Financial Analysis: Working Capital Policy Report of Barclays PLC

VerifiedAdded on 2019/12/28

|7

|1134

|77

Report

AI Summary

This report provides an analysis of Barclays Bank's working capital policy, focusing on the management of debtors (trade receivables) and cash & bank balances. The report examines the trends in receivables from 2011 to 2015, highlighting fluctuations and their implications on liquidity and credit risk. It also assesses the cash and bank balance trends, noting a continuous reduction and its potential adverse impacts on the company's quick ratio. The report provides recommendations for maintaining stability in financial values, balancing profitability with liquidity, and managing receivables to mitigate the risk of bad debts. The analysis is supported by data from Barclays' annual reports and other financial resources, offering insights into the bank's strategies and financial performance.

Working Capital

Policy Report

Policy Report

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

Working Capital Policy Report........................................................................................................3

Sundry Debtor of Barclay Bank ..................................................................................................3

Cash & Bank Balance of Barclays PLC......................................................................................3

References........................................................................................................................................4

2

Working Capital Policy Report........................................................................................................3

Sundry Debtor of Barclay Bank ..................................................................................................3

Cash & Bank Balance of Barclays PLC......................................................................................3

References........................................................................................................................................4

2

WORKING CAPITAL POLICY REPORT

Barclays is engaged in providing banking and financial services to the public. It is

universal bank as they operate in retail, wholesale and investment banking. Company is

operating in more than 50 countries and territories with the 48 million customers. Present

working capital policy report is focused on evaluation of currents assets of the bank mainly

debtors and cash.

Sundry Debtor of Barclay Bank

Trade receivables are significant part of the working capital because it consists major

portion of working capital. High debtors can create issue of excessive blockage of funds while

low debtors makes reduction in the liquidity of the company. Due to this aspect, it is important

