Advanced Management Accounting Report: Stakeholder & Variance Analysis

VerifiedAdded on 2020/12/09

|18

|6176

|132

Report

AI Summary

This report provides a comprehensive overview of advanced management accounting, focusing on the purpose and presentation of financial information from the perspective of various stakeholders, including owners, investors, management, employees, customers, and government entities. It explores the use of financial information in making financial plans and decisions, emphasizing its role in assessing a company's financial position and aiding investment decisions. The report then evaluates different microeconomic techniques, such as cost accounting and CVP analysis, highlighting their advantages and disadvantages in supporting organizational performance. A significant portion of the report is dedicated to variance analysis, explaining its importance and application using actual and standard costs to correct and control variances. Finally, the report concludes by summarizing the effects of internal and external changes on management accounting, emphasizing the importance of adaptability and communication in response to these changes. The report provides a detailed analysis of the financial information and accounting techniques used by the RBS Accountants, highlighting the importance of financial information for various stakeholders.

ADVANCED MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

LO 1.................................................................................................................................................3

P 1. Purpose and presentation of financial information from the perspective of different

stakeholders............................................................................................................................3

M 1. & D 1. Use of Financial Information in making financial plans and decision making

process....................................................................................................................................5

LO 2.................................................................................................................................................6

P 2. Evaluate different micro economic techniques to support organizational performance

along with its advantages and disadvantages.........................................................................6

M 2. Evaluating accounting techniques by assessing both the advantages and disadvantages.. .8

LO 3 ..............................................................................................................................................10

P3 Analyse the concept of variance analysis and its importance.........................................10

M 3. & D 2. Application of different accounting techniques and variances along with

Advantages and disadvantages.............................................................................................11

P 4. Use of actual and standard cost to correct and control variances..................................12

LO 4...............................................................................................................................................13

P 5. & M 4. Effect of external and internal change on management accounting................13

D 3. Impact of changes for future communication and acceptance of change.....................15

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION...........................................................................................................................3

LO 1.................................................................................................................................................3

P 1. Purpose and presentation of financial information from the perspective of different

stakeholders............................................................................................................................3

M 1. & D 1. Use of Financial Information in making financial plans and decision making

process....................................................................................................................................5

LO 2.................................................................................................................................................6

P 2. Evaluate different micro economic techniques to support organizational performance

along with its advantages and disadvantages.........................................................................6

M 2. Evaluating accounting techniques by assessing both the advantages and disadvantages.. .8

LO 3 ..............................................................................................................................................10

P3 Analyse the concept of variance analysis and its importance.........................................10

M 3. & D 2. Application of different accounting techniques and variances along with

Advantages and disadvantages.............................................................................................11

P 4. Use of actual and standard cost to correct and control variances..................................12

LO 4...............................................................................................................................................13

P 5. & M 4. Effect of external and internal change on management accounting................13

D 3. Impact of changes for future communication and acceptance of change.....................15

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION

Management accounting is the presentation of accounting information which is used by

the managers of the company in formulating the policies and to assist day to day activities. It

helps the company in planning, organizing, directing and controlling the activities of the business.

Management accounting is useful to provide financial information to external as well as internal

users which it provides in the form of financial statements. This information is required by

stakeholders of the company which includes employees, shareholders, customers etc. This report

will include purpose and presentation of these financial information from the perspective of

different shareholders. Moreover, it includes different micro factor techniques that support

performance of the organization. These factors play a very important role in the organization,

however to get through this the report will show concept of variance analysis and its importance.

At last this report will include use of actual and standard cost to correct and control variances

whereas the report will end summarizing effect of external and internal change on management

accounting.

LO 1

P 1. Purpose and presentation of financial information from the perspective of different

stakeholders

Financial information need to be provide to all the interested parties as it provides

information about the financial position of the company which is used by large number of users to

make economic decisions. The purpose of financial information is to provide information about

the outcome of operations, financial position and cash flow of the organization. This helps the

users in allocating their financial resources. The company has different stake holders who needs

information for different purposes. RBS Accountants is the CA firm in UK with offices in Canary

Wharf, London. It has over 40 years of experience in all areas of business and finance (RBS

Accountants UK, 2019). It has a vibrant and enthusiastic team that are reliable and provide swift

service and strive value of money to its customers.It gives tough competition to its competitors

by offering quality and reliable services to the customers at suitable prices (Pradika, 2018). The

stakeholders of the company who are interested in getting information about RBS Accountants are

its mangers, employees, shareholders, customers, suppliers, creditors, government, debtor etc.

Different stakeholders need the information of the company for following reasons:

Management accounting is the presentation of accounting information which is used by

the managers of the company in formulating the policies and to assist day to day activities. It

helps the company in planning, organizing, directing and controlling the activities of the business.

Management accounting is useful to provide financial information to external as well as internal

users which it provides in the form of financial statements. This information is required by

stakeholders of the company which includes employees, shareholders, customers etc. This report

will include purpose and presentation of these financial information from the perspective of

different shareholders. Moreover, it includes different micro factor techniques that support

performance of the organization. These factors play a very important role in the organization,

however to get through this the report will show concept of variance analysis and its importance.

At last this report will include use of actual and standard cost to correct and control variances

whereas the report will end summarizing effect of external and internal change on management

accounting.

LO 1

P 1. Purpose and presentation of financial information from the perspective of different

stakeholders

Financial information need to be provide to all the interested parties as it provides

information about the financial position of the company which is used by large number of users to

make economic decisions. The purpose of financial information is to provide information about

the outcome of operations, financial position and cash flow of the organization. This helps the

users in allocating their financial resources. The company has different stake holders who needs

information for different purposes. RBS Accountants is the CA firm in UK with offices in Canary

Wharf, London. It has over 40 years of experience in all areas of business and finance (RBS

Accountants UK, 2019). It has a vibrant and enthusiastic team that are reliable and provide swift

service and strive value of money to its customers.It gives tough competition to its competitors

by offering quality and reliable services to the customers at suitable prices (Pradika, 2018). The

stakeholders of the company who are interested in getting information about RBS Accountants are

its mangers, employees, shareholders, customers, suppliers, creditors, government, debtor etc.

Different stakeholders need the information of the company for following reasons:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Owners and investors – Owners and investors of the company are first users of the

information. These are the people who are most interested in financial information of the

company. It helps the owners and investors in making decisions in order to sell, hold or buy more

shares of the company. Investors need the information to assess and evaluate potential of the

company to grab success and profitability. RBS Accountants is situated in London for many years

now and is located in Canary Wharf which is one of the city's main financial centers. and hence it

has many investors and this financial information help them in determining if the company will

want to continue, improve or stop operating (Lee, 2015). The financial information helps the

owners in safeguarding their assets and they usually have access to all financial records and files.

Management – They act as an agent of the owners and their motto is maximizing sales

and profit of the company. The managers of the company need financial information to assist day

to day activities if the company and to ensure internal control on the organization. They are also

concerned about their won remuneration as if the company will not operate in profits, their

remuneration will be low and vice versa. Management have access to all records and this

information help them in taking regular decisions related to liquidity, profitability and cash flow

of the company.

Competitors – Companies which are in competition against a business will attempt to gain

access to the financial information of the rivals to analyze and evaluate their financial position.

