Analyzing Intangible Assets & AASB 138 Impact on Tech Enterprises

VerifiedAdded on 2023/03/23

|8

|3204

|33

Report

AI Summary

This report provides a detailed analysis of intangible assets and their accounting treatment in Technology Enterprises Limited, focusing on compliance with AASB 138/IAS 38. It examines how projects involving intangible assets should be accounted for in financial statements, the impact of AASB 138/IAS 38 on the comparability of financial statements, and a comprehensive understanding of the standard itself. The report discusses the valuation of projects using current value processes, the identification and measurement of intangible assets, the treatment of research and development costs, and the criteria for recognizing assets. It also highlights the limitations AASB 138 imposes on comparing financial data across companies due to variations in asset identification and valuation methods. The conclusion emphasizes the importance of adhering to AASB 138 for accurate bookkeeping analysis and recommends transparent disclosures to mitigate stockholder concerns.

Running head: FINANCIAL ACCOUNTING

Financial Accounting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Financial Accounting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL ACCOUNTING

Executive Summary:

This project is made with the aim to regulate the precise book-keeping analysis of "intangible

assets" and expenditures incorporated with the same in "Technology Enterprises Limited".

The study takes into consideration the explanation of "AASB 138/IAS 38" incorporated with

the "intangible assets". Next, this study focuses on the reduction in the comparisons of the

"operating statements" due to the limitations and rules provided in "AASB 138/IAS 38".

Lastly, the project emphasizes upon comprehending the grades of "AASB 138/IAS 38".

Executive Summary:

This project is made with the aim to regulate the precise book-keeping analysis of "intangible

assets" and expenditures incorporated with the same in "Technology Enterprises Limited".

The study takes into consideration the explanation of "AASB 138/IAS 38" incorporated with

the "intangible assets". Next, this study focuses on the reduction in the comparisons of the

"operating statements" due to the limitations and rules provided in "AASB 138/IAS 38".

Lastly, the project emphasizes upon comprehending the grades of "AASB 138/IAS 38".

2FINANCIAL ACCOUNTING

Table of Contents

Introduction:...............................................................................................................................3

a. Accounting for the project in the operating statement of Technology Enterprises Limited:. 3

b. Reduction in comparability of the financial statements by AASB 138/IAS 38:....................5

c. Understanding of AASB 138/IAS 38:....................................................................................5

Conclusion and recommendations:............................................................................................6

References:.................................................................................................................................7

Table of Contents

Introduction:...............................................................................................................................3

a. Accounting for the project in the operating statement of Technology Enterprises Limited:. 3

b. Reduction in comparability of the financial statements by AASB 138/IAS 38:....................5

c. Understanding of AASB 138/IAS 38:....................................................................................5

Conclusion and recommendations:............................................................................................6

References:.................................................................................................................................7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCIAL ACCOUNTING

Introduction:

Every company despite of their character and magnitude are responsible to comply

with various book-keeping schemes and propositions in order to fulfill the "book-keeping"

analysis of the "assets and liabilities", among which "intangible assets", are considered to be

crucial business "assets". The study takes into consideration the explaining of "AASB

138/IAS 38" involved with "intangible assets". These have to comply to the precise "book-

keeping" propositions and grades regarding the "book-keeping" analysis of "intangible

assets" and more precisely, they require to report for their "research and development"

"(R&D)" costs in order to create "intangible assets" (Balakrishnan, Watts and Zuo, 2016). In

Australia, the companies enlisted in "ASX" have to comply to the grades instructions

provided in "AASB 138 Intangible Assets" with respect to "book-keeping" analysis of

"intangible assets" alongside the "research and development" expenditures incorporated with

them.

Depending upon the provided data of "Technology Enterprises Ltd", the book keeper

of the company is facing a notable unpredictability while handling the "projects". The study

aims at giving an outline of the precise "book-keeping" analysis of the "project" tackled by

the concerned company. After this, it focuses on the reduction in the comparisons of the

"profit and loss statements" due to the limitations and rules provided in "AASB 138/IAS 38".

