BMP6018 Financial Accounting: Evaluating Concepts & Regulations

VerifiedAdded on 2023/06/16

|8

|3035

|78

Essay

AI Summary

This essay provides a comprehensive analysis of fundamental financial accounting concepts and conventions, examining their impact on financial statements and users. It explores the history of accounting regulations, highlighting the reasons for constant changes in response to the dynamic global economy. The essay differentiates between accounting rules and principles, emphasizing the importance of concepts like accrual, matching, and economic entity, as well as conventions such as conservatism, consistency, and full disclosure. Each concept and convention is discussed in detail, outlining their impact on financial reporting and the insights they provide to investors and other stakeholders. The overall aim is to provide a clear understanding of how these foundational elements ensure the reliability, comparability, and relevance of financial information.

BSc (Hons) Business Management Top up

BMP6018

Financial Accounting & Reporting Framework

A discussion of the fundamental

accounting concepts, and how they

are linked with the users of financial

reports

0

BMP6018

Financial Accounting & Reporting Framework

A discussion of the fundamental

accounting concepts, and how they

are linked with the users of financial

reports

0

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

A critical evaluation of the fundamental financial accounting

concepts and conventions, and how these have an impact on

the contents of the financial statements and its users. The

history of the accounting regulations and reasons for the

constant changes

Financial accounting can be simply defined as one of the branch of accounting that

basically involves a procedure of recording, classifying, arranging, summarizing and

reporting the different types of financial transactions that have been generated out of

the business operations over a specific period of time (Prewett and Terry, 2018). The

major role of these transactions are utilized for the purpose of the preparation of the

different financial statements. This will basically include balance sheet, income

statement, cash flow statement. Therefore, this will help in assessing the

performance of the company effectively.

History of Accounting Regulations

The accounting regulations are created and set up by the FAFs standard-setting

boards the Financial Accounting Standards Board and the Governmental Accounting

Standards Board are the guidelines that decide how that language is composed. Those

guidelines are referred to altogether as U.S. By and large Accepted Accounting

Principles or U.S. GAAP. Organizations, not-for-benefits, legislatures, and different

associations use these accounting regulations as the establishment whereupon to furnish

clients of budget summaries with the data they need to settle on choices regarding how

well an association or government is dealing with its assets. Financial backers and banks

can utilize this data to choose where to supply assets or loan cash. Including

establishments and grantors, can utilize this data to choose where to give. Therefore, the

financial data should be clear, compact, practically identical, important and illustratively in

nature to maintain the highest level of efficiency in the accounting records.

Reasons for Constant Changes in the Accounting Regulations

The worldwide economy is highly dynamic and regularly erratic. To keep up

with security, institutional and retail financial backers should have the option to trust

openly accessible monetary data. Accounting regulations are made to address this

issue, and are sanctioned to direct announcing organizations along this way. There

is an important requirement of changing or updating the accounting policies, rules

and regulations on a regular basis to meet up with the dynamic economy which is

changing on a regular basis (van de Velde, 2018). The reasons for that can be

external as well as internal. Therefore, the major reason behind making changes will

help in maintaining effectiveness, efficiency and consistency in context to the

accounting records.

