Accounting Fundamentals: Financial Reporting for Maxim, Pendo, Mafuta

VerifiedAdded on 2021/01/01

|22

|4827

|473

Homework Assignment

AI Summary

This assignment delves into the core principles of accounting through the analysis of three businesses: Maxim, Pendo, and Mafuta. It begins with journal entries and ledger postings for each company, meticulously recording financial transactions. The assignment then progresses to the creation of trial balances, ensuring the accuracy of the recorded data. Following the trial balances, profit and loss statements and financial position statements are prepared for each business, providing a comprehensive view of their financial performance and position. The tasks cover various transactions, including capital contributions, purchases, sales, loan activities, and expense management, demonstrating a practical application of accounting concepts. The report also touches upon the difference between capital and revenue expenditures, reinforcing fundamental accounting knowledge. This assignment serves as a valuable resource for understanding financial reporting and analysis.

ACCOUNTING

FUNDAMENTALS

FUNDAMENTALS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

(a) Ledger accounts from accounting transactions of Maxim.....................................................1

b) Trial balance of Maxim...........................................................................................................3

c) Profit and loss statement and financial position statement of Maxim ...................................3

TASK 2............................................................................................................................................4

a) Ledger accounts with above transactions with dates and descriptions of Pendo ...................4

b) Trial balance at 31st January of Pendo...................................................................................6

