ECT-ACAF-ACAFO-FRM.011 Project: ADIX and DFM Financial Analysis

VerifiedAdded on 2023/01/11

|16

|3523

|42

Project

AI Summary

This project report analyzes the Abu Dhabi Securities Exchange (ADIX) and the Dubai Financial Market (DFM), exploring their nature, development, and differences. It investigates the benefits and drawbacks of long-term capital markets, identifies the types of financial securities used in ADIX and DFM, and examines strategies for reducing financial risk. The report includes a literature review covering these aspects and provides an analysis of Sharjah Islamic Bank, a company listed on the Abu Dhabi stock market. The analysis includes the bank's overview, financial services, and size. The project aims to familiarize students with real-life financial markets and asset valuation, utilizing public financial information to evaluate market performance and financial institutions, specifically within the UAE context. The student demonstrates extensive readings and supports their views with peer-reviewed journals, meeting the project's objective of understanding financial markets and their impact on investor decisions.

Financial Institutions & Markets – 1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION & BACKGROUND......................................................................................................3

MAIN BODY..............................................................................................................................................3

Problem statement:..................................................................................................................................3

Research question:...................................................................................................................................4

Literature review:....................................................................................................................................4

Discussion.................................................................................................................................................12

Conclusion and recommendations.............................................................................................................12

REFERENCES..........................................................................................................................................14

INTRODUCTION & BACKGROUND......................................................................................................3

MAIN BODY..............................................................................................................................................3

Problem statement:..................................................................................................................................3

Research question:...................................................................................................................................4

Literature review:....................................................................................................................................4

Discussion.................................................................................................................................................12

Conclusion and recommendations.............................................................................................................12

REFERENCES..........................................................................................................................................14

INTRODUCTION & BACKGROUND

The FI is a business which deals with payments such as deposits, loans, investments and

the exchange rates, both economic and currency. Investment firms include a broad range of

financial services business practices from finance, trust, brokerage, investment and securities

supplies. Virtually everybody in a developing economy has a constant or at least intermittent

requirement for banks' services. A financial market is a system that exchanges financial

instruments and options at low expense. Few stocks and shares and commodities contain bonds.

The project report is based on analyzing of Abu Dhabi stock exchange market and Dubai

financial market.

Abu Dhabi Securities Exchange (ADX) has also been known as the Abu Dhabi Securities Market

(ADSM). ADX is participating in mid east shares trade level with United Arab Emirates (UAE)

share Dubai Financial Market (DFM) (About Abu Dhabi Securities Exchange, 2019). It decided

to work with NYSE Euro next on innovations. The Dubai Financial Market was founded on 26

March 2000 and the DFM had accomplished considerable achievements and growth in its brief

existence, due largely to the supportive help and commitment shown by its respected business

partners, employees and stakeholders (About Dubai financial market, 2019).

MAIN BODY

Problem statement:

A problem statement is a succinct explanation of a problem that needs to be solved or

strengthened. It measures the difference between the present state of a system or service and its

desired condition (Ewing and Malik, 2016). In the project report is based on problem statement

which is related to analyzing Abu Dhabi stock Exchange Markets (ADIX) and Dubai Financial

Market (DFM).

The FI is a business which deals with payments such as deposits, loans, investments and

the exchange rates, both economic and currency. Investment firms include a broad range of

financial services business practices from finance, trust, brokerage, investment and securities

supplies. Virtually everybody in a developing economy has a constant or at least intermittent

requirement for banks' services. A financial market is a system that exchanges financial

instruments and options at low expense. Few stocks and shares and commodities contain bonds.

The project report is based on analyzing of Abu Dhabi stock exchange market and Dubai

financial market.

Abu Dhabi Securities Exchange (ADX) has also been known as the Abu Dhabi Securities Market

(ADSM). ADX is participating in mid east shares trade level with United Arab Emirates (UAE)

share Dubai Financial Market (DFM) (About Abu Dhabi Securities Exchange, 2019). It decided

to work with NYSE Euro next on innovations. The Dubai Financial Market was founded on 26

March 2000 and the DFM had accomplished considerable achievements and growth in its brief

existence, due largely to the supportive help and commitment shown by its respected business

partners, employees and stakeholders (About Dubai financial market, 2019).

MAIN BODY

Problem statement:

A problem statement is a succinct explanation of a problem that needs to be solved or

strengthened. It measures the difference between the present state of a system or service and its

desired condition (Ewing and Malik, 2016). In the project report is based on problem statement

which is related to analyzing Abu Dhabi stock Exchange Markets (ADIX) and Dubai Financial

Market (DFM).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Research question:

A research question is "a question to be answered by a research project." The collection

of research problems is a key component of quantitative and qualitative analysis. Work includes

data analysis, and its approach varies widely. Herein, below some research questions are

mentioned that are as follows:

What is nature and development of Abu Dhabi stock market and Dubai financial market?

What is difference between Abu Dhabi stock market and Dubai financial market?

What is benefit and drawbacks of long term capital market?

Which types of financial market securities are used in ADIX and DFM?

What are strategies which are used in future market for reducing financial risk?

Literature review:

A literature review is a literature quest and examination of the topic or issue. It records

the latest technology about the subject or topic on which users are writing (Paramati, Ummall

and Apergis, 2016). A literary analysis seeks to examine the research in the field of study.

Herein, below literature review of above mentioned questions has been done in such manner:

1. What is nature and development of Abu Dhabi stock market and Dubai financial market?

According to Ewers (2017) The Abu Dhabi stock markets is a transfer of stocks in Abu

Dhabi, UAE. Abu Dhabi Securities Exchange (A.D.X.; previously Abu Dhabi Securities

Market (ADSM): or the exchange of rights is a foreign exchange in the US (Arabic). or

the first-time sale of stock in Abu Dhabi, UAE). It was founded by UAE corporations on

15 November 2000. In Abu Dhabi, Al Ain, Fujeirah, Sharjah and Ras Al Khaimah, there

are trade points. Dubai Financial sector (DFM) is a separate market which sells stocks in

other UAE businesses, but ADSM stocks with some traders based on DFM can also be

exchanged by shareholders. The ADSM is mentioned by more businesses than DFM, but

the quantity of trading is often far less. The stock prices and market volatility rose

A research question is "a question to be answered by a research project." The collection

of research problems is a key component of quantitative and qualitative analysis. Work includes

data analysis, and its approach varies widely. Herein, below some research questions are

mentioned that are as follows:

What is nature and development of Abu Dhabi stock market and Dubai financial market?

