Management Accounting Report for Excite Entertainment Ltd: Analysis

VerifiedAdded on 2021/01/02

|18

|5737

|68

Report

AI Summary

This report provides a comprehensive analysis of management accounting principles and their application within Excite Entertainment Ltd. It begins by differentiating between financial and management accounting, followed by a detailed exploration of various management accounting systems, including inventory management and cost accounting systems. The report then examines different management accounting reporting methods, such as budget reports, performance reports, and job costing reports, highlighting their significance in the company's operations. The integration of management accounting systems and reporting is discussed, emphasizing how these elements enhance the company's efficiency and performance. Furthermore, the report includes the preparation of an income statement using both marginal and absorption costing methods. It analyzes the benefits and limitations of planning tools used for budgetary control, and explores the application of management accounting systems in solving financial problems, including the use of CVP analysis. The report aims to provide valuable insights into how management accounting can support strategic decision-making and improve financial outcomes within Excite Entertainment Ltd.

Management Accounting

report for Excite

Entertainment Ltd

report for Excite

Entertainment Ltd

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

LO 1................................................................................................................................................. 3

P1 Management accounting and types of management accounting system...............................3

P2 Different methods used for management accounting reporting.............................................5

M1 & D1 Integration of management accounting system and management accounting

reporting...................................................................................................................................... 6

LO 2 ................................................................................................................................................ 7

P3 Calculation to prepare income statement using marginal and absorption costing.................7

M2 & D2 Application of management techniques in preparation of financial reporting

documents................................................................................................................................... 9

LO 3............................................................................................................................................... 10

P4. Explaining the benefits and the limitations of various planning tools that are used for the

budgetary control...................................................................................................................... 10

M3. Analysing the applications and uses of several planning tools in formulating and

forecasting the budget. .............................................................................................................12

LO 4............................................................................................................................................... 13

P5 & M4 Adaptation of management accounting systems to solve financial problems in

different organisations...............................................................................................................13

CVP analysis............................................................................................................................. 15

INTRODUCTION...........................................................................................................................3

LO 1................................................................................................................................................. 3

P1 Management accounting and types of management accounting system...............................3

P2 Different methods used for management accounting reporting.............................................5

M1 & D1 Integration of management accounting system and management accounting

reporting...................................................................................................................................... 6

LO 2 ................................................................................................................................................ 7

P3 Calculation to prepare income statement using marginal and absorption costing.................7

M2 & D2 Application of management techniques in preparation of financial reporting

documents................................................................................................................................... 9

LO 3............................................................................................................................................... 10

P4. Explaining the benefits and the limitations of various planning tools that are used for the

budgetary control...................................................................................................................... 10

M3. Analysing the applications and uses of several planning tools in formulating and

forecasting the budget. .............................................................................................................12

LO 4............................................................................................................................................... 13

P5 & M4 Adaptation of management accounting systems to solve financial problems in

different organisations...............................................................................................................13

CVP analysis............................................................................................................................. 15

INTRODUCTION

Managerial accounting is that branch of accounting which helps the managers of the

company in taking various decisions like preparation of budgets, making policies, changing

procedures etc. of the company to maintain its profitability and sustainability. The report will

talk about difference between financial and management accounting along with describing

different management accounting systems. With systems the report depicts various types of

management accounting reporting along with its application in Excite limited. This company

deals in event planning of various functions including providing different kind of props and

decoration. Moreover, the report will analyse the advantages and disadvantages of different

planning tools which are used to control the budget of the company. At last the report will show

various performance indicators which will help the company in solving its financial problems.

LO 1

P1 Management accounting and types of management accounting system

The combination of two words which is management and accounting means study of

accounting with the perspective of managers. It helps the management of the company in

formulating policies, appreciating effectiveness, and making decisions for the betterment of the

organization. It helps the management to coordinate and control the operations of the business by

making budgets for the company. The tools of management accounting like standard costing and

budgetary tool helps in controlling performance (Hopper, 2016).

Management accounting is different from financial accounting in many ways as financial

accounting records and summarize financial transactions of the company whereas management

accounting helps in taking effective decisions of the company. Financial accounting shows

accurate and fair picture of financial transactions whereas management accounting helps in

taking steps and strategize. Financial accounting deals with quantitative aspect whereas the other

one deal with both the aspects, qualitative and quantitative aspect. It is compulsory to do

financial accounting whereas management accounting has no such requirement (Zhang and et.al,

2019). Financial accounting prepares financial statement that are for stakeholders and investors

of the company whereas management accounting is only for management.

The different types of management accounting systems are:

Inventory management system – Inventory management system helps the company in

tracking entire supply chain of the business or the part of the business in which it operates. The

Managerial accounting is that branch of accounting which helps the managers of the

company in taking various decisions like preparation of budgets, making policies, changing

procedures etc. of the company to maintain its profitability and sustainability. The report will

talk about difference between financial and management accounting along with describing

different management accounting systems. With systems the report depicts various types of

management accounting reporting along with its application in Excite limited. This company

deals in event planning of various functions including providing different kind of props and

decoration. Moreover, the report will analyse the advantages and disadvantages of different

planning tools which are used to control the budget of the company. At last the report will show

various performance indicators which will help the company in solving its financial problems.

LO 1

P1 Management accounting and types of management accounting system

The combination of two words which is management and accounting means study of

accounting with the perspective of managers. It helps the management of the company in

formulating policies, appreciating effectiveness, and making decisions for the betterment of the

organization. It helps the management to coordinate and control the operations of the business by

making budgets for the company. The tools of management accounting like standard costing and

budgetary tool helps in controlling performance (Hopper, 2016).

Management accounting is different from financial accounting in many ways as financial

accounting records and summarize financial transactions of the company whereas management

accounting helps in taking effective decisions of the company. Financial accounting shows

accurate and fair picture of financial transactions whereas management accounting helps in

taking steps and strategize. Financial accounting deals with quantitative aspect whereas the other

one deal with both the aspects, qualitative and quantitative aspect. It is compulsory to do

financial accounting whereas management accounting has no such requirement (Zhang and et.al,

2019). Financial accounting prepares financial statement that are for stakeholders and investors

of the company whereas management accounting is only for management.

The different types of management accounting systems are:

Inventory management system – Inventory management system helps the company in

tracking entire supply chain of the business or the part of the business in which it operates. The

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

inventory management system covers everything from production to retail, warehousing to

shipping and all the movement of stock. It helps Excite limited in recording each new and

returned product as it leaves and enters in the warehouse. It uses variety of data to keep the track

of the goods as they move through process, lot numbers, cost of goods and the dates when they

move through the process which maintains the inventory in Excite limited (Panchenko, 2018).

The system uses different types of methodologies like Just in time, ABC analysis and stock

review which focuses on minimizing cost of inventory along with the ability to provide to

customer the products in timely manner. It consists of two methods which are:

FIFO – First in and first out assumes that good purchased at first will be sold at first too

LIFO – Last in first out assumes that goods purchase at last are the first goods sold.

