Financial Accounting: Disclosure Principles and Journal Entry Tasks

VerifiedAdded on 2023/06/15

|18

|3771

|380

Homework Assignment

AI Summary

This assignment solution addresses key aspects of financial accounting, beginning with a letter to the IASB providing feedback on disclosure principles, specifically concerning the annual reports of Commonwealth Bank (CBA) and National Australia Bank (NAB). It identifies issues such as irrelevant information, insufficient disclosure, and ineffective communication, recommending improvements in data presentation, formatting, and entity-specific information. The solution also includes journal entries for Beach Supplies Ltd., detailing transactions related to share issuance, underwriting, and forfeiture. Furthermore, it provides a worksheet for current and deferred tax liabilities, calculating taxable income, tax losses, and temporary differences arising from depreciation and provisions.

Running head: FINANCIAL ACCOUNTING

Financial accounting

Name of the University

Name of the student

Authors note

Financial accounting

Name of the University

Name of the student

Authors note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

FINANCIAL ACCOUNTING

Table of Contents

Answer to Question 1:.....................................................................................................................2

Answer to Question 2:.....................................................................................................................7

Answer to Question 3:...................................................................................................................10

Answer to Question 4:...................................................................................................................14

Answer to Question 5:...................................................................................................................15

Reference list:................................................................................................................................17

FINANCIAL ACCOUNTING

Table of Contents

Answer to Question 1:.....................................................................................................................2

Answer to Question 2:.....................................................................................................................7

Answer to Question 3:...................................................................................................................10

Answer to Question 4:...................................................................................................................14

Answer to Question 5:...................................................................................................................15

Reference list:................................................................................................................................17

2

FINANCIAL ACCOUNTING

Answer to Question 1:

To,

Chairperson

International standard accounting board (IASB)

30 cannon street, London- EC4M 6XH, United Kingdom

Date: 3rd March, 2018

Subject: To provide feedback and recommendation on principles of effective communication

Sir,

I have been planning to make investment in two selected organizations

listed on the Australian stock exchange that is Common wealth bank (CBA) and National

Australia bank (NAB). I have viewed the notes disclosure by comparing and reviewing the

annual report of both organizations and in lieu of that, I have planned to make submission of my

response through this report. The disclosure of financial statements are faced with some of the

concerns such as prevalence of irrelevant information in the notes, insufficient information in the

notes and existence of ineffective communication on the information provided. The disclosure

issues are intended to be addressed by the board by releasing of discussion paper that is

Disclosure Initiative- Principles of disclosures. Such paper has been released for improving the

communication in the financial report. Financial statement prepares finds it difficult and complex

to report the information from the annual report to the external users and therefore, it is

perceived by the investors that the information displayed in the annual report is not relevant and

FINANCIAL ACCOUNTING

Answer to Question 1:

To,

Chairperson

International standard accounting board (IASB)

30 cannon street, London- EC4M 6XH, United Kingdom

Date: 3rd March, 2018

Subject: To provide feedback and recommendation on principles of effective communication

Sir,

I have been planning to make investment in two selected organizations

listed on the Australian stock exchange that is Common wealth bank (CBA) and National

Australia bank (NAB). I have viewed the notes disclosure by comparing and reviewing the

annual report of both organizations and in lieu of that, I have planned to make submission of my

response through this report. The disclosure of financial statements are faced with some of the

concerns such as prevalence of irrelevant information in the notes, insufficient information in the

notes and existence of ineffective communication on the information provided. The disclosure

issues are intended to be addressed by the board by releasing of discussion paper that is

Disclosure Initiative- Principles of disclosures. Such paper has been released for improving the

communication in the financial report. Financial statement prepares finds it difficult and complex

to report the information from the annual report to the external users and therefore, it is

perceived by the investors that the information displayed in the annual report is not relevant and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

FINANCIAL ACCOUNTING

sometimes it is insufficient (Christensen et al., 2016). If the information is not properly

presented, then the reliability of the information would be reduced.

I am writing this letter to raise some of the disclosure issues that have been identified by

me while reviewing the annual reports of NAB and CBA. Investor’s faces difficulty in

evaluating the financial data presented in the annual report because of absence of illustrative

disclosures of financial data and insufficient information presented in the explanatory notes. The

presentation should be standardized in terms of both disclosure and preparation of financial

statements according to the principles of effective communication as discussed in the discussion

paper that IASB have proposed. The communication effectiveness should be increased by

banking institutions by disclosing the information in a detailed and proper way (Rutherford,

2016).

The proposed set of principles of effective communication in the discussion paper has

been reviewed by me that have assisted me in identifying some of the disclosures issues of the

banks. Disclosure initiative that has been proposed by the standard intends to enhance the

financial reporting communication by addressing how the disclosure effectiveness can be

improved. Seven principles have been identified in the disclosure initiatives for creation of

effective communication information in the financial statements. Reviewing the disclosures

principles have depicted that the disclosed information in the financial statements should be

specific to entity that is it should be tailored according to specific circumstances and business of

entity. The disclosed information should be simple and clear so that material information is not

lost. In addition to this, the information disclosed should be linked to other related information so

that navigation is improved and relationship between the pieces of information is highlighted.

