Management Accounting Report: Analysis of FORD's Financial Strategies

VerifiedAdded on 2020/06/04

|17

|5254

|101

Report

AI Summary

This report analyzes management accounting principles within the context of the Ford Motor Company. It explores the fundamentals of management accounting, including cost accounting, manufacturing processes, planning, and inventory management. The report delves into various cost calculation techniques, such as marginal and absorption costing, and examines different methods of management accounting reporting, including financial statements, managerial reports, and costing reports. Furthermore, it discusses the advantages and disadvantages of planning tools used for budgetary control and compares how organizations adapt management accounting systems to address financial problems. The report highlights the importance of these accounting systems in decision-making, cost control, and overall financial management within a global organization like Ford.

UNIT: 5 – Management Accounting (Core unit 5)

UNIT 5 MANAGEMENT ACCOUNTING

TABLE OF CONTENTS

Introduction (page 4)

TASK 1

LO1 P1 Explain management accounting and give the essential requirements of different types of management accounting systems to the

chosen scenario (page 5-6-7)

P2 Explain different methods used for management accounting reporting (page 8-9)

TASK 2

LO2 P3 Calculate costs using appropriate techniques of cost analysis to prepare an income statement of marginal and absorption costing as

specified above (page 10-11-12)

TASK 3

LO3 P4 Explain the advantages and disadvantages of different types of planning tools that can be used for budgetary control for the chosen

scenario. (page 13-14)

LO4 P5 Compare how organisations such as yours should adapt management accounting systems to respond to financial problems. (page 15)

References (page 16)

UNIT 5 MANAGEMENT ACCOUNTING

TABLE OF CONTENTS

Introduction (page 4)

TASK 1

LO1 P1 Explain management accounting and give the essential requirements of different types of management accounting systems to the

chosen scenario (page 5-6-7)

P2 Explain different methods used for management accounting reporting (page 8-9)

TASK 2

LO2 P3 Calculate costs using appropriate techniques of cost analysis to prepare an income statement of marginal and absorption costing as

specified above (page 10-11-12)

TASK 3

LO3 P4 Explain the advantages and disadvantages of different types of planning tools that can be used for budgetary control for the chosen

scenario. (page 13-14)

LO4 P5 Compare how organisations such as yours should adapt management accounting systems to respond to financial problems. (page 15)

References (page 16)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Introduction

FORD is a global organization structure and it’s main focus is the car industry.

FORD takes second place in the world as the largest US car manufacturer due to her business growth and the way it performs.

The main functional steps in FORD’s organizational structure are: global manufacturing, marketing, sales, human resources, quality, finance,

communication.

Globalization and control is the biggest advantage that FORD has.

FORD’s strategy is cost leadership and it’s vision was to create cheaper cars for the lower class people.

The company then create a method to minimise costs and maximise productivity.

FORD’s first growth strategy was to be able to launch itself into the market by creating a bigger amount of sales and dealership.

FORD is a global organization structure and it’s main focus is the car industry.

FORD takes second place in the world as the largest US car manufacturer due to her business growth and the way it performs.

The main functional steps in FORD’s organizational structure are: global manufacturing, marketing, sales, human resources, quality, finance,

communication.

Globalization and control is the biggest advantage that FORD has.

FORD’s strategy is cost leadership and it’s vision was to create cheaper cars for the lower class people.

The company then create a method to minimise costs and maximise productivity.

FORD’s first growth strategy was to be able to launch itself into the market by creating a bigger amount of sales and dealership.

TASK 1

LO1 P1: Management accounting and its various types

Management accounting is the process of recording, summarising and controlling the financial transactions which are done by the

company in its day to day operations. It is an important part for the company to record and maintain each transaction into the concern books of

accounting in order to take crucial decision at the time of planning.

Objectives:

For the cited company, the main purpose of management accounting is to assists the administration in performing its operation and

function in effective manner. As it help in discharging its control functions through the use of budgetary control and costing techniques.

Advantages:

It has been seen that owners of the business entity are facing curtness decisions in day to day basis. By using accounting system the

collection provides data-given as input signal to these decisions that can be modify decision making for future.

Management accounting has different types of systems which are: Cost Accounting, Manufacturing Process, Process and Controlling,

Inventories.

Cost Accounting is a process that determine and provide the cost data for managers so they can take control of the activities and operations

and also plan the future of the organization.

Cost Accounting includes both financial and management accounting.

Cost Accounting main objectives are: - to determine the cost of the product

- to control the cost and its competitors

- to analyse the profit

Manufacturing process involves the transformation of raw materials into finished goods. Most of the companies nowadays require the

implementation of ISO 9000 certified who is an international organization for standards and quality.

Manufacturing process has a series of objectives to improve company’s strategy like:

- Quality (maintain a high standard level of products)

LO1 P1: Management accounting and its various types

Management accounting is the process of recording, summarising and controlling the financial transactions which are done by the

company in its day to day operations. It is an important part for the company to record and maintain each transaction into the concern books of

accounting in order to take crucial decision at the time of planning.

Objectives:

For the cited company, the main purpose of management accounting is to assists the administration in performing its operation and

function in effective manner. As it help in discharging its control functions through the use of budgetary control and costing techniques.

Advantages:

It has been seen that owners of the business entity are facing curtness decisions in day to day basis. By using accounting system the

collection provides data-given as input signal to these decisions that can be modify decision making for future.

Management accounting has different types of systems which are: Cost Accounting, Manufacturing Process, Process and Controlling,

Inventories.

Cost Accounting is a process that determine and provide the cost data for managers so they can take control of the activities and operations

and also plan the future of the organization.

Cost Accounting includes both financial and management accounting.

Cost Accounting main objectives are: - to determine the cost of the product

- to control the cost and its competitors

- to analyse the profit

Manufacturing process involves the transformation of raw materials into finished goods. Most of the companies nowadays require the

implementation of ISO 9000 certified who is an international organization for standards and quality.

Manufacturing process has a series of objectives to improve company’s strategy like:

- Quality (maintain a high standard level of products)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

- Safety (reduce the risk of injuries in the company and avoid that their products do not hurt customers)

- Problems (discover the appearance of problems in order to avoid risks)

-Cost and efficiency (if the company is more efficient then the prices will go down)

Planning is a process of setting goals for the company in order to achieve business objectives.