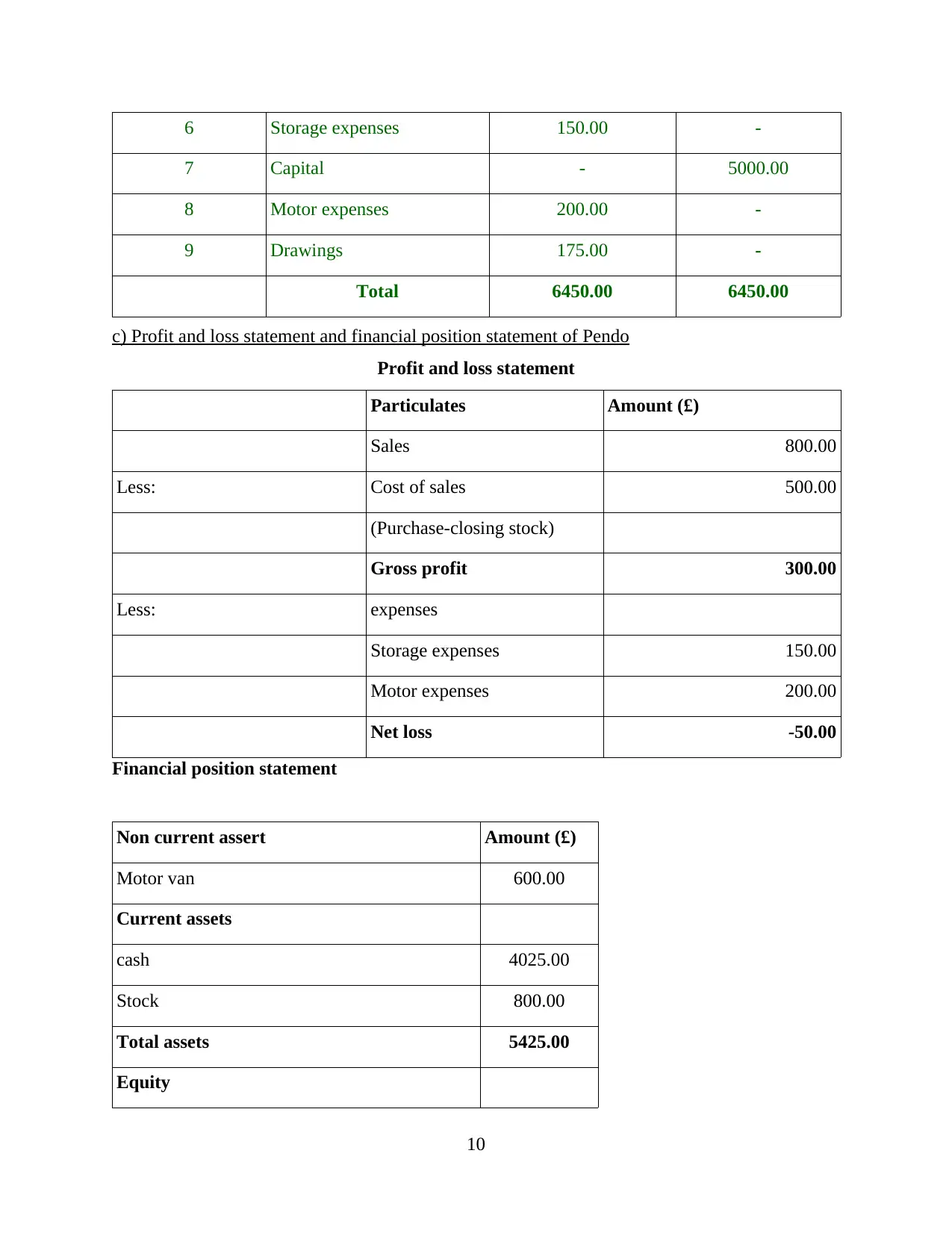

c) Profit and loss statement and financial position statement of Pendo......................................6

TASK 3............................................................................................................................................7

a) Ledger accounts of Mafuta.....................................................................................................7

b) Trial balance at 31st January of Mafuta..................................................................................9

Profit and loss statement and financial position statement at 31st January of Mafuta.............10

TASK 4..........................................................................................................................................11

Ledger accounts and recording of transactions.........................................................................11

TASK 5..........................................................................................................................................13

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

(a) Ledger accounts from accounting transactions of Maxim.....................................................1

b) Trial balance of Maxim...........................................................................................................3

c) Profit and loss statement and financial position statement of Maxim ...................................3

TASK 2............................................................................................................................................4

a) Ledger accounts with above transactions with dates and descriptions of Pendo ...................4

b) Trial balance at 31st January of Pendo...................................................................................6

c) Profit and loss statement and financial position statement of Pendo......................................6

TASK 3............................................................................................................................................7

a) Ledger accounts of Mafuta.....................................................................................................7

b) Trial balance at 31st January of Mafuta..................................................................................9

Profit and loss statement and financial position statement at 31st January of Mafuta.............10

TASK 4..........................................................................................................................................11

Ledger accounts and recording of transactions.........................................................................11

TASK 5..........................................................................................................................................13

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

INTRODUCTION

Accounting fundamentals contains basic accounting concepts, principles, accounting

concepts, money measurement, monetary terms, dual aspects, going concern etc. Nature,

behaviour and purpose of cost accounting and cost accounting concepts illustrated with practical

problems (Zeff, 2016). Accounting treatments subject to business transactions with appropriate

principles and rules are provided in this report. Basic accounting principles of accounting

reviewed with implementation of appropriate online software. Financial statements are prepared

in the basis of initial data with both routine and non routine tacticians. An evaluation of financial

statements with confidence also presented in this report.

Structure of this report is base upon providing information related to defining the

accounting principles. There are five task given in this report. First four task are related to

treatment of transactions and recording them in primary books of accounts. There is a difference

between capital expenditure and revenue expenditure also defined in this report.

TASK 1

Journal entries: IT is a part of recording primary books of accounting that helps in

recording day to day business transaction with in organisation (Wright, 2017).

Ledger posting: this is one of the accounting procedure that mainly associated with

recording the information of initial business transactions (Dobija and Kurek, 2013).