The inside information helps the company in formulating their strategies and to have competitive

advantage over other firms (Schweisfurth, 2017). Every company for this purpose strengthen their

sources to find out the information of other companies to maximize their market share and

profitability.

Employees – Employees need to know about the financial information of the company in

order to know where the company stands, how secure the job is, and how possible can the pay

rise, how often they can get promoted etc. RBS Accountants has limited employees but they are

trust worthy and honest and provide swift services to the customers of the company. Employees

are all interested in company's profitability and stability so that company can provide them with

bonuses and employment benefits. Employees are also interested in knowing financial

information so that they can assess company expansion and career development opportunities and

can compare companies to know that they are placed in the best company or not.

information. These are the people who are most interested in financial information of the

company. It helps the owners and investors in making decisions in order to sell, hold or buy more

shares of the company. Investors need the information to assess and evaluate potential of the

company to grab success and profitability. RBS Accountants is situated in London for many years

now and is located in Canary Wharf which is one of the city's main financial centers. and hence it

has many investors and this financial information help them in determining if the company will

want to continue, improve or stop operating (Lee, 2015). The financial information helps the

owners in safeguarding their assets and they usually have access to all financial records and files.

Management – They act as an agent of the owners and their motto is maximizing sales

and profit of the company. The managers of the company need financial information to assist day

to day activities if the company and to ensure internal control on the organization. They are also

concerned about their won remuneration as if the company will not operate in profits, their

remuneration will be low and vice versa. Management have access to all records and this

information help them in taking regular decisions related to liquidity, profitability and cash flow

of the company.

Competitors – Companies which are in competition against a business will attempt to gain

access to the financial information of the rivals to analyze and evaluate their financial position.

The inside information helps the company in formulating their strategies and to have competitive

advantage over other firms (Schweisfurth, 2017). Every company for this purpose strengthen their

sources to find out the information of other companies to maximize their market share and

profitability.

Employees – Employees need to know about the financial information of the company in

order to know where the company stands, how secure the job is, and how possible can the pay

rise, how often they can get promoted etc. RBS Accountants has limited employees but they are

trust worthy and honest and provide swift services to the customers of the company. Employees

are all interested in company's profitability and stability so that company can provide them with

bonuses and employment benefits. Employees are also interested in knowing financial

information so that they can assess company expansion and career development opportunities and

can compare companies to know that they are placed in the best company or not.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Customers – When customers are associated with the company for a long term which is

the case of RBS Accountants as its customers are loyal then customers do get interested in

knowing the financial position as well as information about the company's ability to continue its

existence and maintain stability of its operations. When a customer considers that which supplier

to select for major contract, it reviews financial statements of the company to judge financial

ability of the supplier to remain in the business to provide good and services mandated in the

contract.

Government – Governing bodies like state, tax authorities etc. are interested in getting

financial information of the company for the purpose of taxation and regulatory purposes. Taxes

of RBS Accountants are computed based on the results of operations and other tax basis. The state

government like to know how much does the company be paying on the name of tax. It also helps

the government in knowing how the economy is performing in order to plan industrial and

financial policies. Tax authorities use financial statements of the company as the basis of tax

computation. It also helps the government in informing regional as well as national economic

development. Also, helps in competition regulation and making employment policies.

Public – The public feels like assessing the effects of the company on economy, local

environment and local community by the company (Susanto, 2015). RBS Accountants contributes

to their local economy and community by providing employment and business to local suppliers.

With the motive to fulfill public’s expectation company also lay emphasis on doing CSR activity

which in turn contributes in sustainable environment. The public may involve researchers,

students, analysts, etc. who will be interested in company's financial information for project and

research purpose.

In conclusion to this section, it can be presented that for the purpose of decision making

stakeholders undertake financial information. It can be summarized that management and

employees are the internal stakeholders of the firm which make evaluation of final accounts with

the motive to take suitable decision for near future. Beside this, it can be inferred that firm’s

financial information also supports decision making of external; stakeholders to a great extent.

M 1. & D 1. Use of Financial Information in making financial plans and decision making process.

It can be concluded from the analysis made that financial information plays a vital role in

providing information to the different users. With the help of financial information, the users can

the case of RBS Accountants as its customers are loyal then customers do get interested in

knowing the financial position as well as information about the company's ability to continue its

existence and maintain stability of its operations. When a customer considers that which supplier

to select for major contract, it reviews financial statements of the company to judge financial

ability of the supplier to remain in the business to provide good and services mandated in the

contract.

Government – Governing bodies like state, tax authorities etc. are interested in getting

financial information of the company for the purpose of taxation and regulatory purposes. Taxes

of RBS Accountants are computed based on the results of operations and other tax basis. The state

government like to know how much does the company be paying on the name of tax. It also helps

the government in knowing how the economy is performing in order to plan industrial and

financial policies. Tax authorities use financial statements of the company as the basis of tax

computation. It also helps the government in informing regional as well as national economic

development. Also, helps in competition regulation and making employment policies.

Public – The public feels like assessing the effects of the company on economy, local

environment and local community by the company (Susanto, 2015). RBS Accountants contributes

to their local economy and community by providing employment and business to local suppliers.

With the motive to fulfill public’s expectation company also lay emphasis on doing CSR activity

which in turn contributes in sustainable environment. The public may involve researchers,

students, analysts, etc. who will be interested in company's financial information for project and

research purpose.

In conclusion to this section, it can be presented that for the purpose of decision making

stakeholders undertake financial information. It can be summarized that management and

employees are the internal stakeholders of the firm which make evaluation of final accounts with

the motive to take suitable decision for near future. Beside this, it can be inferred that firm’s

financial information also supports decision making of external; stakeholders to a great extent.

M 1. & D 1. Use of Financial Information in making financial plans and decision making process.

It can be concluded from the analysis made that financial information plays a vital role in

providing information to the different users. With the help of financial information, the users can

very easily take economic decisions related to investing in the company, selling and buying shares

of the company etc. With the help of financial information, investors can decide whether to make

investment in the capital in the shares of the company (Mohr, 2016). Thus, the financial statement

provides a true picture about the financial as well as liquidity or solvency position of the business.

It plays an important role in decision making purpose by providing useful as well as crucial

business and finance related information to its stakeholders for making investment decision. With

the help of financial statements of the company, investors and other stakeholders can make plan

their taxation decision as well.

Financial information should be developed in a manner which can assist the management

of the company as well as investors in making crucial investment and lending decisions. One of

the most important features of financial information is that it should be appropriately recorded and

presented so as to support in financial planning and decision-making to both the internal as well as

external users of the company. Correct and accurate financial information helps in:

1. Providing baseline to the investors for making analysis and comparison between financial

position and health of the company in which investment has been made.

2. It helps creditors and other stakeholders such as traders, vendors in assessing the solvency,

liquidity position and creditworthiness of businesses.

3. It also assists companies in making decisions related to how to allocate scarce resources

effectively.

LO 2

P 2. Evaluate different micro economic techniques to support organizational performance along

with its advantages and disadvantages.

Management accounting techniques include cost accounting, CVP analysis, marginal,

absorption and standing cost. All such techniques are highly significant which in turn provide

assistance in analyzing business strategies and thereby facilitates effectual decision making as

well as risk management.

