Accounting 2012 Case Study: Wine River Winery Analysis

VerifiedAdded on 2023/06/03

|9

|1094

|277

Case Study

AI Summary

This case study focuses on Wine River Winery, a boutique winery in Adelaide, and its efforts to improve profitability and efficiency. The analysis involves two major cost analysis systems: ABC costing of the Barreling and Maturation Cost Centre and variance analysis of budgeted sales prices and producti...

Accounting 2012

Assignment

Assignment

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Executive Summary

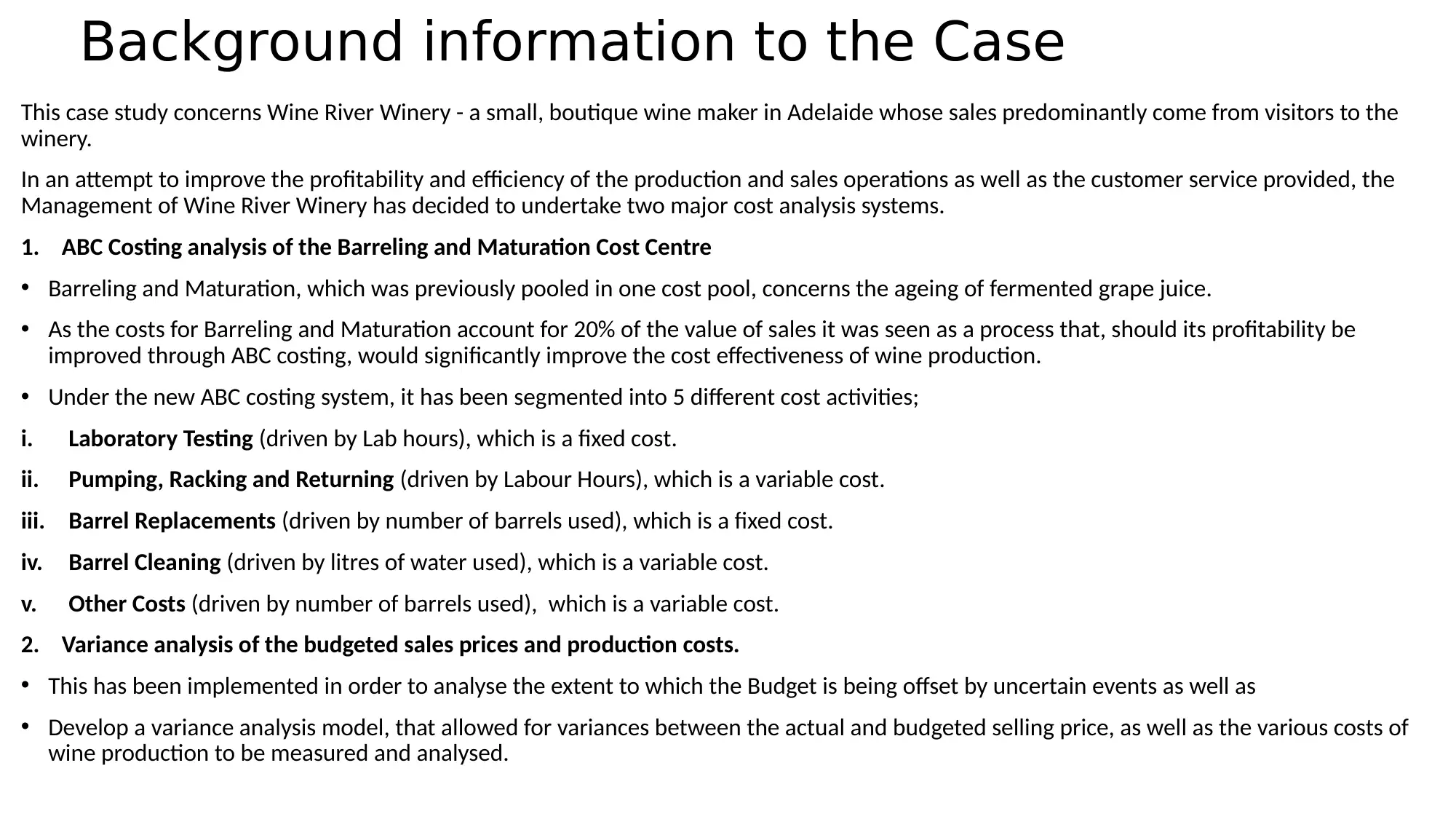

Background information to the Case

This case study concerns Wine River Winery - a small, boutique wine maker in Adelaide whose sales predominantly come from visitors to the

winery.

In an attempt to improve the profitability and efficiency of the production and sales operations as well as the customer service provided, the

Management of Wine River Winery has decided to undertake two major cost analysis systems.

