Business Accounting Report: Anne York's Financial Statements Analysis

VerifiedAdded on 2023/02/06

|20

|2408

|28

Report

AI Summary

This report provides a comprehensive analysis of Anne York's accounting and bookkeeping practices. It begins with an examination of double-entry recording, utilizing T-accounts to illustrate transaction postings and balance calculations. The report then progresses to a trial balance, followed by evaluations of the income statement and the statement of financial position. A key section delves into the impact of drawings on small businesses, followed by a detailed calculation and analysis of various financial ratios, including profitability, current, and acid-test ratios, as well as accounts receivable collection and accounts payable payment periods. The report also addresses the impact of the COVID-19 pandemic on these ratios. Overall, the report offers insights into Anne York's financial performance, liquidity, and efficiency, providing a basis for recommendations to improve financial outcomes.

Recording Business transaction

Student Name:

ID:

1

Student Name:

ID:

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Introduction......................................................................................................................................3

Double Entry Record Posting in T-Accounts and Balancing the Account......................................4

Accessing a Trial Balance.............................................................................................................11

Evaluating an Income Statement...................................................................................................12

Preparing a Statement of Financial Position..................................................................................13

Impact of Drawings in Small Business..........................................................................................15

Calculation and Analysing of Ratios.............................................................................................16

Conclusion.....................................................................................................................................18

2

Introduction......................................................................................................................................3

Double Entry Record Posting in T-Accounts and Balancing the Account......................................4

Accessing a Trial Balance.............................................................................................................11

Evaluating an Income Statement...................................................................................................12

Preparing a Statement of Financial Position..................................................................................13

Impact of Drawings in Small Business..........................................................................................15

Calculation and Analysing of Ratios.............................................................................................16

Conclusion.....................................................................................................................................18

2

Introduction

The many accounting and bookkeeping components of Anne York will be examined in this

paper. Bookkeeping is a step-by-step process that records company activities and occurrences to

keep financial paperwork up to date (Douglas Hillman et al., 2019). This report will use Anne

York's double-entry recording, and the results will be submitted to the T-account when they have

been processed (Ledger). Anne York will also be tested in terms of her trial balance. Following

that, various financial statements for Anne York will be shown. It will then be discussed in detail

throughout the paper how drawings are relevant to small businesses. In the end, several financial

ratios of Anne York will be computed, and her financial ratios will be assessed right away. In

addition, the influence of the Covid -19 epidemic on the average ratios will be discussed in

detail.

3

The many accounting and bookkeeping components of Anne York will be examined in this

paper. Bookkeeping is a step-by-step process that records company activities and occurrences to

keep financial paperwork up to date (Douglas Hillman et al., 2019). This report will use Anne

York's double-entry recording, and the results will be submitted to the T-account when they have

been processed (Ledger). Anne York will also be tested in terms of her trial balance. Following

that, various financial statements for Anne York will be shown. It will then be discussed in detail

throughout the paper how drawings are relevant to small businesses. In the end, several financial

ratios of Anne York will be computed, and her financial ratios will be assessed right away. In

addition, the influence of the Covid -19 epidemic on the average ratios will be discussed in

detail.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

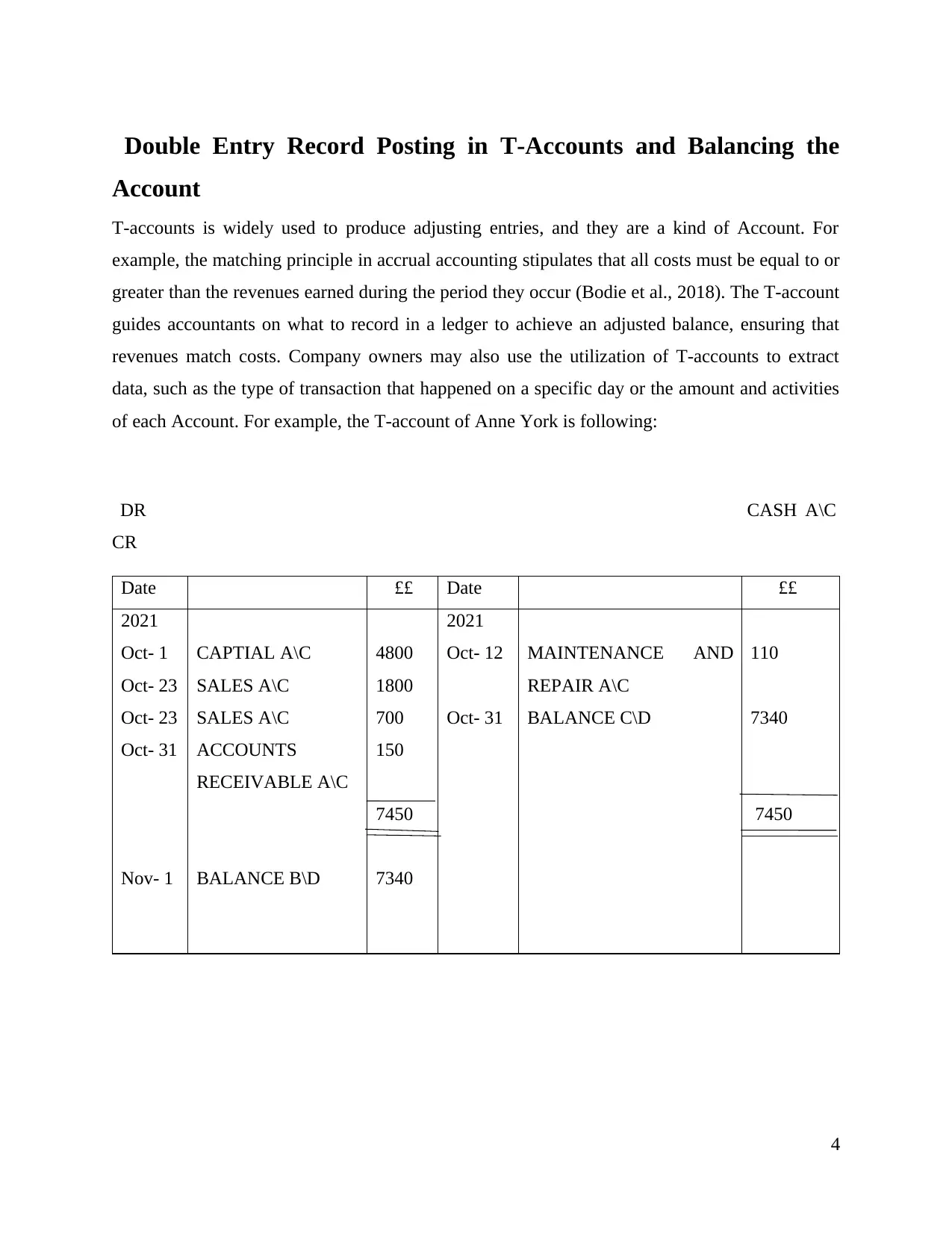

Double Entry Record Posting in T-Accounts and Balancing the

Account

T-accounts is widely used to produce adjusting entries, and they are a kind of Account. For

