Zoopla PLC: A Comprehensive Corporate Finance Analysis Report

VerifiedAdded on 2023/06/03

|19

|3000

|242

Report

AI Summary

This report provides a comprehensive financial analysis of Zoopla Property Group PLC (ZPG) over the past five years, focusing on its success in delivering value to shareholders. It includes an Economic Value Added (EVA) analysis using net asset valuation, price-earnings ratios, EBITDA capitalization, and discounted free cash flows, assessing the company's ability to generate returns above its cost of capital. The report also analyzes the Total Shareholder Return (TSR), considering both dividend payments and capital appreciation. Furthermore, the document undertakes a current valuation of ZPG's equity using net asset value, comparable ratios (P/E, P/B, EV/EBITDA), and discounted free cash flow methods, providing a multifaceted perspective on the company's financial health and shareholder value creation.

Running head: CORPORATE FINANCE

Corporate Finance

Name of the Student:

Name of the University:

Authors Note:

Corporate Finance

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1CORPORATE FINANCE

Contents

Introduction:....................................................................................................................................2

Zoopla PLC:.....................................................................................................................................2

Economic Value Addition (EVA) analysis:....................................................................................2

Current valuation of equity:...........................................................................................................10

Conclusion:....................................................................................................................................16

References:....................................................................................................................................17

Contents

Introduction:....................................................................................................................................2

Zoopla PLC:.....................................................................................................................................2

Economic Value Addition (EVA) analysis:....................................................................................2

Current valuation of equity:...........................................................................................................10

Conclusion:....................................................................................................................................16

References:....................................................................................................................................17

2CORPORATE FINANCE

Introduction:

The investors and the shareholders of an organization primarily have two objectives

while making investment, namely to earn return on their investment in the form of dividend for

the shareholders and to maximize their wealth in the form of capital appreciation of their

investments. The economic value addition (EVA) is a concept often used to calculate the return

earned by the shareholders over a period of time on the amount investment in the form of capital

appreciation. Detailed calculation has been made to discuss the EVA to the shareholder of

Zoopla Property Group PLC in this document.

Zoopla PLC:

Owned by Silver Lake Partners, Zoopla Property Group PLC, here in after to be

mentioned as ZPG only in this document, is a company based in United Kingdom. The company

is a listed entity of London Stock Exchange. It is mainly involved in providing customers access

to the information about real estate properties including statics about current valuation along

with expected future values of such properties. The renowned property website Zoopla belongs

to the company and provides useful information to the users about prices of sold houses,

statistics and other data about such properties.

Economic Value Addition (EVA) analysis:

As already mentioned that EVA analysis helps in identifying the effects on the wealth of

investors in a company over period of time. In order to analyse the EVA of the company over the

last five years the financial information required has been collected from the annual reports of

the company of last five years including 2017 (Laszlo and Cescau, 2017).

Net asset valuation:

Introduction:

The investors and the shareholders of an organization primarily have two objectives

while making investment, namely to earn return on their investment in the form of dividend for

the shareholders and to maximize their wealth in the form of capital appreciation of their

investments. The economic value addition (EVA) is a concept often used to calculate the return

earned by the shareholders over a period of time on the amount investment in the form of capital

appreciation. Detailed calculation has been made to discuss the EVA to the shareholder of

Zoopla Property Group PLC in this document.

Zoopla PLC:

Owned by Silver Lake Partners, Zoopla Property Group PLC, here in after to be

mentioned as ZPG only in this document, is a company based in United Kingdom. The company

is a listed entity of London Stock Exchange. It is mainly involved in providing customers access

to the information about real estate properties including statics about current valuation along

with expected future values of such properties. The renowned property website Zoopla belongs

to the company and provides useful information to the users about prices of sold houses,

statistics and other data about such properties.

Economic Value Addition (EVA) analysis:

As already mentioned that EVA analysis helps in identifying the effects on the wealth of

investors in a company over period of time. In order to analyse the EVA of the company over the

last five years the financial information required has been collected from the annual reports of

the company of last five years including 2017 (Laszlo and Cescau, 2017).

Net asset valuation:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3CORPORATE FINANCE