Disclosed information should be capable of easy comparing so that usefulness of information

FINANCIAL ACCOUNTING

sometimes it is insufficient (Christensen et al., 2016). If the information is not properly

presented, then the reliability of the information would be reduced.

I am writing this letter to raise some of the disclosure issues that have been identified by

me while reviewing the annual reports of NAB and CBA. Investor’s faces difficulty in

evaluating the financial data presented in the annual report because of absence of illustrative

disclosures of financial data and insufficient information presented in the explanatory notes. The

presentation should be standardized in terms of both disclosure and preparation of financial

statements according to the principles of effective communication as discussed in the discussion

paper that IASB have proposed. The communication effectiveness should be increased by

banking institutions by disclosing the information in a detailed and proper way (Rutherford,

2016).

The proposed set of principles of effective communication in the discussion paper has

been reviewed by me that have assisted me in identifying some of the disclosures issues of the

banks. Disclosure initiative that has been proposed by the standard intends to enhance the

financial reporting communication by addressing how the disclosure effectiveness can be

improved. Seven principles have been identified in the disclosure initiatives for creation of

effective communication information in the financial statements. Reviewing the disclosures

principles have depicted that the disclosed information in the financial statements should be

specific to entity that is it should be tailored according to specific circumstances and business of

entity. The disclosed information should be simple and clear so that material information is not

lost. In addition to this, the information disclosed should be linked to other related information so

that navigation is improved and relationship between the pieces of information is highlighted.

Disclosed information should be capable of easy comparing so that usefulness of information

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

FINANCIAL ACCOUNTING

cannot be compromised. Information disclosed should be fee from unnecessary duplication in

different part of financial information. Moreover, information should be organized in a manner

that helps in emphasizing on important matters and are arranged in an appropriate order. The

disclosed information should be in an appropriate format by making use of graphs, tables and

charts.

Being an investor, it would of crucial importance to provide feedback to the IASB for

contributing to robust discussion and well grounded disclosure of disclosure principles. It can be

inferred from the analysis of annual report of both the entities that there are no appropriate and

sufficient disclosures of information to be presented to the users of financial statements or

investors. For both the organizations, it is depicted by reviewing the annual report that

presentation of financial information have not been done by using segmental approach and does

not have any consistent segmental definition (Beatty & Liao, 2014). All the disclosures made in

the notes to financial statements are not presented separately. Therefore, it can be said that there

is a need to improve navigation as the relationship between the information that have been

presented in the report are not appropriate manner. However, I have been able to compare the

financial information presented in the table format for considerable number of years that have

assisted me in identifying the trend. Such trend helps investors in identifying whether the

performance of improved or it has deteriorated over the number of years. Moreover, there is

separate presentation of liquidity and credit risk in the notes to financial statement.

Furthermore, the Basel requirement disclosure is considered very important on part of

banking institution as Basel is reforms that helps in strengthening the regulations. Reviewing the

annual report of both the organization, it can be seen that notes to financial statements adequately

discloses the requirement of Basel. Differences in the presentation of financial information using

FINANCIAL ACCOUNTING

cannot be compromised. Information disclosed should be fee from unnecessary duplication in

different part of financial information. Moreover, information should be organized in a manner

that helps in emphasizing on important matters and are arranged in an appropriate order. The

disclosed information should be in an appropriate format by making use of graphs, tables and

charts.

Being an investor, it would of crucial importance to provide feedback to the IASB for

contributing to robust discussion and well grounded disclosure of disclosure principles. It can be

inferred from the analysis of annual report of both the entities that there are no appropriate and

sufficient disclosures of information to be presented to the users of financial statements or

investors. For both the organizations, it is depicted by reviewing the annual report that

presentation of financial information have not been done by using segmental approach and does

not have any consistent segmental definition (Beatty & Liao, 2014). All the disclosures made in

the notes to financial statements are not presented separately. Therefore, it can be said that there

is a need to improve navigation as the relationship between the information that have been

presented in the report are not appropriate manner. However, I have been able to compare the

financial information presented in the table format for considerable number of years that have

assisted me in identifying the trend. Such trend helps investors in identifying whether the

performance of improved or it has deteriorated over the number of years. Moreover, there is

separate presentation of liquidity and credit risk in the notes to financial statement.

