Evaluation of Accounting Process of Woolworths Limited

VerifiedAdded on 2023/06/12

|12

|2632

|264

AI Summary

This report evaluates the accounting process of Woolworths Limited, including cash flow statement, comprehensive income statement, tax expenses, deferred tax assets and liabilities, income tax payable, and tax treatment.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

qwertyuiopasdfghjklzxcvbnmqwert

yuiopasdfghjklzxcvbnmqwertyuiopas

dfghjklzxcvbnmqwertyuiopasdfghjklz

xcvbnmqwertyuiopasdfghjklzxcvbnm

qwertyuiopasdfghjklzxcvbnmqwerty

uiopasdfghjklzxcvbnmqwertyuiopasd

fghjklzxcvbnmqwertyuiopasdfghjklzx

cvbnmqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopasdfg

hjklzxcvbnmqwertyuiopasdfghjklzxc

vbnmqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwertyui

Corporate Accounting

Accounting Evaluation

5/24/2018

Student’s Name

yuiopasdfghjklzxcvbnmqwertyuiopas

dfghjklzxcvbnmqwertyuiopasdfghjklz

xcvbnmqwertyuiopasdfghjklzxcvbnm

qwertyuiopasdfghjklzxcvbnmqwerty

uiopasdfghjklzxcvbnmqwertyuiopasd

fghjklzxcvbnmqwertyuiopasdfghjklzx

cvbnmqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopasdfg

hjklzxcvbnmqwertyuiopasdfghjklzxc

vbnmqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwertyui

Corporate Accounting

Accounting Evaluation

5/24/2018

Student’s Name

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Contents

Introduction:.....................................................................................................................3

Woolworths limited:.........................................................................................................3

Cash flow statement:.........................................................................................................3

Comparison of cash flow statement:.................................................................................4

Comprehensive income statement:...................................................................................5

Comprehensive income statement items:.........................................................................6

Why it has not been reported in income statement:..........................................................6

Tax expenses:....................................................................................................................6

Tax expenses according to accounting income:...............................................................7

Deferred tax assets and liabilities:....................................................................................7

Income tax payable:..........................................................................................................8

Income tax paid:...............................................................................................................9

Tax treatment:...................................................................................................................9

References:.....................................................................................................................11

Introduction:.....................................................................................................................3

Woolworths limited:.........................................................................................................3

Cash flow statement:.........................................................................................................3

Comparison of cash flow statement:.................................................................................4

Comprehensive income statement:...................................................................................5

Comprehensive income statement items:.........................................................................6

Why it has not been reported in income statement:..........................................................6

Tax expenses:....................................................................................................................6

Tax expenses according to accounting income:...............................................................7

Deferred tax assets and liabilities:....................................................................................7

Income tax payable:..........................................................................................................8

Income tax paid:...............................................................................................................9

Tax treatment:...................................................................................................................9

References:.....................................................................................................................11

Introduction:

Accounting explains about the recording and processing of the various accounting

transactions of the company in the income statement, cash flow statement and the balance

sheet of the company. The report has been prepared to understand about the accounting

concept and the standards of the company which has been followed by the company to record

the transactions and the notes to accounts of the company. In this report, taxation amount and

the income tax, cash flow statement etc has been evaluated to measure the accounting

process. Woolworths limited company has been chosen to evaluate the accounting process in

the paper.

Woolworths limited:

Woolworths limited is a retiling comapny which is one of the largest companies in

Australian market. The company also operates its business in New Zealand. The company is

recognized as the second largest company in Australian market. The main subsidiary business

of the company is supermarkets, petrol, liquor, general merchandise etc. The subsidiary

business of the company is operating the various operations and the activities of the

company. The company has commenced its business in 1924 (Home, 2018). The company

has also started its business in Indian market. Currently, 2,02,000 people has been employed

by the company.

Annual report (2017) of Woolworths limited explains that the company has recorded

and generated the final financial statement of the company on the basis of the international

financial recording rules and the Australian accounting standard board. The financial and non

financial projection of the company explains about the better position of the company.

Cash flow statement:

Cash flow statement is a one of the main part of the annual report of the company. It

makes it easy for the investors to recognize that how much cash are hold by the company and

how much cash have been paid by the company. The statements briefs about the cash

liquidity position of the company. The cash flow statement of Woolworths limited has been

calculated and measured on the basis of the various activities of the company.

Accounting explains about the recording and processing of the various accounting

transactions of the company in the income statement, cash flow statement and the balance

sheet of the company. The report has been prepared to understand about the accounting

concept and the standards of the company which has been followed by the company to record

the transactions and the notes to accounts of the company. In this report, taxation amount and

the income tax, cash flow statement etc has been evaluated to measure the accounting

process. Woolworths limited company has been chosen to evaluate the accounting process in

the paper.

Woolworths limited:

Woolworths limited is a retiling comapny which is one of the largest companies in

Australian market. The company also operates its business in New Zealand. The company is

recognized as the second largest company in Australian market. The main subsidiary business

of the company is supermarkets, petrol, liquor, general merchandise etc. The subsidiary

business of the company is operating the various operations and the activities of the

company. The company has commenced its business in 1924 (Home, 2018). The company

has also started its business in Indian market. Currently, 2,02,000 people has been employed

by the company.

Annual report (2017) of Woolworths limited explains that the company has recorded

and generated the final financial statement of the company on the basis of the international

financial recording rules and the Australian accounting standard board. The financial and non

financial projection of the company explains about the better position of the company.

Cash flow statement:

Cash flow statement is a one of the main part of the annual report of the company. It

makes it easy for the investors to recognize that how much cash are hold by the company and

how much cash have been paid by the company. The statements briefs about the cash

liquidity position of the company. The cash flow statement of Woolworths limited has been

calculated and measured on the basis of the various activities of the company.

