Accounting Principles Report: Financial Analysis and Decision Making

VerifiedAdded on 2023/06/04

|23

|5270

|391

Report

AI Summary

This report delves into the core principles of accounting, examining its purpose within organizations and its role in informing decision-making for various stakeholders. It explores the accounting function in the context of regulatory and ethical constraints, emphasizing the importance of accurate financial reporting. The report provides a detailed analysis of financial statements for sole traders, partnerships, and not-for-profit organizations, including the calculation and presentation of financial ratios to assess organizational performance over time. Furthermore, it covers the creation and benefits of cash budgets, along with budgetary control mechanisms. The content emphasizes the application of accounting principles in complex operating environments, highlighting their significance in meeting organizational, stakeholder, and societal needs, and concludes with a discussion on how budgetary controls support effective decision-making processes.

Accounting

Principle

Principle

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................3

TASK...............................................................................................................................................3

P1. Examine the purpose of the accounting function within an organisation:.......................3

M1. Evaluate the context and purpose of the accounting function in meeting organisational,

stakeholder and societal needs and expectations:...................................................................4

D1. Critically evaluate the role of accounting in informing decision making to meet

organisational, stakeholder and societal needs within complex operating environments:.....4

P2. Assess the accounting function within the organisation in the context of regulatory and

ethical constraints:..................................................................................................................5

P3. Financial statements for sole traders, partnerships and not for profit organisation.........6

M2 and D2 Financial statements from given trial balance after appropriate adjustments.....7

P4. Calculate and present financial ratios from a set of final accounts:...............................15

P5. Compare the performance of an organisation over time using financial ratios.............16

P6. Cash budget....................................................................................................................17

P7. Benefits and limitation of budgets................................................................................20

M4. Budgetary control..........................................................................................................20

D3 Budgetary controls helps in decision making.................................................................21

CONCLUSION..............................................................................................................................21

REFERENCES..............................................................................................................................23

INTRODUCTION...........................................................................................................................3

TASK...............................................................................................................................................3

P1. Examine the purpose of the accounting function within an organisation:.......................3

M1. Evaluate the context and purpose of the accounting function in meeting organisational,

stakeholder and societal needs and expectations:...................................................................4

D1. Critically evaluate the role of accounting in informing decision making to meet

organisational, stakeholder and societal needs within complex operating environments:.....4

P2. Assess the accounting function within the organisation in the context of regulatory and

ethical constraints:..................................................................................................................5

P3. Financial statements for sole traders, partnerships and not for profit organisation.........6

M2 and D2 Financial statements from given trial balance after appropriate adjustments.....7

P4. Calculate and present financial ratios from a set of final accounts:...............................15

P5. Compare the performance of an organisation over time using financial ratios.............16

P6. Cash budget....................................................................................................................17

P7. Benefits and limitation of budgets................................................................................20

M4. Budgetary control..........................................................................................................20

D3 Budgetary controls helps in decision making.................................................................21

CONCLUSION..............................................................................................................................21

REFERENCES..............................................................................................................................23

INTRODUCTION

Accounting principles refers to the rules, guidelines, regulations which must have to be

followed by the business organisation and other institutions when they are reporting financial

data (Lucas, 2021). These rules and regulates make the work of the organisation easier and

effective in analysing the financial condition of the business. The one and only specific goal of

accounting principle is to ensure that the financial statement of the organisation are

accomplished, compatible and proportional. This report includes complete explanation about the

accounting principles, and purpose of accounting. Further this report also includes financial

statement and ratio analysis. Remaining parts of the project are going to be discussed in the

below report.

TASK

P1. Examine the purpose of the accounting function within an organisation:

Definition of Accounting- Accounting is the process of identifying, recording, analyzing and

reporting financial information to owners and other users. This is a broader term. The accounting

function plays a vital role in an organization. Accounting features help organizations keep track

of their financial data, which will help them keep financial records. These functions will assist

senior management in decision making.

The purposes of accounting are as follows-

For identification and recording of transaction- The very first purpose of accounting is

the identification and recording of the transaction of business. Due to this the separate

books of accounts can be prepared easily. Due to this the organisations did not have to

do any extra effort for finding any transaction which have passed through out the year.

For determining the result- The another purpose of accounting is to determine the result of the

business organisation. If the organisation have earn enough profit then can continue with the

same strategy. But if the organisation suffer from the loss then they have to make more effective

and efficient strategy so that they can achieve their target in the next year (Czerny and Juras,

2018).

To determine the financial assets and liabilities- Accounting includes all the financial

statement which includes assets and liabilities through the owners of the organisation can

determine the actual value of their assets and liabilities.

Accounting principles refers to the rules, guidelines, regulations which must have to be

followed by the business organisation and other institutions when they are reporting financial

data (Lucas, 2021). These rules and regulates make the work of the organisation easier and

effective in analysing the financial condition of the business. The one and only specific goal of

accounting principle is to ensure that the financial statement of the organisation are

accomplished, compatible and proportional. This report includes complete explanation about the

accounting principles, and purpose of accounting. Further this report also includes financial

statement and ratio analysis. Remaining parts of the project are going to be discussed in the

below report.