Furthermore, the Basel requirement disclosure is considered very important on part of

banking institution as Basel is reforms that helps in strengthening the regulations. Reviewing the

annual report of both the organization, it can be seen that notes to financial statements adequately

discloses the requirement of Basel. Differences in the presentation of financial information using

5

FINANCIAL ACCOUNTING

a proper formation have also been identified in the annual report. Data is properly presented by

using graph, tables and lists. It can be seen from the annual report of Common wealth bank that

there has been very limited use of graphs for presentation of financial data. On other hand, the

National Australia bank has not made use of any charts or graphs for disclosing the financial

information. NAB divisional performance has not been explained in detailed and are presented

only in format of table. CBA on other hand has presented their divisional performance in the

table format and the same information’s have been disclosed in a detailed way on the notes to

financial statements (Battiston et al., 20160.

Some of the recommendations that I would like to make that will assist in improving the

effectiveness of communication of information presented in the financial report. In regards to the

gaps that have been identified above, it is required by organization to make some improvement

for improving the effectiveness of communication. Organization while presenting the data should

incorporate entity specific principle as the specific information’s are collected only through the

annual report and general information can be accessed from outside. In addition to this, I would

recommend to present data in an appropriate format and using graphs and table should be

facilitated. Formatting techniques should be used by organization as the information presented in

a proper format would disclose relevant information (Macve, 2015). However, depending upon

the circumstances and operations of reporting entity, there should be usage of some common

formatting. Moreover, the standard should also outline the common objective for identifying the

disclosure requirement.

I would recommend to IASB as an investor by properly evaluating the disclosure issues

of both the banks that they should take every possible measure for adopting the effective

communication principles. This is so because such effective principles would help investors and

FINANCIAL ACCOUNTING

a proper formation have also been identified in the annual report. Data is properly presented by

using graph, tables and lists. It can be seen from the annual report of Common wealth bank that

there has been very limited use of graphs for presentation of financial data. On other hand, the

National Australia bank has not made use of any charts or graphs for disclosing the financial

information. NAB divisional performance has not been explained in detailed and are presented

only in format of table. CBA on other hand has presented their divisional performance in the

table format and the same information’s have been disclosed in a detailed way on the notes to

financial statements (Battiston et al., 20160.

Some of the recommendations that I would like to make that will assist in improving the

effectiveness of communication of information presented in the financial report. In regards to the

gaps that have been identified above, it is required by organization to make some improvement

for improving the effectiveness of communication. Organization while presenting the data should

incorporate entity specific principle as the specific information’s are collected only through the

annual report and general information can be accessed from outside. In addition to this, I would

recommend to present data in an appropriate format and using graphs and table should be

facilitated. Formatting techniques should be used by organization as the information presented in

a proper format would disclose relevant information (Macve, 2015). However, depending upon

the circumstances and operations of reporting entity, there should be usage of some common

formatting. Moreover, the standard should also outline the common objective for identifying the

disclosure requirement.

I would recommend to IASB as an investor by properly evaluating the disclosure issues

of both the banks that they should take every possible measure for adopting the effective

communication principles. This is so because such effective principles would help investors and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

FINANCIAL ACCOUNTING

users by providing detail information and facilitate the process of decision making. The purpose

of disclosure requirement should be understood by reporting entities so that the disclosed

financial information can be understood in a proper manner. In addition to this, there should be

guidance development by considering the factors that are specific to reporting entities.

FINANCIAL ACCOUNTING

users by providing detail information and facilitate the process of decision making. The purpose

of disclosure requirement should be understood by reporting entities so that the disclosed

financial information can be understood in a proper manner. In addition to this, there should be

guidance development by considering the factors that are specific to reporting entities.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