to manage debtors

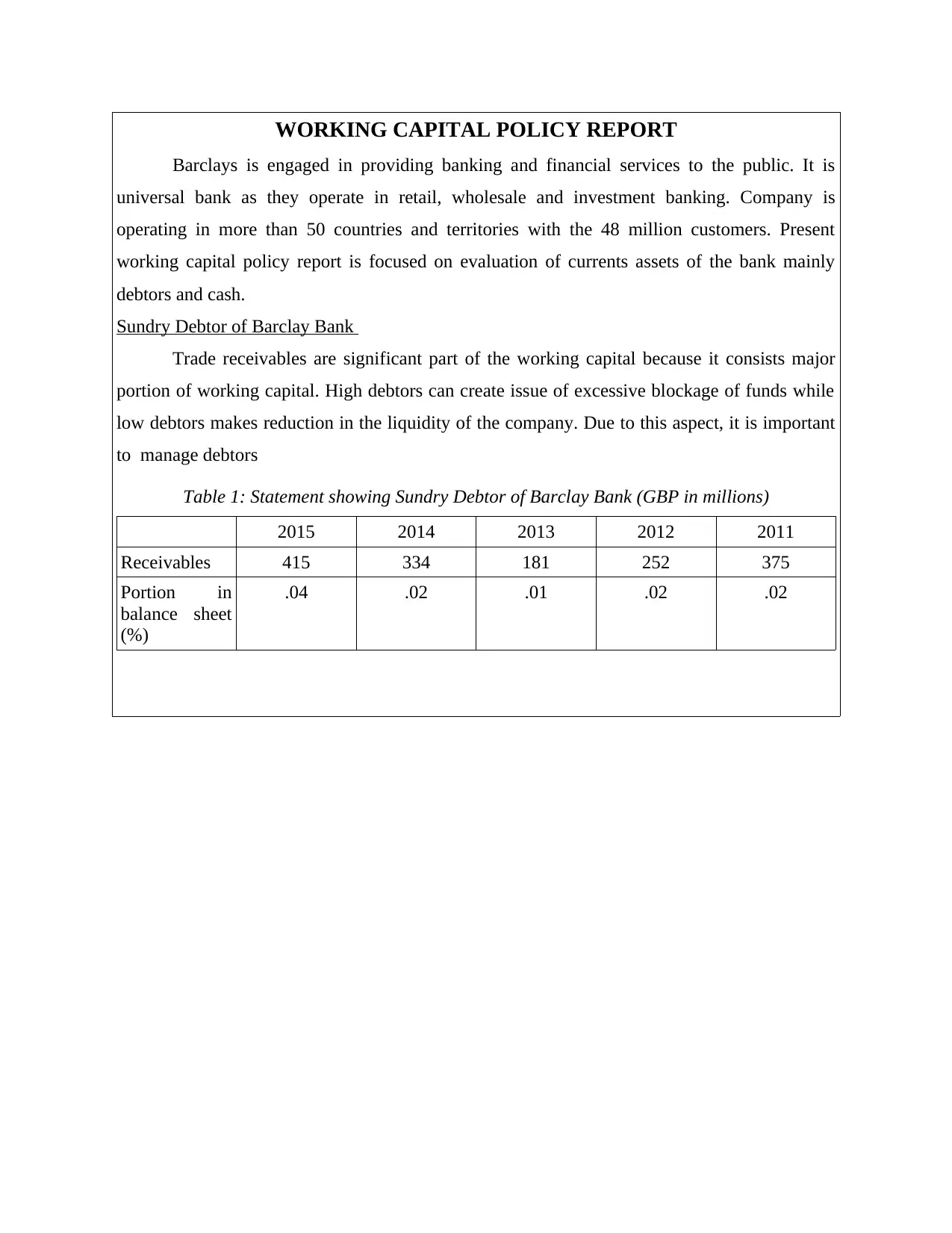

Table 1: Statement showing Sundry Debtor of Barclay Bank (GBP in millions)

2015 2014 2013 2012 2011

Receivables 415 334 181 252 375

Portion in

balance sheet

(%)

.04 .02 .01 .02 .02

Barclays is engaged in providing banking and financial services to the public. It is

universal bank as they operate in retail, wholesale and investment banking. Company is

operating in more than 50 countries and territories with the 48 million customers. Present

working capital policy report is focused on evaluation of currents assets of the bank mainly

debtors and cash.

Sundry Debtor of Barclay Bank

Trade receivables are significant part of the working capital because it consists major

portion of working capital. High debtors can create issue of excessive blockage of funds while

low debtors makes reduction in the liquidity of the company. Due to this aspect, it is important

to manage debtors

Table 1: Statement showing Sundry Debtor of Barclay Bank (GBP in millions)

2015 2014 2013 2012 2011

Receivables 415 334 181 252 375

Portion in

balance sheet

(%)

