Accounting Decision Support Tools Assessment Item 3 Solution [Date]

VerifiedAdded on 2021/06/14

|14

|1275

|19

Homework Assignment

AI Summary

This assignment solution addresses various aspects of accounting decision support tools. Question 1 focuses on the decision-making process, payoff matrices, and different decision models like optimistic, pessimistic, and Laplace rules, alongside maximizing expected value and determining optimal seafood purchase quantities based on normal distribution. Question 2 is missing. Question 3 presents a simulation model for hotel room costs, analyzing overbooking policies and recommending improvements to maximize profit. Question 4 involves regression analysis, comparing models based on mileage and age to predict car prices, and discussing the validity of multiple regression assumptions, including multicollinearity. Finally, Question 5 covers cost-volume-profit (CVP) analysis, calculating break-even points and determining production units for profit targets, including a scenario with two products and a fixed production ratio. The solution integrates financial analysis, statistical methods, and practical business recommendations.

Accounting Decision Support Tools

Assessment item – 3

[Pick the date]

Student Name

Assessment item – 3

[Pick the date]

Student Name

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 1

(a) The process invovled in decision making is not a single step process but rather consists of a

number of steps.

First, the decision related expectations needs to be defined along with identification

of possible outcomes in relation to the decision to be made.

The various alternatives available at the behest of the decision maker need to be

outlined.

Considering the crucial role of the states of nature, they must be defined and also their

underlying possibility predicted with as much accuracy possible.

Further, in the light of the states of nature, the payoff matrix needs to be formed

which would highlight the payoffs associated with each alternative.

Taking the payoff matrix into consideration along with the decision model approved,

a decision is finalised by the decision maker.

(b) In case of any particular decision, the decision maker would have a plethora of possible

strategies to choose from which are categorised as alternatives. Choosing a suitable

alternative from the perspective of the decision maker becomes challenging owing to the

various states of nature or future scenarios that can arise. A particular alternative may not

work in different states of nature and hence the decision maker needs to choose one

considering the potential states of nature.

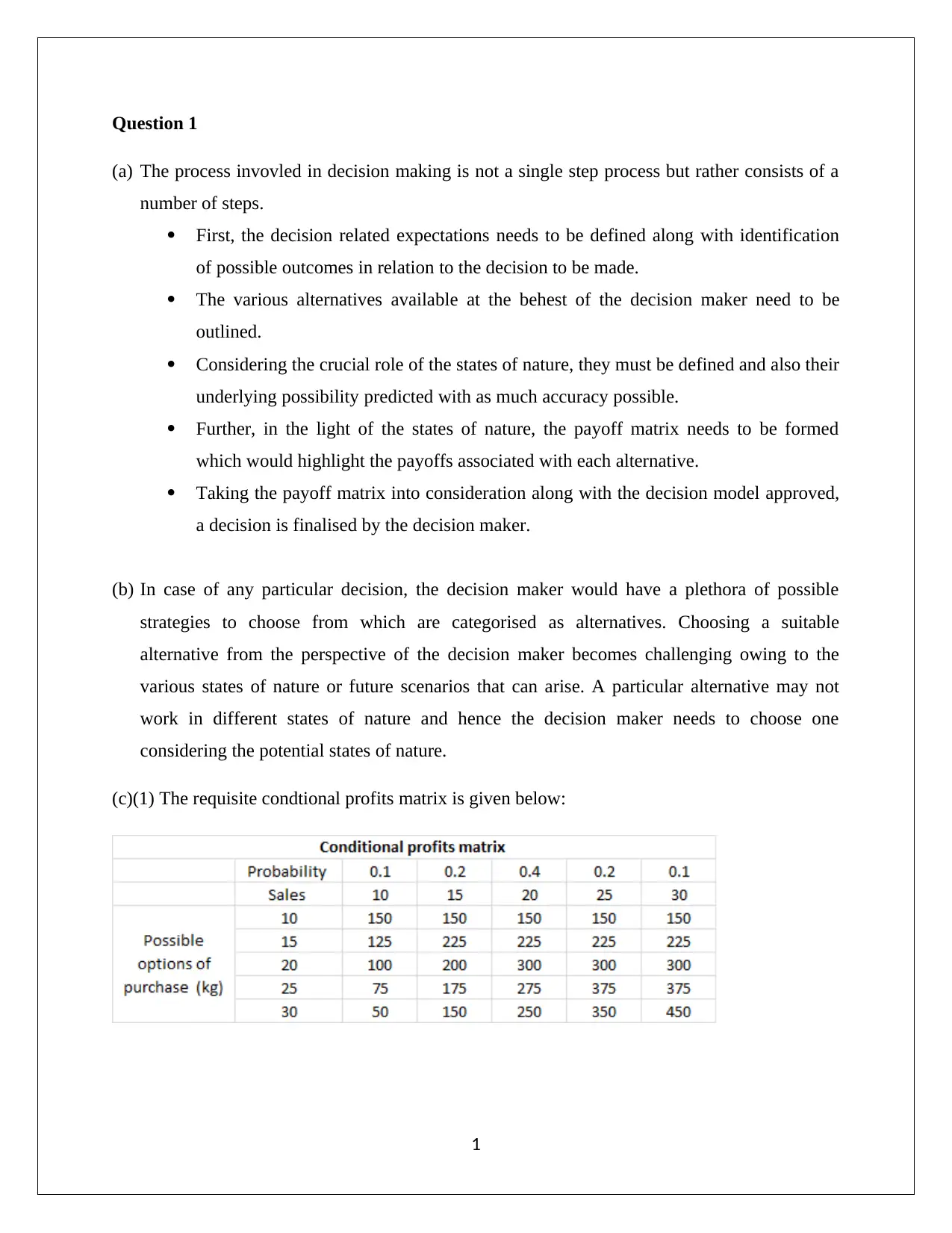

(c)(1) The requisite condtional profits matrix is given below:

1

(a) The process invovled in decision making is not a single step process but rather consists of a

number of steps.

First, the decision related expectations needs to be defined along with identification

of possible outcomes in relation to the decision to be made.

The various alternatives available at the behest of the decision maker need to be

outlined.

Considering the crucial role of the states of nature, they must be defined and also their

underlying possibility predicted with as much accuracy possible.

