Taxation Analysis: Green Manufacturing Company Income Statement Review

VerifiedAdded on 2022/09/07

|22

|2454

|26

Homework Assignment

AI Summary

This assignment analyzes the personal taxation of Mr. Douglas Hern, the 100% owner of Green Manufacturing Company, for the year 2019. It begins with an adjusted income statement for the company, detailing sales, cost of goods sold, and various expenses, with explanations for adjustments made to several line items. The assignment then calculates Mr. Hern's employment income tax from another company, including gross salary, benefits, deductions, and tax due. Further calculations involve capital gains tax from the sale of shares, car allowance, property tax, interest income, rental income, and interest expenses. Detailed assumptions and workings are provided for each section. The document also explores gifts and donations, medical expenses, and CCA (Capital Cost Allowance) calculations for various asset classes. It concludes with calculations for contributions to RRP (Registered Retirement Plan) and non-refundable tax credits, including basic personal, spousal, and medical expenses, to arrive at Mr. Hern's total tax liability. The analysis covers various aspects of personal and corporate taxation, providing a comprehensive overview of Mr. Hern's financial situation for the specified tax year.

Running head: TAX

Taxation

Name:

Institution:

Date:

Taxation

Name:

Institution:

Date:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TAX

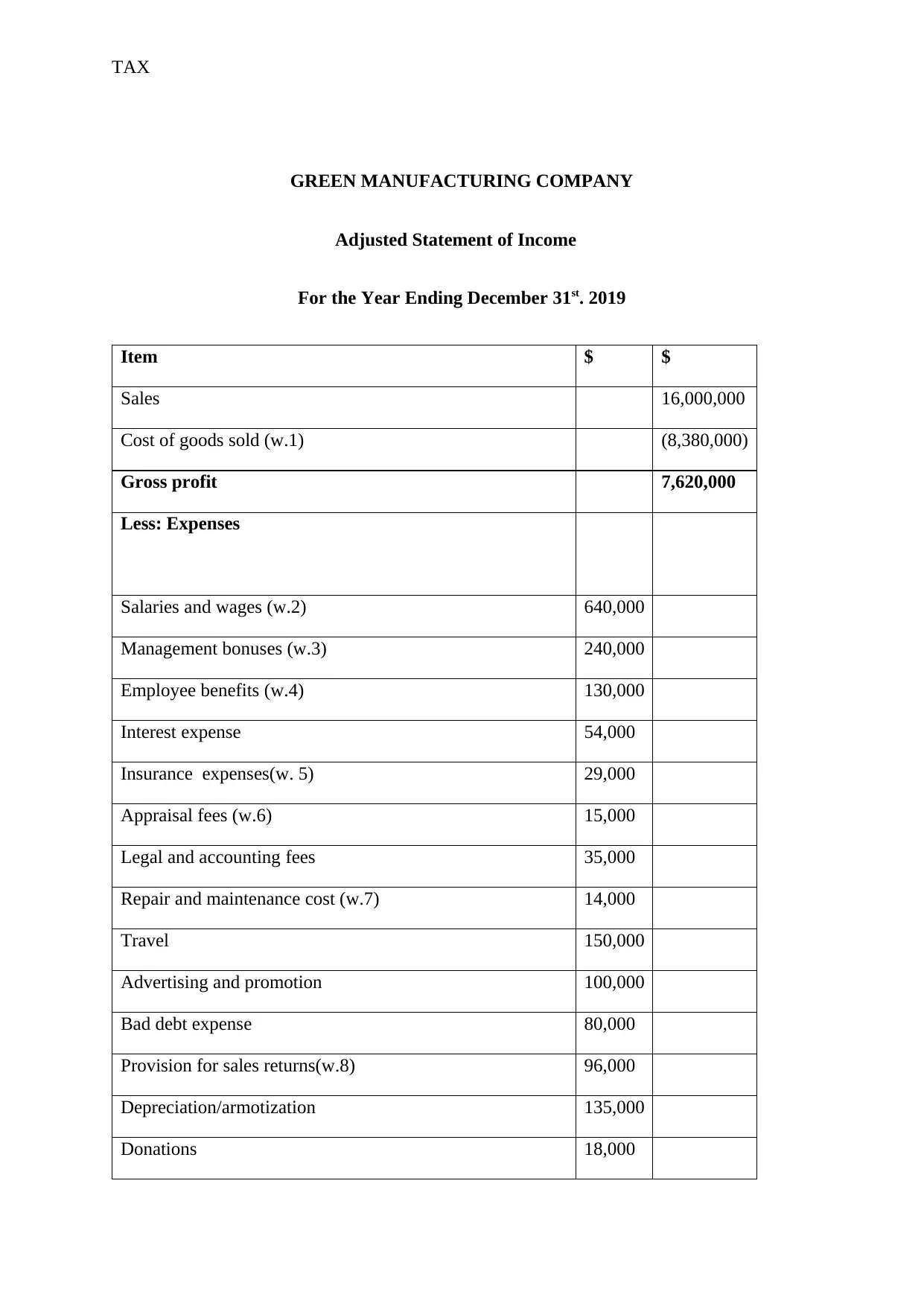

GREEN MANUFACTURING COMPANY

Adjusted Statement of Income

For the Year Ending December 31st. 2019

Item $ $

Sales 16,000,000

Cost of goods sold (w.1) (8,380,000)

Gross profit 7,620,000

Less: Expenses

Salaries and wages (w.2) 640,000

Management bonuses (w.3) 240,000

Employee benefits (w.4) 130,000

Interest expense 54,000

Insurance expenses(w. 5) 29,000

Appraisal fees (w.6) 15,000

Legal and accounting fees 35,000

Repair and maintenance cost (w.7) 14,000

Travel 150,000

Advertising and promotion 100,000

Bad debt expense 80,000

Provision for sales returns(w.8) 96,000

Depreciation/armotization 135,000

Donations 18,000

GREEN MANUFACTURING COMPANY

Adjusted Statement of Income

For the Year Ending December 31st. 2019

Item $ $

Sales 16,000,000

Cost of goods sold (w.1) (8,380,000)

