Accounting for Leases: Impact of AASB (IFRS) 16 on Wesfarmers Limited

VerifiedAdded on 2023/01/20

|12

|2845

|62

Essay

AI Summary

This essay comprehensively analyzes the impact of AASB (IFRS) 16, the new leasing standard, on financial reporting, using Wesfarmers Limited as a case study. The study explores the differences between AASB 16 and its predecessor, AASB 117, emphasizing the requirement for lessees to recognize right-of-use assets and lease liabilities. It examines the implications of the new standard on financial statements, including balance sheets, income statements, and cash flow statements. The essay details the impact on Wesfarmers, including the reclassification of operating leases and the effects on key financial metrics and gearing ratios. It also addresses the broader implications for the Australian retail industry, including the lifecycle and stages of leases. The essay concludes by highlighting the benefits of AASB 16, such as enhanced financial reporting transparency, while acknowledging the associated implementation costs for organizations.

Running head: ACCOUNTING FOR LEASES- THE IMPACT OF AASB (IFRS) 16

Accounting for Leases- The Impact of AASB (IFRS) 16

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Accounting for Leases- The Impact of AASB (IFRS) 16

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ACCOUNTING FOR LEASES- THE IMPACT OF AASB (IFRS) 16

Abstract:

The essay is prepared with the intent to analyse the new leasing standard, which is AASB (IFRS) 16 as well as its

effect on different financial reporting areas of one of the leading retailers in Australia, Wesfarmers Limited. The

organisation has to report right-of-use assets and lease liabilities in its statement of financial position with certain

additional disclosures in accordance with the above-stated standard. It has been evaluated that the implementation of

the standard would raise the transparency and quality of financial reporting.

Abstract:

The essay is prepared with the intent to analyse the new leasing standard, which is AASB (IFRS) 16 as well as its

effect on different financial reporting areas of one of the leading retailers in Australia, Wesfarmers Limited. The

organisation has to report right-of-use assets and lease liabilities in its statement of financial position with certain

additional disclosures in accordance with the above-stated standard. It has been evaluated that the implementation of

the standard would raise the transparency and quality of financial reporting.

2ACCOUNTING FOR LEASES- THE IMPACT OF AASB (IFRS) 16

Introduction:

The presence of different funding sources could be observed for the business organisations, out of which

lease financing is one of them. Lease is deemed to be a significant source of long-term and medium-term financing,

in which the owner of a specific asset provides another individual with the opportunity of using that specific asset

compared to the periodic payments (Akbulut, 2017). There are of two types of leases, which include operating leases

and finance leases. The organisations are obliged to adhere to the AASB lease standards for accounting their leases.

In Australia, the organisations have to conform to the guidelines and norms of AASB 117 until 31st December 2018

for lease accounting purpose. However, in accordance with the “Australian Accounting Standards Board (AASB)”,

new lease accounting standard has been in effect from 1st January 2019, which is AASB 16 and all organisations

have to abide by this standard on compulsory basis. The objective of this essay is to analyse the various aspects of

the new leasing standard and the previous one. In addition, the essay would consider the evaluation of lease

accounting in Wesfarmers Limited and the effect of the standard on the financial reports.

Understanding of lease agreements and impact on financial reports:

According to AASB 117, the organisations are required disclosing information regarding their operating

leases. In case of operating lease, the lessor has the ownership of an asset for the entire term of lease; however, for

financial lease, the lessor owns the ownership even after the completion of the lease term (Aasb.gov.au, 2018). The

primary reason that AASB 16 has been put in place is due to the failure of AASB 117 in obliging the organisations

to disclose material amounts of operating leases in their statement of financial position.

AASB 16 has certain differences compared to AASB 117; however, the effect on lessors is almost minimal.

This standard requires categorisation of all lease contracts under leases. The lessees have to take into account the

current value of lease liabilities and right-of-use assets in their statements of financial position. However, this is not

applicable for short-term leases and leased assets having lower amounts. Besides, according to AASB 116 and

AASB 136, it is necessary to depreciate and impair right-of-use assets. For lease liabilities, there would be

recognition of interest according to AASB 140. Thus, both lessees and lessors have to conform to the disclosure

objectives under AASB 16 rather than rigorous checklists (Aasb.gov.au, 2018). The lessees have to disclose their

right-of-use assets appropriately in balance sheets accompanied by notes to the financial reports. Segregation is

Introduction:

The presence of different funding sources could be observed for the business organisations, out of which

lease financing is one of them. Lease is deemed to be a significant source of long-term and medium-term financing,

in which the owner of a specific asset provides another individual with the opportunity of using that specific asset

compared to the periodic payments (Akbulut, 2017). There are of two types of leases, which include operating leases

and finance leases. The organisations are obliged to adhere to the AASB lease standards for accounting their leases.

In Australia, the organisations have to conform to the guidelines and norms of AASB 117 until 31st December 2018

for lease accounting purpose. However, in accordance with the “Australian Accounting Standards Board (AASB)”,

new lease accounting standard has been in effect from 1st January 2019, which is AASB 16 and all organisations

have to abide by this standard on compulsory basis. The objective of this essay is to analyse the various aspects of

the new leasing standard and the previous one. In addition, the essay would consider the evaluation of lease

accounting in Wesfarmers Limited and the effect of the standard on the financial reports.