example, the matching principle in accrual accounting stipulates that all costs must be equal to or

greater than the revenues earned during the period they occur (Bodie et al., 2018). The T-account

guides accountants on what to record in a ledger to achieve an adjusted balance, ensuring that

revenues match costs. Company owners may also use the utilization of T-accounts to extract

data, such as the type of transaction that happened on a specific day or the amount and activities

of each Account. For example, the T-account of Anne York is following:

DR CASH A\C

CR

Date ££ Date ££

2021

Oct- 1

Oct- 23

Oct- 23

Oct- 31

Nov- 1

CAPTIAL A\C

SALES A\C

SALES A\C

ACCOUNTS

RECEIVABLE A\C

BALANCE B\D

4800

1800

700

150

7450

7340

2021

Oct- 12

Oct- 31

MAINTENANCE AND

REPAIR A\C

BALANCE C\D

110

7340

7450

4

Account

T-accounts is widely used to produce adjusting entries, and they are a kind of Account. For

example, the matching principle in accrual accounting stipulates that all costs must be equal to or

greater than the revenues earned during the period they occur (Bodie et al., 2018). The T-account

guides accountants on what to record in a ledger to achieve an adjusted balance, ensuring that

revenues match costs. Company owners may also use the utilization of T-accounts to extract

data, such as the type of transaction that happened on a specific day or the amount and activities

of each Account. For example, the T-account of Anne York is following:

DR CASH A\C

CR

Date ££ Date ££

2021

Oct- 1

Oct- 23

Oct- 23

Oct- 31

Nov- 1

CAPTIAL A\C

SALES A\C

SALES A\C

ACCOUNTS

RECEIVABLE A\C

BALANCE B\D

4800

1800

700

150

7450

7340

2021

Oct- 12

Oct- 31

MAINTENANCE AND

REPAIR A\C

BALANCE C\D

110

7340

7450

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

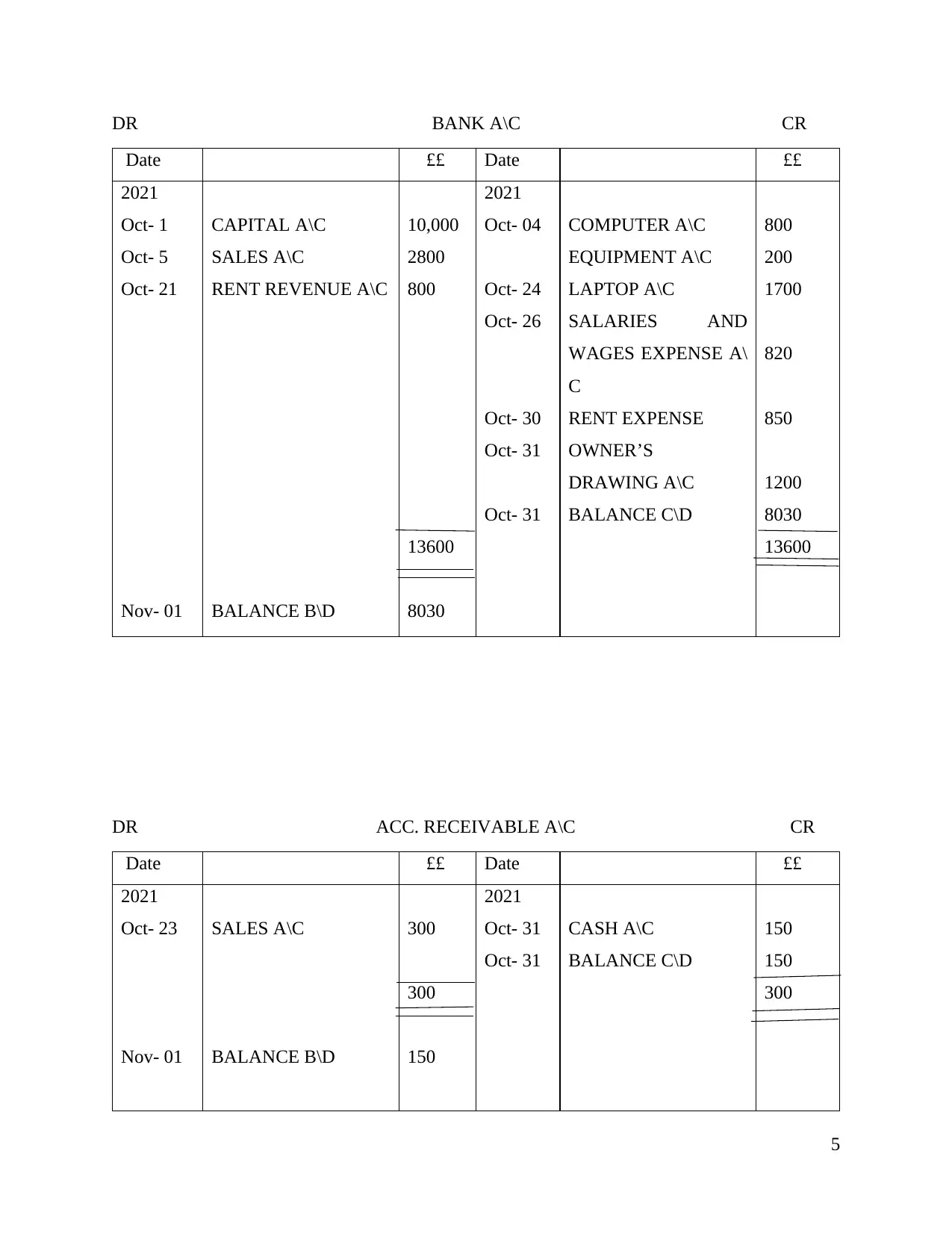

DR BANK A\C CR

Date ££ Date ££

2021

Oct- 1

Oct- 5

Oct- 21

Nov- 01

CAPITAL A\C

SALES A\C

RENT REVENUE A\C

BALANCE B\D

10,000

2800

800

13600

8030

2021

Oct- 04

Oct- 24

Oct- 26

Oct- 30

Oct- 31

Oct- 31

COMPUTER A\C

EQUIPMENT A\C

LAPTOP A\C

SALARIES AND

WAGES EXPENSE A\

C

RENT EXPENSE

OWNER’S

DRAWING A\C

BALANCE C\D

800

200

1700

820

850

1200

8030

13600

DR ACC. RECEIVABLE A\C CR

Date ££ Date ££

2021

Oct- 23

Nov- 01

SALES A\C

BALANCE B\D

300

300

150

2021

Oct- 31

Oct- 31

CASH A\C

BALANCE C\D

150

150

300

5

Date ££ Date ££

2021

Oct- 1

Oct- 5

Oct- 21

Nov- 01

CAPITAL A\C

SALES A\C

RENT REVENUE A\C

BALANCE B\D

10,000

2800

800

13600

8030

2021

Oct- 04

Oct- 24

Oct- 26

Oct- 30

Oct- 31

Oct- 31

COMPUTER A\C

EQUIPMENT A\C

LAPTOP A\C

SALARIES AND

WAGES EXPENSE A\

C

RENT EXPENSE

OWNER’S

DRAWING A\C

BALANCE C\D

800

200

1700

820

850

1200

8030

13600

DR ACC. RECEIVABLE A\C CR

Date ££ Date ££

2021

Oct- 23

Nov- 01

SALES A\C

BALANCE B\D

300

300

150

2021

Oct- 31

Oct- 31

CASH A\C

BALANCE C\D

150

150

300

5

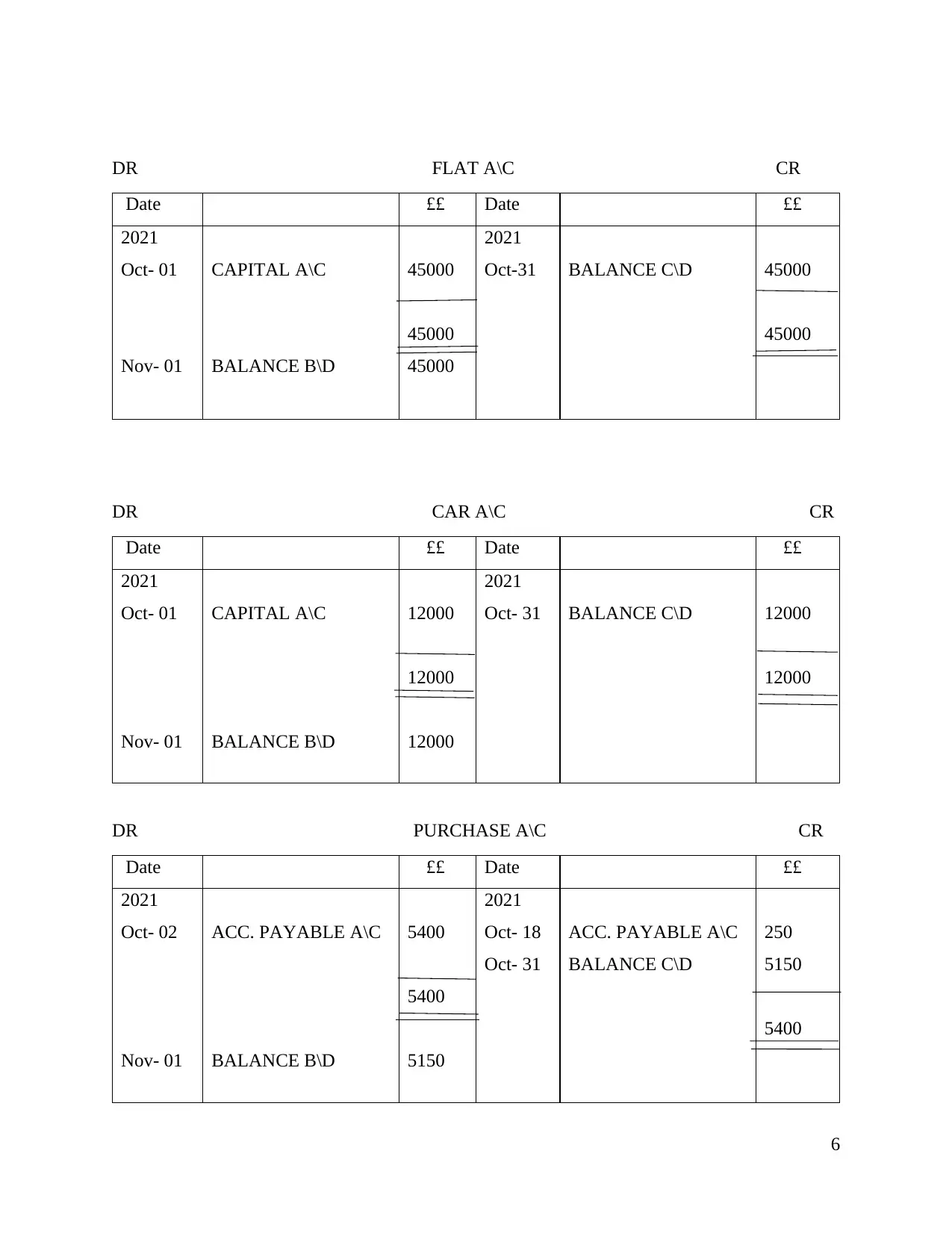

DR FLAT A\C CR

Date ££ Date ££

