Business Case Study: British American Tobacco (BAT) Financial Report

VerifiedAdded on 2023/01/05

|9

|1377

|64

Report

AI Summary

This report provides a business case study of British American Tobacco (BAT), a major UK consumer goods company. It explores BAT's financial strategies, including sources of finance, such as equity and sales revenue, and analyzes financial documents from the 2019-20 annual report, including the income statement, balance sheet, and cash flow statement. The report examines BAT's budget, including the CEO's compensation and the company's approach to budgeting, and discusses the company's pricing policy, focusing on how taxation and pricing strategies influence revenue. The analysis draws on the company's annual reports and relevant academic sources to provide a comprehensive overview of BAT's financial operations and business practices.

Word

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................3

TASK...............................................................................................................................................3

1. Source of Finance..........................................................................................................3

2. Example of financial documents...................................................................................3

3. Kind of Budget..............................................................................................................7

4. Pricing policy................................................................................................................7

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION...........................................................................................................................3

TASK...............................................................................................................................................3

1. Source of Finance..........................................................................................................3

2. Example of financial documents...................................................................................3

3. Kind of Budget..............................................................................................................7

4. Pricing policy................................................................................................................7

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION

In this report, to better understand the concept of business case study British American

Tobacco has been selected which is largest consumer good company of UK. The report covers,

sources of finance, examples of finance records, budget implemented within company and the

pricing policy is discussed.

TASK

1. Source of Finance

The BAT gets their finance organized, with the high level of debts on its balance sheet, which

makes it financially strong even if the flow of cash is stacked up (Czerniawska, 2016).

Equity finance: For BATs, the ratio for debt to equity is more than 100%, which signifies that the

company is having a high level of debt in relation to its net worth. During financial crisis, the

company may go through difficulties meeting interest and other debt accountabilities. It does not

matter if the company is debt is high if it can cover the interest payments with ease, it is signified

to be essential with its use of excess leverage.

Sales revenue: The BATs are producing earnings which are at least three times its interest

payments are being examined as financially strong. BATs interest on debt is satisfactory as it is

covered by earnings which are around 9.56 xs. The debtors are approaching to loan the company

more money, providing BATs with a variety of opportunity to expand its debt facilities. In the

last year, the BATs cash flow was 0.25 xs to its current debt. The ratio estimates over a 0.25x is

an assertive factor for the company and it also represents that the BATs is producing enough

amount of money from its business, which will also increase its capacity to pay back.

