Corporate Accounting Report: Sources of Funds for ASX Listed Companies

VerifiedAdded on 2022/08/28

|17

|3118

|47

Report

AI Summary

This report analyzes the sources of funds for Evolution Mining and Incitec Pivot over a three-year period, examining their issued capital, reserves, retained earnings, and liabilities. It explores the merits and demerits of each funding source, including trade payables, interest-bearing liabilities, and issued capital, and assesses how each company utilizes these sources. The report details the companies' liability structures, including current and non-current liabilities, and their compliance with AASB 137 regarding provisions, contingent liabilities, and assets. It also identifies the categories of assets used by each company and their respective measurement bases, such as cash and cash equivalents, receivables, inventories, and property, plant, and equipment, providing a comprehensive overview of their financial strategies and accounting practices. The analysis is based on the companies' annual reports, offering insights into their financial health and operational decisions.

CORPORATE ACCOUNTING

EVOLUTION MINING GROUP &

INCITEC PIVOT LIMITED

EVOLUTION MINING GROUP &

INCITEC PIVOT LIMITED

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

SOURCES OF FUNDS

Evolution Mining: Issued capital, reserves, retained earnings, trade and other

payables and interest bearing liabilities (evolutionmining.com.au 2020).

Incitec Pivot: Trade and other payables, interest bearing liabilities, issued

capital, reserves and retained earnings (investors.incitecpivot.com.au

2020).

Evolution Mining: Issued capital, reserves, retained earnings, trade and other

payables and interest bearing liabilities (evolutionmining.com.au 2020).

Incitec Pivot: Trade and other payables, interest bearing liabilities, issued

capital, reserves and retained earnings (investors.incitecpivot.com.au

2020).

SOURCES OF FUND EVOLUTION

Evolution Mining: Trade and other payables have decreased from 2017 to 2018 and have

increased in 2019. Current interest bearing liabilities have registered an increasing trend

from 2017 to 2019 while the non-current interest bearing liabilities have continuously

decreased from 2017 to 2019. There has not been any change in the issued capital from 2017

to 2019. However, the company has continuously increased its reserves from 2017 to 2019.

In 2017, the company reported accumulated losses of $94,270,000 instead of retained

earnings. However, improvement in this situation can be seen in 2018 when the company

reported retained earnings of $59,260,000 (evolutionmining.com.au 2020).

Incitec Pivot: There has been a continuous increase in the trade and other payable of the

company from 2017 to 2019. The company has reported a huge increase in the current

interest bearing liabilities from 2017 to 2019. There has been a continuous decrease in the

non-current interest bearing liabilities of the company from 2017 to 2019. The same trend

can be seen in the issued capital of Incitec Pivot. The presence of negative reserves can be

seen in 2017 to 2019 which denotes the presence of accurate losses. However, Incitec Pivot

has been able in reducing this loss significantly from 2017 to 2019. Retained earnings of

Incitec Pivot have increased from 2017 to 2019 continuously. On the overall, increase in the

company’s funds can be seen over the last three years (investors.incitecpivot.com.au 2020).

Evolution Mining: Trade and other payables have decreased from 2017 to 2018 and have

increased in 2019. Current interest bearing liabilities have registered an increasing trend

from 2017 to 2019 while the non-current interest bearing liabilities have continuously

decreased from 2017 to 2019. There has not been any change in the issued capital from 2017

to 2019. However, the company has continuously increased its reserves from 2017 to 2019.

In 2017, the company reported accumulated losses of $94,270,000 instead of retained

earnings. However, improvement in this situation can be seen in 2018 when the company

reported retained earnings of $59,260,000 (evolutionmining.com.au 2020).

