Unit 5 Accounting Principles: Informing Decisions and Performance

VerifiedAdded on 2023/06/09

|17

|4631

|198

Report

AI Summary

This report provides a critical evaluation of accounting's role in informing decision-making, considering organizational, stakeholder, and societal needs within complex operating environments. It addresses the purpose of accounting functions within regulatory and ethical constraints. The report includes an evaluation of financial statements to assess organizational performance, using various measures and benchmarks. It computes financial ratios, analyzes them, and discusses the benefits and limitations of budgets and budgetary planning, focusing on Duck Cafe. The report also includes a prepared cash budget for Duck Cafe and justifies budgetary control solutions to ensure efficient resource deployment. The report analyzes accounting principles, financial statements, and budgeting. It also contains a cash budget, financial ratio calculations, and discussions on budgetary control.

Unit 5 Accounting

Principles

Principles

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION ..........................................................................................................................3

MAIN BODY...................................................................................................................................3

A critical evaluation of the role of accounting in informing decision-making to meet

organisational, stakeholders, and societal needs within complex operating environments. Your

evaluation should effectively address the purpose of the accounting functions in the context of

regulatory and ethical constraints................................................................................................3

A critical evaluation of financial statements to assess organisational performance using a range

of measures and benchmarks to make justified conclusions.......................................................6

Compute the financial ratios......................................................................................................10

Make an evaluation of the ratios for knowing about the company’s performance....................11

Discuss the benefits and limitations of budgets and budgetary planning, and control for Duck

Cafe?..........................................................................................................................................12

Prepare Duck Café’s cash budget for the 3 months ended 30 June 2022 using a spreadsheet..13

Justify budgetary control solutions for Duck Cafe and their impact on the business to ensure

efficient and effective deployment of resources in the future....................................................13

CONCLUSION .............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION ..........................................................................................................................3

MAIN BODY...................................................................................................................................3

A critical evaluation of the role of accounting in informing decision-making to meet

organisational, stakeholders, and societal needs within complex operating environments. Your

evaluation should effectively address the purpose of the accounting functions in the context of

regulatory and ethical constraints................................................................................................3

A critical evaluation of financial statements to assess organisational performance using a range

of measures and benchmarks to make justified conclusions.......................................................6

Compute the financial ratios......................................................................................................10

Make an evaluation of the ratios for knowing about the company’s performance....................11

Discuss the benefits and limitations of budgets and budgetary planning, and control for Duck

Cafe?..........................................................................................................................................12

Prepare Duck Café’s cash budget for the 3 months ended 30 June 2022 using a spreadsheet..13

Justify budgetary control solutions for Duck Cafe and their impact on the business to ensure

efficient and effective deployment of resources in the future....................................................13

CONCLUSION .............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION

Accounting Principles are the regulation and instructions that organisations and other

operating bodies must accompany when disclosing financial data. These rules make its simple to

analyse financial data by regulating the terms and techniques that bookkeeper must exercise.

These are enforced to amend and improvise the quality of financial data (Richard and Rambaud,

2021). Bush Consulting group focuses in serving entrepreneurs to expand and carry out the

organisations most critical growth initiatives. Their scope of work covers the entire product and

business cycle for clients who leads a different ambit of invention driven business. In this report,

function of accounting in decision making process in relation with regulatory and social

restriction is included. It also contents evaluation of financial statements of sole proprietor,

partnership firm and not for profit organisation and computation of financial ratios. Cash budget,

budgetary control solutions and its impacts has also been concluded.

MAIN BODY

A critical evaluation of the role of accounting in informing decision-making to meet

organisational, stakeholders, and societal needs within complex operating environments.

Your evaluation should effectively address the purpose of the accounting functions in the

context of regulatory and ethical constraints

Accounting is a continuing process in an organisation to record. Post and interpret the

financial transaction taking place inside the organisation. It monitors all the happenings in the

organisation and communicate financial health of the organisation to management, stakeholders

and analyst so that decision making process could be more efficient in any regards to the

company. there are

some of the accounting principal which need to be follow for financial accounting, majorly

followed is generally accepted accounting principles. The three main areas where accounting

information helps in decision making(Alhaj-Yaseen, Wu and Fletcher, 2018):

It provides shareholder basic information about the financial position of the company.

It tells about the credit worthiness of the company, how capable it is to meet its liabilities

and earn profit in the market.

Accounting Principles are the regulation and instructions that organisations and other

operating bodies must accompany when disclosing financial data. These rules make its simple to

analyse financial data by regulating the terms and techniques that bookkeeper must exercise.

These are enforced to amend and improvise the quality of financial data (Richard and Rambaud,

2021). Bush Consulting group focuses in serving entrepreneurs to expand and carry out the

organisations most critical growth initiatives. Their scope of work covers the entire product and

business cycle for clients who leads a different ambit of invention driven business. In this report,

function of accounting in decision making process in relation with regulatory and social

restriction is included. It also contents evaluation of financial statements of sole proprietor,

partnership firm and not for profit organisation and computation of financial ratios. Cash budget,

budgetary control solutions and its impacts has also been concluded.

MAIN BODY

A critical evaluation of the role of accounting in informing decision-making to meet

organisational, stakeholders, and societal needs within complex operating environments.

Your evaluation should effectively address the purpose of the accounting functions in the

context of regulatory and ethical constraints

Accounting is a continuing process in an organisation to record. Post and interpret the

financial transaction taking place inside the organisation. It monitors all the happenings in the

organisation and communicate financial health of the organisation to management, stakeholders

and analyst so that decision making process could be more efficient in any regards to the

company. there are

some of the accounting principal which need to be follow for financial accounting, majorly

followed is generally accepted accounting principles. The three main areas where accounting

information helps in decision making(Alhaj-Yaseen, Wu and Fletcher, 2018):

It provides shareholder basic information about the financial position of the company.

It tells about the credit worthiness of the company, how capable it is to meet its liabilities

and earn profit in the market.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Along with the other accounting i.e. managerial accounting and cost accounting it helps

in identifying potential opportunities of the company.

In order to be decision accurate and effective one it should be made on the basis of complete

financial information. There are various reasons accounting information’s are needed for

decision making includes:

Creating budget

Hiring employees

Downsizing workforce Purchasing assets

Role of accounting information:

1. For meeting organisational goals: The financial accounts of the company depict the status of

company's overall position. It gives critical information about the company’s financial positions

and stability in the market. Keeping the records helps in keeping control and check on the

organisations operations. It basically helps in keeping the operations of the business smooth and

function properly so that so that organisational objective can be achieved. The financial

statement gives clear picture of the company and helps in meeting all the compliance, rules and

regulation to be met also it keeps a check on the liabilities to be met with respect to the market.

Accounting is not only restricted to monetary department but also required for (Callejas, D.G.

and Ocampo-Salazar, 2021)-

2. Making budget and comparing the results and with those reference helps in making

policies for future and framework needed to be followed to achieve desired results.

3. Keeping up with statutory compliance.

4. Evaluation and analysis of performance.

5. It helps to review performance of the employees.

6. And also help to keep a check on the quality of the product being delivered in the market.

2. For stakeholders: A stakeholder is someone who has got interest in the company's business

operations and performance. These people are basically investors, employees, customer,

suppliers, communities, government and trade associations.

Investors: Financial statements of the organisation allows the investor to know about

profitability of the company, overall objective of the company, dividend policies and also

rate of return of the investment they are going to make in the company. Wide knowledge

in identifying potential opportunities of the company.