Lastly, the paper emphasizes on comprehending the grades of "AASB 138/IAS 38".

a. Ways through which the project could be accounted for in the financial statements:

It is possible to use the current value process for predicting the actual worth of the

"project". It is owing to the reason that it would help in determining the current "project"

worth and anticipated to be gained by "Technology Enterprises Ltd". Conforming to "fair

value accounting", the plan has "value-in-use" of "$4,000,000" and by utilising the "present

value method", the "fair value" of the plan is evaluated to be "$3,000,000". It creates the

contrast between "fair value" and "value in use" of the plan apparently, that could be shown

in the following way:

"$1,000,000 = $4,000,000 - $3,000,000"

In conformity to the above calculation, a contrast of "$1,000,000" could be noticed between

the cost of "market capitalisation" and "reported price" and it requires to be taken into

consideration by the administration of "Technology Enterprises Ltd".

AASB 138/IAS 38:

In conformity to the explanation provided in "AASB 138/IAS 38", "intangible assets"

are treated in the "form" of "non-monetary" and "intangible assets" of the companies, that

could be sensed palpably. While there is no clear presence, it is considered to be the notable

feature of "intangible assets" along with the characteristics of "non-monetary" worth. Due to

this factor, "AASB 138/IAS 38" composes of the explanation of both "monetary assets" and

"non-monetary assets". A company has "two" options incorporated with "intangible assets",

that involve either "internal generation" or "acquisition" of the same (Aasb.gov.au, 2019).

Intangible asset identification:

As stated in "AASB 138, Para 21", the companies are responsible to perceive

"intangible assets" in the existence of possibility that the company would gain anticipated

Introduction:

Every company despite of their character and magnitude are responsible to comply

with various book-keeping schemes and propositions in order to fulfill the "book-keeping"

analysis of the "assets and liabilities", among which "intangible assets", are considered to be

crucial business "assets". The study takes into consideration the explaining of "AASB

138/IAS 38" involved with "intangible assets". These have to comply to the precise "book-

keeping" propositions and grades regarding the "book-keeping" analysis of "intangible

assets" and more precisely, they require to report for their "research and development"

"(R&D)" costs in order to create "intangible assets" (Balakrishnan, Watts and Zuo, 2016). In

Australia, the companies enlisted in "ASX" have to comply to the grades instructions

provided in "AASB 138 Intangible Assets" with respect to "book-keeping" analysis of

"intangible assets" alongside the "research and development" expenditures incorporated with

them.

Depending upon the provided data of "Technology Enterprises Ltd", the book keeper

of the company is facing a notable unpredictability while handling the "projects". The study

aims at giving an outline of the precise "book-keeping" analysis of the "project" tackled by

the concerned company. After this, it focuses on the reduction in the comparisons of the

"profit and loss statements" due to the limitations and rules provided in "AASB 138/IAS 38".

Lastly, the paper emphasizes on comprehending the grades of "AASB 138/IAS 38".

a. Ways through which the project could be accounted for in the financial statements:

It is possible to use the current value process for predicting the actual worth of the

"project". It is owing to the reason that it would help in determining the current "project"

worth and anticipated to be gained by "Technology Enterprises Ltd". Conforming to "fair

value accounting", the plan has "value-in-use" of "$4,000,000" and by utilising the "present

value method", the "fair value" of the plan is evaluated to be "$3,000,000". It creates the

contrast between "fair value" and "value in use" of the plan apparently, that could be shown

in the following way:

"$1,000,000 = $4,000,000 - $3,000,000"

In conformity to the above calculation, a contrast of "$1,000,000" could be noticed between

the cost of "market capitalisation" and "reported price" and it requires to be taken into

consideration by the administration of "Technology Enterprises Ltd".

AASB 138/IAS 38:

In conformity to the explanation provided in "AASB 138/IAS 38", "intangible assets"

are treated in the "form" of "non-monetary" and "intangible assets" of the companies, that

could be sensed palpably. While there is no clear presence, it is considered to be the notable

feature of "intangible assets" along with the characteristics of "non-monetary" worth. Due to

this factor, "AASB 138/IAS 38" composes of the explanation of both "monetary assets" and

"non-monetary assets". A company has "two" options incorporated with "intangible assets",

that involve either "internal generation" or "acquisition" of the same (Aasb.gov.au, 2019).