FINANCIAL ACCOUNTING

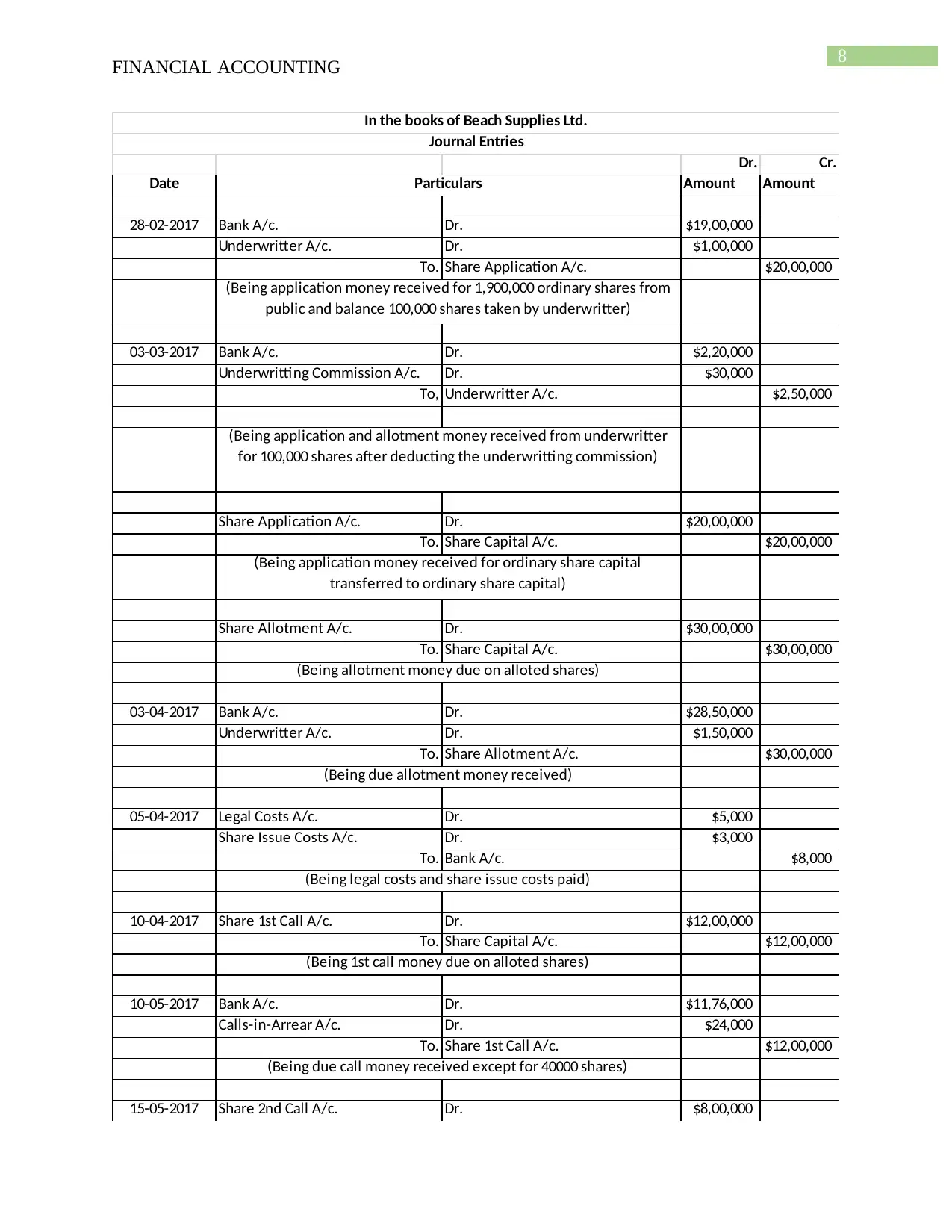

Answer to Question 2:

FINANCIAL ACCOUNTING

Answer to Question 2:

8

FINANCIAL ACCOUNTING

Dr. Cr.

Date Amount Amount

28-02-2017 Bank A/c. Dr. $19,00,000

Underwritter A/c. Dr. $1,00,000

To. Share Application A/c. $20,00,000

03-03-2017 Bank A/c. Dr. $2,20,000

Underwritting Commission A/c. Dr. $30,000

To, Underwritter A/c. $2,50,000

Share Application A/c. Dr. $20,00,000

To. Share Capital A/c. $20,00,000

Share Allotment A/c. Dr. $30,00,000

To. Share Capital A/c. $30,00,000

03-04-2017 Bank A/c. Dr. $28,50,000

Underwritter A/c. Dr. $1,50,000

To. Share Allotment A/c. $30,00,000

05-04-2017 Legal Costs A/c. Dr. $5,000

Share Issue Costs A/c. Dr. $3,000

To. Bank A/c. $8,000

10-04-2017 Share 1st Call A/c. Dr. $12,00,000

To. Share Capital A/c. $12,00,000

10-05-2017 Bank A/c. Dr. $11,76,000

Calls-in-Arrear A/c. Dr. $24,000

To. Share 1st Call A/c. $12,00,000

15-05-2017 Share 2nd Call A/c. Dr. $8,00,000

Particulars

(Being application money received for 1,900,000 ordinary shares from

public and balance 100,000 shares taken by underwritter)

(Being application and allotment money received from underwritter

for 100,000 shares after deducting the underwritting commission)

(Being application money received for ordinary share capital

transferred to ordinary share capital)

(Being allotment money due on alloted shares)

(Being due allotment money received)

(Being 1st call money due on alloted shares)

(Being due call money received except for 40000 shares)

(Being legal costs and share issue costs paid)

In the books of Beach Supplies Ltd.

Journal Entries

FINANCIAL ACCOUNTING

Dr. Cr.

