University Accounting and Financial Reporting Assignment Solution

VerifiedAdded on 2023/01/16

|11

|1545

|25

Homework Assignment

AI Summary

This document provides a comprehensive solution to an accounting and financial reporting assignment. It begins by analyzing changes in accounting standards from December 1, 2018, to March 31, 2019, focusing on amendments by AASB. The solution then addresses specific questions regarding financial reporting, including the application of AASB 101 and the proper presentation of financial statements. The analysis highlights the importance of correctly categorizing assets, liabilities, and equity, as well as the accurate reporting of items such as share investments, tax liabilities, and dividend payments. The solution critiques the financial statements of Whirl Limited, identifying errors in classification and presentation and suggesting corrections based on AASB guidelines. It emphasizes the importance of adhering to specific steps when preparing the income statement and provides examples of corrected balance sheets and statements of changes in equity. The document references several sources, including AASB publications and academic articles, to support its analysis and recommendations.

Running head: ACCOUNTING AND FINANCIAL REPORTING

Accounting and Financial Reporting

Name of the Student

Name of the University

Author’s Note

Accounting and Financial Reporting

Name of the Student

Name of the University

Author’s Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2ACCOUNTING AND FINANCIAL REPORTING

Table of Contents

Answer to question 1..................................................................................................................3

Answer to Question 2.................................................................................................................5

References::................................................................................................................................7

Table of Contents

Answer to question 1..................................................................................................................3

Answer to Question 2.................................................................................................................5

References::................................................................................................................................7

3ACCOUNTING AND FINANCIAL REPORTING

ANSWER TO QUESTION 1

CHANGES IN ACCOUNTING FROM 1 DECEMBER 2018 TO 31 MARCH 201 9 BY

AASB

AUSTRALIAN

AASB 2019-X

AMENDMENTS IN

THE ACCOUNTING

STANDARDS OF

AUSTRALIA (DATE:

24.01.2019)

This proposed standard of

AASB 2019-X includes

significant changes to

provide support to AASB

to publish Conceptual

Framework for Financial

Reporting (aasb.gov.au,

2019). Apart from this, as

per AASB, it is possible

for different users of the

financial statements to

comment on any

loopholes associated in

this proposed standard by

March 22, 2019. This

new standard will be for

the companies in private

sector having

accountability and it is

voluntary requirements

for other not-for-profit

firms to apply this

(aasb.gov.au, 2019).

ONEROUS

CONTRACTS – COST

TO FULFILL A

CONTRACT (DATE:

08.01.2019)

The intention of onerous

contracts is altering

AASB 137 to stipulate

the fact that the fulfilling

cost considers the

incremental costs

(aasb.gov.au, 2019). This

cost consists of material

and other costs that have

direct connection with the

contracts such as

depreciation changed on

the plant being used for

the contract (aasb.gov.au,

2019).

NOT-FOR-PROFIT

LESSEES’S RIGHT

OF USE ASSETS

(DATE: 20.12.2018)

AASB is considering

amending a specific

standard for providing a

provisional substitute for

not-for-profit lessees to

measure the right-of-use

assets under

concessionary leases at

cost price instead of fair

value (aasb.gov.au,

2019). The expected date

for the publication of this

standard is December 24,

2018. Concessionary

leases are the leases with

below market terms and

conditions to allow the

firms to advance their

objectives (aasb.gov.au,

2019). The standard of

this draft is based on

AASB Exposure Draft

ED 286 Amendments to

ANSWER TO QUESTION 1

CHANGES IN ACCOUNTING FROM 1 DECEMBER 2018 TO 31 MARCH 201 9 BY

AASB

AUSTRALIAN

AASB 2019-X

AMENDMENTS IN

THE ACCOUNTING

STANDARDS OF

AUSTRALIA (DATE:

24.01.2019)

This proposed standard of

AASB 2019-X includes

significant changes to

provide support to AASB

to publish Conceptual

Framework for Financial

Reporting (aasb.gov.au,

2019). Apart from this, as

per AASB, it is possible

for different users of the

financial statements to

comment on any

loopholes associated in

this proposed standard by

March 22, 2019. This

new standard will be for

the companies in private

sector having

accountability and it is

voluntary requirements

for other not-for-profit

firms to apply this

(aasb.gov.au, 2019).

