Accounting for Managers (ACC00724) Assignment 2 Solution Analysis

VerifiedAdded on 2023/06/08

|11

|1212

|390

Homework Assignment

AI Summary

This document presents a detailed solution to an Accounting for Managers assignment, addressing key concepts such as cash conversion cycles, financial data analysis, and special order pricing. The solution begins by calculating the cash conversion cycle for a company over a five-year period, analyzing trends and liquidity positions. It then delves into a profitability analysis based on financial data from FreeWheels, evaluating three alternative proposals and recommending the best option based on both quantitative and qualitative factors. Finally, the solution explores special order pricing, calculating bid prices under different production capacity scenarios and determining the optimal pricing strategy for the company. The document also includes a bibliography of relevant sources.

ACCOUNTING FOR MANAGERS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Solution 1:..................................................................................................................................2

Solution 2:..................................................................................................................................3

Solution 3:..................................................................................................................................6

Part 1.......................................................................................................................................6

Part 2.......................................................................................................................................7

Bibliography...............................................................................................................................8

Solution 1:..................................................................................................................................2

Solution 2:..................................................................................................................................3

Solution 3:..................................................................................................................................6

Part 1.......................................................................................................................................6

Part 2.......................................................................................................................................7

Bibliography...............................................................................................................................8

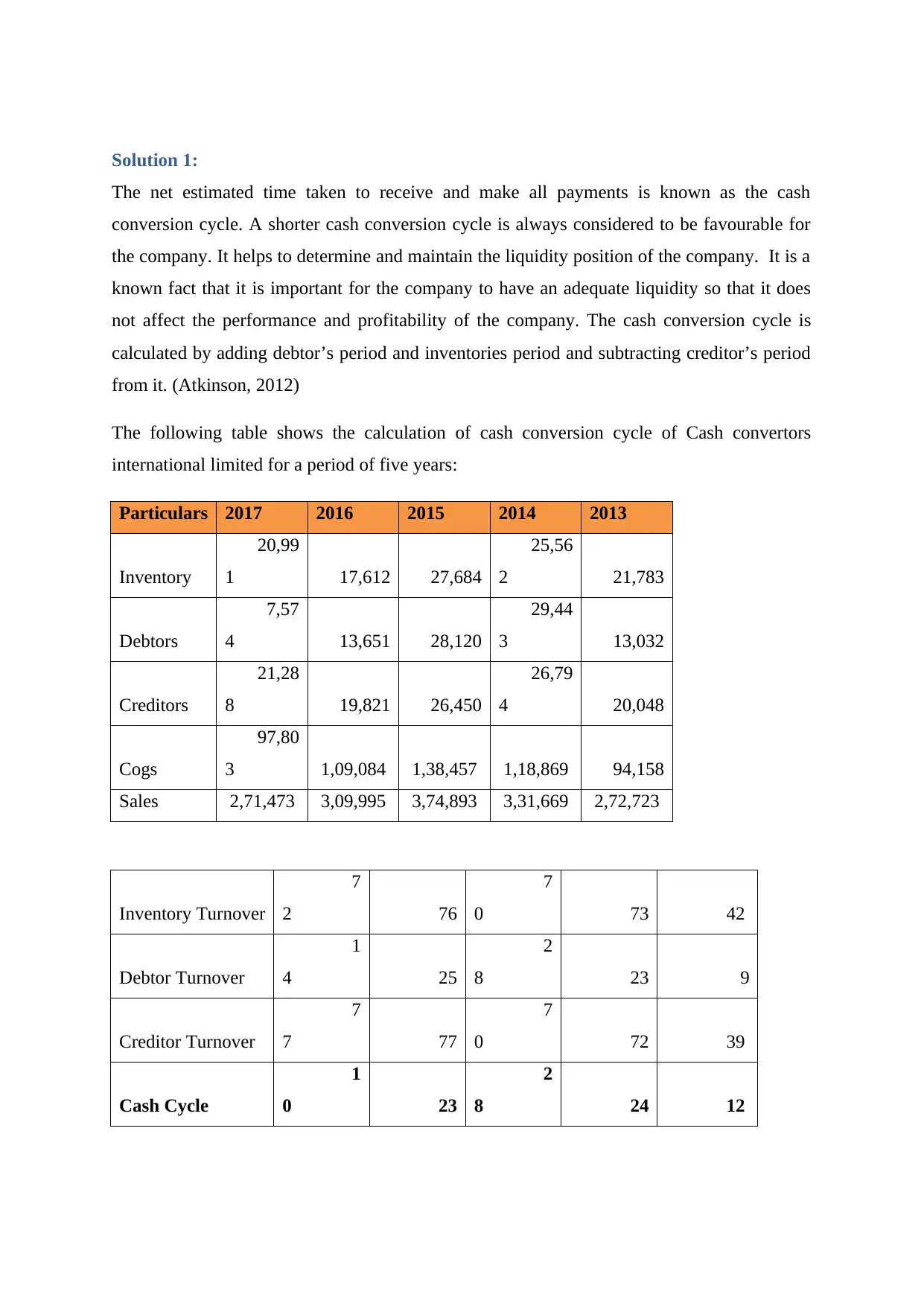

Solution 1:

The net estimated time taken to receive and make all payments is known as the cash

conversion cycle. A shorter cash conversion cycle is always considered to be favourable for

the company. It helps to determine and maintain the liquidity position of the company. It is a

known fact that it is important for the company to have an adequate liquidity so that it does

not affect the performance and profitability of the company. The cash conversion cycle is

calculated by adding debtor’s period and inventories period and subtracting creditor’s period

from it. (Atkinson, 2012)

The following table shows the calculation of cash conversion cycle of Cash convertors

international limited for a period of five years:

Particulars 2017 2016 2015 2014 2013

Inventory

20,99

1 17,612 27,684

25,56

2 21,783

Debtors

7,57

4 13,651 28,120

29,44

3 13,032

Creditors

21,28

8 19,821 26,450

26,79

4 20,048

Cogs

97,80

3 1,09,084 1,38,457 1,18,869 94,158

Sales 2,71,473 3,09,995 3,74,893 3,31,669 2,72,723

Inventory Turnover

7

2 76

7

0 73 42

Debtor Turnover

1

4 25

2

8 23 9

Creditor Turnover

7

7 77

7

0 72 39

Cash Cycle

1

0 23

2

8 24 12

The net estimated time taken to receive and make all payments is known as the cash

conversion cycle. A shorter cash conversion cycle is always considered to be favourable for

the company. It helps to determine and maintain the liquidity position of the company. It is a

known fact that it is important for the company to have an adequate liquidity so that it does

not affect the performance and profitability of the company. The cash conversion cycle is

calculated by adding debtor’s period and inventories period and subtracting creditor’s period

from it. (Atkinson, 2012)

The following table shows the calculation of cash conversion cycle of Cash convertors

international limited for a period of five years:

Particulars 2017 2016 2015 2014 2013

Inventory

20,99

1 17,612 27,684

25,56

2 21,783

Debtors

7,57

4 13,651 28,120

29,44

3 13,032

Creditors

21,28

8 19,821 26,450

26,79

4 20,048

Cogs

97,80

3 1,09,084 1,38,457 1,18,869 94,158

Sales 2,71,473 3,09,995 3,74,893 3,31,669 2,72,723

Inventory Turnover

7

2 76

7

0 73 42

Debtor Turnover

1

4 25

2

8 23 9

Creditor Turnover

7

7 77

7

0 72 39

Cash Cycle

1

0 23

2

8 24 12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

From the above table, it is observable that the cash conversion cycle is the lowest of the five

years. However, we can also see that there has been an increasing period over the five years.

The inventory has been moving faster because of which there has been an increase in the

production as well as sales volume. We can conclude that the company is at a good liquidity

position as it is able to settle it in 10 days.

There has been an increase in the cash inflows when compared to the previous years. (Datar

M. S., 2015) This increase is mainly because of the increase of cash inflow from operating

activities by $700000. This huge difference was cause because the company has tax refund

this year while it had to pay taxes in the last year.

years. However, we can also see that there has been an increasing period over the five years.

The inventory has been moving faster because of which there has been an increase in the

production as well as sales volume. We can conclude that the company is at a good liquidity

position as it is able to settle it in 10 days.

There has been an increase in the cash inflows when compared to the previous years. (Datar

M. S., 2015) This increase is mainly because of the increase of cash inflow from operating

activities by $700000. This huge difference was cause because the company has tax refund

this year while it had to pay taxes in the last year.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Solution 2:

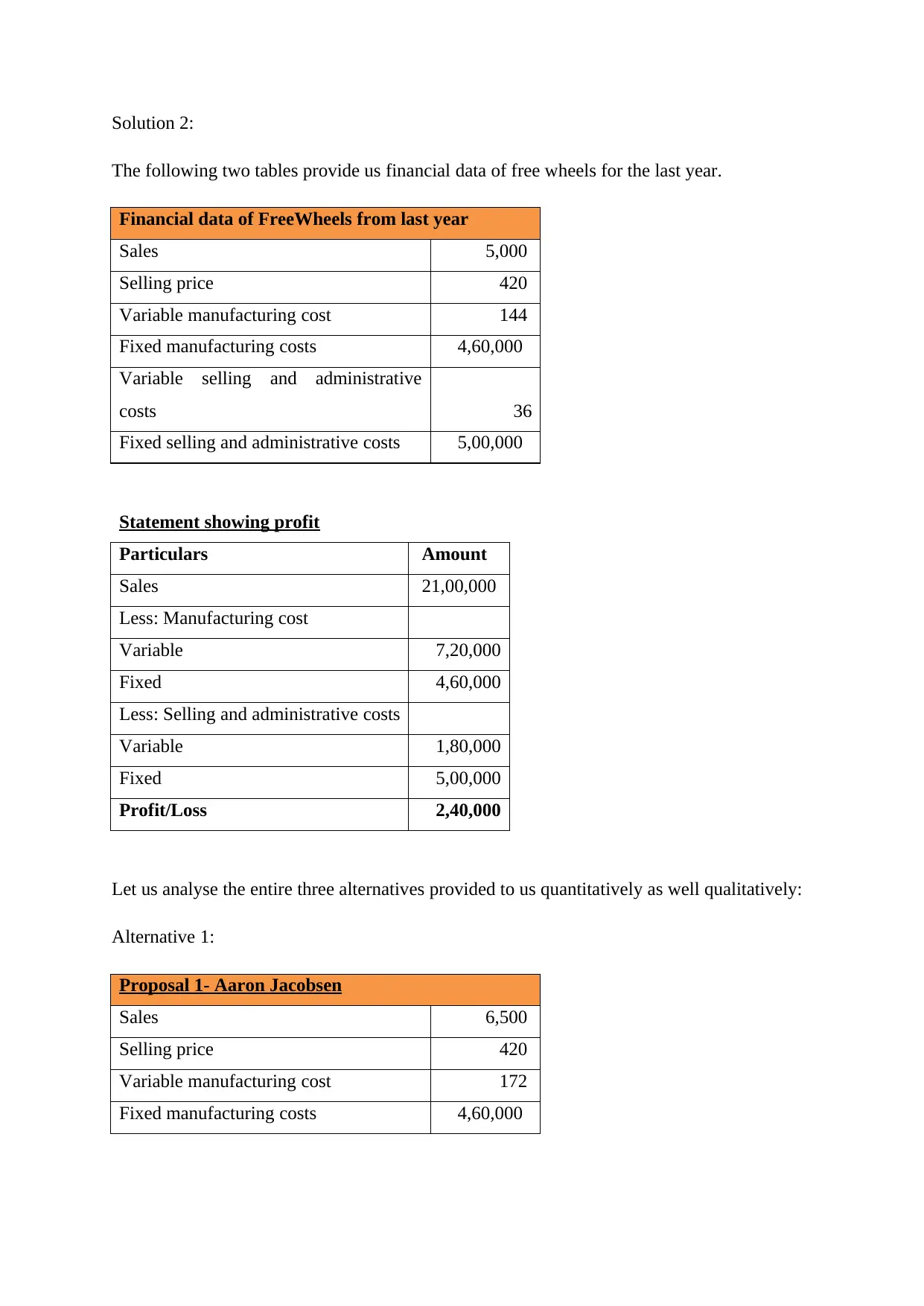

The following two tables provide us financial data of free wheels for the last year.

Financial data of FreeWheels from last year

Sales 5,000

Selling price 420

Variable manufacturing cost 144

Fixed manufacturing costs 4,60,000

Variable selling and administrative

costs 36

Fixed selling and administrative costs 5,00,000

Statement showing profit

Particulars Amount

Sales 21,00,000

Less: Manufacturing cost

Variable 7,20,000

Fixed 4,60,000

Less: Selling and administrative costs

Variable 1,80,000

Fixed 5,00,000

Profit/Loss 2,40,000

Let us analyse the entire three alternatives provided to us quantitatively as well qualitatively:

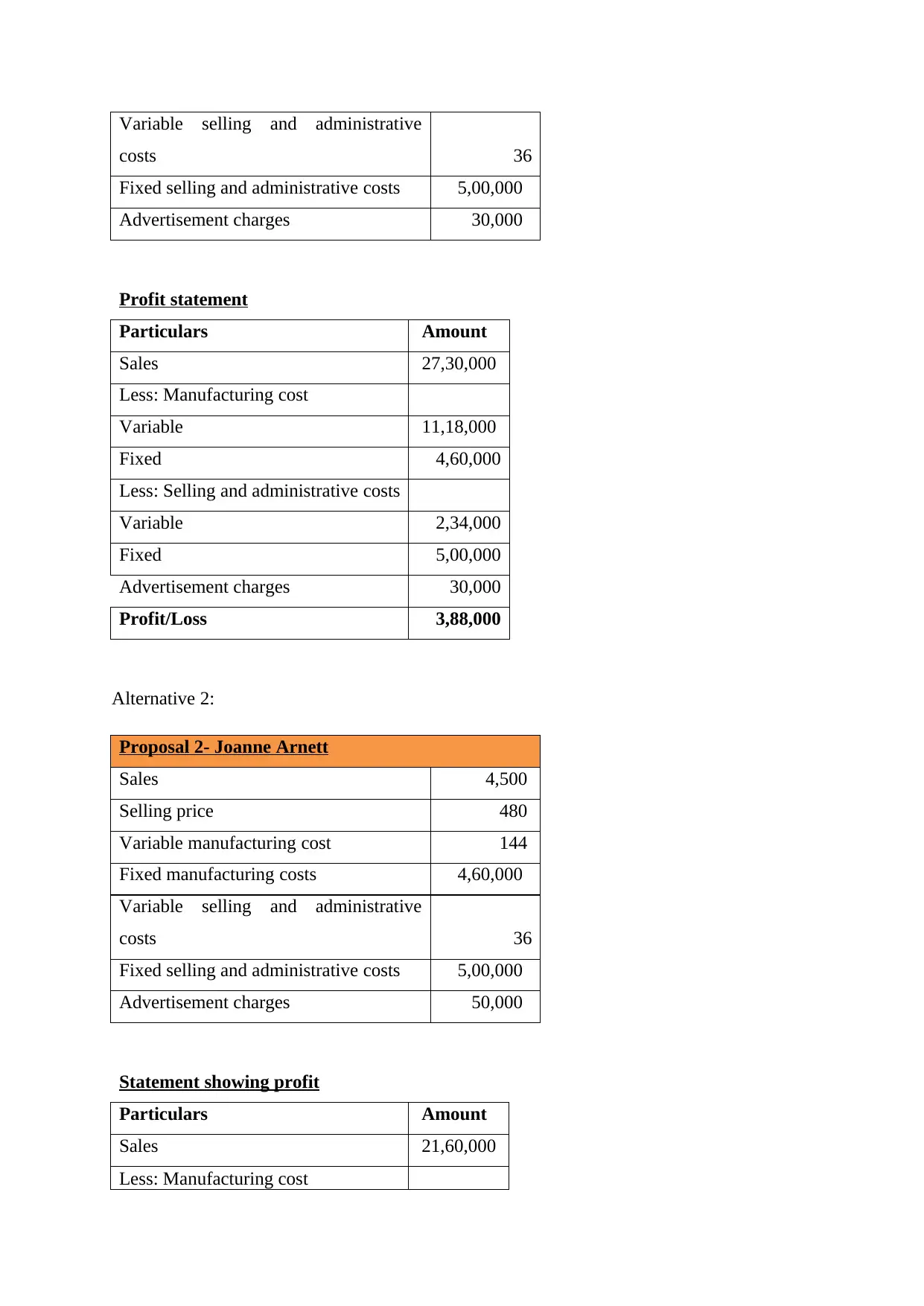

Alternative 1:

Proposal 1- Aaron Jacobsen

Sales 6,500

Selling price 420

Variable manufacturing cost 172

Fixed manufacturing costs 4,60,000

The following two tables provide us financial data of free wheels for the last year.

Financial data of FreeWheels from last year

Sales 5,000

Selling price 420

Variable manufacturing cost 144

Fixed manufacturing costs 4,60,000

Variable selling and administrative

costs 36

Fixed selling and administrative costs 5,00,000

Statement showing profit

Particulars Amount

Sales 21,00,000

Less: Manufacturing cost

Variable 7,20,000

Fixed 4,60,000

Less: Selling and administrative costs

Variable 1,80,000

Fixed 5,00,000

Profit/Loss 2,40,000

Let us analyse the entire three alternatives provided to us quantitatively as well qualitatively:

Alternative 1:

Proposal 1- Aaron Jacobsen

Sales 6,500

Selling price 420

Variable manufacturing cost 172

Fixed manufacturing costs 4,60,000

Variable selling and administrative

costs 36

Fixed selling and administrative costs 5,00,000

Advertisement charges 30,000

Profit statement

Particulars Amount

Sales 27,30,000

Less: Manufacturing cost

Variable 11,18,000

Fixed 4,60,000

Less: Selling and administrative costs

Variable 2,34,000

Fixed 5,00,000

Advertisement charges 30,000

Profit/Loss 3,88,000

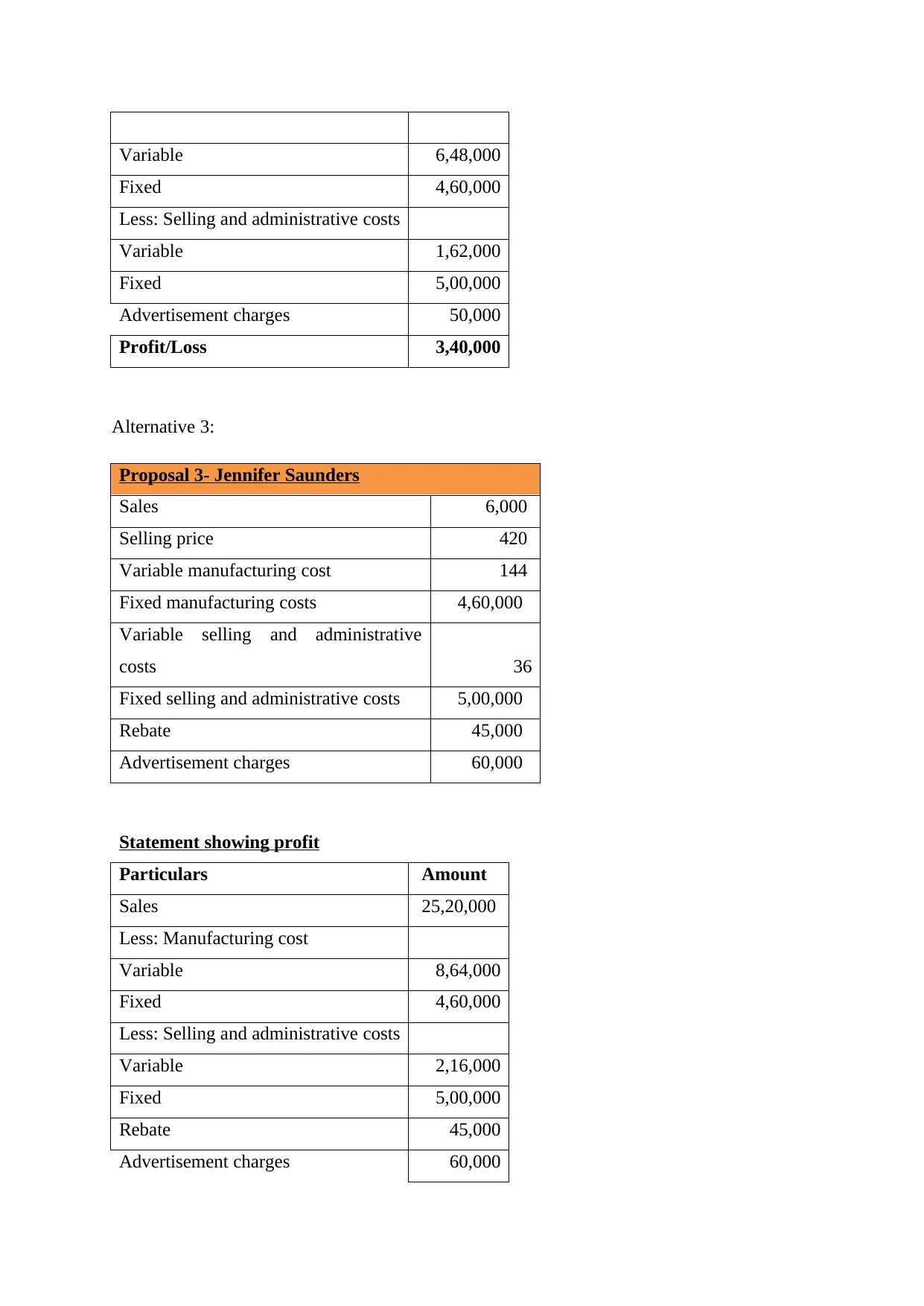

Alternative 2:

Proposal 2- Joanne Arnett

Sales 4,500

Selling price 480

Variable manufacturing cost 144

Fixed manufacturing costs 4,60,000

Variable selling and administrative

costs 36

Fixed selling and administrative costs 5,00,000

Advertisement charges 50,000

Statement showing profit

Particulars Amount

Sales 21,60,000

Less: Manufacturing cost

costs 36

Fixed selling and administrative costs 5,00,000

Advertisement charges 30,000

Profit statement

Particulars Amount

Sales 27,30,000

Less: Manufacturing cost

Variable 11,18,000

Fixed 4,60,000

Less: Selling and administrative costs

Variable 2,34,000

Fixed 5,00,000

Advertisement charges 30,000

Profit/Loss 3,88,000

Alternative 2:

Proposal 2- Joanne Arnett

Sales 4,500

Selling price 480

Variable manufacturing cost 144

Fixed manufacturing costs 4,60,000

Variable selling and administrative

costs 36

Fixed selling and administrative costs 5,00,000

Advertisement charges 50,000

Statement showing profit

Particulars Amount

Sales 21,60,000

Less: Manufacturing cost

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Variable 6,48,000

Fixed 4,60,000

Less: Selling and administrative costs

Variable 1,62,000

Fixed 5,00,000

Advertisement charges 50,000

Profit/Loss 3,40,000

Alternative 3:

Proposal 3- Jennifer Saunders

Sales 6,000

Selling price 420

Variable manufacturing cost 144

Fixed manufacturing costs 4,60,000

Variable selling and administrative

costs 36

Fixed selling and administrative costs 5,00,000

Rebate 45,000

Advertisement charges 60,000

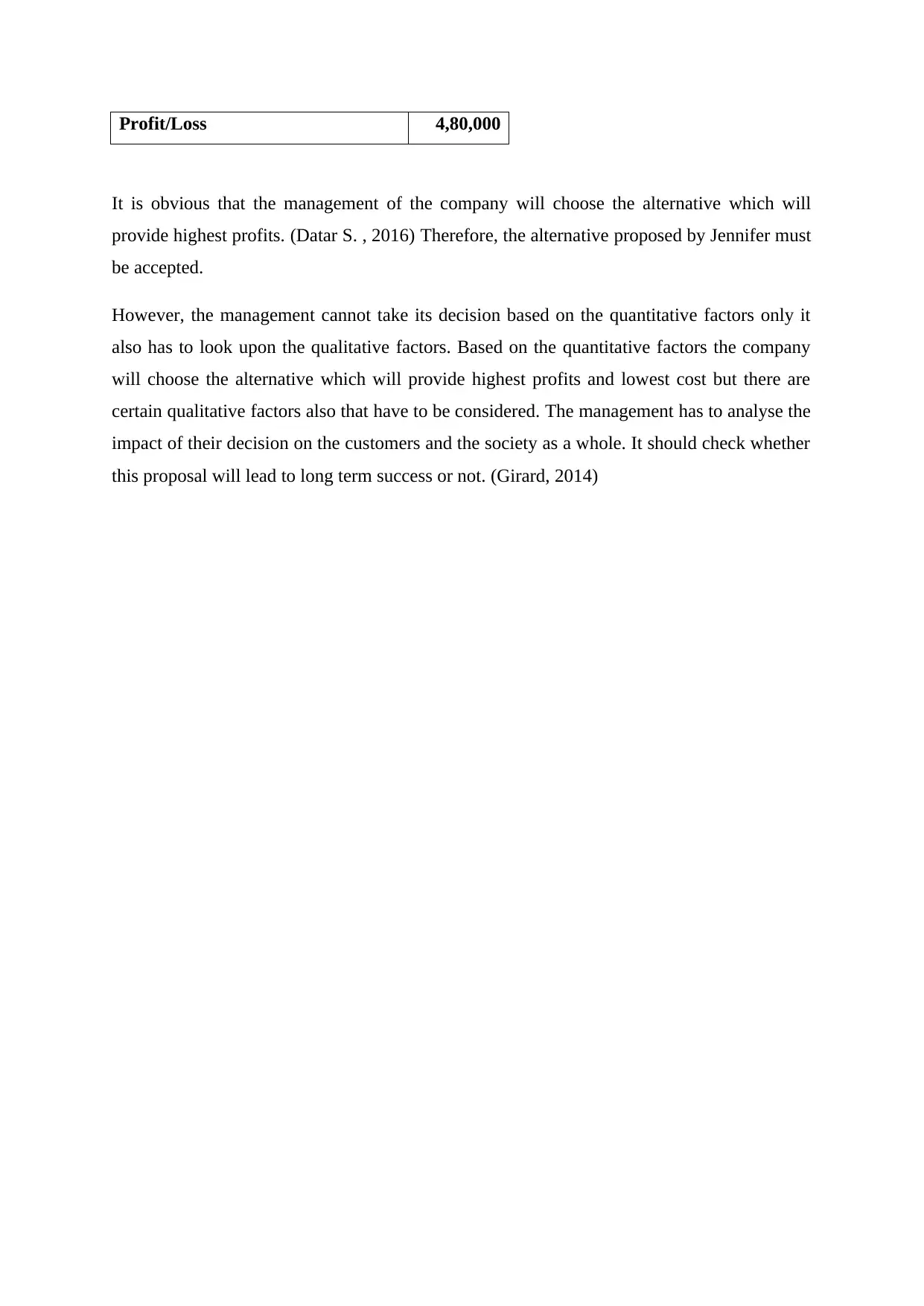

Statement showing profit

Particulars Amount

Sales 25,20,000

Less: Manufacturing cost

Variable 8,64,000

Fixed 4,60,000

Less: Selling and administrative costs

Variable 2,16,000

Fixed 5,00,000

Rebate 45,000

Advertisement charges 60,000

Fixed 4,60,000

Less: Selling and administrative costs

Variable 1,62,000

Fixed 5,00,000

Advertisement charges 50,000

Profit/Loss 3,40,000

Alternative 3:

Proposal 3- Jennifer Saunders

Sales 6,000

Selling price 420

Variable manufacturing cost 144

Fixed manufacturing costs 4,60,000

Variable selling and administrative

costs 36

Fixed selling and administrative costs 5,00,000

Rebate 45,000

Advertisement charges 60,000

Statement showing profit

Particulars Amount

Sales 25,20,000

Less: Manufacturing cost

Variable 8,64,000

Fixed 4,60,000

Less: Selling and administrative costs

Variable 2,16,000

Fixed 5,00,000

Rebate 45,000

Advertisement charges 60,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Profit/Loss 4,80,000

It is obvious that the management of the company will choose the alternative which will

provide highest profits. (Datar S. , 2016) Therefore, the alternative proposed by Jennifer must

be accepted.

However, the management cannot take its decision based on the quantitative factors only it

also has to look upon the qualitative factors. Based on the quantitative factors the company

will choose the alternative which will provide highest profits and lowest cost but there are

certain qualitative factors also that have to be considered. The management has to analyse the

impact of their decision on the customers and the society as a whole. It should check whether

this proposal will lead to long term success or not. (Girard, 2014)

It is obvious that the management of the company will choose the alternative which will

provide highest profits. (Datar S. , 2016) Therefore, the alternative proposed by Jennifer must

be accepted.

However, the management cannot take its decision based on the quantitative factors only it

also has to look upon the qualitative factors. Based on the quantitative factors the company

will choose the alternative which will provide highest profits and lowest cost but there are

certain qualitative factors also that have to be considered. The management has to analyse the

impact of their decision on the customers and the society as a whole. It should check whether

this proposal will lead to long term success or not. (Girard, 2014)

Solution 3:

Part 1.

(a)