Intangible asset identification:

As stated in "AASB 138, Para 21", the companies are responsible to perceive

"intangible assets" in the existence of possibility that the company would gain anticipated

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCIAL ACCOUNTING

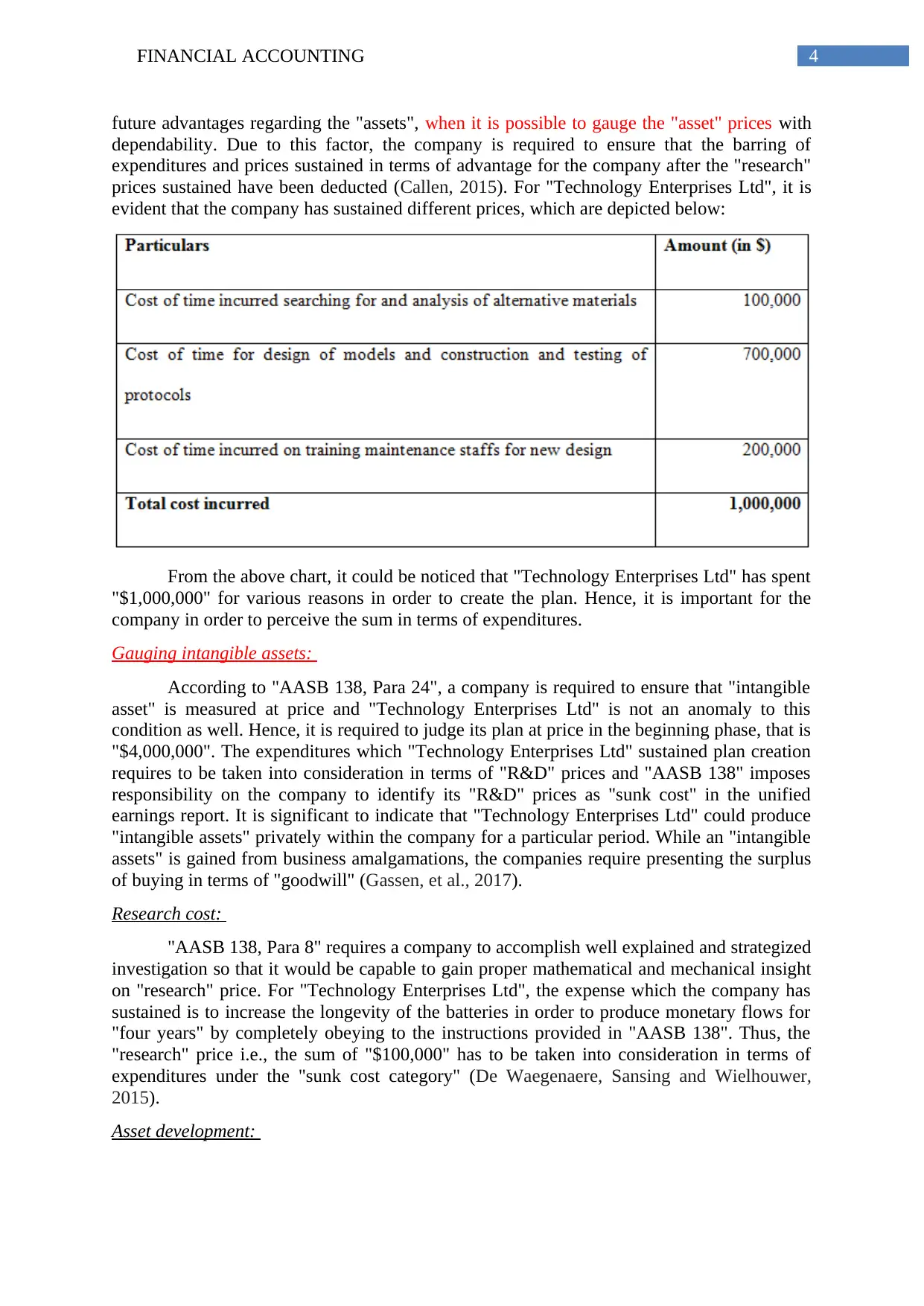

future advantages regarding the "assets", when it is possible to gauge the "asset" prices with

dependability. Due to this factor, the company is required to ensure that the barring of

expenditures and prices sustained in terms of advantage for the company after the "research"

prices sustained have been deducted (Callen, 2015). For "Technology Enterprises Ltd", it is

evident that the company has sustained different prices, which are depicted below:

From the above chart, it could be noticed that "Technology Enterprises Ltd" has spent

"$1,000,000" for various reasons in order to create the plan. Hence, it is important for the

company in order to perceive the sum in terms of expenditures.