Cost accounting system – Cost accounting system is the framework used by firms which

helps the company in estimating the cost of the products for analysis of profitability, valuation of

inventory and controlling cost. It estimates accurate cost of products which is important for

profitable operations in Excite limited. This helps the company in knowing its profitable and non

profitable products (Drake, 2016). The product costing system helps in estimating closing value

of inventory materials, work in progress and inventory of finished goods which helps in making

financial statements of the company. The cost accounting system consists of direct and indirect

costing

Direct costing – A direct cost can be assigned to specific cost objects which can be

product or a service. Direct cost included cost of labor, materials, wages etc. direct cost varies

and hence tend to be variable cost.

Indirect costing – This cost are assigned to do cost analysis. These costs are part of

corporate overhead which exist even when the specific product or service is not created. These

are more likely to be fixed cost which includes salaries, quality control etc.

Job order costing system – It is a system that assign and collect manufacturing cost of

an individual unit of output. This method is used by Excite limited as items and services

produced by the company are different from each other and have different cost. The jobs costing

system needs information on the direct materials, labor and overheads. Once the job has been

completed by the company, the job costing system may close down. Job costing system contains

many specialized rules but are not applicable to all the jobs. The job order costing system

consists of Job order costing and process costing.

shipping and all the movement of stock. It helps Excite limited in recording each new and

returned product as it leaves and enters in the warehouse. It uses variety of data to keep the track

of the goods as they move through process, lot numbers, cost of goods and the dates when they

move through the process which maintains the inventory in Excite limited (Panchenko, 2018).

The system uses different types of methodologies like Just in time, ABC analysis and stock

review which focuses on minimizing cost of inventory along with the ability to provide to

customer the products in timely manner. It consists of two methods which are:

FIFO – First in and first out assumes that good purchased at first will be sold at first too

LIFO – Last in first out assumes that goods purchase at last are the first goods sold.

Cost accounting system – Cost accounting system is the framework used by firms which

helps the company in estimating the cost of the products for analysis of profitability, valuation of

inventory and controlling cost. It estimates accurate cost of products which is important for

profitable operations in Excite limited. This helps the company in knowing its profitable and non

profitable products (Drake, 2016). The product costing system helps in estimating closing value

of inventory materials, work in progress and inventory of finished goods which helps in making

financial statements of the company. The cost accounting system consists of direct and indirect

costing

Direct costing – A direct cost can be assigned to specific cost objects which can be

product or a service. Direct cost included cost of labor, materials, wages etc. direct cost varies

and hence tend to be variable cost.

Indirect costing – This cost are assigned to do cost analysis. These costs are part of

corporate overhead which exist even when the specific product or service is not created. These

are more likely to be fixed cost which includes salaries, quality control etc.

Job order costing system – It is a system that assign and collect manufacturing cost of

an individual unit of output. This method is used by Excite limited as items and services

produced by the company are different from each other and have different cost. The jobs costing

system needs information on the direct materials, labor and overheads. Once the job has been

completed by the company, the job costing system may close down. Job costing system contains

many specialized rules but are not applicable to all the jobs. The job order costing system

consists of Job order costing and process costing.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Job order costing – It gathers all the cost related to manufacturing for each job

separately. The firms that are engaged in production of products that are unique or provide

special services like Excite limited which organize events opt for job costing system as it tells the

company about which area of its is more profitable.

Process costing – It collects manufacturing cost for each process. It is suitable for the

product whose process of production consists of different departments and the cost flow between

them.

There are some situations where company uses both types of costing which is called

hybrid cost accounting system

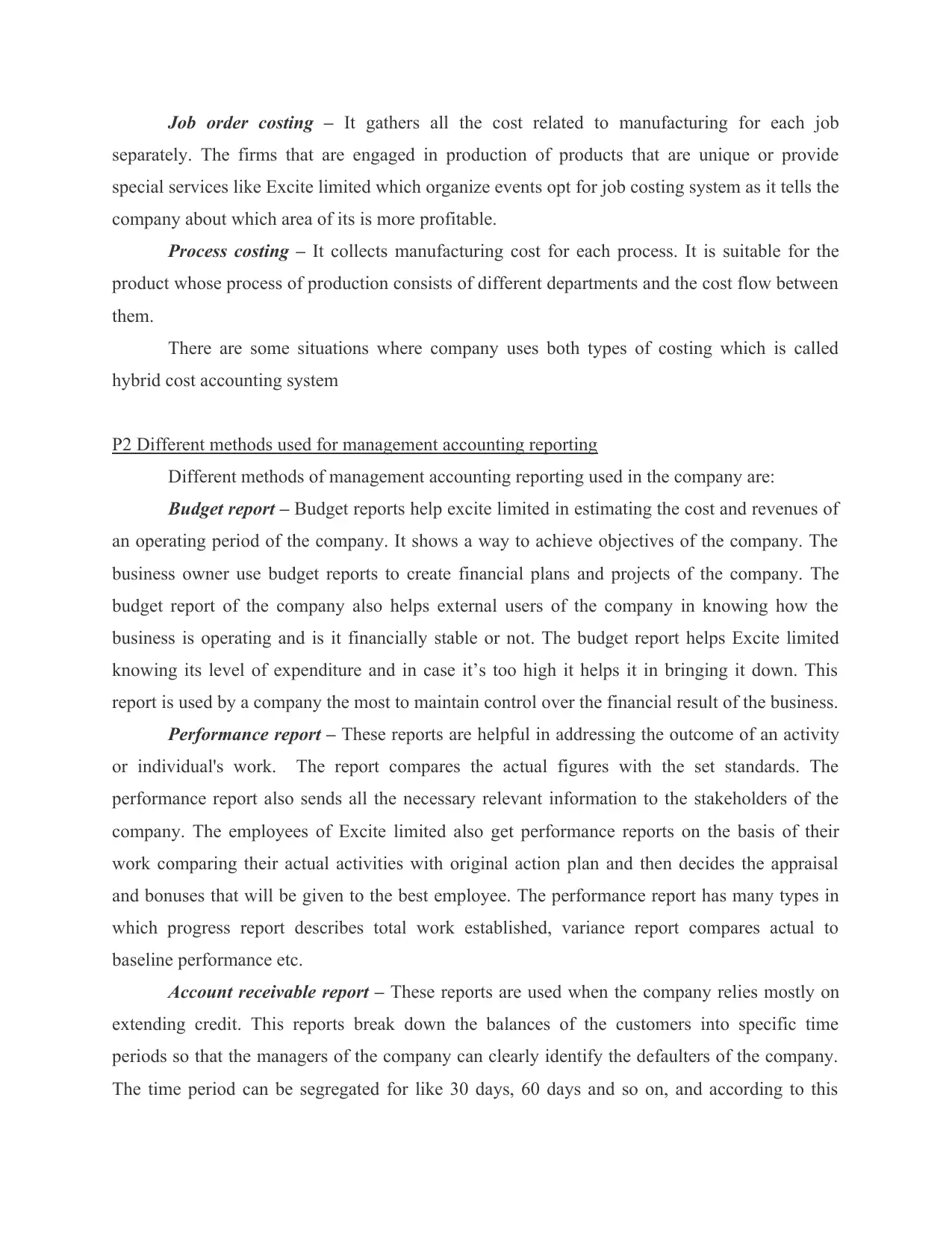

P2 Different methods used for management accounting reporting

Different methods of management accounting reporting used in the company are:

Budget report – Budget reports help excite limited in estimating the cost and revenues of

an operating period of the company. It shows a way to achieve objectives of the company. The

business owner use budget reports to create financial plans and projects of the company. The

budget report of the company also helps external users of the company in knowing how the

business is operating and is it financially stable or not. The budget report helps Excite limited

knowing its level of expenditure and in case it’s too high it helps it in bringing it down. This

report is used by a company the most to maintain control over the financial result of the business.

