Accounting Fundamentals: Journal Entries, Ledgers, and Statements

VerifiedAdded on 2023/01/16

|21

|3102

|56

Homework Assignment

AI Summary

This accounting assignment provides a detailed exploration of fundamental accounting principles. It begins with an introduction to accounting and its various fields, followed by a series of tasks designed to reinforce key concepts. Task 1 focuses on journal entries, ledgers, and the preparation of a profit and loss statement and balance sheet. Task 2 continues with journal entries and account balances, culminating in the creation of financial statements. Task 3 delves into journals, trial balances, and the preparation of profit and loss statements and balance sheets. Task 4 focuses on journal entries and trial balances. Task 5 explains the difference between revenue and capital expenditure. The assignment concludes with a comprehensive overview of the topics covered and references to support the findings.

ACCOUNTING

FUNDAMENTALS

FUNDAMENTALS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

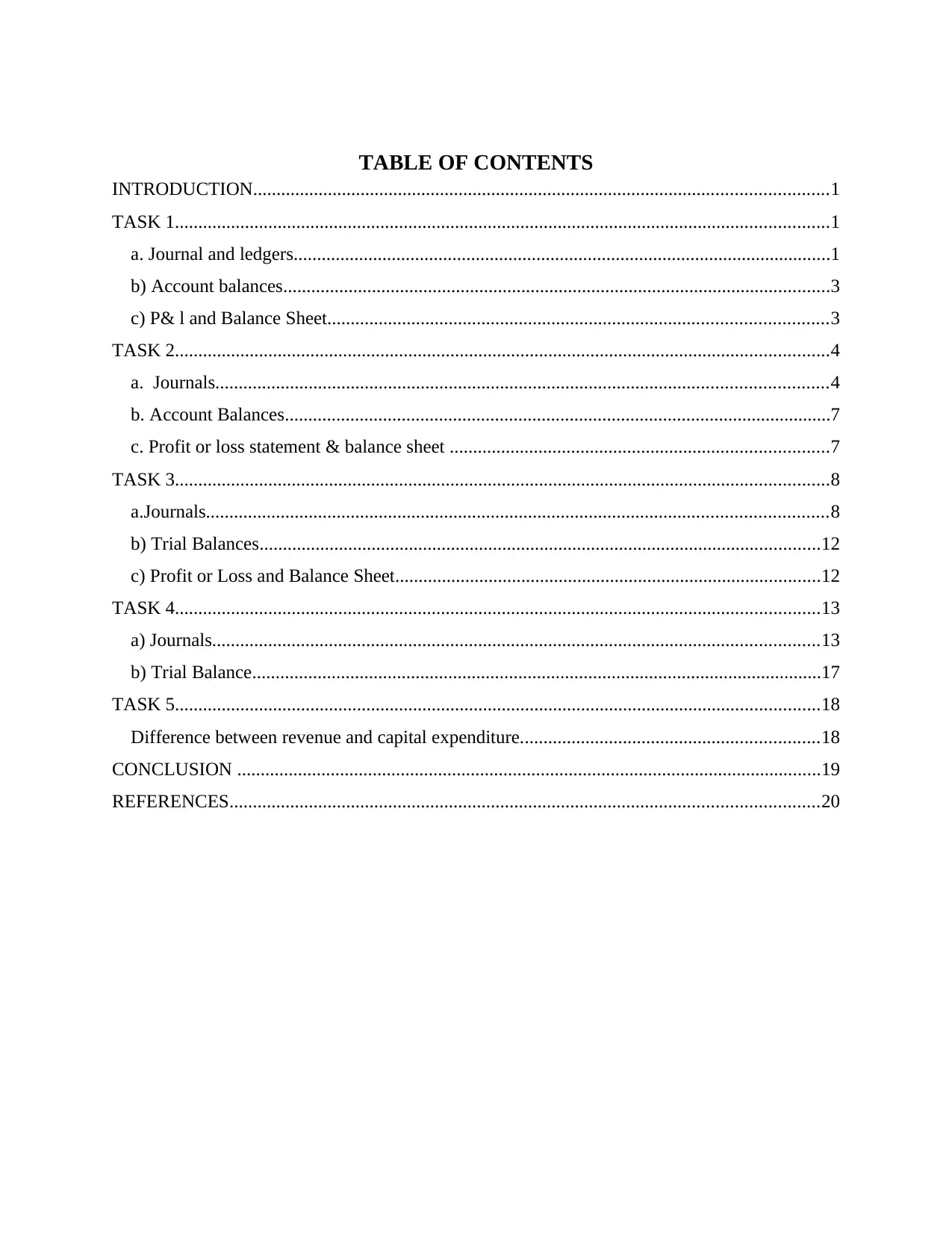

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

a. Journal and ledgers...................................................................................................................1

b) Account balances.....................................................................................................................3

c) P& l and Balance Sheet...........................................................................................................3

TASK 2............................................................................................................................................4

a. Journals...................................................................................................................................4

b. Account Balances.....................................................................................................................7

c. Profit or loss statement & balance sheet .................................................................................7

TASK 3............................................................................................................................................8

a.Journals.....................................................................................................................................8

b) Trial Balances........................................................................................................................12

c) Profit or Loss and Balance Sheet...........................................................................................12

TASK 4..........................................................................................................................................13

a) Journals..................................................................................................................................13

b) Trial Balance..........................................................................................................................17

TASK 5..........................................................................................................................................18

Difference between revenue and capital expenditure................................................................18

CONCLUSION .............................................................................................................................19

REFERENCES..............................................................................................................................20

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

a. Journal and ledgers...................................................................................................................1

b) Account balances.....................................................................................................................3

c) P& l and Balance Sheet...........................................................................................................3

TASK 2............................................................................................................................................4

a. Journals...................................................................................................................................4

b. Account Balances.....................................................................................................................7

c. Profit or loss statement & balance sheet .................................................................................7

TASK 3............................................................................................................................................8

a.Journals.....................................................................................................................................8

b) Trial Balances........................................................................................................................12

c) Profit or Loss and Balance Sheet...........................................................................................12

TASK 4..........................................................................................................................................13

a) Journals..................................................................................................................................13

b) Trial Balance..........................................................................................................................17

TASK 5..........................................................................................................................................18

Difference between revenue and capital expenditure................................................................18

CONCLUSION .............................................................................................................................19

REFERENCES..............................................................................................................................20

