ACC210 - Management Accounting: Budgeting, Costing and Performance

VerifiedAdded on 2023/06/13

|17

|3521

|466

Report

AI Summary

This management accounting report provides a detailed analysis of various concepts and applications, including manufacturing cost flows, international issues in management accounting, and comprehensive manufacturing budgets. It covers topics such as the advantages of Australian dairy products in China, differences in Western and Chinese approaches to management accounting, and the concepts of Guanxi and power distance. The report includes a five-year budget analysis, an evaluation of increased production constraints, and a report to the CEO on project opportunities and risks. Furthermore, it distinguishes between variable and fixed costs, product and period costs, and discusses the relevant range concept. The report also features a strategic management accounting case study, including a before-and-after budget comparison and an ethics case study, offering advice and recommended actions. Students can find similar assignments and study resources on Desklib.

MANAGEMENT ACCOUNTING

Management accounting

Name of the student

Name of the university

Student ID

Author note

Management accounting

Name of the student

Name of the university

Student ID

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1MANAGEMENT ACCOUNTING

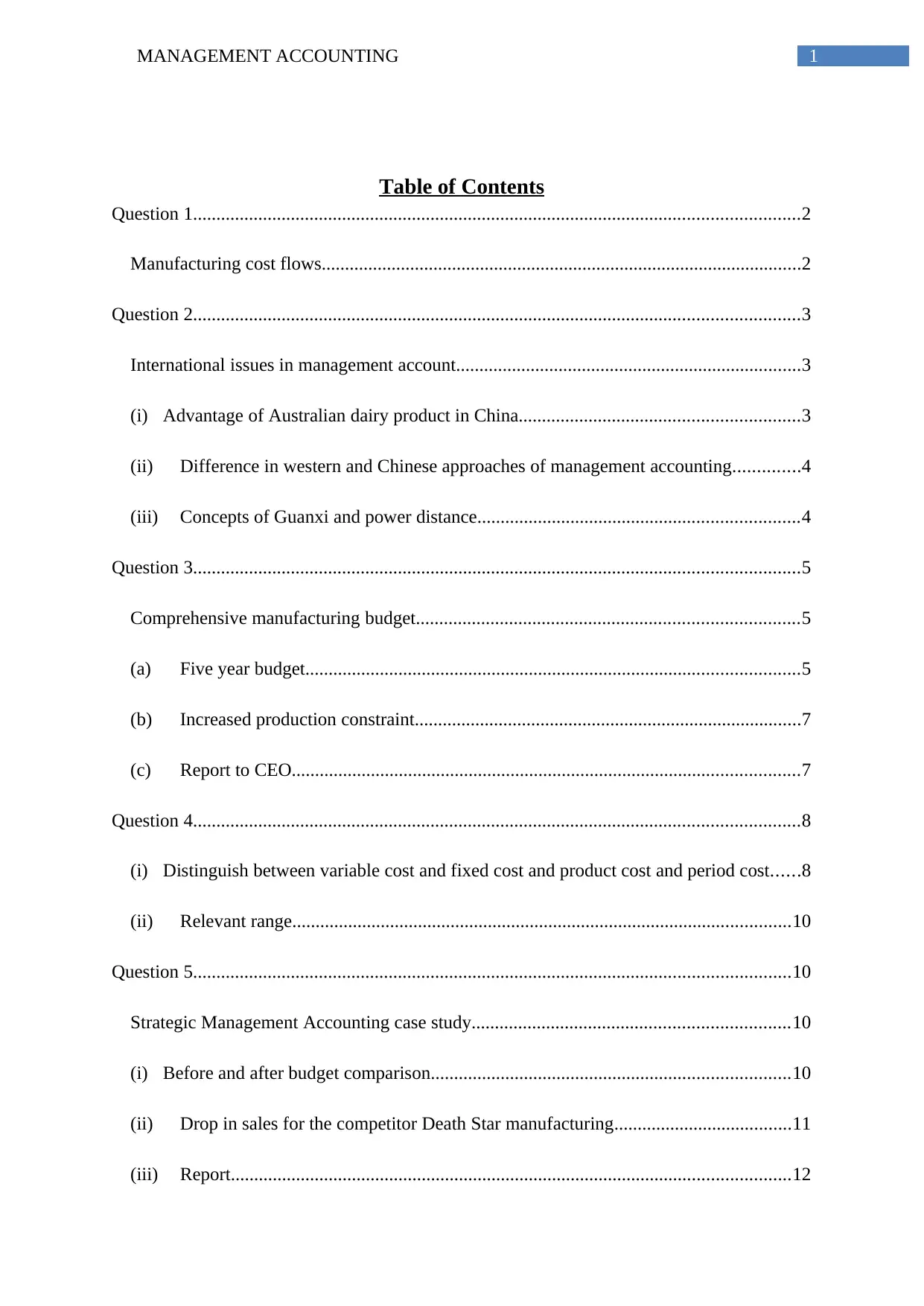

Table of Contents

Question 1..................................................................................................................................2

Manufacturing cost flows.......................................................................................................2

Question 2..................................................................................................................................3

International issues in management account..........................................................................3

(i) Advantage of Australian dairy product in China............................................................3

(ii) Difference in western and Chinese approaches of management accounting..............4

(iii) Concepts of Guanxi and power distance.....................................................................4

Question 3..................................................................................................................................5

Comprehensive manufacturing budget..................................................................................5

(a) Five year budget..........................................................................................................5

(b) Increased production constraint...................................................................................7

(c) Report to CEO.............................................................................................................7

Question 4..................................................................................................................................8

(i) Distinguish between variable cost and fixed cost and product cost and period cost......8

(ii) Relevant range...........................................................................................................10

Question 5................................................................................................................................10

Strategic Management Accounting case study....................................................................10

(i) Before and after budget comparison.............................................................................10

(ii) Drop in sales for the competitor Death Star manufacturing......................................11

(iii) Report........................................................................................................................12

Table of Contents

Question 1..................................................................................................................................2

Manufacturing cost flows.......................................................................................................2

Question 2..................................................................................................................................3

International issues in management account..........................................................................3

(i) Advantage of Australian dairy product in China............................................................3

(ii) Difference in western and Chinese approaches of management accounting..............4

(iii) Concepts of Guanxi and power distance.....................................................................4

Question 3..................................................................................................................................5

Comprehensive manufacturing budget..................................................................................5

(a) Five year budget..........................................................................................................5

(b) Increased production constraint...................................................................................7

(c) Report to CEO.............................................................................................................7

Question 4..................................................................................................................................8

(i) Distinguish between variable cost and fixed cost and product cost and period cost......8

(ii) Relevant range...........................................................................................................10

Question 5................................................................................................................................10

Strategic Management Accounting case study....................................................................10

(i) Before and after budget comparison.............................................................................10

(ii) Drop in sales for the competitor Death Star manufacturing......................................11

(iii) Report........................................................................................................................12

2MANAGEMENT ACCOUNTING

Question 5................................................................................................................................12

Ethics case study..................................................................................................................12

(i) Advice to Burdon..........................................................................................................12

(ii) Recommended actions for Burdon............................................................................13

Reference..................................................................................................................................14

Question 5................................................................................................................................12

Ethics case study..................................................................................................................12

(i) Advice to Burdon..........................................................................................................12

(ii) Recommended actions for Burdon............................................................................13

Reference..................................................................................................................................14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3MANAGEMENT ACCOUNTING