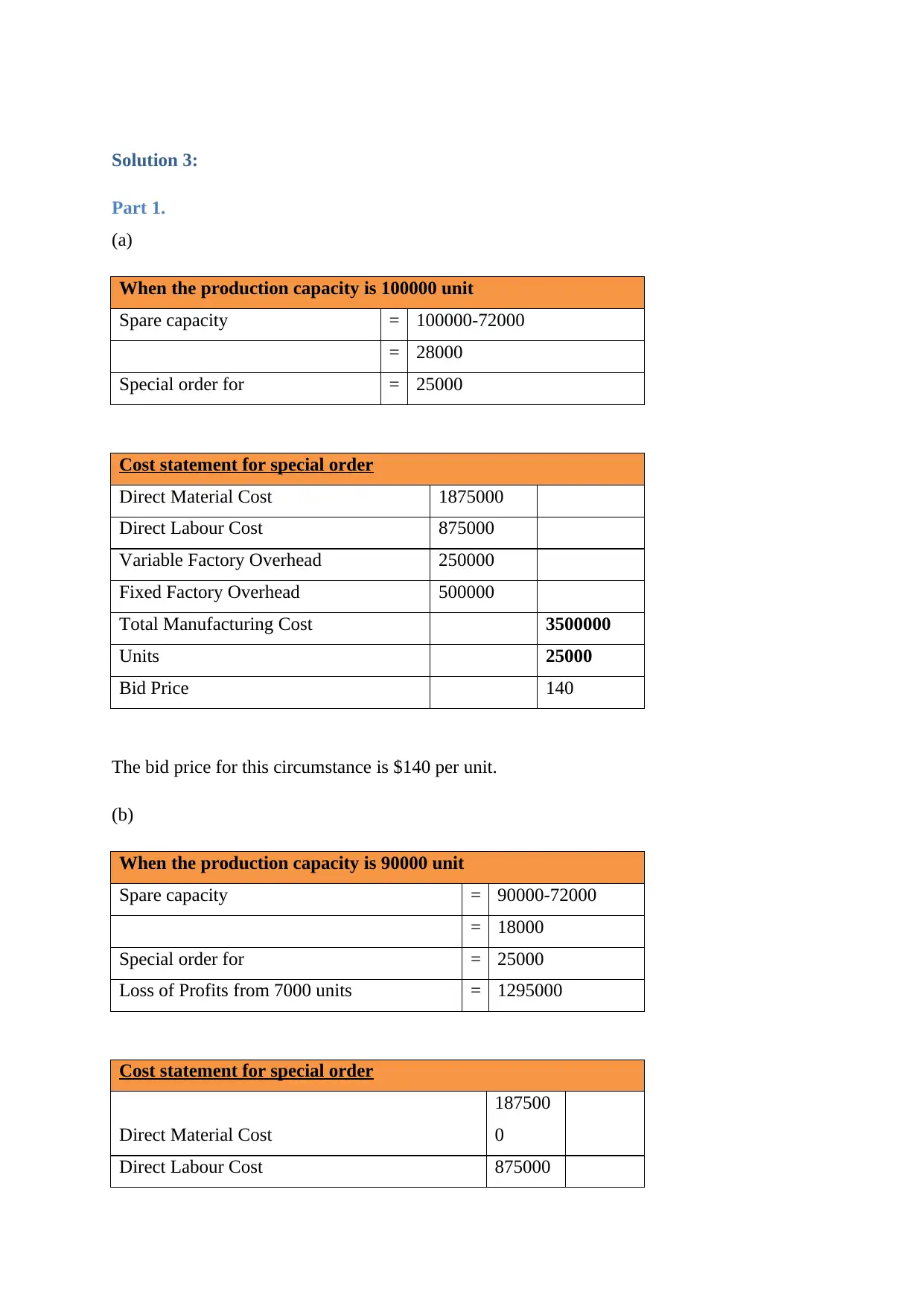

When the production capacity is 100000 unit

Spare capacity = 100000-72000

= 28000

Special order for = 25000

Cost statement for special order

Direct Material Cost 1875000

Direct Labour Cost 875000

Variable Factory Overhead 250000

Fixed Factory Overhead 500000

Total Manufacturing Cost 3500000

Units 25000

Bid Price 140

The bid price for this circumstance is $140 per unit.