2. Example of financial documents

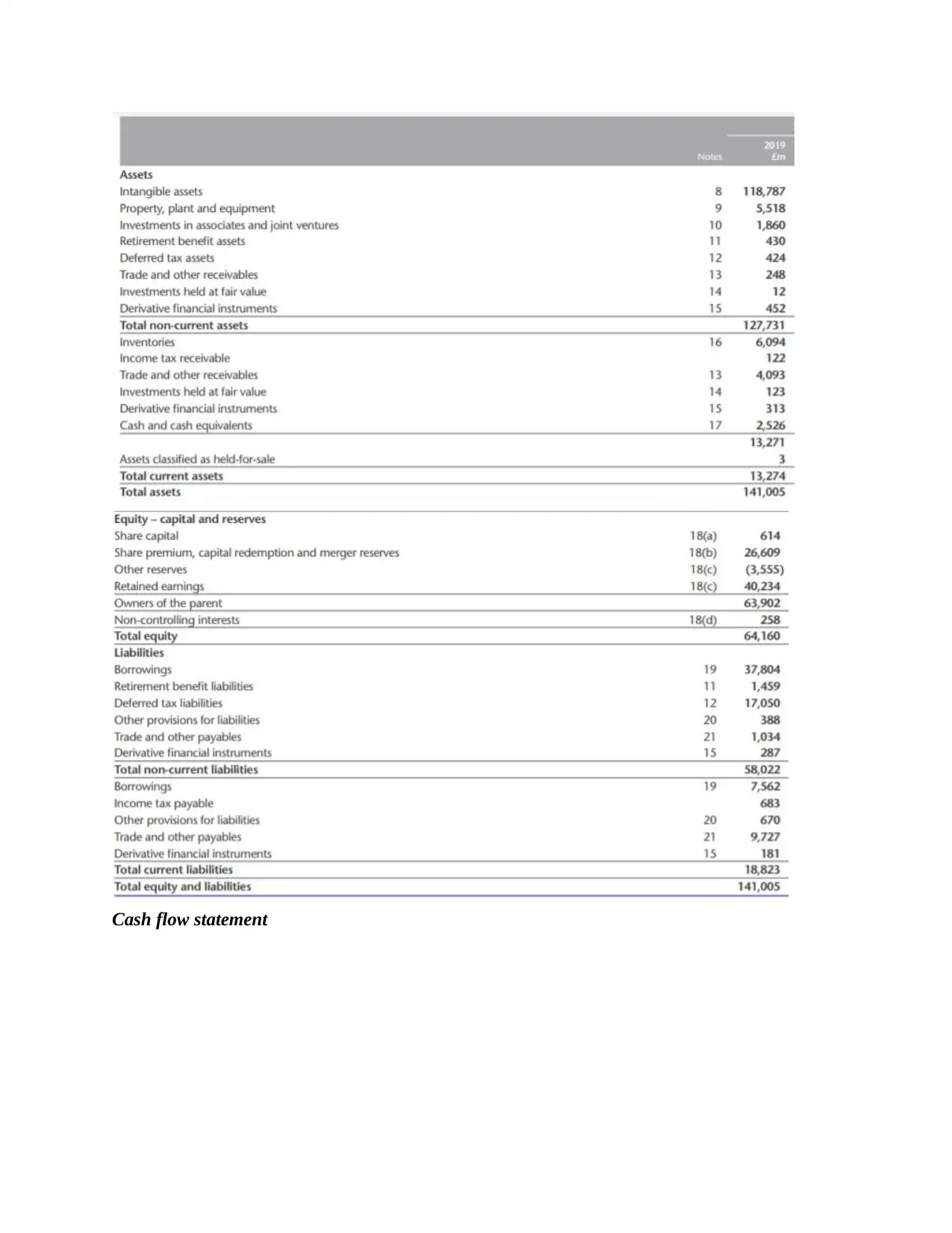

From the annual report of 2019-20 some of the main financial records of British American

Tobacco have been presented and interpreted which shows the example of assets, liabilities, net

cash flow from different activities and net profit for the year (Annual report of BAT, 2019). The

same is discussed below:

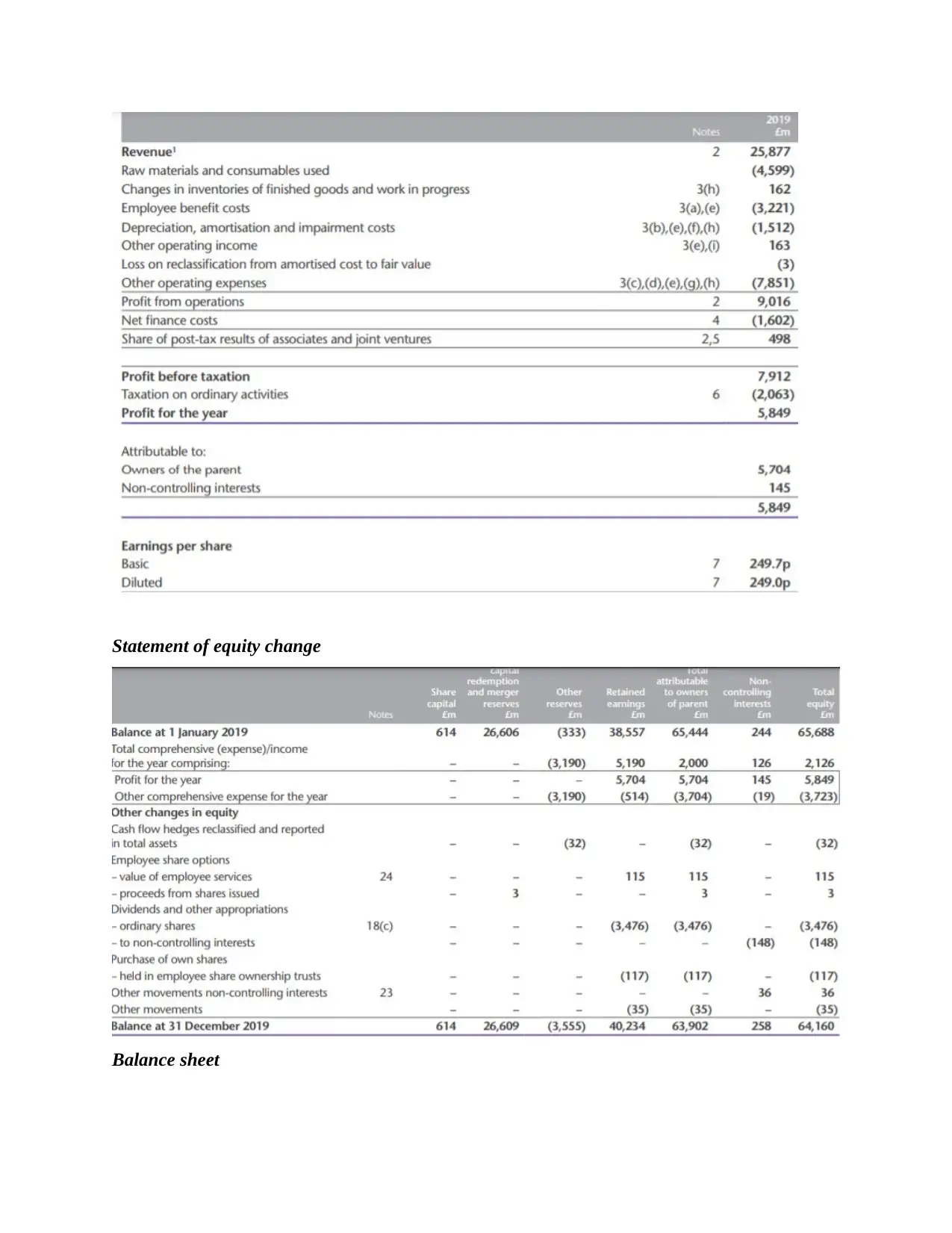

Income statement

In this report, to better understand the concept of business case study British American

Tobacco has been selected which is largest consumer good company of UK. The report covers,

sources of finance, examples of finance records, budget implemented within company and the

pricing policy is discussed.

TASK

1. Source of Finance

The BAT gets their finance organized, with the high level of debts on its balance sheet, which

makes it financially strong even if the flow of cash is stacked up (Czerniawska, 2016).

Equity finance: For BATs, the ratio for debt to equity is more than 100%, which signifies that the

company is having a high level of debt in relation to its net worth. During financial crisis, the

company may go through difficulties meeting interest and other debt accountabilities. It does not

matter if the company is debt is high if it can cover the interest payments with ease, it is signified

to be essential with its use of excess leverage.

Sales revenue: The BATs are producing earnings which are at least three times its interest

payments are being examined as financially strong. BATs interest on debt is satisfactory as it is

covered by earnings which are around 9.56 xs. The debtors are approaching to loan the company

more money, providing BATs with a variety of opportunity to expand its debt facilities. In the

last year, the BATs cash flow was 0.25 xs to its current debt. The ratio estimates over a 0.25x is

an assertive factor for the company and it also represents that the BATs is producing enough

amount of money from its business, which will also increase its capacity to pay back.

2. Example of financial documents

From the annual report of 2019-20 some of the main financial records of British American

Tobacco have been presented and interpreted which shows the example of assets, liabilities, net

cash flow from different activities and net profit for the year (Annual report of BAT, 2019). The

same is discussed below:

Income statement

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Statement of equity change

Balance sheet

Balance sheet

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

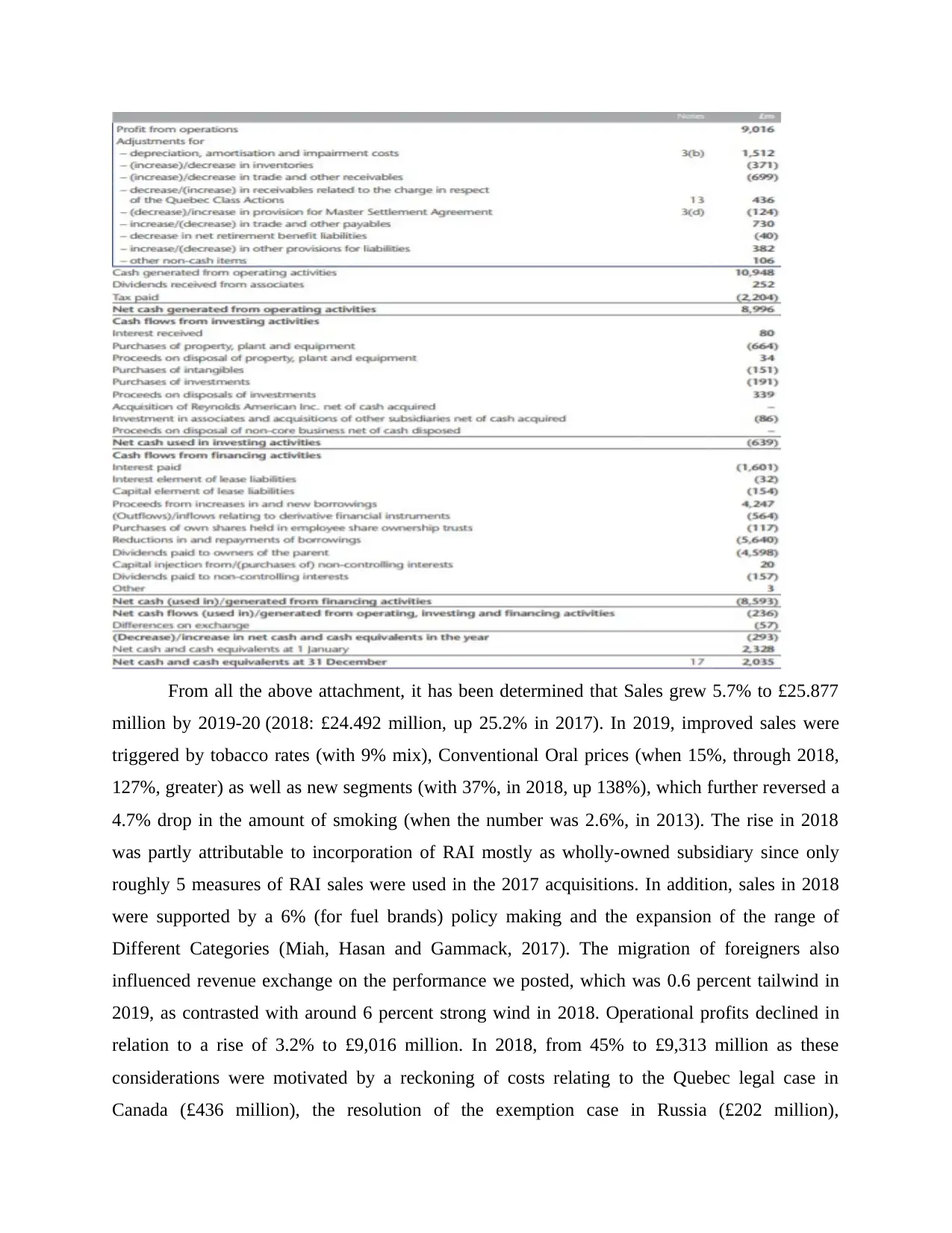

Cash flow statement

From all the above attachment, it has been determined that Sales grew 5.7% to £25.877

million by 2019-20 (2018: £24.492 million, up 25.2% in 2017). In 2019, improved sales were

triggered by tobacco rates (with 9% mix), Conventional Oral prices (when 15%, through 2018,

127%, greater) as well as new segments (with 37%, in 2018, up 138%), which further reversed a

