Accounting and Finance for Managers: Food Industry Performance Report

VerifiedAdded on 2022/12/29

|18

|3128

|45

Report

AI Summary

This report examines the application of accounting and finance principles within the food industry, focusing on three key organizations: Green Core Group plc, Premier Food plc, and Hilton Food Group plc. Section A provides an overview of the strategic business policies employed by each company, highlighting their objectives and approaches to market positioning. It then delves into a detailed evaluation of their financial performance using various financial ratios such as ROE, profit margins, and turnover ratios, comparing their performance over several years to assess trends and relative strengths. Section B addresses the sources of finance available to these companies, particularly focusing on external sources like equity and loans, and how these are utilized to manage their business operations. The analysis includes the calculation and interpretation of financial ratios to assess profitability, efficiency, and financial health, culminating in a final decision regarding investment opportunities. The report offers a comprehensive overview of financial management within the food industry, providing insights into strategic planning, financial analysis, and investment decision-making.

ACCOUNTING AND FINANCE FOR

MANAGERS

MANAGERS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

Section A.....................................................................................................................................3

Question 1...................................................................................................................................3

SECTION B.....................................................................................................................................8

Question 2...................................................................................................................................8

CONCLUSION................................................................................................................................1

REFERENCES................................................................................................................................2

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

Section A.....................................................................................................................................3

Question 1...................................................................................................................................3

SECTION B.....................................................................................................................................8

Question 2...................................................................................................................................8

CONCLUSION................................................................................................................................1

REFERENCES................................................................................................................................2

INTRODUCTION

Business organization to maintain record of their day to day transaction and represent

them in front of their internal and external users, use accounting and financial application. This

report has been formulated to define relevance of account and finance by evaluating performance

of three food industry organizations. Which incudes, Green core group plc, Premier food plc &

Hilton food group plc. This report showcase policies and strategies theses organization use for

run their business. In the second part of this report, essential elements and factors require to

collect sources of finance are define in effective and systematic way.

MAIN BODY

Section A

Question 1

a) Overview of strategic business policy used by Green core group plc, Premier food plc &

Hilton food group plc.

Green core group plc: This organization is consider as one of the most popular business

organization of UK which engaged in dealing with food products. This organization run business

as manufacturer, markets and disturber of food and convince food products.

Strategic objectives: Managers for attain their vision formulate future business objectives which

help in achieving their vision. Green Core focus on maintain top position in market area for this

purpose they use effective financial strategy. In order to achieve their business goals organization

focus on food, quality , process and their target market customers. This organization focus on

their long term goal by investing in portfolio for increase their retain business earnings.

Hilton food group plc: This organization is incorporated as multinational organization

which run its business as meat packing organization. However it spread its market share by

running business in providing food packaging services (Barari Nokashti, Banimahd and

Yaghoubnejad, 2018).

Strategic objective of this organization is generally based on spreading their market share

by innovate new business products in market. Managers in order to attract their business

customers focus in investing in long term businesses goals. Management department of Hilton

generally focus on build strong relation with small organizations and their rival business

companies. Which will beneficial to cut throat their competitors.

Business organization to maintain record of their day to day transaction and represent

them in front of their internal and external users, use accounting and financial application. This

report has been formulated to define relevance of account and finance by evaluating performance

of three food industry organizations. Which incudes, Green core group plc, Premier food plc &

Hilton food group plc. This report showcase policies and strategies theses organization use for

run their business. In the second part of this report, essential elements and factors require to

collect sources of finance are define in effective and systematic way.

MAIN BODY

Section A

Question 1

a) Overview of strategic business policy used by Green core group plc, Premier food plc &

Hilton food group plc.

Green core group plc: This organization is consider as one of the most popular business

organization of UK which engaged in dealing with food products. This organization run business

as manufacturer, markets and disturber of food and convince food products.

Strategic objectives: Managers for attain their vision formulate future business objectives which

help in achieving their vision. Green Core focus on maintain top position in market area for this

purpose they use effective financial strategy. In order to achieve their business goals organization

focus on food, quality , process and their target market customers. This organization focus on

their long term goal by investing in portfolio for increase their retain business earnings.

Hilton food group plc: This organization is incorporated as multinational organization

which run its business as meat packing organization. However it spread its market share by

running business in providing food packaging services (Barari Nokashti, Banimahd and

Yaghoubnejad, 2018).

Strategic objective of this organization is generally based on spreading their market share

by innovate new business products in market. Managers in order to attract their business

customers focus in investing in long term businesses goals. Management department of Hilton

generally focus on build strong relation with small organizations and their rival business

companies. Which will beneficial to cut throat their competitors.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Premier food plc: It is British multinational organization which engaged in

manufacturing and distribute sauce, ambient food , cake and offer quick meal services This

business entity to spread its market share deal with many multinational organization which

includes Tesco, Sainsbury and other super market and food manufacturing organizations.

Strategic objective of this organization is to generally focusing on maintain position of

organization in market place by effectively maintain quality of Premier Food Plc in market.

