Accounting and Financial Management Assignment Analysis Report

VerifiedAdded on 2022/08/26

|7

|704

|14

Homework Assignment

AI Summary

This assignment solution addresses various aspects of accounting and financial management. It begins by presenting a chart of accounts, followed by a detailed closing entry. The solution then tackles three questions: The first question focuses on calculating the initial cost of acquisition and annual amortization fees for a printer. The second question involves calculating impairment losses for multiple cameras, considering their carrying amounts and recoverable amounts. The final question covers the accounting treatment of a patent, including journal entries for its acquisition and revaluation. The assignment incorporates relevant accounting principles and provides clear explanations and calculations. The document also includes a bibliography of related academic sources.

Running head: ACCOUNTING AND FINANCIAL MANAGEMENT

Accounting and Financial Management

Name of the Student:

Name of the University:

Author’s Note:

Accounting and Financial Management

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ACCOUNTING AND FINANCIAL MANAGEMENT

Table of Contents

Chart of accounts:............................................................................................................................2

Closing entry:...................................................................................................................................3

Question 1:.......................................................................................................................................3

Question 2:.......................................................................................................................................4

Question 3:.......................................................................................................................................5

Bibliography:...................................................................................................................................6

Table of Contents

Chart of accounts:............................................................................................................................2

Closing entry:...................................................................................................................................3

Question 1:.......................................................................................................................................3

Question 2:.......................................................................................................................................4

Question 3:.......................................................................................................................................5

Bibliography:...................................................................................................................................6