What is difference between Abu Dhabi stock market and Dubai financial market?

What is benefit and drawbacks of long term capital market?

Which types of financial market securities are used in ADIX and DFM?

What are strategies which are used in future market for reducing financial risk?

Literature review:

A literature review is a literature quest and examination of the topic or issue. It records

the latest technology about the subject or topic on which users are writing (Paramati, Ummall

and Apergis, 2016). A literary analysis seeks to examine the research in the field of study.

Herein, below literature review of above mentioned questions has been done in such manner:

1. What is nature and development of Abu Dhabi stock market and Dubai financial market?

According to Ewers (2017) The Abu Dhabi stock markets is a transfer of stocks in Abu

Dhabi, UAE. Abu Dhabi Securities Exchange (A.D.X.; previously Abu Dhabi Securities

Market (ADSM): or the exchange of rights is a foreign exchange in the US (Arabic). or

the first-time sale of stock in Abu Dhabi, UAE). It was founded by UAE corporations on

15 November 2000. In Abu Dhabi, Al Ain, Fujeirah, Sharjah and Ras Al Khaimah, there

are trade points. Dubai Financial sector (DFM) is a separate market which sells stocks in

other UAE businesses, but ADSM stocks with some traders based on DFM can also be

exchanged by shareholders. The ADSM is mentioned by more businesses than DFM, but

the quantity of trading is often far less. The stock prices and market volatility rose

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

substantially in 2004-2005. The ADSM level total decreased by just over 30 percent

during the first six quarters of 2006 between the end of 2005 and the middle of 2006.

According to Bhavani and Kukunuru (2016) The Dubai Financial Market (DFM)

provides full access to digital data for the most precise and appropriate market. Access

complete updates, surveys, historical records, and updates from DFM directly or via the

DFM’s approved providers to different data feeds. The Dubai Financial Market (DFM),

that has the authority to enforce the rules and requirements that must be met by the DFM,

is controlled and supervised by the UAE securities and futures Authority (SCA). The

DFM collaborates with the SCA to safeguard shareholders and provide an excellent

payment system that involves measures such as the creation of transaction and

distribution frameworks.

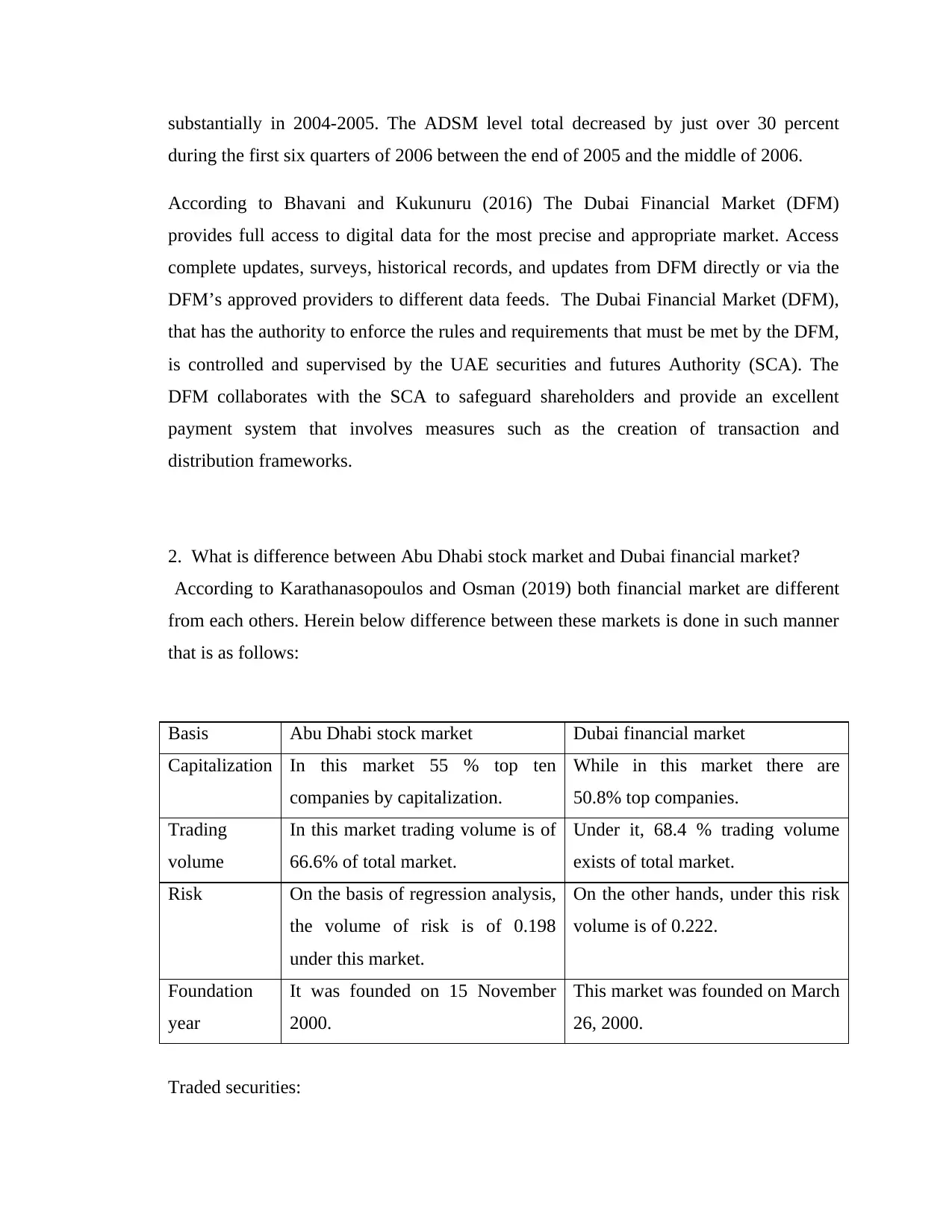

2. What is difference between Abu Dhabi stock market and Dubai financial market?

According to Karathanasopoulos and Osman (2019) both financial market are different

from each others. Herein below difference between these markets is done in such manner

that is as follows:

Basis Abu Dhabi stock market Dubai financial market

Capitalization In this market 55 % top ten

companies by capitalization.