Planning process has the following steps:

-Discovering/identifying the plan

-Searching for information

-Analysing the information

-Set the plan/vision

-Set goals and objectives

-Apply the plan into the business

Controlling it’s the way a company and it’s operation are been monitored to identify if the planning process objectives are being done.

Control objectives:

-To make sure that activities are being done according to standard rules of company

-To discover what’s happening in the company

-To take corrective action if any product requires that

-Improve the efficiency of operations

Inventory is the stock that the company keeps for future productions and selling .

Most manufacturers uses the inventory system ( FIFO, LIFO).

Inventory has some objectives such as :

-The company should have a good supply of materials inside for trade

- To maintain record of inventory

- To reduce damages, losses of materials

- To minimise the cost

- To stabilise the price

Job costing represents a tool that is used for gaining costs at a small level. Job costing implements a few accounting activities such as:

*Materials. It gains the cost of elements and then deliver these costs to a product after all the elements are being used.

- Problems (discover the appearance of problems in order to avoid risks)

-Cost and efficiency (if the company is more efficient then the prices will go down)

Planning is a process of setting goals for the company in order to achieve business objectives.

Planning process has the following steps:

-Discovering/identifying the plan

-Searching for information

-Analysing the information

-Set the plan/vision

-Set goals and objectives

-Apply the plan into the business

Controlling it’s the way a company and it’s operation are been monitored to identify if the planning process objectives are being done.

Control objectives:

-To make sure that activities are being done according to standard rules of company

-To discover what’s happening in the company

-To take corrective action if any product requires that

-Improve the efficiency of operations

Inventory is the stock that the company keeps for future productions and selling .

Most manufacturers uses the inventory system ( FIFO, LIFO).

Inventory has some objectives such as :

-The company should have a good supply of materials inside for trade

- To maintain record of inventory

- To reduce damages, losses of materials

- To minimise the cost

- To stabilise the price

Job costing represents a tool that is used for gaining costs at a small level. Job costing implements a few accounting activities such as:

*Materials. It gains the cost of elements and then deliver these costs to a product after all the elements are being used.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

*Labour. Most of the employees are putting a price on some particular jobs which then are given to those jobs with the labour cost of

employees.

*Overhead. It gets all the overhead costs and then delivers these costs to jobs.

Price optimization is the numerical analysis done by the cited company to established that how customers will react to various prices

for its goods and services through different transmission channel. It is based on that prices which is fixed by the company in order to achieved

its objectives and increase operating profits.

Cost accounting system: In an organisation it is important to plan its costs which are levied during production of a products. As they

are categorised into various costing methods such as normal, standard and actual costing techniques. They all are directly related with the

direct cost to the factors of productions.

Batch costing: It is a form of particular order costing system. It is relatively common as Job costing within each unit of batch are

allotted with a number to identified its production date and year. But all the batch have different numbers.

Inventory management system: It is that system of accounting in which stocks are maintain according to their durability. In order to

control them the cited company's are used various software for tracking the orders, sales and deliveries. In the manufacturing sector these are

more helpful as they are utilized to create a work order, production related information documents.

The essential of accounting system is very much useful for the business concern in order to manage and record their financial

transactions. Hence, all the basic decision related with the development of the cited company's are based on the performance and financial

growth.

M1 Evaluate the benefits of management accounting systems and their application within an organizational context.

From the above accounting system explained regarding the management of company's financial statements in order to acquired

maximum advantages from their available resources. It will help to minimise the operational expenses that are incurred during manufacturing

process. So the job costing and inventory management systems can be more relevant to achieve maximum advantages for the cited company.

It also help to increase the efficiency and productivity of the company.

Management accounting is often used by business owners in order to track, record and report financial information.

Management accounting systems can be implemented by business owners in the way the business needs it.

Management accounting has a few advantages in order to improve services and profit.

employees.

*Overhead. It gets all the overhead costs and then delivers these costs to jobs.

Price optimization is the numerical analysis done by the cited company to established that how customers will react to various prices

for its goods and services through different transmission channel. It is based on that prices which is fixed by the company in order to achieved

its objectives and increase operating profits.

Cost accounting system: In an organisation it is important to plan its costs which are levied during production of a products. As they

are categorised into various costing methods such as normal, standard and actual costing techniques. They all are directly related with the

direct cost to the factors of productions.

Batch costing: It is a form of particular order costing system. It is relatively common as Job costing within each unit of batch are

allotted with a number to identified its production date and year. But all the batch have different numbers.

Inventory management system: It is that system of accounting in which stocks are maintain according to their durability. In order to

control them the cited company's are used various software for tracking the orders, sales and deliveries. In the manufacturing sector these are

more helpful as they are utilized to create a work order, production related information documents.

The essential of accounting system is very much useful for the business concern in order to manage and record their financial

transactions. Hence, all the basic decision related with the development of the cited company's are based on the performance and financial

growth.

M1 Evaluate the benefits of management accounting systems and their application within an organizational context.

From the above accounting system explained regarding the management of company's financial statements in order to acquired

maximum advantages from their available resources. It will help to minimise the operational expenses that are incurred during manufacturing

process. So the job costing and inventory management systems can be more relevant to achieve maximum advantages for the cited company.

It also help to increase the efficiency and productivity of the company.

Management accounting is often used by business owners in order to track, record and report financial information.

Management accounting systems can be implemented by business owners in the way the business needs it.

Management accounting has a few advantages in order to improve services and profit.

*Reduce expenses: Management accounting is used by business owners to check the resources cost and business operation so in this way they

will see the money they are spending to run the business. Also business owners can analyse the quality of the resources need it to produce

goods and services.

*Business decisions: Management accounting is being used by managers as a decision making tool and it provides analysis for different

opportunities. Business owners can look deeply into the quantitative analysis to make sure they understood properly the business decisions.

*Increase Financial Return: Management accounting can also be used by the business owners to increase their company financial returns by

providing financial reports involving customer demand. They need to be sure that they can make plenty of goods and services so they can meet

customer expectations. Companies are overlooking competition who is taking place in the economic market and it can diminuate the company

financial returns.

P2 Explain different methods used for management accounting reporting

In an organization business reports are fundamental because it helps a lot managers and business owners to run, monitor and take

decisions in the company. Managers or owners can ask for daily, weekly, monthly or quarterly reports depending on the information gathered

from the company. Management accounting reporting is focused more on decision making.

