Taxation Law ACC304: Analysis of Tax Residency and Income Assessment

VerifiedAdded on 2023/06/08

|5

|2073

|207

Report

AI Summary

This report provides tax advice to Mr. Elwood and Inda Blues regarding their tax residency status in Australia for the year 2017-18, based on the Australian Income Tax Assessment Act. It analyses various residency tests, including the resides test, domicile test, and 183-day test, concluding that they are likely considered tax residents. The report also assesses Jack's income tax obligations, including PAYG, travel expenses, interest income, dividend reinvestment, and capital gains tax on shares and personal items. Furthermore, it discusses the benefits and drawbacks of negative gearing as an investment strategy, highlighting its potential to reduce taxable income. The analysis references relevant sections of the Income Tax Assessment Act, case laws, and taxation rulings to support its conclusions.

PART 1:

Mr. Elwood and Inda Blues,

Unit 52,

246 Queen Street,

Brisbane, QLD,4000.

Date: 12-09-2018.

Sub: Advice on tax Residency status of Mr. Elwood and Inda for 2017-18

Sir,

Hope you are doing great.

In this regard, please note that it has been our privilege to act as your advisor for determining of

tax residency of you and your wife for the Year 2017-18. For the purpose of determination, the

followingdetails have been shared:

(a) Mr .Elwood and his wife Inda arrived in Australia on 01-07-2017 along with children;

(b) The transfer period is minimum 3 year;

(c) No intention to stay permanently;

(d) House has been purchased in Australia;

(e) Social connection and relation has been established.

Tax Laws

Let us first analyse the Australian Income Tax Assessment Act, where in under subsection 5 (1)

10(1) and 10(2) of Section 6 it has been stated for an individual resident in Australia his/her

world wide income both ordinary and statutory income shall be taxable in Australia while for a

non-resident only the income earned in Australia shall be taxable.

In terms of Section 6(1)(Anon., n.d.)of Australian Income Tax Assessment Act, 1936 the term

resident and resident of Australia has been defined. The term shall mean a person shall be

considered resident of Australia if he satisfies any of the three tests stated here-in-below

(a) Resides Test: For this test, we look at the person’s permanent dwelling place or for a

considerable period of time. This test has been dealt in depth in the following judgements:

(i) Levene v IRC [1928] AC 217;

(ii) IRC v Lysaght [1928] AC 234;

(iii) TR98/17

Under the said judgement it has been highlighted that if an individual has family connection

in Australia or one has a habitual abode he shall be considered tax resident in Australia.

Mr. Elwood and Inda Blues,

Unit 52,

246 Queen Street,

Brisbane, QLD,4000.

Date: 12-09-2018.

Sub: Advice on tax Residency status of Mr. Elwood and Inda for 2017-18

Sir,

Hope you are doing great.

In this regard, please note that it has been our privilege to act as your advisor for determining of

tax residency of you and your wife for the Year 2017-18. For the purpose of determination, the

followingdetails have been shared:

(a) Mr .Elwood and his wife Inda arrived in Australia on 01-07-2017 along with children;

(b) The transfer period is minimum 3 year;

(c) No intention to stay permanently;

(d) House has been purchased in Australia;

(e) Social connection and relation has been established.

Tax Laws

Let us first analyse the Australian Income Tax Assessment Act, where in under subsection 5 (1)

10(1) and 10(2) of Section 6 it has been stated for an individual resident in Australia his/her

world wide income both ordinary and statutory income shall be taxable in Australia while for a

non-resident only the income earned in Australia shall be taxable.

