Corporate Accounting Analysis: Myer Holdings and Kathmandu Holdings

VerifiedAdded on 2023/06/07

|31

|3496

|244

Report

AI Summary

This report provides a detailed analysis of the financial statements of Myer Holdings and Kathmandu Holdings, both departmental store companies listed on the Australian Securities Exchange (ASX). The report examines key components of the statement of equity, statement of cash flows, and statement of comprehensive income for both companies. It delves into the understanding of each line item within these statements, including contributed equity, reserves, retained earnings, receipts from customers, payments to suppliers, and various cash flow activities. The analysis further explores deferred taxes, effective tax rates, and cash tax rates, comparing and contrasting these financial metrics. The report is structured to provide a comprehensive overview of the companies' financial positions, offering insights into their performance and financial health based on the provided financial data. The report is formatted according to the assignment brief, including an executive summary, table of contents, introduction, body, conclusion, and a list of references.

CORPORATE ACCOUNTING 1

CORPORATE

ACCOUNTING

CORPORATE

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CORPORATE ACCOUNTING 2

Executive summary:

The companies undertaken for review are Myer holdings and the Kathmandu holdings

Limited. Both of these companies are departmental stores. They deal in the women’s wear,

men’s wear etc. The report aims at understand each one of the line items contains in the

statement of equity, the statement of cash flows and the statement of comprehensive income.

It further talks about the deferred taxes, effective tax rates, the cash tax rates, the difference

between the 2.

Executive summary:

The companies undertaken for review are Myer holdings and the Kathmandu holdings

Limited. Both of these companies are departmental stores. They deal in the women’s wear,

men’s wear etc. The report aims at understand each one of the line items contains in the

statement of equity, the statement of cash flows and the statement of comprehensive income.

It further talks about the deferred taxes, effective tax rates, the cash tax rates, the difference

between the 2.

CORPORATE ACCOUNTING 3

Contents

Introduction:........................................................................................................................................4

Owners’ equity:...................................................................................................................................4

Part i:................................................................................................................................................4

Part ii:...............................................................................................................................................7

Part iii:..............................................................................................................................................8

Part IV:...........................................................................................................................................20

Part v:.............................................................................................................................................21

Part vi:............................................................................................................................................22

Part vii:...........................................................................................................................................24

Part viii:..........................................................................................................................................25

Part ix:............................................................................................................................................25

Part x:.............................................................................................................................................26

Part xi:............................................................................................................................................26

Part xii:...........................................................................................................................................27

Part xiii:..........................................................................................................................................27

Part xiv:..........................................................................................................................................27

Part xv:...........................................................................................................................................28

Part xvi:..........................................................................................................................................29

References:.....................................................................................................................................31

Contents

Introduction:........................................................................................................................................4

Owners’ equity:...................................................................................................................................4

Part i:................................................................................................................................................4

Part ii:...............................................................................................................................................7

Part iii:..............................................................................................................................................8

Part IV:...........................................................................................................................................20

Part v:.............................................................................................................................................21

Part vi:............................................................................................................................................22

Part vii:...........................................................................................................................................24

Part viii:..........................................................................................................................................25

Part ix:............................................................................................................................................25

Part x:.............................................................................................................................................26

Part xi:............................................................................................................................................26

Part xii:...........................................................................................................................................27

Part xiii:..........................................................................................................................................27

Part xiv:..........................................................................................................................................27

Part xv:...........................................................................................................................................28

Part xvi:..........................................................................................................................................29

References:.....................................................................................................................................31

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CORPORATE ACCOUNTING 4

Introduction:

The first company chosen is Myer holdings which is the company based in the country of

Australia. It is a departmental store. The company has a number of store networks which

includes in the footprint of about 60 stores in the various different retail locations all across

the country. The company has products which includes women wear, men’s wear, miss shop

etc. the company has its own women’s wear brand, saas and bide. The company also has the

top brands such as TOPSHOP, Seed etc. the subsidiaries of the company includes Myer Pty

Ltd, NB Elizabeth Pty Ltd, NB Russell Pty Ltd, Warehouse Solutions Pty Ltd, Myer Group

Finance Limited, Myer Group Pty Ltd and Myer Travel Pty Ltd. There are many more

activities that are undertaken by the departments store retail business as well and this is done

through its subsidiaries (Reuters, 2018).

The second company undertaken for review include Kathmandu Holdings Limited which is

the company that has some transnational chain of the retail stores. The company deals in the

travel and adventure apparel. The company is also one of the leading retailers of clothing and

equipment for the purposes of travelling and also for adventure in the countries of New

Zealand, Australia and the UK. The company has about 163 stores all around the globe

(Kathmandu Holdings, 2018).

Owners’ equity:

Part i:

The following are the desired statements:

Myer Holdings:

Owner's equity:

(Amounts in $ in

Introduction:

The first company chosen is Myer holdings which is the company based in the country of

Australia. It is a departmental store. The company has a number of store networks which

includes in the footprint of about 60 stores in the various different retail locations all across

the country. The company has products which includes women wear, men’s wear, miss shop

etc. the company has its own women’s wear brand, saas and bide. The company also has the

top brands such as TOPSHOP, Seed etc. the subsidiaries of the company includes Myer Pty

Ltd, NB Elizabeth Pty Ltd, NB Russell Pty Ltd, Warehouse Solutions Pty Ltd, Myer Group

Finance Limited, Myer Group Pty Ltd and Myer Travel Pty Ltd. There are many more

activities that are undertaken by the departments store retail business as well and this is done

through its subsidiaries (Reuters, 2018).