Gauging intangible assets:

According to "AASB 138, Para 24", a company is required to ensure that "intangible

asset" is measured at price and "Technology Enterprises Ltd" is not an anomaly to this

condition as well. Hence, it is required to judge its plan at price in the beginning phase, that is

"$4,000,000". The expenditures which "Technology Enterprises Ltd" sustained plan creation

requires to be taken into consideration in terms of "R&D" prices and "AASB 138" imposes

responsibility on the company to identify its "R&D" prices as "sunk cost" in the unified

earnings report. It is significant to indicate that "Technology Enterprises Ltd" could produce

"intangible assets" privately within the company for a particular period. While an "intangible

assets" is gained from business amalgamations, the companies require presenting the surplus

of buying in terms of "goodwill" (Gassen, et al., 2017).

Research cost:

"AASB 138, Para 8" requires a company to accomplish well explained and strategized

investigation so that it would be capable to gain proper mathematical and mechanical insight

on "research" price. For "Technology Enterprises Ltd", the expense which the company has

sustained is to increase the longevity of the batteries in order to produce monetary flows for

"four years" by completely obeying to the instructions provided in "AASB 138". Thus, the

"research" price i.e., the sum of "$100,000" has to be taken into consideration in terms of

expenditures under the "sunk cost category" (De Waegenaere, Sansing and Wielhouwer,

2015).

Asset development:

future advantages regarding the "assets", when it is possible to gauge the "asset" prices with

dependability. Due to this factor, the company is required to ensure that the barring of

expenditures and prices sustained in terms of advantage for the company after the "research"

prices sustained have been deducted (Callen, 2015). For "Technology Enterprises Ltd", it is

evident that the company has sustained different prices, which are depicted below:

From the above chart, it could be noticed that "Technology Enterprises Ltd" has spent

"$1,000,000" for various reasons in order to create the plan. Hence, it is important for the

company in order to perceive the sum in terms of expenditures.

Gauging intangible assets:

According to "AASB 138, Para 24", a company is required to ensure that "intangible

asset" is measured at price and "Technology Enterprises Ltd" is not an anomaly to this

condition as well. Hence, it is required to judge its plan at price in the beginning phase, that is

"$4,000,000". The expenditures which "Technology Enterprises Ltd" sustained plan creation

requires to be taken into consideration in terms of "R&D" prices and "AASB 138" imposes

responsibility on the company to identify its "R&D" prices as "sunk cost" in the unified

earnings report. It is significant to indicate that "Technology Enterprises Ltd" could produce

"intangible assets" privately within the company for a particular period. While an "intangible

assets" is gained from business amalgamations, the companies require presenting the surplus

of buying in terms of "goodwill" (Gassen, et al., 2017).

Research cost:

"AASB 138, Para 8" requires a company to accomplish well explained and strategized

investigation so that it would be capable to gain proper mathematical and mechanical insight

on "research" price. For "Technology Enterprises Ltd", the expense which the company has

sustained is to increase the longevity of the batteries in order to produce monetary flows for

"four years" by completely obeying to the instructions provided in "AASB 138". Thus, the

"research" price i.e., the sum of "$100,000" has to be taken into consideration in terms of

expenditures under the "sunk cost category" (De Waegenaere, Sansing and Wielhouwer,

2015).