.04 .02 .01 .02 .02

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

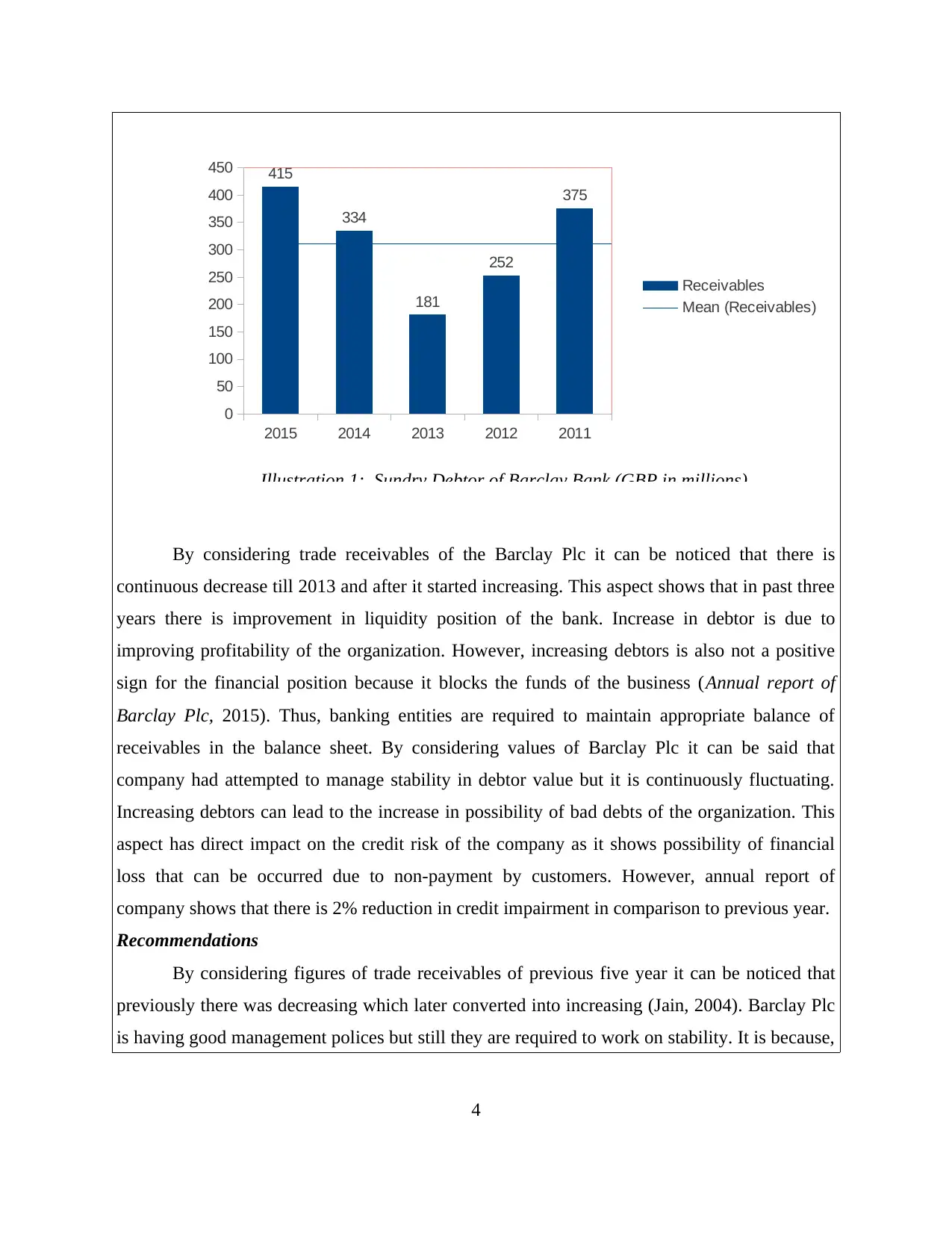

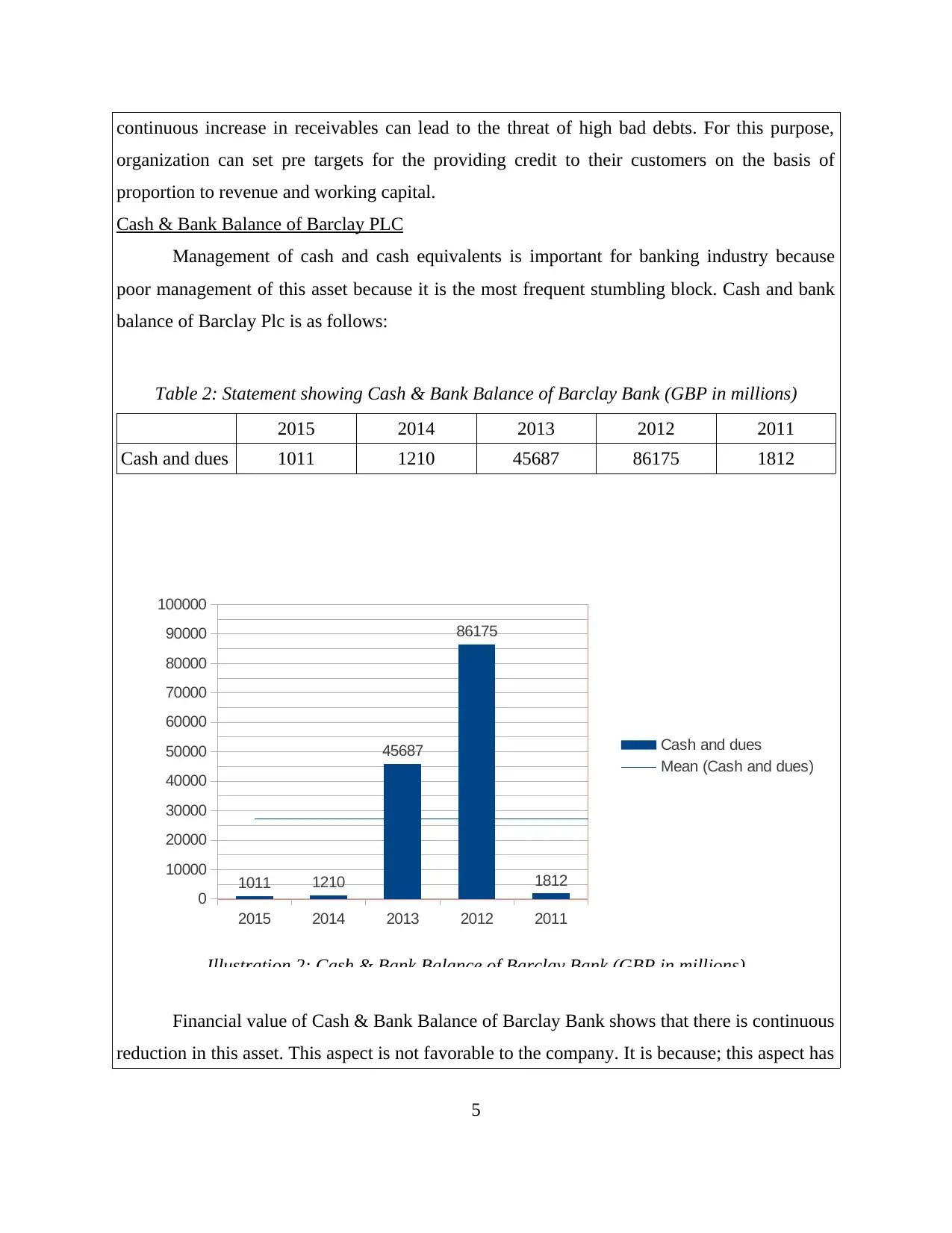

By considering trade receivables of the Barclay Plc it can be noticed that there is

continuous decrease till 2013 and after it started increasing. This aspect shows that in past three

years there is improvement in liquidity position of the bank. Increase in debtor is due to

improving profitability of the organization. However, increasing debtors is also not a positive

sign for the financial position because it blocks the funds of the business (Annual report of

Barclay Plc, 2015). Thus, banking entities are required to maintain appropriate balance of

receivables in the balance sheet. By considering values of Barclay Plc it can be said that

company had attempted to manage stability in debtor value but it is continuously fluctuating.

Increasing debtors can lead to the increase in possibility of bad debts of the organization. This

aspect has direct impact on the credit risk of the company as it shows possibility of financial

loss that can be occurred due to non-payment by customers. However, annual report of

company shows that there is 2% reduction in credit impairment in comparison to previous year.

Recommendations

By considering figures of trade receivables of previous five year it can be noticed that

previously there was decreasing which later converted into increasing (Jain, 2004). Barclay Plc

is having good management polices but still they are required to work on stability. It is because,

4

2015 2014 2013 2012 2011

0

50

100

150

200

250

300

350

400

450 415

334

181

252

375

Receivables

Mean (Receivables)

Illustration 1: Sundry Debtor of Barclay Bank (GBP in millions)

