Assignment on Westpac is a Banking Organisation?

VerifiedAdded on 2022/09/18

|6

|2528

|27

Assignment

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Introduction

Westpac is a banking organisation that operates globally. The sector that westpac operates in

is the financial services industry in which they provide a wide range of financial services to

their customers. These services include; Online banking, Managing deposits, Currency

converting, using Westpac ATM’s etc. The scale of the company in Australia focuses on four

divisions these are; Consumer, where services are provided to their customers. Business, in

which services are provided to micro to medium sized businesses. Westpac Institutional bank

(WIB) which provides services to corporate and government organisations. Westpac New-

Zealand, which operates their services within New-Zealand. Westpac also produces

performance reports that reflect how their business is achieving their goals each year.

Current Policies and Management Strategies

Westpac were the first Australian bank to recognise the importance of limiting global

warming and to do this global emission needed to reach a net zero in the second half of this

century. Westpac has provided an action plan to reduce the risks and impact of climate

change. They believe implementing these actions by effectively identifying, managing and

mitigating climate change risk will have a positive impact on the community and economic

benefits in the future.

(1). Provide finance to back climate change solutions:

Westpac is working towards a transition to a net zero emissions economy but is dependent on

the availability of cost-effective low carbon solutions. Net Zero emissions mean that

greenhouses gases that are emitted must be equally captured through adopting renewable

energy and clean technologies.

(2). Energy systems:

Westpac is taking into consideration the energy system’s entire value chain, from energy fuel

to power generations. Westpac uses thermal coal as an energy fuel because of its abundance,

affordability and reliability and is one of their main energy generators. However, limiting our

lending to any new thermal coal mine or project we will be actively reducing the contribution

to greenhouse gases and reducing the contribution to air pollution.

(3). Agribusiness:

Agribusiness plays a fundamental role worldwide and is essential for our future with

providing food and other essentials needs to people. It also is a major contributor to driving

the economic growth, reducing poverty and supporting communities. The Banking

Environment Initiative (BEI) and the New York declaration on forests are working towards

transforming banks to achieve a zero-net deforestation by 2020 (Verhagan, 2020). The

intention is to lead the banking industry to identify and implement measures that support

practices and that reduce deforestation. Westpac is committed to a net zero deforestation by

2020 to do this; they have minimised the quantity of paper purchased and maximised the

sustainable qualities of the paper used. Westpac has committed to new technologies and

practices that will reduce their environmental footprint by having the availability of e-

statements and paperless processes for all customers (Westpac Banking Corporation, 2013)

(4). Mitigating Low Carbon Emissions:

Financial institutions have become incentivised through their years where they put

regulations to mitigate the effects on climate change. Previous literature has discussed the

regulations that have been put into place over the years to reduce the effects of climate

change (Bowman, 2010). The first one is to create incentives to be placed on energy-efficient

Westpac is a banking organisation that operates globally. The sector that westpac operates in

is the financial services industry in which they provide a wide range of financial services to

their customers. These services include; Online banking, Managing deposits, Currency

converting, using Westpac ATM’s etc. The scale of the company in Australia focuses on four

divisions these are; Consumer, where services are provided to their customers. Business, in

which services are provided to micro to medium sized businesses. Westpac Institutional bank

(WIB) which provides services to corporate and government organisations. Westpac New-

Zealand, which operates their services within New-Zealand. Westpac also produces

performance reports that reflect how their business is achieving their goals each year.

Current Policies and Management Strategies

Westpac were the first Australian bank to recognise the importance of limiting global

warming and to do this global emission needed to reach a net zero in the second half of this

century. Westpac has provided an action plan to reduce the risks and impact of climate

change. They believe implementing these actions by effectively identifying, managing and

mitigating climate change risk will have a positive impact on the community and economic

benefits in the future.

(1). Provide finance to back climate change solutions:

Westpac is working towards a transition to a net zero emissions economy but is dependent on

the availability of cost-effective low carbon solutions. Net Zero emissions mean that

greenhouses gases that are emitted must be equally captured through adopting renewable

energy and clean technologies.

(2). Energy systems:

Westpac is taking into consideration the energy system’s entire value chain, from energy fuel

to power generations. Westpac uses thermal coal as an energy fuel because of its abundance,

affordability and reliability and is one of their main energy generators. However, limiting our

lending to any new thermal coal mine or project we will be actively reducing the contribution

to greenhouse gases and reducing the contribution to air pollution.

(3). Agribusiness:

Agribusiness plays a fundamental role worldwide and is essential for our future with

providing food and other essentials needs to people. It also is a major contributor to driving

the economic growth, reducing poverty and supporting communities. The Banking

Environment Initiative (BEI) and the New York declaration on forests are working towards

transforming banks to achieve a zero-net deforestation by 2020 (Verhagan, 2020). The

intention is to lead the banking industry to identify and implement measures that support

practices and that reduce deforestation. Westpac is committed to a net zero deforestation by

2020 to do this; they have minimised the quantity of paper purchased and maximised the

sustainable qualities of the paper used. Westpac has committed to new technologies and

practices that will reduce their environmental footprint by having the availability of e-

statements and paperless processes for all customers (Westpac Banking Corporation, 2013)

(4). Mitigating Low Carbon Emissions:

Financial institutions have become incentivised through their years where they put

regulations to mitigate the effects on climate change. Previous literature has discussed the

regulations that have been put into place over the years to reduce the effects of climate

change (Bowman, 2010). The first one is to create incentives to be placed on energy-efficient

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

projects (Bowman, 2010). The second being to have monitoring of a company's greenhouse

gas emissions (GHS). The third is to reduce spending on projects that take on large GHS

emission projects (Bowma, 2010). Westpac has incorporated this strategy to mitigate the risk

of the effects of climate change. An example of this in 2020 had been incorporated through a

sustainability linked loan from Westpac NZ to Contact Energy where Westpac used the triple

bottom line approach when setting out this sustainability loan to Contact Energy. Contact

Energy received the four year loan to improve its social, environmental and governance

(ESG) targets. As a result of this if Contact energy were able to meet their targets Westpac

NZ will provide lower interest rates (Westpac, 2020). If Contact Energy were not able to

meet their ESG targets they will have to pay a higher interest rate. This sustainability linked

loan provides an incentive for business owners to maintain their sustainability goals.

(5). Sustainability Strategy:

Westpac has developed a sustainability strategy for 2018-2020 that focuses on three key

areas, these areas are (1) to ensure that customers make better financial decisions. (2) In times

of need Westpac will be able to support their customers and (3) help achieve a successful

nation.

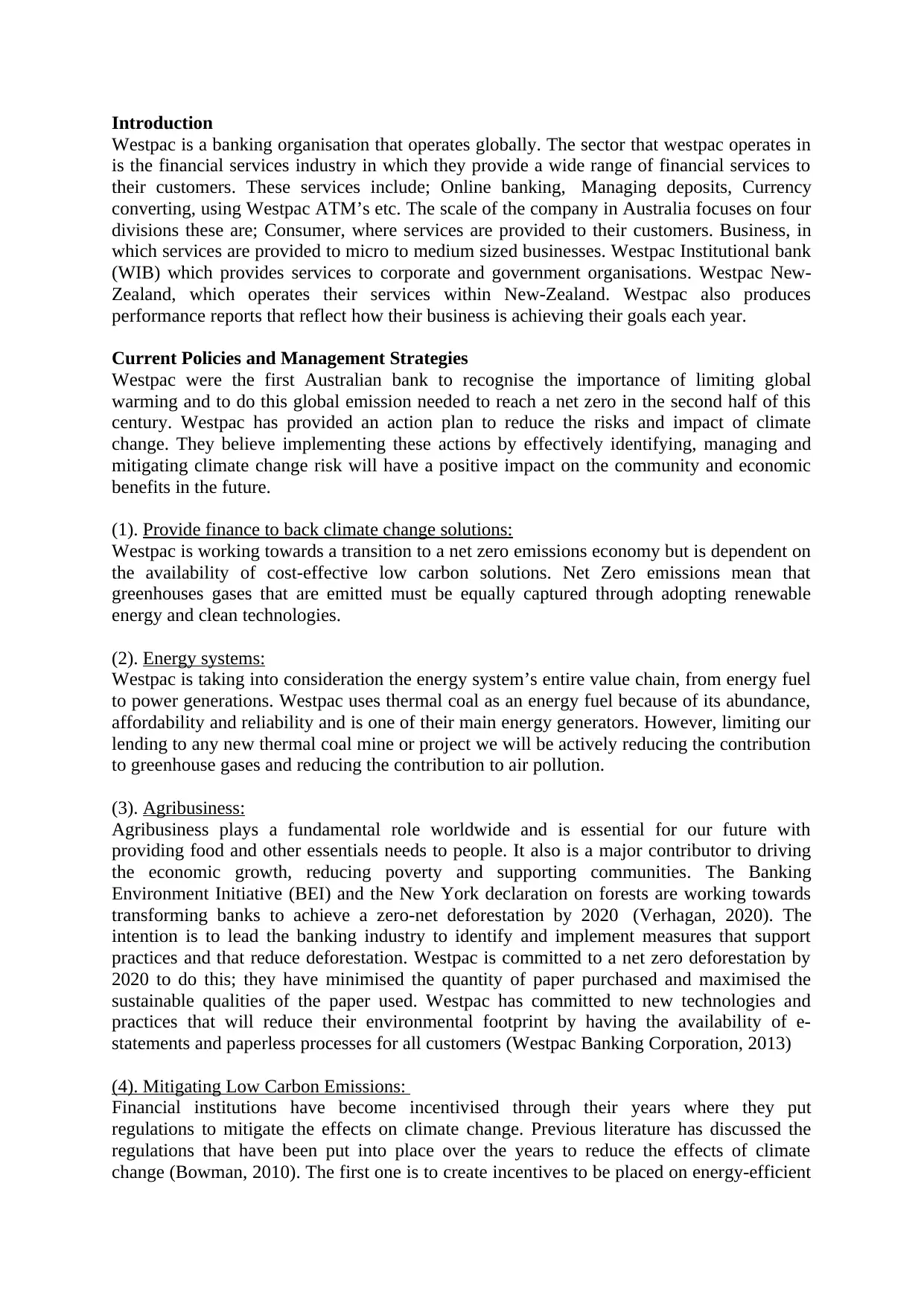

Strengths Weakness

The advantages you have over the competition concerning

the project

What are your strengths

In 2015 Westpac was the first bank to commit to

support the Paris Climate Agreement and work

towards transitioning to a net zero emission economy

by 2050.

