Thesis: Z-Altman Model for Predicting Bank Failures in European Banks

VerifiedAdded on 2023/04/21

|46

|11558

|286

Thesis and Dissertation

AI Summary

This master's thesis assesses the effectiveness of the Z-Altman model in predicting bank failures, focusing on European banks. It reviews existing literature on bankruptcy prediction models, particularly those based on multivariate discriminant analysis, and presents an empirical study using Altman's Z-score model adapted for emerging markets. The study analyzes financial data from both 'failed' banks (primarily in Southern Europe) and 'active' banks (Central Europe) to determine the model's accuracy in measuring financial health within the banking sector. The research investigates whether Altman's specialized formula for emerging markets is suitable for banking organizations, ultimately questioning the model's predictability for highly leveraged private firms. The thesis acknowledges the support received from Lund University, professors, and family, highlighting the significance of understanding and mitigating bank failures to maintain economic stability.

Z-Altman’s model effectiveness

in bank failure prediction -

The case of European banks

Charalampos-Orestis Manousaridis

Master thesis

MSc programme in Finance

Supervisor: Prof. Anders Vilhelmsson

July 2017, Lund, Sweden

in bank failure prediction -

The case of European banks

Charalampos-Orestis Manousaridis

Master thesis

MSc programme in Finance

Supervisor: Prof. Anders Vilhelmsson

July 2017, Lund, Sweden

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

i

Contents

Abstract ..................................................................................................................................... 1

Acknowledgements ................................................................................................................... 2

Introduction ............................................................................................................................... 3

Research objectives and tasks................................................................................................... 4

Literature review ....................................................................................................................... 5

Risks faced by financial institutions....................................................................................... 5

Financial Distress and Corporate Bankruptcy ....................................................................... 8

MDA analysis ....................................................................................................................... 10

Altman’s prediction models ................................................................................................ 11

Z score formula ................................................................................................................... 13‐

Grover’s model .................................................................................................................... 15

Grover's formula.................................................................................................................. 16

Springate’s model................................................................................................................ 16

Springate's formula ............................................................................................................. 16

Ohlson’s model.................................................................................................................... 17

Ohlson's formula ................................................................................................................. 17

Zmijewski's Model ............................................................................................................... 18

Zmijewski’s formula............................................................................................................. 18

Empirical Study........................................................................................................................ 19

Sample and data.................................................................................................................. 20

Methodology .................................................................................................................... ... 23

Financial data analysis and results ...................................................................................... 24

Limitations of the empirical study....................................................................................... 29

Conclusions.................................................................................................................... .......... 31

References ............................................................................................................................... 33

Digital references .................................................................................................................... 35

Contents

Abstract ..................................................................................................................................... 1

Acknowledgements ................................................................................................................... 2

Introduction ............................................................................................................................... 3

Research objectives and tasks................................................................................................... 4

Literature review ....................................................................................................................... 5

Risks faced by financial institutions....................................................................................... 5

Financial Distress and Corporate Bankruptcy ....................................................................... 8

MDA analysis ....................................................................................................................... 10

Altman’s prediction models ................................................................................................ 11

Z score formula ................................................................................................................... 13‐

Grover’s model .................................................................................................................... 15

Grover's formula.................................................................................................................. 16

Springate’s model................................................................................................................ 16

Springate's formula ............................................................................................................. 16

Ohlson’s model.................................................................................................................... 17

Ohlson's formula ................................................................................................................. 17

Zmijewski's Model ............................................................................................................... 18

Zmijewski’s formula............................................................................................................. 18

Empirical Study........................................................................................................................ 19

Sample and data.................................................................................................................. 20

Methodology .................................................................................................................... ... 23

Financial data analysis and results ...................................................................................... 24

Limitations of the empirical study....................................................................................... 29

Conclusions.................................................................................................................... .......... 31

References ............................................................................................................................... 33

Digital references .................................................................................................................... 35

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ii

Appendix I Processed data and ratios of failed banks............................................................. 37

Appendix II Processed data and ratios of non failed banks .................................................... 40‐

