Accounting Principles Portfolio: GST, Ledger, Trial Balance (BZ102)

VerifiedAdded on 2021/04/21

|8

|1336

|28

Homework Assignment

AI Summary

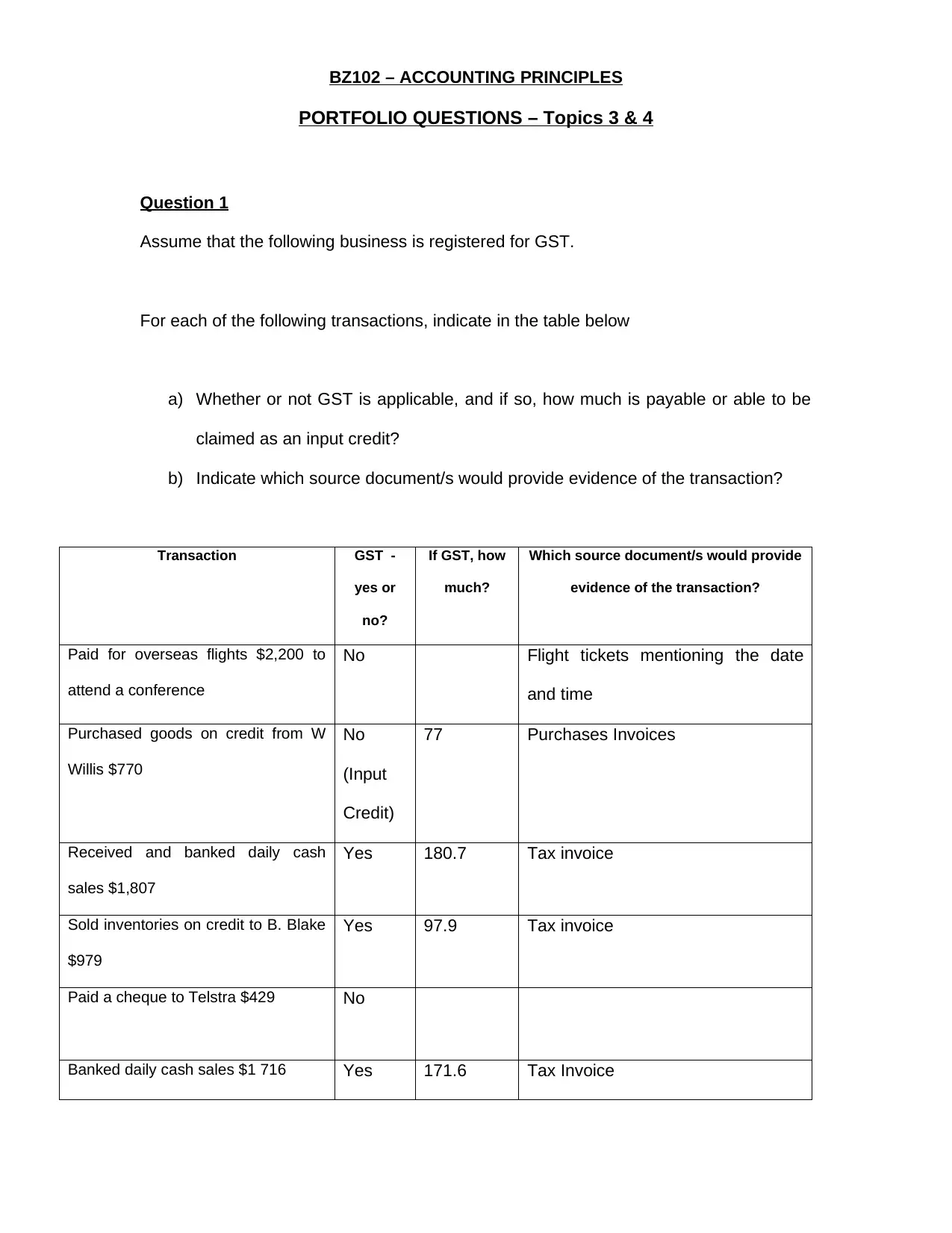