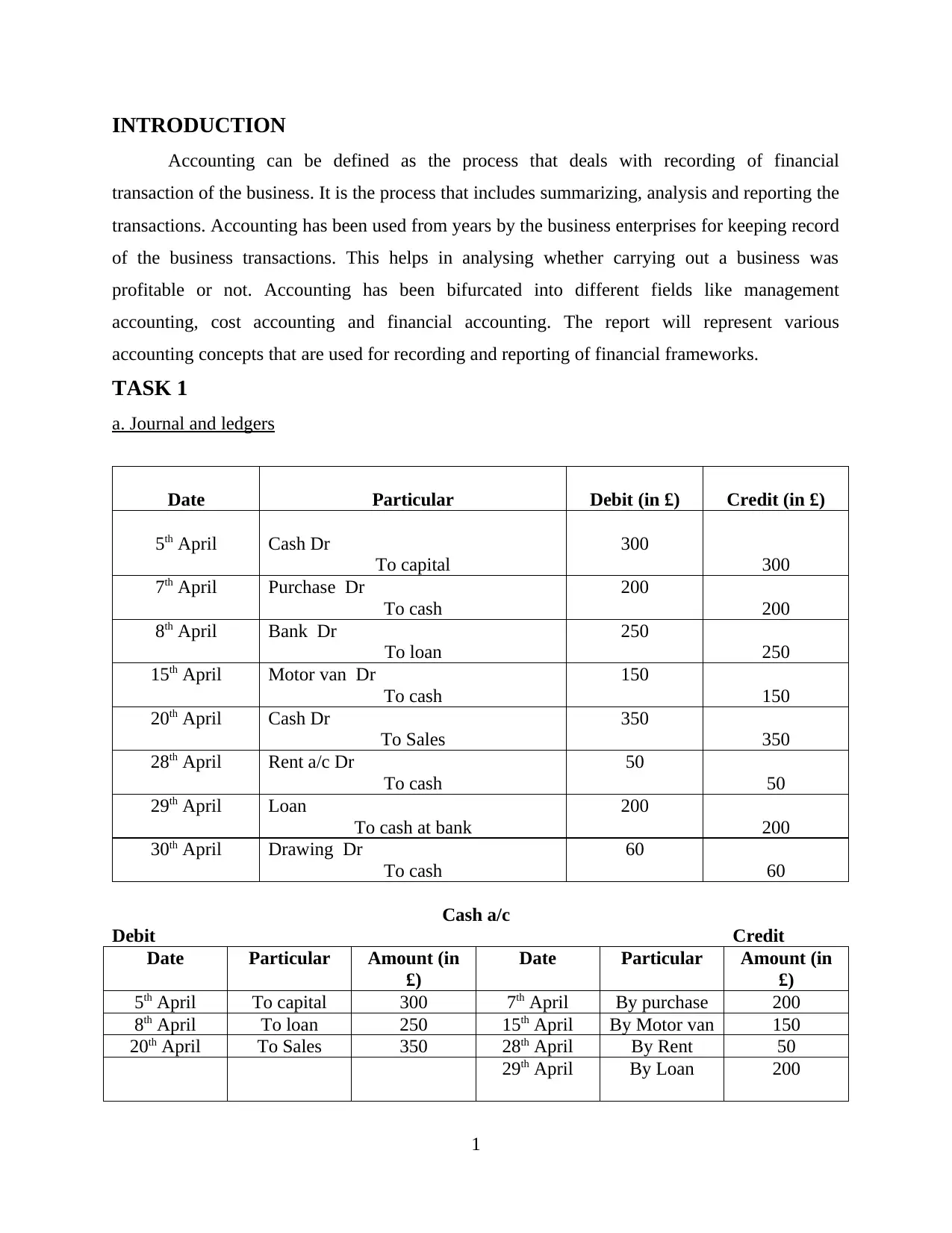

INTRODUCTION

Accounting can be defined as the process that deals with recording of financial

transaction of the business. It is the process that includes summarizing, analysis and reporting the

transactions. Accounting has been used from years by the business enterprises for keeping record

of the business transactions. This helps in analysing whether carrying out a business was

profitable or not. Accounting has been bifurcated into different fields like management

accounting, cost accounting and financial accounting. The report will represent various

accounting concepts that are used for recording and reporting of financial frameworks.

TASK 1

a. Journal and ledgers

Date Particular Debit (in £) Credit (in £)

5th April Cash Dr

To capital

300

300

7th April Purchase Dr

To cash

200

200

8th April Bank Dr

To loan

250

250

15th April Motor van Dr

To cash

150

150

20th April Cash Dr

To Sales

350

350

28th April Rent a/c Dr

To cash

50

50

29th April Loan

To cash at bank

200

200

30th April Drawing Dr

To cash

60

60

Cash a/c

Debit Credit

Date Particular Amount (in

£)

Date Particular Amount (in

£)

5th April To capital 300 7th April By purchase 200

8th April To loan 250 15th April By Motor van 150

20th April To Sales 350 28th April By Rent 50

29th April By Loan 200

1

Accounting can be defined as the process that deals with recording of financial

transaction of the business. It is the process that includes summarizing, analysis and reporting the

transactions. Accounting has been used from years by the business enterprises for keeping record

of the business transactions. This helps in analysing whether carrying out a business was

profitable or not. Accounting has been bifurcated into different fields like management

accounting, cost accounting and financial accounting. The report will represent various

accounting concepts that are used for recording and reporting of financial frameworks.

TASK 1

a. Journal and ledgers

Date Particular Debit (in £) Credit (in £)

5th April Cash Dr

To capital

300

300

7th April Purchase Dr

To cash

200

200

8th April Bank Dr

To loan

250

250

15th April Motor van Dr

To cash

150

150

20th April Cash Dr

To Sales

350

350

28th April Rent a/c Dr

To cash

50

50

29th April Loan

To cash at bank

200

200

30th April Drawing Dr

To cash

60

60

Cash a/c

Debit Credit

Date Particular Amount (in

£)

Date Particular Amount (in

£)

5th April To capital 300 7th April By purchase 200

8th April To loan 250 15th April By Motor van 150

20th April To Sales 350 28th April By Rent 50

29th April By Loan 200

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

30th April By Drawing 60

30th April By balance

c/d

240

900 900

Capital a/c

Debit Credit

Date Particulars Amount (in

£)

Date Particulars Amount (in

£)

5th April By cash 300

30th April To balance

c/d

300

300 300

Purchase a/c

Debit Credit

Date Particulars Amount (in

£)

Date Particulars Amount (in

£)

7th April To cash 200

30th April By balance

c/d

200

200 200

Sales a/c

Debit Credit

Date Particulars Amount (in

£)

Date Particulars Amount (in

£)

20th April By Cash 350

30th April To balance

c/d

350

350 350

Motor van a/c

Debit Credit

Date Particulars Amount (in

£)

Date Particulars Amount (in

£)

15th April To cash 150

30th April To balance

c/d

150

150 150

Rent a/c

Debit Credit

Date Particulars Amount (in

£)

Date Particulars Amount (in

£)

2

30th April By balance

c/d

240

900 900

Capital a/c

Debit Credit

Date Particulars Amount (in

£)

Date Particulars Amount (in

£)

5th April By cash 300

30th April To balance

c/d

300

300 300

Purchase a/c

Debit Credit

Date Particulars Amount (in

£)

Date Particulars Amount (in

£)

7th April To cash 200

30th April By balance

c/d

200

200 200

Sales a/c

Debit Credit

Date Particulars Amount (in

£)

Date Particulars Amount (in

£)

20th April By Cash 350

30th April To balance

c/d

350

350 350

Motor van a/c

Debit Credit

Date Particulars Amount (in

£)