The different micro economic techniques to support organizational performance are as follows:

Cost accounting - It is the branch of accounting that deals with classifying, recording and

allocating current cost along with prospective cost. It helps RBS Accountants in

of the company etc. With the help of financial information, investors can decide whether to make

investment in the capital in the shares of the company (Mohr, 2016). Thus, the financial statement

provides a true picture about the financial as well as liquidity or solvency position of the business.

It plays an important role in decision making purpose by providing useful as well as crucial

business and finance related information to its stakeholders for making investment decision. With

the help of financial statements of the company, investors and other stakeholders can make plan

their taxation decision as well.

Financial information should be developed in a manner which can assist the management

of the company as well as investors in making crucial investment and lending decisions. One of

the most important features of financial information is that it should be appropriately recorded and

presented so as to support in financial planning and decision-making to both the internal as well as

external users of the company. Correct and accurate financial information helps in:

1. Providing baseline to the investors for making analysis and comparison between financial

position and health of the company in which investment has been made.

2. It helps creditors and other stakeholders such as traders, vendors in assessing the solvency,

liquidity position and creditworthiness of businesses.

3. It also assists companies in making decisions related to how to allocate scarce resources

effectively.

LO 2

P 2. Evaluate different micro economic techniques to support organizational performance along

with its advantages and disadvantages.

Management accounting techniques include cost accounting, CVP analysis, marginal,

absorption and standing cost. All such techniques are highly significant which in turn provide

assistance in analyzing business strategies and thereby facilitates effectual decision making as

well as risk management.

The different micro economic techniques to support organizational performance are as follows:

Cost accounting - It is the branch of accounting that deals with classifying, recording and

allocating current cost along with prospective cost. It helps RBS Accountants in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

classifying its prime cost, direct cost, factory cost which allows the management of RBS

Accountants to control the cost and ascertain profitability of these processes. It helps the

company in controlling the cost of inventory, labor and other overhead costs. It helps the

company in determining difference between fixed and variable cost and help RBS

Accountants in fixing the prices of its product to survive in market fluctuations. Company

uses standards to make estimates for the future and measures the efficiency which lead to

cost reduction and helps in increasing efficiency in operations of the company. This

technique of management accounting is highly significant which provides assistance in

determining unit cost of products or services. Hence, referring this effectual cost sheet can

be prepared by the firm which further helps in assessing variances. Moreover, using cost

figures firm can do comparison of actual performance in against to the standards and

thereby would become able to undertake competent framework for improvement.

Cost value profit – CVP is used by companies to make informed decisions on the

products and services they sale. It plays important role in management accounting rather

than financial accounting. It helps RBS Accountants in comparing cost of operating goods

and producing goods. The three basic elements of CVP analysis are cost, volume and

profit. Cost means expenses that were incurred at the time of manufacturing the product.

Volume means number of units produced of physical product and profit means difference

between selling price of the product and service minus cost to produce it. It helps RBS

Accountants in determining its contribution margin which is sales revenue minus variable

expenses.

Marginal and absorption costing – Absorption costing take both fixed and variable cost

as cost of the product under absorption costing. It identifies the importance of fixed cost

involved in the production. It helps RBS Accountants in preparing its financial accounts

which includes balance sheet of the company, income statement etc.

Marginal costing helps the company in ascertaining the impact of volume on profit

margin. All cost under marginal costing are classified into the basis of variability into fixed and

variable cost. It is treated as the cost of product or service by the company and stock of finished

goods and work in progress are value on basis of marginal costing. Selling price of the product

is marginal cost plus contribution.

Accountants to control the cost and ascertain profitability of these processes. It helps the

company in controlling the cost of inventory, labor and other overhead costs. It helps the

company in determining difference between fixed and variable cost and help RBS

Accountants in fixing the prices of its product to survive in market fluctuations. Company

uses standards to make estimates for the future and measures the efficiency which lead to

cost reduction and helps in increasing efficiency in operations of the company. This

technique of management accounting is highly significant which provides assistance in

determining unit cost of products or services. Hence, referring this effectual cost sheet can

be prepared by the firm which further helps in assessing variances. Moreover, using cost

figures firm can do comparison of actual performance in against to the standards and

thereby would become able to undertake competent framework for improvement.

Cost value profit – CVP is used by companies to make informed decisions on the

products and services they sale. It plays important role in management accounting rather

than financial accounting. It helps RBS Accountants in comparing cost of operating goods

and producing goods. The three basic elements of CVP analysis are cost, volume and

profit. Cost means expenses that were incurred at the time of manufacturing the product.

Volume means number of units produced of physical product and profit means difference

between selling price of the product and service minus cost to produce it. It helps RBS

Accountants in determining its contribution margin which is sales revenue minus variable

expenses.

Marginal and absorption costing – Absorption costing take both fixed and variable cost

as cost of the product under absorption costing. It identifies the importance of fixed cost

involved in the production. It helps RBS Accountants in preparing its financial accounts

which includes balance sheet of the company, income statement etc.

Marginal costing helps the company in ascertaining the impact of volume on profit

margin. All cost under marginal costing are classified into the basis of variability into fixed and

variable cost. It is treated as the cost of product or service by the company and stock of finished

goods and work in progress are value on basis of marginal costing. Selling price of the product

is marginal cost plus contribution.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Standard costing – Standard costing is used by company to control cost of the company.

They are pre-determined cost which is calculated from management standards of

operations and expenditures. It helps the company in determining the cost of per unit of

product in the future. It helps the company in controlling cost and elimination of

inefficiency and wastage. It provides norms with which the company can measure actual

performance. It helps in fixing responsibility with the help of variance analysis by

determining the person responsible for each variance. It helps the company in valuing

stocks and makes it an easy process (Setiawan, 2016.). On the other hand, it also faces the

problem of variation in price and varying in level of output. It also faces difficulty in

changing standard of technology which affect production of the company. It cannot be

used under the companies where non standardized products are used. To set standards,

technical skills are needed which often creates a limitation in using standard costing.

