International Business Essay: Walmart's FDI in the Australian Market

VerifiedAdded on 2023/06/07

|16

|4221

|466

Essay

AI Summary

This essay analyzes Walmart's potential entry into the Australian market, focusing on the challenges and opportunities associated with Foreign Direct Investment (FDI). It examines Walmart's internal strengths and weaknesses, particularly its brand image and distribution network, while acknowledging its limited presence outside the US market. The essay discusses the Australian government's regulations for foreign investment, including the proposal submission process, case analysis, and the importance of complying with Australian laws and ethical corporate behavior. It highlights key requirements such as professional corporate governance, OECD guidelines, and registration with the Australian Securities and Investments Commission (ASIC). The analysis also considers the challenges Walmart might face, such as hiring a local agent and adapting to the Corporations Act 2001. The essay provides a comprehensive overview of the factors influencing Walmart's strategic decision-making and operational strategies within the Australian market.

Running head: ESSAY

INTERNATIONAL BUSINESS

Name of Student

Name of University

Author note

INTERNATIONAL BUSINESS

Name of Student

Name of University

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ESSAY

Question 1:

Part 1:

Foreign invest and expansion is very essential for a company to survive and develop

in the modern market. However, in Australia, it is not upon looked else just as a procedure,

but there are several ways of guidelines and rules to do business. For example, if a company

chooses to invest in Australia through FDI it has to follow certain trade guidelines which

have been set according to Australia. In this discussion, we have taken Walmart as a MNC

who wishes to do business in Australia. The discussion will investigate and analyse the key

elements of the trade and identify the challenges that Walmart can face while doing business

in Australia.

Walmart is an American retail company which has a dominant presence in the retail

chain industry. The Walmart retail stores detail in several sectors and products which gives it

the opportunity to expand and operate in a number of fields. With its headquarters present in

USA, the Walmart Inc. is one of the largest MNCs in the retail chain sector in the world. It

has a large dominant presence in the world and currently operates in 28 countries. Walmart

has more than 11718 stores all over the world which heralds the dominance in the retail chain

industry. Besides this Walmart, in terms of revenue collection is the world’s largest company

which sums up to approximately US$500 billion. Walmart also has the reputation of being

the largest employer in the world in the private sector with more than 2.3 million employees

all around the world. However, despite its dominant presence all over the world, Walmart

Inc. has not yet ventured into the Australian market. The Australian market still remains open

with its vast potentiality. In 2017, we have seen the entry of Amazon, another retail chain

giant in the Australian market, while possibilities remain for Walmart Inc. to invest in the

Australian market and expand into the vast market.

Question 1:

Part 1:

Foreign invest and expansion is very essential for a company to survive and develop

in the modern market. However, in Australia, it is not upon looked else just as a procedure,

but there are several ways of guidelines and rules to do business. For example, if a company

chooses to invest in Australia through FDI it has to follow certain trade guidelines which

have been set according to Australia. In this discussion, we have taken Walmart as a MNC

who wishes to do business in Australia. The discussion will investigate and analyse the key

elements of the trade and identify the challenges that Walmart can face while doing business

in Australia.

Walmart is an American retail company which has a dominant presence in the retail

chain industry. The Walmart retail stores detail in several sectors and products which gives it

the opportunity to expand and operate in a number of fields. With its headquarters present in

USA, the Walmart Inc. is one of the largest MNCs in the retail chain sector in the world. It

has a large dominant presence in the world and currently operates in 28 countries. Walmart

has more than 11718 stores all over the world which heralds the dominance in the retail chain

industry. Besides this Walmart, in terms of revenue collection is the world’s largest company

which sums up to approximately US$500 billion. Walmart also has the reputation of being

the largest employer in the world in the private sector with more than 2.3 million employees

all around the world. However, despite its dominant presence all over the world, Walmart

Inc. has not yet ventured into the Australian market. The Australian market still remains open

with its vast potentiality. In 2017, we have seen the entry of Amazon, another retail chain

giant in the Australian market, while possibilities remain for Walmart Inc. to invest in the

Australian market and expand into the vast market.

2ESSAY

However, if Walmart Inc. comes to Australia on the lines of FDI, it has to go through

certain processes, which have been set by the Australian government to review the purpose

and productivity of the FDI. Australian government is open to foreign investments which can

benefit the Australian economy. According to the government, the Australian economy had

been built by foreign investments and it is necessary for large foreign companies to come and

invest in Australia so that the economy sustains its growth and development in the future

(Aph.gov.au 2018).