In order to be decision accurate and effective one it should be made on the basis of complete

financial information. There are various reasons accounting information’s are needed for

decision making includes:

Creating budget

Hiring employees

Downsizing workforce Purchasing assets

Role of accounting information:

1. For meeting organisational goals: The financial accounts of the company depict the status of

company's overall position. It gives critical information about the company’s financial positions

and stability in the market. Keeping the records helps in keeping control and check on the

organisations operations. It basically helps in keeping the operations of the business smooth and

function properly so that so that organisational objective can be achieved. The financial

statement gives clear picture of the company and helps in meeting all the compliance, rules and

regulation to be met also it keeps a check on the liabilities to be met with respect to the market.

Accounting is not only restricted to monetary department but also required for (Callejas, D.G.

and Ocampo-Salazar, 2021)-

2. Making budget and comparing the results and with those reference helps in making

policies for future and framework needed to be followed to achieve desired results.

3. Keeping up with statutory compliance.

4. Evaluation and analysis of performance.

5. It helps to review performance of the employees.

6. And also help to keep a check on the quality of the product being delivered in the market.

2. For stakeholders: A stakeholder is someone who has got interest in the company's business

operations and performance. These people are basically investors, employees, customer,

suppliers, communities, government and trade associations.

Investors: Financial statements of the organisation allows the investor to know about

profitability of the company, overall objective of the company, dividend policies and also

rate of return of the investment they are going to make in the company. Wide knowledge

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

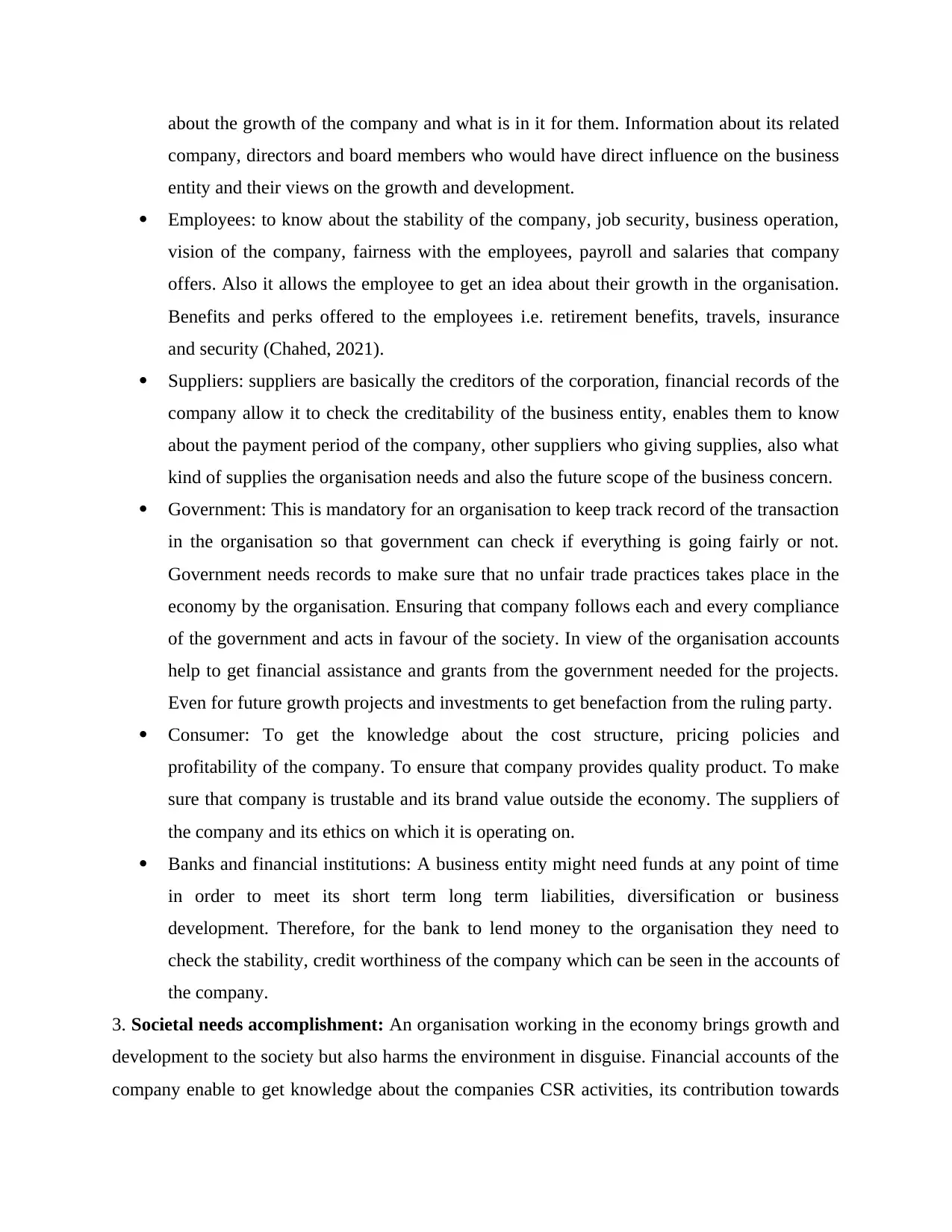

about the growth of the company and what is in it for them. Information about its related

company, directors and board members who would have direct influence on the business

entity and their views on the growth and development.

Employees: to know about the stability of the company, job security, business operation,

vision of the company, fairness with the employees, payroll and salaries that company

offers. Also it allows the employee to get an idea about their growth in the organisation.

Benefits and perks offered to the employees i.e. retirement benefits, travels, insurance

and security (Chahed, 2021).

Suppliers: suppliers are basically the creditors of the corporation, financial records of the

company allow it to check the creditability of the business entity, enables them to know

about the payment period of the company, other suppliers who giving supplies, also what

kind of supplies the organisation needs and also the future scope of the business concern.

Government: This is mandatory for an organisation to keep track record of the transaction

in the organisation so that government can check if everything is going fairly or not.

Government needs records to make sure that no unfair trade practices takes place in the

economy by the organisation. Ensuring that company follows each and every compliance

of the government and acts in favour of the society. In view of the organisation accounts

help to get financial assistance and grants from the government needed for the projects.

Even for future growth projects and investments to get benefaction from the ruling party.

Consumer: To get the knowledge about the cost structure, pricing policies and

profitability of the company. To ensure that company provides quality product. To make

sure that company is trustable and its brand value outside the economy. The suppliers of

the company and its ethics on which it is operating on.

Banks and financial institutions: A business entity might need funds at any point of time

in order to meet its short term long term liabilities, diversification or business

development. Therefore, for the bank to lend money to the organisation they need to

check the stability, credit worthiness of the company which can be seen in the accounts of

the company.

3. Societal needs accomplishment: An organisation working in the economy brings growth and

development to the society but also harms the environment in disguise. Financial accounts of the

company enable to get knowledge about the companies CSR activities, its contribution towards

company, directors and board members who would have direct influence on the business

entity and their views on the growth and development.

Employees: to know about the stability of the company, job security, business operation,

vision of the company, fairness with the employees, payroll and salaries that company

offers. Also it allows the employee to get an idea about their growth in the organisation.

Benefits and perks offered to the employees i.e. retirement benefits, travels, insurance

and security (Chahed, 2021).

Suppliers: suppliers are basically the creditors of the corporation, financial records of the

company allow it to check the creditability of the business entity, enables them to know

about the payment period of the company, other suppliers who giving supplies, also what

kind of supplies the organisation needs and also the future scope of the business concern.

