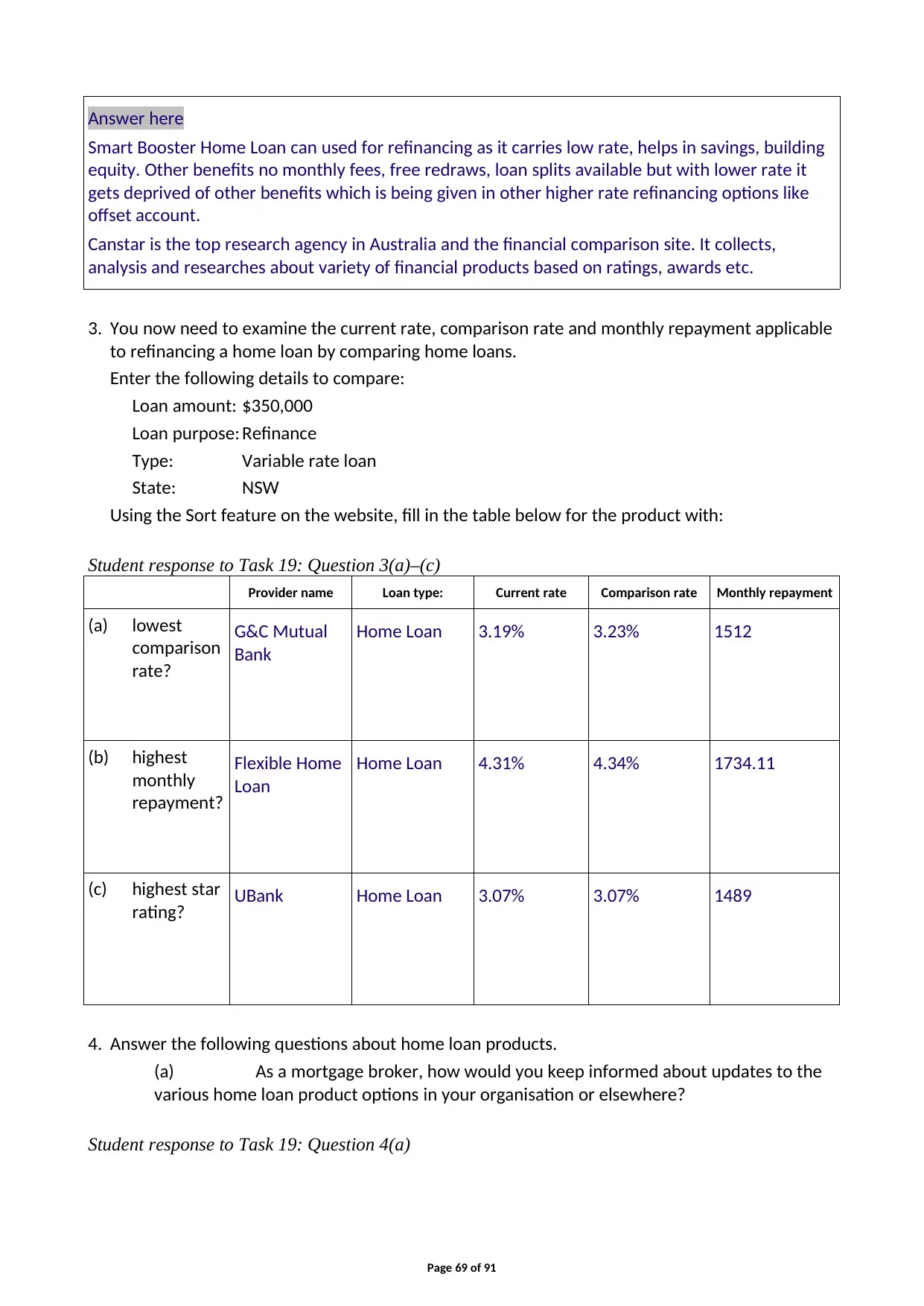

Case Study 1: Philip and Jennifer Brown

VerifiedAdded on 2023/01/07

|91

|19289

|44

AI Summary

This case study focuses on the financial situation and loan requirements of Philip and Jennifer Brown, a young couple looking to buy their first home. It includes details of the property they wish to purchase and their financial and employment information.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Written

CIVMB_AS_v5A2

CIVMB_AS_v5A2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Certificate IV in Finance and Mortgage Broking

(CIVMB_AS_v5A2)

Page 2 of 91

(CIVMB_AS_v5A2)

Page 2 of 91

Student identification (student to complete)

Please complete the fields shaded grey.

Page 3 of 91

Please complete the fields shaded grey.

Page 3 of 91

Written assignment overall result (assessor to complete)

Page 4 of 91

Page 4 of 91

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

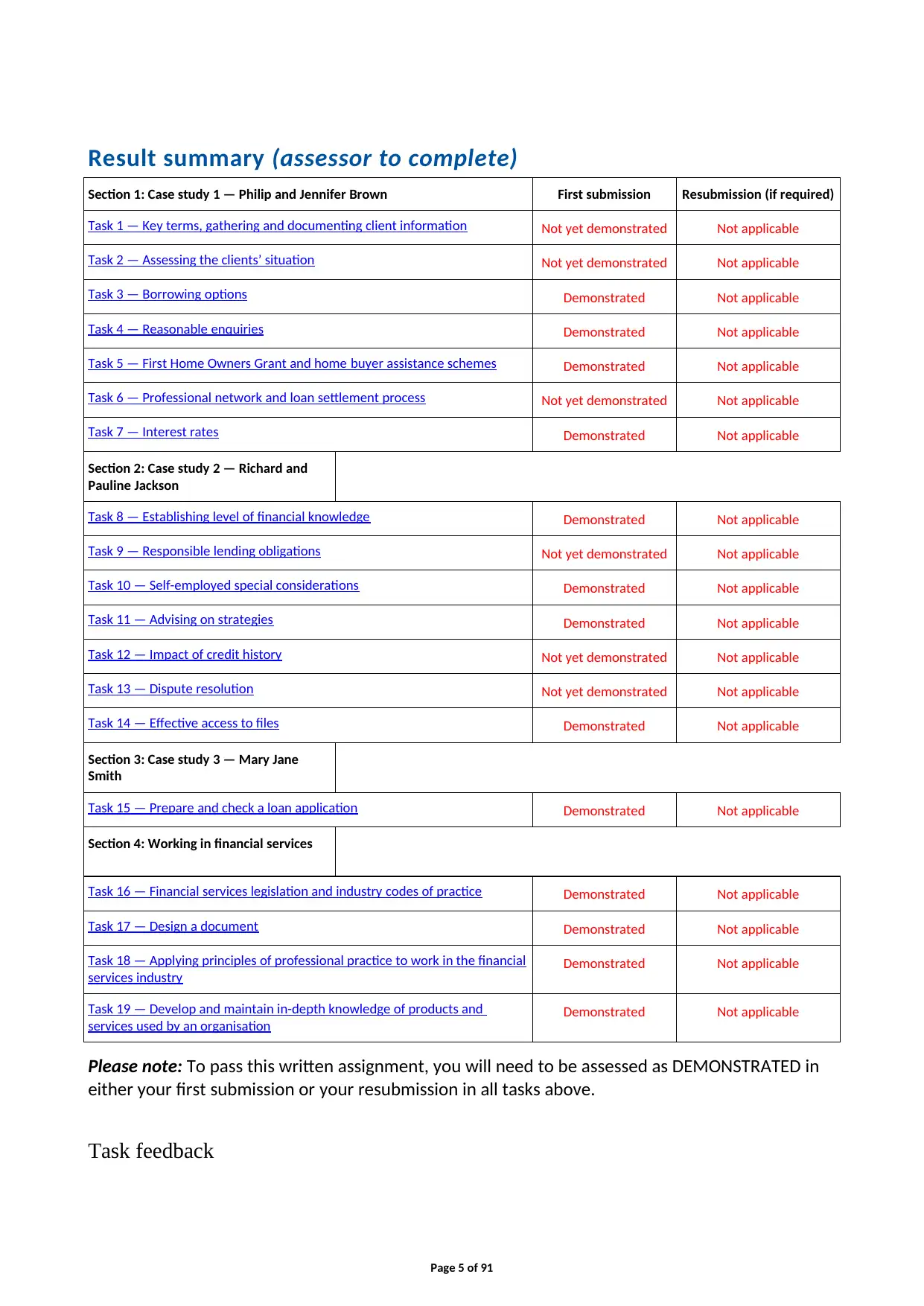

Result summary (assessor to complete)

Section 1: Case study 1 — Philip and Jennifer Brown First submission Resubmission (if required)

Task 1 — Key terms, gathering and documenting client information Not yet demonstrated Not applicable

Task 2 — Assessing the clients’ situation Not yet demonstrated Not applicable

Task 3 — Borrowing options Demonstrated Not applicable

Task 4 — Reasonable enquiries Demonstrated Not applicable

Task 5 — First Home Owners Grant and home buyer assistance schemes Demonstrated Not applicable

Task 6 — Professional network and loan settlement process Not yet demonstrated Not applicable