The second company undertaken for review include Kathmandu Holdings Limited which is

the company that has some transnational chain of the retail stores. The company deals in the

travel and adventure apparel. The company is also one of the leading retailers of clothing and

equipment for the purposes of travelling and also for adventure in the countries of New

Zealand, Australia and the UK. The company has about 163 stores all around the globe

(Kathmandu Holdings, 2018).

Owners’ equity:

Part i:

The following are the desired statements:

Myer Holdings:

Owner's equity:

(Amounts in $ in

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

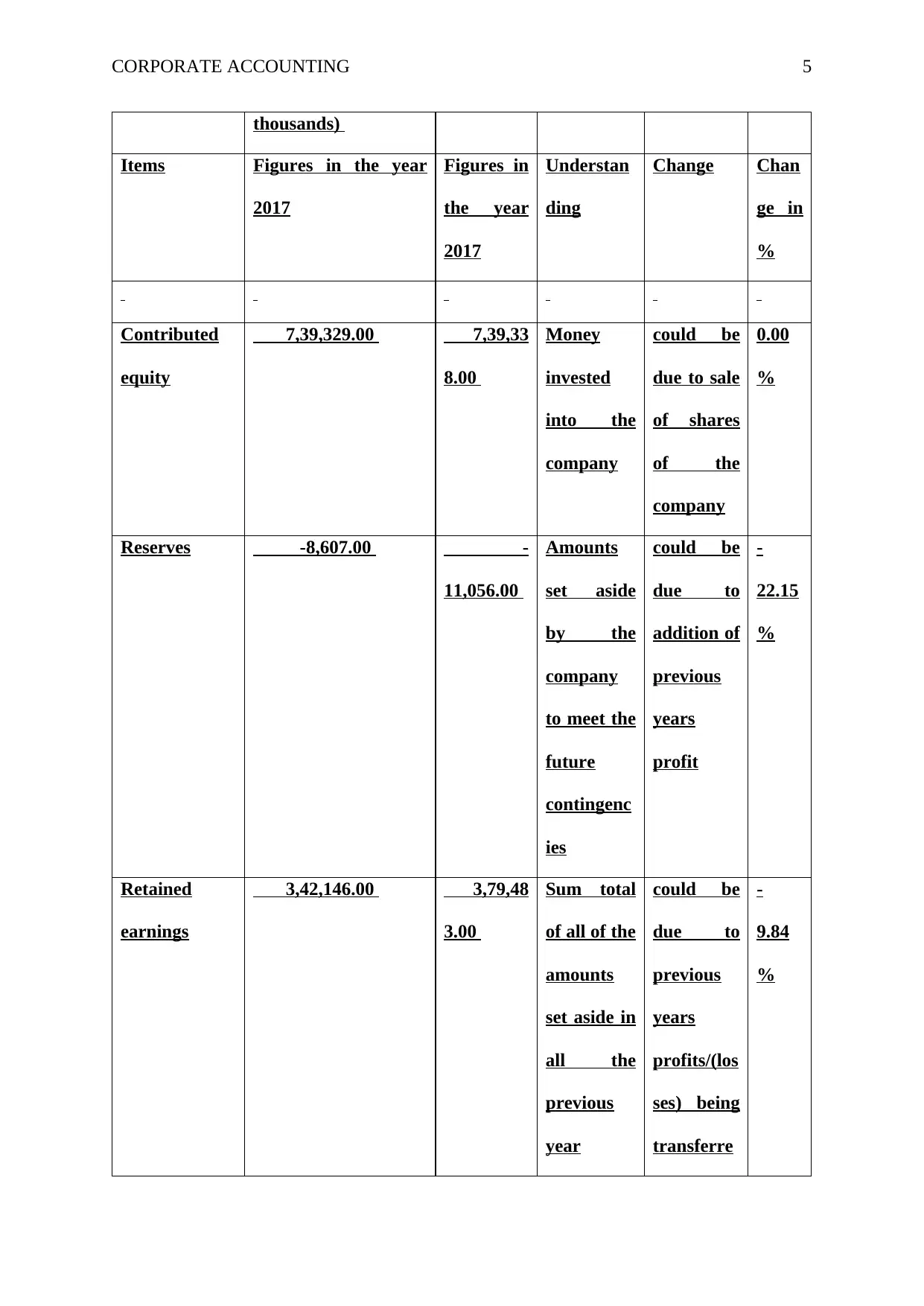

CORPORATE ACCOUNTING 5

thousands)

Items Figures in the year

2017

Figures in

the year

2017

Understan

ding

Change Chan

ge in

%

Contributed

equity

7,39,329.00 7,39,33

8.00

Money

invested

into the

company

could be

due to sale

of shares

of the

company

0.00

%

Reserves -8,607.00 -

11,056.00

Amounts

set aside

by the

company

to meet the

future

contingenc

ies

could be

due to

addition of

previous

years

profit

-

22.15

%

Retained

earnings

3,42,146.00 3,79,48

3.00

Sum total

of all of the

amounts

set aside in

all the

previous

year

could be

due to

previous

years

profits/(los

ses) being

transferre

-

9.84

%

thousands)