Appendix I Processed data and ratios of failed banks............................................................. 37

Appendix II Processed data and ratios of non failed banks .................................................... 40‐

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

Abstract

The corporate bankruptcy is a significant problem for economy since it is considered

as a limiting factor for economic growth. The financial crisis that broke out in USA

on 2007 as a result of miscalculated subprime mortgage strategies turn into a full

international banking crisis affecting successively the European banks, especially

those of South European countries. Given that the role and the impact of the banks in

the national and international economies are significant , it is vital for all interested

economy stakeholders to constantly assess and measure the financial health of banks

by use of reliable bankruptcy prediction models.

This work includes a literature review of known prediction models for firm

bankruptcy which are based on multivariate discriminant analysis. Additionally, it

presents the findings of the empirical study implemented by use of Altman’s Z-score

model specialized for firms from emerging markets. The main tasks carried out were:

Financial data analysis for “failed” banks located mostly in South European

countries (GIIPS group)

Application of the above analysis outcome to benchmark the financial status

of Central European banks that are still active

The aim of this work was to examine the effectiveness and accuracy of Altman's Z-

score model for measuring the financial health of banking sector organizations and

answer the research question whether Altman’s specialized formula, for firms from

emerging markets, could be used for banking sector organizations too.

The findings of the empirical study, allows someone to claim that the accuracy and

predictability of the tested Altman Z-score model, specialized for firms from

emerging markets, is questionable as regards predictions for private firms operating

with high leverage.

Keywords: European banks, financial health, prediction models, multivariate

discriminant analysis, Z- score model , Altman

Abstract

The corporate bankruptcy is a significant problem for economy since it is considered

as a limiting factor for economic growth. The financial crisis that broke out in USA

on 2007 as a result of miscalculated subprime mortgage strategies turn into a full

international banking crisis affecting successively the European banks, especially

those of South European countries. Given that the role and the impact of the banks in

the national and international economies are significant , it is vital for all interested

economy stakeholders to constantly assess and measure the financial health of banks

by use of reliable bankruptcy prediction models.

This work includes a literature review of known prediction models for firm

bankruptcy which are based on multivariate discriminant analysis. Additionally, it

presents the findings of the empirical study implemented by use of Altman’s Z-score

model specialized for firms from emerging markets. The main tasks carried out were:

Financial data analysis for “failed” banks located mostly in South European

countries (GIIPS group)

Application of the above analysis outcome to benchmark the financial status

of Central European banks that are still active

The aim of this work was to examine the effectiveness and accuracy of Altman's Z-

score model for measuring the financial health of banking sector organizations and

answer the research question whether Altman’s specialized formula, for firms from

emerging markets, could be used for banking sector organizations too.

The findings of the empirical study, allows someone to claim that the accuracy and

predictability of the tested Altman Z-score model, specialized for firms from

emerging markets, is questionable as regards predictions for private firms operating

with high leverage.

Keywords: European banks, financial health, prediction models, multivariate

discriminant analysis, Z- score model , Altman

2

Acknowledgements

From this step, I would like to express my deep appreciation for the admission in the

very demanding and of high quality MSc programme in Finance of Lund University.

It was very significant and emotional event for me as I returned after 23 years into my

birthplace. Moreover, I ‘d like to express my sincere gratitude to my supervisor prof.

Anders Vilhelmsson and the MSc programme director prof. Hossein Asgharian

although their summer days-off during my working procedure on the thesis, they were

there to help me by providing valuable feedback and instructions. Finally, special

thanks are given to my family which supported me in order to realize my dream to

become a financial expert, without them this would not be achievable.

Lund, July 2017

Charalampos-Orestis Manousaridis

Acknowledgements

From this step, I would like to express my deep appreciation for the admission in the

very demanding and of high quality MSc programme in Finance of Lund University.

It was very significant and emotional event for me as I returned after 23 years into my

birthplace. Moreover, I ‘d like to express my sincere gratitude to my supervisor prof.