Westpac has actively seek out technologies and

practices that have reduced the use of paper and their

impact on environmental footprint.

One of the first Australian companies to commit to

source 100% of global electricity consumption

through renewable energy sources by 2025.

What do you do better than others?

Westpac is the largest lender to new renewable

energy projects in Australia

Westpac’s commitments to climate change solutions

increased to $9.3 billion last year

Investing in energy efficient technologies and

exploring opportunities to use recycled materials.

What unique capabilities and resources do you possess

Committed to sourcing 100% of our global electricity

consumption through renewable energy source by

2025.

The disadvantages you have internally compared to

your competitors

What are your weaknesses

Uncertainty about the rate of innovation and

adoption of clean energy technologies

What do your competitors do better than others

Still providing but, limiting funding to

companies that produce large amounts of GHG

emissions.

What can you improve given the current situation?

What do other perceive as your weakness

Having commitments to achieve results that are

not fulfilled by the timeframe suggested.

gas emissions (GHS). The third is to reduce spending on projects that take on large GHS

emission projects (Bowma, 2010). Westpac has incorporated this strategy to mitigate the risk

of the effects of climate change. An example of this in 2020 had been incorporated through a

sustainability linked loan from Westpac NZ to Contact Energy where Westpac used the triple

bottom line approach when setting out this sustainability loan to Contact Energy. Contact

Energy received the four year loan to improve its social, environmental and governance

(ESG) targets. As a result of this if Contact energy were able to meet their targets Westpac

NZ will provide lower interest rates (Westpac, 2020). If Contact Energy were not able to

meet their ESG targets they will have to pay a higher interest rate. This sustainability linked

loan provides an incentive for business owners to maintain their sustainability goals.

(5). Sustainability Strategy:

Westpac has developed a sustainability strategy for 2018-2020 that focuses on three key

areas, these areas are (1) to ensure that customers make better financial decisions. (2) In times

of need Westpac will be able to support their customers and (3) help achieve a successful

nation.

Strengths Weakness

The advantages you have over the competition concerning

the project

What are your strengths

In 2015 Westpac was the first bank to commit to

support the Paris Climate Agreement and work

towards transitioning to a net zero emission economy

by 2050.

Westpac has actively seek out technologies and

practices that have reduced the use of paper and their

impact on environmental footprint.

One of the first Australian companies to commit to

source 100% of global electricity consumption

through renewable energy sources by 2025.

What do you do better than others?

Westpac is the largest lender to new renewable

energy projects in Australia

Westpac’s commitments to climate change solutions

increased to $9.3 billion last year

Investing in energy efficient technologies and

exploring opportunities to use recycled materials.

What unique capabilities and resources do you possess

Committed to sourcing 100% of our global electricity

consumption through renewable energy source by

2025.

The disadvantages you have internally compared to

your competitors

What are your weaknesses

Uncertainty about the rate of innovation and

adoption of clean energy technologies

What do your competitors do better than others

Still providing but, limiting funding to

companies that produce large amounts of GHG

emissions.

What can you improve given the current situation?

What do other perceive as your weakness

Having commitments to achieve results that are

not fulfilled by the timeframe suggested.