Their main focus is to attain their strategic business objective by offering healthy and nutritions

food products. Theses food products are helpful in attract customers of organization. They set

principle and choose those strategies which useful in influence customer for purchase food

products from branch of this organization (Appuhami, 2019).

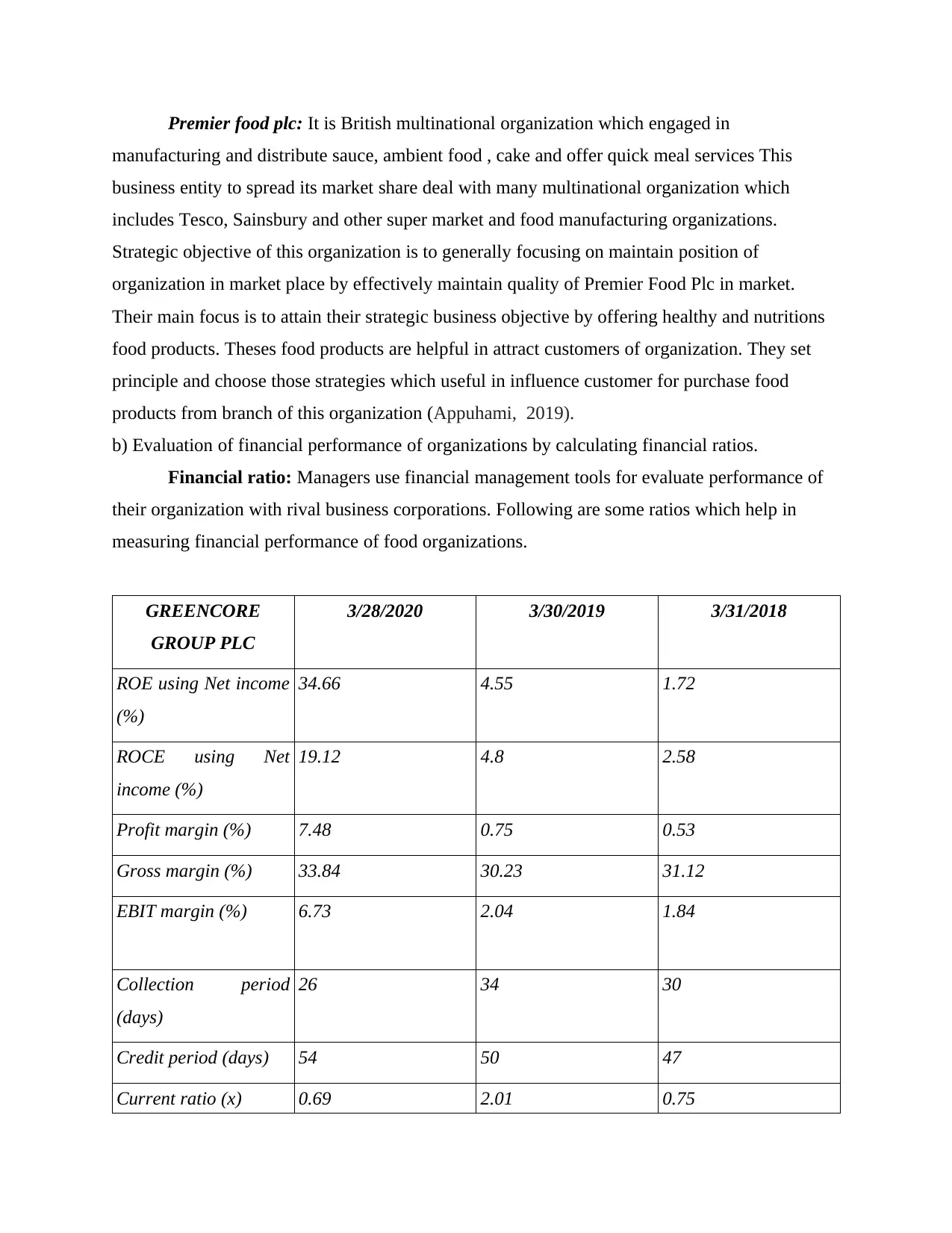

b) Evaluation of financial performance of organizations by calculating financial ratios.

Financial ratio: Managers use financial management tools for evaluate performance of

their organization with rival business corporations. Following are some ratios which help in

measuring financial performance of food organizations.

GREENCORE

GROUP PLC

3/28/2020 3/30/2019 3/31/2018

ROE using Net income

(%)

34.66 4.55 1.72

ROCE using Net

income (%)

19.12 4.8 2.58

Profit margin (%) 7.48 0.75 0.53

Gross margin (%) 33.84 30.23 31.12

EBIT margin (%) 6.73 2.04 1.84

Collection period

(days)

26 34 30

Credit period (days) 54 50 47

Current ratio (x) 0.69 2.01 0.75

manufacturing and distribute sauce, ambient food , cake and offer quick meal services This

business entity to spread its market share deal with many multinational organization which

includes Tesco, Sainsbury and other super market and food manufacturing organizations.

Strategic objective of this organization is to generally focusing on maintain position of

organization in market place by effectively maintain quality of Premier Food Plc in market.