Government: This is mandatory for an organisation to keep track record of the transaction

in the organisation so that government can check if everything is going fairly or not.

Government needs records to make sure that no unfair trade practices takes place in the

economy by the organisation. Ensuring that company follows each and every compliance

of the government and acts in favour of the society. In view of the organisation accounts

help to get financial assistance and grants from the government needed for the projects.

Even for future growth projects and investments to get benefaction from the ruling party.

Consumer: To get the knowledge about the cost structure, pricing policies and

profitability of the company. To ensure that company provides quality product. To make

sure that company is trustable and its brand value outside the economy. The suppliers of

the company and its ethics on which it is operating on.

Banks and financial institutions: A business entity might need funds at any point of time

in order to meet its short term long term liabilities, diversification or business

development. Therefore, for the bank to lend money to the organisation they need to

check the stability, credit worthiness of the company which can be seen in the accounts of

the company.

3. Societal needs accomplishment: An organisation working in the economy brings growth and

development to the society but also harms the environment in disguise. Financial accounts of the

company enable to get knowledge about the companies CSR activities, its contribution towards

the economy, what growth it beholds for the future of the country, what value it depicts at the

international level, awareness about its operations effecting the environment and steps it is taking

towards nature protection and balanced growth (Vakutin and Fedulova, 2018).

Accounting Regulations refers to the accounting laws, statutes, regulations, rules,

standards and systems published by any Governmental Authority. Their main aim is to maintain

transparency and establish a standard way of recording and comparing the financial statements

so that they are consistent and reliable when presented to the users of the financial data. The

accounting regulations in the financial reporting standards provide with various principles for

preparing financial reports and ascertain the various types and quantity of data and subject matter

that should definitely be supplied to users of financial statements, including investors and

creditors, enabling them to make informed and aware decisions.

Risk management: In this role of accounting, the accountant provides to the various

modern frameworks and practices that assist in the identification, measurement, management and

reporting of the various risks that are present to a business for accomplishing the business goals

and objectives. Accounting helps an organisation to attain the goals and objectives that has been

already standardised and set by the business. As it helps business to maintain, organise and

communicate the integral business informations and results of its activities simplifying the

complexity that occurs in present massive transactions and business dealings.

Sustainability accounting is referred to the practice of measuring, analyzing and

reporting the social and environmental impacts that an organisation has. Accounting helps the

businesses to assess, xamine and evaluate all its social and environmental steps or after results

that it generates in the economy and gives area to improve and work on them.

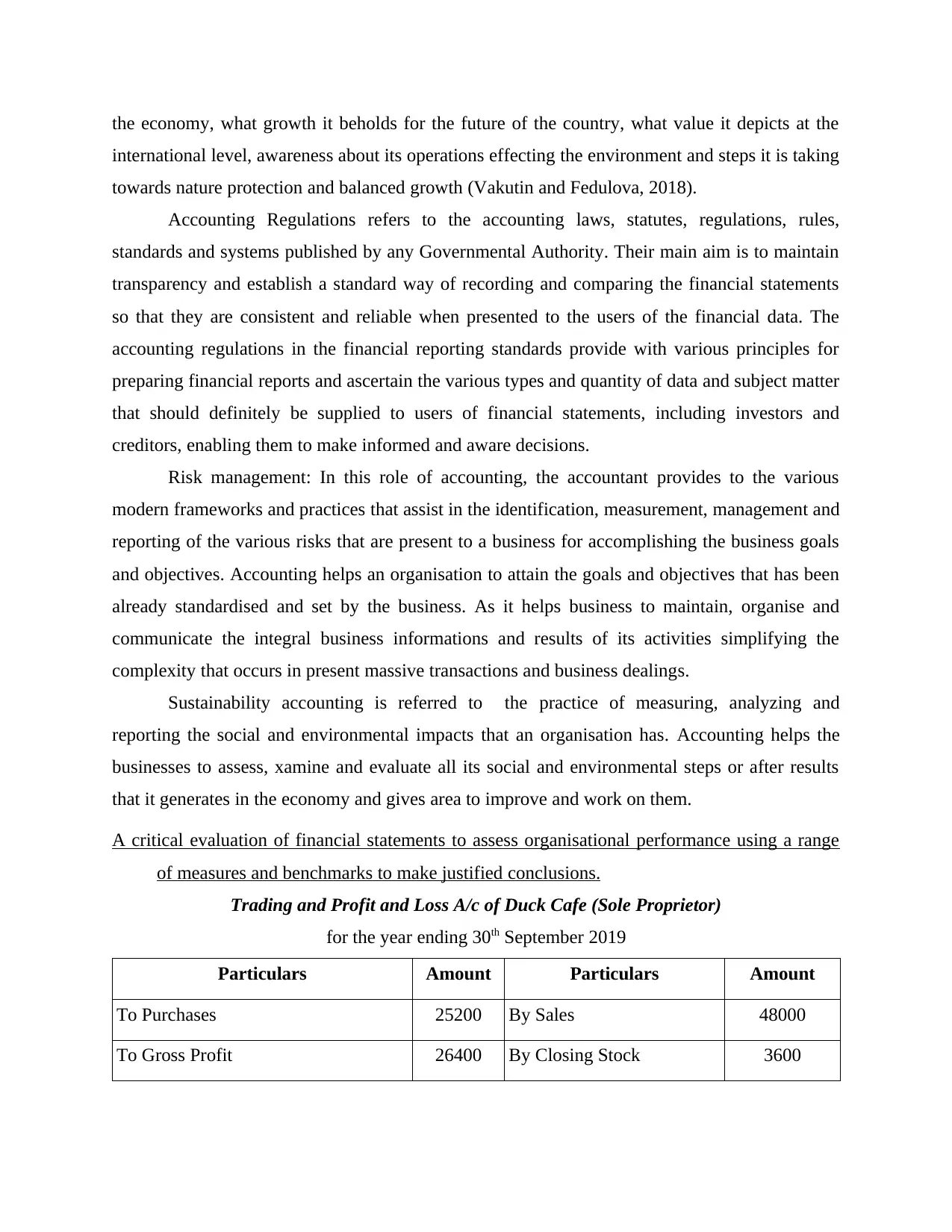

A critical evaluation of financial statements to assess organisational performance using a range

of measures and benchmarks to make justified conclusions.

Trading and Profit and Loss A/c of Duck Cafe (Sole Proprietor)

for the year ending 30th September 2019

Particulars Amount Particulars Amount

To Purchases 25200 By Sales 48000

To Gross Profit 26400 By Closing Stock 3600

international level, awareness about its operations effecting the environment and steps it is taking

towards nature protection and balanced growth (Vakutin and Fedulova, 2018).

Accounting Regulations refers to the accounting laws, statutes, regulations, rules,

standards and systems published by any Governmental Authority. Their main aim is to maintain

transparency and establish a standard way of recording and comparing the financial statements

so that they are consistent and reliable when presented to the users of the financial data. The

accounting regulations in the financial reporting standards provide with various principles for

preparing financial reports and ascertain the various types and quantity of data and subject matter

that should definitely be supplied to users of financial statements, including investors and

creditors, enabling them to make informed and aware decisions.

Risk management: In this role of accounting, the accountant provides to the various

modern frameworks and practices that assist in the identification, measurement, management and

reporting of the various risks that are present to a business for accomplishing the business goals

and objectives. Accounting helps an organisation to attain the goals and objectives that has been

already standardised and set by the business. As it helps business to maintain, organise and

communicate the integral business informations and results of its activities simplifying the

complexity that occurs in present massive transactions and business dealings.