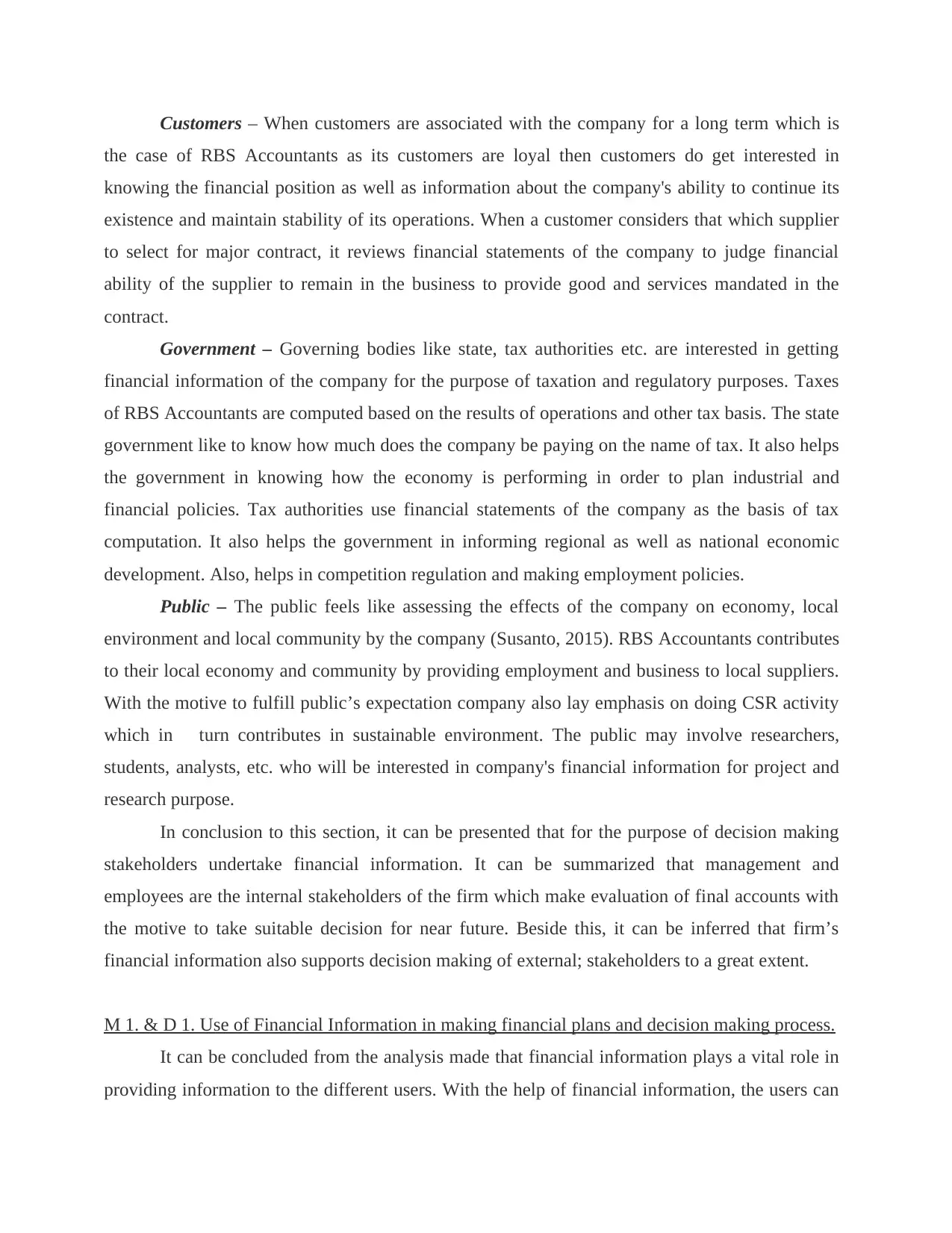

M 2. Evaluating accounting techniques by assessing both the advantages and disadvantages.

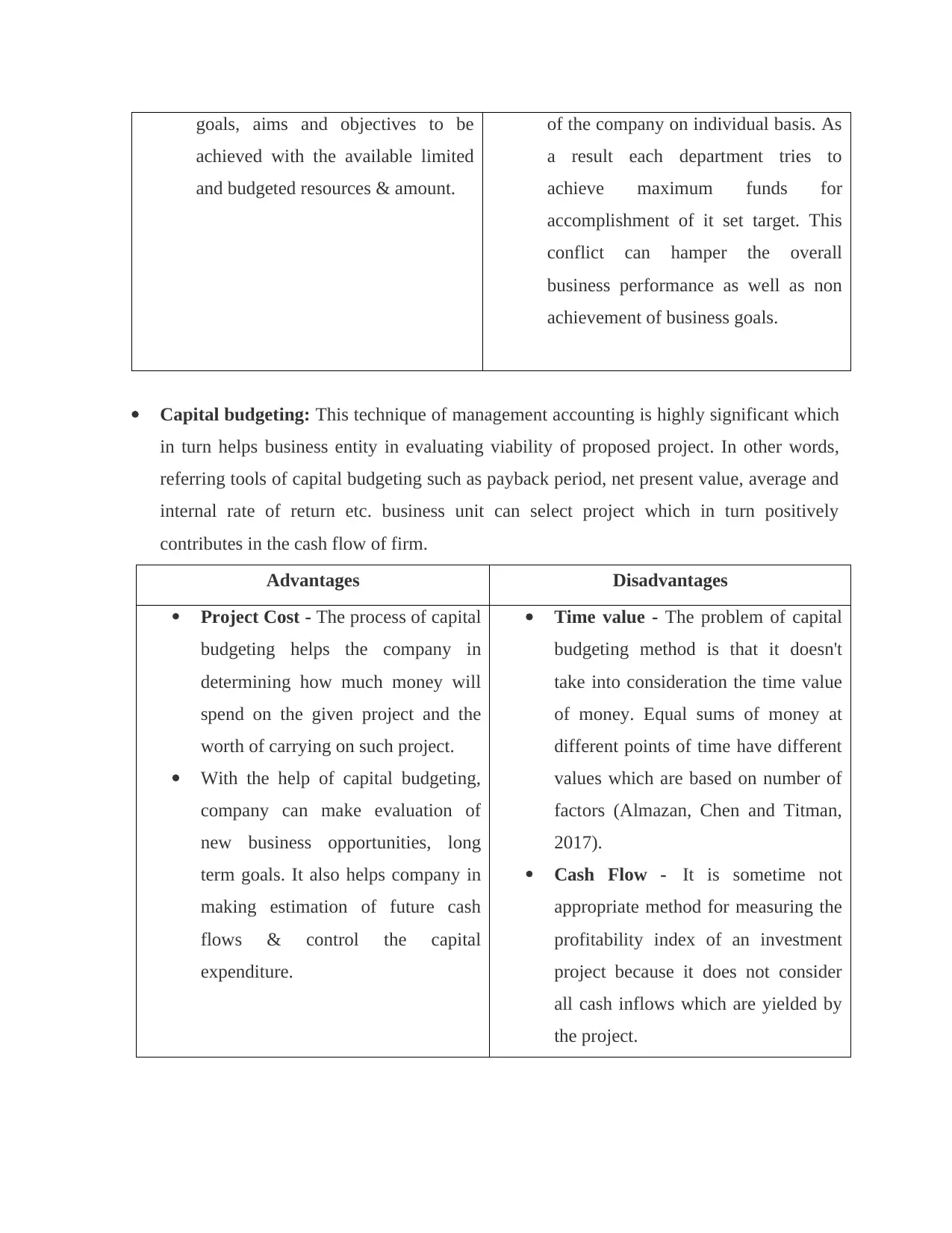

Budgeting and budgetary control – In the context of business unit, budgetary control

tool helps in assessing deviations which take place in company’s performance. By using

such tool performance of each department can be assessed and monitored within RBS

Accountants in financial terms. By doing comparison of budgeted figures with actual

manager can identify deviation. This in turn enables manager to improve performance by

taking corrective measure within suitable time frame.

Advantages Disadvantages

Maximization of Profit – It helps in

increasing the overall business

profits. With the help of Budgetary

control techniques, company can

control its cost expenses by making

proper planning, coordination

thereby achieving the objective of

profit maximization (Myint, 2019).

Goals and Objectives - It helps

company in specifying its business

Making prediction of uncertain

future – Budgetary control method is

based on making estimation and

forecast of future sales and revenue

along with its cost expenses. But this

forecast can be inaccurate as future

cannot be predicted properly.

