Comprehensive Accounting and Financial Management Assignment

VerifiedAdded on 2024/04/25

|34

|6387

|324

Homework Assignment

AI Summary

This accounting assignment solution includes three tasks covering written activities, workplace activities, and financial planning. The written activity addresses topics such as allowable and disallowed expenses, taxation of trust income, forecast returns, and client objectives. The workplace activity involves financial analysis, cost-benefit analysis, profitability analysis, and solvency analysis, along with a discussion of financial management stages and the role of a finance manager. It also includes a file note regarding changes in financial responsibilities. The final task focuses on cash flow forecasting, debt ratio calculation, and compliance with reporting deadlines, along with graphical representation of customer purchasing activity. The document provides detailed calculations, summaries, and explanations related to financial management concepts and practical applications.

Accounting

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Task 1: Written activity...................................................................................................................6

Q1................................................................................................................................................6

Q2................................................................................................................................................6

Q3................................................................................................................................................6

Q4................................................................................................................................................6

Q5................................................................................................................................................6

Q6................................................................................................................................................7

Q7................................................................................................................................................7

Q8................................................................................................................................................7

Q9................................................................................................................................................7

Q10..............................................................................................................................................8

Q11..............................................................................................................................................8

Q12..............................................................................................................................................8

Q13..............................................................................................................................................8

Q14..............................................................................................................................................8

Q15..............................................................................................................................................9

Q16..............................................................................................................................................9

Q17..............................................................................................................................................9

Q18............................................................................................................................................10

Q19............................................................................................................................................10

Q20............................................................................................................................................10

Q21............................................................................................................................................11

Q22............................................................................................................................................11

Q23............................................................................................................................................11

Q24............................................................................................................................................12

Task 2: Workplace activity............................................................................................................13

Q1..............................................................................................................................................13

Q2..............................................................................................................................................13

Q3..............................................................................................................................................14

Q4..............................................................................................................................................15

Q5..............................................................................................................................................15

Q6..............................................................................................................................................15

Q7..............................................................................................................................................16

Q8..............................................................................................................................................17

Q9..............................................................................................................................................17

(a)...........................................................................................................................................17

(b)...........................................................................................................................................17

(c)...........................................................................................................................................18

Q. 10..........................................................................................................................................18

Q11............................................................................................................................................19

Q12............................................................................................................................................21

Q13............................................................................................................................................22

Q14............................................................................................................................................22

Q15............................................................................................................................................23

Q16............................................................................................................................................23

2

Task 1: Written activity...................................................................................................................6

Q1................................................................................................................................................6

Q2................................................................................................................................................6

Q3................................................................................................................................................6

Q4................................................................................................................................................6

Q5................................................................................................................................................6

Q6................................................................................................................................................7

Q7................................................................................................................................................7

Q8................................................................................................................................................7

Q9................................................................................................................................................7

Q10..............................................................................................................................................8

Q11..............................................................................................................................................8

Q12..............................................................................................................................................8

Q13..............................................................................................................................................8

Q14..............................................................................................................................................8

Q15..............................................................................................................................................9

Q16..............................................................................................................................................9

Q17..............................................................................................................................................9

Q18............................................................................................................................................10

Q19............................................................................................................................................10

Q20............................................................................................................................................10

Q21............................................................................................................................................11

Q22............................................................................................................................................11

Q23............................................................................................................................................11

Q24............................................................................................................................................12

Task 2: Workplace activity............................................................................................................13

Q1..............................................................................................................................................13

Q2..............................................................................................................................................13

Q3..............................................................................................................................................14

Q4..............................................................................................................................................15

Q5..............................................................................................................................................15

Q6..............................................................................................................................................15

Q7..............................................................................................................................................16

Q8..............................................................................................................................................17

Q9..............................................................................................................................................17

(a)...........................................................................................................................................17

(b)...........................................................................................................................................17

(c)...........................................................................................................................................18

Q. 10..........................................................................................................................................18

Q11............................................................................................................................................19

Q12............................................................................................................................................21

Q13............................................................................................................................................22

Q14............................................................................................................................................22

Q15............................................................................................................................................23

Q16............................................................................................................................................23

2

Q17............................................................................................................................................23

Q18............................................................................................................................................24

Q19............................................................................................................................................25

Q20............................................................................................................................................26

Q21............................................................................................................................................26

Q22............................................................................................................................................26

Task 3.............................................................................................................................................28

Q1..............................................................................................................................................28

Q2..............................................................................................................................................28

Q3..............................................................................................................................................29

Q4..............................................................................................................................................29

Q5..............................................................................................................................................30

Q6..............................................................................................................................................30

Q7..............................................................................................................................................30

Q8..............................................................................................................................................31

Q9..............................................................................................................................................32

References:-...................................................................................................................................34

3

Q18............................................................................................................................................24

Q19............................................................................................................................................25

Q20............................................................................................................................................26

Q21............................................................................................................................................26

Q22............................................................................................................................................26

Task 3.............................................................................................................................................28

Q1..............................................................................................................................................28

Q2..............................................................................................................................................28

Q3..............................................................................................................................................29

Q4..............................................................................................................................................29

Q5..............................................................................................................................................30

Q6..............................................................................................................................................30

Q7..............................................................................................................................................30

Q8..............................................................................................................................................31

Q9..............................................................................................................................................32

References:-...................................................................................................................................34

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Task 1: Written activity

Q1.

The expenses when are allowed then the tax is not applicable to those expenses i.e. they are

reduced from the taxable income like the expenses for day to day operation like advertisement,

bank charges, etc. while disallowed expenses are liable to taxation i.e. they are not reduced from

the taxable income like donations, amortization of expenses, etc. (Australian Government, 2017).