Asset development:

5FINANCIAL ACCOUNTING

As per "AASB 138", an "asset" is created by a company after there is the fulfilment of

the "research project". The company has to perceive the "asset" after its mechanical detect-

ability is approved giving the company an option to use alongside selling the "asset" (Dutta

and Patatoukas, 2016). In order to recognise the worth of the "asset" in the "balance sheet

statement", it is important to recognise precisely the "book-keeping" grades and it is

considered to be a crucial factor after the suitability test. "Technology Enterprises Ltd" has

sustained significant "research" expenditure for plan creation. After the suitability test, it has

been observed that the "project" would bring a worth of "$4,000,000" to the company.

b. Decline in financial statement comparability owing to the use of AASB 138/IAS 38:

"Comparability" is a vital aspect of the "operating statements" with the utilisation of

which the "users" could contrast between the "financial" data of the companies (Howieson, et

al., 2015). This particular aspect is presented from the "book-keeping" grades and schemes

embraced by the companies. In conformity with "AASB 138", the companies obtain the

alternatives of producing "intangible assets" privately or they could gain the same from

business amalgamations. The above exploration makes it essential as well that the "intangible

assets" are categorised as "non-monetary assets" due to the non-existence of real material.

These factors are the outcome of differing identification of the "assets" from company to

company depending upon the anticipated advantages they obtain, as they require to perceive

advantages gained from the "intangible assets" (Trenholm, et al., 2016). Furthermore, the

companies are required to take into account the classification and identification of the

relevant expenditures spent on those "assets".

As cited in "AASB 138", the companies are responsible to perceive the profit

regarding the "intangible assets" in an identical manner at the same time the "intangible

assets" gain is made as part of various "assets". Under this situation, it is important to follow

the "book-keeping" instructions provided in "AASB 138" for "asset" identification the

expense sustained regarding the "R&D" has to be realised. The comparison characteristic has

to be existing in the "operating statements" of the concerned company. While this

characteristic is existing, it gives a chance to the "profit and loss statements" in differing data

for financial factors like- "assets and liabilities" with other company or varying period of the

same business (Macve, 2015). In the form of comparisons, it is to be kept in mind that the

diversifications among estimation, identification and analysis from company to company

could affect the comparison aspects of financial data. It is majorly because of the reason that

there is no constant process regarding the analysis, estimation and identification of

"intangible assets" (Maynard, 2017).

Correspondingly, the "users" of the "operating statements" are restricted to comparing

worth or systems of analysis or systems of identification of "intangible assets" of "one"

company with similar data of another company. Therefore, the effect is direct on the

"decision-making" method of the "profit and loss statement" "users". It depicts that "AASB

138" diminishes the comparisons of the "operating statements" to a particular level

(Mullinova, 2016).

c. Understanding of AASB 138/IAS 38:

"AASB 138" is considered to be noteworthy for the Australian companies, as it

behaves as a crucial paper and guidelines to carry out the "book-keeping" analysis regarding

the "intangible assets". The companies could gain the needed "book-keeping" schemes and

As per "AASB 138", an "asset" is created by a company after there is the fulfilment of

the "research project". The company has to perceive the "asset" after its mechanical detect-

ability is approved giving the company an option to use alongside selling the "asset" (Dutta

and Patatoukas, 2016). In order to recognise the worth of the "asset" in the "balance sheet

statement", it is important to recognise precisely the "book-keeping" grades and it is

considered to be a crucial factor after the suitability test. "Technology Enterprises Ltd" has

sustained significant "research" expenditure for plan creation. After the suitability test, it has

been observed that the "project" would bring a worth of "$4,000,000" to the company.

b. Decline in financial statement comparability owing to the use of AASB 138/IAS 38:

"Comparability" is a vital aspect of the "operating statements" with the utilisation of

which the "users" could contrast between the "financial" data of the companies (Howieson, et

al., 2015). This particular aspect is presented from the "book-keeping" grades and schemes

embraced by the companies. In conformity with "AASB 138", the companies obtain the

alternatives of producing "intangible assets" privately or they could gain the same from

business amalgamations. The above exploration makes it essential as well that the "intangible

assets" are categorised as "non-monetary assets" due to the non-existence of real material.

These factors are the outcome of differing identification of the "assets" from company to

company depending upon the anticipated advantages they obtain, as they require to perceive

advantages gained from the "intangible assets" (Trenholm, et al., 2016). Furthermore, the

companies are required to take into account the classification and identification of the

relevant expenditures spent on those "assets".