Leads to conflict among different

departments - Budgetary control set

down targets for different department

They are pre-determined cost which is calculated from management standards of

operations and expenditures. It helps the company in determining the cost of per unit of

product in the future. It helps the company in controlling cost and elimination of

inefficiency and wastage. It provides norms with which the company can measure actual

performance. It helps in fixing responsibility with the help of variance analysis by

determining the person responsible for each variance. It helps the company in valuing

stocks and makes it an easy process (Setiawan, 2016.). On the other hand, it also faces the

problem of variation in price and varying in level of output. It also faces difficulty in

changing standard of technology which affect production of the company. It cannot be

used under the companies where non standardized products are used. To set standards,

technical skills are needed which often creates a limitation in using standard costing.

M 2. Evaluating accounting techniques by assessing both the advantages and disadvantages.

Budgeting and budgetary control – In the context of business unit, budgetary control

tool helps in assessing deviations which take place in company’s performance. By using

such tool performance of each department can be assessed and monitored within RBS

Accountants in financial terms. By doing comparison of budgeted figures with actual

manager can identify deviation. This in turn enables manager to improve performance by

taking corrective measure within suitable time frame.

Advantages Disadvantages

Maximization of Profit – It helps in

increasing the overall business

profits. With the help of Budgetary

control techniques, company can

control its cost expenses by making

proper planning, coordination

thereby achieving the objective of

profit maximization (Myint, 2019).

Goals and Objectives - It helps

company in specifying its business

Making prediction of uncertain

future – Budgetary control method is

based on making estimation and

forecast of future sales and revenue

along with its cost expenses. But this

forecast can be inaccurate as future

cannot be predicted properly.

Leads to conflict among different

departments - Budgetary control set

down targets for different department

goals, aims and objectives to be

achieved with the available limited

and budgeted resources & amount.

of the company on individual basis. As

a result each department tries to

achieve maximum funds for

accomplishment of it set target. This

conflict can hamper the overall

business performance as well as non

achievement of business goals.

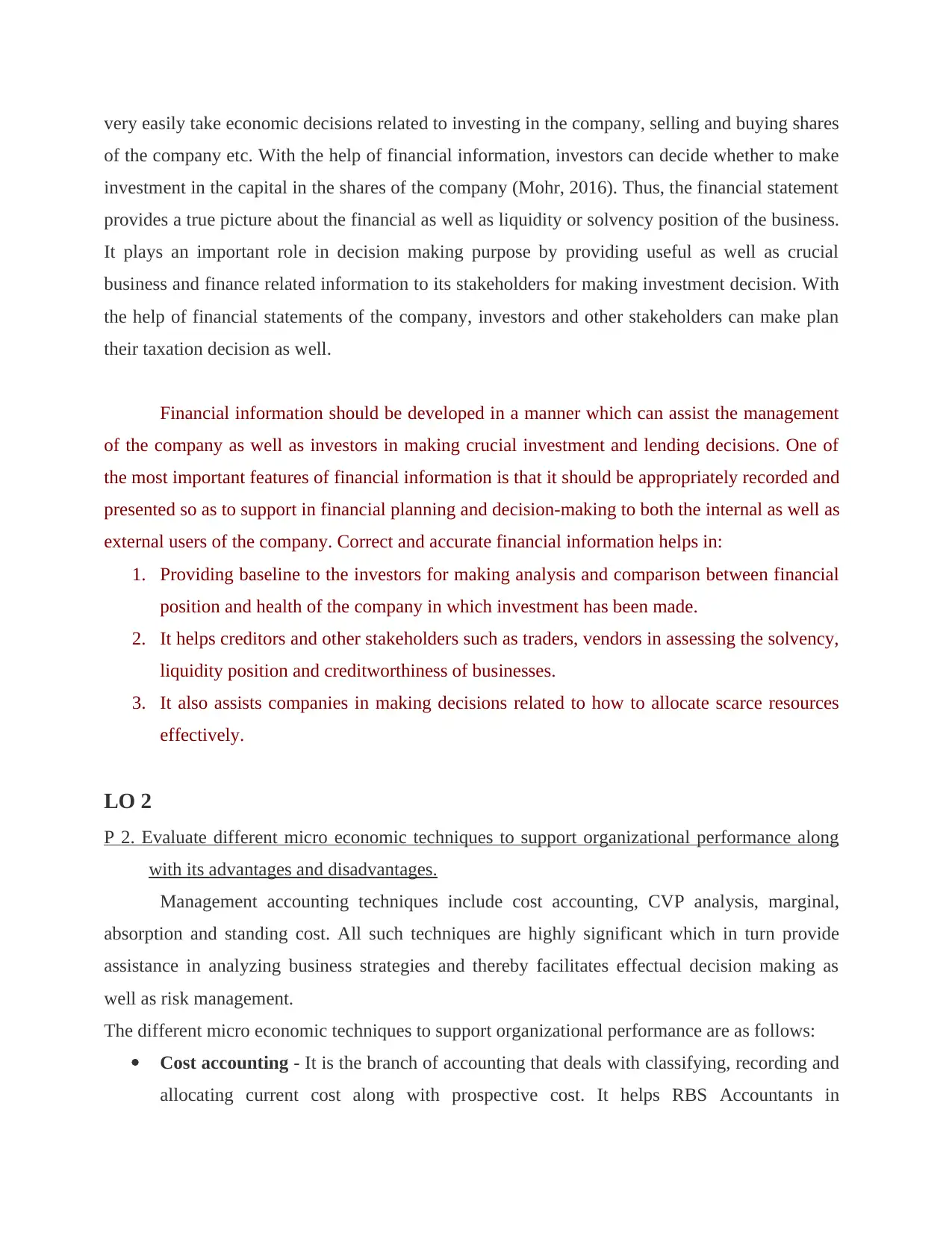

Capital budgeting: This technique of management accounting is highly significant which

in turn helps business entity in evaluating viability of proposed project. In other words,

referring tools of capital budgeting such as payback period, net present value, average and

internal rate of return etc. business unit can select project which in turn positively

contributes in the cash flow of firm.

Advantages Disadvantages

Project Cost - The process of capital

budgeting helps the company in

determining how much money will

spend on the given project and the

worth of carrying on such project.

With the help of capital budgeting,

company can make evaluation of

new business opportunities, long

term goals. It also helps company in

making estimation of future cash

flows & control the capital

expenditure.

Time value - The problem of capital

budgeting method is that it doesn't

take into consideration the time value

of money. Equal sums of money at

different points of time have different

values which are based on number of

factors (Almazan, Chen and Titman,

2017).

Cash Flow - It is sometime not

appropriate method for measuring the

profitability index of an investment

project because it does not consider

all cash inflows which are yielded by

the project.

achieved with the available limited

and budgeted resources & amount.

of the company on individual basis. As

a result each department tries to

achieve maximum funds for

accomplishment of it set target. This

conflict can hamper the overall

business performance as well as non

achievement of business goals.

Capital budgeting: This technique of management accounting is highly significant which

in turn helps business entity in evaluating viability of proposed project. In other words,

referring tools of capital budgeting such as payback period, net present value, average and

internal rate of return etc. business unit can select project which in turn positively

contributes in the cash flow of firm.

Advantages Disadvantages

Project Cost - The process of capital

budgeting helps the company in

determining how much money will

spend on the given project and the

worth of carrying on such project.