Date Amount Amount

28-02-2017 Bank A/c. Dr. $19,00,000

Underwritter A/c. Dr. $1,00,000

To. Share Application A/c. $20,00,000

03-03-2017 Bank A/c. Dr. $2,20,000

Underwritting Commission A/c. Dr. $30,000

To, Underwritter A/c. $2,50,000

Share Application A/c. Dr. $20,00,000

To. Share Capital A/c. $20,00,000

Share Allotment A/c. Dr. $30,00,000

To. Share Capital A/c. $30,00,000

03-04-2017 Bank A/c. Dr. $28,50,000

Underwritter A/c. Dr. $1,50,000

To. Share Allotment A/c. $30,00,000

05-04-2017 Legal Costs A/c. Dr. $5,000

Share Issue Costs A/c. Dr. $3,000

To. Bank A/c. $8,000

10-04-2017 Share 1st Call A/c. Dr. $12,00,000

To. Share Capital A/c. $12,00,000

10-05-2017 Bank A/c. Dr. $11,76,000

Calls-in-Arrear A/c. Dr. $24,000

To. Share 1st Call A/c. $12,00,000

15-05-2017 Share 2nd Call A/c. Dr. $8,00,000

Particulars

(Being application money received for 1,900,000 ordinary shares from

public and balance 100,000 shares taken by underwritter)

(Being application and allotment money received from underwritter

for 100,000 shares after deducting the underwritting commission)

(Being application money received for ordinary share capital

transferred to ordinary share capital)

(Being allotment money due on alloted shares)

(Being due allotment money received)

(Being 1st call money due on alloted shares)

(Being due call money received except for 40000 shares)

(Being legal costs and share issue costs paid)

In the books of Beach Supplies Ltd.