While in this market there are

50.8% top companies.

Trading

volume

In this market trading volume is of

66.6% of total market.

Under it, 68.4 % trading volume

exists of total market.

Risk On the basis of regression analysis,

the volume of risk is of 0.198

under this market.

On the other hands, under this risk

volume is of 0.222.

Foundation

year

It was founded on 15 November

2000.

This market was founded on March

26, 2000.

Traded securities:

during the first six quarters of 2006 between the end of 2005 and the middle of 2006.

According to Bhavani and Kukunuru (2016) The Dubai Financial Market (DFM)

provides full access to digital data for the most precise and appropriate market. Access

complete updates, surveys, historical records, and updates from DFM directly or via the

DFM’s approved providers to different data feeds. The Dubai Financial Market (DFM),

that has the authority to enforce the rules and requirements that must be met by the DFM,

is controlled and supervised by the UAE securities and futures Authority (SCA). The

DFM collaborates with the SCA to safeguard shareholders and provide an excellent

payment system that involves measures such as the creation of transaction and

distribution frameworks.

2. What is difference between Abu Dhabi stock market and Dubai financial market?

According to Karathanasopoulos and Osman (2019) both financial market are different

from each others. Herein below difference between these markets is done in such manner

that is as follows:

Basis Abu Dhabi stock market Dubai financial market

Capitalization In this market 55 % top ten

companies by capitalization.

While in this market there are

50.8% top companies.

Trading

volume

In this market trading volume is of

66.6% of total market.

Under it, 68.4 % trading volume

exists of total market.

Risk On the basis of regression analysis,

the volume of risk is of 0.198

under this market.

On the other hands, under this risk

volume is of 0.222.

Foundation

year

It was founded on 15 November

2000.

This market was founded on March

26, 2000.

Traded securities:

Abu Dhabi stock market - Currently, there are three forms of shares which are exchanged

and are: equities (market listed companies), Debt (Abu Dhabi National Bank Bonds),

Debt securities, Exchanged Funds Trade (NBAD).

Dubai financial market- This financial market of the UAE mainly deal with equities,

shares, debt, debt, futures (Islamic Bonds) and sukuk (Islamic Bonds).

3. What is benefit and drawbacks of long term capital market?

According to Zhou, Simnett and Green (2017), a stock market is a bond market in

which bonds funded by long-lasting debt (over a year) or capital are purchased and sold.

Financial sector transfer the wealth of depositors, such as corporations or governments

that make long-term saving, to those that can make long-term productive usage.

Benefits:

The debt capital can be extremely versatile in raising bonds. It may be protected or

unencrypted and determine the importance they give to other liabilities (Khaidem, Saha

and Dey, 2016). They can also provide a way to manage the assets of the business with

large fixed-rate debts. This protects against rising rates of interest or currency

fluctuations.

Drawbacks:

Bondholder restrictions - Investors may enforce such agreements or

undertakings in the activity and financial results, to minimize their risk as they

lock the capital for a possibly long time.

Communication with shareholders can be somewhat restricted so that it would

be harder to change the terms of service or exemptions contrasted with dealings

with borrowers who tend to have a deeper bond.

Need to meet with many listings rules to improve the tradability of exchange-

listed bonds-in particular the duty to make details accessible to the public in the

issue process and periodically during the bond life.

4. Which types of financial market securities are used in ADIX and DFM?

and are: equities (market listed companies), Debt (Abu Dhabi National Bank Bonds),

Debt securities, Exchanged Funds Trade (NBAD).

Dubai financial market- This financial market of the UAE mainly deal with equities,

shares, debt, debt, futures (Islamic Bonds) and sukuk (Islamic Bonds).

3. What is benefit and drawbacks of long term capital market?

According to Zhou, Simnett and Green (2017), a stock market is a bond market in

which bonds funded by long-lasting debt (over a year) or capital are purchased and sold.

Financial sector transfer the wealth of depositors, such as corporations or governments

that make long-term saving, to those that can make long-term productive usage.

Benefits:

The debt capital can be extremely versatile in raising bonds. It may be protected or

unencrypted and determine the importance they give to other liabilities (Khaidem, Saha

and Dey, 2016). They can also provide a way to manage the assets of the business with

large fixed-rate debts. This protects against rising rates of interest or currency

fluctuations.

Drawbacks:

Bondholder restrictions - Investors may enforce such agreements or

undertakings in the activity and financial results, to minimize their risk as they

lock the capital for a possibly long time.

Communication with shareholders can be somewhat restricted so that it would

be harder to change the terms of service or exemptions contrasted with dealings

with borrowers who tend to have a deeper bond.

Need to meet with many listings rules to improve the tradability of exchange-

listed bonds-in particular the duty to make details accessible to the public in the

issue process and periodically during the bond life.

4. Which types of financial market securities are used in ADIX and DFM?

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

According to Naser and Hassan, 2016, financial markets are a system where

people exchange financial and derivatives instruments at low transactions costs. Some

assets include shares and securities and valuable metals. In the above mentioned markets

there are different types of securities which are traded. Herein, below analysis of these

securities has been done in such manner:

EQUITY SECURITIES- The share capital stock is a share of a company, corporation or

partnership's capital stock. Equity interests may also be acquired in other aspects of the

corporation other than those listed above. Holding a position on equities means adding to

the company's money. This can be achieved by buying shares from an organization they

like. A share of a company is a currency. The amount of money that makes the

contribution to the company is this financial interest.