Task 7 — Interest rates Demonstrated Not applicable

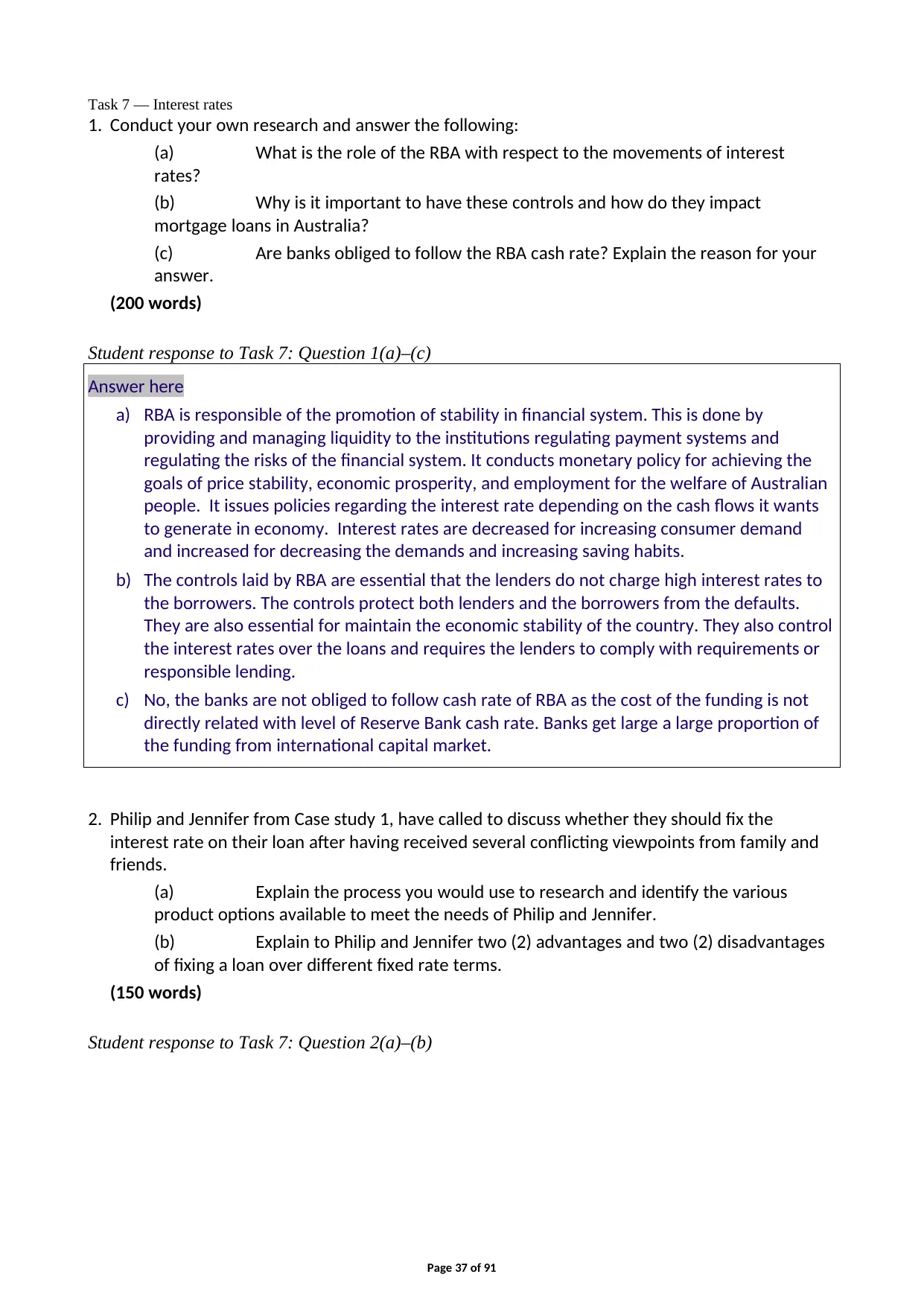

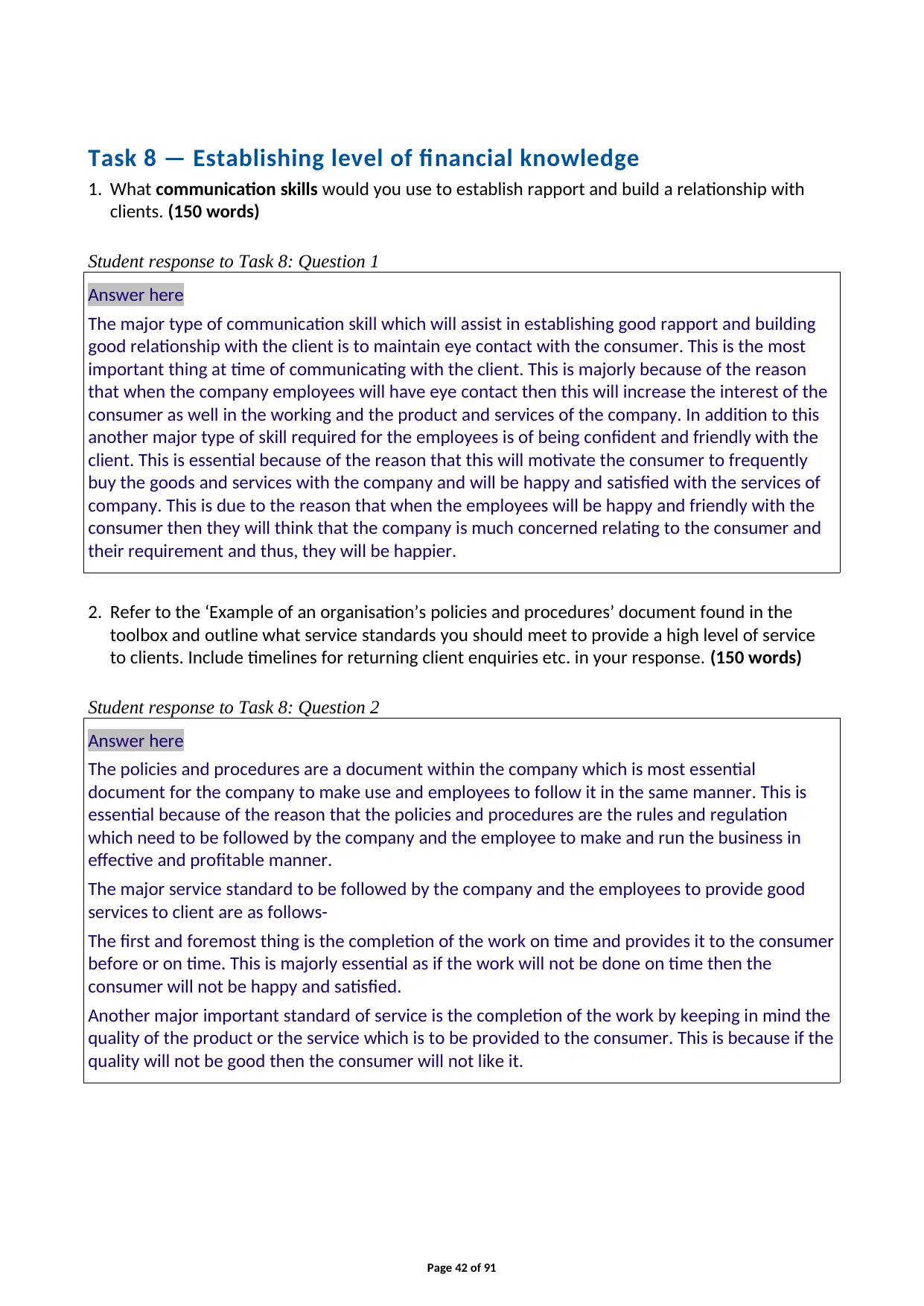

Section 2: Case study 2 — Richard and

Pauline Jackson

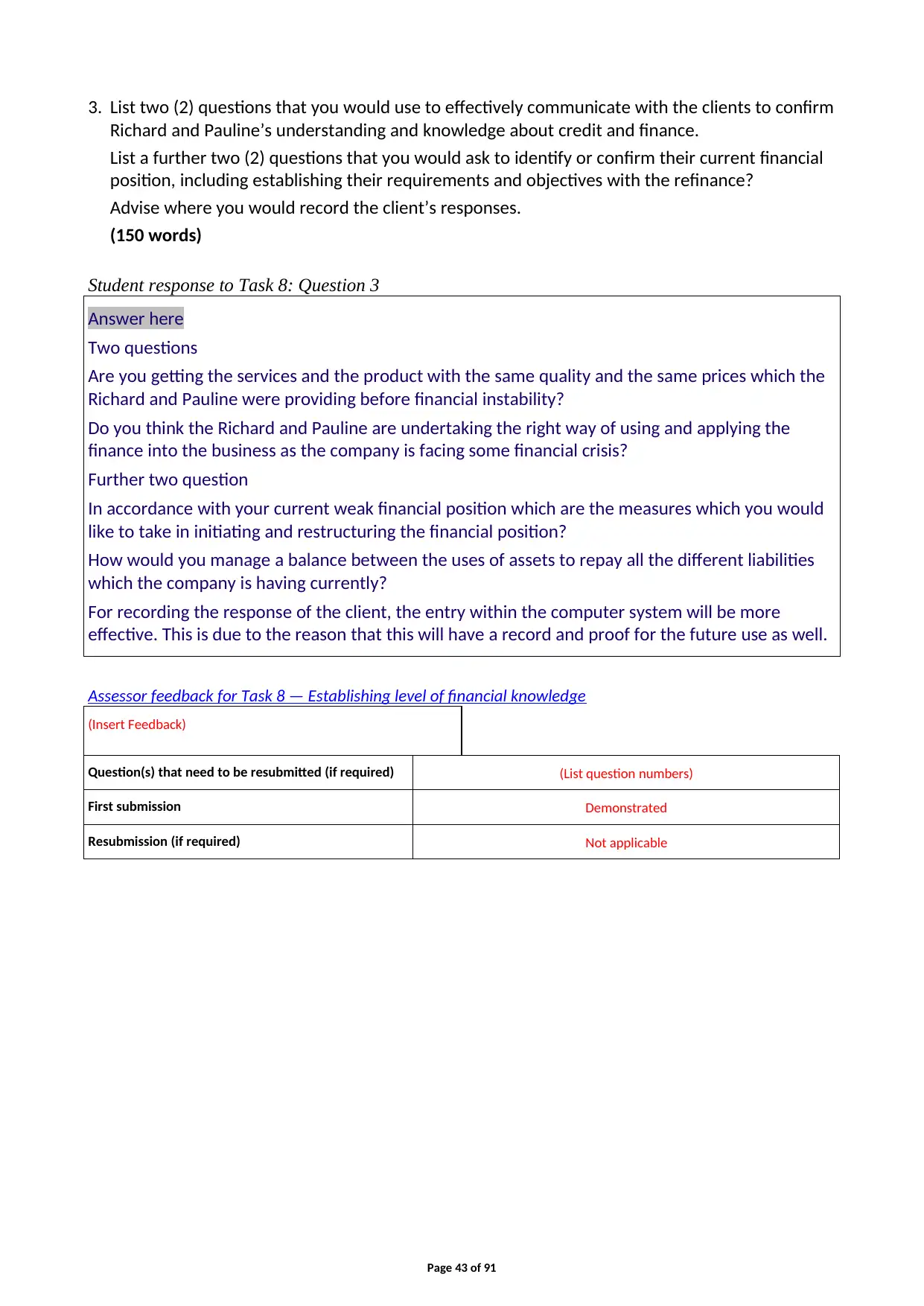

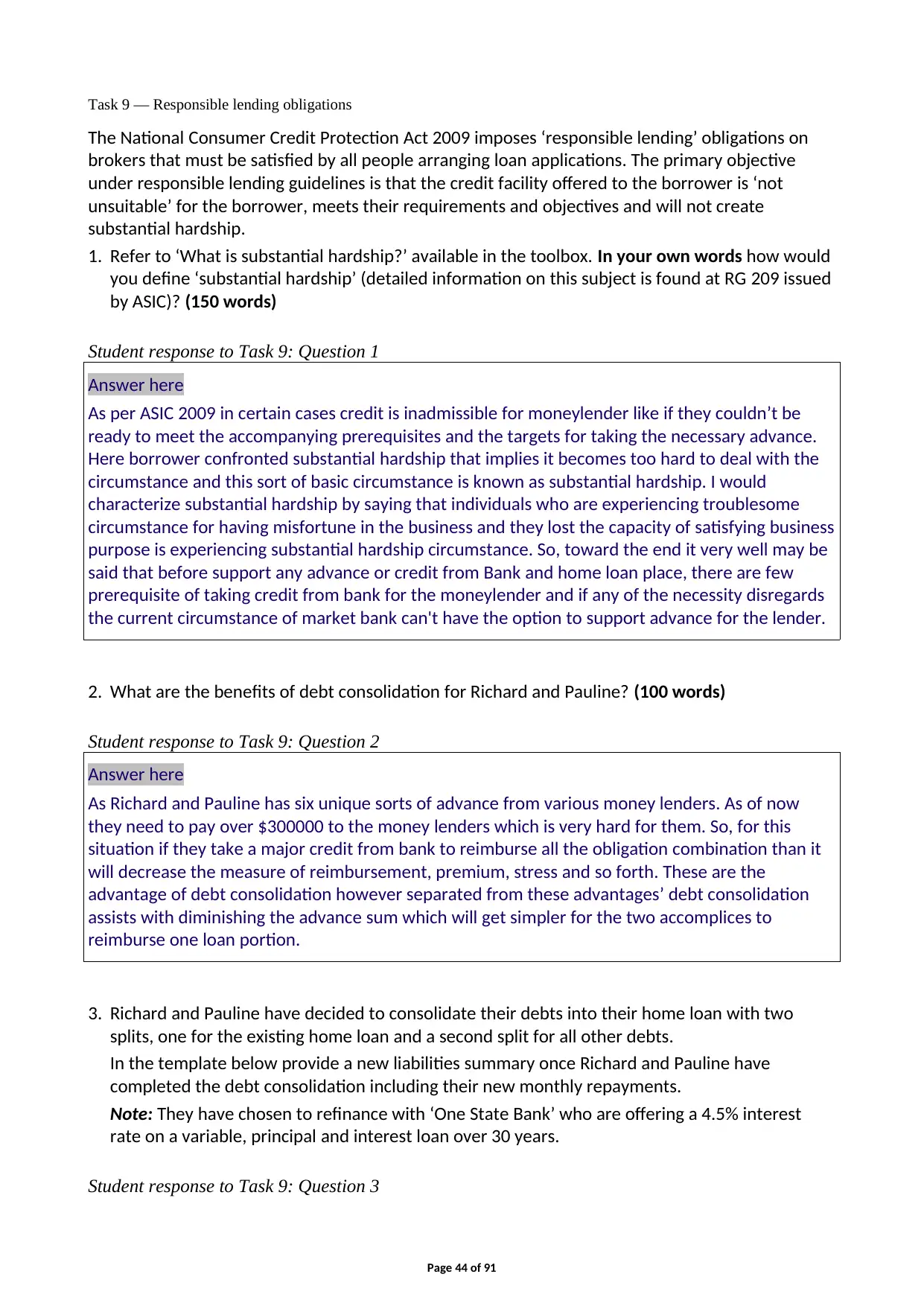

Task 8 — Establishing level of financial knowledge Demonstrated Not applicable

Task 9 — Responsible lending obligations Not yet demonstrated Not applicable

Task 10 — Self-employed special considerations Demonstrated Not applicable

Task 11 — Advising on strategies Demonstrated Not applicable

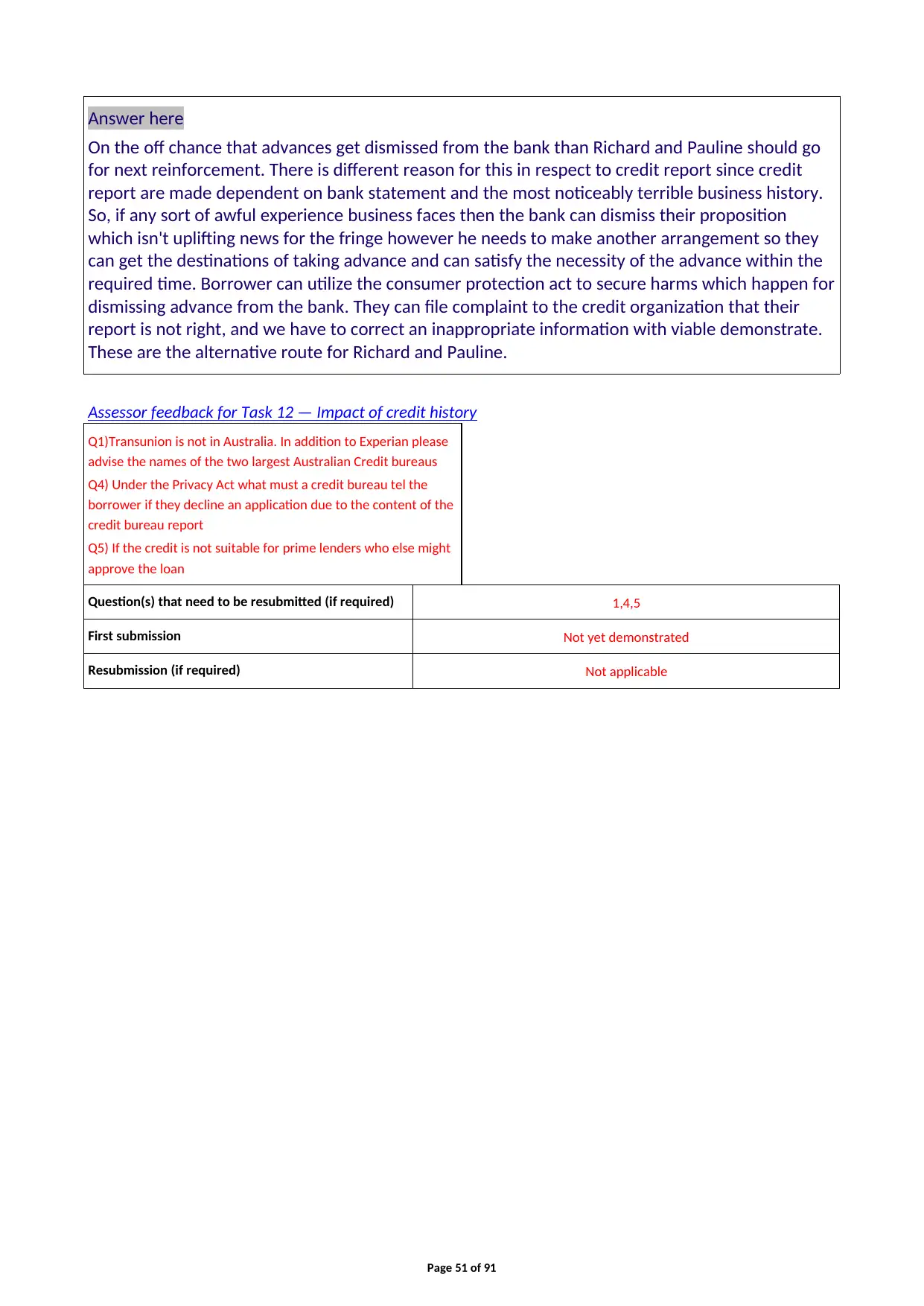

Task 12 — Impact of credit history Not yet demonstrated Not applicable

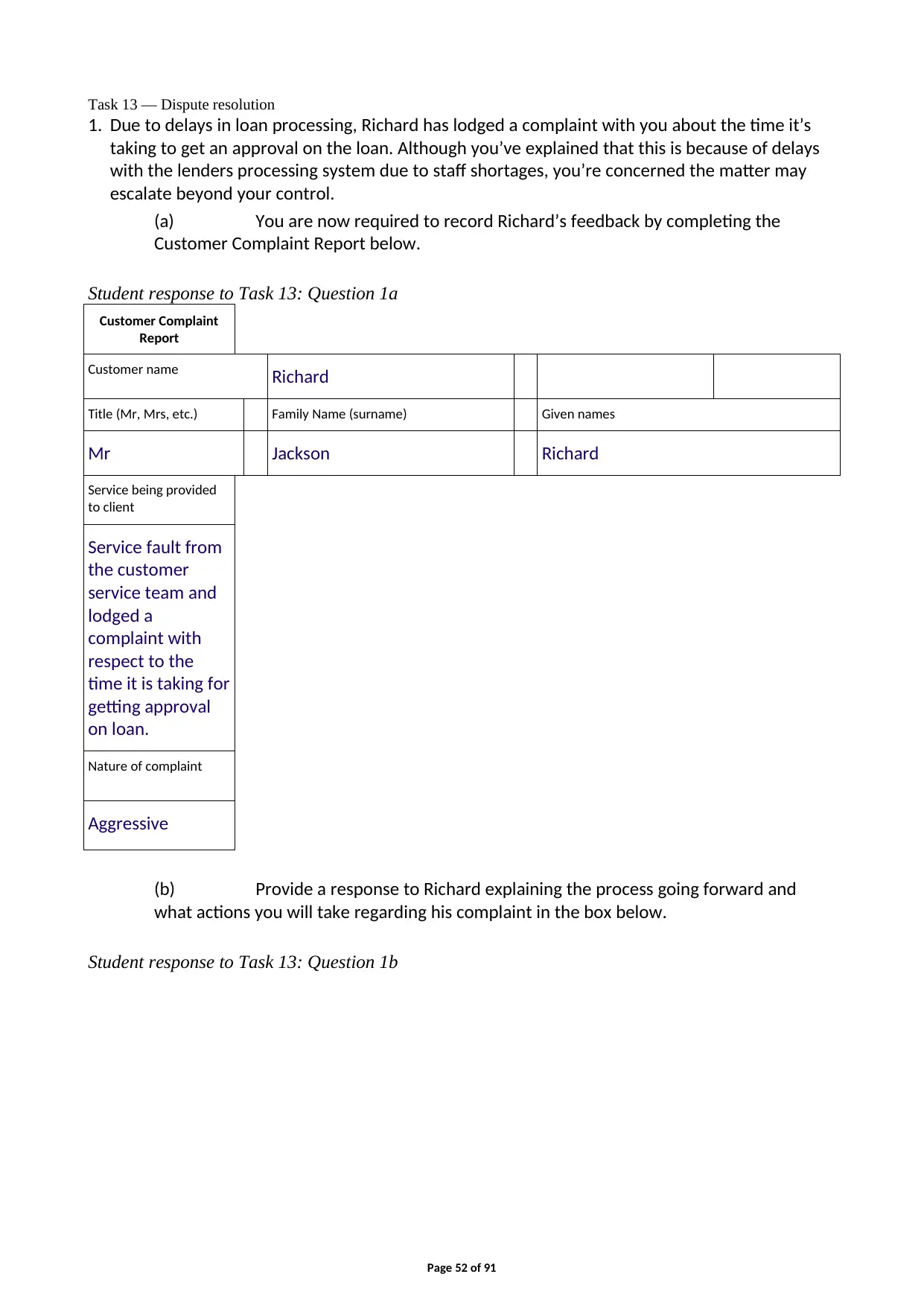

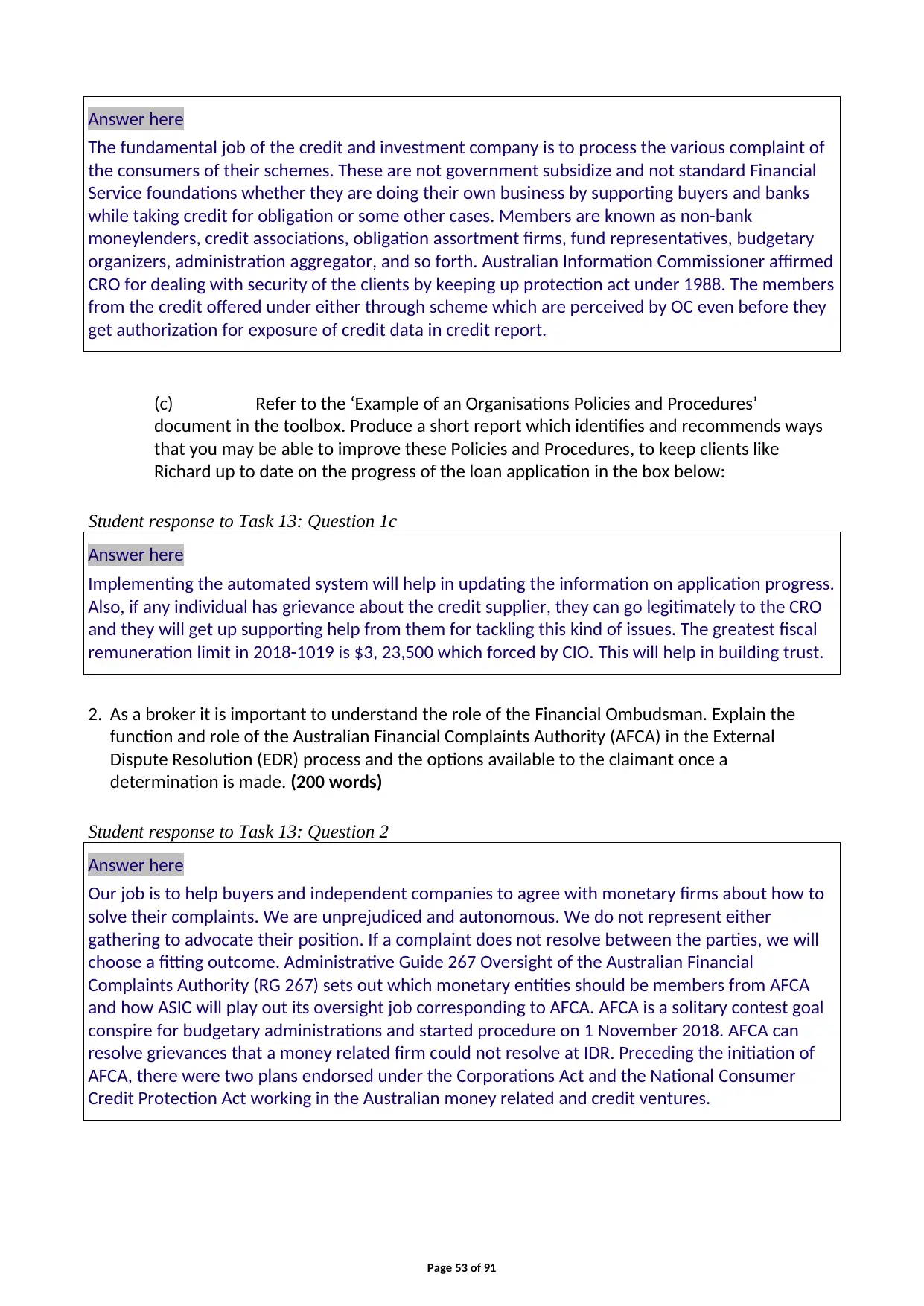

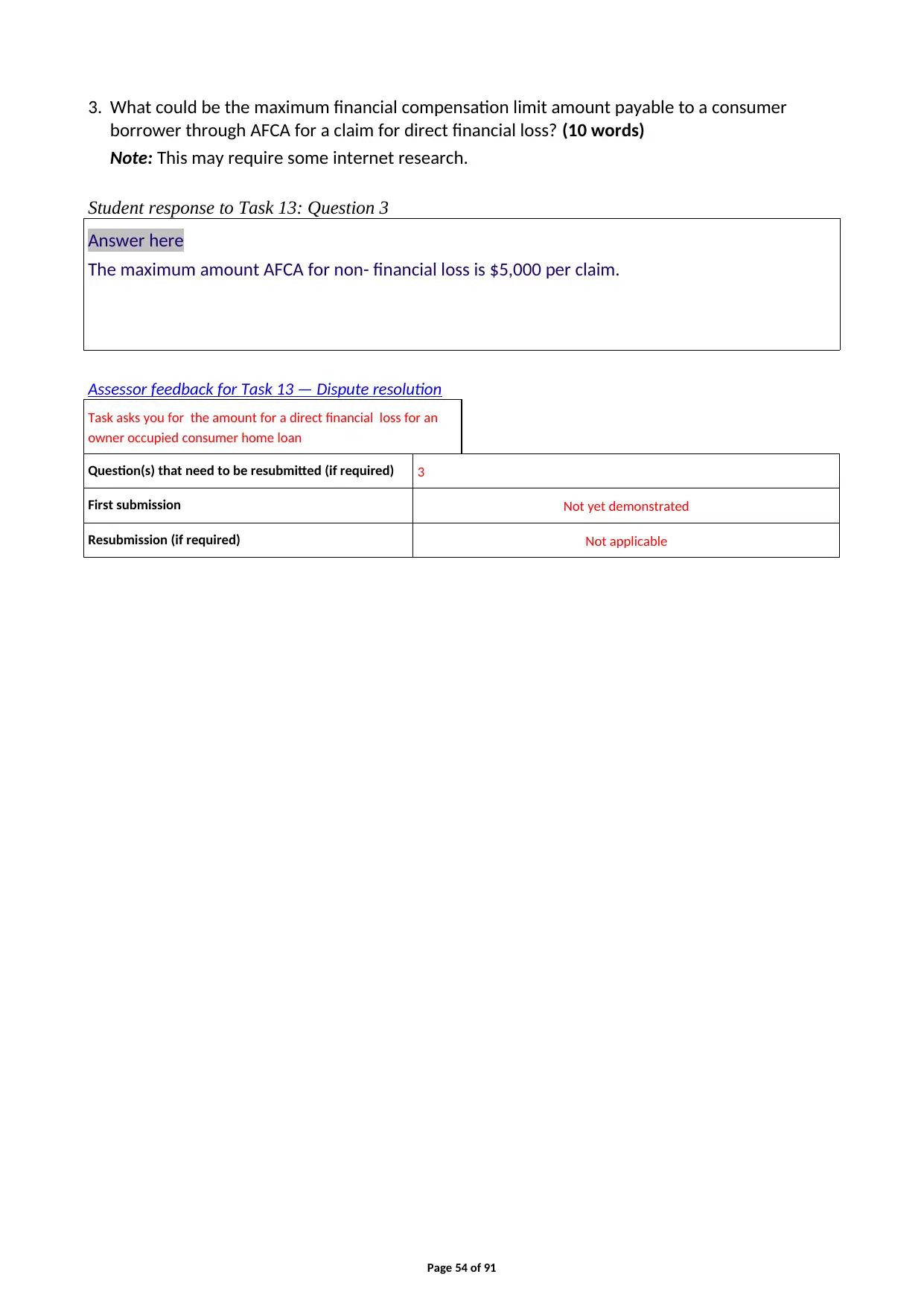

Task 13 — Dispute resolution Not yet demonstrated Not applicable

Task 14 — Effective access to files Demonstrated Not applicable

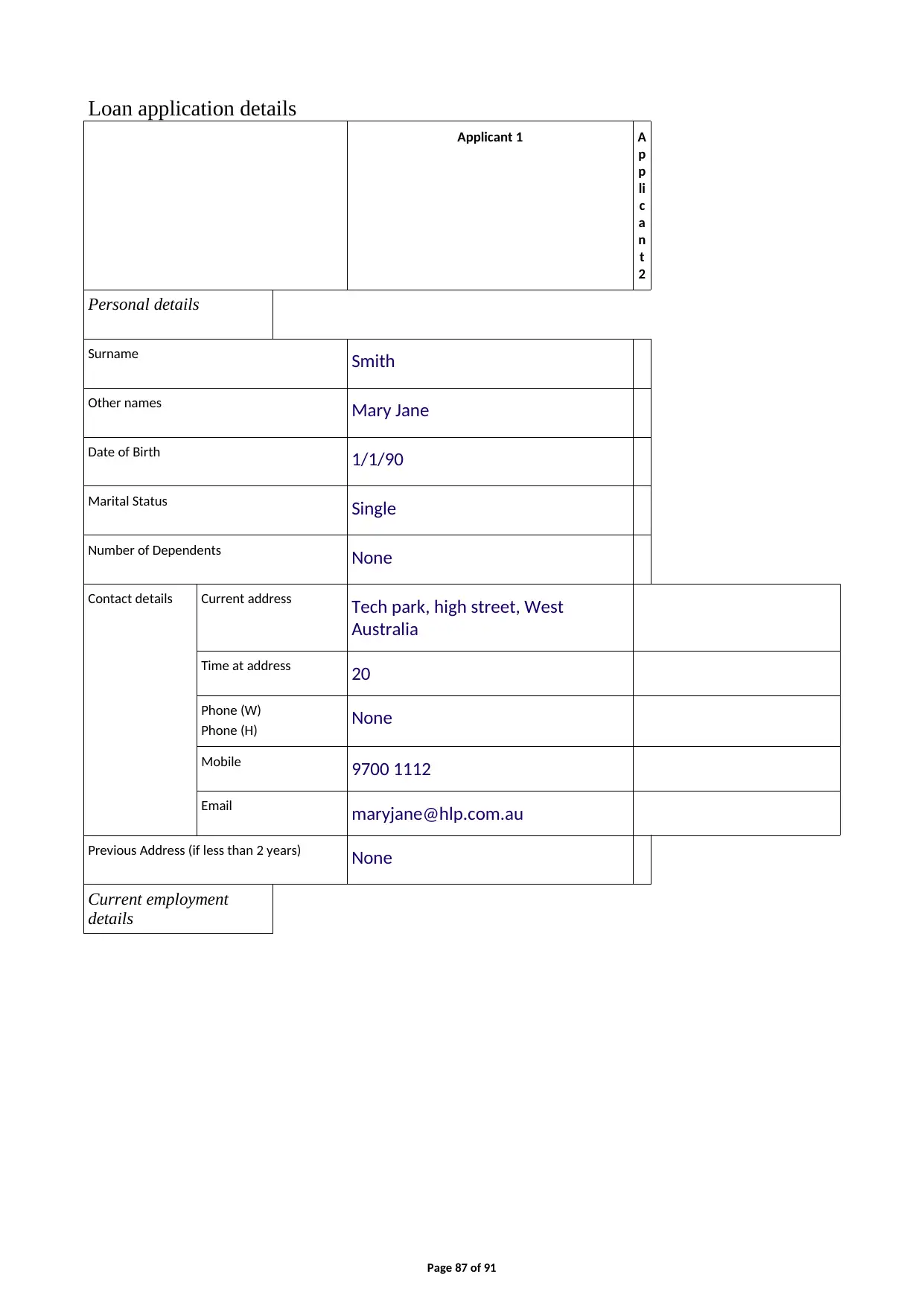

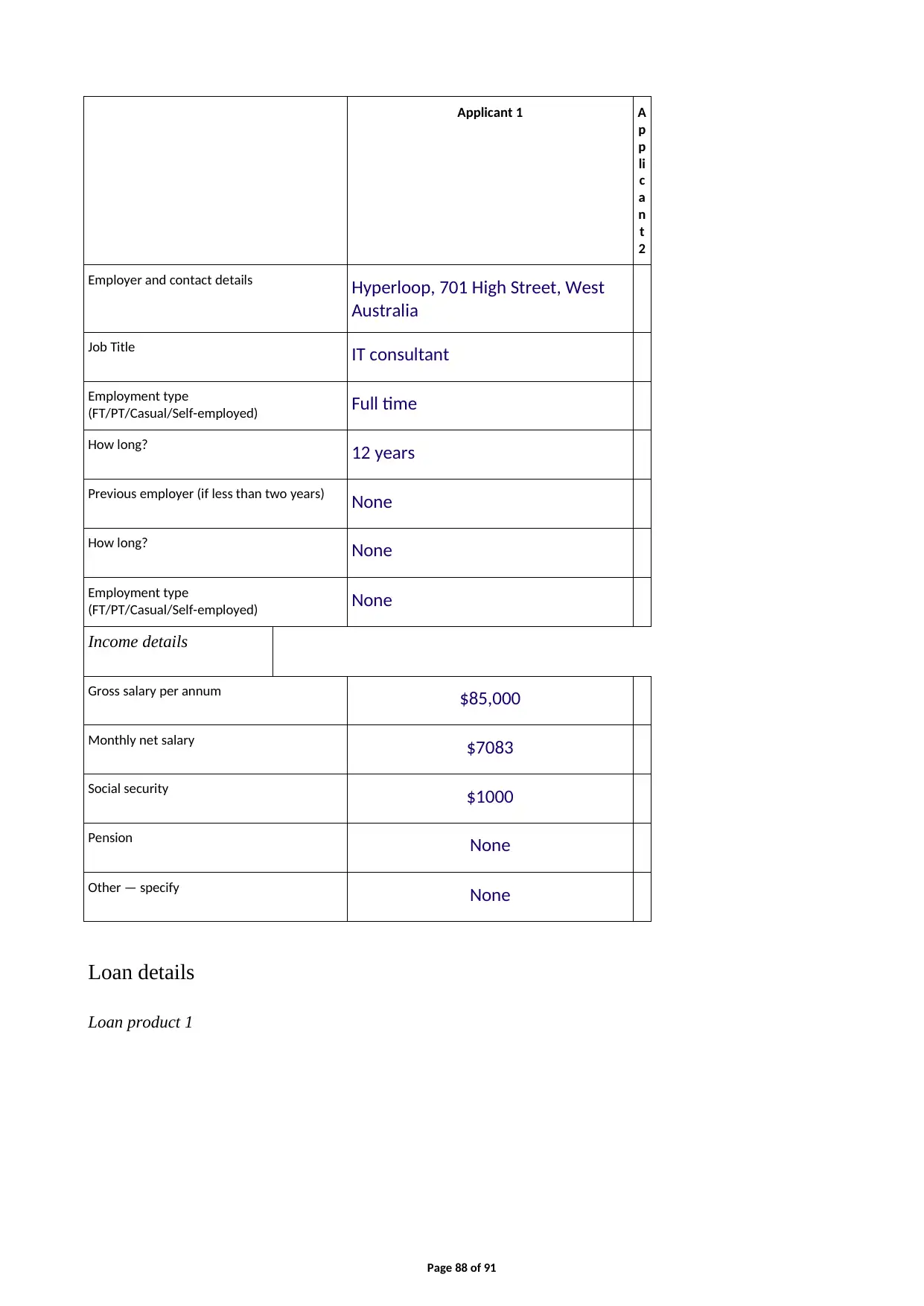

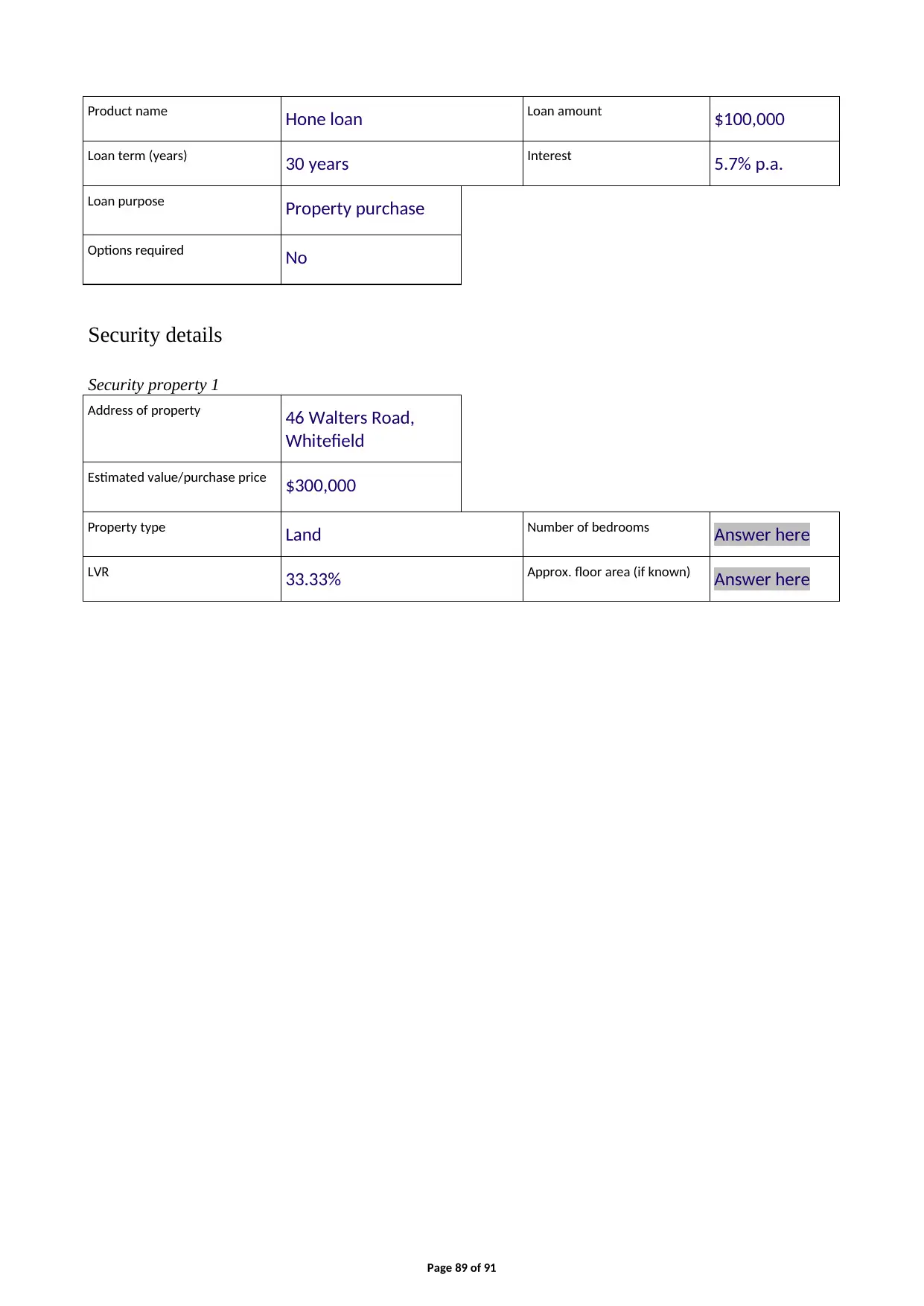

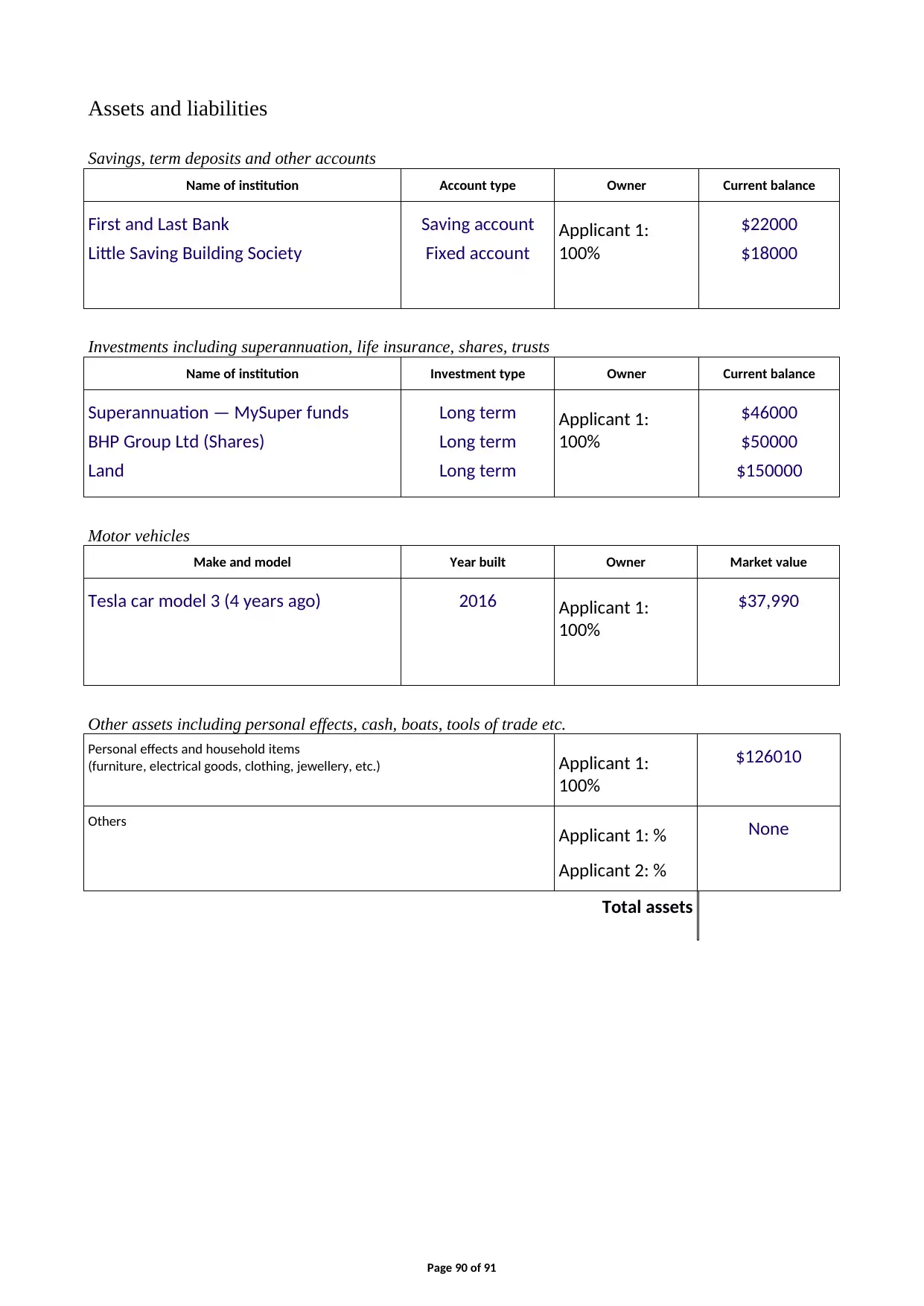

Section 3: Case study 3 — Mary Jane

Smith

Task 15 — Prepare and check a loan application Demonstrated Not applicable

Section 4: Working in financial services

Task 16 — Financial services legislation and industry codes of practice Demonstrated Not applicable

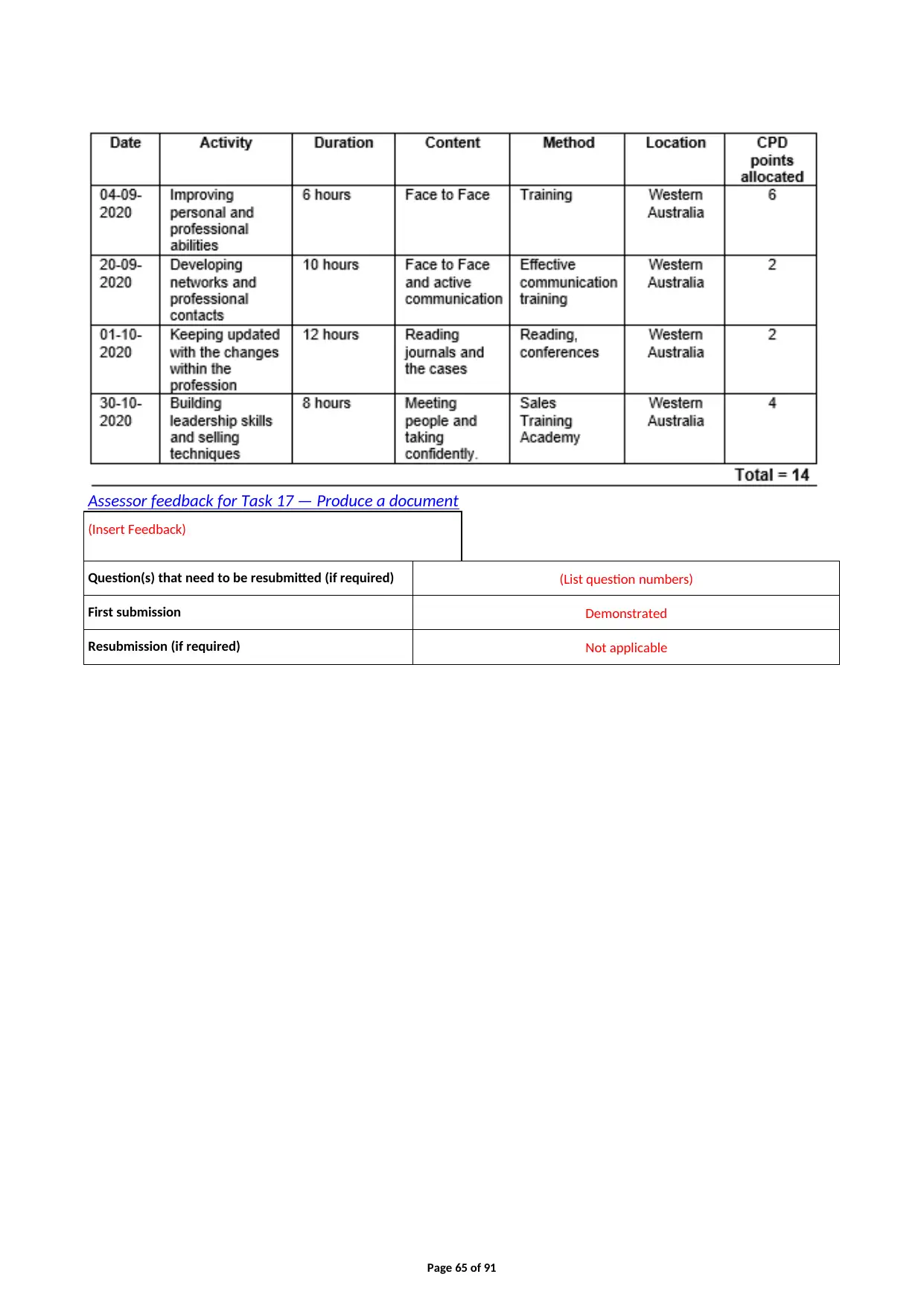

Task 17 — Design a document Demonstrated Not applicable

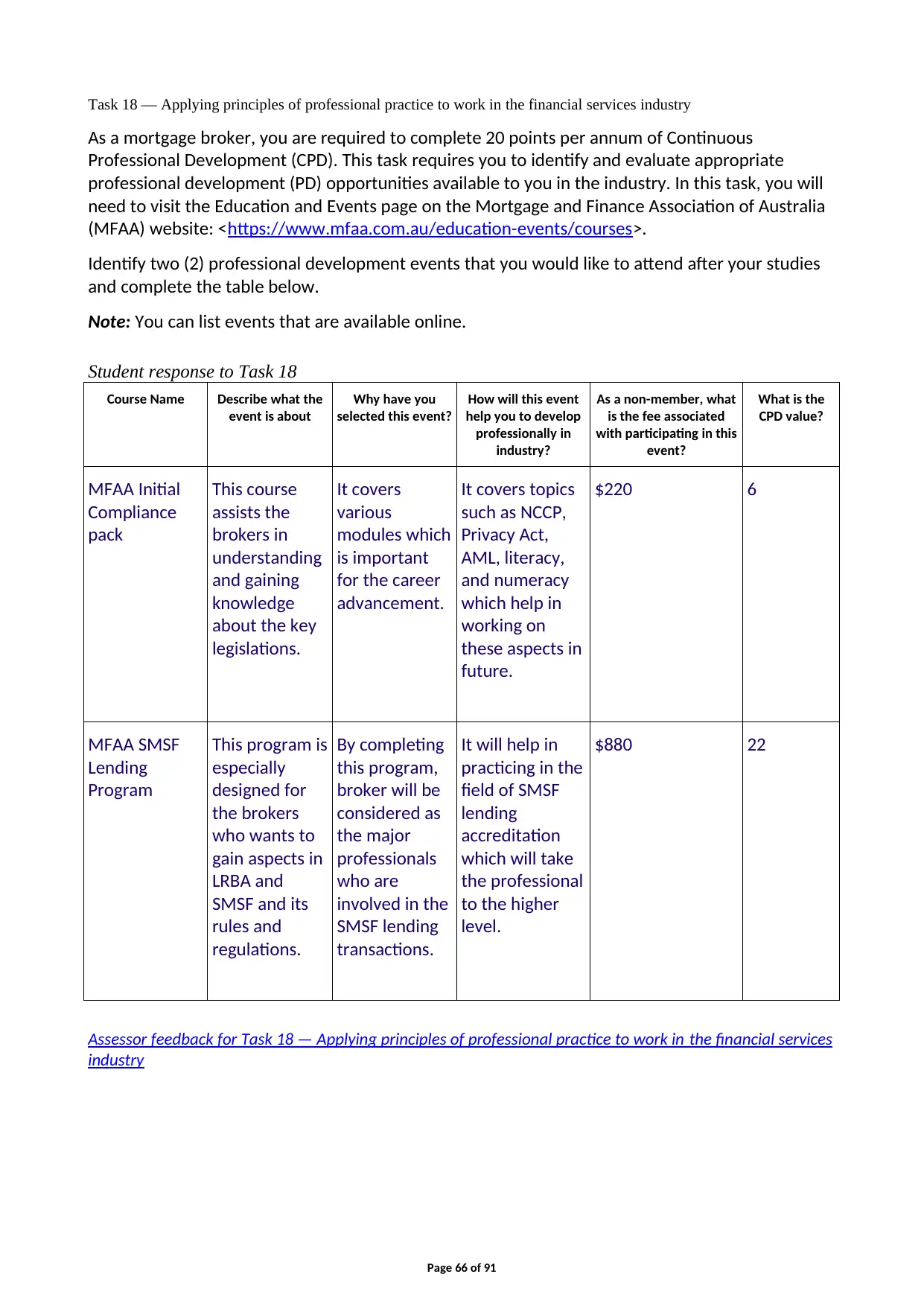

Task 18 — Applying principles of professional practice to work in the financial

services industry Demonstrated Not applicable

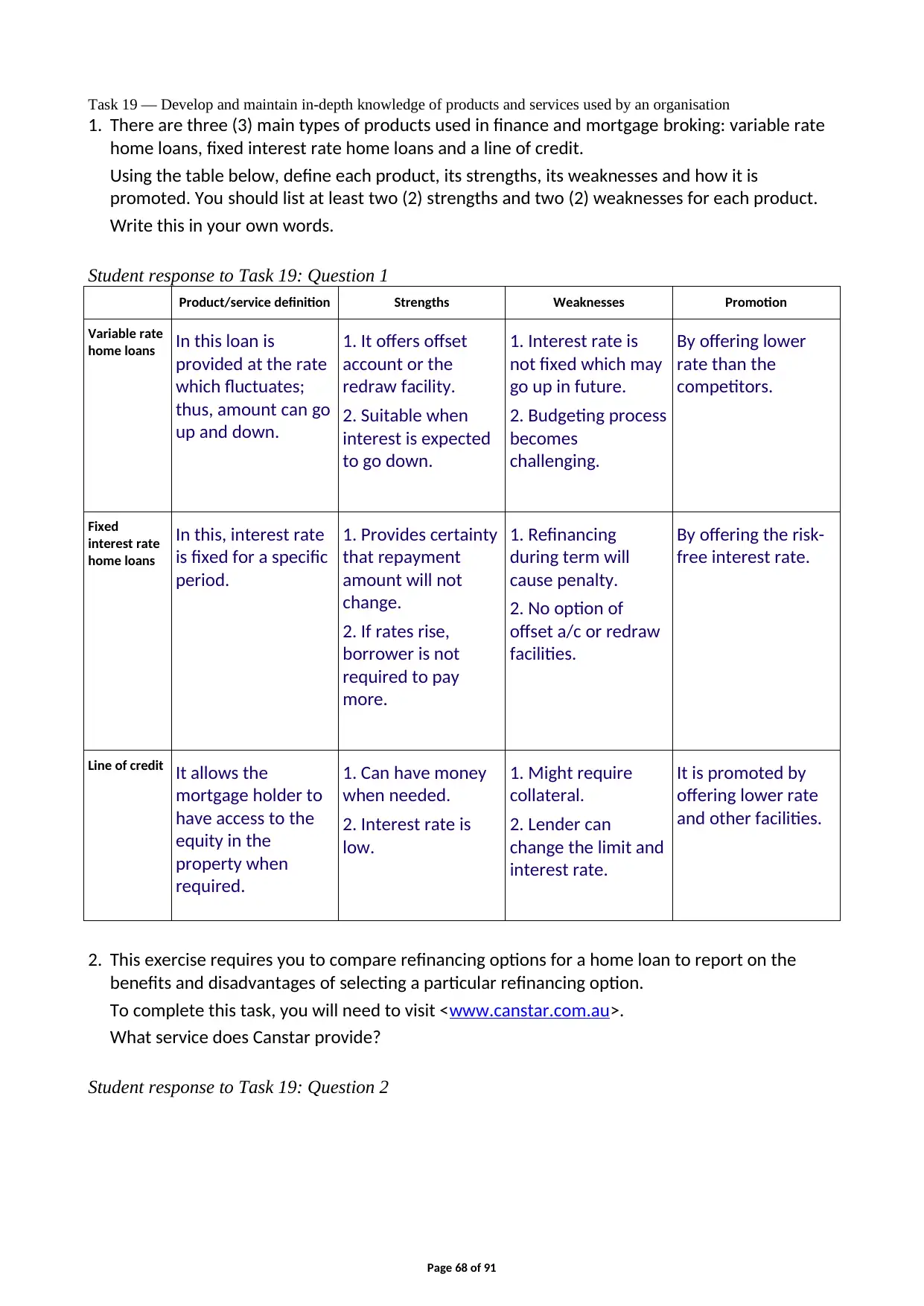

Task 19 — Develop and maintain in-depth knowledge of products and

services used by an organisation Demonstrated Not applicable

Please note: To pass this written assignment, you will need to be assessed as DEMONSTRATED in

either your first submission or your resubmission in all tasks above.

Task feedback

Page 5 of 91

Section 1: Case study 1 — Philip and Jennifer Brown First submission Resubmission (if required)

Task 1 — Key terms, gathering and documenting client information Not yet demonstrated Not applicable

Task 2 — Assessing the clients’ situation Not yet demonstrated Not applicable

Task 3 — Borrowing options Demonstrated Not applicable

Task 4 — Reasonable enquiries Demonstrated Not applicable

Task 5 — First Home Owners Grant and home buyer assistance schemes Demonstrated Not applicable

Task 6 — Professional network and loan settlement process Not yet demonstrated Not applicable

