Detailed Financial Statement Analysis Report: A2 Milk Company (GBS003)

VerifiedAdded on 2022/08/20

|17

|3428

|10

Report

AI Summary

This report provides a comprehensive financial analysis of The A2 Milk Co. Ltd. (A2M), an Australian company specializing in infant milk formula and dairy products. The analysis examines A2M's financial performance using data from its financial statements, including the income statement, balance sheet, and cash flow statement. The report delves into various financial ratios, such as liquidity, leverage, efficiency, and profitability ratios, to assess the company's financial health and performance. It discusses the changes in these ratios over time, providing insights into the company's ability to meet its obligations, manage its assets, and generate profits. The report also compares A2M's performance with previous years, highlighting trends and providing a detailed overview of the company's financial position and operational effectiveness, with reference to its geographical segments.

Running head: FINANCIAL STATEMENT ANALYSIS

FINANCIAL STATEMENT ANALYSIS

Name of the Student

Name of the University

Author Note:

FINANCIAL STATEMENT ANALYSIS

Name of the Student

Name of the University

Author Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL STATEMENT ANALYSIS

Executive Summary

This report is based on an Australian organization A2 Milk Company Ltd which is indulged in

producing infant milk formula and other dairy products, and it is listed in the ASX200. This

report provides a precise analysis of the company’s financial performance. The study provides

the changes that occurred in financial ratios and the reason for such change and a comparison of

a company’s performance with previous year results.

Executive Summary

This report is based on an Australian organization A2 Milk Company Ltd which is indulged in

producing infant milk formula and other dairy products, and it is listed in the ASX200. This

report provides a precise analysis of the company’s financial performance. The study provides

the changes that occurred in financial ratios and the reason for such change and a comparison of

a company’s performance with previous year results.

2FINANCIAL STATEMENT ANALYSIS

Table of Contents

Introduction......................................................................................................................................4

Discussion........................................................................................................................................4

Income Statement Analysis.............................................................................................................5

Financial Ratio Analysis..................................................................................................................6

Liquidity Ratio:................................................................................................................................6

Current Ratio:..............................................................................................................................7

Acid-test Ratio:............................................................................................................................7

Cash Ratio:...................................................................................................................................8

Leverage Financial Ratio.................................................................................................................8

Debt Ratio:...................................................................................................................................9

Debt-Equity Ratio:.......................................................................................................................9

Efficiency Ratio.............................................................................................................................10

Asset Turnover Ratio:................................................................................................................10

Inventory Turnover Ratio:.........................................................................................................10

Days sales in inventory ratio:....................................................................................................11

Profitability Ratio..........................................................................................................................11

Gross Profit Margin Ratio:........................................................................................................12

Operating Profit Margin:...........................................................................................................12

Return on Asset:........................................................................................................................13

Table of Contents

Introduction......................................................................................................................................4

Discussion........................................................................................................................................4

Income Statement Analysis.............................................................................................................5

Financial Ratio Analysis..................................................................................................................6

Liquidity Ratio:................................................................................................................................6

Current Ratio:..............................................................................................................................7

Acid-test Ratio:............................................................................................................................7

Cash Ratio:...................................................................................................................................8

Leverage Financial Ratio.................................................................................................................8

Debt Ratio:...................................................................................................................................9

Debt-Equity Ratio:.......................................................................................................................9

Efficiency Ratio.............................................................................................................................10

Asset Turnover Ratio:................................................................................................................10

Inventory Turnover Ratio:.........................................................................................................10

Days sales in inventory ratio:....................................................................................................11

Profitability Ratio..........................................................................................................................11

Gross Profit Margin Ratio:........................................................................................................12

Operating Profit Margin:...........................................................................................................12

Return on Asset:........................................................................................................................13

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCIAL STATEMENT ANALYSIS

Return on Equity:.......................................................................................................................13

Conclusion.....................................................................................................................................14

Reference.......................................................................................................................................15

Return on Equity:.......................................................................................................................13

Conclusion.....................................................................................................................................14

Reference.......................................................................................................................................15

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCIAL STATEMENT ANALYSIS

Introduction

This paper will focus on the financial performance of The A2 Milk Co. Ltd. (A2M)

which is a listed company established in New Zealand in the year 2000. It operates in Australia

and New Zealand, United Kingdom, and the USA. A2M generates revenue from producing and

distributing infant formula, milk and dairy products. The A2M is the inheritor of the A2

Corporation Limited, a New Zealand company founded in 2000. The company commercializes

in intellectual property that is related to A1 milk which is protein-free and is traded under A2

milk brands. The headquarter of A2M is located in Auckland, New Zealand. The founder of the

A2 Milk Co. Ltd is Corran Mclachlan and Howard Paterson, and the latter is also New Zealand’s

richest men.

Discussion

The company is earning significant revenue over the previous years and has delivered a

record financial statement and market share information for 2019, which was accompanied by

solid progression. The upsurge in the growth is seen because of the increasing awareness of the

consumers for health and wellbeing, focus on food safety, developing middle class of Asia,

naturalness, and provenance and the rapid pace of digitalization (Thea2milkcompany.com.

2020).

The company A2M is devoted in sustaining the highest standard of corporate governance

and it is nurtured according to the NZX Corporate Governance Code and the ASX Corporate

Governance Council’s Corporate Governance Principal and Recommendation. The financial

statement of the company is prepared based on General Accepted Accounting Practice in New

Zealand and it complies with the International Financial Reporting Standards (IFRS). The

Introduction

This paper will focus on the financial performance of The A2 Milk Co. Ltd. (A2M)

which is a listed company established in New Zealand in the year 2000. It operates in Australia

and New Zealand, United Kingdom, and the USA. A2M generates revenue from producing and

distributing infant formula, milk and dairy products. The A2M is the inheritor of the A2

Corporation Limited, a New Zealand company founded in 2000. The company commercializes

in intellectual property that is related to A1 milk which is protein-free and is traded under A2

milk brands. The headquarter of A2M is located in Auckland, New Zealand. The founder of the

A2 Milk Co. Ltd is Corran Mclachlan and Howard Paterson, and the latter is also New Zealand’s

richest men.