Anders Vilhelmsson and the MSc programme director prof. Hossein Asgharian

although their summer days-off during my working procedure on the thesis, they were

there to help me by providing valuable feedback and instructions. Finally, special

thanks are given to my family which supported me in order to realize my dream to

become a financial expert, without them this would not be achievable.

Lund, July 2017

Charalampos-Orestis Manousaridis

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

Introduction

The financial crisis that broke out in USA on 2007 as a result of miscalculated

subprime mortgage strategies turn into a full international banking crisis affecting

successively the banks in Europe as well. Some European banks with high exposure

on the American banking system were directly affected and brought to the brink of

collapse. However, this was not the only reason for bank collapsing. A plethora of

additional reasons contributed in this as well i.e. inefficient fiscal policies of European

countries for consecutive years, overloaded public sector that did not correspond to

the real country’s needs etc. In Greece, a sovereign national debt in conjunction to the

impact of the international financial crisis put in troubles many banks.

Several Greek banks were exposed to the threat of a "disorderly bankruptcy" as a bi-

effect of the policies of non-cautious lending activity and the over-investment in the

past years. The lack of crucial funds for these banks imposed the need of an urgent

recapitalization of them. The Greek government was surprised and reacted gradually

to this by taking a series of measures (bail-out programme) in order to avoid a

collapse of the Greek banking system that could lead to chaotic situation with

tremendous economic and social consequences for the country.

Undoubtedly, the role and the impact of banks in the social-economic life of any

country are of great significance and this applies for Greece too. Therefore their

financial health is matter of great concern for all involved to financial activities and

finance researchers as well.

This work aimed to check if it is possible to measure and predict the financial health

of banks in an efficient and reliable way.

Inspiration about choosing this research topic was the collapse threat that Greek banks

faced when the Eurozone crisis broke out. According to my point of view, if there

were effective predicting tools for corporate default which could also be used in the

banking sector too, it would be a significant tool for European governments in their

decision making. These would be able to immediately react and take appropriate

mitigation measures for their economies which in combination with assistance from

the European Central Bank and the International Monetary Fund could keep off

Introduction

The financial crisis that broke out in USA on 2007 as a result of miscalculated

subprime mortgage strategies turn into a full international banking crisis affecting

successively the banks in Europe as well. Some European banks with high exposure

on the American banking system were directly affected and brought to the brink of

collapse. However, this was not the only reason for bank collapsing. A plethora of

additional reasons contributed in this as well i.e. inefficient fiscal policies of European

countries for consecutive years, overloaded public sector that did not correspond to

the real country’s needs etc. In Greece, a sovereign national debt in conjunction to the

impact of the international financial crisis put in troubles many banks.

Several Greek banks were exposed to the threat of a "disorderly bankruptcy" as a bi-

effect of the policies of non-cautious lending activity and the over-investment in the

past years. The lack of crucial funds for these banks imposed the need of an urgent

recapitalization of them. The Greek government was surprised and reacted gradually

to this by taking a series of measures (bail-out programme) in order to avoid a

collapse of the Greek banking system that could lead to chaotic situation with

tremendous economic and social consequences for the country.

Undoubtedly, the role and the impact of banks in the social-economic life of any

country are of great significance and this applies for Greece too. Therefore their

financial health is matter of great concern for all involved to financial activities and

finance researchers as well.

This work aimed to check if it is possible to measure and predict the financial health

of banks in an efficient and reliable way.

Inspiration about choosing this research topic was the collapse threat that Greek banks

faced when the Eurozone crisis broke out. According to my point of view, if there

were effective predicting tools for corporate default which could also be used in the

banking sector too, it would be a significant tool for European governments in their

decision making. These would be able to immediately react and take appropriate

mitigation measures for their economies which in combination with assistance from

the European Central Bank and the International Monetary Fund could keep off

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

upcoming default of European banks and consequently avoid their catastrophic effects

on the social-economic life of the European countries affected.