Task 7 — Interest rates Demonstrated Not applicable

Section 2: Case study 2 — Richard and

Pauline Jackson

Task 8 — Establishing level of financial knowledge Demonstrated Not applicable

Task 9 — Responsible lending obligations Not yet demonstrated Not applicable

Task 10 — Self-employed special considerations Demonstrated Not applicable

Task 11 — Advising on strategies Demonstrated Not applicable

Task 12 — Impact of credit history Not yet demonstrated Not applicable

Task 13 — Dispute resolution Not yet demonstrated Not applicable

Task 14 — Effective access to files Demonstrated Not applicable

Section 3: Case study 3 — Mary Jane

Smith

Task 15 — Prepare and check a loan application Demonstrated Not applicable

Section 4: Working in financial services

Task 16 — Financial services legislation and industry codes of practice Demonstrated Not applicable

Task 17 — Design a document Demonstrated Not applicable

Task 18 — Applying principles of professional practice to work in the financial

services industry Demonstrated Not applicable

Task 19 — Develop and maintain in-depth knowledge of products and

services used by an organisation Demonstrated Not applicable

Please note: To pass this written assignment, you will need to be assessed as DEMONSTRATED in

either your first submission or your resubmission in all tasks above.

Task feedback

Page 5 of 91

Please refer to the assessor’s detailed feedback found at the end of each task so that you know

what to do for any tasks you need to resubmit. To finalise this assignment you need to revisit the

above tasks and then resubmit for further assessment. Please leave the assessor comments intact

and use a different colour and font for your additional work.

Page 6 of 91

what to do for any tasks you need to resubmit. To finalise this assignment you need to revisit the

above tasks and then resubmit for further assessment. Please leave the assessor comments intact

and use a different colour and font for your additional work.

Page 6 of 91

Before you begin

Read everything in this document before you start your written assignment for Certificate IV in

Finance and Mortgage Broking (CIVMB_ASMG_v5A2).

Page 7 of 91

Read everything in this document before you start your written assignment for Certificate IV in

Finance and Mortgage Broking (CIVMB_ASMG_v5A2).

Page 7 of 91

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

About this document

This document is the written assignment — half of the overall Written and Oral Assignment.