Understanding of lease agreements and impact on financial reports:

According to AASB 117, the organisations are required disclosing information regarding their operating

leases. In case of operating lease, the lessor has the ownership of an asset for the entire term of lease; however, for

financial lease, the lessor owns the ownership even after the completion of the lease term (Aasb.gov.au, 2018). The

primary reason that AASB 16 has been put in place is due to the failure of AASB 117 in obliging the organisations

to disclose material amounts of operating leases in their statement of financial position.

AASB 16 has certain differences compared to AASB 117; however, the effect on lessors is almost minimal.

This standard requires categorisation of all lease contracts under leases. The lessees have to take into account the

current value of lease liabilities and right-of-use assets in their statements of financial position. However, this is not

applicable for short-term leases and leased assets having lower amounts. Besides, according to AASB 116 and

AASB 136, it is necessary to depreciate and impair right-of-use assets. For lease liabilities, there would be

recognition of interest according to AASB 140. Thus, both lessees and lessors have to conform to the disclosure

objectives under AASB 16 rather than rigorous checklists (Aasb.gov.au, 2018). The lessees have to disclose their

right-of-use assets appropriately in balance sheets accompanied by notes to the financial reports. Segregation is

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ACCOUNTING FOR LEASES- THE IMPACT OF AASB (IFRS) 16

necessary for finance costs and depreciation in the income statement and payments in the cash flow statements.

These payments mainly include cash payment on lease liabilities under financing activities, complying with interest

payment on lease liabilities in accordance with AASB 107 and payments for leased assets with lower values and

short-term leases (Cpaaustralia.com.au, 2019). Thus, the financial reporting quality is enhanced through these

changes and the financial transactions for leases could be represented faithfully, which ensures transparency in

financial reporting.

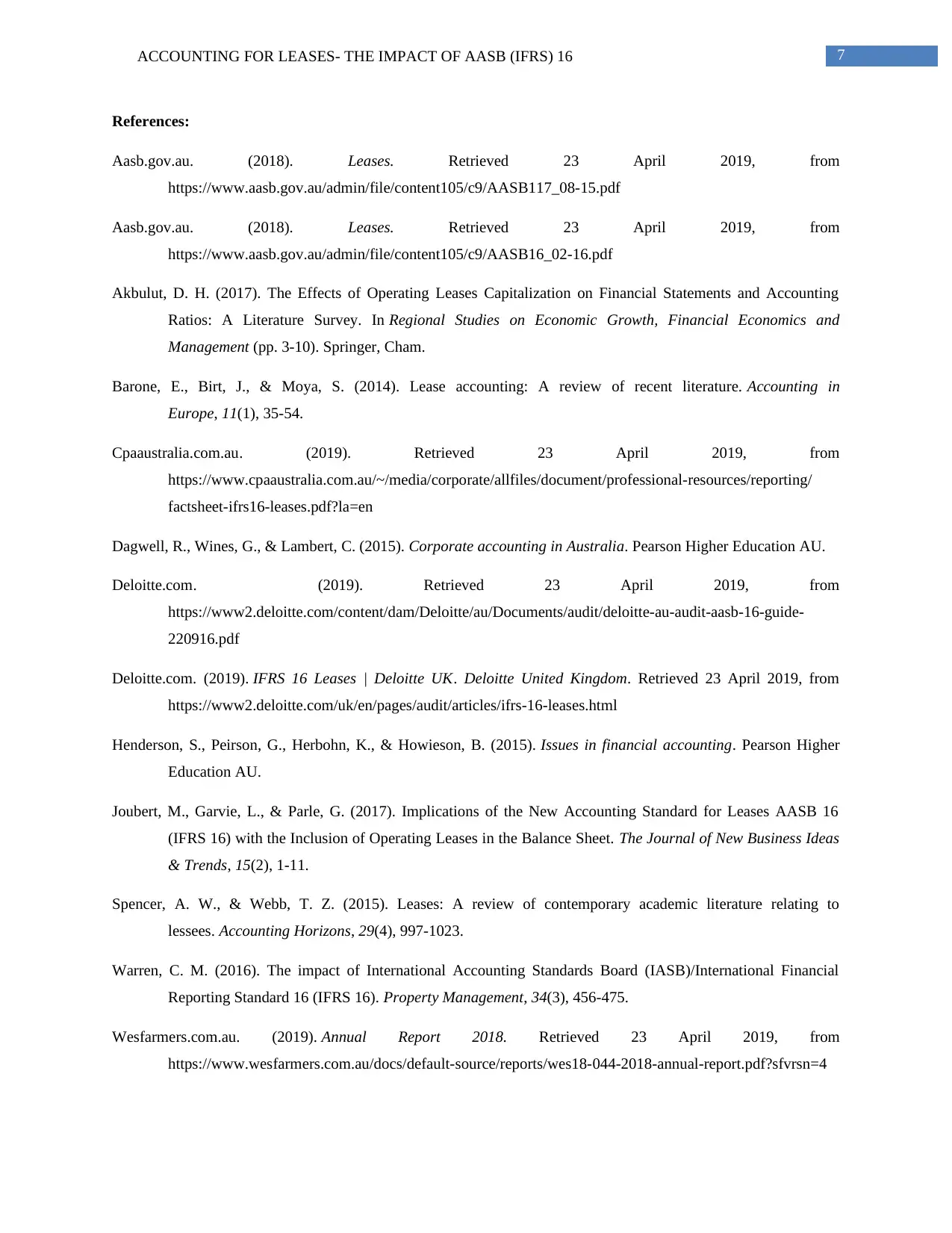

For instance, it is assumed that an organisation undertakes 20-year lease at a yearly rental of £1 million

with borrowing rate of 6% for recognising right-of-use assets and financial liability of £11.5 million discounted at

6% of future lease payments. In the beginning year, depreciation of £573,000 and interest cost of £688,000 would be

recognised in the income statement. This would lead to one year income statement expense of £1.26 million, which

is an increase compared to the rental expense of £1 million and this would be realised on simple operating lease

under AASB 117 (IAS 17). Moreover, the values of leased assets and leased liability would not be identical at the

beginning of the first year, as liability is higher and the impact would be on net assets. There would be reduction in

assets to £10.9 million owing to depreciation along with fall in liability to £11.1 million from £11.5 million due to

loan repayment (Refer to Appendix, Figure 1 for diagrammatic representation).