2ACCOUNTING AND FINANCIAL MANAGEMENT

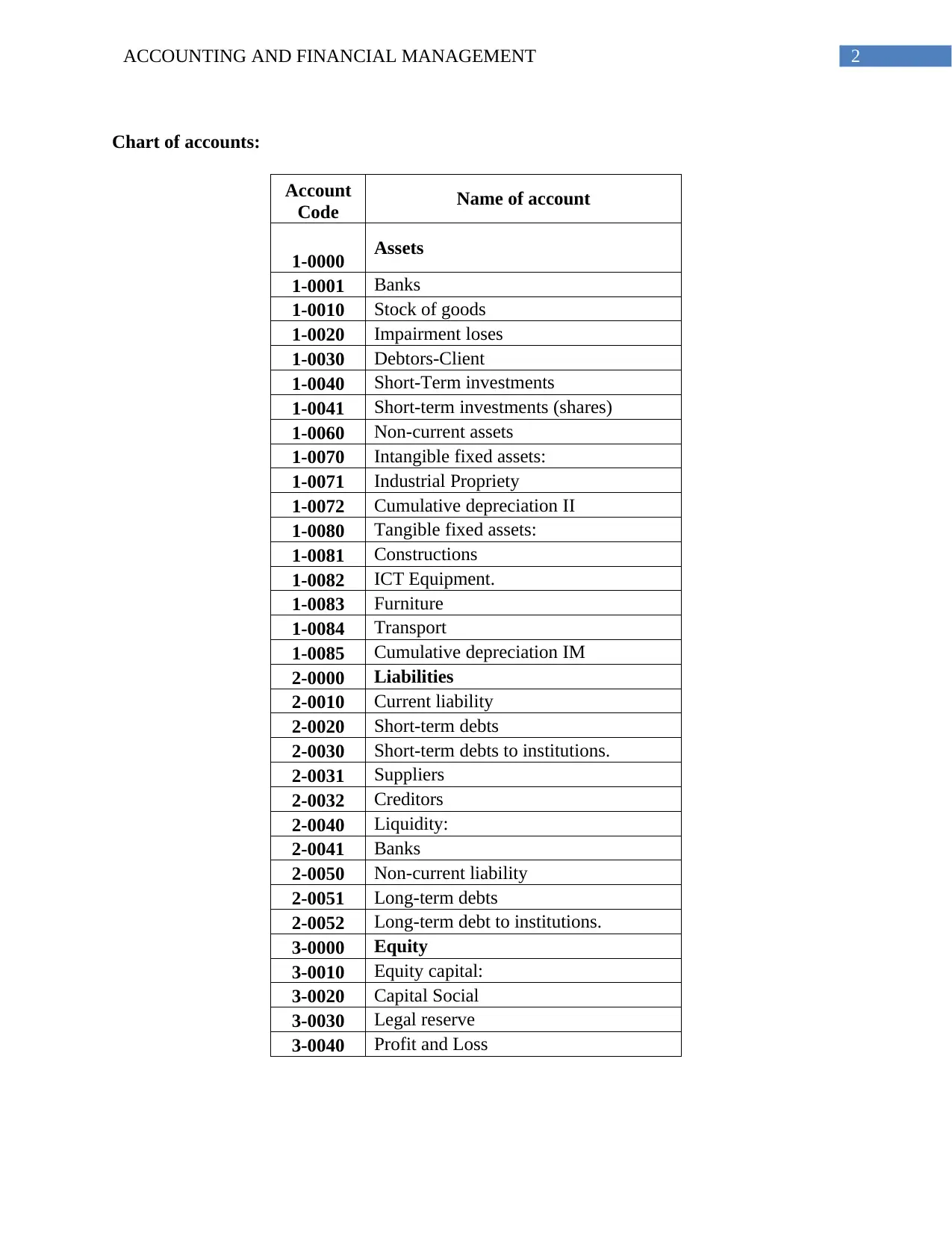

Chart of accounts:

Account

Code Name of account

1-0000 Assets

1-0001 Banks

1-0010 Stock of goods

1-0020 Impairment loses

1-0030 Debtors-Client

1-0040 Short-Term investments

1-0041 Short-term investments (shares)

1-0060 Non-current assets

1-0070 Intangible fixed assets:

1-0071 Industrial Propriety

1-0072 Cumulative depreciation II

1-0080 Tangible fixed assets:

1-0081 Constructions

1-0082 ICT Equipment.

1-0083 Furniture

1-0084 Transport

1-0085 Cumulative depreciation IM

2-0000 Liabilities

2-0010 Current liability

2-0020 Short-term debts

2-0030 Short-term debts to institutions.

2-0031 Suppliers

2-0032 Creditors

2-0040 Liquidity:

2-0041 Banks

2-0050 Non-current liability

2-0051 Long-term debts

2-0052 Long-term debt to institutions.

3-0000 Equity

3-0010 Equity capital:

3-0020 Capital Social

3-0030 Legal reserve

3-0040 Profit and Loss

Chart of accounts:

Account

Code Name of account

1-0000 Assets

1-0001 Banks

1-0010 Stock of goods

1-0020 Impairment loses

1-0030 Debtors-Client

1-0040 Short-Term investments

1-0041 Short-term investments (shares)

1-0060 Non-current assets

1-0070 Intangible fixed assets:

1-0071 Industrial Propriety

1-0072 Cumulative depreciation II

1-0080 Tangible fixed assets:

1-0081 Constructions

1-0082 ICT Equipment.

1-0083 Furniture

1-0084 Transport

1-0085 Cumulative depreciation IM

2-0000 Liabilities

2-0010 Current liability

2-0020 Short-term debts

2-0030 Short-term debts to institutions.

2-0031 Suppliers

2-0032 Creditors

2-0040 Liquidity:

2-0041 Banks

2-0050 Non-current liability

2-0051 Long-term debts

2-0052 Long-term debt to institutions.

3-0000 Equity

3-0010 Equity capital:

3-0020 Capital Social

3-0030 Legal reserve

3-0040 Profit and Loss

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ACCOUNTING AND FINANCIAL MANAGEMENT