Sustainability accounting is referred to the practice of measuring, analyzing and

reporting the social and environmental impacts that an organisation has. Accounting helps the

businesses to assess, xamine and evaluate all its social and environmental steps or after results

that it generates in the economy and gives area to improve and work on them.

A critical evaluation of financial statements to assess organisational performance using a range

of measures and benchmarks to make justified conclusions.

Trading and Profit and Loss A/c of Duck Cafe (Sole Proprietor)

for the year ending 30th September 2019

Particulars Amount Particulars Amount

To Purchases 25200 By Sales 48000

To Gross Profit 26400 By Closing Stock 3600

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

51600 51600

To General Expenses 16800 By Gross Profit 26400

To Insurance 2400

Less : Prepaid Insurance (240) 2160

To Telephone Expense 1800

Add : Outstanding Expense 600 2400

To Depreciation on Furniture 1440

To Bad Debts 1200

Add : Provision for Bad Debts 240 1440

To Net Profit 2160

26400 26400

Balance Sheet of Duck cafe

as on 30th September 2019

Liabilities Amount Assets Amount

Capital 7200

Add : Net Profit 2160 9360

Cash 1680

Creditors 8280 Debtors 6000

Less: Bad Debts (1200)

Less: Provision For

doubtful Debts (240) 4560

Outstanding Travelling Expense 600 Furniture 9600

Less : Depreciation (1440) 8160

Closing Stock 3600

Prepaid Insurance 240

18240 18240

Evaluation of Duck Cafe (sole proprietor)

To General Expenses 16800 By Gross Profit 26400

To Insurance 2400

Less : Prepaid Insurance (240) 2160

To Telephone Expense 1800

Add : Outstanding Expense 600 2400

To Depreciation on Furniture 1440

To Bad Debts 1200

Add : Provision for Bad Debts 240 1440

To Net Profit 2160

26400 26400

Balance Sheet of Duck cafe

as on 30th September 2019

Liabilities Amount Assets Amount

Capital 7200

Add : Net Profit 2160 9360

Cash 1680

Creditors 8280 Debtors 6000

Less: Bad Debts (1200)

Less: Provision For

doubtful Debts (240) 4560

Outstanding Travelling Expense 600 Furniture 9600

Less : Depreciation (1440) 8160

Closing Stock 3600

Prepaid Insurance 240

18240 18240

Evaluation of Duck Cafe (sole proprietor)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

From analysing the final accounts of Duck cafe, it can be observed that the gross profit margin is

55% computed using gross profit of 26400 and sales of 48000, and the net profit margin of the

organisation is 4.5% obtained using net profit of 2160 and sales of 48000. the huge difference

between the two, gross profit margin and net profit margin, is due to the general expenses

incurred, depreciation calculated on the cost of fixed assets and bad debts of the company.

It can also be noticed that the creditors of the company is more than its debtors, which results in

creation of debt and weakening of the financial position of the company.

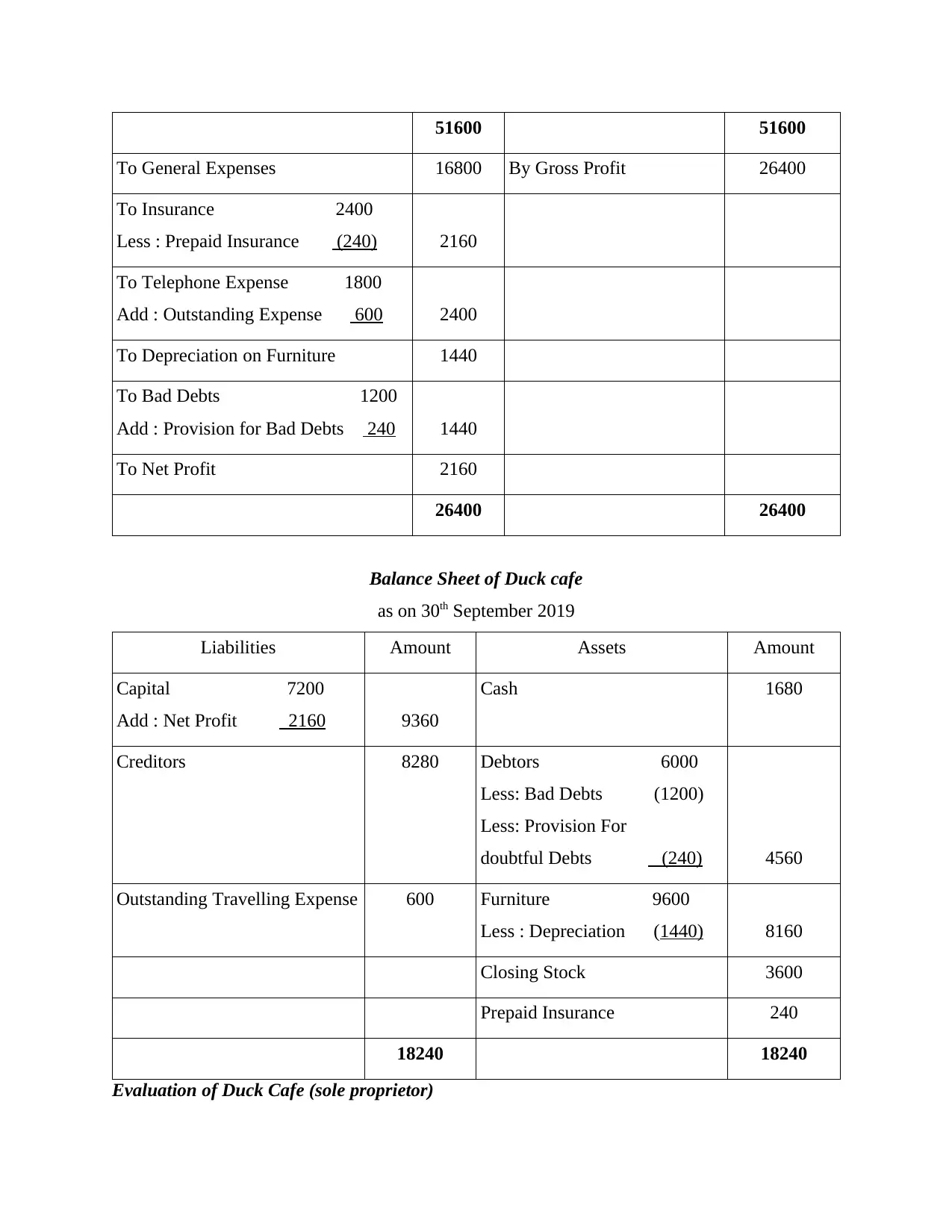

Trading and Profit and Loss A/c of Johnson & Joseph (Partnership Organisation)

for the year ending 30th September 2019

Particulars Amount Particulars Amount

To Purchases 25200 By Sales 48000

To Gross Profit 26400 By Closing Stock 3600

51600 51600

To General Expenses 16800 By Gross Profit 26400

To Insurance 2400

Less : Prepaid Insurance (240) 2160

By Interest On Drawings 60

To Telephone Expense 1800

Add : Outstanding Expense 600 2400

To Depreciation on Furniture 1440

To Bad Debts 1200

Add : Provision for Bad Debts 240 1440

To Net Profit 2220

26460 26460

Balance Sheet of Johnson & Joseph

as on 30th September 2019

Liabilities Amount Assets Amount

55% computed using gross profit of 26400 and sales of 48000, and the net profit margin of the

organisation is 4.5% obtained using net profit of 2160 and sales of 48000. the huge difference

between the two, gross profit margin and net profit margin, is due to the general expenses

incurred, depreciation calculated on the cost of fixed assets and bad debts of the company.