Incitec Pivot: There has been a continuous increase in the trade and other payable of the

company from 2017 to 2019. The company has reported a huge increase in the current

interest bearing liabilities from 2017 to 2019. There has been a continuous decrease in the

non-current interest bearing liabilities of the company from 2017 to 2019. The same trend

can be seen in the issued capital of Incitec Pivot. The presence of negative reserves can be

seen in 2017 to 2019 which denotes the presence of accurate losses. However, Incitec Pivot

has been able in reducing this loss significantly from 2017 to 2019. Retained earnings of

Incitec Pivot have increased from 2017 to 2019 continuously. On the overall, increase in the

company’s funds can be seen over the last three years (investors.incitecpivot.com.au 2020).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

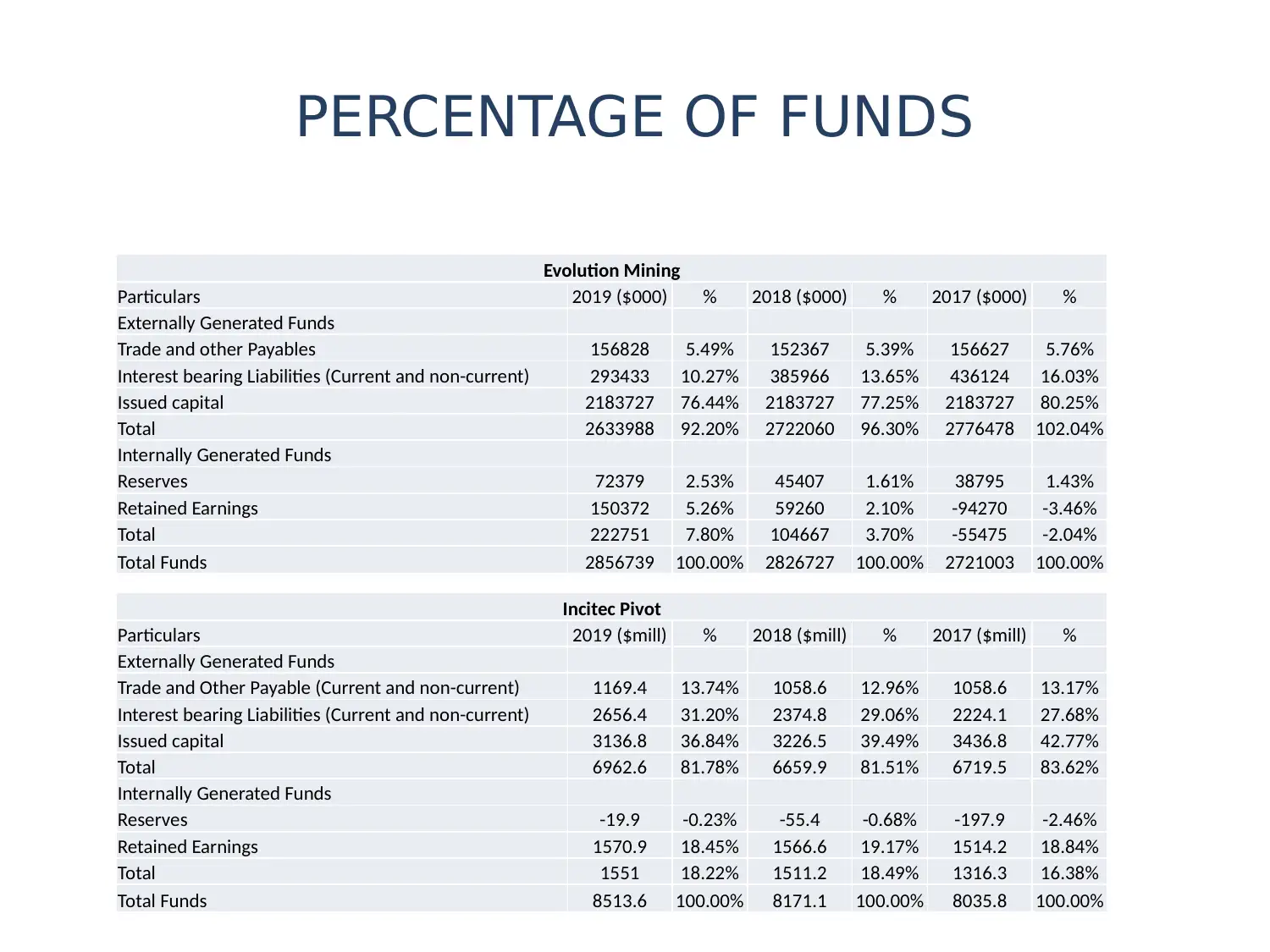

PERCENTAGE OF FUNDS

Evolution Mining

Particulars 2019 ($000) % 2018 ($000) % 2017 ($000) %

Externally Generated Funds

Trade and other Payables 156828 5.49% 152367 5.39% 156627 5.76%

Interest bearing Liabilities (Current and non-current) 293433 10.27% 385966 13.65% 436124 16.03%

Issued capital 2183727 76.44% 2183727 77.25% 2183727 80.25%

Total 2633988 92.20% 2722060 96.30% 2776478 102.04%

Internally Generated Funds

Reserves 72379 2.53% 45407 1.61% 38795 1.43%

Retained Earnings 150372 5.26% 59260 2.10% -94270 -3.46%

Total 222751 7.80% 104667 3.70% -55475 -2.04%

Total Funds 2856739 100.00% 2826727 100.00% 2721003 100.00%

Incitec Pivot

Particulars 2019 ($mill) % 2018 ($mill) % 2017 ($mill) %

Externally Generated Funds

Trade and Other Payable (Current and non-current) 1169.4 13.74% 1058.6 12.96% 1058.6 13.17%

Interest bearing Liabilities (Current and non-current) 2656.4 31.20% 2374.8 29.06% 2224.1 27.68%