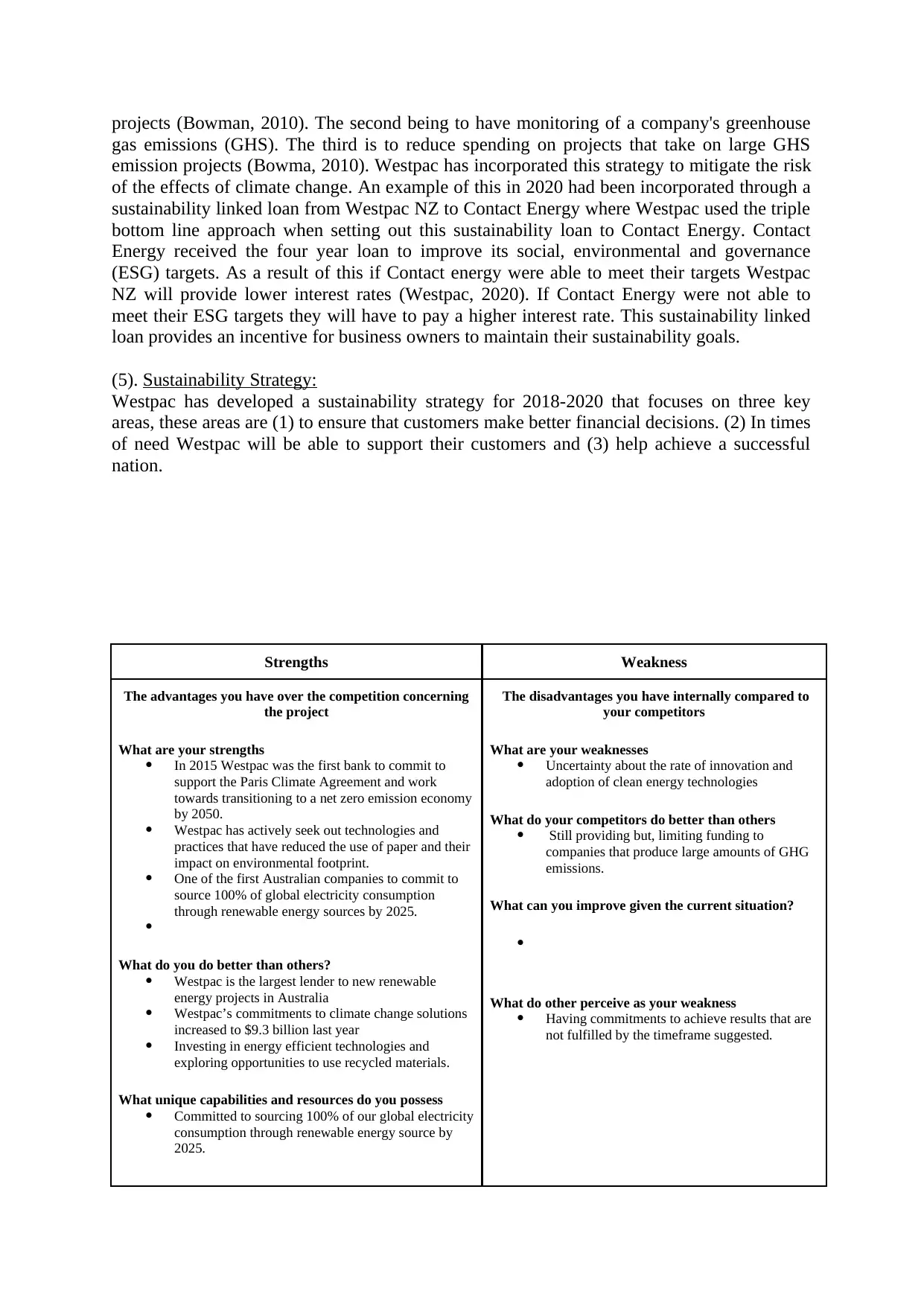

What do other perceive as your strengths

Commitments to achieve/mitigate the risks of climate

change.

Opportunities Threats

Current external trends which are waiting to be taken

advantage of

What trends or conditions may positively impact you

Companies wanting to receive incentive based loans

to fulfill sustainable projects or renewable energy

sources.

Westpac will become a member of RE100 one of the

worlds most influential business who have

committed to go 100% renewable

Engaging suppliers and other value chain partners in

GHG management and sustainability.

Increase stakeholders information and corporate

reputation through public reporting.

What opportunities are available to you?

Contracted loans where providing money to a

company to achieve its sustainable goals providing

lower interest rates if accomplished and higher

interest rate if the goal is not achieved by the end of

the contract. These are incentive based targets that

align with social, environmental and economic

pillars.

External movements which may cause a problem and

have a negative impact on your business

What trends or conditions may negative impact you?

The increased effects of climate change can

cause policy-makers to create policies that affect

the economic profits of financial institutes

(Westpac) this can be through limiting

technological or adapting new ways to use

technology. The added risk of lack of

resilience in this area.

The effect on severe weather and the impact that

can have on Westpac through supply shocks.

The Uncertainty that this can happen.

Target may be more challenging to achieve if

the company grows and growth is linked to

GHG emissions.

What are your competitors doing that may impact

you?

Competitor banks supply more funding to fossil

fuel companies.

Do you have a solid financial support?

Diversion of resources from innovation to

adaptation capital

What impact do your weaknesses have on the threat of

you?

Develop a plan as to how these policies and strategies and their implementation

could be improved to minimise business impacts relevant to climate change and

to foster sustainable outcomes

Develop a Plan

Climate change is a global problem and businesses operate in a global environment. In the

Paris Agreement national governments committed to limit temperature rise to well below 2

degrees Celsius in the hope to reduce dangerous climate impacts and humanitarian crises

worldwide (wbcsd, n.d.). Therefore, companies have a vital role in ensuring that the global

temperatures are met. The majority of global GHG emissions are directly or indirectly

influenced by the companies sector. Westpac has recognised the risk of climate change and

proposes to incentivise energy efficient projects as well as decentivise projects that produce a

lot of GHG emissions such as large fossil fuel companies. Westpac does this strategy well to

mitigate the effects of climate change that align with the triple bottom line approach as

explained in the case study above. However this current plan can be improved further by

making new commitments such as … with added time frames to meet those deadlines.

Incentives aligns with triple bottom line,

Decentives is a way to mitigate the effects of climate change

The use of thermal energy coal ? (limit lending thermal coal mining based on

stringent quality criteria)

Commitments to achieve/mitigate the risks of climate

change.

Opportunities Threats

Current external trends which are waiting to be taken

advantage of

What trends or conditions may positively impact you

Companies wanting to receive incentive based loans

to fulfill sustainable projects or renewable energy

sources.

Westpac will become a member of RE100 one of the

worlds most influential business who have

committed to go 100% renewable

Engaging suppliers and other value chain partners in

GHG management and sustainability.

Increase stakeholders information and corporate

reputation through public reporting.

What opportunities are available to you?

Contracted loans where providing money to a

company to achieve its sustainable goals providing

lower interest rates if accomplished and higher

interest rate if the goal is not achieved by the end of

the contract. These are incentive based targets that

align with social, environmental and economic

pillars.