This document includes the following parts:

• Instructions for completing and submitting this assignment

• Section 1: Case study 1 — Philip and Jennifer Brown

A case study with a series of short-answer questions:

– Task 1 — Key terms, gathering and documenting client information

– Task 2 — Assessing the clients’ situation

– Task 3 — Borrowing options

– Task 4 — Reasonable enquiries

– Task 5 — First Home Owners Grant and home buyer assistance schemes

– Task 6 —Professional network and loan settlement process

– Task 7 — Interest rates

• Section 2: Case study 2 — Richard and Pauline Jackson

A case study and a series of short-answer questions:

– Task 8 — Establishing level of financial knowledge

– Task 9 — Responsible lending obligations

– Task 10 — Self-employed special considerations

– Task 11 — Advising on strategies

– Task 12 — Impact of credit history

– Task 13 — Dispute resolution

– Task 14 — Effective access to files

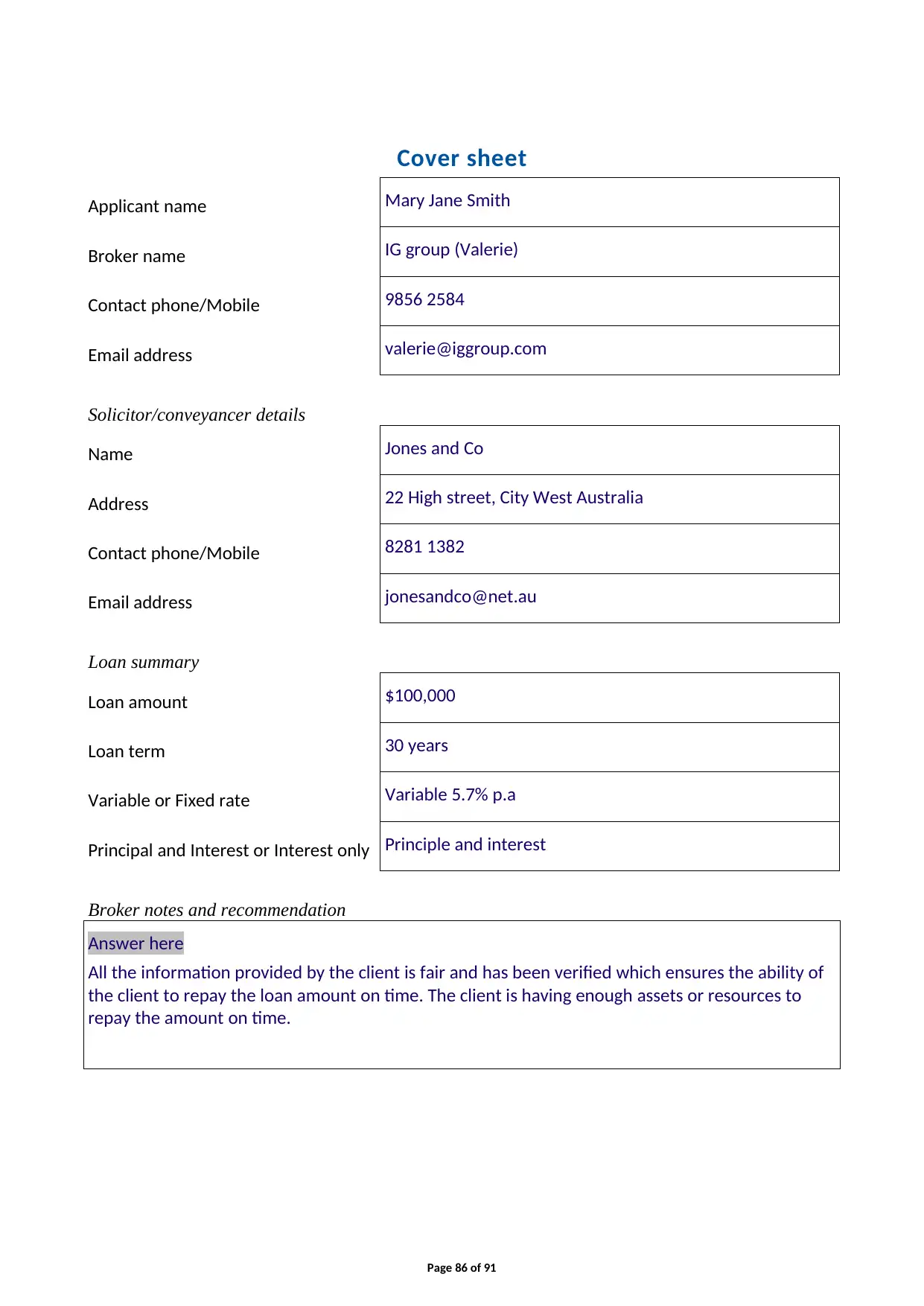

• Section 3: Case study 3 — Mary Jane Smith

A case study and a series of short-answer questions:

– Task 15 — Prepare and check a loan application

• Section 4: Working in financial services

– Task 16 — Financial services legislation and industry codes of practice

– Task 17 — Design a document

– Task 18 — Applying principles of professional practice to work in the financial services

industry

– Task 19 — Develop and maintain in depth knowledge of products and services used by an

organisation

• Appendix 1: Key terms

• Appendix 2: Client information collection tool/Fact finder

• Appendix 3: Loan application.

Page 8 of 91

This document is the written assignment — half of the overall Written and Oral Assignment.

This document includes the following parts:

• Instructions for completing and submitting this assignment

• Section 1: Case study 1 — Philip and Jennifer Brown

A case study with a series of short-answer questions:

– Task 1 — Key terms, gathering and documenting client information

– Task 2 — Assessing the clients’ situation

– Task 3 — Borrowing options

– Task 4 — Reasonable enquiries

– Task 5 — First Home Owners Grant and home buyer assistance schemes

– Task 6 —Professional network and loan settlement process

– Task 7 — Interest rates

• Section 2: Case study 2 — Richard and Pauline Jackson

A case study and a series of short-answer questions:

– Task 8 — Establishing level of financial knowledge

– Task 9 — Responsible lending obligations

– Task 10 — Self-employed special considerations

– Task 11 — Advising on strategies

– Task 12 — Impact of credit history

– Task 13 — Dispute resolution

– Task 14 — Effective access to files

• Section 3: Case study 3 — Mary Jane Smith

A case study and a series of short-answer questions:

– Task 15 — Prepare and check a loan application

• Section 4: Working in financial services

– Task 16 — Financial services legislation and industry codes of practice

– Task 17 — Design a document

– Task 18 — Applying principles of professional practice to work in the financial services

industry

– Task 19 — Develop and maintain in depth knowledge of products and services used by an

organisation

• Appendix 1: Key terms

• Appendix 2: Client information collection tool/Fact finder

• Appendix 3: Loan application.

Page 8 of 91

How to use the study plan

We recommend that you use the study plan for this subject to help you manage your time to

complete the written assignment within your enrolment period. Your study plan is in the KapLearn

Certificate IV in Finance and Mortgage Broking (CIVMBv5) subject room.

Page 9 of 91

We recommend that you use the study plan for this subject to help you manage your time to

complete the written assignment within your enrolment period. Your study plan is in the KapLearn

Certificate IV in Finance and Mortgage Broking (CIVMBv5) subject room.

Page 9 of 91

Instructions for completing and submitting the

written assignment

Page 10 of 91

written assignment

Page 10 of 91

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Completing the written assignment

Page 11 of 91

Page 11 of 91

Saving your work

Download this document to your desktop, type your answers in the spaces provided and save your

work regularly.

• Use the template provided, as other formats will not be accepted for these assignments.

• Name your file as follows:

Studentnumber_SubjectCode_Assignment_versionnumber_Submissionnumber

(e.g. 12345678_CIVMB_AS_v5A2_Submission1).

• Include your student ID on the first page of the assignment.

Before you submit your work, please do a spell check and proofread your work to ensure that

everything is clear and unambiguous.

Page 12 of 91

Download this document to your desktop, type your answers in the spaces provided and save your

work regularly.

• Use the template provided, as other formats will not be accepted for these assignments.

• Name your file as follows:

Studentnumber_SubjectCode_Assignment_versionnumber_Submissionnumber

(e.g. 12345678_CIVMB_AS_v5A2_Submission1).

• Include your student ID on the first page of the assignment.

Before you submit your work, please do a spell check and proofread your work to ensure that

everything is clear and unambiguous.

Page 12 of 91

Word count

The word count shown with each question is indicative only. You will not be penalised for

exceeding the suggested word count. Please do not include additional information which is

outside the scope of the question.

Page 13 of 91

The word count shown with each question is indicative only. You will not be penalised for

exceeding the suggested word count. Please do not include additional information which is

outside the scope of the question.

Page 13 of 91

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Additional research

When completing the ‘Client information collection tool’ in Appendix 2, assumptions are

permitted, although they must not be in conflict with the information provided in the Case study.

Throughout the assignment you will also be required to research additional information from

other organisations in the finance industry to find the right products or services to meet your

client’s requirements or to calculate any service fees that may be applicable.

Page 14 of 91

When completing the ‘Client information collection tool’ in Appendix 2, assumptions are

permitted, although they must not be in conflict with the information provided in the Case study.

Throughout the assignment you will also be required to research additional information from

other organisations in the finance industry to find the right products or services to meet your

client’s requirements or to calculate any service fees that may be applicable.

Page 14 of 91

Submitting the written assignment

Only Microsoft Office compatible written assignments submitted in the template file will be

accepted for marking by Kaplan Professional Education. You need to save and submit this entire

document.

Do not remove any sections of the document.

Do not save your completed assignment as a PDF.

The written assignment must be completed before submitting it to Kaplan Professional Education.

Incomplete written assignments will be returned to you unmarked. The written assignment must

be submitted together with the oral assignment. If you do not submit both completed assignments

at the one time it will be returned to you unmarked.

The maximum file size is 20MB for the written and oral assignment. Once you submit your

written assignment for marking you will be unable to make any further changes to it.

Once you submit your written assignment for marking you will be unable to make any further

changes to it.

You are able to submit both assignments earlier than the deadline if you are confident you have

completed all parts and have prepared a quality submission.

Please refer to the Assignment submission/resubmission videos in the Assessment section of

KapLearn under your ‘Assignment Enrolment’ for details on how to submit/resubmit your written

assignment.

Your Written Assignment and Oral Assignment must be submitted together on or before your

due date. Please check KapLearn for the due date.

Page 15 of 91

Only Microsoft Office compatible written assignments submitted in the template file will be

accepted for marking by Kaplan Professional Education. You need to save and submit this entire

document.

Do not remove any sections of the document.

Do not save your completed assignment as a PDF.

The written assignment must be completed before submitting it to Kaplan Professional Education.

Incomplete written assignments will be returned to you unmarked. The written assignment must

be submitted together with the oral assignment. If you do not submit both completed assignments

at the one time it will be returned to you unmarked.

The maximum file size is 20MB for the written and oral assignment. Once you submit your

written assignment for marking you will be unable to make any further changes to it.

Once you submit your written assignment for marking you will be unable to make any further

changes to it.

You are able to submit both assignments earlier than the deadline if you are confident you have

completed all parts and have prepared a quality submission.

Please refer to the Assignment submission/resubmission videos in the Assessment section of

KapLearn under your ‘Assignment Enrolment’ for details on how to submit/resubmit your written

assignment.

Your Written Assignment and Oral Assignment must be submitted together on or before your

due date. Please check KapLearn for the due date.

Page 15 of 91

The written assignment marking process

You have 26 weeks from the date of your enrolment in this subject to submit your

completed assignment.

If you reach the end of your initial enrolment period and have been deemed ‘Not yet

demonstrated’ in one or more assessment items, then an additional four (4) weeks will be

granted, provided you attempted all assessment tasks during the initial enrolment period.

Your assessor will mark your written and oral assignment and return it to you in the

Certificate IV in Finance and Mortgage Broking (CIVMBv5) subject room in KapLearn under the

‘Assessment’ tab.

Page 16 of 91

You have 26 weeks from the date of your enrolment in this subject to submit your

completed assignment.

If you reach the end of your initial enrolment period and have been deemed ‘Not yet

demonstrated’ in one or more assessment items, then an additional four (4) weeks will be

granted, provided you attempted all assessment tasks during the initial enrolment period.

Your assessor will mark your written and oral assignment and return it to you in the

Certificate IV in Finance and Mortgage Broking (CIVMBv5) subject room in KapLearn under the

‘Assessment’ tab.

Page 16 of 91

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Make a reasonable attempt

You must demonstrate that you have made a reasonable attempt to answer all of the questions in

your written assignment. Failure to do so will mean that your assignment will not be accepted for

marking; therefore you will not receive the benefit of feedback on your submission.

If you do not meet these requirements, you will be notified. You will then have until your

submission deadline to submit your completed written and oral assignment.

Page 17 of 91

You must demonstrate that you have made a reasonable attempt to answer all of the questions in

your written assignment. Failure to do so will mean that your assignment will not be accepted for

marking; therefore you will not receive the benefit of feedback on your submission.

If you do not meet these requirements, you will be notified. You will then have until your

submission deadline to submit your completed written and oral assignment.

Page 17 of 91

How your written assignment is graded

Assignment tasks are used to determine your ‘competence’ in demonstrating the required

knowledge and/or skills for each subject. As a result, you will be graded as either Demonstrated or

Not yet demonstrated.

Your assessor will follow the below process when marking your assignment:

• Assess your responses to each question, and sub-parts if applicable, and then determine

whether you have demonstrated competence in each question.

• Determine if, on a holistic basis, your responses to the questions have demonstrated overall

competence.

You must be deemed to be demonstrated in all assessment items in order to be awarded the units

of competency in this subject, including:

• all of the exam questions

• the written and oral assignment.

Page 18 of 91

Assignment tasks are used to determine your ‘competence’ in demonstrating the required

knowledge and/or skills for each subject. As a result, you will be graded as either Demonstrated or

Not yet demonstrated.

Your assessor will follow the below process when marking your assignment:

• Assess your responses to each question, and sub-parts if applicable, and then determine

whether you have demonstrated competence in each question.

• Determine if, on a holistic basis, your responses to the questions have demonstrated overall

competence.

You must be deemed to be demonstrated in all assessment items in order to be awarded the units

of competency in this subject, including:

• all of the exam questions

• the written and oral assignment.

Page 18 of 91

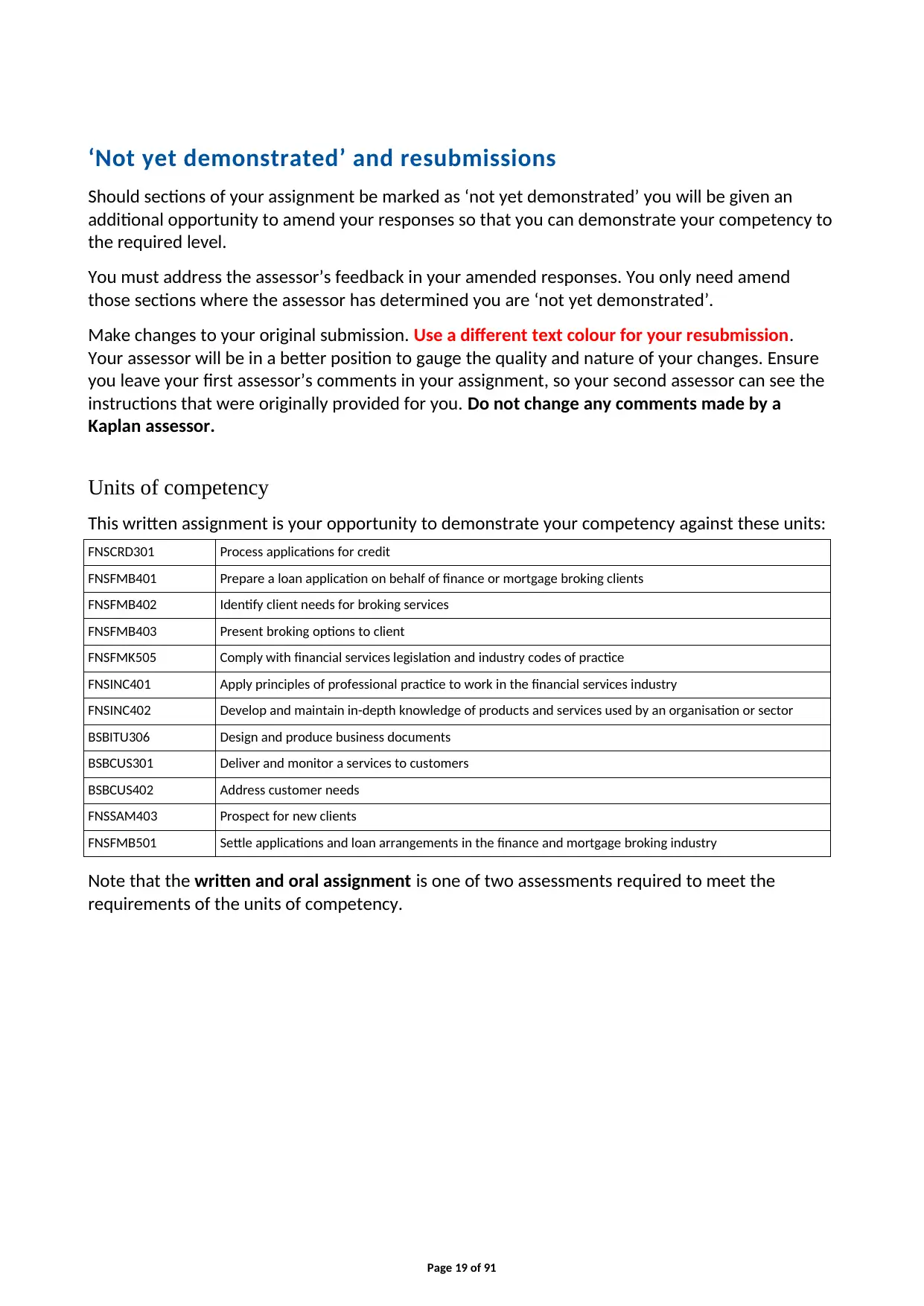

‘Not yet demonstrated’ and resubmissions

Should sections of your assignment be marked as ‘not yet demonstrated’ you will be given an

additional opportunity to amend your responses so that you can demonstrate your competency to

the required level.

You must address the assessor’s feedback in your amended responses. You only need amend

those sections where the assessor has determined you are ‘not yet demonstrated’.

Make changes to your original submission. Use a different text colour for your resubmission.

Your assessor will be in a better position to gauge the quality and nature of your changes. Ensure

you leave your first assessor’s comments in your assignment, so your second assessor can see the

instructions that were originally provided for you. Do not change any comments made by a

Kaplan assessor.

Units of competency

This written assignment is your opportunity to demonstrate your competency against these units:

FNSCRD301 Process applications for credit

FNSFMB401 Prepare a loan application on behalf of finance or mortgage broking clients

FNSFMB402 Identify client needs for broking services

FNSFMB403 Present broking options to client

FNSFMK505 Comply with financial services legislation and industry codes of practice

FNSINC401 Apply principles of professional practice to work in the financial services industry

FNSINC402 Develop and maintain in-depth knowledge of products and services used by an organisation or sector

BSBITU306 Design and produce business documents

BSBCUS301 Deliver and monitor a services to customers

BSBCUS402 Address customer needs

FNSSAM403 Prospect for new clients

FNSFMB501 Settle applications and loan arrangements in the finance and mortgage broking industry

Note that the written and oral assignment is one of two assessments required to meet the

requirements of the units of competency.

Page 19 of 91

Should sections of your assignment be marked as ‘not yet demonstrated’ you will be given an

additional opportunity to amend your responses so that you can demonstrate your competency to

the required level.

You must address the assessor’s feedback in your amended responses. You only need amend

those sections where the assessor has determined you are ‘not yet demonstrated’.

Make changes to your original submission. Use a different text colour for your resubmission.

Your assessor will be in a better position to gauge the quality and nature of your changes. Ensure

you leave your first assessor’s comments in your assignment, so your second assessor can see the

instructions that were originally provided for you. Do not change any comments made by a

Kaplan assessor.

Units of competency

This written assignment is your opportunity to demonstrate your competency against these units:

FNSCRD301 Process applications for credit

FNSFMB401 Prepare a loan application on behalf of finance or mortgage broking clients

FNSFMB402 Identify client needs for broking services

FNSFMB403 Present broking options to client

FNSFMK505 Comply with financial services legislation and industry codes of practice

FNSINC401 Apply principles of professional practice to work in the financial services industry

FNSINC402 Develop and maintain in-depth knowledge of products and services used by an organisation or sector

BSBITU306 Design and produce business documents

BSBCUS301 Deliver and monitor a services to customers

BSBCUS402 Address customer needs

FNSSAM403 Prospect for new clients

FNSFMB501 Settle applications and loan arrangements in the finance and mortgage broking industry

Note that the written and oral assignment is one of two assessments required to meet the

requirements of the units of competency.

Page 19 of 91

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

We are here to help

If you have any questions about this written assignment you can post your query at the ‘Ask your

Tutor’ forum in your subject room. You can expect an answer within 24 hours of your posting from

one of our technical advisers or student support staff.

Page 20 of 91

If you have any questions about this written assignment you can post your query at the ‘Ask your

Tutor’ forum in your subject room. You can expect an answer within 24 hours of your posting from

one of our technical advisers or student support staff.