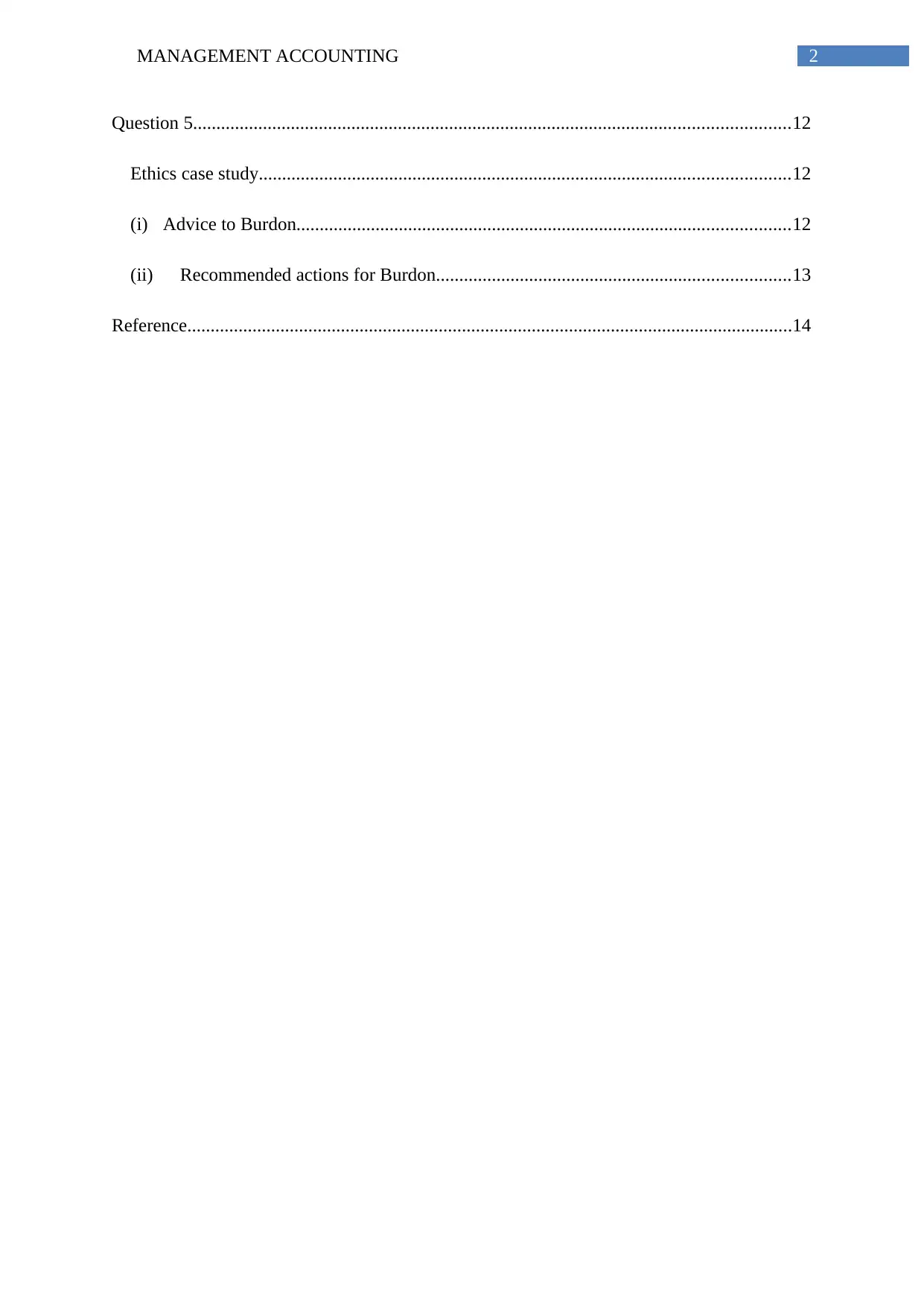

Question 1

Manufacturing cost flows

Cost of goods manufactured schedule

Opening work in progress $ 6,20,000.00

Direct material

Opening raw material inventory $ 4,86,000.00

Add: Raw material purchases $ 86,51,500.00

Add: Freight inward $ 1,00,500.00

Raw material available for use $ 92,38,000.00

Less: Closing raw material inventory $ 7,86,500.00

Direct material used $ 84,51,500.00

Direct labour cost $ 43,28,500.00

Manufacturing overhead

Indirect labour $ 12,50,000.00

Direct manufacturing overhead $ 22,55,500.00

Other manufacturing overhead $ 8,47,000.00

Factory rent $ 2,50,000.00

Factory heat, light and power $ 15,67,500.00

Total manufacturing overhead $ 61,70,000.00

Less: Closing work in progress $ 11,87,500.00

Cost of goods manufactured $ 183,82,500.00

Cost of goods sold schedule

Cost of goods manufactured $ 183,82,500.00

Add: Opening finished goods inventory $ 2,75,500.00

Cost of goods available for sale $ 186,58,000.00

Less: Closing finished goods inventory $ 7,52,000.00

Cost of goods sold $ 179,06,000.00

Income statement for Snoozy Trading Co Ltd

Particulars Amount Amount

Sales revenue $ 357,26,840.00

Less: Cost of goods sold $ 179,06,000.00

Gross profit $ 178,20,840.00

Less: Selling and administration expenses

Sales Rep Salary and Commission Costs $ 33,24,500.00

Administration Salaries and Costs $ 8,75,500.00

Question 1

Manufacturing cost flows

Cost of goods manufactured schedule

Opening work in progress $ 6,20,000.00

Direct material

Opening raw material inventory $ 4,86,000.00

Add: Raw material purchases $ 86,51,500.00

Add: Freight inward $ 1,00,500.00

Raw material available for use $ 92,38,000.00

Less: Closing raw material inventory $ 7,86,500.00

Direct material used $ 84,51,500.00

Direct labour cost $ 43,28,500.00

Manufacturing overhead

Indirect labour $ 12,50,000.00

Direct manufacturing overhead $ 22,55,500.00

Other manufacturing overhead $ 8,47,000.00

Factory rent $ 2,50,000.00

Factory heat, light and power $ 15,67,500.00

Total manufacturing overhead $ 61,70,000.00

Less: Closing work in progress $ 11,87,500.00

Cost of goods manufactured $ 183,82,500.00

Cost of goods sold schedule

Cost of goods manufactured $ 183,82,500.00

Add: Opening finished goods inventory $ 2,75,500.00

Cost of goods available for sale $ 186,58,000.00

Less: Closing finished goods inventory $ 7,52,000.00

Cost of goods sold $ 179,06,000.00

Income statement for Snoozy Trading Co Ltd

Particulars Amount Amount

Sales revenue $ 357,26,840.00

Less: Cost of goods sold $ 179,06,000.00

Gross profit $ 178,20,840.00

Less: Selling and administration expenses

Sales Rep Salary and Commission Costs $ 33,24,500.00

Administration Salaries and Costs $ 8,75,500.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