continuous decrease till 2013 and after it started increasing. This aspect shows that in past three

years there is improvement in liquidity position of the bank. Increase in debtor is due to

improving profitability of the organization. However, increasing debtors is also not a positive

sign for the financial position because it blocks the funds of the business (Annual report of

Barclay Plc, 2015). Thus, banking entities are required to maintain appropriate balance of

receivables in the balance sheet. By considering values of Barclay Plc it can be said that

company had attempted to manage stability in debtor value but it is continuously fluctuating.

Increasing debtors can lead to the increase in possibility of bad debts of the organization. This

aspect has direct impact on the credit risk of the company as it shows possibility of financial

loss that can be occurred due to non-payment by customers. However, annual report of

company shows that there is 2% reduction in credit impairment in comparison to previous year.

Recommendations

By considering figures of trade receivables of previous five year it can be noticed that

previously there was decreasing which later converted into increasing (Jain, 2004). Barclay Plc

is having good management polices but still they are required to work on stability. It is because,

4

2015 2014 2013 2012 2011

0

50

100

150

200

250

300

350

400

450 415

334

181

252

375

Receivables

Mean (Receivables)

Illustration 1: Sundry Debtor of Barclay Bank (GBP in millions)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

continuous increase in receivables can lead to the threat of high bad debts. For this purpose,

organization can set pre targets for the providing credit to their customers on the basis of

proportion to revenue and working capital.