Research objectives and tasks

Based on the fact that the banking sector could be considered as a service sector

organisation which plays a crucial role in development of the economy, both on

national and international level, it is always challenging and valuable to measure the

financial health of banks, especially on economic recession time.

First objective of this work is to present known prediction models for the

measurement of firm financial health. Special focus is given on those of multivariate

discriminant analysis which are commonly used by many finance researchers and

professionals. The second objective, the main one, was to test and evaluate the

strength and accuracy of Altman’s Z- score model and its suitability to be used for

predicting imminent threats of financial distress in banking sector. For that, a data

sample of European banks was selected which was divided in two target groups.

In the first group were included banks mainly from countries of South Europe, namely

Greece, Italy, Ireland, Portugal, Spain plus Cyprus. Further on, this group will be

referred to as GIIPS banks or “failed” group. The second was consisted of banks from

countries of Central Europe, namely Germany, France, Belgium, Netherlands and

Switzerland which will be called as CE banks or “active” group.

The main tasks of the second objective were:

Analysis of financial data of failed banks of GIIPS group by use of the

Altman’s Z-score specialized for firms from emerging markets

Application of the analysis outcome in benchmarking of the financial status of

CE banks

in order to examine the effectiveness and accuracy of Altman's Z-score in measuring

the financial health of banking sector organizations and answer the research question

whether Altman’s specialized formula for emerging markets could be used for

banking sector organizations too.

upcoming default of European banks and consequently avoid their catastrophic effects

on the social-economic life of the European countries affected.

Research objectives and tasks

Based on the fact that the banking sector could be considered as a service sector

organisation which plays a crucial role in development of the economy, both on

national and international level, it is always challenging and valuable to measure the

financial health of banks, especially on economic recession time.

First objective of this work is to present known prediction models for the

measurement of firm financial health. Special focus is given on those of multivariate

discriminant analysis which are commonly used by many finance researchers and

professionals. The second objective, the main one, was to test and evaluate the

strength and accuracy of Altman’s Z- score model and its suitability to be used for

predicting imminent threats of financial distress in banking sector. For that, a data

sample of European banks was selected which was divided in two target groups.

In the first group were included banks mainly from countries of South Europe, namely

Greece, Italy, Ireland, Portugal, Spain plus Cyprus. Further on, this group will be

referred to as GIIPS banks or “failed” group. The second was consisted of banks from

countries of Central Europe, namely Germany, France, Belgium, Netherlands and

Switzerland which will be called as CE banks or “active” group.

The main tasks of the second objective were:

Analysis of financial data of failed banks of GIIPS group by use of the

Altman’s Z-score specialized for firms from emerging markets

Application of the analysis outcome in benchmarking of the financial status of

CE banks

in order to examine the effectiveness and accuracy of Altman's Z-score in measuring

the financial health of banking sector organizations and answer the research question

whether Altman’s specialized formula for emerging markets could be used for

banking sector organizations too.