Firstly, let us look into the internal strengths and weaknesses of Walmart Inc. to do

determine its efficiency to enter into the Australian market. Walmart’s primary strength is its

strong brand image. Walmart is known all over the world for its dominant presence in the

retail chain sector and it has a large and well equipped distribution network which lets it to

cater to a number of people all over the world. Walmart uses advanced technology to

maintain its strong distribution network, which also helps the company to maintain the supply

chain worldwide. Besides the strengths, the primary weakness of Walmart is that though it

has a significant presence worldwide, majority of its market shares come from the US

markets. Hence it can be seen that Walmart needs to expand significantly in other countries

such as Asia or Australia to capture the potential markets and increase its market share.

Walmart should look forward to increase its presence in the Australian market by

following the competitive theories and increase its profitability. Active strategy and

management can help Walmart develop its operational market strategies in Australia.

Australia is an open market which allows investors from all over the world to swarm

in the Australian market to do business. This helps the in the dual benefits both for the

investors in terms of profit and for the Australian economy in terms of economic growth,

employment and income flow. It also helps in the creation of new jobs besides the existing

However, if Walmart Inc. comes to Australia on the lines of FDI, it has to go through

certain processes, which have been set by the Australian government to review the purpose

and productivity of the FDI. Australian government is open to foreign investments which can

benefit the Australian economy. According to the government, the Australian economy had

been built by foreign investments and it is necessary for large foreign companies to come and

invest in Australia so that the economy sustains its growth and development in the future

(Aph.gov.au 2018).

Firstly, let us look into the internal strengths and weaknesses of Walmart Inc. to do

determine its efficiency to enter into the Australian market. Walmart’s primary strength is its

strong brand image. Walmart is known all over the world for its dominant presence in the

retail chain sector and it has a large and well equipped distribution network which lets it to

cater to a number of people all over the world. Walmart uses advanced technology to

maintain its strong distribution network, which also helps the company to maintain the supply

chain worldwide. Besides the strengths, the primary weakness of Walmart is that though it

has a significant presence worldwide, majority of its market shares come from the US

markets. Hence it can be seen that Walmart needs to expand significantly in other countries

such as Asia or Australia to capture the potential markets and increase its market share.

Walmart should look forward to increase its presence in the Australian market by

following the competitive theories and increase its profitability. Active strategy and

management can help Walmart develop its operational market strategies in Australia.

Australia is an open market which allows investors from all over the world to swarm

in the Australian market to do business. This helps the in the dual benefits both for the

investors in terms of profit and for the Australian economy in terms of economic growth,

employment and income flow. It also helps in the creation of new jobs besides the existing

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ESSAY

jobs and help in the introduction of new and innovative technologies in the country, which

can be later used for the further growth of the market in the future (Armstrong 2015).

However, doing business in Australia requires following several guidelines. Though the

business formalities of the Australian government have been kept flexible by the Australian

government compared to other countries in order to draw a larger number of direct foreign

investors, it is mandatory for the investors to follow the regulations accordingly (Fan et al.

2016). Following these procedures can ensure the clarity of the business operations and the

benefits that the business firm tends to give to the host nation’s economy.

Walmart needs to prepare accordingly to follow these regulations in order to establish

business in Australia. Firstly, Walmart Inc. requires producing an in-depth proposal regarding

its business policies and its plan of operations in Australia. This includes the amount of

investment that is being planned by the company to be invested in Australia, the number of

stores that it plans to open in Australia, the strategic locations it has chosen in Australia and

the benefits that the company has in its mind for the people of Australia (firb.gov.au 2018).

This includes the people who are to be employed by the company and the people whom they

are going to cater to. An overall planning like this can help the company to determine the

benefits that they are going to give Australian economy in its due course of business.

The next part of the proposal submission includes the review by the Australian

government. The duty of the Australian government is to review the proposal submitted by

Walmart in a detailed manner, judging the interests of the people and the economy in the

lines of the case summaries provided by Walmart. The approach by the government is a

flexible one compared to the other nations who require the company to go through several

procedures to present its idea in front of the host government (firb.gov.au 2018). The

approach of the Australian government is such because it believes that hard and fast rules,

and rigid environment prohibits large companies who require flexibility to invest from

jobs and help in the introduction of new and innovative technologies in the country, which

can be later used for the further growth of the market in the future (Armstrong 2015).

However, doing business in Australia requires following several guidelines. Though the

business formalities of the Australian government have been kept flexible by the Australian

government compared to other countries in order to draw a larger number of direct foreign

investors, it is mandatory for the investors to follow the regulations accordingly (Fan et al.

2016). Following these procedures can ensure the clarity of the business operations and the

benefits that the business firm tends to give to the host nation’s economy.

