Managerial Accounting: Activity Based Costing at Angelo Ltd (MBA)

VerifiedAdded on 2023/06/04

|17

|3841

|397

Report

AI Summary

This report provides a detailed analysis of Activity Based Costing (ABC) and its advantages over traditional costing methods, using Angelo Ltd as a case study. It begins with an explanation of ABC, highlighting its ability to allocate overhead costs based on actual resource consumption. The report then presents a comparative analysis of overhead cost per unit and profit per unit for two parts, alpha and beta, manufactured by Angelo Ltd, using both ABC and traditional costing approaches. The ABC method allocates overhead costs based on activities like machine department cost, set-up cost, inspection/quality control, material handling, and delivery. The report includes detailed calculations of overhead cost per cost driver unit and the allocation of these costs to each part. The findings reveal significant differences in overhead cost allocation and profitability between the two costing methods, demonstrating the benefits of ABC in providing more accurate cost information for decision-making. The report concludes by summarizing the key advantages and disadvantages of ABC in the context of Angelo Ltd.

1

Master of Business Administration

Managerial Accounting

Master of Business Administration

Managerial Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

Executive Summary

The present report is developed for providing an understanding of the usefulness of

Activity Based Costing over the traditional approach to costing used by management accountants

for determining the product costs. This has been carried out in the report by computation of

overhead cost per unit and profits per unit of Angelo Ltd that is involved in manufacturing of

two parts that are, alpha and beta. The computation of overhead costs has been carried out for

explaining the benefits of ABC costing in calculating the product costs on the basis of the actual

overhead activities consumed. This has been followed by providing a discussion of the various

advantages and disadvantages of ABC for management accounting information in context of the

application of Angelo ltd.

Executive Summary

The present report is developed for providing an understanding of the usefulness of

Activity Based Costing over the traditional approach to costing used by management accountants

for determining the product costs. This has been carried out in the report by computation of

overhead cost per unit and profits per unit of Angelo Ltd that is involved in manufacturing of

two parts that are, alpha and beta. The computation of overhead costs has been carried out for

explaining the benefits of ABC costing in calculating the product costs on the basis of the actual

overhead activities consumed. This has been followed by providing a discussion of the various

advantages and disadvantages of ABC for management accounting information in context of the

application of Angelo ltd.

3

Contents

Executive Summary.........................................................................................................................2

Introduction......................................................................................................................................4

Application of activity based costing and how cost are allocated using the activity based costing5

Part A: Use of activity based cost information to identify the overhead cost per unit and profits

per unit (Comparison of overhead cost per unit with the percentage of overhead cost for two

parts).............................................................................................................................................5

Part B: Through using the number of units to assign the overhead cost to each part and

identification of overhead cost per unit and profits per unit (Comparison of overhead cost per

unit with the percentage of overhead cost for two parts)...........................................................10

Part C: Difference between unit overhead cost under part A and part B of this report.............13

Conclusion.....................................................................................................................................14

References......................................................................................................................................16

Contents

Executive Summary.........................................................................................................................2

Introduction......................................................................................................................................4

Application of activity based costing and how cost are allocated using the activity based costing5

Part A: Use of activity based cost information to identify the overhead cost per unit and profits

per unit (Comparison of overhead cost per unit with the percentage of overhead cost for two

parts).............................................................................................................................................5

Part B: Through using the number of units to assign the overhead cost to each part and

identification of overhead cost per unit and profits per unit (Comparison of overhead cost per

unit with the percentage of overhead cost for two parts)...........................................................10

Part C: Difference between unit overhead cost under part A and part B of this report.............13

Conclusion.....................................................................................................................................14

References......................................................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4

Introduction

The ever changing business environment has led managers or decision makers to change

the way they determine the cost structure of the company. Activity based costing is the most

innovative and useful management accounting tool that has been developed during the last

century. Activity based costing (ABC) has changed the way through which cost is determined of

different products. This method of cost accounting believes that each class of product passes

through different activities and consumes some resources. Under activity based costing all the

overhead cost are being segregated into different activities and are being allocated to each

product on the basis of activity being used by each product. Activity based costing provides true

cost of each product and helps in making the accurate decisions regarding the products.

In this report there will be discussion on activity based costing together with its

advantages and disadvantages. Further this report will provide insight view of why activity based

costing is preferred over the traditional costing approach. After that, three question on activity

based costing will answered in details to understand the activity based costing more precisely.

Activity based costing

Activity based costing (ABC) can be simply defined as the costing method used to

allocate the cost to the product or services that identifies the activities of the firm to assign

overhead costs to each cost object. Activity based costing is the two stage procedure to assign the

overhead cost to products. At first stage all the activities are being identified that are being

performed while converting the raw material into the finished goods or activities performed

during the rendering of services. After that cost is assigned to each activity based on the

resources consumed it. The statement of cost pool is being prepared to identify the cost of each

activity. In stage two cost drivers are identified for each overhead cost and overhead cost per unit

of cost driver is calculated. At last overhead cost are assigned to each product or service on the

basis of cost driver and activity consumed by each product and services (Akyol, 2007).

Activity based costing versus traditional costing

Businesses are largely emphasizing to adopt the use of activity-based costing as

compared to the traditional method of cost allocation. The traditional method of costing can be

Introduction

The ever changing business environment has led managers or decision makers to change

the way they determine the cost structure of the company. Activity based costing is the most

innovative and useful management accounting tool that has been developed during the last

century. Activity based costing (ABC) has changed the way through which cost is determined of

different products. This method of cost accounting believes that each class of product passes

through different activities and consumes some resources. Under activity based costing all the

overhead cost are being segregated into different activities and are being allocated to each

product on the basis of activity being used by each product. Activity based costing provides true

cost of each product and helps in making the accurate decisions regarding the products.

In this report there will be discussion on activity based costing together with its

advantages and disadvantages. Further this report will provide insight view of why activity based

costing is preferred over the traditional costing approach. After that, three question on activity

based costing will answered in details to understand the activity based costing more precisely.

Activity based costing

Activity based costing (ABC) can be simply defined as the costing method used to

allocate the cost to the product or services that identifies the activities of the firm to assign

overhead costs to each cost object. Activity based costing is the two stage procedure to assign the

overhead cost to products. At first stage all the activities are being identified that are being

performed while converting the raw material into the finished goods or activities performed

during the rendering of services. After that cost is assigned to each activity based on the

resources consumed it. The statement of cost pool is being prepared to identify the cost of each

activity. In stage two cost drivers are identified for each overhead cost and overhead cost per unit

of cost driver is calculated. At last overhead cost are assigned to each product or service on the

basis of cost driver and activity consumed by each product and services (Akyol, 2007).