Issued capital 3136.8 36.84% 3226.5 39.49% 3436.8 42.77%

Total 6962.6 81.78% 6659.9 81.51% 6719.5 83.62%

Internally Generated Funds

Reserves -19.9 -0.23% -55.4 -0.68% -197.9 -2.46%

Retained Earnings 1570.9 18.45% 1566.6 19.17% 1514.2 18.84%

Total 1551 18.22% 1511.2 18.49% 1316.3 16.38%

Total Funds 8513.6 100.00% 8171.1 100.00% 8035.8 100.00%

Evolution Mining

Particulars 2019 ($000) % 2018 ($000) % 2017 ($000) %

Externally Generated Funds

Trade and other Payables 156828 5.49% 152367 5.39% 156627 5.76%

Interest bearing Liabilities (Current and non-current) 293433 10.27% 385966 13.65% 436124 16.03%

Issued capital 2183727 76.44% 2183727 77.25% 2183727 80.25%

Total 2633988 92.20% 2722060 96.30% 2776478 102.04%

Internally Generated Funds

Reserves 72379 2.53% 45407 1.61% 38795 1.43%

Retained Earnings 150372 5.26% 59260 2.10% -94270 -3.46%

Total 222751 7.80% 104667 3.70% -55475 -2.04%

Total Funds 2856739 100.00% 2826727 100.00% 2721003 100.00%

Incitec Pivot

Particulars 2019 ($mill) % 2018 ($mill) % 2017 ($mill) %

Externally Generated Funds

Trade and Other Payable (Current and non-current) 1169.4 13.74% 1058.6 12.96% 1058.6 13.17%

Interest bearing Liabilities (Current and non-current) 2656.4 31.20% 2374.8 29.06% 2224.1 27.68%

Issued capital 3136.8 36.84% 3226.5 39.49% 3436.8 42.77%

Total 6962.6 81.78% 6659.9 81.51% 6719.5 83.62%

Internally Generated Funds

Reserves -19.9 -0.23% -55.4 -0.68% -197.9 -2.46%

Retained Earnings 1570.9 18.45% 1566.6 19.17% 1514.2 18.84%

Total 1551 18.22% 1511.2 18.49% 1316.3 16.38%

Total Funds 8513.6 100.00% 8171.1 100.00% 8035.8 100.00%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MERITS AND DEMERITS OF SOURCES

OF FUNDS

Trade and Other Payable

Merit

• It is an easy and automatic source of short-term funds.

• It assists the businesses in focusing on the core activities.