Their main focus is to attain their strategic business objective by offering healthy and nutritions

food products. Theses food products are helpful in attract customers of organization. They set

principle and choose those strategies which useful in influence customer for purchase food

products from branch of this organization (Appuhami, 2019).

b) Evaluation of financial performance of organizations by calculating financial ratios.

Financial ratio: Managers use financial management tools for evaluate performance of

their organization with rival business corporations. Following are some ratios which help in

measuring financial performance of food organizations.

GREENCORE

GROUP PLC

3/28/2020 3/30/2019 3/31/2018

ROE using Net income

(%)

34.66 4.55 1.72

ROCE using Net

income (%)

19.12 4.8 2.58

Profit margin (%) 7.48 0.75 0.53

Gross margin (%) 33.84 30.23 31.12

EBIT margin (%) 6.73 2.04 1.84

Collection period

(days)

26 34 30

Credit period (days) 54 50 47

Current ratio (x) 0.69 2.01 0.75

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

GREENCORE

GROUP PLC

3/28/2020 3/30/2019 3/31/2018

Gearing (%) 156.67 90.47 119.39

Net assets turnover (x) 2.06 1.81 1.49

Non-financial ratios 3/28/2020 3/30/2019 3/31/2018

Shareholders’ funds

per employee

26 64 58

Total assets per

employee

100 173 167

HILTON FOOD

GROUP PLC

3/28/2020 3/30/2019 3/31/2018

ROE using Net income

(%)

17.23 17.95 15.2

ROCE using Net

income (%)

9.02 11.98 12.43

Profit margin (%) 2.38 2.63 2.52

Gross margin (%) 16.17 12.69 11.93

EBIT margin (%) 3.08 2.8 2.58

Collection period

(days)

37 31 30

Credit period (days) 54 50 47

Current ratio (x) 1.05 1.23 1.2

Gearing (%) 175.87 66.57 36.16

GROUP PLC

3/28/2020 3/30/2019 3/31/2018

Gearing (%) 156.67 90.47 119.39

Net assets turnover (x) 2.06 1.81 1.49

Non-financial ratios 3/28/2020 3/30/2019 3/31/2018

Shareholders’ funds

per employee

26 64 58

Total assets per

employee

100 173 167

HILTON FOOD

GROUP PLC

3/28/2020 3/30/2019 3/31/2018

ROE using Net income

(%)

17.23 17.95 15.2

ROCE using Net

income (%)

9.02 11.98 12.43

Profit margin (%) 2.38 2.63 2.52

Gross margin (%) 16.17 12.69 11.93

EBIT margin (%) 3.08 2.8 2.58

Collection period

(days)