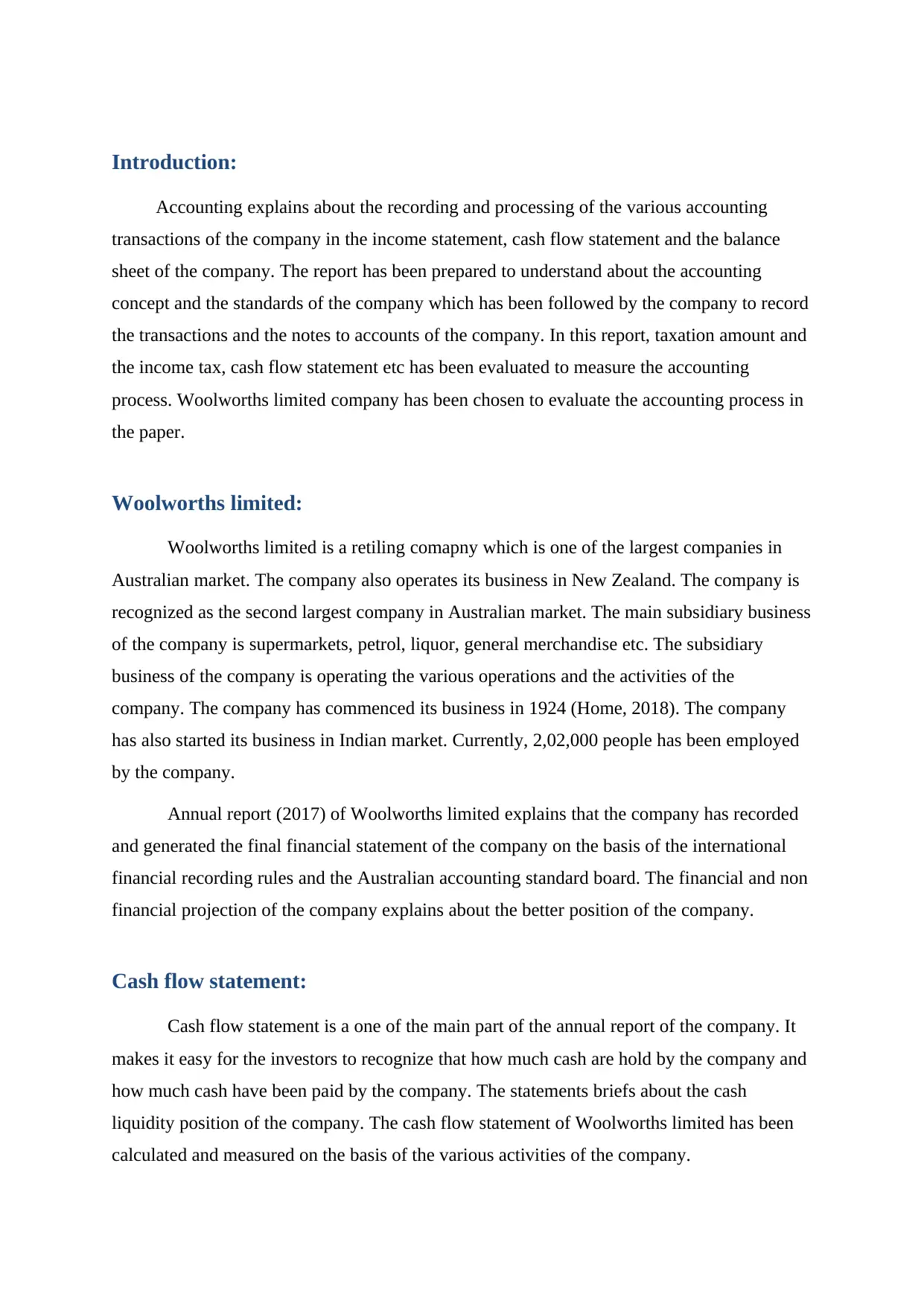

The net cash flow position of the company has been lowered in the current year due to

various operating and non operating activities of the company in an accounting period. The

cash flow statement explains that the revenues of the company have been altered from last

year and affected the net cash flow of the company by a great level (Walsh et al, 2008).

The intangibles purchase and the investment into the PPE of the Woolworths limited

explains about $ -1887 million in 2017 which explains about the lower investment from

2016. The company has repaid the debt amount to most of the debt holders as well as the

dividend amount has been paid. Though, the dividend amount has been lower from 2016.

It explains that the net cash flow of the company of 2016 and 2017 has been lowered

more and explains about higher cash outflows of the company.