Further, in the light of the states of nature, the payoff matrix needs to be formed

which would highlight the payoffs associated with each alternative.

Taking the payoff matrix into consideration along with the decision model approved,

a decision is finalised by the decision maker.

(b) In case of any particular decision, the decision maker would have a plethora of possible

strategies to choose from which are categorised as alternatives. Choosing a suitable

alternative from the perspective of the decision maker becomes challenging owing to the

various states of nature or future scenarios that can arise. A particular alternative may not

work in different states of nature and hence the decision maker needs to choose one

considering the potential states of nature.

(c)(1) The requisite condtional profits matrix is given below:

1

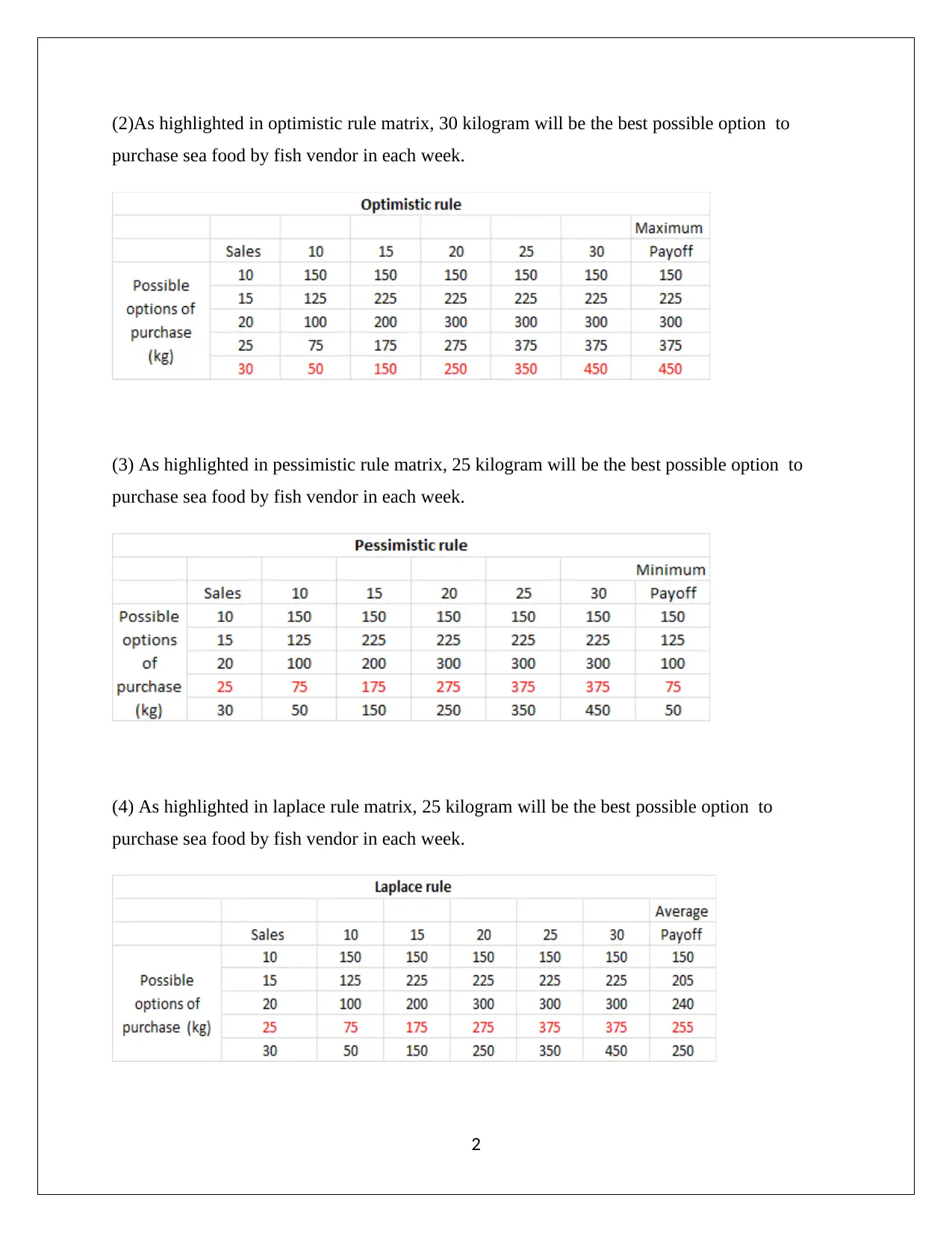

(2)As highlighted in optimistic rule matrix, 30 kilogram will be the best possible option to

purchase sea food by fish vendor in each week.

(3) As highlighted in pessimistic rule matrix, 25 kilogram will be the best possible option to

purchase sea food by fish vendor in each week.

(4) As highlighted in laplace rule matrix, 25 kilogram will be the best possible option to

purchase sea food by fish vendor in each week.

2

purchase sea food by fish vendor in each week.

(3) As highlighted in pessimistic rule matrix, 25 kilogram will be the best possible option to

purchase sea food by fish vendor in each week.

(4) As highlighted in laplace rule matrix, 25 kilogram will be the best possible option to

purchase sea food by fish vendor in each week.

