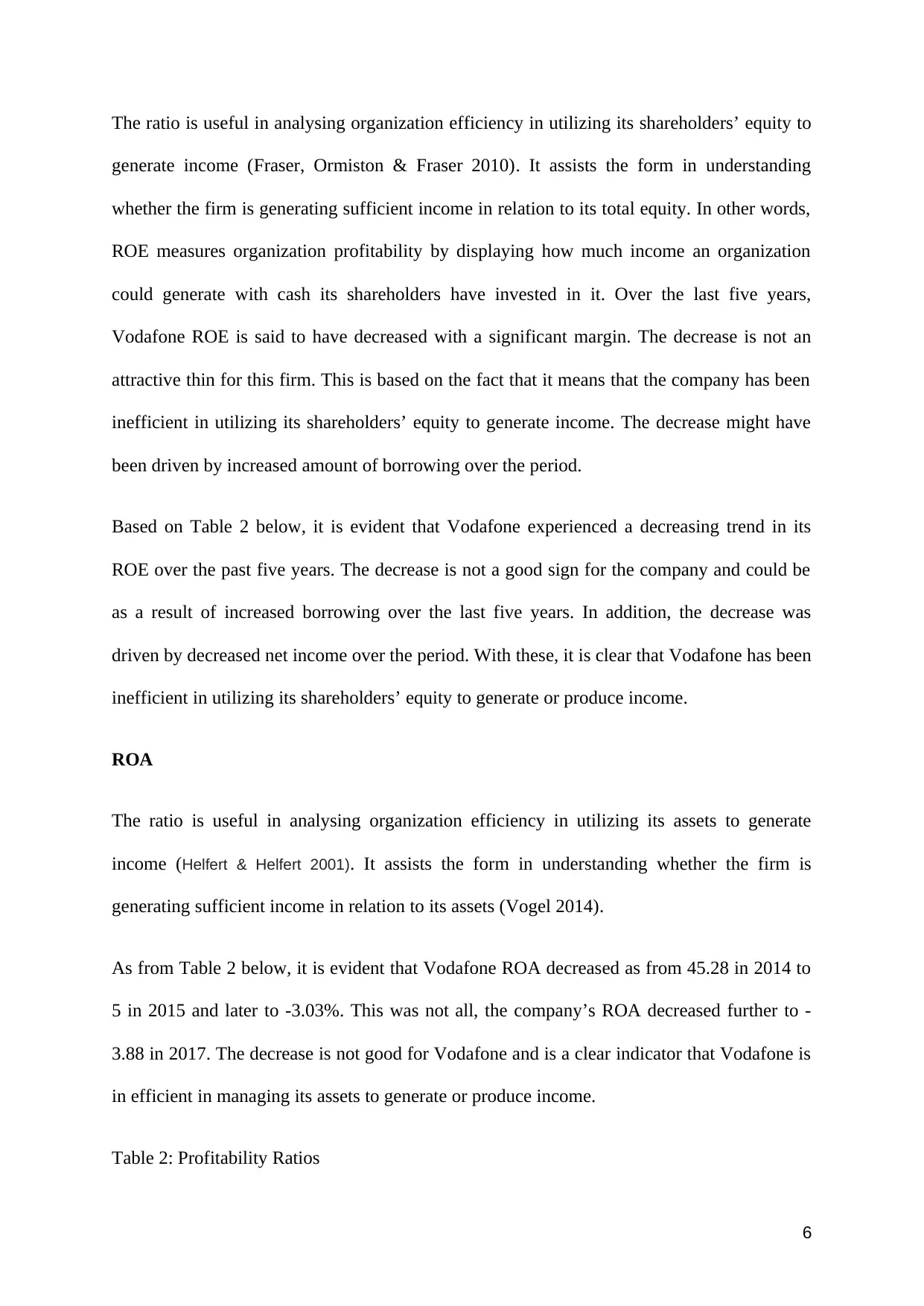

Based on Table 2 below, it can be stated that Vodafone experienced unstable trend in its

gross margin. This is due to the fact that the company gross margin decreased from 30.2 in

2013 to 27.1 in 2014 and later increased to 27.5 in 2015. This was not all, gross margin

decreased to 26.3 in 2016 but in 2017, the gross margin increased to 27.4. Such unstable

trend in the gross margin is not a good sign for the company since it means that the company

has been experiencing some challenges in its profit generation over time. Besides, the

unstable trend in the company’s gross margin is a clear sign of how ineffective the company

has been in managing its cost of sales over the last five years.