4.7% drop in the amount of smoking (when the number was 2.6%, in 2013). The rise in 2018

was partly attributable to incorporation of RAI mostly as wholly-owned subsidiary since only

roughly 5 measures of RAI sales were used in the 2017 acquisitions. In addition, sales in 2018

were supported by a 6% (for fuel brands) policy making and the expansion of the range of

Different Categories (Miah, Hasan and Gammack, 2017). The migration of foreigners also

influenced revenue exchange on the performance we posted, which was 0.6 percent tailwind in

2019, as contrasted with around 6 percent strong wind in 2018. Operational profits declined in

relation to a rise of 3.2% to £9,016 million. In 2018, from 45% to £9,313 million as these

considerations were motivated by a reckoning of costs relating to the Quebec legal case in

Canada (£436 million), the resolution of the exemption case in Russia (£202 million),

million by 2019-20 (2018: £24.492 million, up 25.2% in 2017). In 2019, improved sales were

triggered by tobacco rates (with 9% mix), Conventional Oral prices (when 15%, through 2018,

127%, greater) as well as new segments (with 37%, in 2018, up 138%), which further reversed a

4.7% drop in the amount of smoking (when the number was 2.6%, in 2013). The rise in 2018

was partly attributable to incorporation of RAI mostly as wholly-owned subsidiary since only

roughly 5 measures of RAI sales were used in the 2017 acquisitions. In addition, sales in 2018

were supported by a 6% (for fuel brands) policy making and the expansion of the range of

Different Categories (Miah, Hasan and Gammack, 2017). The migration of foreigners also

influenced revenue exchange on the performance we posted, which was 0.6 percent tailwind in

2019, as contrasted with around 6 percent strong wind in 2018. Operational profits declined in

relation to a rise of 3.2% to £9,016 million. In 2018, from 45% to £9,313 million as these

considerations were motivated by a reckoning of costs relating to the Quebec legal case in

Canada (£436 million), the resolution of the exemption case in Russia (£202 million),

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

depreciation and damages of brands and like intangibles ($481 million), damages to Indonesian

goodwill (€172 million), other expenses of smoking including health cases (including the Engle

offspring) in the sum of £236 million Development in 2018 stemmed from RAI participation in

mid-2017.

3. Kind of Budget

From the annual report, it has been observed that, From 1 April 2019, the chief executive’s fee

expanded around £685,000 to £698,000. The financial compensation Committee has decided that

the Chairman 's compensation would be £718,940 (+3.100) in line with the amount of wage

rewards given to UK workers in compliance with such a budget rise of 2,5 percent by 1 April

2020. The estimation of the valuation of use uses cash flows mostly on basis of comprehensive

brand budgets drawn out by executives using estimated sales volumes, profits and estimated

brand viability that span a time period of five years to ten years and are then perpetualised. The

company expenditures are assigned organisational expenses focused on, where applicable, or

volume-based specific budgets. Company government gained through experience, specific

industry and brand patterns and price and expense forecasts, has defined nominal discount rates,

varying from 8.32 to 9.02%, including tall-term rates of inflation ranging from 1.0 percent and

0.75 percent. There has been no sign of disability during the implementation of a sufficient set of

sensitivities (Eloquin, 2016).

4. Pricing policy

This report is to mainly aim the pricing strategy of tobacco industries and to examine how the

BAT pricing segments its cigarettes by price and to identify how price, volume and revenue

differ by this price segment. BAT taxes generate a huge amount of funds for many governments

and also become an important source for their revenue (Howard, 2016). By raising the taxes or

the high taxation rates can be helpful in supporting the particular pricing policies of the tobacco

companies and its surprising that when economic crises faced by the country affects the nation’s

budget the high taxes on tobacco products are often been considered as the sufficient source of

income. However, the effectiveness of BAT tax policies depends on the pricing policies of the

companies. The companies can select to take up the increase tax so that it is not passed to the

consumers as an increase in price which is undermining the effect of tax policy this is an act

which is known as under shifting or to pass it to the consumers or to increases the price on the

goodwill (€172 million), other expenses of smoking including health cases (including the Engle

offspring) in the sum of £236 million Development in 2018 stemmed from RAI participation in

mid-2017.

