University Accounting for Managers (ACC00724) Assignment Solution

VerifiedAdded on 2022/11/09

|7

|525

|320

Homework Assignment

AI Summary

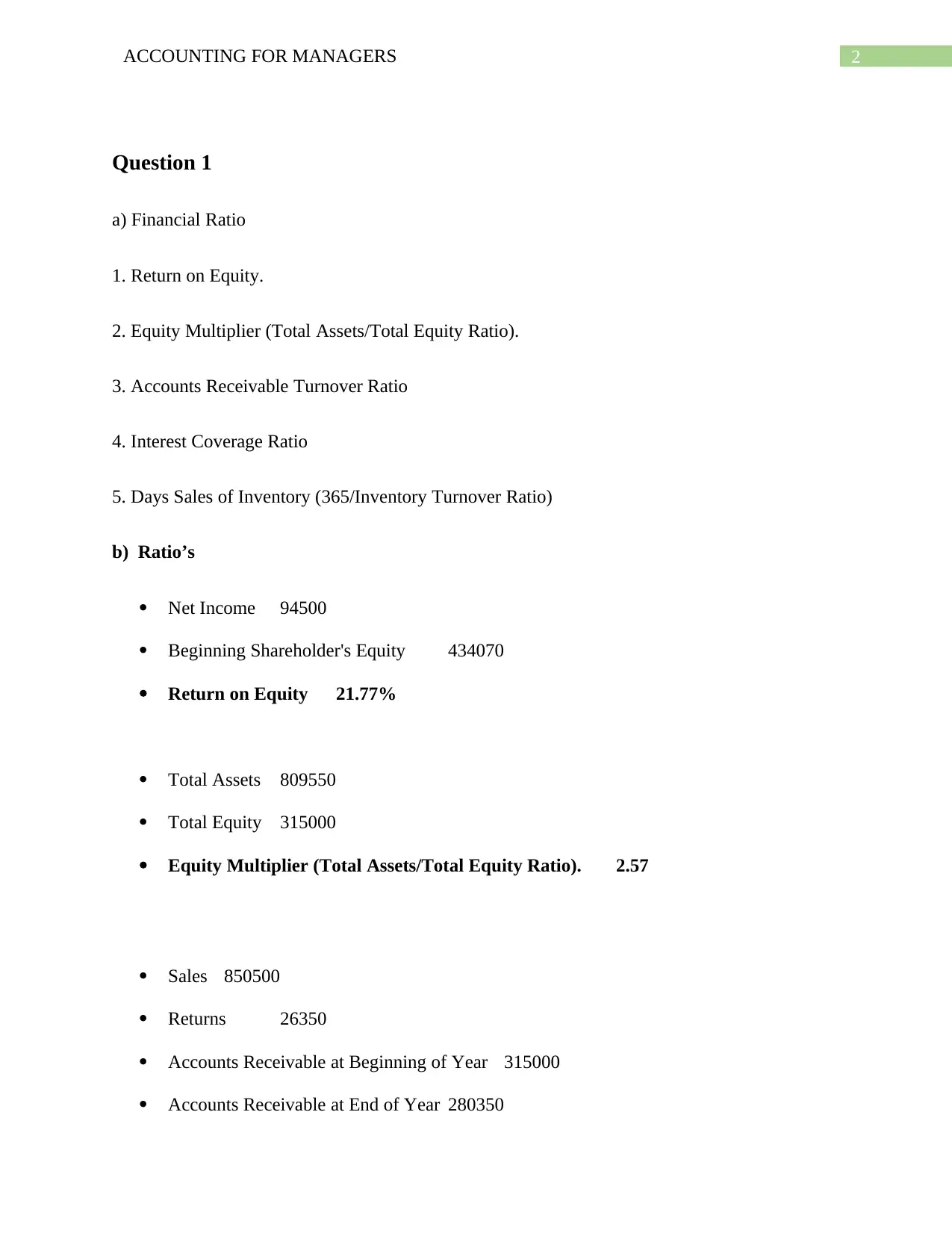

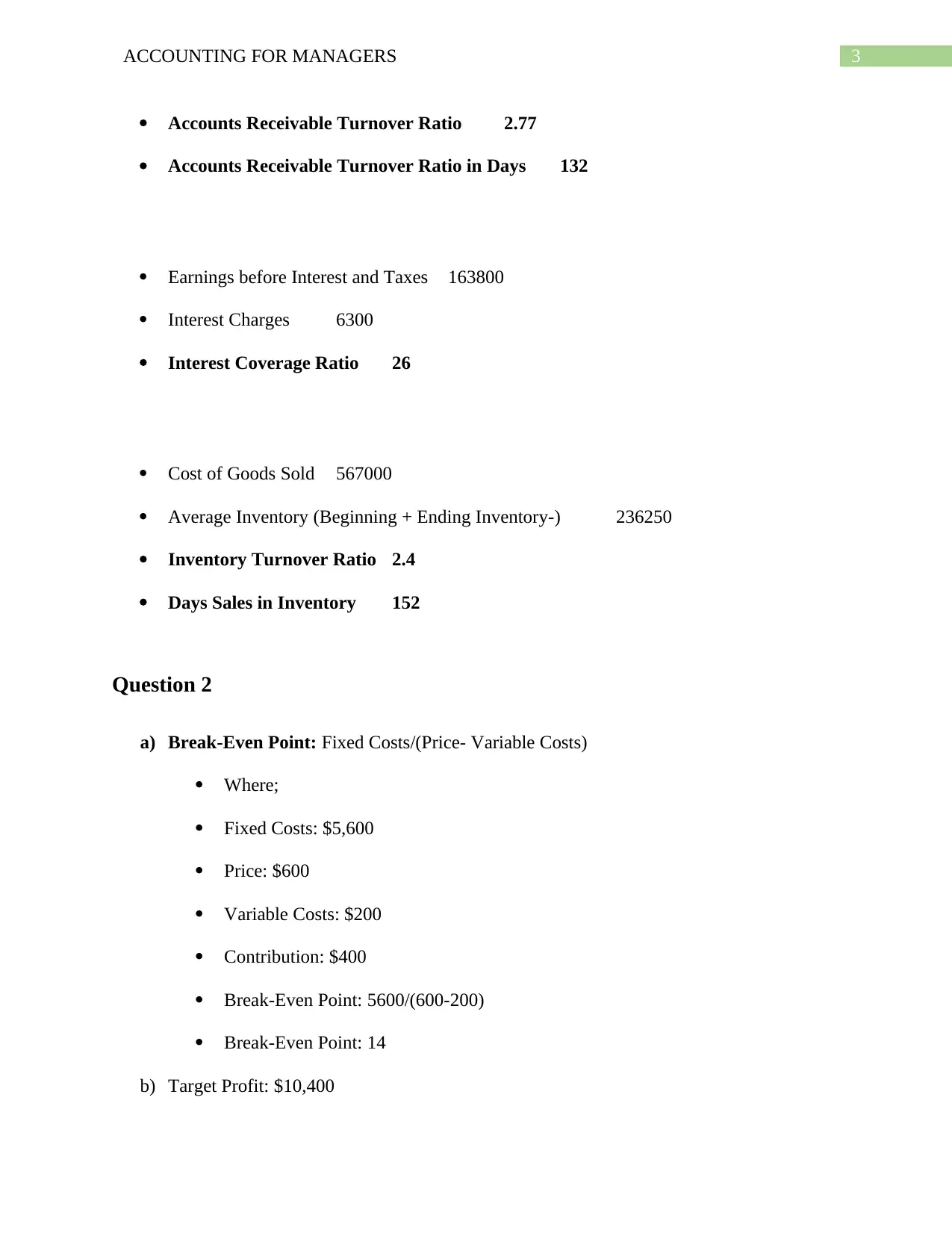

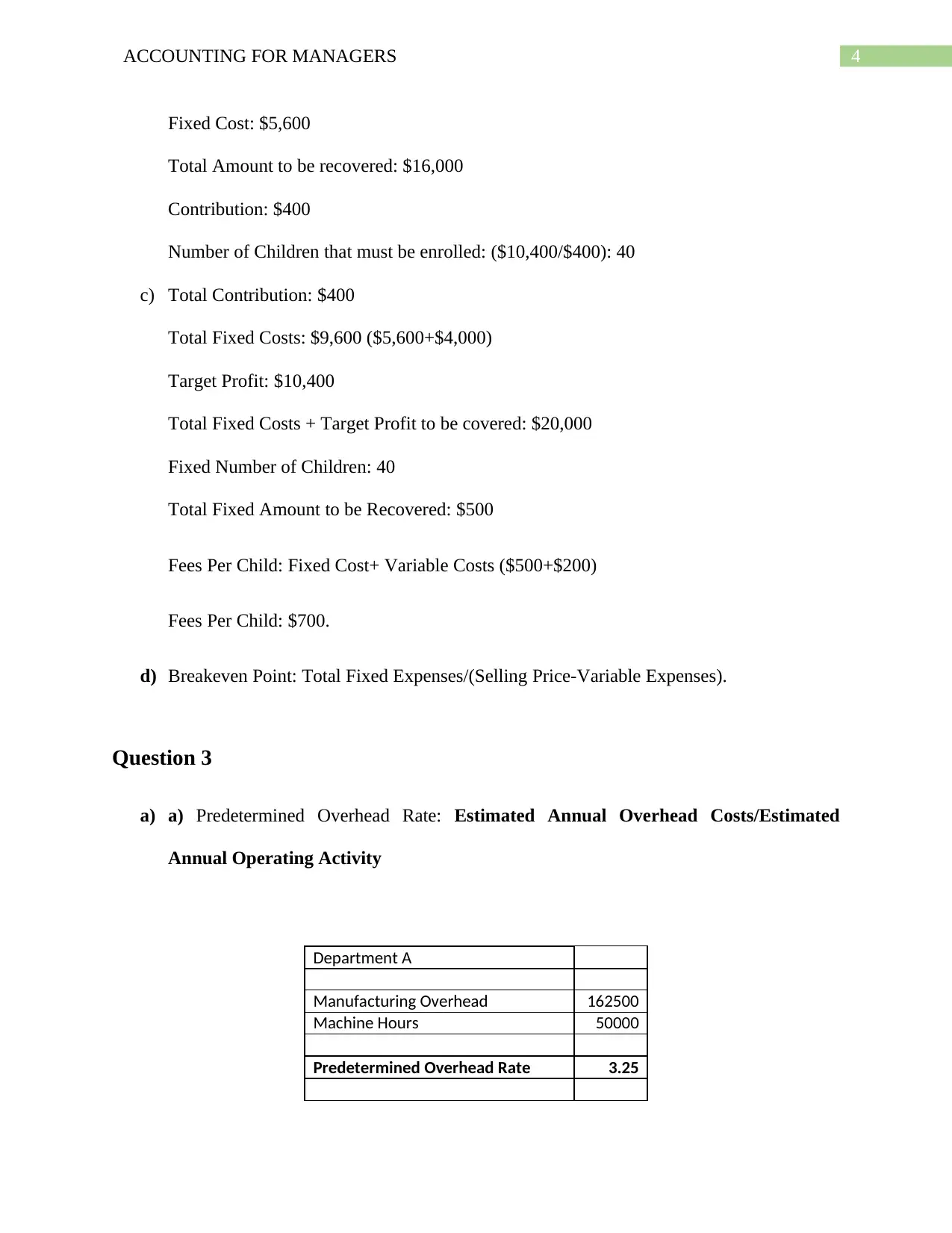

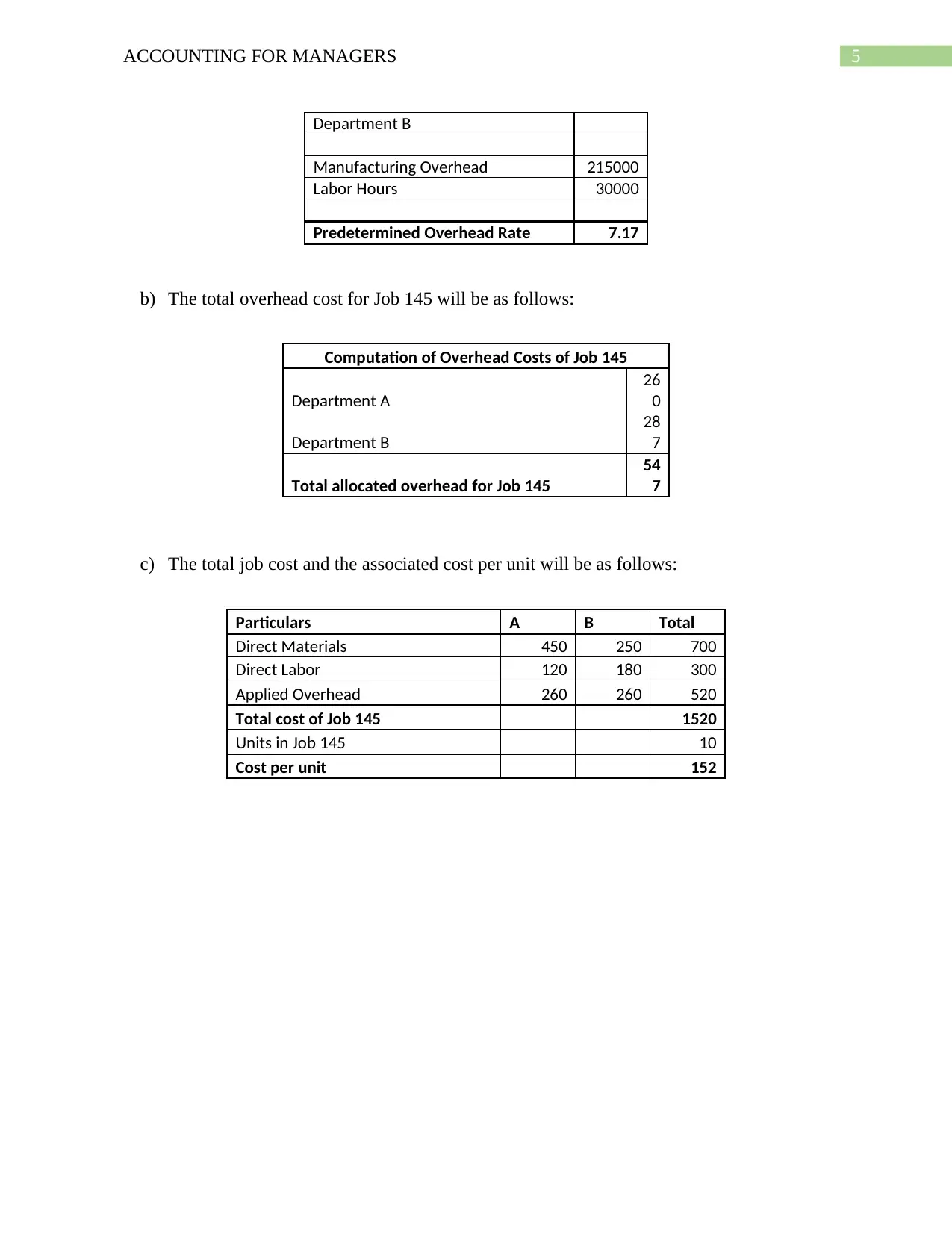

This document presents a comprehensive solution to an Accounting for Managers assignment. The solution begins with an analysis of financial ratios, including Return on Equity, Equity Multiplier, Accounts Receivable Turnover, Interest Coverage, and Days Sales of Inventory, using provided financial statement data. The assignment then delves into break-even point analysis, calculating the break-even point in units, determining the target profit, and calculating fees per child based on fixed and variable costs. Finally, the solution addresses overhead allocation, calculating predetermined overhead rates for two departments and applying these rates to determine the total overhead cost for a specific job, including the total job cost and cost per unit. The solution includes detailed calculations and explanations for each section, demonstrating a strong understanding of accounting principles.

1 out of 7

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)