With the help of capital budgeting,

company can make evaluation of

new business opportunities, long

term goals. It also helps company in

making estimation of future cash

flows & control the capital

expenditure.

Time value - The problem of capital

budgeting method is that it doesn't

take into consideration the time value

of money. Equal sums of money at

different points of time have different

values which are based on number of

factors (Almazan, Chen and Titman,

2017).

Cash Flow - It is sometime not

appropriate method for measuring the

profitability index of an investment

project because it does not consider

all cash inflows which are yielded by

the project.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

LO 3

P3 Analyse the concept of variance analysis and its importance

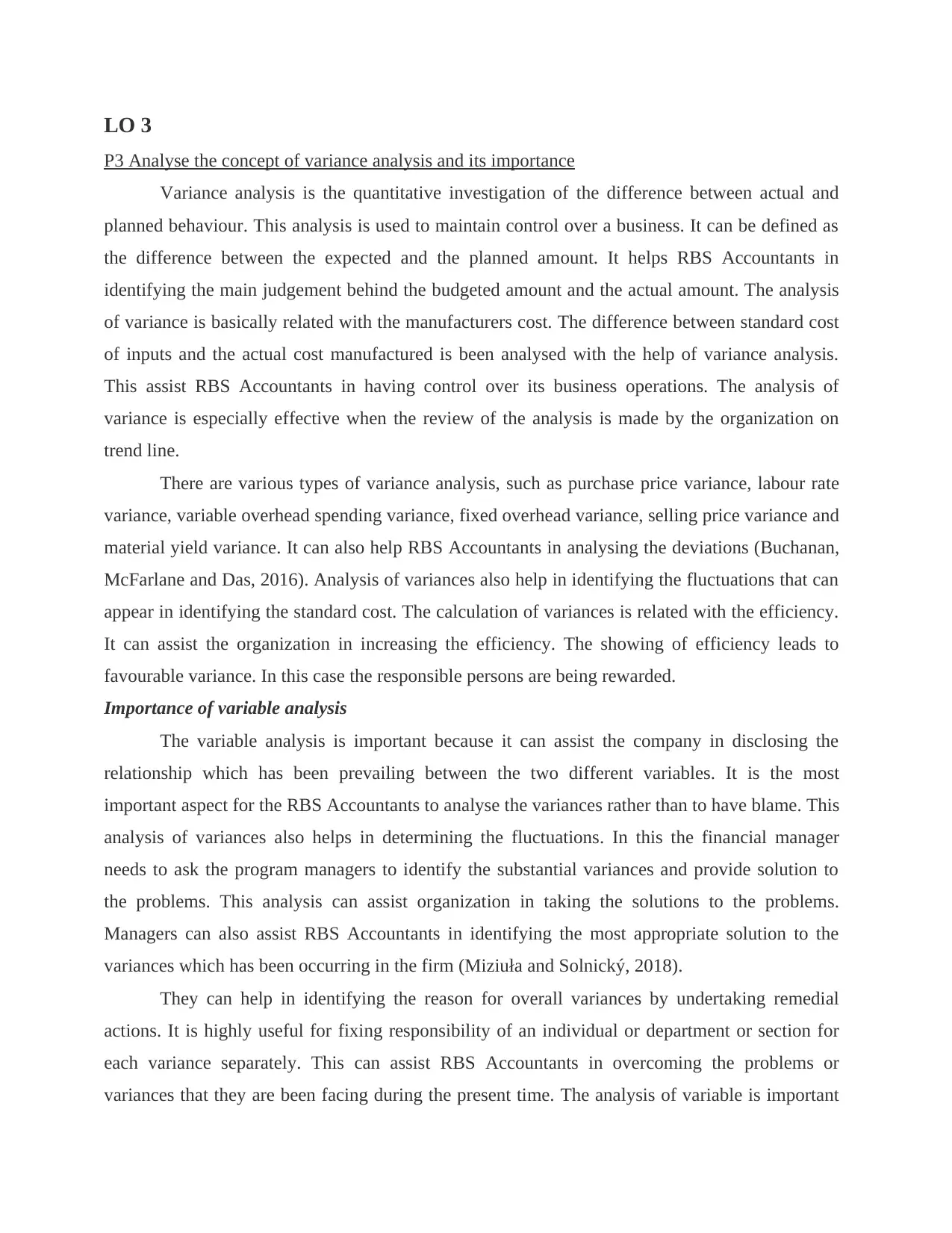

Variance analysis is the quantitative investigation of the difference between actual and

planned behaviour. This analysis is used to maintain control over a business. It can be defined as

the difference between the expected and the planned amount. It helps RBS Accountants in

identifying the main judgement behind the budgeted amount and the actual amount. The analysis

of variance is basically related with the manufacturers cost. The difference between standard cost

of inputs and the actual cost manufactured is been analysed with the help of variance analysis.

This assist RBS Accountants in having control over its business operations. The analysis of

variance is especially effective when the review of the analysis is made by the organization on

trend line.

There are various types of variance analysis, such as purchase price variance, labour rate

variance, variable overhead spending variance, fixed overhead variance, selling price variance and

material yield variance. It can also help RBS Accountants in analysing the deviations (Buchanan,

McFarlane and Das, 2016). Analysis of variances also help in identifying the fluctuations that can

appear in identifying the standard cost. The calculation of variances is related with the efficiency.

It can assist the organization in increasing the efficiency. The showing of efficiency leads to

favourable variance. In this case the responsible persons are being rewarded.

Importance of variable analysis

The variable analysis is important because it can assist the company in disclosing the

relationship which has been prevailing between the two different variables. It is the most

important aspect for the RBS Accountants to analyse the variances rather than to have blame. This

analysis of variances also helps in determining the fluctuations. In this the financial manager

needs to ask the program managers to identify the substantial variances and provide solution to

the problems. This analysis can assist organization in taking the solutions to the problems.

Managers can also assist RBS Accountants in identifying the most appropriate solution to the

variances which has been occurring in the firm (Miziuła and Solnický, 2018).

They can help in identifying the reason for overall variances by undertaking remedial

actions. It is highly useful for fixing responsibility of an individual or department or section for

each variance separately. This can assist RBS Accountants in overcoming the problems or

variances that they are been facing during the present time. The analysis of variable is important

P3 Analyse the concept of variance analysis and its importance

Variance analysis is the quantitative investigation of the difference between actual and

planned behaviour. This analysis is used to maintain control over a business. It can be defined as

the difference between the expected and the planned amount. It helps RBS Accountants in

identifying the main judgement behind the budgeted amount and the actual amount. The analysis

of variance is basically related with the manufacturers cost. The difference between standard cost

of inputs and the actual cost manufactured is been analysed with the help of variance analysis.

This assist RBS Accountants in having control over its business operations. The analysis of

variance is especially effective when the review of the analysis is made by the organization on

trend line.

There are various types of variance analysis, such as purchase price variance, labour rate

variance, variable overhead spending variance, fixed overhead variance, selling price variance and

material yield variance. It can also help RBS Accountants in analysing the deviations (Buchanan,

McFarlane and Das, 2016). Analysis of variances also help in identifying the fluctuations that can

appear in identifying the standard cost. The calculation of variances is related with the efficiency.

It can assist the organization in increasing the efficiency. The showing of efficiency leads to

favourable variance. In this case the responsible persons are being rewarded.