2021

Oct- 01

Nov- 01

CAPITAL A\C

BALANCE B\D

45000

45000

45000

2021

Oct-31 BALANCE C\D 45000

45000

DR CAR A\C CR

Date ££ Date ££

2021

Oct- 01

Nov- 01

CAPITAL A\C

BALANCE B\D

12000

12000

12000

2021

Oct- 31 BALANCE C\D 12000

12000

DR PURCHASE A\C CR

Date ££ Date ££

2021

Oct- 02

Nov- 01

ACC. PAYABLE A\C

BALANCE B\D

5400

5400

5150

2021

Oct- 18

Oct- 31

ACC. PAYABLE A\C

BALANCE C\D

250

5150

5400

6

Date ££ Date ££

2021

Oct- 01

Nov- 01

CAPITAL A\C

BALANCE B\D

45000

45000

45000

2021

Oct-31 BALANCE C\D 45000

45000

DR CAR A\C CR

Date ££ Date ££

2021

Oct- 01

Nov- 01

CAPITAL A\C

BALANCE B\D

12000

12000

12000

2021

Oct- 31 BALANCE C\D 12000

12000

DR PURCHASE A\C CR

Date ££ Date ££

2021

Oct- 02

Nov- 01

ACC. PAYABLE A\C

BALANCE B\D

5400

5400

5150

2021

Oct- 18

Oct- 31

ACC. PAYABLE A\C

BALANCE C\D

250

5150

5400

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

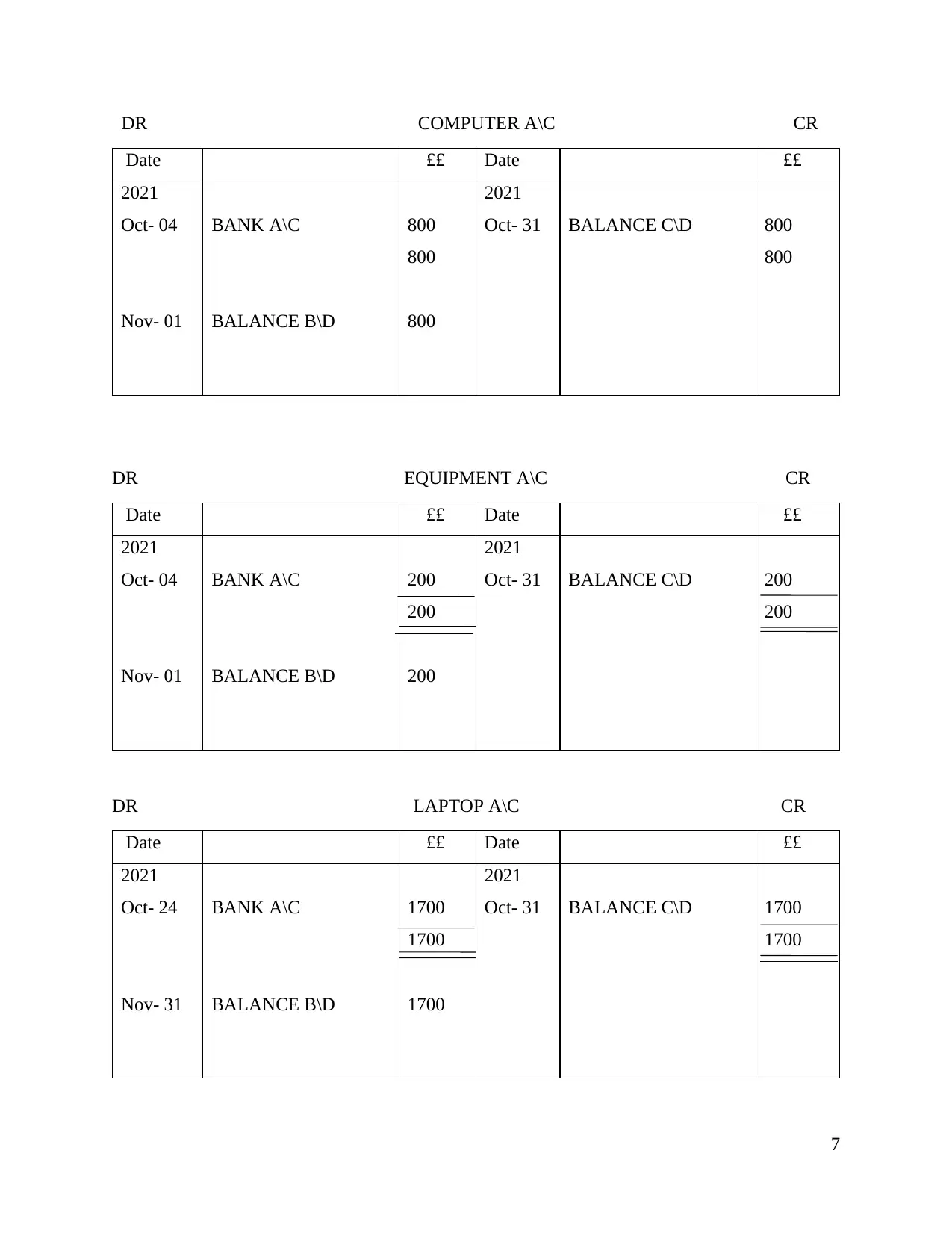

DR COMPUTER A\C CR

Date ££ Date ££

2021

Oct- 04

Nov- 01

BANK A\C

BALANCE B\D

800

800

800

2021

Oct- 31 BALANCE C\D 800

800

DR EQUIPMENT A\C CR

Date ££ Date ££

2021

Oct- 04

Nov- 01

BANK A\C

BALANCE B\D

200

200

200

2021

Oct- 31 BALANCE C\D 200

200

DR LAPTOP A\C CR

Date ££ Date ££

2021

Oct- 24

Nov- 31

BANK A\C

BALANCE B\D

1700

1700

1700

2021

Oct- 31 BALANCE C\D 1700

1700

7

Date ££ Date ££

2021

Oct- 04

Nov- 01

BANK A\C

BALANCE B\D

800

800

800

2021

Oct- 31 BALANCE C\D 800

800

DR EQUIPMENT A\C CR

Date ££ Date ££

2021

