Accounting 5 (Fall 2024): Adjustment Entries, Financial Statements

VerifiedAdded on 2019/10/31

|6

|366

|151

Homework Assignment

AI Summary

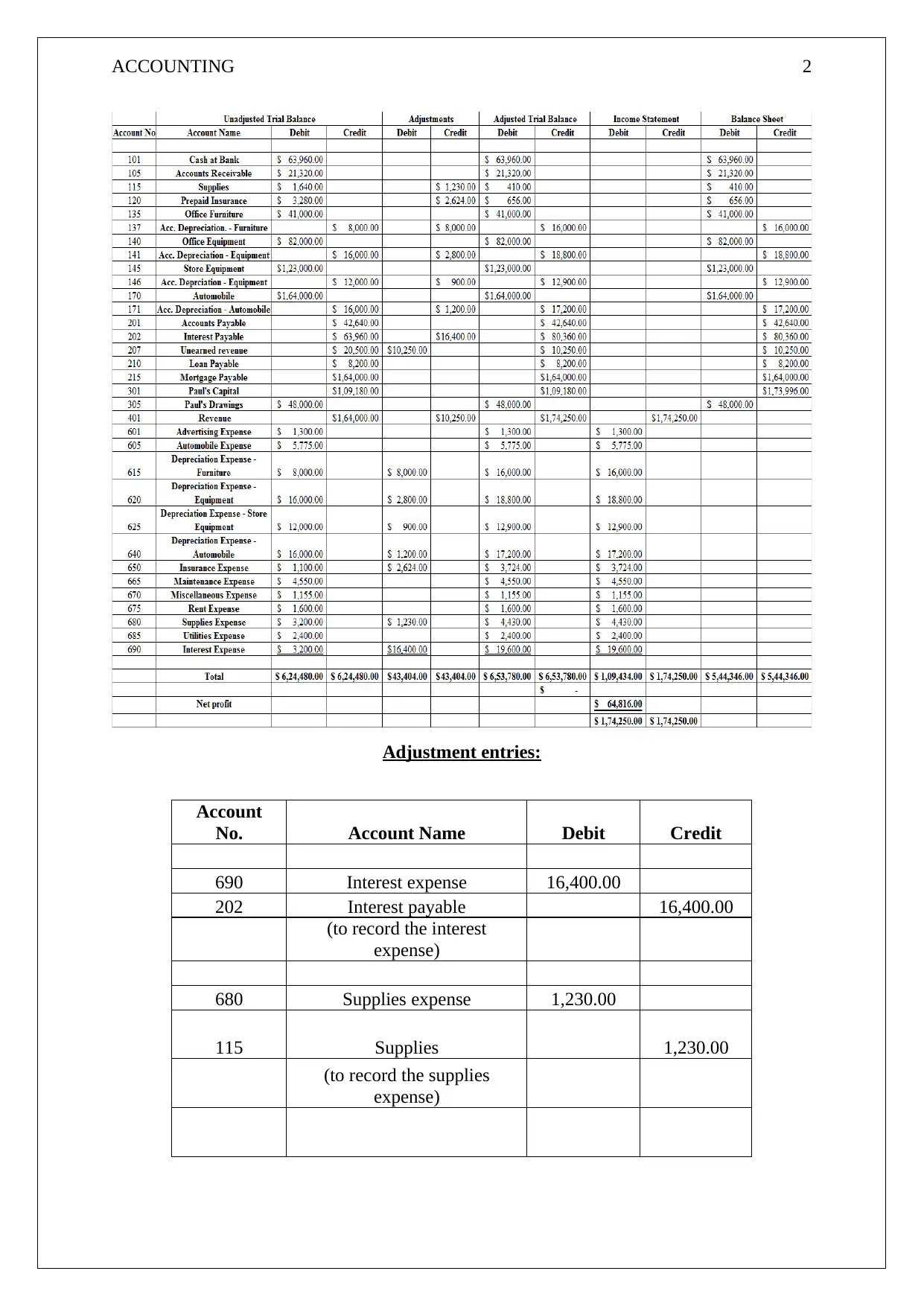

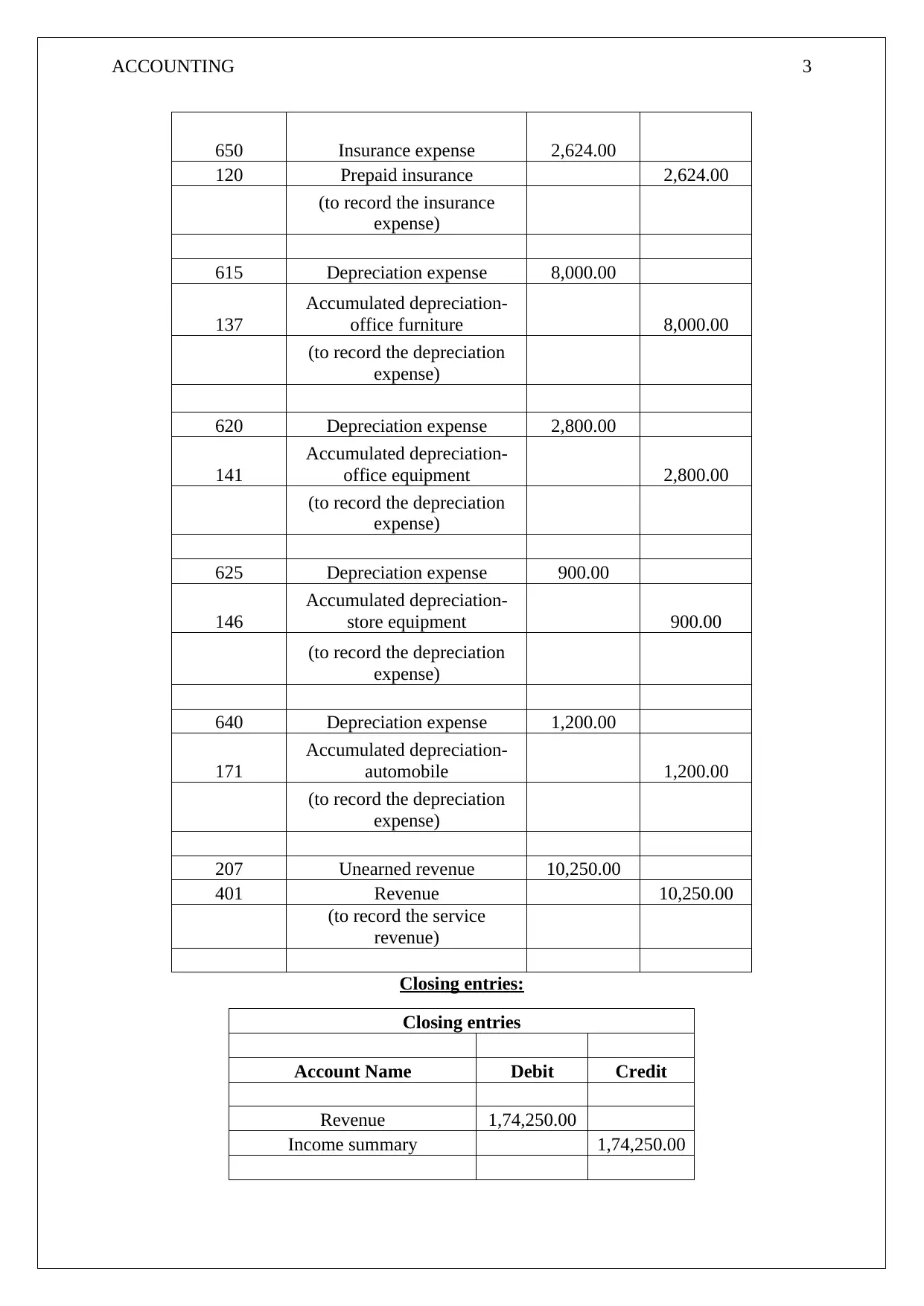

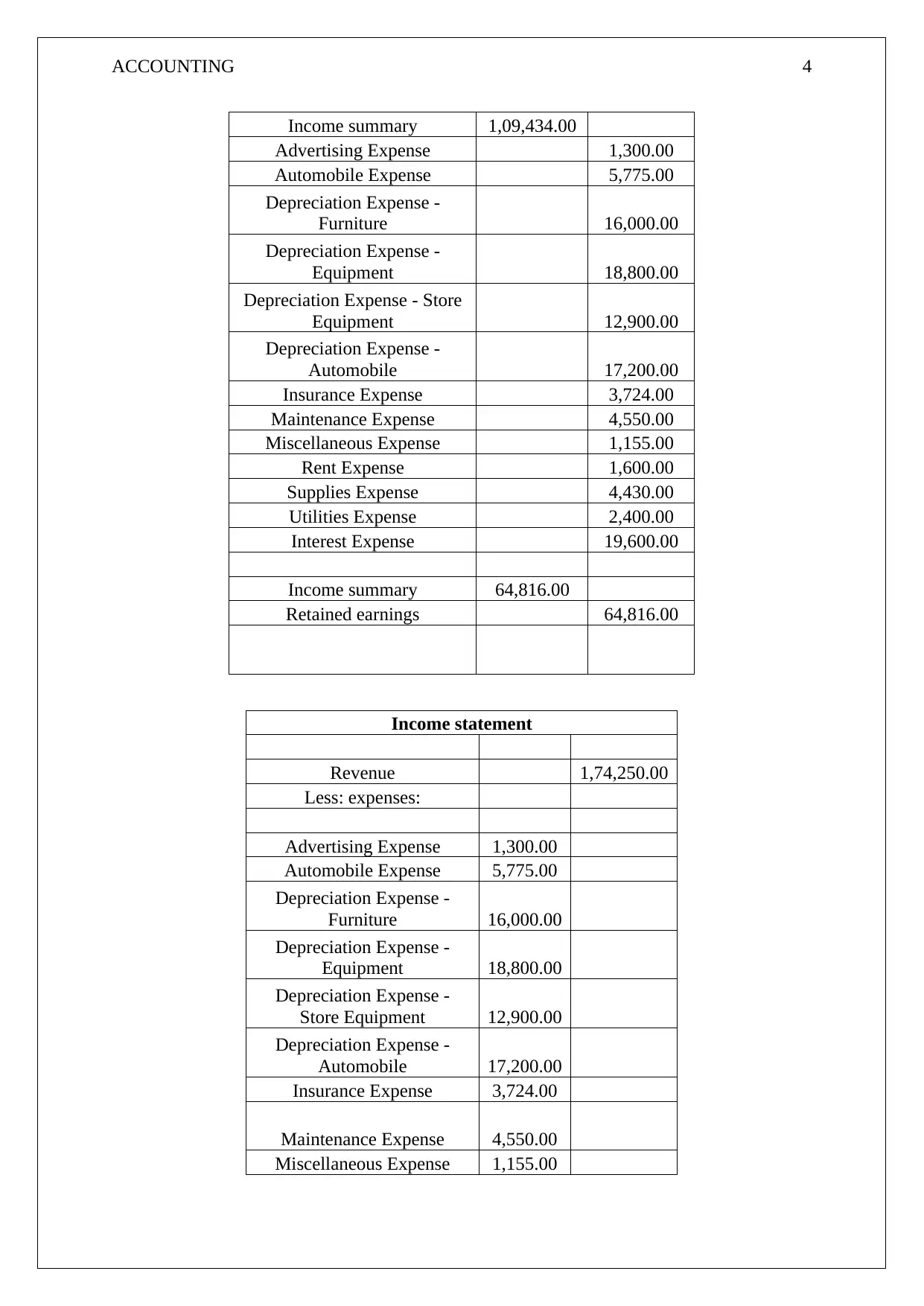