In terms of Section 6(1)(Anon., n.d.)of Australian Income Tax Assessment Act, 1936 the term

resident and resident of Australia has been defined. The term shall mean a person shall be

considered resident of Australia if he satisfies any of the three tests stated here-in-below

(a) Resides Test: For this test, we look at the person’s permanent dwelling place or for a

considerable period of time. This test has been dealt in depth in the following judgements:

(i) Levene v IRC [1928] AC 217;

(ii) IRC v Lysaght [1928] AC 234;

(iii) TR98/17

Under the said judgement it has been highlighted that if an individual has family connection

in Australia or one has a habitual abode he shall be considered tax resident in Australia.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(b) Domicile Test: For this test, the authorities generally look at the place of birth of individual

along with permanent home. Under the Australian Domicile Act, 1982 a person domicile id

determined at birth and same shall continue until he extinguishes the same. Further, for

determining the permanent place of abode one need to look at place where one sleeps and

stay with his familyThe same has been stated in the following cases:

FCT v Applegate 79 ATC 4307;

FCT v Jenkins (1982) 12 ATR 745 ;

(c) 183 Days test: For this test, the tax authorities generally check for the number of days an

individual stayedin Australia. If such day count, exceed 183 days then the individual is

considered a tax resident. In addition the test shall hold good unless any of the following

conditions are triggered:-

(i) The individual has a house of permanent nature outside Australia;

(ii) There exists no intention among individual to take up residence in Australia.

The same has been detailed in Case S19 85 ATC 225;

On the basis of above, it may be seen, the number of stay days in Australia exceeded 183 days

and there has been an acquisition of permanent abode in Australia. Further the stay period in

Australia exceeds two years. Thus, on the basis of the above it may be concluded that you and

your wife may be considered tax resident of Australia.

Regards,

Tax Advisor,

PART 2A

1. In the present circumstance, Jack has been working with MD & A Architects during the captioned

year. He has received salary form his employer and the same is taxable under the Australian Income Tax

Assessment Act. Further, the employer has deducted PAYG (Pay As You Go) on his income which is

generally deducted on the basis of individual estimated tax liability while the actual tax liability may

differ. Thus, Jack while filing tax return has to pay the difference or claim the refund for the same.

(Powerbuy technologies, 2018)

2. Under the said case , since Jack travelled to and fro his office as a part of daily routine said shall be

treated to be incurred for generating income of a private or domestic nature and accordingly shall be

allowed to be claim as deduction in terms of Section 8-1(2)(b) of Income Tax Assessment Act,

1997.However, if jack had travelled to another workplace and the same was not a part of routine

along with permanent home. Under the Australian Domicile Act, 1982 a person domicile id

determined at birth and same shall continue until he extinguishes the same. Further, for

determining the permanent place of abode one need to look at place where one sleeps and

stay with his familyThe same has been stated in the following cases:

FCT v Applegate 79 ATC 4307;

FCT v Jenkins (1982) 12 ATR 745 ;

(c) 183 Days test: For this test, the tax authorities generally check for the number of days an

individual stayedin Australia. If such day count, exceed 183 days then the individual is

considered a tax resident. In addition the test shall hold good unless any of the following

conditions are triggered:-

(i) The individual has a house of permanent nature outside Australia;

(ii) There exists no intention among individual to take up residence in Australia.

The same has been detailed in Case S19 85 ATC 225;

On the basis of above, it may be seen, the number of stay days in Australia exceeded 183 days

and there has been an acquisition of permanent abode in Australia. Further the stay period in

Australia exceeds two years. Thus, on the basis of the above it may be concluded that you and

your wife may be considered tax resident of Australia.

Regards,

Tax Advisor,

PART 2A

1. In the present circumstance, Jack has been working with MD & A Architects during the captioned

year. He has received salary form his employer and the same is taxable under the Australian Income Tax

Assessment Act. Further, the employer has deducted PAYG (Pay As You Go) on his income which is

generally deducted on the basis of individual estimated tax liability while the actual tax liability may

differ. Thus, Jack while filing tax return has to pay the difference or claim the refund for the same.

(Powerbuy technologies, 2018)

2. Under the said case , since Jack travelled to and fro his office as a part of daily routine said shall be

treated to be incurred for generating income of a private or domestic nature and accordingly shall be

allowed to be claim as deduction in terms of Section 8-1(2)(b) of Income Tax Assessment Act,

1997.However, if jack had travelled to another workplace and the same was not a part of routine

activity, he shall be able to claim deduction to a maximum of 5000 business kilometres and maximum of

66 cents per kilometre as log book is not maintained..(Commonwealth of Australia, 2018)

Further, for PAYG deducted the same shall be deducted while paying the tax amount under the return.