Discussion

The company is earning significant revenue over the previous years and has delivered a

record financial statement and market share information for 2019, which was accompanied by

solid progression. The upsurge in the growth is seen because of the increasing awareness of the

consumers for health and wellbeing, focus on food safety, developing middle class of Asia,

naturalness, and provenance and the rapid pace of digitalization (Thea2milkcompany.com.

2020).

The company A2M is devoted in sustaining the highest standard of corporate governance

and it is nurtured according to the NZX Corporate Governance Code and the ASX Corporate

Governance Council’s Corporate Governance Principal and Recommendation. The financial

statement of the company is prepared based on General Accepted Accounting Practice in New

Zealand and it complies with the International Financial Reporting Standards (IFRS). The

5FINANCIAL STATEMENT ANALYSIS

financial statements has been prepared using the historical cost concept, except for the listed

investment, as it does not consider the changing monetary values i.e, fair values of asset.

Substantial accounting policies used to prepare the financial statement while recording the

transaction is that foreign currency are initially converted into the corresponding functional

currency of the group companies at a rate in which the transaction takes place. All the financial

assets and liabilities which are epitomized in foreign currencies are decoded to the functional

currencies at the exchange rate reigning on the date of reporting. The difference in the foreign

exchange is documented in the comprehensive income statement.

Income Statement Analysis

The consolidated income statement are acknowledged from the internal reports of the

company, and the group is organized based on the geographical location (Robinson, T.R., 2020).

From 1st June the group operating segment has been divided into four groups:

The external returns received by Australia and New Zealand from the sale of infant

formula, milk, and other dairy product. The additional income received by the company

is income from license fees and royalty.

The Asian segment receives income from the sale of milk, infant formula, and dairy

products.

The segment of the USA receives income from the sale of milk.

The segment of the UK receives income from the sale of milk and infant formula.

The above revenues are considered after deducting all the items of variable consideration,

like rebates, trade discounts as agreed with the customers. The sales of the company are

recognized at the time when the products are actually transferred to the customer. The credit

financial statements has been prepared using the historical cost concept, except for the listed

investment, as it does not consider the changing monetary values i.e, fair values of asset.

Substantial accounting policies used to prepare the financial statement while recording the

transaction is that foreign currency are initially converted into the corresponding functional

currency of the group companies at a rate in which the transaction takes place. All the financial

assets and liabilities which are epitomized in foreign currencies are decoded to the functional

currencies at the exchange rate reigning on the date of reporting. The difference in the foreign

exchange is documented in the comprehensive income statement.

Income Statement Analysis

The consolidated income statement are acknowledged from the internal reports of the

company, and the group is organized based on the geographical location (Robinson, T.R., 2020).

From 1st June the group operating segment has been divided into four groups:

The external returns received by Australia and New Zealand from the sale of infant

formula, milk, and other dairy product. The additional income received by the company

is income from license fees and royalty.

The Asian segment receives income from the sale of milk, infant formula, and dairy

products.

The segment of the USA receives income from the sale of milk.

The segment of the UK receives income from the sale of milk and infant formula.

The above revenues are considered after deducting all the items of variable consideration,

like rebates, trade discounts as agreed with the customers. The sales of the company are

recognized at the time when the products are actually transferred to the customer. The credit

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCIAL STATEMENT ANALYSIS

period that is granted to the debtors does not exceeds more than 60 days, while other options for

settlement are cash on delivery and prepaid terms.

Financial Ratio Analysis

When numerical values are taken from the financial statement to arrive at meaningful

information which are reflected in terms of the ratio is termed as financial ratios (Rashid, 2018).

An analysis of the financial ratio requires examination of the company’s financial statement –

balance sheet, income statement, cash flow and comprehensive income statement. It is a

quantitative analysis which provides result regarding the company’s liquidity, leverage, growth,

rate of return, profit margins and more. The report serves two main purposes (Robinson et al.,

2015):

Tracking company performance

Making a judgment on the enactment of the company.

The users of the financial ratios include external and internal parties. External parties include

creditors, tax authorities, regulatory authorities, investors and financial analysts. Internal users

include employees, management team, and the owners of the company. The analysis of the

financial ratio is done in four main categories:

Liquidity Ratio:

The purpose of this ratio is to examines the capability of the A2M to settle its current

liabilities as and when they become payable. It measures how easy the company can raise

enough cash or how well it can convert its assets into cash (Garanina and Belova, 2015). The

liquidity of the company is measured by the current ratio, acid-test ratio, and cash ratio, the

calculation of which has been listed below:

period that is granted to the debtors does not exceeds more than 60 days, while other options for

settlement are cash on delivery and prepaid terms.

Financial Ratio Analysis

When numerical values are taken from the financial statement to arrive at meaningful

information which are reflected in terms of the ratio is termed as financial ratios (Rashid, 2018).

An analysis of the financial ratio requires examination of the company’s financial statement –

balance sheet, income statement, cash flow and comprehensive income statement. It is a

quantitative analysis which provides result regarding the company’s liquidity, leverage, growth,

rate of return, profit margins and more. The report serves two main purposes (Robinson et al.,

2015):

Tracking company performance

Making a judgment on the enactment of the company.