Q2.

The income of the trust is distributed to the adults then the trust is not liable for the tax, while if

the income is distributed to the minor or non-residents then the trustee will be liable on their

behalf. The trust income is accumulated and liable for the highest rate of tax (Australian

Government, 2017).

Q3.

The forecast returns show the expected cash flows of the future from the business. The returns

which predict the future taxable income with the help of the historical information and the

forecast returns help to the company to make an estimate of the position of the company in

future. The past trends of the expenses and the income will help in making the forecast returns

(Masturzo, 2016).

Q4.

The organization which is incorporated is required to fulfill the objectives for which it has been

incorporated. The organizations do not focus on earning the profits. While preparing the

statutory returns the not for profit organization will be required to abide by the applicable

legislation (Australian Government, 2017).

4

Q1.

The expenses when are allowed then the tax is not applicable to those expenses i.e. they are

reduced from the taxable income like the expenses for day to day operation like advertisement,

bank charges, etc. while disallowed expenses are liable to taxation i.e. they are not reduced from

the taxable income like donations, amortization of expenses, etc. (Australian Government, 2017).

Q2.

The income of the trust is distributed to the adults then the trust is not liable for the tax, while if

the income is distributed to the minor or non-residents then the trustee will be liable on their

behalf. The trust income is accumulated and liable for the highest rate of tax (Australian

Government, 2017).

Q3.

The forecast returns show the expected cash flows of the future from the business. The returns

which predict the future taxable income with the help of the historical information and the

forecast returns help to the company to make an estimate of the position of the company in

future. The past trends of the expenses and the income will help in making the forecast returns

(Masturzo, 2016).

Q4.

The organization which is incorporated is required to fulfill the objectives for which it has been

incorporated. The organizations do not focus on earning the profits. While preparing the

statutory returns the not for profit organization will be required to abide by the applicable

legislation (Australian Government, 2017).

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Q5.

The client objectives can be presented with the help of methods for quantitative objects such as

preparing various reports for performance evaluation like sales, accounting, etc., budget, etc. For

qualitative objects, the performance can be evaluated by following the methods like observing,

feedback, etc.

Q6.

The cash flow for an organization is mainly through the trade receivables, payables or any

shortfalls (Driver, 2018). The cash flow can be controlled by following the below-mentioned

methods:

1. Maintain reserves for cash which can be used to meet the shortfalls.

2. The customers of an organization should be encouraged to pay fast.

Q7.

The legislative acts which a business organization is required to follow are:

1. Taxation Act, 2003

2. Occupational Health and Safety Act, 1989

There is much more legislation which the organization is required to follow as per the structure

and business that the company is doing (Australian Government, 2017).

Q8.

The financing information can be provided by various means i.e. through consulting the financial

consultants, taxation consultants, etc. The information can be referred to the applicable

regulations which the company is required to follow the taxation act, 2003 and the auditing and

assurance standards board, Australian Financial Security Authority, etc.

5

The client objectives can be presented with the help of methods for quantitative objects such as

preparing various reports for performance evaluation like sales, accounting, etc., budget, etc. For

qualitative objects, the performance can be evaluated by following the methods like observing,

feedback, etc.

Q6.

The cash flow for an organization is mainly through the trade receivables, payables or any

shortfalls (Driver, 2018). The cash flow can be controlled by following the below-mentioned

methods:

1. Maintain reserves for cash which can be used to meet the shortfalls.

2. The customers of an organization should be encouraged to pay fast.

Q7.

The legislative acts which a business organization is required to follow are:

1. Taxation Act, 2003

2. Occupational Health and Safety Act, 1989

There is much more legislation which the organization is required to follow as per the structure

and business that the company is doing (Australian Government, 2017).

Q8.

The financing information can be provided by various means i.e. through consulting the financial

consultants, taxation consultants, etc. The information can be referred to the applicable

regulations which the company is required to follow the taxation act, 2003 and the auditing and

assurance standards board, Australian Financial Security Authority, etc.

5

Q9.

The client is following the business of veterinary services and the main objective of the client is

to provide the financial management regarding the GST and the reduced taxation on income and

various other reports of legislation.

Q10.

The business assets of Anthony Bowman are building, equipment, inventories, and vehicles.

These assets are necessary for an organization to run and achieve success and the objective

which it desires.

Q11.

The size of the business can be evaluated by determining the staff size or the size in terms of the

quantity. In terms of staff, the size of the business is 5 who are in full-time employment. If the

size is determined in terms of quantity then the size of the business will be:

1. Balance sheet basis- $ 550,000- $ 50,000= $ 500,000.

2. Income basis- $ 1,000,000- $ 680,000= $ 320,000.

Q12.

Anthony Bowman, who is a director, is currently in a sole proprietorship business where the sole

proprietor alone will be responsible for all the acts and the liability. The veterinary services are

being provided by Anthony Bowman. The business can be termed as a small business since the

revenue of the business is less than $ 2Million.

Q13.

The information which is provided is that the business the client is operating since five years and

the administrative staffs that are part-time are providing the internal reports about the payment

which is required to be done to the accounts and banking people including the payment which is

paid for fortnightly.

6

The client is following the business of veterinary services and the main objective of the client is

to provide the financial management regarding the GST and the reduced taxation on income and

various other reports of legislation.

Q10.

The business assets of Anthony Bowman are building, equipment, inventories, and vehicles.

These assets are necessary for an organization to run and achieve success and the objective

which it desires.

Q11.