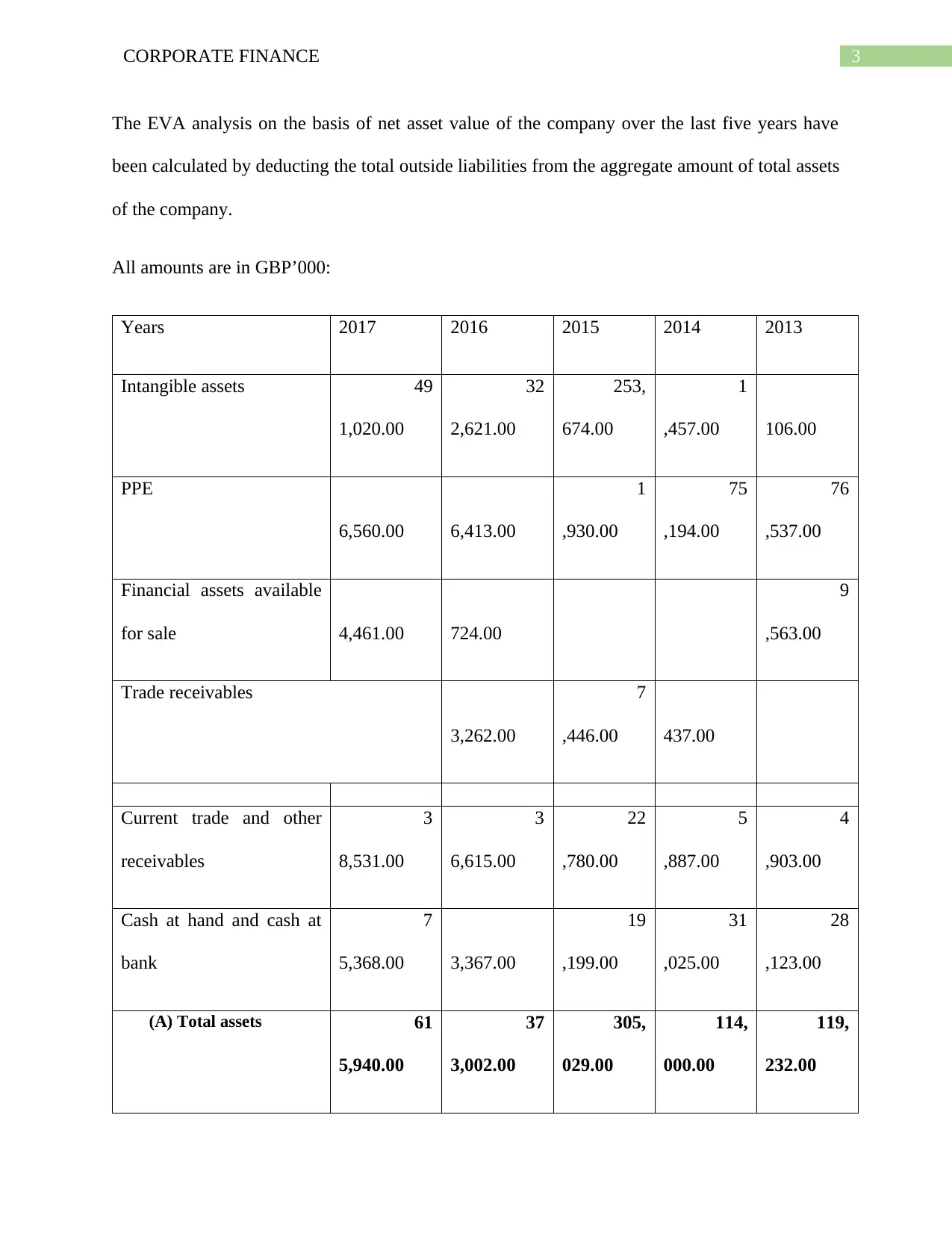

The EVA analysis on the basis of net asset value of the company over the last five years have

been calculated by deducting the total outside liabilities from the aggregate amount of total assets

of the company.

All amounts are in GBP’000:

Years 2017 2016 2015 2014 2013

Intangible assets 49

1,020.00

32

2,621.00

253,

674.00

1

,457.00 106.00

PPE

6,560.00 6,413.00

1

,930.00

75

,194.00

76

,537.00

Financial assets available

for sale 4,461.00 724.00

9

,563.00

Trade receivables

3,262.00

7

,446.00 437.00

Current trade and other

receivables

3

8,531.00

3

6,615.00

22

,780.00

5

,887.00

4

,903.00

Cash at hand and cash at

bank

7

5,368.00 3,367.00

19

,199.00

31

,025.00

28

,123.00

(A) Total assets 61

5,940.00

37

3,002.00

305,

029.00

114,

000.00

119,

232.00

The EVA analysis on the basis of net asset value of the company over the last five years have

been calculated by deducting the total outside liabilities from the aggregate amount of total assets

of the company.

All amounts are in GBP’000:

Years 2017 2016 2015 2014 2013

Intangible assets 49

1,020.00

32

2,621.00

253,

674.00

1

,457.00 106.00

PPE

6,560.00 6,413.00

1

,930.00

75

,194.00

76

,537.00

Financial assets available

for sale 4,461.00 724.00

9

,563.00

Trade receivables

3,262.00

7

,446.00 437.00

Current trade and other

receivables

3

8,531.00

3

6,615.00

22

,780.00

5

,887.00

4

,903.00

Cash at hand and cash at

bank

7

5,368.00 3,367.00

19

,199.00

31

,025.00

28

,123.00

(A) Total assets 61

5,940.00

37

3,002.00

305,

029.00

114,

000.00

119,

232.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

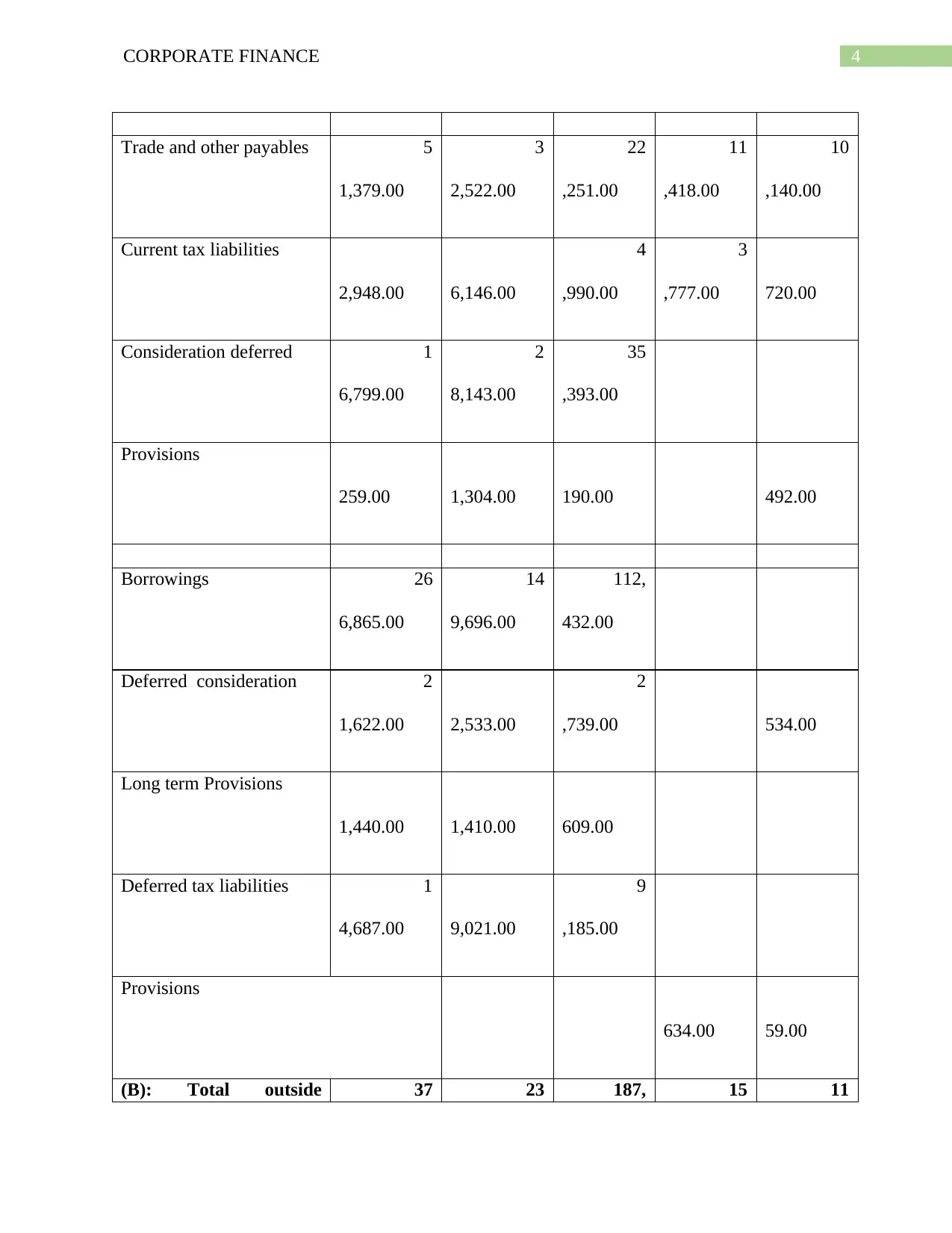

4CORPORATE FINANCE

Trade and other payables 5

1,379.00

3

2,522.00

22

,251.00

11

,418.00

10

,140.00

Current tax liabilities

2,948.00 6,146.00

4

,990.00

3

,777.00 720.00

Consideration deferred 1

6,799.00

2

8,143.00

35

,393.00

Provisions

259.00 1,304.00 190.00 492.00

Borrowings 26

6,865.00

14

9,696.00

112,

432.00

Deferred consideration 2

1,622.00 2,533.00

2

,739.00 534.00

Long term Provisions

1,440.00 1,410.00 609.00

Deferred tax liabilities 1

4,687.00 9,021.00

9

,185.00

Provisions

634.00 59.00

(B): Total outside 37 23 187, 15 11

Trade and other payables 5

1,379.00

3

2,522.00

22

,251.00

11

,418.00

10

,140.00

Current tax liabilities

2,948.00 6,146.00

4

,990.00

3

,777.00 720.00

Consideration deferred 1

6,799.00

2

8,143.00

35

,393.00

Provisions

259.00 1,304.00 190.00 492.00

Borrowings 26

6,865.00

14

9,696.00

112,

432.00

Deferred consideration 2

1,622.00 2,533.00

2

,739.00 534.00

Long term Provisions

1,440.00 1,410.00 609.00

Deferred tax liabilities 1

4,687.00 9,021.00

9

,185.00

Provisions

634.00 59.00

(B): Total outside 37 23 187, 15 11

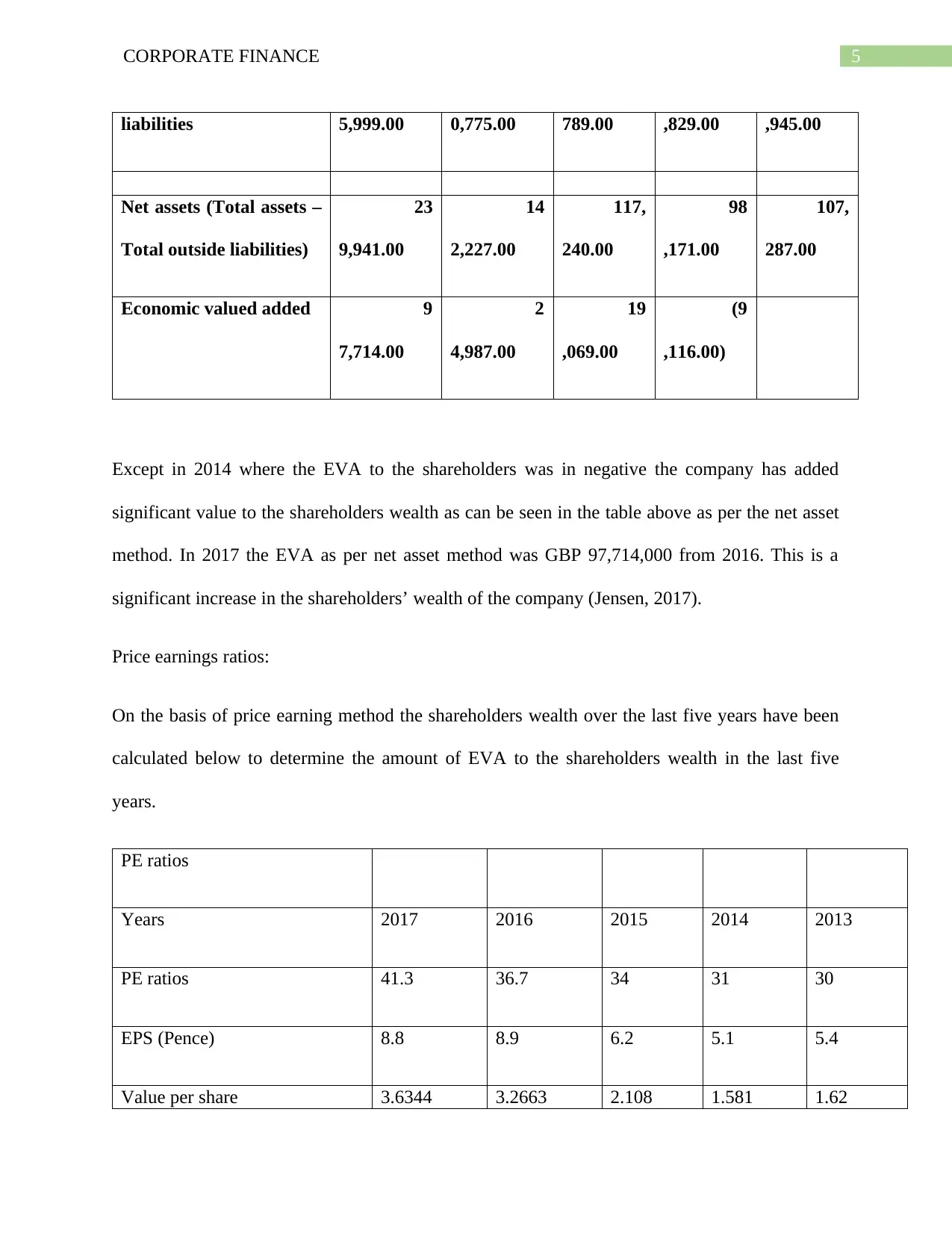

5CORPORATE FINANCE

liabilities 5,999.00 0,775.00 789.00 ,829.00 ,945.00

Net assets (Total assets –

Total outside liabilities)

23

9,941.00

14

2,227.00

117,

240.00

98

,171.00

107,

287.00

Economic valued added 9

7,714.00

2

4,987.00

19

,069.00

(9

,116.00)

Except in 2014 where the EVA to the shareholders was in negative the company has added

significant value to the shareholders wealth as can be seen in the table above as per the net asset

method. In 2017 the EVA as per net asset method was GBP 97,714,000 from 2016. This is a

significant increase in the shareholders’ wealth of the company (Jensen, 2017).

Price earnings ratios:

On the basis of price earning method the shareholders wealth over the last five years have been

calculated below to determine the amount of EVA to the shareholders wealth in the last five

years.

PE ratios

Years 2017 2016 2015 2014 2013

PE ratios 41.3 36.7 34 31 30

EPS (Pence) 8.8 8.9 6.2 5.1 5.4

Value per share 3.6344 3.2663 2.108 1.581 1.62

liabilities 5,999.00 0,775.00 789.00 ,829.00 ,945.00

Net assets (Total assets –

Total outside liabilities)

23

9,941.00

14

2,227.00

117,

240.00

98

,171.00

107,

287.00

Economic valued added 9

7,714.00

2

4,987.00

19

,069.00

(9

,116.00)

Except in 2014 where the EVA to the shareholders was in negative the company has added

significant value to the shareholders wealth as can be seen in the table above as per the net asset

method. In 2017 the EVA as per net asset method was GBP 97,714,000 from 2016. This is a

significant increase in the shareholders’ wealth of the company (Jensen, 2017).