Page 20 of 91

Section 1: Case study 1 — Philip and Jennifer Brown

Page 21 of 91

Page 21 of 91

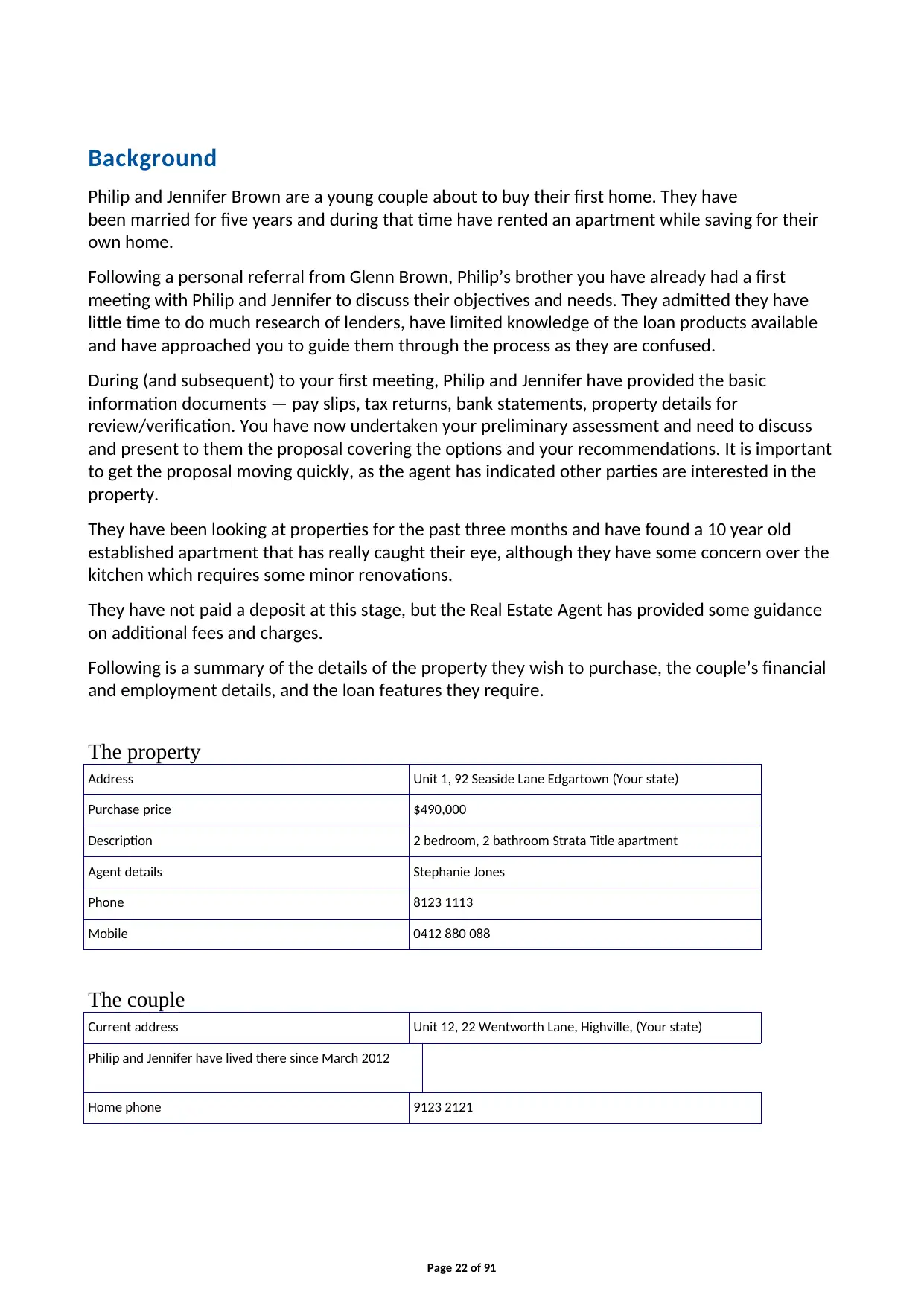

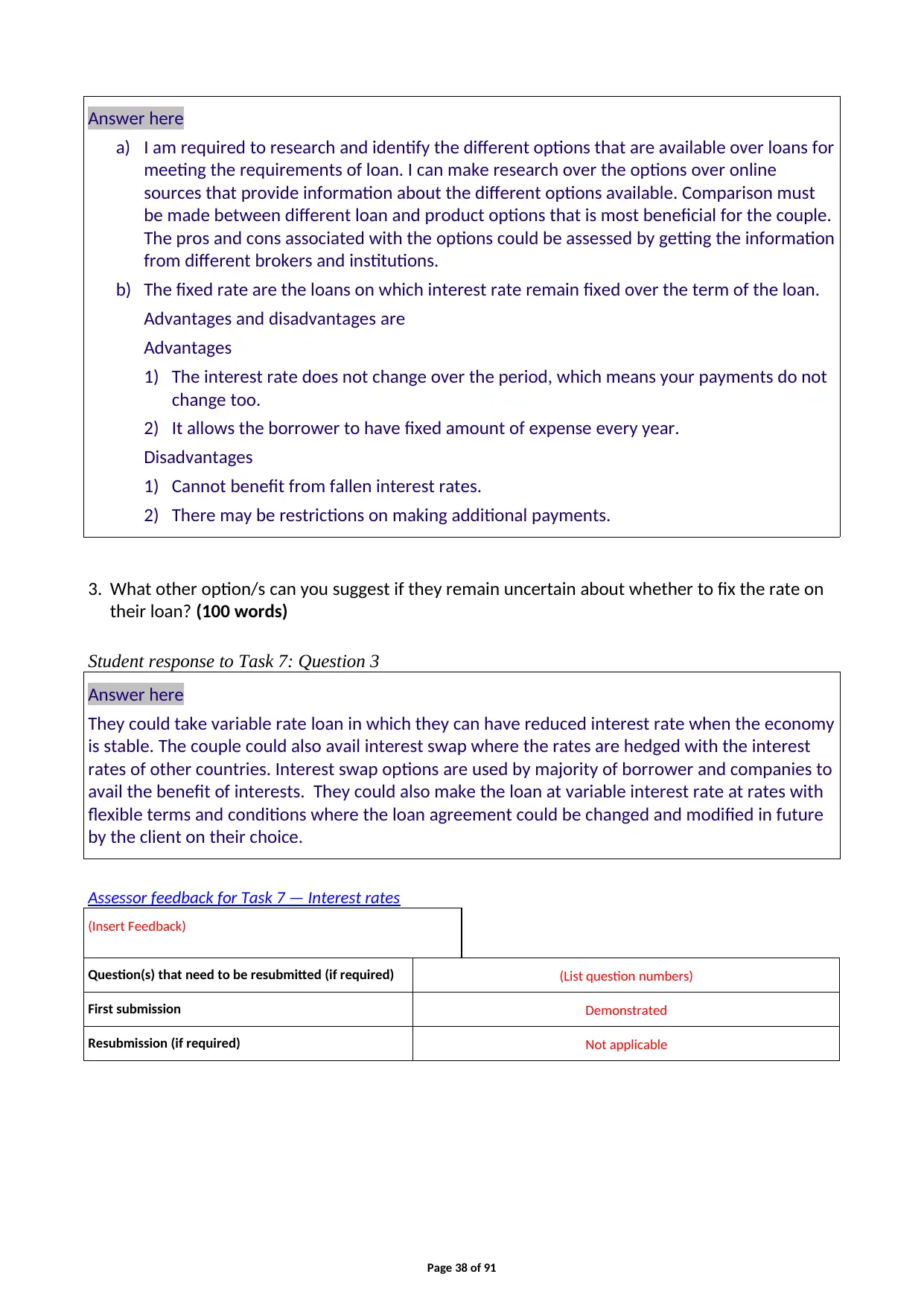

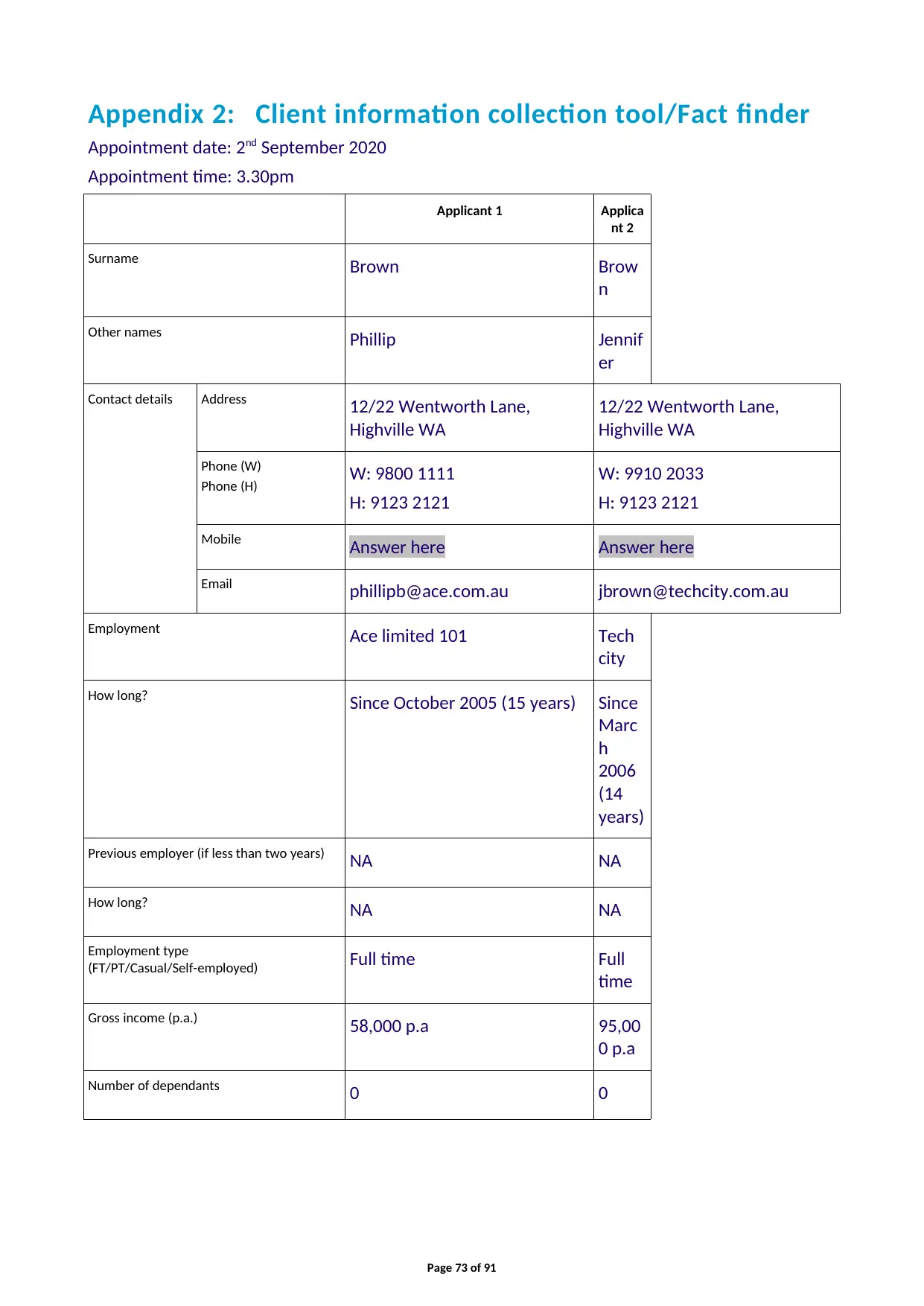

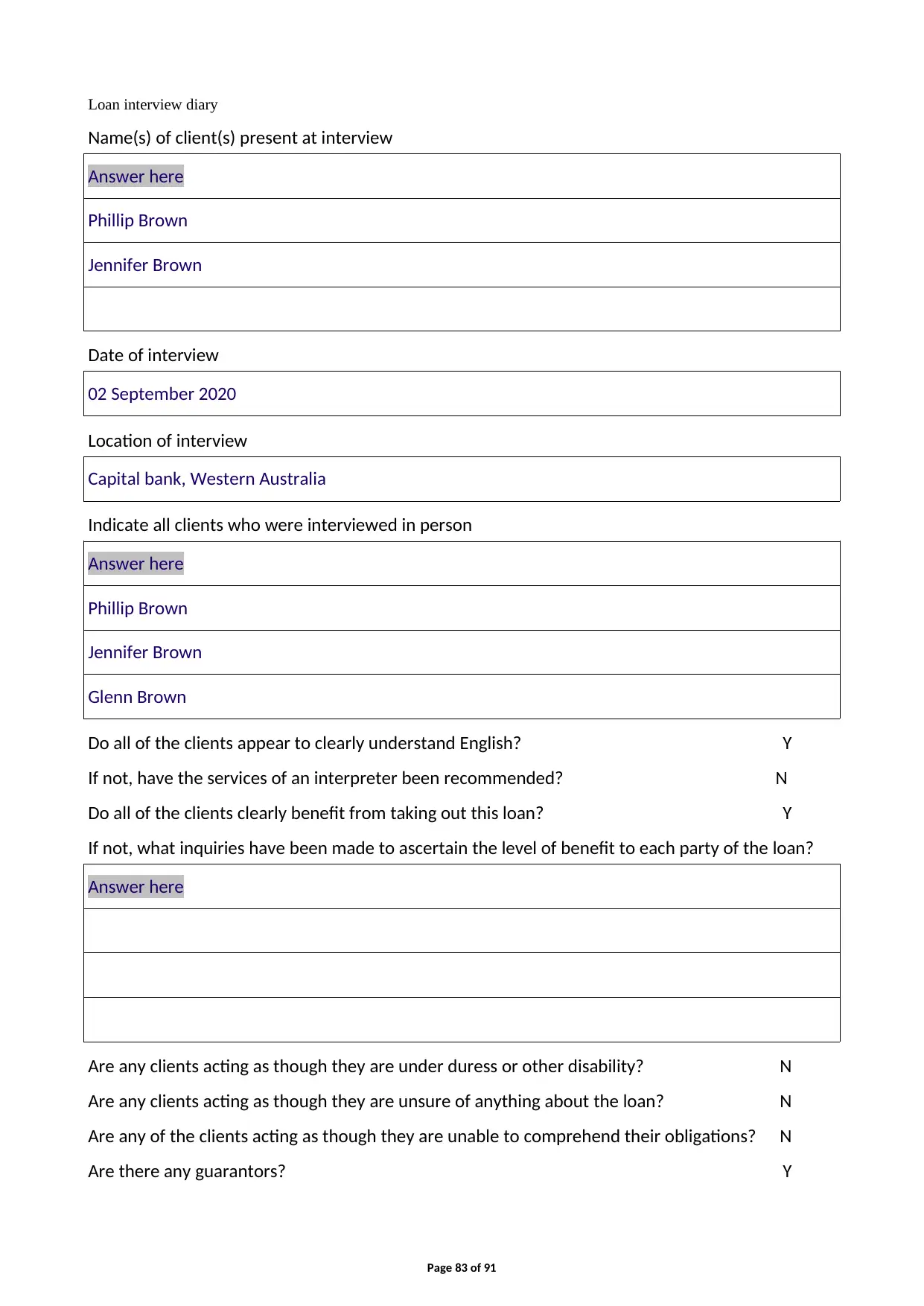

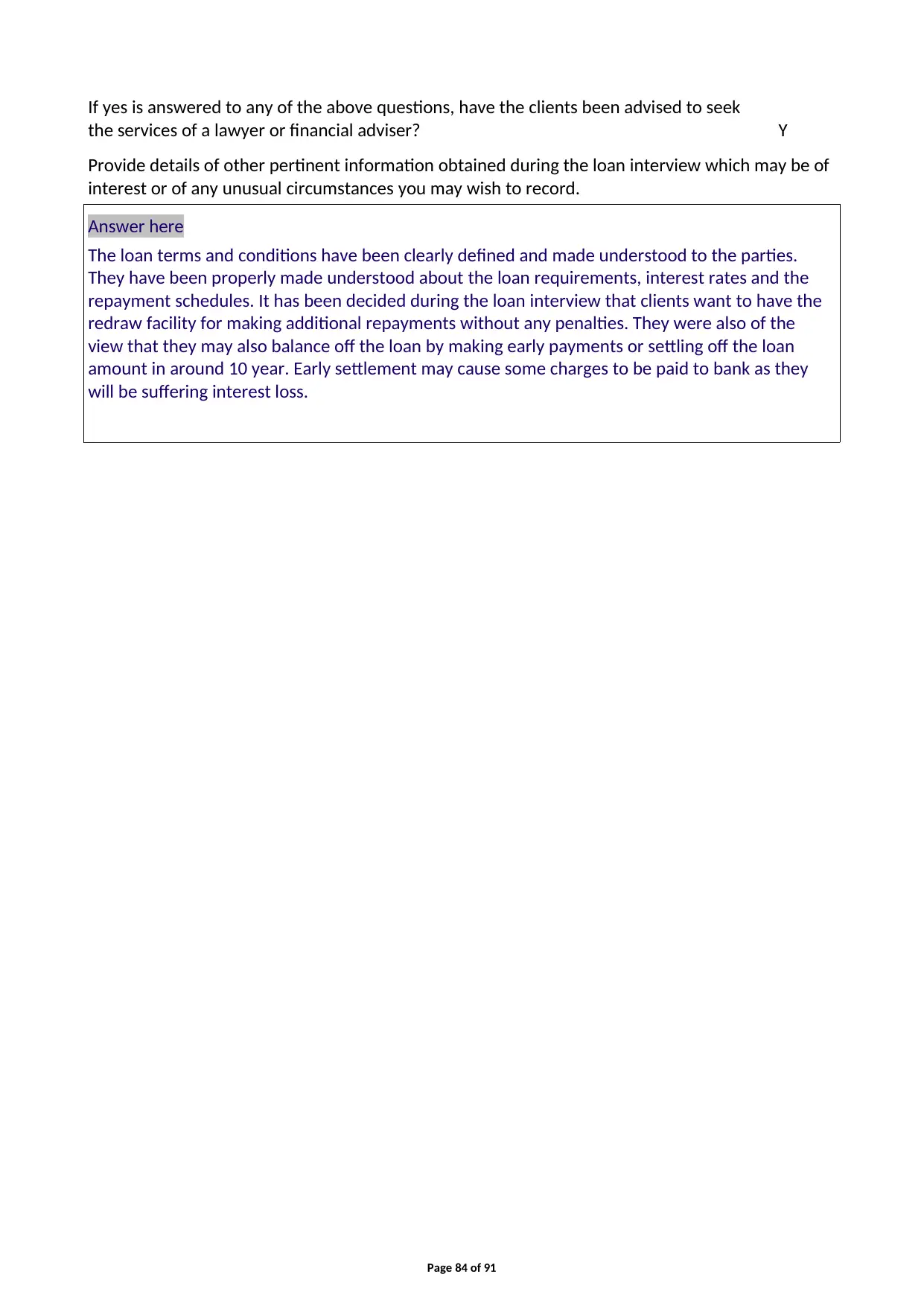

Background

Philip and Jennifer Brown are a young couple about to buy their first home. They have

been married for five years and during that time have rented an apartment while saving for their

own home.

Following a personal referral from Glenn Brown, Philip’s brother you have already had a first

meeting with Philip and Jennifer to discuss their objectives and needs. They admitted they have

little time to do much research of lenders, have limited knowledge of the loan products available

and have approached you to guide them through the process as they are confused.

During (and subsequent) to your first meeting, Philip and Jennifer have provided the basic

information documents — pay slips, tax returns, bank statements, property details for

review/verification. You have now undertaken your preliminary assessment and need to discuss

and present to them the proposal covering the options and your recommendations. It is important

to get the proposal moving quickly, as the agent has indicated other parties are interested in the

property.

They have been looking at properties for the past three months and have found a 10 year old

established apartment that has really caught their eye, although they have some concern over the

kitchen which requires some minor renovations.

They have not paid a deposit at this stage, but the Real Estate Agent has provided some guidance

on additional fees and charges.

Following is a summary of the details of the property they wish to purchase, the couple’s financial

and employment details, and the loan features they require.

The property

Address Unit 1, 92 Seaside Lane Edgartown (Your state)

Purchase price $490,000

Description 2 bedroom, 2 bathroom Strata Title apartment

Agent details Stephanie Jones

Phone 8123 1113

Mobile 0412 880 088

The couple

Current address Unit 12, 22 Wentworth Lane, Highville, (Your state)

Philip and Jennifer have lived there since March 2012

Home phone 9123 2121

Page 22 of 91

Philip and Jennifer Brown are a young couple about to buy their first home. They have

been married for five years and during that time have rented an apartment while saving for their

own home.

Following a personal referral from Glenn Brown, Philip’s brother you have already had a first

meeting with Philip and Jennifer to discuss their objectives and needs. They admitted they have

little time to do much research of lenders, have limited knowledge of the loan products available

and have approached you to guide them through the process as they are confused.

During (and subsequent) to your first meeting, Philip and Jennifer have provided the basic

information documents — pay slips, tax returns, bank statements, property details for

review/verification. You have now undertaken your preliminary assessment and need to discuss

and present to them the proposal covering the options and your recommendations. It is important

to get the proposal moving quickly, as the agent has indicated other parties are interested in the

property.

They have been looking at properties for the past three months and have found a 10 year old

established apartment that has really caught their eye, although they have some concern over the

kitchen which requires some minor renovations.

They have not paid a deposit at this stage, but the Real Estate Agent has provided some guidance

on additional fees and charges.

Following is a summary of the details of the property they wish to purchase, the couple’s financial

and employment details, and the loan features they require.

The property

Address Unit 1, 92 Seaside Lane Edgartown (Your state)

Purchase price $490,000

Description 2 bedroom, 2 bathroom Strata Title apartment

Agent details Stephanie Jones

Phone 8123 1113

Mobile 0412 880 088

The couple

Current address Unit 12, 22 Wentworth Lane, Highville, (Your state)