TASK

P1. Examine the purpose of the accounting function within an organisation:

Definition of Accounting- Accounting is the process of identifying, recording, analyzing and

reporting financial information to owners and other users. This is a broader term. The accounting

function plays a vital role in an organization. Accounting features help organizations keep track

of their financial data, which will help them keep financial records. These functions will assist

senior management in decision making.

The purposes of accounting are as follows-

For identification and recording of transaction- The very first purpose of accounting is

the identification and recording of the transaction of business. Due to this the separate

books of accounts can be prepared easily. Due to this the organisations did not have to

do any extra effort for finding any transaction which have passed through out the year.

For determining the result- The another purpose of accounting is to determine the result of the

business organisation. If the organisation have earn enough profit then can continue with the

same strategy. But if the organisation suffer from the loss then they have to make more effective

and efficient strategy so that they can achieve their target in the next year (Czerny and Juras,

2018).

To determine the financial assets and liabilities- Accounting includes all the financial

statement which includes assets and liabilities through the owners of the organisation can

determine the actual value of their assets and liabilities.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

To Determine flow of cash- By the help of accounting the net inflow and out flow of cash can

be determined (Alfadhli, ElHaddad and Elhaddad, 2019). Through which the the organisation

can control the cash and able to maintain the availability of cash in the organisation.

Help in tax fixation- The next purpose of accounting is to identify the tax liability of the

organisation. Due to this the operations of organisations cannot be discontinued in the

operations.

Making strategies- As it is already discussed above that the accounting includes all the

monetary transaction of the business thorough the organisation can determine their

financial position. By the help of accounting the organisation can make effective and

efficient strategies so that they can beat their competitors in the competitive market.

M1. Evaluate the context and purpose of the accounting function in meeting organisational,

stakeholder and societal needs and expectations:

The main purpose of accounting function is to assist the owners and managers of the

business so that they can make judgement in the most top-quality of business institution. The

main purpose of accounting is to help controlling body of a business to determine the areas that

are require for specific thought and effort in order to benefit the business organization as a

whole. It also helps the stakeholder by determining that that what amount of profit they can earn

in future if they continue to invest their money in the operations of the business. It can also fulfil

the need and basic requirement of the society by paying the tax and give best quality of product

to the consumer at a reasonable price.

D1. Critically evaluate the role of accounting in informing decision making to meet

organisational, stakeholder and societal needs within complex operating environments:

For operating a business accurate data are needed on the institution's assets, liabilities,

profits and Cash position. Accounting facilitate that crucial content. Accounting act as an very

essential part in analysing the property of an particular investment. Decent thinking of an

investment requires cautious investigation of costs and prediction of particular segment, like

determination of the hardships to return on investment, must be fulfil (Abhishek and Divyashree,

2019).

Regards, whether the judgement managers rarely face the query to invest in a new project

or spread out an active facility. One option might can be to invest $15 million in a new

production facility, or $45,00,000 to spread out on the line of the production. Each option will

be determined (Alfadhli, ElHaddad and Elhaddad, 2019). Through which the the organisation

can control the cash and able to maintain the availability of cash in the organisation.

Help in tax fixation- The next purpose of accounting is to identify the tax liability of the

organisation. Due to this the operations of organisations cannot be discontinued in the

operations.

Making strategies- As it is already discussed above that the accounting includes all the

monetary transaction of the business thorough the organisation can determine their

financial position. By the help of accounting the organisation can make effective and

efficient strategies so that they can beat their competitors in the competitive market.

M1. Evaluate the context and purpose of the accounting function in meeting organisational,

stakeholder and societal needs and expectations:

The main purpose of accounting function is to assist the owners and managers of the

business so that they can make judgement in the most top-quality of business institution. The

main purpose of accounting is to help controlling body of a business to determine the areas that

are require for specific thought and effort in order to benefit the business organization as a

whole. It also helps the stakeholder by determining that that what amount of profit they can earn

in future if they continue to invest their money in the operations of the business. It can also fulfil

the need and basic requirement of the society by paying the tax and give best quality of product

to the consumer at a reasonable price.

D1. Critically evaluate the role of accounting in informing decision making to meet

organisational, stakeholder and societal needs within complex operating environments:

For operating a business accurate data are needed on the institution's assets, liabilities,

profits and Cash position. Accounting facilitate that crucial content. Accounting act as an very

essential part in analysing the property of an particular investment. Decent thinking of an

investment requires cautious investigation of costs and prediction of particular segment, like

determination of the hardships to return on investment, must be fulfil (Abhishek and Divyashree,

2019).

Regards, whether the judgement managers rarely face the query to invest in a new project

or spread out an active facility. One option might can be to invest $15 million in a new

production facility, or $45,00,000 to spread out on the line of the production. Each option will

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

start with a various cash outflow and a various upcoming cash inflow. Each approach can various

number of return on investment.