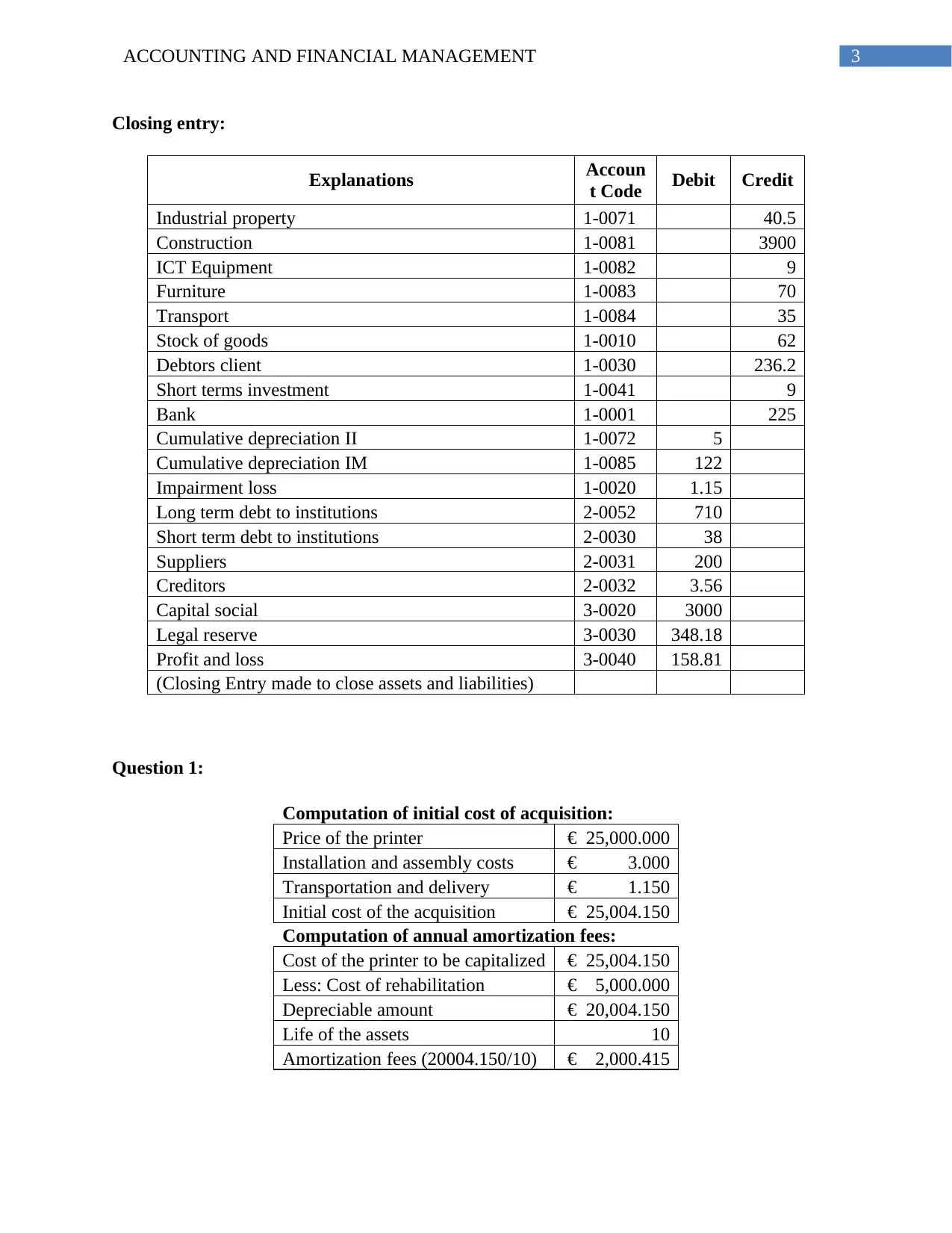

Closing entry:

Explanations Accoun

t Code Debit Credit

Industrial property 1-0071 40.5

Construction 1-0081 3900

ICT Equipment 1-0082 9

Furniture 1-0083 70

Transport 1-0084 35

Stock of goods 1-0010 62

Debtors client 1-0030 236.2

Short terms investment 1-0041 9

Bank 1-0001 225

Cumulative depreciation II 1-0072 5

Cumulative depreciation IM 1-0085 122

Impairment loss 1-0020 1.15

Long term debt to institutions 2-0052 710

Short term debt to institutions 2-0030 38

Suppliers 2-0031 200

Creditors 2-0032 3.56

Capital social 3-0020 3000

Legal reserve 3-0030 348.18

Profit and loss 3-0040 158.81

(Closing Entry made to close assets and liabilities)

Question 1:

Computation of initial cost of acquisition:

Price of the printer € 25,000.000

Installation and assembly costs € 3.000

Transportation and delivery € 1.150

Initial cost of the acquisition € 25,004.150

Computation of annual amortization fees:

Cost of the printer to be capitalized € 25,004.150

Less: Cost of rehabilitation € 5,000.000

Depreciable amount € 20,004.150

Life of the assets 10

Amortization fees (20004.150/10) € 2,000.415

Closing entry:

Explanations Accoun

t Code Debit Credit

Industrial property 1-0071 40.5

Construction 1-0081 3900

ICT Equipment 1-0082 9

Furniture 1-0083 70

Transport 1-0084 35

Stock of goods 1-0010 62

Debtors client 1-0030 236.2

Short terms investment 1-0041 9

Bank 1-0001 225

Cumulative depreciation II 1-0072 5

Cumulative depreciation IM 1-0085 122

Impairment loss 1-0020 1.15

Long term debt to institutions 2-0052 710

Short term debt to institutions 2-0030 38

Suppliers 2-0031 200

Creditors 2-0032 3.56

Capital social 3-0020 3000

Legal reserve 3-0030 348.18

Profit and loss 3-0040 158.81

(Closing Entry made to close assets and liabilities)

Question 1:

Computation of initial cost of acquisition:

Price of the printer € 25,000.000

Installation and assembly costs € 3.000

Transportation and delivery € 1.150

Initial cost of the acquisition € 25,004.150

Computation of annual amortization fees:

Cost of the printer to be capitalized € 25,004.150

Less: Cost of rehabilitation € 5,000.000

Depreciable amount € 20,004.150

Life of the assets 10

Amortization fees (20004.150/10) € 2,000.415

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ACCOUNTING AND FINANCIAL MANAGEMENT

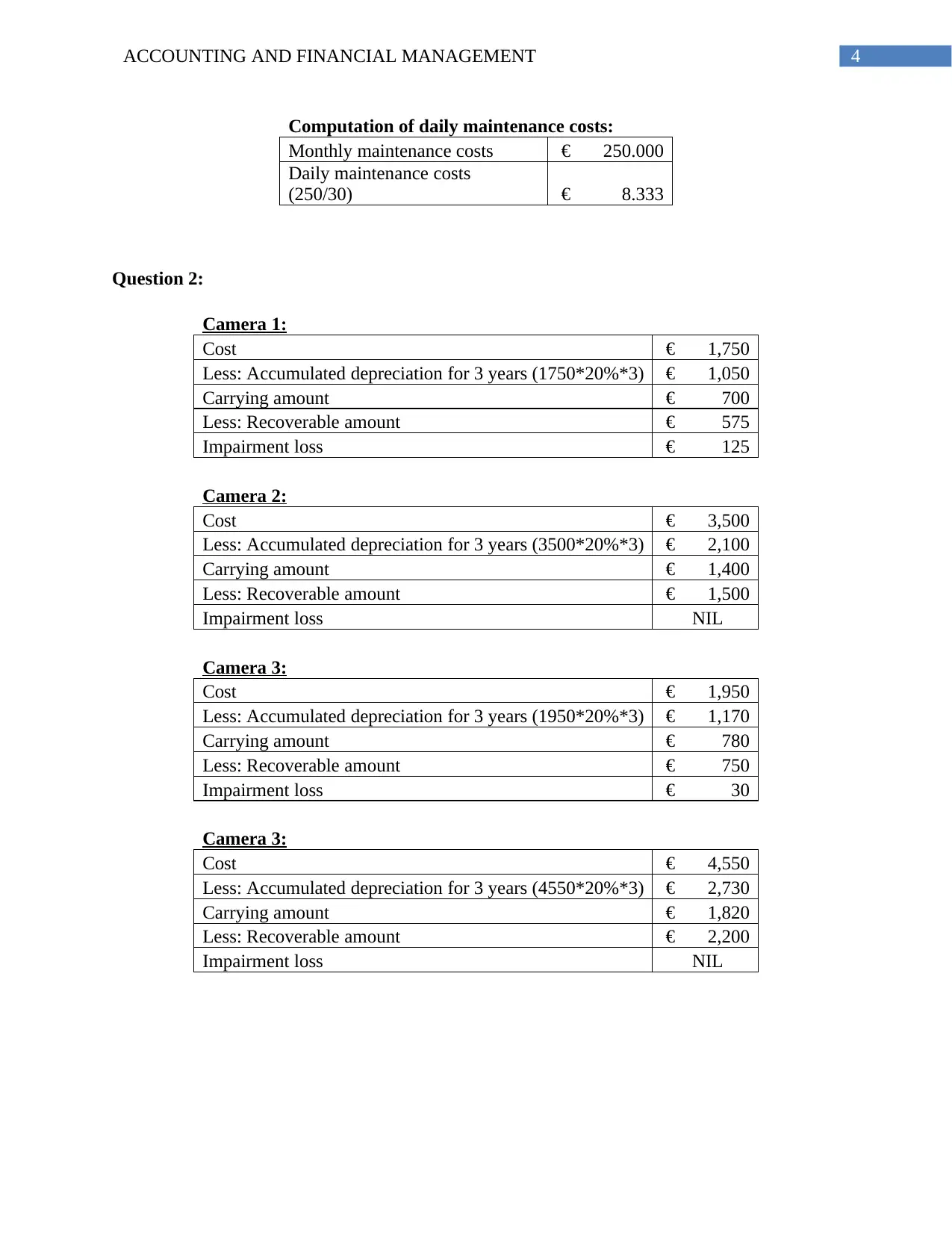

Computation of daily maintenance costs:

Monthly maintenance costs € 250.000

Daily maintenance costs

(250/30) € 8.333

Question 2:

Camera 1:

Cost € 1,750

Less: Accumulated depreciation for 3 years (1750*20%*3) € 1,050

Carrying amount € 700

Less: Recoverable amount € 575

Impairment loss € 125

Camera 2:

Cost € 3,500

Less: Accumulated depreciation for 3 years (3500*20%*3) € 2,100

Carrying amount € 1,400

Less: Recoverable amount € 1,500

Impairment loss NIL

Camera 3:

Cost € 1,950

Less: Accumulated depreciation for 3 years (1950*20%*3) € 1,170

Carrying amount € 780

Less: Recoverable amount € 750

Impairment loss € 30

Camera 3:

Cost € 4,550

Less: Accumulated depreciation for 3 years (4550*20%*3) € 2,730

Carrying amount € 1,820

Less: Recoverable amount € 2,200

Impairment loss NIL

Computation of daily maintenance costs:

Monthly maintenance costs € 250.000

Daily maintenance costs

(250/30) € 8.333

Question 2:

Camera 1:

Cost € 1,750

Less: Accumulated depreciation for 3 years (1750*20%*3) € 1,050

Carrying amount € 700

Less: Recoverable amount € 575

Impairment loss € 125

Camera 2:

Cost € 3,500

Less: Accumulated depreciation for 3 years (3500*20%*3) € 2,100

Carrying amount € 1,400

Less: Recoverable amount € 1,500

Impairment loss NIL

Camera 3:

Cost € 1,950

Less: Accumulated depreciation for 3 years (1950*20%*3) € 1,170

Carrying amount € 780

Less: Recoverable amount € 750

Impairment loss € 30

Camera 3:

Cost € 4,550

Less: Accumulated depreciation for 3 years (4550*20%*3) € 2,730

Carrying amount € 1,820

Less: Recoverable amount € 2,200

Impairment loss NIL

5ACCOUNTING AND FINANCIAL MANAGEMENT

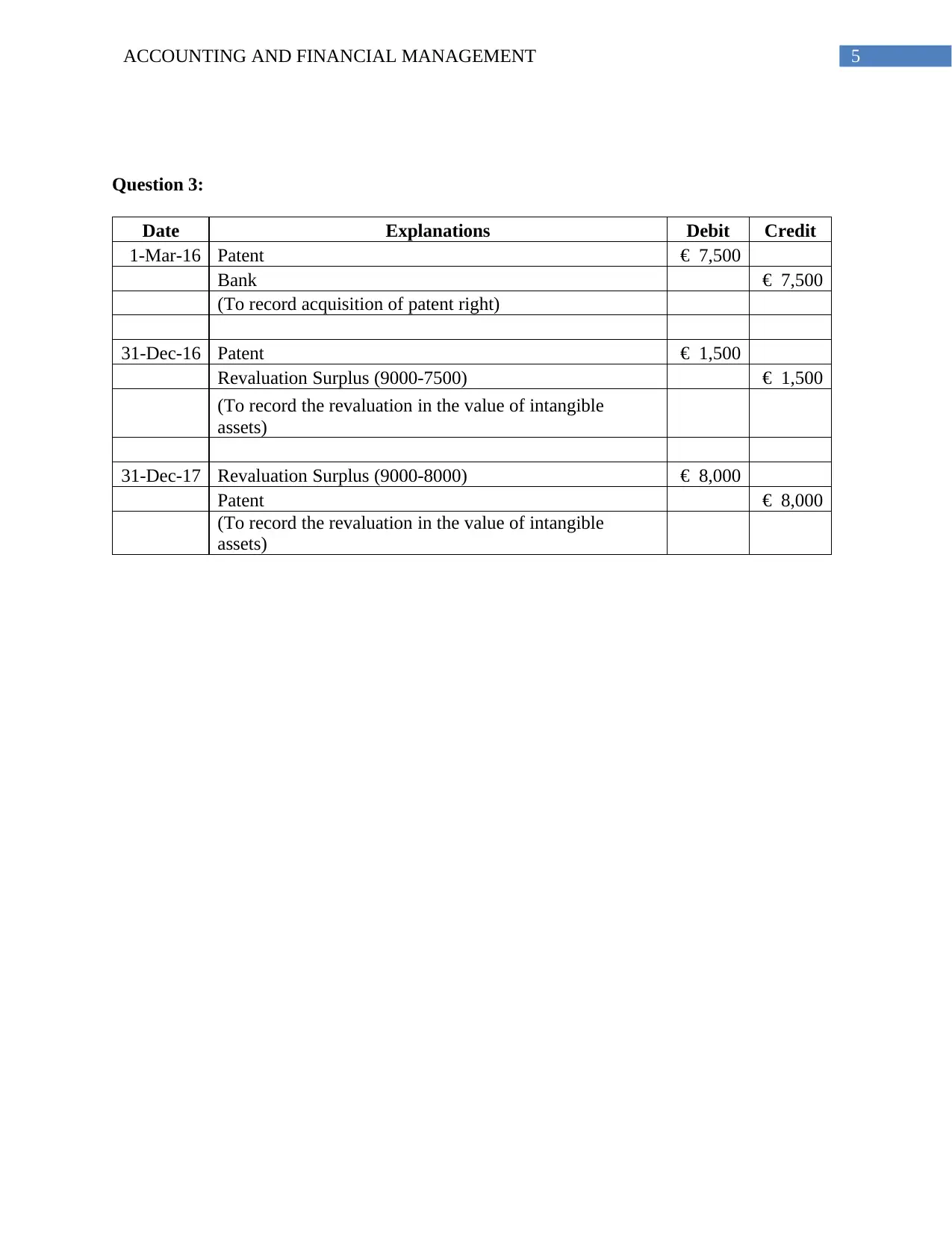

Question 3:

Date Explanations Debit Credit

1-Mar-16 Patent € 7,500

Bank € 7,500

(To record acquisition of patent right)

31-Dec-16 Patent € 1,500

Revaluation Surplus (9000-7500) € 1,500

(To record the revaluation in the value of intangible

assets)

31-Dec-17 Revaluation Surplus (9000-8000) € 8,000

Patent € 8,000

(To record the revaluation in the value of intangible

assets)

Question 3:

Date Explanations Debit Credit

1-Mar-16 Patent € 7,500

Bank € 7,500

(To record acquisition of patent right)

31-Dec-16 Patent € 1,500

Revaluation Surplus (9000-7500) € 1,500

(To record the revaluation in the value of intangible

assets)

31-Dec-17 Revaluation Surplus (9000-8000) € 8,000

Patent € 8,000

(To record the revaluation in the value of intangible

assets)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ACCOUNTING AND FINANCIAL MANAGEMENT

Bibliography:

Avallone, F. and Quagli, A., 2015. Insight into the variables used to manage the goodwill

impairment test under IAS 36. Advances in accounting, 31(1), pp.107-114.

Novák, M., 2016. The Quality of Disclosure under IAS 38 in Financial Statements of Entities

Listed on PSE. European Financial and Accounting Journal, pp.31-44.

Svoboda, P. and Bohušová, H., 2017. Amendments to IAS 16 and IAS 41: Are there any

differences between plant and animal from a financial reporting point of view?. Acta

Universitatis Agriculturae et Silviculturae Mendelianae Brunensis, 65(1), pp.327-337.

Bibliography:

Avallone, F. and Quagli, A., 2015. Insight into the variables used to manage the goodwill

impairment test under IAS 36. Advances in accounting, 31(1), pp.107-114.

Novák, M., 2016. The Quality of Disclosure under IAS 38 in Financial Statements of Entities

Listed on PSE. European Financial and Accounting Journal, pp.31-44.

Svoboda, P. and Bohušová, H., 2017. Amendments to IAS 16 and IAS 41: Are there any

differences between plant and animal from a financial reporting point of view?. Acta

Universitatis Agriculturae et Silviculturae Mendelianae Brunensis, 65(1), pp.327-337.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.