Performance report – These reports are helpful in addressing the outcome of an activity

or individual's work. The report compares the actual figures with the set standards. The

performance report also sends all the necessary relevant information to the stakeholders of the

company. The employees of Excite limited also get performance reports on the basis of their

work comparing their actual activities with original action plan and then decides the appraisal

and bonuses that will be given to the best employee. The performance report has many types in

which progress report describes total work established, variance report compares actual to

baseline performance etc.

Account receivable report – These reports are used when the company relies mostly on

extending credit. This reports break down the balances of the customers into specific time

periods so that the managers of the company can clearly identify the defaulters of the company.

The time period can be segregated for like 30 days, 60 days and so on, and according to this

separately. The firms that are engaged in production of products that are unique or provide

special services like Excite limited which organize events opt for job costing system as it tells the

company about which area of its is more profitable.

Process costing – It collects manufacturing cost for each process. It is suitable for the

product whose process of production consists of different departments and the cost flow between

them.

There are some situations where company uses both types of costing which is called

hybrid cost accounting system

P2 Different methods used for management accounting reporting

Different methods of management accounting reporting used in the company are:

Budget report – Budget reports help excite limited in estimating the cost and revenues of

an operating period of the company. It shows a way to achieve objectives of the company. The

business owner use budget reports to create financial plans and projects of the company. The

budget report of the company also helps external users of the company in knowing how the

business is operating and is it financially stable or not. The budget report helps Excite limited

knowing its level of expenditure and in case it’s too high it helps it in bringing it down. This

report is used by a company the most to maintain control over the financial result of the business.

Performance report – These reports are helpful in addressing the outcome of an activity

or individual's work. The report compares the actual figures with the set standards. The

performance report also sends all the necessary relevant information to the stakeholders of the

company. The employees of Excite limited also get performance reports on the basis of their

work comparing their actual activities with original action plan and then decides the appraisal

and bonuses that will be given to the best employee. The performance report has many types in

which progress report describes total work established, variance report compares actual to

baseline performance etc.

Account receivable report – These reports are used when the company relies mostly on

extending credit. This reports break down the balances of the customers into specific time

periods so that the managers of the company can clearly identify the defaulters of the company.

The time period can be segregated for like 30 days, 60 days and so on, and according to this

separation the management of Excite limited can take the decision of tighten its credit policies so

that the cash flow of the company do not get affected and liquidity of the company can be

maintained.

Job costing report – Job cost reports are important for Excite limited as it tracks the

ongoing cost of the project. It also adds up the cost after the job is done which helps the company

in identifying issues to avoid when starting new job. It helps the company in knowing low profit

month was the result of which job and can identify the project that continuously performs above

or below budget. Proper job costing report and can be made by using good software and it takes

persistence to make such reports.

The information presented in these reports need to be accurate as many decisions of

mangers depends on the authentication of these reports. The information presented in these

reports need to be relevant to the users as all internal as well as external users uses these reports

for investment decisions, lending decisions etc. therefore relevant information need to be

provided by such reports in concise manner. These reports also need to be updated in timely

manner so that the business does not suffer and manager can take important decision based on

these reports. These reports need to be concise, systematic with adequate and relevant

information and easy to understand to internal as well as external users.

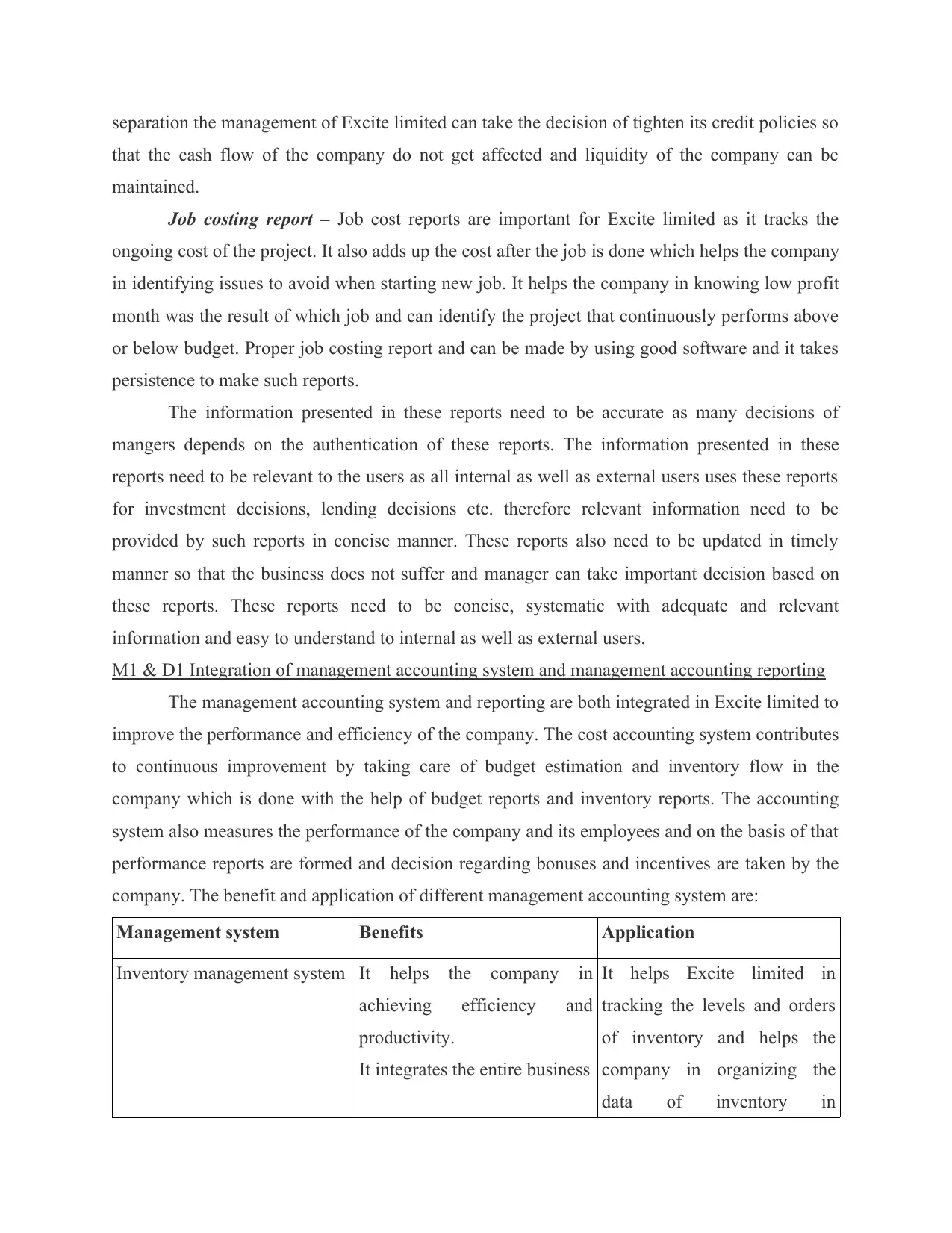

M1 & D1 Integration of management accounting system and management accounting reporting

The management accounting system and reporting are both integrated in Excite limited to

improve the performance and efficiency of the company. The cost accounting system contributes

to continuous improvement by taking care of budget estimation and inventory flow in the

company which is done with the help of budget reports and inventory reports. The accounting

system also measures the performance of the company and its employees and on the basis of that

performance reports are formed and decision regarding bonuses and incentives are taken by the

company. The benefit and application of different management accounting system are:

Management system Benefits Application

Inventory management system It helps the company in

achieving efficiency and

productivity.