Gross profit 7,620,000

Less: Expenses

Salaries and wages (w.2) 640,000

Management bonuses (w.3) 240,000

Employee benefits (w.4) 130,000

Interest expense 54,000

Insurance expenses(w. 5) 29,000

Appraisal fees (w.6) 15,000

Legal and accounting fees 35,000

Repair and maintenance cost (w.7) 14,000

Travel 150,000

Advertising and promotion 100,000

Bad debt expense 80,000

Provision for sales returns(w.8) 96,000

Depreciation/armotization 135,000

Donations 18,000

TAX

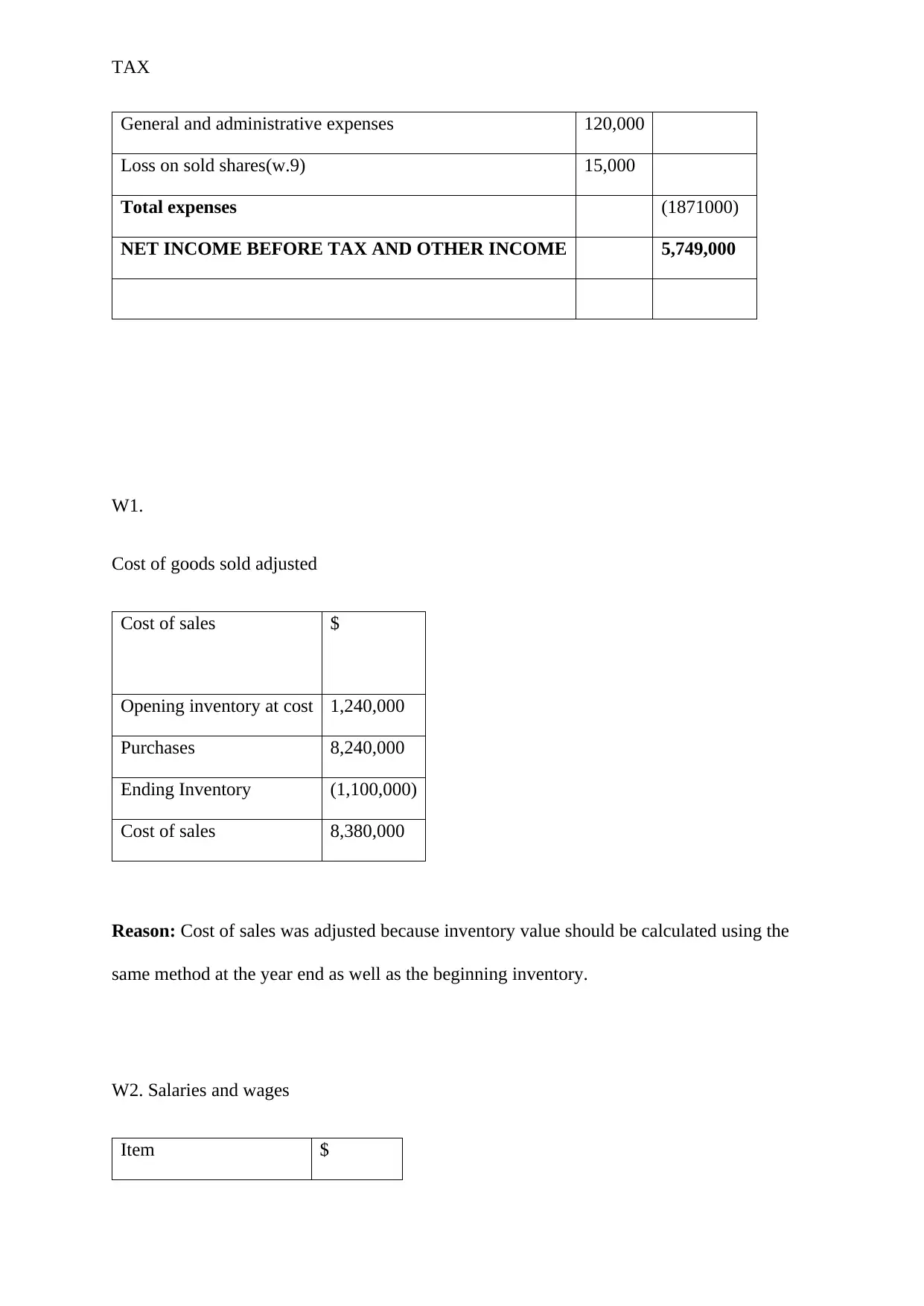

General and administrative expenses 120,000

Loss on sold shares(w.9) 15,000

Total expenses (1871000)

NET INCOME BEFORE TAX AND OTHER INCOME 5,749,000

W1.

Cost of goods sold adjusted

Cost of sales $

Opening inventory at cost 1,240,000

Purchases 8,240,000

Ending Inventory (1,100,000)

Cost of sales 8,380,000

Reason: Cost of sales was adjusted because inventory value should be calculated using the

same method at the year end as well as the beginning inventory.

W2. Salaries and wages

Item $

General and administrative expenses 120,000

Loss on sold shares(w.9) 15,000

Total expenses (1871000)

NET INCOME BEFORE TAX AND OTHER INCOME 5,749,000

W1.

Cost of goods sold adjusted

Cost of sales $

Opening inventory at cost 1,240,000

Purchases 8,240,000

Ending Inventory (1,100,000)

Cost of sales 8,380,000

Reason: Cost of sales was adjusted because inventory value should be calculated using the

same method at the year end as well as the beginning inventory.

W2. Salaries and wages

Item $

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

TAX

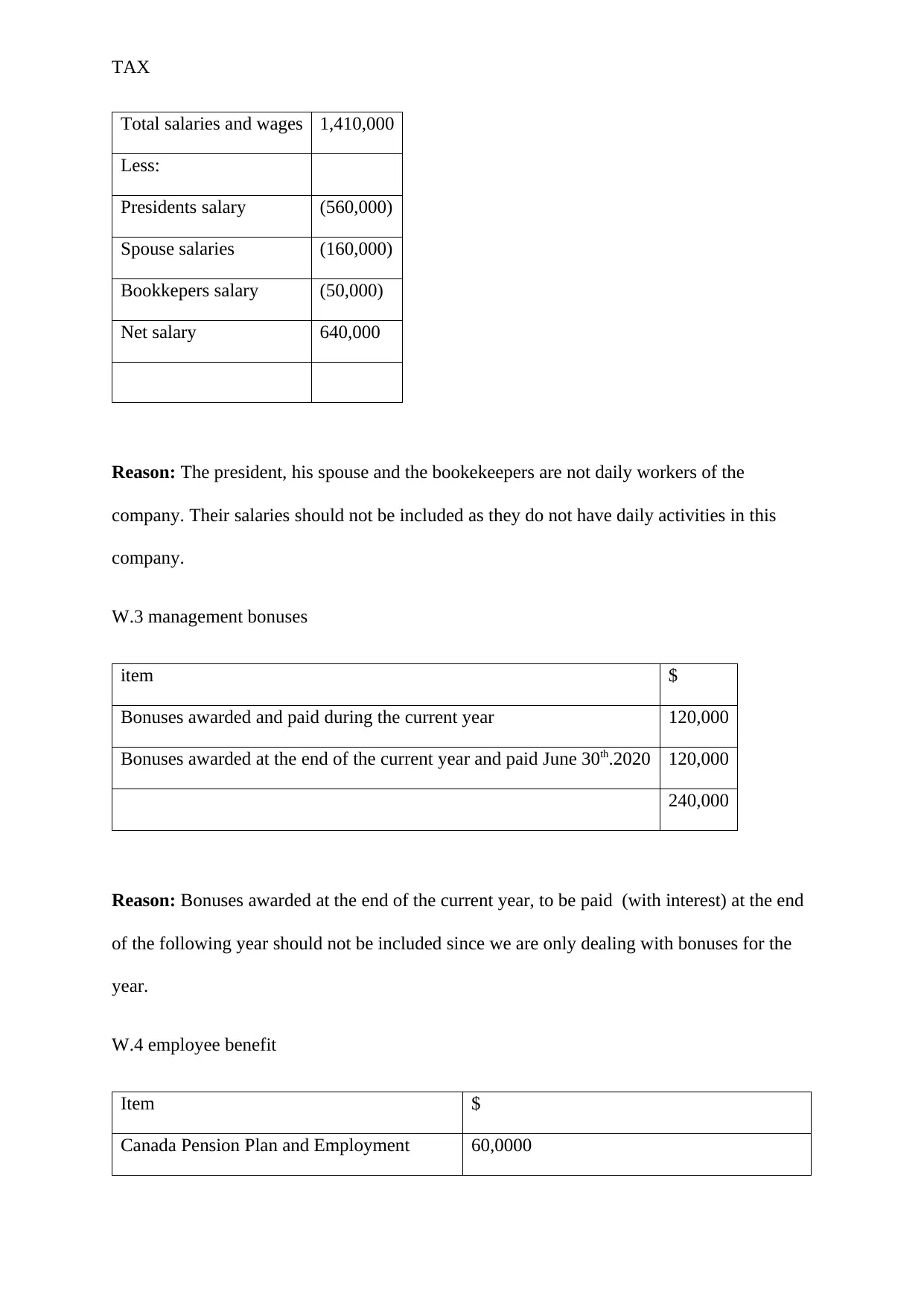

Total salaries and wages 1,410,000

Less:

Presidents salary (560,000)

Spouse salaries (160,000)

Bookkepers salary (50,000)

Net salary 640,000

Reason: The president, his spouse and the bookekeepers are not daily workers of the

company. Their salaries should not be included as they do not have daily activities in this

company.