DEBT SECURITIES- Debt instruments are mainly business loans. These bonds, as the

title suggests, are a debt owed to lenders by a corporation. Debt instruments such as

shares, debentures, corporate debt, etc. are numerous styles. These bonds vary in size,

leverage and other features from each other. They vary in the context that debenture

investors are the corporation's shareholders from financial assets. Unlike investors who

own the business, this applies.

DERIVATIVE SECURITIES- Derivative bonds are instruments that derive their value

from a futures contract. These financial fundamentals can include shares, inventories,

goods, currencies and other properties (Chong, Han and Park, 2017). The exchange of

such securities as other financial instruments varies with the shift in the underlying assets.

They don't have their own meaning. It should be noted that owning a product does not

mean owning an asset. Derivative investments are more advanced than equity and debt.

They work very differently and need sound knowledge of finance to reduce risks and

produce good returns.

people exchange financial and derivatives instruments at low transactions costs. Some

assets include shares and securities and valuable metals. In the above mentioned markets

there are different types of securities which are traded. Herein, below analysis of these

securities has been done in such manner:

EQUITY SECURITIES- The share capital stock is a share of a company, corporation or

partnership's capital stock. Equity interests may also be acquired in other aspects of the

corporation other than those listed above. Holding a position on equities means adding to

the company's money. This can be achieved by buying shares from an organization they

like. A share of a company is a currency. The amount of money that makes the

contribution to the company is this financial interest.

DEBT SECURITIES- Debt instruments are mainly business loans. These bonds, as the

title suggests, are a debt owed to lenders by a corporation. Debt instruments such as

shares, debentures, corporate debt, etc. are numerous styles. These bonds vary in size,

leverage and other features from each other. They vary in the context that debenture

investors are the corporation's shareholders from financial assets. Unlike investors who

own the business, this applies.

DERIVATIVE SECURITIES- Derivative bonds are instruments that derive their value

from a futures contract. These financial fundamentals can include shares, inventories,

goods, currencies and other properties (Chong, Han and Park, 2017). The exchange of

such securities as other financial instruments varies with the shift in the underlying assets.

They don't have their own meaning. It should be noted that owning a product does not

mean owning an asset. Derivative investments are more advanced than equity and debt.

They work very differently and need sound knowledge of finance to reduce risks and

produce good returns.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5. What are strategies which are used in future market for reducing financial risk?

According to Kiio and Jagongo (2017) Based on the resources or asset portfolio that are

leveraged, there are many successful hedge techniques to growing market risk. Portfolio

building, options and liquidity measures are three of the most common ones. In the aspect of

above mentioned UAE markets following strategies have been used such as:

Modern Portfolio Theory- the Modern Portfolio Theory (MPT), using liquidity to

establish asset classes that reduce volatility, is one of the principal means of doing so. For

the purpose of determining an efficient limit for the expected profit sum for the stated

risk, MPT uses statistical steps. In order to create an ideal portfolio, the theory explores

the correlation around various assets and the liquidity of assets.

Volatility Index Indicator- The Volatility Index (VIX) measure can be used to hedge

investors as well. The VIX tests and applies the S&P 500 benchmark for the

backwardation of cash calls (Adam, Marcet and Nicolini, 2016). The fear flange is often

named the VIX when its volatility increases during times when it is continued to increase.

A moderate level of volatility is typically below 20 and a volatile level of 30. Exchanged

funds (ETFs) are available that monitor the VIX. As a liquidity-specific hedge,

shareholders can use ETF equities or options to extend the VIX.

6. Analysis of company listed in Abu Dhabi stock market:

Sharjah Islamic Bank is financial sector company which is listed in Abu Dhabi stock

market. Analysis of this company has been done below in such manner that is as follows:

Overview of company:

Sharjah Islamic Bank is a publically traded Islamic bank, once recognized as Sharjah

National Bank, which is located in the UAE Sharjah Emirate. The corporation was

incorporated in 1976 and became a fully Shariah-compatible bank in 2004 (About

financial statement of Sharjah Islamic Bank, 2019).

According to Kiio and Jagongo (2017) Based on the resources or asset portfolio that are

leveraged, there are many successful hedge techniques to growing market risk. Portfolio

building, options and liquidity measures are three of the most common ones. In the aspect of

above mentioned UAE markets following strategies have been used such as:

Modern Portfolio Theory- the Modern Portfolio Theory (MPT), using liquidity to

establish asset classes that reduce volatility, is one of the principal means of doing so. For

the purpose of determining an efficient limit for the expected profit sum for the stated

risk, MPT uses statistical steps. In order to create an ideal portfolio, the theory explores

the correlation around various assets and the liquidity of assets.

Volatility Index Indicator- The Volatility Index (VIX) measure can be used to hedge

investors as well. The VIX tests and applies the S&P 500 benchmark for the

backwardation of cash calls (Adam, Marcet and Nicolini, 2016). The fear flange is often

named the VIX when its volatility increases during times when it is continued to increase.

A moderate level of volatility is typically below 20 and a volatile level of 30. Exchanged

funds (ETFs) are available that monitor the VIX. As a liquidity-specific hedge,

shareholders can use ETF equities or options to extend the VIX.

6. Analysis of company listed in Abu Dhabi stock market:

Sharjah Islamic Bank is financial sector company which is listed in Abu Dhabi stock

market. Analysis of this company has been done below in such manner that is as follows:

Overview of company:

Sharjah Islamic Bank is a publically traded Islamic bank, once recognized as Sharjah

National Bank, which is located in the UAE Sharjah Emirate. The corporation was

incorporated in 1976 and became a fully Shariah-compatible bank in 2004 (About

financial statement of Sharjah Islamic Bank, 2019).

Headquarter of company- Sharjah, United Arab Emirates.

CEO- Muhammad Abdullah

Company was founded in year 1976.

This bank is listed in Abu Dhabi stock market.

Symbol:

This company does not have any debt in last few years.

Sharjah Islamic Bank is involved in financial sector and provides financial services such

as:

Deposit of money- This is the main service that is provided by above bank. They

accept funds from general public and provide interest on deposited amount.