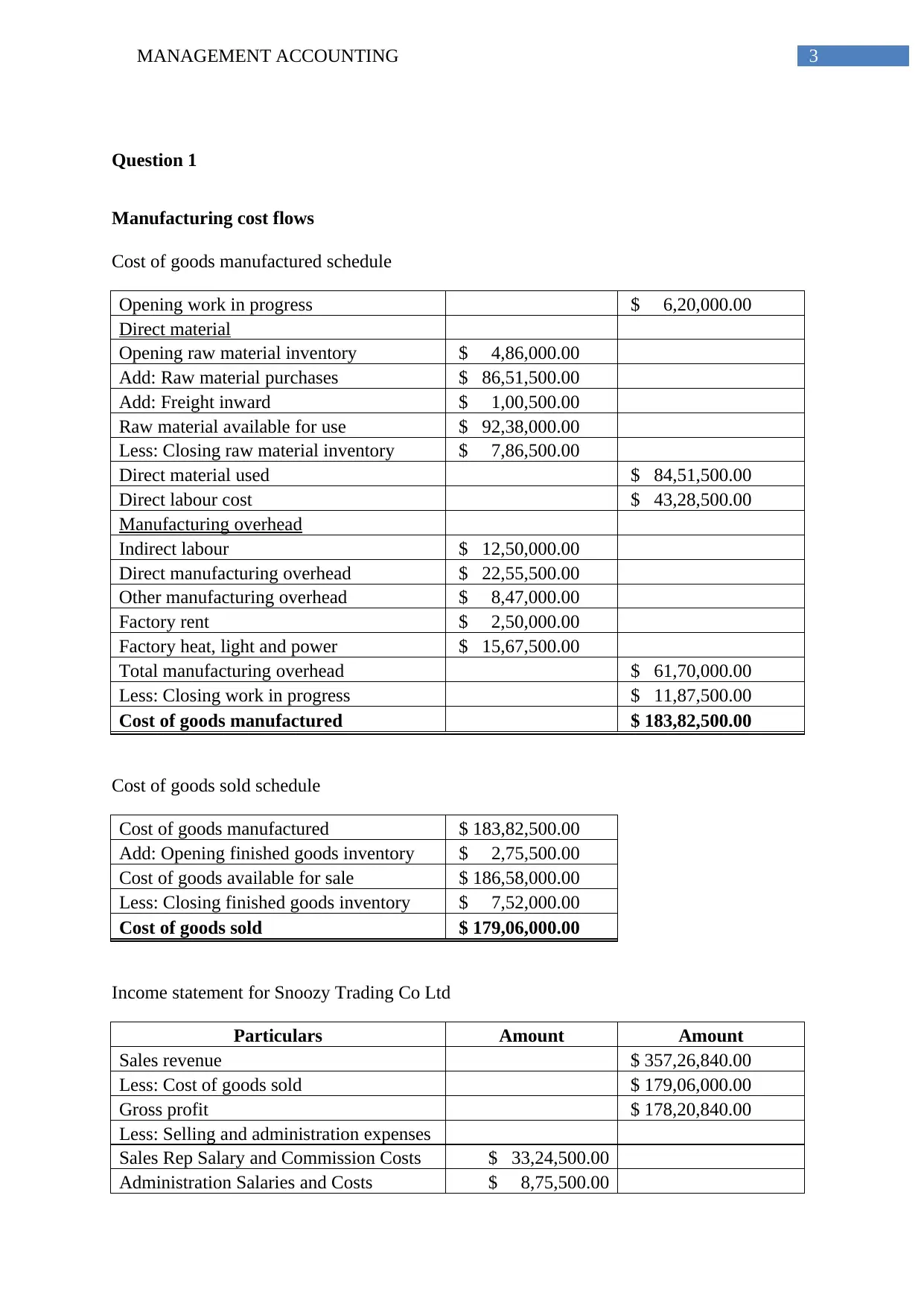

4MANAGEMENT ACCOUNTING

Accounting and audit costs $ 1,50,000.00

Sales & marketing expenses $ 8,71,500.00

Total expenses $ 52,21,500.00

Net profit before interest and tax $ 125,99,340.00

Less: Financing costs $ 5,47,500.00

Net profit before tax $ 120,51,840.00

Less: Tax @ 30% $ 36,15,552.00

Net profit after tax $ 84,36,288.00

Question 2

International issues in management account

(i) Advantage of Australian dairy product in China

Australia can be benefitted from exporting their dairy products in China as the global

demand for the dairy products are currently in high demand in China. Further, Australia can

be benefitted as the free trade deal with China will reduce the export tariff and Australia can

take the advantages of that fact. Moreover over next 4 to 11 years tariff on the formula milk

on infant ay the rate of 15% will be removed. It will increase demand for quality, safe and

healthy and protein rich dairy products in China (Douphrate et al., 2013)

Reduction of export tariff will improve the overall investment status of the company.

Further it will improve trade balance and reduce the private consumption. However, as per

competitive effect even the reduction of tariff will lead to higher demand for import in the

exporting country, the impact of such increase in demand will not significant owing to low

price elasticity of the product. However, with the reduction in export tariff the exporting

company will manufacture more units of product for exporting as it will have more amount

for investment (Fuller & Beghin, 2015).

Accounting and audit costs $ 1,50,000.00

Sales & marketing expenses $ 8,71,500.00

Total expenses $ 52,21,500.00

Net profit before interest and tax $ 125,99,340.00

Less: Financing costs $ 5,47,500.00

Net profit before tax $ 120,51,840.00

Less: Tax @ 30% $ 36,15,552.00

Net profit after tax $ 84,36,288.00

Question 2

International issues in management account

(i) Advantage of Australian dairy product in China

Australia can be benefitted from exporting their dairy products in China as the global

demand for the dairy products are currently in high demand in China. Further, Australia can

be benefitted as the free trade deal with China will reduce the export tariff and Australia can

take the advantages of that fact. Moreover over next 4 to 11 years tariff on the formula milk

on infant ay the rate of 15% will be removed. It will increase demand for quality, safe and

healthy and protein rich dairy products in China (Douphrate et al., 2013)

Reduction of export tariff will improve the overall investment status of the company.

Further it will improve trade balance and reduce the private consumption. However, as per

competitive effect even the reduction of tariff will lead to higher demand for import in the

exporting country, the impact of such increase in demand will not significant owing to low

price elasticity of the product. However, with the reduction in export tariff the exporting

company will manufacture more units of product for exporting as it will have more amount

for investment (Fuller & Beghin, 2015).

5MANAGEMENT ACCOUNTING

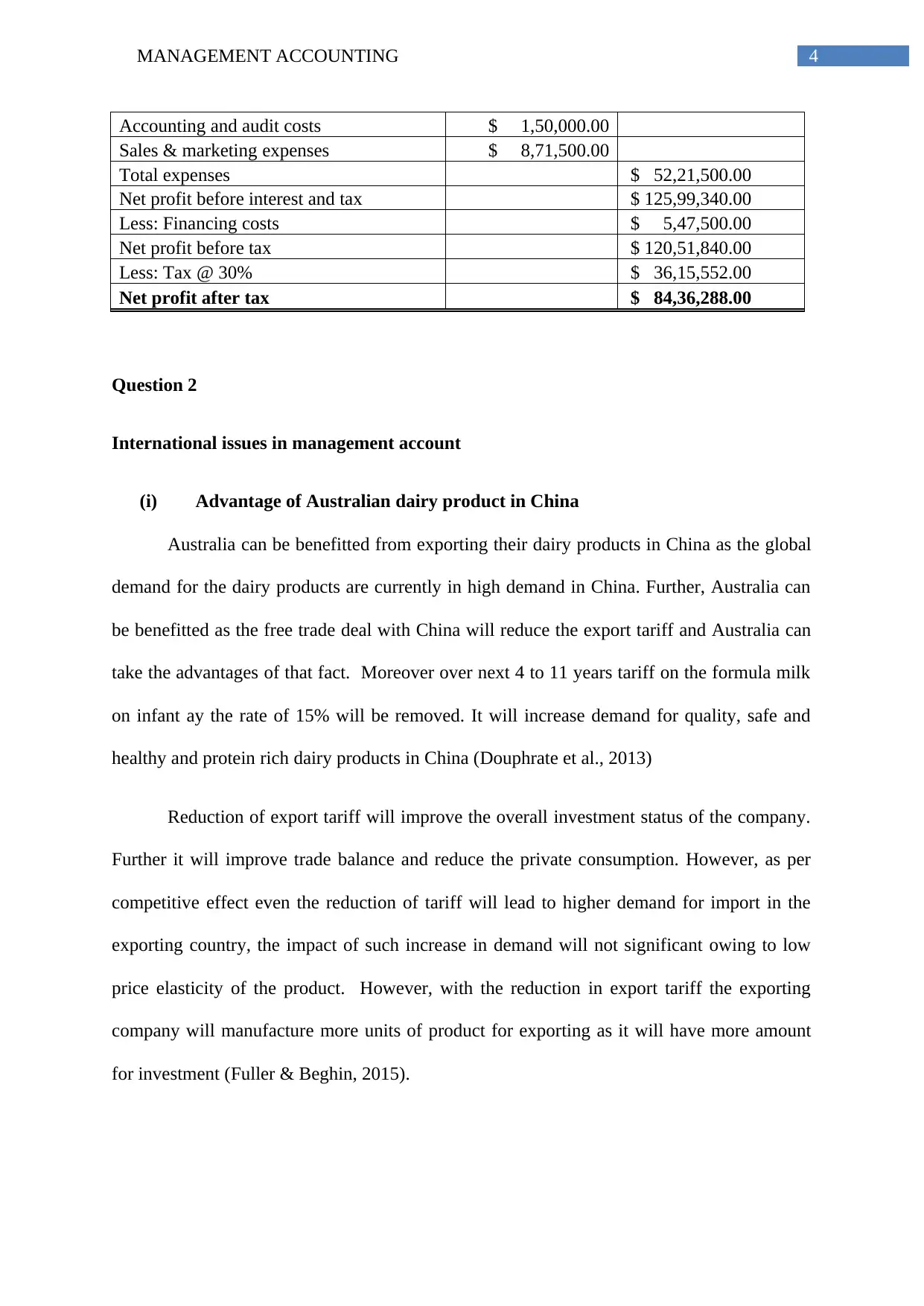

(ii) Difference in western and Chinese approaches of management accounting

In China the system of management accounting is developing for the last 3 decades

and it is among the other fields that is undergoing rapid changes. Concepts of western

management accounting have been in practice in China from 1970s and since then it is

developing steadily. Generally it is assumed that there is no consistent and comprehensive

theory for management accounting anywhere in the world. Therefore, various discrete

management accounting branches like activity based costing faces various challenges in

application and adoption. It is further difficult while quantifying the information and values

in management accounting for the purpose of strategic management and decision making.

Further, in China the management accounting is not properly emphasized from the firm as

well the government perspectives. Moreover, there are lack of required software for

supporting the calculations and decision making under management accounting.

(iii) Concepts of Guanxi and power distance

Guanxi refers to have strong relationship and personal trust with someone that can

involve exchange of favours and moral obligations. Sometimes it is wrongly perceived under

western business as bordering the unethical behaviour related to corruption. Guanxi is

generally translated as relationship, networks or connections (Kaynak, Wong & Leung,

2013). However, none of the mentioned terms justifies the complex and fundamental concept

of the term and its role in the Chinese culture. The term can also be used to state the network

of contacts that the individual can call while something is required to be done (Luo, 2013).