W.3 management bonuses

item $

Bonuses awarded and paid during the current year 120,000

Bonuses awarded at the end of the current year and paid June 30th.2020 120,000

240,000

Reason: Bonuses awarded at the end of the current year, to be paid (with interest) at the end

of the following year should not be included since we are only dealing with bonuses for the

year.

W.4 employee benefit

Item $

Canada Pension Plan and Employment 60,0000

Total salaries and wages 1,410,000

Less:

Presidents salary (560,000)

Spouse salaries (160,000)

Bookkepers salary (50,000)

Net salary 640,000

Reason: The president, his spouse and the bookekeepers are not daily workers of the

company. Their salaries should not be included as they do not have daily activities in this

company.

W.3 management bonuses

item $

Bonuses awarded and paid during the current year 120,000

Bonuses awarded at the end of the current year and paid June 30th.2020 120,000

240,000

Reason: Bonuses awarded at the end of the current year, to be paid (with interest) at the end

of the following year should not be included since we are only dealing with bonuses for the

year.

W.4 employee benefit

Item $

Canada Pension Plan and Employment 60,0000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

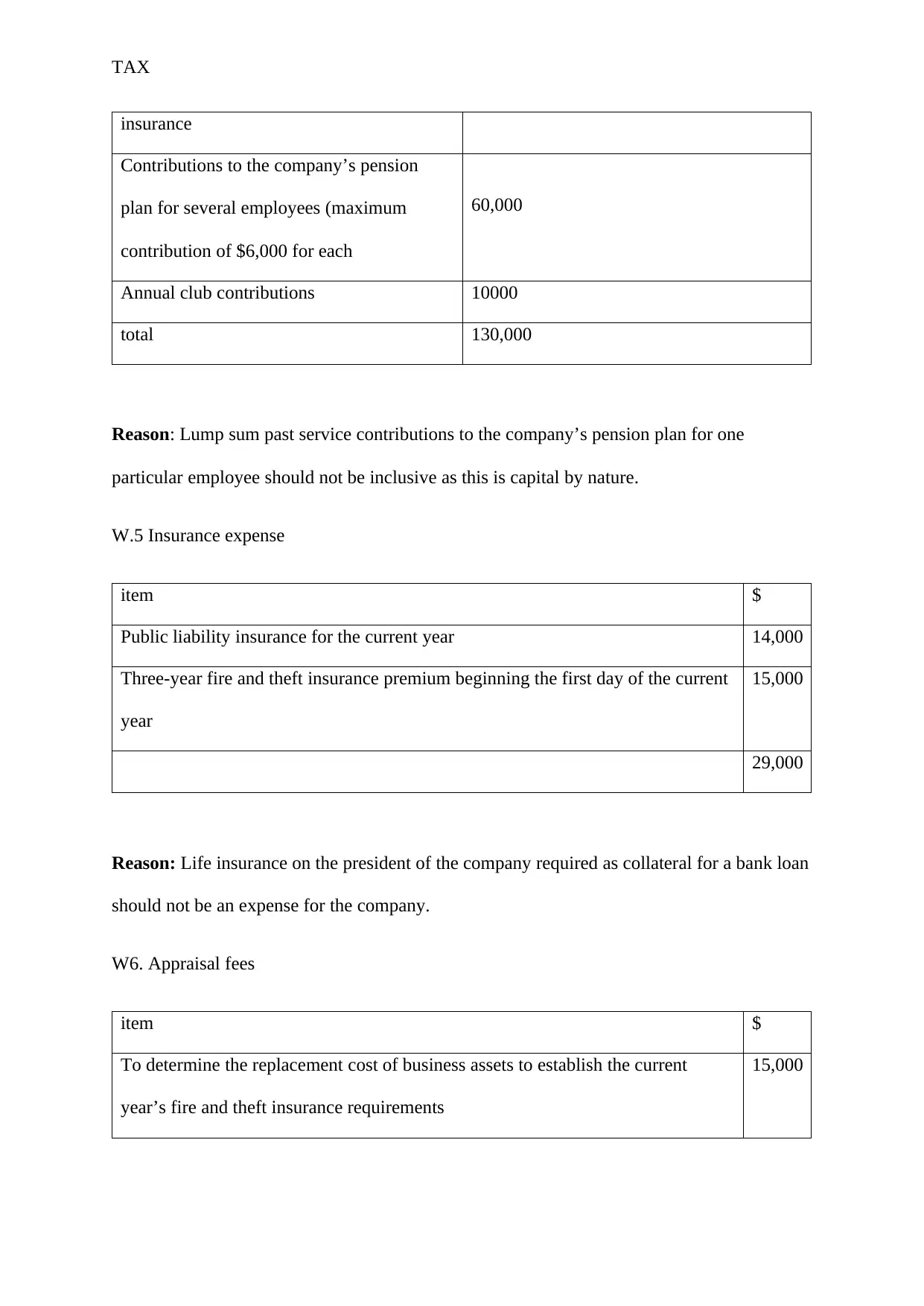

TAX

insurance

Contributions to the company’s pension

plan for several employees (maximum

contribution of $6,000 for each

60,000

Annual club contributions 10000

total 130,000

Reason: Lump sum past service contributions to the company’s pension plan for one

particular employee should not be inclusive as this is capital by nature.

W.5 Insurance expense

item $

Public liability insurance for the current year 14,000

Three-year fire and theft insurance premium beginning the first day of the current

year

15,000

29,000

Reason: Life insurance on the president of the company required as collateral for a bank loan

should not be an expense for the company.

W6. Appraisal fees

item $

To determine the replacement cost of business assets to establish the current

year’s fire and theft insurance requirements

15,000

insurance

Contributions to the company’s pension

plan for several employees (maximum

contribution of $6,000 for each

60,000

Annual club contributions 10000

total 130,000

Reason: Lump sum past service contributions to the company’s pension plan for one

particular employee should not be inclusive as this is capital by nature.

W.5 Insurance expense

item $

Public liability insurance for the current year 14,000

Three-year fire and theft insurance premium beginning the first day of the current

year

15,000

29,000

Reason: Life insurance on the president of the company required as collateral for a bank loan

should not be an expense for the company.