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

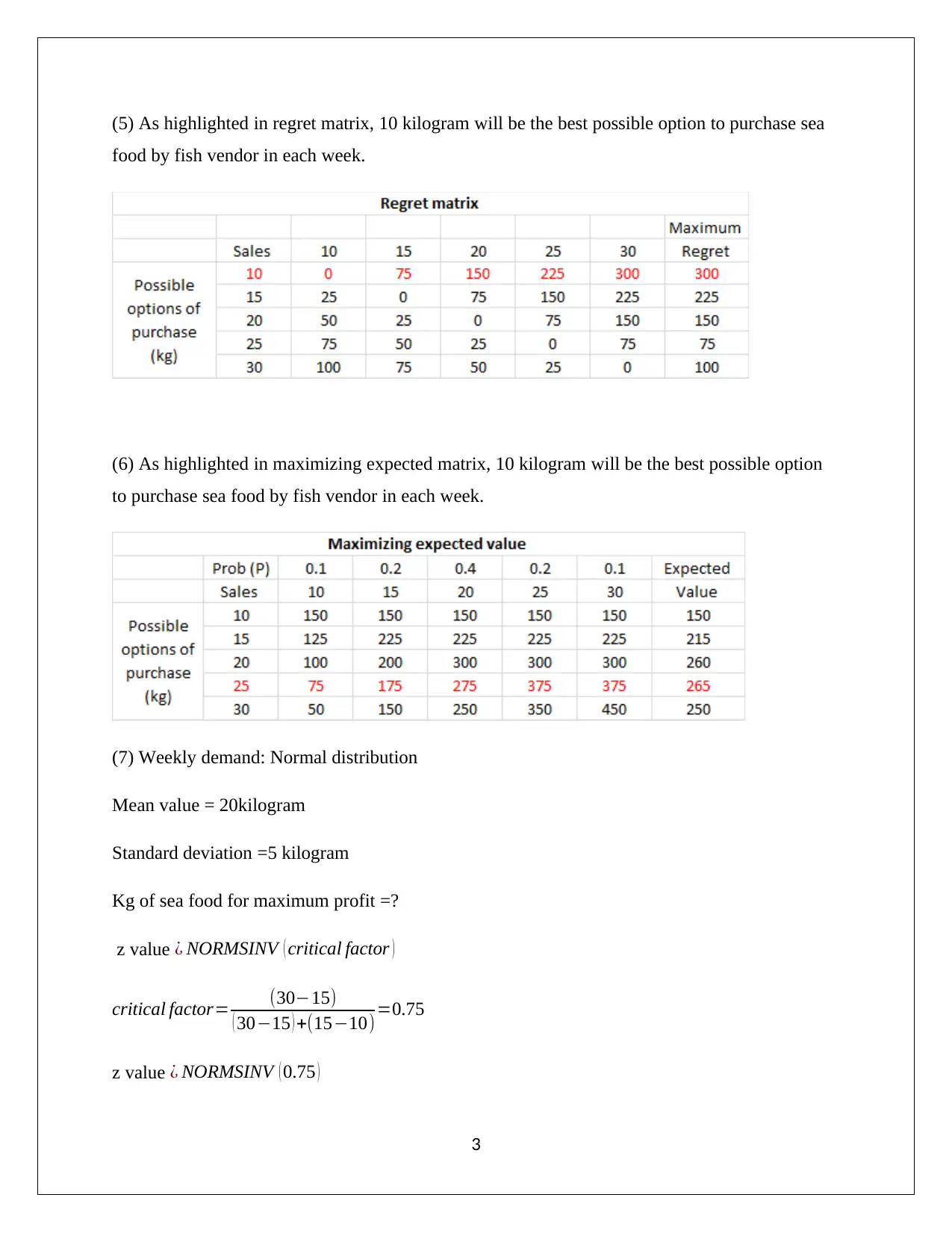

(5) As highlighted in regret matrix, 10 kilogram will be the best possible option to purchase sea

food by fish vendor in each week.

(6) As highlighted in maximizing expected matrix, 10 kilogram will be the best possible option

to purchase sea food by fish vendor in each week.

(7) Weekly demand: Normal distribution

Mean value = 20kilogram

Standard deviation =5 kilogram

Kg of sea food for maximum profit =?

z value ¿ NORMSINV ( critical factor )

critical factor= (30−15)

( 30−15 ) +(15−10)=0.75

z value ¿ NORMSINV ( 0.75 )

3

food by fish vendor in each week.

(6) As highlighted in maximizing expected matrix, 10 kilogram will be the best possible option

to purchase sea food by fish vendor in each week.

(7) Weekly demand: Normal distribution

Mean value = 20kilogram

Standard deviation =5 kilogram

Kg of sea food for maximum profit =?

z value ¿ NORMSINV ( critical factor )

critical factor= (30−15)

( 30−15 ) +(15−10)=0.75

z value ¿ NORMSINV ( 0.75 )