ONEROUS

CONTRACTS – COST

TO FULFILL A

CONTRACT (DATE:

08.01.2019)

The intention of onerous

contracts is altering

AASB 137 to stipulate

the fact that the fulfilling

cost considers the

incremental costs

(aasb.gov.au, 2019). This

cost consists of material

and other costs that have

direct connection with the

contracts such as

depreciation changed on

the plant being used for

the contract (aasb.gov.au,

2019).

NOT-FOR-PROFIT

LESSEES’S RIGHT

OF USE ASSETS

(DATE: 20.12.2018)

AASB is considering

amending a specific

standard for providing a

provisional substitute for

not-for-profit lessees to

measure the right-of-use

assets under

concessionary leases at

cost price instead of fair

value (aasb.gov.au,

2019). The expected date

for the publication of this

standard is December 24,

2018. Concessionary

leases are the leases with

below market terms and

conditions to allow the

firms to advance their

objectives (aasb.gov.au,

2019). The standard of

this draft is based on

AASB Exposure Draft

ED 286 Amendments to

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4ACCOUNTING AND FINANCIAL REPORTING

Australian Accounting

Standards- Right-of-Use

Assets of Not-for-Profit

Entities”. Ensuring

additional disclosure in

AASB 16 is the prime

objective of this standard.

Due to this, the users will

be able in gaining

additional information to

the financial statements’

users on concessionary

leases in the absence of

fair value information

(aasb.gov.au, 2019).

NEW AUSTRALIAN

ACCOUNTING

STANDARD (DATE:

20.12.2018)

AASB’s two new

standards have provided

clarification on business

and material definition;

and it is known as

“AASB 3 Business

Combination’ to help the

firms to determine

whether they need to

consider a transaction as

business combination or

as acquisition of assets

(aasb.gov.au, 2019). In

addition, another standard

“AASB 2018-7” assists in

clarifying the definition

of material and its

application in the AASB

standards and other

pronouncements. These

changes will be presented

in “AASB 101

Presentation of Financial

Statements”. The date of

applying these two

standards is January 1,

2019 (aasb.gov.au, 2019).

RESULTS OF

SURVEY ON THE

IMPORTANCE OF

SPECIFIC PURPOSE

FINANCIAL

STATEMENTS (DATE:

13.12.2018)

AASB has conducted a

survey to determine the

usefulness of special

purpose financial

statements. As per 78

percent of primary users,

it is needed to address the

issue that raises from the

failure to consider

measurement and

recognition of accounts.

For this reason, there is

need for additional

transitional relief to help

the equity and

consolidation accounting

in the companies

(aasb.gov.au, 2019).

Australian Accounting

Standards- Right-of-Use

Assets of Not-for-Profit

Entities”. Ensuring

additional disclosure in

AASB 16 is the prime

objective of this standard.

Due to this, the users will

be able in gaining

additional information to

the financial statements’

users on concessionary

leases in the absence of

fair value information

(aasb.gov.au, 2019).

NEW AUSTRALIAN

ACCOUNTING

STANDARD (DATE:

20.12.2018)

AASB’s two new

standards have provided

clarification on business

and material definition;

and it is known as

“AASB 3 Business

Combination’ to help the

firms to determine

whether they need to

consider a transaction as

business combination or

as acquisition of assets

(aasb.gov.au, 2019). In

addition, another standard

“AASB 2018-7” assists in

clarifying the definition

of material and its

application in the AASB

standards and other

pronouncements. These

changes will be presented

in “AASB 101

Presentation of Financial

Statements”. The date of

applying these two

standards is January 1,

2019 (aasb.gov.au, 2019).

RESULTS OF

SURVEY ON THE

IMPORTANCE OF

SPECIFIC PURPOSE

FINANCIAL

STATEMENTS (DATE:

13.12.2018)

AASB has conducted a

survey to determine the

usefulness of special

purpose financial

statements. As per 78

percent of primary users,

it is needed to address the

issue that raises from the

failure to consider

measurement and

recognition of accounts.