Price earnings ratios:

On the basis of price earning method the shareholders wealth over the last five years have been

calculated below to determine the amount of EVA to the shareholders wealth in the last five

years.

PE ratios

Years 2017 2016 2015 2014 2013

PE ratios 41.3 36.7 34 31 30

EPS (Pence) 8.8 8.9 6.2 5.1 5.4

Value per share 3.6344 3.2663 2.108 1.581 1.62

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6CORPORATE FINANCE

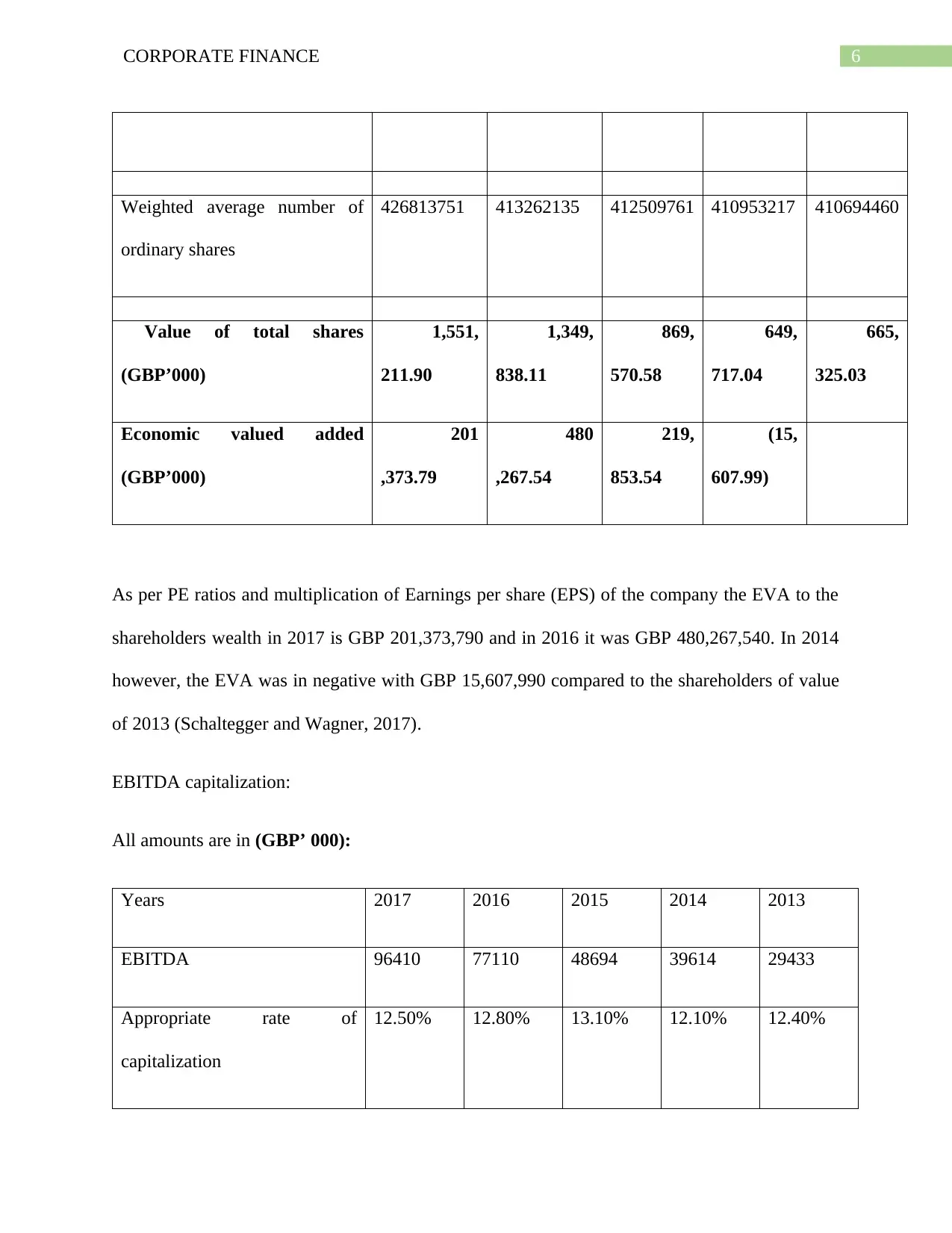

Weighted average number of

ordinary shares

426813751 413262135 412509761 410953217 410694460

Value of total shares

(GBP’000)

1,551,

211.90

1,349,

838.11

869,

570.58

649,

717.04

665,

325.03

Economic valued added

(GBP’000)

201

,373.79

480

,267.54

219,

853.54

(15,

607.99)

As per PE ratios and multiplication of Earnings per share (EPS) of the company the EVA to the

shareholders wealth in 2017 is GBP 201,373,790 and in 2016 it was GBP 480,267,540. In 2014

however, the EVA was in negative with GBP 15,607,990 compared to the shareholders of value

of 2013 (Schaltegger and Wagner, 2017).

EBITDA capitalization:

All amounts are in (GBP’ 000):

Years 2017 2016 2015 2014 2013

EBITDA 96410 77110 48694 39614 29433

Appropriate rate of

capitalization

12.50% 12.80% 13.10% 12.10% 12.40%

Weighted average number of

ordinary shares

426813751 413262135 412509761 410953217 410694460

Value of total shares

(GBP’000)

1,551,

211.90

1,349,

838.11

869,

570.58

649,

717.04

665,

325.03

Economic valued added

(GBP’000)

201

,373.79

480

,267.54

219,

853.54

(15,

607.99)

As per PE ratios and multiplication of Earnings per share (EPS) of the company the EVA to the

shareholders wealth in 2017 is GBP 201,373,790 and in 2016 it was GBP 480,267,540. In 2014

however, the EVA was in negative with GBP 15,607,990 compared to the shareholders of value

of 2013 (Schaltegger and Wagner, 2017).

