Costing & Profitability Analysis: Accounting for Managers Report

VerifiedAdded on 2023/06/15

|17

|3306

|366

Report

AI Summary

This report provides a detailed analysis of accounting for managers, focusing on cost analysis, profitability, and overhead allocation. It examines Bonza Handtools Limited's profitability under different proposals, recommending Tom Tune's proposal for enhancing product quality and sales volume. The report also assesses The Tassie Company's production capacity and pricing strategies, determining optimal pricing for government contracts. Furthermore, it evaluates ABC Limited's overhead allocation methods, comparing direct labor hours and machine hours, and discusses the significance of activity-based costing. Finally, the report explores the role of overhead segmentation in allocating costs to individual jobs or services, highlighting its benefits in identifying profitable business segments. Desklib offers this report along with a wealth of past papers and solved assignments for students.

Running head: ACCOUNTING FOR MANAGERS

Accounting for Managers

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Accounting for Managers

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ACCOUNTING FOR MANAGERS

Table of Contents

Question 1: Bonza Handtools Limited............................................................................................2

Question 2: The Tassie Company....................................................................................................6

(i) Production capacity of the factory at 200,000 units per year:................................................7

(ii) Production capacity of the factory at 180,000 units per year:...............................................8

Question 3: ABC Limited................................................................................................................9

1. Overhead allocation rate:.........................................................................................................9

2. Total costs of the special order:.............................................................................................10

3. Cost of the special order:.......................................................................................................10

4. Minimum price per trailer:.....................................................................................................11

5. Significance of activity-based costing and segmented overhead cost pools for pricing

purpose:......................................................................................................................................11

Question 4: Role of overhead segmentation in allocating overhead costs to individual jobs or

services..........................................................................................................................................12

References:....................................................................................................................................15

Table of Contents

Question 1: Bonza Handtools Limited............................................................................................2

Question 2: The Tassie Company....................................................................................................6

(i) Production capacity of the factory at 200,000 units per year:................................................7

(ii) Production capacity of the factory at 180,000 units per year:...............................................8

Question 3: ABC Limited................................................................................................................9

1. Overhead allocation rate:.........................................................................................................9

2. Total costs of the special order:.............................................................................................10

3. Cost of the special order:.......................................................................................................10

4. Minimum price per trailer:.....................................................................................................11

5. Significance of activity-based costing and segmented overhead cost pools for pricing

purpose:......................................................................................................................................11

Question 4: Role of overhead segmentation in allocating overhead costs to individual jobs or

services..........................................................................................................................................12

References:....................................................................................................................................15