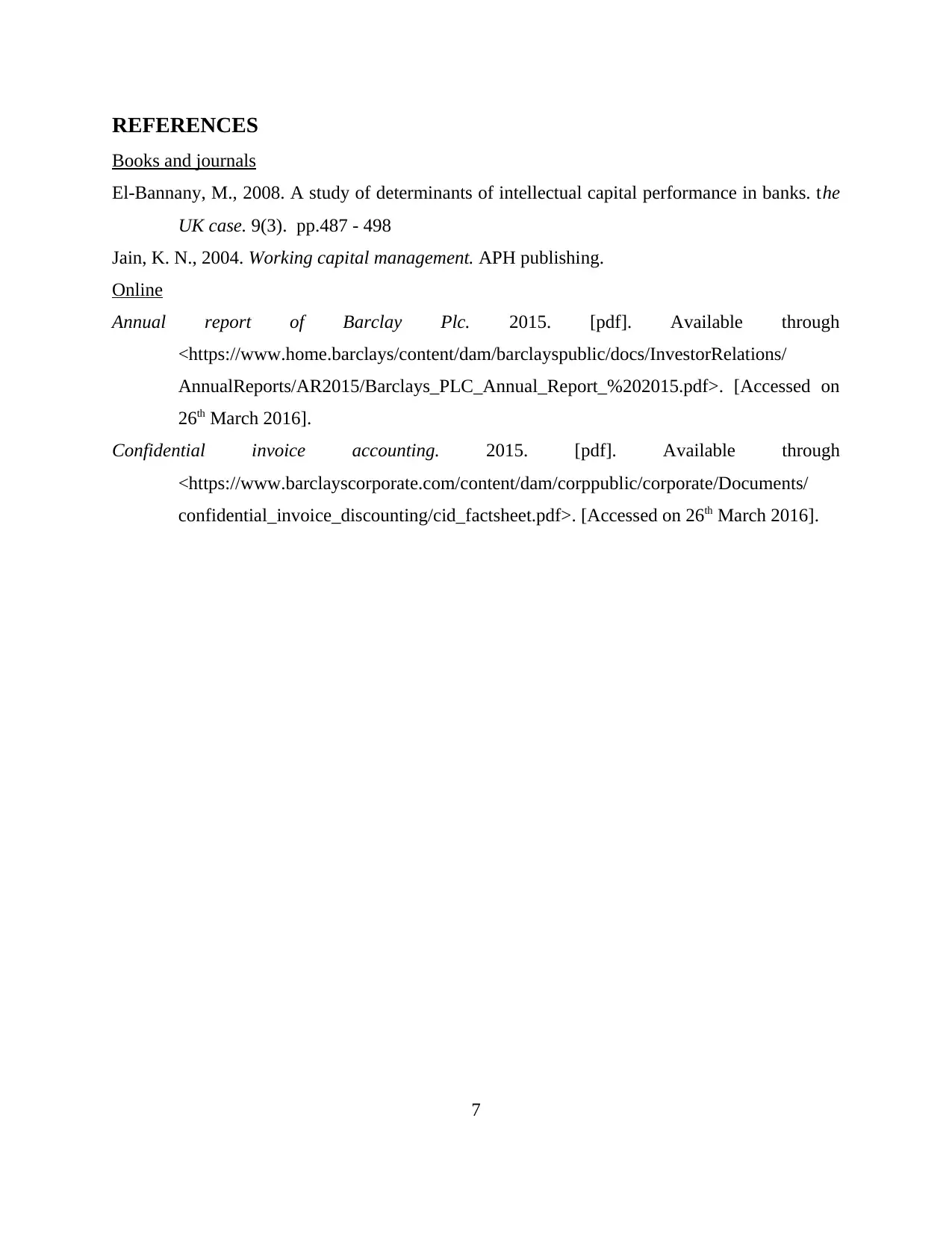

Cash & Bank Balance of Barclay PLC

Management of cash and cash equivalents is important for banking industry because

poor management of this asset because it is the most frequent stumbling block. Cash and bank

balance of Barclay Plc is as follows:

Table 2: Statement showing Cash & Bank Balance of Barclay Bank (GBP in millions)

2015 2014 2013 2012 2011

Cash and dues 1011 1210 45687 86175 1812

Financial value of Cash & Bank Balance of Barclay Bank shows that there is continuous

reduction in this asset. This aspect is not favorable to the company. It is because; this aspect has

5

2015 2014 2013 2012 2011

0

10000

20000

30000

40000

50000

60000

70000

80000

90000

100000

1011 1210

45687

86175

1812

Cash and dues

Mean (Cash and dues)

Illustration 2: Cash & Bank Balance of Barclay Bank (GBP in millions)

organization can set pre targets for the providing credit to their customers on the basis of

proportion to revenue and working capital.