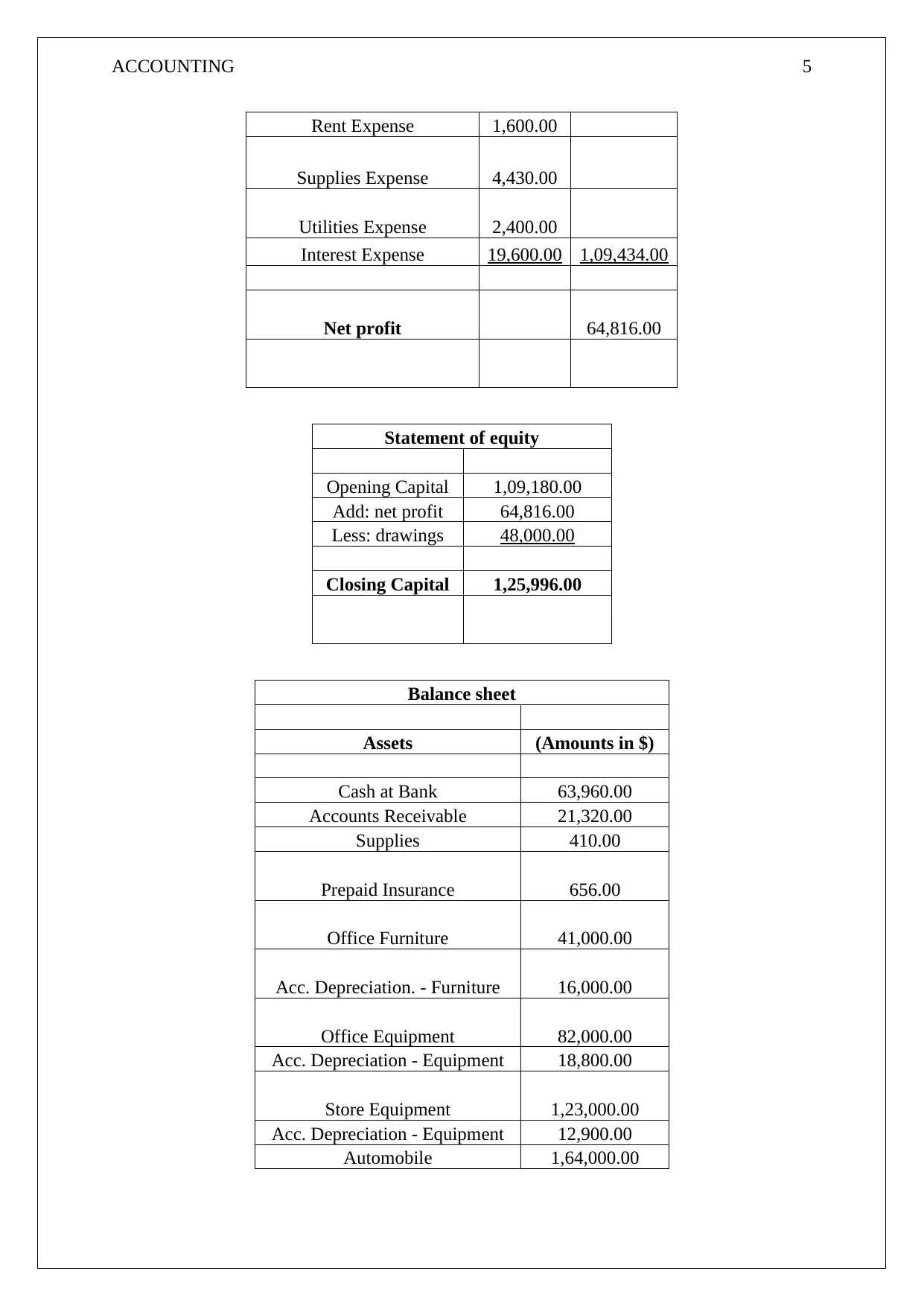

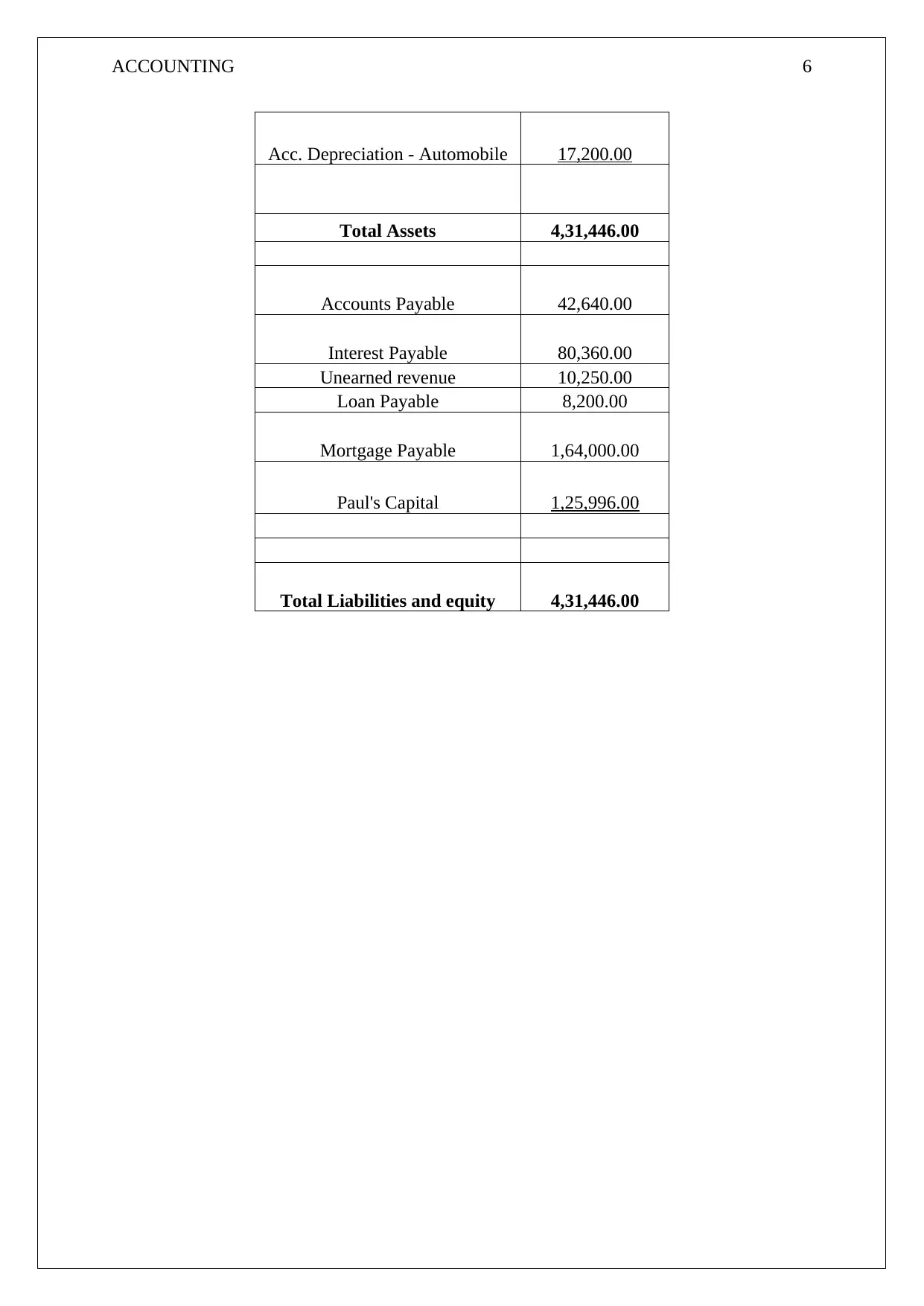

This accounting assignment solution encompasses a comprehensive set of accounting tasks, including the creation of adjustment entries, closing entries, an income statement, a statement of equity, and a balance sheet. The adjustment entries account for various expenses and revenues, such as interest expense, supplies expense, insurance expense, and depreciation. The closing entries transfer revenue and expense account balances to the income summary and retained earnings. The income statement presents revenue and expenses to determine net profit. The statement of equity details the changes in owner's equity, and the balance sheet provides a snapshot of assets, liabilities, and equity. The assignment demonstrates a complete accounting cycle and preparation of financial statements, providing a clear understanding of financial reporting.

1 out of 6

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)