Oct- 04

Nov- 01

BANK A\C

BALANCE B\D

200

200

200

2021

Oct- 31 BALANCE C\D 200

200

DR LAPTOP A\C CR

Date ££ Date ££

2021

Oct- 24

Nov- 31

BANK A\C

BALANCE B\D

1700

1700

1700

2021

Oct- 31 BALANCE C\D 1700

1700

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

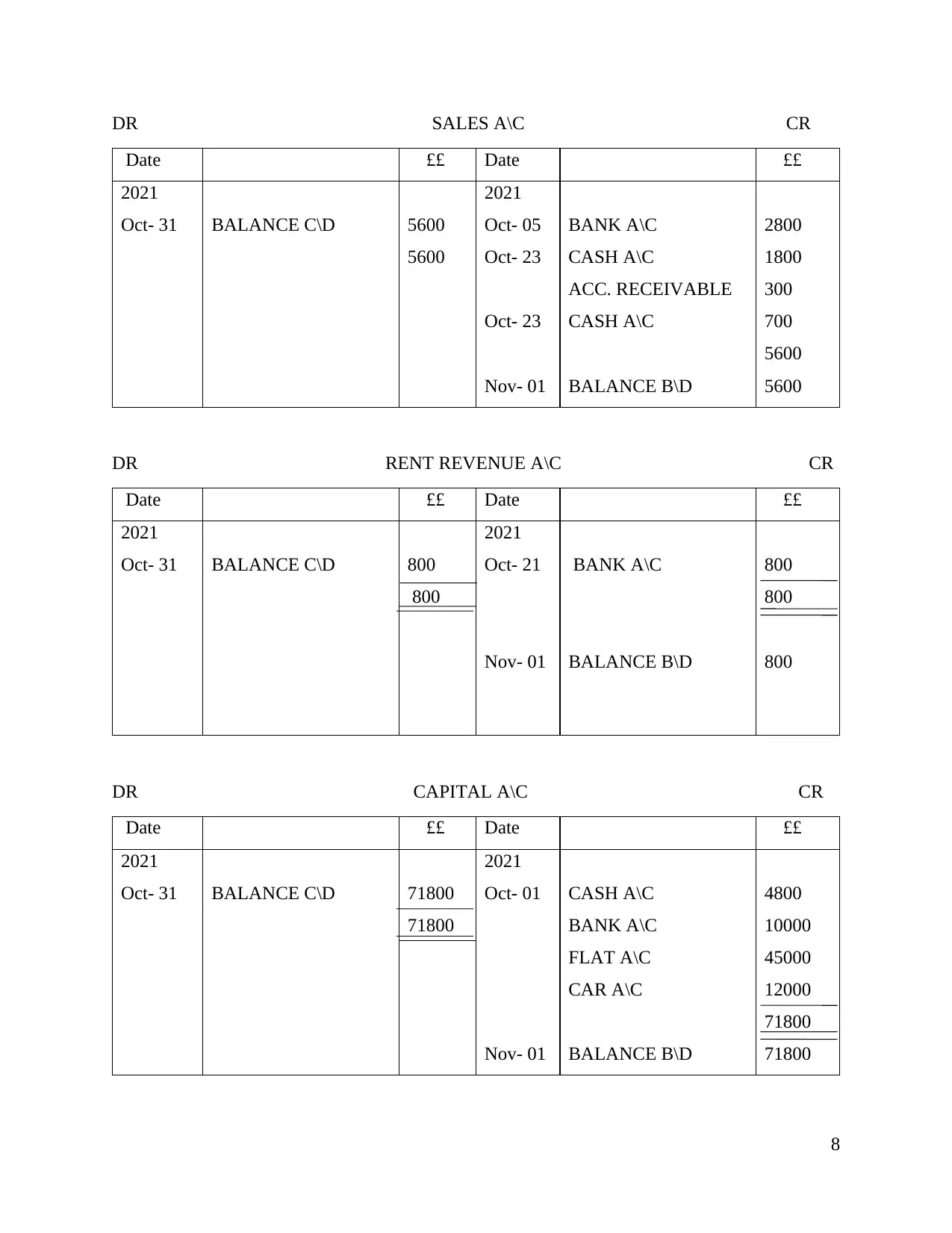

DR SALES A\C CR

Date ££ Date ££

2021

Oct- 31 BALANCE C\D 5600

5600

2021

Oct- 05

Oct- 23

Oct- 23

Nov- 01

BANK A\C

CASH A\C

ACC. RECEIVABLE

CASH A\C

BALANCE B\D

2800

1800

300

700

5600

5600

DR RENT REVENUE A\C CR

Date ££ Date ££

2021

Oct- 31 BALANCE C\D 800

800

2021

Oct- 21

Nov- 01

BANK A\C

BALANCE B\D

800

800

800

DR CAPITAL A\C CR

Date ££ Date ££

2021

Oct- 31 BALANCE C\D 71800

71800

2021

Oct- 01

Nov- 01

CASH A\C

BANK A\C

FLAT A\C

CAR A\C

BALANCE B\D

4800

10000

45000

12000

71800

71800

8

Date ££ Date ££

2021

Oct- 31 BALANCE C\D 5600

5600

2021

Oct- 05

Oct- 23

Oct- 23

Nov- 01

BANK A\C

CASH A\C

ACC. RECEIVABLE

CASH A\C

BALANCE B\D

2800

1800

300

700

5600

5600

DR RENT REVENUE A\C CR

Date ££ Date ££

2021

Oct- 31 BALANCE C\D 800

800

2021

Oct- 21

Nov- 01

BANK A\C

BALANCE B\D

800

800

800

DR CAPITAL A\C CR

Date ££ Date ££

2021

Oct- 31 BALANCE C\D 71800

71800

2021

Oct- 01

Nov- 01

CASH A\C

BANK A\C

FLAT A\C

CAR A\C

BALANCE B\D

4800

10000

45000

12000

71800

71800

8

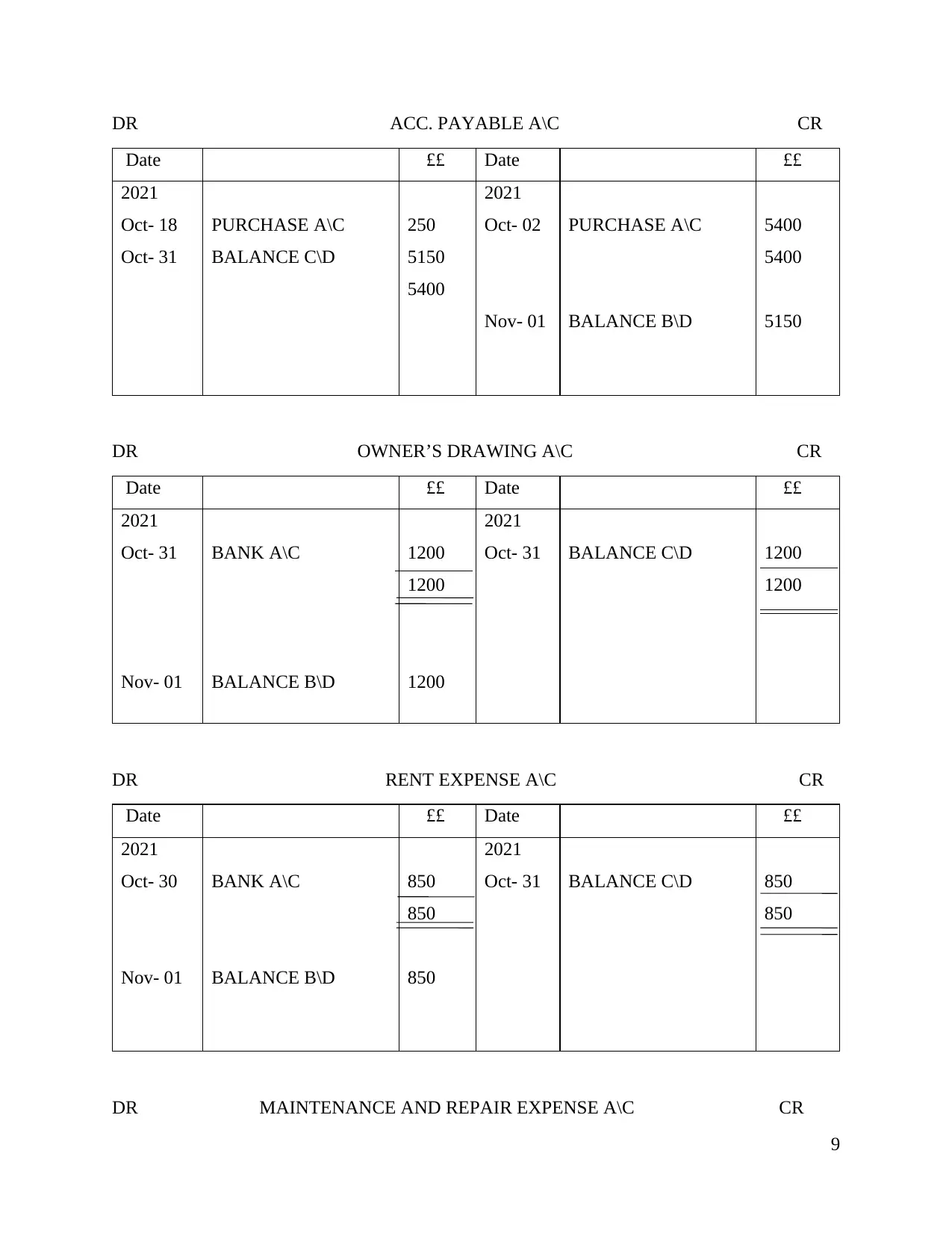

DR ACC. PAYABLE A\C CR

Date ££ Date ££

2021

Oct- 18

Oct- 31

PURCHASE A\C

BALANCE C\D

250

5150

5400

2021