The size of the business can be evaluated by determining the staff size or the size in terms of the

quantity. In terms of staff, the size of the business is 5 who are in full-time employment. If the

size is determined in terms of quantity then the size of the business will be:

1. Balance sheet basis- $ 550,000- $ 50,000= $ 500,000.

2. Income basis- $ 1,000,000- $ 680,000= $ 320,000.

Q12.

Anthony Bowman, who is a director, is currently in a sole proprietorship business where the sole

proprietor alone will be responsible for all the acts and the liability. The veterinary services are

being provided by Anthony Bowman. The business can be termed as a small business since the

revenue of the business is less than $ 2Million.

Q13.

The information which is provided is that the business the client is operating since five years and

the administrative staffs that are part-time are providing the internal reports about the payment

which is required to be done to the accounts and banking people including the payment which is

paid for fortnightly.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Q14.

The financial options available to the company are:

1. The company can consider the factoring method.

2. The company can obtain a loan from the bank to increase the performance of the

business.

3. The company can raise the finance with the help of accelerators and incubators.

4. Crowdfunding is the best way in today’s world to raise the finance.

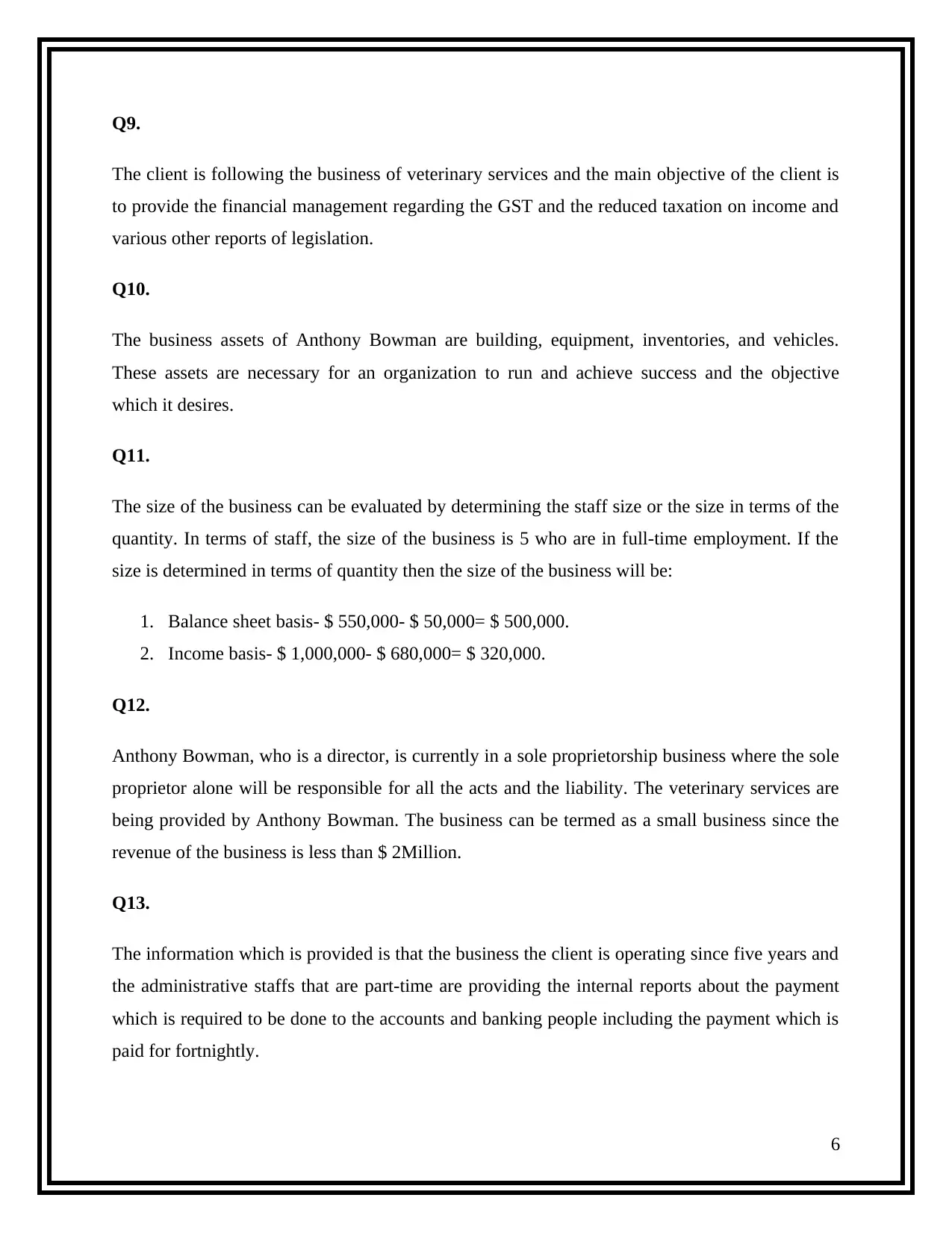

Q15.

Bowman Company

Operational Project

Forecast Returns Vs. Actual Returns

Quarter Forecast Actual

Amount ($) Amount ($)

September 5000 5500

December 5000 9000

March 5000 3000

June 5000

Total 20000 17500

Summary:

Until the year-end, the company has an actual return of $ 16,500 which is $ 2,500 more than the

estimated forecast returns. The returns are more due to the reason the peak time in the Quarter of

December. The estimations of the company will be reached at the end of the financial year.

Q16.

The review point in financial management will be analyzing the results from the budget. The

budget that has been prepared and the results when compared to the actual, then the actual results

are more and the company is expecting that the company will reach the budget estimation.