It integrates the entire business

It helps Excite limited in

tracking the levels and orders

of inventory and helps the

company in organizing the

data of inventory in

that the cash flow of the company do not get affected and liquidity of the company can be

maintained.

Job costing report – Job cost reports are important for Excite limited as it tracks the

ongoing cost of the project. It also adds up the cost after the job is done which helps the company

in identifying issues to avoid when starting new job. It helps the company in knowing low profit

month was the result of which job and can identify the project that continuously performs above

or below budget. Proper job costing report and can be made by using good software and it takes

persistence to make such reports.

The information presented in these reports need to be accurate as many decisions of

mangers depends on the authentication of these reports. The information presented in these

reports need to be relevant to the users as all internal as well as external users uses these reports

for investment decisions, lending decisions etc. therefore relevant information need to be

provided by such reports in concise manner. These reports also need to be updated in timely

manner so that the business does not suffer and manager can take important decision based on

these reports. These reports need to be concise, systematic with adequate and relevant

information and easy to understand to internal as well as external users.

M1 & D1 Integration of management accounting system and management accounting reporting

The management accounting system and reporting are both integrated in Excite limited to

improve the performance and efficiency of the company. The cost accounting system contributes

to continuous improvement by taking care of budget estimation and inventory flow in the

company which is done with the help of budget reports and inventory reports. The accounting

system also measures the performance of the company and its employees and on the basis of that

performance reports are formed and decision regarding bonuses and incentives are taken by the

company. The benefit and application of different management accounting system are:

Management system Benefits Application

Inventory management system It helps the company in

achieving efficiency and

productivity.

It integrates the entire business

It helps Excite limited in

tracking the levels and orders

of inventory and helps the

company in organizing the

data of inventory in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

It maintains customer

satisfaction by providing

inventory on time.

spreadsheet.

Job order costing system It helps the company in

knowing expenses before

manufacturing the product.

It helps in finding profit of

each job separately.

It also helps in estimating the

cost of similar job by

providing details of past cost.

It helps Excite limited in

evaluating performance,

efficiency and profitability of

different events separately

which helps the management

of the company in knowing the

profitable and non profitable

area of the business.

Cost accounting system It helps in disclosure of

profitable and unprofitable

activities.

It gives guidance for future

production policies.

This system helps Excite

limited in making various

budgets which shows the cost,

profit, production and also

efficiency of workers. It helps

in keeping a positive check on

misleading activities in the

business.

LO 2

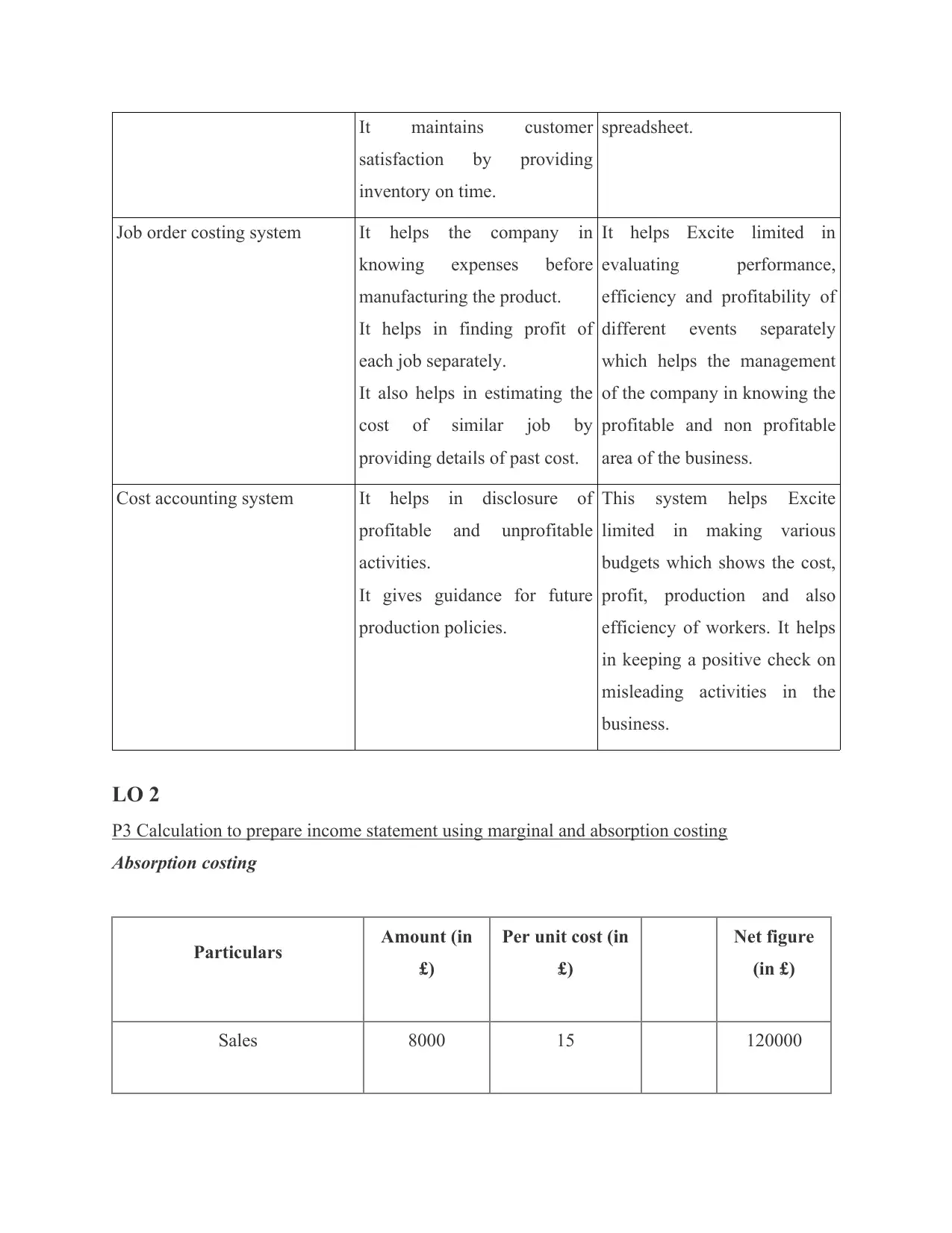

P3 Calculation to prepare income statement using marginal and absorption costing

Absorption costing

Particulars Amount (in

£)

Per unit cost (in

£)

Net figure

(in £)

Sales 8000 15 120000

satisfaction by providing

inventory on time.

spreadsheet.