On the other hand, the term power distance is stated as the extent by which less

powerful members of the institutions and organization expect and accept that the power is

unequally distributed. In Australia power distance is low that is there is no gap among the

wealthy and poor people. On the contrary, power distance in China is at very high level

(Sriramesh, 2013). Therefore, the culture inequalities in Chian are normal and acceptable.

(ii) Difference in western and Chinese approaches of management accounting

In China the system of management accounting is developing for the last 3 decades

and it is among the other fields that is undergoing rapid changes. Concepts of western

management accounting have been in practice in China from 1970s and since then it is

developing steadily. Generally it is assumed that there is no consistent and comprehensive

theory for management accounting anywhere in the world. Therefore, various discrete

management accounting branches like activity based costing faces various challenges in

application and adoption. It is further difficult while quantifying the information and values

in management accounting for the purpose of strategic management and decision making.

Further, in China the management accounting is not properly emphasized from the firm as

well the government perspectives. Moreover, there are lack of required software for

supporting the calculations and decision making under management accounting.

(iii) Concepts of Guanxi and power distance

Guanxi refers to have strong relationship and personal trust with someone that can

involve exchange of favours and moral obligations. Sometimes it is wrongly perceived under

western business as bordering the unethical behaviour related to corruption. Guanxi is

generally translated as relationship, networks or connections (Kaynak, Wong & Leung,

2013). However, none of the mentioned terms justifies the complex and fundamental concept

of the term and its role in the Chinese culture. The term can also be used to state the network

of contacts that the individual can call while something is required to be done (Luo, 2013).

On the other hand, the term power distance is stated as the extent by which less

powerful members of the institutions and organization expect and accept that the power is

unequally distributed. In Australia power distance is low that is there is no gap among the

wealthy and poor people. On the contrary, power distance in China is at very high level

(Sriramesh, 2013). Therefore, the culture inequalities in Chian are normal and acceptable.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6MANAGEMENT ACCOUNTING

They feel more comfortable when the superiors do not waive the power to the subordinates.

On the other hand, the superiors will prefer to take decisions themselves (Hu, Chand &

Evans, 2013).

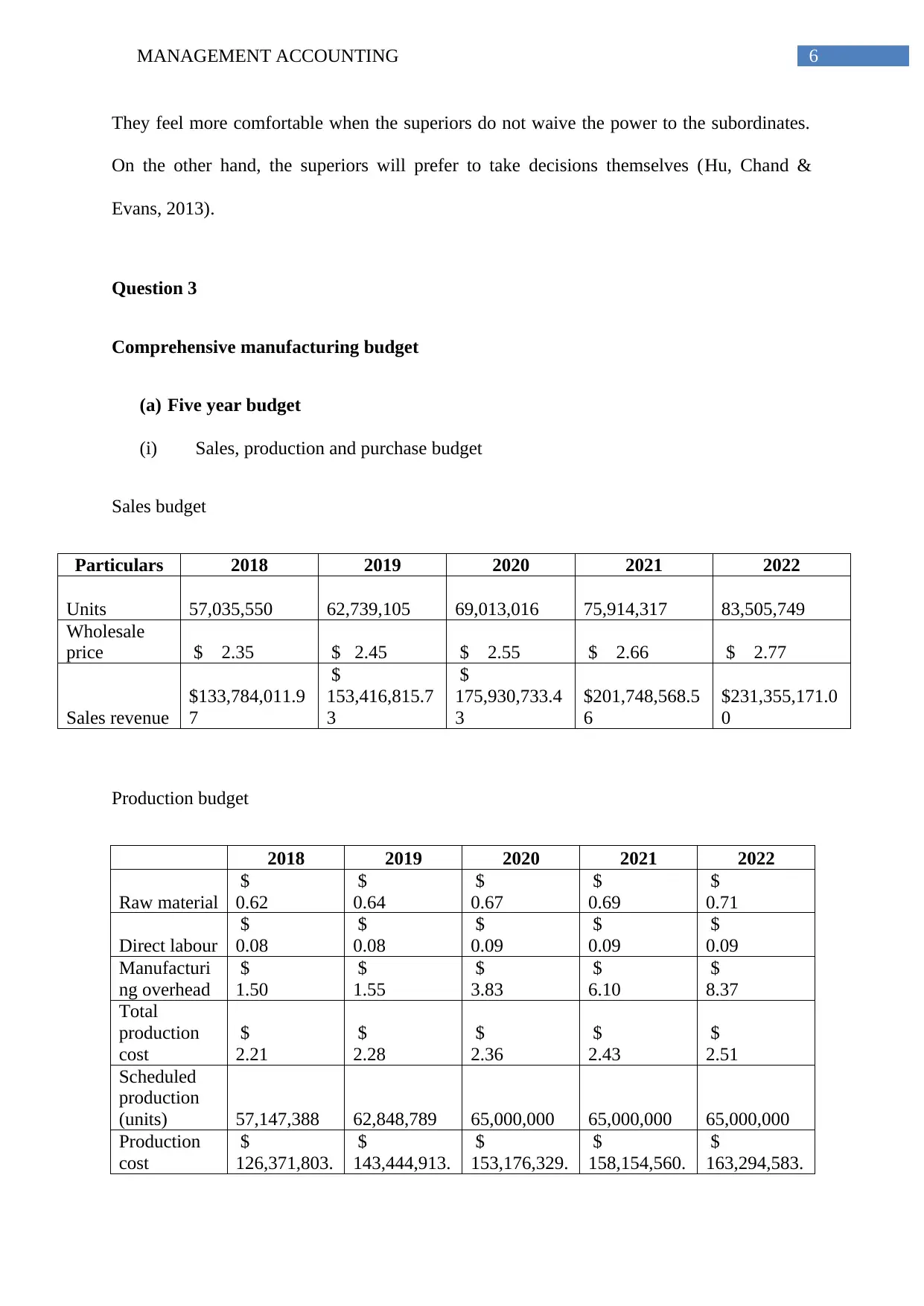

Question 3

Comprehensive manufacturing budget

(a) Five year budget

(i) Sales, production and purchase budget

Sales budget

Particulars 2018 2019 2020 2021 2022

Units 57,035,550 62,739,105 69,013,016 75,914,317 83,505,749

Wholesale

price $ 2.35 $ 2.45 $ 2.55 $ 2.66 $ 2.77

Sales revenue

$133,784,011.9

7

$

153,416,815.7

3

$

175,930,733.4

3

$201,748,568.5

6

$231,355,171.0

0

Production budget

2018 2019 2020 2021 2022

Raw material

$

0.62

$

0.64

$

0.67

$

0.69

$

0.71

Direct labour

$

0.08

$

0.08

$

0.09

$

0.09

$

0.09

Manufacturi

ng overhead

$

1.50

$

1.55

$

3.83

$

6.10

$

8.37

Total

production

cost

$

2.21

$

2.28

$

2.36

$

2.43

$

2.51

Scheduled

production

(units) 57,147,388 62,848,789 65,000,000 65,000,000 65,000,000

Production

cost

$

126,371,803.

$

143,444,913.

$

153,176,329.

$

158,154,560.

$

163,294,583.

They feel more comfortable when the superiors do not waive the power to the subordinates.

On the other hand, the superiors will prefer to take decisions themselves (Hu, Chand &

Evans, 2013).

Question 3

Comprehensive manufacturing budget

(a) Five year budget

(i) Sales, production and purchase budget

Sales budget

Particulars 2018 2019 2020 2021 2022

Units 57,035,550 62,739,105 69,013,016 75,914,317 83,505,749

Wholesale

price $ 2.35 $ 2.45 $ 2.55 $ 2.66 $ 2.77

Sales revenue

$133,784,011.9

7

$

153,416,815.7

3

$

175,930,733.4

3

$201,748,568.5

6

$231,355,171.0

0

Production budget

2018 2019 2020 2021 2022

Raw material

$

0.62

$

0.64

$

0.67

$

0.69

$

0.71

Direct labour

$

0.08

$

0.08

$

0.09

$

0.09

$

0.09

Manufacturi

ng overhead

$

1.50

$

1.55

$

3.83

$

6.10

$

8.37

Total

production

cost

$

2.21

$

2.28

$

2.36

$

2.43

$

2.51

Scheduled

production

(units) 57,147,388 62,848,789 65,000,000 65,000,000 65,000,000

Production

cost

$

126,371,803.