7

The financial options available to the company are:

1. The company can consider the factoring method.

2. The company can obtain a loan from the bank to increase the performance of the

business.

3. The company can raise the finance with the help of accelerators and incubators.

4. Crowdfunding is the best way in today’s world to raise the finance.

Q15.

Bowman Company

Operational Project

Forecast Returns Vs. Actual Returns

Quarter Forecast Actual

Amount ($) Amount ($)

September 5000 5500

December 5000 9000

March 5000 3000

June 5000

Total 20000 17500

Summary:

Until the year-end, the company has an actual return of $ 16,500 which is $ 2,500 more than the

estimated forecast returns. The returns are more due to the reason the peak time in the Quarter of

December. The estimations of the company will be reached at the end of the financial year.

Q16.

The review point in financial management will be analyzing the results from the budget. The

budget that has been prepared and the results when compared to the actual, then the actual results

are more and the company is expecting that the company will reach the budget estimation.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

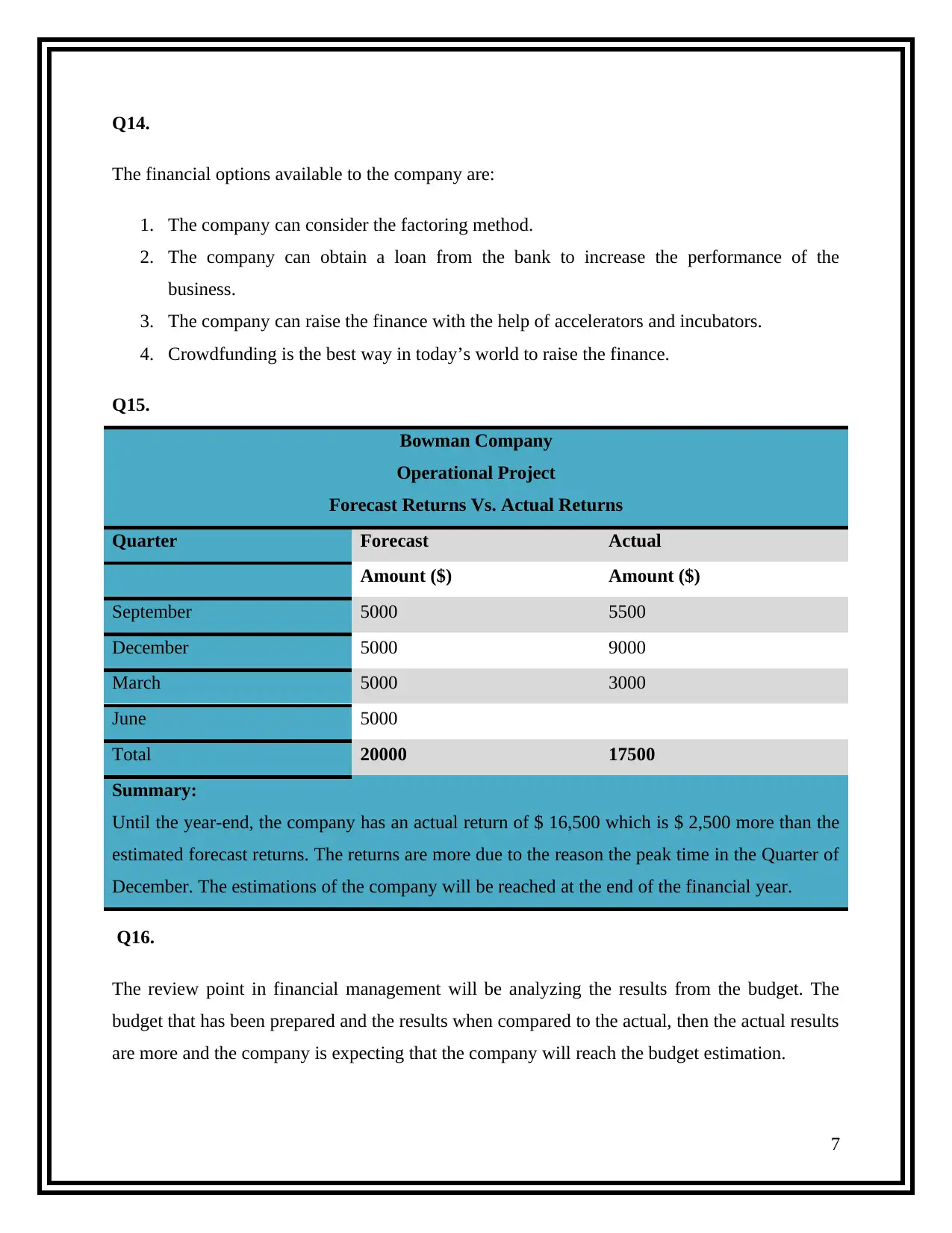

Q17.

Bowman Company Financial Management

Quarterly Questionnaire

Current Objective Change to Comments

Financial Statements

Reporting

No Change Satisfied

BAS Preparation No Change Satisfied

IT Return Preparation No Change Satisfied

Q18.

The company is a need to change the objectives. The new objective of the company is to provide

more responsibilities to the secretary so that the financial authority duties are also fulfilled. This

objective will include providing the information regarding BAS. The secretary will also be

responsible to prepare the financial statements at the meeting.

Q19.

The following ratios are to measure the stability of the business:

1. Debt-Equity Ratio

2. Interest Coverage Ratio

The above ratios will be computed and accordingly, the stability of the business will be

understood. Since, on the basis of the debt-equity ratio, the company will be able to understand

whether there are more debts than the assets (Basu, 2018).