P2. Assess the accounting function within the organisation in the context of regulatory and

ethical constraints:

They are numerous accounting functions of a business organisation which need to create

the process of accounting more reliable and systematized in order to achieve the highest goals of

the organization (Almagtome, 2021). The accounting function required to be done to attain the

eventual objectives of an organization's accounting procedure. The numbers of accounting

functions are given below which are as follows-

Payroll- Salary is what a company pays an employee for a specific period or date. It is

usually carry out by the company's accounts or HR department. Payroll for a small

business can be processed directly by the owner or employees. Payroll is increasingly

outsourced to specialized firms that handle accounting tasks such as payroll processing,

employee benefits, insurance, and billing. B. Withholding Tax. Large number of payroll

fintech companies, such as Atomic, Bit-wage, Finch, Pin-wheel, and Wage stream, are

using technology to simplify the payroll process. These mixtures make it easier and faster

to pay employees and render electrical payroll documentation and innovation.

Legal compliance- The next function which can be done by the help of the accounting is

the compliance of the legal requirement. Due to the recording of financial transaction the

organisation is know their profit and loss which they earn in particular year. Due to this

the organisations are able to determine their tax liability and save themselves from the

legal cases of the government.

Accounts receivable and payables- This Function helps the top level management of of the

organisation to control the funds in the form of receivables and payables. Whether the business

institution is capable to get the funds from their debtors in a specific period of time and create the

cost to the creditors of the business institution. By the help of this analysis the top level

management can be able to determine how effectively the business organisation can make cost to

their creditors in a less period as well as how effective the strategies of the management generate

the funds from their debtors (Dănescu and Prozan, 2019).

Budgeting- By the help of this the organisation can make the budget for their operations

through which they can assess their performance throughout the year. Budget contain the

number of return on investment.

P2. Assess the accounting function within the organisation in the context of regulatory and

ethical constraints:

They are numerous accounting functions of a business organisation which need to create

the process of accounting more reliable and systematized in order to achieve the highest goals of

the organization (Almagtome, 2021). The accounting function required to be done to attain the

eventual objectives of an organization's accounting procedure. The numbers of accounting

functions are given below which are as follows-

Payroll- Salary is what a company pays an employee for a specific period or date. It is

usually carry out by the company's accounts or HR department. Payroll for a small

business can be processed directly by the owner or employees. Payroll is increasingly

outsourced to specialized firms that handle accounting tasks such as payroll processing,

employee benefits, insurance, and billing. B. Withholding Tax. Large number of payroll

fintech companies, such as Atomic, Bit-wage, Finch, Pin-wheel, and Wage stream, are

using technology to simplify the payroll process. These mixtures make it easier and faster

to pay employees and render electrical payroll documentation and innovation.

Legal compliance- The next function which can be done by the help of the accounting is

the compliance of the legal requirement. Due to the recording of financial transaction the

organisation is know their profit and loss which they earn in particular year. Due to this

the organisations are able to determine their tax liability and save themselves from the

legal cases of the government.

Accounts receivable and payables- This Function helps the top level management of of the

organisation to control the funds in the form of receivables and payables. Whether the business

institution is capable to get the funds from their debtors in a specific period of time and create the

cost to the creditors of the business institution. By the help of this analysis the top level

management can be able to determine how effectively the business organisation can make cost to

their creditors in a less period as well as how effective the strategies of the management generate

the funds from their debtors (Dănescu and Prozan, 2019).

Budgeting- By the help of this the organisation can make the budget for their operations

through which they can assess their performance throughout the year. Budget contain the

hypothetical data which the organisation estimate so that they run their business

according to the budget and control the expenses and cost of the business. Because of

this they are bale to reduce their cost and can increase the profit margin as well.

P3. Financial statements for sole traders, partnerships and not for profit organisation

Every business has operating regularly so have some sort of different activities, they need to

record these data at one place (Hamour and et.al., 2021). In other words, every financial

transactions to be recorded in day to day activities termed as financial statements. While

preparing financial books, every organisation need to comply with accounting standards.

Financial statements are written records which are prepared by management of company to

present financial position and performance at a given point of time. These are prepared with a

motive to give detailed information about business to its interested parties like owners, investors,

government, creditors and many more. There are more compliances for publicly listed companies

as they required to prepare financial statements for the quarters as well as for year. They need to

present to different regulators agencies like to stock market, monetary units and banking units.

Practically, there exist three types of financial statements such as statement of financial position,

statements of profit and loss and statements of cash flows. These statement help their users to

forecast the future value of their entity and which assists them in analyse the earning capabilities

of the company.

Statement of financial position – This is also known as balance sheet which is capable to show

the financial position of an organisation on a particular date. It is prepared after proper drafting

of Income statements which is trading and profit & loss account. It indicates the assets and

liabilities of a concern at particular point of time. The various items should appear in the balance

sheet in a specific order which is termed as marshalling. When the assets which are most

permanent in nature appear at top and below to them is current assets and when it comes to

liabilities, the capital and long term liabilities appear above the short term liabilities, it is termed

as marshalling under permanence order (Kolat, 2019). Income statements – It a generic term which refers to those components of financial

statement which are associated with determination of operating result that is

ascertainment of profit earned or loss suffered. There is sub categories in income

statements which is trading and profit and loss account which are discussed hereunder:

according to the budget and control the expenses and cost of the business. Because of

this they are bale to reduce their cost and can increase the profit margin as well.

P3. Financial statements for sole traders, partnerships and not for profit organisation

Every business has operating regularly so have some sort of different activities, they need to

record these data at one place (Hamour and et.al., 2021). In other words, every financial

transactions to be recorded in day to day activities termed as financial statements. While

preparing financial books, every organisation need to comply with accounting standards.