CASH FLOW STATEMENT

AUD in millions

2016-

06

2017-

06

Investments in property, plant, and equipment -1938 -1887

Purchases of intangibles -45 -23

Long-term debt repayment -994 -1406

Cash dividends paid -1217 -562

Net cash provided by (used for) financing

activities -1475 -1729

Net change in cash -2735 -3161

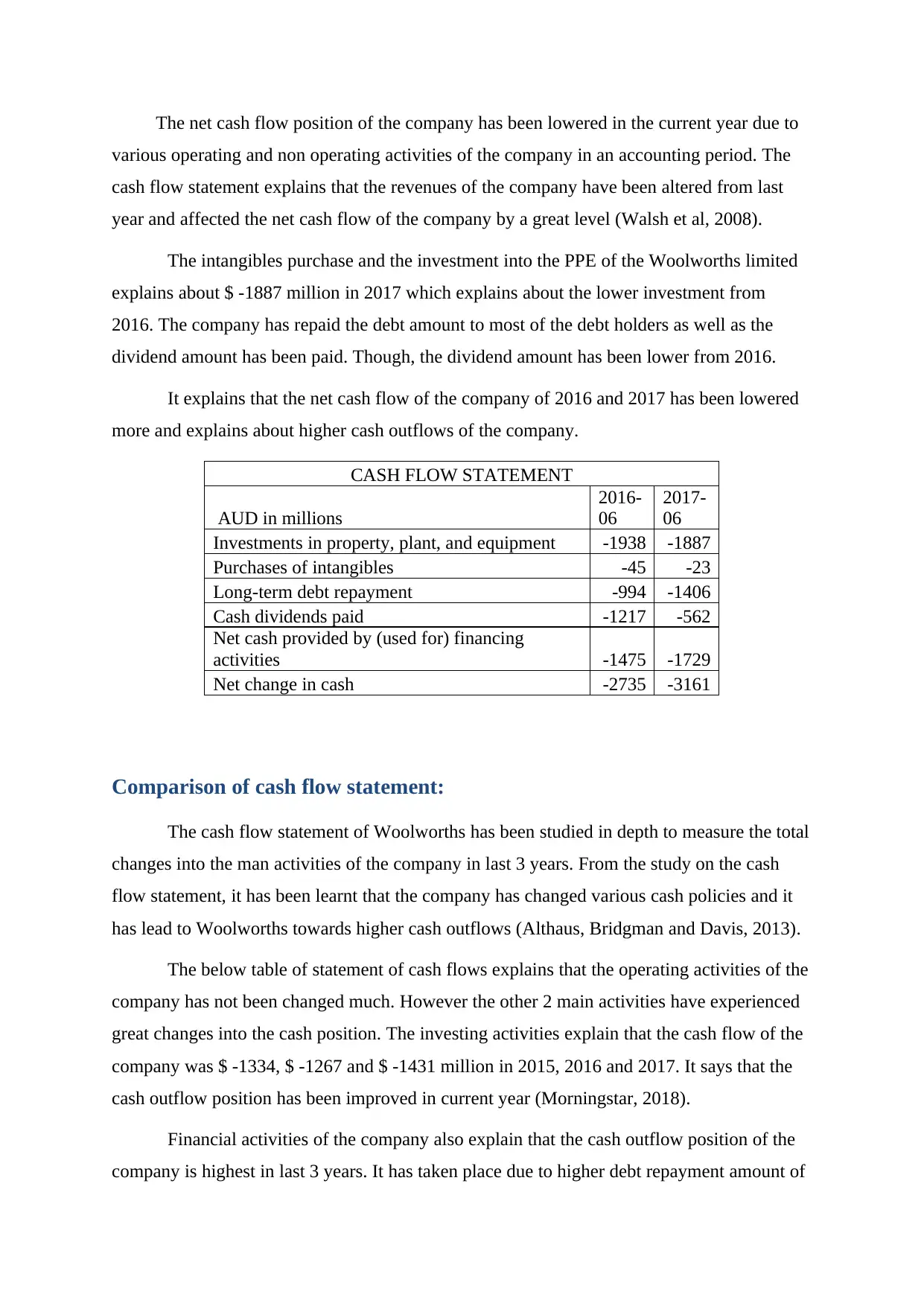

Comparison of cash flow statement:

The cash flow statement of Woolworths has been studied in depth to measure the total

changes into the man activities of the company in last 3 years. From the study on the cash

flow statement, it has been learnt that the company has changed various cash policies and it

has lead to Woolworths towards higher cash outflows (Althaus, Bridgman and Davis, 2013).

The below table of statement of cash flows explains that the operating activities of the

company has not been changed much. However the other 2 main activities have experienced

great changes into the cash position. The investing activities explain that the cash flow of the

company was $ -1334, $ -1267 and $ -1431 million in 2015, 2016 and 2017. It says that the

cash outflow position has been improved in current year (Morningstar, 2018).

Financial activities of the company also explain that the cash outflow position of the

company is highest in last 3 years. It has taken place due to higher debt repayment amount of

various operating and non operating activities of the company in an accounting period. The

cash flow statement explains that the revenues of the company have been altered from last

year and affected the net cash flow of the company by a great level (Walsh et al, 2008).

The intangibles purchase and the investment into the PPE of the Woolworths limited

explains about $ -1887 million in 2017 which explains about the lower investment from

2016. The company has repaid the debt amount to most of the debt holders as well as the

dividend amount has been paid. Though, the dividend amount has been lower from 2016.

It explains that the net cash flow of the company of 2016 and 2017 has been lowered

more and explains about higher cash outflows of the company.

CASH FLOW STATEMENT

AUD in millions

2016-

06

2017-

06

Investments in property, plant, and equipment -1938 -1887

Purchases of intangibles -45 -23

Long-term debt repayment -994 -1406

Cash dividends paid -1217 -562

Net cash provided by (used for) financing

activities -1475 -1729

Net change in cash -2735 -3161

Comparison of cash flow statement:

The cash flow statement of Woolworths has been studied in depth to measure the total

changes into the man activities of the company in last 3 years. From the study on the cash

flow statement, it has been learnt that the company has changed various cash policies and it

has lead to Woolworths towards higher cash outflows (Althaus, Bridgman and Davis, 2013).