Net profit margin

The ratio is a significant financial indicator of an organization’s financial performance since

it assists in comparing the net profit of an organization from previous periods (Costae 2008).

In this case, Vodafone net profit margin is said to have experienced a decreased trend over

the last five years. The decrease is driven by increased administrative expenses as well as

exceptional operating items. In addition, the decrease could be attributable to decreased sales

value as well as decrease in its operating income.

As from the profitability analysis in Table 2 below, it can be stated that Vodafone

experienced a decreasing trend in its net margin over the last five years. Such is evident from

the fact that the net margin decreased as from 154.52 in 2014 to 13.64 in 2015. This trend is

also said to worsen by 2016 with the company registering a net margin of -9.82 and 13.22 in

2017. The decrease was attributable to increase in the operating expenses as well as decrease

in sales level over time. This means that for the latest five years, the company has not been

profitable at all.

ROE

5

gross margin. This is due to the fact that the company gross margin decreased from 30.2 in

2013 to 27.1 in 2014 and later increased to 27.5 in 2015. This was not all, gross margin

decreased to 26.3 in 2016 but in 2017, the gross margin increased to 27.4. Such unstable

trend in the gross margin is not a good sign for the company since it means that the company

has been experiencing some challenges in its profit generation over time. Besides, the

unstable trend in the company’s gross margin is a clear sign of how ineffective the company

has been in managing its cost of sales over the last five years.

Net profit margin

The ratio is a significant financial indicator of an organization’s financial performance since

it assists in comparing the net profit of an organization from previous periods (Costae 2008).

In this case, Vodafone net profit margin is said to have experienced a decreased trend over

the last five years. The decrease is driven by increased administrative expenses as well as

exceptional operating items. In addition, the decrease could be attributable to decreased sales

value as well as decrease in its operating income.

As from the profitability analysis in Table 2 below, it can be stated that Vodafone

experienced a decreasing trend in its net margin over the last five years. Such is evident from

the fact that the net margin decreased as from 154.52 in 2014 to 13.64 in 2015. This trend is

also said to worsen by 2016 with the company registering a net margin of -9.82 and 13.22 in

2017. The decrease was attributable to increase in the operating expenses as well as decrease

in sales level over time. This means that for the latest five years, the company has not been

profitable at all.

ROE

5

The ratio is useful in analysing organization efficiency in utilizing its shareholders’ equity to

generate income (Fraser, Ormiston & Fraser 2010). It assists the form in understanding

whether the firm is generating sufficient income in relation to its total equity. In other words,

ROE measures organization profitability by displaying how much income an organization

could generate with cash its shareholders have invested in it. Over the last five years,

Vodafone ROE is said to have decreased with a significant margin. The decrease is not an

attractive thin for this firm. This is based on the fact that it means that the company has been

inefficient in utilizing its shareholders’ equity to generate income. The decrease might have

been driven by increased amount of borrowing over the period.

Based on Table 2 below, it is evident that Vodafone experienced a decreasing trend in its

ROE over the past five years. The decrease is not a good sign for the company and could be

as a result of increased borrowing over the last five years. In addition, the decrease was

driven by decreased net income over the period. With these, it is clear that Vodafone has been

inefficient in utilizing its shareholders’ equity to generate or produce income.

ROA

The ratio is useful in analysing organization efficiency in utilizing its assets to generate

income (Helfert & Helfert 2001). It assists the form in understanding whether the firm is

generating sufficient income in relation to its assets (Vogel 2014).

As from Table 2 below, it is evident that Vodafone ROA decreased as from 45.28 in 2014 to

5 in 2015 and later to -3.03%. This was not all, the company’s ROA decreased further to -

3.88 in 2017. The decrease is not good for Vodafone and is a clear indicator that Vodafone is

in efficient in managing its assets to generate or produce income.

Table 2: Profitability Ratios

6

generate income (Fraser, Ormiston & Fraser 2010). It assists the form in understanding

whether the firm is generating sufficient income in relation to its total equity. In other words,

ROE measures organization profitability by displaying how much income an organization

could generate with cash its shareholders have invested in it. Over the last five years,

Vodafone ROE is said to have decreased with a significant margin. The decrease is not an

attractive thin for this firm. This is based on the fact that it means that the company has been

inefficient in utilizing its shareholders’ equity to generate income. The decrease might have

been driven by increased amount of borrowing over the period.

Based on Table 2 below, it is evident that Vodafone experienced a decreasing trend in its

ROE over the past five years. The decrease is not a good sign for the company and could be

as a result of increased borrowing over the last five years. In addition, the decrease was

driven by decreased net income over the period. With these, it is clear that Vodafone has been

inefficient in utilizing its shareholders’ equity to generate or produce income.