$

143,444,913.

$

153,176,329.

$

158,154,560.

$

163,294,583.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7MANAGEMENT ACCOUNTING

83 72 47 18 38

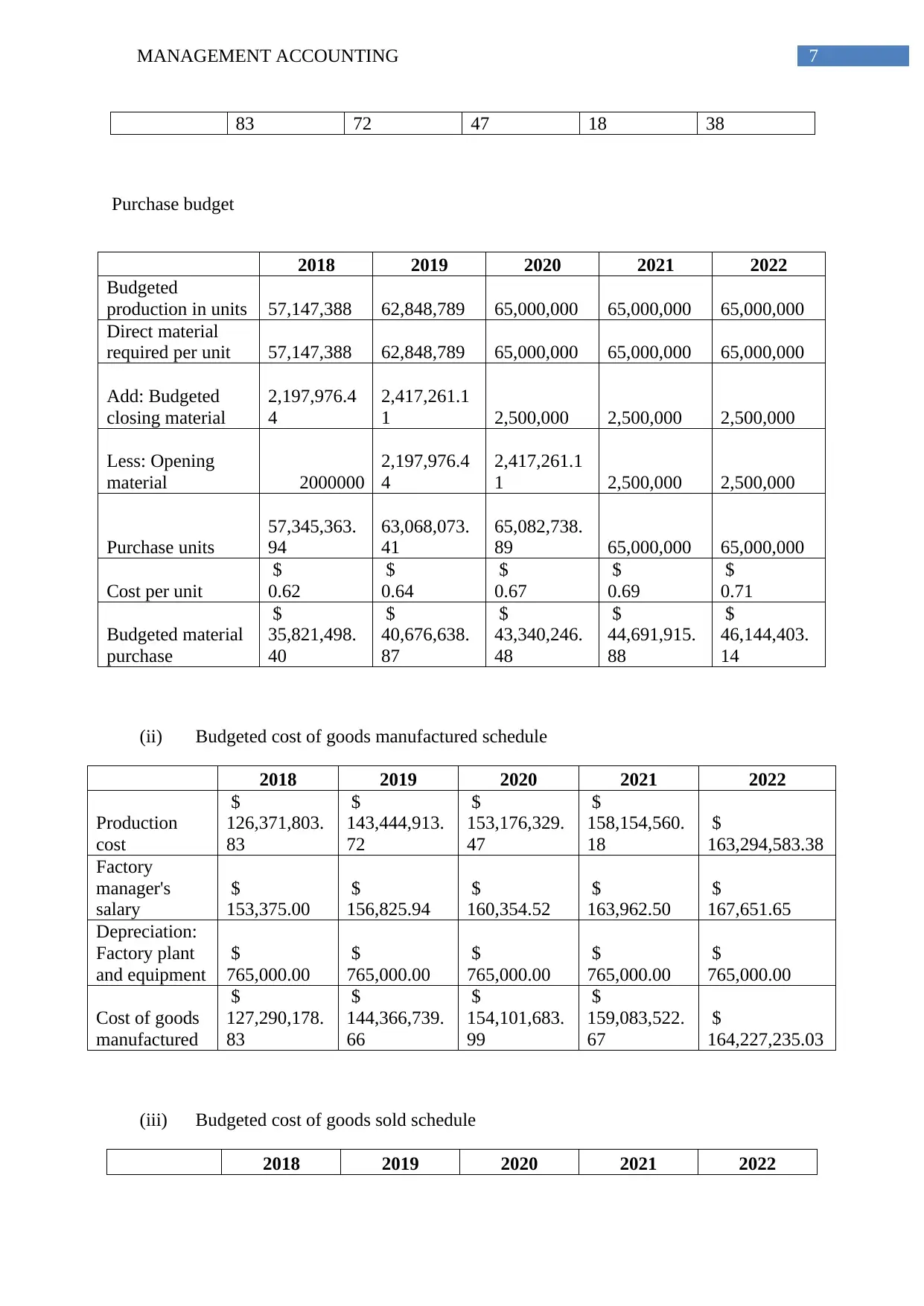

Purchase budget

2018 2019 2020 2021 2022

Budgeted

production in units 57,147,388 62,848,789 65,000,000 65,000,000 65,000,000

Direct material

required per unit 57,147,388 62,848,789 65,000,000 65,000,000 65,000,000

Add: Budgeted

closing material

2,197,976.4

4

2,417,261.1

1 2,500,000 2,500,000 2,500,000

Less: Opening

material 2000000

2,197,976.4

4

2,417,261.1

1 2,500,000 2,500,000

Purchase units

57,345,363.

94

63,068,073.

41

65,082,738.

89 65,000,000 65,000,000

Cost per unit

$

0.62

$

0.64

$

0.67

$

0.69

$

0.71

Budgeted material

purchase

$

35,821,498.

40

$

40,676,638.

87

$

43,340,246.

48

$

44,691,915.

88

$

46,144,403.

14

(ii) Budgeted cost of goods manufactured schedule

2018 2019 2020 2021 2022

Production

cost

$

126,371,803.

83

$

143,444,913.

72

$

153,176,329.

47

$

158,154,560.

18

$

163,294,583.38

Factory

manager's

salary

$

153,375.00

$

156,825.94

$

160,354.52

$

163,962.50

$

167,651.65

Depreciation:

Factory plant

and equipment

$

765,000.00

$

765,000.00

$

765,000.00

$

765,000.00

$

765,000.00

Cost of goods

manufactured

$

127,290,178.

83

$

144,366,739.

66

$

154,101,683.

99

$

159,083,522.

67

$

164,227,235.03

(iii) Budgeted cost of goods sold schedule

2018 2019 2020 2021 2022

83 72 47 18 38

Purchase budget

2018 2019 2020 2021 2022

Budgeted

production in units 57,147,388 62,848,789 65,000,000 65,000,000 65,000,000

Direct material

required per unit 57,147,388 62,848,789 65,000,000 65,000,000 65,000,000

Add: Budgeted

closing material

2,197,976.4

4

2,417,261.1

1 2,500,000 2,500,000 2,500,000

Less: Opening

material 2000000

2,197,976.4

4

2,417,261.1

1 2,500,000 2,500,000

Purchase units

57,345,363.

94

63,068,073.

41

65,082,738.

89 65,000,000 65,000,000

Cost per unit

$

0.62

$

0.64

$

0.67

$

0.69

$

0.71

Budgeted material

purchase

$

35,821,498.

40

$

40,676,638.

87

$

43,340,246.

48

$

44,691,915.

88

$

46,144,403.

14

(ii) Budgeted cost of goods manufactured schedule

2018 2019 2020 2021 2022

Production

cost

$

126,371,803.

83

$

143,444,913.

72

$

153,176,329.

47

$

158,154,560.

18

$

163,294,583.38

Factory

manager's

salary

$

153,375.00

$

156,825.94

$

160,354.52

$

163,962.50

$

167,651.65

Depreciation:

Factory plant

and equipment

$

765,000.00

$

765,000.00

$

765,000.00

$

765,000.00

$

765,000.00

Cost of goods

manufactured

$

127,290,178.

83

$

144,366,739.

66

$

154,101,683.

99

$

159,083,522.