Job order costing system It helps the company in

knowing expenses before

manufacturing the product.

It helps in finding profit of

each job separately.

It also helps in estimating the

cost of similar job by

providing details of past cost.

It helps Excite limited in

evaluating performance,

efficiency and profitability of

different events separately

which helps the management

of the company in knowing the

profitable and non profitable

area of the business.

Cost accounting system It helps in disclosure of

profitable and unprofitable

activities.

It gives guidance for future

production policies.

This system helps Excite

limited in making various

budgets which shows the cost,

profit, production and also

efficiency of workers. It helps

in keeping a positive check on

misleading activities in the

business.

LO 2

P3 Calculation to prepare income statement using marginal and absorption costing

Absorption costing

Particulars Amount (in

£)

Per unit cost (in

£)

Net figure

(in £)

Sales 8000 15 120000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Opening stock 500 10 5000

production 10000 10 100000

Closing stock 2500 10 25000

Cost of goods sold

(Opening stock + purchase –

closing stock) 80000

Net profit 40000

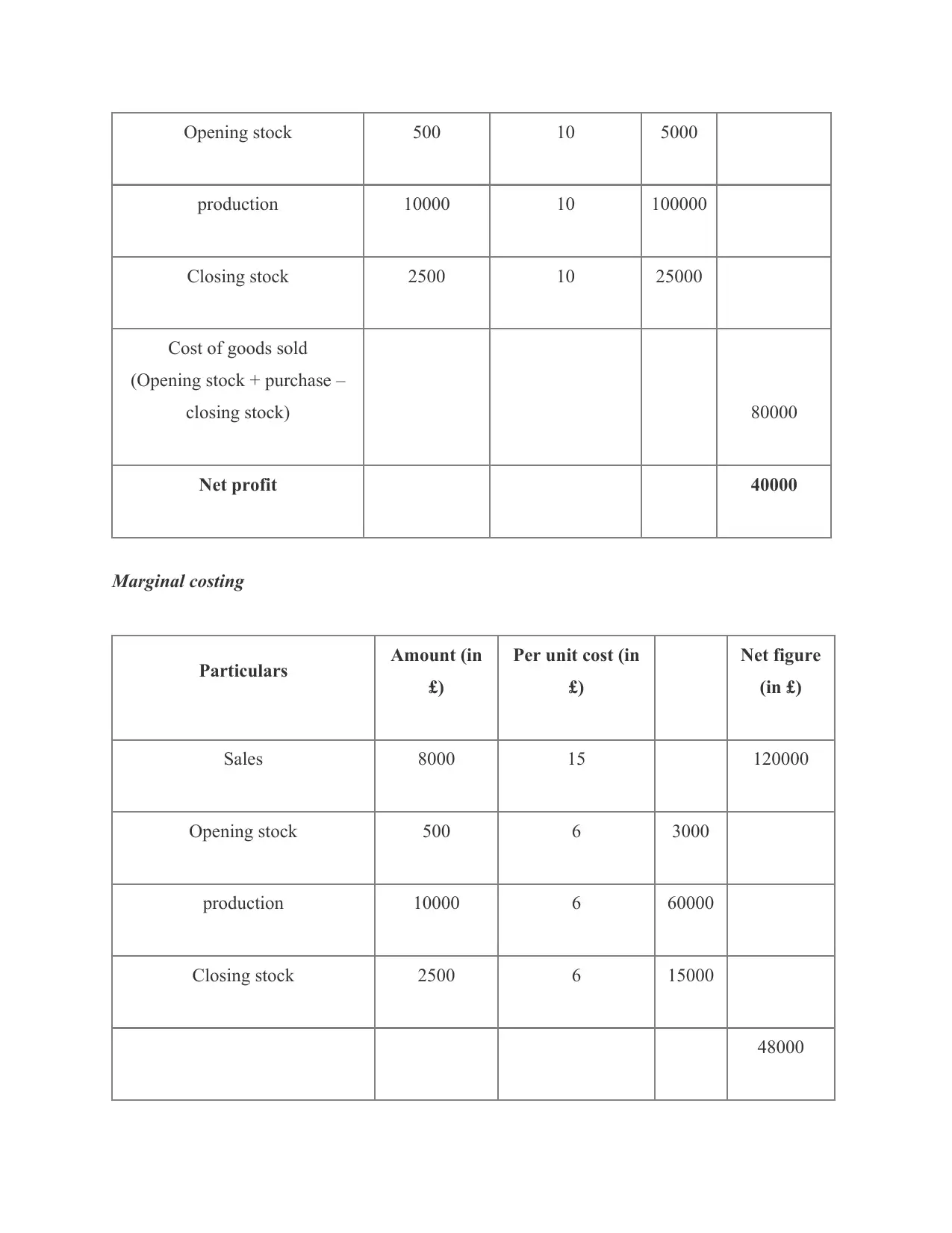

Marginal costing

Particulars Amount (in

£)

Per unit cost (in

£)

Net figure

(in £)

Sales 8000 15 120000

Opening stock 500 6 3000

production 10000 6 60000

Closing stock 2500 6 15000

48000

production 10000 10 100000

Closing stock 2500 10 25000

Cost of goods sold

(Opening stock + purchase –

closing stock) 80000

Net profit 40000

Marginal costing

Particulars Amount (in

£)

Per unit cost (in

£)

Net figure

(in £)