Loan services- It is a type of function that is offered by all financial institutes. The

above bank gives loan to needed persons at a lower cost and rate. Due to which it

becomes easier for people to acquire fund. As well as process of providing loan is

also easier.

Other financial services- Apart from above mentioned financial services, above bank

provide some other services such as locker facility, security of deposited items and

many more.

Size of company:

Particulars 2019

CEO- Muhammad Abdullah

Company was founded in year 1976.

This bank is listed in Abu Dhabi stock market.

Symbol:

This company does not have any debt in last few years.

Sharjah Islamic Bank is involved in financial sector and provides financial services such

as:

Deposit of money- This is the main service that is provided by above bank. They

accept funds from general public and provide interest on deposited amount.

Loan services- It is a type of function that is offered by all financial institutes. The

above bank gives loan to needed persons at a lower cost and rate. Due to which it

becomes easier for people to acquire fund. As well as process of providing loan is

also easier.

Other financial services- Apart from above mentioned financial services, above bank

provide some other services such as locker facility, security of deposited items and

many more.

Size of company:

Particulars 2019

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Total assets 924 Million

Total sales 1819 Million

Total employees 1194

EPS and PE ratio:

Earnings per share ratio- The EPS ratio calculates the quantity of net revenue dollars

received from each ordinary shares share for a specified duration. It is determined by the

division by the amount of common shares remaining during the duration of the net profit

less preferred dividends.

PE ratio- The ratio between a company's price-earnings and its profits is also known as

the P / E or the PER ratio. The ratio is used to measure firms to see if they are

underestimated or overestimated.

Below analysis of above ratio is done regards to Sharjah Islamic bank in such manner:

Sharjah

Islamic

Bank Dubai Islamic bank

2016 2017 2018 2016 2017 2018

Earnings per

share 0.17 0.15 0.15 0.6 0.61 0.72

P/E ratio 7.3 7.56 7.51 8.31 7.94 6.92

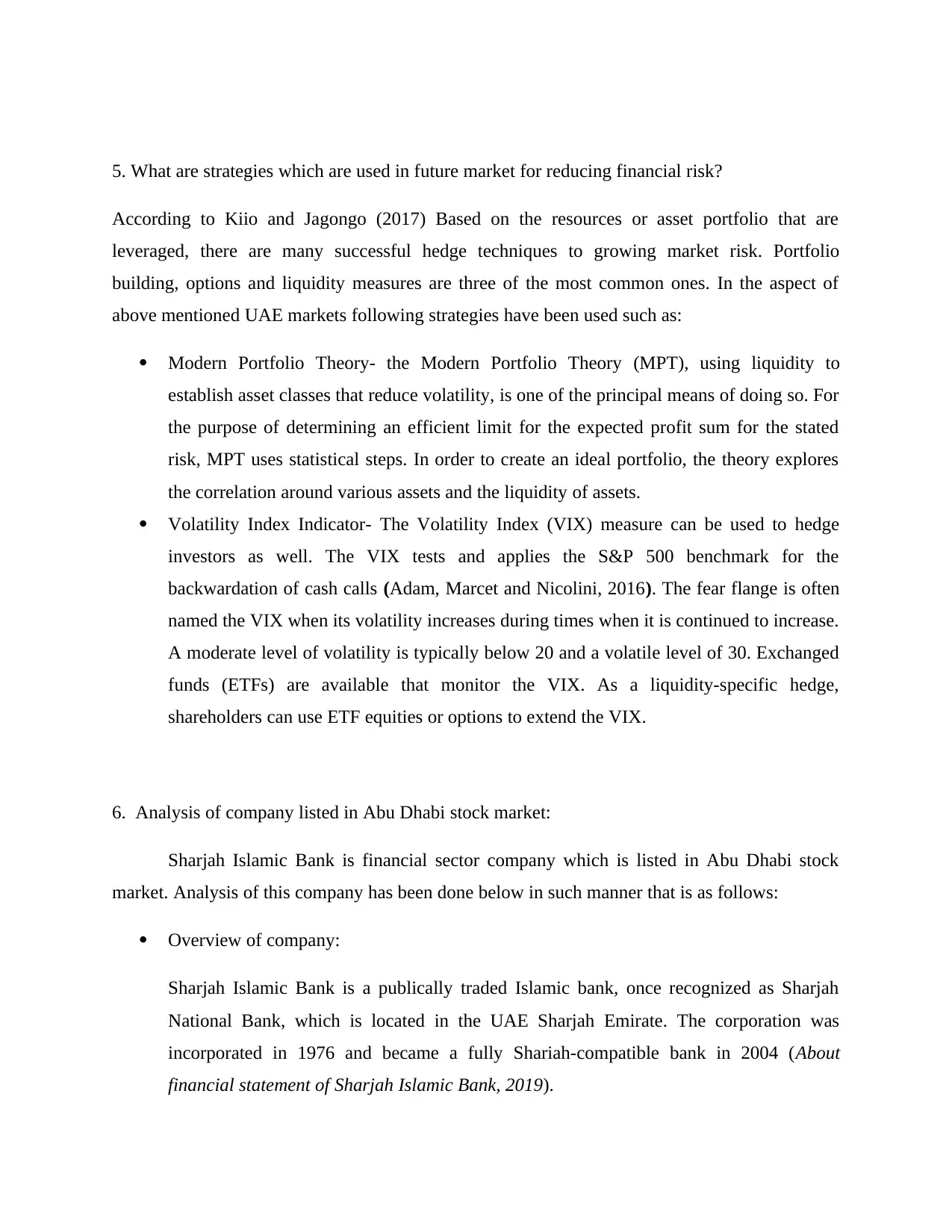

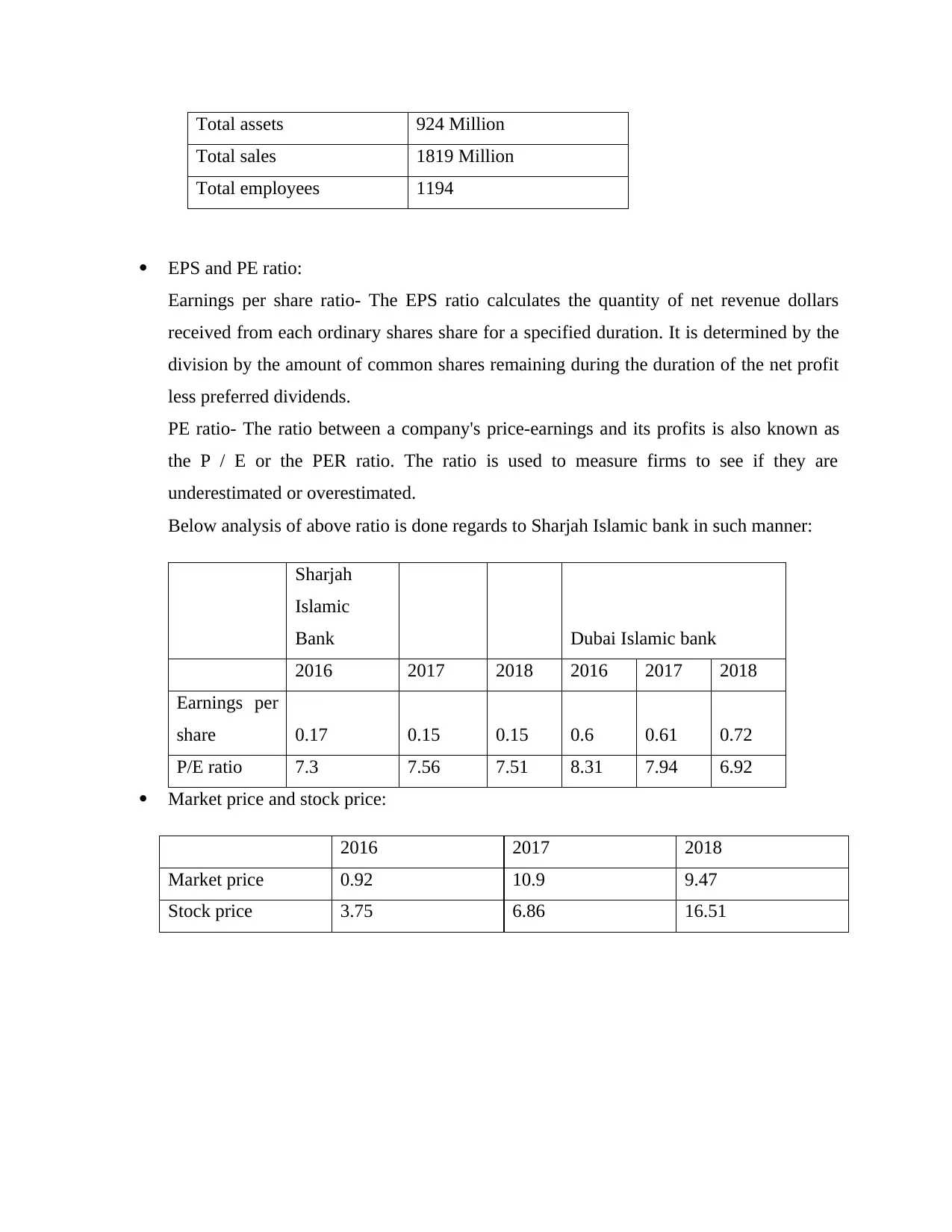

Market price and stock price:

2016 2017 2018

Market price 0.92 10.9 9.47

Stock price 3.75 6.86 16.51

Total sales 1819 Million

Total employees 1194

EPS and PE ratio:

Earnings per share ratio- The EPS ratio calculates the quantity of net revenue dollars

received from each ordinary shares share for a specified duration. It is determined by the

division by the amount of common shares remaining during the duration of the net profit

less preferred dividends.

PE ratio- The ratio between a company's price-earnings and its profits is also known as

the P / E or the PER ratio. The ratio is used to measure firms to see if they are

underestimated or overestimated.

Below analysis of above ratio is done regards to Sharjah Islamic bank in such manner:

Sharjah

Islamic

Bank Dubai Islamic bank

2016 2017 2018 2016 2017 2018

Earnings per

share 0.17 0.15 0.15 0.6 0.61 0.72

P/E ratio 7.3 7.56 7.51 8.31 7.94 6.92

Market price and stock price:

2016 2017 2018

Market price 0.92 10.9 9.47

Stock price 3.75 6.86 16.51

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2016 2017 2018

0

2

4

6

8

10

12

14

16

18

3.75

6.86

16.51

Market price

Stock price

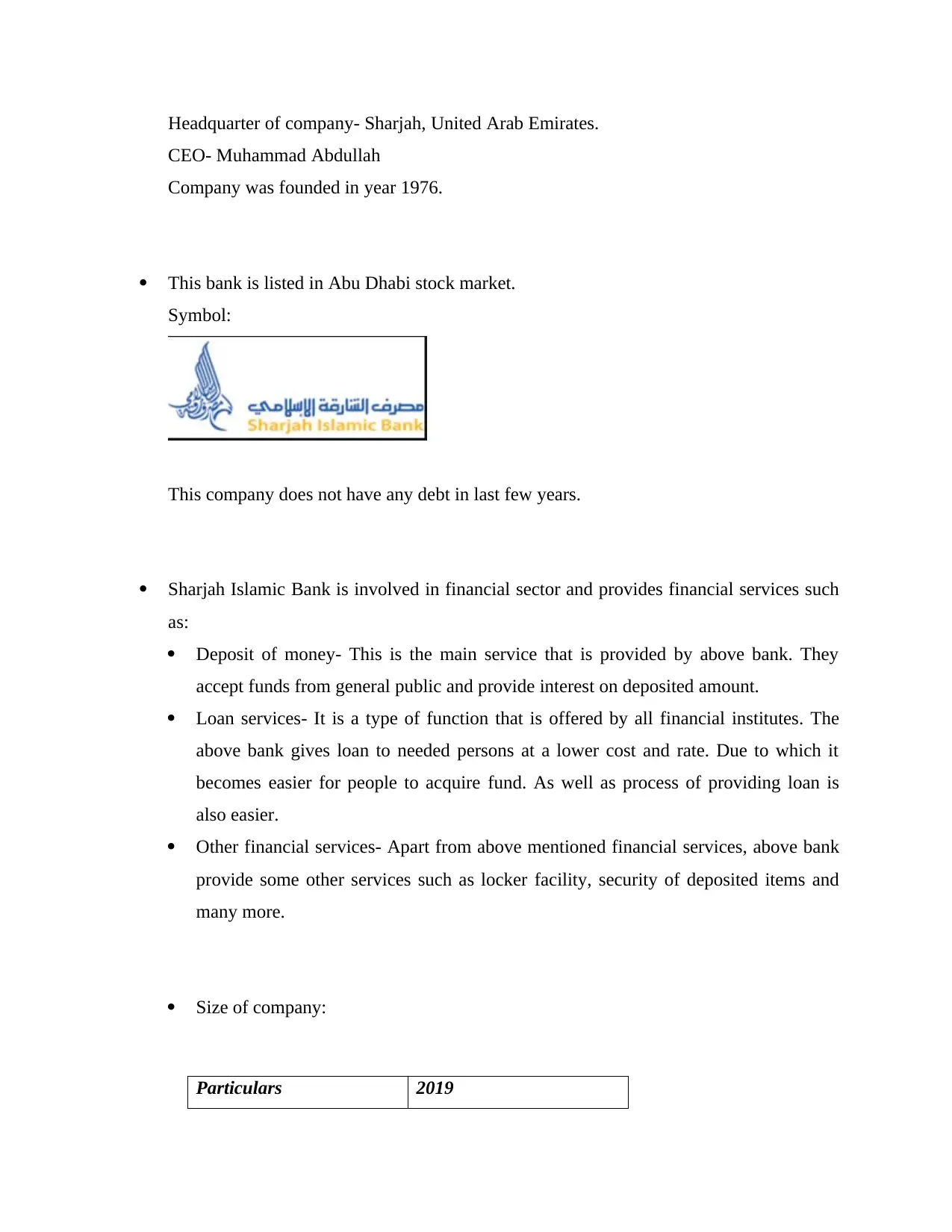

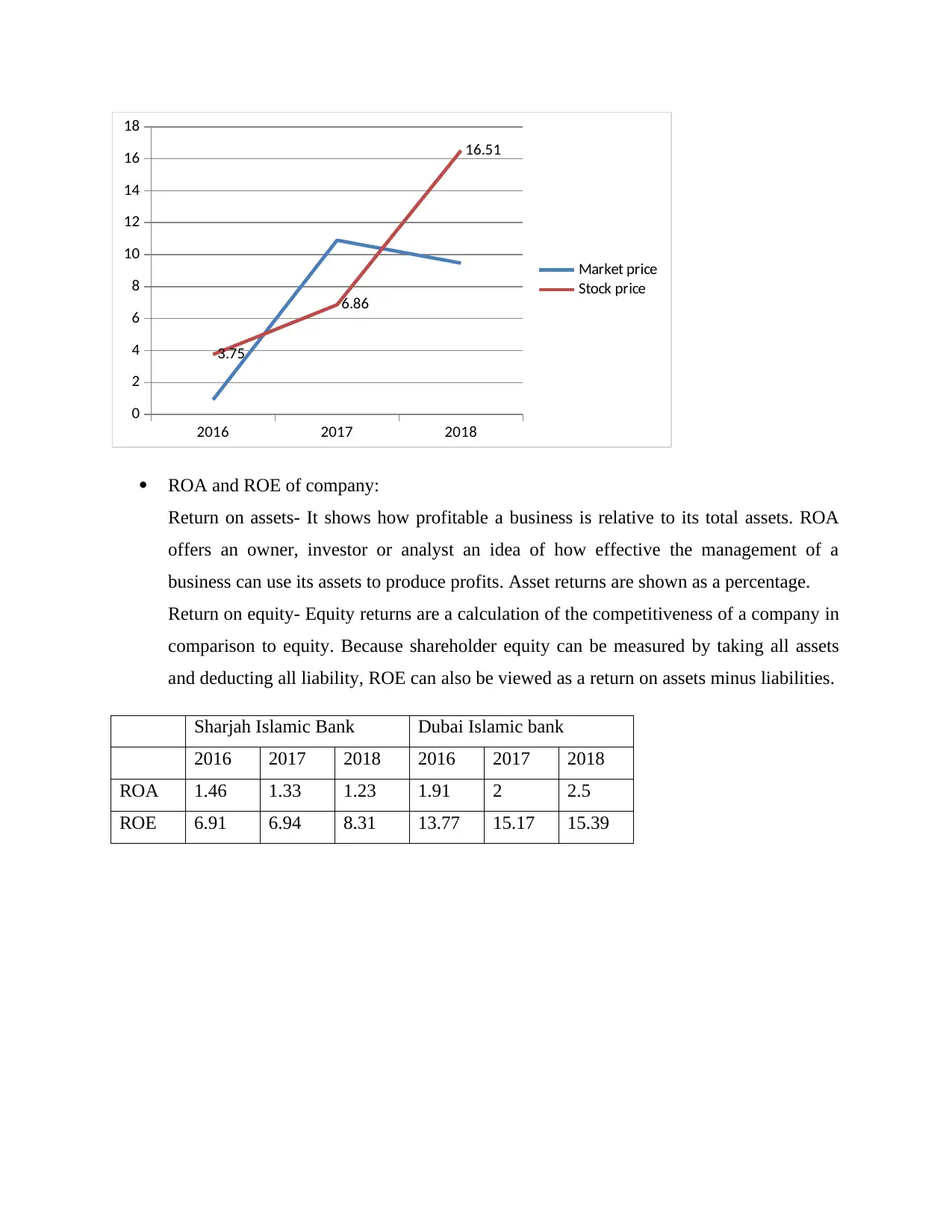

ROA and ROE of company:

Return on assets- It shows how profitable a business is relative to its total assets. ROA

offers an owner, investor or analyst an idea of how effective the management of a

business can use its assets to produce profits. Asset returns are shown as a percentage.