Oct- 02

Nov- 01

PURCHASE A\C

BALANCE B\D

5400

5400

5150

DR OWNER’S DRAWING A\C CR

Date ££ Date ££

2021

Oct- 31

Nov- 01

BANK A\C

BALANCE B\D

1200

1200

1200

2021

Oct- 31 BALANCE C\D 1200

1200

DR RENT EXPENSE A\C CR

Date ££ Date ££

2021

Oct- 30

Nov- 01

BANK A\C

BALANCE B\D

850

850

850

2021

Oct- 31 BALANCE C\D 850

850

DR MAINTENANCE AND REPAIR EXPENSE A\C CR

9

Date ££ Date ££

2021

Oct- 18

Oct- 31

PURCHASE A\C

BALANCE C\D

250

5150

5400

2021

Oct- 02

Nov- 01

PURCHASE A\C

BALANCE B\D

5400

5400

5150

DR OWNER’S DRAWING A\C CR

Date ££ Date ££

2021

Oct- 31

Nov- 01

BANK A\C

BALANCE B\D

1200

1200

1200

2021

Oct- 31 BALANCE C\D 1200

1200

DR RENT EXPENSE A\C CR

Date ££ Date ££

2021

Oct- 30

Nov- 01

BANK A\C

BALANCE B\D

850

850

850

2021

Oct- 31 BALANCE C\D 850

850

DR MAINTENANCE AND REPAIR EXPENSE A\C CR

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

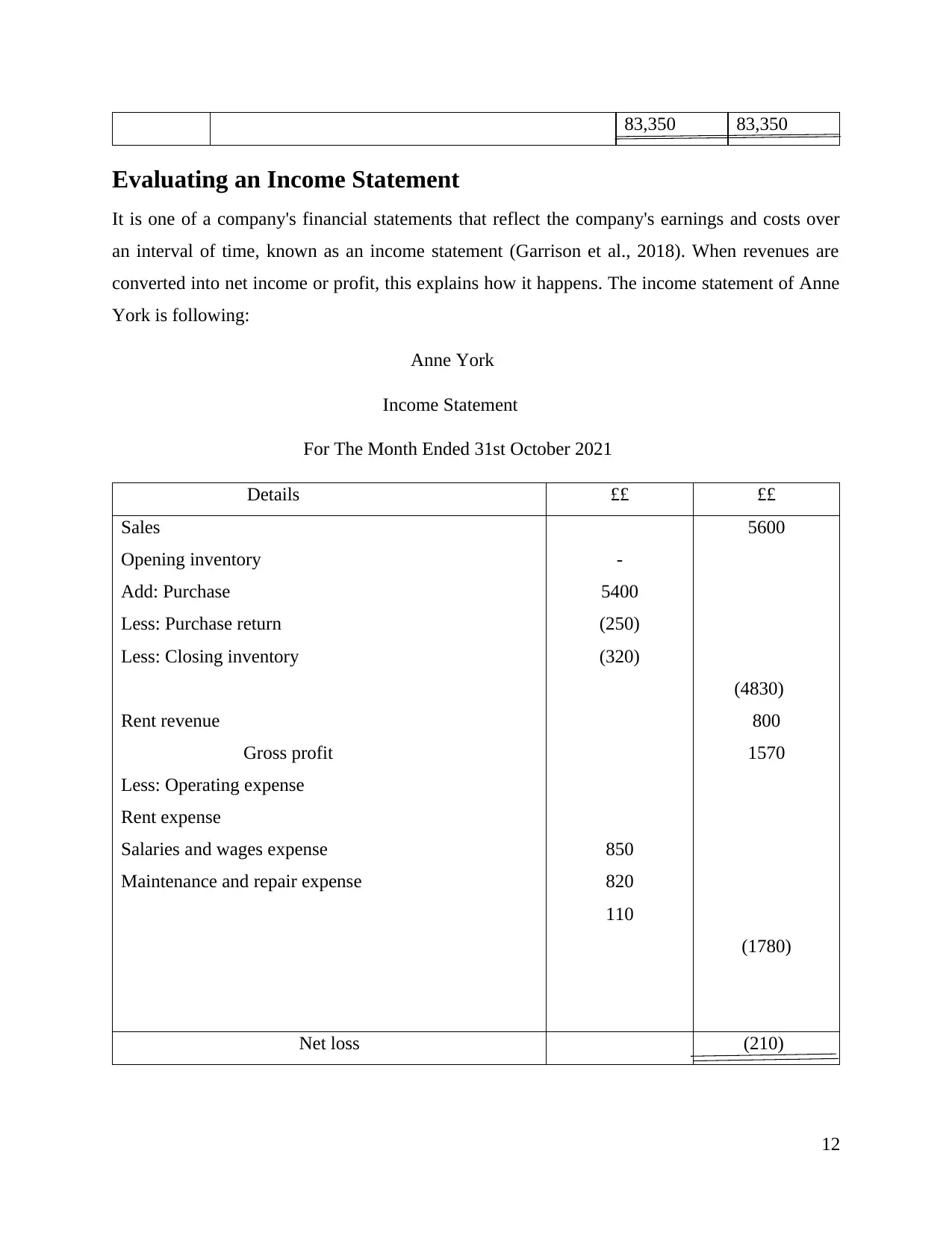

Date ££ Date ££

2021

Oct- 12

Nov- 01

CASH A\C

BALANCE B\D

110

110

110

2021

Oct- 31 BALANCE C\D 110

110

DR SALARIES AND WAGES EXPENSE A\C CR

Date ££ Date ££

2021

Oct- 26

Nov- 01

BANK A\C

BALANCE B\D

820

820

820

2021

Oct- 31 BALANCE C\D 820

820

10

2021

Oct- 12

Nov- 01

CASH A\C

BALANCE B\D

110

110

110

2021

Oct- 31 BALANCE C\D 110

110

DR SALARIES AND WAGES EXPENSE A\C CR

Date ££ Date ££

2021

Oct- 26

Nov- 01

BANK A\C

BALANCE B\D

820

820

820

2021

Oct- 31 BALANCE C\D 820

820

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