1. ABC Costing analysis of the Barreling and Maturation Cost Centre

• Barreling and Maturation, which was previously pooled in one cost pool, concerns the ageing of fermented grape juice.

• As the costs for Barreling and Maturation account for 20% of the value of sales it was seen as a process that, should its profitability be

improved through ABC costing, would significantly improve the cost effectiveness of wine production.

• Under the new ABC costing system, it has been segmented into 5 different cost activities;

i. Laboratory Testing (driven by Lab hours), which is a fixed cost.

ii. Pumping, Racking and Returning (driven by Labour Hours), which is a variable cost.

iii. Barrel Replacements (driven by number of barrels used), which is a fixed cost.

iv. Barrel Cleaning (driven by litres of water used), which is a variable cost.

v. Other Costs (driven by number of barrels used), which is a variable cost.

2. Variance analysis of the budgeted sales prices and production costs.

• This has been implemented in order to analyse the extent to which the Budget is being offset by uncertain events as well as

• Develop a variance analysis model, that allowed for variances between the actual and budgeted selling price, as well as the various costs of

wine production to be measured and analysed.

This case study concerns Wine River Winery - a small, boutique wine maker in Adelaide whose sales predominantly come from visitors to the

winery.

In an attempt to improve the profitability and efficiency of the production and sales operations as well as the customer service provided, the

Management of Wine River Winery has decided to undertake two major cost analysis systems.

1. ABC Costing analysis of the Barreling and Maturation Cost Centre

• Barreling and Maturation, which was previously pooled in one cost pool, concerns the ageing of fermented grape juice.

• As the costs for Barreling and Maturation account for 20% of the value of sales it was seen as a process that, should its profitability be

improved through ABC costing, would significantly improve the cost effectiveness of wine production.

• Under the new ABC costing system, it has been segmented into 5 different cost activities;

i. Laboratory Testing (driven by Lab hours), which is a fixed cost.

ii. Pumping, Racking and Returning (driven by Labour Hours), which is a variable cost.

iii. Barrel Replacements (driven by number of barrels used), which is a fixed cost.

iv. Barrel Cleaning (driven by litres of water used), which is a variable cost.

v. Other Costs (driven by number of barrels used), which is a variable cost.

2. Variance analysis of the budgeted sales prices and production costs.

• This has been implemented in order to analyse the extent to which the Budget is being offset by uncertain events as well as

• Develop a variance analysis model, that allowed for variances between the actual and budgeted selling price, as well as the various costs of

wine production to be measured and analysed.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Results of ABC Costing Analysis

Activity Cost/Unit of Cost

Driver (Budgeted)

Cost/Unit of Cost

Driver (Actual)