Importance of variable analysis

The variable analysis is important because it can assist the company in disclosing the

relationship which has been prevailing between the two different variables. It is the most

important aspect for the RBS Accountants to analyse the variances rather than to have blame. This

analysis of variances also helps in determining the fluctuations. In this the financial manager

needs to ask the program managers to identify the substantial variances and provide solution to

the problems. This analysis can assist organization in taking the solutions to the problems.

Managers can also assist RBS Accountants in identifying the most appropriate solution to the

variances which has been occurring in the firm (Miziuła and Solnický, 2018).

They can help in identifying the reason for overall variances by undertaking remedial

actions. It is highly useful for fixing responsibility of an individual or department or section for

each variance separately. This can assist RBS Accountants in overcoming the problems or

variances that they are been facing during the present time. The analysis of variable is important

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

as it helps in deterring all the performances which are inefficient in a firm. This analysis also

determines the extend of inefficiency. Variances are also being segmented as controllable and

uncontrollable. The controllable variances are those that can be controlled by the company in

every aspect. These variances are taken into consideration for the further action. Also these

creates cost consciousness in the mind of every employee of the business of firm. The analysis of

variances can help RBS Accountants in easily plan for the profit. This can also help the company

in reducing the cost. Analysis of variances supports in determining the deviations. This tool can

help in controlling the cost which can be beneficial to the firm.