The users of the financial ratios include external and internal parties. External parties include

creditors, tax authorities, regulatory authorities, investors and financial analysts. Internal users

include employees, management team, and the owners of the company. The analysis of the

financial ratio is done in four main categories:

Liquidity Ratio:

The purpose of this ratio is to examines the capability of the A2M to settle its current

liabilities as and when they become payable. It measures how easy the company can raise

enough cash or how well it can convert its assets into cash (Garanina and Belova, 2015). The

liquidity of the company is measured by the current ratio, acid-test ratio, and cash ratio, the

calculation of which has been listed below:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL STATEMENT ANALYSIS

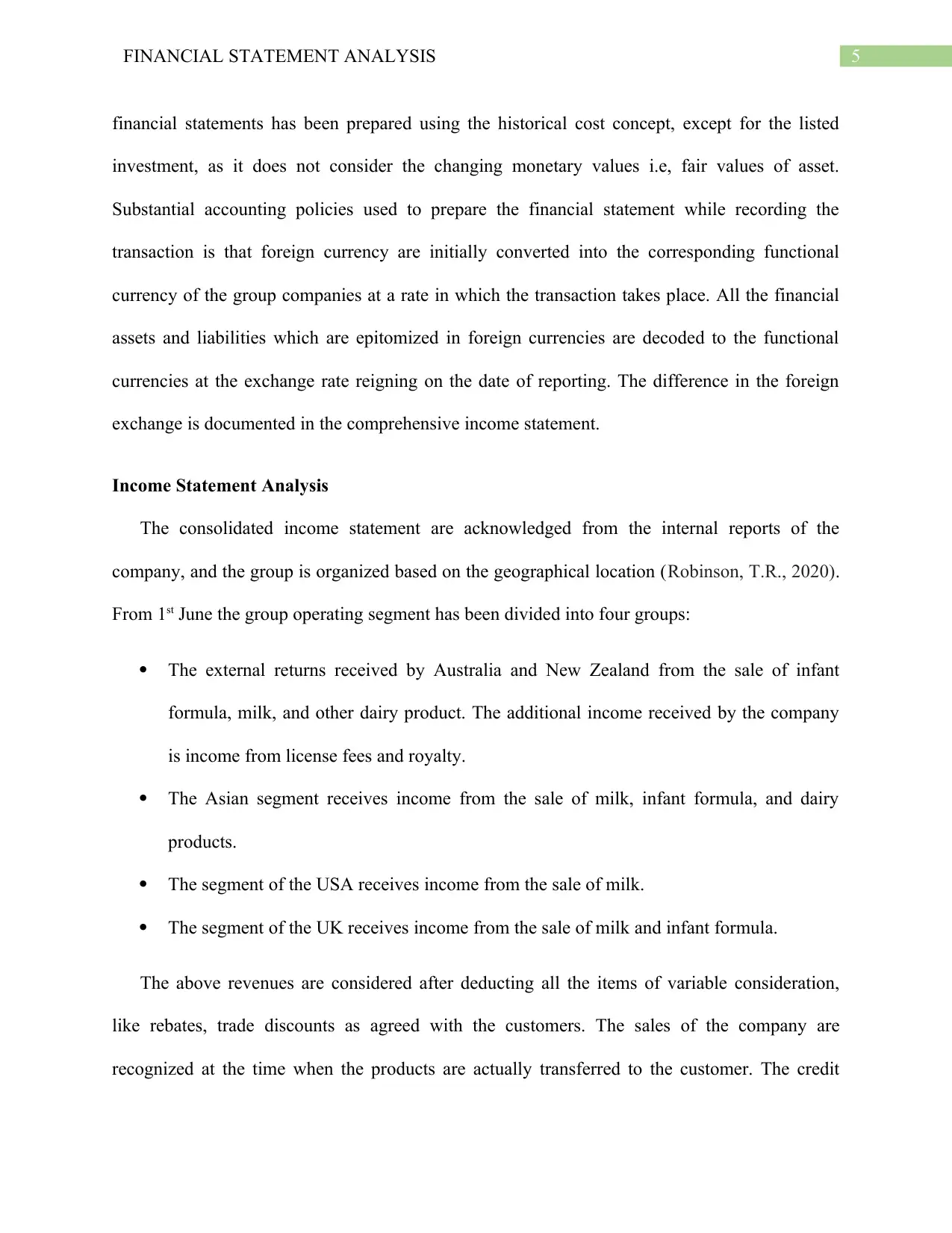

Current Ratio:

The current ratio is evaluated by dividing the current asset with the current liability. The

current ratio of the A2M is greater than the ideal ratio, which is 2:1 i.e. current asset is twice the

current liability (Arkan, 2016). Such high ratio (3.3:1) signifies that the company is financially

sound and has enough liquid to pay off its current obligation before it becomes overdue. The

current ratio of the company has increased by more than 32% as compared with the previous

year. The increase in the current ratio is because of the rise in the asset, as the A2M company

decided to increase the inventory due to rising sales and as a result of which the asset has been

increased.