37 31 30

Credit period (days) 54 50 47

Current ratio (x) 1.05 1.23 1.2

Gearing (%) 175.87 66.57 36.16

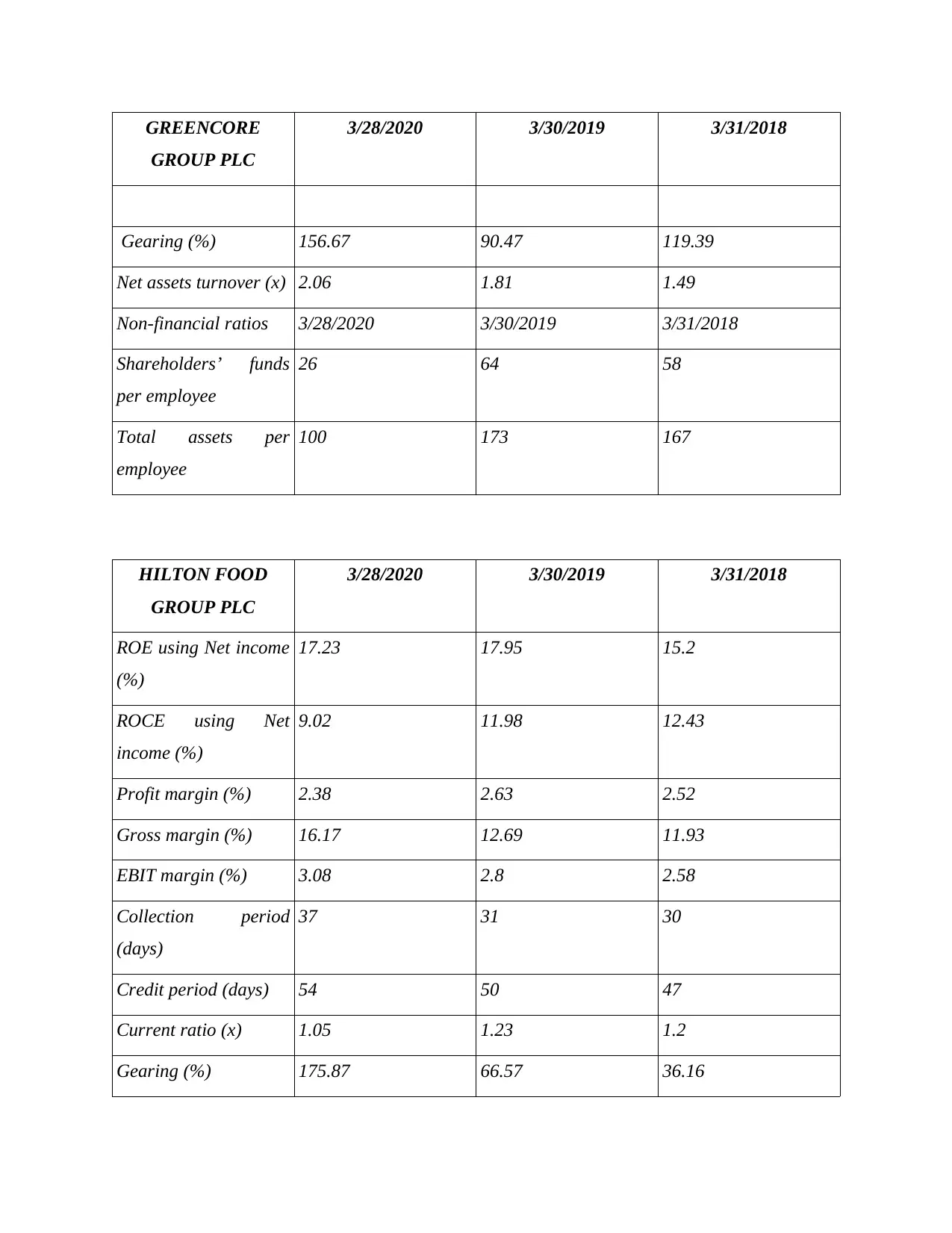

HILTON FOOD

GROUP PLC

3/28/2020 3/30/2019 3/31/2018

Net assets turnover (x) 3.58 5.56 6.53

Non-financial ratios 3/28/2020 3/30/2019 3/31/2018

Shareholders’ funds

per employee (

38 38 44

Total assets per

employee

181 121 116

PREMIER FOODS

PLC

3/28/2020 3/30/2019 3/31/2018

ROE using Net income

(%)

income (%)

2.77 -3.51 0.76

ROCE using Net

income (%)

3.37 1.16 2.94

Profit margin (%) 6.33 -5.18 2.55

Gross margin (%) 40.94 44.12 40.42

EBIT margin (%) 11.25 0.55 8.48

Collection period

(days)

27 29 24

Credit period (days) 65 65 59

Current ratio (x) 0.98 0.78 0.78

Gearing (%) 64.91 105.83 106.9

Net assets turnover (x) 0.32 0.42 0.42

Non-financial ratios 3/28/2020 3/30/2019 3/31/2018

GROUP PLC

3/28/2020 3/30/2019 3/31/2018

Net assets turnover (x) 3.58 5.56 6.53

Non-financial ratios 3/28/2020 3/30/2019 3/31/2018

Shareholders’ funds

per employee (

38 38 44

Total assets per

employee

181 121 116

PREMIER FOODS

PLC

3/28/2020 3/30/2019 3/31/2018

ROE using Net income

(%)

income (%)

2.77 -3.51 0.76

ROCE using Net

income (%)

3.37 1.16 2.94

Profit margin (%) 6.33 -5.18 2.55

Gross margin (%) 40.94 44.12 40.42

EBIT margin (%) 11.25 0.55 8.48

Collection period

(days)