8

Bowman Company Financial Management

Quarterly Questionnaire

Current Objective Change to Comments

Financial Statements

Reporting

No Change Satisfied

BAS Preparation No Change Satisfied

IT Return Preparation No Change Satisfied

Q18.

The company is a need to change the objectives. The new objective of the company is to provide

more responsibilities to the secretary so that the financial authority duties are also fulfilled. This

objective will include providing the information regarding BAS. The secretary will also be

responsible to prepare the financial statements at the meeting.

Q19.

The following ratios are to measure the stability of the business:

1. Debt-Equity Ratio

2. Interest Coverage Ratio

The above ratios will be computed and accordingly, the stability of the business will be

understood. Since, on the basis of the debt-equity ratio, the company will be able to understand

whether there are more debts than the assets (Basu, 2018).

8

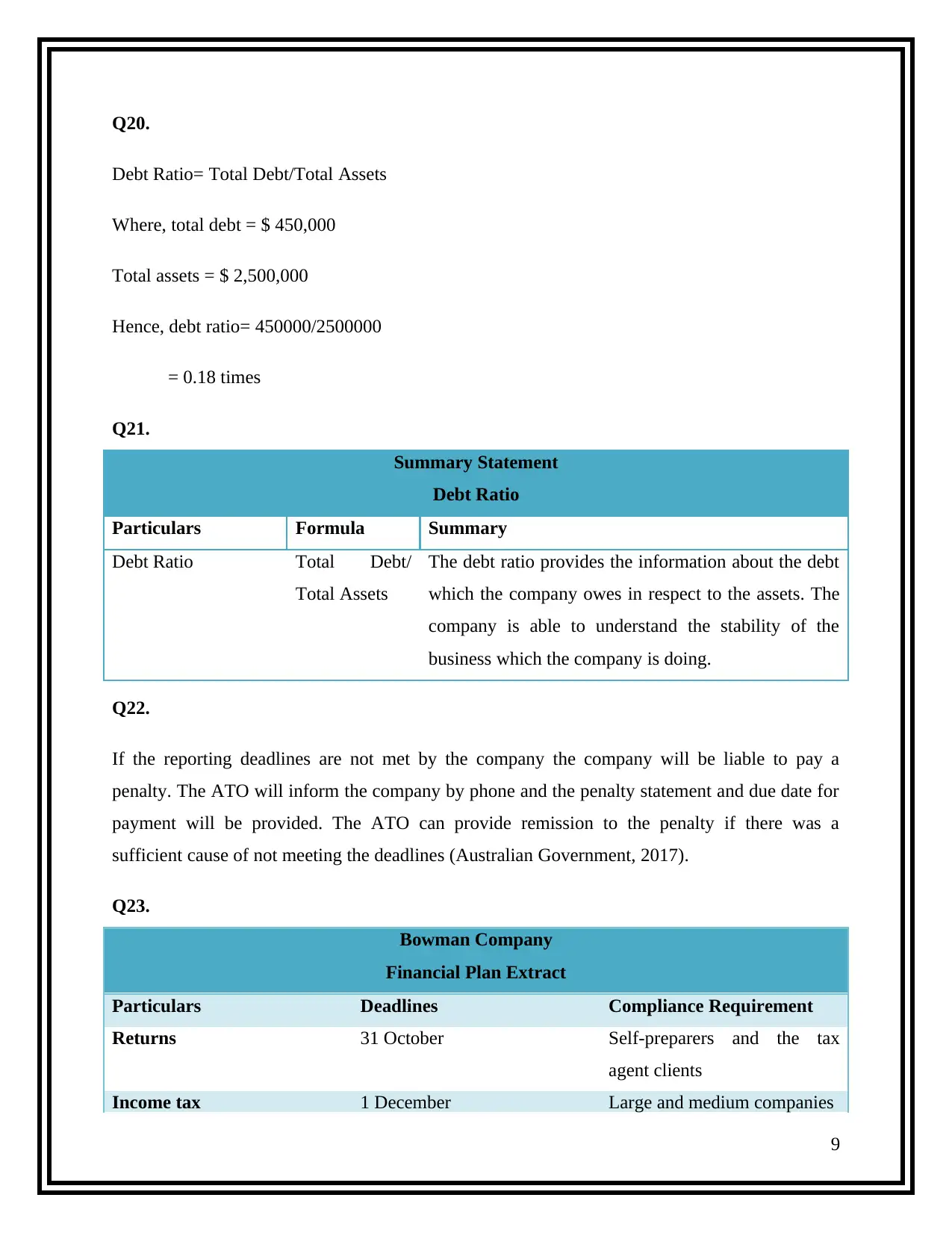

Q20.

Debt Ratio= Total Debt/Total Assets

Where, total debt = $ 450,000

Total assets = $ 2,500,000

Hence, debt ratio= 450000/2500000

= 0.18 times

Q21.

Summary Statement

Debt Ratio

Particulars Formula Summary

Debt Ratio Total Debt/

Total Assets

The debt ratio provides the information about the debt

which the company owes in respect to the assets. The

company is able to understand the stability of the

business which the company is doing.

Q22.

If the reporting deadlines are not met by the company the company will be liable to pay a

penalty. The ATO will inform the company by phone and the penalty statement and due date for

payment will be provided. The ATO can provide remission to the penalty if there was a

sufficient cause of not meeting the deadlines (Australian Government, 2017).

Q23.