Activity based costing versus traditional costing

Businesses are largely emphasizing to adopt the use of activity-based costing as

compared to the traditional method of cost allocation. The traditional method of costing can be

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5

regarded as a simple an easy way that is largely sued by the management accountants for

determining the cost of a product. However, this method of costing is largely criticized by the

accounting experts as it does not helps in accurate allocation of overhead costs associated with

manufacturing a product. The cost of a product is mainly assessed on the basis of direct cost in

the conventional system of accounting as it does not help in accurate allocation of overhead costs

to the products. As such, these systems eventually result in under or over costing and do not

facilitate the business managers to take accurate strategies or operational decisions that can result

in improving business growth (Bradtke, 2007).

On the other hand, the use of Activity-Based Costing (ABC) helps in overcoming the

significant drawbacks associated with the traditional method of costing. This is because it

enables in determining the cost of a product on the basis of actual amount of resources

consumed. The method of ABC assigns the overhead costs to the products on the basis of

average rate and helps in accurate breakdown of indirect cost related with the production of

different type of products. ABC method of costing primarily involves allocating the indirect

costs to the activities and then assigns the costs to the products on the basis of the actual

activities consumed during product manufacturing. In this context, it is recommended that

business companies at the time of incurring high overhead during product manufacturing must

adopt the use of ABC costing method. This will help in collection of reliable cost information

that assists the managers in taking accurate decisions regarding the business growth and

development (Fadzil and Rababah, 2012).

Application of activity based costing and how cost are allocated using the activity based

costing

Part A: Use of activity based cost information to identify the overhead cost per unit and

profits per unit (Comparison of overhead cost per unit with the percentage of overhead

cost for two parts)

In this part overhead cost are being allocated through using the activity based costing. In

the given question Angelo Limited manufactures various parts for laboratory equipment. The

two major parts manufactured by the Angelo Limited are Alpha and Beta. Activity based costing

used more than single overhead rate to assign the overhead cost to the products while traditional

regarded as a simple an easy way that is largely sued by the management accountants for

determining the cost of a product. However, this method of costing is largely criticized by the

accounting experts as it does not helps in accurate allocation of overhead costs associated with

manufacturing a product. The cost of a product is mainly assessed on the basis of direct cost in

the conventional system of accounting as it does not help in accurate allocation of overhead costs

to the products. As such, these systems eventually result in under or over costing and do not

facilitate the business managers to take accurate strategies or operational decisions that can result

in improving business growth (Bradtke, 2007).

On the other hand, the use of Activity-Based Costing (ABC) helps in overcoming the

significant drawbacks associated with the traditional method of costing. This is because it

enables in determining the cost of a product on the basis of actual amount of resources

consumed. The method of ABC assigns the overhead costs to the products on the basis of

average rate and helps in accurate breakdown of indirect cost related with the production of

different type of products. ABC method of costing primarily involves allocating the indirect

costs to the activities and then assigns the costs to the products on the basis of the actual

activities consumed during product manufacturing. In this context, it is recommended that

business companies at the time of incurring high overhead during product manufacturing must

adopt the use of ABC costing method. This will help in collection of reliable cost information

that assists the managers in taking accurate decisions regarding the business growth and

development (Fadzil and Rababah, 2012).

Application of activity based costing and how cost are allocated using the activity based

costing

Part A: Use of activity based cost information to identify the overhead cost per unit and

profits per unit (Comparison of overhead cost per unit with the percentage of overhead

cost for two parts)

In this part overhead cost are being allocated through using the activity based costing. In

the given question Angelo Limited manufactures various parts for laboratory equipment. The

two major parts manufactured by the Angelo Limited are Alpha and Beta. Activity based costing

used more than single overhead rate to assign the overhead cost to the products while traditional

6

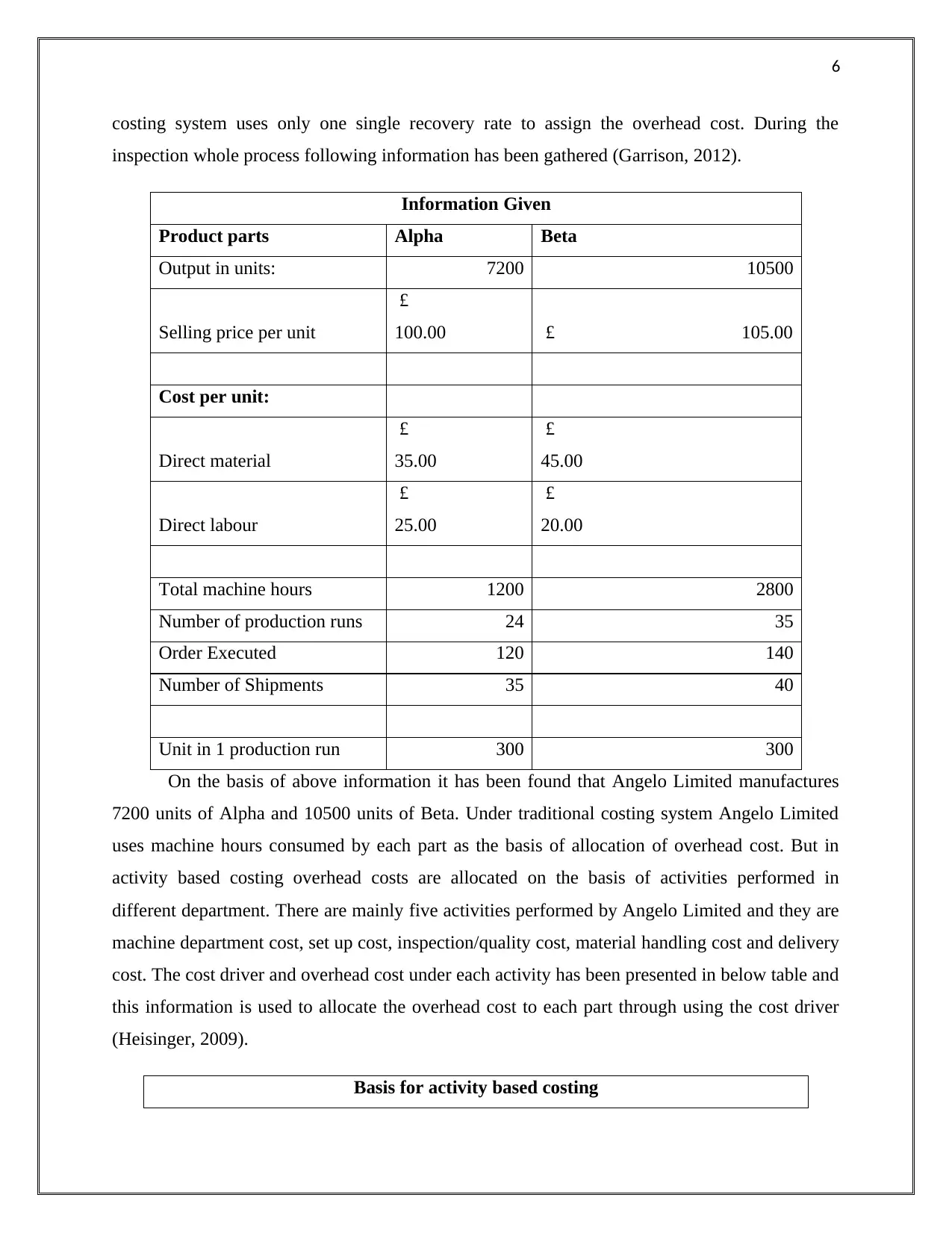

costing system uses only one single recovery rate to assign the overhead cost. During the

inspection whole process following information has been gathered (Garrison, 2012).