3. Under the Australian tax system, a resident is required to provide Tax File Number known as TFN to

bank for the purpose of receiving interest taxed at lower rate. If the person fails to do so, he shall be

liable to pay tax at highest marginal tax rate and same shall be deducted while making payment.

(Powerbuy technologies, 2018)

Thus, on basis of above tax shall be deducted at maximum marginal rate.

4. Under the Australian Tax system, if a resident earn under dividend reinvestment scheme any UN

franked dividend and if the same dividend is reinvested than it will be deemed to be dividend earned

and tax shall be chargeable on the dividend earned amount.(Powerbuy technologies, 2018).

Thus on the basis of above earned dividend amount invested in shares shall be chargeable to tax as it is

deemed to be dividend earned

5. Under the Australian Tax system, Capital gain tax is levied in case of selling the shares at profit and tax

is levied on such gain.

1000 ANZ bank share on 1 March 2015 purchase by Jakeat $ 22 each with brokerage cost $50 and sold

500 shares on 1 June 2018 for $ 24 each and brokerage cost $55.

Total Selling price of 500 shares= (500*24-55) = $11945

Total Purchase price of 500 shares= (500*22+25) =$11025

Capital Gain =$920

And as the holding period is more than 12 months than a further discount of 50% shall be given.

6. Under the Australian Tax system, Capital gain tax is levied if a person sells something out of his daily

business activity than any gain or loss arising from such activity shall be chargeable to tax.

Cricket bat bought by Jake between 1999 and 2004 and he sold the same at $ 900 which cost him $

2600, sothere is a capital loss amounts to $ 1700 for Jake.

7. Under the Australian Tax system, if one incur car expenses for person and business use so the

resident must have all the material support documents to it for the distance travel for business and

personal use under log book method.

As failure by Jaketo maintain a logbook but he has still managed to maintain a diary keeping records of

all the supporting documents so on the basis of above Jake can claim the deduction.(Commonwealth of

Australia, 2018)Including depreciation the total expense of car amounts to $6200 so Jake can claim 95%

amount value=$5890 if he has all supporting documents of the car used for business use.

66 cents per kilometre as log book is not maintained..(Commonwealth of Australia, 2018)

Further, for PAYG deducted the same shall be deducted while paying the tax amount under the return.

3. Under the Australian tax system, a resident is required to provide Tax File Number known as TFN to

bank for the purpose of receiving interest taxed at lower rate. If the person fails to do so, he shall be

liable to pay tax at highest marginal tax rate and same shall be deducted while making payment.

(Powerbuy technologies, 2018)

Thus, on basis of above tax shall be deducted at maximum marginal rate.

4. Under the Australian Tax system, if a resident earn under dividend reinvestment scheme any UN

franked dividend and if the same dividend is reinvested than it will be deemed to be dividend earned

and tax shall be chargeable on the dividend earned amount.(Powerbuy technologies, 2018).

Thus on the basis of above earned dividend amount invested in shares shall be chargeable to tax as it is

deemed to be dividend earned

5. Under the Australian Tax system, Capital gain tax is levied in case of selling the shares at profit and tax

is levied on such gain.

1000 ANZ bank share on 1 March 2015 purchase by Jakeat $ 22 each with brokerage cost $50 and sold

500 shares on 1 June 2018 for $ 24 each and brokerage cost $55.

Total Selling price of 500 shares= (500*24-55) = $11945

Total Purchase price of 500 shares= (500*22+25) =$11025

Capital Gain =$920

And as the holding period is more than 12 months than a further discount of 50% shall be given.

6. Under the Australian Tax system, Capital gain tax is levied if a person sells something out of his daily

business activity than any gain or loss arising from such activity shall be chargeable to tax.

Cricket bat bought by Jake between 1999 and 2004 and he sold the same at $ 900 which cost him $

2600, sothere is a capital loss amounts to $ 1700 for Jake.