Financial statements are written records which are prepared by management of company to

present financial position and performance at a given point of time. These are prepared with a

motive to give detailed information about business to its interested parties like owners, investors,

government, creditors and many more. There are more compliances for publicly listed companies

as they required to prepare financial statements for the quarters as well as for year. They need to

present to different regulators agencies like to stock market, monetary units and banking units.

Practically, there exist three types of financial statements such as statement of financial position,

statements of profit and loss and statements of cash flows. These statement help their users to

forecast the future value of their entity and which assists them in analyse the earning capabilities

of the company.

Statement of financial position – This is also known as balance sheet which is capable to show

the financial position of an organisation on a particular date. It is prepared after proper drafting

of Income statements which is trading and profit & loss account. It indicates the assets and

liabilities of a concern at particular point of time. The various items should appear in the balance

sheet in a specific order which is termed as marshalling. When the assets which are most

permanent in nature appear at top and below to them is current assets and when it comes to

liabilities, the capital and long term liabilities appear above the short term liabilities, it is termed

as marshalling under permanence order (Kolat, 2019). Income statements – It a generic term which refers to those components of financial

statement which are associated with determination of operating result that is

ascertainment of profit earned or loss suffered. There is sub categories in income

statements which is trading and profit and loss account which are discussed hereunder:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Trading account – This is first income statement prepared by non-corporate business entity. It is

used to ascertain gross operating results which can be gross loss or gross profit. Its principle

involves matching of Cost of Goods Sold (COGS) of a financial period against the corresponding

sales (Lopez, Schuldt and Vega, 2022). It considers only direct costs and direct income for

determination of gross profit or gross loss. By nature, it can be considered as nominal account as

it is closed by transferring balance amount to profit and loss.

Profit and Loss account – The second income statement which is drafted after

determination of gross operating results. The main motive of this account to

determine net profit or net loss of an organisation for a particular financial year.

While preparing this account, it considers indirect expenses and losses against the

gross profit and other indirect incomes.

Cash flow statements – This statements help you provide critical overview of inflows and

outflows of cash and cash equivalent in an organisation. The cash go with the drift declaration

has the statistics displaying the inflows of cash in addition to the sources. Besides, it additionally

well-known shows how the commercial enterprise makes use of the outflows to finance the

numerous activities. It is a critical declaration that aids each investor to recognize the monetary

decision-making of the organisation they are inclined to make investments in (Mamazhonov,

2020).