Date Particulars Amount (in

£)

15th April To cash 150

30th April To balance

c/d

150

150 150

Rent a/c

Debit Credit

Date Particulars Amount (in

£)

Date Particulars Amount (in

£)

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

28th April To cash 50

30th April To balance

c/d

50

Loan a/c

Debit Credit

Date Particulars Amount (in

£)

Date Particulars Amount (in

£)

29th April To cash at

bank

200 8th April By cash at

bank

250

30th April To balance

c/d

50

250 250

Drawing a/c

Debit Credit

Date Particulars Amount (in

£)

Date Particulars Amount (in

£)

30th April To cash 60

30th April To balance

c/d

60

60 60

b) Account balances

Trial balance

Debit (in £) Credit (in £)

Cash 240

Capital 300

Loan 50

Purchase 200

Sales 350

Closing stock 100

Motor van 150

Rent 50

Drawing 60

c) P& l and Balance Sheet

Income statement of Maxim at the end of 30th April

Income Statement

Particulars Amount (in £) Amount (in £)

Sales 350

3

30th April To balance

c/d

50

Loan a/c

Debit Credit

Date Particulars Amount (in

£)

Date Particulars Amount (in

£)

29th April To cash at

bank

200 8th April By cash at

bank

250

30th April To balance

c/d

50

250 250

Drawing a/c

Debit Credit

Date Particulars Amount (in

£)

Date Particulars Amount (in

£)

30th April To cash 60

30th April To balance

c/d

60

60 60

b) Account balances

Trial balance

Debit (in £) Credit (in £)

Cash 240

Capital 300

Loan 50

Purchase 200

Sales 350

Closing stock 100

Motor van 150

Rent 50

Drawing 60

c) P& l and Balance Sheet

Income statement of Maxim at the end of 30th April

Income Statement

Particulars Amount (in £) Amount (in £)