• There is no need of formal agreement or negotiation in this (Bastos and Pindado 2013).

Demerit

• Only companies with good track record of repayment can avail the opportunity of trade and other payable.

• It can be very expenses in case payment is not made in due date (Desai, Foley and Hines Jr 2016).

Interest Bearing Liabilities

Merits

• It helps the companies in retaining the ownership of the business.

• Tax deductions facility can be availed on the payment of interest.

• Businesses get more freedom and flexibility by using interest bearing liabilities (Jackson and Victor 2015).

Demerits

• It puts the obligation on the companies repay the principal amount with interest.

• This affects the credit rating of the businesses.

• Companies need to consider the cash requirement of the lender (Claessens, Coleman and Donnelly 2018).

OF FUNDS

Trade and Other Payable

Merit

• It is an easy and automatic source of short-term funds.

• It assists the businesses in focusing on the core activities.

• There is no need of formal agreement or negotiation in this (Bastos and Pindado 2013).

Demerit

• Only companies with good track record of repayment can avail the opportunity of trade and other payable.

• It can be very expenses in case payment is not made in due date (Desai, Foley and Hines Jr 2016).

Interest Bearing Liabilities

Merits

• It helps the companies in retaining the ownership of the business.

• Tax deductions facility can be availed on the payment of interest.

• Businesses get more freedom and flexibility by using interest bearing liabilities (Jackson and Victor 2015).

Demerits

• It puts the obligation on the companies repay the principal amount with interest.

• This affects the credit rating of the businesses.

• Companies need to consider the cash requirement of the lender (Claessens, Coleman and Donnelly 2018).

MERITS AND DEMERITS OF SOURCES

OF FUNDS

Issued Capital

Merits

• This does not have any repayment requirements unlike interest bearing liabilities.

• Lower risk of insolvency is involved in the use of issued capital.

• This brings in new partners who share the business risks (Fatoki 2014).

Demerits

• Dilution of ownership of business is a main disadvantage of this which means loss of control over the business.

• Despite of the absence of any interest payment, it has higher overall costs as compared to debt financing

(Bhattacharya and Londhe 2014).

Reserves

Merits

• It plays a crucial role in supplying the additional working capital.

• This can be used for meeting unknown and unforeseen crisis.

• This strengthens the companies’ financial position (Caglayan and Demir 2014).

Demerits

• Due to the development of reserves, shareholders cannot get fair amount of dividend.

• It is difficult to ascertain reserve funds.

• This does not reflect on the companies’ real profit.

• It is not possible for all companies to make reserves (Osei-Assibey 2013).

OF FUNDS

Issued Capital

Merits

• This does not have any repayment requirements unlike interest bearing liabilities.

• Lower risk of insolvency is involved in the use of issued capital.

• This brings in new partners who share the business risks (Fatoki 2014).

Demerits

• Dilution of ownership of business is a main disadvantage of this which means loss of control over the business.

• Despite of the absence of any interest payment, it has higher overall costs as compared to debt financing

(Bhattacharya and Londhe 2014).

Reserves

Merits

• It plays a crucial role in supplying the additional working capital.

• This can be used for meeting unknown and unforeseen crisis.

• This strengthens the companies’ financial position (Caglayan and Demir 2014).

Demerits

• Due to the development of reserves, shareholders cannot get fair amount of dividend.

• It is difficult to ascertain reserve funds.

• This does not reflect on the companies’ real profit.

• It is not possible for all companies to make reserves (Osei-Assibey 2013).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MERITS AND DEMERITS OF SOURCES

OF FUNDS

Retained Earnings

Merits

• It provides financial stability to the companies by strengthen the financial position.

• This provides the shareholders stable dividend even in the absence of adequate profit.

• This helps in increasing the market value of the companies (Christensen, Cottrell and Baker

2013).

Demerits

• This can contribute to sloppy utilization of funds unless used for proper purpose.

• This can lead to over-capitalization in the presence of conservative dividend policy.

• Shareholders cannot avail the full benefit of the company’s actual earnings in the presence of

retained earnings that may develop dissatisfaction among the shareholders (Allen, Qian and

Xie 2019).