It can also be noticed that the creditors of the company is more than its debtors, which results in

creation of debt and weakening of the financial position of the company.

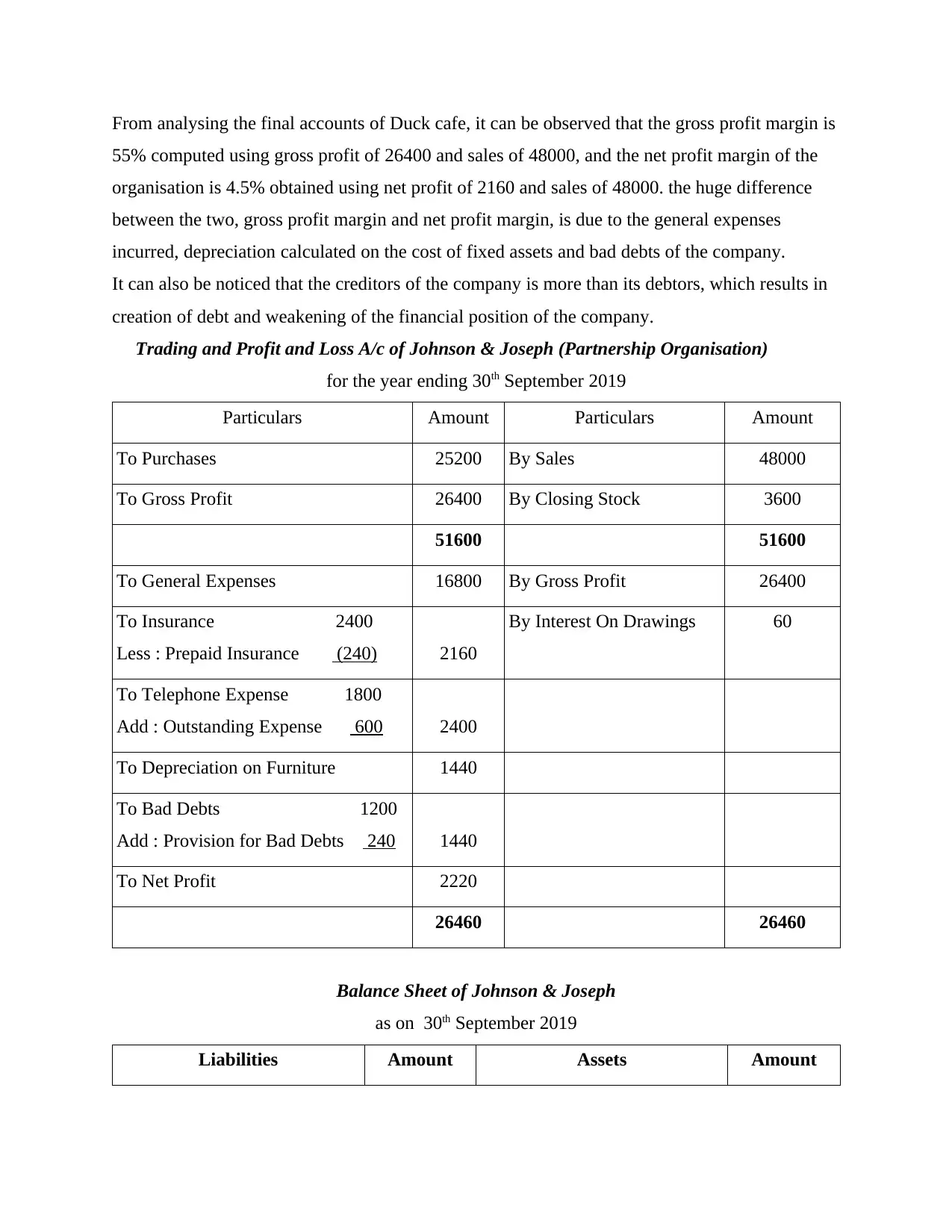

Trading and Profit and Loss A/c of Johnson & Joseph (Partnership Organisation)

for the year ending 30th September 2019

Particulars Amount Particulars Amount

To Purchases 25200 By Sales 48000

To Gross Profit 26400 By Closing Stock 3600

51600 51600

To General Expenses 16800 By Gross Profit 26400

To Insurance 2400

Less : Prepaid Insurance (240) 2160

By Interest On Drawings 60

To Telephone Expense 1800

Add : Outstanding Expense 600 2400

To Depreciation on Furniture 1440

To Bad Debts 1200

Add : Provision for Bad Debts 240 1440

To Net Profit 2220

26460 26460

Balance Sheet of Johnson & Joseph

as on 30th September 2019

Liabilities Amount Assets Amount

Capital

Johnson 3600

Joseph 3600

Less: Drawings (1200)

Add: Interest on

Drawings 60 2460

6060

Add : Net Profit 2220 8280

Cash 1680

Less : Drawings (1200)

480

Creditors 8280 Debtors 6000

Less: Bad Debts (1200)