Sales 350

3

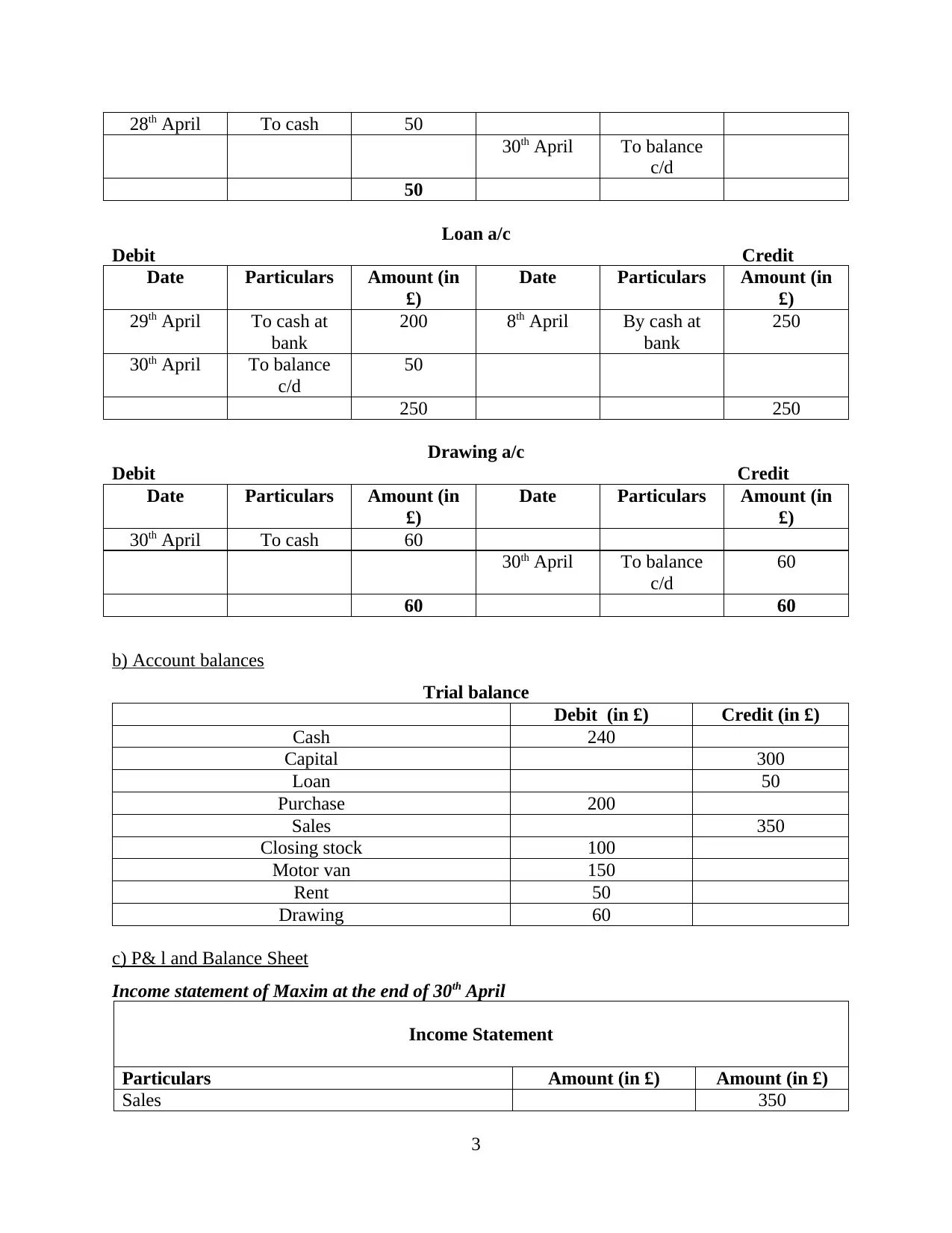

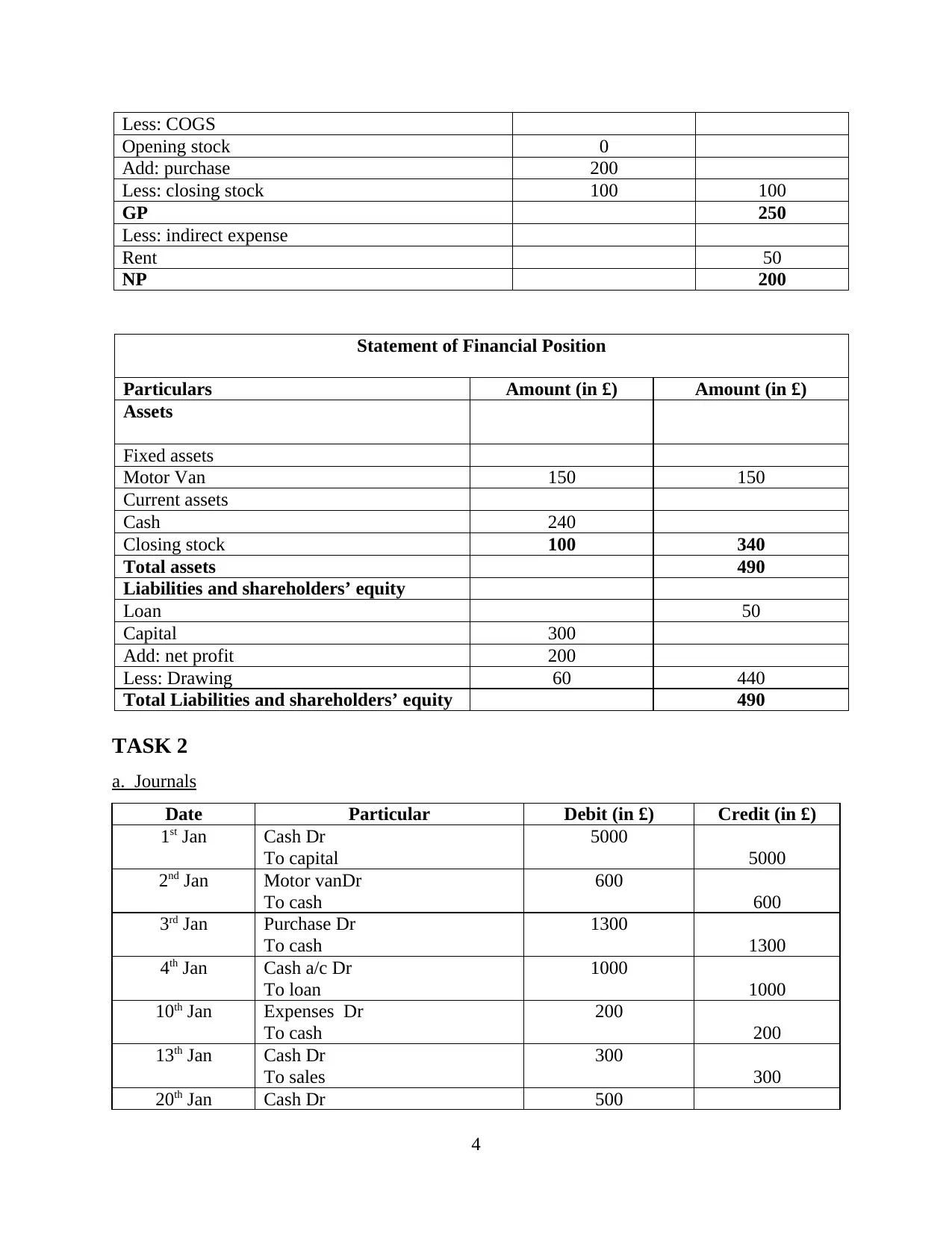

Less: COGS

Opening stock 0

Add: purchase 200

Less: closing stock 100 100

GP 250

Less: indirect expense

Rent 50

NP 200

Statement of Financial Position

Particulars Amount (in £) Amount (in £)

Assets

Fixed assets

Motor Van 150 150

Current assets

Cash 240

Closing stock 100 340

Total assets 490

Liabilities and shareholders’ equity

Loan 50

Capital 300

Add: net profit 200

Less: Drawing 60 440

Total Liabilities and shareholders’ equity 490

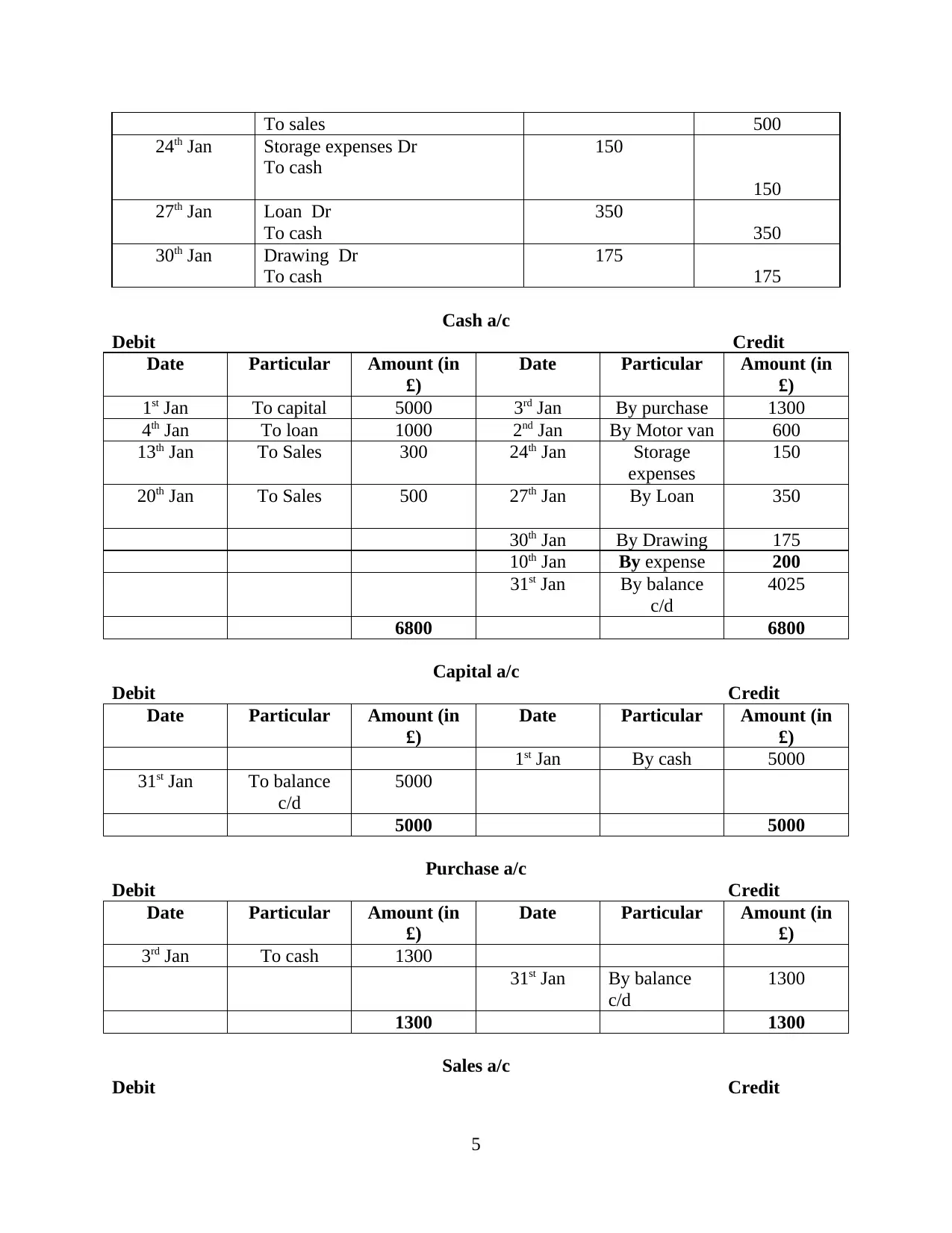

TASK 2

a. Journals

Date Particular Debit (in £) Credit (in £)