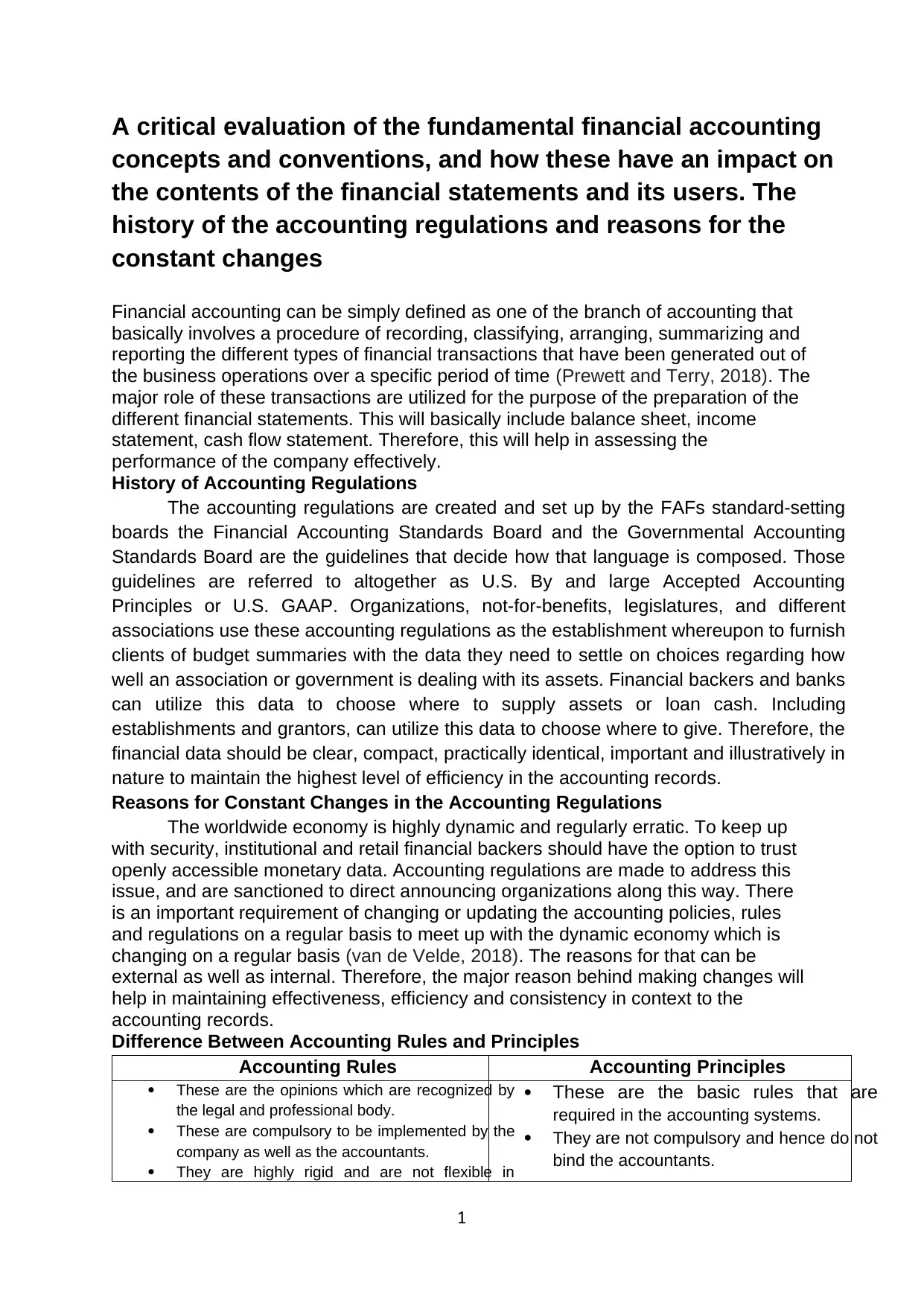

Difference Between Accounting Rules and Principles

Accounting Rules Accounting Principles

These are the opinions which are recognized by

the legal and professional body.

These are compulsory to be implemented by the

company as well as the accountants.

They are highly rigid and are not flexible in

These are the basic rules that are

required in the accounting systems.

They are not compulsory and hence do not

bind the accountants.

1

concepts and conventions, and how these have an impact on

the contents of the financial statements and its users. The

history of the accounting regulations and reasons for the

constant changes

Financial accounting can be simply defined as one of the branch of accounting that

basically involves a procedure of recording, classifying, arranging, summarizing and

reporting the different types of financial transactions that have been generated out of

the business operations over a specific period of time (Prewett and Terry, 2018). The

major role of these transactions are utilized for the purpose of the preparation of the

different financial statements. This will basically include balance sheet, income

statement, cash flow statement. Therefore, this will help in assessing the

performance of the company effectively.

History of Accounting Regulations

The accounting regulations are created and set up by the FAFs standard-setting

boards the Financial Accounting Standards Board and the Governmental Accounting

Standards Board are the guidelines that decide how that language is composed. Those

guidelines are referred to altogether as U.S. By and large Accepted Accounting

Principles or U.S. GAAP. Organizations, not-for-benefits, legislatures, and different

associations use these accounting regulations as the establishment whereupon to furnish

clients of budget summaries with the data they need to settle on choices regarding how

well an association or government is dealing with its assets. Financial backers and banks

can utilize this data to choose where to supply assets or loan cash. Including

establishments and grantors, can utilize this data to choose where to give. Therefore, the

financial data should be clear, compact, practically identical, important and illustratively in

nature to maintain the highest level of efficiency in the accounting records.