ROA

The ratio is useful in analysing organization efficiency in utilizing its assets to generate

income (Helfert & Helfert 2001). It assists the form in understanding whether the firm is

generating sufficient income in relation to its assets (Vogel 2014).

As from Table 2 below, it is evident that Vodafone ROA decreased as from 45.28 in 2014 to

5 in 2015 and later to -3.03%. This was not all, the company’s ROA decreased further to -

3.88 in 2017. The decrease is not good for Vodafone and is a clear indicator that Vodafone is

in efficient in managing its assets to generate or produce income.

Table 2: Profitability Ratios

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2017 2016 2015 2014 2013

Gross Margin 27.4 26.3 27.5 27.1 30.2

Net Margin % -13.22 -9.82 13.64 154.52 0.97

Return on Assets % -3.88 -3.03 5 45.28 0.3

Return on Equity % -8.09 -5.87 8.95 84.12 0.57

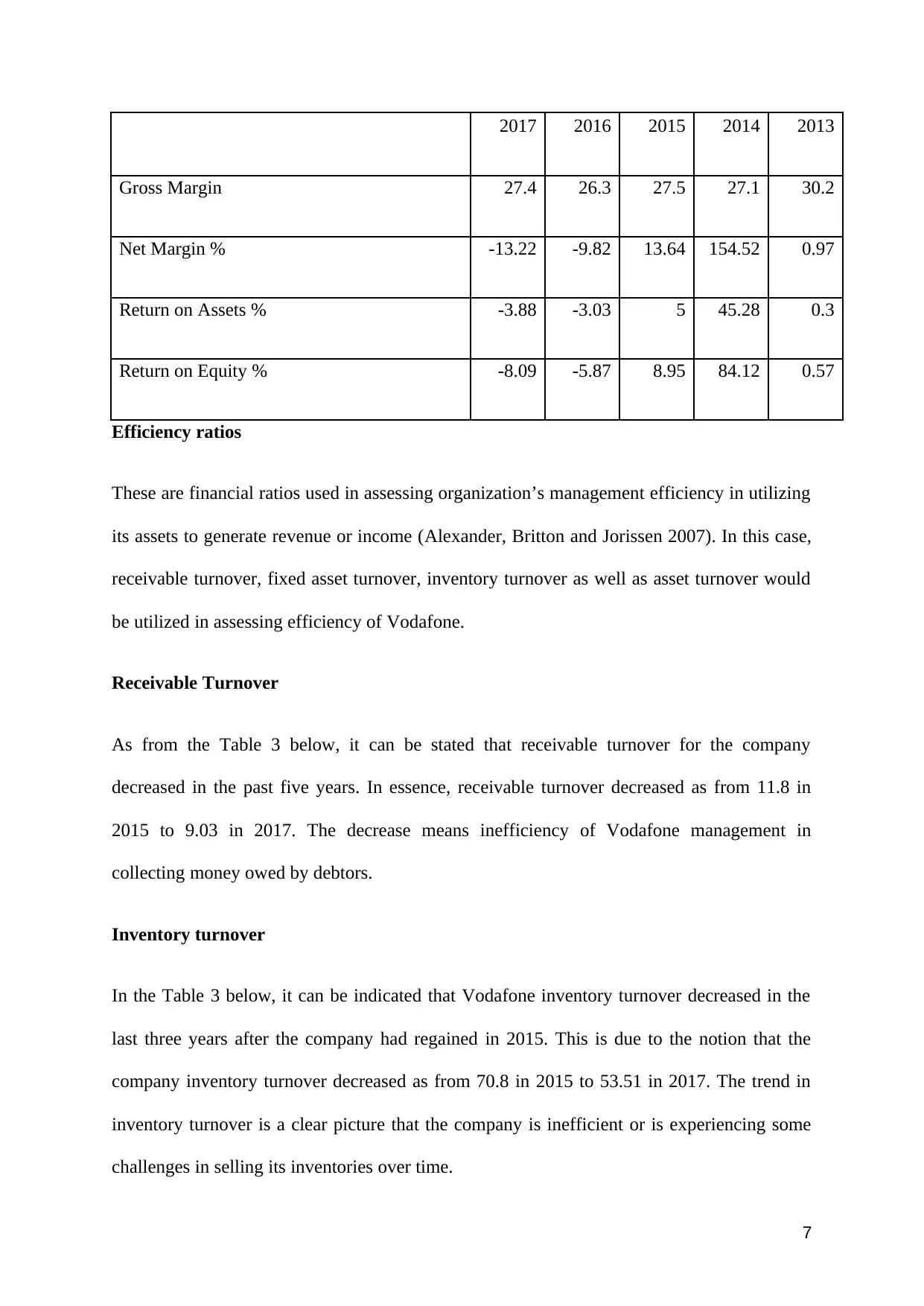

Efficiency ratios

These are financial ratios used in assessing organization’s management efficiency in utilizing