1st Jan Cash Dr

To capital

5000

5000

2nd Jan Motor vanDr

To cash

600

600

3rd Jan Purchase Dr

To cash

1300

1300

4th Jan Cash a/c Dr

To loan

1000

1000

10th Jan Expenses Dr

To cash

200

200

13th Jan Cash Dr

To sales

300

300

20th Jan Cash Dr 500

4

Opening stock 0

Add: purchase 200

Less: closing stock 100 100

GP 250

Less: indirect expense

Rent 50

NP 200

Statement of Financial Position

Particulars Amount (in £) Amount (in £)

Assets

Fixed assets

Motor Van 150 150

Current assets

Cash 240

Closing stock 100 340

Total assets 490

Liabilities and shareholders’ equity

Loan 50

Capital 300

Add: net profit 200

Less: Drawing 60 440

Total Liabilities and shareholders’ equity 490

TASK 2

a. Journals

Date Particular Debit (in £) Credit (in £)

1st Jan Cash Dr

To capital

5000

5000

2nd Jan Motor vanDr

To cash

600

600

3rd Jan Purchase Dr

To cash

1300

1300

4th Jan Cash a/c Dr

To loan

1000

1000

10th Jan Expenses Dr

To cash

200

200

13th Jan Cash Dr

To sales

300

300

20th Jan Cash Dr 500

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

To sales 500

24th Jan Storage expenses Dr

To cash

150

150

27th Jan Loan Dr

To cash

350

350

30th Jan Drawing Dr

To cash

175

175

Cash a/c

Debit Credit

Date Particular Amount (in

£)

Date Particular Amount (in

£)

1st Jan To capital 5000 3rd Jan By purchase 1300

4th Jan To loan 1000 2nd Jan By Motor van 600

13th Jan To Sales 300 24th Jan Storage

expenses

150

20th Jan To Sales 500 27th Jan By Loan 350

30th Jan By Drawing 175

10th Jan By expense 200

31st Jan By balance

c/d

4025

6800 6800

Capital a/c

Debit Credit

Date Particular Amount (in

£)

Date Particular Amount (in

£)

1st Jan By cash 5000

31st Jan To balance

c/d

5000

5000 5000

Purchase a/c

Debit Credit

Date Particular Amount (in

£)

Date Particular Amount (in

£)

3rd Jan To cash 1300

31st Jan By balance

c/d

1300

1300 1300

Sales a/c

Debit Credit

5

24th Jan Storage expenses Dr

To cash

150

150

27th Jan Loan Dr

To cash

350

350

30th Jan Drawing Dr

To cash

175

175

Cash a/c

Debit Credit

Date Particular Amount (in

£)

Date Particular Amount (in

£)

1st Jan To capital 5000 3rd Jan By purchase 1300

4th Jan To loan 1000 2nd Jan By Motor van 600

13th Jan To Sales 300 24th Jan Storage

expenses

150

20th Jan To Sales 500 27th Jan By Loan 350

30th Jan By Drawing 175

10th Jan By expense 200

31st Jan By balance

c/d

4025

6800 6800

Capital a/c

Debit Credit

Date Particular Amount (in

£)

Date Particular Amount (in

£)

1st Jan By cash 5000

31st Jan To balance

c/d

5000

5000 5000

Purchase a/c

Debit Credit

Date Particular Amount (in

£)

Date Particular Amount (in

£)

3rd Jan To cash 1300

31st Jan By balance

c/d

1300

1300 1300

Sales a/c

Debit Credit

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Date Particular Amount (in

£)

Date Particular Amount (in

£)

13th Jan By Cash 300

30th April To balance

c/d

800 20th Jan By Cash 500

800 800

Motor van a/c

Debit Credit

Date Particular Amount (in

£)

Date Particular Amount (in

£)

2nd Jan To cash 600

31st Jan To balance

c/d

600

600 600

Storage expenses a/c

Debit Credit

Date Particular Amount (in

£)

Date Particular Amount (in

£)

24th Jan To cash 150

30th April To balance

c/d

150

150 150

Loan a/c

Debit Credit

Date Particular Amount (in

£)

Date Particular Amount (in

£)

27th Jan To cash at

bank

350 4th Jan By cash at

bank

1000

31st Jan To balance

c/d

650

1000 1000

Drawing a/c

Debit Credit

Date Particulars Amount (in

£)

Date Particulars Amount (in

£)

30th Jan To cash 175

31st Jan To balance

c/d

175

175 175

Expenses a/c

Debit Credit

6

£)

Date Particular Amount (in

£)

13th Jan By Cash 300

30th April To balance

c/d

800 20th Jan By Cash 500

800 800

Motor van a/c

Debit Credit

Date Particular Amount (in

£)

Date Particular Amount (in

£)

2nd Jan To cash 600

31st Jan To balance

c/d

600

600 600

Storage expenses a/c

Debit Credit

Date Particular Amount (in

£)

Date Particular Amount (in

£)

24th Jan To cash 150

30th April To balance

c/d

150

150 150

Loan a/c

Debit Credit

Date Particular Amount (in

£)

Date Particular Amount (in

£)

27th Jan To cash at

bank

350 4th Jan By cash at

bank

1000

31st Jan To balance

c/d

650

1000 1000

Drawing a/c

Debit Credit

Date Particulars Amount (in

£)

Date Particulars Amount (in

£)

30th Jan To cash 175

31st Jan To balance

c/d

175

175 175

Expenses a/c

Debit Credit

6

Date Particular Amount (in

£)

Date Particular Amount (in

£)