Information Given

Product parts Alpha Beta

Output in units: 7200 10500

Selling price per unit

£

100.00 £ 105.00

Cost per unit:

Direct material

£

35.00

£

45.00

Direct labour

£

25.00

£

20.00

Total machine hours 1200 2800

Number of production runs 24 35

Order Executed 120 140

Number of Shipments 35 40

Unit in 1 production run 300 300

On the basis of above information it has been found that Angelo Limited manufactures

7200 units of Alpha and 10500 units of Beta. Under traditional costing system Angelo Limited

uses machine hours consumed by each part as the basis of allocation of overhead cost. But in

activity based costing overhead costs are allocated on the basis of activities performed in

different department. There are mainly five activities performed by Angelo Limited and they are

machine department cost, set up cost, inspection/quality cost, material handling cost and delivery

cost. The cost driver and overhead cost under each activity has been presented in below table and

this information is used to allocate the overhead cost to each part through using the cost driver

(Heisinger, 2009).

Basis for activity based costing

costing system uses only one single recovery rate to assign the overhead cost. During the

inspection whole process following information has been gathered (Garrison, 2012).

Information Given

Product parts Alpha Beta

Output in units: 7200 10500

Selling price per unit

£

100.00 £ 105.00

Cost per unit:

Direct material

£

35.00

£

45.00

Direct labour

£

25.00

£

20.00

Total machine hours 1200 2800

Number of production runs 24 35

Order Executed 120 140

Number of Shipments 35 40

Unit in 1 production run 300 300

On the basis of above information it has been found that Angelo Limited manufactures

7200 units of Alpha and 10500 units of Beta. Under traditional costing system Angelo Limited

uses machine hours consumed by each part as the basis of allocation of overhead cost. But in

activity based costing overhead costs are allocated on the basis of activities performed in

different department. There are mainly five activities performed by Angelo Limited and they are

machine department cost, set up cost, inspection/quality cost, material handling cost and delivery

cost. The cost driver and overhead cost under each activity has been presented in below table and

this information is used to allocate the overhead cost to each part through using the cost driver

(Heisinger, 2009).

Basis for activity based costing

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

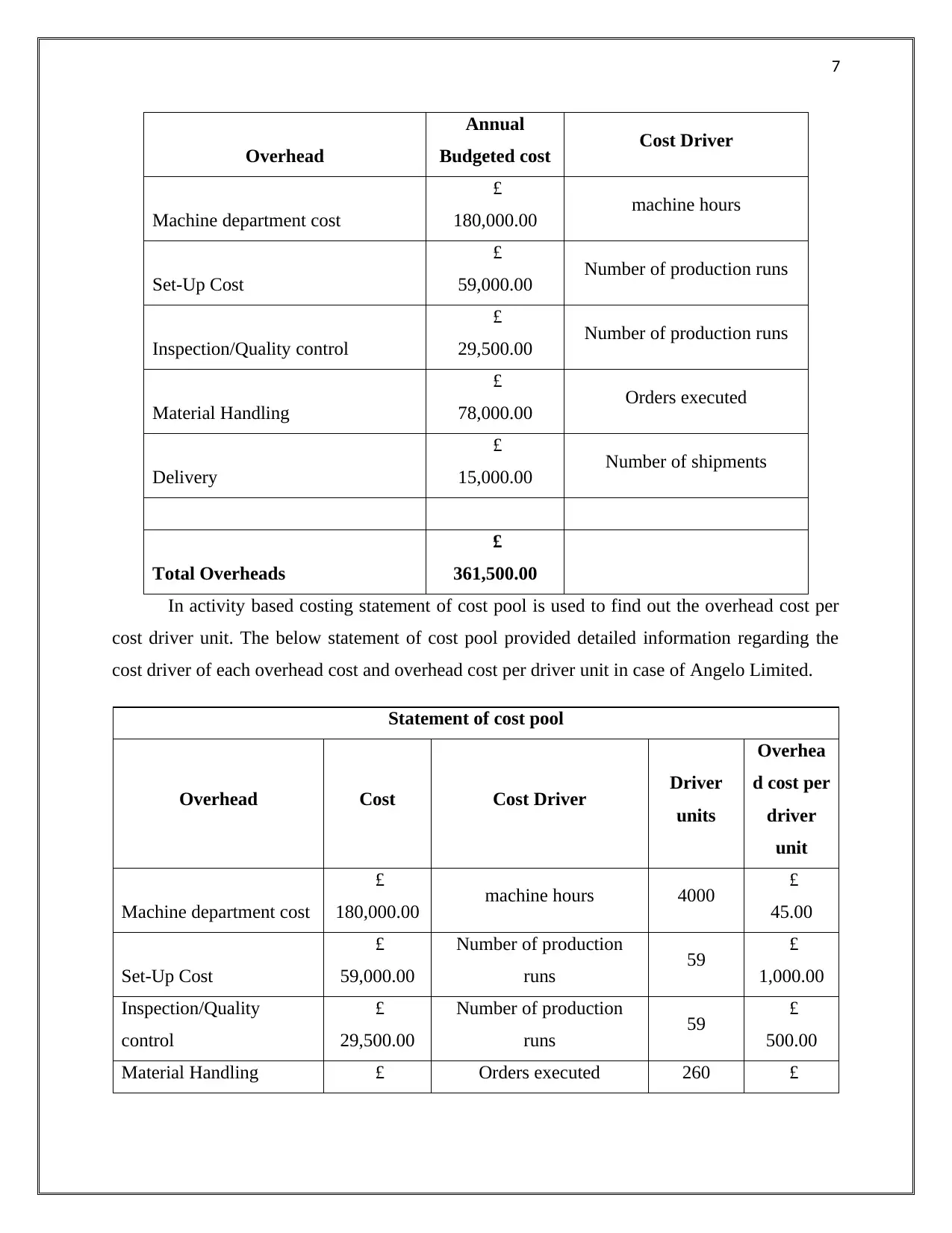

7

Overhead

Annual

Budgeted cost Cost Driver

Machine department cost

£

180,000.00 machine hours

Set-Up Cost

£

59,000.00 Number of production runs

Inspection/Quality control

£

29,500.00 Number of production runs

Material Handling

£

78,000.00 Orders executed

Delivery

£

15,000.00 Number of shipments

Total Overheads

£

361,500.00

In activity based costing statement of cost pool is used to find out the overhead cost per

cost driver unit. The below statement of cost pool provided detailed information regarding the

cost driver of each overhead cost and overhead cost per driver unit in case of Angelo Limited.