EBITDA capitalization:

All amounts are in (GBP’ 000):

Years 2017 2016 2015 2014 2013

EBITDA 96410 77110 48694 39614 29433

Appropriate rate of

capitalization

12.50% 12.80% 13.10% 12.10% 12.40%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7CORPORATE FINANCE

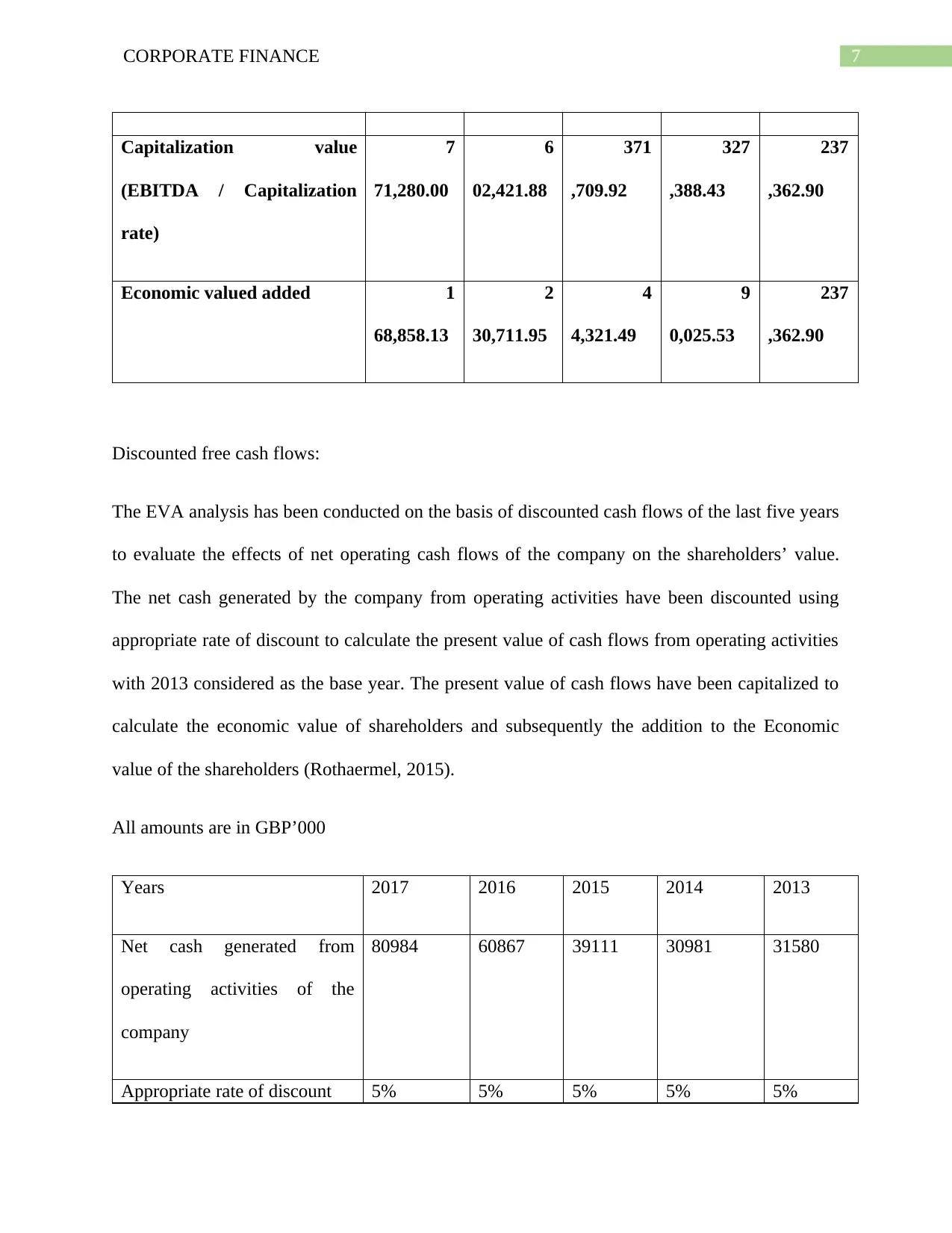

Capitalization value

(EBITDA / Capitalization

rate)

7

71,280.00

6

02,421.88

371

,709.92

327

,388.43

237

,362.90

Economic valued added 1

68,858.13

2

30,711.95

4

4,321.49

9

0,025.53

237

,362.90

Discounted free cash flows:

The EVA analysis has been conducted on the basis of discounted cash flows of the last five years

to evaluate the effects of net operating cash flows of the company on the shareholders’ value.

The net cash generated by the company from operating activities have been discounted using

appropriate rate of discount to calculate the present value of cash flows from operating activities

with 2013 considered as the base year. The present value of cash flows have been capitalized to

calculate the economic value of shareholders and subsequently the addition to the Economic

value of the shareholders (Rothaermel, 2015).

All amounts are in GBP’000

Years 2017 2016 2015 2014 2013

Net cash generated from

operating activities of the

company

80984 60867 39111 30981 31580

Appropriate rate of discount 5% 5% 5% 5% 5%

Capitalization value

(EBITDA / Capitalization

rate)

7

71,280.00

6

02,421.88

371

,709.92

327

,388.43

237

,362.90

Economic valued added 1

68,858.13

2

30,711.95

4

4,321.49

9

0,025.53

237

,362.90

Discounted free cash flows:

The EVA analysis has been conducted on the basis of discounted cash flows of the last five years

to evaluate the effects of net operating cash flows of the company on the shareholders’ value.

The net cash generated by the company from operating activities have been discounted using

appropriate rate of discount to calculate the present value of cash flows from operating activities

with 2013 considered as the base year. The present value of cash flows have been capitalized to

calculate the economic value of shareholders and subsequently the addition to the Economic

value of the shareholders (Rothaermel, 2015).