Budgeted

Cost

Actual Cost

Lab Testing $240 $216.67 $108,000 $146,250

Pumping, Racking,

Cleaning

$19 $20 $106,400 $145,600

Barrel replacements $350 $400.19 $63,000 $101,250

Barrel cleaning $1 $1.178 $18,000 $27,843.75

Other $50 $44.46 $9,000 $11,250

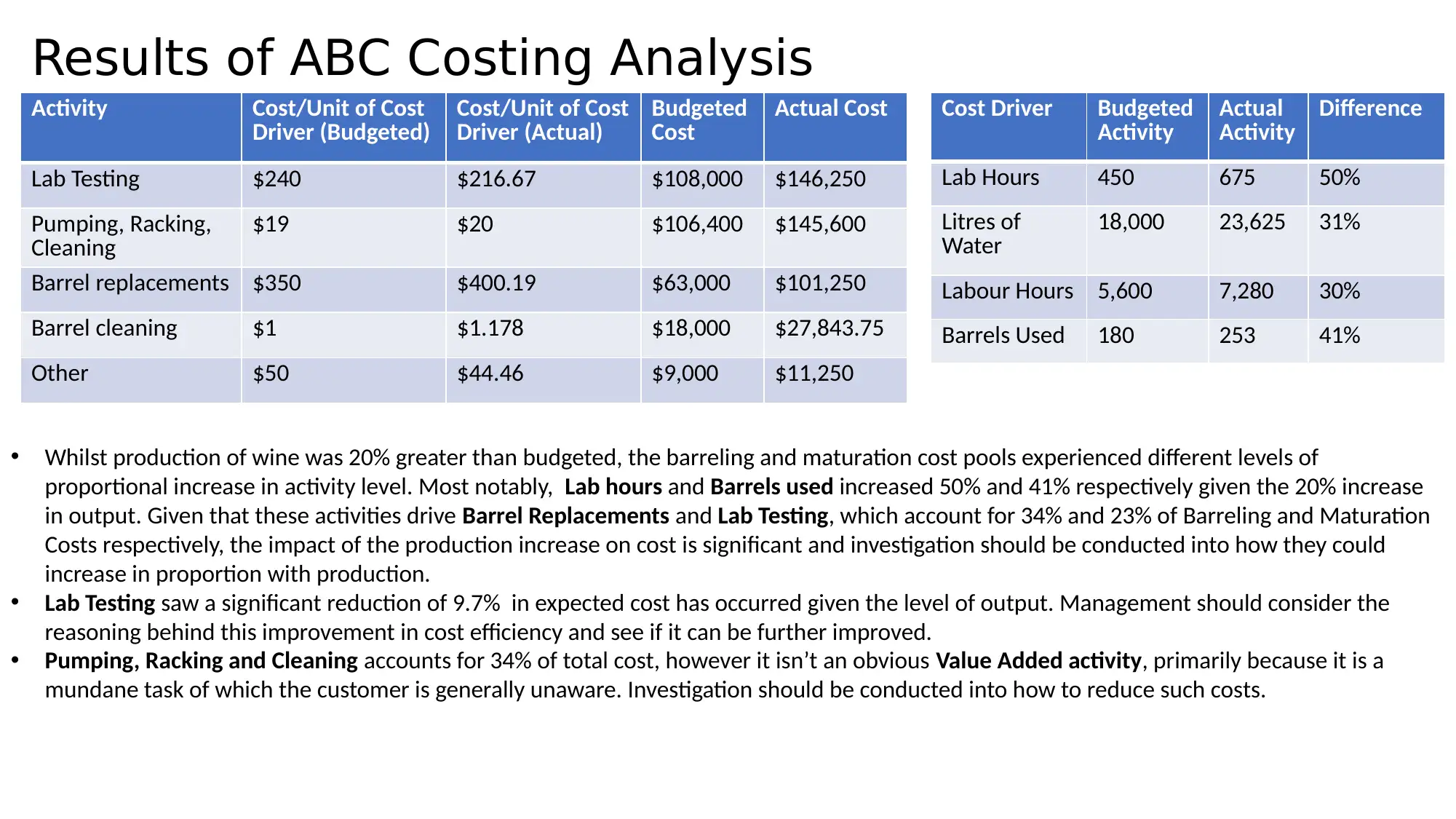

• Whilst production of wine was 20% greater than budgeted, the barreling and maturation cost pools experienced different levels of

proportional increase in activity level. Most notably, Lab hours and Barrels used increased 50% and 41% respectively given the 20% increase

in output. Given that these activities drive Barrel Replacements and Lab Testing, which account for 34% and 23% of Barreling and Maturation

Costs respectively, the impact of the production increase on cost is significant and investigation should be conducted into how they could

increase in proportion with production.

• Lab Testing saw a significant reduction of 9.7% in expected cost has occurred given the level of output. Management should consider the

reasoning behind this improvement in cost efficiency and see if it can be further improved.

• Pumping, Racking and Cleaning accounts for 34% of total cost, however it isn’t an obvious Value Added activity, primarily because it is a

mundane task of which the customer is generally unaware. Investigation should be conducted into how to reduce such costs.

Cost Driver Budgeted

Activity

Actual

Activity

Difference

Lab Hours 450 675 50%

Litres of

Water

18,000 23,625 31%

Labour Hours 5,600 7,280 30%

Barrels Used 180 253 41%

Activity Cost/Unit of Cost

Driver (Budgeted)

Cost/Unit of Cost

Driver (Actual)

Budgeted

Cost

Actual Cost

Lab Testing $240 $216.67 $108,000 $146,250

Pumping, Racking,

Cleaning

$19 $20 $106,400 $145,600

Barrel replacements $350 $400.19 $63,000 $101,250

Barrel cleaning $1 $1.178 $18,000 $27,843.75

Other $50 $44.46 $9,000 $11,250

• Whilst production of wine was 20% greater than budgeted, the barreling and maturation cost pools experienced different levels of

proportional increase in activity level. Most notably, Lab hours and Barrels used increased 50% and 41% respectively given the 20% increase

in output. Given that these activities drive Barrel Replacements and Lab Testing, which account for 34% and 23% of Barreling and Maturation

Costs respectively, the impact of the production increase on cost is significant and investigation should be conducted into how they could

increase in proportion with production.

• Lab Testing saw a significant reduction of 9.7% in expected cost has occurred given the level of output. Management should consider the

reasoning behind this improvement in cost efficiency and see if it can be further improved.

• Pumping, Racking and Cleaning accounts for 34% of total cost, however it isn’t an obvious Value Added activity, primarily because it is a

mundane task of which the customer is generally unaware. Investigation should be conducted into how to reduce such costs.