Statement of cost pool

Overhead Cost Cost Driver Driver

units

Overhea

d cost per

driver

unit

Machine department cost

£

180,000.00 machine hours 4000 £

45.00

Set-Up Cost

£

59,000.00

Number of production

runs 59 £

1,000.00

Inspection/Quality

control

£

29,500.00

Number of production

runs 59 £

500.00

Material Handling £ Orders executed 260 £

Overhead

Annual

Budgeted cost Cost Driver

Machine department cost

£

180,000.00 machine hours

Set-Up Cost

£

59,000.00 Number of production runs

Inspection/Quality control

£

29,500.00 Number of production runs

Material Handling

£

78,000.00 Orders executed

Delivery

£

15,000.00 Number of shipments

Total Overheads

£

361,500.00

In activity based costing statement of cost pool is used to find out the overhead cost per

cost driver unit. The below statement of cost pool provided detailed information regarding the

cost driver of each overhead cost and overhead cost per driver unit in case of Angelo Limited.

Statement of cost pool

Overhead Cost Cost Driver Driver

units

Overhea

d cost per

driver

unit

Machine department cost

£

180,000.00 machine hours 4000 £

45.00

Set-Up Cost

£

59,000.00

Number of production

runs 59 £

1,000.00

Inspection/Quality

control

£

29,500.00

Number of production

runs 59 £

500.00

Material Handling £ Orders executed 260 £

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

78,000.00 300.00

Delivery

£

15,000.00 Number of shipments 75 £

200.00

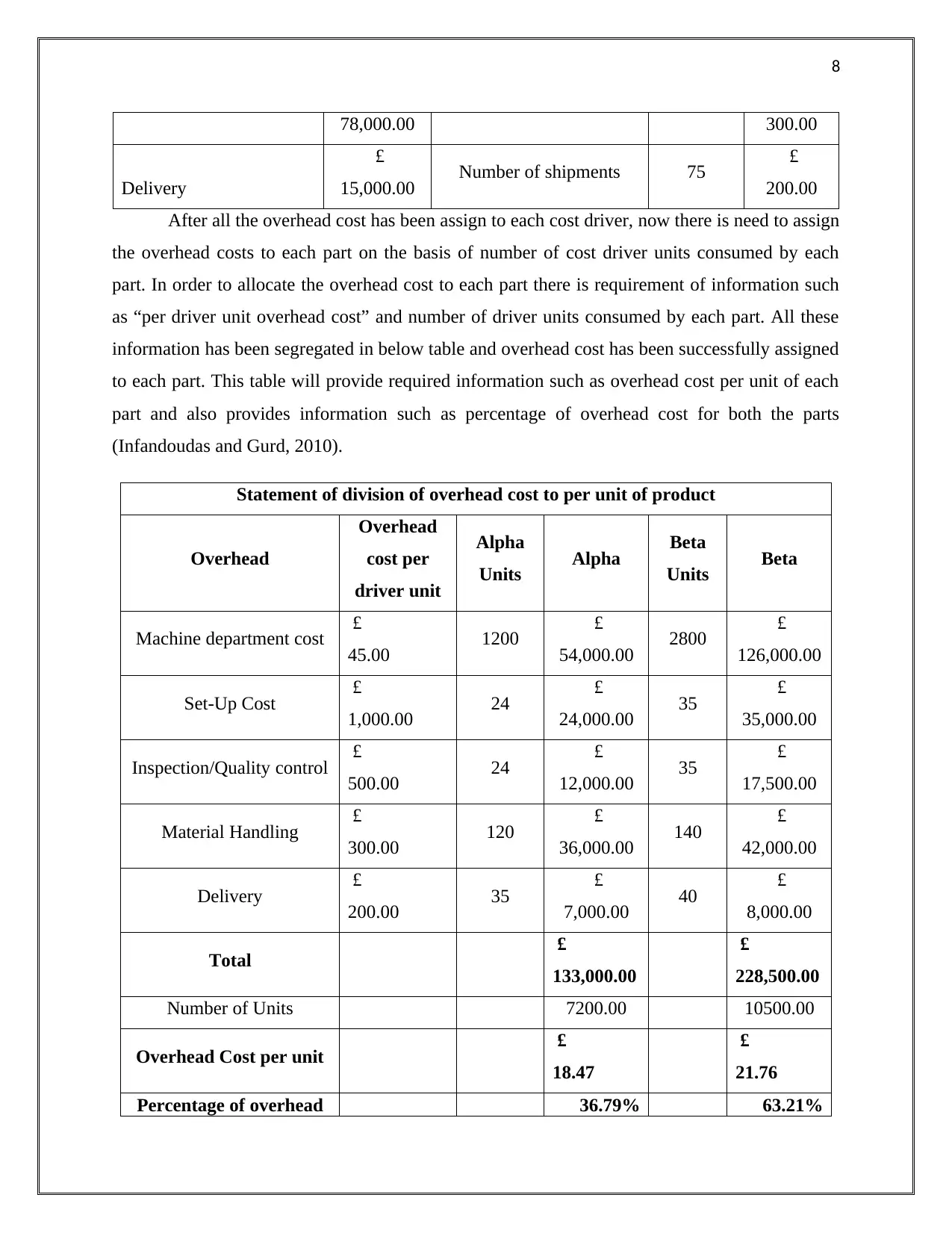

After all the overhead cost has been assign to each cost driver, now there is need to assign

the overhead costs to each part on the basis of number of cost driver units consumed by each

part. In order to allocate the overhead cost to each part there is requirement of information such

as “per driver unit overhead cost” and number of driver units consumed by each part. All these

information has been segregated in below table and overhead cost has been successfully assigned

to each part. This table will provide required information such as overhead cost per unit of each

part and also provides information such as percentage of overhead cost for both the parts

(Infandoudas and Gurd, 2010).