All amounts are in GBP’000

Years 2017 2016 2015 2014 2013

Net cash generated from

operating activities of the

company

80984 60867 39111 30981 31580

Appropriate rate of discount 5% 5% 5% 5% 5%

8CORPORATE FINANCE

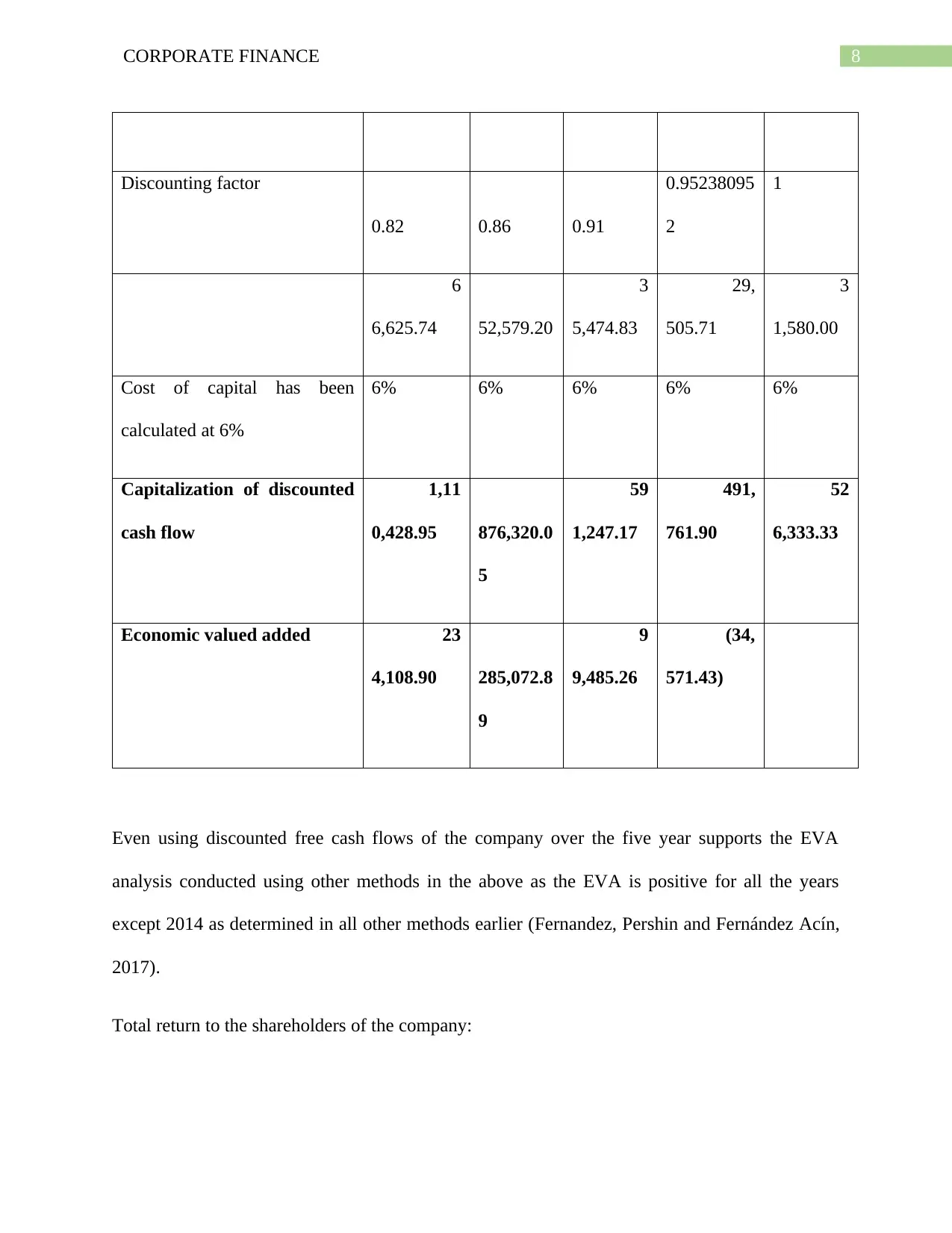

Discounting factor

0.82 0.86 0.91

0.95238095

2

1

6

6,625.74 52,579.20

3

5,474.83

29,

505.71

3

1,580.00

Cost of capital has been

calculated at 6%

6% 6% 6% 6% 6%

Capitalization of discounted

cash flow

1,11

0,428.95 876,320.0

5

59

1,247.17

491,

761.90

52

6,333.33

Economic valued added 23

4,108.90 285,072.8

9

9

9,485.26

(34,

571.43)

Even using discounted free cash flows of the company over the five year supports the EVA

analysis conducted using other methods in the above as the EVA is positive for all the years

except 2014 as determined in all other methods earlier (Fernandez, Pershin and Fernández Acín,

2017).

Total return to the shareholders of the company:

Discounting factor

0.82 0.86 0.91

0.95238095

2

1

6

6,625.74 52,579.20

3

5,474.83

29,

505.71

3

1,580.00

Cost of capital has been

calculated at 6%

6% 6% 6% 6% 6%

Capitalization of discounted

cash flow

1,11

0,428.95 876,320.0

5

59

1,247.17

491,

761.90

52

6,333.33

Economic valued added 23

4,108.90 285,072.8

9

9

9,485.26

(34,

571.43)

Even using discounted free cash flows of the company over the five year supports the EVA

analysis conducted using other methods in the above as the EVA is positive for all the years

except 2014 as determined in all other methods earlier (Fernandez, Pershin and Fernández Acín,

2017).

Total return to the shareholders of the company:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9CORPORATE FINANCE