Philip and Jennifer have lived there since March 2012

Home phone 9123 2121

Page 22 of 91

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

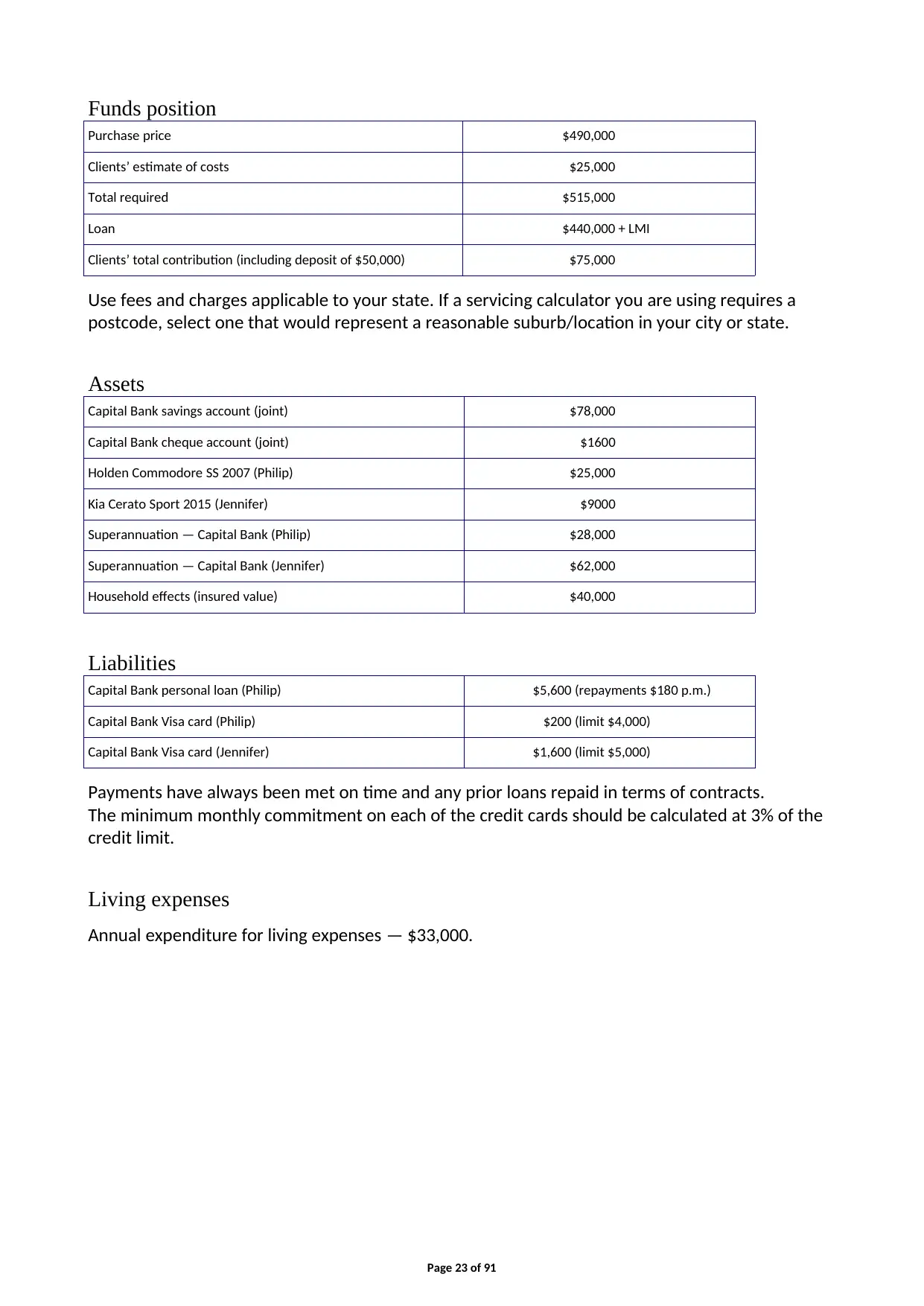

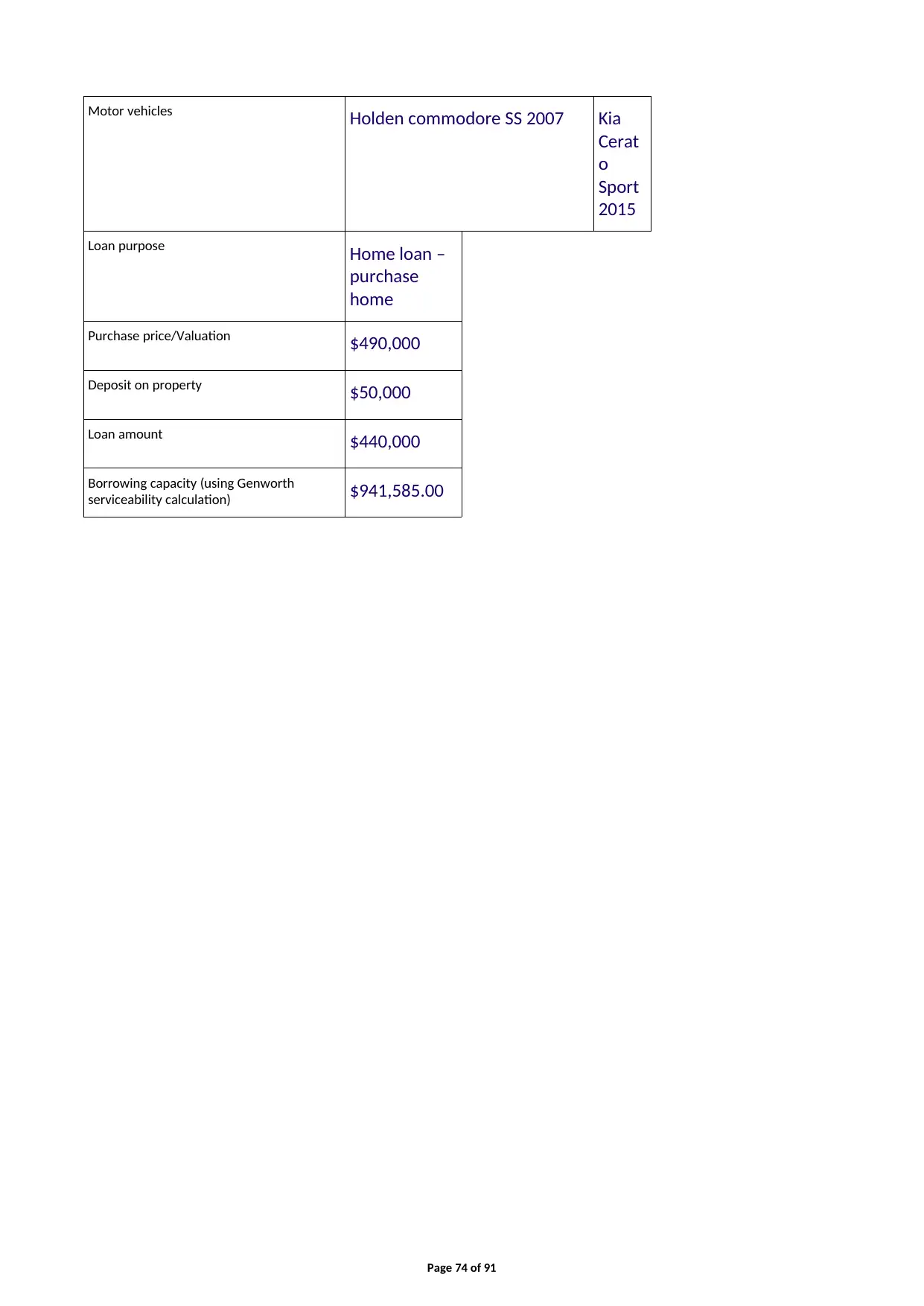

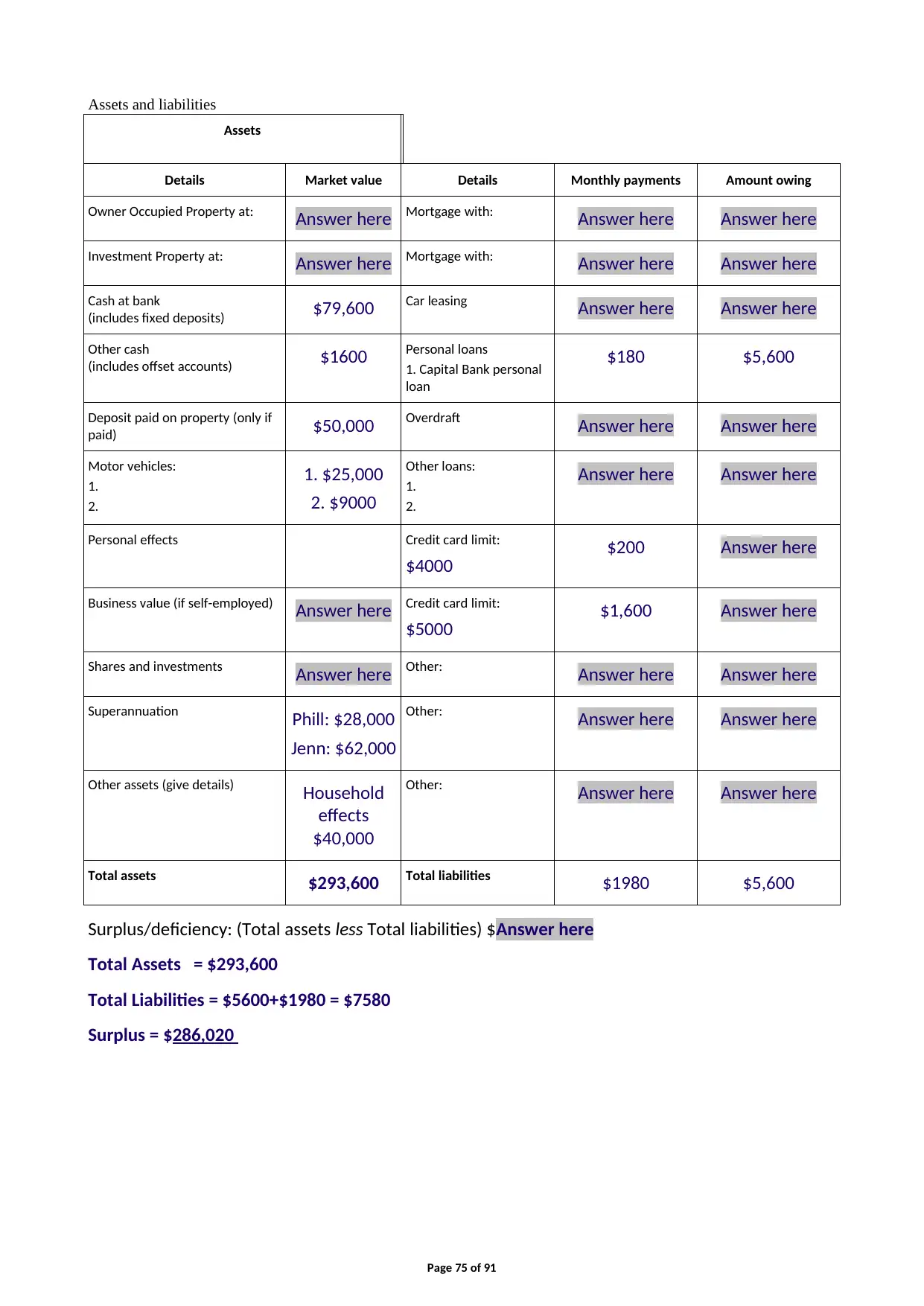

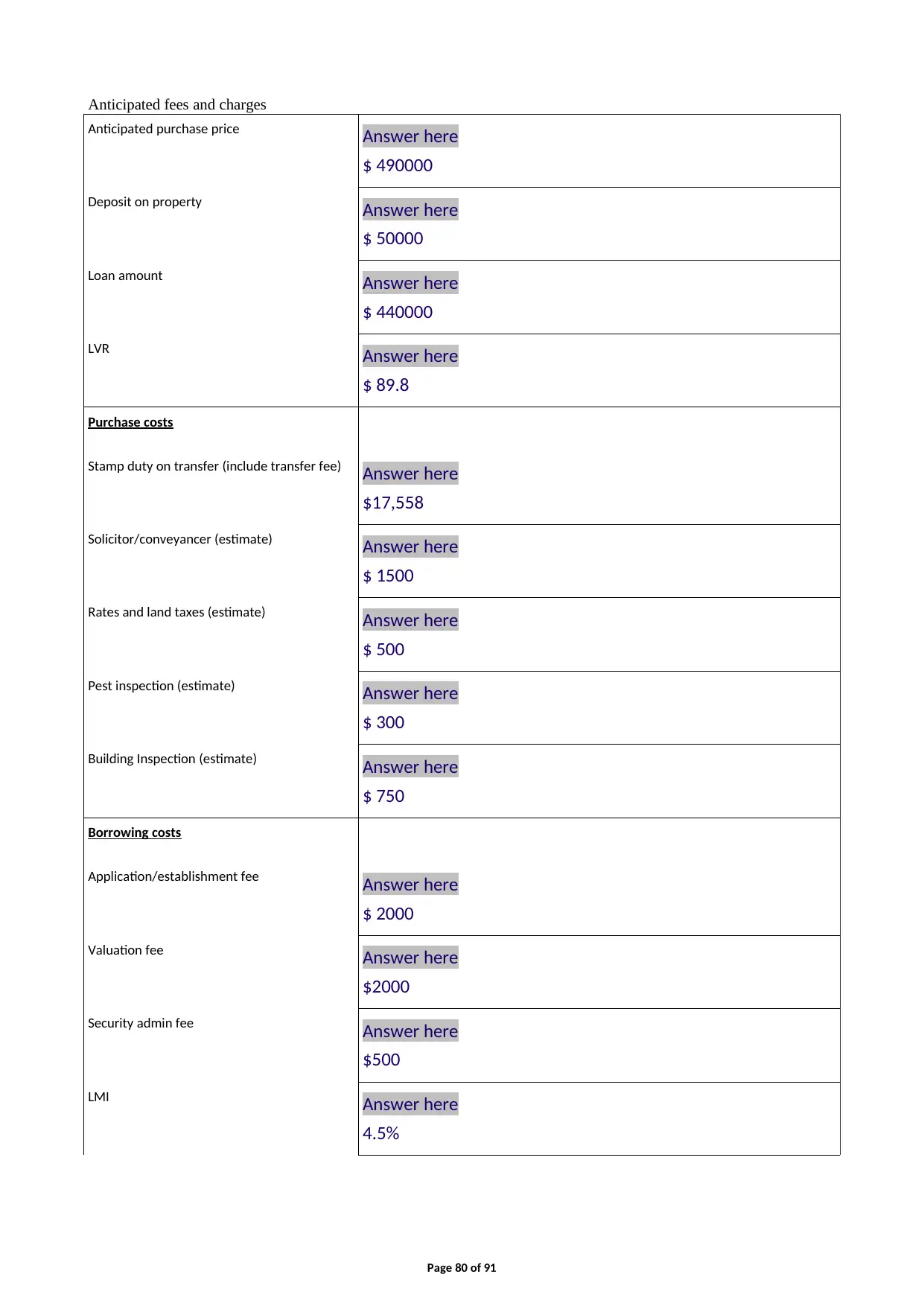

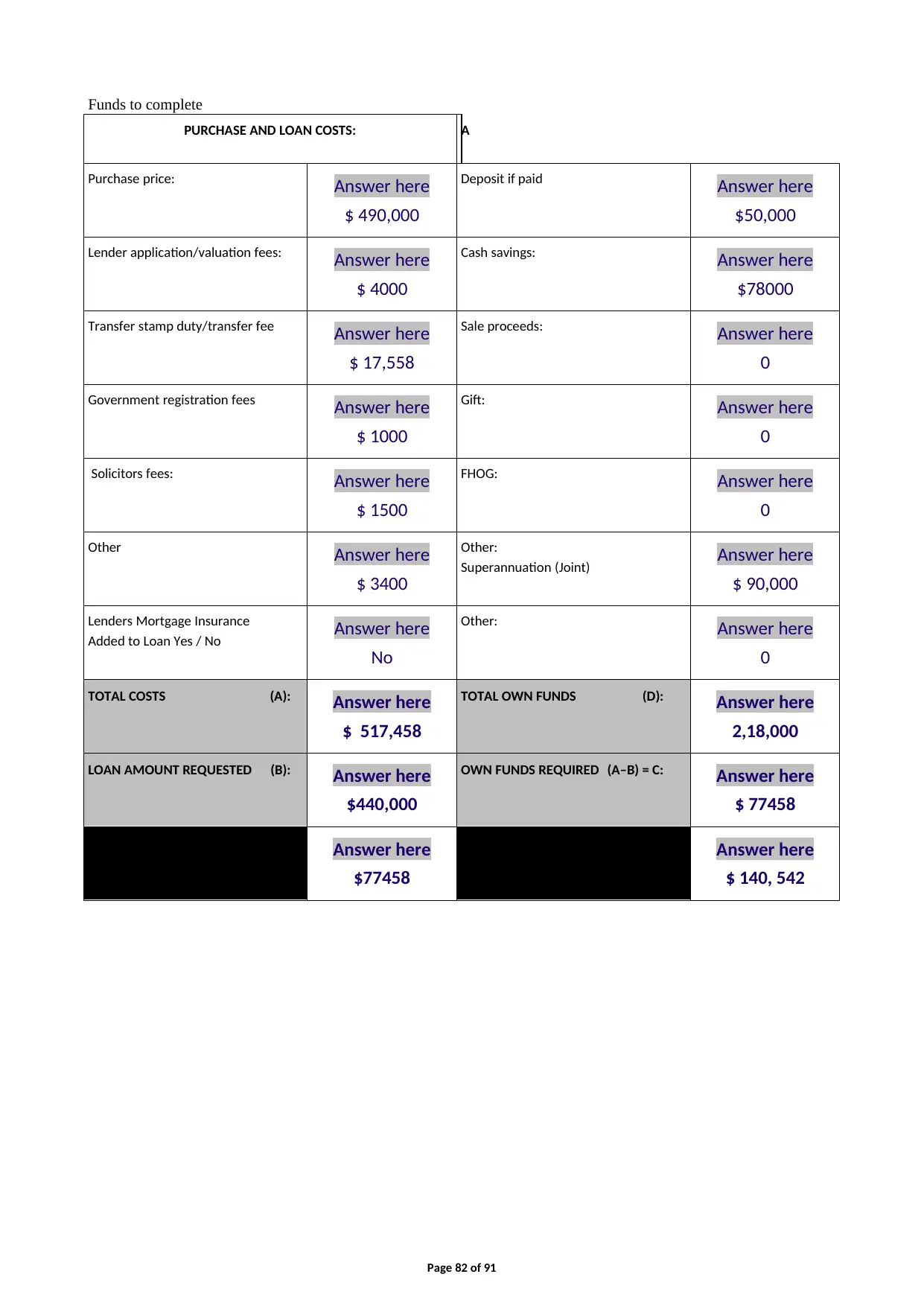

Funds position

Purchase price $490,000

Clients’ estimate of costs $25,000

Total required $515,000

Loan $440,000 + LMI

Clients’ total contribution (including deposit of $50,000) $75,000

Use fees and charges applicable to your state. If a servicing calculator you are using requires a

postcode, select one that would represent a reasonable suburb/location in your city or state.

Assets

Capital Bank savings account (joint) $78,000

Capital Bank cheque account (joint) $1600

Holden Commodore SS 2007 (Philip) $25,000

Kia Cerato Sport 2015 (Jennifer) $9000

Superannuation — Capital Bank (Philip) $28,000

Superannuation — Capital Bank (Jennifer) $62,000

Household effects (insured value) $40,000

Liabilities

Capital Bank personal loan (Philip) $5,600 (repayments $180 p.m.)

Capital Bank Visa card (Philip) $200 (limit $4,000)

Capital Bank Visa card (Jennifer) $1,600 (limit $5,000)

Payments have always been met on time and any prior loans repaid in terms of contracts.

The minimum monthly commitment on each of the credit cards should be calculated at 3% of the

credit limit.

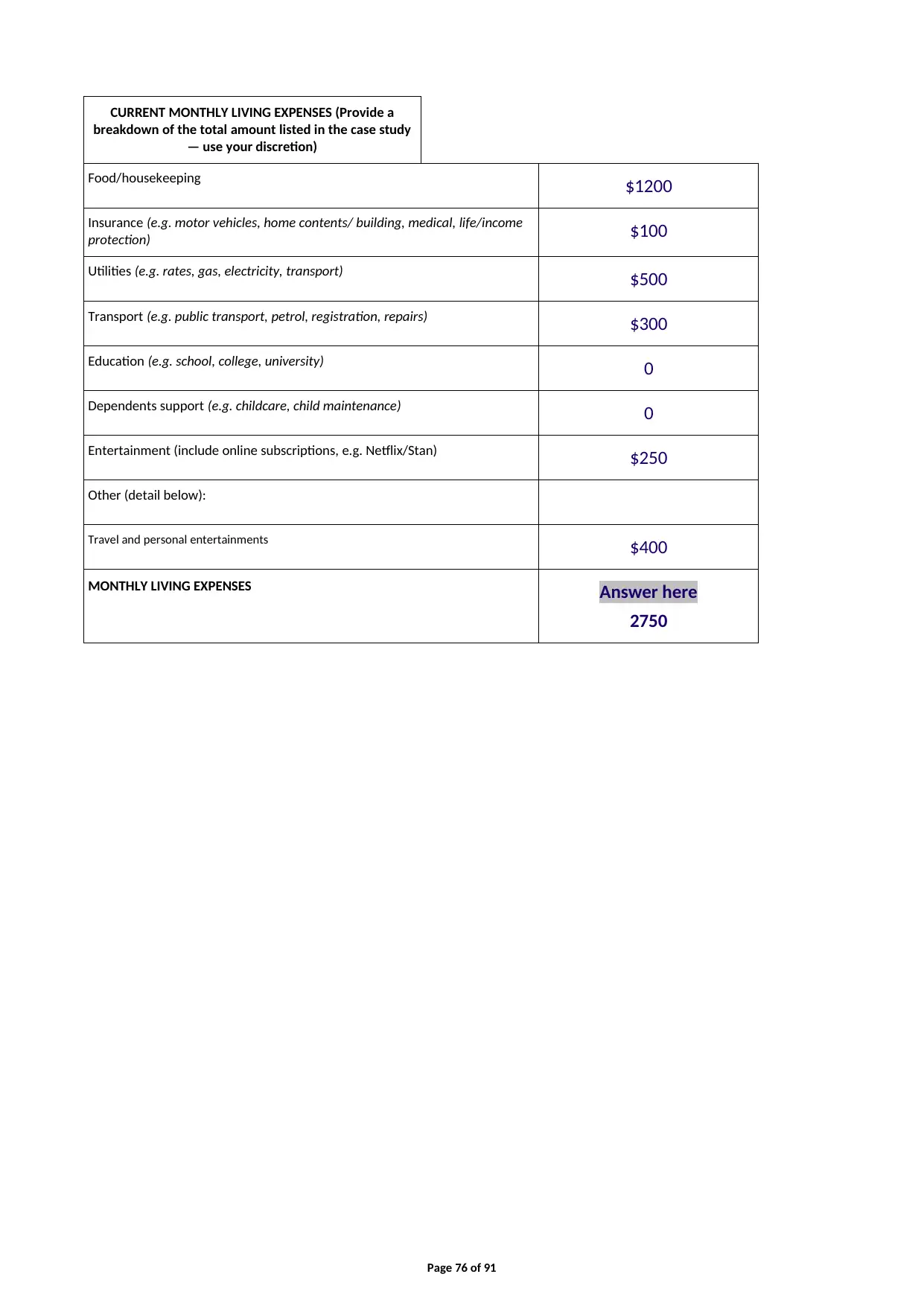

Living expenses

Annual expenditure for living expenses — $33,000.

Page 23 of 91

Purchase price $490,000

Clients’ estimate of costs $25,000

Total required $515,000

Loan $440,000 + LMI

Clients’ total contribution (including deposit of $50,000) $75,000

Use fees and charges applicable to your state. If a servicing calculator you are using requires a

postcode, select one that would represent a reasonable suburb/location in your city or state.

Assets

Capital Bank savings account (joint) $78,000

Capital Bank cheque account (joint) $1600

Holden Commodore SS 2007 (Philip) $25,000

Kia Cerato Sport 2015 (Jennifer) $9000

Superannuation — Capital Bank (Philip) $28,000

Superannuation — Capital Bank (Jennifer) $62,000

Household effects (insured value) $40,000

Liabilities

Capital Bank personal loan (Philip) $5,600 (repayments $180 p.m.)

Capital Bank Visa card (Philip) $200 (limit $4,000)

Capital Bank Visa card (Jennifer) $1,600 (limit $5,000)

Payments have always been met on time and any prior loans repaid in terms of contracts.

The minimum monthly commitment on each of the credit cards should be calculated at 3% of the

credit limit.

Living expenses

Annual expenditure for living expenses — $33,000.