W6. Appraisal fees

item $

To determine the replacement cost of business assets to establish the current

year’s fire and theft insurance requirements

15,000

TAX

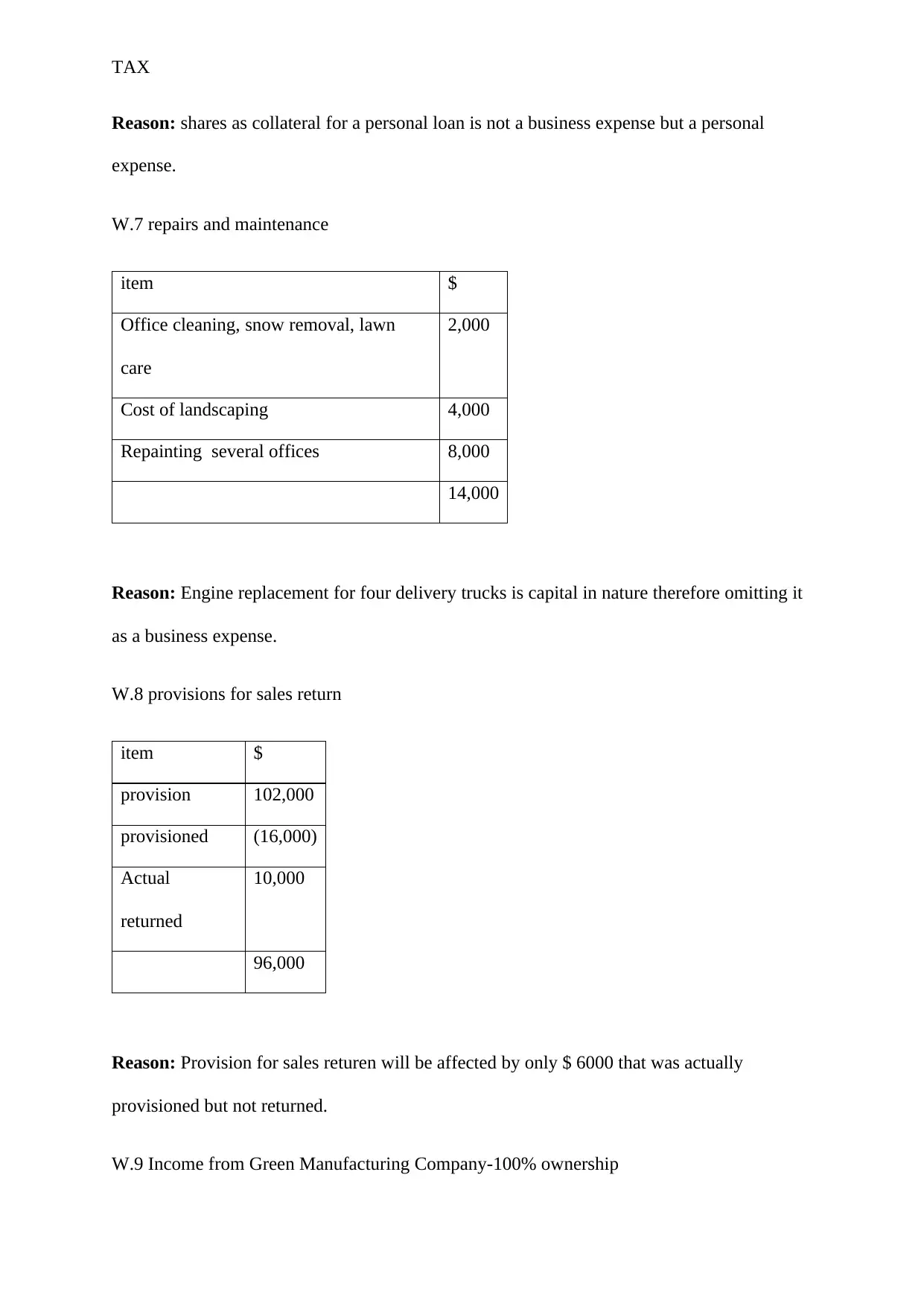

Reason: shares as collateral for a personal loan is not a business expense but a personal

expense.

W.7 repairs and maintenance

item $

Office cleaning, snow removal, lawn

care

2,000

Cost of landscaping 4,000

Repainting several offices 8,000

14,000

Reason: Engine replacement for four delivery trucks is capital in nature therefore omitting it

as a business expense.

W.8 provisions for sales return

item $

provision 102,000

provisioned (16,000)

Actual

returned

10,000

96,000

Reason: Provision for sales returen will be affected by only $ 6000 that was actually

provisioned but not returned.

W.9 Income from Green Manufacturing Company-100% ownership

Reason: shares as collateral for a personal loan is not a business expense but a personal

expense.

W.7 repairs and maintenance

item $

Office cleaning, snow removal, lawn

care

2,000

Cost of landscaping 4,000

Repainting several offices 8,000

14,000

Reason: Engine replacement for four delivery trucks is capital in nature therefore omitting it

as a business expense.

W.8 provisions for sales return

item $

provision 102,000

provisioned (16,000)

Actual

returned

10,000

96,000

Reason: Provision for sales returen will be affected by only $ 6000 that was actually

provisioned but not returned.

W.9 Income from Green Manufacturing Company-100% ownership

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

TAX

Item $

Income to the company’s president 560,000

Presidents spouse 160,000

Bookkeepers salary 50,000

Reason: Income from Green manufacturing will feature as other incomes for mr. hern but not

as an expense for the company.