OF FUNDS

Retained Earnings

Merits

• It provides financial stability to the companies by strengthen the financial position.

• This provides the shareholders stable dividend even in the absence of adequate profit.

• This helps in increasing the market value of the companies (Christensen, Cottrell and Baker

2013).

Demerits

• This can contribute to sloppy utilization of funds unless used for proper purpose.

• This can lead to over-capitalization in the presence of conservative dividend policy.

• Shareholders cannot avail the full benefit of the company’s actual earnings in the presence of

retained earnings that may develop dissatisfaction among the shareholders (Allen, Qian and

Xie 2019).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

LIABILITY TYPES

• It can be observed from the annual reports of 2017, 2018 and 2019 of Evolution Mining and Incitec Pivot that

both these companies have followed the current/non-current presentation format for presenting the

consolidated balance sheet (evolutionmining.com.au 2020).

• These two companies have segregated their liabilities into two parts that are current liabilities and non-current

liabilities (investors.incitecpivot.com.au 2020). Current liabilities are the short-term business obligations of

these companies that are due and payable within 12 months of reporting date; and non-current liabilities are

the long-term obligations of these companies that are due after 12 months or more after the reporting date.

• Current liabilities of these companies include trade and other payable, interest bearing liabilities, current tax

liabilities, provisions, other current liabilities (Bobryshev et al. 2014).

• Non-current liabilities of these two companies include trade and other payables, interest bearing liabilities,

other financial liabilities, provisions, deferred tax liabilities and retirement benefit obligations (Carpenter et

al. 2013).

• Interest bearing liabilities are the debts that cost money to the companies for holding. This includes the

financial debts on which the companies have to pay interests on periodic basis. In Evolution Mining, the

interest bearing liability is the bank loans. In case of Incitec Pivot, the interest bearing liabilities are other

loans, loans from joint ventures and fixed interest rate bonds. It is the obligation on these two companies to

make interest payments on these interest bearing liabilities. However, trade and other payables can also be

considered as interest bearing liabilities when they are being paid after several months of the due date as this

requires payment of interests.

• It can be observed from the annual reports of 2017, 2018 and 2019 of Evolution Mining and Incitec Pivot that

both these companies have followed the current/non-current presentation format for presenting the

consolidated balance sheet (evolutionmining.com.au 2020).

• These two companies have segregated their liabilities into two parts that are current liabilities and non-current

liabilities (investors.incitecpivot.com.au 2020). Current liabilities are the short-term business obligations of

these companies that are due and payable within 12 months of reporting date; and non-current liabilities are

the long-term obligations of these companies that are due after 12 months or more after the reporting date.

• Current liabilities of these companies include trade and other payable, interest bearing liabilities, current tax

liabilities, provisions, other current liabilities (Bobryshev et al. 2014).

• Non-current liabilities of these two companies include trade and other payables, interest bearing liabilities,

other financial liabilities, provisions, deferred tax liabilities and retirement benefit obligations (Carpenter et

al. 2013).

• Interest bearing liabilities are the debts that cost money to the companies for holding. This includes the

financial debts on which the companies have to pay interests on periodic basis. In Evolution Mining, the

interest bearing liability is the bank loans. In case of Incitec Pivot, the interest bearing liabilities are other

loans, loans from joint ventures and fixed interest rate bonds. It is the obligation on these two companies to

make interest payments on these interest bearing liabilities. However, trade and other payables can also be

considered as interest bearing liabilities when they are being paid after several months of the due date as this

requires payment of interests.

KEY PROVISIONS OF AASB 137

• Para 14 states that an entity needs to recognize a provision by having a present obligation because of any

past event that requires probable future outflow of resources in the presence of a reliable estimation

(aasb.gov.au 2020).

• Para 27 states that there is no need to recognize a contingent liability.

• Para 28 states that an entity needs to disclose the contingent liability unless there is remote possibility of

the outflow of resources representing economic benefit.

• Para 31 states that there is no need for recognizing a contingent asset.