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

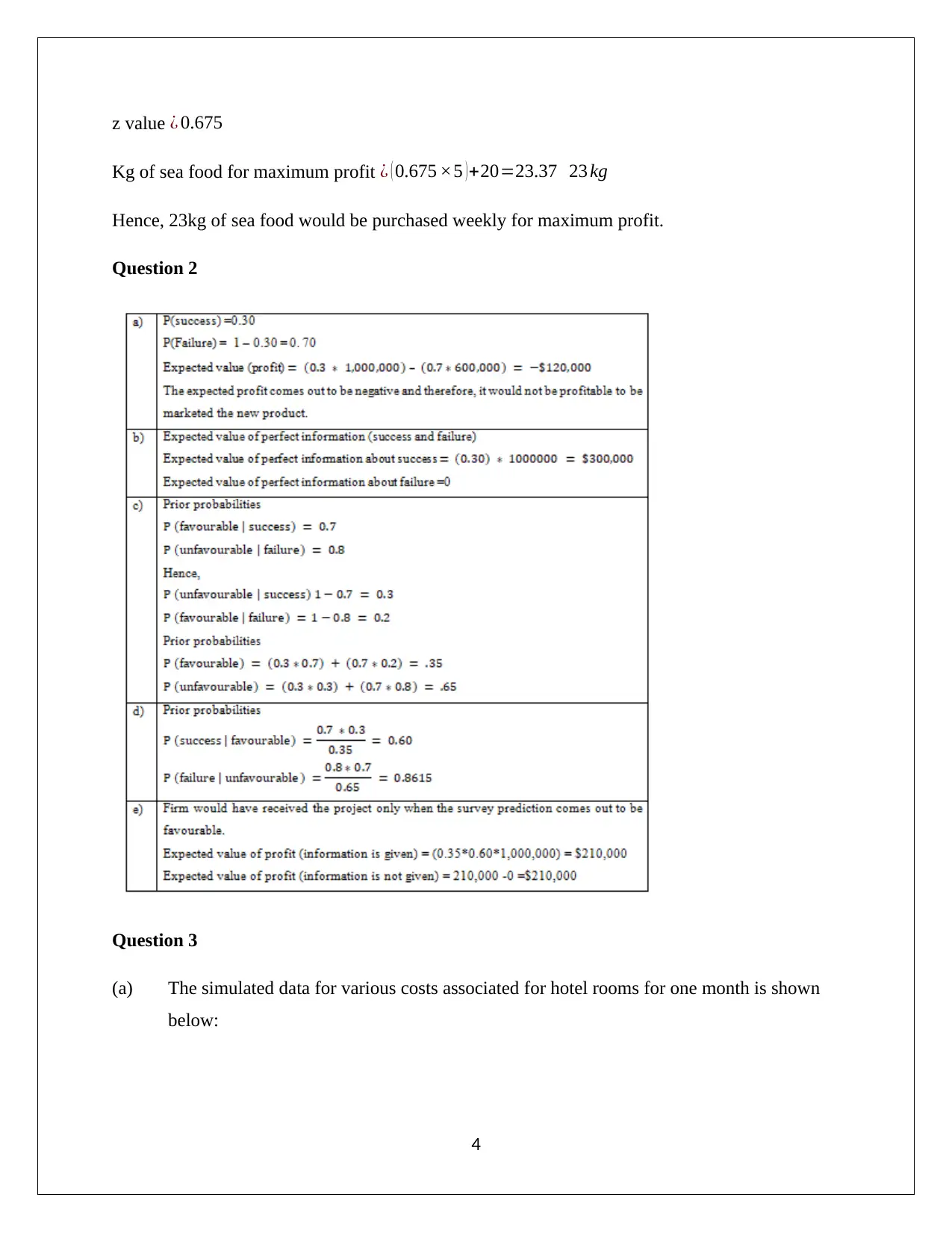

z value ¿ 0.675

Kg of sea food for maximum profit ¿ ( 0.675 ×5 )+20=23.37 23 kg

Hence, 23kg of sea food would be purchased weekly for maximum profit.

Question 2

Question 3

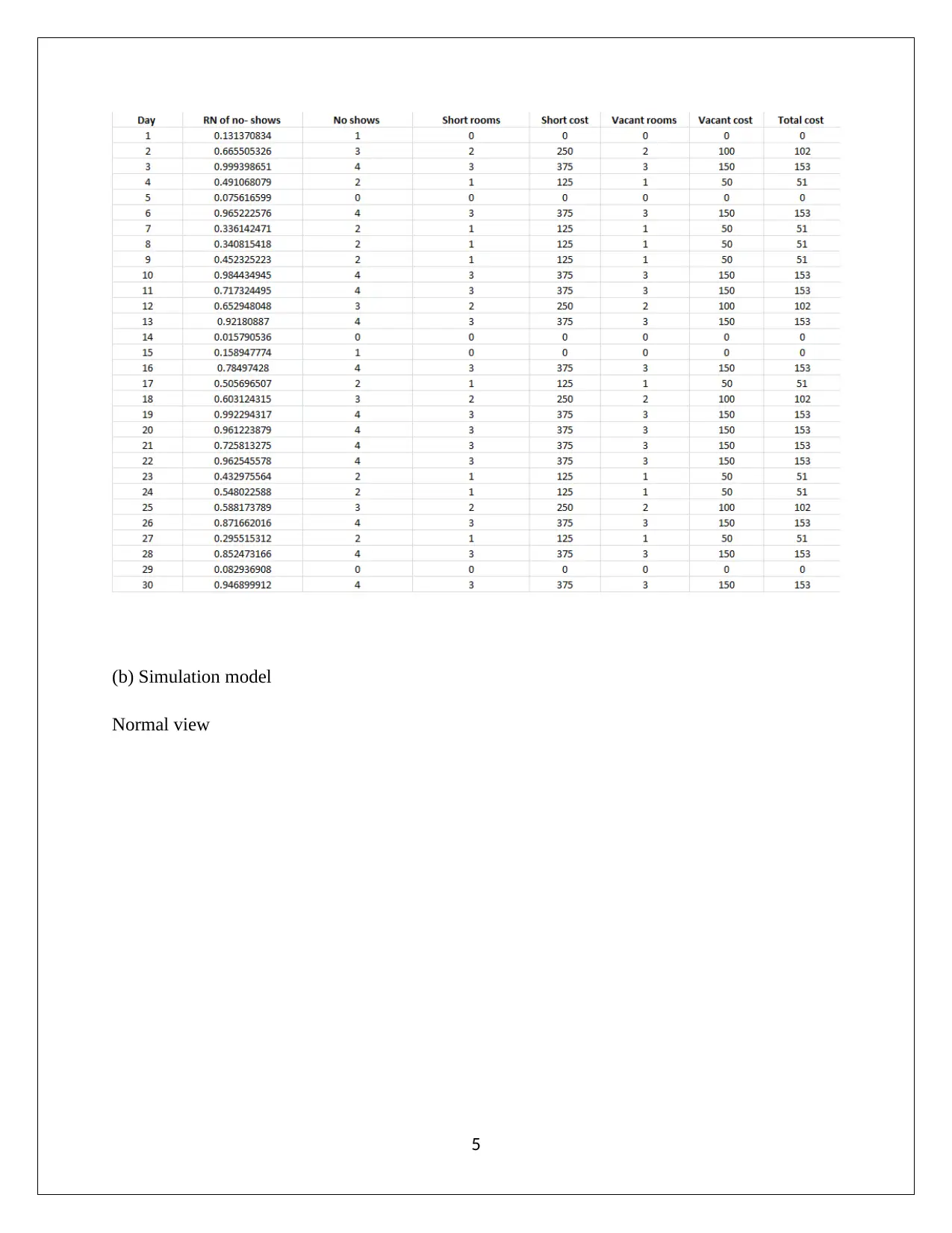

(a) The simulated data for various costs associated for hotel rooms for one month is shown

below:

4

Kg of sea food for maximum profit ¿ ( 0.675 ×5 )+20=23.37 23 kg

Hence, 23kg of sea food would be purchased weekly for maximum profit.