Journal Entries

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

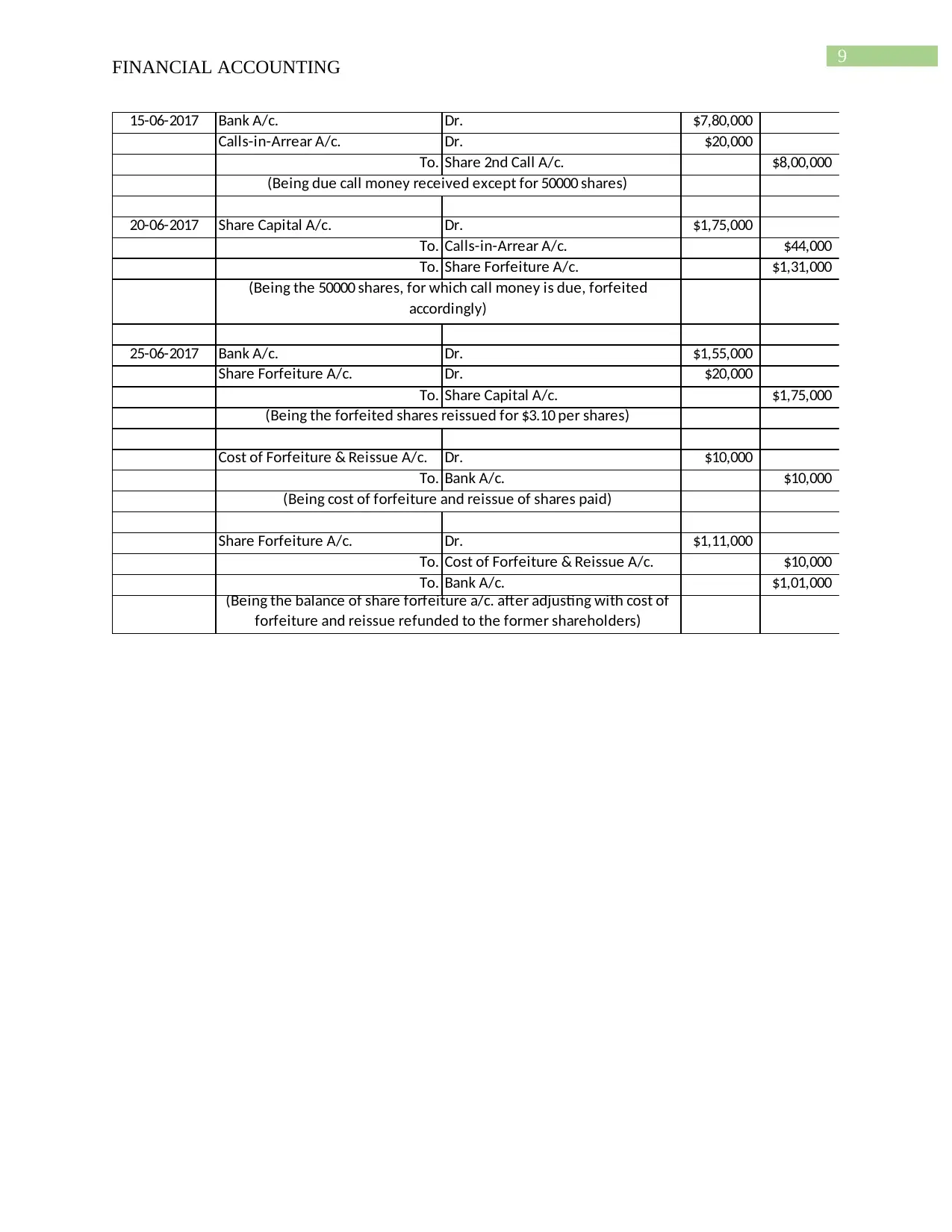

9

FINANCIAL ACCOUNTING

15-06-2017 Bank A/c. Dr. $7,80,000

Calls-in-Arrear A/c. Dr. $20,000

To. Share 2nd Call A/c. $8,00,000

20-06-2017 Share Capital A/c. Dr. $1,75,000

To. Calls-in-Arrear A/c. $44,000

To. Share Forfeiture A/c. $1,31,000

25-06-2017 Bank A/c. Dr. $1,55,000

Share Forfeiture A/c. Dr. $20,000

To. Share Capital A/c. $1,75,000

Cost of Forfeiture & Reissue A/c. Dr. $10,000

To. Bank A/c. $10,000

Share Forfeiture A/c. Dr. $1,11,000

To. Cost of Forfeiture & Reissue A/c. $10,000

To. Bank A/c. $1,01,000

(Being the balance of share forfeiture a/c. after adjusting with cost of

forfeiture and reissue refunded to the former shareholders)

(Being the 50000 shares, for which call money is due, forfeited

accordingly)

(Being the forfeited shares reissued for $3.10 per shares)

(Being cost of forfeiture and reissue of shares paid)

(Being due call money received except for 50000 shares)

FINANCIAL ACCOUNTING

15-06-2017 Bank A/c. Dr. $7,80,000

Calls-in-Arrear A/c. Dr. $20,000

To. Share 2nd Call A/c. $8,00,000

20-06-2017 Share Capital A/c. Dr. $1,75,000

To. Calls-in-Arrear A/c. $44,000

To. Share Forfeiture A/c. $1,31,000

25-06-2017 Bank A/c. Dr. $1,55,000

Share Forfeiture A/c. Dr. $20,000

To. Share Capital A/c. $1,75,000

Cost of Forfeiture & Reissue A/c. Dr. $10,000

To. Bank A/c. $10,000

Share Forfeiture A/c. Dr. $1,11,000

To. Cost of Forfeiture & Reissue A/c. $10,000

To. Bank A/c. $1,01,000

(Being the balance of share forfeiture a/c. after adjusting with cost of

forfeiture and reissue refunded to the former shareholders)

(Being the 50000 shares, for which call money is due, forfeited

accordingly)

(Being the forfeited shares reissued for $3.10 per shares)

(Being cost of forfeiture and reissue of shares paid)

(Being due call money received except for 50000 shares)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