Reasons for Constant Changes in the Accounting Regulations

The worldwide economy is highly dynamic and regularly erratic. To keep up

with security, institutional and retail financial backers should have the option to trust

openly accessible monetary data. Accounting regulations are made to address this

issue, and are sanctioned to direct announcing organizations along this way. There

is an important requirement of changing or updating the accounting policies, rules

and regulations on a regular basis to meet up with the dynamic economy which is

changing on a regular basis (van de Velde, 2018). The reasons for that can be

external as well as internal. Therefore, the major reason behind making changes will

help in maintaining effectiveness, efficiency and consistency in context to the

accounting records.

Difference Between Accounting Rules and Principles

Accounting Rules Accounting Principles

These are the opinions which are recognized by

the legal and professional body.

These are compulsory to be implemented by the

company as well as the accountants.

They are highly rigid and are not flexible in

These are the basic rules that are

required in the accounting systems.

They are not compulsory and hence do not

bind the accountants.

1

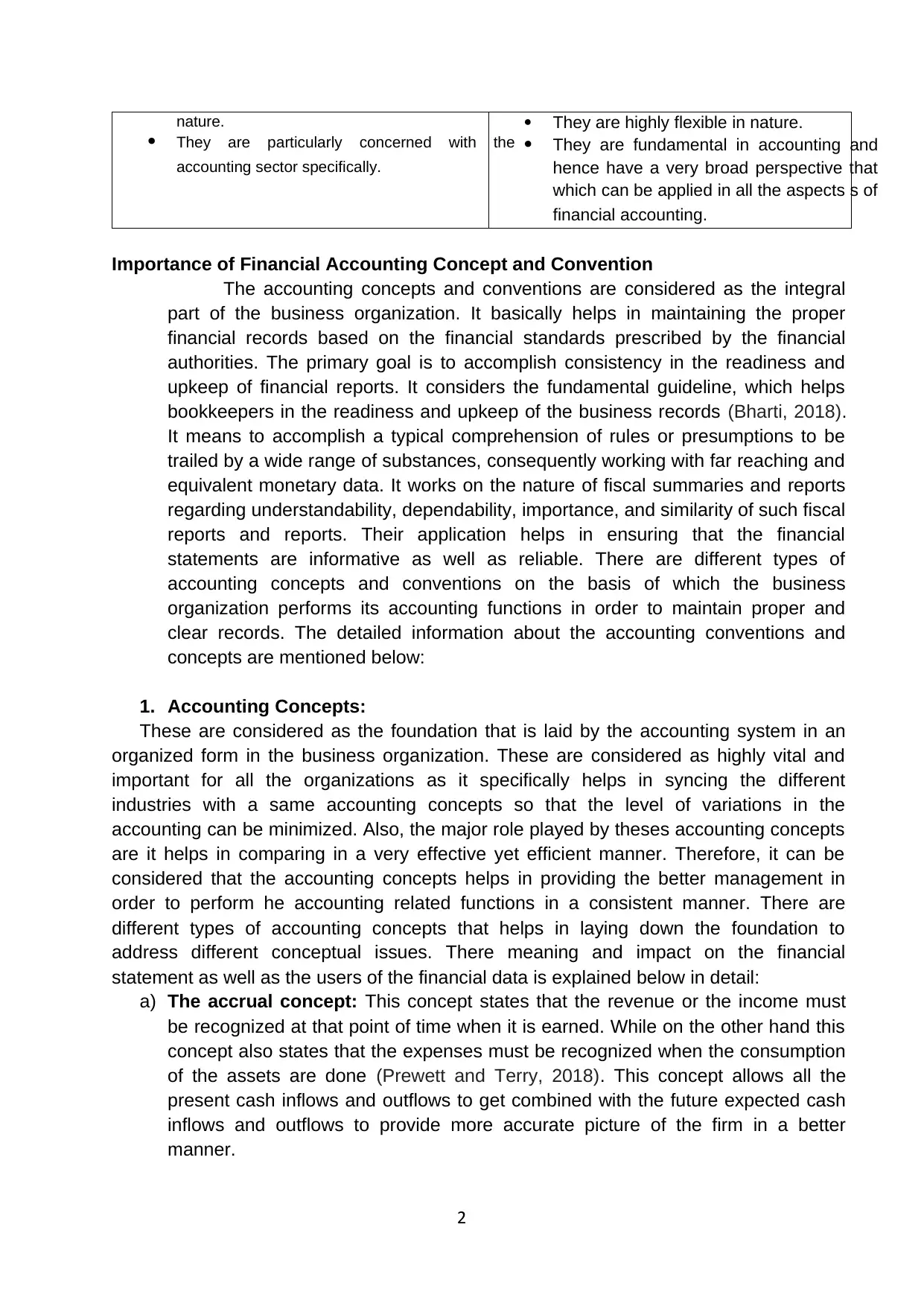

nature.

They are particularly concerned with the

accounting sector specifically.

They are highly flexible in nature.

They are fundamental in accounting and

hence have a very broad perspective that

which can be applied in all the aspects s of

financial accounting.

Importance of Financial Accounting Concept and Convention

The accounting concepts and conventions are considered as the integral

part of the business organization. It basically helps in maintaining the proper

financial records based on the financial standards prescribed by the financial

authorities. The primary goal is to accomplish consistency in the readiness and

upkeep of financial reports. It considers the fundamental guideline, which helps

bookkeepers in the readiness and upkeep of the business records (Bharti, 2018).

It means to accomplish a typical comprehension of rules or presumptions to be

trailed by a wide range of substances, consequently working with far reaching and

equivalent monetary data. It works on the nature of fiscal summaries and reports

regarding understandability, dependability, importance, and similarity of such fiscal

reports and reports. Their application helps in ensuring that the financial

statements are informative as well as reliable. There are different types of

accounting concepts and conventions on the basis of which the business

organization performs its accounting functions in order to maintain proper and

clear records. The detailed information about the accounting conventions and

concepts are mentioned below:

1. Accounting Concepts:

These are considered as the foundation that is laid by the accounting system in an

organized form in the business organization. These are considered as highly vital and

important for all the organizations as it specifically helps in syncing the different

industries with a same accounting concepts so that the level of variations in the

accounting can be minimized. Also, the major role played by theses accounting concepts

are it helps in comparing in a very effective yet efficient manner. Therefore, it can be

considered that the accounting concepts helps in providing the better management in

order to perform he accounting related functions in a consistent manner. There are

different types of accounting concepts that helps in laying down the foundation to