67

$

164,227,235.03

(iii) Budgeted cost of goods sold schedule

2018 2019 2020 2021 2022

8MANAGEMENT ACCOUNTING

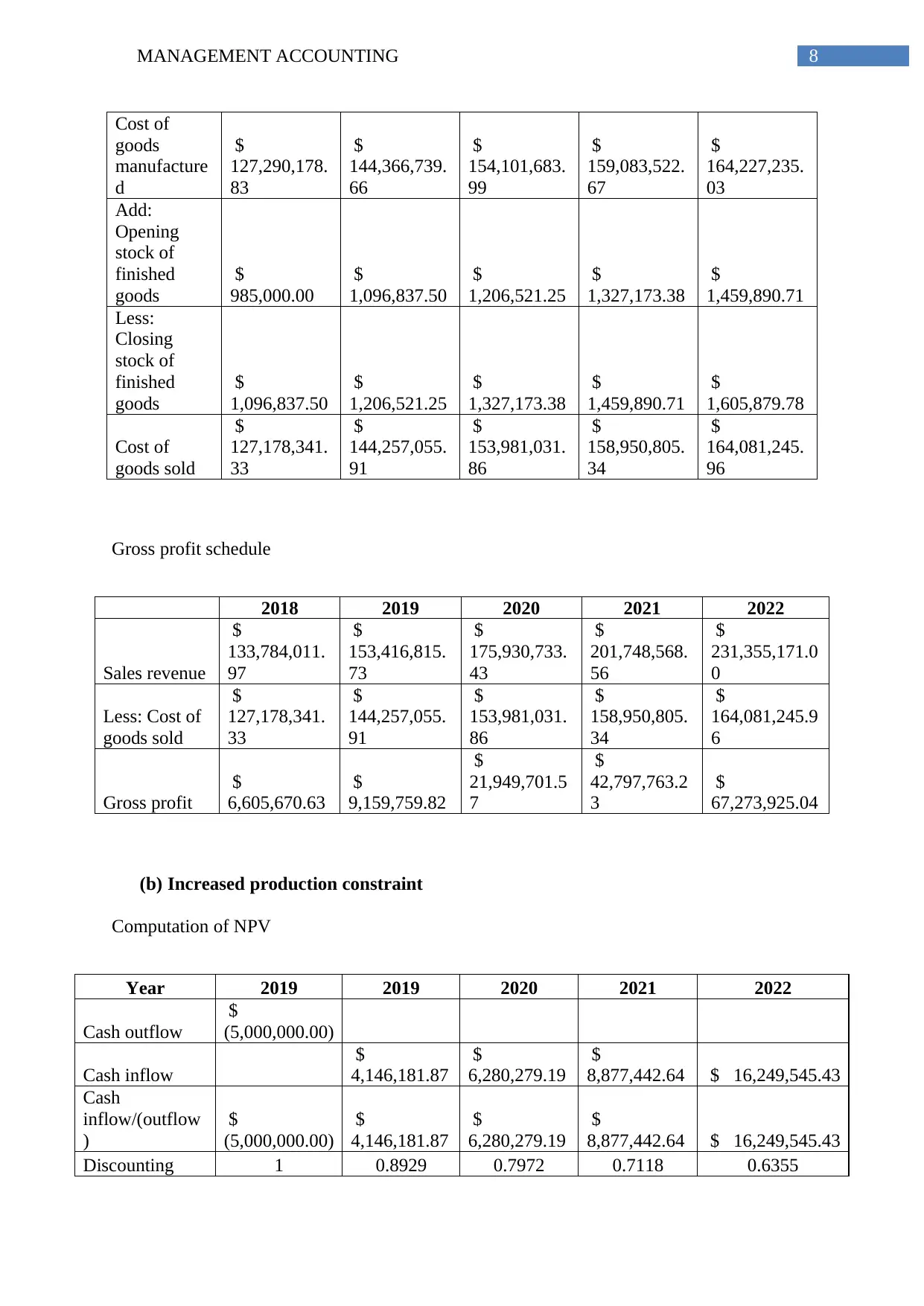

Cost of

goods

manufacture

d

$

127,290,178.

83

$

144,366,739.

66

$

154,101,683.

99

$

159,083,522.

67

$

164,227,235.

03

Add:

Opening

stock of

finished

goods

$

985,000.00

$

1,096,837.50

$

1,206,521.25

$

1,327,173.38

$

1,459,890.71

Less:

Closing

stock of

finished

goods

$

1,096,837.50

$

1,206,521.25

$

1,327,173.38

$

1,459,890.71

$

1,605,879.78

Cost of

goods sold

$

127,178,341.

33

$

144,257,055.

91

$

153,981,031.

86

$

158,950,805.

34

$

164,081,245.

96

Gross profit schedule

2018 2019 2020 2021 2022

Sales revenue

$

133,784,011.

97

$

153,416,815.

73

$

175,930,733.

43

$

201,748,568.

56

$

231,355,171.0

0

Less: Cost of

goods sold

$

127,178,341.

33

$

144,257,055.

91

$

153,981,031.

86

$

158,950,805.

34

$

164,081,245.9

6

Gross profit

$

6,605,670.63

$

9,159,759.82

$

21,949,701.5

7

$

42,797,763.2

3

$

67,273,925.04

(b) Increased production constraint

Computation of NPV

Year 2019 2019 2020 2021 2022

Cash outflow

$

(5,000,000.00)

Cash inflow

$

4,146,181.87

$

6,280,279.19

$

8,877,442.64 $ 16,249,545.43

Cash

inflow/(outflow

)

$

(5,000,000.00)

$

4,146,181.87

$

6,280,279.19

$

8,877,442.64 $ 16,249,545.43

Discounting 1 0.8929 0.7972 0.7118 0.6355

Cost of

goods

manufacture

d

$

127,290,178.

83

$

144,366,739.

66

$

154,101,683.

99

$

159,083,522.

67

$

164,227,235.

03

Add:

Opening

stock of

finished

goods

$

985,000.00

$

1,096,837.50

$

1,206,521.25

$

1,327,173.38

$

1,459,890.71

Less:

Closing

stock of

finished

goods

$

1,096,837.50

$

1,206,521.25

$

1,327,173.38

$

1,459,890.71

$

1,605,879.78

Cost of

goods sold

$

127,178,341.

33

$

144,257,055.

91

$

153,981,031.

86

$

158,950,805.

34

$

164,081,245.

96

Gross profit schedule

2018 2019 2020 2021 2022

Sales revenue

$

133,784,011.

97

$

153,416,815.

73

$

175,930,733.

43

$

201,748,568.

56

$

231,355,171.0

0

Less: Cost of

goods sold

$

127,178,341.

33

$

144,257,055.

91

$

153,981,031.

86

$

158,950,805.

34

$

164,081,245.9

6

Gross profit

$

6,605,670.63

$

9,159,759.82

$

21,949,701.5

7

$

42,797,763.2

3

$

67,273,925.04

(b) Increased production constraint

Computation of NPV

Year 2019 2019 2020 2021 2022

Cash outflow

$

(5,000,000.00)

Cash inflow

$

4,146,181.87

$

6,280,279.19

$

8,877,442.64 $ 16,249,545.43

Cash

inflow/(outflow

)

$

(5,000,000.00)