7. Under the Australian Tax system, if one incur car expenses for person and business use so the

resident must have all the material support documents to it for the distance travel for business and

personal use under log book method.

As failure by Jaketo maintain a logbook but he has still managed to maintain a diary keeping records of

all the supporting documents so on the basis of above Jake can claim the deduction.(Commonwealth of

Australia, 2018)Including depreciation the total expense of car amounts to $6200 so Jake can claim 95%

amount value=$5890 if he has all supporting documents of the car used for business use.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

8. Under Australian Taxation rule, expenses incurred for office will be eligible for deduction provided

supporting documents are kept with respect to use.

As Jake is using the mobile phone for office and personal purpose both but does not have any material

support evidence to claim the amount used the office purpose,so Jake will not be allowed to claim the

expenses incurred on mobile phone.

9. Under Australian Taxation system, Section25-5 ITAA97 states that deduction shall be allowed if

expenses are incurred in relation to paying accountant fees or agent fees for filing tax return.

On the basis of above Jake will be eligible for the paid invoice amounted to $400.

10. Under the Australian Tax, holding of medical insurance policy is compulsory for the Australian tax

resident otherwiseMedicare levy surcharge is imposed on the basis of income of the individual.

On the basis of above Medicare levy surcease will be imposed on Jake as he is not covered with any

medical policy.