Walmart needs to prepare accordingly to follow these regulations in order to establish

business in Australia. Firstly, Walmart Inc. requires producing an in-depth proposal regarding

its business policies and its plan of operations in Australia. This includes the amount of

investment that is being planned by the company to be invested in Australia, the number of

stores that it plans to open in Australia, the strategic locations it has chosen in Australia and

the benefits that the company has in its mind for the people of Australia (firb.gov.au 2018).

This includes the people who are to be employed by the company and the people whom they

are going to cater to. An overall planning like this can help the company to determine the

benefits that they are going to give Australian economy in its due course of business.

The next part of the proposal submission includes the review by the Australian

government. The duty of the Australian government is to review the proposal submitted by

Walmart in a detailed manner, judging the interests of the people and the economy in the

lines of the case summaries provided by Walmart. The approach by the government is a

flexible one compared to the other nations who require the company to go through several

procedures to present its idea in front of the host government (firb.gov.au 2018). The

approach of the Australian government is such because it believes that hard and fast rules,

and rigid environment prohibits large companies who require flexibility to invest from

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ESSAY

investing their most valuable assets. The incomplete investments are not valuable both for the

host nation and the company willing to invest (Koojaroenprasit 2013). The limited

investment results in the limitation of flow of the cash and thus defeats the idea of total

development. However, the process followed by the Australian government, which is the case

analysis of the proposal, helps the company to maximize its investments to a larger scale and

at the same time also safeguards the interests of the Australian people and the economy as a

whole.

It is often seen that large corporate MNCs like Walmart, in order to maximize their

profits devise different ways to avoid the benefits that they had earlier promised to the

government. Australia follows a very strict policy regarding these policies (firb.gov.au 2018).

The flexibility shown in the case analysis of the proposal doesn’t ensure that the proposals

are approved. It is approved only after the detailed analysis where benefits are judged at

every step of the investment. If the government doesn’t find any process or step suitable then

the project might not be approved or be cancelled (Lee 2013). This aspect safeguards

Australia’s interest against the exploitation by the corporate bodies, which is often done in

many developing nations.

This type of strictness in the trade-policy might pose a challenge for Walmart as it

would be bound to comply with the national interests and might have to alter some of its own

policies to do business in Australia. The Australian government presumes the fact that all the

investors are expected to comply with the high standards of Australian law, and maintain its

conduct accordingly (firb.gov.au 2018). This aspect allows the government to place complete

trust in the investors and give them the permission to carry out their business in Australia.

There are several behavioural regulations that have been set up by the Australian

government to ensure the ethical corporate behaviour of the foreign investors (Turnbull, Sun

investing their most valuable assets. The incomplete investments are not valuable both for the

host nation and the company willing to invest (Koojaroenprasit 2013). The limited

investment results in the limitation of flow of the cash and thus defeats the idea of total

development. However, the process followed by the Australian government, which is the case

analysis of the proposal, helps the company to maximize its investments to a larger scale and

at the same time also safeguards the interests of the Australian people and the economy as a

whole.

It is often seen that large corporate MNCs like Walmart, in order to maximize their

profits devise different ways to avoid the benefits that they had earlier promised to the

government. Australia follows a very strict policy regarding these policies (firb.gov.au 2018).

The flexibility shown in the case analysis of the proposal doesn’t ensure that the proposals

are approved. It is approved only after the detailed analysis where benefits are judged at

every step of the investment. If the government doesn’t find any process or step suitable then

the project might not be approved or be cancelled (Lee 2013). This aspect safeguards

Australia’s interest against the exploitation by the corporate bodies, which is often done in

many developing nations.

This type of strictness in the trade-policy might pose a challenge for Walmart as it

would be bound to comply with the national interests and might have to alter some of its own

policies to do business in Australia. The Australian government presumes the fact that all the

investors are expected to comply with the high standards of Australian law, and maintain its

conduct accordingly (firb.gov.au 2018). This aspect allows the government to place complete

trust in the investors and give them the permission to carry out their business in Australia.

There are several behavioural regulations that have been set up by the Australian

government to ensure the ethical corporate behaviour of the foreign investors (Turnbull, Sun

5ESSAY

and Anwar 2016). Walmart should consider these regulations while planning their business

proposal.

Firstly, Walmart is expected to main professional corporate governance, which should

aim at the economic efficiency and the development of both the company and the nation.

Ensuring good relations between the management, employees and the stakeholders can

maintain a professional corporate governance (firb.gov.au 2018). Proper and timely

compensations, lucrative incentives help the stakeholders to remain aligned to the company.