address different conceptual issues. There meaning and impact on the financial

statement as well as the users of the financial data is explained below in detail:

a) The accrual concept: This concept states that the revenue or the income must

be recognized at that point of time when it is earned. While on the other hand this

concept also states that the expenses must be recognized when the consumption

of the assets are done (Prewett and Terry, 2018). This concept allows all the

present cash inflows and outflows to get combined with the future expected cash

inflows and outflows to provide more accurate picture of the firm in a better

manner.

2

They are particularly concerned with the

accounting sector specifically.

They are highly flexible in nature.

They are fundamental in accounting and

hence have a very broad perspective that

which can be applied in all the aspects s of

financial accounting.

Importance of Financial Accounting Concept and Convention

The accounting concepts and conventions are considered as the integral

part of the business organization. It basically helps in maintaining the proper

financial records based on the financial standards prescribed by the financial

authorities. The primary goal is to accomplish consistency in the readiness and

upkeep of financial reports. It considers the fundamental guideline, which helps

bookkeepers in the readiness and upkeep of the business records (Bharti, 2018).

It means to accomplish a typical comprehension of rules or presumptions to be

trailed by a wide range of substances, consequently working with far reaching and

equivalent monetary data. It works on the nature of fiscal summaries and reports

regarding understandability, dependability, importance, and similarity of such fiscal

reports and reports. Their application helps in ensuring that the financial

statements are informative as well as reliable. There are different types of

accounting concepts and conventions on the basis of which the business

organization performs its accounting functions in order to maintain proper and

clear records. The detailed information about the accounting conventions and

concepts are mentioned below:

1. Accounting Concepts:

These are considered as the foundation that is laid by the accounting system in an

organized form in the business organization. These are considered as highly vital and

important for all the organizations as it specifically helps in syncing the different

industries with a same accounting concepts so that the level of variations in the

accounting can be minimized. Also, the major role played by theses accounting concepts

are it helps in comparing in a very effective yet efficient manner. Therefore, it can be

considered that the accounting concepts helps in providing the better management in

order to perform he accounting related functions in a consistent manner. There are

different types of accounting concepts that helps in laying down the foundation to

address different conceptual issues. There meaning and impact on the financial

statement as well as the users of the financial data is explained below in detail:

a) The accrual concept: This concept states that the revenue or the income must

be recognized at that point of time when it is earned. While on the other hand this

concept also states that the expenses must be recognized when the consumption

of the assets are done (Prewett and Terry, 2018). This concept allows all the

present cash inflows and outflows to get combined with the future expected cash

inflows and outflows to provide more accurate picture of the firm in a better

manner.