Overview of Wesfarmers Limited and its leases:

Wesfarmers Limited is the leading retailer operating in Australia and New Zealand and it is listed in

“Australian Securities Exchange (ASX)”. The organisation deals with different products like home improvement

suppliers, department stores, office supplies, energy, fertilisers, chemicals, safety products and others. At present,

Wesfarmers has staff base of above 100,000 and shareholders of nearly 495,000 (Wesfarmers.com.au, 2019).

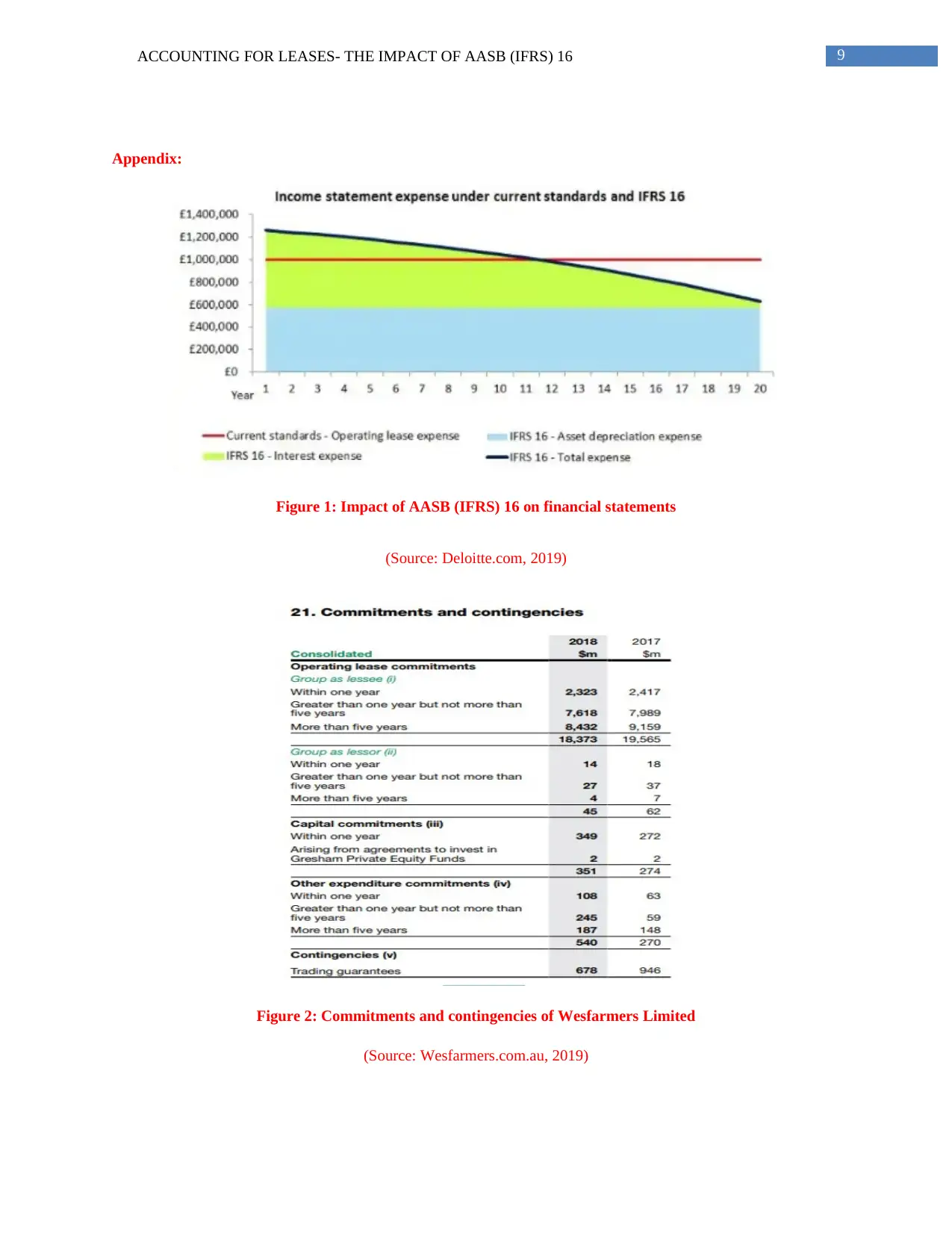

From the annual report of Wesfarmers in 2018, it is identified that the organisation contains both finance

lease and operating lease and in order to classify them, it uses some judgements. The significant leased assets

include distribution and retail properties, offices, office equipment and motor vehicles. The leased assets are

categorised based on whether the organisation holds all rewards and risks associated with asset ownership. The

organisation does not have any financial lease in 2018. The details of operating lease are represented as follows:

necessary for finance costs and depreciation in the income statement and payments in the cash flow statements.