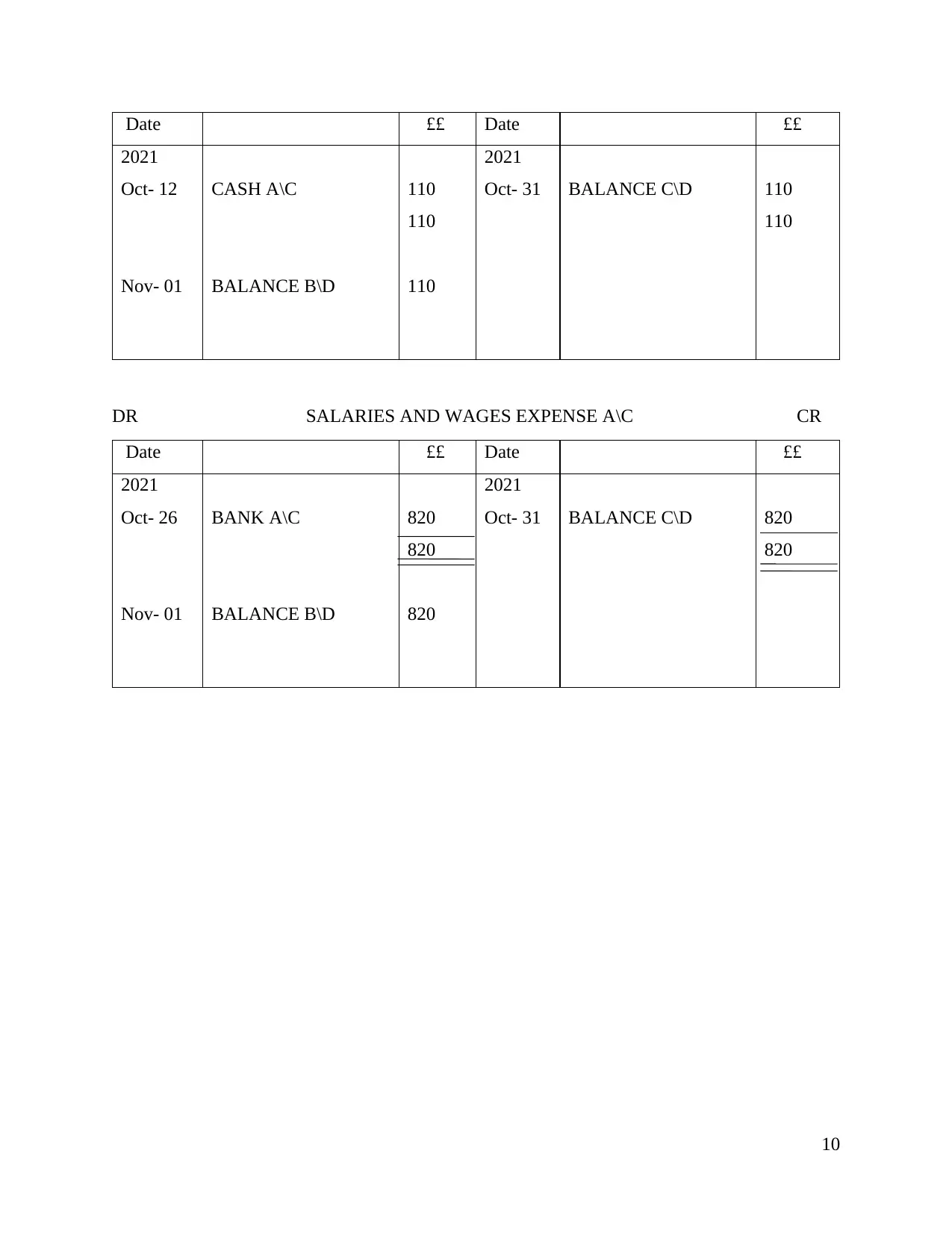

Accessing a Trial Balance

A trial balance is an accounting document in which the proportions of all ledgers are gathered

into totals in the debit and credit account columns equal in both the worksheet's debit and credit

account columns (Chartered Institute Of Management Accountants, 2014). Producing a trial

balance has the general objective of assuring that the entries in a company's accounting system

are mathematically valid. For example, the trial balance of Anne York is following:

Anne York

Trial Balance

For the month ended October 31, 2021

Sl. No. Ledger Name DR Balance CR Balance

01

02

03

04

05

06

07

08

09

10

11

12

13

14

15

16

17

CASH A\C

BANK A\C

ACC. RECEIVABLE A\C

FLAT A\C

CAR A\C

PURCHASE A\C

COMPUTER A\C

EQUIPMENT A\C

LAPTOP A\C

SALES A\C

RENT REVENUE A\C

CAPITAL A\C

ACCOUNTS PAYABLE A\C

OWNER’S DRAWING A\C

RENT EXPENSE A\C

MAINTENANCE AND REPAIR A\C

SALARIES AND WAGES EXPENSE A\C

7340

8030

150

45000

12000

5150

800

200

1700

1200

850

110

820

5600

800

71800

5150

11

A trial balance is an accounting document in which the proportions of all ledgers are gathered

into totals in the debit and credit account columns equal in both the worksheet's debit and credit

account columns (Chartered Institute Of Management Accountants, 2014). Producing a trial

balance has the general objective of assuring that the entries in a company's accounting system

are mathematically valid. For example, the trial balance of Anne York is following:

Anne York

Trial Balance

For the month ended October 31, 2021

Sl. No. Ledger Name DR Balance CR Balance

01

02

03

04

05

06

07

08

09

10

11

12

13

14

15

16

17

CASH A\C

BANK A\C

ACC. RECEIVABLE A\C

FLAT A\C

CAR A\C

PURCHASE A\C

COMPUTER A\C

EQUIPMENT A\C

LAPTOP A\C

SALES A\C

RENT REVENUE A\C

CAPITAL A\C

ACCOUNTS PAYABLE A\C

OWNER’S DRAWING A\C

RENT EXPENSE A\C

MAINTENANCE AND REPAIR A\C

SALARIES AND WAGES EXPENSE A\C

7340

8030

150

45000

12000

5150

800

200

1700

1200

850

110

820

5600

800

71800

5150

11

83,350 83,350

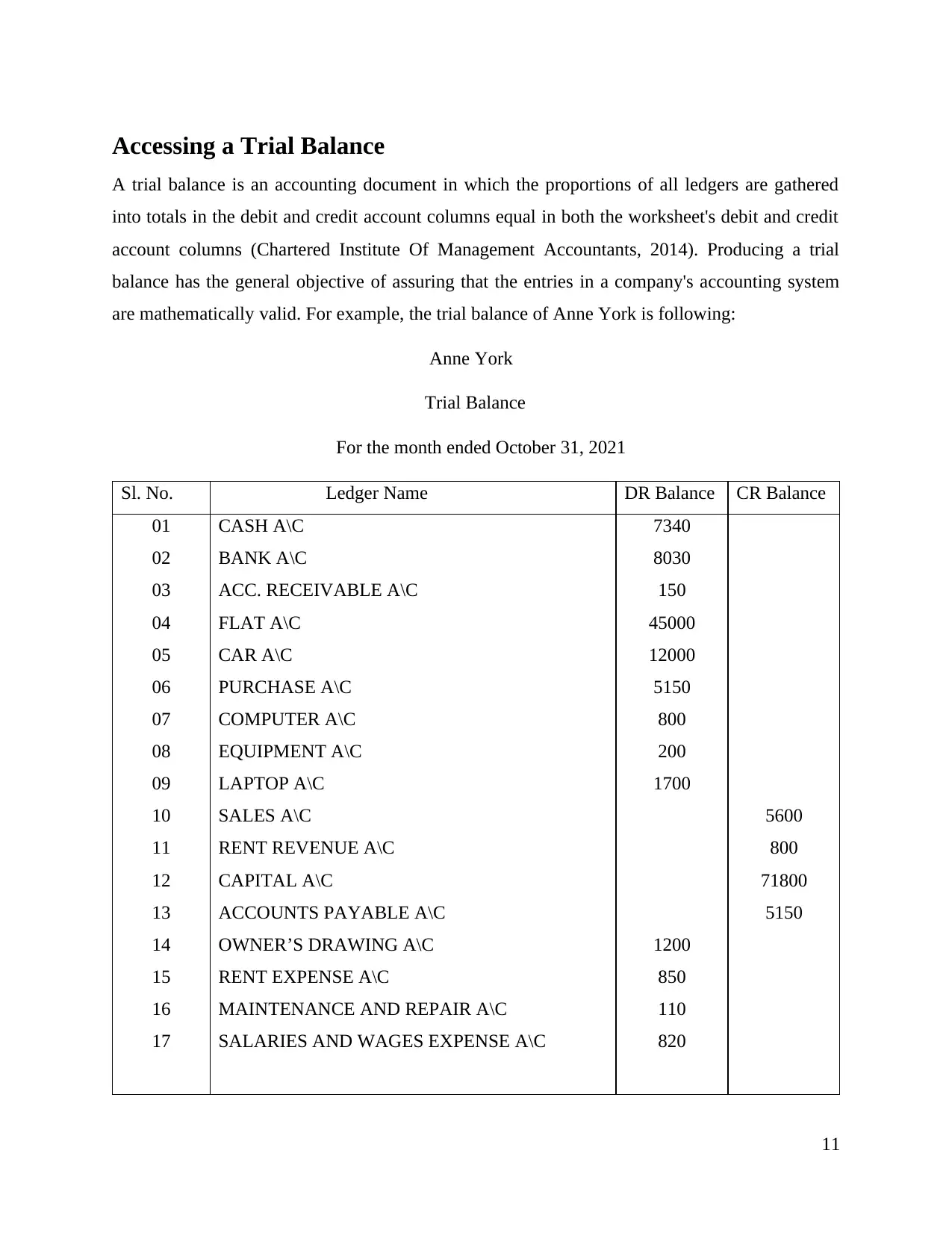

Evaluating an Income Statement

It is one of a company's financial statements that reflect the company's earnings and costs over

an interval of time, known as an income statement (Garrison et al., 2018). When revenues are

converted into net income or profit, this explains how it happens. The income statement of Anne

York is following:

Anne York

Income Statement

For The Month Ended 31st October 2021

Details ££ ££

Sales

Opening inventory

Add: Purchase

Less: Purchase return

Less: Closing inventory

Rent revenue

Gross profit

Less: Operating expense

Rent expense

Salaries and wages expense

Maintenance and repair expense

-

5400

(250)

(320)

850

820

110

5600

(4830)

800

1570

(1780)

Net loss (210)

12

Evaluating an Income Statement

It is one of a company's financial statements that reflect the company's earnings and costs over

an interval of time, known as an income statement (Garrison et al., 2018). When revenues are

converted into net income or profit, this explains how it happens. The income statement of Anne

York is following:

Anne York

Income Statement

For The Month Ended 31st October 2021

Details ££ ££

Sales

Opening inventory

Add: Purchase

Less: Purchase return

Less: Closing inventory

Rent revenue

Gross profit

Less: Operating expense

Rent expense

Salaries and wages expense

Maintenance and repair expense

-

5400

(250)

(320)

850

820

110

5600

(4830)

800

1570

(1780)

Net loss (210)

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.