5

Literature review

Risks faced by financial institutions

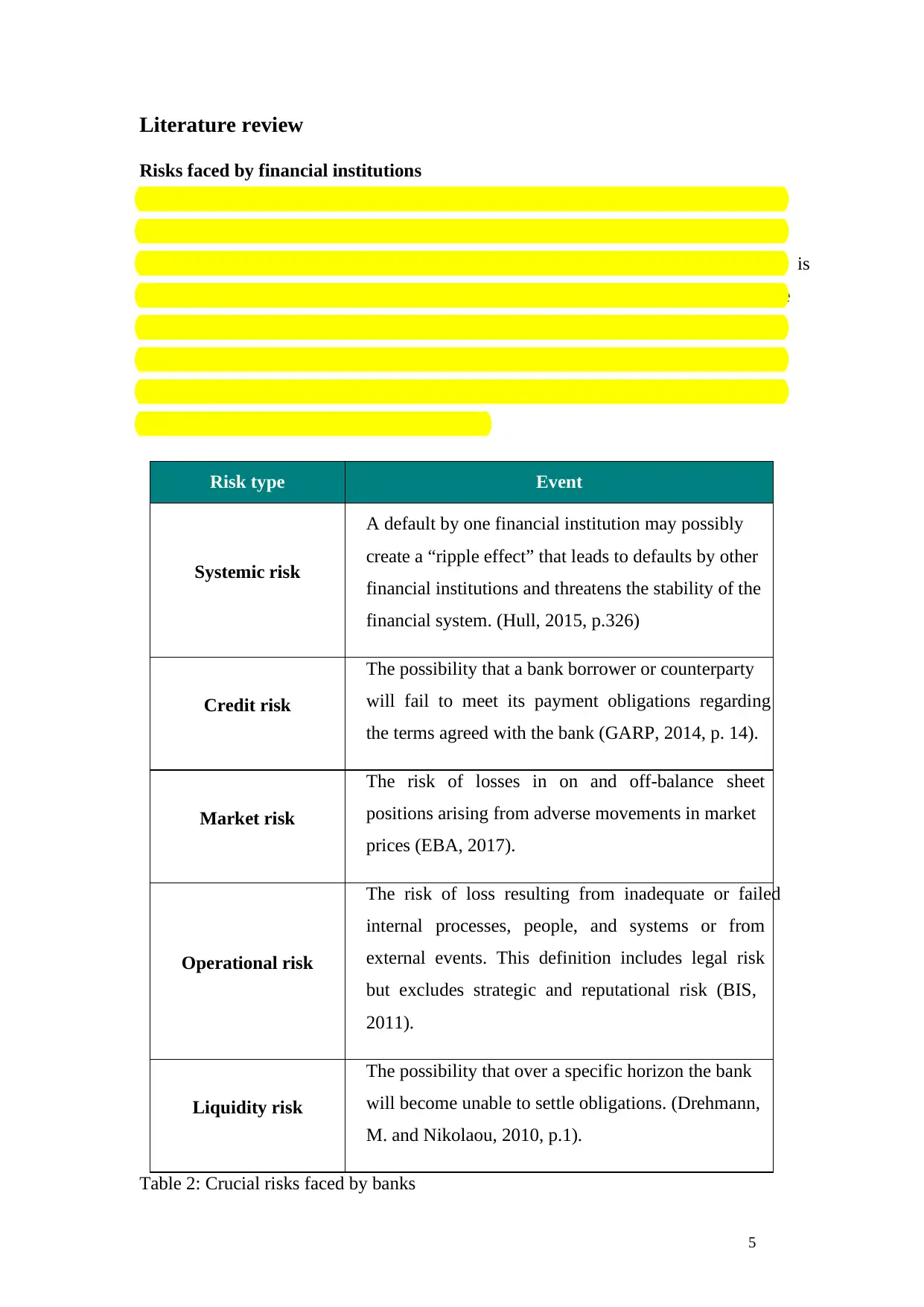

According to organisation theory, any organisation is confronted with many different

risks during its whole life. Financial institutions are characterized as organizations of

the service sector. Their role and impact in the social-economic life of countries is

significant and multifarious. They are evolved in different financial activities like

lending, asset management, deposit keeping etc. which means that these are exposed

to different kind of risks explained below. The financial health of banks reflects to the

economy of a country and in some cases of the whole world. The most crucial risks

faced by banks are outlined in the below table:

Risk type Event

Systemic risk

A default by one financial institution may possibly

create a “ripple effect” that leads to defaults by other

financial institutions and threatens the stability of the

financial system. (Hull, 2015, p.326)

Credit risk

The possibility that a bank borrower or counterparty

will fail to meet its payment obligations regarding

the terms agreed with the bank (GARP, 2014, p. 14).

Market risk

The risk of losses in on and off-balance sheet

positions arising from adverse movements in market

prices (EBA, 2017).

Operational risk

The risk of loss resulting from inadequate or failed

internal processes, people, and systems or from

external events. This definition includes legal risk

but excludes strategic and reputational risk (BIS,

2011).