Items Figures in the year

2017

Figures in

the year

2017

Understan

ding

Change Chan

ge in

%

Contributed

equity

7,39,329.00 7,39,33

8.00

Money

invested

into the

company

could be

due to sale

of shares

of the

company

0.00

%

Reserves -8,607.00 -

11,056.00

Amounts

set aside

by the

company

to meet the

future

contingenc

ies

could be

due to

addition of

previous

years

profit

-

22.15

%

Retained

earnings

3,42,146.00 3,79,48

3.00

Sum total

of all of the

amounts

set aside in

all the

previous

year

could be

due to

previous

years

profits/(los

ses) being

transferre

-

9.84

%

CORPORATE ACCOUNTING 6

d in this

account

Total 10,72,868.00 11,07,76

5.00

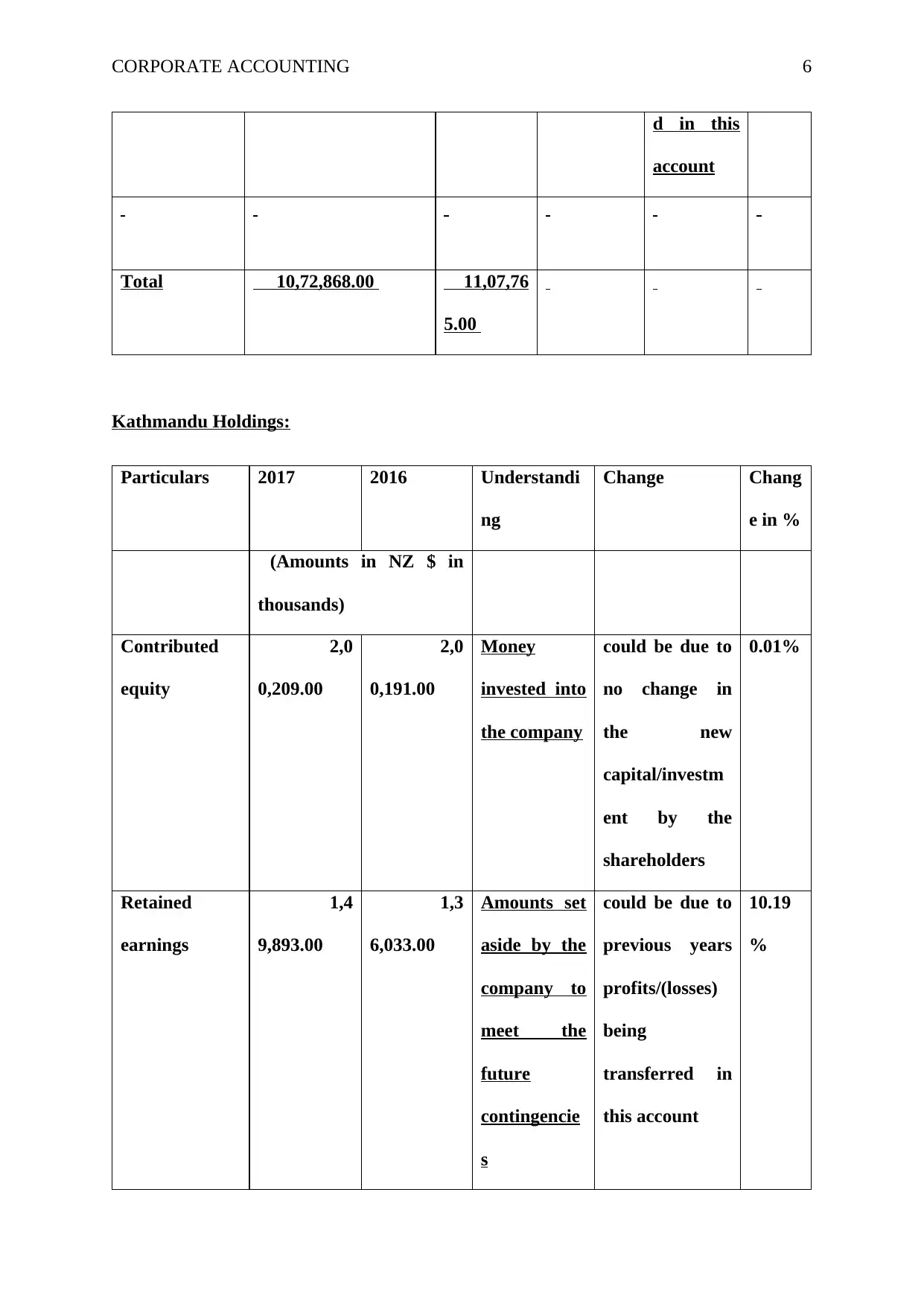

Kathmandu Holdings:

Particulars 2017 2016 Understandi

ng

Change Chang

e in %

(Amounts in NZ $ in

thousands)

Contributed

equity

2,0

0,209.00

2,0

0,191.00

Money

invested into

the company

could be due to

no change in

the new

capital/investm

ent by the

shareholders

0.01%

Retained

earnings

1,4

9,893.00

1,3

6,033.00

Amounts set

aside by the

company to

meet the

future

contingencie

s

could be due to

previous years

profits/(losses)

being

transferred in

this account

10.19

%

d in this

account

Total 10,72,868.00 11,07,76

5.00

Kathmandu Holdings:

Particulars 2017 2016 Understandi

ng

Change Chang

e in %

(Amounts in NZ $ in

thousands)

Contributed

equity

2,0

0,209.00

2,0

0,191.00

Money

invested into

the company

could be due to

no change in

the new

capital/investm

ent by the

shareholders

0.01%

Retained

earnings

1,4

9,893.00

1,3

6,033.00

Amounts set

aside by the

company to

meet the

future

contingencie

s

could be due to

previous years

profits/(losses)

being

transferred in

this account

10.19

%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CORPORATE ACCOUNTING 7

Reserves -

23,002.00

-

24,541.00

Sum total of

all of the

amounts set

aside in all

the previous

year

could be due to

addition of

previous year’s

profit/(losses)

-

6.27%

Total 3,2

7,100.00

3,1

1,683.00

Part ii:

Myer Kathmandu

Particulars 2017 2017

Contributed equity

7,39,329.0

0

2,00,209.0

0

Reserves -8607

-

Reserves -

23,002.00

-

24,541.00

Sum total of

all of the

amounts set

aside in all

the previous

year

could be due to

addition of

previous year’s

profit/(losses)

-

6.27%

Total 3,2

7,100.00

3,1

1,683.00

Part ii:

Myer Kathmandu

Particulars 2017 2017

Contributed equity

7,39,329.0

0

2,00,209.0

0

Reserves -8607

-

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

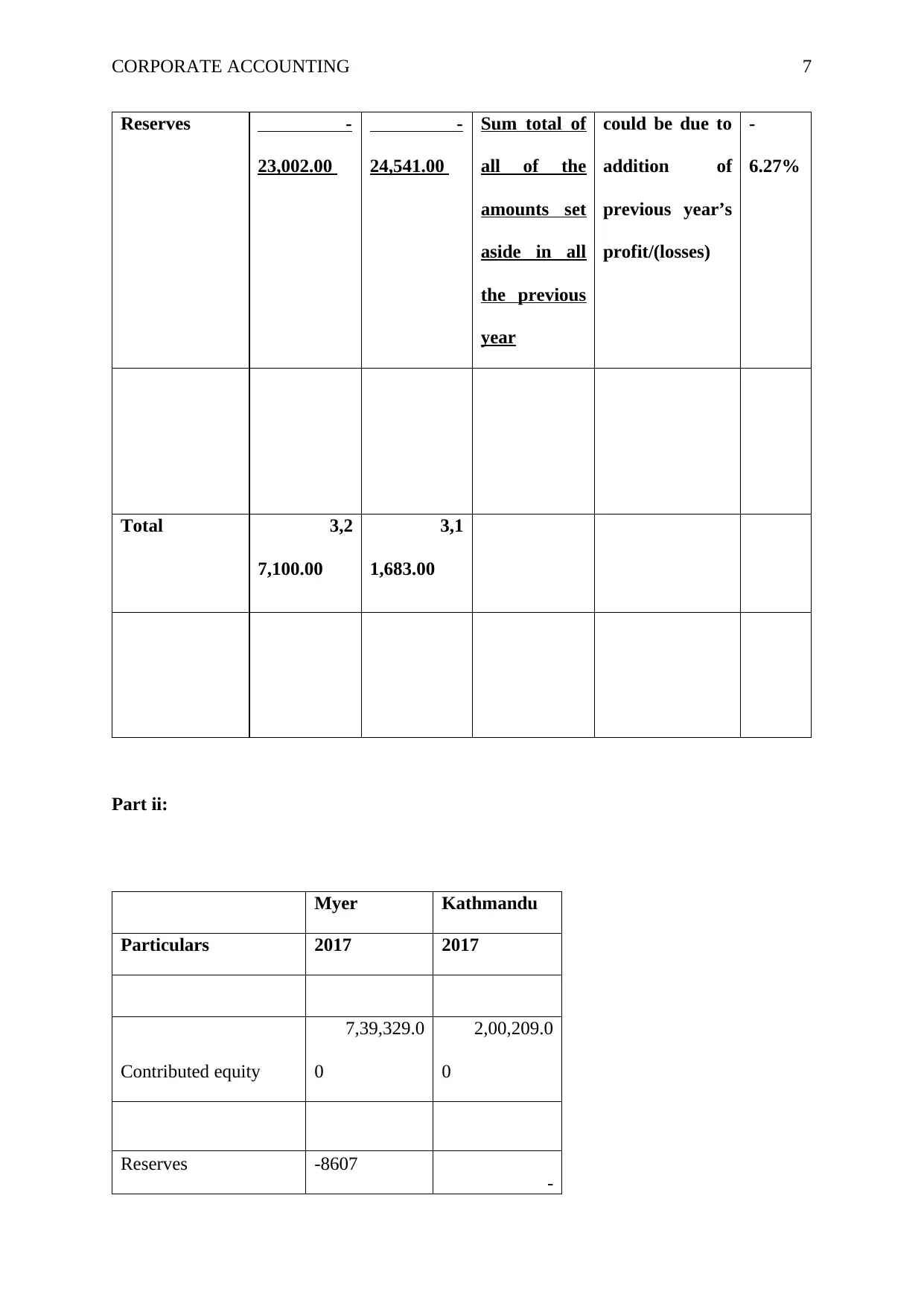

CORPORATE ACCOUNTING 8

23,002.00

Retained earnings

3,42,146.0

0

1,49,893.0

0

- -

Total

10,72,868.0

0

3,27,100.0

0

Part iii:

Myer Holdings:

Statement of cash flows

(Amounts in $

in thousands)

Particulars 2017 2016 Understanding Change in %

Cash flows from

operating

activities:

Receipts from

customers

29,31,853.00 31,

01,149.

amounts

received from

-5.46%

23,002.00

Retained earnings

3,42,146.0

0

1,49,893.0

0

- -

Total

10,72,868.0

0

3,27,100.0

0

Part iii:

Myer Holdings:

Statement of cash flows

(Amounts in $

in thousands)

Particulars 2017 2016 Understanding Change in %

Cash flows from

operating

activities:

Receipts from

customers

29,31,853.00 31,

01,149.