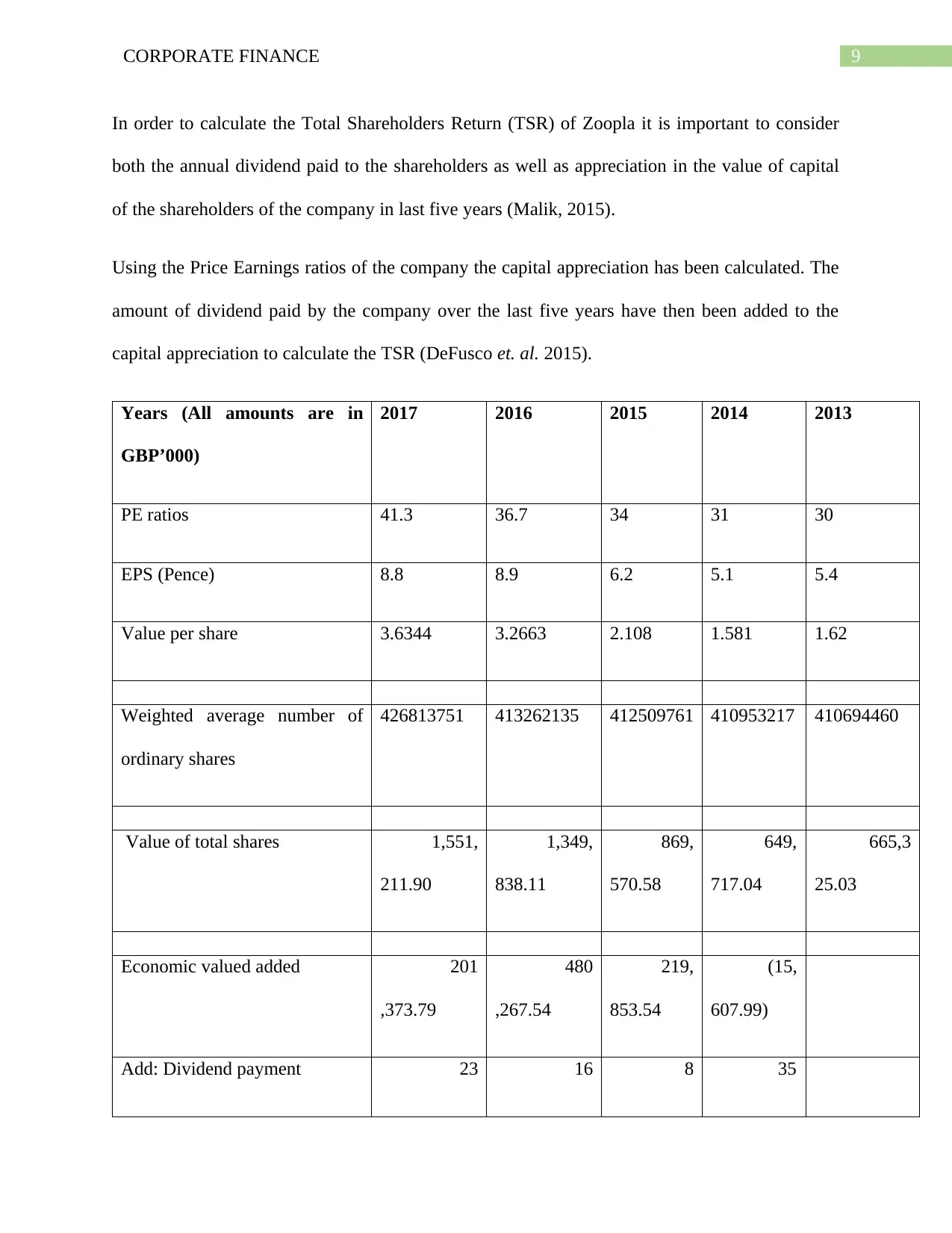

In order to calculate the Total Shareholders Return (TSR) of Zoopla it is important to consider

both the annual dividend paid to the shareholders as well as appreciation in the value of capital

of the shareholders of the company in last five years (Malik, 2015).

Using the Price Earnings ratios of the company the capital appreciation has been calculated. The

amount of dividend paid by the company over the last five years have then been added to the

capital appreciation to calculate the TSR (DeFusco et. al. 2015).

Years (All amounts are in

GBP’000)

2017 2016 2015 2014 2013

PE ratios 41.3 36.7 34 31 30

EPS (Pence) 8.8 8.9 6.2 5.1 5.4

Value per share 3.6344 3.2663 2.108 1.581 1.62

Weighted average number of

ordinary shares

426813751 413262135 412509761 410953217 410694460

Value of total shares 1,551,

211.90

1,349,

838.11

869,

570.58

649,

717.04

665,3

25.03

Economic valued added 201

,373.79

480

,267.54

219,

853.54

(15,

607.99)

Add: Dividend payment 23 16 8 35

In order to calculate the Total Shareholders Return (TSR) of Zoopla it is important to consider

both the annual dividend paid to the shareholders as well as appreciation in the value of capital

of the shareholders of the company in last five years (Malik, 2015).

Using the Price Earnings ratios of the company the capital appreciation has been calculated. The

amount of dividend paid by the company over the last five years have then been added to the

capital appreciation to calculate the TSR (DeFusco et. al. 2015).

Years (All amounts are in

GBP’000)

2017 2016 2015 2014 2013

PE ratios 41.3 36.7 34 31 30

EPS (Pence) 8.8 8.9 6.2 5.1 5.4

Value per share 3.6344 3.2663 2.108 1.581 1.62

Weighted average number of

ordinary shares

426813751 413262135 412509761 410953217 410694460

Value of total shares 1,551,

211.90

1,349,

838.11

869,

570.58

649,

717.04

665,3

25.03

Economic valued added 201

,373.79

480

,267.54

219,

853.54

(15,

607.99)

Add: Dividend payment 23 16 8 35

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10CORPORATE FINANCE

,609.00 ,554.00 ,667.00 ,528.00

Total return to the

shareholders

224

,982.79

496

,821.54

228,

520.54

19

,920.01

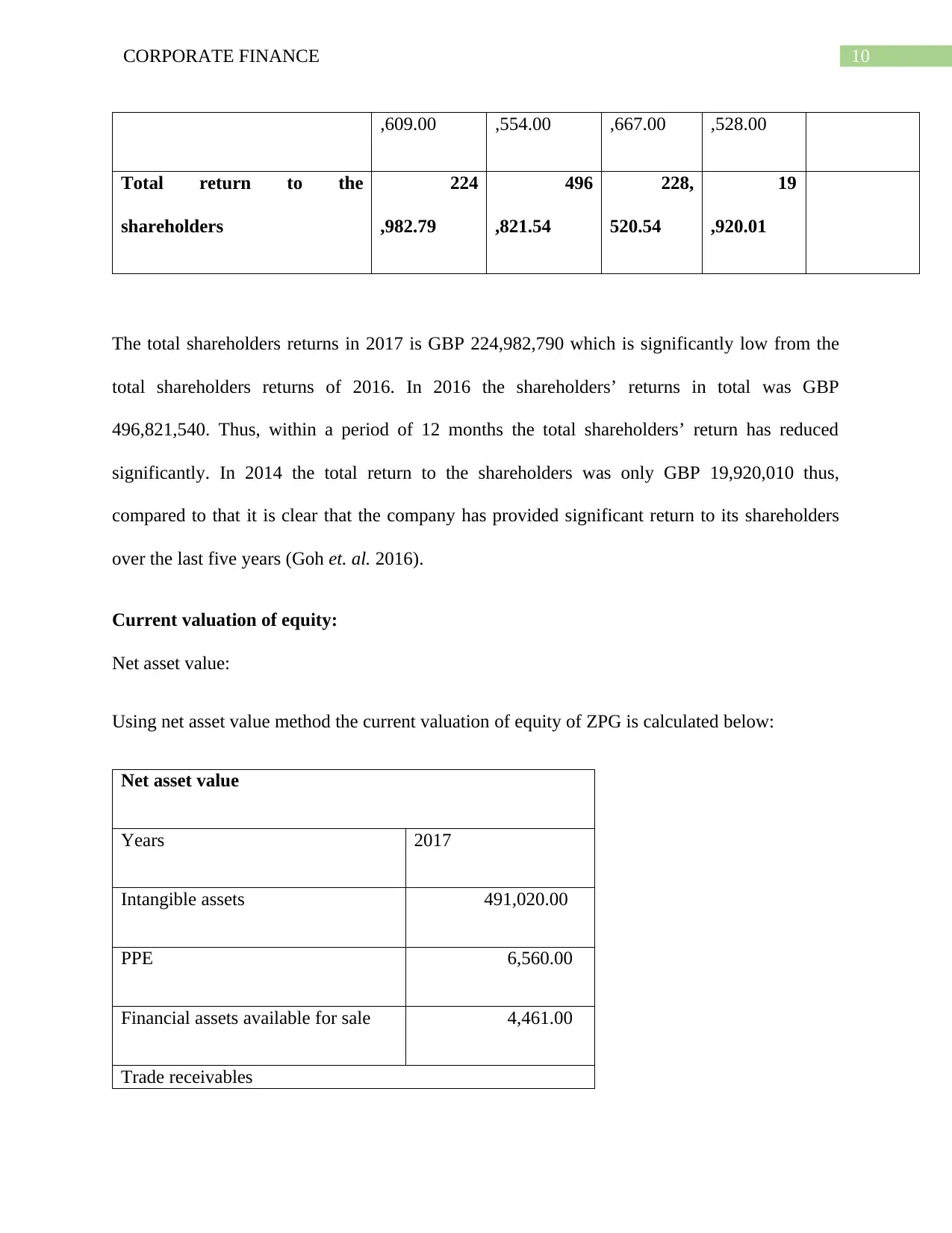

The total shareholders returns in 2017 is GBP 224,982,790 which is significantly low from the

total shareholders returns of 2016. In 2016 the shareholders’ returns in total was GBP

496,821,540. Thus, within a period of 12 months the total shareholders’ return has reduced

significantly. In 2014 the total return to the shareholders was only GBP 19,920,010 thus,

compared to that it is clear that the company has provided significant return to its shareholders

over the last five years (Goh et. al. 2016).