As cited in "AASB 138", the companies are responsible to perceive the profit

regarding the "intangible assets" in an identical manner at the same time the "intangible

assets" gain is made as part of various "assets". Under this situation, it is important to follow

the "book-keeping" instructions provided in "AASB 138" for "asset" identification the

expense sustained regarding the "R&D" has to be realised. The comparison characteristic has

to be existing in the "operating statements" of the concerned company. While this

characteristic is existing, it gives a chance to the "profit and loss statements" in differing data

for financial factors like- "assets and liabilities" with other company or varying period of the

same business (Macve, 2015). In the form of comparisons, it is to be kept in mind that the

diversifications among estimation, identification and analysis from company to company

could affect the comparison aspects of financial data. It is majorly because of the reason that

there is no constant process regarding the analysis, estimation and identification of

"intangible assets" (Maynard, 2017).

Correspondingly, the "users" of the "operating statements" are restricted to comparing

worth or systems of analysis or systems of identification of "intangible assets" of "one"

company with similar data of another company. Therefore, the effect is direct on the

"decision-making" method of the "profit and loss statement" "users". It depicts that "AASB

138" diminishes the comparisons of the "operating statements" to a particular level

(Mullinova, 2016).

c. Understanding of AASB 138/IAS 38:

"AASB 138" is considered to be noteworthy for the Australian companies, as it

behaves as a crucial paper and guidelines to carry out the "book-keeping" analysis regarding

the "intangible assets". The companies could gain the needed "book-keeping" schemes and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCIAL ACCOUNTING

from the above mentioned grades relating to "intangible assets" (Narayanaswamy, 2017). As

per the instructions provided in "AASB 138", "intangible assets" are considered to be the

"assets", which could be recognised in the absenteeism of any real material. Furthermore, the

"AASB 138" instructions depicts that companies are required to ensure the "intangible assets"

gain in a way via which it would be feasible to trade or sell those in the "market" (Pratt,

2016). However, the paper of the grade consists of the explanation financial "assets" as well

as "non-monetary assets". Alongside these, "AASB 138" gives options to the businesses,

through which either they would produce "intangible assets" normally or the identical one

might be gained from business amalgamations that would bring about "goodwill"

identification in terms of surplus of buying deliberation (Stockenstrand and Nilsson, 2017).

"AASB 138" requires the businesses to ensure the analysis of "intangible assets" at

price in the beginning phases and the privately produced "intangible assets" have to be

notified at "cost value" as well. While the "intangible assets" are identified, the companies

need assuring the existence of an opportunity, which the future "economic" advantages

included in those "assets" would be rushed against them and those "assets" price could be

analysed with authenticity (Tong and Saladrigues, 2018). However, the grades depict that the

companies require to perceive expenses sustained in order to produce "intangible assets" in

terms of "research and development", which are required to be revealed in the unified "profit

and loss statement" in terms of "sunk costs". The feasibility of those "assets" has to be

gauged by the companies while those "assets" would be "reported" in the combined

statements of financial status of the businesses (Trotman and Carson, 2018).

Conclusion and recommendations:

Depending on the above conversation, it could be observed that "Technology

Enterprises Ltd" requires to utilise the current worth process in order to evaluate the worth of

the "research and development project". In order to carry out the "book-keeping" analysis for

this "project", the business has to comply with the instructions and grades provided in the

"AASB 138". It has been assessed that "intangible assets" take into account "monetary" as

well as "non-monetary assets". It is the responsibility of the companies to ensure that the

worth of "assets and liabilities" are revealed timely in the "operating statement" when

obeying the important "book-keeping" propositions and instructions. In case of "Technology

Enterprises Ltd", the problem of the stockholders could be diminished, if the administration

of the company gives specific crucial declarations regarding the financial attributes like-

"intangible assets". The organisations are considered to be liable to "report" the worth of

"assets" periodically and aptly.