amounts

received from

-5.46%

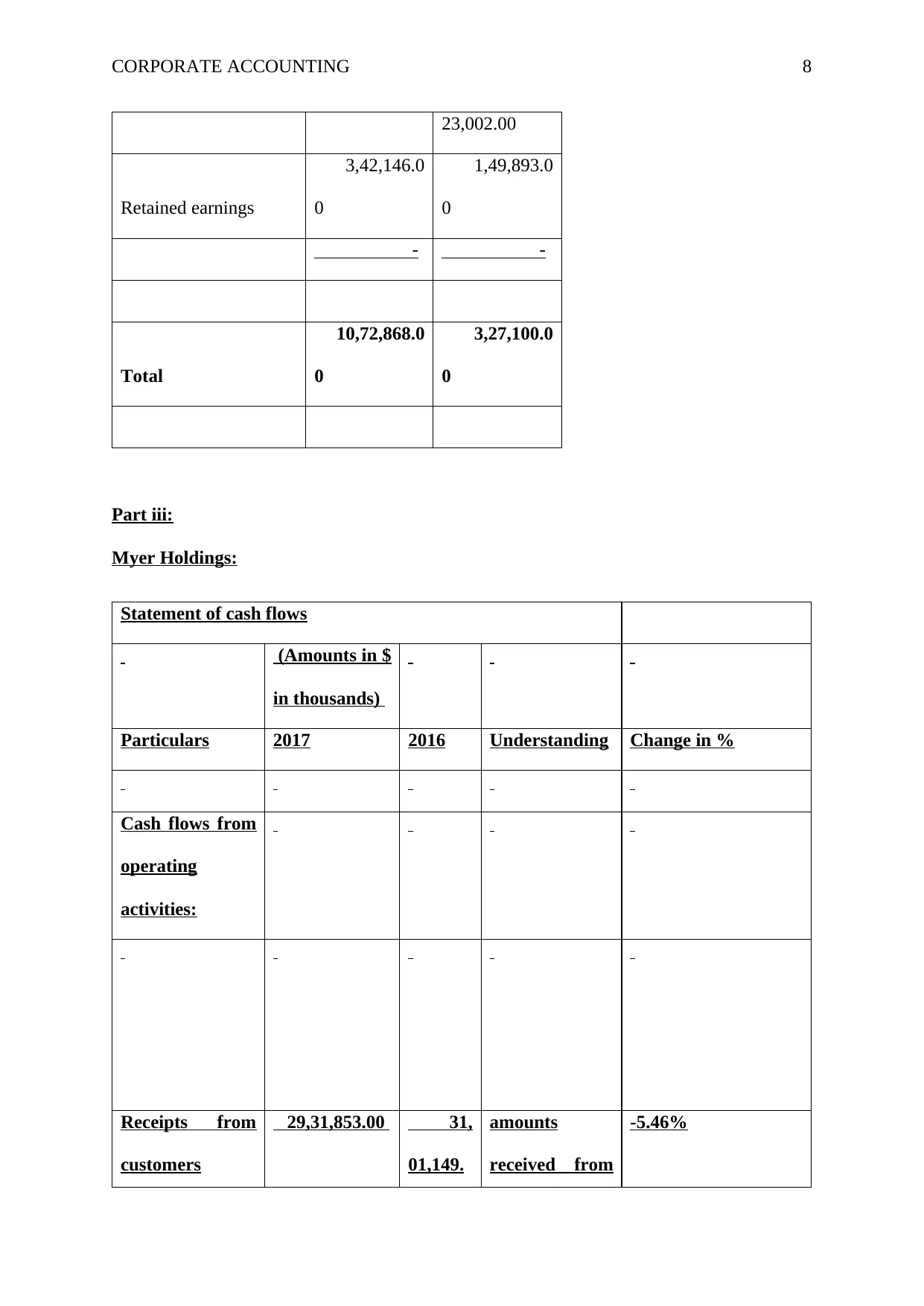

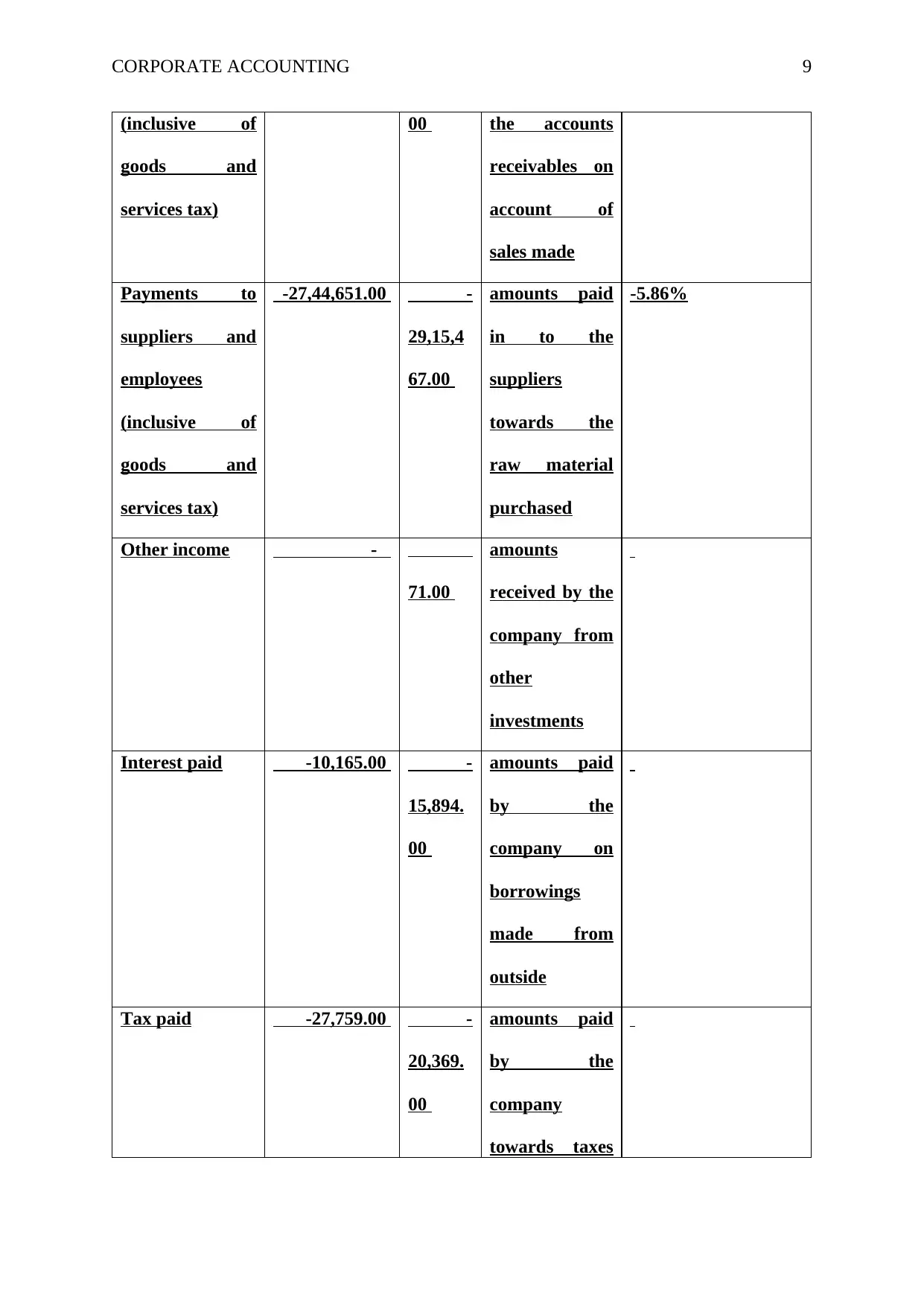

CORPORATE ACCOUNTING 9

(inclusive of

goods and

services tax)

00 the accounts

receivables on

account of

sales made

Payments to

suppliers and

employees

(inclusive of

goods and

services tax)

-27,44,651.00 -

29,15,4

67.00

amounts paid

in to the

suppliers

towards the

raw material

purchased

-5.86%

Other income -

71.00

amounts

received by the

company from

other

investments

Interest paid -10,165.00 -

15,894.

00

amounts paid

by the

company on

borrowings

made from

outside

Tax paid -27,759.00 -

20,369.

00

amounts paid

by the

company

towards taxes

(inclusive of

goods and

services tax)