Sales 8000 15 120000

Opening stock 500 6 3000

production 10000 6 60000

Closing stock 2500 6 15000

48000

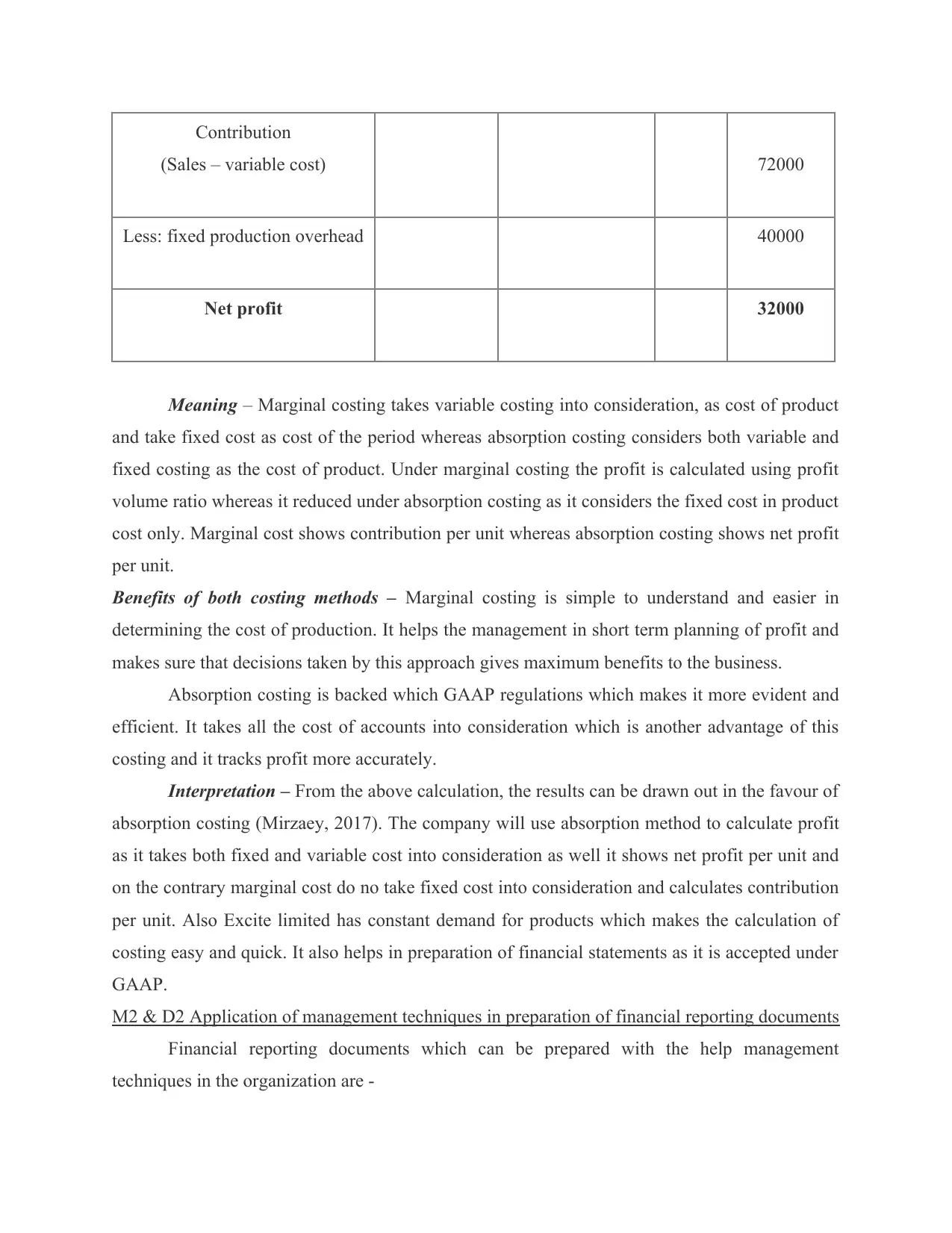

Contribution

(Sales – variable cost) 72000

Less: fixed production overhead 40000

Net profit 32000

Meaning – Marginal costing takes variable costing into consideration, as cost of product

and take fixed cost as cost of the period whereas absorption costing considers both variable and

fixed costing as the cost of product. Under marginal costing the profit is calculated using profit

volume ratio whereas it reduced under absorption costing as it considers the fixed cost in product

cost only. Marginal cost shows contribution per unit whereas absorption costing shows net profit

per unit.

Benefits of both costing methods – Marginal costing is simple to understand and easier in

determining the cost of production. It helps the management in short term planning of profit and

makes sure that decisions taken by this approach gives maximum benefits to the business.

Absorption costing is backed which GAAP regulations which makes it more evident and

efficient. It takes all the cost of accounts into consideration which is another advantage of this

costing and it tracks profit more accurately.

Interpretation – From the above calculation, the results can be drawn out in the favour of

absorption costing (Mirzaey, 2017). The company will use absorption method to calculate profit

as it takes both fixed and variable cost into consideration as well it shows net profit per unit and

on the contrary marginal cost do no take fixed cost into consideration and calculates contribution

per unit. Also Excite limited has constant demand for products which makes the calculation of

costing easy and quick. It also helps in preparation of financial statements as it is accepted under

GAAP.

M2 & D2 Application of management techniques in preparation of financial reporting documents

Financial reporting documents which can be prepared with the help management

techniques in the organization are -

(Sales – variable cost) 72000

Less: fixed production overhead 40000

Net profit 32000

Meaning – Marginal costing takes variable costing into consideration, as cost of product

and take fixed cost as cost of the period whereas absorption costing considers both variable and

fixed costing as the cost of product. Under marginal costing the profit is calculated using profit

volume ratio whereas it reduced under absorption costing as it considers the fixed cost in product

cost only. Marginal cost shows contribution per unit whereas absorption costing shows net profit

per unit.

Benefits of both costing methods – Marginal costing is simple to understand and easier in

determining the cost of production. It helps the management in short term planning of profit and

makes sure that decisions taken by this approach gives maximum benefits to the business.

Absorption costing is backed which GAAP regulations which makes it more evident and

efficient. It takes all the cost of accounts into consideration which is another advantage of this

costing and it tracks profit more accurately.

Interpretation – From the above calculation, the results can be drawn out in the favour of

absorption costing (Mirzaey, 2017). The company will use absorption method to calculate profit

as it takes both fixed and variable cost into consideration as well it shows net profit per unit and

on the contrary marginal cost do no take fixed cost into consideration and calculates contribution

per unit. Also Excite limited has constant demand for products which makes the calculation of

costing easy and quick. It also helps in preparation of financial statements as it is accepted under

GAAP.

M2 & D2 Application of management techniques in preparation of financial reporting documents