(a) Ledger accounts from accounting transactions of Maxim

Date Particular

Debit

amount

Credit

amount

05/04/18 Cash a/c 300.00

To capital 300.00

07/04/18

Purchase

a/c 200.00

To cash a/c 200.00

1

Accounting fundamentals contains basic accounting concepts, principles, accounting

concepts, money measurement, monetary terms, dual aspects, going concern etc. Nature,

behaviour and purpose of cost accounting and cost accounting concepts illustrated with practical

problems (Zeff, 2016). Accounting treatments subject to business transactions with appropriate

principles and rules are provided in this report. Basic accounting principles of accounting

reviewed with implementation of appropriate online software. Financial statements are prepared

in the basis of initial data with both routine and non routine tacticians. An evaluation of financial

statements with confidence also presented in this report.

Structure of this report is base upon providing information related to defining the

accounting principles. There are five task given in this report. First four task are related to

treatment of transactions and recording them in primary books of accounts. There is a difference

between capital expenditure and revenue expenditure also defined in this report.

TASK 1

Journal entries: IT is a part of recording primary books of accounting that helps in

recording day to day business transaction with in organisation (Wright, 2017).

Ledger posting: this is one of the accounting procedure that mainly associated with

recording the information of initial business transactions (Dobija and Kurek, 2013).