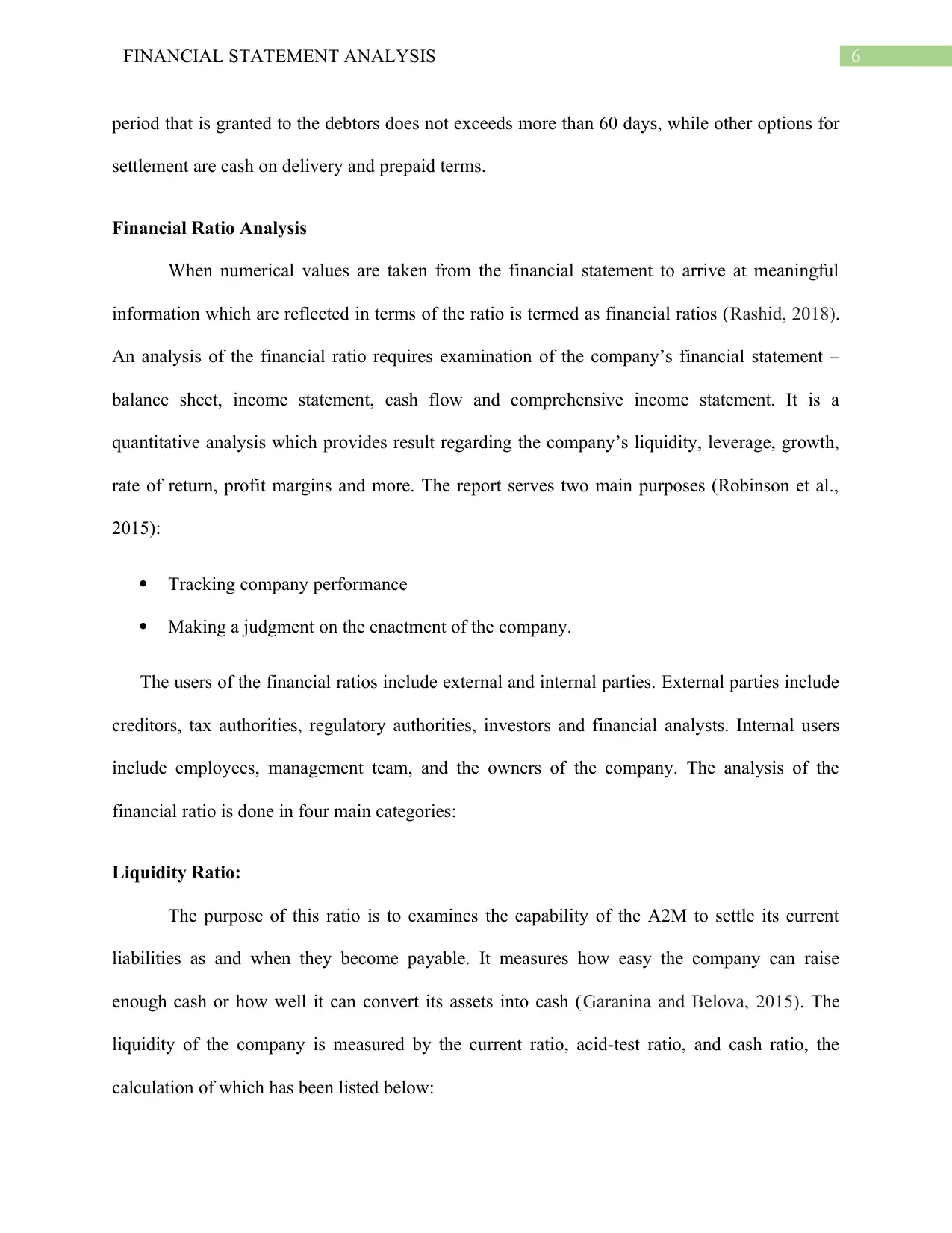

Acid-test Ratio:

Calculation of the quick ratio, also known as acid test ratio, is very much akin to that of

the current ratio the only difference arise is because of the inventory which gets subtracted from

the current asset since it cannot be sold immediately as it is less liquid (DRM13, 2019). The acid

test ratio of the company A2M is more than the ideal ratio which is 1:1. Anything greater than

Current Ratio:

The current ratio is evaluated by dividing the current asset with the current liability. The

current ratio of the A2M is greater than the ideal ratio, which is 2:1 i.e. current asset is twice the

current liability (Arkan, 2016). Such high ratio (3.3:1) signifies that the company is financially

sound and has enough liquid to pay off its current obligation before it becomes overdue. The

current ratio of the company has increased by more than 32% as compared with the previous

year. The increase in the current ratio is because of the rise in the asset, as the A2M company

decided to increase the inventory due to rising sales and as a result of which the asset has been

increased.

Acid-test Ratio:

Calculation of the quick ratio, also known as acid test ratio, is very much akin to that of

the current ratio the only difference arise is because of the inventory which gets subtracted from

the current asset since it cannot be sold immediately as it is less liquid (DRM13, 2019). The acid

test ratio of the company A2M is more than the ideal ratio which is 1:1. Anything greater than

8FINANCIAL STATEMENT ANALYSIS

the ideal ratio is considered that the company is experiencing solid top-line growth and the

receivables are quickly convertible which makes it easy for the company to cover its financial

obligation. Comparing the figures of the company A2M with the last year, an upsurge of more

than 26% has been seen in the fiscal year. Since there is an increase in the inventory, the growth

has increased but at a declining rate.