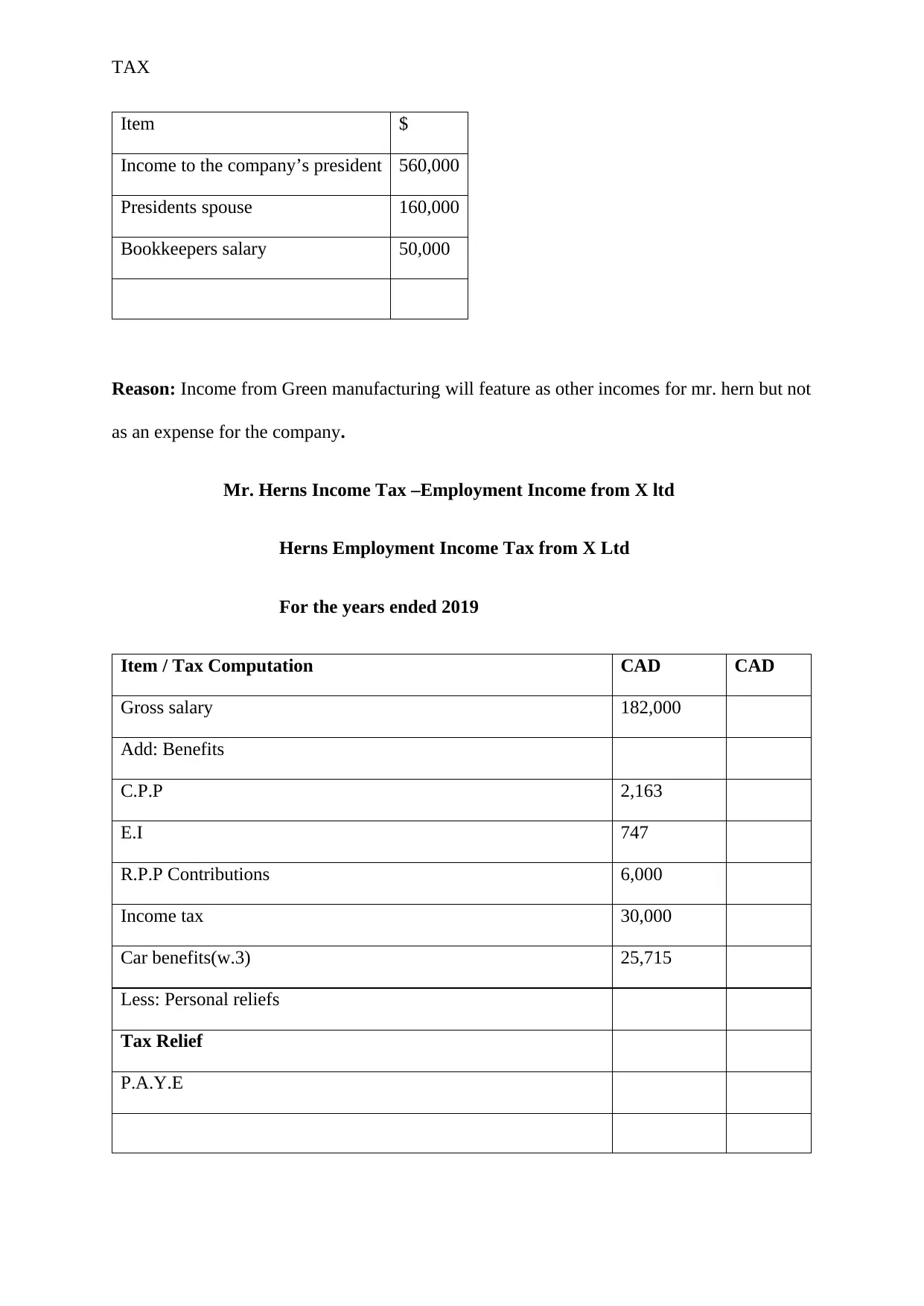

Mr. Herns Income Tax –Employment Income from X ltd

Herns Employment Income Tax from X Ltd

For the years ended 2019

Item / Tax Computation CAD CAD

Gross salary 182,000

Add: Benefits

C.P.P 2,163

E.I 747

R.P.P Contributions 6,000

Income tax 30,000

Car benefits(w.3) 25,715

Less: Personal reliefs

Tax Relief

P.A.Y.E

Item $

Income to the company’s president 560,000

Presidents spouse 160,000

Bookkeepers salary 50,000

Reason: Income from Green manufacturing will feature as other incomes for mr. hern but not

as an expense for the company.

Mr. Herns Income Tax –Employment Income from X ltd

Herns Employment Income Tax from X Ltd

For the years ended 2019

Item / Tax Computation CAD CAD

Gross salary 182,000

Add: Benefits

C.P.P 2,163

E.I 747

R.P.P Contributions 6,000

Income tax 30,000

Car benefits(w.3) 25,715

Less: Personal reliefs

Tax Relief

P.A.Y.E

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TAX

Total Taxable Net Pay 246625

$47,630 or less………………………………………………………………………..…15%

in excess of $47,630………………………………………………………..…………

$7,145*+ 20.5% on next $47,629

in excess of $95,259…………………………………………………………………..

$16,909 ** + 26% on next $52,408

in excess of $147,667……………………………………………………………….…

$30,535***+29% on next 62,705

in excess of $210,371…………………………………………………………………..

$48,719*** + 33% on remainder

Tax Due 114,027.9

Total Tax Due

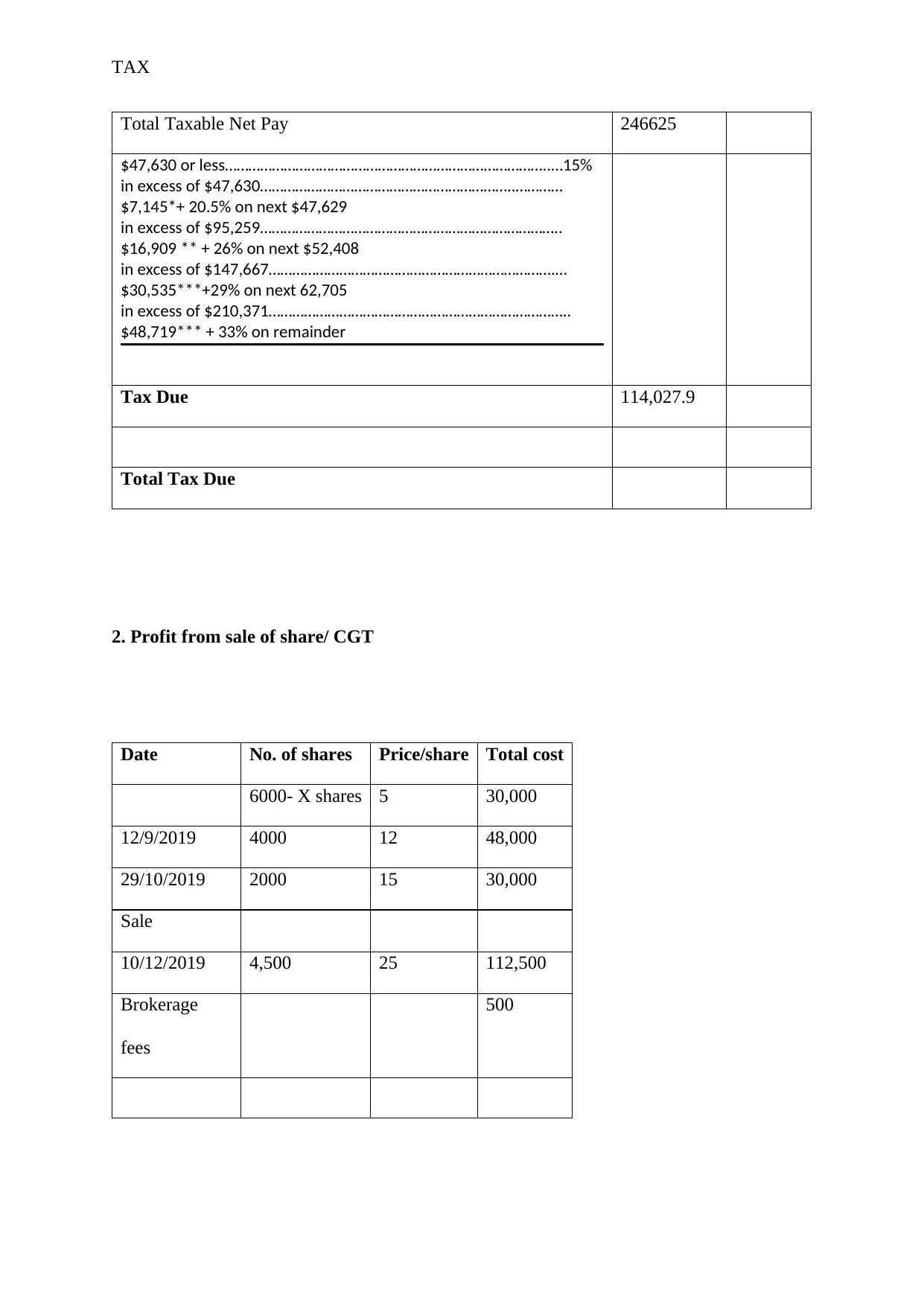

2. Profit from sale of share/ CGT

Date No. of shares Price/share Total cost

6000- X shares 5 30,000

12/9/2019 4000 12 48,000

29/10/2019 2000 15 30,000

Sale

10/12/2019 4,500 25 112,500

Brokerage

fees

500

Total Taxable Net Pay 246625

$47,630 or less………………………………………………………………………..…15%

in excess of $47,630………………………………………………………..…………

$7,145*+ 20.5% on next $47,629

in excess of $95,259…………………………………………………………………..

$16,909 ** + 26% on next $52,408

in excess of $147,667……………………………………………………………….…

$30,535***+29% on next 62,705

in excess of $210,371…………………………………………………………………..