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

IMPACT: The impact of accrual concept on the financial statements is that all the

financial transactions are recorded in the books of accounts when they occur. This

helps in making the financial statements even more reliable as well consistent.

Also, this system of recording the transactions is better than the cash basis of

accounting. In addition to this, the financial user will also receive all the

information about the business transactions from the financial statements because

with this concept they will not only get the information about the cash transactions

but also the credit transactions effectively.

b) The Matching Concept: This concept of financial accounting states that the

financial transactions related to the incomes and expenditures should be

recognized in the same accounting period. This concept aims at equalizing the

values of the expenditures and incomes at same level and avoiding any chances

of misstating the earnings. After a specific period of time it is made sure that all

the expenditures and incomes of the business must be matched so that the

financial report can disclose a better position of the firm in financial terms.

IMPACT: This accounting concept is considered as a component of accrual

accounting concept. It majorly affects the income statement of the organization

because it helps in depicting the true image of the company business operations

specifically (Flower and Ebbers, 2018). The users of the financial statements

namely investors always want to consider the business’s income statement which

smooth as well as normalized where there must be a perfect connection between

the revenues and expenses. Therefore, from this the investor gets much more

information about the organization’s economics.

c) The economic entity concept: It is considered as an accounting principle that

majorly states there must be separation between the business entity’s finances

and the owners, partners or shareholders. Regardless from any structure,

economic entity principle applies to all the financial organization.

IMPACT: Such kind of separation between the owners and entity is highly useful

for the financial statement users. The reason behind that is they can easily

differentiate between the existence of the actual company operations and the

involvement of ownership. Therefore, it helps in keeping the transactions related

to the business and it owners classified properly in different groups. This will help

the investors to analyze that whether the business is having good cash flow from

the profitable operations or the entity has been constantly using the funding of the

business to run.

2. Accounting Conventions:

These are considered as the fundamental rules that are utilized to assist the business

organizations with deciding how to record the transactions which are not completely

adjusted based on the bookkeeping norms or the accounting standards. These

techniques and standards are however not lawfully restricting yet these are for the most

part acknowledged by the accounting bodies (Sassen, 2018). Fundamentally, these are

intended to advance the consistency and assist the finance mangers and accountants

with dealing with the useful issues which can emerge while setting up the fiscal reports

for an business organization. Accounting conventions are significant on the grounds that

3

financial transactions are recorded in the books of accounts when they occur. This

helps in making the financial statements even more reliable as well consistent.

Also, this system of recording the transactions is better than the cash basis of

accounting. In addition to this, the financial user will also receive all the

information about the business transactions from the financial statements because

with this concept they will not only get the information about the cash transactions

but also the credit transactions effectively.

b) The Matching Concept: This concept of financial accounting states that the

financial transactions related to the incomes and expenditures should be

recognized in the same accounting period. This concept aims at equalizing the

values of the expenditures and incomes at same level and avoiding any chances

of misstating the earnings. After a specific period of time it is made sure that all

the expenditures and incomes of the business must be matched so that the

financial report can disclose a better position of the firm in financial terms.

IMPACT: This accounting concept is considered as a component of accrual

accounting concept. It majorly affects the income statement of the organization

because it helps in depicting the true image of the company business operations

specifically (Flower and Ebbers, 2018). The users of the financial statements

namely investors always want to consider the business’s income statement which

smooth as well as normalized where there must be a perfect connection between

the revenues and expenses. Therefore, from this the investor gets much more

information about the organization’s economics.

c) The economic entity concept: It is considered as an accounting principle that

majorly states there must be separation between the business entity’s finances

and the owners, partners or shareholders. Regardless from any structure,

economic entity principle applies to all the financial organization.