The administration of "Technology Enterprises Ltd" is recommended to carry out

appraisal and evaluation of the "intangible assets" after assessing financial suitability of these

"assets". For assuring the aforesaid, it is important for the administration of the concerned

business to follow the schemes and rules in order to ensure revelation and complying

incorporated with the financial "assets". These revelations regarding the financial factors of

the company play a significant part in the evaluation of the financial data alongside the

definitions of the "assets and liabilities" of the business. "Technology Enterprises Ltd" is not

excluded from these conditions as well and they have to obey the aforementioned instructions

for assuring the rush of "economic" advantages towards the company.

from the above mentioned grades relating to "intangible assets" (Narayanaswamy, 2017). As

per the instructions provided in "AASB 138", "intangible assets" are considered to be the

"assets", which could be recognised in the absenteeism of any real material. Furthermore, the

"AASB 138" instructions depicts that companies are required to ensure the "intangible assets"

gain in a way via which it would be feasible to trade or sell those in the "market" (Pratt,

2016). However, the paper of the grade consists of the explanation financial "assets" as well

as "non-monetary assets". Alongside these, "AASB 138" gives options to the businesses,

through which either they would produce "intangible assets" normally or the identical one

might be gained from business amalgamations that would bring about "goodwill"

identification in terms of surplus of buying deliberation (Stockenstrand and Nilsson, 2017).

"AASB 138" requires the businesses to ensure the analysis of "intangible assets" at

price in the beginning phases and the privately produced "intangible assets" have to be

notified at "cost value" as well. While the "intangible assets" are identified, the companies

need assuring the existence of an opportunity, which the future "economic" advantages

included in those "assets" would be rushed against them and those "assets" price could be

analysed with authenticity (Tong and Saladrigues, 2018). However, the grades depict that the

companies require to perceive expenses sustained in order to produce "intangible assets" in

terms of "research and development", which are required to be revealed in the unified "profit

and loss statement" in terms of "sunk costs". The feasibility of those "assets" has to be

gauged by the companies while those "assets" would be "reported" in the combined

statements of financial status of the businesses (Trotman and Carson, 2018).

Conclusion and recommendations:

Depending on the above conversation, it could be observed that "Technology

Enterprises Ltd" requires to utilise the current worth process in order to evaluate the worth of

the "research and development project". In order to carry out the "book-keeping" analysis for

this "project", the business has to comply with the instructions and grades provided in the

"AASB 138". It has been assessed that "intangible assets" take into account "monetary" as

well as "non-monetary assets". It is the responsibility of the companies to ensure that the

worth of "assets and liabilities" are revealed timely in the "operating statement" when

obeying the important "book-keeping" propositions and instructions. In case of "Technology

Enterprises Ltd", the problem of the stockholders could be diminished, if the administration

of the company gives specific crucial declarations regarding the financial attributes like-

"intangible assets". The organisations are considered to be liable to "report" the worth of

"assets" periodically and aptly.

The administration of "Technology Enterprises Ltd" is recommended to carry out

appraisal and evaluation of the "intangible assets" after assessing financial suitability of these

"assets". For assuring the aforesaid, it is important for the administration of the concerned

business to follow the schemes and rules in order to ensure revelation and complying

incorporated with the financial "assets". These revelations regarding the financial factors of

the company play a significant part in the evaluation of the financial data alongside the

definitions of the "assets and liabilities" of the business. "Technology Enterprises Ltd" is not

excluded from these conditions as well and they have to obey the aforementioned instructions

for assuring the rush of "economic" advantages towards the company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL ACCOUNTING

References:

Aasb.gov.au., 2019. Available at:

https://www.aasb.gov.au/admin/file/content105/c9/AASB138_08-15_COMPoct15_01-18.pdf

[Accessed 13 May 2019].

Balakrishnan, K., Watts, R. and Zuo, L., 2016. The effect of accounting conservatism on

corporate investment during the global financial crisis. Journal of Business Finance &

Accounting, 43(5-6), pp.513-542.

Callen, J.L., 2015. A selective critical review of financial accounting research. Critical

Perspectives on Accounting, 26, pp.157-167.

Cascino, S., Clatworthy, M., Garcia Osma, B., Gassen, J. and Imam, S., 2017. The

Usefulness of Financial Accounting Information: Evidence from the Field.

De Waegenaere, A., Sansing, R. and Wielhouwer, J.L., 2015. Financial accounting effects of

tax aggressiveness: Contracting and measurement. Contemporary Accounting

Research, 32(1), pp.223-242.