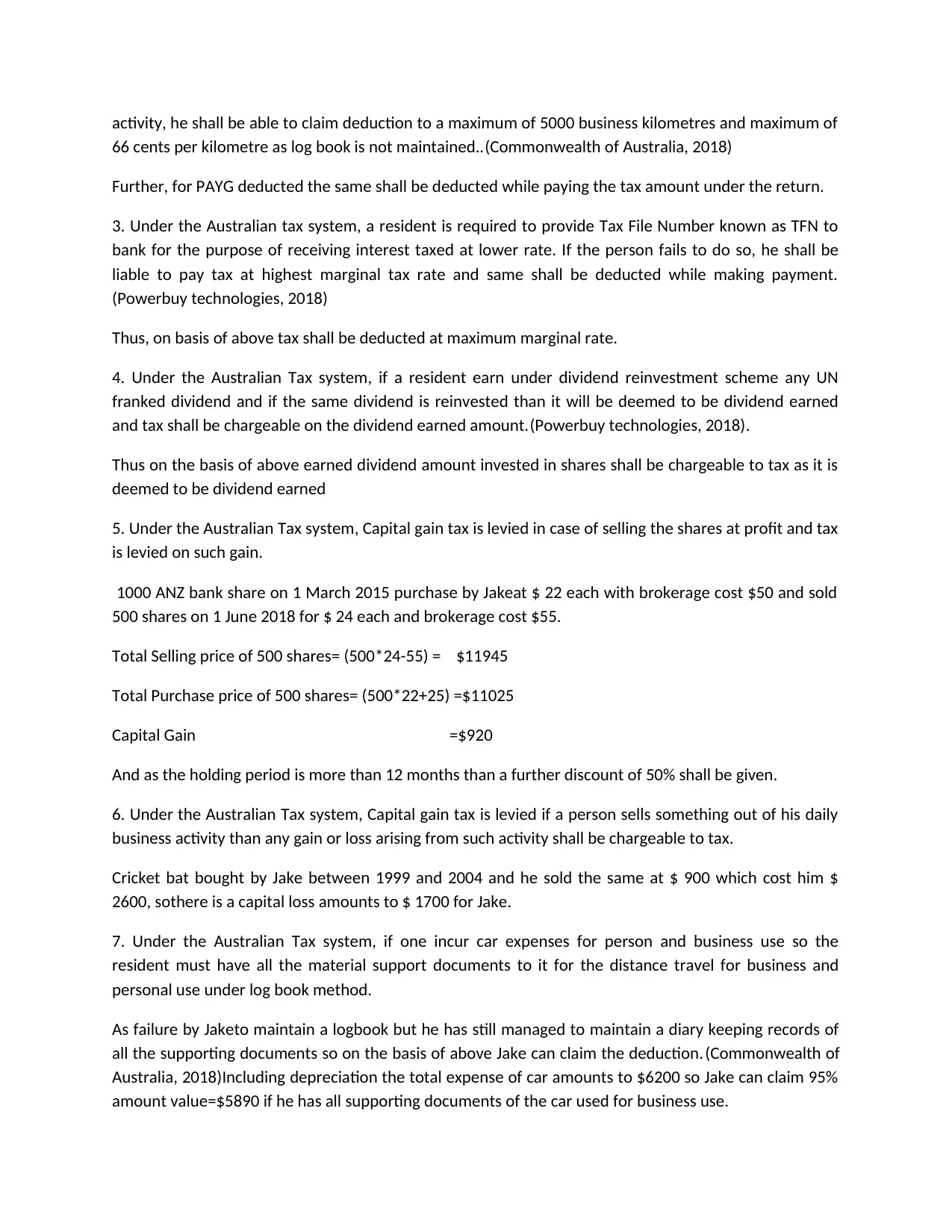

The computation has been below:

Computation of Taxable Income

Sl. No. Particulars Amount Amount

1 Salary 86000

2 Un franked dividend 3500

3 Capital Gain Income 920 460

4 Travelling expense -5890

5 Payment to tax agent -400

6 Taxable Income 83670

PART 2(B)

Negative gearing is a form of financial leverage and if one is keen in investing in property than one

should properly analyse the positive and negative aspects of negative gearing.Negative gearing is the

case in which the borrower borrow money to purchase an income generating assets but the return

derive from such an asset is less than the cost spend on acquiring such assets, this is called as negative

gearing. The property can be said to be positively geared when the return from your investmentsare

higher than the outgoing interest.Employees and negative gearing benefits can be taken in wide range

and through negative gearing property losses can be set off from other types of income such as wages or

income with a few restrictions on it.(Commonwealth Bank of Australia, 2018)

There are two types of tax gearing positive gearing and the other is negative gearing.

supporting documents are kept with respect to use.

As Jake is using the mobile phone for office and personal purpose both but does not have any material

support evidence to claim the amount used the office purpose,so Jake will not be allowed to claim the

expenses incurred on mobile phone.

9. Under Australian Taxation system, Section25-5 ITAA97 states that deduction shall be allowed if

expenses are incurred in relation to paying accountant fees or agent fees for filing tax return.

On the basis of above Jake will be eligible for the paid invoice amounted to $400.

10. Under the Australian Tax, holding of medical insurance policy is compulsory for the Australian tax

resident otherwiseMedicare levy surcharge is imposed on the basis of income of the individual.

On the basis of above Medicare levy surcease will be imposed on Jake as he is not covered with any

medical policy.

The computation has been below:

Computation of Taxable Income

Sl. No. Particulars Amount Amount

1 Salary 86000

2 Un franked dividend 3500

3 Capital Gain Income 920 460

4 Travelling expense -5890

5 Payment to tax agent -400

6 Taxable Income 83670

PART 2(B)

Negative gearing is a form of financial leverage and if one is keen in investing in property than one

should properly analyse the positive and negative aspects of negative gearing.Negative gearing is the

case in which the borrower borrow money to purchase an income generating assets but the return

derive from such an asset is less than the cost spend on acquiring such assets, this is called as negative

gearing. The property can be said to be positively geared when the return from your investmentsare

higher than the outgoing interest.Employees and negative gearing benefits can be taken in wide range

and through negative gearing property losses can be set off from other types of income such as wages or

income with a few restrictions on it.(Commonwealth Bank of Australia, 2018)

There are two types of tax gearing positive gearing and the other is negative gearing.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Benefits of Negative Gearing:

(a) Under Australian Taxation rule, any loss can be adjusted against other income earned such as

salary, wages thereby reducing your taxable income and also the tax portion on your income.