27 29 24

Credit period (days) 65 65 59

Current ratio (x) 0.98 0.78 0.78

Gearing (%) 64.91 105.83 106.9

Net assets turnover (x) 0.32 0.42 0.42

Non-financial ratios 3/28/2020 3/30/2019 3/31/2018

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

PREMIER FOODS

PLC

3/28/2020 3/30/2019 3/31/2018

Shareholders’ funds

per employee

404 230 234

Total assets per

employee

729 533 540

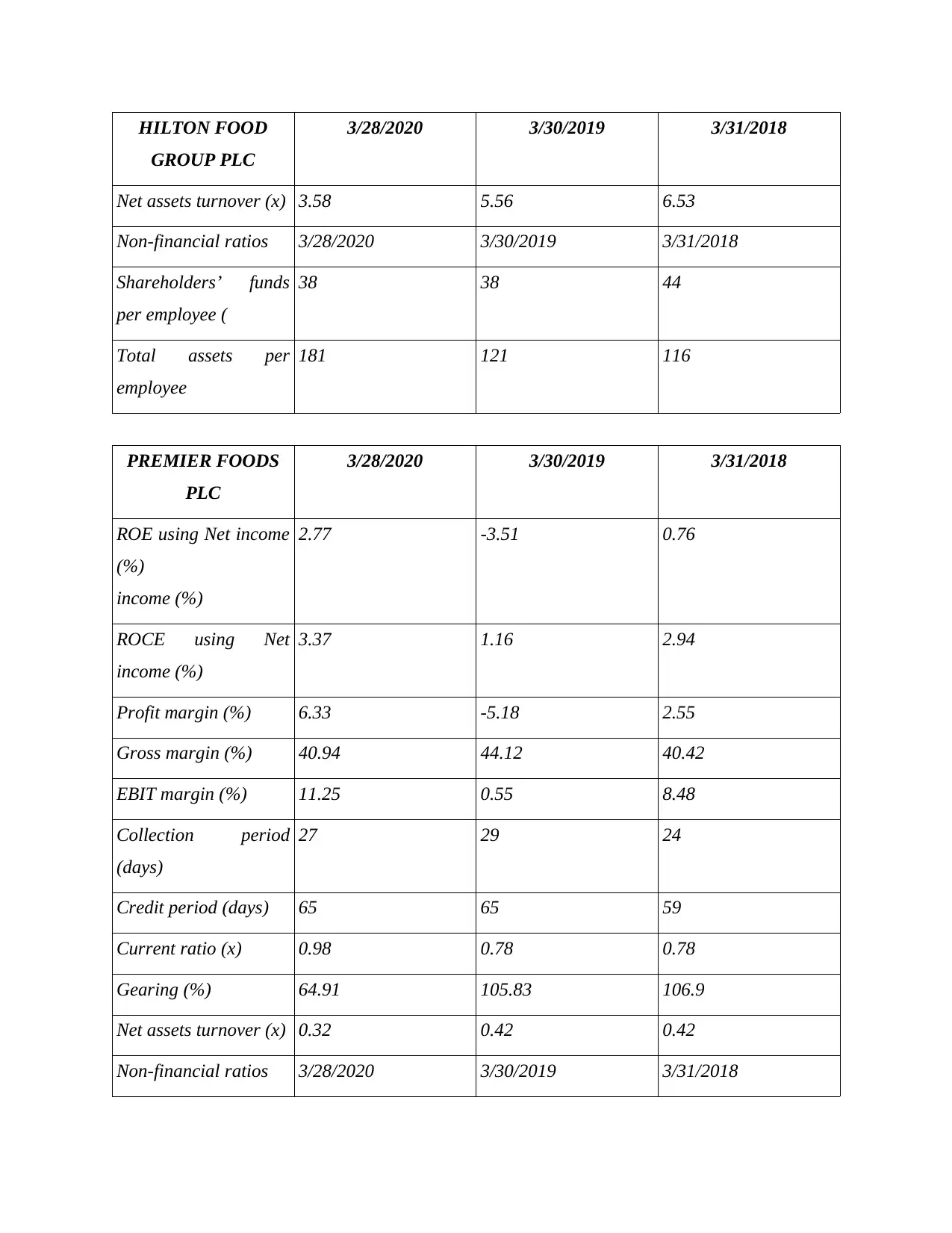

ROE using Net income (%): This is part of profitability ratio. Which help in analysing

ability of generate profit by running business operations. This graphical representation showcase

that GREENCORE GROUP PLC able to generate more return on earning as compare with its

rival business organizations. Value of Hilton earning ratio has been decile which showcase that

this organization is not able to generate its revenue by using their net income (Chen,

Gallagherand Warren, 2019).

PLC

3/28/2020 3/30/2019 3/31/2018

Shareholders’ funds

per employee

404 230 234

Total assets per

employee

729 533 540

ROE using Net income (%): This is part of profitability ratio. Which help in analysing

ability of generate profit by running business operations. This graphical representation showcase

that GREENCORE GROUP PLC able to generate more return on earning as compare with its

rival business organizations. Value of Hilton earning ratio has been decile which showcase that

this organization is not able to generate its revenue by using their net income (Chen,