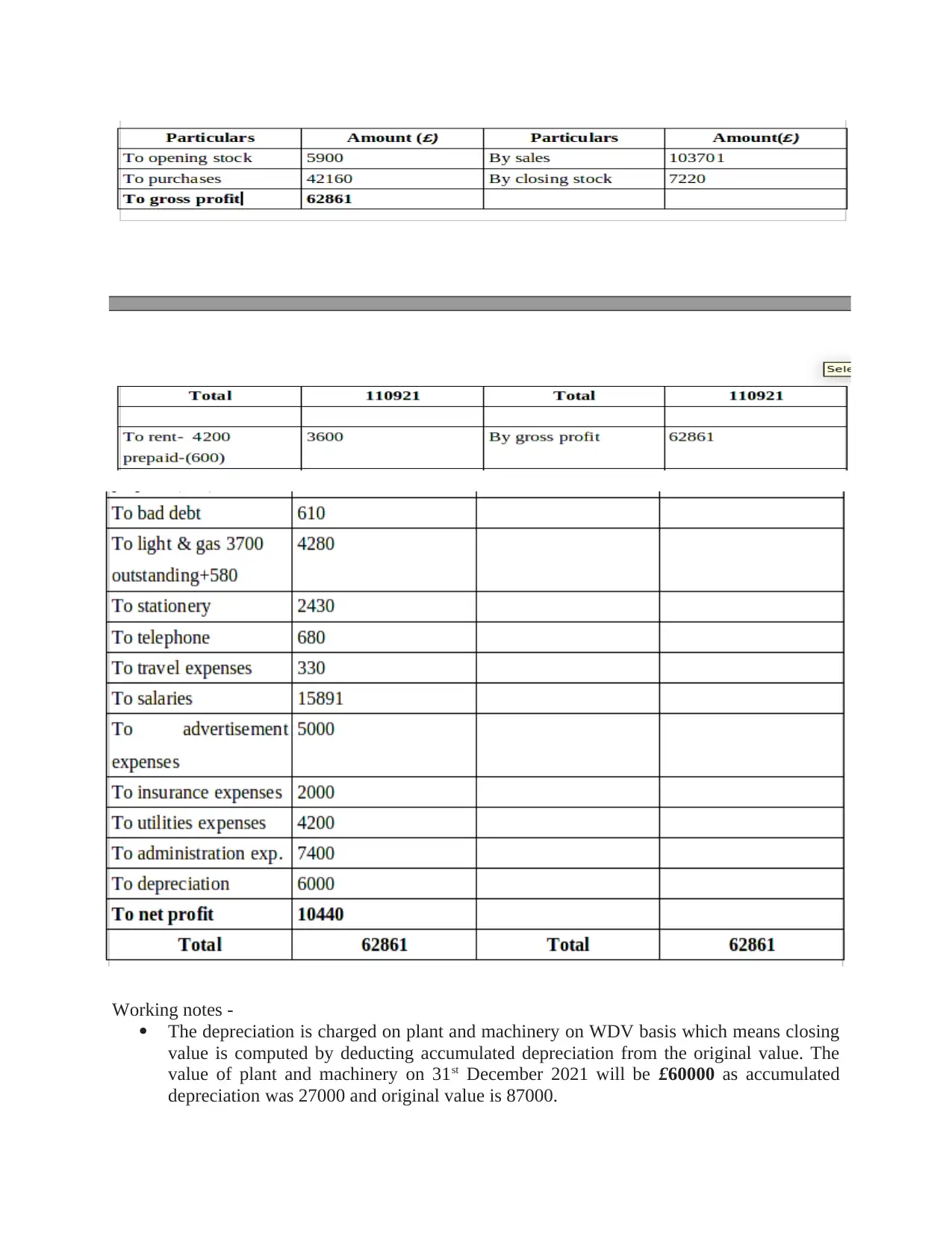

M2 and D2 Financial statements from given trial balance after appropriate adjustments

Financial statements of M queen ( sole trader )

Income statements for the year ended 31st December 2021

used to ascertain gross operating results which can be gross loss or gross profit. Its principle

involves matching of Cost of Goods Sold (COGS) of a financial period against the corresponding

sales (Lopez, Schuldt and Vega, 2022). It considers only direct costs and direct income for

determination of gross profit or gross loss. By nature, it can be considered as nominal account as

it is closed by transferring balance amount to profit and loss.

Profit and Loss account – The second income statement which is drafted after

determination of gross operating results. The main motive of this account to

determine net profit or net loss of an organisation for a particular financial year.

While preparing this account, it considers indirect expenses and losses against the

gross profit and other indirect incomes.

Cash flow statements – This statements help you provide critical overview of inflows and

outflows of cash and cash equivalent in an organisation. The cash go with the drift declaration

has the statistics displaying the inflows of cash in addition to the sources. Besides, it additionally

well-known shows how the commercial enterprise makes use of the outflows to finance the

numerous activities. It is a critical declaration that aids each investor to recognize the monetary

decision-making of the organisation they are inclined to make investments in (Mamazhonov,

2020).

M2 and D2 Financial statements from given trial balance after appropriate adjustments

Financial statements of M queen ( sole trader )

Income statements for the year ended 31st December 2021

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Working notes -

The depreciation is charged on plant and machinery on WDV basis which means closing

value is computed by deducting accumulated depreciation from the original value. The

value of plant and machinery on 31st December 2021 will be £60000 as accumulated

depreciation was 27000 and original value is 87000.

The depreciation is charged on plant and machinery on WDV basis which means closing

value is computed by deducting accumulated depreciation from the original value. The

value of plant and machinery on 31st December 2021 will be £60000 as accumulated

depreciation was 27000 and original value is 87000.