FINANCIAL ACCOUNTING

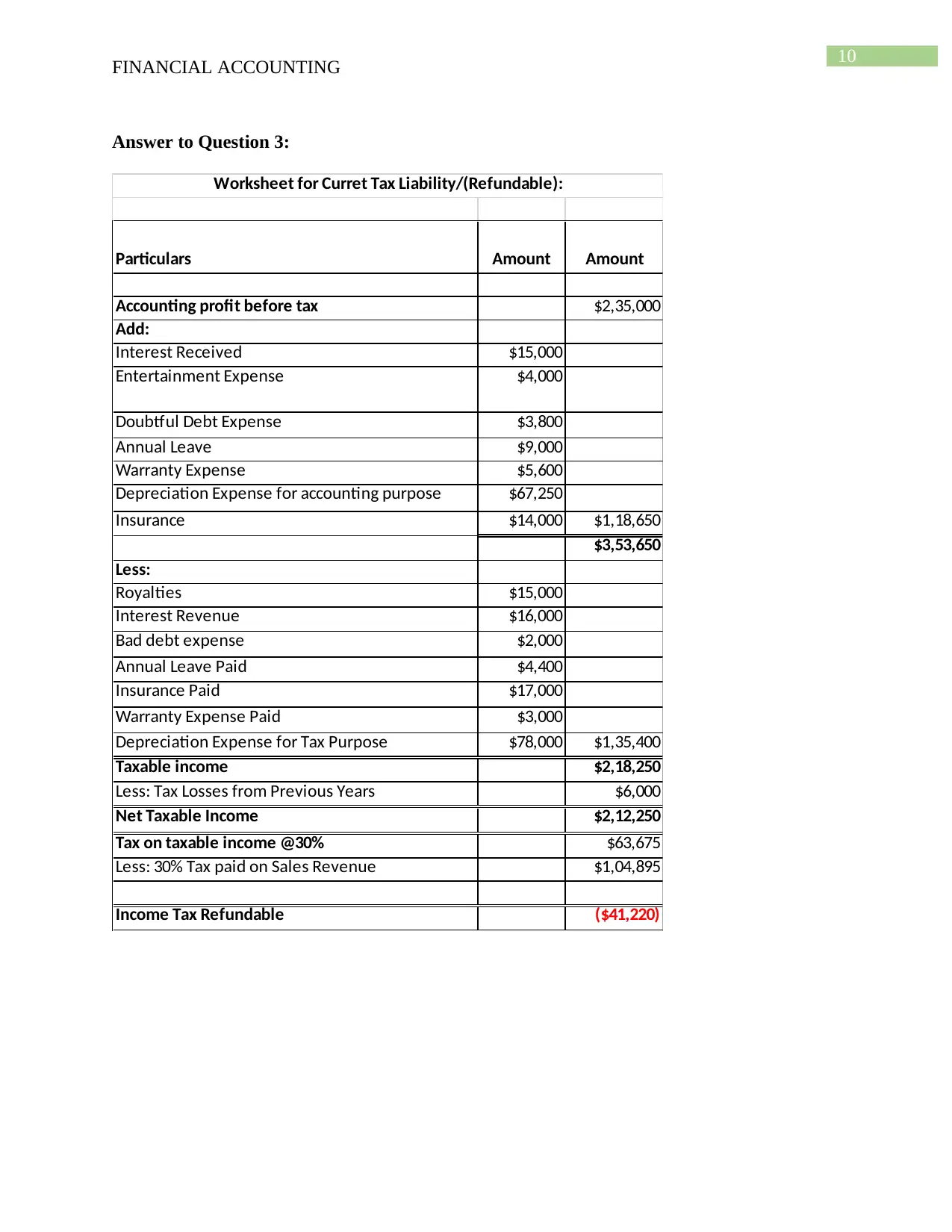

Answer to Question 3:

Particulars Amount Amount

Accounting profit before tax $2,35,000

Add:

Interest Received $15,000

Entertainment Expense $4,000

Doubtful Debt Expense $3,800

Annual Leave $9,000

Warranty Expense $5,600

Depreciation Expense for accounting purpose $67,250

Insurance $14,000 $1,18,650

$3,53,650

Less:

Royalties $15,000

Interest Revenue $16,000

Bad debt expense $2,000

Annual Leave Paid $4,400

Insurance Paid $17,000

Warranty Expense Paid $3,000

Depreciation Expense for Tax Purpose $78,000 $1,35,400

Taxable income $2,18,250

Less: Tax Losses from Previous Years $6,000

Net Taxable Income $2,12,250

Tax on taxable income @30% $63,675

Less: 30% Tax paid on Sales Revenue $1,04,895

Income Tax Refundable ($41,220)

Worksheet for Curret Tax Liability/(Refundable):

FINANCIAL ACCOUNTING

Answer to Question 3:

Particulars Amount Amount

Accounting profit before tax $2,35,000

Add:

Interest Received $15,000

Entertainment Expense $4,000

Doubtful Debt Expense $3,800

Annual Leave $9,000

Warranty Expense $5,600

Depreciation Expense for accounting purpose $67,250

Insurance $14,000 $1,18,650

$3,53,650

Less:

Royalties $15,000

Interest Revenue $16,000

Bad debt expense $2,000

Annual Leave Paid $4,400

Insurance Paid $17,000

Warranty Expense Paid $3,000

Depreciation Expense for Tax Purpose $78,000 $1,35,400

Taxable income $2,18,250

Less: Tax Losses from Previous Years $6,000

Net Taxable Income $2,12,250

Tax on taxable income @30% $63,675

Less: 30% Tax paid on Sales Revenue $1,04,895

Income Tax Refundable ($41,220)

Worksheet for Curret Tax Liability/(Refundable):