There are a few methods being used in management accounting reporting:

Financial statements which offers details about the loss and profit and also about expenses. Also breaks costs down into fixed and variable

elements. Financial statements shows if the company is doing well or bad.

There are a few people who are most interested in financial statements such as:

-Business owners: they are most interested to see financial reports to see how the business is doing. If the business goes well and it performs at

a good level then they make more money.

-Managers ( who are the people working for the business owners ) will loose their job if the company is not doing well or they can get bonuses

and salary rises if the company performs good.

-Investors will go further with their investment only if the business performs good.

-Banks are interested in the financial statement to see how high the risk is if they will loan money for that company.

-The government and tax authorities they need to see if the business is meeting her legal duties, standards and tax paying.

-Suppliers want to make sure that they will be paid by the business before they start to supply goods for them.

-Employees need to be secure on their job so they can plan ahead for the future because if the company is doing bad then they will look for

another job.

will see the money they are spending to run the business. Also business owners can analyse the quality of the resources need it to produce

goods and services.

*Business decisions: Management accounting is being used by managers as a decision making tool and it provides analysis for different

opportunities. Business owners can look deeply into the quantitative analysis to make sure they understood properly the business decisions.

*Increase Financial Return: Management accounting can also be used by the business owners to increase their company financial returns by

providing financial reports involving customer demand. They need to be sure that they can make plenty of goods and services so they can meet

customer expectations. Companies are overlooking competition who is taking place in the economic market and it can diminuate the company

financial returns.

P2 Explain different methods used for management accounting reporting

In an organization business reports are fundamental because it helps a lot managers and business owners to run, monitor and take

decisions in the company. Managers or owners can ask for daily, weekly, monthly or quarterly reports depending on the information gathered

from the company. Management accounting reporting is focused more on decision making.

There are a few methods being used in management accounting reporting:

Financial statements which offers details about the loss and profit and also about expenses. Also breaks costs down into fixed and variable

elements. Financial statements shows if the company is doing well or bad.

There are a few people who are most interested in financial statements such as:

-Business owners: they are most interested to see financial reports to see how the business is doing. If the business goes well and it performs at

a good level then they make more money.

-Managers ( who are the people working for the business owners ) will loose their job if the company is not doing well or they can get bonuses

and salary rises if the company performs good.

-Investors will go further with their investment only if the business performs good.

-Banks are interested in the financial statement to see how high the risk is if they will loan money for that company.

-The government and tax authorities they need to see if the business is meeting her legal duties, standards and tax paying.

-Suppliers want to make sure that they will be paid by the business before they start to supply goods for them.

-Employees need to be secure on their job so they can plan ahead for the future because if the company is doing bad then they will look for

another job.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

*Managerial reports that shows all the money that the customer owes to the company . This reports are important because it monitors fraud

accounts also customers with due invoices.

*Costing reports shows all the money that the company it’s making it by units. Managers are using this reports to see which sectors from the

business are making profit and which sectors have problems in achieving profit.

*Income statements that are the profit and loss statement and it lists all the expenses made by a business.

Following are various types of management reporting used in an organisations:

Job Cost reporting: It refers to be that tool which the cited company uses in order to calculate costs of products those are produce

during the time. Basically, this report is consist of all the cost related records which a company incurred while production process. The records

are summarised with direct cost of labour, material and other additional cost are considered.

Operating Budget reporting: It is said to be most effective reporting system that a company have. It provide the cited company to

compare, analyse and manage there performance and control the extra cost and expenses. The total budget determine for a particular period of

time those are associated with actual expenses.

Performance report: It is used to compare actual expenses and revenues to the budgeted cost. The difference is analysed during the

time of budget preparation in order to analyse the performance report.

Inventory report: under this report all the matters which are associated with the wastage of stocks and cost which are incurred in

order to protect there inventories from getting damage. It also covers various information regarding the opining and closing entries of stocks

that are ordered by the company.

M2: Techniques of accounting reporting

In order to maintain the operations of company they need perfect accounting reporting system which can record each transactions those

are done in a day. Some of the reporting methods are operation budget reproting which is used to analyse the total expenses incurred over the

production of products. The other is job costing and inventory reporting. All are responsible for making proper record of transaction done in an

accounting year.

TASK 2

accounts also customers with due invoices.

*Costing reports shows all the money that the company it’s making it by units. Managers are using this reports to see which sectors from the

business are making profit and which sectors have problems in achieving profit.

*Income statements that are the profit and loss statement and it lists all the expenses made by a business.

Following are various types of management reporting used in an organisations:

Job Cost reporting: It refers to be that tool which the cited company uses in order to calculate costs of products those are produce

during the time. Basically, this report is consist of all the cost related records which a company incurred while production process. The records

are summarised with direct cost of labour, material and other additional cost are considered.

Operating Budget reporting: It is said to be most effective reporting system that a company have. It provide the cited company to

compare, analyse and manage there performance and control the extra cost and expenses. The total budget determine for a particular period of

time those are associated with actual expenses.

Performance report: It is used to compare actual expenses and revenues to the budgeted cost. The difference is analysed during the

time of budget preparation in order to analyse the performance report.

Inventory report: under this report all the matters which are associated with the wastage of stocks and cost which are incurred in

order to protect there inventories from getting damage. It also covers various information regarding the opining and closing entries of stocks

that are ordered by the company.

M2: Techniques of accounting reporting

In order to maintain the operations of company they need perfect accounting reporting system which can record each transactions those

are done in a day. Some of the reporting methods are operation budget reproting which is used to analyse the total expenses incurred over the

production of products. The other is job costing and inventory reporting. All are responsible for making proper record of transaction done in an

accounting year.