(b) Interest paid on loan can be claimed thus reducing your tax liability(Commonwealth Bank of

Australia, 2018)

Thus, negative gearing has its own pros and cons as negative has the benefit to reduce your tax liability

through smart tax mechanism and planning system and acting within the guide of Australian rules, and

positive gearing too has its own impact on the income and tax of the individual.

In brief we can say both gearing i.e. negative and positive has its own advantages and dis advantages

depending upon how one plan their tax mechanism.(Commonwealth Bank of Australia, 2018)

References:

Anon., n.d, INCOME TAX ASSESSMENT ACT 1936 - SECT 6, [Online]

Available at: http://www5.austlii.edu.au/au/legis/cth/consol_act/itaa1936240/s6.html

[Accessed 12 September 2018].

Commonwealth Bank of Australia, 2018, What is negative gearing?. [Online]

Available at: https://www.commbank.com.au/guidance/property/negative-gearing-and-tax-

201605.html

[Accessed 12 September 2018].

Commonwealth of Australia, 2018, Car expenses, [Online]

Available at: https://www.ato.gov.au/individuals/income-and-deductions/deductions-you-can-claim/

vehicle-and-travel-expenses/car-expenses/

[Accessed 5 September 2018].

Commonwealth of Australia, 2018, Logbook method, [Online]

Available at: https://www.ato.gov.au/Business/Income-and-deductions-for-business/Deductions/Motor-

vehicle-expenses/Claiming-motor-vehicle-expenses-as-a-sole-trader/Logbook-method/

[Accessed 5 September 2018].

Finder AU, 2018, What is negative gearing and how does it actually work?, [Online]

Available at: https://www.finder.com.au/what-is-negative-gearing

[Accessed 5 September 2018].

Powerbuy technologies, 2018, Tax fully franked versus unfranked dividend, [Online]

Available at: https://www.powerbuy.com.au/blog/tax-fully-franked-versus-unfranked-dividends/

[Accessed 12 September 2018].

(a) Under Australian Taxation rule, any loss can be adjusted against other income earned such as

salary, wages thereby reducing your taxable income and also the tax portion on your income.

(b) Interest paid on loan can be claimed thus reducing your tax liability(Commonwealth Bank of

Australia, 2018)

Thus, negative gearing has its own pros and cons as negative has the benefit to reduce your tax liability

through smart tax mechanism and planning system and acting within the guide of Australian rules, and

positive gearing too has its own impact on the income and tax of the individual.

In brief we can say both gearing i.e. negative and positive has its own advantages and dis advantages

depending upon how one plan their tax mechanism.(Commonwealth Bank of Australia, 2018)

References:

Anon., n.d, INCOME TAX ASSESSMENT ACT 1936 - SECT 6, [Online]

Available at: http://www5.austlii.edu.au/au/legis/cth/consol_act/itaa1936240/s6.html

[Accessed 12 September 2018].

Commonwealth Bank of Australia, 2018, What is negative gearing?. [Online]

Available at: https://www.commbank.com.au/guidance/property/negative-gearing-and-tax-

201605.html

[Accessed 12 September 2018].

Commonwealth of Australia, 2018, Car expenses, [Online]

Available at: https://www.ato.gov.au/individuals/income-and-deductions/deductions-you-can-claim/

vehicle-and-travel-expenses/car-expenses/

[Accessed 5 September 2018].

Commonwealth of Australia, 2018, Logbook method, [Online]

Available at: https://www.ato.gov.au/Business/Income-and-deductions-for-business/Deductions/Motor-

vehicle-expenses/Claiming-motor-vehicle-expenses-as-a-sole-trader/Logbook-method/

[Accessed 5 September 2018].

Finder AU, 2018, What is negative gearing and how does it actually work?, [Online]

Available at: https://www.finder.com.au/what-is-negative-gearing

[Accessed 5 September 2018].

Powerbuy technologies, 2018, Tax fully franked versus unfranked dividend, [Online]

Available at: https://www.powerbuy.com.au/blog/tax-fully-franked-versus-unfranked-dividends/

[Accessed 12 September 2018].

1 out of 5

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.