its assets to generate revenue or income (Alexander, Britton and Jorissen 2007). In this case,

receivable turnover, fixed asset turnover, inventory turnover as well as asset turnover would

be utilized in assessing efficiency of Vodafone.

Receivable Turnover

As from the Table 3 below, it can be stated that receivable turnover for the company

decreased in the past five years. In essence, receivable turnover decreased as from 11.8 in

2015 to 9.03 in 2017. The decrease means inefficiency of Vodafone management in

collecting money owed by debtors.

Inventory turnover

In the Table 3 below, it can be indicated that Vodafone inventory turnover decreased in the

last three years after the company had regained in 2015. This is due to the notion that the

company inventory turnover decreased as from 70.8 in 2015 to 53.51 in 2017. The trend in

inventory turnover is a clear picture that the company is inefficient or is experiencing some

challenges in selling its inventories over time.

7

Gross Margin 27.4 26.3 27.5 27.1 30.2

Net Margin % -13.22 -9.82 13.64 154.52 0.97

Return on Assets % -3.88 -3.03 5 45.28 0.3

Return on Equity % -8.09 -5.87 8.95 84.12 0.57

Efficiency ratios

These are financial ratios used in assessing organization’s management efficiency in utilizing

its assets to generate revenue or income (Alexander, Britton and Jorissen 2007). In this case,

receivable turnover, fixed asset turnover, inventory turnover as well as asset turnover would

be utilized in assessing efficiency of Vodafone.

Receivable Turnover

As from the Table 3 below, it can be stated that receivable turnover for the company

decreased in the past five years. In essence, receivable turnover decreased as from 11.8 in

2015 to 9.03 in 2017. The decrease means inefficiency of Vodafone management in

collecting money owed by debtors.

Inventory turnover

In the Table 3 below, it can be indicated that Vodafone inventory turnover decreased in the

last three years after the company had regained in 2015. This is due to the notion that the

company inventory turnover decreased as from 70.8 in 2015 to 53.51 in 2017. The trend in

inventory turnover is a clear picture that the company is inefficient or is experiencing some

challenges in selling its inventories over time.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Fixed asset turnover

As from Table 3 below, it can be stated that Vodafone fixed asset turnover decreased as from

1.8 in 2015 to 1.45 in 2017. The decrease implies that the firm has been inefficient in

managing or utilizing its fixed assets to generate sales.

Asset turnover

The asset turnover as from Table 3 below is said to have decreased as from 0.37 in 2015 to

0.29 in 2017. The low and decreased asset turnover is not a good thing for Vodafone since it

means that the company has been inefficient in managing its assets to generate sales. The

decreased and low asset turnover was mainly attributable to decreased sales level over time.

Table 3: Efficiency Ratios

2017 2016 2015 2014 2013

Receivables Turnover 9.03 9.46 11.8 10.17 11.22

Inventory Turnover 53.51 56.11 70.8 63.35 64.79

Fixed Assets Turnover 1.45 1.44 1.8 1.79 2.27

Asset Turnover 0.29 0.31 0.37 0.29 0.31

Solvency ratios

These ratios are useful in measuring or evaluating organization’s capacity in settling its long-

term debts over time (Brealey, Stewart and Allen 2008). In this case, debt/equity, leverage

and interest coverage ratios would be used in assessing Vodafone solvency level.

Debt/Equity

8

As from Table 3 below, it can be stated that Vodafone fixed asset turnover decreased as from

1.8 in 2015 to 1.45 in 2017. The decrease implies that the firm has been inefficient in

managing or utilizing its fixed assets to generate sales.

Asset turnover

The asset turnover as from Table 3 below is said to have decreased as from 0.37 in 2015 to

0.29 in 2017. The low and decreased asset turnover is not a good thing for Vodafone since it

means that the company has been inefficient in managing its assets to generate sales. The

decreased and low asset turnover was mainly attributable to decreased sales level over time.