TASK 2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

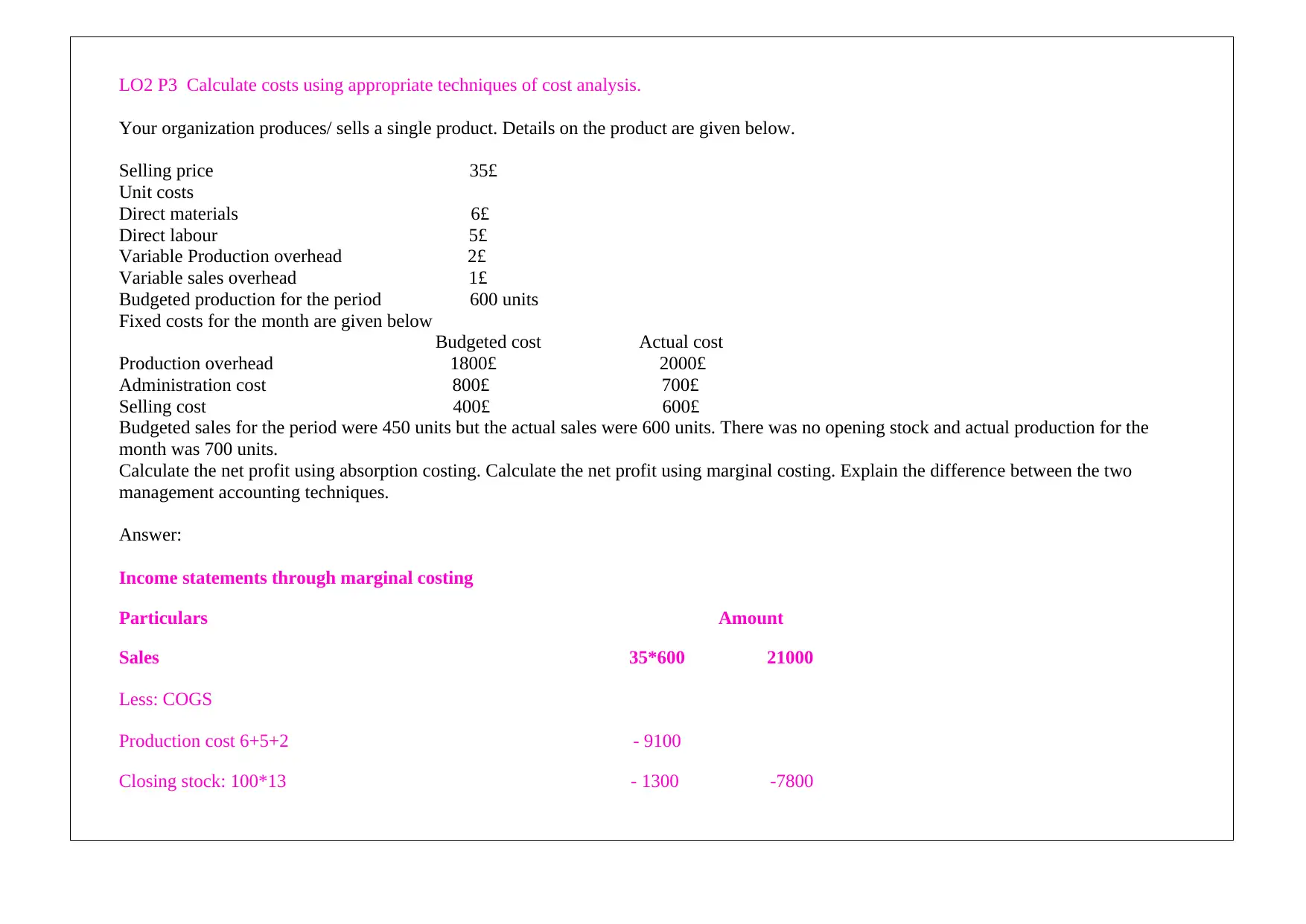

LO2 P3 Calculate costs using appropriate techniques of cost analysis.

Your organization produces/ sells a single product. Details on the product are given below.

Selling price 35£

Unit costs

Direct materials 6£

Direct labour 5£

Variable Production overhead 2£

Variable sales overhead 1£

Budgeted production for the period 600 units

Fixed costs for the month are given below

Budgeted cost Actual cost

Production overhead 1800£ 2000£

Administration cost 800£ 700£

Selling cost 400£ 600£

Budgeted sales for the period were 450 units but the actual sales were 600 units. There was no opening stock and actual production for the

month was 700 units.

Calculate the net profit using absorption costing. Calculate the net profit using marginal costing. Explain the difference between the two

management accounting techniques.

Answer:

Income statements through marginal costing

Particulars Amount

Sales 35*600 21000

Less: COGS

Production cost 6+5+2 - 9100

Closing stock: 100*13 - 1300 -7800

Your organization produces/ sells a single product. Details on the product are given below.

Selling price 35£

Unit costs

Direct materials 6£

Direct labour 5£

Variable Production overhead 2£

Variable sales overhead 1£

Budgeted production for the period 600 units

Fixed costs for the month are given below

Budgeted cost Actual cost

Production overhead 1800£ 2000£

Administration cost 800£ 700£

Selling cost 400£ 600£

Budgeted sales for the period were 450 units but the actual sales were 600 units. There was no opening stock and actual production for the

month was 700 units.

Calculate the net profit using absorption costing. Calculate the net profit using marginal costing. Explain the difference between the two

management accounting techniques.

Answer:

Income statements through marginal costing

Particulars Amount

Sales 35*600 21000

Less: COGS

Production cost 6+5+2 - 9100

Closing stock: 100*13 - 1300 -7800

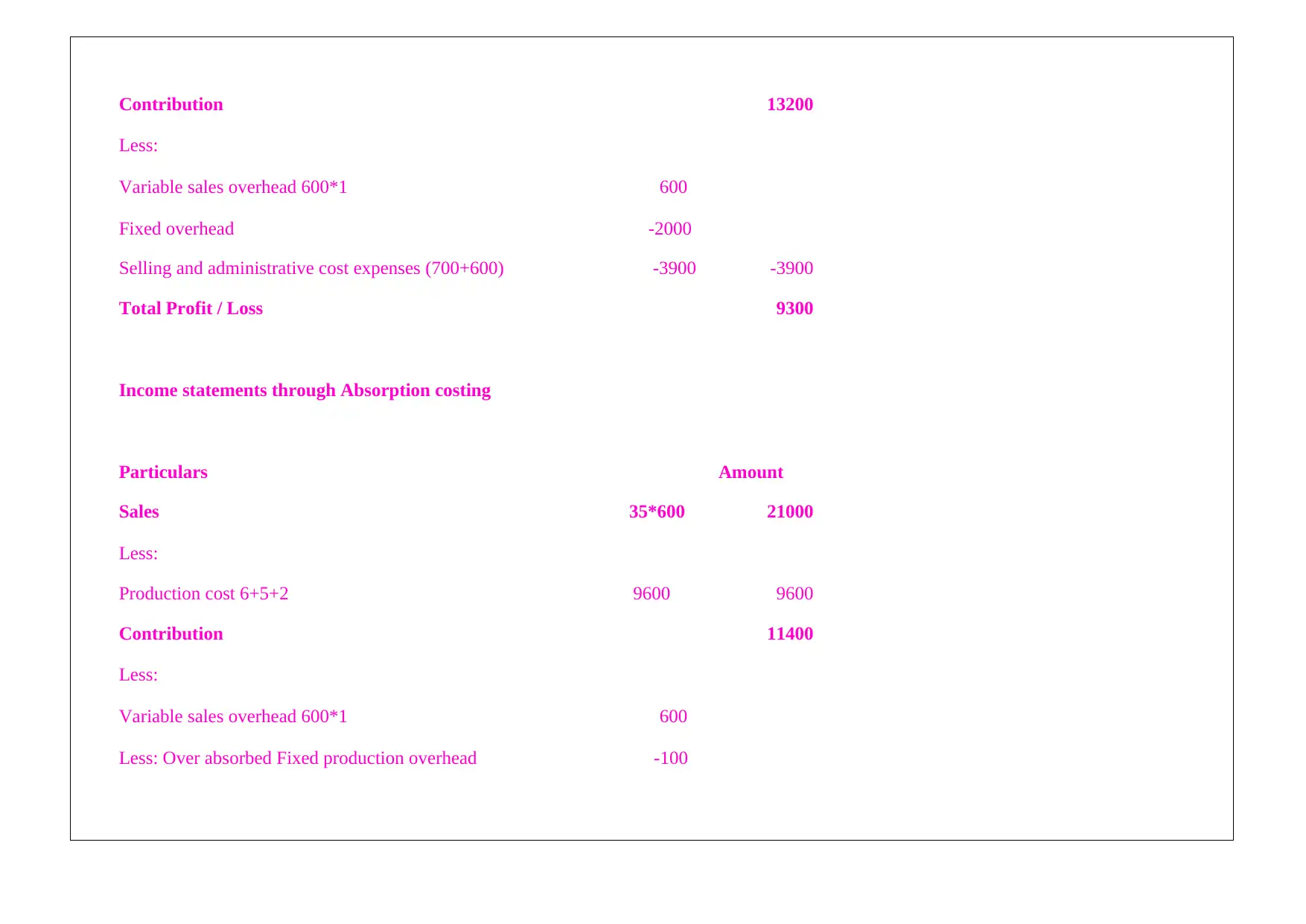

Contribution 13200

Less:

Variable sales overhead 600*1 600

Fixed overhead -2000

Selling and administrative cost expenses (700+600) -3900 -3900

Total Profit / Loss 9300

Income statements through Absorption costing

Particulars Amount

Sales 35*600 21000

Less:

Production cost 6+5+2 9600 9600

Contribution 11400

Less:

Variable sales overhead 600*1 600

Less: Over absorbed Fixed production overhead -100

Less:

Variable sales overhead 600*1 600

Fixed overhead -2000

Selling and administrative cost expenses (700+600) -3900 -3900

Total Profit / Loss 9300

Income statements through Absorption costing

Particulars Amount

Sales 35*600 21000

Less:

Production cost 6+5+2 9600 9600

Contribution 11400

Less:

Variable sales overhead 600*1 600

Less: Over absorbed Fixed production overhead -100

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

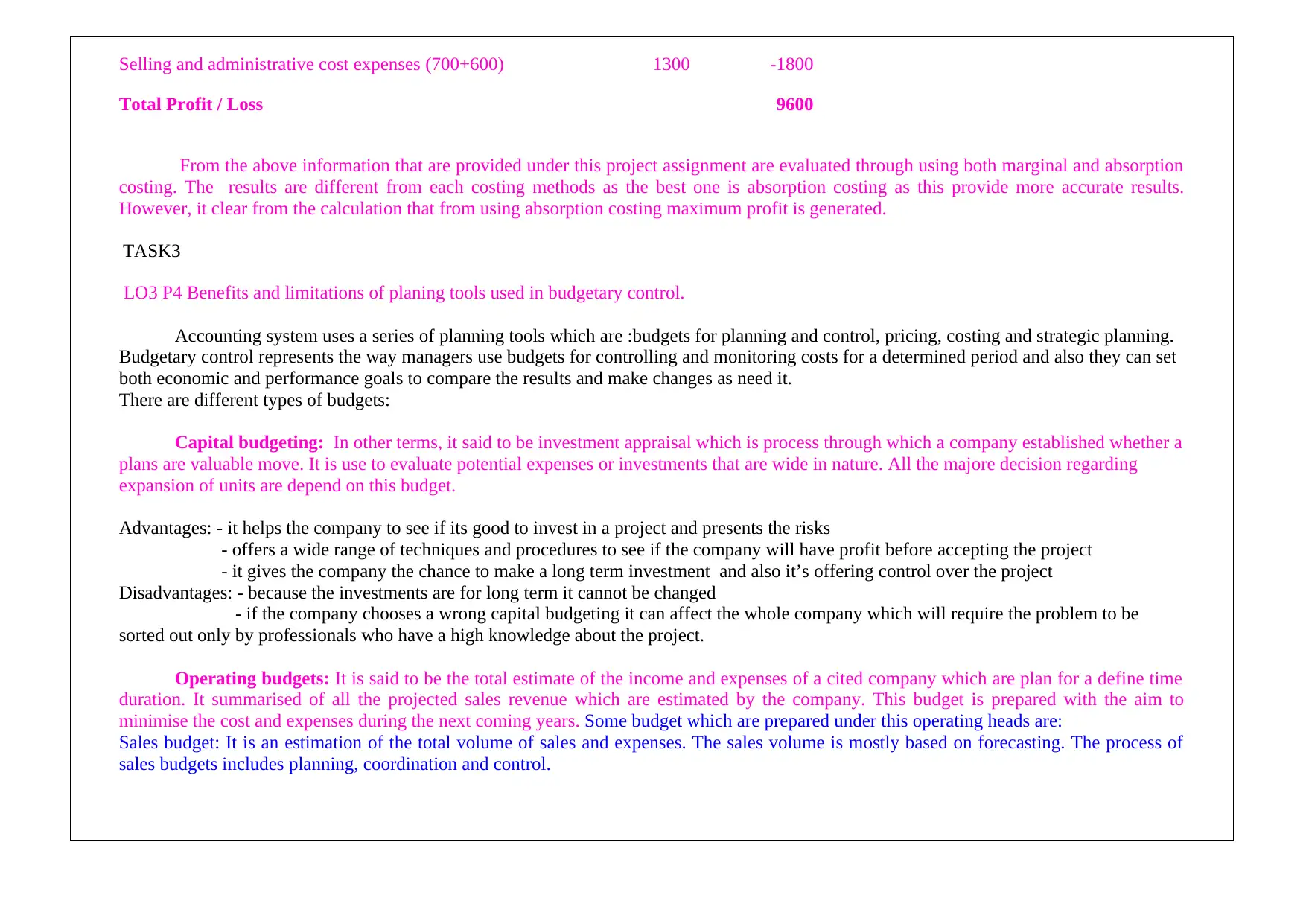

Selling and administrative cost expenses (700+600) 1300 -1800

Total Profit / Loss 9600

From the above information that are provided under this project assignment are evaluated through using both marginal and absorption

costing. The results are different from each costing methods as the best one is absorption costing as this provide more accurate results.

However, it clear from the calculation that from using absorption costing maximum profit is generated.

TASK3

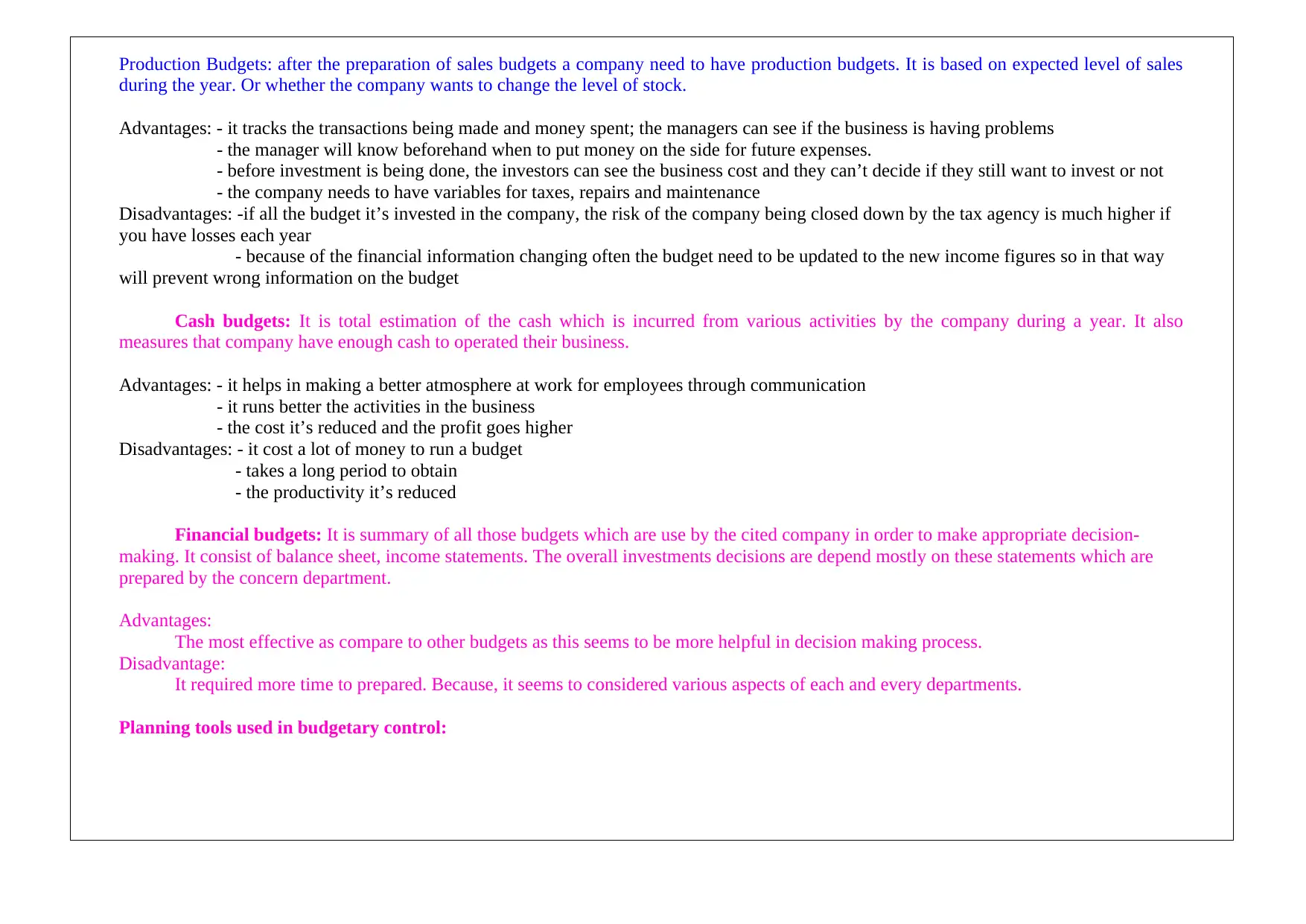

LO3 P4 Benefits and limitations of planing tools used in budgetary control.

Accounting system uses a series of planning tools which are :budgets for planning and control, pricing, costing and strategic planning.

Budgetary control represents the way managers use budgets for controlling and monitoring costs for a determined period and also they can set

both economic and performance goals to compare the results and make changes as need it.

There are different types of budgets:

Capital budgeting: In other terms, it said to be investment appraisal which is process through which a company established whether a

plans are valuable move. It is use to evaluate potential expenses or investments that are wide in nature. All the majore decision regarding

expansion of units are depend on this budget.

Advantages: - it helps the company to see if its good to invest in a project and presents the risks

- offers a wide range of techniques and procedures to see if the company will have profit before accepting the project

- it gives the company the chance to make a long term investment and also it’s offering control over the project

Disadvantages: - because the investments are for long term it cannot be changed

- if the company chooses a wrong capital budgeting it can affect the whole company which will require the problem to be

sorted out only by professionals who have a high knowledge about the project.