Liquidity risk

The possibility that over a specific horizon the bank

will become unable to settle obligations. (Drehmann,

M. and Nikolaou, 2010, p.1).

Table 2: Crucial risks faced by banks

Literature review

Risks faced by financial institutions

According to organisation theory, any organisation is confronted with many different

risks during its whole life. Financial institutions are characterized as organizations of

the service sector. Their role and impact in the social-economic life of countries is

significant and multifarious. They are evolved in different financial activities like

lending, asset management, deposit keeping etc. which means that these are exposed

to different kind of risks explained below. The financial health of banks reflects to the

economy of a country and in some cases of the whole world. The most crucial risks

faced by banks are outlined in the below table:

Risk type Event

Systemic risk

A default by one financial institution may possibly

create a “ripple effect” that leads to defaults by other

financial institutions and threatens the stability of the

financial system. (Hull, 2015, p.326)

Credit risk

The possibility that a bank borrower or counterparty

will fail to meet its payment obligations regarding

the terms agreed with the bank (GARP, 2014, p. 14).

Market risk

The risk of losses in on and off-balance sheet

positions arising from adverse movements in market

prices (EBA, 2017).

Operational risk

The risk of loss resulting from inadequate or failed

internal processes, people, and systems or from

external events. This definition includes legal risk

but excludes strategic and reputational risk (BIS,

2011).

Liquidity risk

The possibility that over a specific horizon the bank

will become unable to settle obligations. (Drehmann,

M. and Nikolaou, 2010, p.1).

Table 2: Crucial risks faced by banks

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

When a bank cannot repay and meet its economic obligations to its investors, lenders

and generally to its stakeholders then reaches a default situation or in other words it

becomes in a ‘failed condition”. If corrective measures are not taken or are incorrect

then the bank's problematic situation can result to a disorderly bankruptcy with

chaotic consequences in every aspect of the social-economic life of the country that

the bank is operating.

In order to predict and avoid bank failure situations and their subsequent economic

disaster a regulatory framework for banking sector was necessary to be established.

Hull (2015) pointed out the importance of regulations in order to avoid bank failing.

He justified this need and explained that “…main purpose of bank regulation is to

ensure that a bank keeps enough capital for the risks it takes. It is not possible to

eliminate altogether the possibility of a bank failing, but governments want to make

the probability of default for any given bank very small. By doing this, they want to

create a stable economic environment where private individuals and businesses have

confidence in the banking system” (Hull, 2015, p. 325).

On 1974, G10 countries represented by their central bank Governors and the monetary

authorities of Luxembourg, Switzerland and Spain formed the Committee of Banking

Regulations and Supervisory Practices. The main goal of this Committee, which

convened in Basel of Switzerland, was to strengthen financial stability worldwide by

setting common principles that all financial institutions should follow and be

supervised for. Nowadays, the Basel Committee has expanded its membership from

the G10 to 45 institutions from 28 jurisdictions. (BIS, 2017; Culp, 2015).

A document entitled “International Convergence of Capital Measurement and Capital

Standards” was the main outcome of Basel Committee. This was referred to as “The

1988 BIS Accord" and was the first attempt to set international risk-based standards

for capital adequacy (Culp, 2015). Later on it became known as Basel I and paved the

way for significant increases in the resources banks devote to measuring,

understanding, and managing risks. The key innovation in the 1988 was a measure,

for assessing the bank total credit exposure, named Cooke ratio. Hull (2015) clarifies

the components of this measure by explaining that “The Cooke ratio considers credit

risk exposures that are both on balance-sheet and off balance-sheet. It is based on

what is known as the banks total risk-weighted assets.” (p. 327).

When a bank cannot repay and meet its economic obligations to its investors, lenders

and generally to its stakeholders then reaches a default situation or in other words it

becomes in a ‘failed condition”. If corrective measures are not taken or are incorrect

then the bank's problematic situation can result to a disorderly bankruptcy with

chaotic consequences in every aspect of the social-economic life of the country that

the bank is operating.

In order to predict and avoid bank failure situations and their subsequent economic

disaster a regulatory framework for banking sector was necessary to be established.