(a) Ledger accounts from accounting transactions of Maxim

Date Particular

Debit

amount

Credit

amount

05/04/18 Cash a/c 300.00

To capital 300.00

07/04/18

Purchase

a/c 200.00

To cash a/c 200.00

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

08/04/18 Cash a/c 250.00

To loan

form

Tatiana 250.00

15/04/18

Motor car

a/c 150.00

To van a/c 150.00

20/04/18 Cash a/c 350.00

To sales 350.00

28/04/18 rent a/c 50.00

To cash a/c 50.00

29/04/18 Loan a/c 200.00

To cash a/c 200.00

30/04/18

Drawing

a/c 60.00

To cash a/c 60.00

Ledger posting

Cash account

Date Particular Amount Date Particular Amount

05/04/18 To capital 300.00 07/04/18 By purchase 200.00

2

To loan

form

Tatiana 250.00

15/04/18

Motor car

a/c 150.00

To van a/c 150.00

20/04/18 Cash a/c 350.00

To sales 350.00

28/04/18 rent a/c 50.00

To cash a/c 50.00

29/04/18 Loan a/c 200.00

To cash a/c 200.00

30/04/18

Drawing

a/c 60.00

To cash a/c 60.00

Ledger posting

Cash account

Date Particular Amount Date Particular Amount

05/04/18 To capital 300.00 07/04/18 By purchase 200.00

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

a/c

08/04/18

To loan

form

Tatiana 250.00 15/04/18 By Motor van 150.00

20/04/18 To sales 350.00 28/04/18 By rent 50.00

29/04/18 By loan paid 200.00

30/04/18 by Drawing 60.00

30/04/18

By closing

balance 240.00

900.00 900.00

Capital a/c

Date Particular Amount Date Particular Amount

30/04/18 To drawing 60.00 05/04/18 By cash 300.00

30/04/18

To closing

balance 240.00

300.00 300.00

Purchase a/c

Date Particular Amount Date Particular Amount

07/04/18 To cash 200.00 30/04/18 By trading a/c 200.00

200.00 200.00

Loan a/c

Date Particular Amount Date Particular Amount

29/04/18 To cash 200.00 08/04/18 By cash 250.00

30/04/18

To closing

balance 50.00

3

08/04/18

To loan

form

Tatiana 250.00 15/04/18 By Motor van 150.00

20/04/18 To sales 350.00 28/04/18 By rent 50.00

29/04/18 By loan paid 200.00

30/04/18 by Drawing 60.00

30/04/18

By closing

balance 240.00

900.00 900.00

Capital a/c

Date Particular Amount Date Particular Amount

30/04/18 To drawing 60.00 05/04/18 By cash 300.00

30/04/18

To closing

balance 240.00

300.00 300.00

Purchase a/c

Date Particular Amount Date Particular Amount

07/04/18 To cash 200.00 30/04/18 By trading a/c 200.00

200.00 200.00

Loan a/c

Date Particular Amount Date Particular Amount

29/04/18 To cash 200.00 08/04/18 By cash 250.00

30/04/18

To closing

balance 50.00

3

250.00 250.00

Motor van

Date Particular Amount Date Particular Amount

15/04/16 To cash 150.00 30/04/16

By closing

balance 150.00

150.00 150.00

Sales a/c

Date Particular Amount Date Particular Amount

30/04/16

To Trading

a/c 350.00 20/04/18 By cash 350.00

350.00 350.00

Rent a/c

Date Particular Amount Date Particular Amount

28/04/18 To cash 50.00 20/04/18 By P&l ac 50.00

50.00 50.00

Drawing a/c

Date Particular Amount Date Particular Amount

30/04/18 To cash a/c 60.00 30/04/18 By capital a/c 60.00

60.00 60.00

b) Trial balance of Maxim

S.N. Particulars Debit amount Credit amount

1 Cash 240.00 0.00

2 Capital 0.00 300.00

3 Purchase 200.00 0.00

4 Loan a/c 0.00 50.00

4

Motor van

Date Particular Amount Date Particular Amount

15/04/16 To cash 150.00 30/04/16

By closing

balance 150.00

150.00 150.00

Sales a/c

Date Particular Amount Date Particular Amount

30/04/16

To Trading

a/c 350.00 20/04/18 By cash 350.00

350.00 350.00

Rent a/c

Date Particular Amount Date Particular Amount

28/04/18 To cash 50.00 20/04/18 By P&l ac 50.00

50.00 50.00

Drawing a/c

Date Particular Amount Date Particular Amount

30/04/18 To cash a/c 60.00 30/04/18 By capital a/c 60.00

60.00 60.00

b) Trial balance of Maxim

S.N. Particulars Debit amount Credit amount

1 Cash 240.00 0.00

2 Capital 0.00 300.00

3 Purchase 200.00 0.00

4 Loan a/c 0.00 50.00

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

5 Motor Van 150.00 0.00

6 Sales 0.00 350.00

7 Drawings 60.00 0.00

8 Rent 50.00 0.00

Total 700.00 700.00

c) Profit and loss statement and financial position statement of Maxim

Trading and P&L a/c Statement

Particular Amount

Sales 350.00

Less: Cost of sales -100.00

(Purchase-closing stock)

Gross profit 250.00

Rent paid 50.00

Net profit 200.00

Financial position statement

Assets Amount

Non Current assets

Motor van 150.00

Current assets

Cash 240.00

Closing stock 100.00

Total assets 490.00

Liabilities

Capital 240

add: profit 200 440.00

5

6 Sales 0.00 350.00

7 Drawings 60.00 0.00

8 Rent 50.00 0.00

Total 700.00 700.00

c) Profit and loss statement and financial position statement of Maxim

Trading and P&L a/c Statement

Particular Amount

Sales 350.00

Less: Cost of sales -100.00

(Purchase-closing stock)

Gross profit 250.00

Rent paid 50.00

Net profit 200.00

Financial position statement

Assets Amount

Non Current assets

Motor van 150.00

Current assets

Cash 240.00

Closing stock 100.00

Total assets 490.00

Liabilities

Capital 240

add: profit 200 440.00

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Loan 50.00

Total liabilities 490.00

TASK 2

a) Ledger accounts with above transactions with dates and descriptions of Pendo

Journal entries

Date Particulars Amount (£) Amount (£)

01/01/18 Cash a/c 5000.00

To capital a/c 5000.00

(Being capital introduced)

02/01/18 Motor van 600.00

To cash a/c 600.00

(Being Motor van acquired)

03/01/18 Purchase a/c 1300.00

To cash a/c 1300.00

(Being purchase made)

04/01/18 Cash a/c 1000.00

To loan form

Sergei a/c 1000.00

(Loan received from Sergie)