00 the accounts

receivables on

account of

sales made

Payments to

suppliers and

employees

(inclusive of

goods and

services tax)

-27,44,651.00 -

29,15,4

67.00

amounts paid

in to the

suppliers

towards the

raw material

purchased

-5.86%

Other income -

71.00

amounts

received by the

company from

other

investments

Interest paid -10,165.00 -

15,894.

00

amounts paid

by the

company on

borrowings

made from

outside

Tax paid -27,759.00 -

20,369.

00

amounts paid

by the

company

towards taxes

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

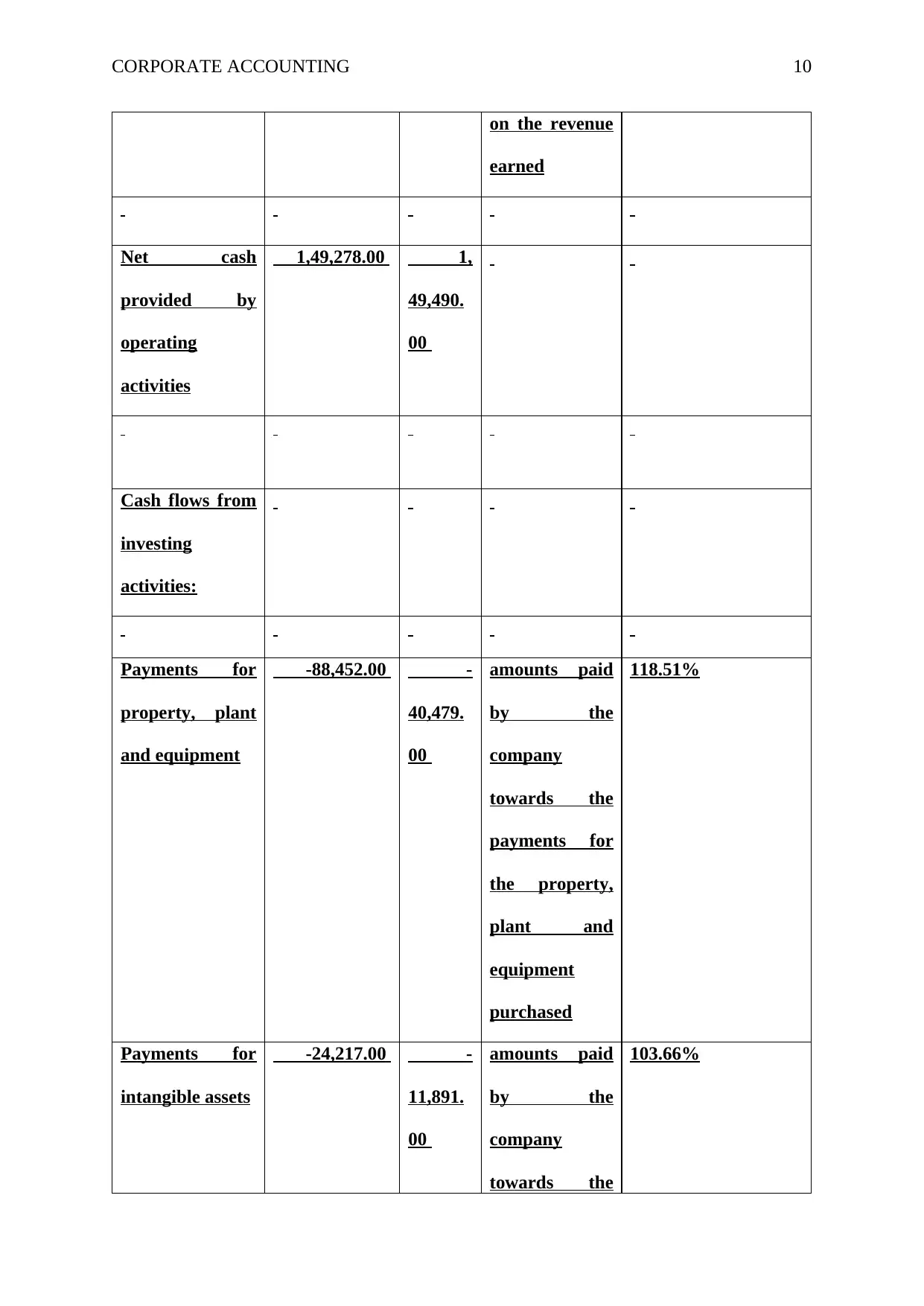

CORPORATE ACCOUNTING 10

on the revenue

earned

Net cash

provided by

operating

activities

1,49,278.00 1,

49,490.