External movements which may cause a problem and

have a negative impact on your business

What trends or conditions may negative impact you?

The increased effects of climate change can

cause policy-makers to create policies that affect

the economic profits of financial institutes

(Westpac) this can be through limiting

technological or adapting new ways to use

technology. The added risk of lack of

resilience in this area.

The effect on severe weather and the impact that

can have on Westpac through supply shocks.

The Uncertainty that this can happen.

Target may be more challenging to achieve if

the company grows and growth is linked to

GHG emissions.

What are your competitors doing that may impact

you?

Competitor banks supply more funding to fossil

fuel companies.

Do you have a solid financial support?

Diversion of resources from innovation to

adaptation capital

What impact do your weaknesses have on the threat of

you?

Develop a plan as to how these policies and strategies and their implementation

could be improved to minimise business impacts relevant to climate change and

to foster sustainable outcomes

Develop a Plan

Climate change is a global problem and businesses operate in a global environment. In the

Paris Agreement national governments committed to limit temperature rise to well below 2

degrees Celsius in the hope to reduce dangerous climate impacts and humanitarian crises

worldwide (wbcsd, n.d.). Therefore, companies have a vital role in ensuring that the global

temperatures are met. The majority of global GHG emissions are directly or indirectly

influenced by the companies sector. Westpac has recognised the risk of climate change and

proposes to incentivise energy efficient projects as well as decentivise projects that produce a

lot of GHG emissions such as large fossil fuel companies. Westpac does this strategy well to

mitigate the effects of climate change that align with the triple bottom line approach as

explained in the case study above. However this current plan can be improved further by

making new commitments such as … with added time frames to meet those deadlines.

Incentives aligns with triple bottom line,

Decentives is a way to mitigate the effects of climate change

The use of thermal energy coal ? (limit lending thermal coal mining based on

stringent quality criteria)

Provide resilience to the company from the effects of climate change? Example

supply shocks or natural disasters that can have an effect on the business operations.

Commitments (timeframe) ?

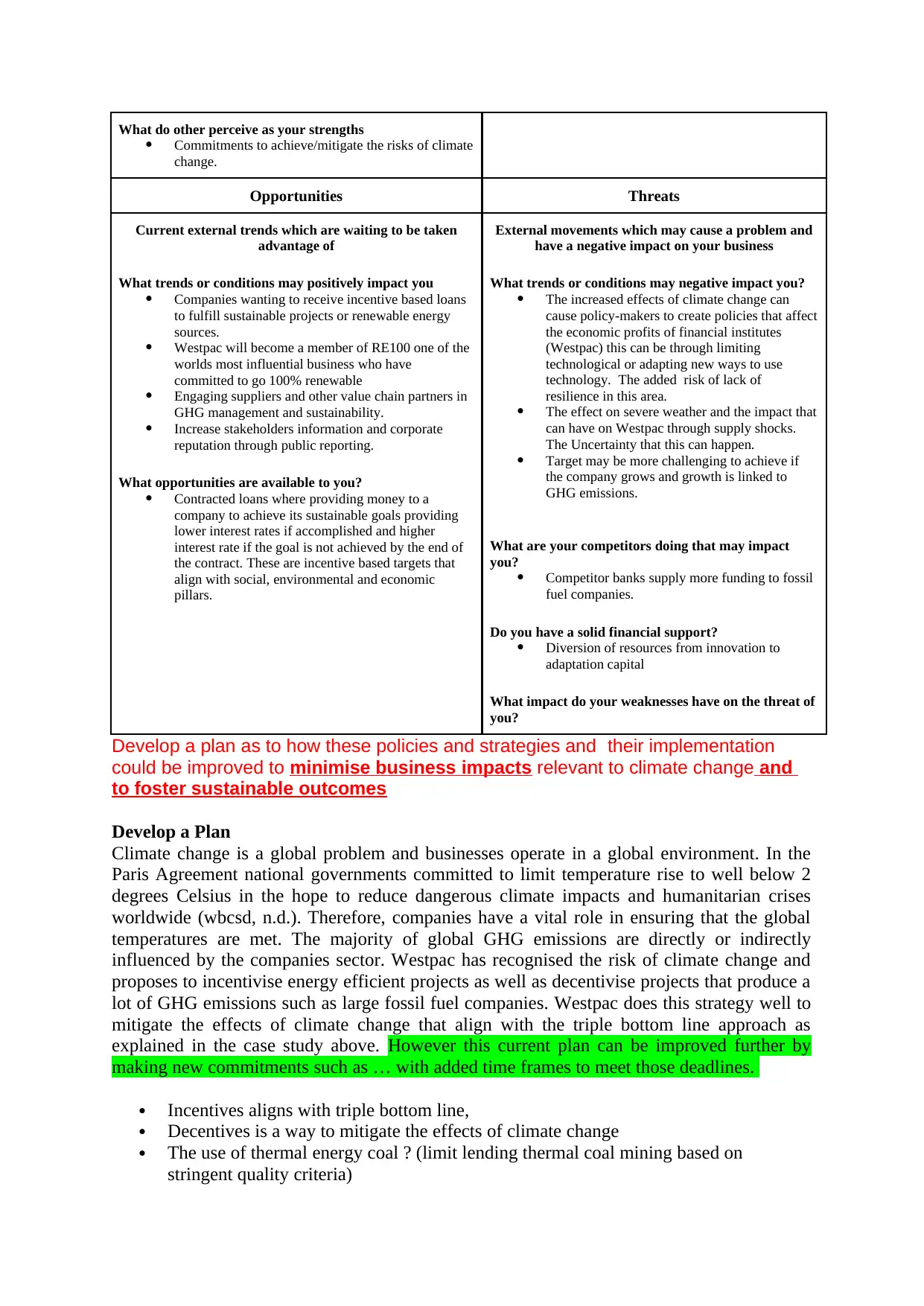

Current plan can be improved by farther :