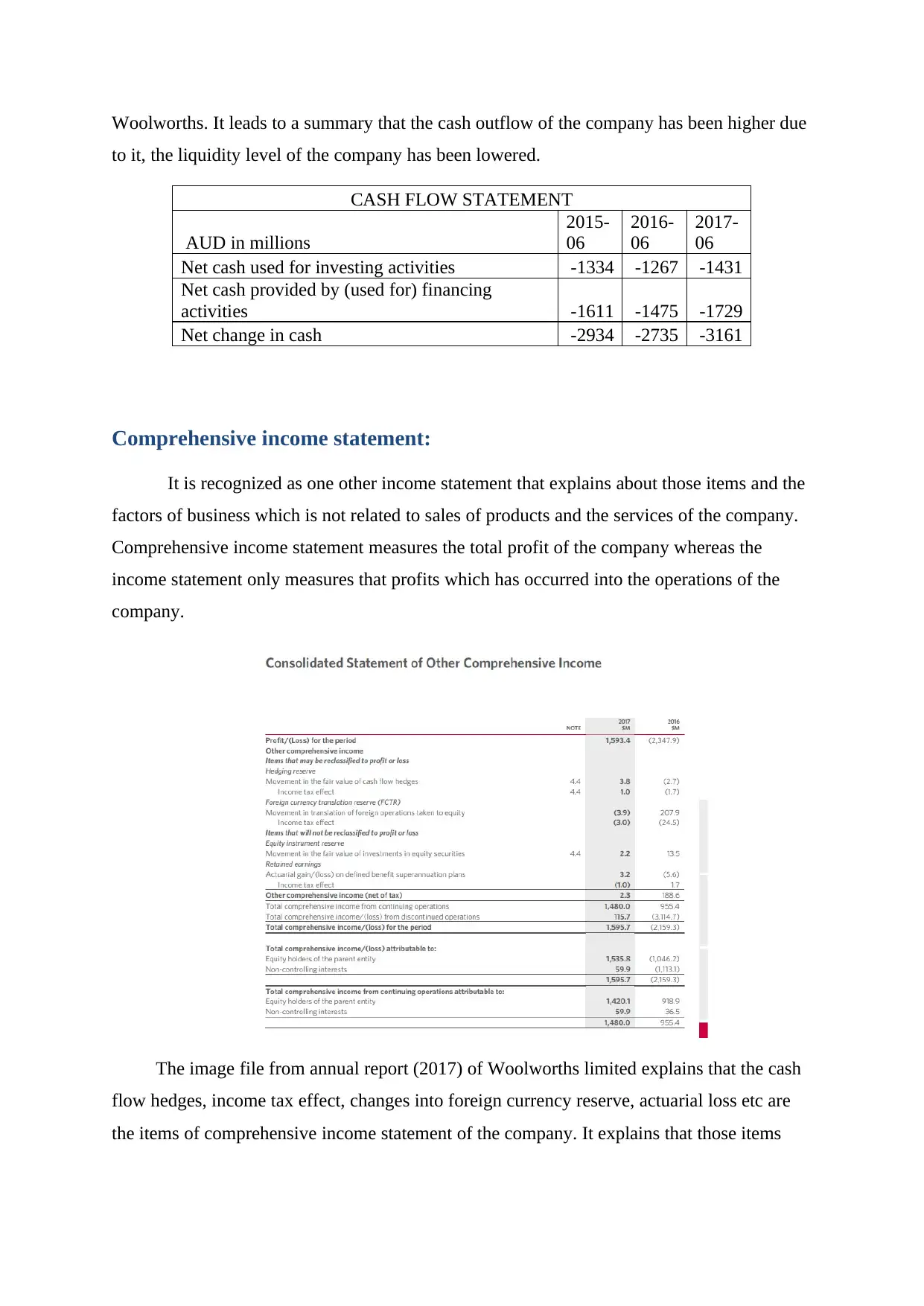

The below table of statement of cash flows explains that the operating activities of the

company has not been changed much. However the other 2 main activities have experienced

great changes into the cash position. The investing activities explain that the cash flow of the

company was $ -1334, $ -1267 and $ -1431 million in 2015, 2016 and 2017. It says that the

cash outflow position has been improved in current year (Morningstar, 2018).

Financial activities of the company also explain that the cash outflow position of the

company is highest in last 3 years. It has taken place due to higher debt repayment amount of

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Woolworths. It leads to a summary that the cash outflow of the company has been higher due

to it, the liquidity level of the company has been lowered.

CASH FLOW STATEMENT

AUD in millions

2015-

06

2016-

06

2017-

06

Net cash used for investing activities -1334 -1267 -1431

Net cash provided by (used for) financing

activities -1611 -1475 -1729

Net change in cash -2934 -2735 -3161

Comprehensive income statement:

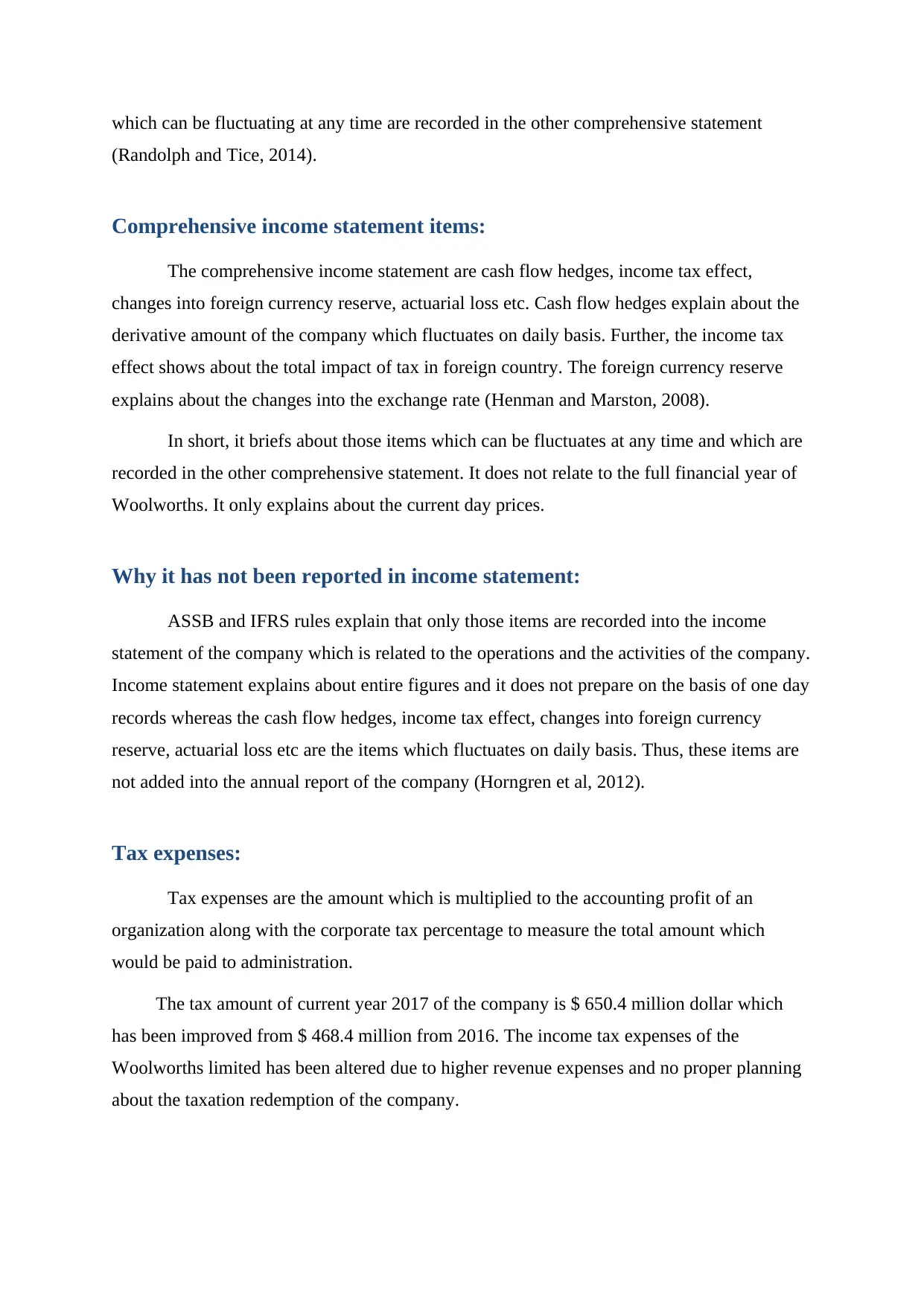

It is recognized as one other income statement that explains about those items and the

factors of business which is not related to sales of products and the services of the company.

Comprehensive income statement measures the total profit of the company whereas the

income statement only measures that profits which has occurred into the operations of the

company.

The image file from annual report (2017) of Woolworths limited explains that the cash

flow hedges, income tax effect, changes into foreign currency reserve, actuarial loss etc are

the items of comprehensive income statement of the company. It explains that those items

to it, the liquidity level of the company has been lowered.

CASH FLOW STATEMENT

AUD in millions

2015-

06

2016-

06

2017-

06

Net cash used for investing activities -1334 -1267 -1431

Net cash provided by (used for) financing

activities -1611 -1475 -1729

Net change in cash -2934 -2735 -3161

Comprehensive income statement:

It is recognized as one other income statement that explains about those items and the

factors of business which is not related to sales of products and the services of the company.

Comprehensive income statement measures the total profit of the company whereas the

income statement only measures that profits which has occurred into the operations of the

company.

The image file from annual report (2017) of Woolworths limited explains that the cash

flow hedges, income tax effect, changes into foreign currency reserve, actuarial loss etc are

the items of comprehensive income statement of the company. It explains that those items

which can be fluctuating at any time are recorded in the other comprehensive statement

(Randolph and Tice, 2014).

Comprehensive income statement items:

The comprehensive income statement are cash flow hedges, income tax effect,

changes into foreign currency reserve, actuarial loss etc. Cash flow hedges explain about the

derivative amount of the company which fluctuates on daily basis. Further, the income tax

effect shows about the total impact of tax in foreign country. The foreign currency reserve

explains about the changes into the exchange rate (Henman and Marston, 2008).

In short, it briefs about those items which can be fluctuates at any time and which are

recorded in the other comprehensive statement. It does not relate to the full financial year of

Woolworths. It only explains about the current day prices.

Why it has not been reported in income statement:

ASSB and IFRS rules explain that only those items are recorded into the income

statement of the company which is related to the operations and the activities of the company.

Income statement explains about entire figures and it does not prepare on the basis of one day

records whereas the cash flow hedges, income tax effect, changes into foreign currency

reserve, actuarial loss etc are the items which fluctuates on daily basis. Thus, these items are

not added into the annual report of the company (Horngren et al, 2012).