• Para 34 states that an entity discloses a provision when there is a probable outflow of economic benefit

(aasb.gov.au 2020).

• Para 36 states that the amount that an entity has recognized as provision shall be the best estimate of the

expenditure needed for settling the present obligation at the end of the reporting period.

• As per Para 42, in order to reach to the best estimate of a provision, the risks and uncertainties that

unavoidably encircle many events and situations need to be taken into consideration (aasb.gov.au 2020).

• Para 84 states that disclosure of provision includes its carrying amount, additional provision made, amount

used, unused amount and increase during the period.

• Para 85 states that an entity needs to disclose certain aspects on each class of provision; they are brief

description on its nature and obligation, an indication of uncertainty and the amount of any unexpected

reimbursement (aasb.gov.au 2020).

• Para 14 states that an entity needs to recognize a provision by having a present obligation because of any

past event that requires probable future outflow of resources in the presence of a reliable estimation

(aasb.gov.au 2020).

• Para 27 states that there is no need to recognize a contingent liability.

• Para 28 states that an entity needs to disclose the contingent liability unless there is remote possibility of

the outflow of resources representing economic benefit.

• Para 31 states that there is no need for recognizing a contingent asset.

• Para 34 states that an entity discloses a provision when there is a probable outflow of economic benefit

(aasb.gov.au 2020).

• Para 36 states that the amount that an entity has recognized as provision shall be the best estimate of the

expenditure needed for settling the present obligation at the end of the reporting period.

• As per Para 42, in order to reach to the best estimate of a provision, the risks and uncertainties that

unavoidably encircle many events and situations need to be taken into consideration (aasb.gov.au 2020).

• Para 84 states that disclosure of provision includes its carrying amount, additional provision made, amount

used, unused amount and increase during the period.

• Para 85 states that an entity needs to disclose certain aspects on each class of provision; they are brief

description on its nature and obligation, an indication of uncertainty and the amount of any unexpected

reimbursement (aasb.gov.au 2020).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCE RELATED TO AASB 137

The analysis of the annual reports of Revolution Mining and Incitec Pivot crearly indicates towards the fact that

both of these companies have referred to the provisions of AASB 137 in order to account for provisions,

contingent asses and contingent liabilities. These are discussed below:

• Both Evolution Mining and Incitec Pivot have recognized provisions that are employee benefits and

rehabilitation for Evolution Mining and employee entitlements, restructuring and relationship,

environmental, asset retirement obligation and legal and others for Incitec Pivot as these are the past events

for which these companies have present obligations; and both these companies have provided appropriate

estimation of the amounts. The estimations and judgments have been disclosed by both of these

companies. In the notes related to provision, both of these companies have disclosed the class of each

provision along with the necessary description and obligations (evolutionmining.com.au 2020).

• These companies have disclosed the carrying amount value provision along with provision made during

the year, used provision, unused provision and others. All these indicate towards the compliance with

AASB 137 by these companies (investors.incitecpivot.com.au 2020).

• In line with the provisions of AASB 137 for contingent assets and contingent liabilities, contingent

liabilities and contingent assets have not been recognized by these companies in the financial statements.

However, the managements of these companies have disclosed the required information associated with

these substances in the associated notes in the presence of remote possibility of outflow of economic

benefits.

The analysis of the annual reports of Revolution Mining and Incitec Pivot crearly indicates towards the fact that

both of these companies have referred to the provisions of AASB 137 in order to account for provisions,

contingent asses and contingent liabilities. These are discussed below:

• Both Evolution Mining and Incitec Pivot have recognized provisions that are employee benefits and

rehabilitation for Evolution Mining and employee entitlements, restructuring and relationship,

environmental, asset retirement obligation and legal and others for Incitec Pivot as these are the past events

for which these companies have present obligations; and both these companies have provided appropriate

estimation of the amounts. The estimations and judgments have been disclosed by both of these

companies. In the notes related to provision, both of these companies have disclosed the class of each

provision along with the necessary description and obligations (evolutionmining.com.au 2020).