Question 2

Question 3

(a) The simulated data for various costs associated for hotel rooms for one month is shown

below:

4

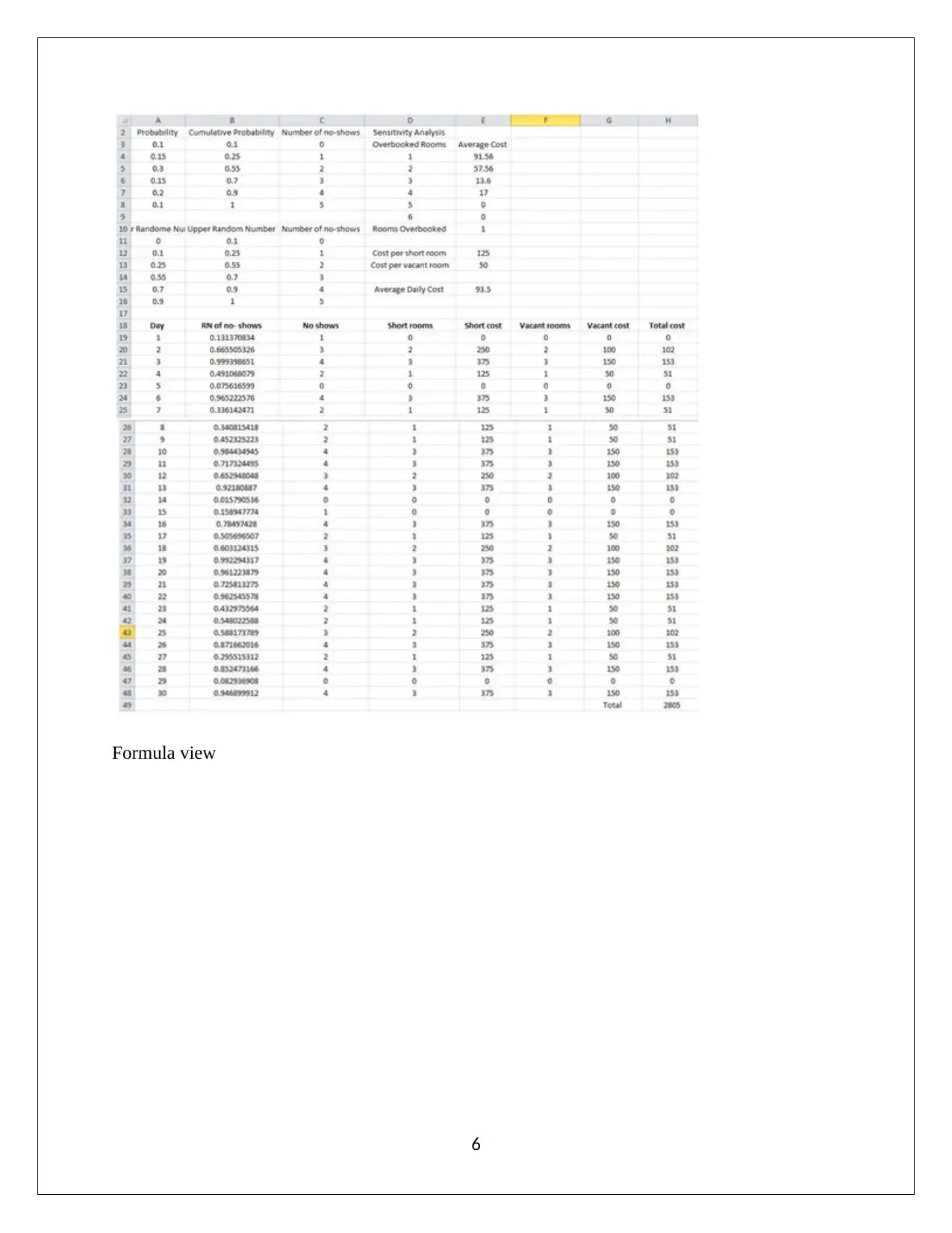

(b) Simulation model

Normal view

5

Normal view

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Formula view

6

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

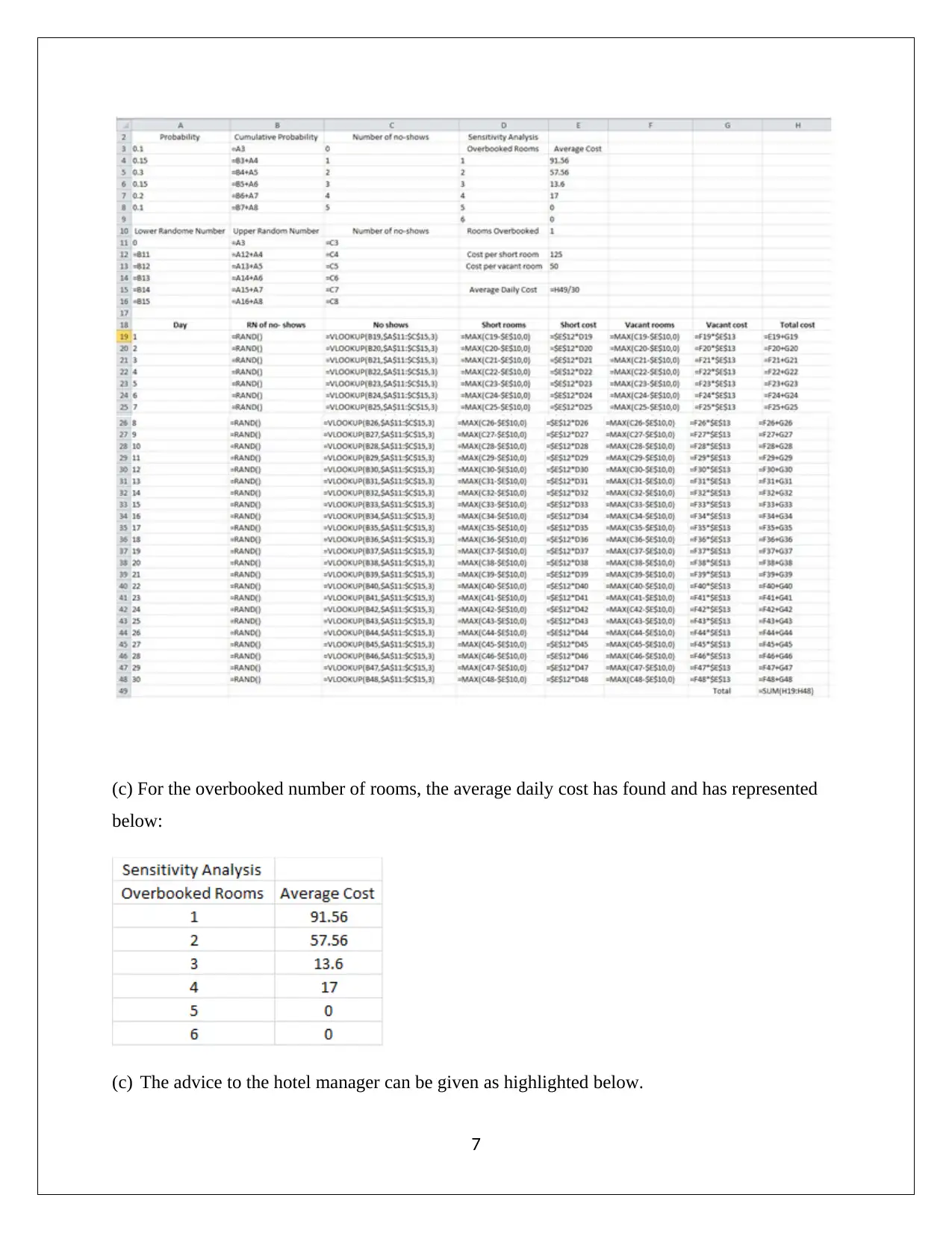

(c) For the overbooked number of rooms, the average daily cost has found and has represented

below:

(c) The advice to the hotel manager can be given as highlighted below.

7

below:

(c) The advice to the hotel manager can be given as highlighted below.

7

To: Hotel Manager

Date: 11 th May, 2018

Dear Sir

Taking into cognizance the current practice of overbooking three rooms, associated cost structure

and the no shows by the clients, a simulation has been run for ascertaining the cost efficiency of

the policy being followed by the hotel. However, comparison of the average costs in this regard

highlights issues with the current policy since cost can be further brought down if the company