10/01/18 Motor expenses 200.00

To cash a/c 200.00

(Being motor expenses paid)

13/01/18 Cash a/c 300.00

To sales 300.00

6

Total liabilities 490.00

TASK 2

a) Ledger accounts with above transactions with dates and descriptions of Pendo

Journal entries

Date Particulars Amount (£) Amount (£)

01/01/18 Cash a/c 5000.00

To capital a/c 5000.00

(Being capital introduced)

02/01/18 Motor van 600.00

To cash a/c 600.00

(Being Motor van acquired)

03/01/18 Purchase a/c 1300.00

To cash a/c 1300.00

(Being purchase made)

04/01/18 Cash a/c 1000.00

To loan form

Sergei a/c 1000.00

(Loan received from Sergie)

10/01/18 Motor expenses 200.00

To cash a/c 200.00

(Being motor expenses paid)

13/01/18 Cash a/c 300.00

To sales 300.00

6

(Sales made)

20/01/18 Cash a/c 500.00

To sales 500.00

(Being sales made)

24/01/18

Storage Expenses

a/c 150.00

To cash a/c 150.00

(Being expenses made)

27/01/18 Loan a/c 350.00

To cash a/c 350.00

(Repayment of loan)

30/01/18 Drawing a/c 175.00

Cash 175.00

(Drawings made)

Ledger accounts

Cash a/c

Date Particular Amount (£) Date Particular Amount (£)

01/01/18 To capital a/c 5000.00 02/01/18 By motor van 600.00

04/01/18

To loan form

sergri 1000.00 03/01/18 By Purchase 1300.00

13/01/18 To sales 300.00 10/01/18

By motor

expenses 200.00

20/01/18 To sales 500.00 24/01/18

By storage

expenses 150.00

27/01/18 By repayment 350.00

7

20/01/18 Cash a/c 500.00

To sales 500.00

(Being sales made)

24/01/18

Storage Expenses

a/c 150.00

To cash a/c 150.00

(Being expenses made)

27/01/18 Loan a/c 350.00

To cash a/c 350.00

(Repayment of loan)

30/01/18 Drawing a/c 175.00

Cash 175.00

(Drawings made)

Ledger accounts

Cash a/c

Date Particular Amount (£) Date Particular Amount (£)

01/01/18 To capital a/c 5000.00 02/01/18 By motor van 600.00

04/01/18

To loan form

sergri 1000.00 03/01/18 By Purchase 1300.00

13/01/18 To sales 300.00 10/01/18

By motor

expenses 200.00

20/01/18 To sales 500.00 24/01/18

By storage

expenses 150.00

27/01/18 By repayment 350.00

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

of loan

30/01/18 By drawing 175.00

31/01/18

By closing

balance 4025.00

6800.00 6800.00

Motor van a/c

Date Particular Amount (£) Date Particular Amount (£)

02/01/18 To Cash 600.00 31/01/18

By closing

balance 600.00

600.00 600.00

Purchase a/c

Date Particular Amount (£) Date Particular Amount (£)

03/01/18 To Cash 1300.00 31/01/18 By trading a/c 1300.00

1300.00 1300.00

Loan form Sergie a/c

Date Particular Amount (£) Date Particular Amount (£)

27/01/18 To Cash 350.00 04/01/18 By cash 1000.00

31/01/18 To balance c/d 650.00

1000.00 1000.00

Sales a/c

Date Particular Amount (£) Date Particular Amount (£)

31/01/18 To trading a/c 800.00 13/01/18 By cash 300.00

20/01/18 By cash 500.00

800.00 800

Storage expenses

Date Particular Amount (£) Date Particular Amount (£)

8

30/01/18 By drawing 175.00

31/01/18

By closing

balance 4025.00

6800.00 6800.00

Motor van a/c

Date Particular Amount (£) Date Particular Amount (£)

02/01/18 To Cash 600.00 31/01/18

By closing

balance 600.00

600.00 600.00

Purchase a/c

Date Particular Amount (£) Date Particular Amount (£)