For this reason, there is

need for additional

transitional relief to help

the equity and

consolidation accounting

in the companies

(aasb.gov.au, 2019).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5ACCOUNTING AND FINANCIAL REPORTING

ANSWER TO QUESTION 2

The standards of AASB 101 puts the obligation on the Australian listed companies to

prepare their financial reports while complying with the current laws and regulations

(aasb.gov.au, 2019). One major law is the general purpose financial reporting representations

that helps in comparing the financial information of the current and previous year. Thus, this

particular standard provides the firms with the requirements for representing the financial

statements in a proper structured manner.

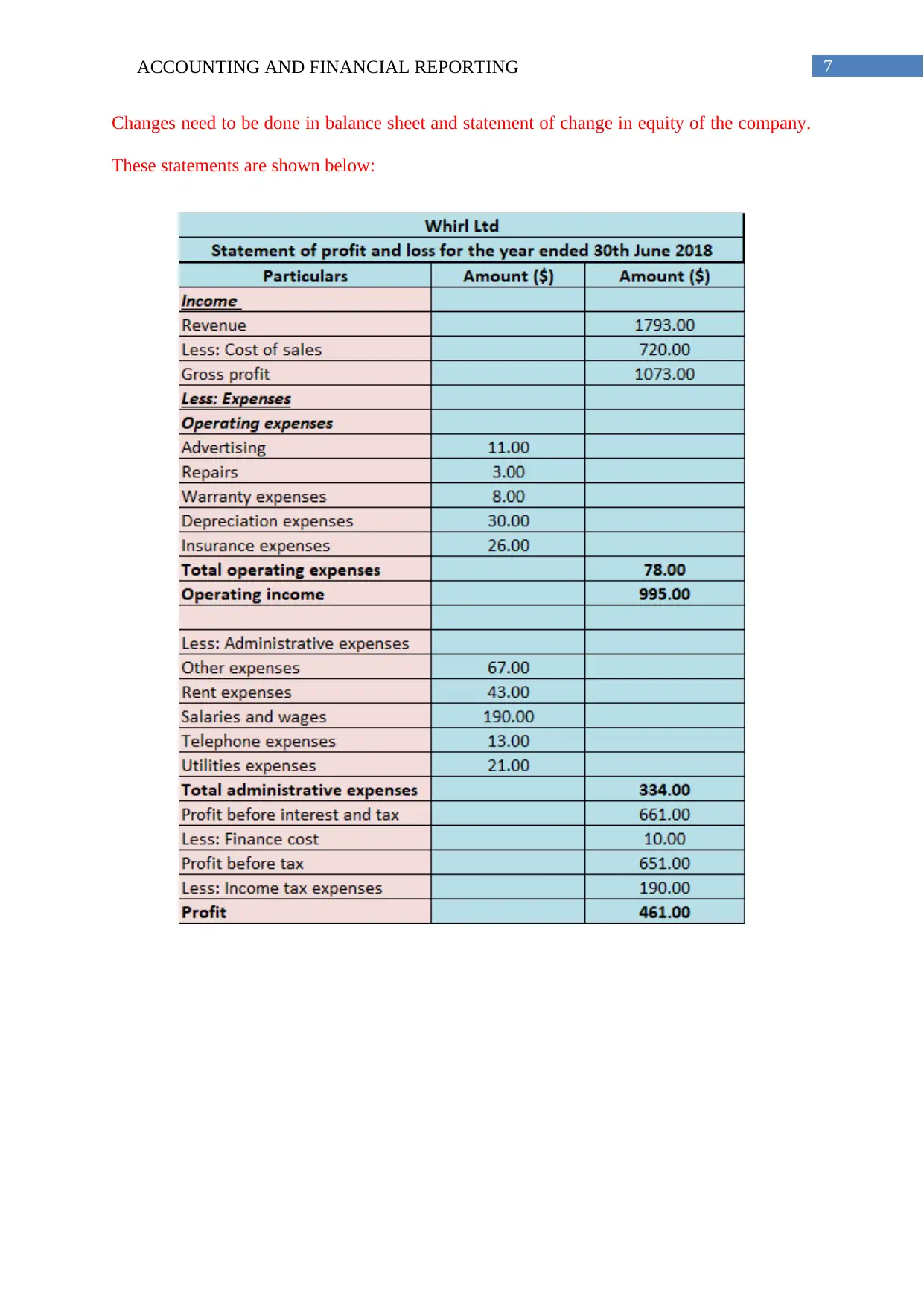

The evaluation of the financial statements of Whirl Limited indicates towards the fact

that the accountant failed in separating the items before reporting them to the financial

statements’ users. It can also be seen at the same time that the accountant also failed in

categorize the assets into two different sections of current assets and non-current assets. In

the same manner, it is needed for the accountants to segregate the liabilities of the companies

into current liabilities and non-current liabilities.