Dutta, S. and Patatoukas, P.N., 2016. Identifying conditional conservatism in financial

accounting data: theory and evidence. The Accounting Review, 92(4), pp.191-216.

Henderson, S., Peirson, G., Herbohn, K. and Howieson, B., 2015. Issues in financial

accounting. Pearson Higher Education AU.

Kimmel, P.D., Weygandt, J.J., Kieso, D.E. and Trenholm, B., 2016. Financial Accounting.

Wiley Custom Learning Solutions.

Macve, R., 2015. A Conceptual Framework for Financial Accounting and Reporting: Vision,

Tool, Or Threat?. Routledge.

Maynard, J., 2017. Financial accounting, reporting, and analysis. Oxford University Press.

Mullinova, S., 2016. Use of the principles of IFRS (IAS) 39" Financial instruments:

recognition and assessment" for bank financial accounting. Modern European Researches,

(1), pp.60-64.

Narayanaswamy, R., 2017. Financial accounting: a managerial perspective. PHI Learning

Pvt. Ltd..

Pratt, J., 2016. Financial accounting in an economic context. John Wiley & Sons.

Stockenstrand, A.K. and Nilsson, F. eds., 2017. Bank Regulation: Effects on Strategy,

Financial Accounting and Management Control. Taylor & Francis.

Tong, Y. and Saladrigues, R., 2018. The predictability of financial, accounting-based, and

industrial factors on the success of newly incorporated Spanish firms. Intangible

Capital, 14(1), pp.127-145.

Trotman, K. and Carson, E., 2018. Financial accounting: an integrated approach. Cengage

AU.

References:

Aasb.gov.au., 2019. Available at:

https://www.aasb.gov.au/admin/file/content105/c9/AASB138_08-15_COMPoct15_01-18.pdf

[Accessed 13 May 2019].

Balakrishnan, K., Watts, R. and Zuo, L., 2016. The effect of accounting conservatism on

corporate investment during the global financial crisis. Journal of Business Finance &

Accounting, 43(5-6), pp.513-542.

Callen, J.L., 2015. A selective critical review of financial accounting research. Critical

Perspectives on Accounting, 26, pp.157-167.

Cascino, S., Clatworthy, M., Garcia Osma, B., Gassen, J. and Imam, S., 2017. The

Usefulness of Financial Accounting Information: Evidence from the Field.

De Waegenaere, A., Sansing, R. and Wielhouwer, J.L., 2015. Financial accounting effects of

tax aggressiveness: Contracting and measurement. Contemporary Accounting

Research, 32(1), pp.223-242.

Dutta, S. and Patatoukas, P.N., 2016. Identifying conditional conservatism in financial

accounting data: theory and evidence. The Accounting Review, 92(4), pp.191-216.

Henderson, S., Peirson, G., Herbohn, K. and Howieson, B., 2015. Issues in financial

accounting. Pearson Higher Education AU.

Kimmel, P.D., Weygandt, J.J., Kieso, D.E. and Trenholm, B., 2016. Financial Accounting.

Wiley Custom Learning Solutions.

Macve, R., 2015. A Conceptual Framework for Financial Accounting and Reporting: Vision,

Tool, Or Threat?. Routledge.

Maynard, J., 2017. Financial accounting, reporting, and analysis. Oxford University Press.

Mullinova, S., 2016. Use of the principles of IFRS (IAS) 39" Financial instruments:

recognition and assessment" for bank financial accounting. Modern European Researches,

(1), pp.60-64.

Narayanaswamy, R., 2017. Financial accounting: a managerial perspective. PHI Learning

Pvt. Ltd..

Pratt, J., 2016. Financial accounting in an economic context. John Wiley & Sons.

Stockenstrand, A.K. and Nilsson, F. eds., 2017. Bank Regulation: Effects on Strategy,

Financial Accounting and Management Control. Taylor & Francis.

Tong, Y. and Saladrigues, R., 2018. The predictability of financial, accounting-based, and

industrial factors on the success of newly incorporated Spanish firms. Intangible

Capital, 14(1), pp.127-145.

Trotman, K. and Carson, E., 2018. Financial accounting: an integrated approach. Cengage

AU.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.