3. Kind of Budget

From the annual report, it has been observed that, From 1 April 2019, the chief executive’s fee

expanded around £685,000 to £698,000. The financial compensation Committee has decided that

the Chairman 's compensation would be £718,940 (+3.100) in line with the amount of wage

rewards given to UK workers in compliance with such a budget rise of 2,5 percent by 1 April

2020. The estimation of the valuation of use uses cash flows mostly on basis of comprehensive

brand budgets drawn out by executives using estimated sales volumes, profits and estimated

brand viability that span a time period of five years to ten years and are then perpetualised. The

company expenditures are assigned organisational expenses focused on, where applicable, or

volume-based specific budgets. Company government gained through experience, specific

industry and brand patterns and price and expense forecasts, has defined nominal discount rates,

varying from 8.32 to 9.02%, including tall-term rates of inflation ranging from 1.0 percent and

0.75 percent. There has been no sign of disability during the implementation of a sufficient set of

sensitivities (Eloquin, 2016).

4. Pricing policy

This report is to mainly aim the pricing strategy of tobacco industries and to examine how the

BAT pricing segments its cigarettes by price and to identify how price, volume and revenue

differ by this price segment. BAT taxes generate a huge amount of funds for many governments

and also become an important source for their revenue (Howard, 2016). By raising the taxes or

the high taxation rates can be helpful in supporting the particular pricing policies of the tobacco

companies and its surprising that when economic crises faced by the country affects the nation’s

budget the high taxes on tobacco products are often been considered as the sufficient source of

income. However, the effectiveness of BAT tax policies depends on the pricing policies of the

companies. The companies can select to take up the increase tax so that it is not passed to the

consumers as an increase in price which is undermining the effect of tax policy this is an act

which is known as under shifting or to pass it to the consumers or to increases the price on the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

top of tax policy and this is a practice known as over shifting which had the effect on both tax

increase and the industrial revenue (Gunter and Mills, 2017).

CONCLUSION

In the last of report, it has been founded that throughout the budget details used during the

goodwill of BAT as the RAI deficit testing, the product estimates used throughout the

profitability-in-use measurements have been merged.

increase and the industrial revenue (Gunter and Mills, 2017).

CONCLUSION

In the last of report, it has been founded that throughout the budget details used during the

goodwill of BAT as the RAI deficit testing, the product estimates used throughout the

profitability-in-use measurements have been merged.

REFERENCES

Books and Journals

Czerniawska, F., 2016. Management Consultancy: what next?. Springer.

Eloquin, X., 2016. Systems-psychodynamics in schools: a framework for EPs undertaking

organisational consultancy. Educational Psychology in Practice, 32(2), pp.163-179.

Gunter, H. M. and Mills, C., 2017. Consultants and consultancy: The case of education.

Switzerland: Springer International Publishing.

Howard, W. ed., 2016. The practice of public relations. Elsevier.

Miah, S. J., Hasan, J. and Gammack, J. G., 2017. On-cloud healthcare clinic: an e-health

consultancy approach for remote communities in a developing country. Telematics and

Informatics, 34(1), pp.311-322.

Online

Annual report of BAT. 2019. [Online] Available Through:

< https://www.bat.com/ar/2019/pdf/BAT_Annual_Report_and_Form_20-F_2019.pdf >.

Books and Journals

Czerniawska, F., 2016. Management Consultancy: what next?. Springer.

Eloquin, X., 2016. Systems-psychodynamics in schools: a framework for EPs undertaking

organisational consultancy. Educational Psychology in Practice, 32(2), pp.163-179.

Gunter, H. M. and Mills, C., 2017. Consultants and consultancy: The case of education.

Switzerland: Springer International Publishing.

Howard, W. ed., 2016. The practice of public relations. Elsevier.

Miah, S. J., Hasan, J. and Gammack, J. G., 2017. On-cloud healthcare clinic: an e-health

consultancy approach for remote communities in a developing country. Telematics and

Informatics, 34(1), pp.311-322.

Online

Annual report of BAT. 2019. [Online] Available Through:

< https://www.bat.com/ar/2019/pdf/BAT_Annual_Report_and_Form_20-F_2019.pdf >.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.