Table 3: Efficiency Ratios

2017 2016 2015 2014 2013

Receivables Turnover 9.03 9.46 11.8 10.17 11.22

Inventory Turnover 53.51 56.11 70.8 63.35 64.79

Fixed Assets Turnover 1.45 1.44 1.8 1.79 2.27

Asset Turnover 0.29 0.31 0.37 0.29 0.31

Solvency ratios

These ratios are useful in measuring or evaluating organization’s capacity in settling its long-

term debts over time (Brealey, Stewart and Allen 2008). In this case, debt/equity, leverage

and interest coverage ratios would be used in assessing Vodafone solvency level.

Debt/Equity

8

This is a solvency ratio used in assessing how

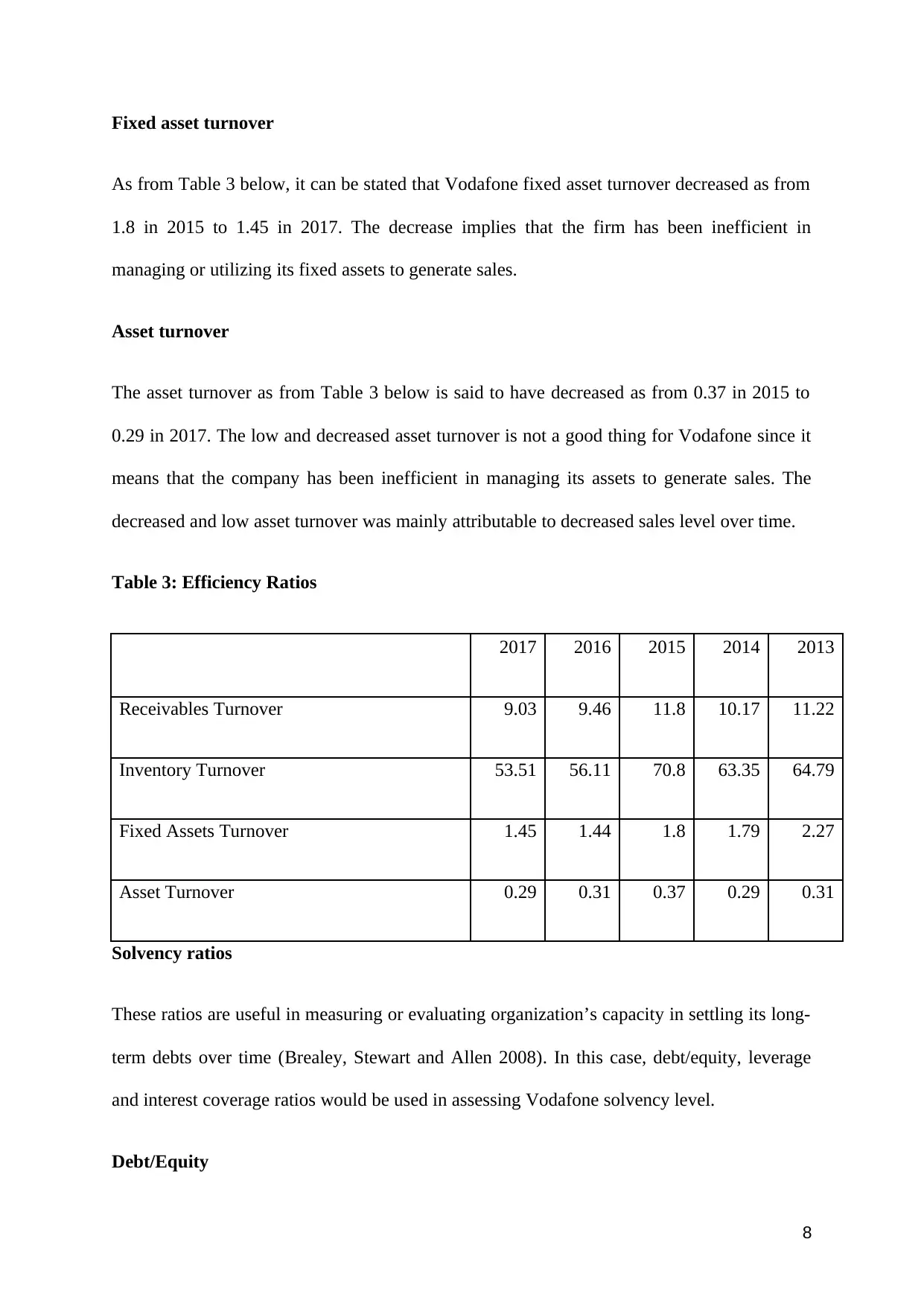

Based on Table 4 below, it is evident that Vodafone’s debt/equity for the latest five years was

relatively below 1. The decreasing and low debt/equity is a clear sign that the company has

been relying more on shareholders’ equity to fund its daily operations. The decrease was as a

result of decreased liabilities and increased equity over time. In essence, the low debt/equity

ratio implies less secure shareholders’ equity capital.