These payments mainly include cash payment on lease liabilities under financing activities, complying with interest

payment on lease liabilities in accordance with AASB 107 and payments for leased assets with lower values and

short-term leases (Cpaaustralia.com.au, 2019). Thus, the financial reporting quality is enhanced through these

changes and the financial transactions for leases could be represented faithfully, which ensures transparency in

financial reporting.

For instance, it is assumed that an organisation undertakes 20-year lease at a yearly rental of £1 million

with borrowing rate of 6% for recognising right-of-use assets and financial liability of £11.5 million discounted at

6% of future lease payments. In the beginning year, depreciation of £573,000 and interest cost of £688,000 would be

recognised in the income statement. This would lead to one year income statement expense of £1.26 million, which

is an increase compared to the rental expense of £1 million and this would be realised on simple operating lease

under AASB 117 (IAS 17). Moreover, the values of leased assets and leased liability would not be identical at the

beginning of the first year, as liability is higher and the impact would be on net assets. There would be reduction in

assets to £10.9 million owing to depreciation along with fall in liability to £11.1 million from £11.5 million due to

loan repayment (Refer to Appendix, Figure 1 for diagrammatic representation).

Overview of Wesfarmers Limited and its leases:

Wesfarmers Limited is the leading retailer operating in Australia and New Zealand and it is listed in

“Australian Securities Exchange (ASX)”. The organisation deals with different products like home improvement

suppliers, department stores, office supplies, energy, fertilisers, chemicals, safety products and others. At present,

Wesfarmers has staff base of above 100,000 and shareholders of nearly 495,000 (Wesfarmers.com.au, 2019).

From the annual report of Wesfarmers in 2018, it is identified that the organisation contains both finance

lease and operating lease and in order to classify them, it uses some judgements. The significant leased assets

include distribution and retail properties, offices, office equipment and motor vehicles. The leased assets are

categorised based on whether the organisation holds all rewards and risks associated with asset ownership. The

organisation does not have any financial lease in 2018. The details of operating lease are represented as follows:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ACCOUNTING FOR LEASES- THE IMPACT OF AASB (IFRS) 16

The operating lease commitments of Wesfarmers have declined from $19,565 million in 2017 to $18,373

million in 2018. From the perspective of lessor, the lease commitment of Wesfarmers has been $45 million in 2018

in comparison to $62 million in 2017 (Refer to Appendix, Figure 2).

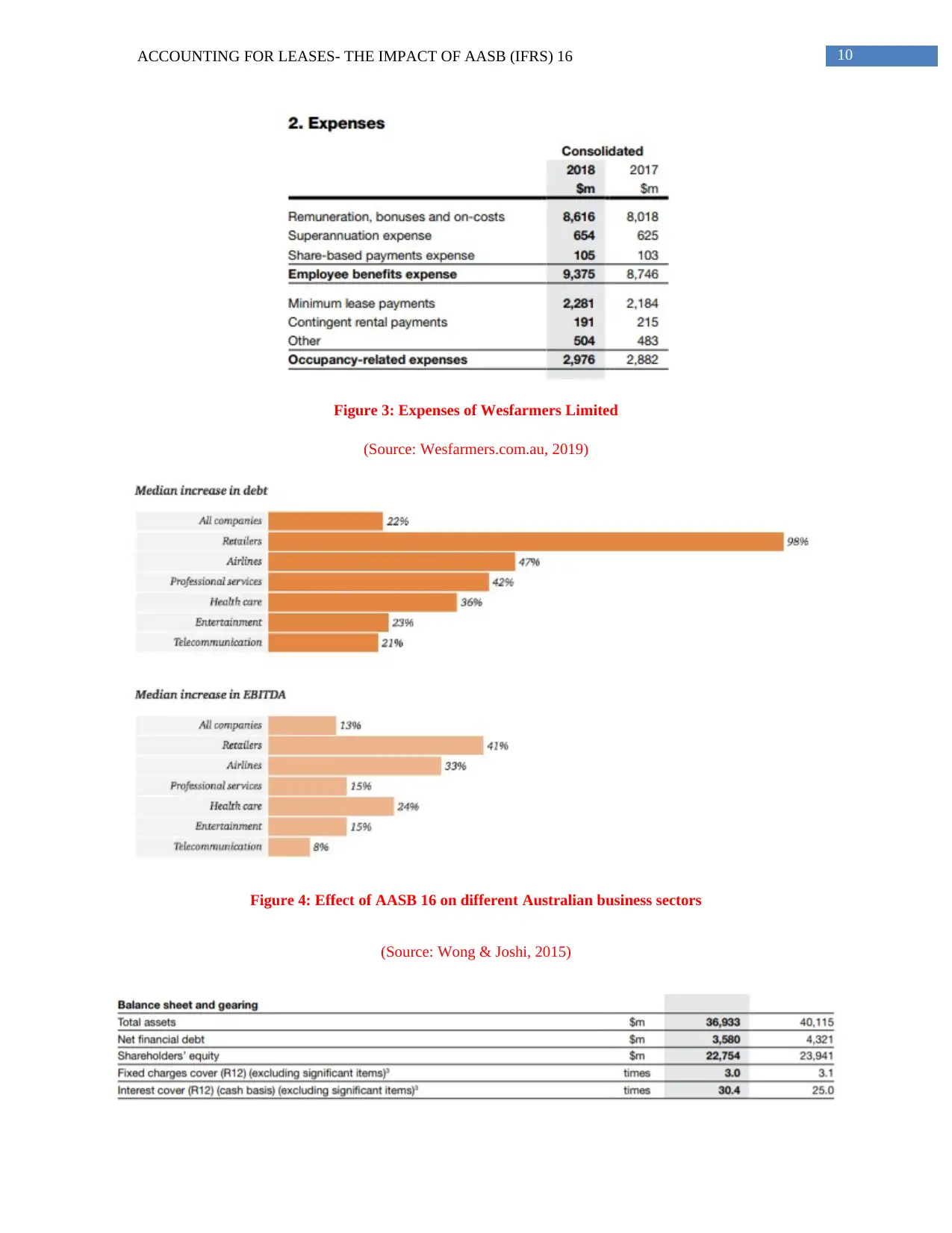

The above figure clearly indicates that the minimum lease payments of Wesfarmers have been $2,281