Westpac Banking Group can make major changes in order to make improvements in the

existing policies and strategies to get better results for climate change. Considering the above

discussion, it has been noticed that Westpac is one of the institutions that give importance to

address the issues of climate change. In order to further improve these operations, the

company is recommended to include a paperless transaction policy into its policies and

strategies of climate change and sustainability. It is known that most of the operations of the

bank are executed through paperwork which is resulting in contributing to deforestation. To

overcome this issue and make zero-emission environments, the company needs to eliminate

the use of paper from its operations and focus on digital transactions. This will not just

contribute to saving the environment but will also help businesses in improving their image in

the market. These paperless transactions can be implemented and monitored by the

environmental sustainability team of the company.

Policy – Paperless Transaction

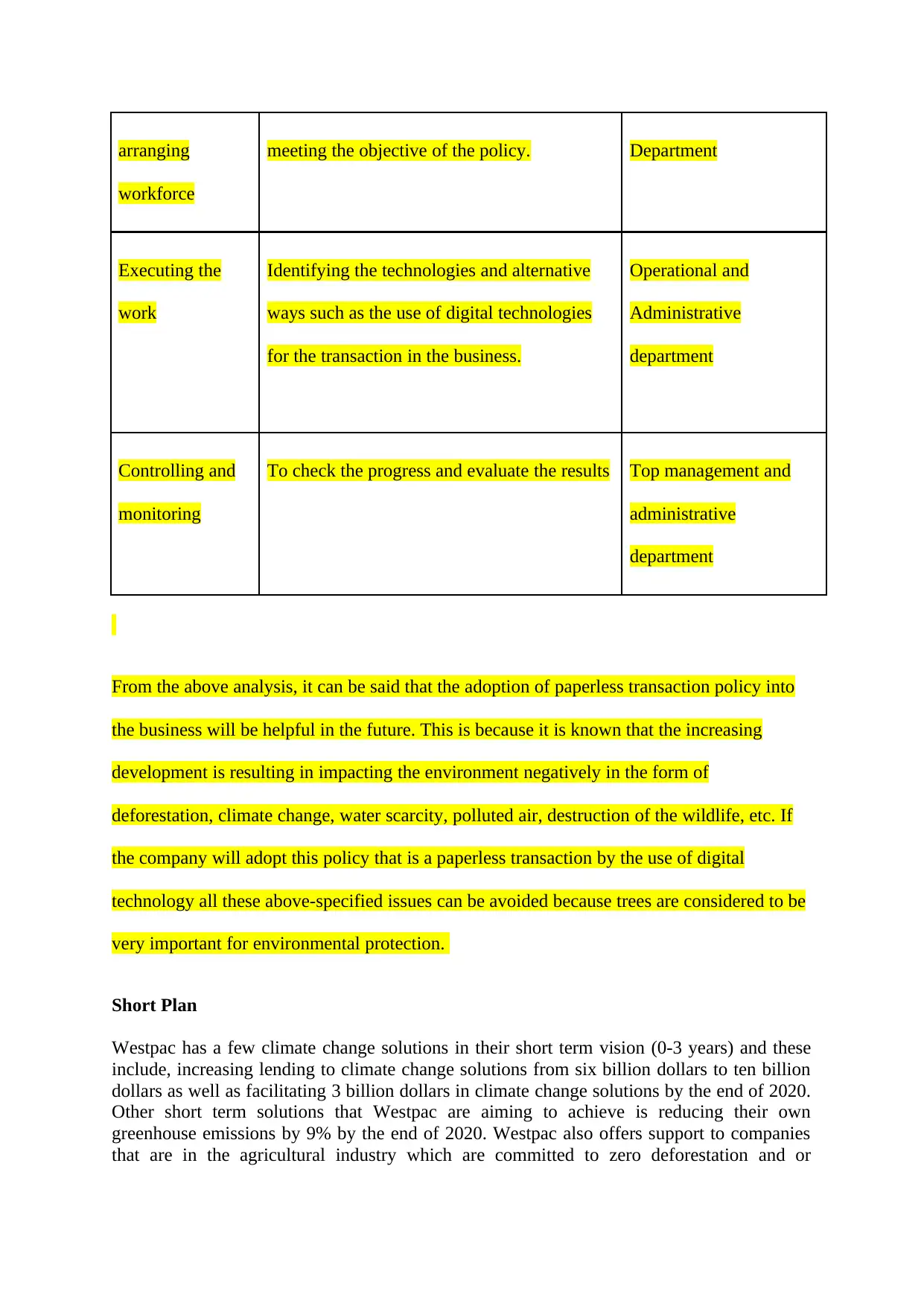

Strategies Objective Responsible

Department

Conducting

market research

To identify the possible technologies that can

help in executing the plan for a paperless

transaction.