Bowman Company

Financial Plan Extract

Particulars Deadlines Compliance Requirement

Returns 31 October Self-preparers and the tax

agent clients

Income tax 1 December Large and medium companies

9

Debt Ratio= Total Debt/Total Assets

Where, total debt = $ 450,000

Total assets = $ 2,500,000

Hence, debt ratio= 450000/2500000

= 0.18 times

Q21.

Summary Statement

Debt Ratio

Particulars Formula Summary

Debt Ratio Total Debt/

Total Assets

The debt ratio provides the information about the debt

which the company owes in respect to the assets. The

company is able to understand the stability of the

business which the company is doing.

Q22.

If the reporting deadlines are not met by the company the company will be liable to pay a

penalty. The ATO will inform the company by phone and the penalty statement and due date for

payment will be provided. The ATO can provide remission to the penalty if there was a

sufficient cause of not meeting the deadlines (Australian Government, 2017).

Q23.

Bowman Company

Financial Plan Extract

Particulars Deadlines Compliance Requirement

Returns 31 October Self-preparers and the tax

agent clients

Income tax 1 December Large and medium companies

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Income tax Return 28 February Non-taxable large and

medium companies

Income Tax Return 31 March Tax agents clients whose

income is in excess of $2

million

Income Tax Return 15 May All companies

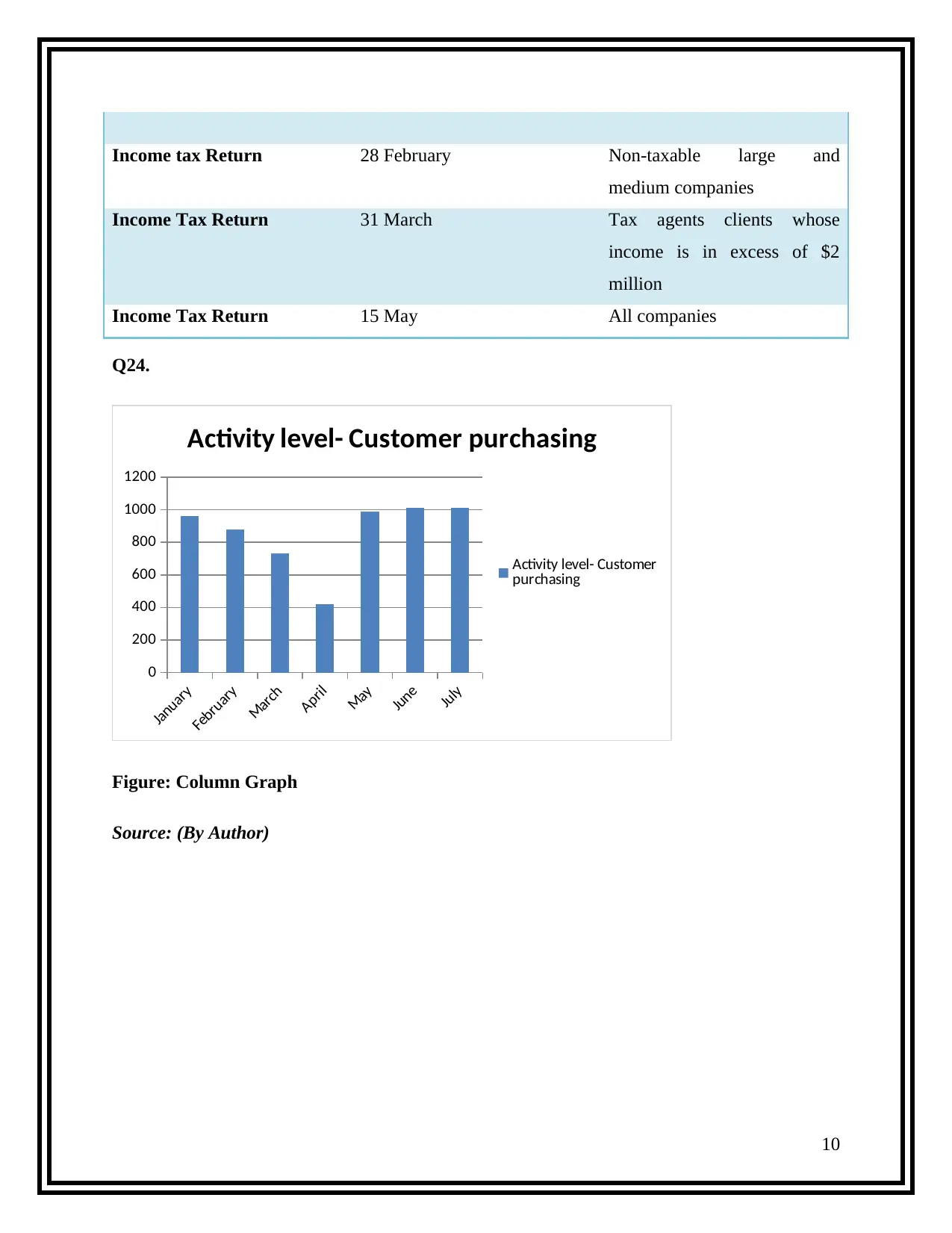

Q24.

January

February

March

April

May

June

July

0

200

400

600

800

1000

1200

Activity level- Customer purchasing

Activity level- Customer

purchasing

Figure: Column Graph

Source: (By Author)

10

medium companies

Income Tax Return 31 March Tax agents clients whose

income is in excess of $2

million

Income Tax Return 15 May All companies

Q24.