According to AASB 101, Section 66 to 76, there is scope for the accountants in

categorizing the assets and liabilities into both short-term and long-term (aasb.gov.au, 2019).

Moreover, the accountant needs to present the work-in-progress inventories, raw materials

and finished goods in one single head and they need to disclose receivables separately. These

transactions need to be considered as input product parts that possess major importance in the

manufacturing processes (Henderson et al., 2015).

In addition, AASB 101, section 54 puts the obligation on the companies to use the

equity methods to treat share investments (aasb.gov.au, 2019). However, as per the provided

scenario, the accountant of Whirl Limited has failed in recording the share investments at

cost that is evident from the provided profit or loss statements. At the same time, the

ANSWER TO QUESTION 2

The standards of AASB 101 puts the obligation on the Australian listed companies to

prepare their financial reports while complying with the current laws and regulations

(aasb.gov.au, 2019). One major law is the general purpose financial reporting representations

that helps in comparing the financial information of the current and previous year. Thus, this

particular standard provides the firms with the requirements for representing the financial

statements in a proper structured manner.

The evaluation of the financial statements of Whirl Limited indicates towards the fact

that the accountant failed in separating the items before reporting them to the financial

statements’ users. It can also be seen at the same time that the accountant also failed in

categorize the assets into two different sections of current assets and non-current assets. In

the same manner, it is needed for the accountants to segregate the liabilities of the companies

into current liabilities and non-current liabilities.

According to AASB 101, Section 66 to 76, there is scope for the accountants in

categorizing the assets and liabilities into both short-term and long-term (aasb.gov.au, 2019).

Moreover, the accountant needs to present the work-in-progress inventories, raw materials

and finished goods in one single head and they need to disclose receivables separately. These

transactions need to be considered as input product parts that possess major importance in the

manufacturing processes (Henderson et al., 2015).

In addition, AASB 101, section 54 puts the obligation on the companies to use the

equity methods to treat share investments (aasb.gov.au, 2019). However, as per the provided

scenario, the accountant of Whirl Limited has failed in recording the share investments at

cost that is evident from the provided profit or loss statements. At the same time, the

6ACCOUNTING AND FINANCIAL REPORTING

accountant has considered both the current and deferred tax together when AASB 101,

Section 54, Points (n) and (o) puts the obligation on the firms to separately recognize these

liabilities (Hodgson & Russell, 2014).

The accountant is needed to make the categorization of receivables as the amounts to

be recovered before and after twelve months as the balance sheet demands the receivables to

be classified as both short-term and long-term. Thus, it become possible for the management

of Whirl Limited to obtain the required information that can be provided to the users of the

financial statements when there is appropriate segregation of these liabilities in the presence

of the needed disclosures (aasb.gov.au, 2019).