Hull (2015) pointed out the importance of regulations in order to avoid bank failing.

He justified this need and explained that “…main purpose of bank regulation is to

ensure that a bank keeps enough capital for the risks it takes. It is not possible to

eliminate altogether the possibility of a bank failing, but governments want to make

the probability of default for any given bank very small. By doing this, they want to

create a stable economic environment where private individuals and businesses have

confidence in the banking system” (Hull, 2015, p. 325).

On 1974, G10 countries represented by their central bank Governors and the monetary

authorities of Luxembourg, Switzerland and Spain formed the Committee of Banking

Regulations and Supervisory Practices. The main goal of this Committee, which

convened in Basel of Switzerland, was to strengthen financial stability worldwide by

setting common principles that all financial institutions should follow and be

supervised for. Nowadays, the Basel Committee has expanded its membership from

the G10 to 45 institutions from 28 jurisdictions. (BIS, 2017; Culp, 2015).

A document entitled “International Convergence of Capital Measurement and Capital

Standards” was the main outcome of Basel Committee. This was referred to as “The

1988 BIS Accord" and was the first attempt to set international risk-based standards

for capital adequacy (Culp, 2015). Later on it became known as Basel I and paved the

way for significant increases in the resources banks devote to measuring,

understanding, and managing risks. The key innovation in the 1988 was a measure,

for assessing the bank total credit exposure, named Cooke ratio. Hull (2015) clarifies

the components of this measure by explaining that “The Cooke ratio considers credit

risk exposures that are both on balance-sheet and off balance-sheet. It is based on

what is known as the banks total risk-weighted assets.” (p. 327).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

Since several issues remained still unsettled, i.e. there was not developed any model

of default correlation, two more Accords were published Basel II and Basel III,

establishing a series of international standards concerning mostly the capital

adequacy.

The Basel II capital requirements applied to “international active” banks. In Europe,

all banks were regulated under Basel II but in the United decided States the regulatory

authorities decided that Basel II would not apply to small regional banks (Hull, 2015,

pp. 336-337). The Basel II is based on the following three “pillars”:

1. Minimum Capital Requirements

2. Supervisory Review

3. Market Discipline

Following the 2007-2009 credit crisis, the Basel committee realized that

improvements on Basel II were necessary. Capital requirements needed to sufficiently

cover not only market risk but credit risk as well. Additionally, it was considered that

the definition of capital had to be tightened and that regulations were needed to

address liquidity risk (BIS, 2017; Hull 2015). The final version of the Basel III

regulations was published in December 2010 and settled issues about:

1. Capital Definition and Requirements

2. Capital Conservation Buffer

3. Countercyclical Buffer

4. Leverage Ratio

5. Counterparty Credit Risk

The establishment of a series of international standards for bank regulation

contributed not only to enhancement of financial stability by improving the quality of

banking supervision worldwide but facilitated also the availability of financial data for

research. More specifically, all type of organizations are obliged to prepare and

provide on an annual basis, specifically processed information about their operation,

which are stored in various databases. This information is considered as credible and

Since several issues remained still unsettled, i.e. there was not developed any model

of default correlation, two more Accords were published Basel II and Basel III,

establishing a series of international standards concerning mostly the capital

adequacy.

The Basel II capital requirements applied to “international active” banks. In Europe,

all banks were regulated under Basel II but in the United decided States the regulatory

authorities decided that Basel II would not apply to small regional banks (Hull, 2015,

pp. 336-337). The Basel II is based on the following three “pillars”:

1. Minimum Capital Requirements

2. Supervisory Review

3. Market Discipline

Following the 2007-2009 credit crisis, the Basel committee realized that

improvements on Basel II were necessary. Capital requirements needed to sufficiently

cover not only market risk but credit risk as well. Additionally, it was considered that

the definition of capital had to be tightened and that regulations were needed to

address liquidity risk (BIS, 2017; Hull 2015). The final version of the Basel III

regulations was published in December 2010 and settled issues about:

1. Capital Definition and Requirements

2. Capital Conservation Buffer

3. Countercyclical Buffer

4. Leverage Ratio

5. Counterparty Credit Risk

The establishment of a series of international standards for bank regulation

contributed not only to enhancement of financial stability by improving the quality of

banking supervision worldwide but facilitated also the availability of financial data for

research. More specifically, all type of organizations are obliged to prepare and

provide on an annual basis, specifically processed information about their operation,

which are stored in various databases. This information is considered as credible and

8

is provided in standard formats which means that someone can easily access and

process it. Subsequently, the testing of any model proposed for financial analysis

purposes can be easily supplied with credible and homogenous data which was the

case for the empirical study of this work too.

Financial Distress and Corporate Bankruptcy

The early prediction of financial distress is essential for investors or lending

institutions who wish to protect their financial investments. As a consequence,

modeling, prediction and classification of firms to determine whether these are

potential candidates for financial distress have become key topics of debate and

detailed research. Financial distress is defined as “… a condition where a company

cannot meet, or has difficulty paying off its official obligations to its creditors. The

chance of financial distress increases when a firm has high fixed costs, illiquid assets

or revenues sensitive to economic downturns” (Sofat and Hiro, 2015, p. 406).

One of the major concerns in the specific research area is the lack of consensus on the

definition of the corporate failure and the financial distress. Several scientists are

using the term bankruptcy instead of the previous two. Moreover Muller et al. (2012)

denote that there are also researchers which define financial distress as mergers,

absorptions, delisting or liquidations or major structural changes to the company.

For this study purposes, financial distress is regarded as a prior step before bankruptcy

therefore a timely prediction of financial status might actuate the assessed firm to

react and take corrective measures and potentially avoid its oncoming bankruptcy.

However, a financially unhealthy firm may not mandatory be bankrupt but to be

merged with others, acquired by another etc. In these cases, the firm could be

considered as a failed one.

From 1930, several theories, models and techniques were proposed by researchers

aiming to predict whether a firm is about to face bankruptcy (Bellovary et al. 2007).

Each of them proposed his/her own formula but in several occasions these are using

similar financial data and ratios in order to calculate indicators and results. Nowadays,

there exist a plethora of methods and models available for measuring and assessing

the financial distress or bankruptcy of firms.

is provided in standard formats which means that someone can easily access and

process it. Subsequently, the testing of any model proposed for financial analysis

purposes can be easily supplied with credible and homogenous data which was the

case for the empirical study of this work too.

Financial Distress and Corporate Bankruptcy

The early prediction of financial distress is essential for investors or lending

institutions who wish to protect their financial investments. As a consequence,

modeling, prediction and classification of firms to determine whether these are

potential candidates for financial distress have become key topics of debate and

detailed research. Financial distress is defined as “… a condition where a company

cannot meet, or has difficulty paying off its official obligations to its creditors. The

chance of financial distress increases when a firm has high fixed costs, illiquid assets

or revenues sensitive to economic downturns” (Sofat and Hiro, 2015, p. 406).

One of the major concerns in the specific research area is the lack of consensus on the

definition of the corporate failure and the financial distress. Several scientists are

using the term bankruptcy instead of the previous two. Moreover Muller et al. (2012)

denote that there are also researchers which define financial distress as mergers,

absorptions, delisting or liquidations or major structural changes to the company.

For this study purposes, financial distress is regarded as a prior step before bankruptcy

therefore a timely prediction of financial status might actuate the assessed firm to

react and take corrective measures and potentially avoid its oncoming bankruptcy.

However, a financially unhealthy firm may not mandatory be bankrupt but to be

merged with others, acquired by another etc. In these cases, the firm could be

considered as a failed one.

From 1930, several theories, models and techniques were proposed by researchers

aiming to predict whether a firm is about to face bankruptcy (Bellovary et al. 2007).

Each of them proposed his/her own formula but in several occasions these are using

similar financial data and ratios in order to calculate indicators and results. Nowadays,

there exist a plethora of methods and models available for measuring and assessing

the financial distress or bankruptcy of firms.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 46

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.