Gallagherand Warren, 2019).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

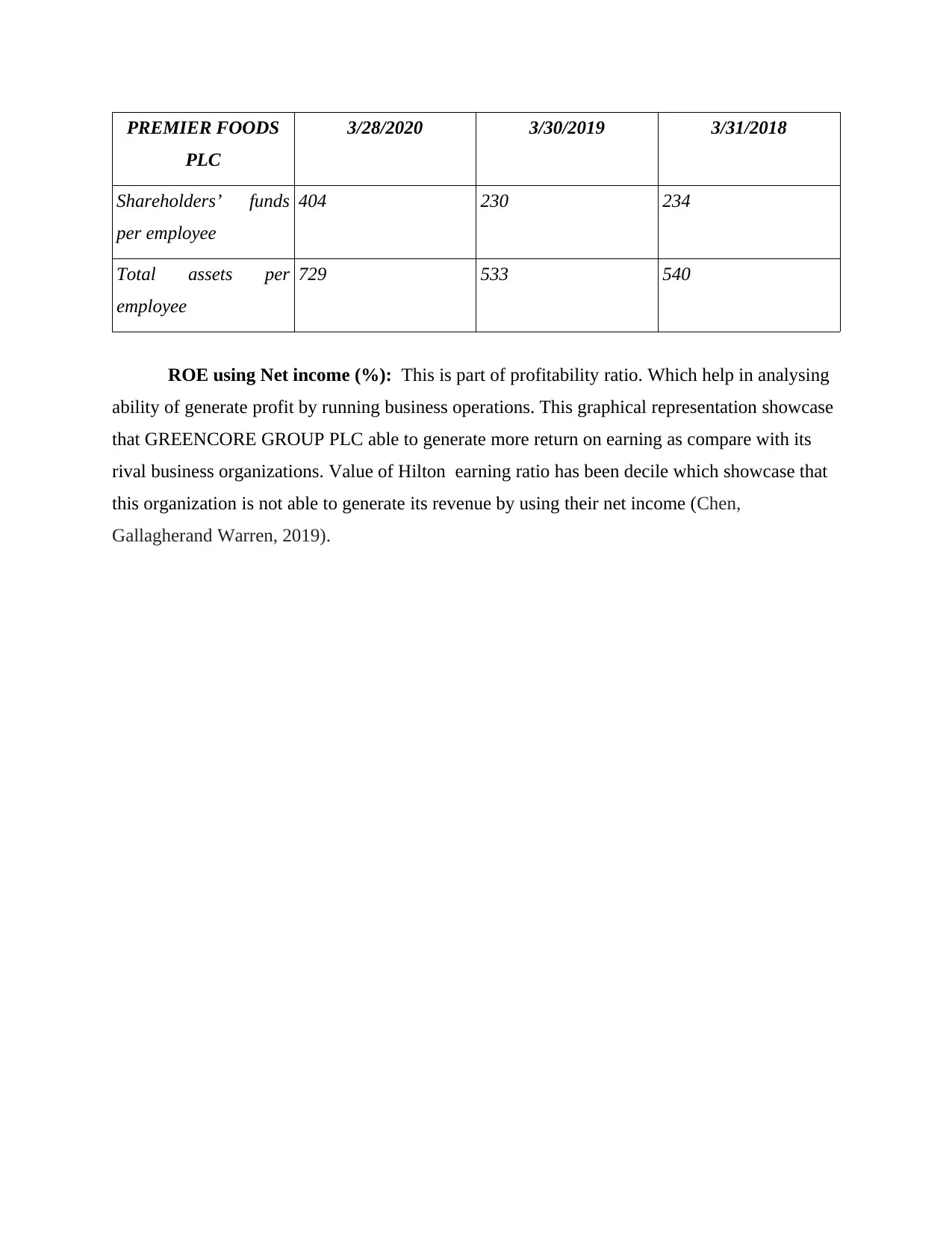

ROCE (Return on capital employee) (%): By calculating this ratio manager can

evaluate rate of generating business profit by using capital employed of organization. Rate of

generating income is increase in all the three organizations however GREEN CORE GROUP

PLC's ability to generate is higher then other business entities.

GREENCORE GROUP PLC Hilton Food group plc

0

5

10

15

20

25

30

35

40

2020 2019 2018

0

5

10

15

20

25

evaluate rate of generating business profit by using capital employed of organization. Rate of

generating income is increase in all the three organizations however GREEN CORE GROUP

PLC's ability to generate is higher then other business entities.