$

4,146,181.87

$

6,280,279.19

$

8,877,442.64 $ 16,249,545.43

Discounting 1 0.8929 0.7972 0.7118 0.6355

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

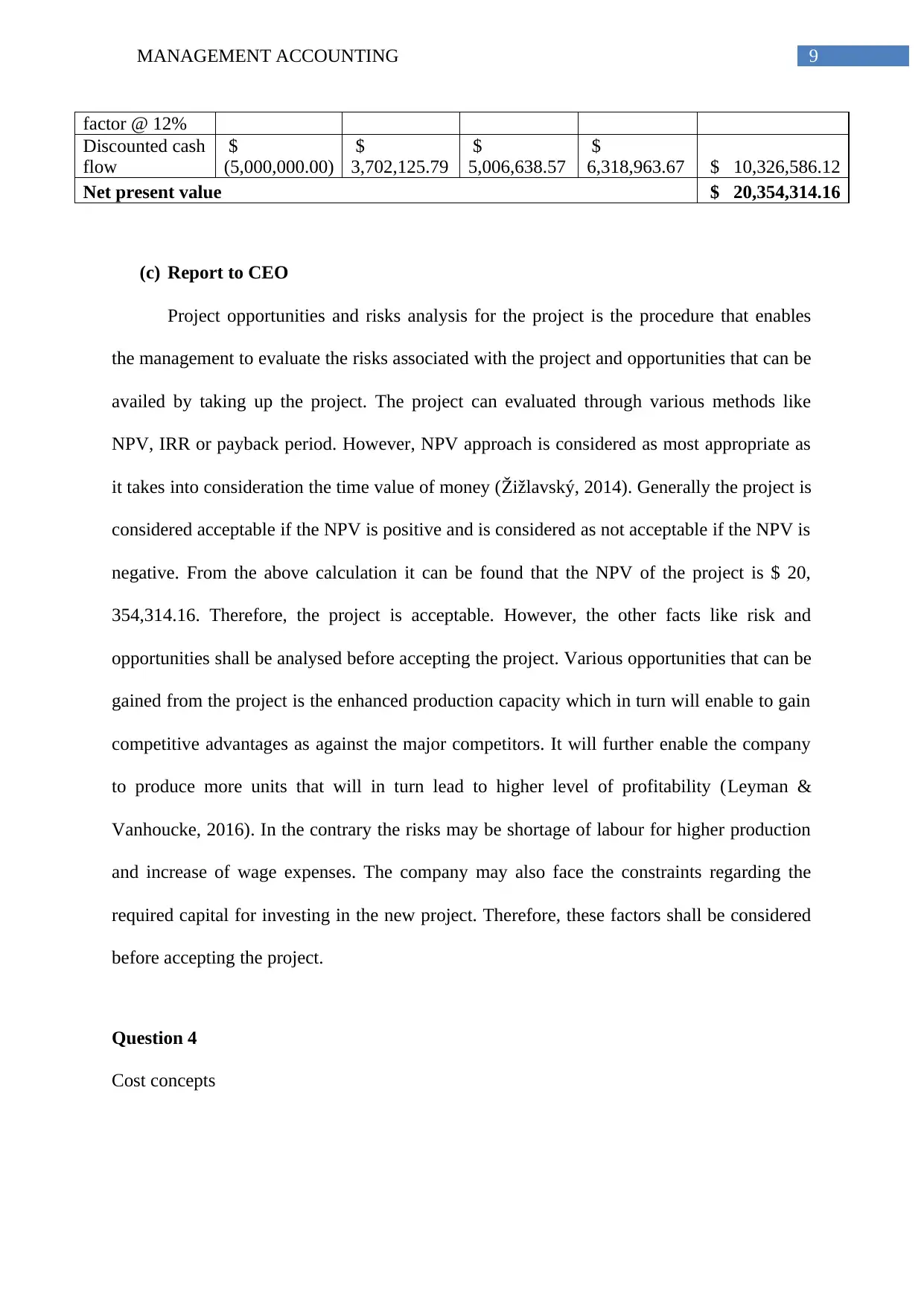

9MANAGEMENT ACCOUNTING

factor @ 12%

Discounted cash

flow

$

(5,000,000.00)

$

3,702,125.79

$

5,006,638.57

$

6,318,963.67 $ 10,326,586.12

Net present value $ 20,354,314.16

(c) Report to CEO

Project opportunities and risks analysis for the project is the procedure that enables

the management to evaluate the risks associated with the project and opportunities that can be

availed by taking up the project. The project can evaluated through various methods like

NPV, IRR or payback period. However, NPV approach is considered as most appropriate as

it takes into consideration the time value of money (Žižlavský, 2014). Generally the project is

considered acceptable if the NPV is positive and is considered as not acceptable if the NPV is

negative. From the above calculation it can be found that the NPV of the project is $ 20,

354,314.16. Therefore, the project is acceptable. However, the other facts like risk and

opportunities shall be analysed before accepting the project. Various opportunities that can be

gained from the project is the enhanced production capacity which in turn will enable to gain

competitive advantages as against the major competitors. It will further enable the company

to produce more units that will in turn lead to higher level of profitability (Leyman &

Vanhoucke, 2016). In the contrary the risks may be shortage of labour for higher production

and increase of wage expenses. The company may also face the constraints regarding the

required capital for investing in the new project. Therefore, these factors shall be considered

before accepting the project.

Question 4

Cost concepts

factor @ 12%

Discounted cash

flow

$

(5,000,000.00)

$

3,702,125.79

$

5,006,638.57

$

6,318,963.67 $ 10,326,586.12

Net present value $ 20,354,314.16

(c) Report to CEO

Project opportunities and risks analysis for the project is the procedure that enables

the management to evaluate the risks associated with the project and opportunities that can be

availed by taking up the project. The project can evaluated through various methods like

NPV, IRR or payback period. However, NPV approach is considered as most appropriate as

it takes into consideration the time value of money (Žižlavský, 2014). Generally the project is

considered acceptable if the NPV is positive and is considered as not acceptable if the NPV is

negative. From the above calculation it can be found that the NPV of the project is $ 20,

354,314.16. Therefore, the project is acceptable. However, the other facts like risk and

opportunities shall be analysed before accepting the project. Various opportunities that can be

gained from the project is the enhanced production capacity which in turn will enable to gain

competitive advantages as against the major competitors. It will further enable the company

to produce more units that will in turn lead to higher level of profitability (Leyman &

Vanhoucke, 2016). In the contrary the risks may be shortage of labour for higher production

and increase of wage expenses. The company may also face the constraints regarding the

required capital for investing in the new project. Therefore, these factors shall be considered

before accepting the project.

Question 4

Cost concepts

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10MANAGEMENT ACCOUNTING

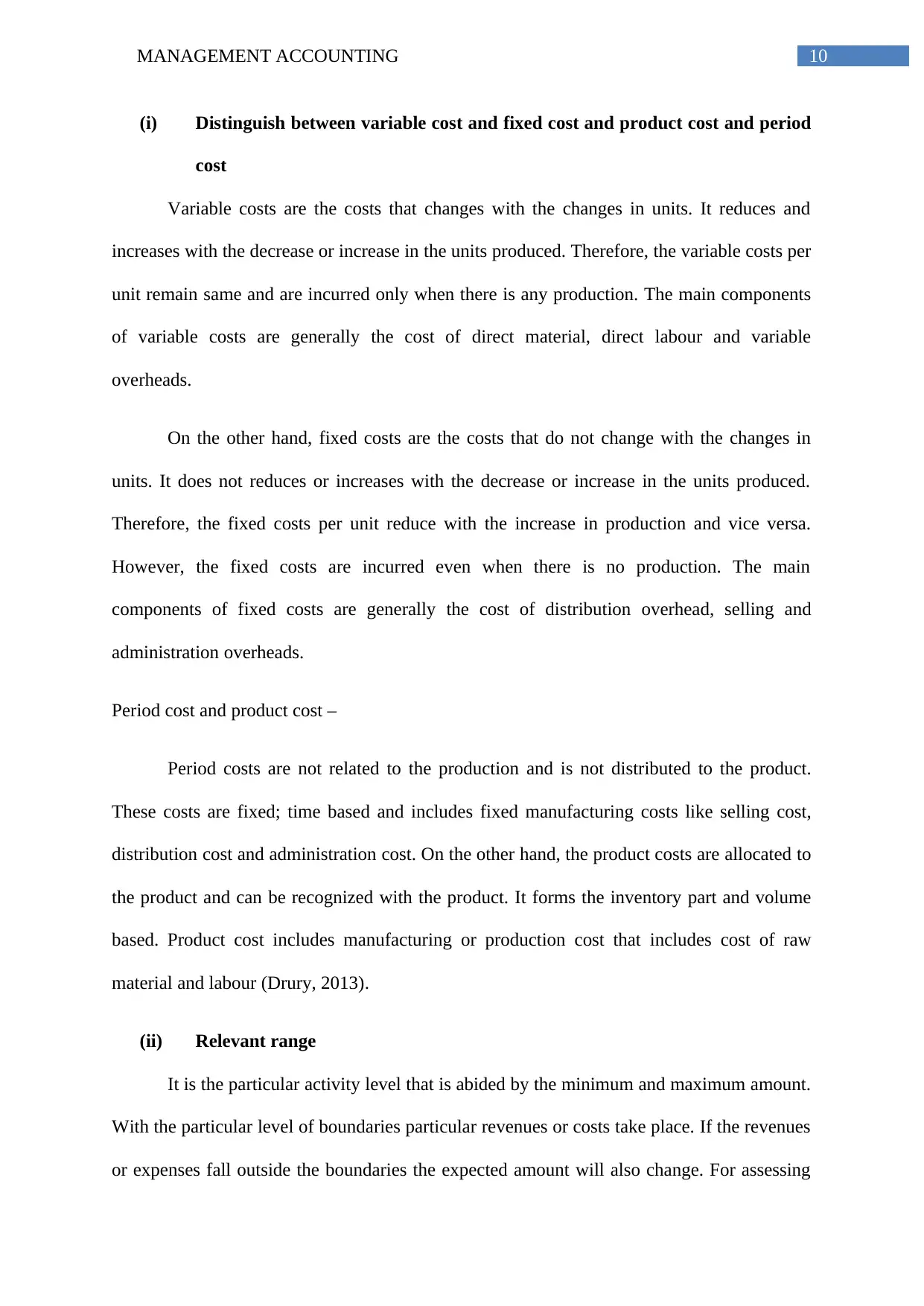

(i) Distinguish between variable cost and fixed cost and product cost and period

cost

Variable costs are the costs that changes with the changes in units. It reduces and

increases with the decrease or increase in the units produced. Therefore, the variable costs per

unit remain same and are incurred only when there is any production. The main components

of variable costs are generally the cost of direct material, direct labour and variable

overheads.

On the other hand, fixed costs are the costs that do not change with the changes in

units. It does not reduces or increases with the decrease or increase in the units produced.

Therefore, the fixed costs per unit reduce with the increase in production and vice versa.

However, the fixed costs are incurred even when there is no production. The main

components of fixed costs are generally the cost of distribution overhead, selling and

administration overheads.

Period cost and product cost –

Period costs are not related to the production and is not distributed to the product.