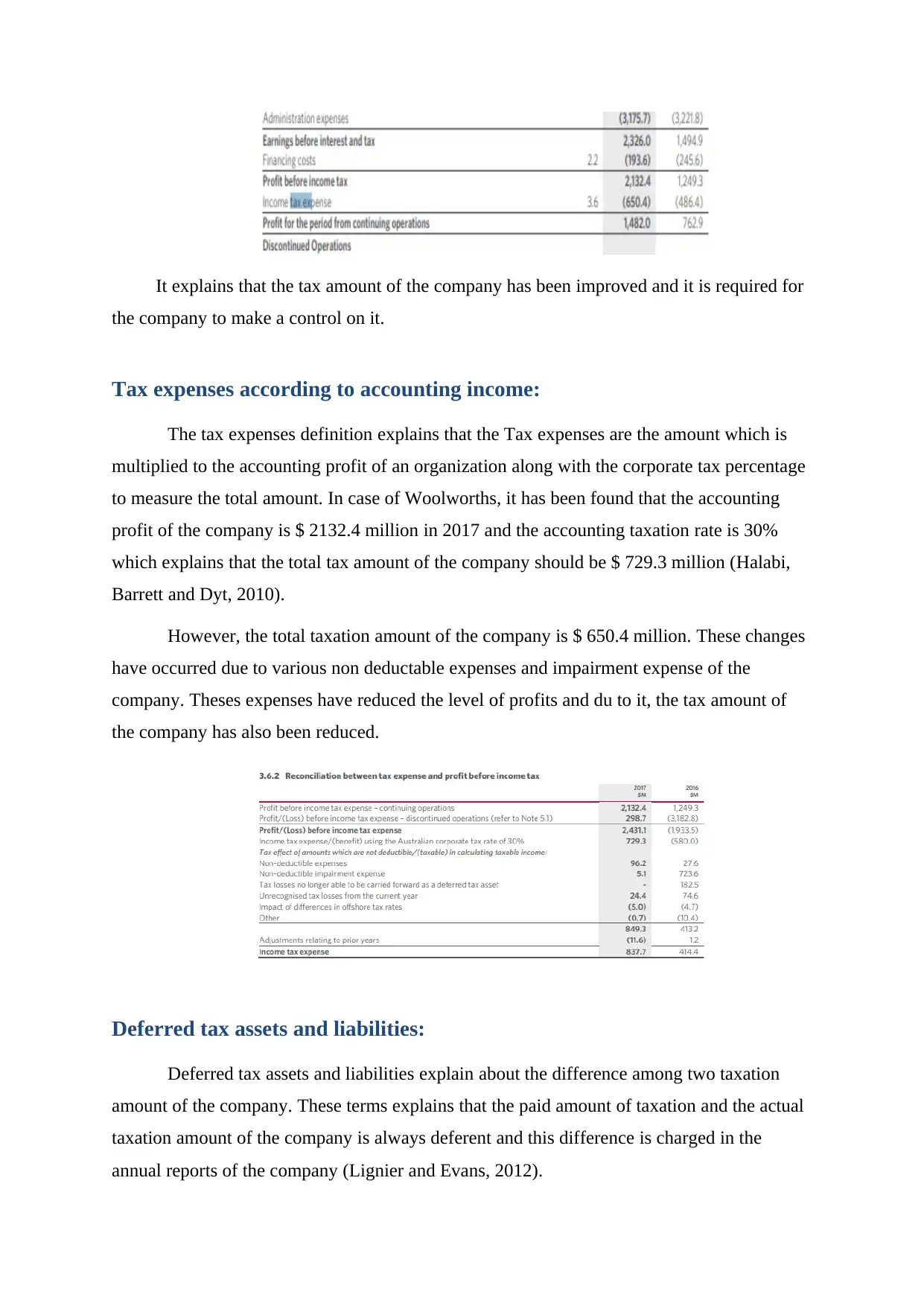

Tax expenses:

Tax expenses are the amount which is multiplied to the accounting profit of an

organization along with the corporate tax percentage to measure the total amount which

would be paid to administration.

The tax amount of current year 2017 of the company is $ 650.4 million dollar which

has been improved from $ 468.4 million from 2016. The income tax expenses of the

Woolworths limited has been altered due to higher revenue expenses and no proper planning

about the taxation redemption of the company.

(Randolph and Tice, 2014).

Comprehensive income statement items:

The comprehensive income statement are cash flow hedges, income tax effect,

changes into foreign currency reserve, actuarial loss etc. Cash flow hedges explain about the

derivative amount of the company which fluctuates on daily basis. Further, the income tax

effect shows about the total impact of tax in foreign country. The foreign currency reserve

explains about the changes into the exchange rate (Henman and Marston, 2008).

In short, it briefs about those items which can be fluctuates at any time and which are

recorded in the other comprehensive statement. It does not relate to the full financial year of

Woolworths. It only explains about the current day prices.

Why it has not been reported in income statement:

ASSB and IFRS rules explain that only those items are recorded into the income

statement of the company which is related to the operations and the activities of the company.

Income statement explains about entire figures and it does not prepare on the basis of one day

records whereas the cash flow hedges, income tax effect, changes into foreign currency

reserve, actuarial loss etc are the items which fluctuates on daily basis. Thus, these items are

not added into the annual report of the company (Horngren et al, 2012).

Tax expenses:

Tax expenses are the amount which is multiplied to the accounting profit of an

organization along with the corporate tax percentage to measure the total amount which

would be paid to administration.

The tax amount of current year 2017 of the company is $ 650.4 million dollar which

has been improved from $ 468.4 million from 2016. The income tax expenses of the

Woolworths limited has been altered due to higher revenue expenses and no proper planning

about the taxation redemption of the company.

It explains that the tax amount of the company has been improved and it is required for

the company to make a control on it.

Tax expenses according to accounting income:

The tax expenses definition explains that the Tax expenses are the amount which is

multiplied to the accounting profit of an organization along with the corporate tax percentage

to measure the total amount. In case of Woolworths, it has been found that the accounting

profit of the company is $ 2132.4 million in 2017 and the accounting taxation rate is 30%

which explains that the total tax amount of the company should be $ 729.3 million (Halabi,

Barrett and Dyt, 2010).

However, the total taxation amount of the company is $ 650.4 million. These changes

have occurred due to various non deductable expenses and impairment expense of the

company. Theses expenses have reduced the level of profits and du to it, the tax amount of

the company has also been reduced.