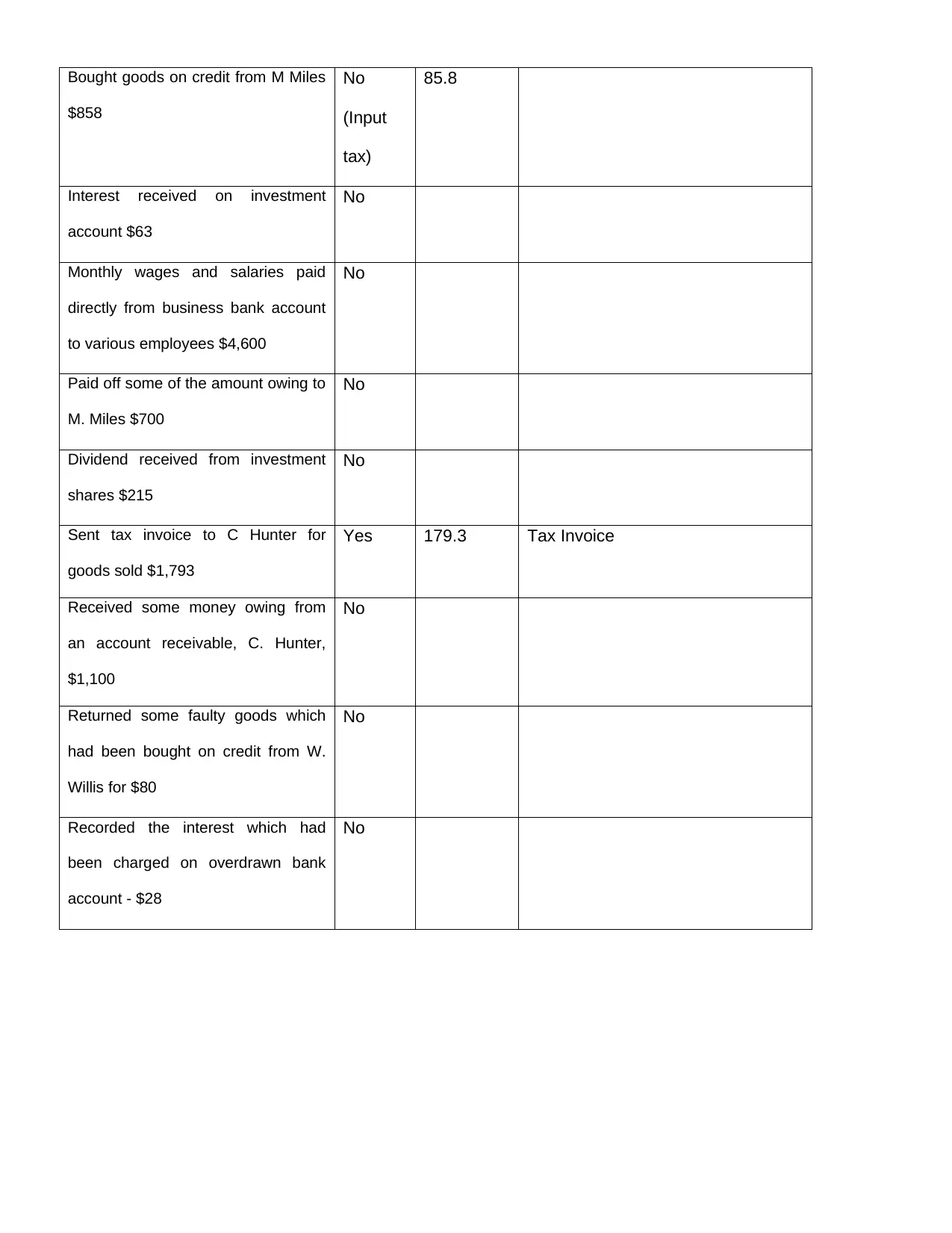

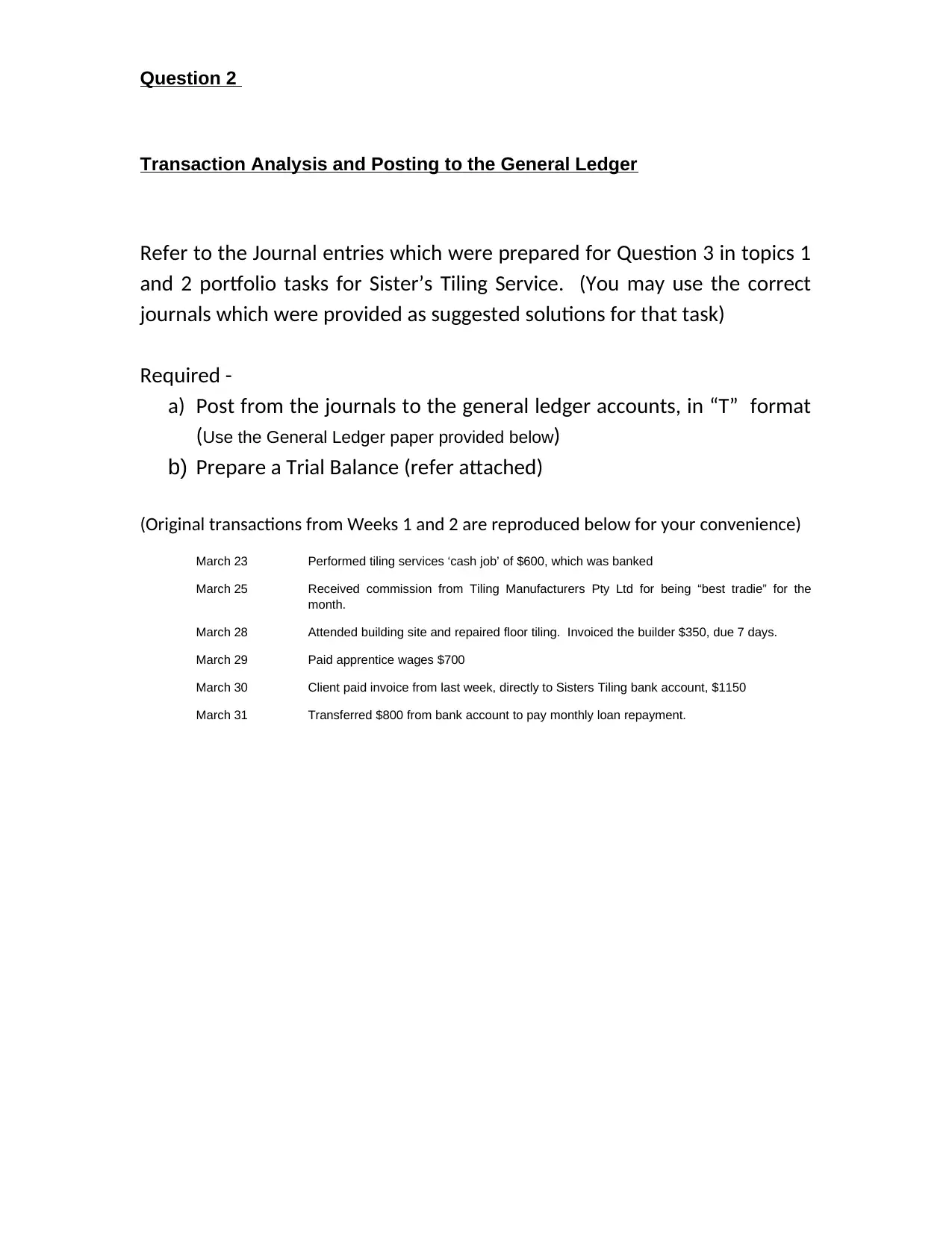

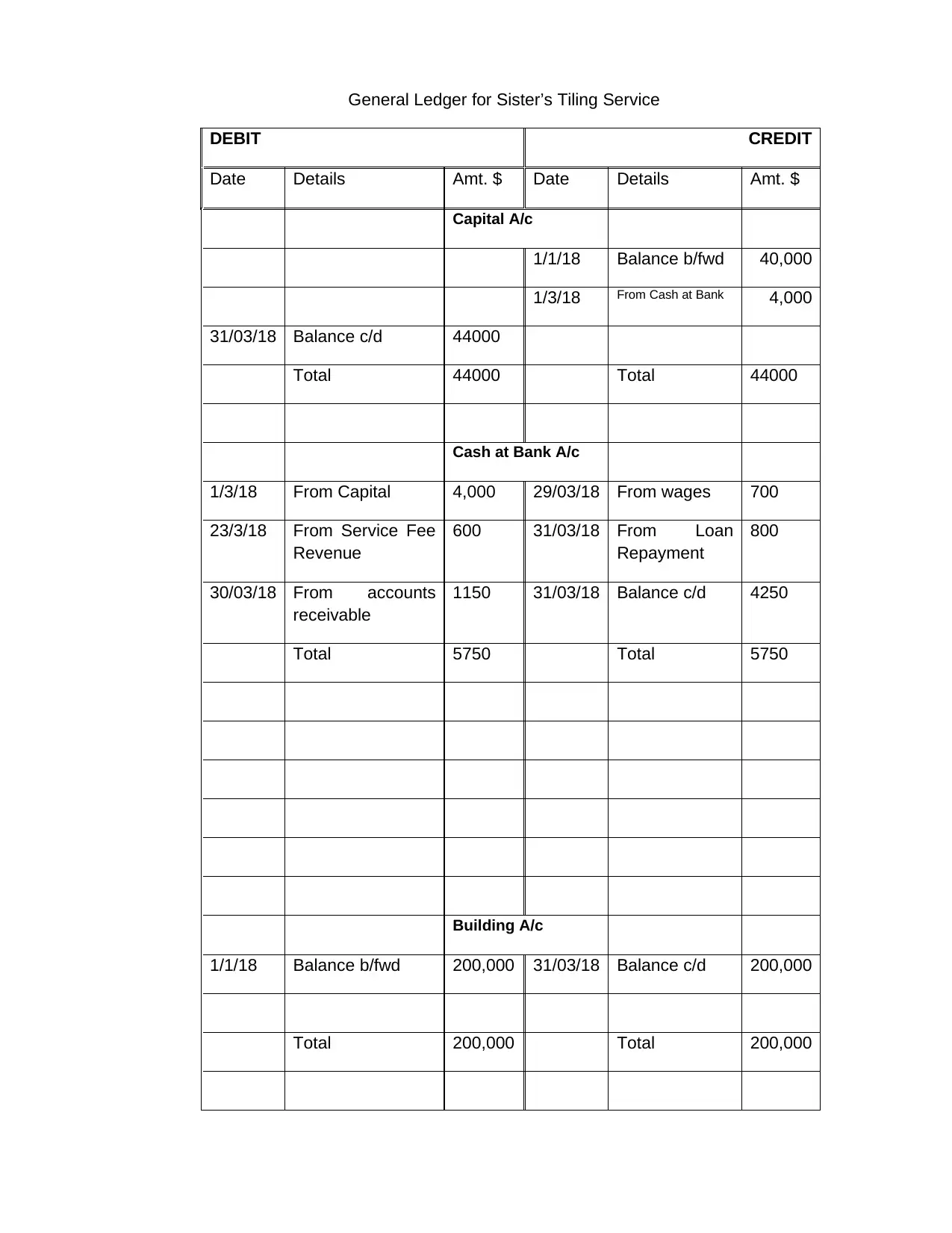

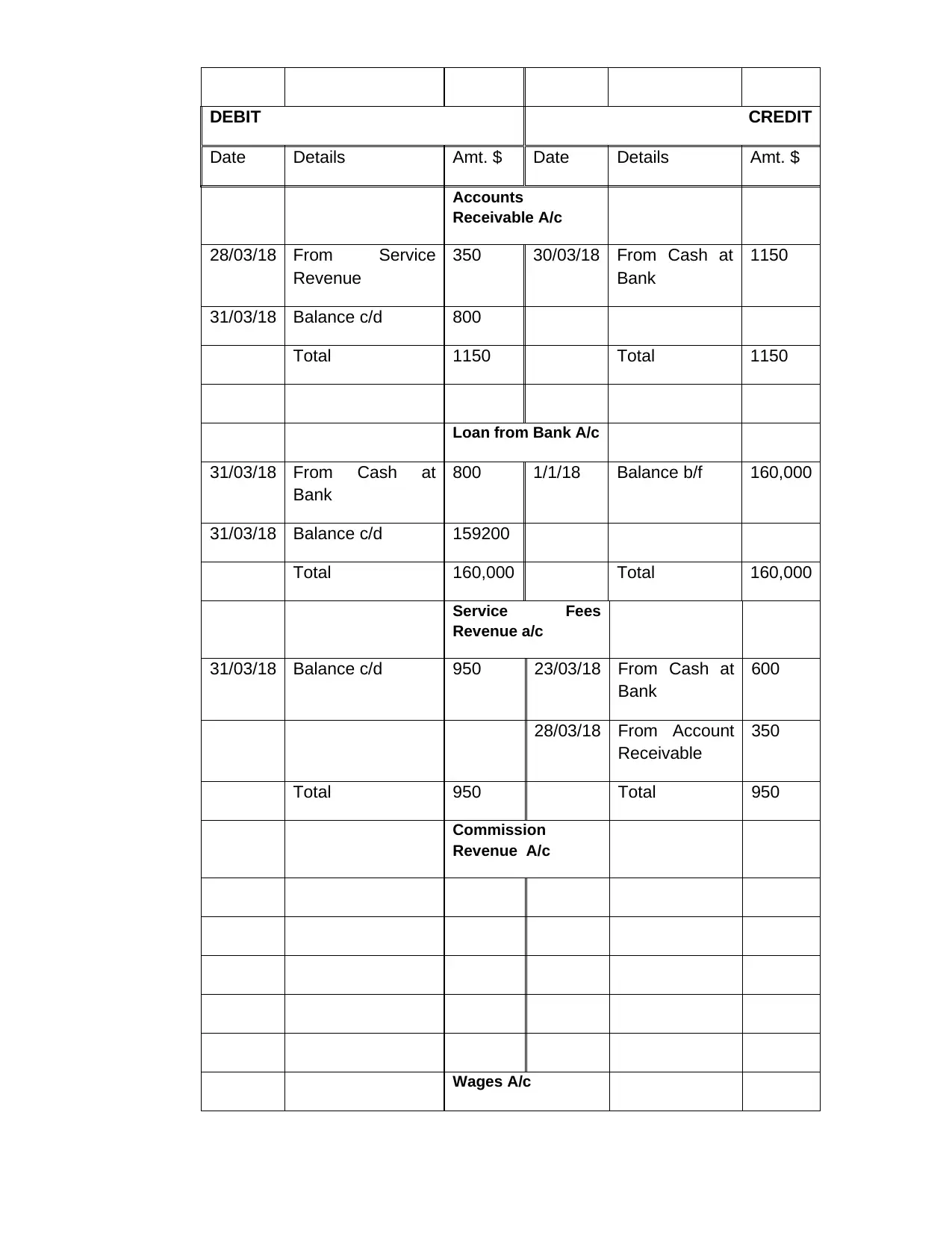

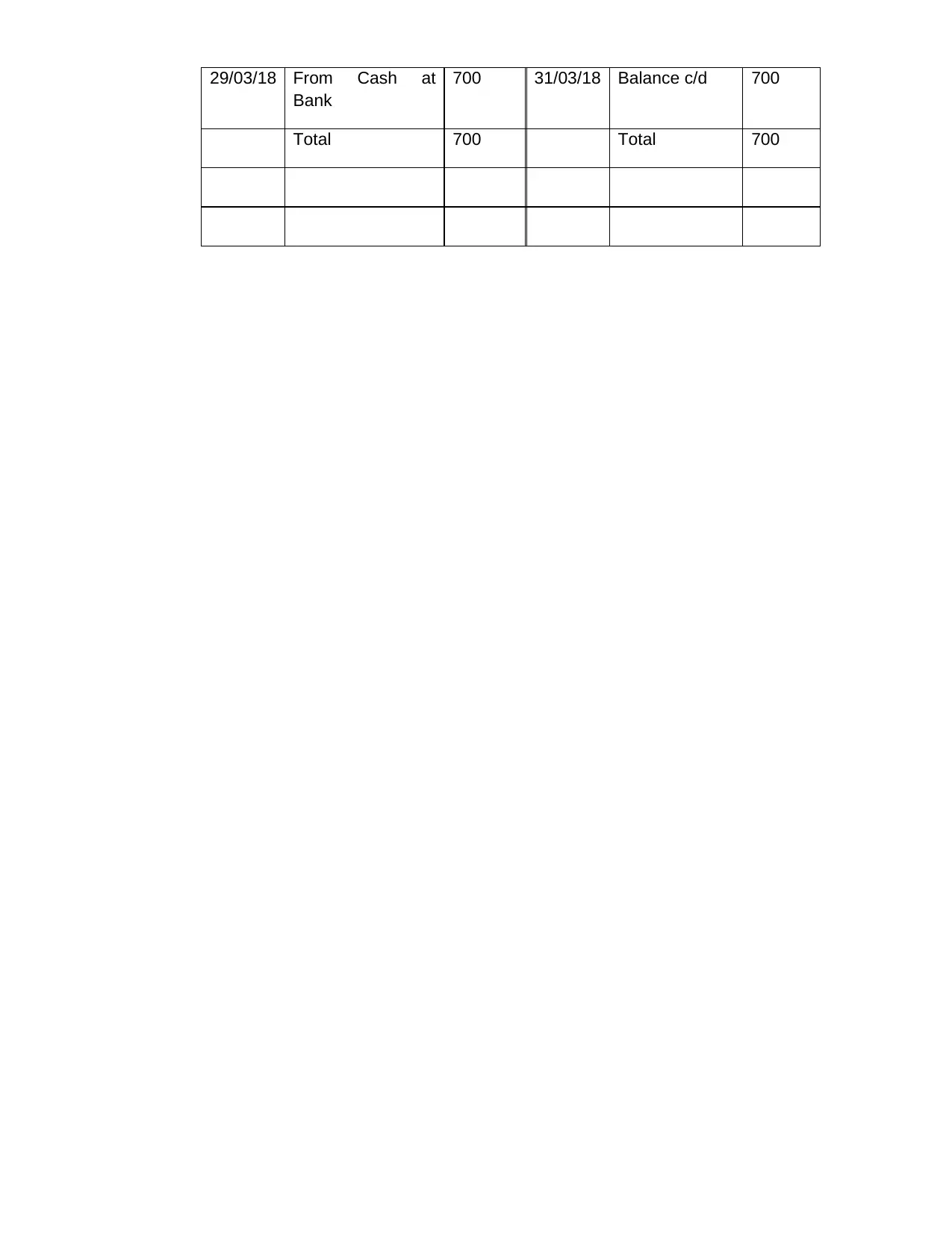