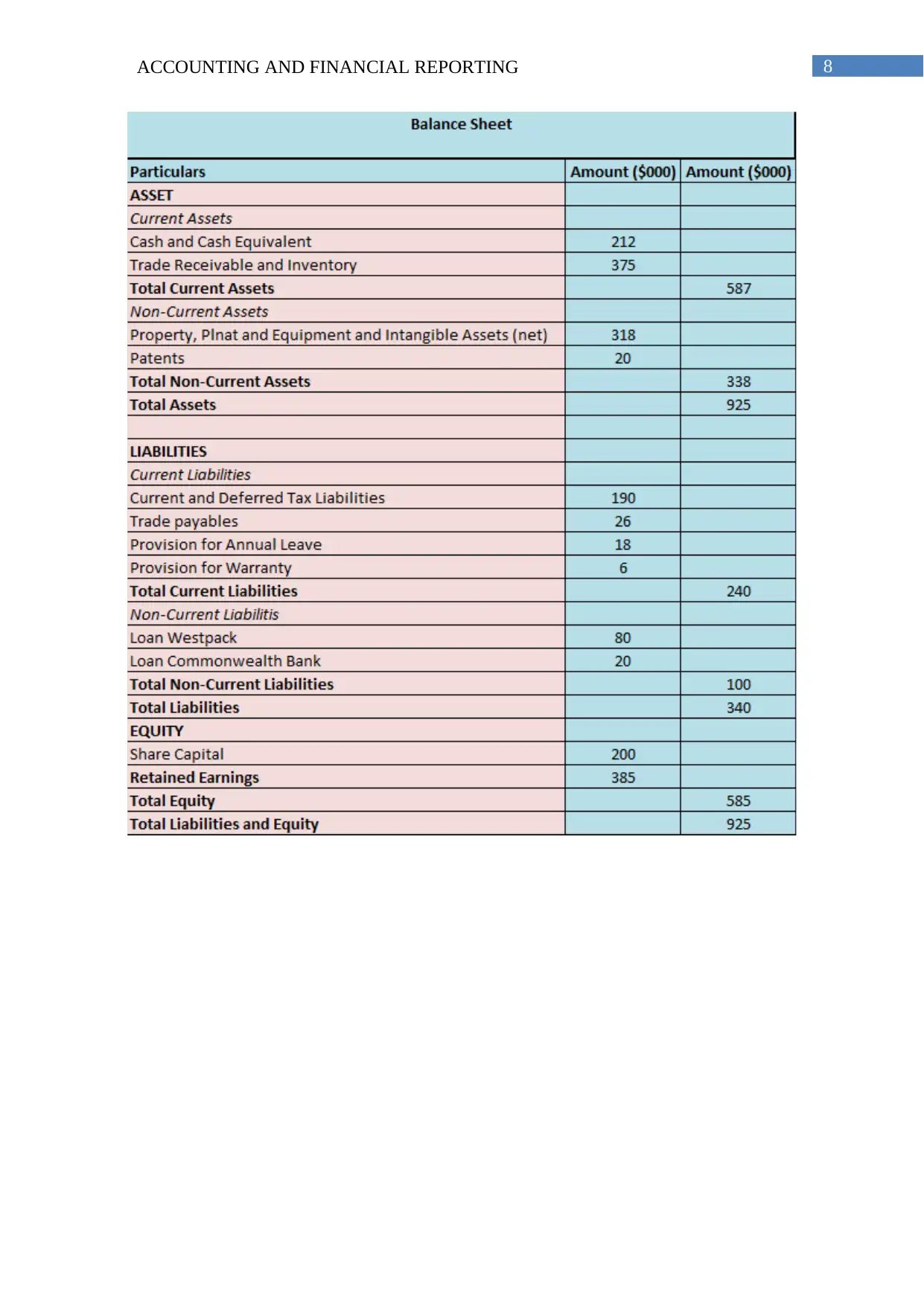

Lastly, it can be seen from the profit or loss statement of Whirl Limited that the

accountant has reported the dividend payment in the profit and loss statement when the

accountant should not report this dividend payment as business expenses. In actual, the

accountant needs to record the payment of dividend in the section of shareholder’s equity in

the balance sheet of the company. Apart from this, the dividend payable per share needs to be

reported in the financial report. In the assistance of this information, the shareholders would

be able in obtaining clear and concise information of return on investments. Moreover,

accumulated depreciation needs to be represented by subtracting the value from non-current

assets instead disclosing as liability (aasb.gov.au, 2019).