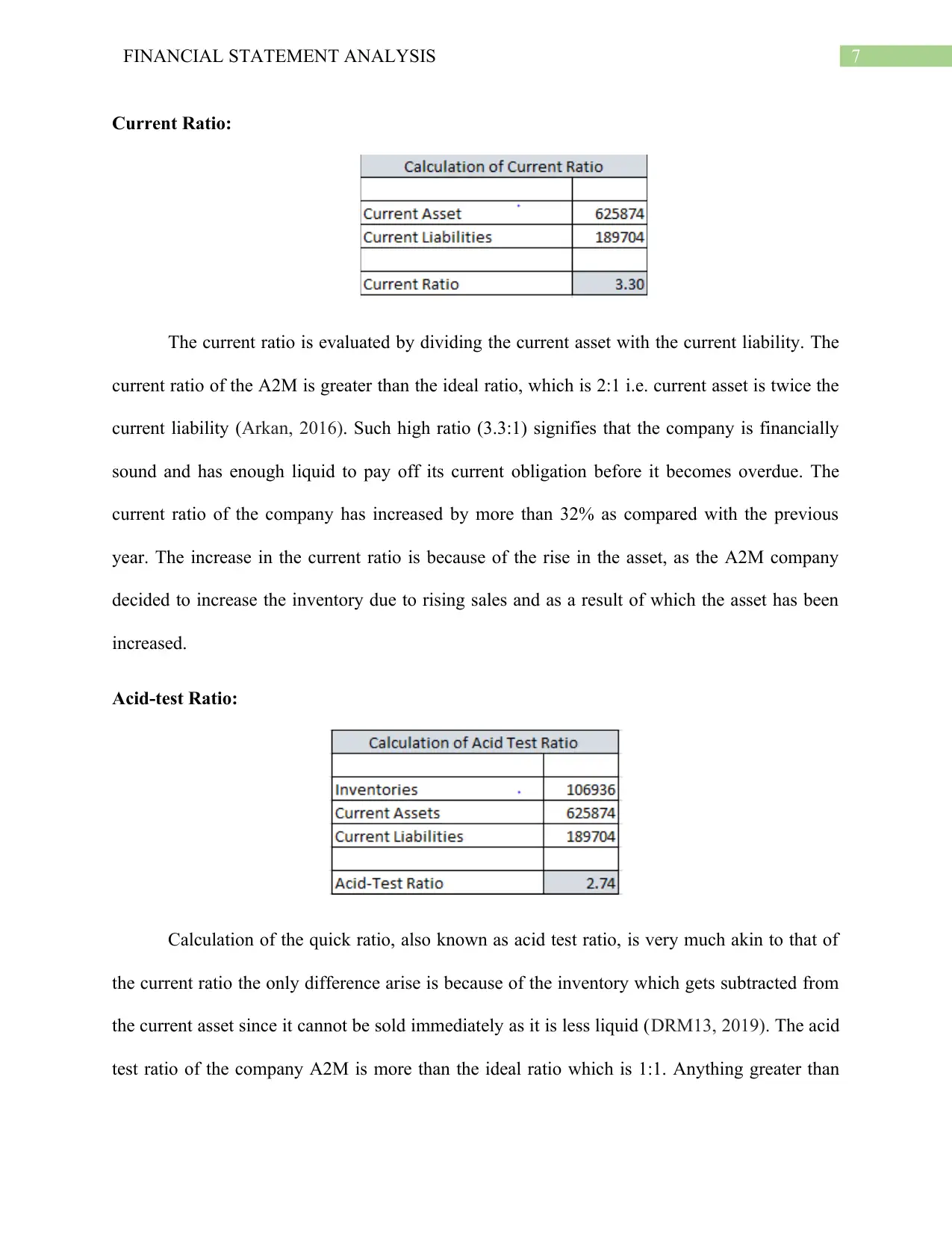

Cash Ratio:

The above ratio has been evaluated by dividing the cash and its equivalent to the current

liability. The ideal cash ratio lies between 0.5 to 1 depending upon the business of the company,

therefore a cash ratio of 2.18 means that the company cash and cash equivalent is itself enough to

pay more than twice the current debt of the company. Creditors are interested in a company if its

cash ratio is more than ideal as they believe that their loan can be repaid along with interest.

Leverage Financial Ratio

This ratio helps in measuring the amount of capital that coming from debt. It is also

known as solvency ratio, used to calculate a load of debt with the existing amount of asset or

equity. When the owners hold or own the majority of an asset than the company is said to be less

leveraged, while if the majority of an asset than the company is said to be more leveraged. All

this measurement is important as it gives the investors an idea about how risky is the capital

the ideal ratio is considered that the company is experiencing solid top-line growth and the

receivables are quickly convertible which makes it easy for the company to cover its financial

obligation. Comparing the figures of the company A2M with the last year, an upsurge of more

than 26% has been seen in the fiscal year. Since there is an increase in the inventory, the growth

has increased but at a declining rate.

Cash Ratio:

The above ratio has been evaluated by dividing the cash and its equivalent to the current

liability. The ideal cash ratio lies between 0.5 to 1 depending upon the business of the company,

therefore a cash ratio of 2.18 means that the company cash and cash equivalent is itself enough to

pay more than twice the current debt of the company. Creditors are interested in a company if its

cash ratio is more than ideal as they believe that their loan can be repaid along with interest.

Leverage Financial Ratio

This ratio helps in measuring the amount of capital that coming from debt. It is also

known as solvency ratio, used to calculate a load of debt with the existing amount of asset or

equity. When the owners hold or own the majority of an asset than the company is said to be less

leveraged, while if the majority of an asset than the company is said to be more leveraged. All

this measurement is important as it gives the investors an idea about how risky is the capital

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCIAL STATEMENT ANALYSIS

structure of the company and whether it will be a profitable investment. (Adenugba, Ige and

Kesinro, 2016).