goes for four overbooking in line with the results obtained. Hence, to enhance profits, the

migration to the new policy should be completed at the earliest.

Yours faithfully

STUDENT NAME

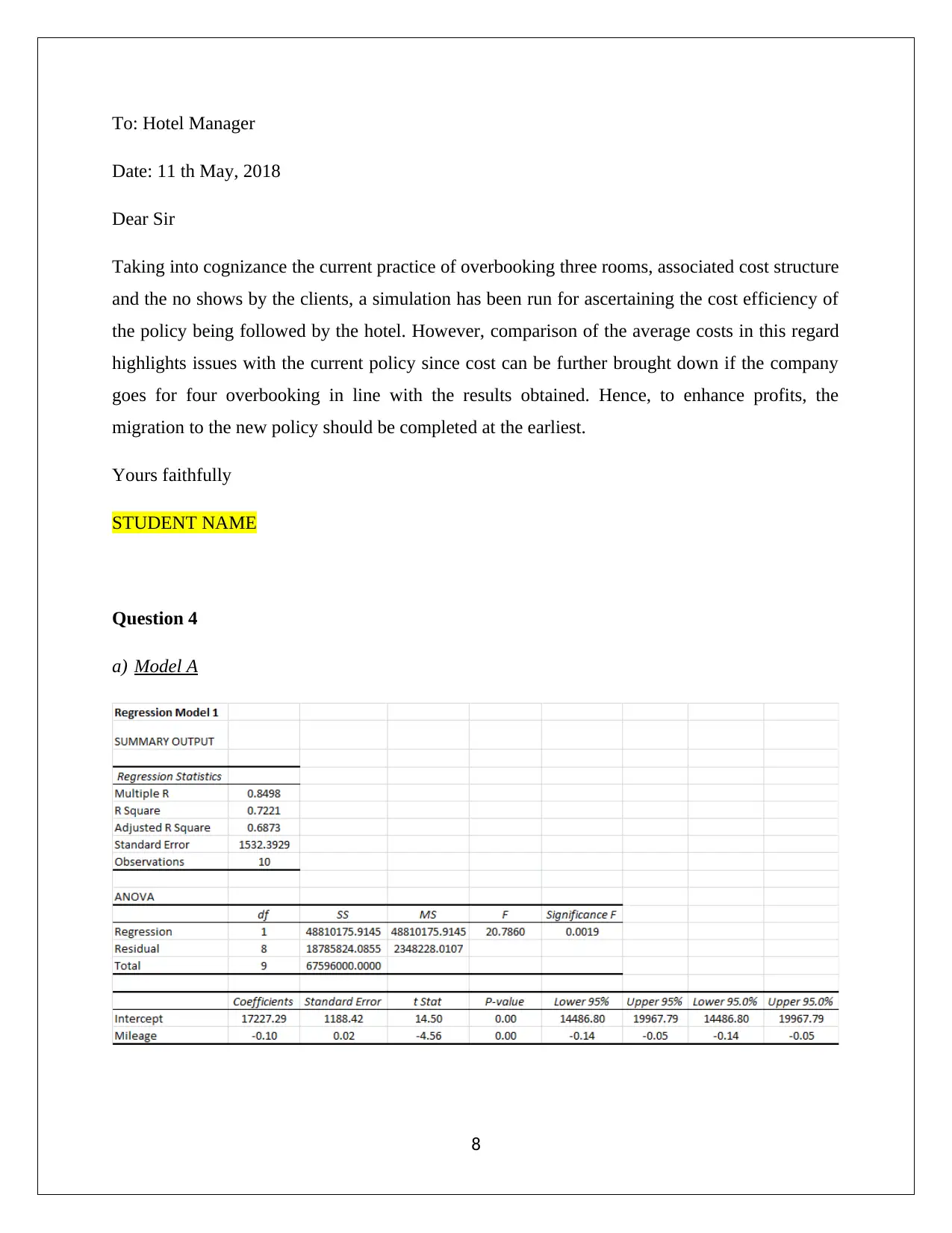

Question 4

a) Model A

8

Date: 11 th May, 2018

Dear Sir

Taking into cognizance the current practice of overbooking three rooms, associated cost structure

and the no shows by the clients, a simulation has been run for ascertaining the cost efficiency of

the policy being followed by the hotel. However, comparison of the average costs in this regard

highlights issues with the current policy since cost can be further brought down if the company

goes for four overbooking in line with the results obtained. Hence, to enhance profits, the

migration to the new policy should be completed at the earliest.

Yours faithfully

STUDENT NAME

Question 4

a) Model A

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The main highlights on the basis of the excel output of regression illustrated above, the following

conclusions may be drawn.