Moreover a monitoring system should be implemented for the maintenance of the effective

governing system along the corporate principles. The standards of the corporate governance

are set by the Australian Securities Exchange and all the corporate bodies are expected to

comply by the set standards (firb.gov.au 2018). These principles require the corporate bodies

to develop a formal mandate which would specifically mention the roles of the management

and the governing board. The board requires to be comprised of independent persons who are

able to do their duties irrespective of any liabilities (Thorpe and Leitão 2014). The principles

also set that the chairperson of the board and the chief executive officer should different

persons, so that they can distinguish between their job roles, and justify them accordingly.

The company should also set a code of conduct for the employees which are to be strictly

followed by all. The company should establish an audit board which will monitor the

activities of the company. The company should also monitor the potential business risks and

avoid the.

The Organization for Economic Co-operation (OECD) is often responsible for the

setting of the principles of international trade. Walmart should also consider the OECD

regulations, which are primarily the guidelines for both the government and the investor

(firb.gov.au 2018). The OECD guidelines are a complete set of strict guideline, which serve

the purpose of reminding the corporate owners their responsibility towards the society. This

and Anwar 2016). Walmart should consider these regulations while planning their business

proposal.

Firstly, Walmart is expected to main professional corporate governance, which should

aim at the economic efficiency and the development of both the company and the nation.

Ensuring good relations between the management, employees and the stakeholders can

maintain a professional corporate governance (firb.gov.au 2018). Proper and timely

compensations, lucrative incentives help the stakeholders to remain aligned to the company.

Moreover a monitoring system should be implemented for the maintenance of the effective

governing system along the corporate principles. The standards of the corporate governance

are set by the Australian Securities Exchange and all the corporate bodies are expected to

comply by the set standards (firb.gov.au 2018). These principles require the corporate bodies

to develop a formal mandate which would specifically mention the roles of the management

and the governing board. The board requires to be comprised of independent persons who are

able to do their duties irrespective of any liabilities (Thorpe and Leitão 2014). The principles

also set that the chairperson of the board and the chief executive officer should different

persons, so that they can distinguish between their job roles, and justify them accordingly.

The company should also set a code of conduct for the employees which are to be strictly

followed by all. The company should establish an audit board which will monitor the

activities of the company. The company should also monitor the potential business risks and

avoid the.

The Organization for Economic Co-operation (OECD) is often responsible for the

setting of the principles of international trade. Walmart should also consider the OECD

regulations, which are primarily the guidelines for both the government and the investor

(firb.gov.au 2018). The OECD guidelines are a complete set of strict guideline, which serve

the purpose of reminding the corporate owners their responsibility towards the society. This

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ESSAY

enables the investors to function in a more efficient, transparent and competitive manner,

which can further help the company to profit and at the same time contribute to the

development of the host economy (Jos Jansen and Stokman 2014).

The Australian Securities and Investments Commission (ASIC) is one of the prime

bodies that looks after the operations of a foreign investing company. The body is

independent of the other commonwealth governing bodies and is responsible for the

registration of the foreign companies for operating in Australia (firb.gov.au 2018). The

company verifies the company details and its policies and he different persons from the board

or management body before registering the company. Walmart should register with the ASIC,

in order to operate its business in Australia. The requirements of the registration process

include the submission of certain reports which are essential for the ASIC to determine the

status of the company. Similarly, Walmart also requires to submit a copy of the balance sheet

of the company, along with the statements of profit and loss for the interval of the previous

15 months (firb.gov.au 2018). The company also requires to submit other documents which

verify its registration in its home location. These documents act as the verifying documents

for the ASIC to determine the authenticity of the company. Moreover, another challenge that

Walmart might face is that the company requires hiring a local agent who would be

answerable for the different activities of the company. The ASIC should always be informed

of any amendments in the company policies at any period of time while operating in

Australia and also require placing formal documents with regards to the amendments (Bayari

2013).

According to the Corporations Act 2001, the Australian law allows the director of the

foreign investing companies to shoulder additional responsibilities in order to maintain the

proper functioning of the company (firb.gov.au 2018). The challenge of Walmart is to give its

directors additional responsibilities, which helps it to maintain the corporate responsibilities.

enables the investors to function in a more efficient, transparent and competitive manner,

which can further help the company to profit and at the same time contribute to the

development of the host economy (Jos Jansen and Stokman 2014).

