Accounting Assignment 2: Inventory Systems and Financial Statements

VerifiedAdded on 2020/05/11

|4

|650

|129

Homework Assignment

AI Summary

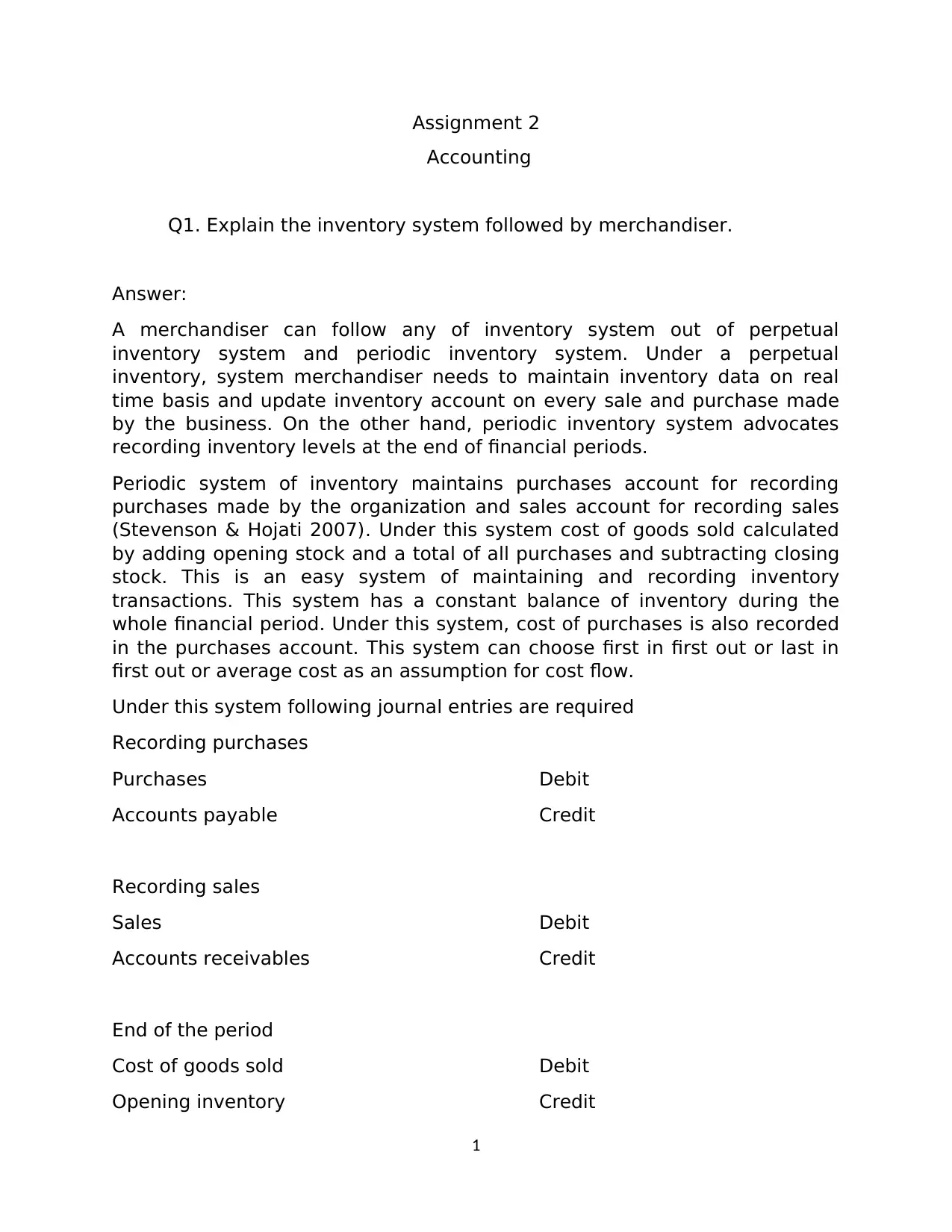

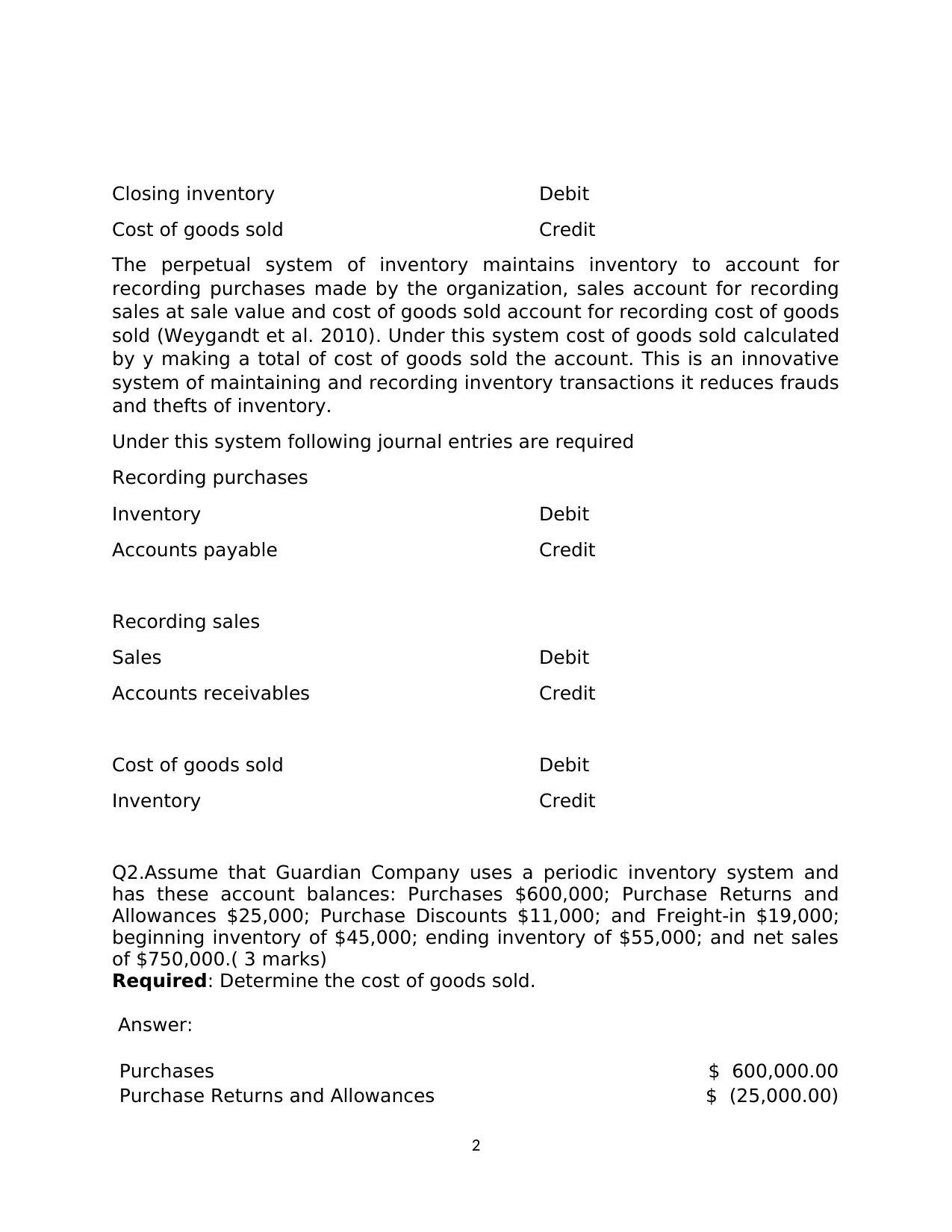

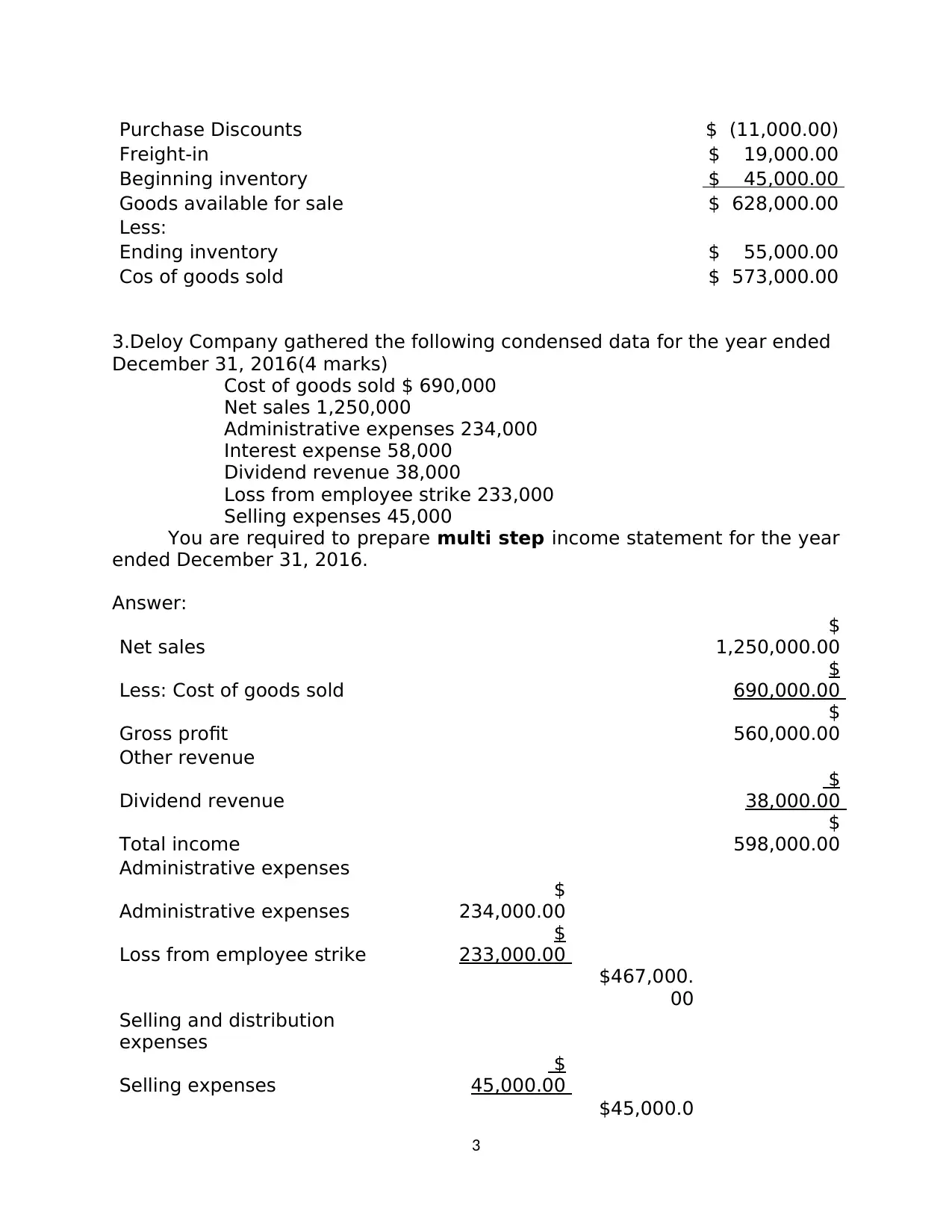

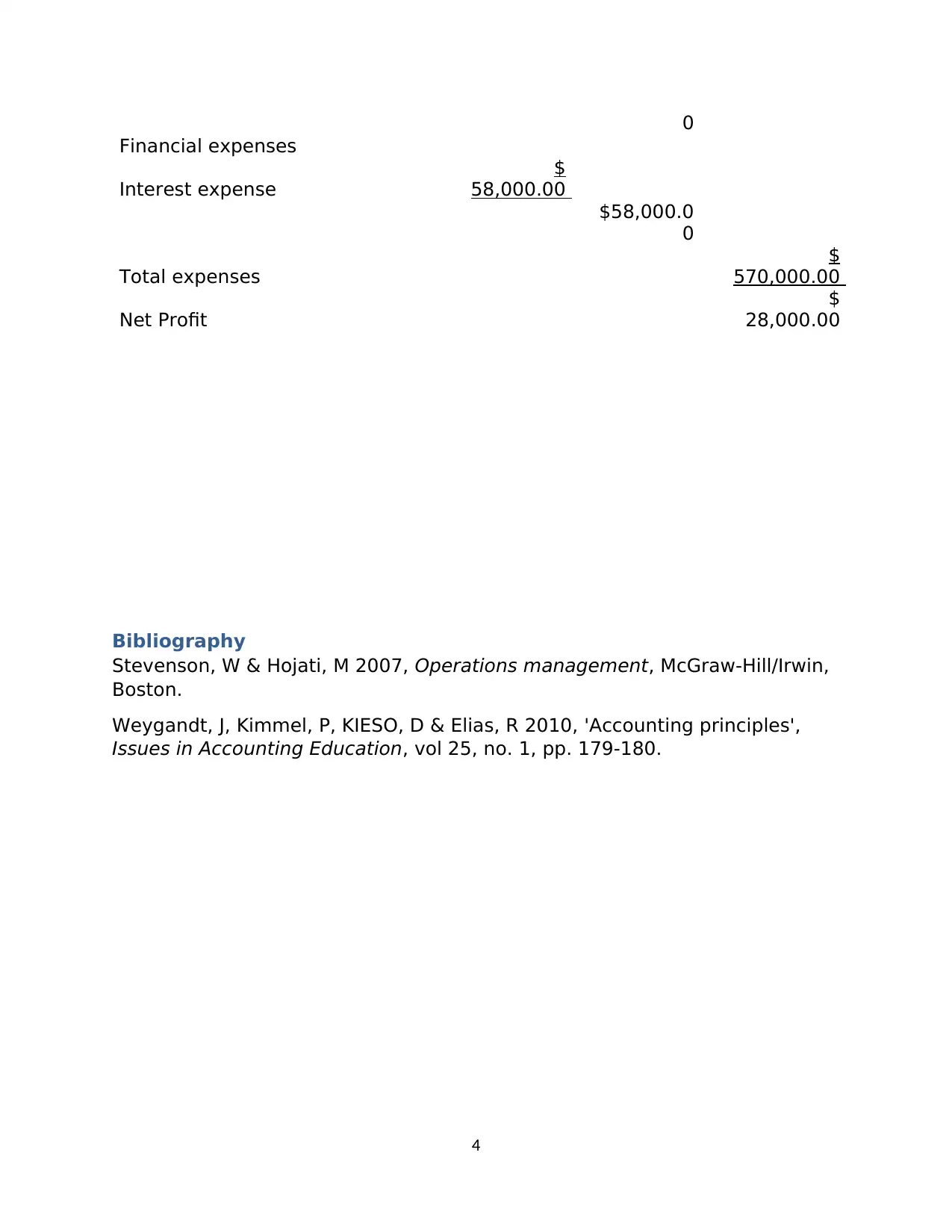

This accounting assignment solution addresses two key questions related to inventory management and financial statement preparation. The first question explains the differences between perpetual and periodic inventory systems, detailing how each system records purchases, sales, and the cost of goods sold, along with the journal entries. The second question involves calculating the cost of goods sold using data from Guardian Company, which employs a periodic inventory system. The solution includes the necessary calculations to determine the cost of goods sold. The third part of the assignment requires preparing a multi-step income statement for Deloy Company, incorporating data such as net sales, cost of goods sold, administrative expenses, interest expense, dividend revenue, loss from employee strike, and selling expenses. The solution presents a detailed income statement, calculating gross profit, total income, total expenses, and net profit. The assignment also includes a bibliography citing the sources used.

1 out of 4

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)