Slope coefficient βmileage is critical or significant as derived from the comparison of p

value and significance level of 5% where the p value emerges as the lower value..

R2 or coefficient of determination highlights that the mileage independent variable can

potentially enable explaining 72.21% of the total variable that is observable in car price.

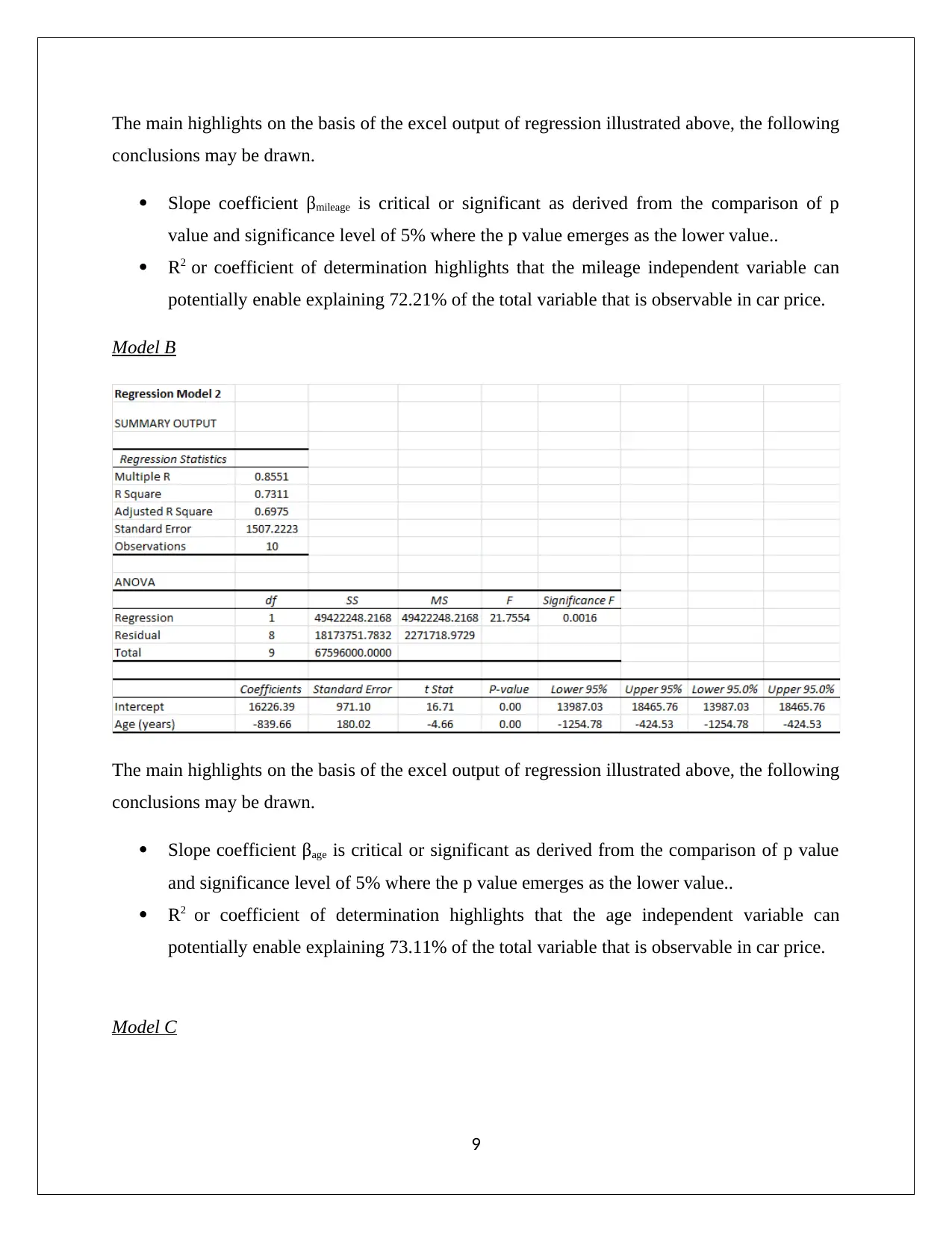

Model B

The main highlights on the basis of the excel output of regression illustrated above, the following

conclusions may be drawn.

Slope coefficient βage is critical or significant as derived from the comparison of p value

and significance level of 5% where the p value emerges as the lower value..

R2 or coefficient of determination highlights that the age independent variable can

potentially enable explaining 73.11% of the total variable that is observable in car price.

Model C

9

conclusions may be drawn.

Slope coefficient βmileage is critical or significant as derived from the comparison of p

value and significance level of 5% where the p value emerges as the lower value..

R2 or coefficient of determination highlights that the mileage independent variable can

potentially enable explaining 72.21% of the total variable that is observable in car price.

Model B

The main highlights on the basis of the excel output of regression illustrated above, the following

conclusions may be drawn.

Slope coefficient βage is critical or significant as derived from the comparison of p value

and significance level of 5% where the p value emerges as the lower value..

R2 or coefficient of determination highlights that the age independent variable can

potentially enable explaining 73.11% of the total variable that is observable in car price.