10th Jan To cash 200

31st Jan To balance 200

200 200

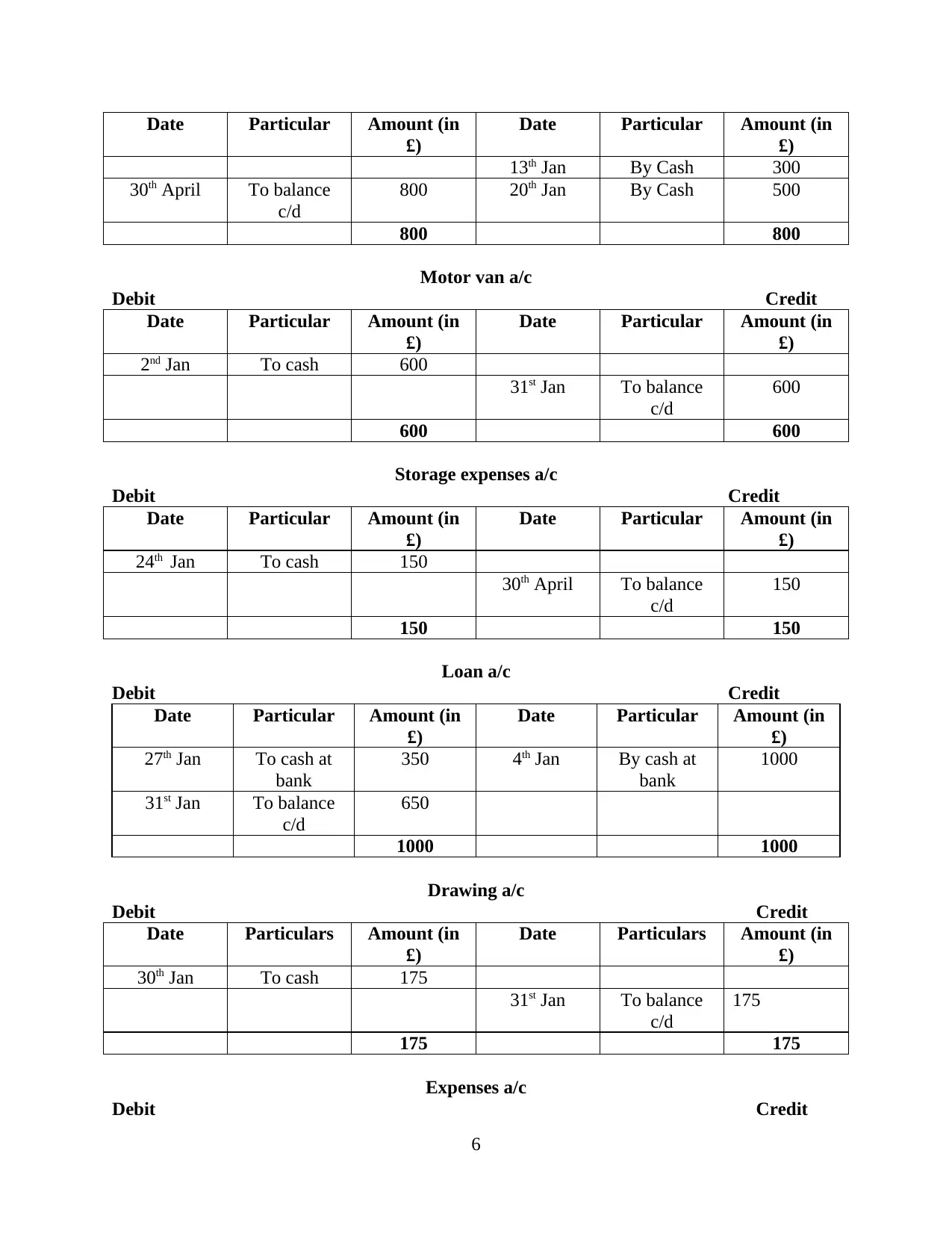

b. Account Balances

Particular Debit (in £) Credit (in £)

Cash 4025

Capital 5000

Loan 650

Purchase 1300

Sales 800

Closing stock 800

Motor van 600

Expenses 200

Drawing 175

Storage expenses 150

c. Profit or loss statement & balance sheet

Profit or loss statement

Particular Figures (in £) Figures (in £)

Sales 800

Less: COGS

Opening stock

Add: purchase 1300

Less: closing stock 800 500

GP 300

Lees: Expenses 200

Less: Storage expenses 150

Net loss 50

Balance sheet

Particulars Amount (in £) Amount (in £)

Assets

Fixed assets

Motor Van 600 600

Current assets

Cash 4025

Closing stock 800 4825

Total assets 5425

Liabilities and shareholders’ equity

Loan 650

Capital 5000

7

£)

Date Particular Amount (in

£)

10th Jan To cash 200

31st Jan To balance 200

200 200

b. Account Balances

Particular Debit (in £) Credit (in £)

Cash 4025

Capital 5000

Loan 650

Purchase 1300

Sales 800

Closing stock 800

Motor van 600

Expenses 200

Drawing 175

Storage expenses 150

c. Profit or loss statement & balance sheet

Profit or loss statement

Particular Figures (in £) Figures (in £)

Sales 800

Less: COGS

Opening stock

Add: purchase 1300

Less: closing stock 800 500

GP 300

Lees: Expenses 200

Less: Storage expenses 150

Net loss 50

Balance sheet

Particulars Amount (in £) Amount (in £)