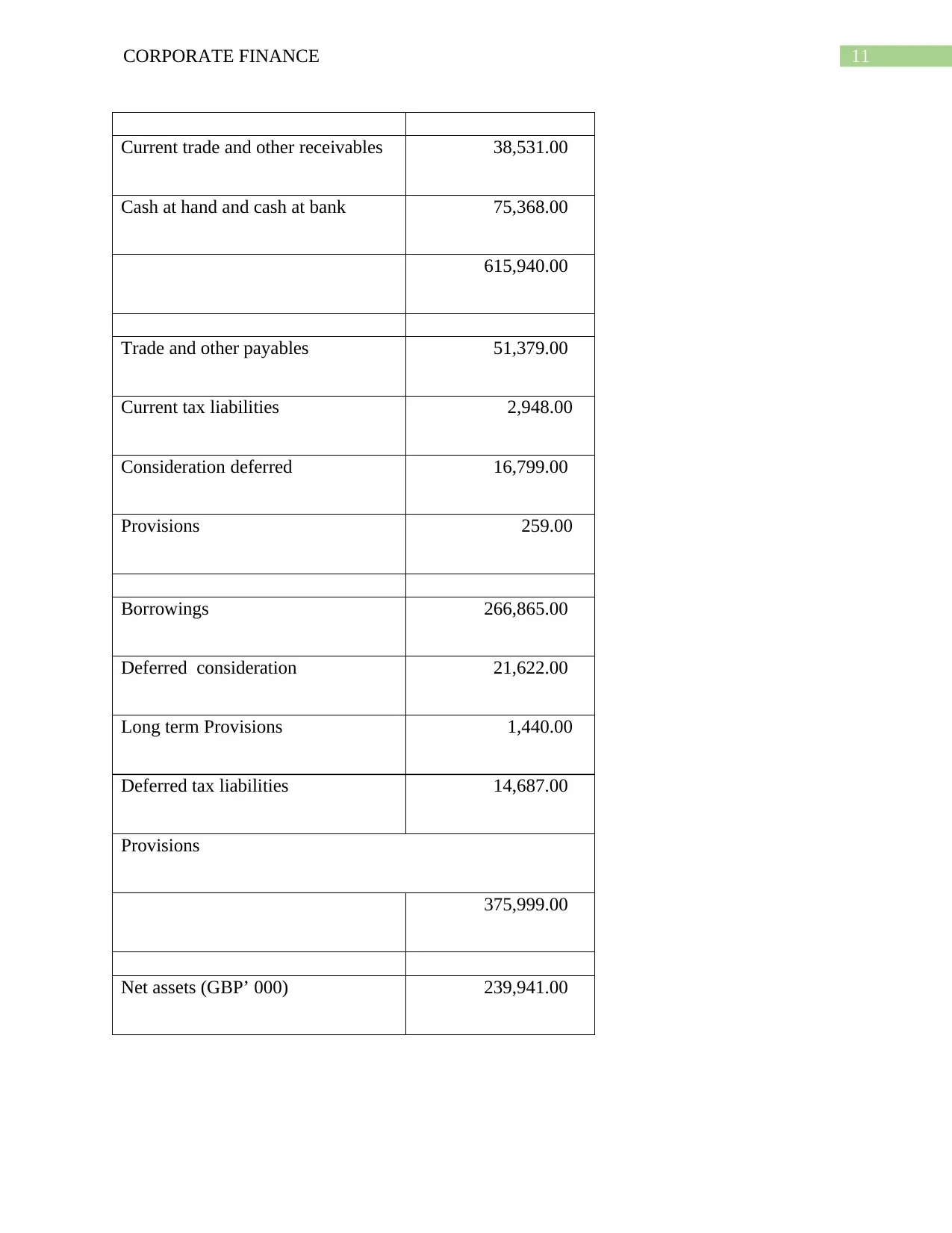

Current valuation of equity:

Net asset value:

Using net asset value method the current valuation of equity of ZPG is calculated below:

Net asset value

Years 2017

Intangible assets 491,020.00

PPE 6,560.00

Financial assets available for sale 4,461.00

Trade receivables

,609.00 ,554.00 ,667.00 ,528.00

Total return to the

shareholders

224

,982.79

496

,821.54

228,

520.54

19

,920.01

The total shareholders returns in 2017 is GBP 224,982,790 which is significantly low from the

total shareholders returns of 2016. In 2016 the shareholders’ returns in total was GBP

496,821,540. Thus, within a period of 12 months the total shareholders’ return has reduced

significantly. In 2014 the total return to the shareholders was only GBP 19,920,010 thus,

compared to that it is clear that the company has provided significant return to its shareholders

over the last five years (Goh et. al. 2016).

Current valuation of equity:

Net asset value:

Using net asset value method the current valuation of equity of ZPG is calculated below:

Net asset value

Years 2017

Intangible assets 491,020.00

PPE 6,560.00

Financial assets available for sale 4,461.00

Trade receivables

11CORPORATE FINANCE

Current trade and other receivables 38,531.00

Cash at hand and cash at bank 75,368.00

615,940.00

Trade and other payables 51,379.00

Current tax liabilities 2,948.00

Consideration deferred 16,799.00

Provisions 259.00

Borrowings 266,865.00

Deferred consideration 21,622.00

Long term Provisions 1,440.00

Deferred tax liabilities 14,687.00

Provisions

375,999.00

Net assets (GBP’ 000) 239,941.00

Current trade and other receivables 38,531.00

Cash at hand and cash at bank 75,368.00

615,940.00

Trade and other payables 51,379.00

Current tax liabilities 2,948.00

Consideration deferred 16,799.00

Provisions 259.00

Borrowings 266,865.00

Deferred consideration 21,622.00

Long term Provisions 1,440.00

Deferred tax liabilities 14,687.00

Provisions

375,999.00

Net assets (GBP’ 000) 239,941.00

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.