Less: Provision For

doubtful Debts (240) 4560

Outstanding Travelling Expense 600 Furniture 9600

Less : Depreciation (1440) 8160

Closing Stock 3600

Prepaid Insurance 240

17040 17040

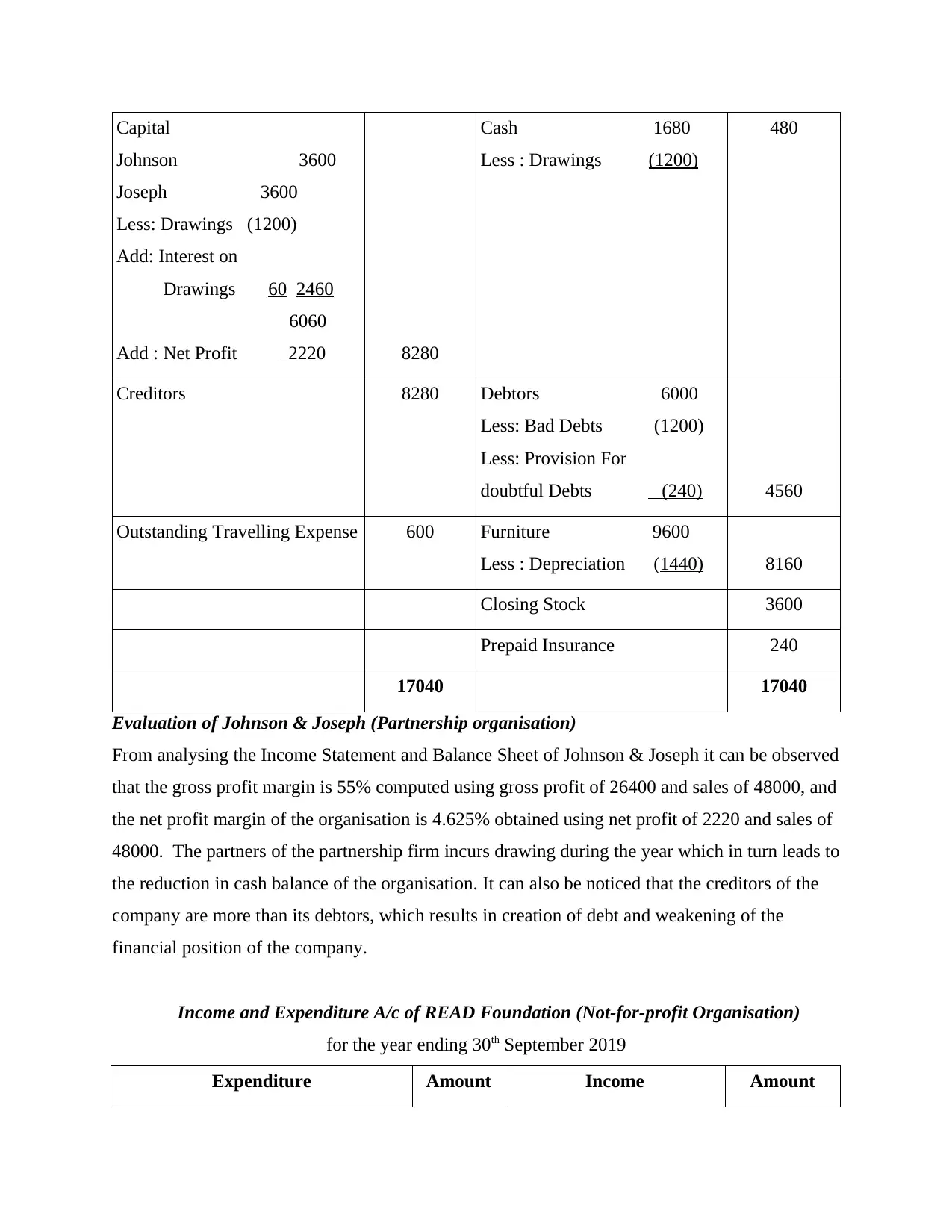

Evaluation of Johnson & Joseph (Partnership organisation)

From analysing the Income Statement and Balance Sheet of Johnson & Joseph it can be observed

that the gross profit margin is 55% computed using gross profit of 26400 and sales of 48000, and

the net profit margin of the organisation is 4.625% obtained using net profit of 2220 and sales of

48000. The partners of the partnership firm incurs drawing during the year which in turn leads to

the reduction in cash balance of the organisation. It can also be noticed that the creditors of the

company are more than its debtors, which results in creation of debt and weakening of the

financial position of the company.

Income and Expenditure A/c of READ Foundation (Not-for-profit Organisation)

for the year ending 30th September 2019

Expenditure Amount Income Amount

Johnson 3600

Joseph 3600

Less: Drawings (1200)

Add: Interest on

Drawings 60 2460

6060

Add : Net Profit 2220 8280

Cash 1680

Less : Drawings (1200)

480

Creditors 8280 Debtors 6000

Less: Bad Debts (1200)

Less: Provision For

doubtful Debts (240) 4560

Outstanding Travelling Expense 600 Furniture 9600

Less : Depreciation (1440) 8160

Closing Stock 3600

Prepaid Insurance 240

17040 17040

Evaluation of Johnson & Joseph (Partnership organisation)

From analysing the Income Statement and Balance Sheet of Johnson & Joseph it can be observed

that the gross profit margin is 55% computed using gross profit of 26400 and sales of 48000, and

the net profit margin of the organisation is 4.625% obtained using net profit of 2220 and sales of

48000. The partners of the partnership firm incurs drawing during the year which in turn leads to

the reduction in cash balance of the organisation. It can also be noticed that the creditors of the

company are more than its debtors, which results in creation of debt and weakening of the

financial position of the company.

Income and Expenditure A/c of READ Foundation (Not-for-profit Organisation)

for the year ending 30th September 2019

Expenditure Amount Income Amount

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

To General Expenses 16800 By Fundraising Income 48000

To Insurance 2400

Less : Prepaid Insurance (240) 2160

To Staff Costs 25200

To Depreciation on Furniture 1440

To Telephone Expense 1800

Add : Outstanding Expense 600 2400

48000 48000

Balance Sheet of READ Foundation

as on 30th September 2019

Liabilities Amount Assets Amount

Capital 7200 Cash 1680

Creditors 8280 Bank 6000

Outstanding Telephone Expense 600 Furniture 9600

Less : Depreciation (1440) 8160

Prepaid Insurance 240

16080 16080

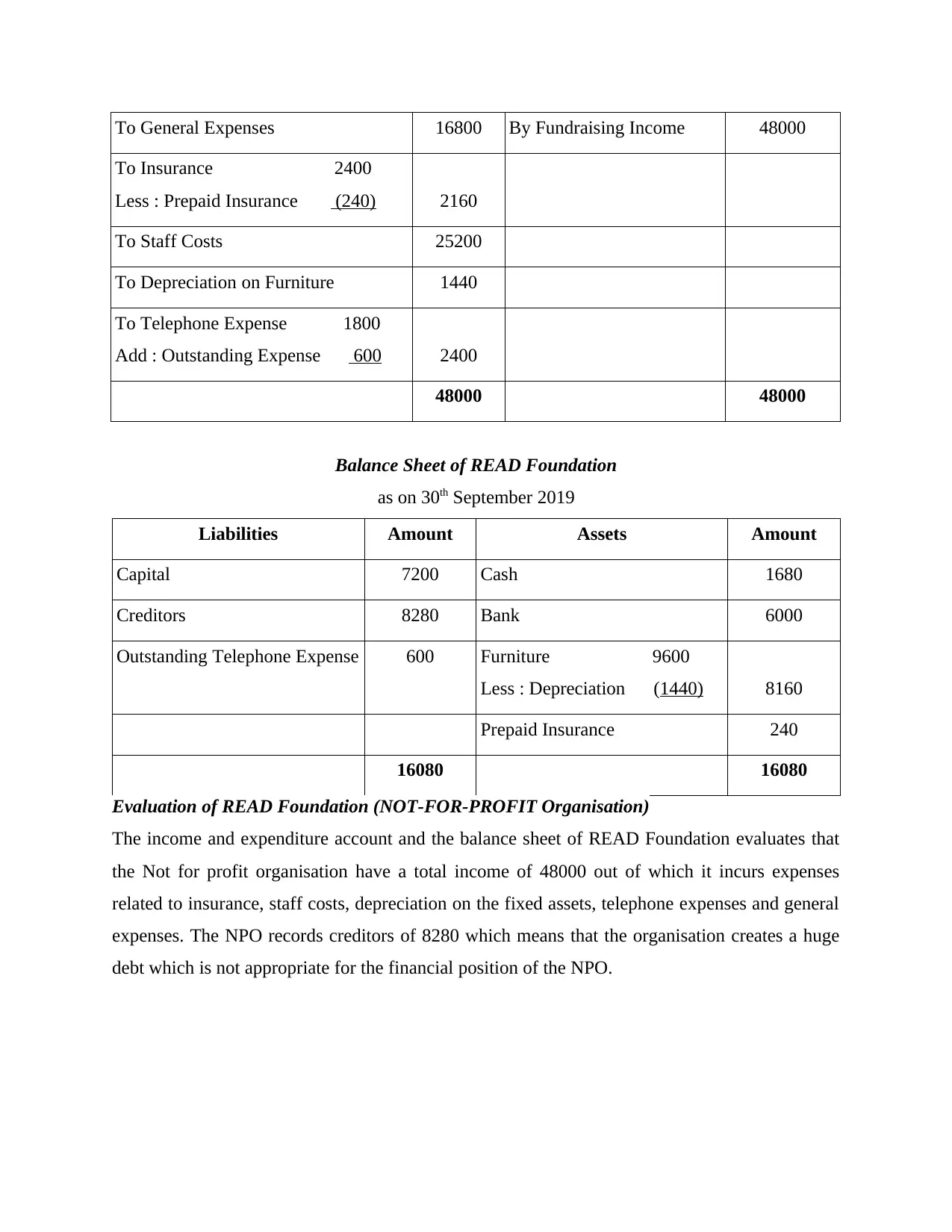

Evaluation of READ Foundation (NOT-FOR-PROFIT Organisation)

The income and expenditure account and the balance sheet of READ Foundation evaluates that

the Not for profit organisation have a total income of 48000 out of which it incurs expenses

related to insurance, staff costs, depreciation on the fixed assets, telephone expenses and general

expenses. The NPO records creditors of 8280 which means that the organisation creates a huge

debt which is not appropriate for the financial position of the NPO.