00

Cash flows from

investing

activities:

Payments for

property, plant

and equipment

-88,452.00 -

40,479.

00

amounts paid

by the

company

towards the

payments for

the property,

plant and

equipment

purchased

118.51%

Payments for

intangible assets

-24,217.00 -

11,891.

00

amounts paid

by the

company

towards the

103.66%

on the revenue

earned

Net cash

provided by

operating

activities

1,49,278.00 1,

49,490.

00

Cash flows from

investing

activities:

Payments for

property, plant

and equipment

-88,452.00 -

40,479.

00

amounts paid

by the

company

towards the

payments for

the property,

plant and

equipment

purchased

118.51%

Payments for

intangible assets

-24,217.00 -

11,891.

00

amounts paid

by the

company

towards the

103.66%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

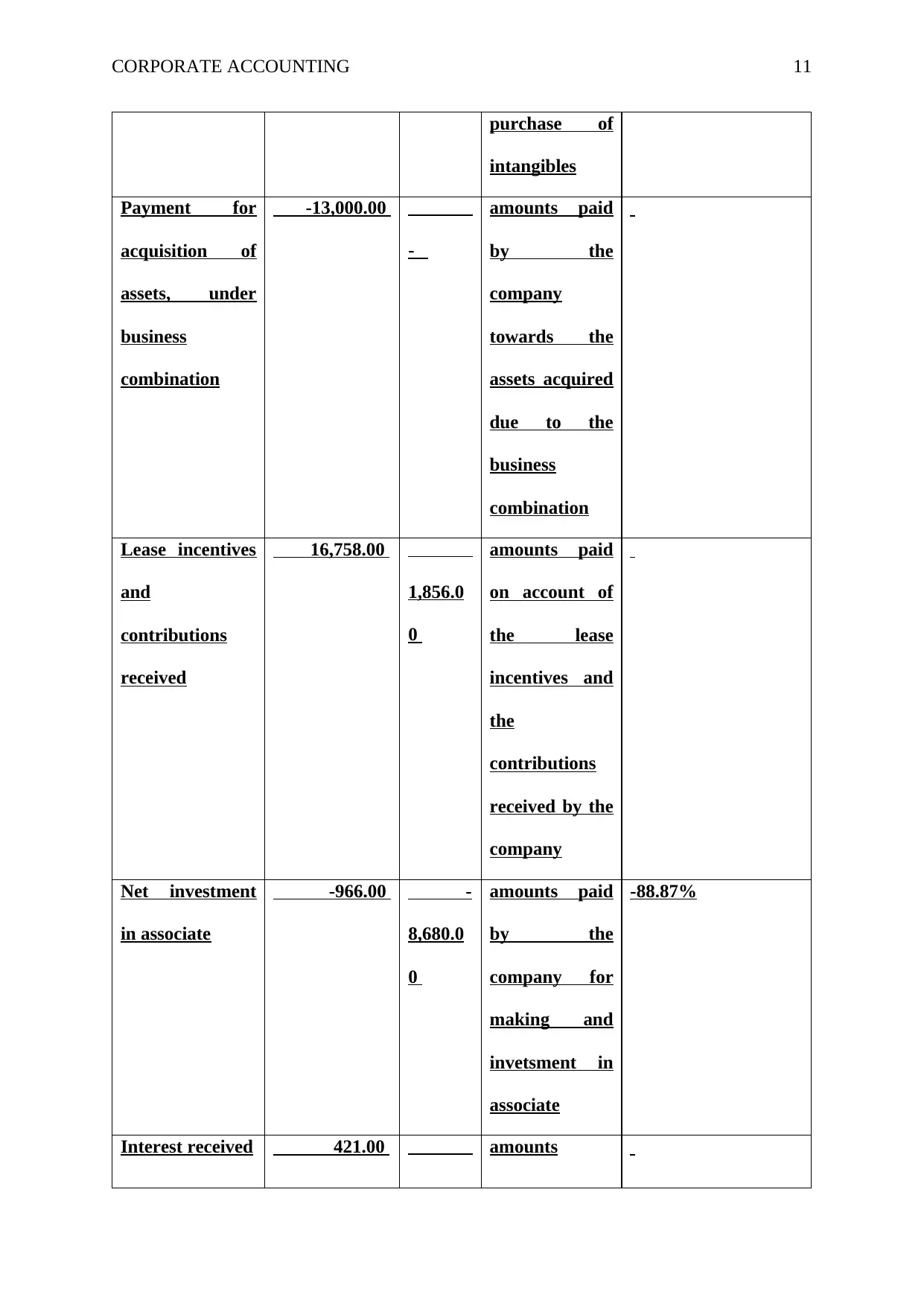

CORPORATE ACCOUNTING 11

purchase of

intangibles

Payment for

acquisition of

assets, under

business

combination

-13,000.00

-

amounts paid

by the

company

towards the

assets acquired

due to the

business

combination

Lease incentives

and

contributions

received

16,758.00

1,856.0

0

amounts paid

on account of

the lease

incentives and

the

contributions

received by the

company

Net investment

in associate

-966.00 -

8,680.0

0

amounts paid

by the

company for

making and

invetsment in

associate

-88.87%

Interest received 421.00 amounts

purchase of

intangibles

Payment for

acquisition of

assets, under

business

combination

-13,000.00

-

amounts paid

by the

company

towards the