GREENCORE GROUP PLC Hilton Food group plc

0

5

10

15

20

25

30

35

40

2020 2019 2018

0

5

10

15

20

25

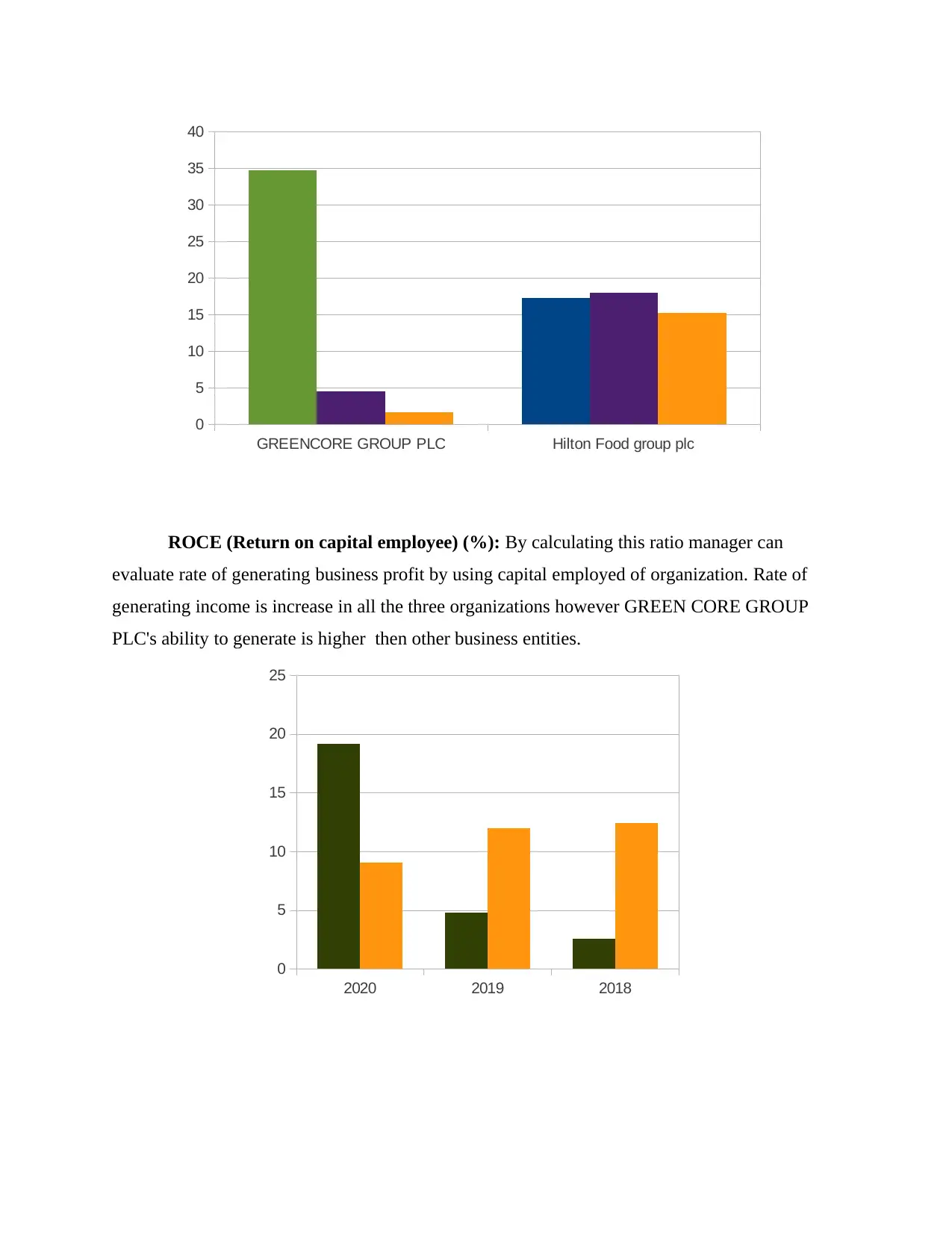

Net profit margin: This ratio is calculated in order to measure relationship between

profit and net sales. When the rate of net margin in high it is symbol of growth of business

organization. By evaluating net margin ratio of all the three companies it recognized that

GREENCORE GROUP PLC rate of net margin has been increases since 2018, and Hilton net

profit ratio also increase however in cases of Premier their profit ratio has been decline which

showcase that as compare to other organizations Premier foods plc not able to manage their

selling related businesses policies.

2020 2019 2018

-6

-4

-2

0

2

4

6

8

10

profit and net sales. When the rate of net margin in high it is symbol of growth of business

organization. By evaluating net margin ratio of all the three companies it recognized that

GREENCORE GROUP PLC rate of net margin has been increases since 2018, and Hilton net

profit ratio also increase however in cases of Premier their profit ratio has been decline which

showcase that as compare to other organizations Premier foods plc not able to manage their

selling related businesses policies.

2020 2019 2018

-6

-4

-2

0

2

4

6

8

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Gross margin: This is also a part of profitability ratio. By calculating this ratio manager

measure ability of their organization to generate business revenue before deducting any kind of

deductions. On the basis of calculating gross margin ratio this graphical representation showcase

that value of Green Core PLC '[s gross margin ratio was measure at 30.23 in 2019 and the rate of

gross margin has been increase in 2020, in case of Hilton this organizations' gross margin ratio

also increase from 12.6 to 16.1. However Premier foods plc not able to enhance their rate of

gross margin earnings (MohammadRezaei and Mohd‐Saleh, 2018).

EBIT:Ability of managerial profit before detection of tax items. Green Core PLC as compare

with other organization have efficiency to effectively manage their profits. By using this ratio

manager can evaluate the rate of earning in order to formulate future business policies.

GREENCORE GROUP PLC HILTON FOOD GROUP PLC

0

10

20

30

40

50

measure ability of their organization to generate business revenue before deducting any kind of

deductions. On the basis of calculating gross margin ratio this graphical representation showcase

that value of Green Core PLC '[s gross margin ratio was measure at 30.23 in 2019 and the rate of

gross margin has been increase in 2020, in case of Hilton this organizations' gross margin ratio

also increase from 12.6 to 16.1. However Premier foods plc not able to enhance their rate of

gross margin earnings (MohammadRezaei and Mohd‐Saleh, 2018).

EBIT:Ability of managerial profit before detection of tax items. Green Core PLC as compare

with other organization have efficiency to effectively manage their profits. By using this ratio

manager can evaluate the rate of earning in order to formulate future business policies.

GREENCORE GROUP PLC HILTON FOOD GROUP PLC

0

10

20

30

40

50

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Collection period: This ratio is used for measuring time required to collect money from

debtors. Evaluating ratio by using chart help in determine that Premier foods plc took less time

as compare to other business organizations to collect money from their debtors. Which showcase

that even this organization not generate high rate of profit but they use effective tools to manage

their debtors.

Credit period: This ratio help in determine time required to fulfil debt liability of

creditors. This graphical representation showcase that organization Hilton have ability to pay

their creditors money within short period of time Premier foods plc tool much more time for

fulfil liability of creditors.

GREENCORE GROUP PLC HILTON FOOD GROUP PLC

0

2

4

6

8

10

12

debtors. Evaluating ratio by using chart help in determine that Premier foods plc took less time

as compare to other business organizations to collect money from their debtors. Which showcase

that even this organization not generate high rate of profit but they use effective tools to manage

their debtors.