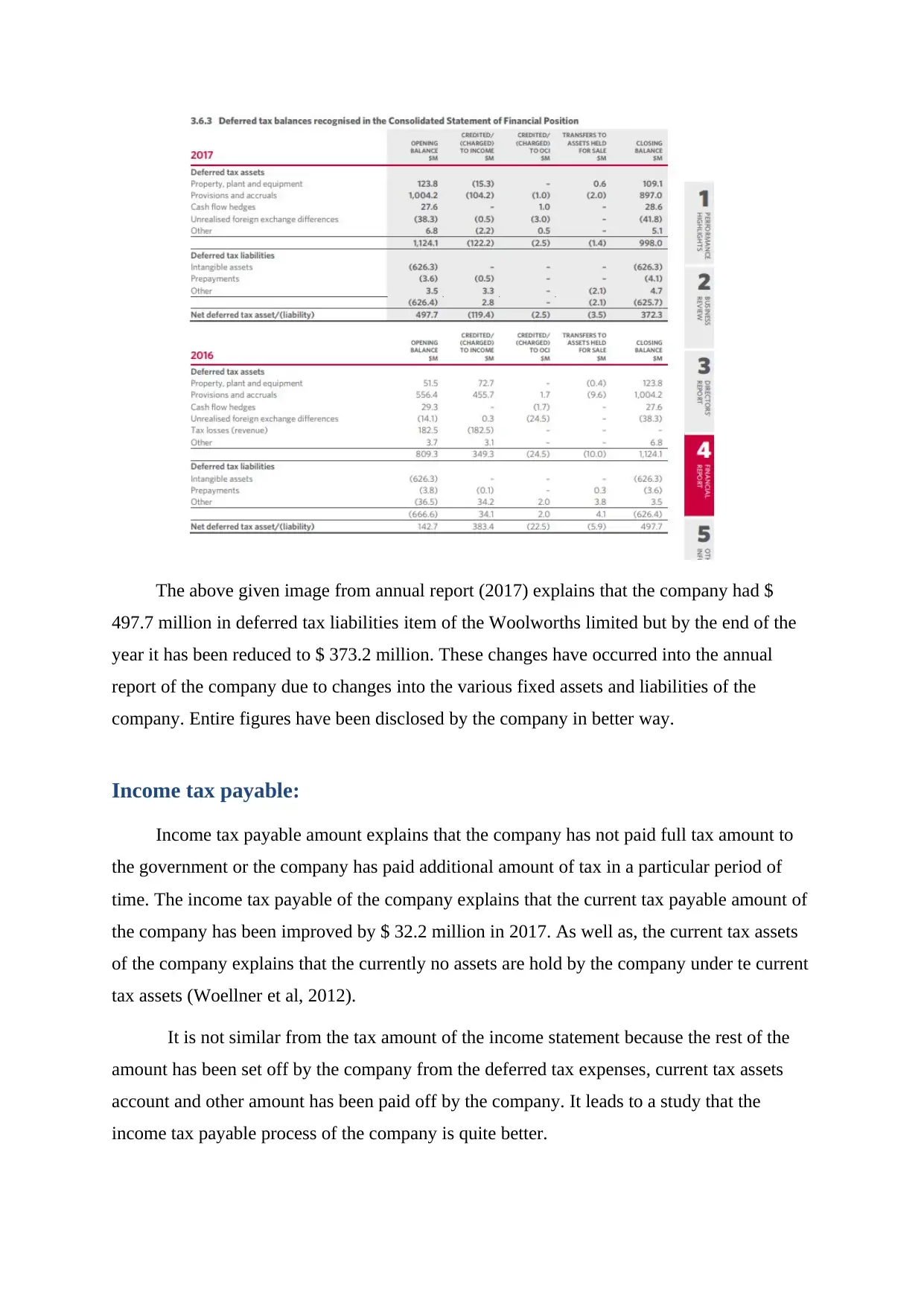

Deferred tax assets and liabilities:

Deferred tax assets and liabilities explain about the difference among two taxation

amount of the company. These terms explains that the paid amount of taxation and the actual

taxation amount of the company is always deferent and this difference is charged in the

annual reports of the company (Lignier and Evans, 2012).

the company to make a control on it.

Tax expenses according to accounting income:

The tax expenses definition explains that the Tax expenses are the amount which is

multiplied to the accounting profit of an organization along with the corporate tax percentage

to measure the total amount. In case of Woolworths, it has been found that the accounting

profit of the company is $ 2132.4 million in 2017 and the accounting taxation rate is 30%

which explains that the total tax amount of the company should be $ 729.3 million (Halabi,

Barrett and Dyt, 2010).

However, the total taxation amount of the company is $ 650.4 million. These changes

have occurred due to various non deductable expenses and impairment expense of the

company. Theses expenses have reduced the level of profits and du to it, the tax amount of

the company has also been reduced.

Deferred tax assets and liabilities:

Deferred tax assets and liabilities explain about the difference among two taxation

amount of the company. These terms explains that the paid amount of taxation and the actual

taxation amount of the company is always deferent and this difference is charged in the

annual reports of the company (Lignier and Evans, 2012).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The above given image from annual report (2017) explains that the company had $

497.7 million in deferred tax liabilities item of the Woolworths limited but by the end of the

year it has been reduced to $ 373.2 million. These changes have occurred into the annual

report of the company due to changes into the various fixed assets and liabilities of the

company. Entire figures have been disclosed by the company in better way.

Income tax payable:

Income tax payable amount explains that the company has not paid full tax amount to

the government or the company has paid additional amount of tax in a particular period of

time. The income tax payable of the company explains that the current tax payable amount of

the company has been improved by $ 32.2 million in 2017. As well as, the current tax assets

of the company explains that the currently no assets are hold by the company under te current

tax assets (Woellner et al, 2012).

It is not similar from the tax amount of the income statement because the rest of the

amount has been set off by the company from the deferred tax expenses, current tax assets

account and other amount has been paid off by the company. It leads to a study that the

income tax payable process of the company is quite better.

497.7 million in deferred tax liabilities item of the Woolworths limited but by the end of the

year it has been reduced to $ 373.2 million. These changes have occurred into the annual

report of the company due to changes into the various fixed assets and liabilities of the

company. Entire figures have been disclosed by the company in better way.

Income tax payable:

Income tax payable amount explains that the company has not paid full tax amount to

the government or the company has paid additional amount of tax in a particular period of

time. The income tax payable of the company explains that the current tax payable amount of

the company has been improved by $ 32.2 million in 2017. As well as, the current tax assets

of the company explains that the currently no assets are hold by the company under te current

tax assets (Woellner et al, 2012).

It is not similar from the tax amount of the income statement because the rest of the

amount has been set off by the company from the deferred tax expenses, current tax assets

account and other amount has been paid off by the company. It leads to a study that the

income tax payable process of the company is quite better.

Woolworths limited has recorded the annual figures and the taxation figures with

proper working notes and notes to accounts so that the performance of the company could be

maintained as well as no manipulation could be done with the financial data of the company.

Income tax paid:

The income statement says that the total taxation amount of the company is $ 650.4

million whereas the cash flow statement of Woolworths limited explains that the $ 668.1

million amount has been given as tax expenses.

It leads that the cash outflow from taxation activities is higher than the actual cash

expenses of the company. It measures that the income tax amount has been altered and has

been paid in advance by the company which has enhanced the deferred tax assets of the

company.

The income tax report and study explains that the recording of these much different

taxation figures are bit confusing as it could lead towards the investigation failure to the non

accounting professional person.

Tax treatment:

The taxation rerecording system has totally been followed by the company according

to the annual report. However, the study has affected and impacted the learning in the

following ways:

Surprising element of taxation study was managing and recording these much of

taxation amount in the annual report with proper notes to accounts (Braithwaite, 2009).