Cost Driver Budgeted

Activity

Actual

Activity

Difference

Lab Hours 450 675 50%

Litres of

Water

18,000 23,625 31%

Labour Hours 5,600 7,280 30%

Barrels Used 180 253 41%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Results of Variance Analysis

Cost Price Variance Efficiency Variance

Direct Materials $24,000 F $90,000 F

Direct Labour $36,400 U $53,200 U

Variable Overheads $40,893.75 U $30,150 U

Fixed Overheads $106,875 U $49,500 F

Direct Materials have been favorably impacted

both in price and efficiency variance.

Direct Materials Price Variance has been

impacted because of a lower price paid of $8.4/kg

than expected. Direct Materials Efficiency

Variance has also been positively impacted as it

only required 0.39 kg of Direct Material to

produce a bottle compared to a budgeted 0.5 kg.

Direct Labour price and efficiency have been

unfavorably impacted. This is because although it

was predicted that each Labour Hour would

produce 2.67 bottles of wine, they in fact only

produced 2.47 bottles of wine. This could be as a

result of an HR issue.

Whilst it was estimated that Variable Overheads would cost

$10.77/Hr they in fact cost $11.89/Hr. Furthermore, although a

20% increase in output was budgeted to result in a 20%

increase in Variable Overheads (bringing it to $361,800),

Variable Overheads increased by 44% which is significantly

more than the production increase. Consequently, both

Variable Overhead Price and Efficiency have been unfavorably

affected. This could be a result of an inefficient system of

production and should be further investigated.

Fixed Overhead Price has been unfavorably affected because

they have increased with production. This could be because the

increased production has required more land thus changing the

relevant range of production.

Cost Price Variance Efficiency Variance

Direct Materials $24,000 F $90,000 F

Direct Labour $36,400 U $53,200 U

Variable Overheads $40,893.75 U $30,150 U

Fixed Overheads $106,875 U $49,500 F

Direct Materials have been favorably impacted

both in price and efficiency variance.

Direct Materials Price Variance has been

impacted because of a lower price paid of $8.4/kg

than expected. Direct Materials Efficiency

Variance has also been positively impacted as it

only required 0.39 kg of Direct Material to

produce a bottle compared to a budgeted 0.5 kg.

Direct Labour price and efficiency have been

unfavorably impacted. This is because although it

was predicted that each Labour Hour would

produce 2.67 bottles of wine, they in fact only

produced 2.47 bottles of wine. This could be as a

result of an HR issue.

Whilst it was estimated that Variable Overheads would cost

$10.77/Hr they in fact cost $11.89/Hr. Furthermore, although a

20% increase in output was budgeted to result in a 20%

increase in Variable Overheads (bringing it to $361,800),

Variable Overheads increased by 44% which is significantly

more than the production increase. Consequently, both

Variable Overhead Price and Efficiency have been unfavorably

affected. This could be a result of an inefficient system of

production and should be further investigated.

Fixed Overhead Price has been unfavorably affected because

they have increased with production. This could be because the

increased production has required more land thus changing the

relevant range of production.

Findings

• The findings from the calculations suggest that the direct materials

purchased variance amounted to $24000 with favourable outcome.

• On the other hand the findings obtained from the computation

suggested that the direct material estimated variance stood

favourable at $90,000.

• The direct material labour variance however represented an

unfavourable amount as the figures stood 36,400

• The findings from the calculations suggest that the direct materials

purchased variance amounted to $24000 with favourable outcome.

• On the other hand the findings obtained from the computation

suggested that the direct material estimated variance stood

favourable at $90,000.

• The direct material labour variance however represented an

unfavourable amount as the figures stood 36,400

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Findings

• Simultaneously the direct labour estimated variance stood 53,200

• The factory overhead variance in the meantime stood 106,875

• Whereas the production volume obtained from the computation

stood negatively at (49,500)

• Simultaneously the direct labour estimated variance stood 53,200

• The factory overhead variance in the meantime stood 106,875

• Whereas the production volume obtained from the computation

stood negatively at (49,500)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Recommendations:

• In order to reduce the break-even point, it is recommended that the

sum of fixed costs should be reduced.

• The contribution margin can be increased per unit.

• It is necessary to scrutinize the purchase of direct materials and total

direct labour.

• In order to reduce the break-even point, it is recommended that the

sum of fixed costs should be reduced.

• The contribution margin can be increased per unit.

• It is necessary to scrutinize the purchase of direct materials and total

direct labour.

Actions Items:

The action items include the following

• Labour hours can be reduced for pumping, racking and returning

• Consumption of per litre water used for cleaning should be

scrutinized.

The action items include the following

• Labour hours can be reduced for pumping, racking and returning

• Consumption of per litre water used for cleaning should be

scrutinized.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.