The Australian Securities and Investments Commission (ASIC) is one of the prime

bodies that looks after the operations of a foreign investing company. The body is

independent of the other commonwealth governing bodies and is responsible for the

registration of the foreign companies for operating in Australia (firb.gov.au 2018). The

company verifies the company details and its policies and he different persons from the board

or management body before registering the company. Walmart should register with the ASIC,

in order to operate its business in Australia. The requirements of the registration process

include the submission of certain reports which are essential for the ASIC to determine the

status of the company. Similarly, Walmart also requires to submit a copy of the balance sheet

of the company, along with the statements of profit and loss for the interval of the previous

15 months (firb.gov.au 2018). The company also requires to submit other documents which

verify its registration in its home location. These documents act as the verifying documents

for the ASIC to determine the authenticity of the company. Moreover, another challenge that

Walmart might face is that the company requires hiring a local agent who would be

answerable for the different activities of the company. The ASIC should always be informed

of any amendments in the company policies at any period of time while operating in

Australia and also require placing formal documents with regards to the amendments (Bayari

2013).

According to the Corporations Act 2001, the Australian law allows the director of the

foreign investing companies to shoulder additional responsibilities in order to maintain the

proper functioning of the company (firb.gov.au 2018). The challenge of Walmart is to give its

directors additional responsibilities, which helps it to maintain the corporate responsibilities.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ESSAY

The directors are required to be extra careful in exercising their powers and should be diligent

enough to take mature decisions. The directors are also required to maintain the best conducts

and act in good faith for promoting the interests of the company, which involves avoidance of

misuse of power or the abstain from the improper use of confidential information for self-

benefits or harming the company. Walmart requires understanding these duties as they are

enforceable in the Australian court of law. Failing to adhere to these aspects might end up in

a legal battle which might be harmful for the company’s operations as well as reputation.

Walmart must adhere to the policies and regulations under the Corporations Act 2001.

This act of law make Walmart liable, to adhere to the laws of Australia while performing any

deals, corporate takeovers of Australian companies or any other financial deals (firb.gov.au

2018). There are certain regulations under the ASIC which gives it the right to supervise over

any deals that take place in Australia. Walmart must be aware of these regulations. As the

licensing of business is done under the independent body of ASIC, Walmart automatically

makes itself answerable for all its dealings in the Australian Market (Rogers and Dufty-Jones

2015). This aspect is followed in order to check the financial misconducts in the Australian

market that might occur due to the personal profit making of the foreign investing firms.

In case of takeovers of Australian firms, Walmart must do so in presence of the

Takeover Panel, which is another body which regulates the control of corporate

organizations. The takeover bids must be transparent and focused on the benefits of the

company as well as the economy (Bowman, Gilligan and O'Brien 2014).

It is improper under the Corporations Act to manipulate the market prices to gain

improper benefits. It is often seen that the companies reduce their capital to a superficial

amount to draw financial benefits from banks or similar organizations. ASIC is bestowed

with the responsibility of monitoring such activities on a daily basis (firb.gov.au 2018). This

The directors are required to be extra careful in exercising their powers and should be diligent

enough to take mature decisions. The directors are also required to maintain the best conducts

and act in good faith for promoting the interests of the company, which involves avoidance of

misuse of power or the abstain from the improper use of confidential information for self-

benefits or harming the company. Walmart requires understanding these duties as they are

enforceable in the Australian court of law. Failing to adhere to these aspects might end up in

a legal battle which might be harmful for the company’s operations as well as reputation.

Walmart must adhere to the policies and regulations under the Corporations Act 2001.

This act of law make Walmart liable, to adhere to the laws of Australia while performing any

deals, corporate takeovers of Australian companies or any other financial deals (firb.gov.au

2018). There are certain regulations under the ASIC which gives it the right to supervise over

any deals that take place in Australia. Walmart must be aware of these regulations. As the

licensing of business is done under the independent body of ASIC, Walmart automatically

makes itself answerable for all its dealings in the Australian Market (Rogers and Dufty-Jones

2015). This aspect is followed in order to check the financial misconducts in the Australian

market that might occur due to the personal profit making of the foreign investing firms.

In case of takeovers of Australian firms, Walmart must do so in presence of the

Takeover Panel, which is another body which regulates the control of corporate

organizations. The takeover bids must be transparent and focused on the benefits of the

company as well as the economy (Bowman, Gilligan and O'Brien 2014).

It is improper under the Corporations Act to manipulate the market prices to gain

improper benefits. It is often seen that the companies reduce their capital to a superficial

amount to draw financial benefits from banks or similar organizations. ASIC is bestowed

with the responsibility of monitoring such activities on a daily basis (firb.gov.au 2018). This

8ESSAY

gives ASIC huge powers to investigate and interrogate with regards to improper conduct in

the market. Walmart should be aware of such illegal practices so as to stay clear of the hassle

of legal issues. Legal issues are brought forward and enforced on the basis of the Corporation

Act.