Cash & Bank Balance of Barclay PLC

Management of cash and cash equivalents is important for banking industry because

poor management of this asset because it is the most frequent stumbling block. Cash and bank

balance of Barclay Plc is as follows:

Table 2: Statement showing Cash & Bank Balance of Barclay Bank (GBP in millions)

2015 2014 2013 2012 2011

Cash and dues 1011 1210 45687 86175 1812

Financial value of Cash & Bank Balance of Barclay Bank shows that there is continuous

reduction in this asset. This aspect is not favorable to the company. It is because; this aspect has

5

2015 2014 2013 2012 2011

0

10000

20000

30000

40000

50000

60000

70000

80000

90000

100000

1011 1210

45687

86175

1812

Cash and dues

Mean (Cash and dues)

Illustration 2: Cash & Bank Balance of Barclay Bank (GBP in millions)

adverse impact on the quick ratio of company. Furthermore, it can create server threats to

organization in future period (Annual report of Barclay Plc, 2015). However, annual report of

Barclay bank shows that corporate had performed strongly through improvement in lending and

cash management. In accordance with the financial strategy of bank they are planning to reduce

their cash balance in order to prevent blocking of funds (Confidential invoice accounting,

2015). However, such significant reduction in cash and bank balance is not prudent. However,

company is investing their cash in Commercial mortgages and business loans in global capital

market where there is less risk. In addition to this, they are also using their cash for Asset and

lease finance, trade and supplier finance and working capital solutions in order to earn high

revenues through interest income. By this approach, they are able to make increase in their

profitability but their liquidity is adversely affected.

Recommendations

In accordance with the trend of cash and bank balance of the organization they are

recommended to maintain stability in their financial value. It is because, changing policies can

create severe threat to their liquidity and working capital efficiencies. By considering their

present strategies, it can be noticed that banking entity is focused on improving profitability

instead to managing balance between their current assets (El‐Bannany, 2008). Due to this

aspect, they are required to focus on both profitability and liquidity.

6

organization in future period (Annual report of Barclay Plc, 2015). However, annual report of

Barclay bank shows that corporate had performed strongly through improvement in lending and

cash management. In accordance with the financial strategy of bank they are planning to reduce

their cash balance in order to prevent blocking of funds (Confidential invoice accounting,

2015). However, such significant reduction in cash and bank balance is not prudent. However,

company is investing their cash in Commercial mortgages and business loans in global capital

market where there is less risk. In addition to this, they are also using their cash for Asset and

lease finance, trade and supplier finance and working capital solutions in order to earn high

revenues through interest income. By this approach, they are able to make increase in their

profitability but their liquidity is adversely affected.

Recommendations

In accordance with the trend of cash and bank balance of the organization they are

recommended to maintain stability in their financial value. It is because, changing policies can

create severe threat to their liquidity and working capital efficiencies. By considering their

present strategies, it can be noticed that banking entity is focused on improving profitability

instead to managing balance between their current assets (El‐Bannany, 2008). Due to this

aspect, they are required to focus on both profitability and liquidity.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Books and journals

El‐Bannany, M., 2008. A study of determinants of intellectual capital performance in banks. the

UK case. 9(3). pp.487 - 498

Jain, K. N., 2004. Working capital management. APH publishing.

Online

Annual report of Barclay Plc. 2015. [pdf]. Available through

<https://www.home.barclays/content/dam/barclayspublic/docs/InvestorRelations/

AnnualReports/AR2015/Barclays_PLC_Annual_Report_%202015.pdf>. [Accessed on

26th March 2016].

Confidential invoice accounting. 2015. [pdf]. Available through

<https://www.barclayscorporate.com/content/dam/corppublic/corporate/Documents/

confidential_invoice_discounting/cid_factsheet.pdf>. [Accessed on 26th March 2016].

7

Books and journals

El‐Bannany, M., 2008. A study of determinants of intellectual capital performance in banks. the

UK case. 9(3). pp.487 - 498

Jain, K. N., 2004. Working capital management. APH publishing.

Online

Annual report of Barclay Plc. 2015. [pdf]. Available through

<https://www.home.barclays/content/dam/barclayspublic/docs/InvestorRelations/

AnnualReports/AR2015/Barclays_PLC_Annual_Report_%202015.pdf>. [Accessed on

26th March 2016].

Confidential invoice accounting. 2015. [pdf]. Available through

<https://www.barclayscorporate.com/content/dam/corppublic/corporate/Documents/

confidential_invoice_discounting/cid_factsheet.pdf>. [Accessed on 26th March 2016].

7

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.