Statement of division of overhead cost to per unit of product

Overhead

Overhead

cost per

driver unit

Alpha

Units Alpha Beta

Units Beta

Machine department cost £

45.00 1200 £

54,000.00 2800 £

126,000.00

Set-Up Cost £

1,000.00 24 £

24,000.00 35 £

35,000.00

Inspection/Quality control £

500.00 24 £

12,000.00 35 £

17,500.00

Material Handling £

300.00 120 £

36,000.00 140 £

42,000.00

Delivery £

200.00 35 £

7,000.00 40 £

8,000.00

Total £

133,000.00

£

228,500.00

Number of Units 7200.00 10500.00

Overhead Cost per unit £

18.47

£

21.76

Percentage of overhead 36.79% 63.21%

78,000.00 300.00

Delivery

£

15,000.00 Number of shipments 75 £

200.00

After all the overhead cost has been assign to each cost driver, now there is need to assign

the overhead costs to each part on the basis of number of cost driver units consumed by each

part. In order to allocate the overhead cost to each part there is requirement of information such

as “per driver unit overhead cost” and number of driver units consumed by each part. All these

information has been segregated in below table and overhead cost has been successfully assigned

to each part. This table will provide required information such as overhead cost per unit of each

part and also provides information such as percentage of overhead cost for both the parts

(Infandoudas and Gurd, 2010).

Statement of division of overhead cost to per unit of product

Overhead

Overhead

cost per

driver unit

Alpha

Units Alpha Beta

Units Beta

Machine department cost £

45.00 1200 £

54,000.00 2800 £

126,000.00

Set-Up Cost £

1,000.00 24 £

24,000.00 35 £

35,000.00

Inspection/Quality control £

500.00 24 £

12,000.00 35 £

17,500.00

Material Handling £

300.00 120 £

36,000.00 140 £

42,000.00

Delivery £

200.00 35 £

7,000.00 40 £

8,000.00

Total £

133,000.00

£

228,500.00

Number of Units 7200.00 10500.00

Overhead Cost per unit £

18.47

£

21.76

Percentage of overhead 36.79% 63.21%

9

cost

On the basis of above table it has been found that total overhead cost assigned to Part

Alpha is equal to 133000 pounds and overhead cost assigned to Part beta is equal to 228500

pounds. According to number of units manufactured for each part the overhead cost of per unit

of Alpha is 18.47 pound and 21.76 pound for part Beta. Percentage of overhead cost allocated to

Alpha and Beta is 36.79% and 63.21% respectively. This shows Beta part consumes most of

overhead cost while Alpha consumes only 36.79% of overhead cost. Activity based costing

provides more meaningful basis to allocate the cost as it assigns the cost systematically and does

not assumes arbitrary basis to allocate the overhead cost. It can be said that assigning overhead

cost using the single recovery rate will provide wrong information each part uses different level

of activities to process the products (Kim, 2017).

Statement of profit per unit of both the products

Particulars Alpha Beta

Selling Price per unit

£

100.00

£

105.00

Less:

Cost per unit:

Direct material

£

35.00

£

45.00

Direct labour

£

25.00

£

20.00

Overhead Cost per

unit

£

18.47

£

21.76

Profit per unit

£

21.53

£

18.24

Using the information calculating through the application of activity based costing in

Angelo Limited the profit per unit of Alpha part is 21.53 pound and 18.24 pound in case of Beta

part.

cost

On the basis of above table it has been found that total overhead cost assigned to Part

Alpha is equal to 133000 pounds and overhead cost assigned to Part beta is equal to 228500

pounds. According to number of units manufactured for each part the overhead cost of per unit

of Alpha is 18.47 pound and 21.76 pound for part Beta. Percentage of overhead cost allocated to

Alpha and Beta is 36.79% and 63.21% respectively. This shows Beta part consumes most of

overhead cost while Alpha consumes only 36.79% of overhead cost. Activity based costing

provides more meaningful basis to allocate the cost as it assigns the cost systematically and does

not assumes arbitrary basis to allocate the overhead cost. It can be said that assigning overhead

cost using the single recovery rate will provide wrong information each part uses different level

of activities to process the products (Kim, 2017).

Statement of profit per unit of both the products

Particulars Alpha Beta

Selling Price per unit

£

100.00

£

105.00

Less:

Cost per unit:

Direct material

£

35.00

£

45.00

Direct labour

£

25.00

£

20.00

Overhead Cost per

unit

£

18.47

£

21.76

Profit per unit

£

21.53

£

18.24

Using the information calculating through the application of activity based costing in

Angelo Limited the profit per unit of Alpha part is 21.53 pound and 18.24 pound in case of Beta