Financial reporting documents which can be prepared with the help management

techniques in the organization are -

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

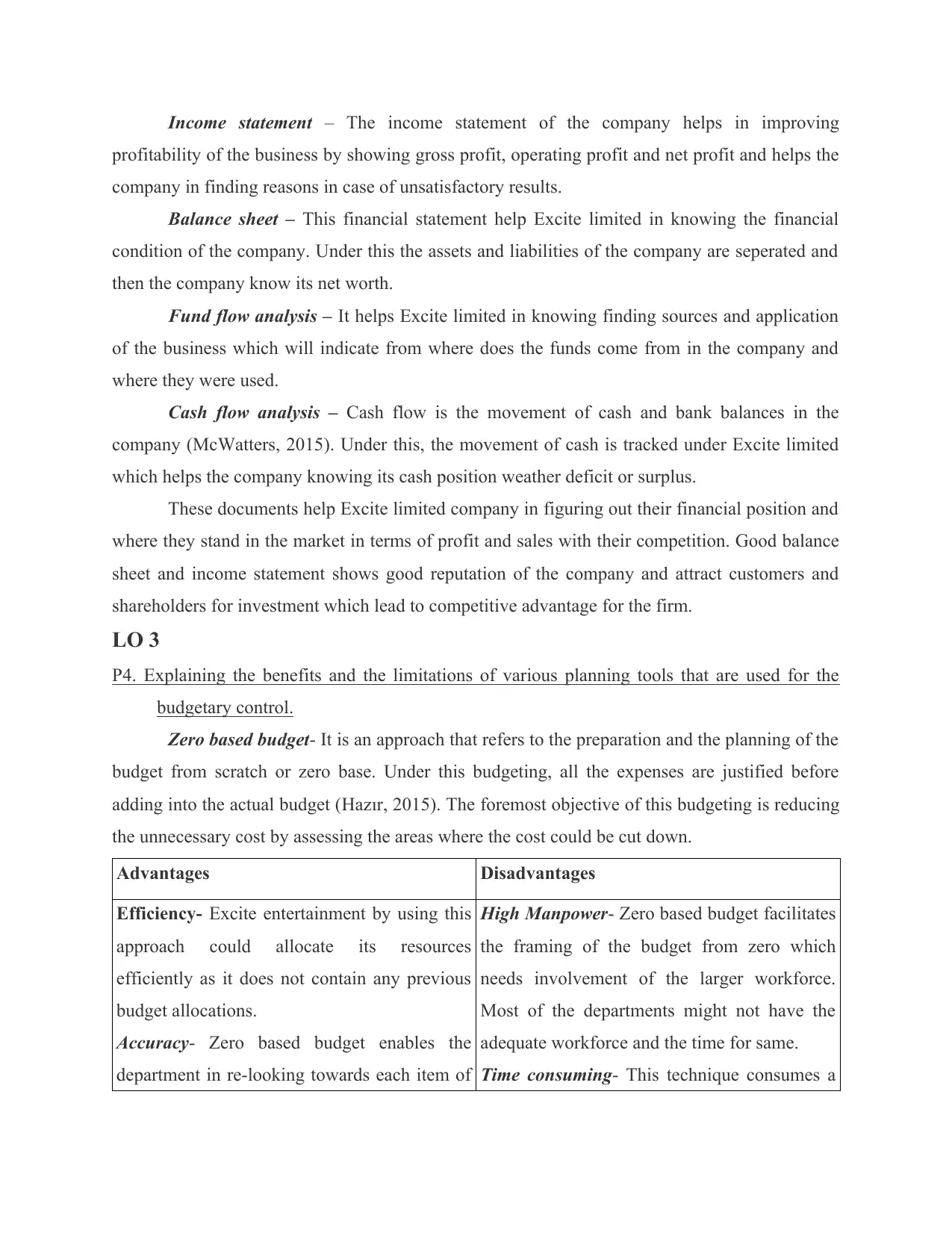

Income statement – The income statement of the company helps in improving

profitability of the business by showing gross profit, operating profit and net profit and helps the

company in finding reasons in case of unsatisfactory results.

Balance sheet – This financial statement help Excite limited in knowing the financial

condition of the company. Under this the assets and liabilities of the company are seperated and

then the company know its net worth.

Fund flow analysis – It helps Excite limited in knowing finding sources and application

of the business which will indicate from where does the funds come from in the company and

where they were used.

Cash flow analysis – Cash flow is the movement of cash and bank balances in the

company (McWatters, 2015). Under this, the movement of cash is tracked under Excite limited

which helps the company knowing its cash position weather deficit or surplus.

These documents help Excite limited company in figuring out their financial position and

where they stand in the market in terms of profit and sales with their competition. Good balance

sheet and income statement shows good reputation of the company and attract customers and

shareholders for investment which lead to competitive advantage for the firm.

LO 3

P4. Explaining the benefits and the limitations of various planning tools that are used for the

budgetary control.

Zero based budget- It is an approach that refers to the preparation and the planning of the

budget from scratch or zero base. Under this budgeting, all the expenses are justified before

adding into the actual budget (Hazır, 2015). The foremost objective of this budgeting is reducing

the unnecessary cost by assessing the areas where the cost could be cut down.

Advantages Disadvantages

Efficiency- Excite entertainment by using this

approach could allocate its resources

efficiently as it does not contain any previous

budget allocations.

Accuracy- Zero based budget enables the

department in re-looking towards each item of

High Manpower- Zero based budget facilitates

the framing of the budget from zero which

needs involvement of the larger workforce.

Most of the departments might not have the

adequate workforce and the time for same.

Time consuming- This technique consumes a

profitability of the business by showing gross profit, operating profit and net profit and helps the

company in finding reasons in case of unsatisfactory results.

Balance sheet – This financial statement help Excite limited in knowing the financial

condition of the company. Under this the assets and liabilities of the company are seperated and

then the company know its net worth.

Fund flow analysis – It helps Excite limited in knowing finding sources and application

of the business which will indicate from where does the funds come from in the company and

where they were used.

Cash flow analysis – Cash flow is the movement of cash and bank balances in the

company (McWatters, 2015). Under this, the movement of cash is tracked under Excite limited

which helps the company knowing its cash position weather deficit or surplus.

These documents help Excite limited company in figuring out their financial position and

where they stand in the market in terms of profit and sales with their competition. Good balance

sheet and income statement shows good reputation of the company and attract customers and

shareholders for investment which lead to competitive advantage for the firm.

LO 3

P4. Explaining the benefits and the limitations of various planning tools that are used for the

budgetary control.

Zero based budget- It is an approach that refers to the preparation and the planning of the

budget from scratch or zero base. Under this budgeting, all the expenses are justified before

adding into the actual budget (Hazır, 2015). The foremost objective of this budgeting is reducing

the unnecessary cost by assessing the areas where the cost could be cut down.

Advantages Disadvantages

Efficiency- Excite entertainment by using this

approach could allocate its resources

efficiently as it does not contain any previous

budget allocations.

Accuracy- Zero based budget enables the

department in re-looking towards each item of

High Manpower- Zero based budget facilitates

the framing of the budget from zero which

needs involvement of the larger workforce.

Most of the departments might not have the

adequate workforce and the time for same.

Time consuming- This technique consumes a

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

cash flow and evaluate the operation cost

(Arkorful and Abaidoo, 2015). This leads to

accuracy in the budget.

Budget inflation- As every expenses are

justified in the zero based budget which results

in overcoming the weakness that is present in

the incremental budget relating to the budget

inflation.

Reduction in irrelevant activities- Zero based

budget is an approach that provides in

determining the optimum opportunities and the

ways of operating the work in a cost effective

method. It eliminates the unproductive

activities from the business.

lot of time as each and every expenses has to

be identified every year from scratch.

Expensive tool- An explanation has to be given

for each line of the item and for all the cost

under this tool which is counted as the

problematic task and needs training for

mangers.

Incremental budget- It is the planning tool under which the budget is formulated on the basis of

the prior period budget with the incremental amounts entered in the new budget.

Advantages Disadvantages

Simplicity- Incremental budgeting is the

simplest method to understand. In comparison,

with the other methods of the budgeting, it is

the easiest method for putting it in the practice.

Gradual change- With this budgeting excite

entertainment can produce a stable budget

from one period to the other (Allegrini, and

et.al., 2015). This results in allowing the

gradual change within organization.

Avoid conflict- The companies that works

under several departments, chances of conflict

No incentives- Such the easiest method does

not facilitate the employees with any reason of

the creativity. They get no room for gaining the

incentives in respect of the innovation or with

any new idea.

Not adjust changes- Incremental budgeting is

based on an idea that the expenses will be

incurred same as they were occurring before in

the previous budget. Thus, they do not look for

changes.

Using or losing it- Most of the employees

(Arkorful and Abaidoo, 2015). This leads to

accuracy in the budget.

Budget inflation- As every expenses are

justified in the zero based budget which results

in overcoming the weakness that is present in

the incremental budget relating to the budget

inflation.

Reduction in irrelevant activities- Zero based

budget is an approach that provides in

determining the optimum opportunities and the

ways of operating the work in a cost effective

method. It eliminates the unproductive

activities from the business.

lot of time as each and every expenses has to

be identified every year from scratch.

Expensive tool- An explanation has to be given

for each line of the item and for all the cost

under this tool which is counted as the

problematic task and needs training for

mangers.

Incremental budget- It is the planning tool under which the budget is formulated on the basis of

the prior period budget with the incremental amounts entered in the new budget.

Advantages Disadvantages

Simplicity- Incremental budgeting is the

simplest method to understand. In comparison,

with the other methods of the budgeting, it is

the easiest method for putting it in the practice.