$48,719*** + 33% on remainder

Tax Due 114,027.9

Total Tax Due

2. Profit from sale of share/ CGT

Date No. of shares Price/share Total cost

6000- X shares 5 30,000

12/9/2019 4000 12 48,000

29/10/2019 2000 15 30,000

Sale

10/12/2019 4,500 25 112,500

Brokerage

fees

500

TAX

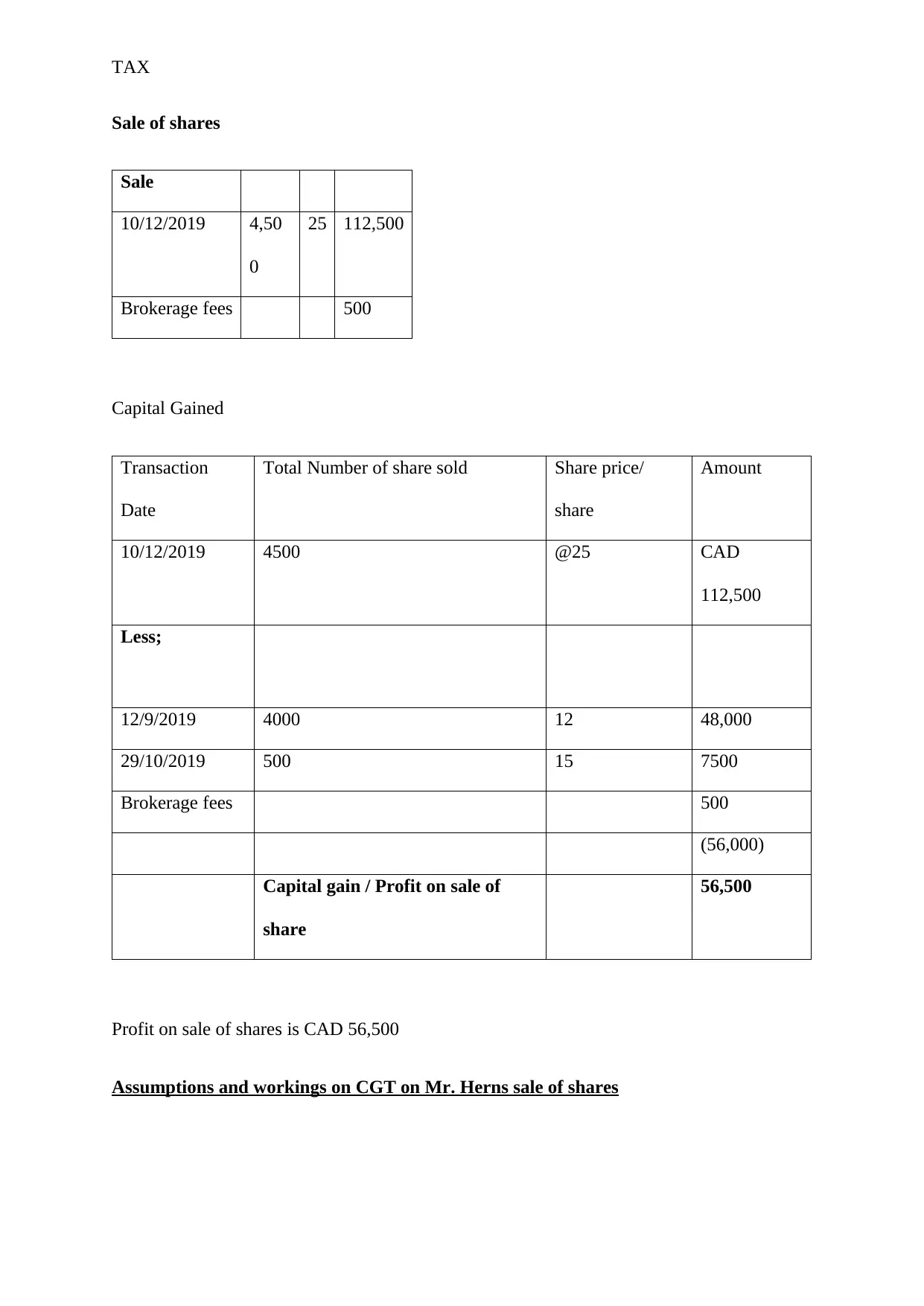

Sale of shares

Sale

10/12/2019 4,50

0

25 112,500

Brokerage fees 500

Capital Gained

Transaction

Date

Total Number of share sold Share price/

share

Amount

10/12/2019 4500 @25 CAD

112,500

Less;

12/9/2019 4000 12 48,000

29/10/2019 500 15 7500

Brokerage fees 500

(56,000)

Capital gain / Profit on sale of

share

56,500

Profit on sale of shares is CAD 56,500

Assumptions and workings on CGT on Mr. Herns sale of shares

Sale of shares

Sale

10/12/2019 4,50

0

25 112,500

Brokerage fees 500

Capital Gained

Transaction

Date

Total Number of share sold Share price/

share

Amount

10/12/2019 4500 @25 CAD

112,500

Less;

12/9/2019 4000 12 48,000

29/10/2019 500 15 7500

Brokerage fees 500

(56,000)