part.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10

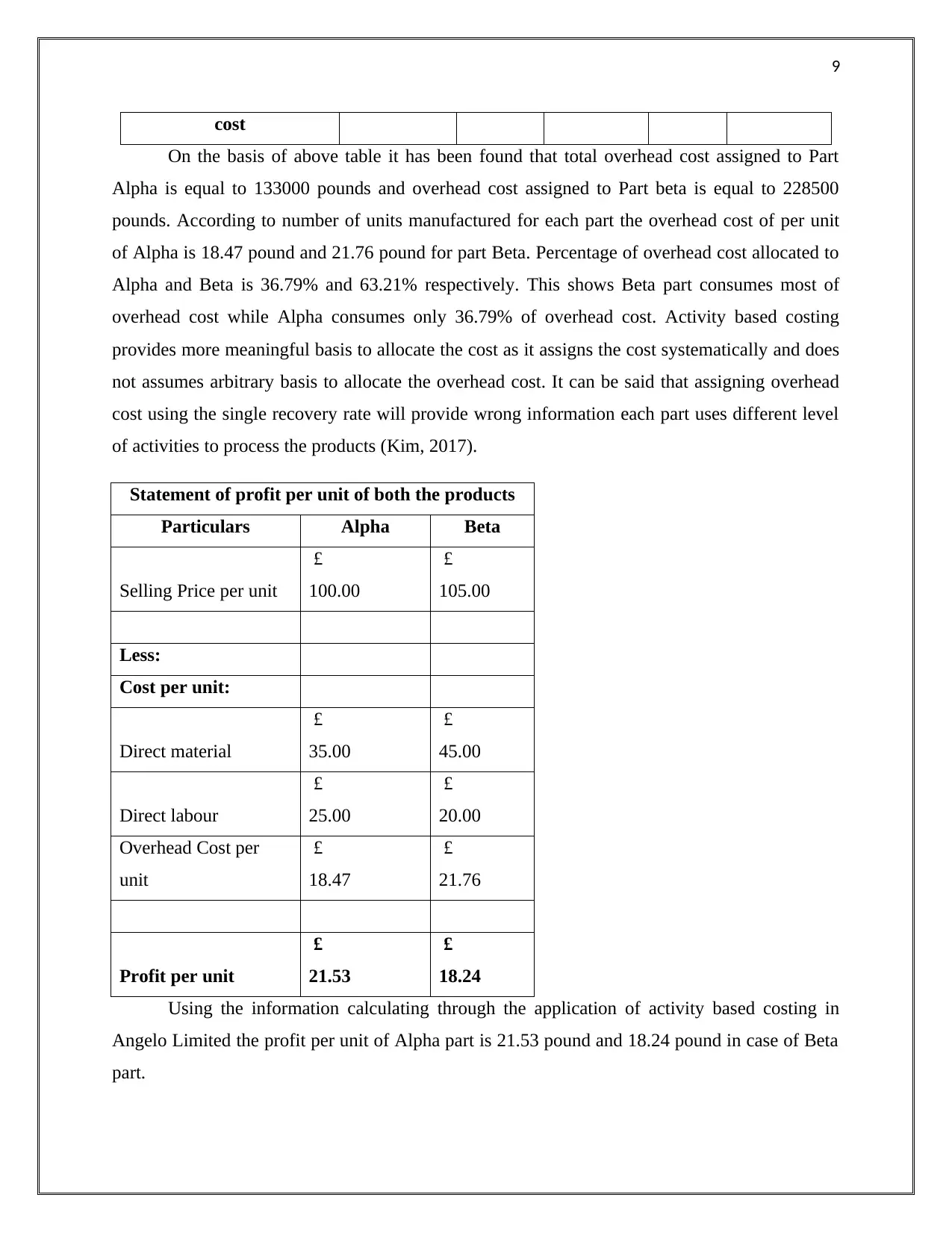

Part B: Through using the number of units to assign the overhead cost to each part and

identification of overhead cost per unit and profits per unit (Comparison of overhead cost

per unit with the percentage of overhead cost for two parts)

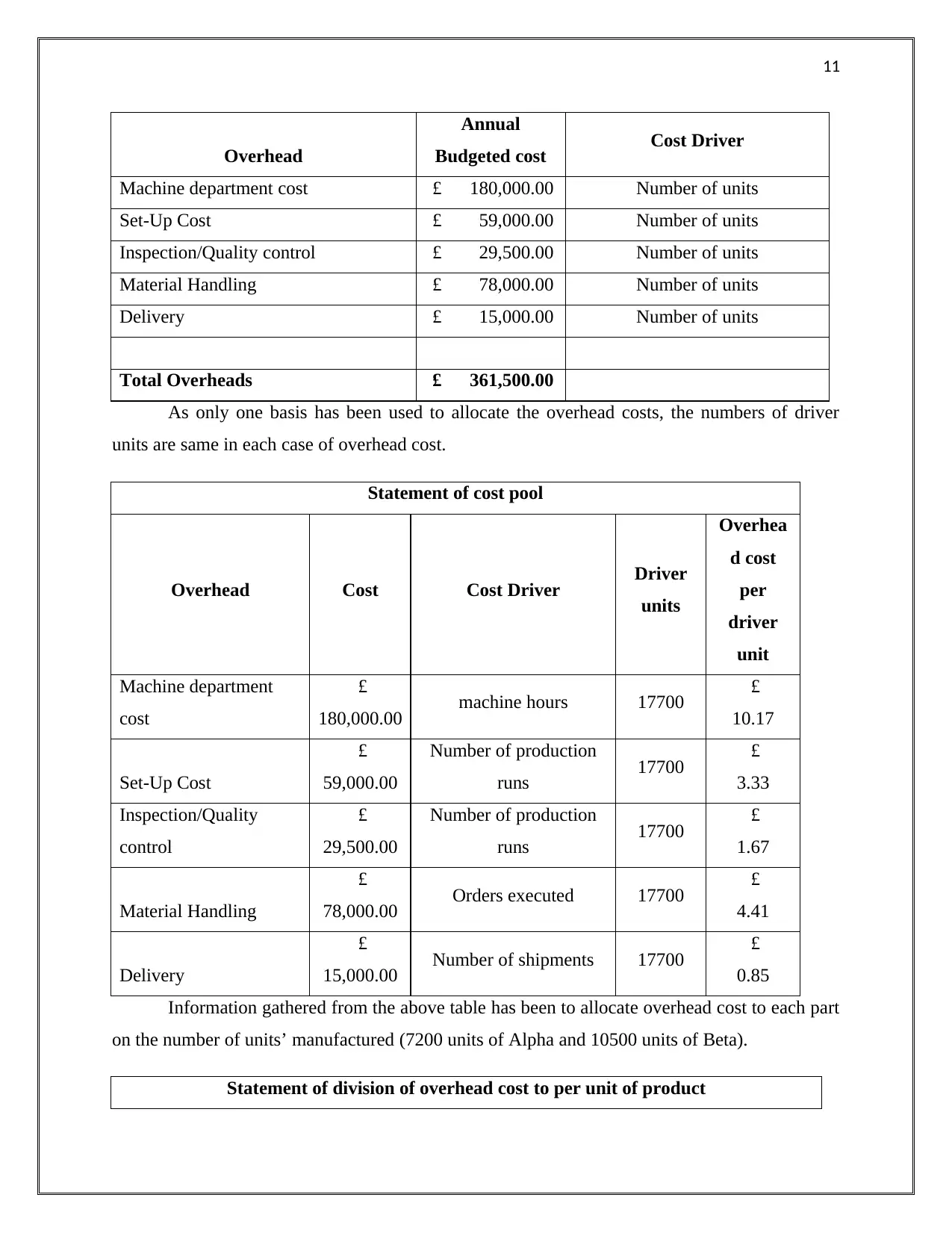

In this section of the assignment overhead cost has been allocated using the traditional

method of costing as only one single overhead has been selected to allocate the overhead cost to

each part produced by the Angelo Limited. Under traditional costing system overhead cost is

being allocated through using the machine hour rate, labour hr rate, number of units

manufactured etc. Angelo Limited has selected number of units as the basis to allocate the

overhead cost to each part (Alpha and Beta). Angelo Limited has manufactured 7200 units of

Alpha and 10500 units of Beta during the period. Other information such as total machine hours,

number of production runs, order executed and number of shipments are irrelevant for

calculation of overhead cost per unit of each part under traditional costing system (Moisell,

2012).

Information Given

Product parts Alpha Beta

Output in units: 7200 10500

Selling price per unit £ 100.00 £ 105.00

Cost per unit:

Direct material £ 35.00 £ 45.00

Direct labour £ 25.00 £ 20.00

Total machine hours 1200 2800

Number of production runs 24 35

Order Executed 120 140

Number of Shipments 35 40

Unit in 1 production run 300 300

All the overhead costs are being allocated through using the number of units and no other

basis has been used to allocate the overhead cost.