Gradual change- With this budgeting excite

entertainment can produce a stable budget

from one period to the other (Allegrini, and

et.al., 2015). This results in allowing the

gradual change within organization.

Avoid conflict- The companies that works

under several departments, chances of conflict

No incentives- Such the easiest method does

not facilitate the employees with any reason of

the creativity. They get no room for gaining the

incentives in respect of the innovation or with

any new idea.

Not adjust changes- Incremental budgeting is

based on an idea that the expenses will be

incurred same as they were occurring before in

the previous budget. Thus, they do not look for

changes.

Using or losing it- Most of the employees

between the different departments increases

due to the several budgets. By adopting this

budgeting method, it becomes easy for the

managers in keeping all the departments at the

same page which in avoid conflict between the

departments.

consider it as the use it or losing it system as

they know that the coming year budget will be

incremented on the basis of this year (Zhang

and et.al., 2019). Therefore, if the employees

do not spend for everything which has been

allocated them, they will not be having

sufficient money for working in the next year.

This encourages wastage in the environment.

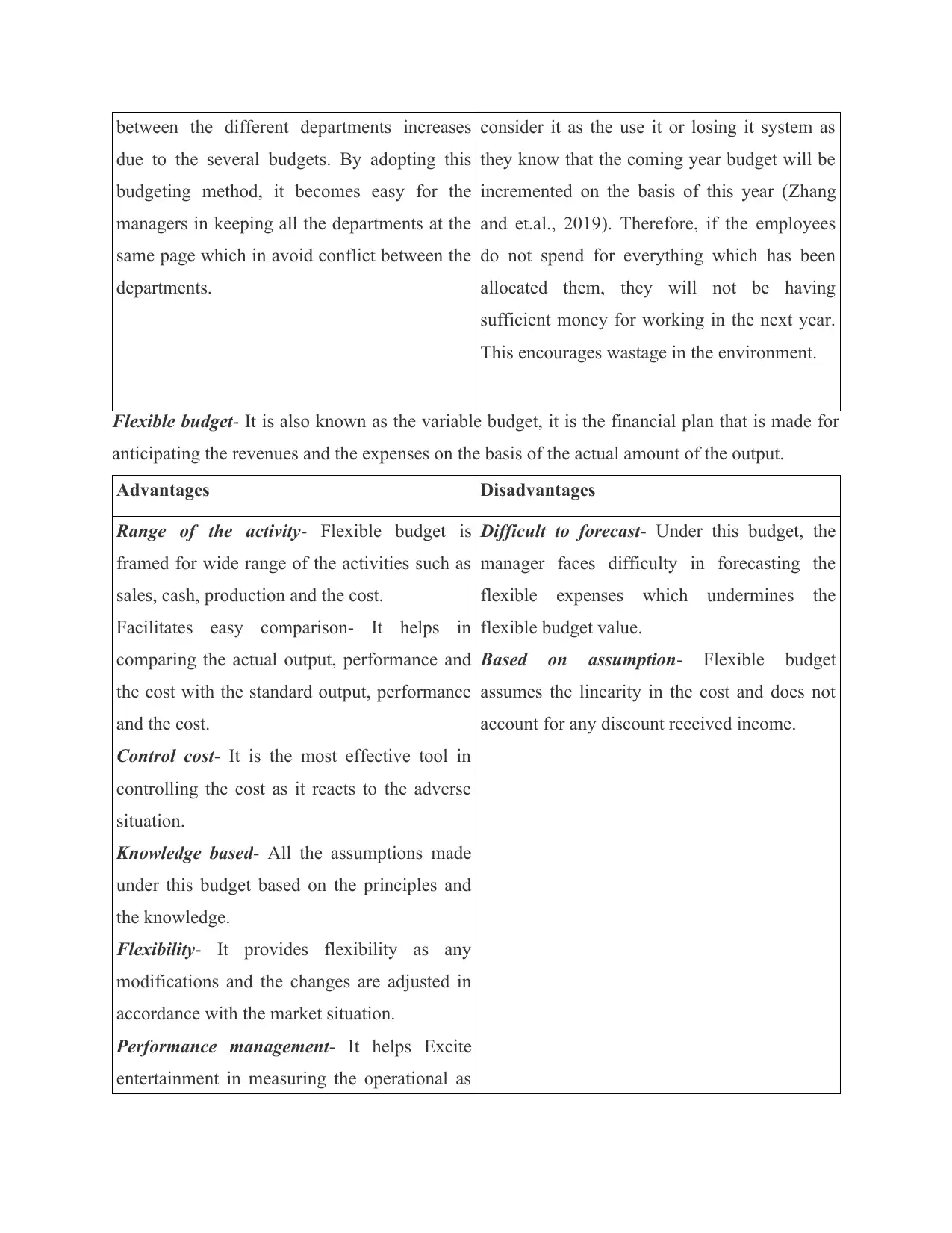

Flexible budget- It is also known as the variable budget, it is the financial plan that is made for

anticipating the revenues and the expenses on the basis of the actual amount of the output.

Advantages Disadvantages

Range of the activity- Flexible budget is

framed for wide range of the activities such as

sales, cash, production and the cost.

Facilitates easy comparison- It helps in

comparing the actual output, performance and

the cost with the standard output, performance

and the cost.

Control cost- It is the most effective tool in

controlling the cost as it reacts to the adverse

situation.

Knowledge based- All the assumptions made

under this budget based on the principles and

the knowledge.

Flexibility- It provides flexibility as any

modifications and the changes are adjusted in

accordance with the market situation.

Performance management- It helps Excite

entertainment in measuring the operational as

Difficult to forecast- Under this budget, the

manager faces difficulty in forecasting the

flexible expenses which undermines the

flexible budget value.

Based on assumption- Flexible budget

assumes the linearity in the cost and does not

account for any discount received income.

due to the several budgets. By adopting this

budgeting method, it becomes easy for the

managers in keeping all the departments at the

same page which in avoid conflict between the

departments.

consider it as the use it or losing it system as

they know that the coming year budget will be

incremented on the basis of this year (Zhang

and et.al., 2019). Therefore, if the employees

do not spend for everything which has been

allocated them, they will not be having

sufficient money for working in the next year.

This encourages wastage in the environment.

Flexible budget- It is also known as the variable budget, it is the financial plan that is made for

anticipating the revenues and the expenses on the basis of the actual amount of the output.

Advantages Disadvantages

Range of the activity- Flexible budget is

framed for wide range of the activities such as

sales, cash, production and the cost.

Facilitates easy comparison- It helps in

comparing the actual output, performance and

the cost with the standard output, performance

and the cost.

Control cost- It is the most effective tool in

controlling the cost as it reacts to the adverse

situation.

Knowledge based- All the assumptions made

under this budget based on the principles and

the knowledge.

Flexibility- It provides flexibility as any

modifications and the changes are adjusted in

accordance with the market situation.

Performance management- It helps Excite

entertainment in measuring the operational as

Difficult to forecast- Under this budget, the

manager faces difficulty in forecasting the

flexible expenses which undermines the

flexible budget value.

Based on assumption- Flexible budget

assumes the linearity in the cost and does not

account for any discount received income.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.