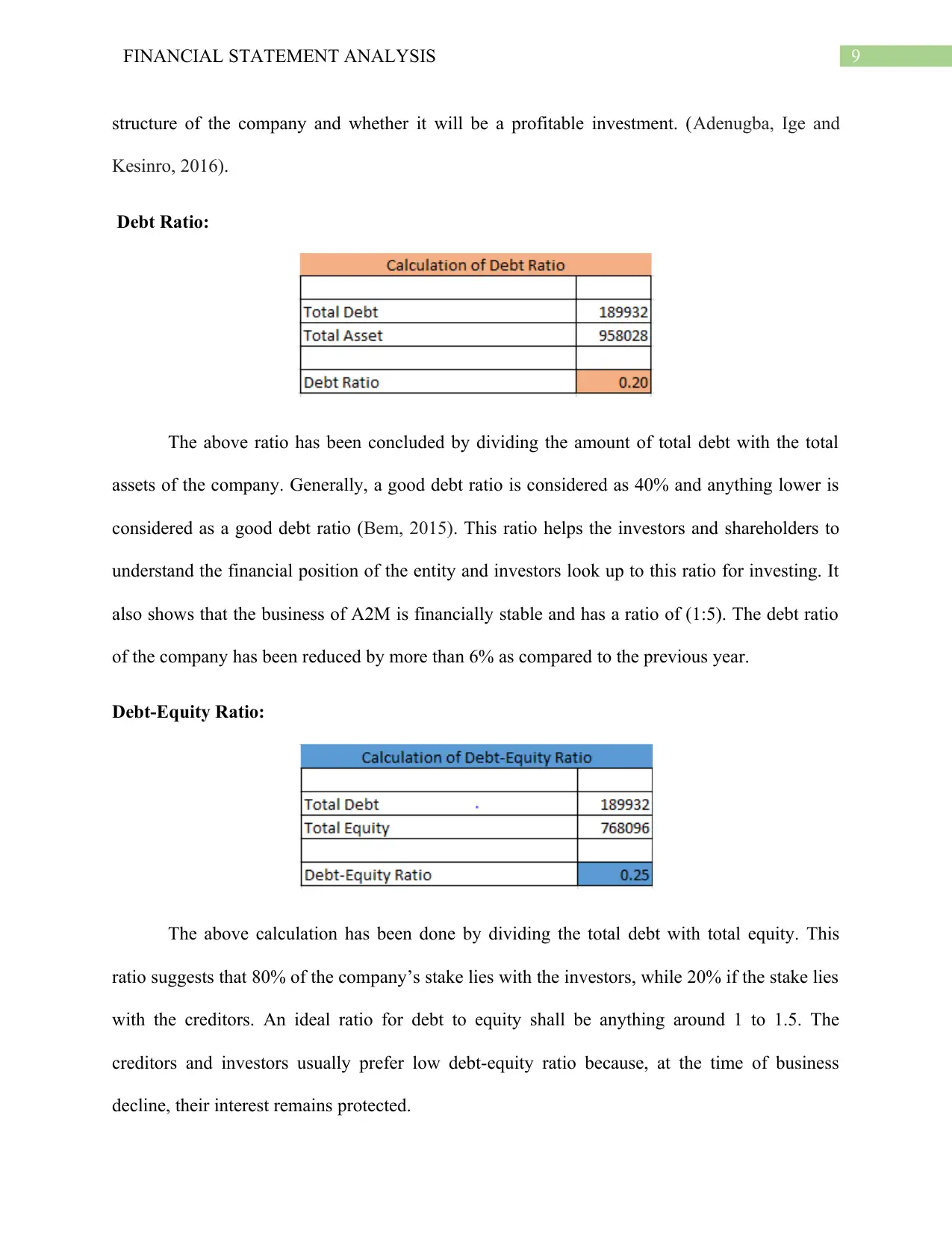

Debt Ratio:

The above ratio has been concluded by dividing the amount of total debt with the total

assets of the company. Generally, a good debt ratio is considered as 40% and anything lower is

considered as a good debt ratio (Bem, 2015). This ratio helps the investors and shareholders to

understand the financial position of the entity and investors look up to this ratio for investing. It

also shows that the business of A2M is financially stable and has a ratio of (1:5). The debt ratio

of the company has been reduced by more than 6% as compared to the previous year.

Debt-Equity Ratio:

The above calculation has been done by dividing the total debt with total equity. This

ratio suggests that 80% of the company’s stake lies with the investors, while 20% if the stake lies

with the creditors. An ideal ratio for debt to equity shall be anything around 1 to 1.5. The

creditors and investors usually prefer low debt-equity ratio because, at the time of business

decline, their interest remains protected.

structure of the company and whether it will be a profitable investment. (Adenugba, Ige and

Kesinro, 2016).

Debt Ratio:

The above ratio has been concluded by dividing the amount of total debt with the total

assets of the company. Generally, a good debt ratio is considered as 40% and anything lower is

considered as a good debt ratio (Bem, 2015). This ratio helps the investors and shareholders to

understand the financial position of the entity and investors look up to this ratio for investing. It

also shows that the business of A2M is financially stable and has a ratio of (1:5). The debt ratio

of the company has been reduced by more than 6% as compared to the previous year.

Debt-Equity Ratio:

The above calculation has been done by dividing the total debt with total equity. This

ratio suggests that 80% of the company’s stake lies with the investors, while 20% if the stake lies

with the creditors. An ideal ratio for debt to equity shall be anything around 1 to 1.5. The

creditors and investors usually prefer low debt-equity ratio because, at the time of business

decline, their interest remains protected.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCIAL STATEMENT ANALYSIS

Efficiency Ratio

The efficiency ratio, also called activity ratio, processes how proficiently a company can

utilize its resources. The lower the ratio healthier for the company. Generally, 50% is regarded as

the highest ideal ratio. An efficient organization minimizes its net investment on the asset and

therefore requires less capital in order to remain in operation (Schaltegger and Burritt, 2017).