Model C

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

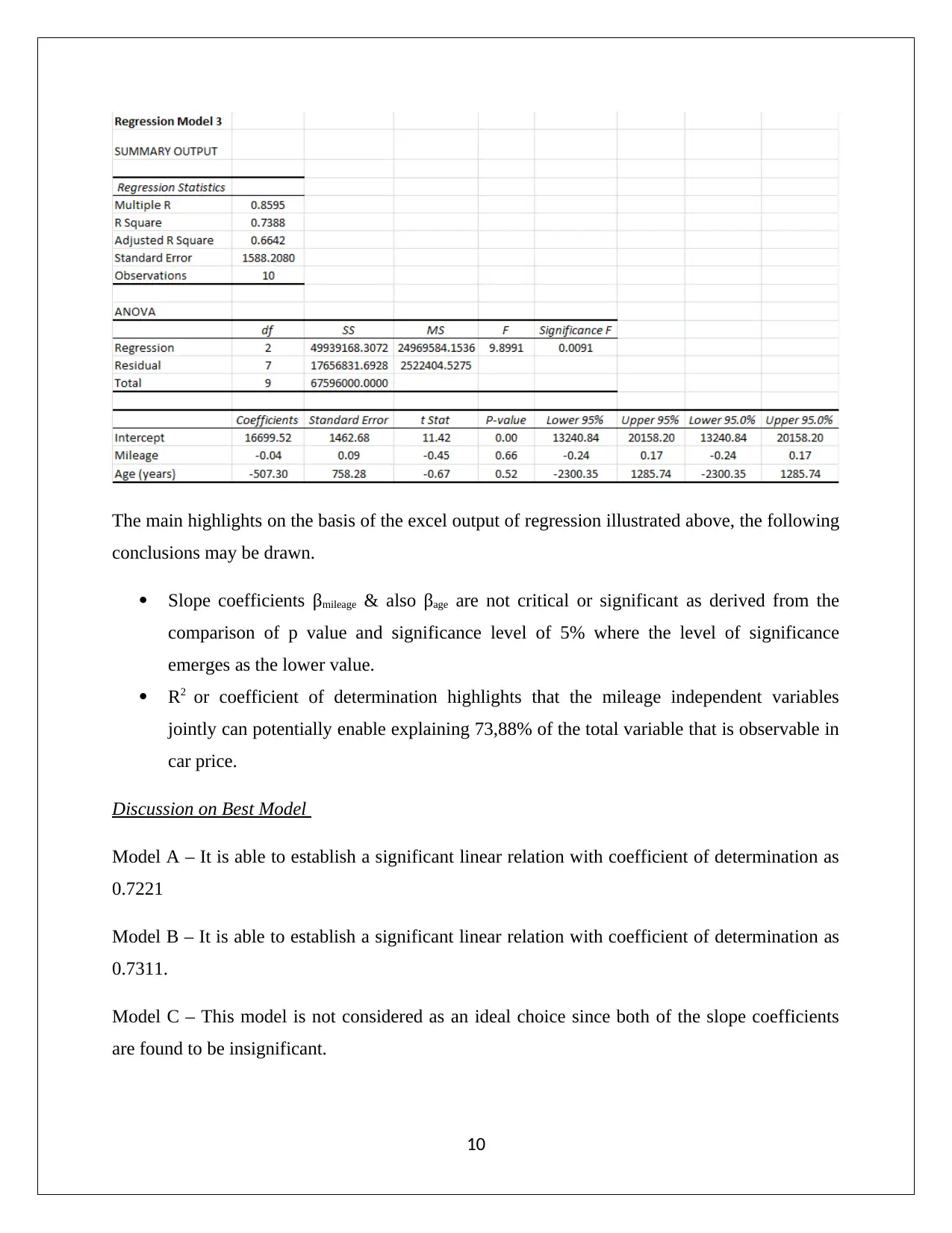

The main highlights on the basis of the excel output of regression illustrated above, the following

conclusions may be drawn.

Slope coefficients βmileage & also βage are not critical or significant as derived from the

comparison of p value and significance level of 5% where the level of significance

emerges as the lower value.

R2 or coefficient of determination highlights that the mileage independent variables

jointly can potentially enable explaining 73,88% of the total variable that is observable in

car price.

Discussion on Best Model

Model A – It is able to establish a significant linear relation with coefficient of determination as

0.7221

Model B – It is able to establish a significant linear relation with coefficient of determination as

0.7311.

Model C – This model is not considered as an ideal choice since both of the slope coefficients

are found to be insignificant.

10

conclusions may be drawn.

Slope coefficients βmileage & also βage are not critical or significant as derived from the

comparison of p value and significance level of 5% where the level of significance

emerges as the lower value.

R2 or coefficient of determination highlights that the mileage independent variables

jointly can potentially enable explaining 73,88% of the total variable that is observable in

car price.

Discussion on Best Model

Model A – It is able to establish a significant linear relation with coefficient of determination as

0.7221

Model B – It is able to establish a significant linear relation with coefficient of determination as

0.7311.

Model C – This model is not considered as an ideal choice since both of the slope coefficients

are found to be insignificant.

10

Considering that model C is not considered, amongst the simple regression models, the choice is

rather straightforward based on the higher value of coefficient of determination. Hence, Model B

emerges as the optimum choice.

b) The superior model from the two simple regression models has already been identified in part

(a). This is the Model B where the independent variable is the car’s age which is a more

significant variable in comparison to car’s mileage. Further, regression also indicates an

inverse relation between age and price which seems correct owing to deterioration in value as

car turns old owing to decline in value and also new models being launched by the company.

Further, higher mileages also diminishes price which also does not pose any surprise since

typically internal damage and general wear and tear is related to mileage.

c) One of the key assumptions which a multiple regression model must follow is that

multicollinearity should not be present. This means that the independent variables used to

construct the model should not have any significant correlation between them. This

assumption is not satisfied owing to the significant correlation between the independent

variables i.e. mileage and age. Thus, the given model would not be considered valid and

hence it must not be used for predicting the price.

Question 5

(a) Firm’s profit becomes zero for break-even point and hence, in CVP analysis put profit

=0.

11

rather straightforward based on the higher value of coefficient of determination. Hence, Model B

emerges as the optimum choice.

b) The superior model from the two simple regression models has already been identified in part

(a). This is the Model B where the independent variable is the car’s age which is a more

significant variable in comparison to car’s mileage. Further, regression also indicates an

inverse relation between age and price which seems correct owing to deterioration in value as

car turns old owing to decline in value and also new models being launched by the company.

Further, higher mileages also diminishes price which also does not pose any surprise since

typically internal damage and general wear and tear is related to mileage.

c) One of the key assumptions which a multiple regression model must follow is that

multicollinearity should not be present. This means that the independent variables used to

construct the model should not have any significant correlation between them. This

assumption is not satisfied owing to the significant correlation between the independent

variables i.e. mileage and age. Thus, the given model would not be considered valid and

hence it must not be used for predicting the price.

Question 5

(a) Firm’s profit becomes zero for break-even point and hence, in CVP analysis put profit

=0.

11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.

![Assignment: Accounting Decision Support Tools - [Date] - Finance](/_next/image/?url=https%3A%2F%2Fdesklib.com%2Fmedia%2Fimages%2Fga%2F85e3fe63d61d4af3a506409b3f137201.jpg&w=256&q=75)