January

February

March

April

May

June

July

0

200

400

600

800

1000

1200

Activity level- Customer purchasing

Activity level- Customer

purchasing

Figure: Column Graph

Source: (By Author)

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

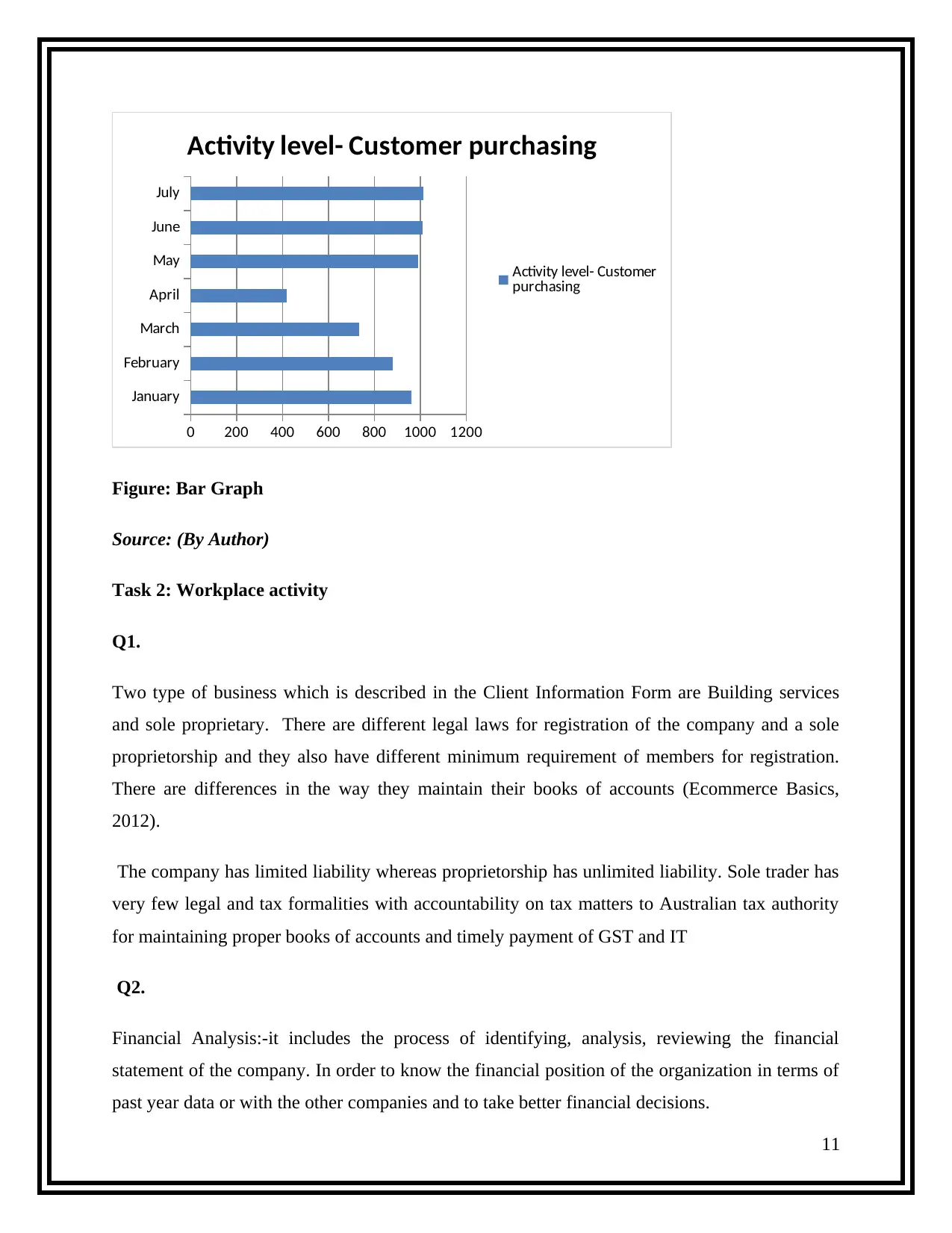

January

February

March

April

May

June

July

0 200 400 600 800 1000 1200

Activity level- Customer purchasing

Activity level- Customer

purchasing

Figure: Bar Graph

Source: (By Author)

Task 2: Workplace activity

Q1.

Two type of business which is described in the Client Information Form are Building services

and sole proprietary. There are different legal laws for registration of the company and a sole

proprietorship and they also have different minimum requirement of members for registration.

There are differences in the way they maintain their books of accounts (Ecommerce Basics,

2012).

The company has limited liability whereas proprietorship has unlimited liability. Sole trader has

very few legal and tax formalities with accountability on tax matters to Australian tax authority

for maintaining proper books of accounts and timely payment of GST and IT

Q2.

Financial Analysis:-it includes the process of identifying, analysis, reviewing the financial

statement of the company. In order to know the financial position of the organization in terms of

past year data or with the other companies and to take better financial decisions.

11

February

March

April

May

June

July

0 200 400 600 800 1000 1200

Activity level- Customer purchasing

Activity level- Customer

purchasing

Figure: Bar Graph

Source: (By Author)

Task 2: Workplace activity

Q1.

Two type of business which is described in the Client Information Form are Building services

and sole proprietary. There are different legal laws for registration of the company and a sole

proprietorship and they also have different minimum requirement of members for registration.

There are differences in the way they maintain their books of accounts (Ecommerce Basics,

2012).

The company has limited liability whereas proprietorship has unlimited liability. Sole trader has

very few legal and tax formalities with accountability on tax matters to Australian tax authority

for maintaining proper books of accounts and timely payment of GST and IT

Q2.

Financial Analysis:-it includes the process of identifying, analysis, reviewing the financial

statement of the company. In order to know the financial position of the organization in terms of

past year data or with the other companies and to take better financial decisions.