million in 2018 compared to $2,184 million in 2017. Moreover, the organisation has short-term lease provision of $2

million in both 2017 and 2018, while its non-current lease provisions have been $233 million and $250 million in

2017 and 2018 respectively (Wesfarmers.com.au, 2019) (Refer to Appendix, Figure 3).

Impact of AASB (IFRS) 16 on Wesfarmers Limited:

According to AASB (IFRS) 16, all organisations have to implement a single lease model, in which assets

and liabilities associated with leases have to be recognised. Therefore, Wesfarmers have to disclose the current value

of lease commitments in the form of liability in its balance sheet statement (Barone, Birt & Moya, 2014). In

addition, it has to report its right-of-use assets in the asset section of the balance sheet statement. There would be

classification and segregation in the income statement between amortisation and interest expense. It is noteworthy to

mention that Wesfarmers intends to enforce modified process of retrospective transition, since it would provide an

opportunity on lease-by-lease basis in order to compute right-of-use assets as either equivalent to lease liability or

based on historical lease payment (Dagwell, Wines & Lambert, 2015).

Short-term and long-term impacts of the changes to reporting for leases on financial statements and gearing

ratios:

Since Wesfarmers has to report its right-of-use assets and lease liabilities, AASB 16 is bound to have

impact on its balance sheet statement. As discussed earlier, Wesfarmers has to include operating lease commitment

of $18,373 million incurred in 2018 in its balance sheet statement in the form of lease liability. This would lead to

rise in total liabilities of the organisation, which is not a favourable indication. Moreover, Wesfarmers has to report

its lease commitments of $45 million as right-of-use asset in the asset section of the balance sheet statement and as a

result, there would be increase in total assets as well. However, there would not be any material difference, since

lease liability would be increased largely (Deloitte.com, 2019).

The operating lease commitments of Wesfarmers have declined from $19,565 million in 2017 to $18,373

million in 2018. From the perspective of lessor, the lease commitment of Wesfarmers has been $45 million in 2018

in comparison to $62 million in 2017 (Refer to Appendix, Figure 2).

The above figure clearly indicates that the minimum lease payments of Wesfarmers have been $2,281

million in 2018 compared to $2,184 million in 2017. Moreover, the organisation has short-term lease provision of $2

million in both 2017 and 2018, while its non-current lease provisions have been $233 million and $250 million in

2017 and 2018 respectively (Wesfarmers.com.au, 2019) (Refer to Appendix, Figure 3).

Impact of AASB (IFRS) 16 on Wesfarmers Limited:

According to AASB (IFRS) 16, all organisations have to implement a single lease model, in which assets

and liabilities associated with leases have to be recognised. Therefore, Wesfarmers have to disclose the current value

of lease commitments in the form of liability in its balance sheet statement (Barone, Birt & Moya, 2014). In

addition, it has to report its right-of-use assets in the asset section of the balance sheet statement. There would be

classification and segregation in the income statement between amortisation and interest expense. It is noteworthy to

mention that Wesfarmers intends to enforce modified process of retrospective transition, since it would provide an

opportunity on lease-by-lease basis in order to compute right-of-use assets as either equivalent to lease liability or

based on historical lease payment (Dagwell, Wines & Lambert, 2015).

Short-term and long-term impacts of the changes to reporting for leases on financial statements and gearing

ratios:

Since Wesfarmers has to report its right-of-use assets and lease liabilities, AASB 16 is bound to have

impact on its balance sheet statement. As discussed earlier, Wesfarmers has to include operating lease commitment

of $18,373 million incurred in 2018 in its balance sheet statement in the form of lease liability. This would lead to

rise in total liabilities of the organisation, which is not a favourable indication. Moreover, Wesfarmers has to report

its lease commitments of $45 million as right-of-use asset in the asset section of the balance sheet statement and as a

result, there would be increase in total assets as well. However, there would not be any material difference, since

lease liability would be increased largely (Deloitte.com, 2019).

5ACCOUNTING FOR LEASES- THE IMPACT OF AASB (IFRS) 16

Since Wesfarmers has to consider interest cost associated with leased assets and liabilities, AASB 16 would

have impact on the income statement of the organisation. More specifically, operating profit might increase, as the

organisation needs to report the off-balance sheet interests of leased assets. Moreover, Wesfarmers has to disclose

interest expenses associated with lease liabilities in the form of expense in its income statement. All these aspects

would result in increased operating profit of the organisation (Henderson et al., 2015).