To Insurance 2400

Less : Prepaid Insurance (240) 2160

To Staff Costs 25200

To Depreciation on Furniture 1440

To Telephone Expense 1800

Add : Outstanding Expense 600 2400

48000 48000

Balance Sheet of READ Foundation

as on 30th September 2019

Liabilities Amount Assets Amount

Capital 7200 Cash 1680

Creditors 8280 Bank 6000

Outstanding Telephone Expense 600 Furniture 9600

Less : Depreciation (1440) 8160

Prepaid Insurance 240

16080 16080

Evaluation of READ Foundation (NOT-FOR-PROFIT Organisation)

The income and expenditure account and the balance sheet of READ Foundation evaluates that

the Not for profit organisation have a total income of 48000 out of which it incurs expenses

related to insurance, staff costs, depreciation on the fixed assets, telephone expenses and general

expenses. The NPO records creditors of 8280 which means that the organisation creates a huge

debt which is not appropriate for the financial position of the NPO.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

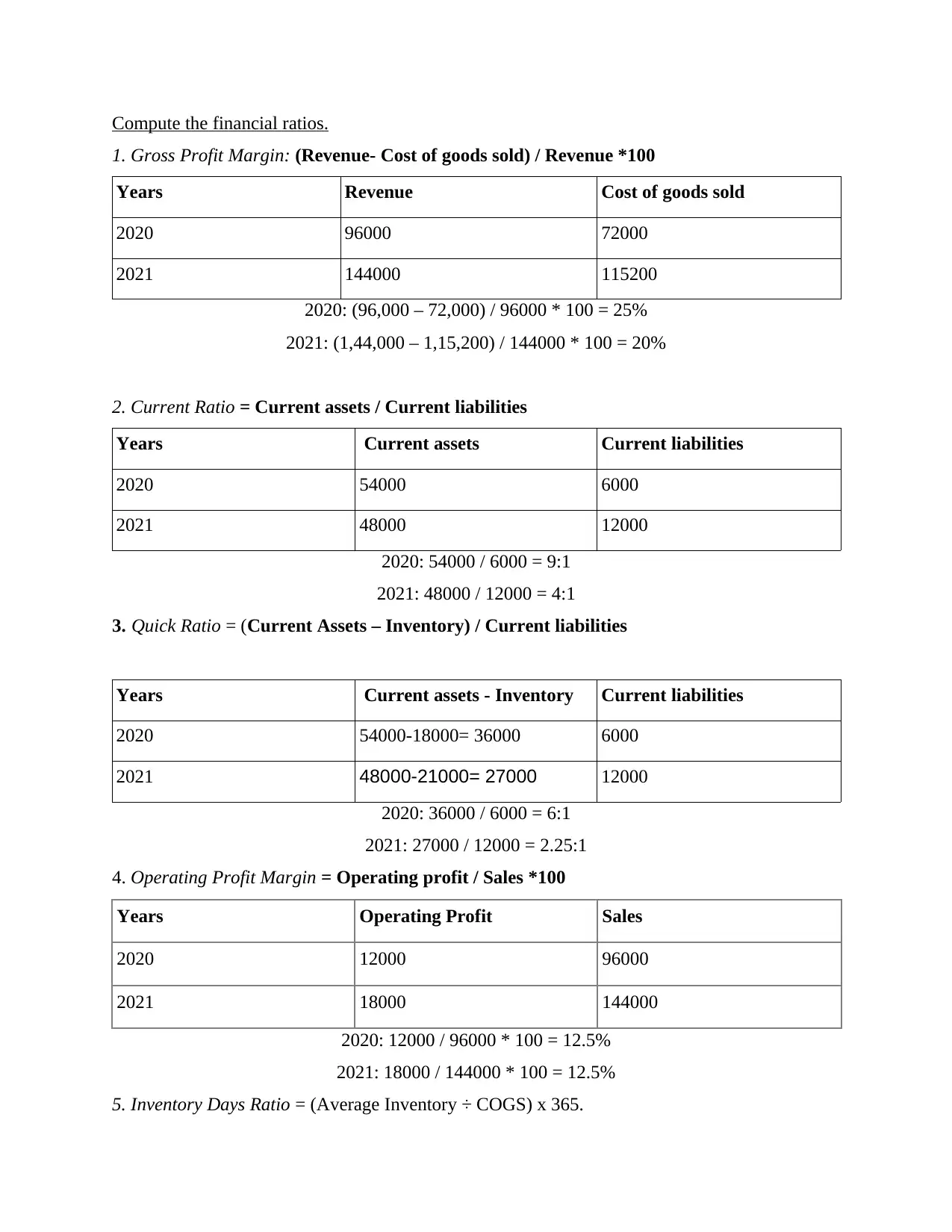

Compute the financial ratios.