Research and

Development

Hiring and To develop an effective team to work on Human Resource

supply shocks or natural disasters that can have an effect on the business operations.

Commitments (timeframe) ?

Current plan can be improved by farther :

Westpac Banking Group can make major changes in order to make improvements in the

existing policies and strategies to get better results for climate change. Considering the above

discussion, it has been noticed that Westpac is one of the institutions that give importance to

address the issues of climate change. In order to further improve these operations, the

company is recommended to include a paperless transaction policy into its policies and

strategies of climate change and sustainability. It is known that most of the operations of the

bank are executed through paperwork which is resulting in contributing to deforestation. To

overcome this issue and make zero-emission environments, the company needs to eliminate

the use of paper from its operations and focus on digital transactions. This will not just

contribute to saving the environment but will also help businesses in improving their image in

the market. These paperless transactions can be implemented and monitored by the

environmental sustainability team of the company.

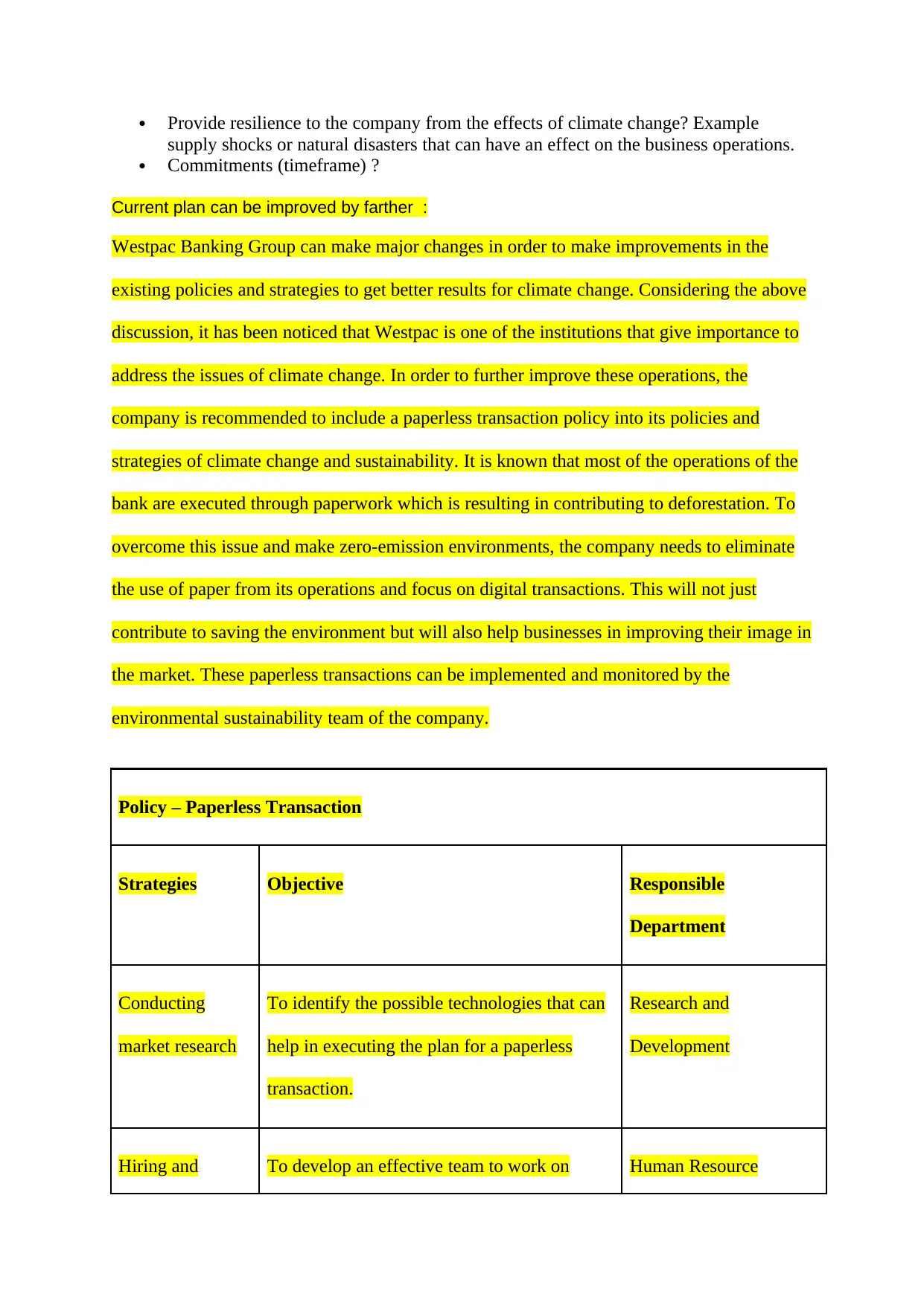

Policy – Paperless Transaction

Strategies Objective Responsible

Department

Conducting

market research

To identify the possible technologies that can

help in executing the plan for a paperless

transaction.

Research and

Development

Hiring and To develop an effective team to work on Human Resource

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

arranging

workforce

meeting the objective of the policy. Department

Executing the

work

Identifying the technologies and alternative

ways such as the use of digital technologies

for the transaction in the business.