As the companies such as Walmart require to be enlisted in the Australian Security

Exchange (ASX), they are bound by the laws regarding stakeholders. The Company needs to

issue notice regarding the stakeholders (Firb.gov.au 2018). The transparency of the process

requires the company to issue such notices every time a transaction is made. This ensures the

safety of the stakeholders who have invested their money into the company. Improper

misconduct regarding stakeholders or professing false statements regarding disclosure of the

stakeholders might lead to fraud cases which will draw upon legal suites by the ASX against

the company (Treasury.gov.au 2018). Companies such as Walmart must take these issues

seriously to avoid such hassles in business operations.

The OECD guidelines form an overall structure consisting of similar regulations that

have been discussed above. Any foreign investing company must adhere to the guidelines of

OECD in order to conduct business in Australia. The OECD guidelines ensure that the

foreign firms act as good entities while dealing in Australia (Firb.gov.au 2018). The OECD is

an independent body and is not governed by any government. However, every country tries to

uphold the OECD guidelines in order to adhere to the fair play policies. This also ensures the

truth and honesty along with transparency of the foreign companies who are ready to invest

in Australia.

One of the senior executive is known as the National Contact Point, who promotes the

OECD guidelines to the foreign investing companies (Firb.gov.au 2018). It is his duty to

guide the foreign investors to invest in Australia by adhering to the guidelines of Australia.

gives ASIC huge powers to investigate and interrogate with regards to improper conduct in

the market. Walmart should be aware of such illegal practices so as to stay clear of the hassle

of legal issues. Legal issues are brought forward and enforced on the basis of the Corporation

Act.

As the companies such as Walmart require to be enlisted in the Australian Security

Exchange (ASX), they are bound by the laws regarding stakeholders. The Company needs to

issue notice regarding the stakeholders (Firb.gov.au 2018). The transparency of the process

requires the company to issue such notices every time a transaction is made. This ensures the

safety of the stakeholders who have invested their money into the company. Improper

misconduct regarding stakeholders or professing false statements regarding disclosure of the

stakeholders might lead to fraud cases which will draw upon legal suites by the ASX against

the company (Treasury.gov.au 2018). Companies such as Walmart must take these issues

seriously to avoid such hassles in business operations.

The OECD guidelines form an overall structure consisting of similar regulations that

have been discussed above. Any foreign investing company must adhere to the guidelines of

OECD in order to conduct business in Australia. The OECD guidelines ensure that the

foreign firms act as good entities while dealing in Australia (Firb.gov.au 2018). The OECD is

an independent body and is not governed by any government. However, every country tries to

uphold the OECD guidelines in order to adhere to the fair play policies. This also ensures the

truth and honesty along with transparency of the foreign companies who are ready to invest

in Australia.

One of the senior executive is known as the National Contact Point, who promotes the

OECD guidelines to the foreign investing companies (Firb.gov.au 2018). It is his duty to

guide the foreign investors to invest in Australia by adhering to the guidelines of Australia.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ESSAY

Part 2:

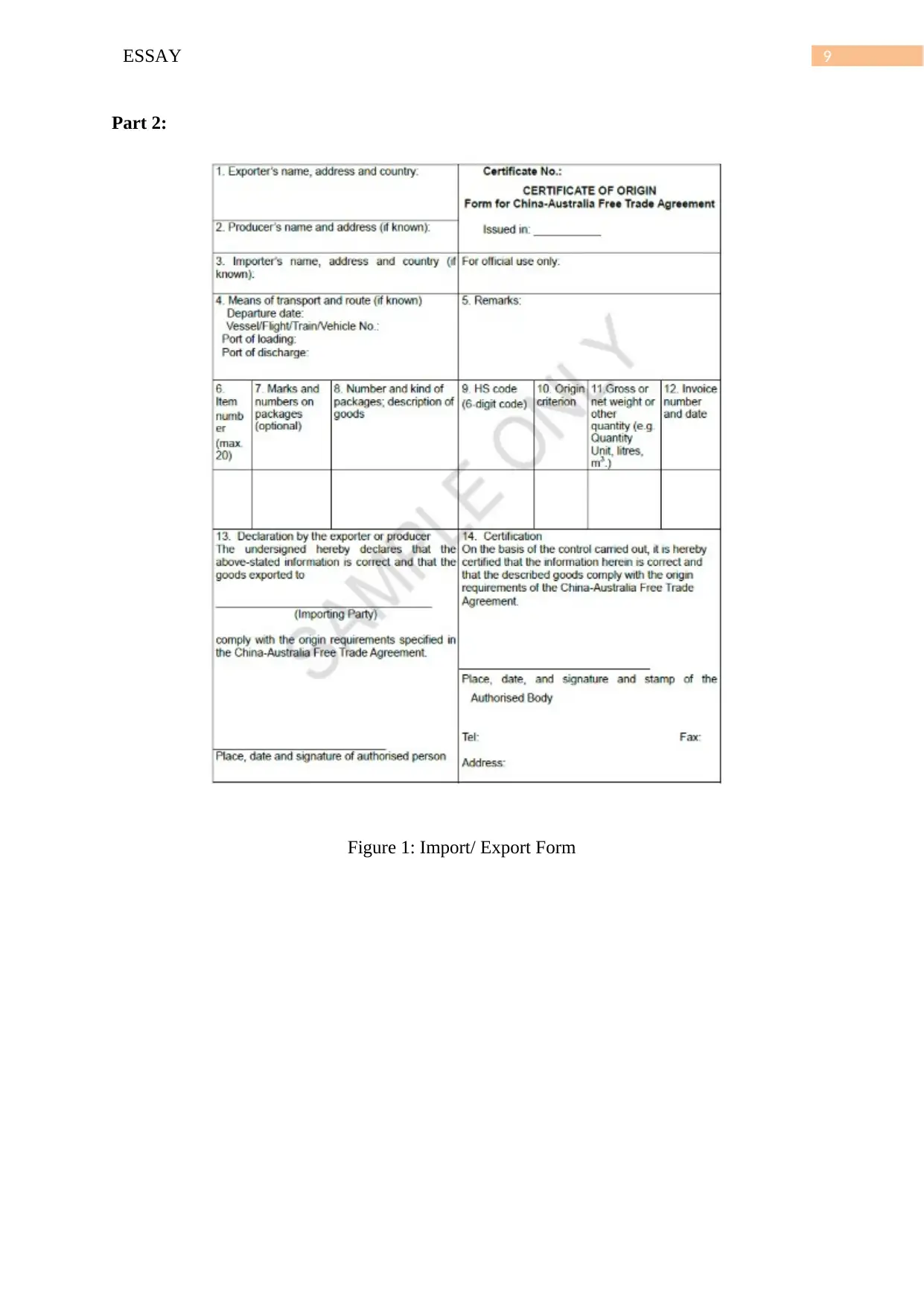

Figure 1: Import/ Export Form

Part 2:

Figure 1: Import/ Export Form

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ESSAY

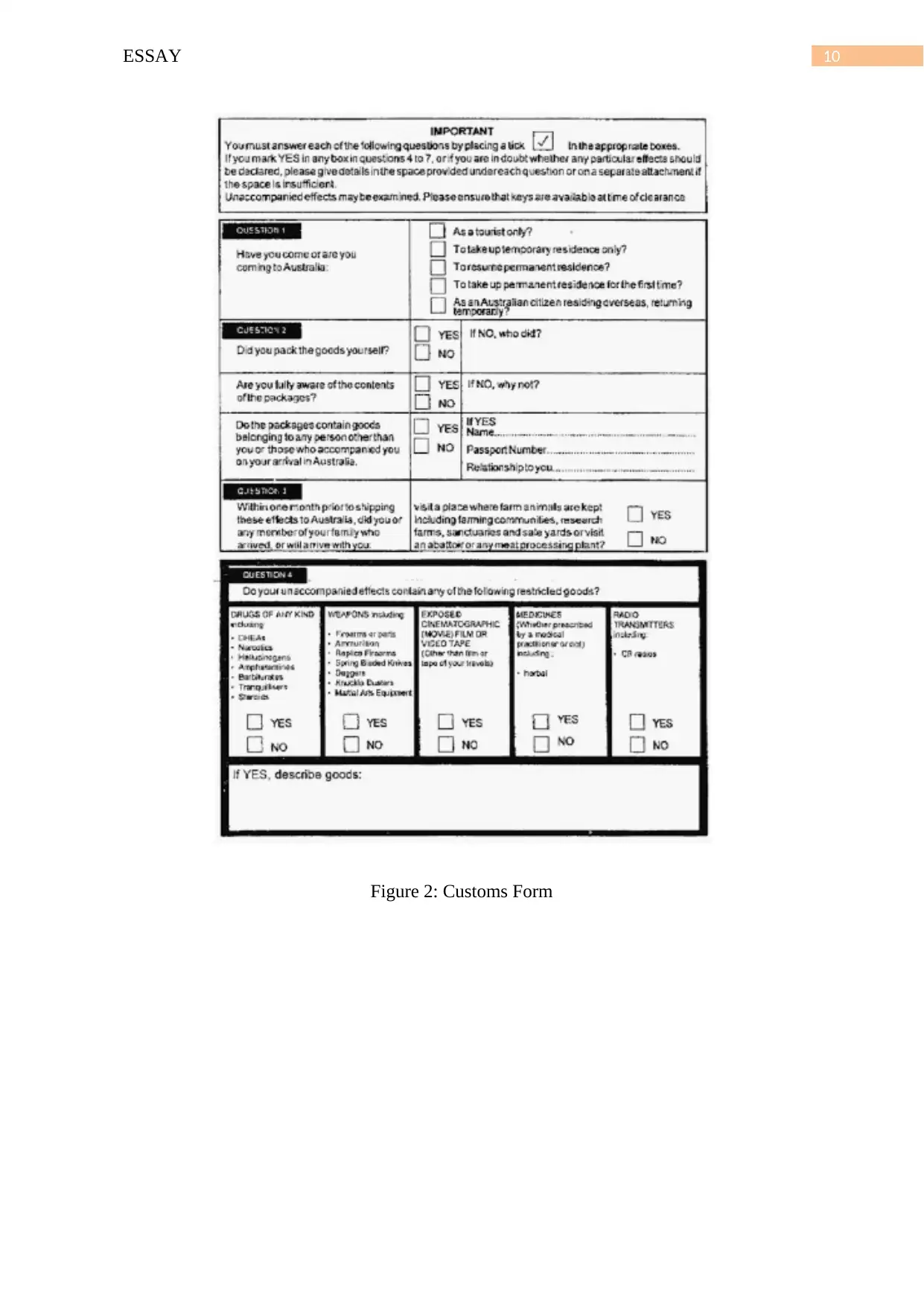

Figure 2: Customs Form

Figure 2: Customs Form

11ESSAY

Question 2:

This unit has been very essential for me to understand the different challenges that a

company can face while promoting their business in the foreign lands. It is also important to

understand that direct foreign investment (FDI) is essential for the development of a

country’s economy. Without FDI the economy of a country goes to a standstill with no

prospective development. Moreover, without the lack of innovation and foreign ideas, a

certain economy cremains backward in terms of development (Kurtz and Nottage 2015).

The analysis and synthesis of the key concepts of foreign business policies in

Australia has enabled to understand the various features that is required to follow to pursue

business ina foreign land. The theories of business have helped in understanding the different

business techniques and the way to implement them while conducting business in foreign

land.

The choice of Walmart as a MNC has helped in the understanding of how a large

company works in the global scenario. The presence of Walmart in all many countries and its

urge for development has helped in the understanding of different laws and regulations that

are important to be considered to conduct the business operations in Australia.

The assignment has also helped in the detailed understanding of regulatory bodies

such as the OECD, ASIC and ASX. The assignment has further helped what are the

regulations that they maintain and how they regulate the foreign investment companies.

Monitoring the activities of the foreign investment companies, help the regulatory bodies to

maintain transparency of the deals of the companies (Pokarier 2017). These monitoring helps

in the reduction of corruption. It also helps in the prevention of exploitation of the employees

and the resources of the nation.

Question 2:

This unit has been very essential for me to understand the different challenges that a

company can face while promoting their business in the foreign lands. It is also important to

understand that direct foreign investment (FDI) is essential for the development of a

country’s economy. Without FDI the economy of a country goes to a standstill with no

prospective development. Moreover, without the lack of innovation and foreign ideas, a

certain economy cremains backward in terms of development (Kurtz and Nottage 2015).

The analysis and synthesis of the key concepts of foreign business policies in

Australia has enabled to understand the various features that is required to follow to pursue

business ina foreign land. The theories of business have helped in understanding the different

business techniques and the way to implement them while conducting business in foreign

land.

The choice of Walmart as a MNC has helped in the understanding of how a large

company works in the global scenario. The presence of Walmart in all many countries and its

urge for development has helped in the understanding of different laws and regulations that

are important to be considered to conduct the business operations in Australia.

The assignment has also helped in the detailed understanding of regulatory bodies

such as the OECD, ASIC and ASX. The assignment has further helped what are the

regulations that they maintain and how they regulate the foreign investment companies.

Monitoring the activities of the foreign investment companies, help the regulatory bodies to

maintain transparency of the deals of the companies (Pokarier 2017). These monitoring helps

in the reduction of corruption. It also helps in the prevention of exploitation of the employees

and the resources of the nation.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.