These costs are fixed; time based and includes fixed manufacturing costs like selling cost,

distribution cost and administration cost. On the other hand, the product costs are allocated to

the product and can be recognized with the product. It forms the inventory part and volume

based. Product cost includes manufacturing or production cost that includes cost of raw

material and labour (Drury, 2013).

(ii) Relevant range

It is the particular activity level that is abided by the minimum and maximum amount.

With the particular level of boundaries particular revenues or costs take place. If the revenues

or expenses fall outside the boundaries the expected amount will also change. For assessing

(i) Distinguish between variable cost and fixed cost and product cost and period

cost

Variable costs are the costs that changes with the changes in units. It reduces and

increases with the decrease or increase in the units produced. Therefore, the variable costs per

unit remain same and are incurred only when there is any production. The main components

of variable costs are generally the cost of direct material, direct labour and variable

overheads.

On the other hand, fixed costs are the costs that do not change with the changes in

units. It does not reduces or increases with the decrease or increase in the units produced.

Therefore, the fixed costs per unit reduce with the increase in production and vice versa.

However, the fixed costs are incurred even when there is no production. The main

components of fixed costs are generally the cost of distribution overhead, selling and

administration overheads.

Period cost and product cost –

Period costs are not related to the production and is not distributed to the product.

These costs are fixed; time based and includes fixed manufacturing costs like selling cost,

distribution cost and administration cost. On the other hand, the product costs are allocated to

the product and can be recognized with the product. It forms the inventory part and volume

based. Product cost includes manufacturing or production cost that includes cost of raw

material and labour (Drury, 2013).

(ii) Relevant range

It is the particular activity level that is abided by the minimum and maximum amount.

With the particular level of boundaries particular revenues or costs take place. If the revenues

or expenses fall outside the boundaries the expected amount will also change. For assessing

11MANAGEMENT ACCOUNTING

the production level relevant range recognition is crucial as it will be used for financial

planning, budgeting and accounting (Seuring & Goldbach (Eds.), 2013). However, apart from

fixed cost the relevant range is also applicable for the variable costs like selling overhead.

The volume that is more than or less than the relevant range will change the per unit variable

cost.

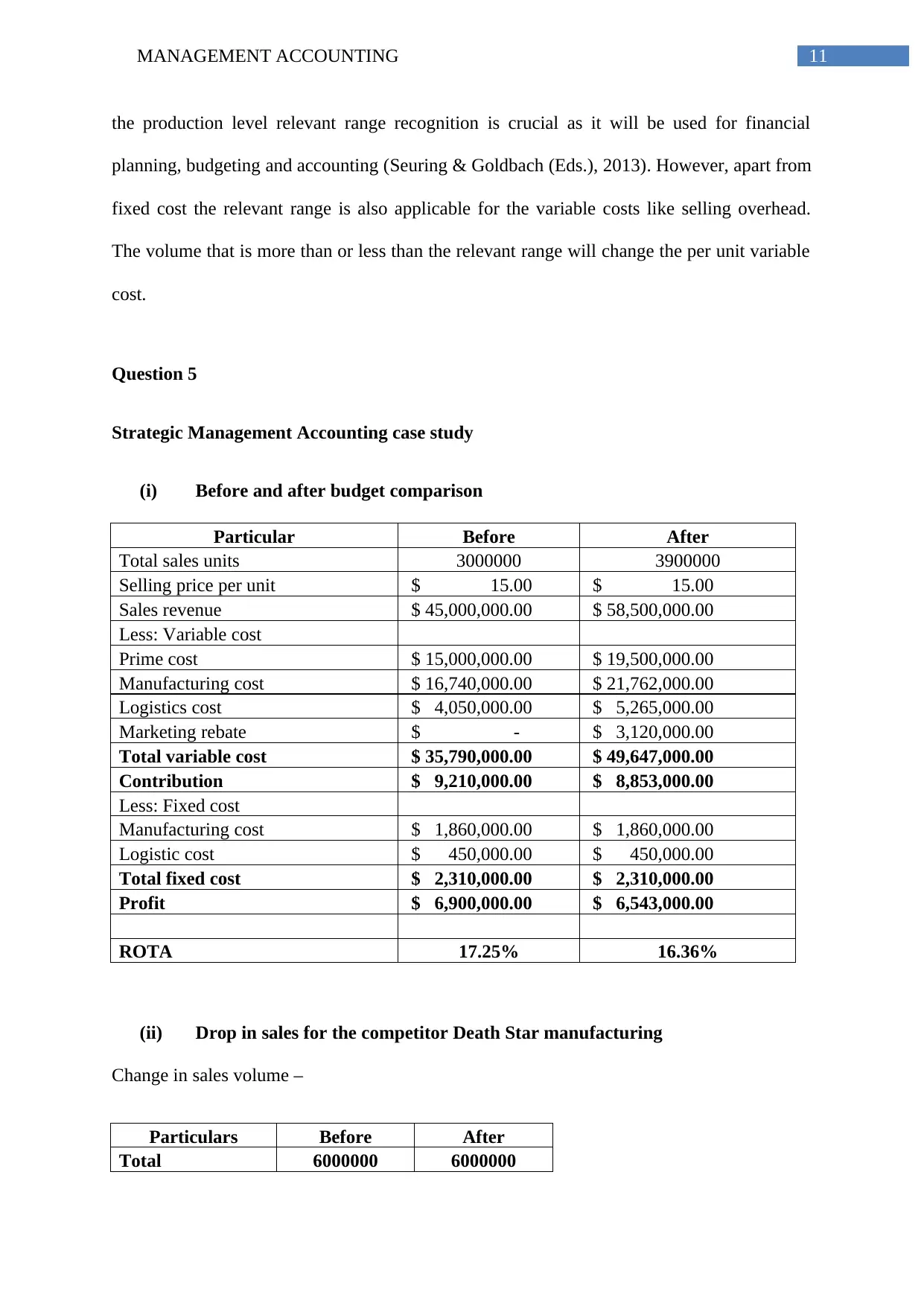

Question 5

Strategic Management Accounting case study

(i) Before and after budget comparison

Particular Before After

Total sales units 3000000 3900000

Selling price per unit $ 15.00 $ 15.00

Sales revenue $ 45,000,000.00 $ 58,500,000.00

Less: Variable cost

Prime cost $ 15,000,000.00 $ 19,500,000.00

Manufacturing cost $ 16,740,000.00 $ 21,762,000.00

Logistics cost $ 4,050,000.00 $ 5,265,000.00

Marketing rebate $ - $ 3,120,000.00

Total variable cost $ 35,790,000.00 $ 49,647,000.00

Contribution $ 9,210,000.00 $ 8,853,000.00

Less: Fixed cost

Manufacturing cost $ 1,860,000.00 $ 1,860,000.00

Logistic cost $ 450,000.00 $ 450,000.00

Total fixed cost $ 2,310,000.00 $ 2,310,000.00

Profit $ 6,900,000.00 $ 6,543,000.00

ROTA 17.25% 16.36%

(ii) Drop in sales for the competitor Death Star manufacturing

Change in sales volume –

Particulars Before After

Total 6000000 6000000

the production level relevant range recognition is crucial as it will be used for financial

planning, budgeting and accounting (Seuring & Goldbach (Eds.), 2013). However, apart from

fixed cost the relevant range is also applicable for the variable costs like selling overhead.

The volume that is more than or less than the relevant range will change the per unit variable

cost.

Question 5

Strategic Management Accounting case study

(i) Before and after budget comparison

Particular Before After

Total sales units 3000000 3900000

Selling price per unit $ 15.00 $ 15.00

Sales revenue $ 45,000,000.00 $ 58,500,000.00

Less: Variable cost

Prime cost $ 15,000,000.00 $ 19,500,000.00

Manufacturing cost $ 16,740,000.00 $ 21,762,000.00

Logistics cost $ 4,050,000.00 $ 5,265,000.00

Marketing rebate $ - $ 3,120,000.00

Total variable cost $ 35,790,000.00 $ 49,647,000.00

Contribution $ 9,210,000.00 $ 8,853,000.00

Less: Fixed cost

Manufacturing cost $ 1,860,000.00 $ 1,860,000.00

Logistic cost $ 450,000.00 $ 450,000.00

Total fixed cost $ 2,310,000.00 $ 2,310,000.00

Profit $ 6,900,000.00 $ 6,543,000.00

ROTA 17.25% 16.36%

(ii) Drop in sales for the competitor Death Star manufacturing

Change in sales volume –

Particulars Before After

Total 6000000 6000000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.