Operating budgets: It is said to be the total estimate of the income and expenses of a cited company which are plan for a define time

duration. It summarised of all the projected sales revenue which are estimated by the company. This budget is prepared with the aim to

minimise the cost and expenses during the next coming years. Some budget which are prepared under this operating heads are:

Sales budget: It is an estimation of the total volume of sales and expenses. The sales volume is mostly based on forecasting. The process of

sales budgets includes planning, coordination and control.

Total Profit / Loss 9600

From the above information that are provided under this project assignment are evaluated through using both marginal and absorption

costing. The results are different from each costing methods as the best one is absorption costing as this provide more accurate results.

However, it clear from the calculation that from using absorption costing maximum profit is generated.

TASK3

LO3 P4 Benefits and limitations of planing tools used in budgetary control.

Accounting system uses a series of planning tools which are :budgets for planning and control, pricing, costing and strategic planning.

Budgetary control represents the way managers use budgets for controlling and monitoring costs for a determined period and also they can set

both economic and performance goals to compare the results and make changes as need it.

There are different types of budgets:

Capital budgeting: In other terms, it said to be investment appraisal which is process through which a company established whether a

plans are valuable move. It is use to evaluate potential expenses or investments that are wide in nature. All the majore decision regarding

expansion of units are depend on this budget.

Advantages: - it helps the company to see if its good to invest in a project and presents the risks

- offers a wide range of techniques and procedures to see if the company will have profit before accepting the project

- it gives the company the chance to make a long term investment and also it’s offering control over the project

Disadvantages: - because the investments are for long term it cannot be changed

- if the company chooses a wrong capital budgeting it can affect the whole company which will require the problem to be

sorted out only by professionals who have a high knowledge about the project.

Operating budgets: It is said to be the total estimate of the income and expenses of a cited company which are plan for a define time

duration. It summarised of all the projected sales revenue which are estimated by the company. This budget is prepared with the aim to

minimise the cost and expenses during the next coming years. Some budget which are prepared under this operating heads are:

Sales budget: It is an estimation of the total volume of sales and expenses. The sales volume is mostly based on forecasting. The process of

sales budgets includes planning, coordination and control.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

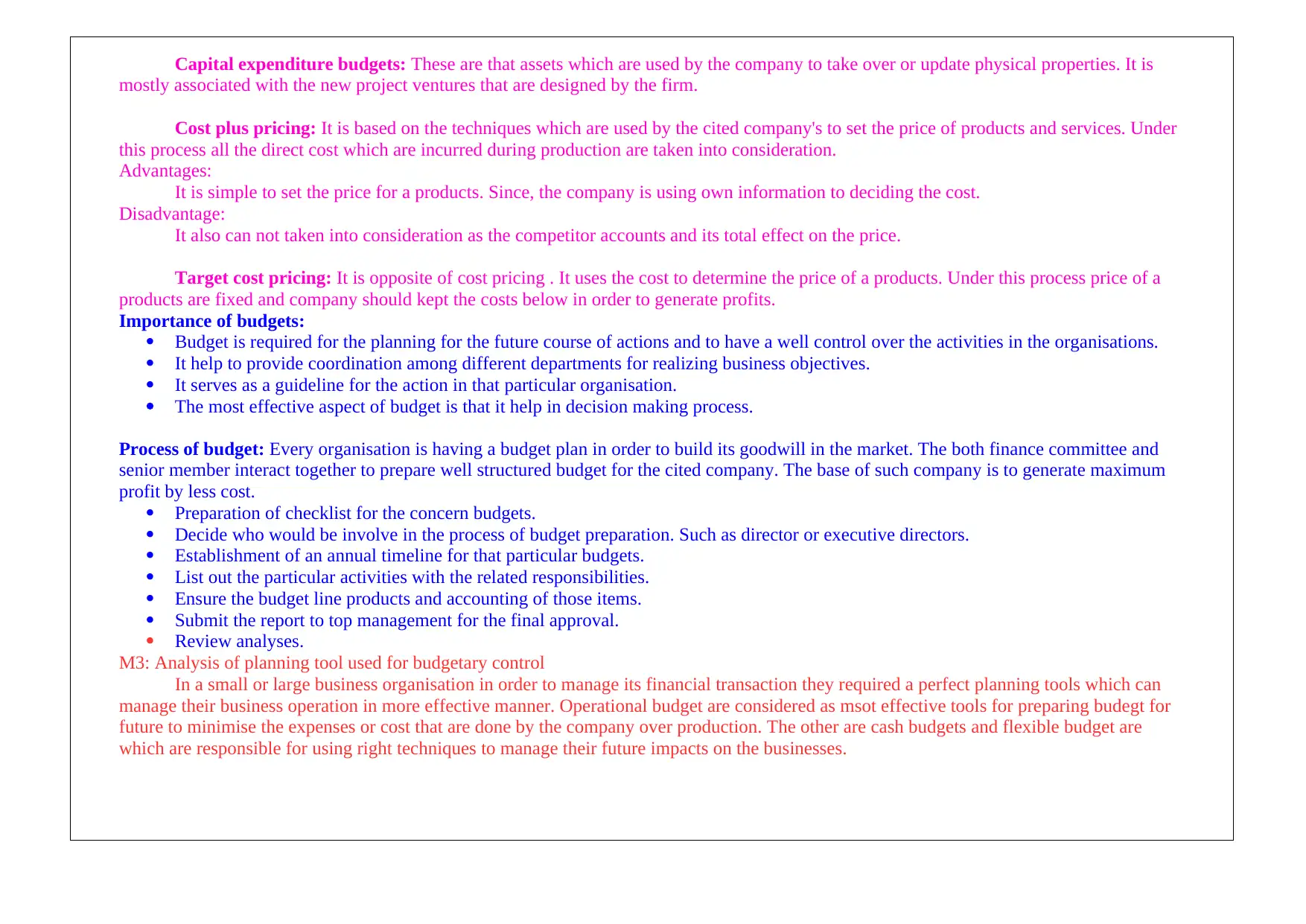

Production Budgets: after the preparation of sales budgets a company need to have production budgets. It is based on expected level of sales

during the year. Or whether the company wants to change the level of stock.