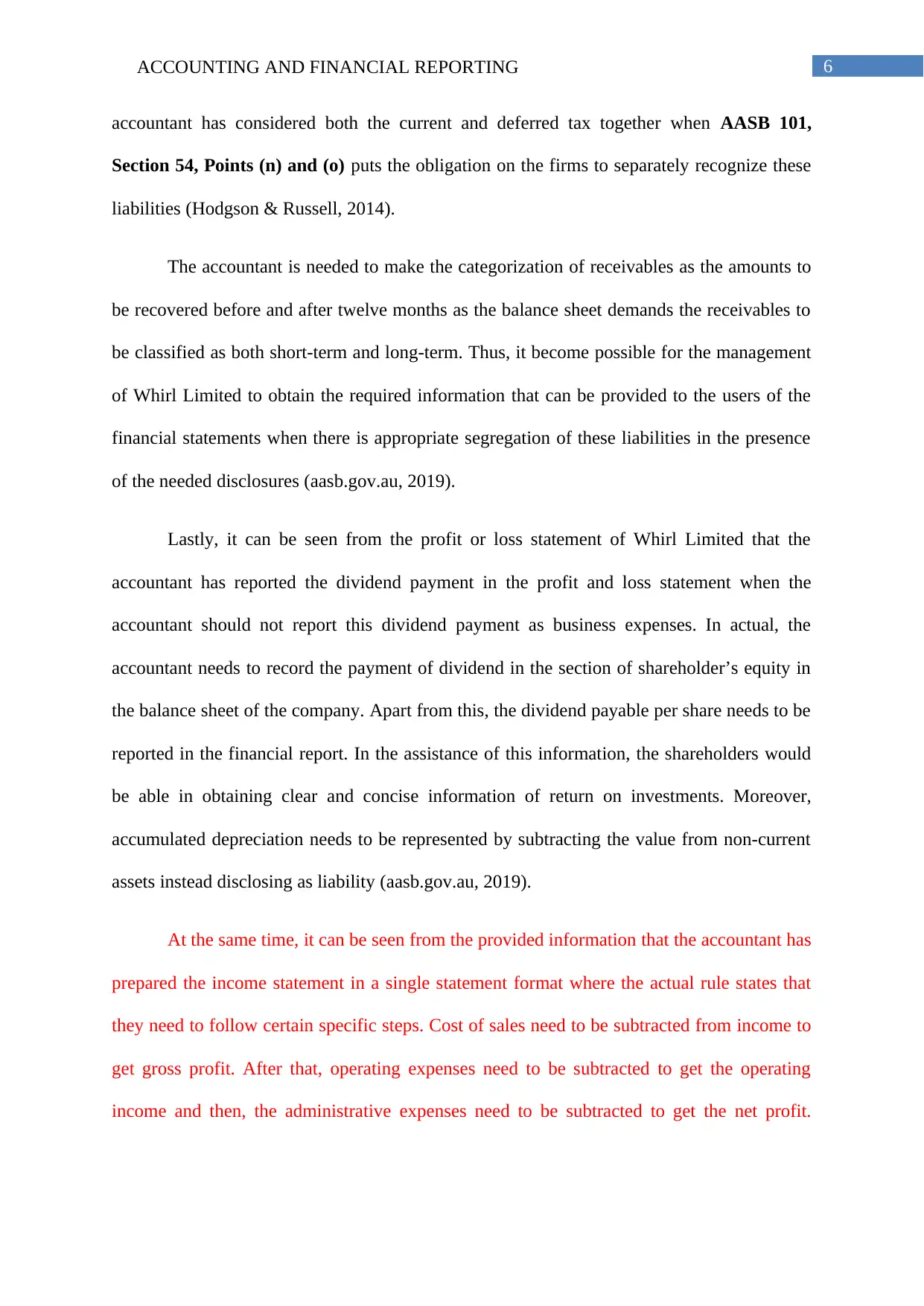

At the same time, it can be seen from the provided information that the accountant has

prepared the income statement in a single statement format where the actual rule states that

they need to follow certain specific steps. Cost of sales need to be subtracted from income to

get gross profit. After that, operating expenses need to be subtracted to get the operating

income and then, the administrative expenses need to be subtracted to get the net profit.

accountant has considered both the current and deferred tax together when AASB 101,

Section 54, Points (n) and (o) puts the obligation on the firms to separately recognize these

liabilities (Hodgson & Russell, 2014).

The accountant is needed to make the categorization of receivables as the amounts to

be recovered before and after twelve months as the balance sheet demands the receivables to

be classified as both short-term and long-term. Thus, it become possible for the management

of Whirl Limited to obtain the required information that can be provided to the users of the

financial statements when there is appropriate segregation of these liabilities in the presence

of the needed disclosures (aasb.gov.au, 2019).

Lastly, it can be seen from the profit or loss statement of Whirl Limited that the

accountant has reported the dividend payment in the profit and loss statement when the

accountant should not report this dividend payment as business expenses. In actual, the

accountant needs to record the payment of dividend in the section of shareholder’s equity in

the balance sheet of the company. Apart from this, the dividend payable per share needs to be

reported in the financial report. In the assistance of this information, the shareholders would

be able in obtaining clear and concise information of return on investments. Moreover,

accumulated depreciation needs to be represented by subtracting the value from non-current

assets instead disclosing as liability (aasb.gov.au, 2019).