Page 23 of 91

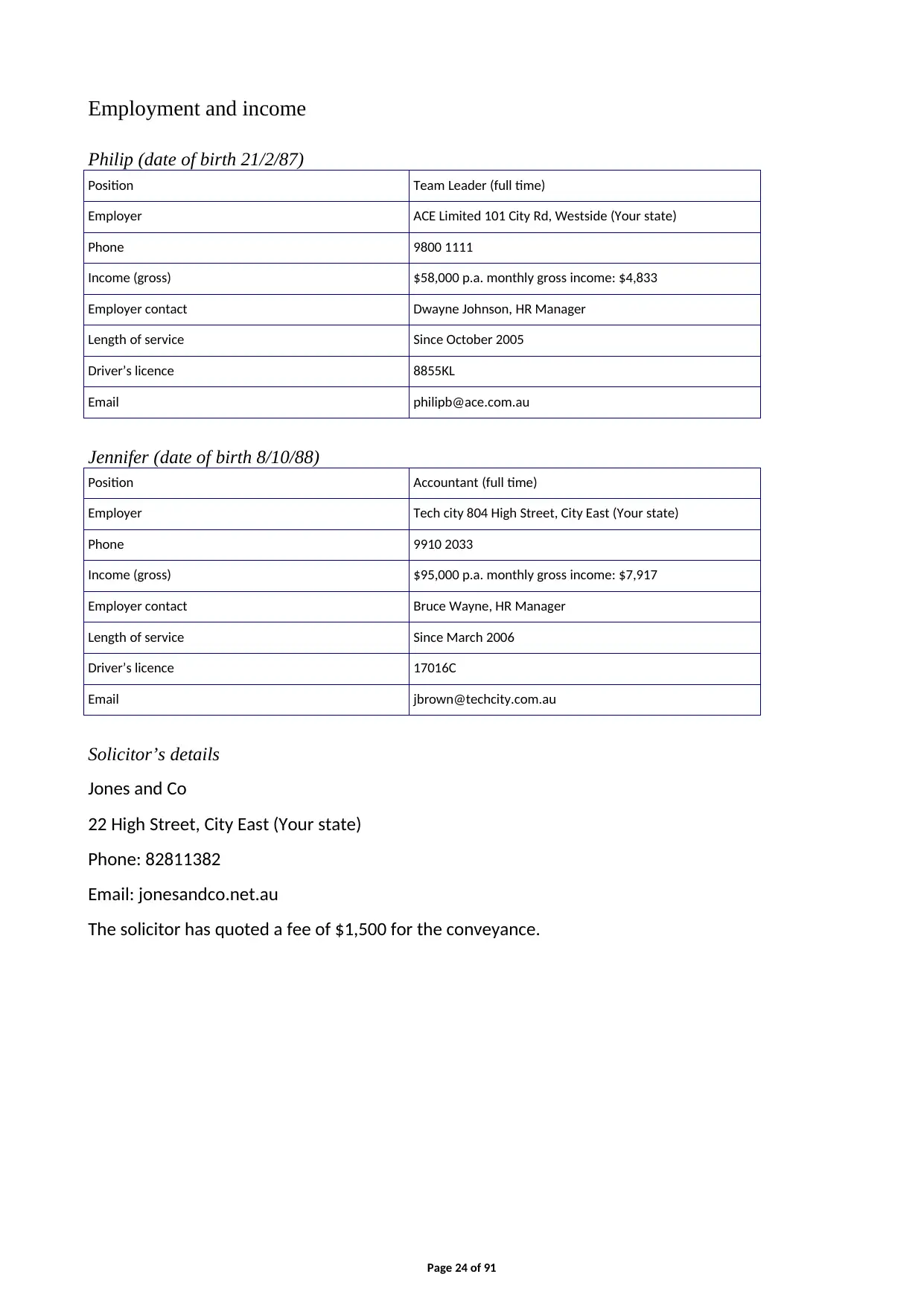

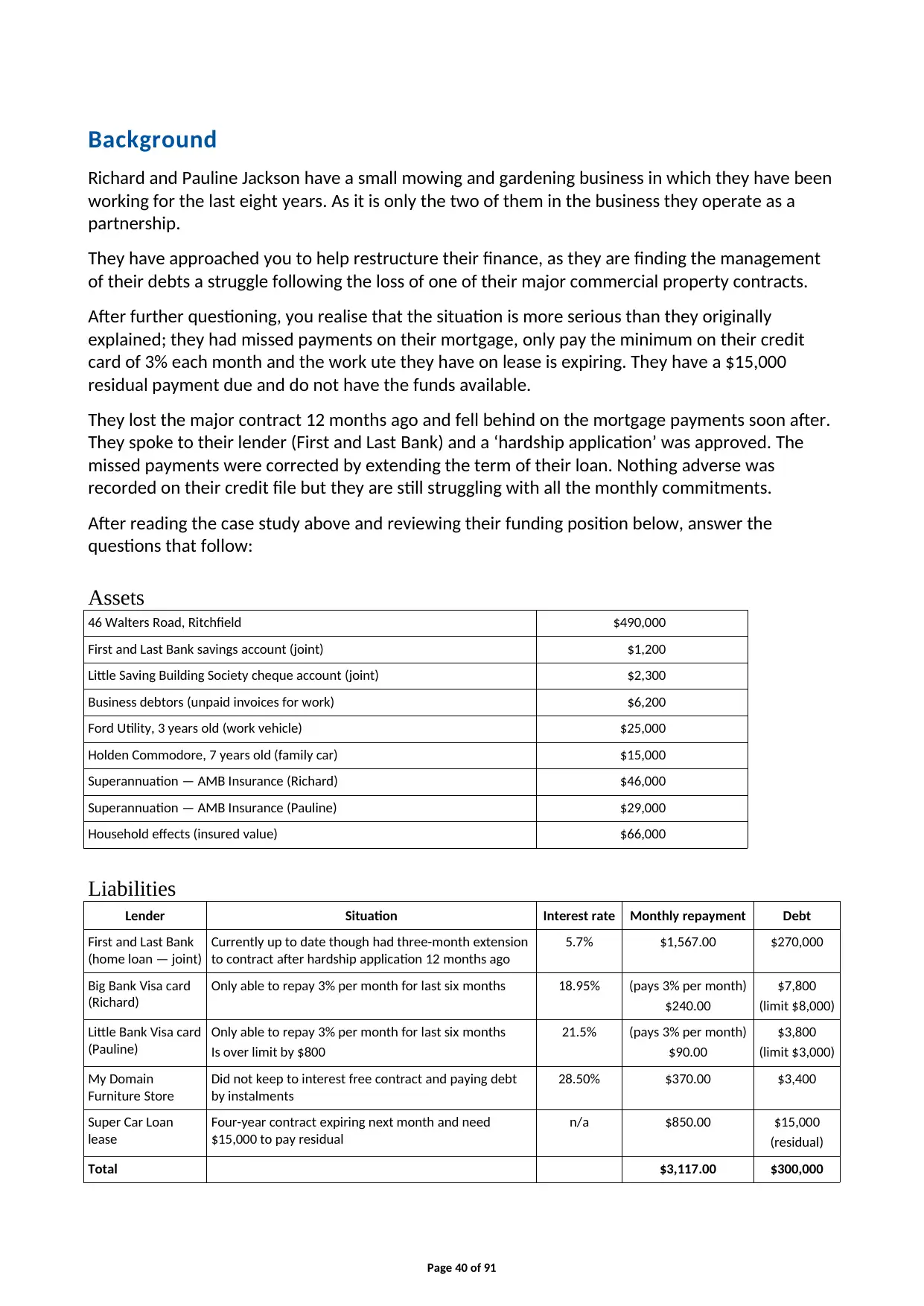

Employment and income

Philip (date of birth 21/2/87)

Position Team Leader (full time)

Employer ACE Limited 101 City Rd, Westside (Your state)

Phone 9800 1111

Income (gross) $58,000 p.a. monthly gross income: $4,833

Employer contact Dwayne Johnson, HR Manager

Length of service Since October 2005

Driver’s licence 8855KL

Email philipb@ace.com.au

Jennifer (date of birth 8/10/88)

Position Accountant (full time)

Employer Tech city 804 High Street, City East (Your state)

Phone 9910 2033

Income (gross) $95,000 p.a. monthly gross income: $7,917

Employer contact Bruce Wayne, HR Manager

Length of service Since March 2006

Driver’s licence 17016C

Email jbrown@techcity.com.au

Solicitor’s details

Jones and Co

22 High Street, City East (Your state)

Phone: 82811382

Email: jonesandco.net.au

The solicitor has quoted a fee of $1,500 for the conveyance.

Page 24 of 91

Philip (date of birth 21/2/87)

Position Team Leader (full time)

Employer ACE Limited 101 City Rd, Westside (Your state)

Phone 9800 1111

Income (gross) $58,000 p.a. monthly gross income: $4,833

Employer contact Dwayne Johnson, HR Manager

Length of service Since October 2005

Driver’s licence 8855KL

Email philipb@ace.com.au

Jennifer (date of birth 8/10/88)

Position Accountant (full time)

Employer Tech city 804 High Street, City East (Your state)

Phone 9910 2033

Income (gross) $95,000 p.a. monthly gross income: $7,917

Employer contact Bruce Wayne, HR Manager

Length of service Since March 2006

Driver’s licence 17016C

Email jbrown@techcity.com.au

Solicitor’s details

Jones and Co

22 High Street, City East (Your state)

Phone: 82811382

Email: jonesandco.net.au

The solicitor has quoted a fee of $1,500 for the conveyance.

Page 24 of 91

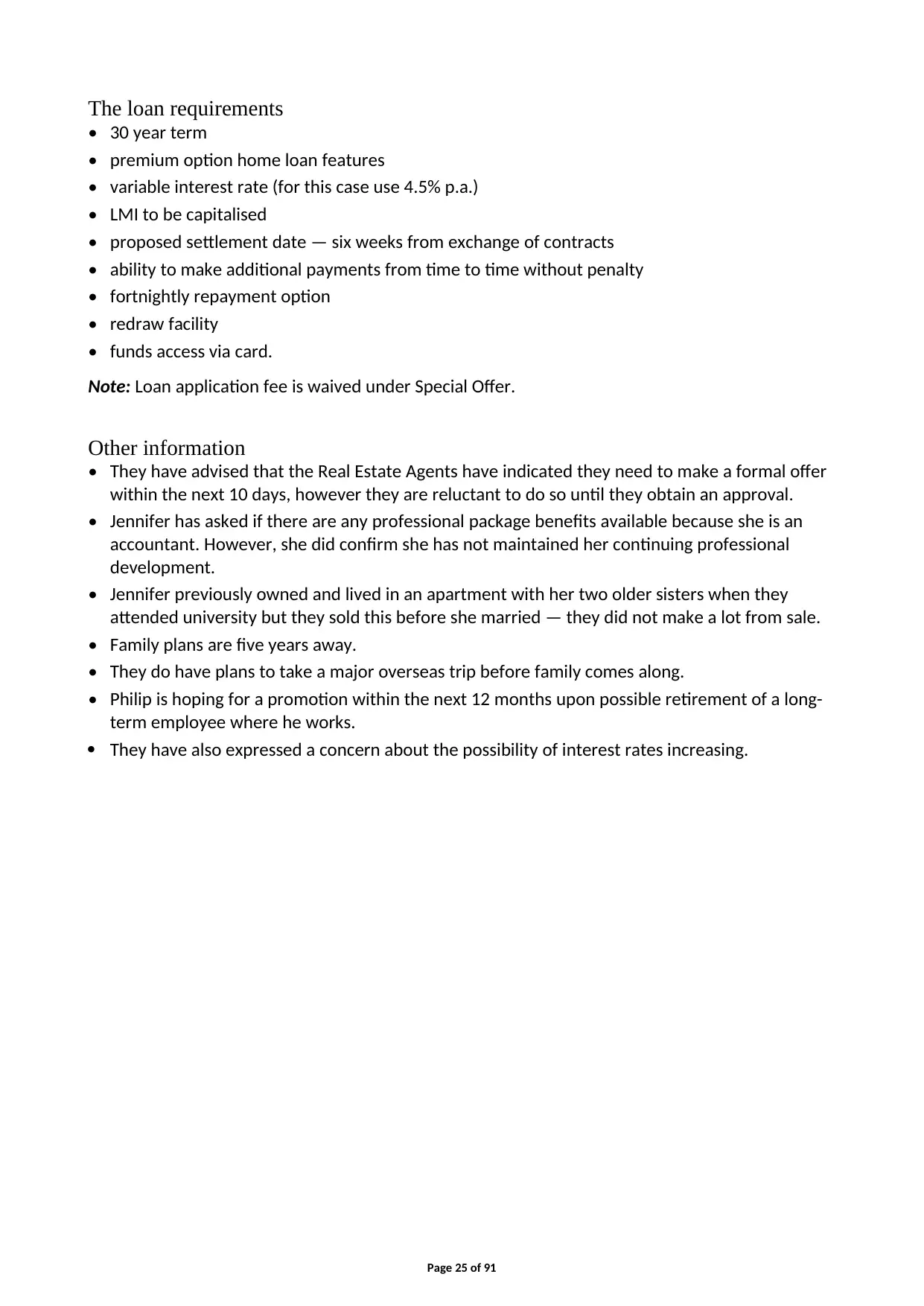

The loan requirements

• 30 year term

• premium option home loan features

• variable interest rate (for this case use 4.5% p.a.)

• LMI to be capitalised

• proposed settlement date — six weeks from exchange of contracts

• ability to make additional payments from time to time without penalty

• fortnightly repayment option

• redraw facility

• funds access via card.

Note: Loan application fee is waived under Special Offer.

Other information

• They have advised that the Real Estate Agents have indicated they need to make a formal offer

within the next 10 days, however they are reluctant to do so until they obtain an approval.

• Jennifer has asked if there are any professional package benefits available because she is an

accountant. However, she did confirm she has not maintained her continuing professional

development.

• Jennifer previously owned and lived in an apartment with her two older sisters when they

attended university but they sold this before she married — they did not make a lot from sale.

• Family plans are five years away.

• They do have plans to take a major overseas trip before family comes along.

• Philip is hoping for a promotion within the next 12 months upon possible retirement of a long-

term employee where he works.

They have also expressed a concern about the possibility of interest rates increasing.

Page 25 of 91

• 30 year term

• premium option home loan features

• variable interest rate (for this case use 4.5% p.a.)

• LMI to be capitalised

• proposed settlement date — six weeks from exchange of contracts

• ability to make additional payments from time to time without penalty

• fortnightly repayment option

• redraw facility

• funds access via card.

Note: Loan application fee is waived under Special Offer.

Other information

• They have advised that the Real Estate Agents have indicated they need to make a formal offer

within the next 10 days, however they are reluctant to do so until they obtain an approval.

• Jennifer has asked if there are any professional package benefits available because she is an

accountant. However, she did confirm she has not maintained her continuing professional

development.

• Jennifer previously owned and lived in an apartment with her two older sisters when they

attended university but they sold this before she married — they did not make a lot from sale.

• Family plans are five years away.

• They do have plans to take a major overseas trip before family comes along.

• Philip is hoping for a promotion within the next 12 months upon possible retirement of a long-

term employee where he works.

They have also expressed a concern about the possibility of interest rates increasing.

Page 25 of 91

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Assignment tasks (student to complete)

Page 26 of 91

Page 26 of 91

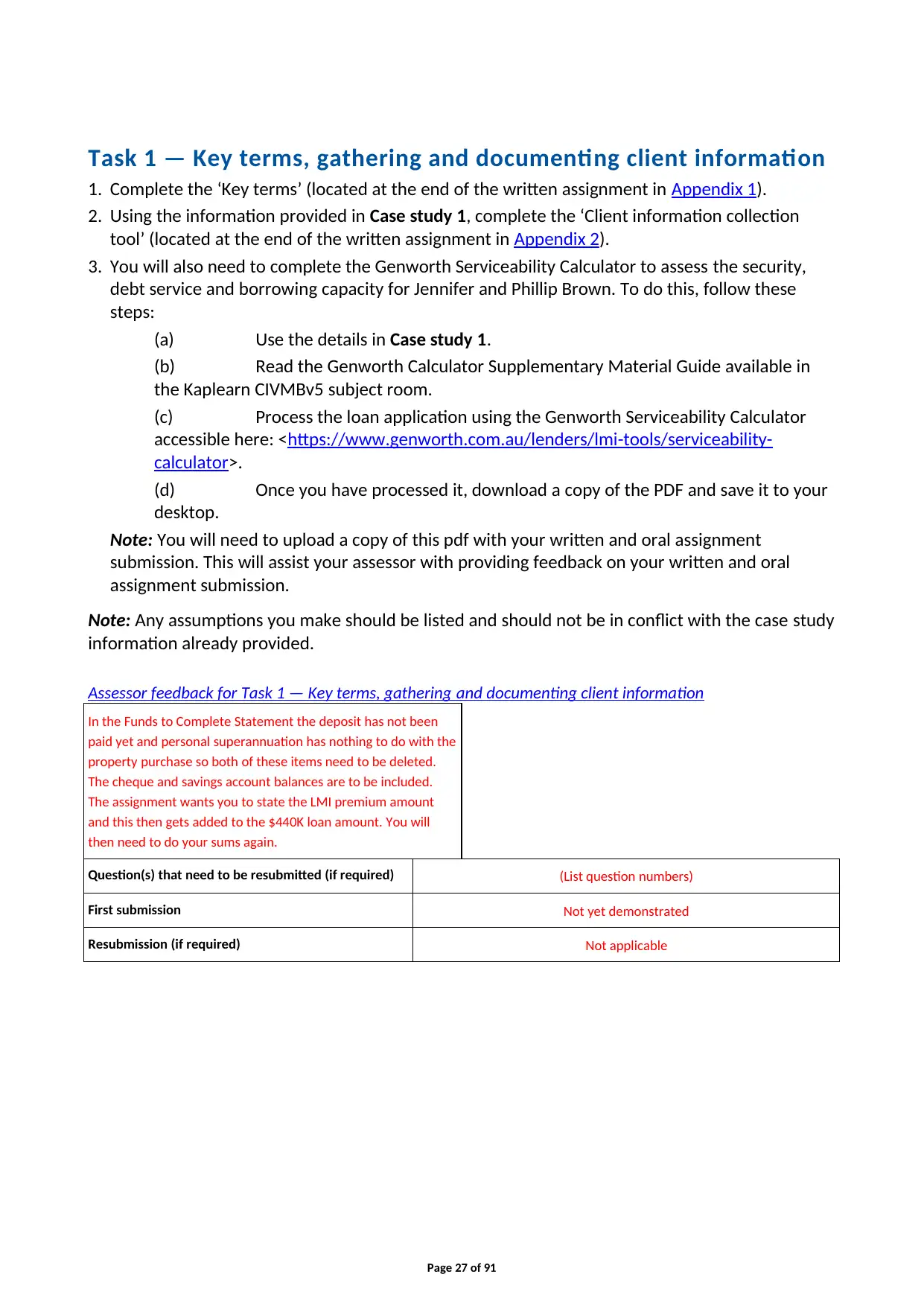

Task 1 — Key terms, gathering and documenting client information

1. Complete the ‘Key terms’ (located at the end of the written assignment in Appendix 1).

2. Using the information provided in Case study 1, complete the ‘Client information collection

tool’ (located at the end of the written assignment in Appendix 2).

3. You will also need to complete the Genworth Serviceability Calculator to assess the security,

debt service and borrowing capacity for Jennifer and Phillip Brown. To do this, follow these

steps:

(a) Use the details in Case study 1.

(b) Read the Genworth Calculator Supplementary Material Guide available in

the Kaplearn CIVMBv5 subject room.

(c) Process the loan application using the Genworth Serviceability Calculator

accessible here: <https://www.genworth.com.au/lenders/lmi-tools/serviceability-

calculator>.

(d) Once you have processed it, download a copy of the PDF and save it to your

desktop.

Note: You will need to upload a copy of this pdf with your written and oral assignment

submission. This will assist your assessor with providing feedback on your written and oral

assignment submission.

Note: Any assumptions you make should be listed and should not be in conflict with the case study

information already provided.

Assessor feedback for Task 1 — Key terms, gathering and documenting client information

In the Funds to Complete Statement the deposit has not been

paid yet and personal superannuation has nothing to do with the

property purchase so both of these items need to be deleted.

The cheque and savings account balances are to be included.

The assignment wants you to state the LMI premium amount

and this then gets added to the $440K loan amount. You will

then need to do your sums again.

Question(s) that need to be resubmitted (if required) (List question numbers)

First submission Not yet demonstrated

Resubmission (if required) Not applicable

Page 27 of 91

1. Complete the ‘Key terms’ (located at the end of the written assignment in Appendix 1).

2. Using the information provided in Case study 1, complete the ‘Client information collection

tool’ (located at the end of the written assignment in Appendix 2).

3. You will also need to complete the Genworth Serviceability Calculator to assess the security,

debt service and borrowing capacity for Jennifer and Phillip Brown. To do this, follow these

steps:

(a) Use the details in Case study 1.

(b) Read the Genworth Calculator Supplementary Material Guide available in

the Kaplearn CIVMBv5 subject room.

(c) Process the loan application using the Genworth Serviceability Calculator

accessible here: <https://www.genworth.com.au/lenders/lmi-tools/serviceability-

calculator>.

(d) Once you have processed it, download a copy of the PDF and save it to your

desktop.

Note: You will need to upload a copy of this pdf with your written and oral assignment

submission. This will assist your assessor with providing feedback on your written and oral

assignment submission.

Note: Any assumptions you make should be listed and should not be in conflict with the case study

information already provided.

Assessor feedback for Task 1 — Key terms, gathering and documenting client information

In the Funds to Complete Statement the deposit has not been

paid yet and personal superannuation has nothing to do with the

property purchase so both of these items need to be deleted.

The cheque and savings account balances are to be included.

The assignment wants you to state the LMI premium amount

and this then gets added to the $440K loan amount. You will

then need to do your sums again.

Question(s) that need to be resubmitted (if required) (List question numbers)

First submission Not yet demonstrated

Resubmission (if required) Not applicable

Page 27 of 91

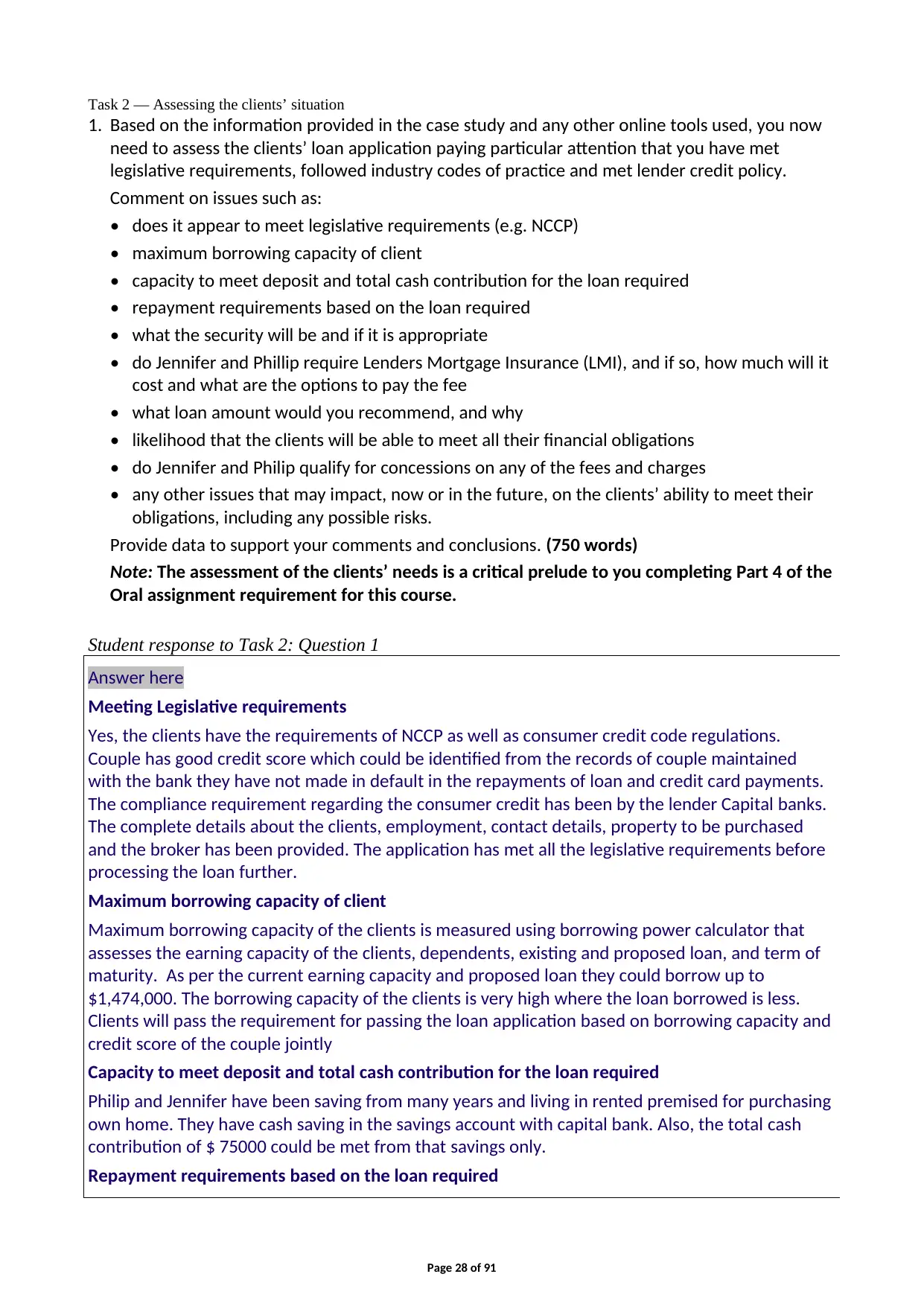

Task 2 — Assessing the clients’ situation

1. Based on the information provided in the case study and any other online tools used, you now

need to assess the clients’ loan application paying particular attention that you have met

legislative requirements, followed industry codes of practice and met lender credit policy.

Comment on issues such as:

• does it appear to meet legislative requirements (e.g. NCCP)

• maximum borrowing capacity of client

• capacity to meet deposit and total cash contribution for the loan required

• repayment requirements based on the loan required

• what the security will be and if it is appropriate

• do Jennifer and Phillip require Lenders Mortgage Insurance (LMI), and if so, how much will it

cost and what are the options to pay the fee

• what loan amount would you recommend, and why

• likelihood that the clients will be able to meet all their financial obligations

• do Jennifer and Philip qualify for concessions on any of the fees and charges

• any other issues that may impact, now or in the future, on the clients’ ability to meet their

obligations, including any possible risks.

Provide data to support your comments and conclusions. (750 words)

Note: The assessment of the clients’ needs is a critical prelude to you completing Part 4 of the

Oral assignment requirement for this course.

Student response to Task 2: Question 1

Answer here

Meeting Legislative requirements

Yes, the clients have the requirements of NCCP as well as consumer credit code regulations.

Couple has good credit score which could be identified from the records of couple maintained

with the bank they have not made in default in the repayments of loan and credit card payments.

The compliance requirement regarding the consumer credit has been by the lender Capital banks.

The complete details about the clients, employment, contact details, property to be purchased

and the broker has been provided. The application has met all the legislative requirements before

processing the loan further.

Maximum borrowing capacity of client

Maximum borrowing capacity of the clients is measured using borrowing power calculator that

assesses the earning capacity of the clients, dependents, existing and proposed loan, and term of

maturity. As per the current earning capacity and proposed loan they could borrow up to

$1,474,000. The borrowing capacity of the clients is very high where the loan borrowed is less.