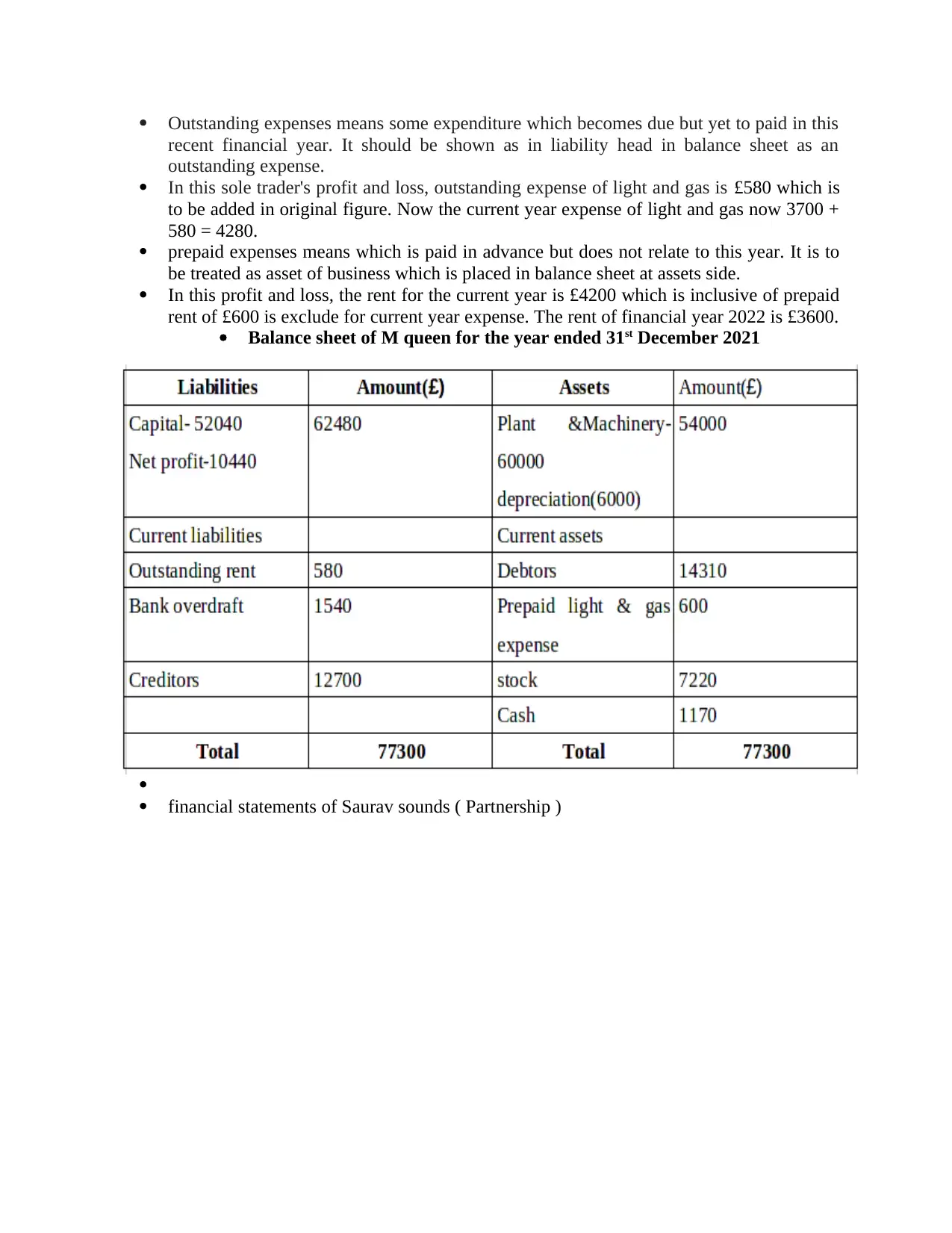

Outstanding expenses means some expenditure which becomes due but yet to paid in this

recent financial year. It should be shown as in liability head in balance sheet as an

outstanding expense.

In this sole trader's profit and loss, outstanding expense of light and gas is £580 which is

to be added in original figure. Now the current year expense of light and gas now 3700 +

580 = 4280.

prepaid expenses means which is paid in advance but does not relate to this year. It is to

be treated as asset of business which is placed in balance sheet at assets side.

In this profit and loss, the rent for the current year is £4200 which is inclusive of prepaid

rent of £600 is exclude for current year expense. The rent of financial year 2022 is £3600.

Balance sheet of M queen for the year ended 31st December 2021

financial statements of Saurav sounds ( Partnership )

recent financial year. It should be shown as in liability head in balance sheet as an

outstanding expense.

In this sole trader's profit and loss, outstanding expense of light and gas is £580 which is

to be added in original figure. Now the current year expense of light and gas now 3700 +

580 = 4280.

prepaid expenses means which is paid in advance but does not relate to this year. It is to

be treated as asset of business which is placed in balance sheet at assets side.

In this profit and loss, the rent for the current year is £4200 which is inclusive of prepaid

rent of £600 is exclude for current year expense. The rent of financial year 2022 is £3600.

Balance sheet of M queen for the year ended 31st December 2021

financial statements of Saurav sounds ( Partnership )