At the same time, it can be seen from the provided information that the accountant has

prepared the income statement in a single statement format where the actual rule states that

they need to follow certain specific steps. Cost of sales need to be subtracted from income to

get gross profit. After that, operating expenses need to be subtracted to get the operating

income and then, the administrative expenses need to be subtracted to get the net profit.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7ACCOUNTING AND FINANCIAL REPORTING

Changes need to be done in balance sheet and statement of change in equity of the company.

These statements are shown below:

Changes need to be done in balance sheet and statement of change in equity of the company.

These statements are shown below:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8ACCOUNTING AND FINANCIAL REPORTING

9ACCOUNTING AND FINANCIAL REPORTING

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10ACCOUNTING AND FINANCIAL REPORTING

REFERENCES::

Aasb.gov.au. (2019). Presentation of Financial Statements. Retrieved 5 April 2019, from

https://www.aasb.gov.au/admin/file/content105/c9/AASB101_07-15.pdf

Aasb.gov.au. (2019). Onerous Contracts – Cost of Fulfilling a Contract. Retrieved 5 April

2019, from https://www.aasb.gov.au/admin/file/content105/c9/ACCED287_01-19.pdf

Hodgson, A., & Russell, M. (2014). Comprehending comprehensive income. Australian

Accounting Review, 24(2), 100-110.

Henderson, S., Peirson, G., Herbohn, K., & Howieson, B. (2015). Issues in financial

accounting. Pearson Higher Education AU.

News . (2019). Aasb.gov.au. Retrieved 5 April 2019, from

https://www.aasb.gov.au/News/Fatal-flaw-review-draft---Proposed-Standard-AASB-

2019-X-Amendments-to-Australian-Accounting-Standards---References-to-the-

Conceptual-Framework?newsID=310721

News . (2019). Aasb.gov.au. Retrieved 5 April 2019, from

https://www.aasb.gov.au/News/New-Accounting-Standard--Right-of-Use-Assets-of-

Not-for-Profit-Entities?newsID=310718

News . (2019). Aasb.gov.au. Retrieved 5 April 2019, from

https://www.aasb.gov.au/News/New-Australian-Accounting-Standards?

newsID=310717

REFERENCES::

Aasb.gov.au. (2019). Presentation of Financial Statements. Retrieved 5 April 2019, from

https://www.aasb.gov.au/admin/file/content105/c9/AASB101_07-15.pdf

Aasb.gov.au. (2019). Onerous Contracts – Cost of Fulfilling a Contract. Retrieved 5 April

2019, from https://www.aasb.gov.au/admin/file/content105/c9/ACCED287_01-19.pdf

Hodgson, A., & Russell, M. (2014). Comprehending comprehensive income. Australian

Accounting Review, 24(2), 100-110.

Henderson, S., Peirson, G., Herbohn, K., & Howieson, B. (2015). Issues in financial

accounting. Pearson Higher Education AU.

News . (2019). Aasb.gov.au. Retrieved 5 April 2019, from

https://www.aasb.gov.au/News/Fatal-flaw-review-draft---Proposed-Standard-AASB-

2019-X-Amendments-to-Australian-Accounting-Standards---References-to-the-

Conceptual-Framework?newsID=310721

News . (2019). Aasb.gov.au. Retrieved 5 April 2019, from

https://www.aasb.gov.au/News/New-Accounting-Standard--Right-of-Use-Assets-of-

Not-for-Profit-Entities?newsID=310718

News . (2019). Aasb.gov.au. Retrieved 5 April 2019, from

https://www.aasb.gov.au/News/New-Australian-Accounting-Standards?

newsID=310717

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11ACCOUNTING AND FINANCIAL REPORTING

News . (2019). Aasb.gov.au. Retrieved 5 April 2019, from

https://www.aasb.gov.au/News/How-special-are-special-purpose-financial-

statements---For-profit-User-and-Preparer-Survey-Results?newsID=310714

News . (2019). Aasb.gov.au. Retrieved 5 April 2019, from

https://www.aasb.gov.au/News/How-special-are-special-purpose-financial-

statements---For-profit-User-and-Preparer-Survey-Results?newsID=310714

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.