Interest coverage

The company interest coverage is found to have experienced decreasing and increasing trend

or asymmetric trend over the last five years. Such trend is a clear indicator that the company

has been experiencing some challenges in some years in settling interests charged for their

long-term debts.

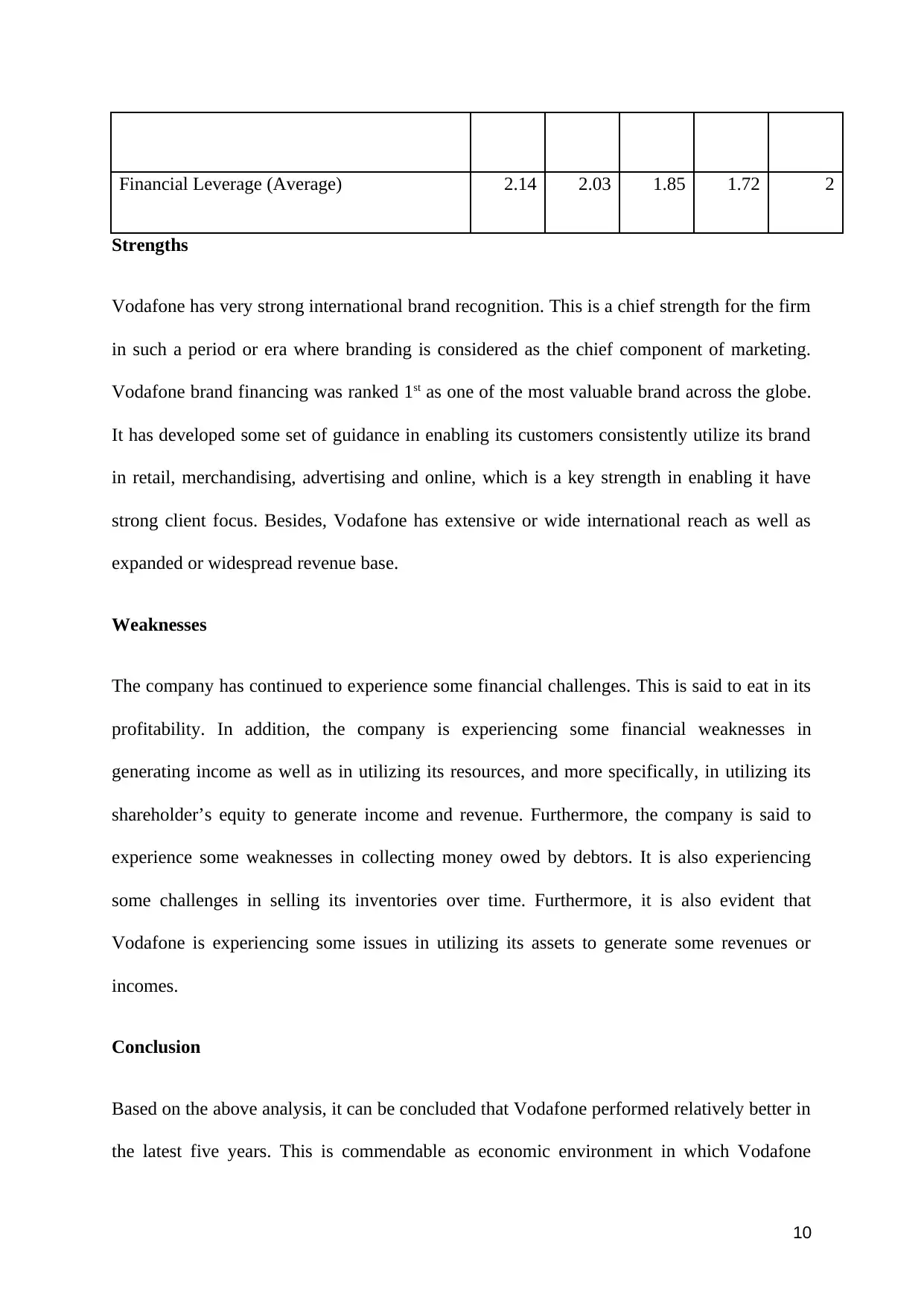

Financial leverage

As from Table 4 below, it can be indicated that Vodafone experienced relatively high and

increasing trend in its financial leverage in the last five years. Such trend is evidenced by an

increase in its leverage from 1.72 in 2014 to 2.14 in 2017. The increasing trend in the

company leverage ratio is a clear sign that the company is at financial risk. Therefore,

necessary actions should be taken to minimize the risk.