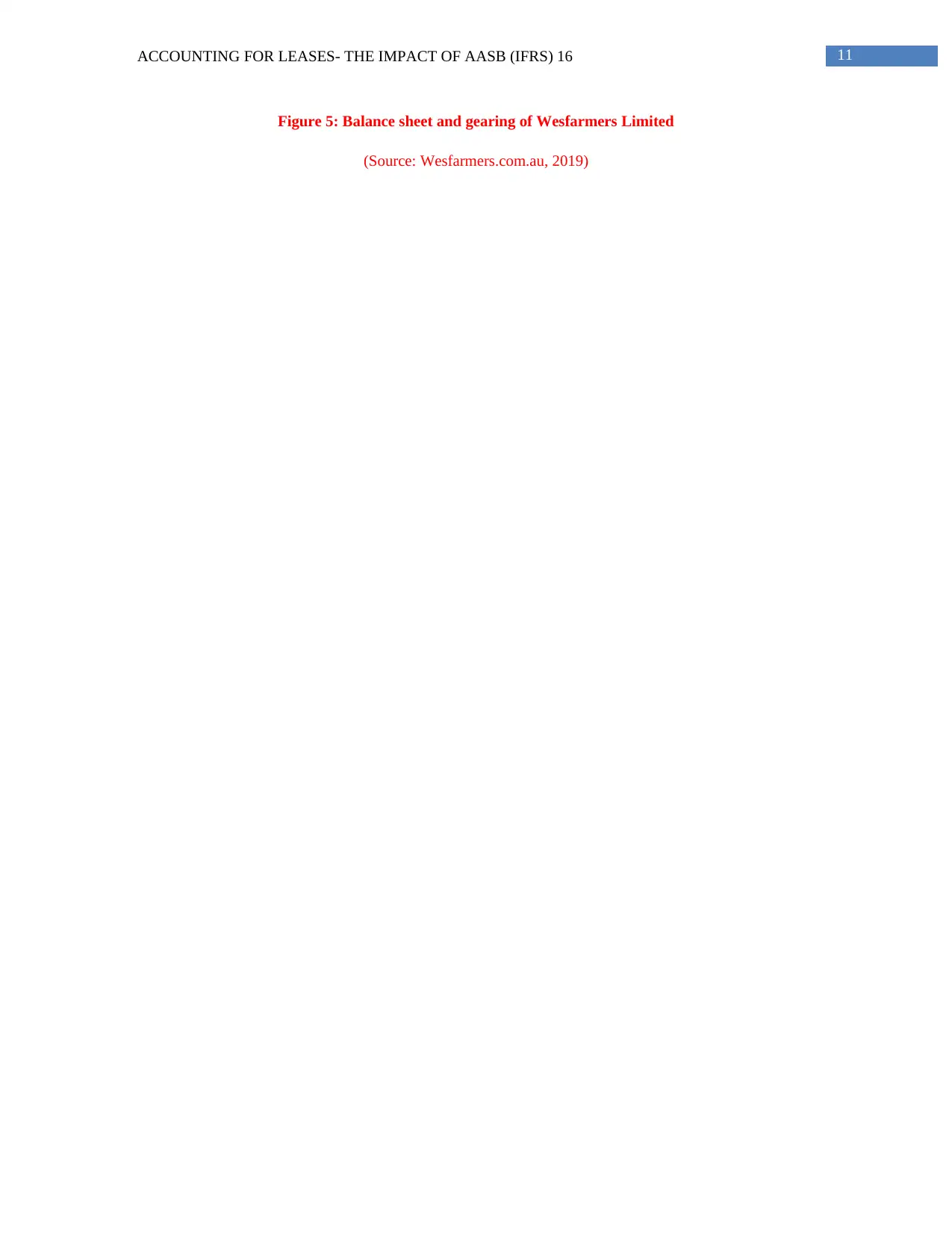

It is noteworthy to mention that there would be no impact of AASB 16 on the cash flow statement of

Wesfarmers. However, the management has to undertake the decision of whether the lease payments would be

recognised under financing activities or investing activities (Joubert, Garvie & Parle, 2017). The most viable option

for Wesfarmers is to recognise them under financing activities owing to the nature of lease financing (Refer to

Appendix, Figure 5 for balance sheet and gearing information).

Understanding of lease agreements for the Australian retail industry and the lifecycle and stage of the lease:

The introduction of AASB 16 is likely to have effect on the different Australian business sectors such as

the telecommunications sector, airline sector, mining sector and others and the retail sector is one of them. The main

reason that the retail sector would be affected is that the organisations operating in the sector have considerable

amount of lease assets and lease liabilities (Spencer & Webb, 2015).

The effect of AASB 16 is deemed to be significant on the lifecycle and stage of the Australian retail

industry (Refer to Appendix, Figure 4). The initial impact would be the realisation of right-of-use assets and lease

liabilities, as lease assets and liabilities are expected to increase considerably. The second impact would be rise in

EBITDA due to the absence of operating lease expense (Warren, 2016). The operating cash flows are expected to

increase, while there would be decline in financing cash flows. The financial metrics would be altered as well when

there is only single leasing model influencing debt agreements, financial leverage, tax, dividend policy and others.

The re-evaluation of particular estimates and judgements associated with lease would increase the volatility of the

financial statements (Xu, Davidson & Cheong, 2017). The organisations operating in the sector have to bear the

expense of implementing the new standard. Finally, there would be increase in administrative work pressure, since

AASB 16 needs detailed leasing disclosures with some additional aspects incorporated in the same.

Conclusion:

Since Wesfarmers has to consider interest cost associated with leased assets and liabilities, AASB 16 would

have impact on the income statement of the organisation. More specifically, operating profit might increase, as the

organisation needs to report the off-balance sheet interests of leased assets. Moreover, Wesfarmers has to disclose

interest expenses associated with lease liabilities in the form of expense in its income statement. All these aspects

would result in increased operating profit of the organisation (Henderson et al., 2015).