Tax report and study explains that the recording of these much different taxation figures

are bit confusing as it could lead towards the investigation failure to the non accounting

professional person.

Difficult part of the report was nothing. The entire study of the taxation has been

performed in the better way and it explains that the ASSB 112 rules of taxation identifying

and recording has been followed by the company to prepare the report.

This report enhances the understanding about the accounting concept and the

standards of the company which has been followed by the company to record the transactions

proper working notes and notes to accounts so that the performance of the company could be

maintained as well as no manipulation could be done with the financial data of the company.

Income tax paid:

The income statement says that the total taxation amount of the company is $ 650.4

million whereas the cash flow statement of Woolworths limited explains that the $ 668.1

million amount has been given as tax expenses.

It leads that the cash outflow from taxation activities is higher than the actual cash

expenses of the company. It measures that the income tax amount has been altered and has

been paid in advance by the company which has enhanced the deferred tax assets of the

company.

The income tax report and study explains that the recording of these much different

taxation figures are bit confusing as it could lead towards the investigation failure to the non

accounting professional person.

Tax treatment:

The taxation rerecording system has totally been followed by the company according

to the annual report. However, the study has affected and impacted the learning in the

following ways:

Surprising element of taxation study was managing and recording these much of

taxation amount in the annual report with proper notes to accounts (Braithwaite, 2009).

Tax report and study explains that the recording of these much different taxation figures

are bit confusing as it could lead towards the investigation failure to the non accounting

professional person.

Difficult part of the report was nothing. The entire study of the taxation has been

performed in the better way and it explains that the ASSB 112 rules of taxation identifying

and recording has been followed by the company to prepare the report.

This report enhances the understanding about the accounting concept and the

standards of the company which has been followed by the company to record the transactions

and the notes to accounts of the company. To conclude, the performance and the accounting

process of the company is quite better and competitive.

process of the company is quite better and competitive.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

References:

Althaus, C., Bridgman, P. and Davis, G., 2013. The Australian policy handbook. Allen &

Unwin.

Annual report. 2017. Woolworth group limited. (online). Available at: https://0.

www.woolworthsgroup.com.au/icms_docs/188795_annual-report-2017.pdf (accessed

25/5/18).

Braithwaite, V.A., 2009. Defiance in taxation and governance: Resisting and dismissing

authority in a democracy. Edward Elgar Publishing.

Halabi, A.K., Barrett, R. and Dyt, R., 2010. Understanding financial information used to

assess small firm performance: An Australian qualitative study. Qualitative Research in

Accounting & Management, 7(2), pp.163-179.

Henman, P. and Marston, G., 2008. The social division of welfare surveillance. Journal of

Social Policy, 37(2), pp.187-205.

Home. 2018. Woolworth group limited. (online). Available at:

https://www.woolworthsgroup.com.au/page/about-us/our-brands (accessed 25/5/18).

Horngren, C., Harrison, W., Oliver, S., Best, P., Fraser, D., Tan, R. and Willett, R.,

2012. Accounting. Pearson Higher Education AU.

Lignier, P. and Evans, C., 2012. The rise and rise of tax compliance costs for the small

business sector in Australia.

Morningstar. 2018. Woolworth group limited. (online). Available at

http://financials.morningstar.com/income-statement/is.html?t=WOW®ion=aus (accessed

25/5/18).

Randolph, B. and Tice, A., 2014. Suburbanizing disadvantage in Australian cities:

sociospatial change in an era of neoliberalism. Journal of urban affairs, 36(s1), pp.384-399.

Walsh, P., McGregor‐Lowndes, M. and Newton, C.J., 2008. Shared services: Lessons from

the public and private sectors for the nonprofit sector. Australian Journal of Public

Administration, 67(2), pp.200-212.

Woellner, R., Barkoczy, S., Murphy, S., Evans, C. and Pinto, D., 2012. Australian taxation

law. CCH Australia.

Althaus, C., Bridgman, P. and Davis, G., 2013. The Australian policy handbook. Allen &

Unwin.

Annual report. 2017. Woolworth group limited. (online). Available at: https://0.

www.woolworthsgroup.com.au/icms_docs/188795_annual-report-2017.pdf (accessed

25/5/18).

Braithwaite, V.A., 2009. Defiance in taxation and governance: Resisting and dismissing

authority in a democracy. Edward Elgar Publishing.

Halabi, A.K., Barrett, R. and Dyt, R., 2010. Understanding financial information used to

assess small firm performance: An Australian qualitative study. Qualitative Research in

Accounting & Management, 7(2), pp.163-179.

Henman, P. and Marston, G., 2008. The social division of welfare surveillance. Journal of

Social Policy, 37(2), pp.187-205.

Home. 2018. Woolworth group limited. (online). Available at:

https://www.woolworthsgroup.com.au/page/about-us/our-brands (accessed 25/5/18).

Horngren, C., Harrison, W., Oliver, S., Best, P., Fraser, D., Tan, R. and Willett, R.,

2012. Accounting. Pearson Higher Education AU.

Lignier, P. and Evans, C., 2012. The rise and rise of tax compliance costs for the small

business sector in Australia.

Morningstar. 2018. Woolworth group limited. (online). Available at

http://financials.morningstar.com/income-statement/is.html?t=WOW®ion=aus (accessed

25/5/18).

Randolph, B. and Tice, A., 2014. Suburbanizing disadvantage in Australian cities:

sociospatial change in an era of neoliberalism. Journal of urban affairs, 36(s1), pp.384-399.

Walsh, P., McGregor‐Lowndes, M. and Newton, C.J., 2008. Shared services: Lessons from

the public and private sectors for the nonprofit sector. Australian Journal of Public

Administration, 67(2), pp.200-212.

Woellner, R., Barkoczy, S., Murphy, S., Evans, C. and Pinto, D., 2012. Australian taxation

law. CCH Australia.

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.