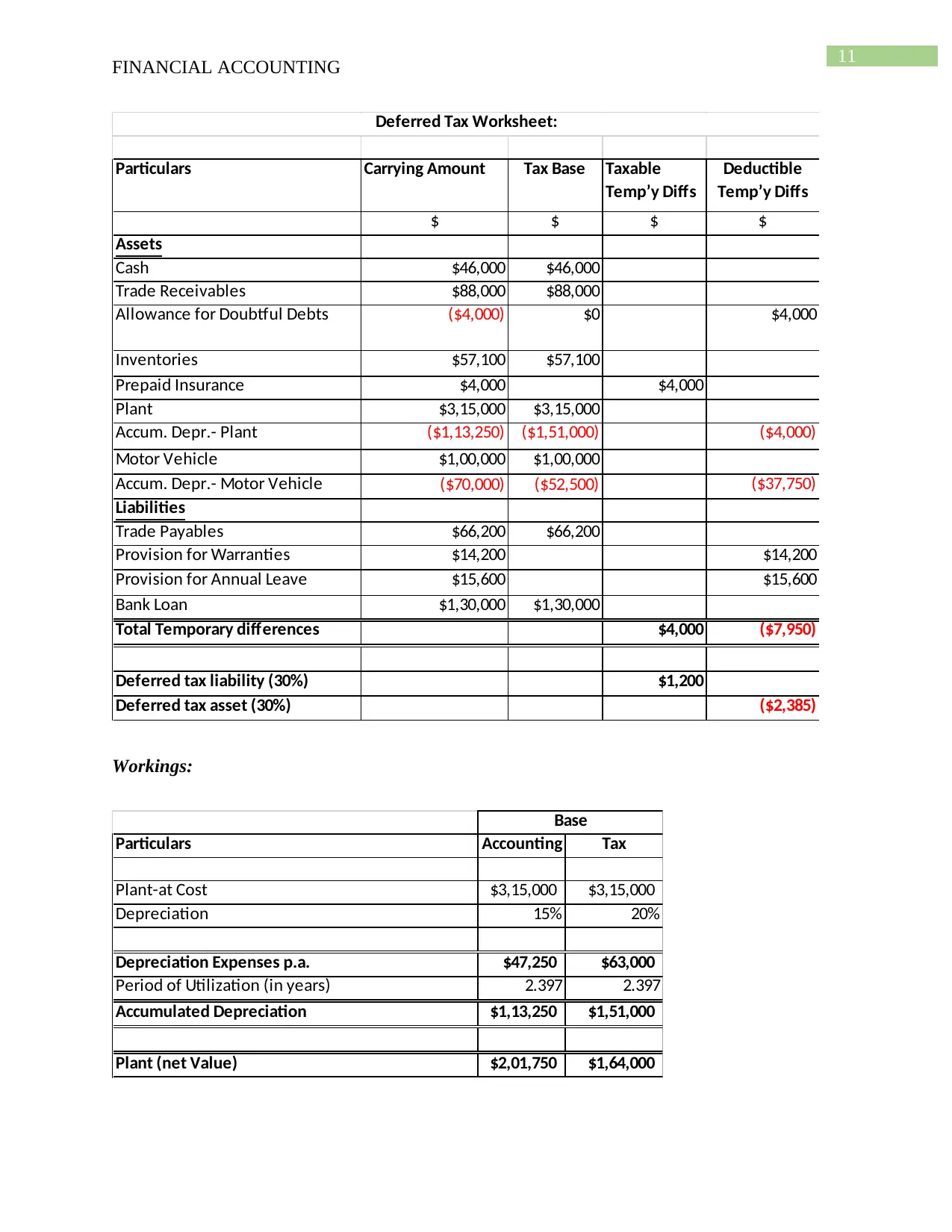

11

FINANCIAL ACCOUNTING

Particulars Carrying Amount Tax Base Taxable

Temp’y Diffs

Deductible

Temp’y Diffs

$ $ $ $

Assets

Cash $46,000 $46,000

Trade Receivables $88,000 $88,000

Allowance for Doubtful Debts ($4,000) $0 $4,000

Inventories $57,100 $57,100

Prepaid Insurance $4,000 $4,000

Plant $3,15,000 $3,15,000

Accum. Depr.- Plant ($1,13,250) ($1,51,000) ($4,000)

Motor Vehicle $1,00,000 $1,00,000

Accum. Depr.- Motor Vehicle ($70,000) ($52,500) ($37,750)

Liabilities

Trade Payables $66,200 $66,200

Provision for Warranties $14,200 $14,200

Provision for Annual Leave $15,600 $15,600

Bank Loan $1,30,000 $1,30,000

Total Temporary differences $4,000 ($7,950)

Deferred tax liability (30%) $1,200

Deferred tax asset (30%) ($2,385)

Deferred Tax Worksheet:

Workings:

Particulars Accounting Tax

Plant-at Cost $3,15,000 $3,15,000

Depreciation 15% 20%

Depreciation Expenses p.a. $47,250 $63,000

Period of Utilization (in years) 2.397 2.397

Accumulated Depreciation $1,13,250 $1,51,000

Plant (net Value) $2,01,750 $1,64,000

Base

FINANCIAL ACCOUNTING

Particulars Carrying Amount Tax Base Taxable

Temp’y Diffs

Deductible

Temp’y Diffs

$ $ $ $

Assets

Cash $46,000 $46,000

Trade Receivables $88,000 $88,000

Allowance for Doubtful Debts ($4,000) $0 $4,000

Inventories $57,100 $57,100

Prepaid Insurance $4,000 $4,000

Plant $3,15,000 $3,15,000

Accum. Depr.- Plant ($1,13,250) ($1,51,000) ($4,000)

Motor Vehicle $1,00,000 $1,00,000

Accum. Depr.- Motor Vehicle ($70,000) ($52,500) ($37,750)

Liabilities

Trade Payables $66,200 $66,200

Provision for Warranties $14,200 $14,200

Provision for Annual Leave $15,600 $15,600

Bank Loan $1,30,000 $1,30,000

Total Temporary differences $4,000 ($7,950)

Deferred tax liability (30%) $1,200

Deferred tax asset (30%) ($2,385)

Deferred Tax Worksheet:

Workings:

Particulars Accounting Tax

Plant-at Cost $3,15,000 $3,15,000

Depreciation 15% 20%

Depreciation Expenses p.a. $47,250 $63,000

Period of Utilization (in years) 2.397 2.397

Accumulated Depreciation $1,13,250 $1,51,000

Plant (net Value) $2,01,750 $1,64,000

Base

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.