Credit period: This ratio help in determine time required to fulfil debt liability of

creditors. This graphical representation showcase that organization Hilton have ability to pay

their creditors money within short period of time Premier foods plc tool much more time for

fulfil liability of creditors.

GREENCORE GROUP PLC HILTON FOOD GROUP PLC

0

2

4

6

8

10

12

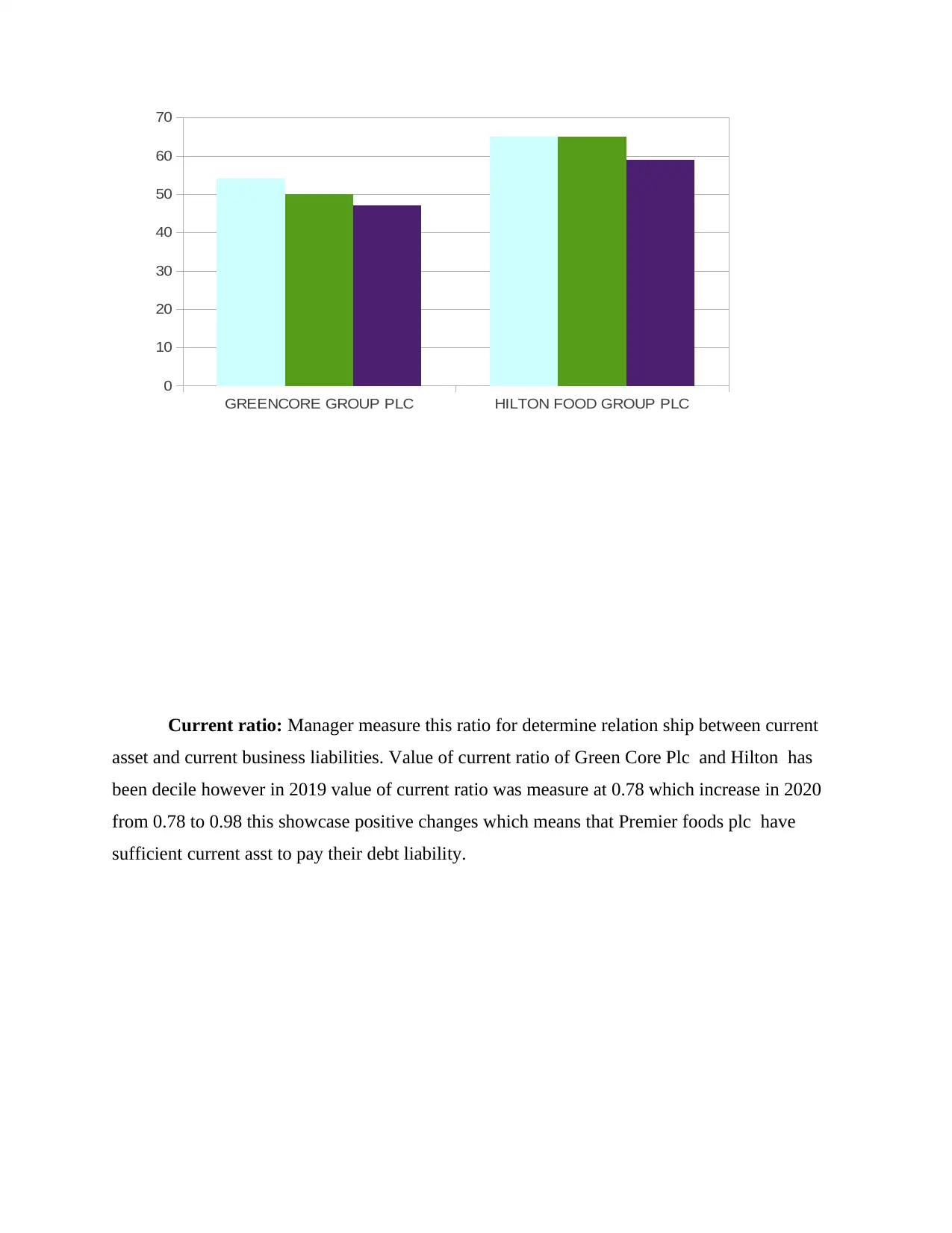

Current ratio: Manager measure this ratio for determine relation ship between current

asset and current business liabilities. Value of current ratio of Green Core Plc and Hilton has

been decile however in 2019 value of current ratio was measure at 0.78 which increase in 2020

from 0.78 to 0.98 this showcase positive changes which means that Premier foods plc have

sufficient current asst to pay their debt liability.

GREENCORE GROUP PLC HILTON FOOD GROUP PLC

0

10

20

30

40

50

60

70

asset and current business liabilities. Value of current ratio of Green Core Plc and Hilton has

been decile however in 2019 value of current ratio was measure at 0.78 which increase in 2020

from 0.78 to 0.98 this showcase positive changes which means that Premier foods plc have

sufficient current asst to pay their debt liability.

GREENCORE GROUP PLC HILTON FOOD GROUP PLC

0

10

20

30

40

50

60

70

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.