Advantages: - it tracks the transactions being made and money spent; the managers can see if the business is having problems

- the manager will know beforehand when to put money on the side for future expenses.

- before investment is being done, the investors can see the business cost and they can’t decide if they still want to invest or not

- the company needs to have variables for taxes, repairs and maintenance

Disadvantages: -if all the budget it’s invested in the company, the risk of the company being closed down by the tax agency is much higher if

you have losses each year

- because of the financial information changing often the budget need to be updated to the new income figures so in that way

will prevent wrong information on the budget

Cash budgets: It is total estimation of the cash which is incurred from various activities by the company during a year. It also

measures that company have enough cash to operated their business.

Advantages: - it helps in making a better atmosphere at work for employees through communication

- it runs better the activities in the business

- the cost it’s reduced and the profit goes higher

Disadvantages: - it cost a lot of money to run a budget

- takes a long period to obtain

- the productivity it’s reduced

Financial budgets: It is summary of all those budgets which are use by the cited company in order to make appropriate decision-

making. It consist of balance sheet, income statements. The overall investments decisions are depend mostly on these statements which are

prepared by the concern department.

Advantages:

The most effective as compare to other budgets as this seems to be more helpful in decision making process.

Disadvantage:

It required more time to prepared. Because, it seems to considered various aspects of each and every departments.

Planning tools used in budgetary control:

during the year. Or whether the company wants to change the level of stock.

Advantages: - it tracks the transactions being made and money spent; the managers can see if the business is having problems

- the manager will know beforehand when to put money on the side for future expenses.

- before investment is being done, the investors can see the business cost and they can’t decide if they still want to invest or not

- the company needs to have variables for taxes, repairs and maintenance

Disadvantages: -if all the budget it’s invested in the company, the risk of the company being closed down by the tax agency is much higher if

you have losses each year

- because of the financial information changing often the budget need to be updated to the new income figures so in that way

will prevent wrong information on the budget

Cash budgets: It is total estimation of the cash which is incurred from various activities by the company during a year. It also

measures that company have enough cash to operated their business.

Advantages: - it helps in making a better atmosphere at work for employees through communication

- it runs better the activities in the business

- the cost it’s reduced and the profit goes higher

Disadvantages: - it cost a lot of money to run a budget

- takes a long period to obtain

- the productivity it’s reduced

Financial budgets: It is summary of all those budgets which are use by the cited company in order to make appropriate decision-

making. It consist of balance sheet, income statements. The overall investments decisions are depend mostly on these statements which are

prepared by the concern department.

Advantages:

The most effective as compare to other budgets as this seems to be more helpful in decision making process.

Disadvantage:

It required more time to prepared. Because, it seems to considered various aspects of each and every departments.

Planning tools used in budgetary control:

Capital expenditure budgets: These are that assets which are used by the company to take over or update physical properties. It is

mostly associated with the new project ventures that are designed by the firm.

Cost plus pricing: It is based on the techniques which are used by the cited company's to set the price of products and services. Under

this process all the direct cost which are incurred during production are taken into consideration.

Advantages:

It is simple to set the price for a products. Since, the company is using own information to deciding the cost.

Disadvantage:

It also can not taken into consideration as the competitor accounts and its total effect on the price.

Target cost pricing: It is opposite of cost pricing . It uses the cost to determine the price of a products. Under this process price of a

products are fixed and company should kept the costs below in order to generate profits.

Importance of budgets:

Budget is required for the planning for the future course of actions and to have a well control over the activities in the organisations.

It help to provide coordination among different departments for realizing business objectives.

It serves as a guideline for the action in that particular organisation.

The most effective aspect of budget is that it help in decision making process.

Process of budget: Every organisation is having a budget plan in order to build its goodwill in the market. The both finance committee and

senior member interact together to prepare well structured budget for the cited company. The base of such company is to generate maximum

profit by less cost.

Preparation of checklist for the concern budgets.

Decide who would be involve in the process of budget preparation. Such as director or executive directors.

Establishment of an annual timeline for that particular budgets.

List out the particular activities with the related responsibilities.

Ensure the budget line products and accounting of those items.

Submit the report to top management for the final approval.

Review analyses.

M3: Analysis of planning tool used for budgetary control

In a small or large business organisation in order to manage its financial transaction they required a perfect planning tools which can

manage their business operation in more effective manner. Operational budget are considered as msot effective tools for preparing budegt for

future to minimise the expenses or cost that are done by the company over production. The other are cash budgets and flexible budget are

which are responsible for using right techniques to manage their future impacts on the businesses.

mostly associated with the new project ventures that are designed by the firm.

Cost plus pricing: It is based on the techniques which are used by the cited company's to set the price of products and services. Under

this process all the direct cost which are incurred during production are taken into consideration.

Advantages:

It is simple to set the price for a products. Since, the company is using own information to deciding the cost.

Disadvantage:

It also can not taken into consideration as the competitor accounts and its total effect on the price.

Target cost pricing: It is opposite of cost pricing . It uses the cost to determine the price of a products. Under this process price of a

products are fixed and company should kept the costs below in order to generate profits.

Importance of budgets:

Budget is required for the planning for the future course of actions and to have a well control over the activities in the organisations.

It help to provide coordination among different departments for realizing business objectives.

It serves as a guideline for the action in that particular organisation.

The most effective aspect of budget is that it help in decision making process.

Process of budget: Every organisation is having a budget plan in order to build its goodwill in the market. The both finance committee and

senior member interact together to prepare well structured budget for the cited company. The base of such company is to generate maximum

profit by less cost.

Preparation of checklist for the concern budgets.

Decide who would be involve in the process of budget preparation. Such as director or executive directors.

Establishment of an annual timeline for that particular budgets.

List out the particular activities with the related responsibilities.

Ensure the budget line products and accounting of those items.

Submit the report to top management for the final approval.

Review analyses.

M3: Analysis of planning tool used for budgetary control

In a small or large business organisation in order to manage its financial transaction they required a perfect planning tools which can

manage their business operation in more effective manner. Operational budget are considered as msot effective tools for preparing budegt for

future to minimise the expenses or cost that are done by the company over production. The other are cash budgets and flexible budget are

which are responsible for using right techniques to manage their future impacts on the businesses.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.