Operational and

Administrative

department

Controlling and

monitoring

To check the progress and evaluate the results Top management and

administrative

department

From the above analysis, it can be said that the adoption of paperless transaction policy into

the business will be helpful in the future. This is because it is known that the increasing

development is resulting in impacting the environment negatively in the form of

deforestation, climate change, water scarcity, polluted air, destruction of the wildlife, etc. If

the company will adopt this policy that is a paperless transaction by the use of digital

technology all these above-specified issues can be avoided because trees are considered to be

very important for environmental protection.

Short Plan

Westpac has a few climate change solutions in their short term vision (0-3 years) and these

include, increasing lending to climate change solutions from six billion dollars to ten billion

dollars as well as facilitating 3 billion dollars in climate change solutions by the end of 2020.

Other short term solutions that Westpac are aiming to achieve is reducing their own

greenhouse emissions by 9% by the end of 2020. Westpac also offers support to companies

that are in the agricultural industry which are committed to zero deforestation and or

workforce

meeting the objective of the policy. Department

Executing the

work

Identifying the technologies and alternative

ways such as the use of digital technologies

for the transaction in the business.

Operational and

Administrative

department

Controlling and

monitoring

To check the progress and evaluate the results Top management and

administrative

department

From the above analysis, it can be said that the adoption of paperless transaction policy into

the business will be helpful in the future. This is because it is known that the increasing

development is resulting in impacting the environment negatively in the form of

deforestation, climate change, water scarcity, polluted air, destruction of the wildlife, etc. If

the company will adopt this policy that is a paperless transaction by the use of digital

technology all these above-specified issues can be avoided because trees are considered to be

very important for environmental protection.

Short Plan

Westpac has a few climate change solutions in their short term vision (0-3 years) and these

include, increasing lending to climate change solutions from six billion dollars to ten billion

dollars as well as facilitating 3 billion dollars in climate change solutions by the end of 2020.

Other short term solutions that Westpac are aiming to achieve is reducing their own

greenhouse emissions by 9% by the end of 2020. Westpac also offers support to companies

that are in the agricultural industry which are committed to zero deforestation and or

companies that do not adversely impact forests. The final short term plan is to reduce lending

to companies that create large amounts of emissions such as coal mining companies.

Westpac has a great short term plan over the next three years for the industry that they are

working in. Being a bank, changing the way that they lend money to businesses depending on

how good they are working on controlling their emissions, Westpac does this as they are in a

field that doesn’t create too many emissions. As well as supporting climate change solutions

to individuals and businesses, Westpac is also trying to minimise their own emissions by 9%

which is also a great goal.

Westpac’s medium term plan (3-10 years)

Lending to climate change solutions $25bn by 2030

Committed in April 2019 that Westpac would source 100% of global electricity

consumption through renewable energy sources by 2025

Westpacs long term plan (10-30 years)

Alignment with the method to set science based target for scope 1 (emissions from

sources that are owned or controlled by the reporting company) and scope 2 emissions

(emissions generated from electricity that has been purchased by the company)

Reflection

As per the analysis presented above, I would like to through some light related to the way

these changes in the system can provide benefit in the future to the industry. As I have

provided some suggestions in the above part of the report that Westpac will incentivize the

energy efficient projects such as construction of energy efficient buildings, this will in the

future lower the emission of GHG and many other pollutants from the environment along

with reduced use of water, which will enable the access to water for the future generation too.

Besides this the enhanced energy efficiency is considered to be less expensive in comparison

to investment in new transmission and generation. In addition to this, decentivising the

projects that produces high level of GHG emission can help in limiting the effects of climate

change. By doing this, Westpac can set an example for the entire industry in terms of making

the sustainable business.

to companies that create large amounts of emissions such as coal mining companies.

Westpac has a great short term plan over the next three years for the industry that they are

working in. Being a bank, changing the way that they lend money to businesses depending on

how good they are working on controlling their emissions, Westpac does this as they are in a

field that doesn’t create too many emissions. As well as supporting climate change solutions

to individuals and businesses, Westpac is also trying to minimise their own emissions by 9%

which is also a great goal.

Westpac’s medium term plan (3-10 years)

Lending to climate change solutions $25bn by 2030

Committed in April 2019 that Westpac would source 100% of global electricity

consumption through renewable energy sources by 2025

Westpacs long term plan (10-30 years)

Alignment with the method to set science based target for scope 1 (emissions from

sources that are owned or controlled by the reporting company) and scope 2 emissions

(emissions generated from electricity that has been purchased by the company)

Reflection

As per the analysis presented above, I would like to through some light related to the way

these changes in the system can provide benefit in the future to the industry. As I have

provided some suggestions in the above part of the report that Westpac will incentivize the

energy efficient projects such as construction of energy efficient buildings, this will in the

future lower the emission of GHG and many other pollutants from the environment along

with reduced use of water, which will enable the access to water for the future generation too.

Besides this the enhanced energy efficiency is considered to be less expensive in comparison

to investment in new transmission and generation. In addition to this, decentivising the

projects that produces high level of GHG emission can help in limiting the effects of climate

change. By doing this, Westpac can set an example for the entire industry in terms of making

the sustainable business.

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.