Clients will pass the requirement for passing the loan application based on borrowing capacity and

credit score of the couple jointly

Capacity to meet deposit and total cash contribution for the loan required

Philip and Jennifer have been saving from many years and living in rented premised for purchasing

own home. They have cash saving in the savings account with capital bank. Also, the total cash

contribution of $ 75000 could be met from that savings only.

Repayment requirements based on the loan required

Page 28 of 91

1. Based on the information provided in the case study and any other online tools used, you now

need to assess the clients’ loan application paying particular attention that you have met

legislative requirements, followed industry codes of practice and met lender credit policy.

Comment on issues such as:

• does it appear to meet legislative requirements (e.g. NCCP)

• maximum borrowing capacity of client

• capacity to meet deposit and total cash contribution for the loan required

• repayment requirements based on the loan required

• what the security will be and if it is appropriate

• do Jennifer and Phillip require Lenders Mortgage Insurance (LMI), and if so, how much will it

cost and what are the options to pay the fee

• what loan amount would you recommend, and why

• likelihood that the clients will be able to meet all their financial obligations

• do Jennifer and Philip qualify for concessions on any of the fees and charges

• any other issues that may impact, now or in the future, on the clients’ ability to meet their

obligations, including any possible risks.

Provide data to support your comments and conclusions. (750 words)

Note: The assessment of the clients’ needs is a critical prelude to you completing Part 4 of the

Oral assignment requirement for this course.

Student response to Task 2: Question 1

Answer here

Meeting Legislative requirements

Yes, the clients have the requirements of NCCP as well as consumer credit code regulations.

Couple has good credit score which could be identified from the records of couple maintained

with the bank they have not made in default in the repayments of loan and credit card payments.

The compliance requirement regarding the consumer credit has been by the lender Capital banks.

The complete details about the clients, employment, contact details, property to be purchased

and the broker has been provided. The application has met all the legislative requirements before

processing the loan further.

Maximum borrowing capacity of client

Maximum borrowing capacity of the clients is measured using borrowing power calculator that

assesses the earning capacity of the clients, dependents, existing and proposed loan, and term of

maturity. As per the current earning capacity and proposed loan they could borrow up to

$1,474,000. The borrowing capacity of the clients is very high where the loan borrowed is less.

Clients will pass the requirement for passing the loan application based on borrowing capacity and

credit score of the couple jointly

Capacity to meet deposit and total cash contribution for the loan required

Philip and Jennifer have been saving from many years and living in rented premised for purchasing

own home. They have cash saving in the savings account with capital bank. Also, the total cash

contribution of $ 75000 could be met from that savings only.

Repayment requirements based on the loan required

Page 28 of 91

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Clients have applied for the home loan for purchasing new House. The loan amount applied is

$440,000. The clients want repayment over loan on fortnight basis so that they are not burdened

with single monthly payments for loan. The clients are also wanting a redraw facility so that they

could make additional payment for setting off the loan as soon as possible. The loan applied from

the bank could provide all the repayment requirements as the term loan is significant period.

However, the set off charges apply to the client on early set off the loan amount.

What the security will be and if it is appropriate

The loan provided by the bank are always provided on some or the other security so that they

could recover the amount in event of default. In the current case the loan will be secured on the

property itself. The title deeds will be transferred to the clients after the loan amount is repaid by

the clients on home. They will have the possession but not the title deeds.

Do Jennifer and Phillip require Lenders Mortgage Insurance (LMI), and if so, how much will it

cost and what are the options to pay the fee

When the amount borrowed in loan is more than 80% of purchase price of the home the clients

are often required to pay lenders mortgage insurance. As the couple is borrowing more that 80%

of the purchase price of loan, they are required to pay lenders mortgage insurance. The couple

will be required to LMI of $ 7,741 over the loan of $ 440,000. It protects the bank in case of default

by the borrower due to any of the discrepancies. It is paid by online means or with the loan.

What loan amount would you recommend, and why

They should have borrowed $ 390,000 which is lower than 80% this would have prevented the

couple to pay the LMI and have also reduced the deposit requirement to an extent. The LMI costs

are non-refundable and additional cost that could be prevented if loan was lower than 80%.

Likelihood that the clients will be able to meet all their financial obligations

The couple have good credit score and has also met the consumer credit regulations. There is

greater likelihood of clients meeting their financial obligations. Both are employed in good

organizations of Western Australia and are getting fixed salary. The salaries are sufficient for

meeting the obligations are carrying out living expenses. Even if one of the members is not earning

then also, they are able to meet the loan repayments.

Do Jennifer and Philip qualify for concessions on any of the fees and charges

They do not qualify for any concession or charges. They are only allowed processing without fees

under special offer.

Any other issues that may impact, now or in the future, on the clients’ ability to meet their

obligations, including any possible risks.

The couple do not currently have any dependents. Should they start a family, it will have an impact

on their earnings.

2. (a) Most lenders stress test loan repayments by adding an additional 2–3% on

to the loan repayments to make sure a borrower can afford the repayments. If interest

rates moved 3% higher, what would Philip and Jennifer’s loan repayments be and do you

think they would be able to cope with the extra repayments? (100 words)

Student response to Task 2: Question 2(a)

Page 29 of 91

$440,000. The clients want repayment over loan on fortnight basis so that they are not burdened

with single monthly payments for loan. The clients are also wanting a redraw facility so that they

could make additional payment for setting off the loan as soon as possible. The loan applied from

the bank could provide all the repayment requirements as the term loan is significant period.

However, the set off charges apply to the client on early set off the loan amount.

What the security will be and if it is appropriate

The loan provided by the bank are always provided on some or the other security so that they

could recover the amount in event of default. In the current case the loan will be secured on the

property itself. The title deeds will be transferred to the clients after the loan amount is repaid by

the clients on home. They will have the possession but not the title deeds.

Do Jennifer and Phillip require Lenders Mortgage Insurance (LMI), and if so, how much will it

cost and what are the options to pay the fee

When the amount borrowed in loan is more than 80% of purchase price of the home the clients

are often required to pay lenders mortgage insurance. As the couple is borrowing more that 80%

of the purchase price of loan, they are required to pay lenders mortgage insurance. The couple

will be required to LMI of $ 7,741 over the loan of $ 440,000. It protects the bank in case of default

by the borrower due to any of the discrepancies. It is paid by online means or with the loan.

What loan amount would you recommend, and why

They should have borrowed $ 390,000 which is lower than 80% this would have prevented the

couple to pay the LMI and have also reduced the deposit requirement to an extent. The LMI costs

are non-refundable and additional cost that could be prevented if loan was lower than 80%.

Likelihood that the clients will be able to meet all their financial obligations

The couple have good credit score and has also met the consumer credit regulations. There is

greater likelihood of clients meeting their financial obligations. Both are employed in good

organizations of Western Australia and are getting fixed salary. The salaries are sufficient for

meeting the obligations are carrying out living expenses. Even if one of the members is not earning

then also, they are able to meet the loan repayments.

Do Jennifer and Philip qualify for concessions on any of the fees and charges

They do not qualify for any concession or charges. They are only allowed processing without fees

under special offer.

Any other issues that may impact, now or in the future, on the clients’ ability to meet their

obligations, including any possible risks.

The couple do not currently have any dependents. Should they start a family, it will have an impact

on their earnings.

2. (a) Most lenders stress test loan repayments by adding an additional 2–3% on

to the loan repayments to make sure a borrower can afford the repayments. If interest

rates moved 3% higher, what would Philip and Jennifer’s loan repayments be and do you

think they would be able to cope with the extra repayments? (100 words)

Student response to Task 2: Question 2(a)

Page 29 of 91

Answer here

Current interest rate 4.5%

Loan amount = $440,000

Monthly repayments = $2,229

Fortnight repayments = $1028

If interest rates are moved 3% higher

Newt interest rate 7.5%

Loan amount = $440,000

Monthly repayments = $3077

Fortnight repayments = $1419

Even if the interest rates are moved higher by 3% they will be able to meet the loan repayments

without making any default. Both Philip and Jennifer earn monthly salary of $ 12750 and they are

making fortnight repayments which also reduce the interest payments on loan.

(b) Identify appropriate product options you can present to the clients that may

remove this interest rate risk? (50 words)

Student response to Task 2: Question 2(b)

Answer here

The client could be suggested fixed interest rates loan which will not change through- out the loan

term. However, the interest charged is somewhat higher than the variable interest rate loan. The

risk of increase in interest rate is removed completely if the client chooses for fixed rate loan.

Assessor feedback for Task 2 — Assessing the clients’ situation

1) The income for the borrowers you have used in the

Servicing calculator is wrong which gives you the

wrong amount they could potentially borrow. This

amount is different to what you have included as your

answer. You also need to do the Genworth LMI

Premium Estimator calculator the get the correct LMI

amount and attach this printout as well

Question(s) that need to be resubmitted (if required) 1

First submission Not yet demonstrated

Resubmission (if required) Not applicable

Page 30 of 91

Current interest rate 4.5%

Loan amount = $440,000

Monthly repayments = $2,229

Fortnight repayments = $1028

If interest rates are moved 3% higher

Newt interest rate 7.5%

Loan amount = $440,000

Monthly repayments = $3077

Fortnight repayments = $1419

Even if the interest rates are moved higher by 3% they will be able to meet the loan repayments

without making any default. Both Philip and Jennifer earn monthly salary of $ 12750 and they are

making fortnight repayments which also reduce the interest payments on loan.

(b) Identify appropriate product options you can present to the clients that may

remove this interest rate risk? (50 words)

Student response to Task 2: Question 2(b)

Answer here

The client could be suggested fixed interest rates loan which will not change through- out the loan

term. However, the interest charged is somewhat higher than the variable interest rate loan. The

risk of increase in interest rate is removed completely if the client chooses for fixed rate loan.

Assessor feedback for Task 2 — Assessing the clients’ situation

1) The income for the borrowers you have used in the

Servicing calculator is wrong which gives you the

wrong amount they could potentially borrow. This

amount is different to what you have included as your

answer. You also need to do the Genworth LMI

Premium Estimator calculator the get the correct LMI

amount and attach this printout as well

Question(s) that need to be resubmitted (if required) 1

First submission Not yet demonstrated

Resubmission (if required) Not applicable

Page 30 of 91

Task 3 — Borrowing options

Although Philip and Jennifer are looking to borrow at approximately 90% LVR, what other options

could you present that would avoid the cost of LMI? (100 words)

Student response to Task 3

Answer here

This is attached with the loan types, amount of loans and the borrowers. The clients could choose

lenders that have discounted LMI provider. LMI increases with the increase in loan amount. The

20% deposit option reduces the requirement of LMI payments over loan. As the clients are

borrowing at 90% LVR they can use guarantor to borrow over 80% it will remove the LMI cost on

loan. If they have guarantor over the home loan, they could avoid the LMI cost completely over

the loan. They can make any person of their knowing to give guarantee over the loan. Brother of

Philip can become guarantor.

Assessor feedback for Task 3 — Borrowing options

(Insert Feedback)

Question(s) that need to be resubmitted (if required) (List question numbers)

First submission Demonstrated

Resubmission (if required) Not applicable

Page 31 of 91

Although Philip and Jennifer are looking to borrow at approximately 90% LVR, what other options

could you present that would avoid the cost of LMI? (100 words)

Student response to Task 3

Answer here

This is attached with the loan types, amount of loans and the borrowers. The clients could choose

lenders that have discounted LMI provider. LMI increases with the increase in loan amount. The

20% deposit option reduces the requirement of LMI payments over loan. As the clients are

borrowing at 90% LVR they can use guarantor to borrow over 80% it will remove the LMI cost on

loan. If they have guarantor over the home loan, they could avoid the LMI cost completely over

the loan. They can make any person of their knowing to give guarantee over the loan. Brother of

Philip can become guarantor.

Assessor feedback for Task 3 — Borrowing options

(Insert Feedback)

Question(s) that need to be resubmitted (if required) (List question numbers)

First submission Demonstrated

Resubmission (if required) Not applicable

Page 31 of 91

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Task 4 — Reasonable enquiries

In the course of gathering information about the couple, you are required under the National

Consumer Credit Protection Act 2009 to make all ‘reasonable’ enquiries to determine a borrower’s

objectives, requirements and financial situation.

Identify at least six (6) ‘reasonable’ enquiries that you would make with the clients in the case

study and explain why these enquiries are important in terms of NCCP compliance. (200 words)

Student response to Task 4

Answer here

After the incorporation of NCCP it has laid responsible lending obligations over the lenders to

assess the credit application of the borrowers before providing loans. These inquiries and principle

are essential as the protect the lenders from default risks by assessing the credit history and other

associated enquiries as the lender may find necessary for granting the loan.

Six enquiries made with client

1. What is the purpose and objective behind loan?

To ensure that the proceeds are applied for legal purpose.

2. What are the current financial conditions and sources of income?

To know the amount which the client can afford and have sufficient income for making

repayments.

3. What is the credit score of the clients?

This is very essential to ensure that they have not defaulted earlier in any loan repayments

4. Cross verifying the details given in the loan application file of client?

To confirm that details given are true and not false information is mentioned

5. How will the client meet the financial obligations?

To know the ways how loan repayments will be made.

6. Existing loans which will go along with the loan applied by the clients.

To identify whether the client will be able to make repayments along with existing loans or not.

Assessor feedback for Task 4 — Reasonable enquiries

(Insert Feedback)

Question(s) that need to be resubmitted (if required) (List question numbers)

First submission Demonstrated

Resubmission (if required) Not applicable

Page 32 of 91

In the course of gathering information about the couple, you are required under the National

Consumer Credit Protection Act 2009 to make all ‘reasonable’ enquiries to determine a borrower’s

objectives, requirements and financial situation.

Identify at least six (6) ‘reasonable’ enquiries that you would make with the clients in the case

study and explain why these enquiries are important in terms of NCCP compliance. (200 words)

Student response to Task 4

Answer here

After the incorporation of NCCP it has laid responsible lending obligations over the lenders to

assess the credit application of the borrowers before providing loans. These inquiries and principle

are essential as the protect the lenders from default risks by assessing the credit history and other

associated enquiries as the lender may find necessary for granting the loan.

Six enquiries made with client

1. What is the purpose and objective behind loan?

To ensure that the proceeds are applied for legal purpose.

2. What are the current financial conditions and sources of income?

To know the amount which the client can afford and have sufficient income for making

repayments.

3. What is the credit score of the clients?

This is very essential to ensure that they have not defaulted earlier in any loan repayments

4. Cross verifying the details given in the loan application file of client?

To confirm that details given are true and not false information is mentioned

5. How will the client meet the financial obligations?

To know the ways how loan repayments will be made.

6. Existing loans which will go along with the loan applied by the clients.

To identify whether the client will be able to make repayments along with existing loans or not.

Assessor feedback for Task 4 — Reasonable enquiries

(Insert Feedback)

Question(s) that need to be resubmitted (if required) (List question numbers)

First submission Demonstrated

Resubmission (if required) Not applicable

Page 32 of 91

Task 5 — First Home Owners Grant and home buyer assistance schemes

Describe the First Home Owner’s Grant or home buyer assistance scheme benefits and stamp duty

concessions that are available in your State or Territory, who would be eligible and what would be

their benefit? Are Philip and Jennifer eligible for any assistance?

Note: Please identify which State or Territory you are from in your answer. (150 words)

Student response to Task 5

Answer here

Under the First home buyer assistance scheme the first buyer who are purchasing existing home

of less than $ 650,000 are allowed with full exemption on the transfer duty. For availing this

exemption, they must move in property within 12 months of buying and live there for continuous

period of not less than six months. This exemption will reduce the cost or transfer duty paid over

purchase.

Clients could apply for First Homeowner Grant scheme through the bank or financial institution

from which loan is borrowed. The application must be made within 12 of settlement for buying of

property. Other conditions are same as in FHBAS.

Federal government has announced grant of $25000 on renovations of existing homes.

The clients are not eligible for the stamp duty exemption in the state of Western Australia where

some of the state’s offer exemption for homes below $600,000.

Assessor feedback for Task 5 — First Home Owners Grant and home buyer assistance schemes

(Insert Feedback)

Question(s) that need to be resubmitted (if required) (List question numbers)

First submission Demonstrated

Resubmission (if required) Not applicable

Page 33 of 91

Describe the First Home Owner’s Grant or home buyer assistance scheme benefits and stamp duty

concessions that are available in your State or Territory, who would be eligible and what would be

their benefit? Are Philip and Jennifer eligible for any assistance?

Note: Please identify which State or Territory you are from in your answer. (150 words)

Student response to Task 5

Answer here

Under the First home buyer assistance scheme the first buyer who are purchasing existing home

of less than $ 650,000 are allowed with full exemption on the transfer duty. For availing this

exemption, they must move in property within 12 months of buying and live there for continuous

period of not less than six months. This exemption will reduce the cost or transfer duty paid over

purchase.

Clients could apply for First Homeowner Grant scheme through the bank or financial institution

from which loan is borrowed. The application must be made within 12 of settlement for buying of

property. Other conditions are same as in FHBAS.

Federal government has announced grant of $25000 on renovations of existing homes.

The clients are not eligible for the stamp duty exemption in the state of Western Australia where

some of the state’s offer exemption for homes below $600,000.

Assessor feedback for Task 5 — First Home Owners Grant and home buyer assistance schemes

(Insert Feedback)

Question(s) that need to be resubmitted (if required) (List question numbers)

First submission Demonstrated

Resubmission (if required) Not applicable

Page 33 of 91

Task 6 — Professional network and loan settlement process

1. Name three (3) parties, who are not directly involved in the processing of a loan and what their

role is. Explain how you would communicate with them in an efficient and effective manner so

that they understand pre-settlement conditions and their involvement required. (100 words)

Student response to Task 6: Question 1

Answer here

There are different parties that are associated with the loan that have significant influence over

the loan transactions and the processing of loan. The three parties involved in loan are

Loan Manager

Loan manager are not directly involved in processing the loan but analyses the application of loan

from clients to ensure that the loan is free from false statement and meets the condition for

qualification of loan. Client will communicate with managers during the processing of loan.

Owner of the property being sold

It is the party to whom loan amount will be paid. They have significant importance but are not

directly involved in loan. They will be communicated directly to inform about the settlements

Guarantor

Third party liable in case of default by clients.

2. Explain how you would develop and maintain relevant networks with professionals such as

those you detailed above or other professionals to ensure you are up to date with the products

or services they provide. (100 words)

Student response to Task 6: Question 2

Answer here

Network and connections with the professional for assisting with the products and information

related to loan will be maintained over phone calls and via email. They will be informed about the

details and conditions about the loan that are essential for the services provided by them. Lawyers

and loan managers can provide important details regarding the new schemes and the benefits that

they could avail under the different schemes coming from time to time.

3. You want to ensure that Philip and Jennifer have all the key insurance protections in place in

case something unfortunate was to happen to one of them. What process would you follow

during your discussion with the clients to ensure you have a good assessment of their needs?

(100 words)

Student response to Task 6: Question 3

Page 34 of 91

1. Name three (3) parties, who are not directly involved in the processing of a loan and what their

role is. Explain how you would communicate with them in an efficient and effective manner so

that they understand pre-settlement conditions and their involvement required. (100 words)

Student response to Task 6: Question 1

Answer here

There are different parties that are associated with the loan that have significant influence over

the loan transactions and the processing of loan. The three parties involved in loan are

Loan Manager

Loan manager are not directly involved in processing the loan but analyses the application of loan

from clients to ensure that the loan is free from false statement and meets the condition for

qualification of loan. Client will communicate with managers during the processing of loan.

Owner of the property being sold

It is the party to whom loan amount will be paid. They have significant importance but are not

directly involved in loan. They will be communicated directly to inform about the settlements

Guarantor

Third party liable in case of default by clients.

2. Explain how you would develop and maintain relevant networks with professionals such as

those you detailed above or other professionals to ensure you are up to date with the products

or services they provide. (100 words)

Student response to Task 6: Question 2

Answer here

Network and connections with the professional for assisting with the products and information

related to loan will be maintained over phone calls and via email. They will be informed about the

details and conditions about the loan that are essential for the services provided by them. Lawyers

and loan managers can provide important details regarding the new schemes and the benefits that

they could avail under the different schemes coming from time to time.

3. You want to ensure that Philip and Jennifer have all the key insurance protections in place in

case something unfortunate was to happen to one of them. What process would you follow

during your discussion with the clients to ensure you have a good assessment of their needs?

(100 words)

Student response to Task 6: Question 3

Page 34 of 91

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Answer here

It is essential for the lender to identify and assess the plans that client in case of the contingencies

where they are not able to meet the financial obligations. These must be clarified and assessed

during the discussions with client. The clients could be asked about their future about the

expansions. They could be asked about the insurance policies they are having at present for

protections against uncertainties. They could also be asked directly about the back up plans in

case one of the members is not able to earn.

4. Briefly explain why it is important for the broker to remain informed of developments in the

lending process despite not being actively involved at every stage. (100 words)

Student response to Task 6: Question 4

Answer here

Brokers are the people that are required to provide their clients with the best deals. They must

provide them benefits associated with the purchase of certain property or land. They must be

updated about the borrowing process and the prevailing lending process so that they could also

give their clients financial assistance to get into the transactions via loan. Most of the transactions

take place through loans or borrowing and borrower must inform their client about the

developments in lending process to make the deal more attractive. It also enables them to meet

the requirements of clients.

5. Application form and related documents have now been signed and forwarded to the Lender

for approval. Philip and Jennifer have agreed that you will keep their Solicitor informed of

progress if/when the loan is approved.

Refer to the ‘Example of an Organisation’s Policies and Procedures’ document in toolbox and

explain what the service standards and timelines are up to and including the issue of offer letter

and mortgage documents. (100 words)

Student response to Task 6: Question 5

Answer here

The service standards provide that the loans applications should be processed as they are received

from the clients. The clients should not be made to wait for long period for knowing the status of

loan application. The loan application should be processes as soon as possible and client should be

informed about the application and if passed the offer letter should be handed over and delivered

at addressed shared and via emails within 7 days. The mortgage document should also be verified

simultaneously with the loan documents so that the solicitor could be informed on time.

Page 35 of 91

It is essential for the lender to identify and assess the plans that client in case of the contingencies

where they are not able to meet the financial obligations. These must be clarified and assessed

during the discussions with client. The clients could be asked about their future about the

expansions. They could be asked about the insurance policies they are having at present for

protections against uncertainties. They could also be asked directly about the back up plans in

case one of the members is not able to earn.

4. Briefly explain why it is important for the broker to remain informed of developments in the

lending process despite not being actively involved at every stage. (100 words)

Student response to Task 6: Question 4

Answer here

Brokers are the people that are required to provide their clients with the best deals. They must

provide them benefits associated with the purchase of certain property or land. They must be

updated about the borrowing process and the prevailing lending process so that they could also

give their clients financial assistance to get into the transactions via loan. Most of the transactions

take place through loans or borrowing and borrower must inform their client about the

developments in lending process to make the deal more attractive. It also enables them to meet

the requirements of clients.

5. Application form and related documents have now been signed and forwarded to the Lender

for approval. Philip and Jennifer have agreed that you will keep their Solicitor informed of

progress if/when the loan is approved.

Refer to the ‘Example of an Organisation’s Policies and Procedures’ document in toolbox and

explain what the service standards and timelines are up to and including the issue of offer letter

and mortgage documents. (100 words)

Student response to Task 6: Question 5

Answer here

The service standards provide that the loans applications should be processed as they are received

from the clients. The clients should not be made to wait for long period for knowing the status of

loan application. The loan application should be processes as soon as possible and client should be

informed about the application and if passed the offer letter should be handed over and delivered