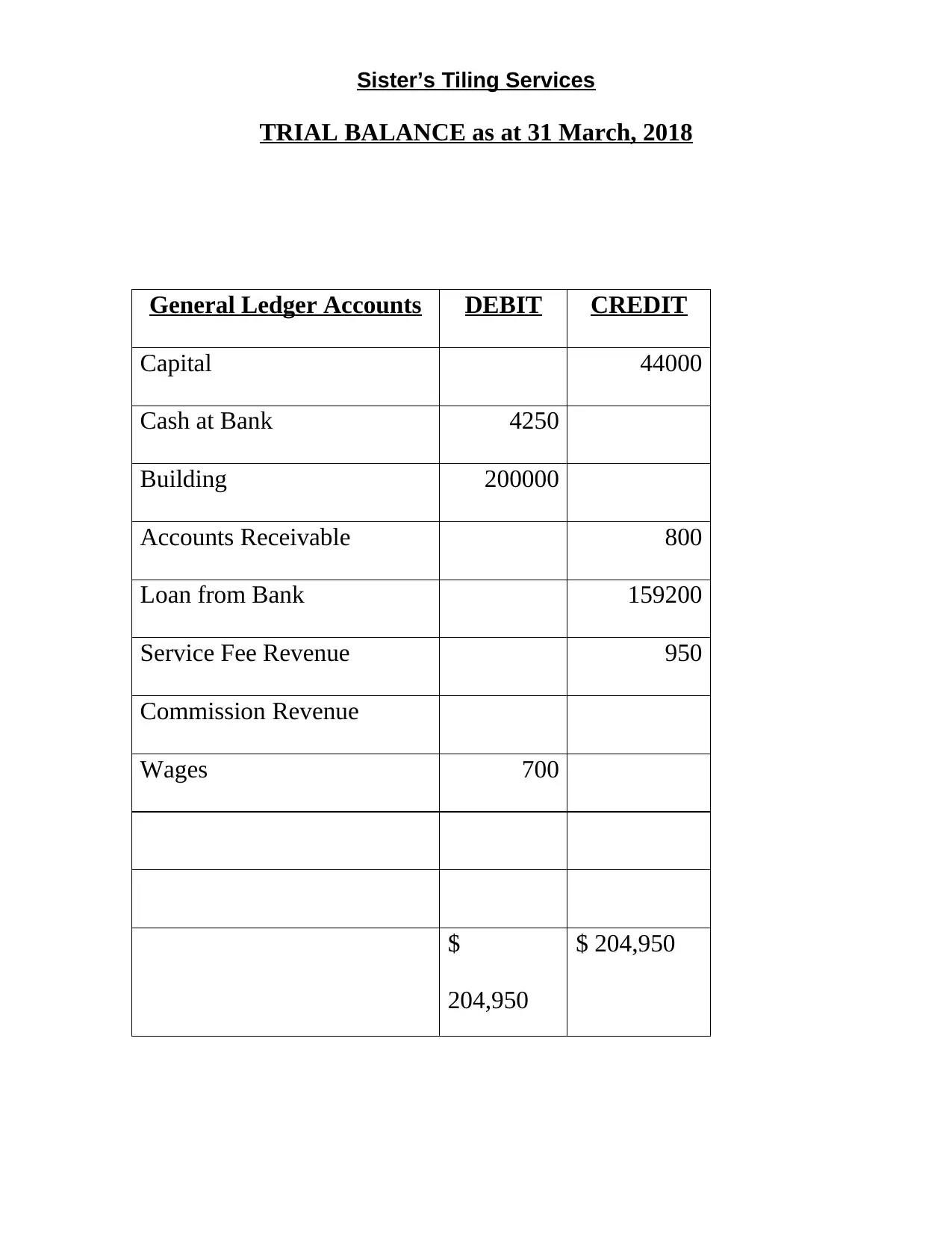

This document presents a comprehensive solution to an accounting principles portfolio assignment. The first part analyzes various business transactions, determining the applicability of GST and calculating the payable or claimable amounts, along with identifying the necessary source documents. The second part focuses on transaction analysis and posting to the general ledger, using journal entries from a previous assignment for Sister's Tiling Service. Students are required to post from the journals to the general ledger accounts in "T" format and then prepare a trial balance. The assignment incorporates real-world scenarios and requires a solid understanding of accounting principles, including journal entries, ledger postings, and the preparation of a trial balance. References are provided to support the concepts presented in the assignment.

1 out of 8

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)