It is noteworthy to mention that there would be no impact of AASB 16 on the cash flow statement of

Wesfarmers. However, the management has to undertake the decision of whether the lease payments would be

recognised under financing activities or investing activities (Joubert, Garvie & Parle, 2017). The most viable option

for Wesfarmers is to recognise them under financing activities owing to the nature of lease financing (Refer to

Appendix, Figure 5 for balance sheet and gearing information).

Understanding of lease agreements for the Australian retail industry and the lifecycle and stage of the lease:

The introduction of AASB 16 is likely to have effect on the different Australian business sectors such as

the telecommunications sector, airline sector, mining sector and others and the retail sector is one of them. The main

reason that the retail sector would be affected is that the organisations operating in the sector have considerable

amount of lease assets and lease liabilities (Spencer & Webb, 2015).

The effect of AASB 16 is deemed to be significant on the lifecycle and stage of the Australian retail

industry (Refer to Appendix, Figure 4). The initial impact would be the realisation of right-of-use assets and lease

liabilities, as lease assets and liabilities are expected to increase considerably. The second impact would be rise in

EBITDA due to the absence of operating lease expense (Warren, 2016). The operating cash flows are expected to

increase, while there would be decline in financing cash flows. The financial metrics would be altered as well when

there is only single leasing model influencing debt agreements, financial leverage, tax, dividend policy and others.

The re-evaluation of particular estimates and judgements associated with lease would increase the volatility of the

financial statements (Xu, Davidson & Cheong, 2017). The organisations operating in the sector have to bear the

expense of implementing the new standard. Finally, there would be increase in administrative work pressure, since

AASB 16 needs detailed leasing disclosures with some additional aspects incorporated in the same.

Conclusion:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ACCOUNTING FOR LEASES- THE IMPACT OF AASB (IFRS) 16

From the above analysis, it is evident that the implementation of AASB (IFRS) 16 is deemed to have

certain effects on different financial statements of the listed Australian organisations and they need to assure detailed

leasing disclosures of different lease aspects in accordance with the new leasing standard. The Australian retail

sector is not exempted from such implementation and it is estimated that the industry would be affected heavily by

the enforcement of this new standard. However, AASB 16 is deemed to possess certain benefits as well. It would

enhance the quality of financial reporting and hence, the financial reports of the organisation would be more

transparent for the users. Finally, it has been evaluated that the organisations have to bear some additional costs such

as ongoing and implementation costs for adopting the new leasing standard, AASB 16.

From the above analysis, it is evident that the implementation of AASB (IFRS) 16 is deemed to have

certain effects on different financial statements of the listed Australian organisations and they need to assure detailed

leasing disclosures of different lease aspects in accordance with the new leasing standard. The Australian retail

sector is not exempted from such implementation and it is estimated that the industry would be affected heavily by

the enforcement of this new standard. However, AASB 16 is deemed to possess certain benefits as well. It would

enhance the quality of financial reporting and hence, the financial reports of the organisation would be more

transparent for the users. Finally, it has been evaluated that the organisations have to bear some additional costs such

as ongoing and implementation costs for adopting the new leasing standard, AASB 16.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ACCOUNTING FOR LEASES- THE IMPACT OF AASB (IFRS) 16

References:

Aasb.gov.au. (2018). Leases. Retrieved 23 April 2019, from

https://www.aasb.gov.au/admin/file/content105/c9/AASB117_08-15.pdf

Aasb.gov.au. (2018). Leases. Retrieved 23 April 2019, from

https://www.aasb.gov.au/admin/file/content105/c9/AASB16_02-16.pdf

Akbulut, D. H. (2017). The Effects of Operating Leases Capitalization on Financial Statements and Accounting

Ratios: A Literature Survey. In Regional Studies on Economic Growth, Financial Economics and

Management (pp. 3-10). Springer, Cham.

Barone, E., Birt, J., & Moya, S. (2014). Lease accounting: A review of recent literature. Accounting in

Europe, 11(1), 35-54.

Cpaaustralia.com.au. (2019). Retrieved 23 April 2019, from

https://www.cpaaustralia.com.au/~/media/corporate/allfiles/document/professional-resources/reporting/

factsheet-ifrs16-leases.pdf?la=en

Dagwell, R., Wines, G., & Lambert, C. (2015). Corporate accounting in Australia. Pearson Higher Education AU.

Deloitte.com. (2019). Retrieved 23 April 2019, from

https://www2.deloitte.com/content/dam/Deloitte/au/Documents/audit/deloitte-au-audit-aasb-16-guide-

220916.pdf

Deloitte.com. (2019). IFRS 16 Leases | Deloitte UK. Deloitte United Kingdom. Retrieved 23 April 2019, from

https://www2.deloitte.com/uk/en/pages/audit/articles/ifrs-16-leases.html

Henderson, S., Peirson, G., Herbohn, K., & Howieson, B. (2015). Issues in financial accounting. Pearson Higher

Education AU.

Joubert, M., Garvie, L., & Parle, G. (2017). Implications of the New Accounting Standard for Leases AASB 16

(IFRS 16) with the Inclusion of Operating Leases in the Balance Sheet. The Journal of New Business Ideas

& Trends, 15(2), 1-11.

Spencer, A. W., & Webb, T. Z. (2015). Leases: A review of contemporary academic literature relating to

lessees. Accounting Horizons, 29(4), 997-1023.