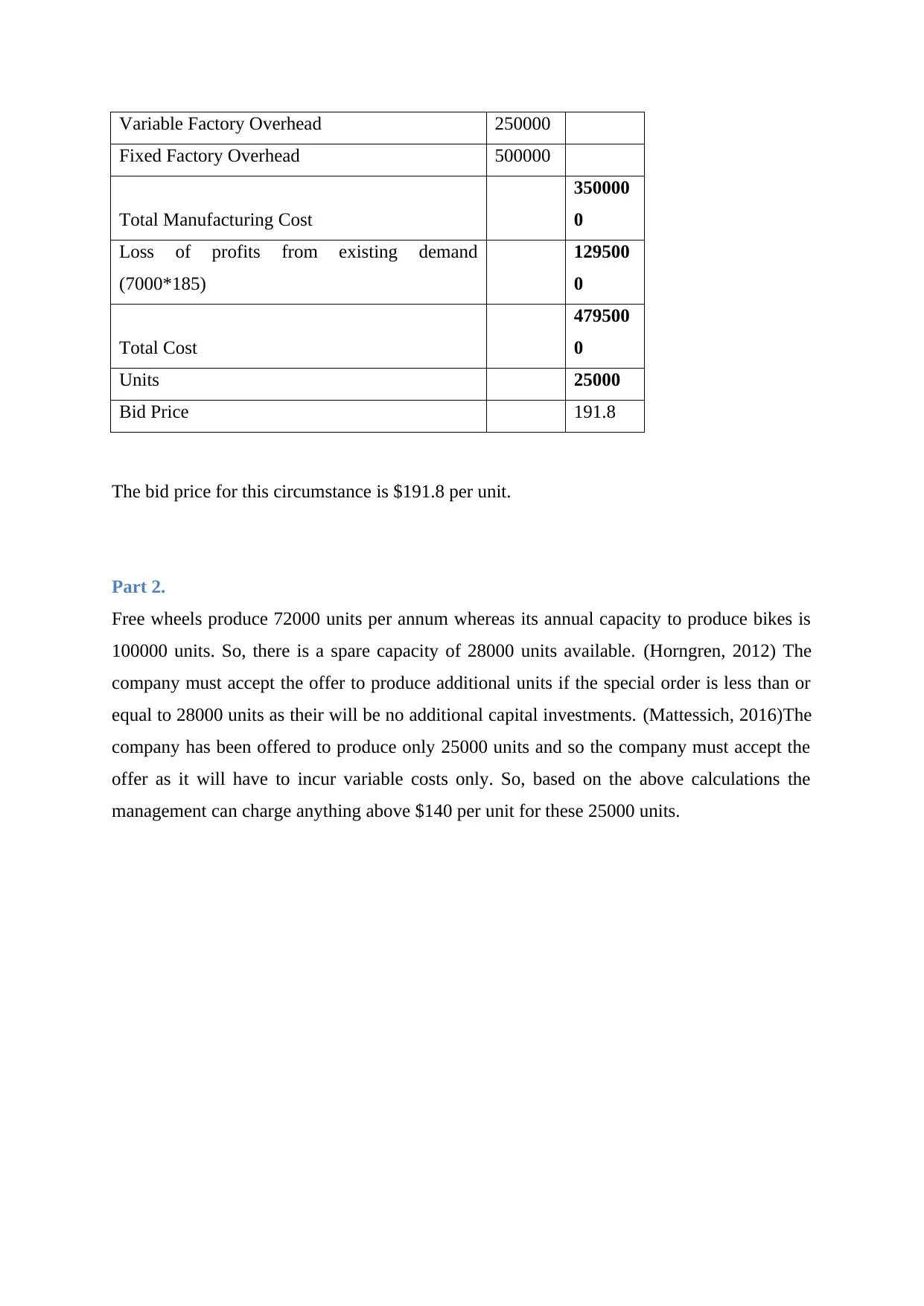

(b)

When the production capacity is 90000 unit

Spare capacity = 90000-72000

= 18000

Special order for = 25000

Loss of Profits from 7000 units = 1295000

Cost statement for special order

Direct Material Cost

187500

0

Direct Labour Cost 875000

Part 1.

(a)

When the production capacity is 100000 unit

Spare capacity = 100000-72000

= 28000

Special order for = 25000

Cost statement for special order

Direct Material Cost 1875000

Direct Labour Cost 875000

Variable Factory Overhead 250000

Fixed Factory Overhead 500000

Total Manufacturing Cost 3500000

Units 25000

Bid Price 140

The bid price for this circumstance is $140 per unit.

(b)

When the production capacity is 90000 unit

Spare capacity = 90000-72000

= 18000

Special order for = 25000

Loss of Profits from 7000 units = 1295000

Cost statement for special order

Direct Material Cost

187500

0

Direct Labour Cost 875000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Variable Factory Overhead 250000

Fixed Factory Overhead 500000

Total Manufacturing Cost

350000

0

Loss of profits from existing demand

(7000*185)

129500

0

Total Cost

479500

0

Units 25000

Bid Price 191.8

The bid price for this circumstance is $191.8 per unit.

Part 2.

Free wheels produce 72000 units per annum whereas its annual capacity to produce bikes is

100000 units. So, there is a spare capacity of 28000 units available. (Horngren, 2012) The

company must accept the offer to produce additional units if the special order is less than or

equal to 28000 units as their will be no additional capital investments. (Mattessich, 2016)The

company has been offered to produce only 25000 units and so the company must accept the

offer as it will have to incur variable costs only. So, based on the above calculations the

management can charge anything above $140 per unit for these 25000 units.

Fixed Factory Overhead 500000

Total Manufacturing Cost

350000

0

Loss of profits from existing demand

(7000*185)

129500

0

Total Cost

479500

0

Units 25000

Bid Price 191.8

The bid price for this circumstance is $191.8 per unit.

Part 2.

Free wheels produce 72000 units per annum whereas its annual capacity to produce bikes is

100000 units. So, there is a spare capacity of 28000 units available. (Horngren, 2012) The

company must accept the offer to produce additional units if the special order is less than or

equal to 28000 units as their will be no additional capital investments. (Mattessich, 2016)The

company has been offered to produce only 25000 units and so the company must accept the

offer as it will have to incur variable costs only. So, based on the above calculations the

management can charge anything above $140 per unit for these 25000 units.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Bibliography

Atkinson, A. A. (2012). Management accounting. Upper Saddle River, N.J.: Paerson.

Datar, M. S. (2015). Cost accounting. Boston: Pearson.

Datar, S. (2016). Horngren's Cost Accounting: A Managerial Emphasis. Hoboken: Wiley.

Girard, S. L. (2014). Business finance basics. Pompton Plains, NJ: Career Press.

Horngren, C. (2012). Cost accounting. Upper Saddle River, N.J.: Pearson/Prentice Hall.

Mattessich, R. (2016). Reality and accounting. [S.I.]: Routledge.

Atkinson, A. A. (2012). Management accounting. Upper Saddle River, N.J.: Paerson.

Datar, M. S. (2015). Cost accounting. Boston: Pearson.

Datar, S. (2016). Horngren's Cost Accounting: A Managerial Emphasis. Hoboken: Wiley.

Girard, S. L. (2014). Business finance basics. Pompton Plains, NJ: Career Press.

Horngren, C. (2012). Cost accounting. Upper Saddle River, N.J.: Pearson/Prentice Hall.

Mattessich, R. (2016). Reality and accounting. [S.I.]: Routledge.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.