assets acquired

due to the

business

combination

Lease incentives

and

contributions

received

16,758.00

1,856.0

0

amounts paid

on account of

the lease

incentives and

the

contributions

received by the

company

Net investment

in associate

-966.00 -

8,680.0

0

amounts paid

by the

company for

making and

invetsment in

associate

-88.87%

Interest received 421.00 amounts

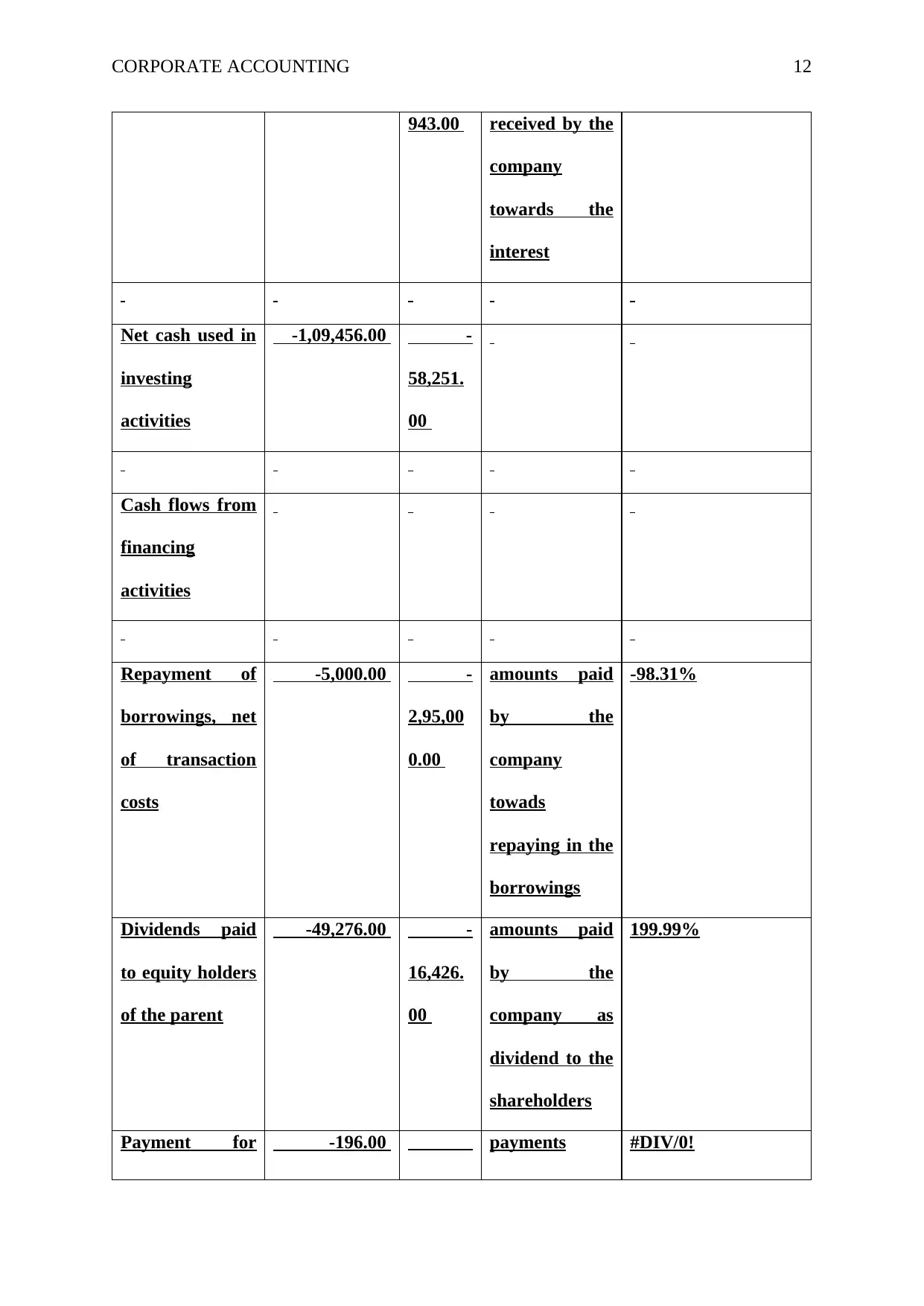

CORPORATE ACCOUNTING 12

943.00 received by the

company

towards the

interest

Net cash used in

investing

activities

-1,09,456.00 -

58,251.

00

Cash flows from

financing

activities

Repayment of

borrowings, net

of transaction

costs

-5,000.00 -

2,95,00

0.00

amounts paid

by the

company

towads

repaying in the

borrowings

-98.31%

Dividends paid

to equity holders

of the parent

-49,276.00 -

16,426.

00

amounts paid

by the

company as

dividend to the

shareholders

199.99%

Payment for -196.00 payments #DIV/0!

943.00 received by the

company

towards the

interest

Net cash used in

investing

activities

-1,09,456.00 -

58,251.

00

Cash flows from

financing

activities

Repayment of

borrowings, net

of transaction

costs

-5,000.00 -

2,95,00

0.00

amounts paid

by the

company

towads

repaying in the

borrowings

-98.31%

Dividends paid

to equity holders

of the parent

-49,276.00 -

16,426.

00

amounts paid

by the

company as

dividend to the

shareholders

199.99%

Payment for -196.00 payments #DIV/0!

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 31

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.