Standard efficiency ratio includes: -

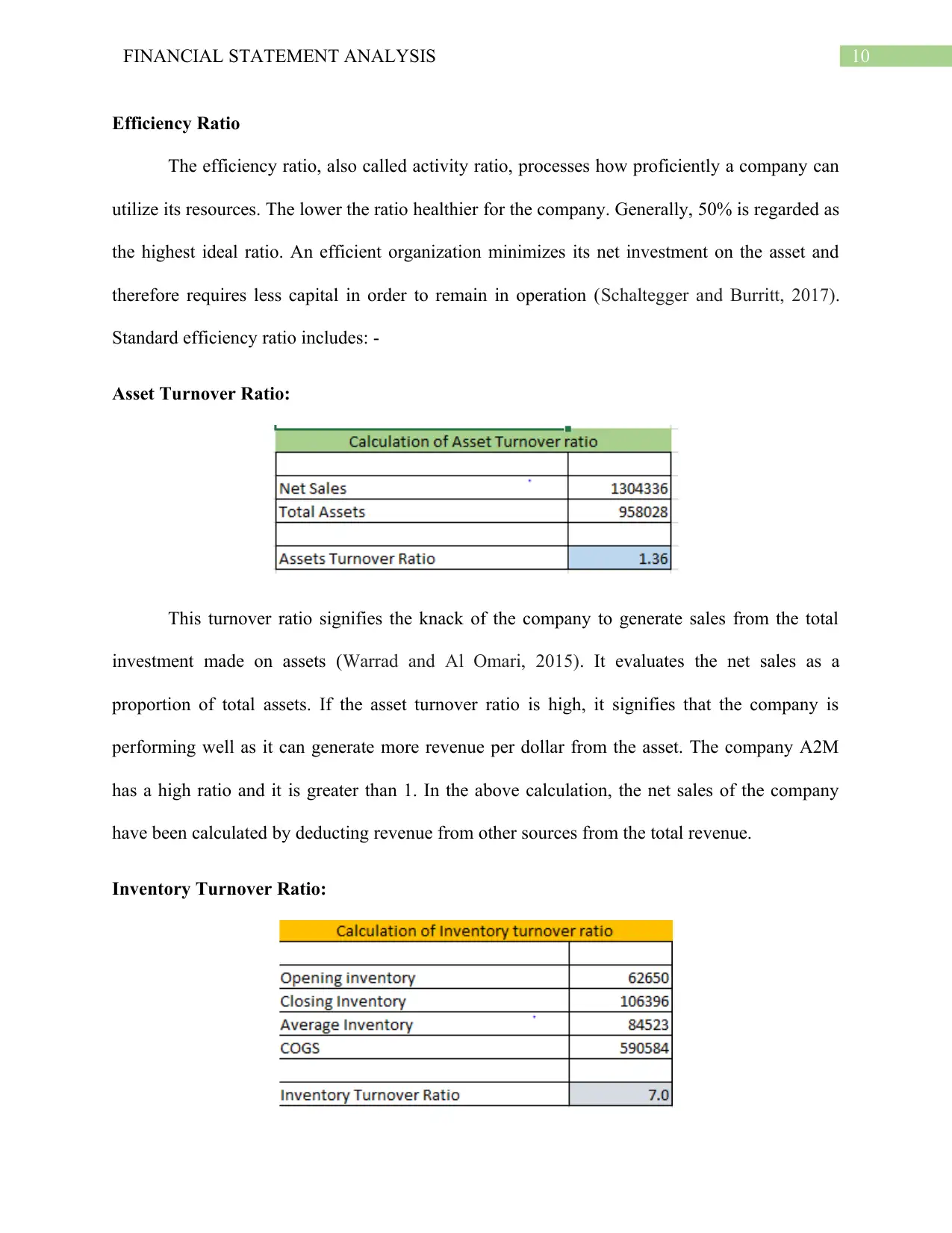

Asset Turnover Ratio:

This turnover ratio signifies the knack of the company to generate sales from the total

investment made on assets (Warrad and Al Omari, 2015). It evaluates the net sales as a

proportion of total assets. If the asset turnover ratio is high, it signifies that the company is

performing well as it can generate more revenue per dollar from the asset. The company A2M

has a high ratio and it is greater than 1. In the above calculation, the net sales of the company

have been calculated by deducting revenue from other sources from the total revenue.

Inventory Turnover Ratio:

Efficiency Ratio

The efficiency ratio, also called activity ratio, processes how proficiently a company can

utilize its resources. The lower the ratio healthier for the company. Generally, 50% is regarded as

the highest ideal ratio. An efficient organization minimizes its net investment on the asset and

therefore requires less capital in order to remain in operation (Schaltegger and Burritt, 2017).

Standard efficiency ratio includes: -

Asset Turnover Ratio:

This turnover ratio signifies the knack of the company to generate sales from the total

investment made on assets (Warrad and Al Omari, 2015). It evaluates the net sales as a

proportion of total assets. If the asset turnover ratio is high, it signifies that the company is

performing well as it can generate more revenue per dollar from the asset. The company A2M

has a high ratio and it is greater than 1. In the above calculation, the net sales of the company

have been calculated by deducting revenue from other sources from the total revenue.

Inventory Turnover Ratio:

11FINANCIAL STATEMENT ANALYSIS

The ratio has been evaluated by dividing the COGS with the average inventory.

Estmation of the average inventory is done by aggregating opening inventory and closing

inventory and dividing it by 2. The ideal inventory ratio lies from around 4 to 6. A higher

inventory turnover ratio reflects the company has effective inventory management. The

inventory turnover has increased which can be a result of higher sales and lower input costs,

which drives profits and cash flow higher (Shardeo, 2015). These will provide better negotiation

power to the business.