03/01/18 To Cash 1300.00 31/01/18 By trading a/c 1300.00

1300.00 1300.00

Loan form Sergie a/c

Date Particular Amount (£) Date Particular Amount (£)

27/01/18 To Cash 350.00 04/01/18 By cash 1000.00

31/01/18 To balance c/d 650.00

1000.00 1000.00

Sales a/c

Date Particular Amount (£) Date Particular Amount (£)

31/01/18 To trading a/c 800.00 13/01/18 By cash 300.00

20/01/18 By cash 500.00

800.00 800

Storage expenses

Date Particular Amount (£) Date Particular Amount (£)

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

24/01/18 To Cash 150.00 31/01/18 By P&L a/c 150.00

150.00 150.00

Drawing a/c

Date Particular Amount (£) Date Particular Amount (£)

30/01/18 To Cash 175.00 31/01/18 By Capital a/c 175.00

175.00 175.00

Capital a/c

Date Particular Amount (£) Date Particular Amount (£)

31/01/18 To Drawing 175.00 01/01/18 By cash 5000.00

31/01/18 To balance c/d 4825.00

5000.00 5000.00

Motor expenses

Date Particular Amount (£) Date Particular Amount (£)

10/01/18 To Cash 200.00 31/01/18 By P&L a/c 200.00

200.00 200.00

b) Trial balance at 31st January of Pendo

Trial balance

Trial balance

S.N. Particulars Debit Amount (£) Credit Amount (£)

1 Cash 4025.00 -

2 Motor Van 600.00 -

3 Purchase 1300.00 -

4 Loan a/c - 650.00

5 Sales a/c - 800.00

9

150.00 150.00

Drawing a/c

Date Particular Amount (£) Date Particular Amount (£)

30/01/18 To Cash 175.00 31/01/18 By Capital a/c 175.00

175.00 175.00

Capital a/c

Date Particular Amount (£) Date Particular Amount (£)

31/01/18 To Drawing 175.00 01/01/18 By cash 5000.00

31/01/18 To balance c/d 4825.00

5000.00 5000.00

Motor expenses

Date Particular Amount (£) Date Particular Amount (£)

10/01/18 To Cash 200.00 31/01/18 By P&L a/c 200.00

200.00 200.00

b) Trial balance at 31st January of Pendo

Trial balance

Trial balance

S.N. Particulars Debit Amount (£) Credit Amount (£)

1 Cash 4025.00 -

2 Motor Van 600.00 -

3 Purchase 1300.00 -

4 Loan a/c - 650.00

5 Sales a/c - 800.00

9

6 Storage expenses 150.00 -

7 Capital - 5000.00

8 Motor expenses 200.00 -

9 Drawings 175.00 -

Total 6450.00 6450.00

c) Profit and loss statement and financial position statement of Pendo

Profit and loss statement

Particulates Amount (£)

Sales 800.00

Less: Cost of sales 500.00

(Purchase-closing stock)

Gross profit 300.00

Less: expenses

Storage expenses 150.00

Motor expenses 200.00

Net loss -50.00

Financial position statement

Non current assert Amount (£)

Motor van 600.00

Current assets

cash 4025.00

Stock 800.00

Total assets 5425.00

Equity

10

7 Capital - 5000.00

8 Motor expenses 200.00 -

9 Drawings 175.00 -

Total 6450.00 6450.00

c) Profit and loss statement and financial position statement of Pendo

Profit and loss statement

Particulates Amount (£)

Sales 800.00

Less: Cost of sales 500.00

(Purchase-closing stock)

Gross profit 300.00

Less: expenses

Storage expenses 150.00

Motor expenses 200.00

Net loss -50.00

Financial position statement

Non current assert Amount (£)

Motor van 600.00

Current assets

cash 4025.00

Stock 800.00

Total assets 5425.00

Equity

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.