IMPACT: Such kind of separation between the owners and entity is highly useful

for the financial statement users. The reason behind that is they can easily

differentiate between the existence of the actual company operations and the

involvement of ownership. Therefore, it helps in keeping the transactions related

to the business and it owners classified properly in different groups. This will help

the investors to analyze that whether the business is having good cash flow from

the profitable operations or the entity has been constantly using the funding of the

business to run.

2. Accounting Conventions:

These are considered as the fundamental rules that are utilized to assist the business

organizations with deciding how to record the transactions which are not completely

adjusted based on the bookkeeping norms or the accounting standards. These

techniques and standards are however not lawfully restricting yet these are for the most

part acknowledged by the accounting bodies (Sassen, 2018). Fundamentally, these are

intended to advance the consistency and assist the finance mangers and accountants

with dealing with the useful issues which can emerge while setting up the fiscal reports

for an business organization. Accounting conventions are significant on the grounds that

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

they guarantee that various organizations record exchanges similarly. Giving a

normalized procedure makes it simpler for financial backers or users of the financial

statements to analyze the monetary consequences of various firms, for example,

contending ones working in a similar area or the marketplace. There are majorly four

types of accounting conventions that helps in guiding the business organizations to take

proper care of the business financial management. They are explained in detail

underneath:

a) Convention of Conservatism: It helps in stating that accountants must be

cautious while recording the transactions in the books of accounts. It is considered

as the doctrine of prudence which states that it is highly important for the business

organization to anticipate all the possible losses instead of the future aims must be

recorded (Lu and Cao, 2018). This policy basically aims at the understating the

net assets and net income rather that overstating them. This also assist the

companies in playing safe in the competitive markets.

IMPACT: The impact of this convention on the financial statements is that all the

underestimated amount of profit and gains and overestimated amount of losses is

recorded in the books of accounts. In case of the statement of finances or the

balance sheet, the value of the assets and revenues are smaller and the liabilities

are in larger amounted value. Also, when the users of the financial information

analyses the financial statements they get certain amount of assurance that the

profits or the assets of the company are not overstated or overestimated which

may bring the essence of lack of authencity. Therefore, it helps in portraying a

normalized image of the company in front of the investors on the basis of financial

grounds.

b) Convention of consistency: In case of convention of consistency, same type of

accounting principles must be used for the preparation of the financial statements

of the business organizations (Suganthi, 2019). When the same accounting

methods or the principles are used it becomes simpler and suitable to compare

the performances over a period and of different organization. The essence of

consistency will make the financial statement results even more efficient and

effective. This will also make it easier for the accountant to make the financial

statements without any error or omission.

IMPACT: The major impact of this convention of consistency on the financial

statement will be it will help in increasing the effectiveness in the comparative

analysis between the financial statements of the two or more years. Not only this,

but also the comparative analysis with the financial forms can also be done in an

effective manner. Also, considering the investors, it will become easier for them to

perform the financial analysis of the annual financial reports with that of other

business organization’s annual financial reports. Therefore, their decision on the

basis of the consistency in financial statement may result into huge profitability for

the business concern.

c) Convention of Full Disclosure: The Full Disclosure Principle expresses that all

important and essential data for the comprehension of an organization's financial

reports should be considered for public organization filings. Realizing where to

4

normalized procedure makes it simpler for financial backers or users of the financial

statements to analyze the monetary consequences of various firms, for example,

contending ones working in a similar area or the marketplace. There are majorly four

types of accounting conventions that helps in guiding the business organizations to take

proper care of the business financial management. They are explained in detail

underneath:

a) Convention of Conservatism: It helps in stating that accountants must be

cautious while recording the transactions in the books of accounts. It is considered

as the doctrine of prudence which states that it is highly important for the business

organization to anticipate all the possible losses instead of the future aims must be

recorded (Lu and Cao, 2018). This policy basically aims at the understating the

net assets and net income rather that overstating them. This also assist the

companies in playing safe in the competitive markets.