Basis for allocation for overhead cost

Part B: Through using the number of units to assign the overhead cost to each part and

identification of overhead cost per unit and profits per unit (Comparison of overhead cost

per unit with the percentage of overhead cost for two parts)

In this section of the assignment overhead cost has been allocated using the traditional

method of costing as only one single overhead has been selected to allocate the overhead cost to

each part produced by the Angelo Limited. Under traditional costing system overhead cost is

being allocated through using the machine hour rate, labour hr rate, number of units

manufactured etc. Angelo Limited has selected number of units as the basis to allocate the

overhead cost to each part (Alpha and Beta). Angelo Limited has manufactured 7200 units of

Alpha and 10500 units of Beta during the period. Other information such as total machine hours,

number of production runs, order executed and number of shipments are irrelevant for

calculation of overhead cost per unit of each part under traditional costing system (Moisell,

2012).

Information Given

Product parts Alpha Beta

Output in units: 7200 10500

Selling price per unit £ 100.00 £ 105.00

Cost per unit:

Direct material £ 35.00 £ 45.00

Direct labour £ 25.00 £ 20.00

Total machine hours 1200 2800

Number of production runs 24 35

Order Executed 120 140

Number of Shipments 35 40

Unit in 1 production run 300 300

All the overhead costs are being allocated through using the number of units and no other

basis has been used to allocate the overhead cost.

Basis for allocation for overhead cost

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11

Overhead

Annual

Budgeted cost Cost Driver

Machine department cost £ 180,000.00 Number of units

Set-Up Cost £ 59,000.00 Number of units

Inspection/Quality control £ 29,500.00 Number of units

Material Handling £ 78,000.00 Number of units

Delivery £ 15,000.00 Number of units

Total Overheads £ 361,500.00

As only one basis has been used to allocate the overhead costs, the numbers of driver

units are same in each case of overhead cost.

Statement of cost pool

Overhead Cost Cost Driver Driver

units

Overhea

d cost

per

driver

unit

Machine department

cost

£

180,000.00 machine hours 17700 £

10.17

Set-Up Cost

£

59,000.00

Number of production

runs 17700 £

3.33

Inspection/Quality

control

£

29,500.00

Number of production

runs 17700 £

1.67

Material Handling

£

78,000.00 Orders executed 17700 £

4.41

Delivery

£

15,000.00 Number of shipments 17700 £

0.85

Information gathered from the above table has been to allocate overhead cost to each part

on the number of units’ manufactured (7200 units of Alpha and 10500 units of Beta).

Statement of division of overhead cost to per unit of product

Overhead

Annual

Budgeted cost Cost Driver

Machine department cost £ 180,000.00 Number of units

Set-Up Cost £ 59,000.00 Number of units

Inspection/Quality control £ 29,500.00 Number of units

Material Handling £ 78,000.00 Number of units

Delivery £ 15,000.00 Number of units

Total Overheads £ 361,500.00

As only one basis has been used to allocate the overhead costs, the numbers of driver

units are same in each case of overhead cost.

Statement of cost pool

Overhead Cost Cost Driver Driver

units

Overhea

d cost

per

driver

unit

Machine department

cost

£

180,000.00 machine hours 17700 £

10.17

Set-Up Cost

£

59,000.00

Number of production

runs 17700 £

3.33

Inspection/Quality

control

£

29,500.00

Number of production

runs 17700 £

1.67

Material Handling

£

78,000.00 Orders executed 17700 £

4.41

Delivery

£

15,000.00 Number of shipments 17700 £

0.85

Information gathered from the above table has been to allocate overhead cost to each part

on the number of units’ manufactured (7200 units of Alpha and 10500 units of Beta).