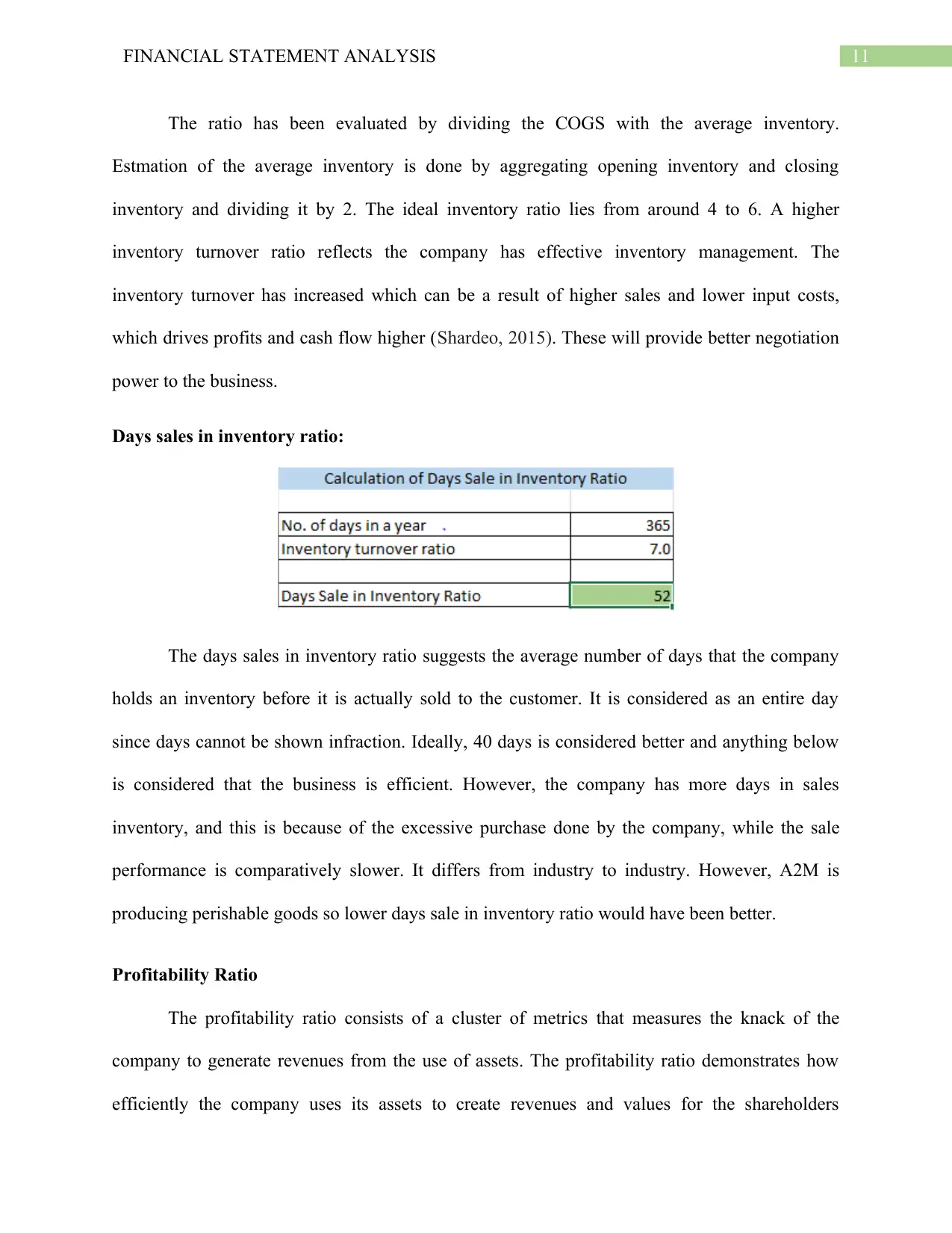

Days sales in inventory ratio:

The days sales in inventory ratio suggests the average number of days that the company

holds an inventory before it is actually sold to the customer. It is considered as an entire day

since days cannot be shown infraction. Ideally, 40 days is considered better and anything below

is considered that the business is efficient. However, the company has more days in sales

inventory, and this is because of the excessive purchase done by the company, while the sale

performance is comparatively slower. It differs from industry to industry. However, A2M is

producing perishable goods so lower days sale in inventory ratio would have been better.

Profitability Ratio

The profitability ratio consists of a cluster of metrics that measures the knack of the

company to generate revenues from the use of assets. The profitability ratio demonstrates how

efficiently the company uses its assets to create revenues and values for the shareholders

The ratio has been evaluated by dividing the COGS with the average inventory.

Estmation of the average inventory is done by aggregating opening inventory and closing

inventory and dividing it by 2. The ideal inventory ratio lies from around 4 to 6. A higher

inventory turnover ratio reflects the company has effective inventory management. The

inventory turnover has increased which can be a result of higher sales and lower input costs,

which drives profits and cash flow higher (Shardeo, 2015). These will provide better negotiation

power to the business.

Days sales in inventory ratio:

The days sales in inventory ratio suggests the average number of days that the company

holds an inventory before it is actually sold to the customer. It is considered as an entire day

since days cannot be shown infraction. Ideally, 40 days is considered better and anything below

is considered that the business is efficient. However, the company has more days in sales

inventory, and this is because of the excessive purchase done by the company, while the sale

performance is comparatively slower. It differs from industry to industry. However, A2M is

producing perishable goods so lower days sale in inventory ratio would have been better.

Profitability Ratio

The profitability ratio consists of a cluster of metrics that measures the knack of the

company to generate revenues from the use of assets. The profitability ratio demonstrates how

efficiently the company uses its assets to create revenues and values for the shareholders

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.