Capital gain / Profit on sale of

share

56,500

Profit on sale of shares is CAD 56,500

Assumptions and workings on CGT on Mr. Herns sale of shares

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

TAX

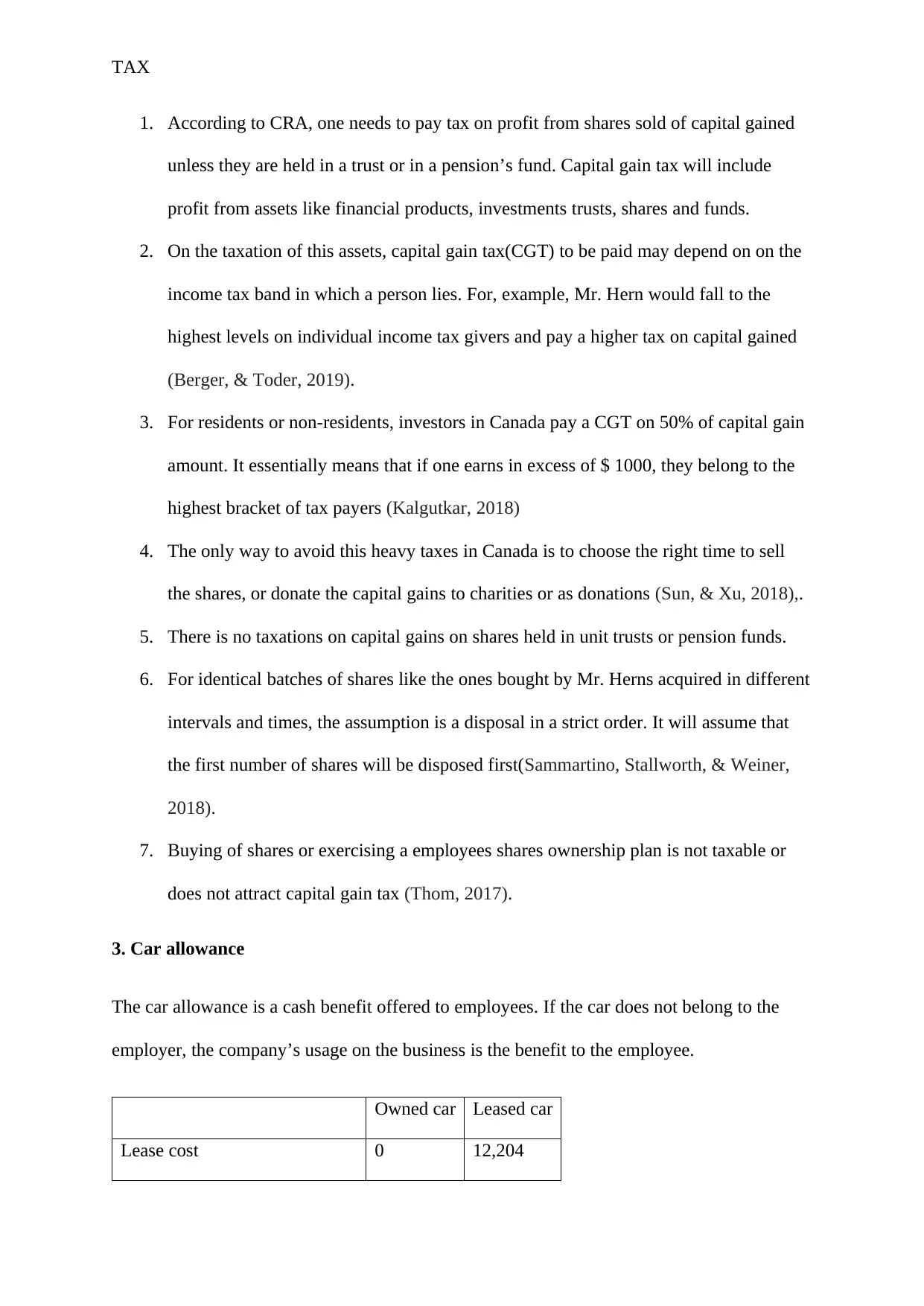

1. According to CRA, one needs to pay tax on profit from shares sold of capital gained

unless they are held in a trust or in a pension’s fund. Capital gain tax will include

profit from assets like financial products, investments trusts, shares and funds.

2. On the taxation of this assets, capital gain tax(CGT) to be paid may depend on on the

income tax band in which a person lies. For, example, Mr. Hern would fall to the

highest levels on individual income tax givers and pay a higher tax on capital gained

(Berger, & Toder, 2019).

3. For residents or non-residents, investors in Canada pay a CGT on 50% of capital gain

amount. It essentially means that if one earns in excess of $ 1000, they belong to the

highest bracket of tax payers (Kalgutkar, 2018)

4. The only way to avoid this heavy taxes in Canada is to choose the right time to sell

the shares, or donate the capital gains to charities or as donations (Sun, & Xu, 2018),.

5. There is no taxations on capital gains on shares held in unit trusts or pension funds.

6. For identical batches of shares like the ones bought by Mr. Herns acquired in different

intervals and times, the assumption is a disposal in a strict order. It will assume that

the first number of shares will be disposed first(Sammartino, Stallworth, & Weiner,

2018).

7. Buying of shares or exercising a employees shares ownership plan is not taxable or

does not attract capital gain tax (Thom, 2017).

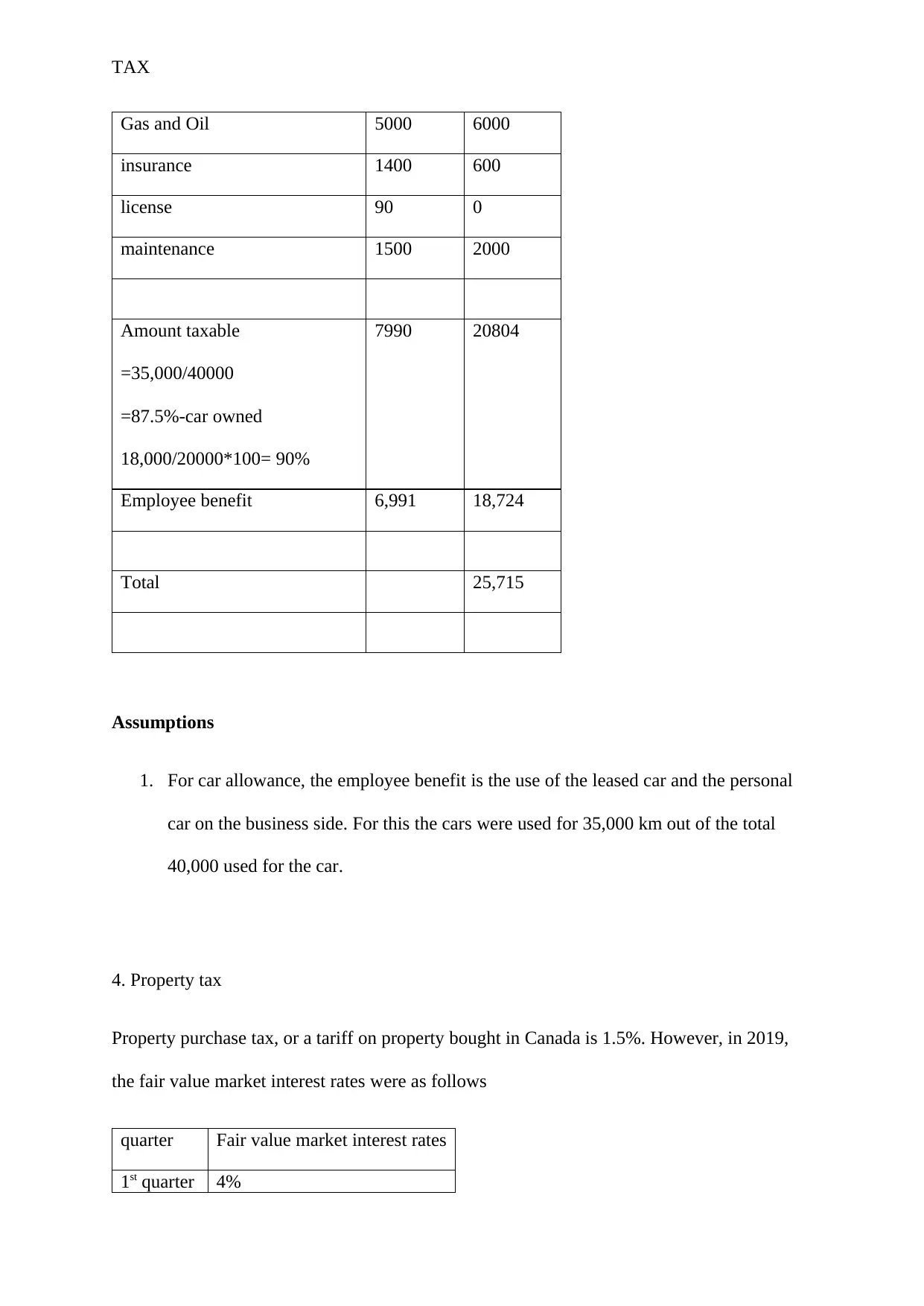

3. Car allowance

The car allowance is a cash benefit offered to employees. If the car does not belong to the

employer, the company’s usage on the business is the benefit to the employee.

Owned car Leased car

Lease cost 0 12,204

1. According to CRA, one needs to pay tax on profit from shares sold of capital gained

unless they are held in a trust or in a pension’s fund. Capital gain tax will include

profit from assets like financial products, investments trusts, shares and funds.

2. On the taxation of this assets, capital gain tax(CGT) to be paid may depend on on the

income tax band in which a person lies. For, example, Mr. Hern would fall to the

highest levels on individual income tax givers and pay a higher tax on capital gained

(Berger, & Toder, 2019).