Statement of division of overhead cost to per unit of product

12

Overhead

Overhead

cost per

driver unit

Alpha

Units Alpha Beta

Units Beta

Machine department cost £

10.17 7200 £

73,220.34 10500 £

106,779.66

Set-Up Cost £

3.33 7200 £

24,000.00 10500 £

35,000.00

Inspection/Quality control £

1.67 7200 £

12,000.00 10500 £

17,500.00

Material Handling £

4.41 7200 £

31,728.81 10500 £

46,271.19

Delivery £

0.85 7200 £

6,101.69 10500 £

8,898.31

Total £

147,050.85

£

214,449.15

Number of Units 7200.00 10500.00

Overhead Cost per unit £

20.42

£

20.42

Percentage of overhead

cost 40.68% 59.32%

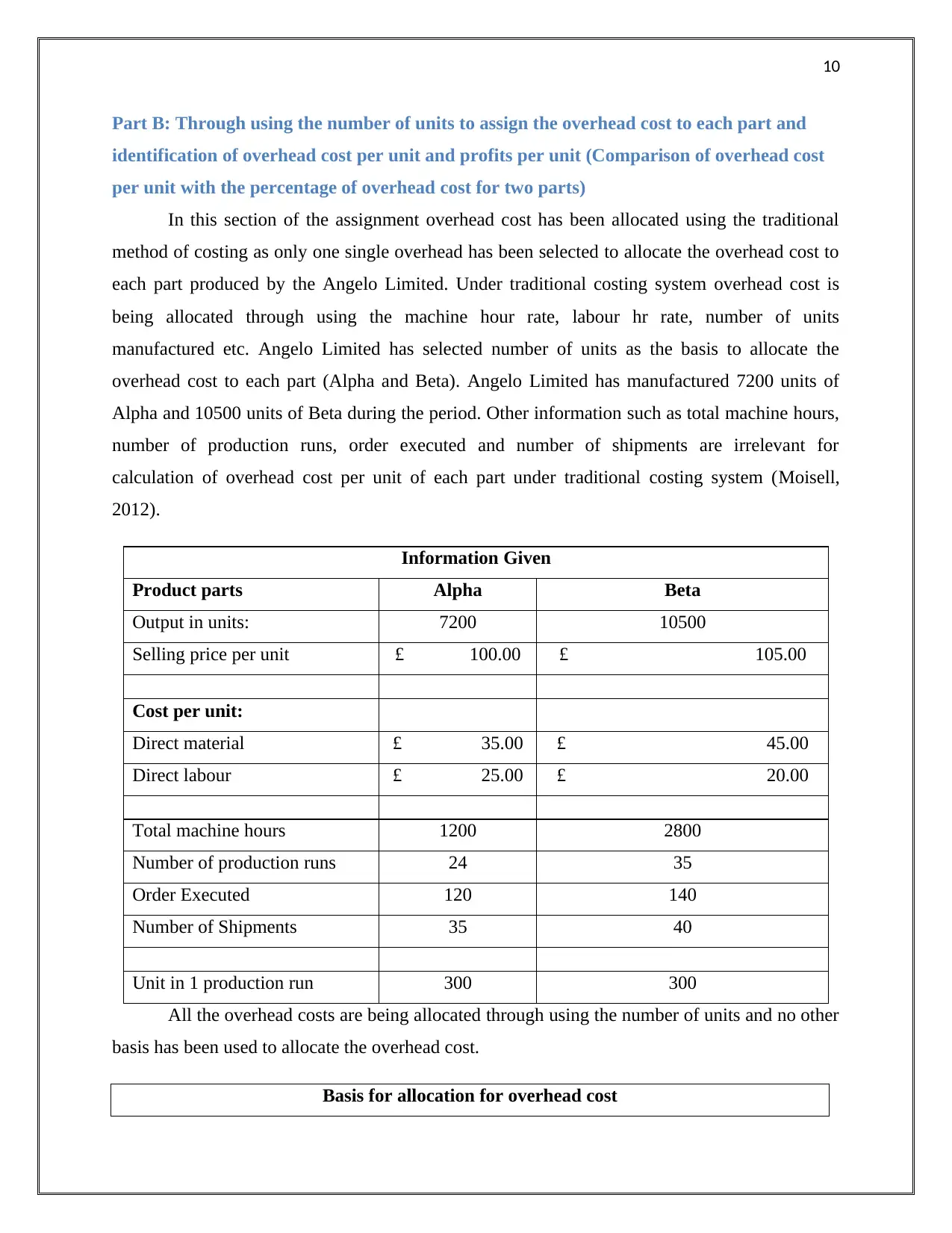

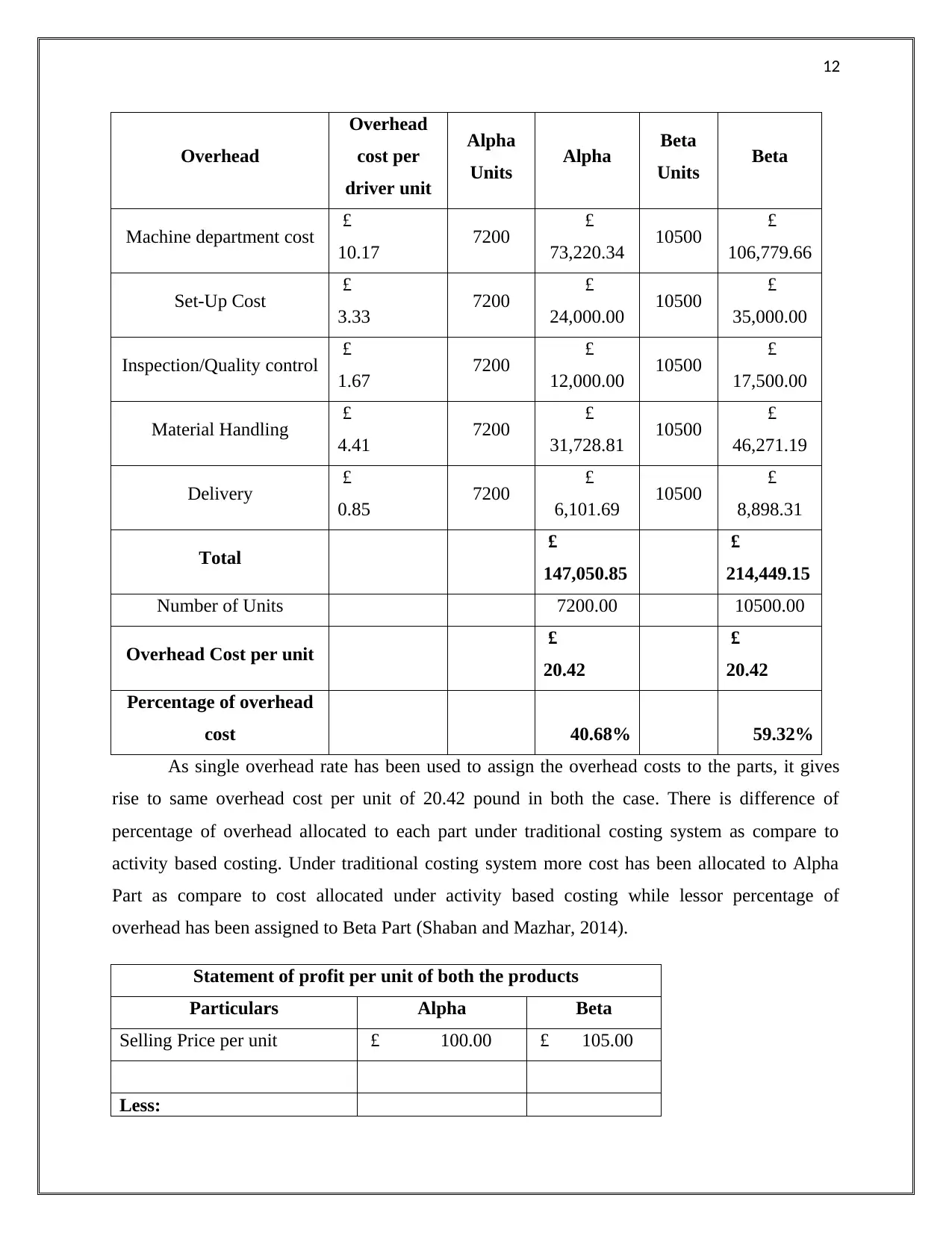

As single overhead rate has been used to assign the overhead costs to the parts, it gives

rise to same overhead cost per unit of 20.42 pound in both the case. There is difference of

percentage of overhead allocated to each part under traditional costing system as compare to

activity based costing. Under traditional costing system more cost has been allocated to Alpha

Part as compare to cost allocated under activity based costing while lessor percentage of

overhead has been assigned to Beta Part (Shaban and Mazhar, 2014).

Statement of profit per unit of both the products

Particulars Alpha Beta

Selling Price per unit £ 100.00 £ 105.00

Less:

Overhead

Overhead

cost per

driver unit

Alpha

Units Alpha Beta

Units Beta

Machine department cost £

10.17 7200 £

73,220.34 10500 £

106,779.66

Set-Up Cost £

3.33 7200 £

24,000.00 10500 £

35,000.00

Inspection/Quality control £

1.67 7200 £

12,000.00 10500 £

17,500.00

Material Handling £

4.41 7200 £

31,728.81 10500 £

46,271.19

Delivery £

0.85 7200 £

6,101.69 10500 £

8,898.31

Total £

147,050.85

£

214,449.15

Number of Units 7200.00 10500.00

Overhead Cost per unit £

20.42

£

20.42

Percentage of overhead

cost 40.68% 59.32%

As single overhead rate has been used to assign the overhead costs to the parts, it gives

rise to same overhead cost per unit of 20.42 pound in both the case. There is difference of

percentage of overhead allocated to each part under traditional costing system as compare to

activity based costing. Under traditional costing system more cost has been allocated to Alpha

Part as compare to cost allocated under activity based costing while lessor percentage of

overhead has been assigned to Beta Part (Shaban and Mazhar, 2014).

Statement of profit per unit of both the products

Particulars Alpha Beta

Selling Price per unit £ 100.00 £ 105.00

Less:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.