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

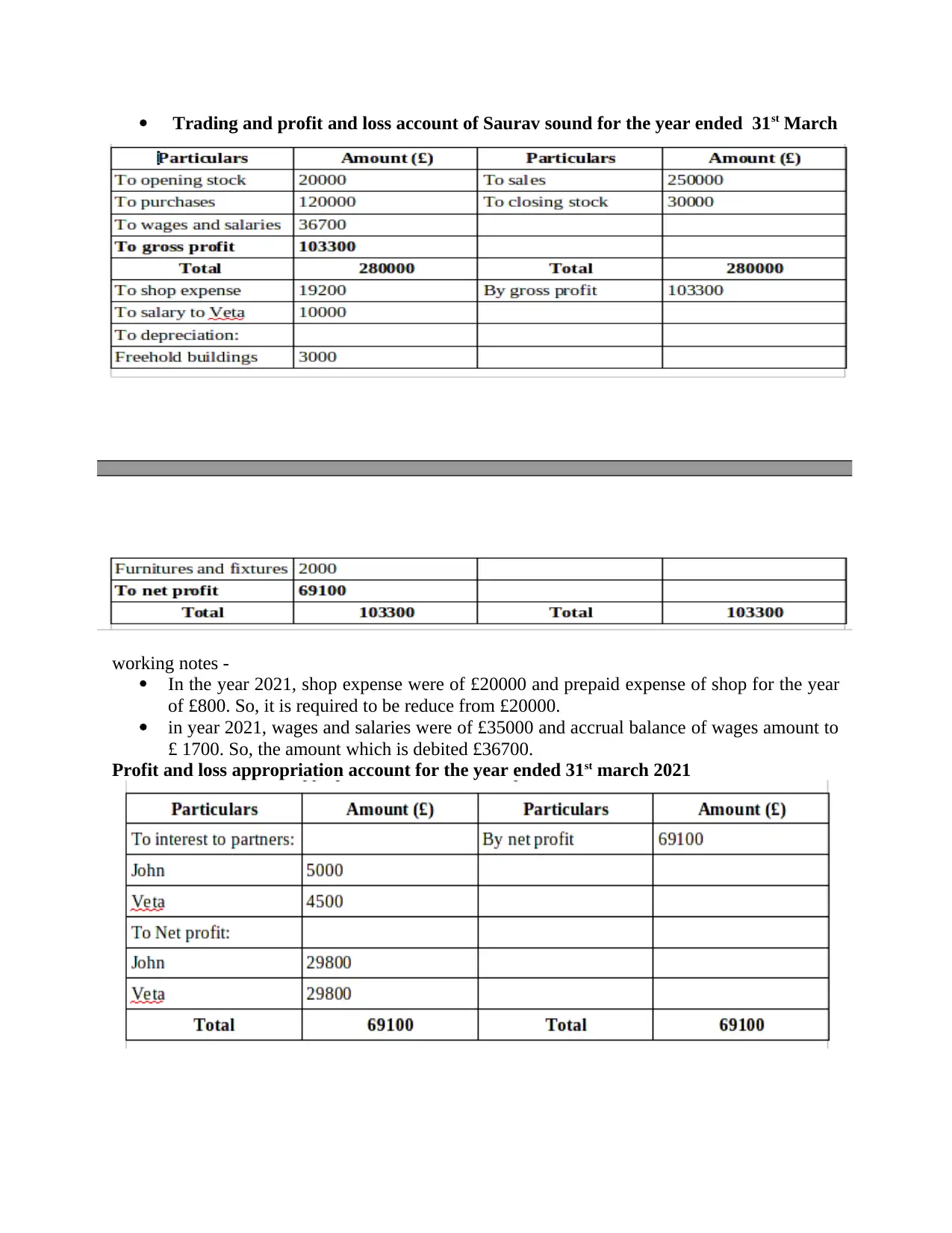

Trading and profit and loss account of Saurav sound for the year ended 31st March

working notes -

In the year 2021, shop expense were of £20000 and prepaid expense of shop for the year

of £800. So, it is required to be reduce from £20000.

in year 2021, wages and salaries were of £35000 and accrual balance of wages amount to

£ 1700. So, the amount which is debited £36700.

Profit and loss appropriation account for the year ended 31st march 2021

working notes -

In the year 2021, shop expense were of £20000 and prepaid expense of shop for the year

of £800. So, it is required to be reduce from £20000.

in year 2021, wages and salaries were of £35000 and accrual balance of wages amount to

£ 1700. So, the amount which is debited £36700.