Warren, C. M. (2016). The impact of International Accounting Standards Board (IASB)/International Financial

Reporting Standard 16 (IFRS 16). Property Management, 34(3), 456-475.

Wesfarmers.com.au. (2019). Annual Report 2018. Retrieved 23 April 2019, from

https://www.wesfarmers.com.au/docs/default-source/reports/wes18-044-2018-annual-report.pdf?sfvrsn=4

References:

Aasb.gov.au. (2018). Leases. Retrieved 23 April 2019, from

https://www.aasb.gov.au/admin/file/content105/c9/AASB117_08-15.pdf

Aasb.gov.au. (2018). Leases. Retrieved 23 April 2019, from

https://www.aasb.gov.au/admin/file/content105/c9/AASB16_02-16.pdf

Akbulut, D. H. (2017). The Effects of Operating Leases Capitalization on Financial Statements and Accounting

Ratios: A Literature Survey. In Regional Studies on Economic Growth, Financial Economics and

Management (pp. 3-10). Springer, Cham.

Barone, E., Birt, J., & Moya, S. (2014). Lease accounting: A review of recent literature. Accounting in

Europe, 11(1), 35-54.

Cpaaustralia.com.au. (2019). Retrieved 23 April 2019, from

https://www.cpaaustralia.com.au/~/media/corporate/allfiles/document/professional-resources/reporting/

factsheet-ifrs16-leases.pdf?la=en

Dagwell, R., Wines, G., & Lambert, C. (2015). Corporate accounting in Australia. Pearson Higher Education AU.

Deloitte.com. (2019). Retrieved 23 April 2019, from

https://www2.deloitte.com/content/dam/Deloitte/au/Documents/audit/deloitte-au-audit-aasb-16-guide-

220916.pdf

Deloitte.com. (2019). IFRS 16 Leases | Deloitte UK. Deloitte United Kingdom. Retrieved 23 April 2019, from

https://www2.deloitte.com/uk/en/pages/audit/articles/ifrs-16-leases.html

Henderson, S., Peirson, G., Herbohn, K., & Howieson, B. (2015). Issues in financial accounting. Pearson Higher

Education AU.

Joubert, M., Garvie, L., & Parle, G. (2017). Implications of the New Accounting Standard for Leases AASB 16

(IFRS 16) with the Inclusion of Operating Leases in the Balance Sheet. The Journal of New Business Ideas

& Trends, 15(2), 1-11.

Spencer, A. W., & Webb, T. Z. (2015). Leases: A review of contemporary academic literature relating to

lessees. Accounting Horizons, 29(4), 997-1023.

Warren, C. M. (2016). The impact of International Accounting Standards Board (IASB)/International Financial

Reporting Standard 16 (IFRS 16). Property Management, 34(3), 456-475.

Wesfarmers.com.au. (2019). Annual Report 2018. Retrieved 23 April 2019, from

https://www.wesfarmers.com.au/docs/default-source/reports/wes18-044-2018-annual-report.pdf?sfvrsn=4

8ACCOUNTING FOR LEASES- THE IMPACT OF AASB (IFRS) 16

Wesfarmers.com.au. (2019). Our businesses. Retrieved 23 April 2019, from https://www.wesfarmers.com.au/our-

businesses/our-businesses

Wong, K., & Joshi, M. (2015). The impact of lease capitalisation on financial statements and key ratios: Evidence

from Australia. Australasian Accounting, Business and Finance Journal, 9(3), 27-44.

Xu, W., Davidson, R. A., & Cheong, C. S. (2017). Converting financial statements: operating to capitalised

leases. Pacific accounting review, 29(1), 34-54.

Wesfarmers.com.au. (2019). Our businesses. Retrieved 23 April 2019, from https://www.wesfarmers.com.au/our-

businesses/our-businesses

Wong, K., & Joshi, M. (2015). The impact of lease capitalisation on financial statements and key ratios: Evidence

from Australia. Australasian Accounting, Business and Finance Journal, 9(3), 27-44.

Xu, W., Davidson, R. A., & Cheong, C. S. (2017). Converting financial statements: operating to capitalised

leases. Pacific accounting review, 29(1), 34-54.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ACCOUNTING FOR LEASES- THE IMPACT OF AASB (IFRS) 16

Appendix:

Figure 1: Impact of AASB (IFRS) 16 on financial statements

(Source: Deloitte.com, 2019)

Figure 2: Commitments and contingencies of Wesfarmers Limited

(Source: Wesfarmers.com.au, 2019)

Appendix:

Figure 1: Impact of AASB (IFRS) 16 on financial statements

(Source: Deloitte.com, 2019)

Figure 2: Commitments and contingencies of Wesfarmers Limited

(Source: Wesfarmers.com.au, 2019)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ACCOUNTING FOR LEASES- THE IMPACT OF AASB (IFRS) 16

Figure 3: Expenses of Wesfarmers Limited

(Source: Wesfarmers.com.au, 2019)

Figure 4: Effect of AASB 16 on different Australian business sectors

(Source: Wong & Joshi, 2015)

Figure 3: Expenses of Wesfarmers Limited

(Source: Wesfarmers.com.au, 2019)

Figure 4: Effect of AASB 16 on different Australian business sectors

(Source: Wong & Joshi, 2015)

11ACCOUNTING FOR LEASES- THE IMPACT OF AASB (IFRS) 16

Figure 5: Balance sheet and gearing of Wesfarmers Limited

(Source: Wesfarmers.com.au, 2019)

Figure 5: Balance sheet and gearing of Wesfarmers Limited

(Source: Wesfarmers.com.au, 2019)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.