Table 4: Solvency Ratios

2017 2016 2015 2014 2013

Debt/Equity 0.31 0.45 0.34 0.3 0.41

0.72 1.62 -8.46 2.93

9

Based on Table 4 below, it is evident that Vodafone’s debt/equity for the latest five years was

relatively below 1. The decreasing and low debt/equity is a clear sign that the company has

been relying more on shareholders’ equity to fund its daily operations. The decrease was as a

result of decreased liabilities and increased equity over time. In essence, the low debt/equity

ratio implies less secure shareholders’ equity capital.

Interest coverage

The company interest coverage is found to have experienced decreasing and increasing trend

or asymmetric trend over the last five years. Such trend is a clear indicator that the company

has been experiencing some challenges in some years in settling interests charged for their

long-term debts.

Financial leverage

As from Table 4 below, it can be indicated that Vodafone experienced relatively high and

increasing trend in its financial leverage in the last five years. Such trend is evidenced by an

increase in its leverage from 1.72 in 2014 to 2.14 in 2017. The increasing trend in the

company leverage ratio is a clear sign that the company is at financial risk. Therefore,

necessary actions should be taken to minimize the risk.

Table 4: Solvency Ratios

2017 2016 2015 2014 2013

Debt/Equity 0.31 0.45 0.34 0.3 0.41

0.72 1.62 -8.46 2.93

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Leverage (Average) 2.14 2.03 1.85 1.72 2

Strengths

Vodafone has very strong international brand recognition. This is a chief strength for the firm

in such a period or era where branding is considered as the chief component of marketing.

Vodafone brand financing was ranked 1st as one of the most valuable brand across the globe.

It has developed some set of guidance in enabling its customers consistently utilize its brand

in retail, merchandising, advertising and online, which is a key strength in enabling it have

strong client focus. Besides, Vodafone has extensive or wide international reach as well as

expanded or widespread revenue base.

Weaknesses

The company has continued to experience some financial challenges. This is said to eat in its

profitability. In addition, the company is experiencing some financial weaknesses in

generating income as well as in utilizing its resources, and more specifically, in utilizing its

shareholder’s equity to generate income and revenue. Furthermore, the company is said to

experience some weaknesses in collecting money owed by debtors. It is also experiencing

some challenges in selling its inventories over time. Furthermore, it is also evident that

Vodafone is experiencing some issues in utilizing its assets to generate some revenues or

incomes.

Conclusion

Based on the above analysis, it can be concluded that Vodafone performed relatively better in

the latest five years. This is commendable as economic environment in which Vodafone

10

Strengths

Vodafone has very strong international brand recognition. This is a chief strength for the firm

in such a period or era where branding is considered as the chief component of marketing.

Vodafone brand financing was ranked 1st as one of the most valuable brand across the globe.

It has developed some set of guidance in enabling its customers consistently utilize its brand

in retail, merchandising, advertising and online, which is a key strength in enabling it have

strong client focus. Besides, Vodafone has extensive or wide international reach as well as

expanded or widespread revenue base.

Weaknesses

The company has continued to experience some financial challenges. This is said to eat in its

profitability. In addition, the company is experiencing some financial weaknesses in

generating income as well as in utilizing its resources, and more specifically, in utilizing its

shareholder’s equity to generate income and revenue. Furthermore, the company is said to

experience some weaknesses in collecting money owed by debtors. It is also experiencing

some challenges in selling its inventories over time. Furthermore, it is also evident that

Vodafone is experiencing some issues in utilizing its assets to generate some revenues or

incomes.

Conclusion

Based on the above analysis, it can be concluded that Vodafone performed relatively better in

the latest five years. This is commendable as economic environment in which Vodafone

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

operates has not been that favourable. In fact, it is evident that Vodafone has been less

profitable or has made no improvement in its ROE and operating profit margin over the latest

five years Decrease or deterioration in the company ROE indicates that Vodafone have made

minimal or less improvement in utilization of its capital employed. Besides, the decreased

trend in the profitability ratios means that for the last five years, the company has been less

profitable. In addition, it is evident that Vodafone has been able to keep or maintain it

solvency level under high control. It is also evident that despite the decreasing or worsening

trend in the company’s efficiency and profitability levels, existing as well as potential

investors are confident on future prospect of Vodafone which is reflected in its increased

share price over time.