Profit and loss appropriation account for the year ended 31st march 2021

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

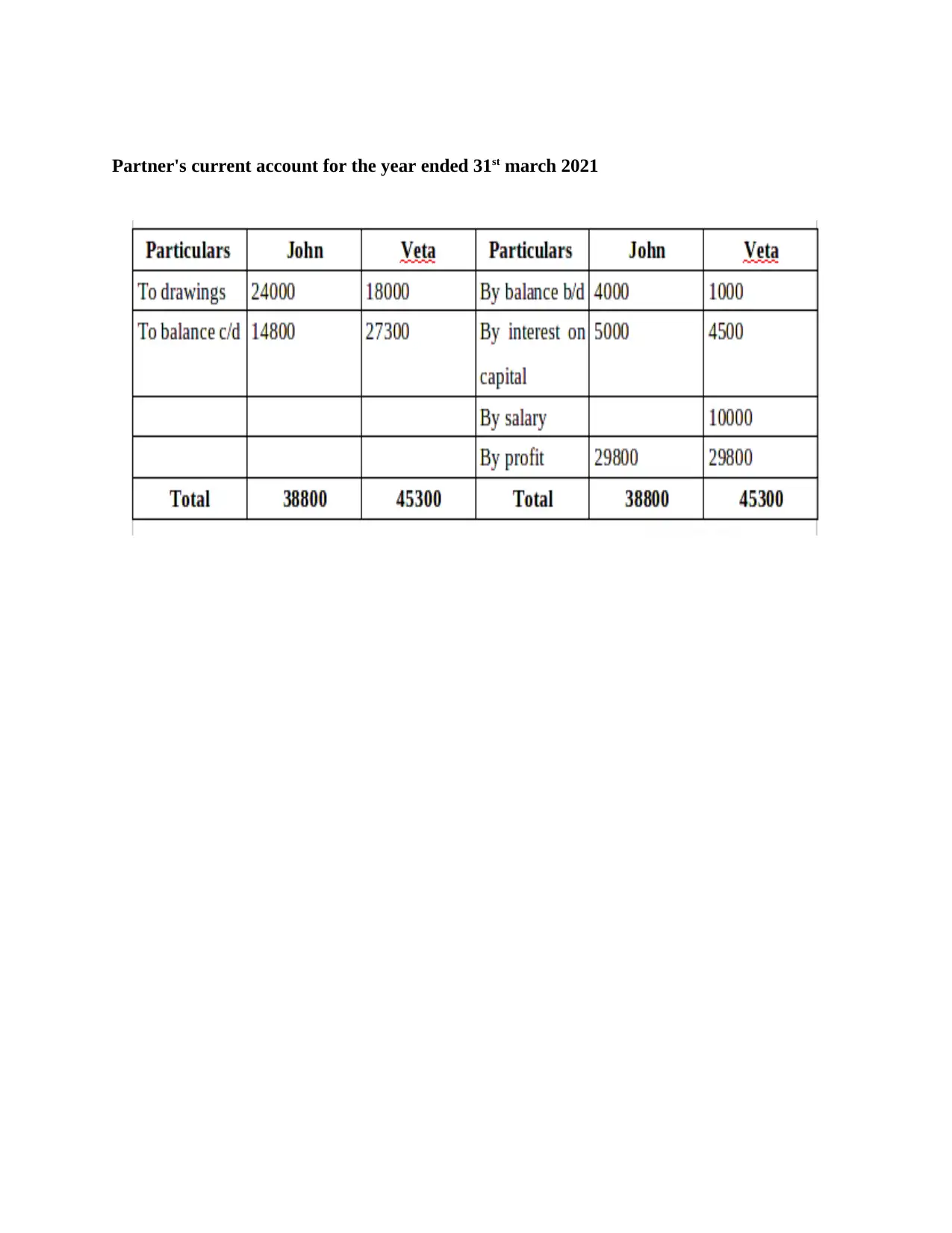

Partner's current account for the year ended 31st march 2021

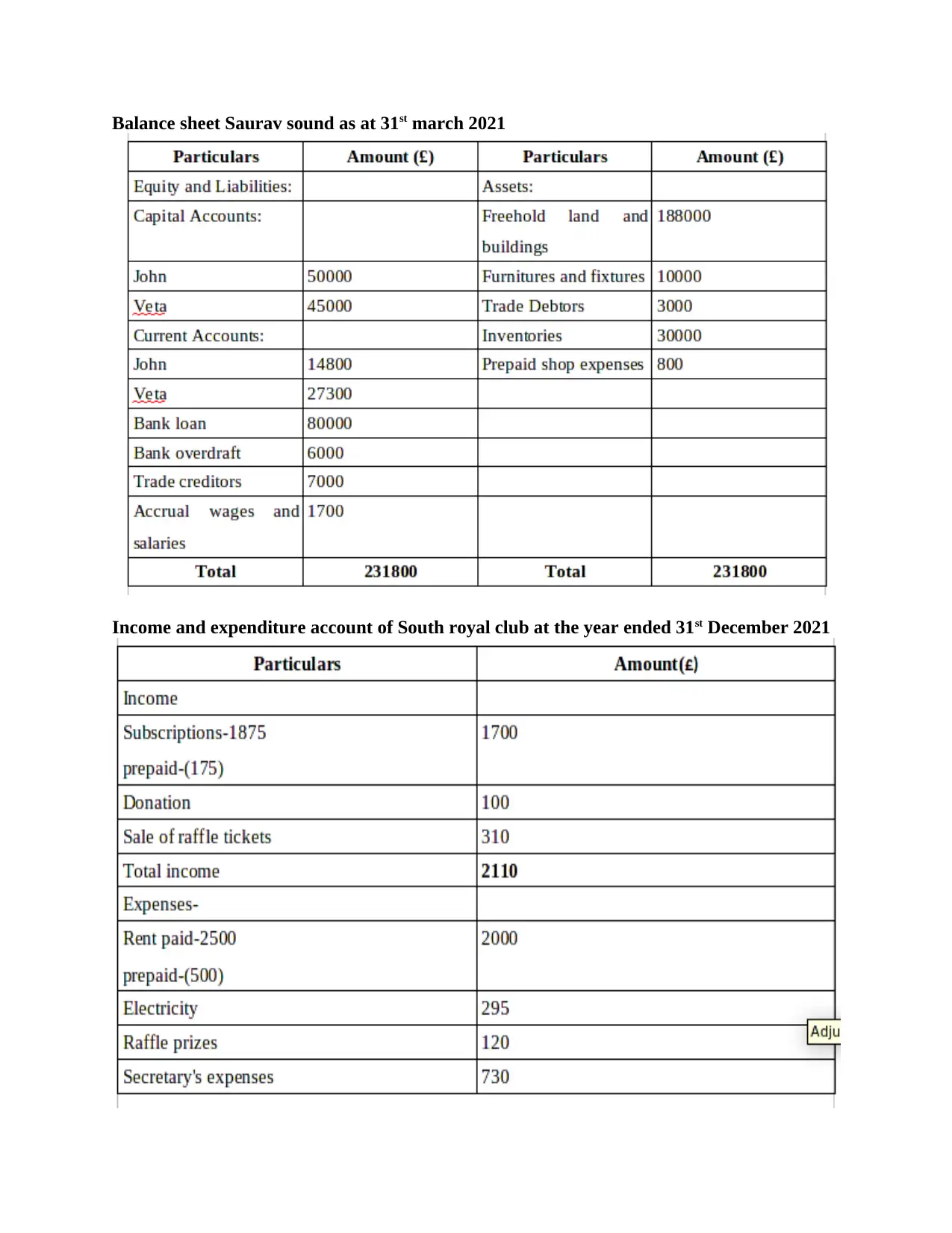

Balance sheet Saurav sound as at 31st march 2021

Income and expenditure account of South royal club at the year ended 31st December 2021

Income and expenditure account of South royal club at the year ended 31st December 2021

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.