3. For residents or non-residents, investors in Canada pay a CGT on 50% of capital gain

amount. It essentially means that if one earns in excess of $ 1000, they belong to the

highest bracket of tax payers (Kalgutkar, 2018)

4. The only way to avoid this heavy taxes in Canada is to choose the right time to sell

the shares, or donate the capital gains to charities or as donations (Sun, & Xu, 2018),.

5. There is no taxations on capital gains on shares held in unit trusts or pension funds.

6. For identical batches of shares like the ones bought by Mr. Herns acquired in different

intervals and times, the assumption is a disposal in a strict order. It will assume that

the first number of shares will be disposed first(Sammartino, Stallworth, & Weiner,

2018).

7. Buying of shares or exercising a employees shares ownership plan is not taxable or

does not attract capital gain tax (Thom, 2017).

3. Car allowance

The car allowance is a cash benefit offered to employees. If the car does not belong to the

employer, the company’s usage on the business is the benefit to the employee.

Owned car Leased car

Lease cost 0 12,204

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TAX

Gas and Oil 5000 6000

insurance 1400 600

license 90 0

maintenance 1500 2000

Amount taxable

=35,000/40000

=87.5%-car owned

18,000/20000*100= 90%

7990 20804

Employee benefit 6,991 18,724

Total 25,715

Assumptions

1. For car allowance, the employee benefit is the use of the leased car and the personal

car on the business side. For this the cars were used for 35,000 km out of the total

40,000 used for the car.

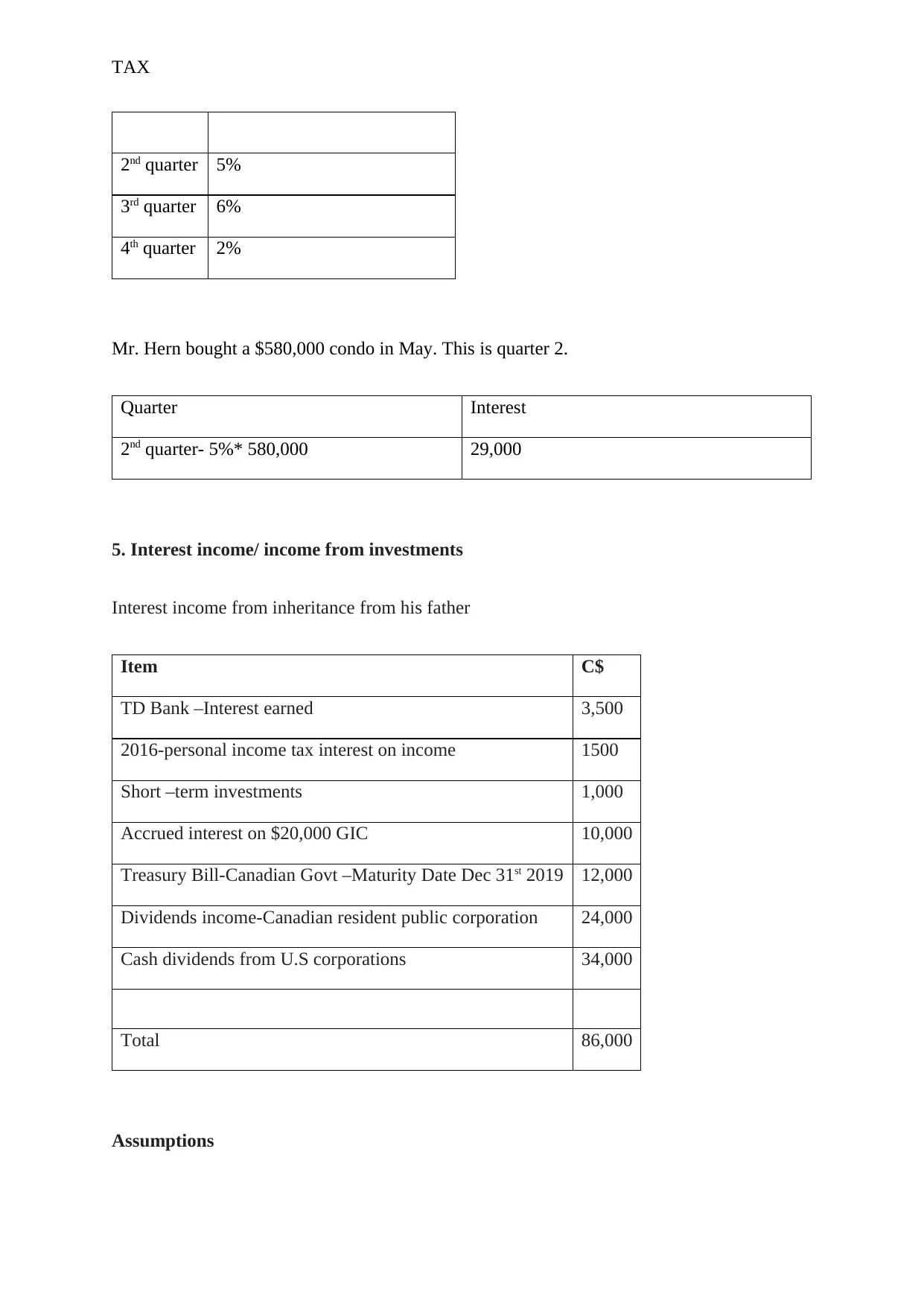

4. Property tax

Property purchase tax, or a tariff on property bought in Canada is 1.5%. However, in 2019,

the fair value market interest rates were as follows

quarter Fair value market interest rates

1st quarter 4%

Gas and Oil 5000 6000

insurance 1400 600

license 90 0

maintenance 1500 2000

Amount taxable

=35,000/40000

=87.5%-car owned

18,000/20000*100= 90%

7990 20804

Employee benefit 6,991 18,724

Total 25,715

Assumptions

1. For car allowance, the employee benefit is the use of the leased car and the personal

car on the business side. For this the cars were used for 35,000 km out of the total

40,000 used for the car.

4. Property tax

Property purchase tax, or a tariff on property bought in Canada is 1.5%. However, in 2019,

the fair value market interest rates were as follows

quarter Fair value market interest rates

1st quarter 4%

TAX

2nd quarter 5%

3rd quarter 6%

4th quarter 2%

Mr. Hern bought a $580,000 condo in May. This is quarter 2.

Quarter Interest

2nd quarter- 5%* 580,000 29,000

5. Interest income/ income from investments

Interest income from inheritance from his father

Item C$

TD Bank –Interest earned 3,500

2016-personal income tax interest on income 1500

Short –term investments 1,000

Accrued interest on $20,000 GIC 10,000

Treasury Bill-Canadian Govt –Maturity Date Dec 31st 2019 12,000

Dividends income-Canadian resident public corporation 24,000

Cash dividends from U.S corporations 34,000

Total 86,000

Assumptions

2nd quarter 5%

3rd quarter 6%

4th quarter 2%

Mr. Hern bought a $580,000 condo in May. This is quarter 2.

Quarter Interest

2nd quarter- 5%* 580,000 29,000

5. Interest income/ income from investments

Interest income from inheritance from his father

Item C$

TD Bank –Interest earned 3,500

2016-personal income tax interest on income 1500

Short –term investments 1,000

Accrued interest on $20,000 GIC 10,000

Treasury Bill-Canadian Govt –Maturity Date Dec 31st 2019 12,000

Dividends income-Canadian resident public corporation 24,000

Cash dividends from U.S corporations 34,000

Total 86,000

Assumptions

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.