• These companies have disclosed the carrying amount value provision along with provision made during

the year, used provision, unused provision and others. All these indicate towards the compliance with

AASB 137 by these companies (investors.incitecpivot.com.au 2020).

• In line with the provisions of AASB 137 for contingent assets and contingent liabilities, contingent

liabilities and contingent assets have not been recognized by these companies in the financial statements.

However, the managements of these companies have disclosed the required information associated with

these substances in the associated notes in the presence of remote possibility of outflow of economic

benefits.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CATEGORIES OF ASSETS

Evolution Mining

Assets under current asset include cash and cash equivalents, trade and other receivables,

inventories and current tax receivables. Assets under non-current assets of this company include

inventories, Equity investments at fair value through other comprehensive income, Property, plant

and equipment, Mine development and exploration, Deferred tax assets and Other non-current

assets (evolutionmining.com.au 2020).

Incitec Pivot

Current assets include cash and cash equivalents, trade and other receivables, inventories, other

assets and other financial assets. The assets under non-current assets of the company are trade and

other receivables, other assets, other financial assets, equity accounted investments, property, plant

and equipment, intangible assets and deferred tax assets (investors.incitecpivot.com.au 2020).

Evolution Mining

Assets under current asset include cash and cash equivalents, trade and other receivables,

inventories and current tax receivables. Assets under non-current assets of this company include

inventories, Equity investments at fair value through other comprehensive income, Property, plant

and equipment, Mine development and exploration, Deferred tax assets and Other non-current

assets (evolutionmining.com.au 2020).

Incitec Pivot

Current assets include cash and cash equivalents, trade and other receivables, inventories, other

assets and other financial assets. The assets under non-current assets of the company are trade and

other receivables, other assets, other financial assets, equity accounted investments, property, plant

and equipment, intangible assets and deferred tax assets (investors.incitecpivot.com.au 2020).

MEASUREMENT BASIS

Evolution Mining

• Cash and Cash Equivalent – Both cash at bank and cash in hand are recognized under cash

and cash equivalent. These are current assets due to the original maturity of three months.

• Trade and Other Receivable – Evolution Mining recognizes the trade and other receivable

initially at fair value and the subsequent measurement is done at amortized cost through the

use of effective interest methoD (evolutionmining.com.au 2020).

• Inventories – Inventories include ore stockpiles, gold dore, metal in transit, metal in circuit,

refined gold bullion and others that are measured at the lower of cost or net realizable value.

This accounting treatment is in line with AASB 102 Inventories(aasb.gov.au 2020).

• FVOCI – There has been changes in the accounting for FVOIC due to the adoption of AASB

9 Financial Instruments in the place of AASB 138 Financial Instruments. These are

recognized at fair value and they are not for the purpose of trading (evolutionmining.com.au

2020).

• Property, Plant and Equipment – In line with AASB 116, property, plant and equipment is

measured at cost less accumulated depreciation and impairment. These are subjected to

deprecation at straight line.

Evolution Mining

• Cash and Cash Equivalent – Both cash at bank and cash in hand are recognized under cash

and cash equivalent. These are current assets due to the original maturity of three months.

• Trade and Other Receivable – Evolution Mining recognizes the trade and other receivable

initially at fair value and the subsequent measurement is done at amortized cost through the

use of effective interest methoD (evolutionmining.com.au 2020).

• Inventories – Inventories include ore stockpiles, gold dore, metal in transit, metal in circuit,

refined gold bullion and others that are measured at the lower of cost or net realizable value.

This accounting treatment is in line with AASB 102 Inventories(aasb.gov.au 2020).

• FVOCI – There has been changes in the accounting for FVOIC due to the adoption of AASB

9 Financial Instruments in the place of AASB 138 Financial Instruments. These are

recognized at fair value and they are not for the purpose of trading (evolutionmining.com.au

2020).

• Property, Plant and Equipment – In line with AASB 116, property, plant and equipment is

measured at cost less accumulated depreciation and impairment. These are subjected to

deprecation at straight line.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.