Recommendations for Improvements

Vodafone should be commended to build and maintain on its strengths, extending its global

reach, maintaining its leads as well as increasing on its brand value. Such is said to have

definite effect on its capacity to improve on its profitability as well as help it do well in spite

of performing in highly competitive and mature environment with dire climate (Revsine

2010). In fact it is unfortunate that none of Vodafone strengths could minimize or eradicate

its weaknesses. Therefore, the company should take care whenever computing and

recognizing its taxes by ensuring that it has put in place appropriate internal controls in

ensuring all regulations and rules are adhered to. As such it should be noted that for any

existing or potential investor willing to invest, they should hold. They should hold selling any

shares invested in the company and those planning to buy shares from profitable firms should

hold any plans to purchase the shares till the company recovers from its current financial

hitches.

11

profitable or has made no improvement in its ROE and operating profit margin over the latest

five years Decrease or deterioration in the company ROE indicates that Vodafone have made

minimal or less improvement in utilization of its capital employed. Besides, the decreased

trend in the profitability ratios means that for the last five years, the company has been less

profitable. In addition, it is evident that Vodafone has been able to keep or maintain it

solvency level under high control. It is also evident that despite the decreasing or worsening

trend in the company’s efficiency and profitability levels, existing as well as potential

investors are confident on future prospect of Vodafone which is reflected in its increased

share price over time.

Recommendations for Improvements

Vodafone should be commended to build and maintain on its strengths, extending its global

reach, maintaining its leads as well as increasing on its brand value. Such is said to have

definite effect on its capacity to improve on its profitability as well as help it do well in spite

of performing in highly competitive and mature environment with dire climate (Revsine

2010). In fact it is unfortunate that none of Vodafone strengths could minimize or eradicate

its weaknesses. Therefore, the company should take care whenever computing and

recognizing its taxes by ensuring that it has put in place appropriate internal controls in

ensuring all regulations and rules are adhered to. As such it should be noted that for any

existing or potential investor willing to invest, they should hold. They should hold selling any

shares invested in the company and those planning to buy shares from profitable firms should

hold any plans to purchase the shares till the company recovers from its current financial

hitches.

11

References

Alexander, D, Britton, A and Jorissen, A (2007), International Financial Reporting and

Analysis, London Thomson Learning.

Brealey, RA, Stewart, CM and Allen, F (2008), Principles of Corporate Finance Singapore:

McGraw-Hill.

Costae, A (2006), 'The Analysis of the Telecommunication Sector by means of Data Mining

Technique', Journal of Applied Quantitative Methods, pp.144-150.

Cox, D (2007), Accounting: the basics of financial and management accounting. Worcester:

Osborne Books Ltd

Foster, G (2009), Financial Statement Analysis, 2/e. Pearson Education India.

Fraser, LM, Ormiston, A & Fraser, LM (2010), Understanding financial statements. Pearson.

Gibson, CH (2011), Financial reporting and analysis. South-Western Cengage Learning.

Grzegorz, M (2011), ‘Financial Analysis in the Enterprise: A Value-Based Liquidity Frame-

work,’ Available at SSRN 1839367.

Helfert, EA & Helfert, EA (2001), Financial analysis: tools and techniques: a guide for

managers (pp. 221-296). New York: McGraw-Hill.

Revsine, C (2010), Johnson. Financial Reporting and Analysis. New Jersey: Prentice Hall.

12

Alexander, D, Britton, A and Jorissen, A (2007), International Financial Reporting and

Analysis, London Thomson Learning.

Brealey, RA, Stewart, CM and Allen, F (2008), Principles of Corporate Finance Singapore:

McGraw-Hill.

Costae, A (2006), 'The Analysis of the Telecommunication Sector by means of Data Mining

Technique', Journal of Applied Quantitative Methods, pp.144-150.

Cox, D (2007), Accounting: the basics of financial and management accounting. Worcester:

Osborne Books Ltd

Foster, G (2009), Financial Statement Analysis, 2/e. Pearson Education India.

Fraser, LM, Ormiston, A & Fraser, LM (2010), Understanding financial statements. Pearson.

Gibson, CH (2011), Financial reporting and analysis. South-Western Cengage Learning.

Grzegorz, M (2011), ‘Financial Analysis in the Enterprise: A Value-Based Liquidity Frame-

work,’ Available at SSRN 1839367.

Helfert, EA & Helfert, EA (2001), Financial analysis: tools and techniques: a guide for

managers (pp. 221-296). New York: McGraw-Hill.

Revsine, C (2010), Johnson. Financial Reporting and Analysis. New Jersey: Prentice Hall.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.