Assets

Fixed assets

Motor Van 600 600

Current assets

Cash 4025

Closing stock 800 4825

Total assets 5425

Liabilities and shareholders’ equity

Loan 650

Capital 5000

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

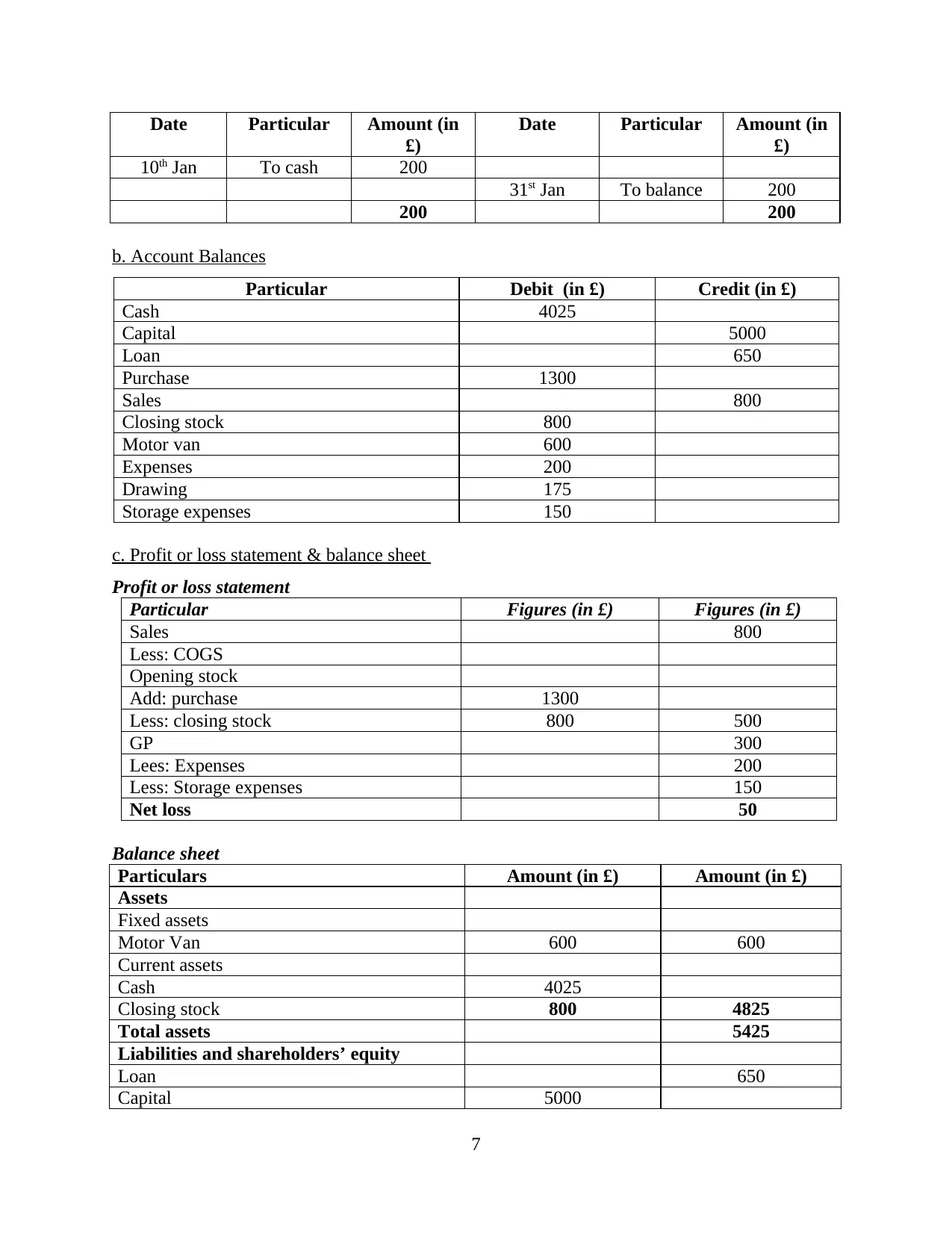

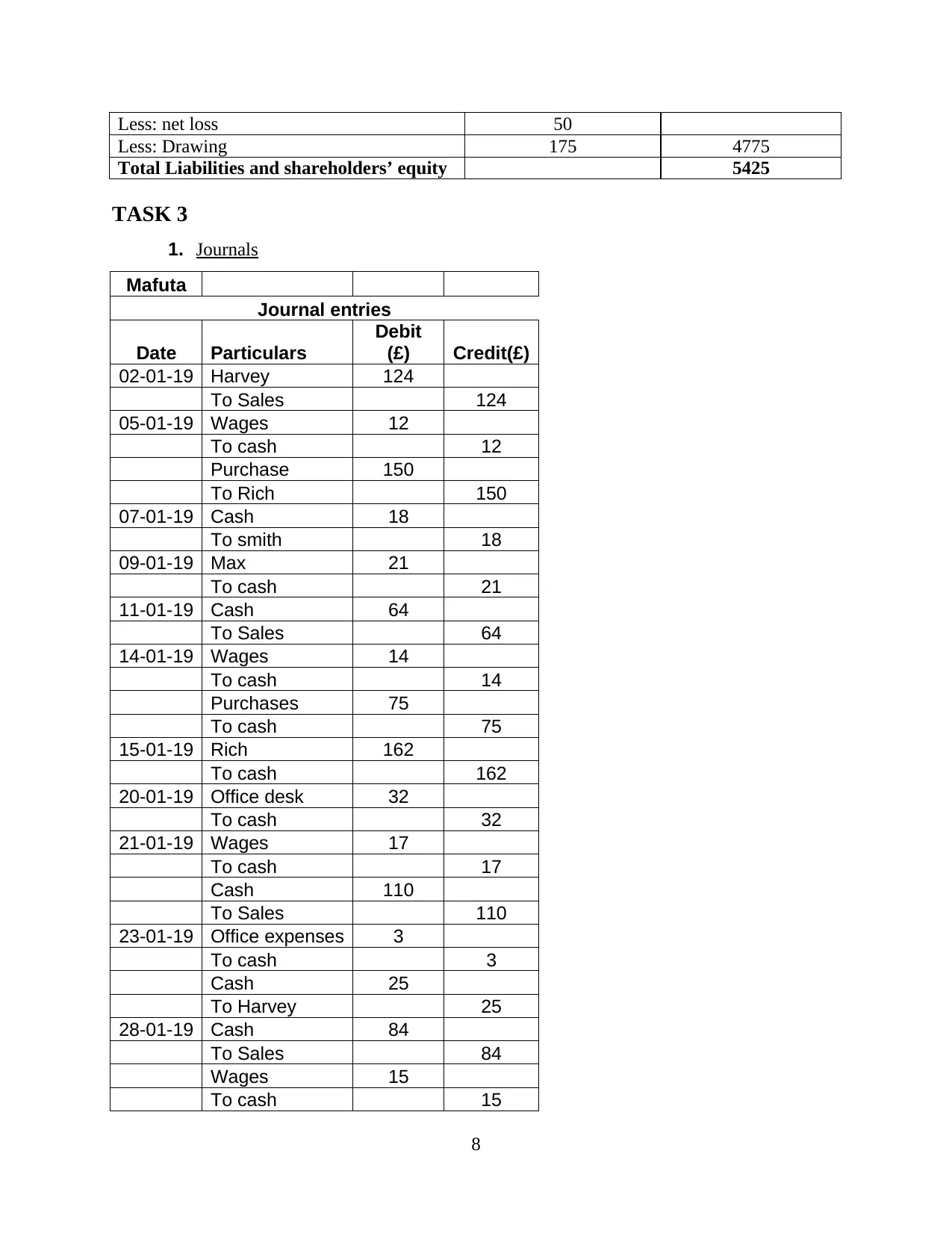

Less: net loss 50

Less: Drawing 175 4775

Total Liabilities and shareholders’ equity 5425

TASK 3

1. Journals

Mafuta

Journal entries

Date Particulars

Debit

(£) Credit(£)

02-01-19 Harvey 124

To Sales 124

05-01-19 Wages 12

To cash 12

Purchase 150

To Rich 150

07-01-19 Cash 18

To smith 18

09-01-19 Max 21

To cash 21

11-01-19 Cash 64

To Sales 64

14-01-19 Wages 14

To cash 14

Purchases 75

To cash 75

15-01-19 Rich 162

To cash 162

20-01-19 Office desk 32

To cash 32

21-01-19 Wages 17

To cash 17

Cash 110

To Sales 110

23-01-19 Office expenses 3

To cash 3

Cash 25

To Harvey 25

28-01-19 Cash 84

To Sales 84

Wages 15

To cash 15

8

Less: Drawing 175 4775

Total Liabilities and shareholders’ equity 5425

TASK 3

1. Journals

Mafuta

Journal entries

Date Particulars

Debit

(£) Credit(£)

02-01-19 Harvey 124

To Sales 124

05-01-19 Wages 12

To cash 12

Purchase 150

To Rich 150

07-01-19 Cash 18

To smith 18

09-01-19 Max 21

To cash 21

11-01-19 Cash 64

To Sales 64

14-01-19 Wages 14

To cash 14

Purchases 75

To cash 75

15-01-19 Rich 162

To cash 162

20-01-19 Office desk 32

To cash 32

21-01-19 Wages 17

To cash 17

Cash 110

To Sales 110

23-01-19 Office expenses 3

To cash 3

Cash 25

To Harvey 25

28-01-19 Cash 84

To Sales 84

Wages 15

To cash 15

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

31-01-19 Cash 30

To Sales 30

£956.00 £956.00

Ledger Account balance

Ledgers

Cash a/c

Date Particulars

Amount(£

) Date Particulars Amount(£)

01-01-

19

To opening

bal. 343

05-01-

19 By wages a/c 12

07-01-

19 To smith 18

09-01-

19 By Max 21

11-01-

19 To Sales 64

14-01-

19 By wages 14

21-01-

19 To Sales 110

15-01-

19 By rich 162

23-01-

19 To Harvey 25

20-01-

19 By office desk 32

28-01-

19 To Sales 84

21-01-

19 By wages 17

31-01-

19 To Sales 30

23-01-

19 By office expenses 3

28-01-

19 By wages 15

14-01-

19 By purchase 75

31-01-

19 By closing bal 323

674 674

Sales a/c

Date Particulars

Amount(£

) Date Particulars Amount(£)