1. Gross Profit Margin: (Revenue- Cost of goods sold) / Revenue *100

Years Revenue Cost of goods sold

2020 96000 72000

2021 144000 115200

2020: (96,000 – 72,000) / 96000 * 100 = 25%

2021: (1,44,000 – 1,15,200) / 144000 * 100 = 20%

2. Current Ratio = Current assets / Current liabilities

Years Current assets Current liabilities

2020 54000 6000

2021 48000 12000

2020: 54000 / 6000 = 9:1

2021: 48000 / 12000 = 4:1

3. Quick Ratio = (Current Assets – Inventory) / Current liabilities

Years Current assets - Inventory Current liabilities

2020 54000-18000= 36000 6000

2021 48000-21000= 27000 12000

2020: 36000 / 6000 = 6:1

2021: 27000 / 12000 = 2.25:1

4. Operating Profit Margin = Operating profit / Sales *100

Years Operating Profit Sales

2020 12000 96000

2021 18000 144000

2020: 12000 / 96000 * 100 = 12.5%

2021: 18000 / 144000 * 100 = 12.5%

5. Inventory Days Ratio = (Average Inventory ÷ COGS) x 365.

1. Gross Profit Margin: (Revenue- Cost of goods sold) / Revenue *100

Years Revenue Cost of goods sold

2020 96000 72000

2021 144000 115200

2020: (96,000 – 72,000) / 96000 * 100 = 25%

2021: (1,44,000 – 1,15,200) / 144000 * 100 = 20%

2. Current Ratio = Current assets / Current liabilities

Years Current assets Current liabilities

2020 54000 6000

2021 48000 12000

2020: 54000 / 6000 = 9:1

2021: 48000 / 12000 = 4:1

3. Quick Ratio = (Current Assets – Inventory) / Current liabilities

Years Current assets - Inventory Current liabilities

2020 54000-18000= 36000 6000

2021 48000-21000= 27000 12000

2020: 36000 / 6000 = 6:1

2021: 27000 / 12000 = 2.25:1

4. Operating Profit Margin = Operating profit / Sales *100

Years Operating Profit Sales

2020 12000 96000

2021 18000 144000

2020: 12000 / 96000 * 100 = 12.5%

2021: 18000 / 144000 * 100 = 12.5%

5. Inventory Days Ratio = (Average Inventory ÷ COGS) x 365.

Years Average Inventory COGS

2020 18000 72000

2021 19500 115200

2020: 18000 / 72000 * 365 = 91.25 days

2021: 19500 / 115200 * 365 = 61.78 days

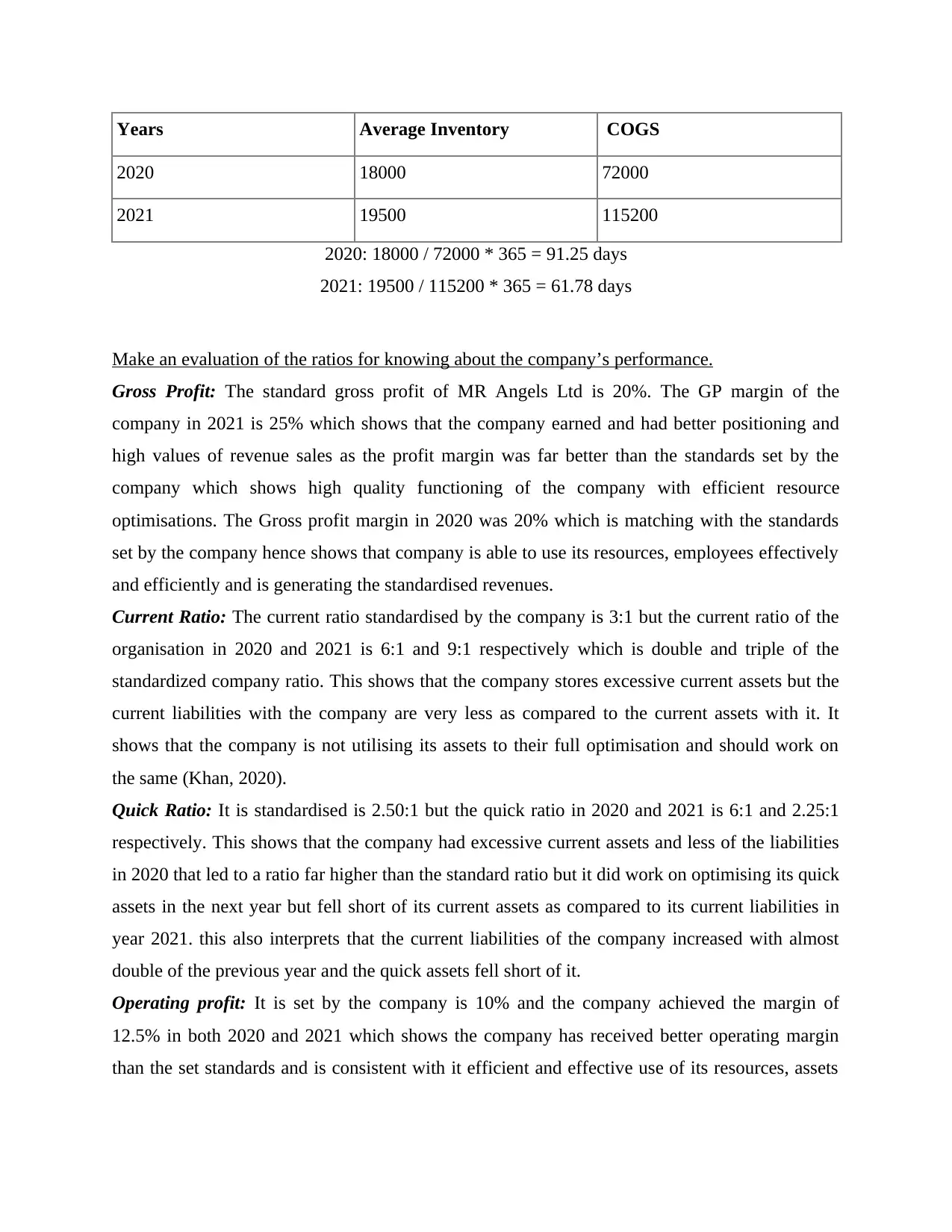

Make an evaluation of the ratios for knowing about the company’s performance.

Gross Profit: The standard gross profit of MR Angels Ltd is 20%. The GP margin of the

company in 2021 is 25% which shows that the company earned and had better positioning and

high values of revenue sales as the profit margin was far better than the standards set by the

company which shows high quality functioning of the company with efficient resource

optimisations. The Gross profit margin in 2020 was 20% which is matching with the standards

set by the company hence shows that company is able to use its resources, employees effectively

and efficiently and is generating the standardised revenues.

Current Ratio: The current ratio standardised by the company is 3:1 but the current ratio of the

organisation in 2020 and 2021 is 6:1 and 9:1 respectively which is double and triple of the

standardized company ratio. This shows that the company stores excessive current assets but the

current liabilities with the company are very less as compared to the current assets with it. It

shows that the company is not utilising its assets to their full optimisation and should work on

the same (Khan, 2020).

Quick Ratio: It is standardised is 2.50:1 but the quick ratio in 2020 and 2021 is 6:1 and 2.25:1

respectively. This shows that the company had excessive current assets and less of the liabilities

in 2020 that led to a ratio far higher than the standard ratio but it did work on optimising its quick

assets in the next year but fell short of its current assets as compared to its current liabilities in

year 2021. this also interprets that the current liabilities of the company increased with almost

double of the previous year and the quick assets fell short of it.

Operating profit: It is set by the company is 10% and the company achieved the margin of

12.5% in both 2020 and 2021 which shows the company has received better operating margin

than the set standards and is consistent with it efficient and effective use of its resources, assets

2020 18000 72000

2021 19500 115200

2020: 18000 / 72000 * 365 = 91.25 days

2021: 19500 / 115200 * 365 = 61.78 days

Make an evaluation of the ratios for knowing about the company’s performance.

Gross Profit: The standard gross profit of MR Angels Ltd is 20%. The GP margin of the

company in 2021 is 25% which shows that the company earned and had better positioning and

high values of revenue sales as the profit margin was far better than the standards set by the

company which shows high quality functioning of the company with efficient resource

optimisations. The Gross profit margin in 2020 was 20% which is matching with the standards

set by the company hence shows that company is able to use its resources, employees effectively

and efficiently and is generating the standardised revenues.

Current Ratio: The current ratio standardised by the company is 3:1 but the current ratio of the

organisation in 2020 and 2021 is 6:1 and 9:1 respectively which is double and triple of the

standardized company ratio. This shows that the company stores excessive current assets but the

current liabilities with the company are very less as compared to the current assets with it. It

shows that the company is not utilising its assets to their full optimisation and should work on

the same (Khan, 2020).

Quick Ratio: It is standardised is 2.50:1 but the quick ratio in 2020 and 2021 is 6:1 and 2.25:1

respectively. This shows that the company had excessive current assets and less of the liabilities

in 2020 that led to a ratio far higher than the standard ratio but it did work on optimising its quick

assets in the next year but fell short of its current assets as compared to its current liabilities in

year 2021. this also interprets that the current liabilities of the company increased with almost

double of the previous year and the quick assets fell short of it.

Operating profit: It is set by the company is 10% and the company achieved the margin of

12.5% in both 2020 and 2021 which shows the company has received better operating margin

than the set standards and is consistent with it efficient and effective use of its resources, assets

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.