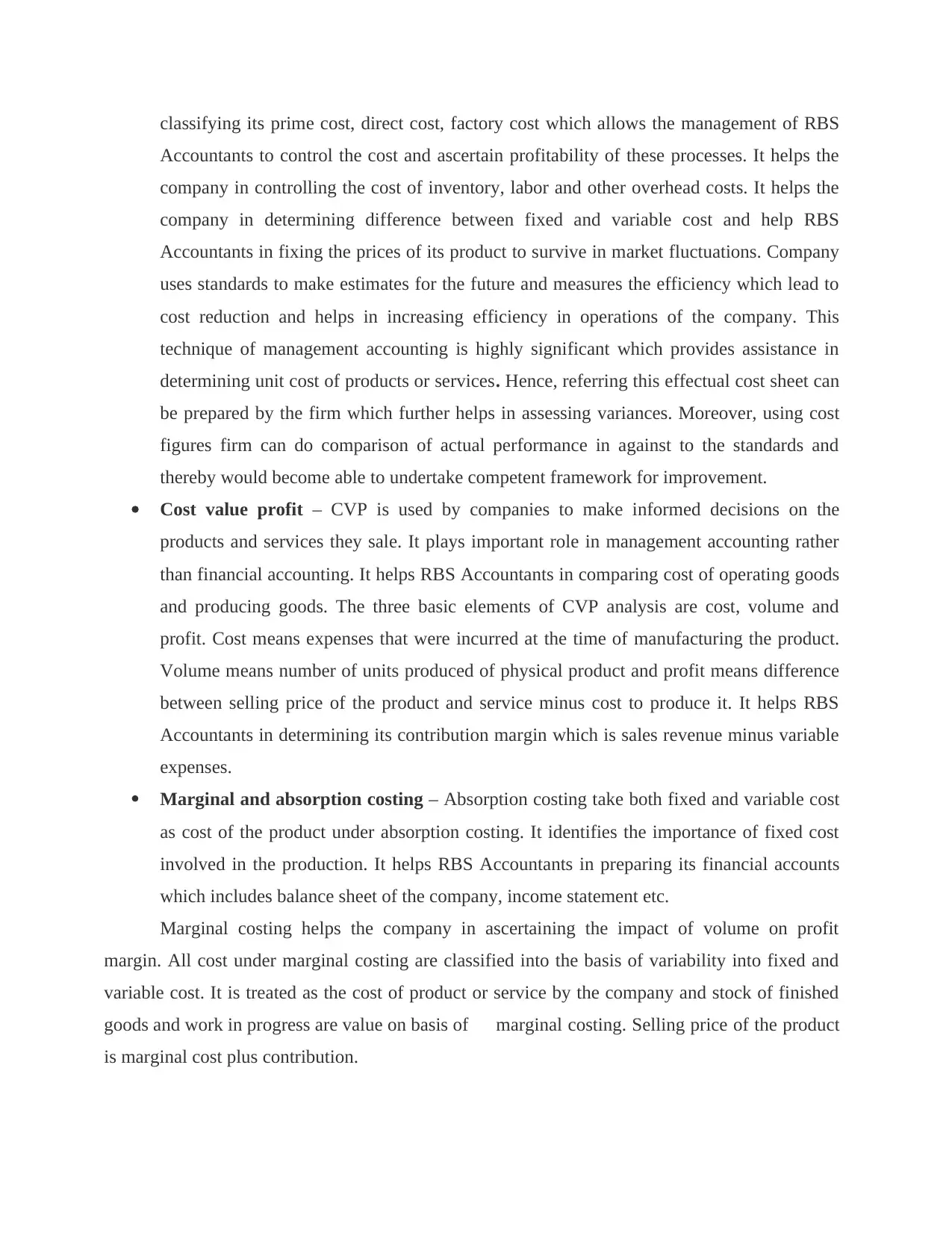

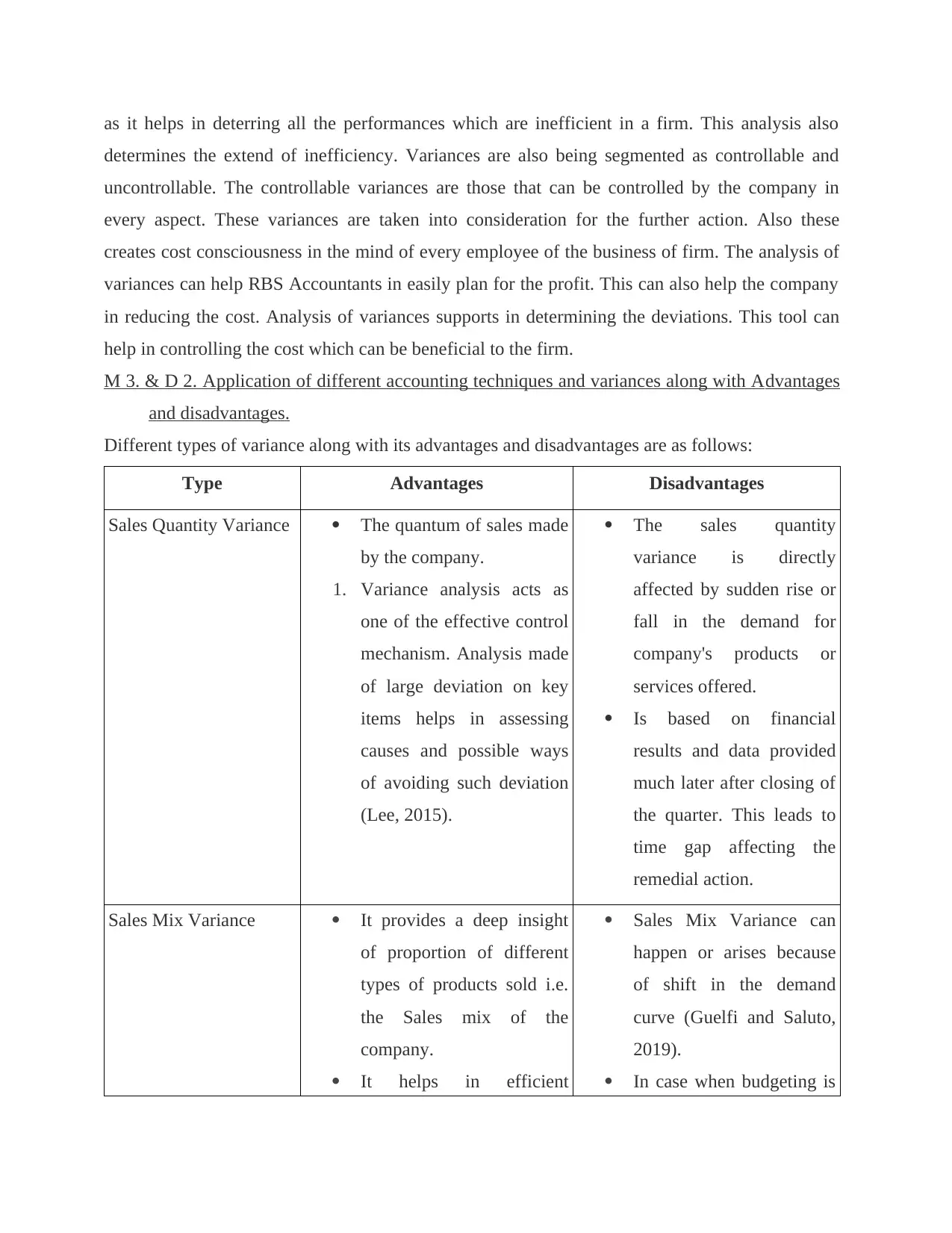

M 3. & D 2. Application of different accounting techniques and variances along with Advantages

and disadvantages.

Different types of variance along with its advantages and disadvantages are as follows:

Type Advantages Disadvantages

Sales Quantity Variance The quantum of sales made

by the company.

1. Variance analysis acts as

one of the effective control

mechanism. Analysis made

of large deviation on key

items helps in assessing

causes and possible ways

of avoiding such deviation

(Lee, 2015).

The sales quantity

variance is directly

affected by sudden rise or

fall in the demand for

company's products or

services offered.

Is based on financial

results and data provided

much later after closing of

the quarter. This leads to

time gap affecting the

remedial action.

Sales Mix Variance It provides a deep insight

of proportion of different

types of products sold i.e.

the Sales mix of the

company.

It helps in efficient

Sales Mix Variance can

happen or arises because

of shift in the demand

curve (Guelfi and Saluto,

2019).

In case when budgeting is

determines the extend of inefficiency. Variances are also being segmented as controllable and

uncontrollable. The controllable variances are those that can be controlled by the company in

every aspect. These variances are taken into consideration for the further action. Also these

creates cost consciousness in the mind of every employee of the business of firm. The analysis of

variances can help RBS Accountants in easily plan for the profit. This can also help the company

in reducing the cost. Analysis of variances supports in determining the deviations. This tool can

help in controlling the cost which can be beneficial to the firm.

M 3. & D 2. Application of different accounting techniques and variances along with Advantages

and disadvantages.

Different types of variance along with its advantages and disadvantages are as follows:

Type Advantages Disadvantages

Sales Quantity Variance The quantum of sales made

by the company.

1. Variance analysis acts as

one of the effective control

mechanism. Analysis made

of large deviation on key

items helps in assessing

causes and possible ways

of avoiding such deviation

(Lee, 2015).

The sales quantity

variance is directly

affected by sudden rise or

fall in the demand for

company's products or

services offered.

Is based on financial

results and data provided

much later after closing of

the quarter. This leads to

time gap affecting the

remedial action.

Sales Mix Variance It provides a deep insight

of proportion of different

types of products sold i.e.

the Sales mix of the

company.

It helps in efficient

Sales Mix Variance can

happen or arises because

of shift in the demand

curve (Guelfi and Saluto,

2019).

In case when budgeting is

budgeting formulation by

making detailed and

forward looking budgetary

decisions thereby ensuring

lower deviations from the

planned budgets.

not done by taking into

consideration, detailed

analysis of each factor,

possibility of deviation

from the actual numbers

increases.

P 4. Use of actual and standard cost to correct and control variances.

Variance analysis is defined as the process of evaluating differences between the standard

costs and actual costs of the business operations. It helps in recognizing the causes of differences

arises between actual and standard cost. Variance analysis can be used by companies in

determining the difference between the actual performance as well as standard performance.

Variance analysis is done by making scrutinizing of each variance by subdividing the total

variance determined. The sub division of total variance assist the management by assigning

responsibility related to the off standard performance.

Standard costing control the cost expenditure of the business. It acts as the variance

analysis which focus is to reduce the cost expenses and increase profitability (Johnson, Tubau and

De Neys, 2016). It is assist the management of the company in fixing of selling price, assessing

the value of closing stocks & work in progress, evaluating the idle capacity of business and

performs various management functions. The standards costing helps in increasing the operational

efficiency and productivity of the business by ensuring the optimal allocation as well as the use of

resources. Standard costing thus helps in controlling the budgetary plans and formulation of

decision. This technique is considered as one of the most economical measure for its users. With

the help of standard costing, company can make comparative analysis between the standard cost

and revenue with the actual outcome so as to determine the variance factor. On assessing the

variance and its causes, the management of company by making sound business strategies and

plans can make improvements. This will result in successful accomplishment of business goals

and objectives.

The actual cost helps the company in making comparison between the actual outcome

and the projected one. This further assist company in formulation of suitable and sound business

making detailed and

forward looking budgetary

decisions thereby ensuring

lower deviations from the

planned budgets.

not done by taking into

consideration, detailed

analysis of each factor,

possibility of deviation

from the actual numbers

increases.

P 4. Use of actual and standard cost to correct and control variances.

Variance analysis is defined as the process of evaluating differences between the standard

costs and actual costs of the business operations. It helps in recognizing the causes of differences

arises between actual and standard cost. Variance analysis can be used by companies in

determining the difference between the actual performance as well as standard performance.

Variance analysis is done by making scrutinizing of each variance by subdividing the total

variance determined. The sub division of total variance assist the management by assigning

responsibility related to the off standard performance.

Standard costing control the cost expenditure of the business. It acts as the variance

analysis which focus is to reduce the cost expenses and increase profitability (Johnson, Tubau and

De Neys, 2016). It is assist the management of the company in fixing of selling price, assessing

the value of closing stocks & work in progress, evaluating the idle capacity of business and

performs various management functions. The standards costing helps in increasing the operational

efficiency and productivity of the business by ensuring the optimal allocation as well as the use of

resources. Standard costing thus helps in controlling the budgetary plans and formulation of

decision. This technique is considered as one of the most economical measure for its users. With

the help of standard costing, company can make comparative analysis between the standard cost

and revenue with the actual outcome so as to determine the variance factor. On assessing the

variance and its causes, the management of company by making sound business strategies and

plans can make improvements. This will result in successful accomplishment of business goals

and objectives.

The actual cost helps the company in making comparison between the actual outcome

and the projected one. This further assist company in formulation of suitable and sound business

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.