11

Cost-benefit analysis: - under this analysis, we try to understand how feasible any project would

be for the organization in terms of cost and return associated with it. If the cost is more than the

return it generates, then the said need not be adopted (Management Study Guide, 2018).

Profitability Analysis: - this type of analysis part of Enterprise resource planning. It helps in

knowing and forecasting the profitability of the said project. It will allow the management to

know how economic the project would be if undertaken and improve the profitability of existing

projects.

Solvency analysis:-there is a ratio to for this analysis. It helps in establishing whether the

company has sufficient balance to meet its long term and short term obligation. It also measures

the liquidity to know how quickly the assets can be converted into cash (Management Study

Guide, 2018).

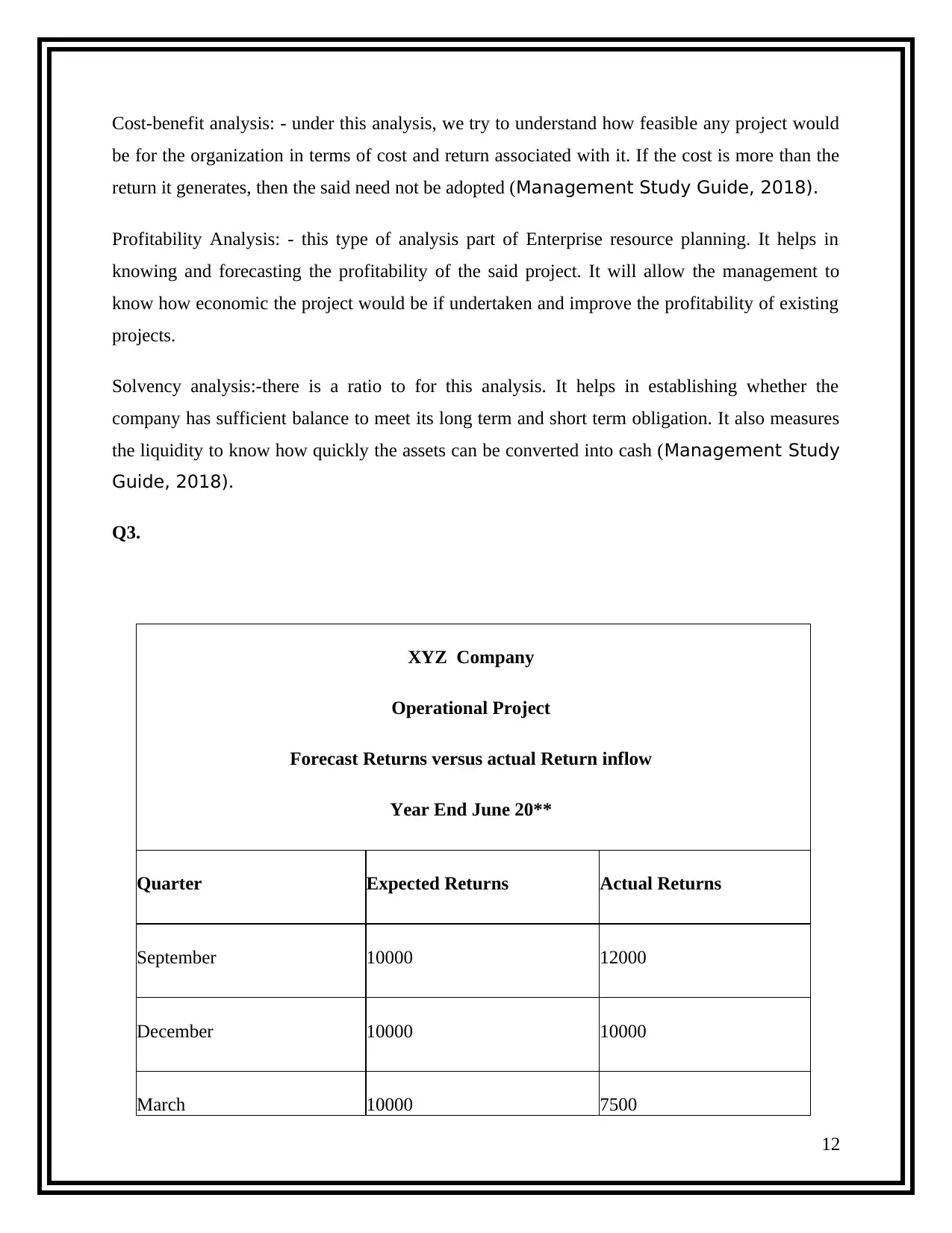

Q3.

XYZ Company

Operational Project

Forecast Returns versus actual Return inflow

Year End June 20**

Quarter Expected Returns Actual Returns

September 10000 12000

December 10000 10000

March 10000 7500

12

be for the organization in terms of cost and return associated with it. If the cost is more than the

return it generates, then the said need not be adopted (Management Study Guide, 2018).

Profitability Analysis: - this type of analysis part of Enterprise resource planning. It helps in

knowing and forecasting the profitability of the said project. It will allow the management to

know how economic the project would be if undertaken and improve the profitability of existing

projects.

Solvency analysis:-there is a ratio to for this analysis. It helps in establishing whether the

company has sufficient balance to meet its long term and short term obligation. It also measures

the liquidity to know how quickly the assets can be converted into cash (Management Study

Guide, 2018).

Q3.

XYZ Company

Operational Project

Forecast Returns versus actual Return inflow

Year End June 20**

Quarter Expected Returns Actual Returns

September 10000 12000

December 10000 10000

March 10000 7500

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 34

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.