IMPACT: The impact of this convention on the financial statements is that all the

underestimated amount of profit and gains and overestimated amount of losses is

recorded in the books of accounts. In case of the statement of finances or the

balance sheet, the value of the assets and revenues are smaller and the liabilities

are in larger amounted value. Also, when the users of the financial information

analyses the financial statements they get certain amount of assurance that the

profits or the assets of the company are not overstated or overestimated which

may bring the essence of lack of authencity. Therefore, it helps in portraying a

normalized image of the company in front of the investors on the basis of financial

grounds.

b) Convention of consistency: In case of convention of consistency, same type of

accounting principles must be used for the preparation of the financial statements

of the business organizations (Suganthi, 2019). When the same accounting

methods or the principles are used it becomes simpler and suitable to compare

the performances over a period and of different organization. The essence of

consistency will make the financial statement results even more efficient and

effective. This will also make it easier for the accountant to make the financial

statements without any error or omission.

IMPACT: The major impact of this convention of consistency on the financial

statement will be it will help in increasing the effectiveness in the comparative

analysis between the financial statements of the two or more years. Not only this,

but also the comparative analysis with the financial forms can also be done in an

effective manner. Also, considering the investors, it will become easier for them to

perform the financial analysis of the annual financial reports with that of other

business organization’s annual financial reports. Therefore, their decision on the

basis of the consistency in financial statement may result into huge profitability for

the business concern.

c) Convention of Full Disclosure: The Full Disclosure Principle expresses that all

important and essential data for the comprehension of an organization's financial

reports should be considered for public organization filings. Realizing where to

4

observe this data is a basic initial phase in performing monetary investigation and

monetary demonstrating (Nicholls, 2018). It basically to the idea that proposes that

a business should report all the essential financial data in their financial

statements and the budget summaries, so the clients who can peruse the

monetary data are in a superior situation to settle on significant choices with

respect to the organization.

IMPACT: The impact of this principle is that it helps in providing the investors

decisions which will help them to take decision regarding the purchasing the stock

or the bonds of the companies. The convention of the full disclosure makes it sure

that the investors are aware of all the warning like statements. Also, considering

the financial statements so that it can reveal the negative or the positive financial

information regarding the company. It helps in disclosing the true and real financial

status of the business organization effectively.

d) Convention of Materiality: The materiality convention of bookkeeping states that

the business ought to remember just the significant or important realities for the

fiscal summaries. Material realities refers to any data, which whenever rejected or

distorted in the financial reports could impact the choice of the clients of such

budget summaries (Hussain, Rigoni and Orij, 2018). It is highly important for the

business organization to completely and totally disclose all the material facts

about the company. Therefore, the business must include all the financial and the

most relevant facts about the financial management. Material facts refers to any

data, which whenever avoided or distorted in the financial management could

impact the choice of the clients of such budget summaries.

IMPACT: The impact of this convention is that the financial information influence

the decisions of the investors based on the financial statements. All the financial

transactions of the materiality nature must be used in such a way to develop the

financial statements that will further be used by the users of the financial

information. This convention is considered as pervasive. All the decisions that are

required to be taken by the business organization are dependent on the material

facts that are disclosed in the financial statements (Zhou and Li, 2019). Also, the

financial auditors use this to determine the account balances and evaluate the

impacts of any type of misstatements in the financial facts and figures.

Conclusion

It can be concluded from the above report that it is highly important for any

business organization to use the financial accounting regulations in recording their

business transactions. The preparation of the different financial statements must be done

in such a way that the books of accounts are not misstated and are highly

comprehensive in nature including all the financial movement of the transactions. This

will help in disclosing the true and fair results to the users if the financial information of

the company.

5

monetary demonstrating (Nicholls, 2018). It basically to the idea that proposes that

a business should report all the essential financial data in their financial

statements and the budget summaries, so the clients who can peruse the

monetary data are in a superior situation to settle on significant choices with

respect to the organization.

IMPACT: The impact of this principle is that it helps in providing the investors

decisions which will help them to take decision regarding the purchasing the stock

or the bonds of the companies. The convention of the full disclosure makes it sure

that the investors are aware of all the warning like statements. Also, considering

the financial statements so that it can reveal the negative or the positive financial

information regarding the company. It helps in disclosing the true and real financial

status of the business organization effectively.

d) Convention of Materiality: The materiality convention of bookkeeping states that

the business ought to remember just the significant or important realities for the

fiscal summaries. Material realities refers to any data, which whenever rejected or

distorted in the financial reports could impact the choice of the clients of such

budget summaries (Hussain, Rigoni and Orij, 2018). It is highly important for the

business organization to completely and totally disclose all the material facts

about the company. Therefore, the business must include all the financial and the

most relevant facts about the financial management. Material facts refers to any

data, which whenever avoided or distorted in the financial management could

impact the choice of the clients of such budget summaries.