02-01-

19 By Harvey 124

11-01-

19 By cash 64

21-01-

19 By cash 110

28-01-

19 By cash 84

31-01-

19 By cash 30

9

To Sales 30

£956.00 £956.00

Ledger Account balance

Ledgers

Cash a/c

Date Particulars

Amount(£

) Date Particulars Amount(£)

01-01-

19

To opening

bal. 343

05-01-

19 By wages a/c 12

07-01-

19 To smith 18

09-01-

19 By Max 21

11-01-

19 To Sales 64

14-01-

19 By wages 14

21-01-

19 To Sales 110

15-01-

19 By rich 162

23-01-

19 To Harvey 25

20-01-

19 By office desk 32

28-01-

19 To Sales 84

21-01-

19 By wages 17

31-01-

19 To Sales 30

23-01-

19 By office expenses 3

28-01-

19 By wages 15

14-01-

19 By purchase 75

31-01-

19 By closing bal 323

674 674

Sales a/c

Date Particulars

Amount(£

) Date Particulars Amount(£)

02-01-

19 By Harvey 124

11-01-

19 By cash 64

21-01-

19 By cash 110

28-01-

19 By cash 84

31-01-

19 By cash 30

9

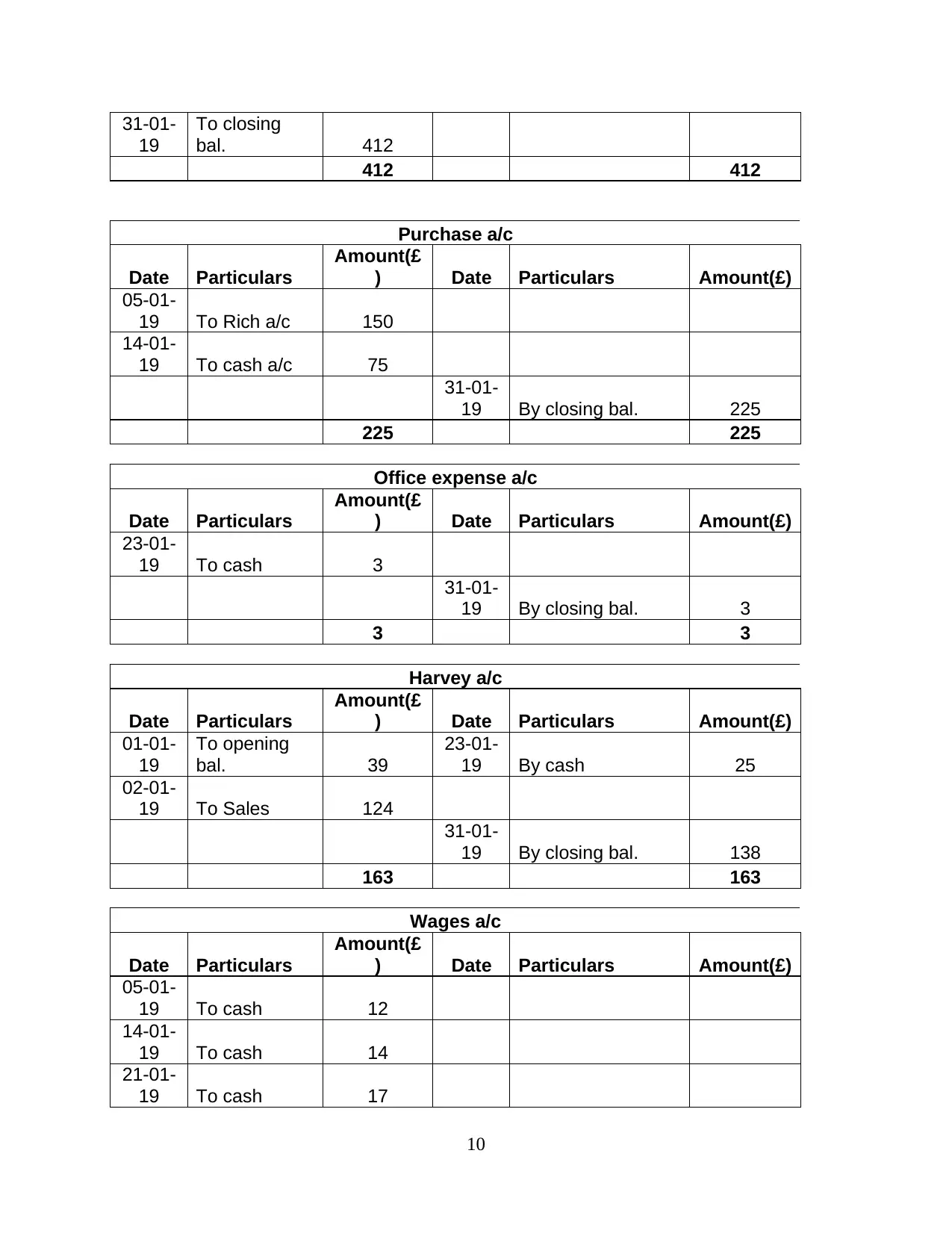

31-01-

19

To closing

bal. 412

412 412

Purchase a/c

Date Particulars

Amount(£

) Date Particulars Amount(£)

05-01-

19 To Rich a/c 150

14-01-

19 To cash a/c 75

31-01-

19 By closing bal. 225

225 225

Office expense a/c

Date Particulars

Amount(£

) Date Particulars Amount(£)

23-01-

19 To cash 3

31-01-

19 By closing bal. 3

3 3

Harvey a/c

Date Particulars

Amount(£

) Date Particulars Amount(£)

01-01-

19

To opening

bal. 39

23-01-

19 By cash 25

02-01-

19 To Sales 124

31-01-

19 By closing bal. 138

163 163

Wages a/c

Date Particulars

Amount(£

) Date Particulars Amount(£)

05-01-

19 To cash 12

14-01-

19 To cash 14

21-01-

19 To cash 17

10

19

To closing

bal. 412

412 412

Purchase a/c

Date Particulars

Amount(£

) Date Particulars Amount(£)

05-01-

19 To Rich a/c 150

14-01-

19 To cash a/c 75

31-01-

19 By closing bal. 225

225 225

Office expense a/c

Date Particulars

Amount(£

) Date Particulars Amount(£)

23-01-

19 To cash 3

31-01-

19 By closing bal. 3

3 3

Harvey a/c

Date Particulars

Amount(£

) Date Particulars Amount(£)

01-01-

19

To opening

bal. 39

23-01-

19 By cash 25

02-01-

19 To Sales 124

31-01-

19 By closing bal. 138

163 163

Wages a/c

Date Particulars

Amount(£

) Date Particulars Amount(£)

05-01-

19 To cash 12

14-01-

19 To cash 14

21-01-

19 To cash 17

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.