Return on equity- Equity returns are a calculation of the competitiveness of a company in

comparison to equity. Because shareholder equity can be measured by taking all assets

and deducting all liability, ROE can also be viewed as a return on assets minus liabilities.

Sharjah Islamic Bank Dubai Islamic bank

2016 2017 2018 2016 2017 2018

ROA 1.46 1.33 1.23 1.91 2 2.5

ROE 6.91 6.94 8.31 13.77 15.17 15.39

0

2

4

6

8

10

12

14

16

18

3.75

6.86

16.51

Market price

Stock price

ROA and ROE of company:

Return on assets- It shows how profitable a business is relative to its total assets. ROA

offers an owner, investor or analyst an idea of how effective the management of a

business can use its assets to produce profits. Asset returns are shown as a percentage.

Return on equity- Equity returns are a calculation of the competitiveness of a company in

comparison to equity. Because shareholder equity can be measured by taking all assets

and deducting all liability, ROE can also be viewed as a return on assets minus liabilities.

Sharjah Islamic Bank Dubai Islamic bank

2016 2017 2018 2016 2017 2018

ROA 1.46 1.33 1.23 1.91 2 2.5

ROE 6.91 6.94 8.31 13.77 15.17 15.39

2016 2017 2018 2016 2017 2018

Sharjah Islamic Bank Dubai Islamic bank

0

2

4

6

8

10

12

14

16

18

1.46 1.33 1.23 1.91 2 2.5

6.91 6.94

8.31

13.77

15.17 15.39

ROA

ROE

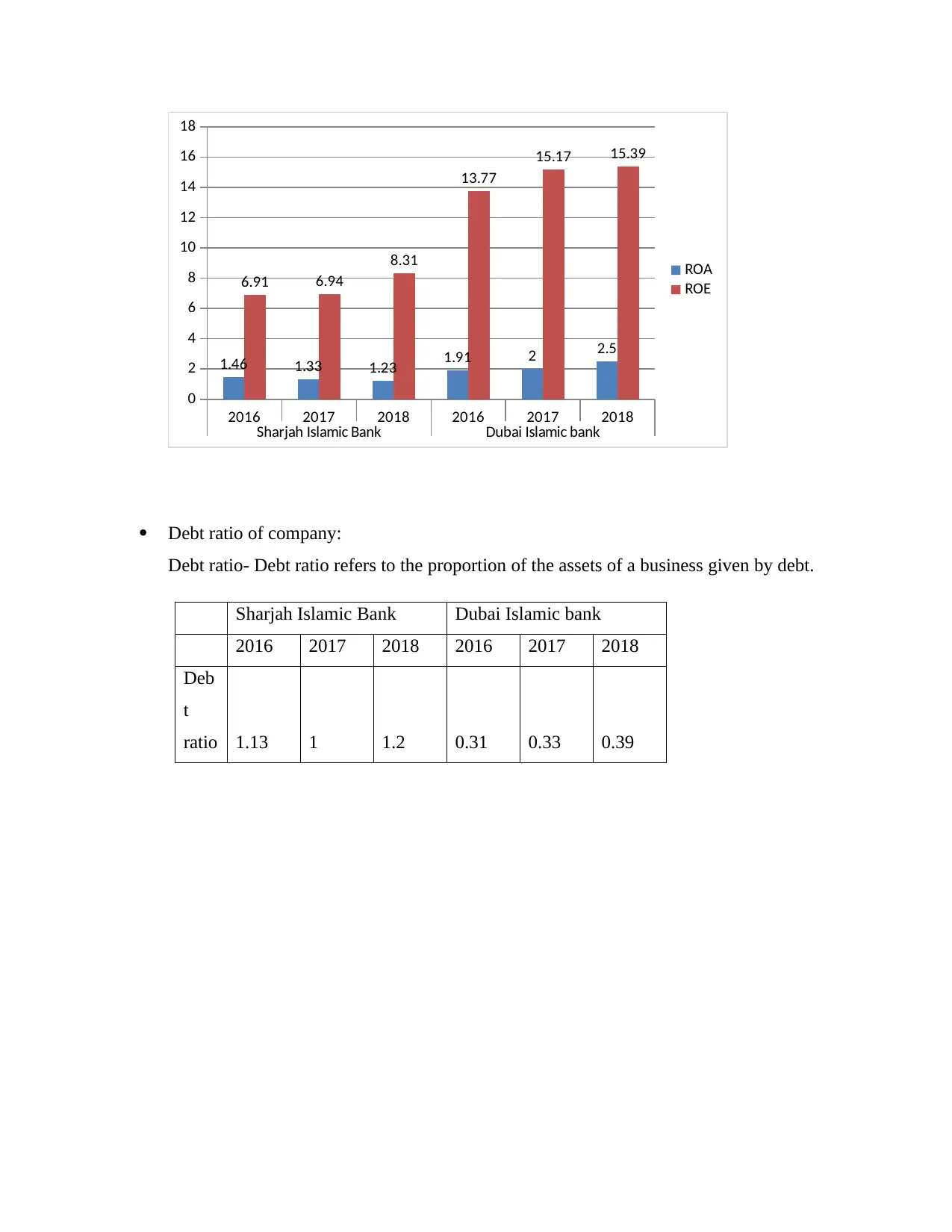

Debt ratio of company:

Debt ratio- Debt ratio refers to the proportion of the assets of a business given by debt.

Sharjah Islamic Bank Dubai Islamic bank

2016 2017 2018 2016 2017 2018

Deb

t

ratio 1.13 1 1.2 0.31 0.33 0.39

Sharjah Islamic Bank Dubai Islamic bank

0

2

4

6

8

10

12

14

16

18

1.46 1.33 1.23 1.91 2 2.5

6.91 6.94

8.31

13.77

15.17 15.39

ROA

ROE

Debt ratio of company:

Debt ratio- Debt ratio refers to the proportion of the assets of a business given by debt.

Sharjah Islamic Bank Dubai Islamic bank

2016 2017 2018 2016 2017 2018

Deb

t

ratio 1.13 1 1.2 0.31 0.33 0.39

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.