IMPACT: The impact of this convention is that the financial information influence

the decisions of the investors based on the financial statements. All the financial

transactions of the materiality nature must be used in such a way to develop the

financial statements that will further be used by the users of the financial

information. This convention is considered as pervasive. All the decisions that are

required to be taken by the business organization are dependent on the material

facts that are disclosed in the financial statements (Zhou and Li, 2019). Also, the

financial auditors use this to determine the account balances and evaluate the

impacts of any type of misstatements in the financial facts and figures.

Conclusion

It can be concluded from the above report that it is highly important for any

business organization to use the financial accounting regulations in recording their

business transactions. The preparation of the different financial statements must be done

in such a way that the books of accounts are not misstated and are highly

comprehensive in nature including all the financial movement of the transactions. This

will help in disclosing the true and fair results to the users if the financial information of

the company.

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

References

Books & Journals

Prewett, K. and Terry, A., 2018. COSO's updated enterprise risk management framework

—A quest for depth and clarity. Journal of Corporate Accounting & Finance, 29(3),

pp.16-23.

van de Velde, D., 2018. Changing trains: railway reform and the role of competition: the

experience of six countries. Routledge.

Bharti, P., 2018. Indian Financial System, 5/e. Pearson Education India.

Prewett, K. and Terry, A., 2018. COSO's updated enterprise risk management framework

—A quest for depth and clarity. Journal of Corporate Accounting & Finance, 29(3).

pp.16-23.

Flower, J. and Ebbers, G., 2018. Global financial reporting. Macmillan International

Higher Education.

Sassen, S., 2018. Cities in a world economy. Sage Publications.

Lu, Y. and Cao, Y., 2018. The individual characteristics of board members and internal

control weakness: Evidence from China. Pacific-Basin Finance Journal, 51. pp.75-

94.

Nicholls, A., 2018. A general theory of social impact accounting: Materiality, uncertainty

and empowerment. Journal of Social Entrepreneurship, 9(2), pp.132-153.

Hussain, N., Rigoni, U. and Orij, R. P., 2018. Corporate governance and sustainability

performance: Analysis of triple bottom line performance. Journal of Business

Ethics, 149(2). pp.411-432.

Zhou, K. and Li, Y., 2019. Carbon finance and carbon market in China: Progress and

challenges. Journal of Cleaner Production, 214. pp.536-549.

Suganthi, L., 2019. Examining the relationship between corporate social responsibility,

performance, employees’ pro-environmental behavior at work with green practices

as mediator. Journal of cleaner production, 232. pp.739-750.

6

Books & Journals

Prewett, K. and Terry, A., 2018. COSO's updated enterprise risk management framework

—A quest for depth and clarity. Journal of Corporate Accounting & Finance, 29(3),

pp.16-23.

van de Velde, D., 2018. Changing trains: railway reform and the role of competition: the

experience of six countries. Routledge.

Bharti, P., 2018. Indian Financial System, 5/e. Pearson Education India.

Prewett, K. and Terry, A., 2018. COSO's updated enterprise risk management framework

—A quest for depth and clarity. Journal of Corporate Accounting & Finance, 29(3).

pp.16-23.

Flower, J. and Ebbers, G., 2018. Global financial reporting. Macmillan International

Higher Education.

Sassen, S., 2018. Cities in a world economy. Sage Publications.

Lu, Y. and Cao, Y., 2018. The individual characteristics of board members and internal

control weakness: Evidence from China. Pacific-Basin Finance Journal, 51. pp.75-

94.

Nicholls, A., 2018. A general theory of social impact accounting: Materiality, uncertainty

and empowerment. Journal of Social Entrepreneurship, 9(2), pp.132-153.

Hussain, N., Rigoni, U. and Orij, R. P., 2018. Corporate governance and sustainability

performance: Analysis of triple bottom line performance. Journal of Business

Ethics, 149(2). pp.411-432.

Zhou, K. and Li, Y., 2019. Carbon finance and carbon market in China: Progress and

challenges. Journal of Cleaner Production, 214. pp.536-549.

Suganthi, L., 2019. Examining the relationship between corporate social responsibility,

performance, employees’ pro-environmental behavior at work with green practices

as mediator. Journal of cleaner production, 232. pp.739-750.

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.