2ACCOUNTING FOR MANAGERS

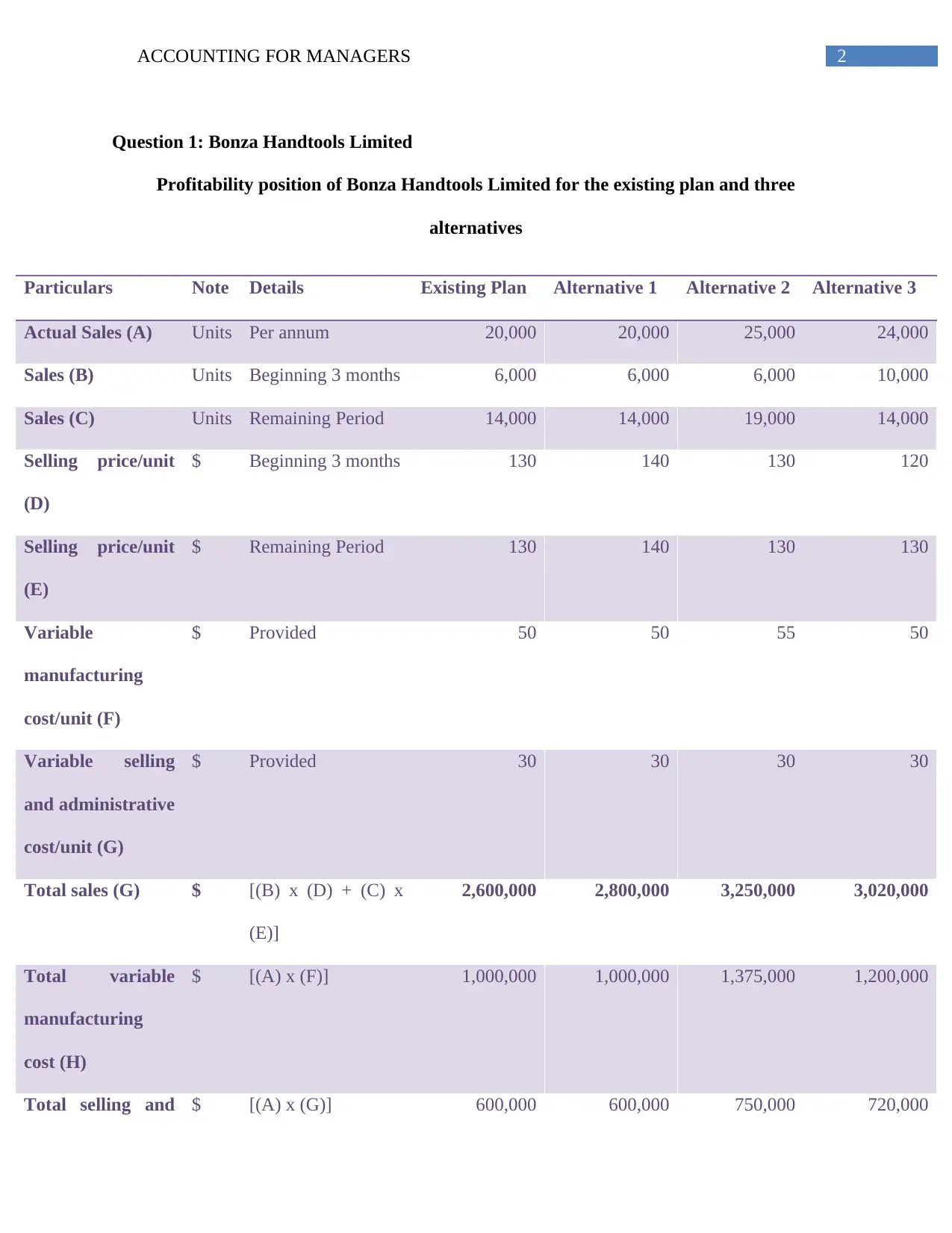

Question 1: Bonza Handtools Limited

Profitability position of Bonza Handtools Limited for the existing plan and three

alternatives

Particulars Note Details Existing Plan Alternative 1 Alternative 2 Alternative 3

Actual Sales (A) Units Per annum 20,000 20,000 25,000 24,000

Sales (B) Units Beginning 3 months 6,000 6,000 6,000 10,000

Sales (C) Units Remaining Period 14,000 14,000 19,000 14,000

Selling price/unit

(D)

$ Beginning 3 months 130 140 130 120

Selling price/unit

(E)

$ Remaining Period 130 140 130 130

Variable

manufacturing

cost/unit (F)

$ Provided 50 50 55 50

Variable selling

and administrative

cost/unit (G)

$ Provided 30 30 30 30

Total sales (G) $ [(B) x (D) + (C) x

(E)]

2,600,000 2,800,000 3,250,000 3,020,000

Total variable

manufacturing

cost (H)

$ [(A) x (F)] 1,000,000 1,000,000 1,375,000 1,200,000

Total selling and $ [(A) x (G)] 600,000 600,000 750,000 720,000

Question 1: Bonza Handtools Limited

Profitability position of Bonza Handtools Limited for the existing plan and three

alternatives

Particulars Note Details Existing Plan Alternative 1 Alternative 2 Alternative 3

Actual Sales (A) Units Per annum 20,000 20,000 25,000 24,000

Sales (B) Units Beginning 3 months 6,000 6,000 6,000 10,000

Sales (C) Units Remaining Period 14,000 14,000 19,000 14,000

Selling price/unit

(D)

$ Beginning 3 months 130 140 130 120

Selling price/unit

(E)

$ Remaining Period 130 140 130 130

Variable

manufacturing

cost/unit (F)

$ Provided 50 50 55 50

Variable selling

and administrative

cost/unit (G)

$ Provided 30 30 30 30

Total sales (G) $ [(B) x (D) + (C) x

(E)]

2,600,000 2,800,000 3,250,000 3,020,000

Total variable

manufacturing

cost (H)

$ [(A) x (F)] 1,000,000 1,000,000 1,375,000 1,200,000

Total selling and $ [(A) x (G)] 600,000 600,000 750,000 720,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

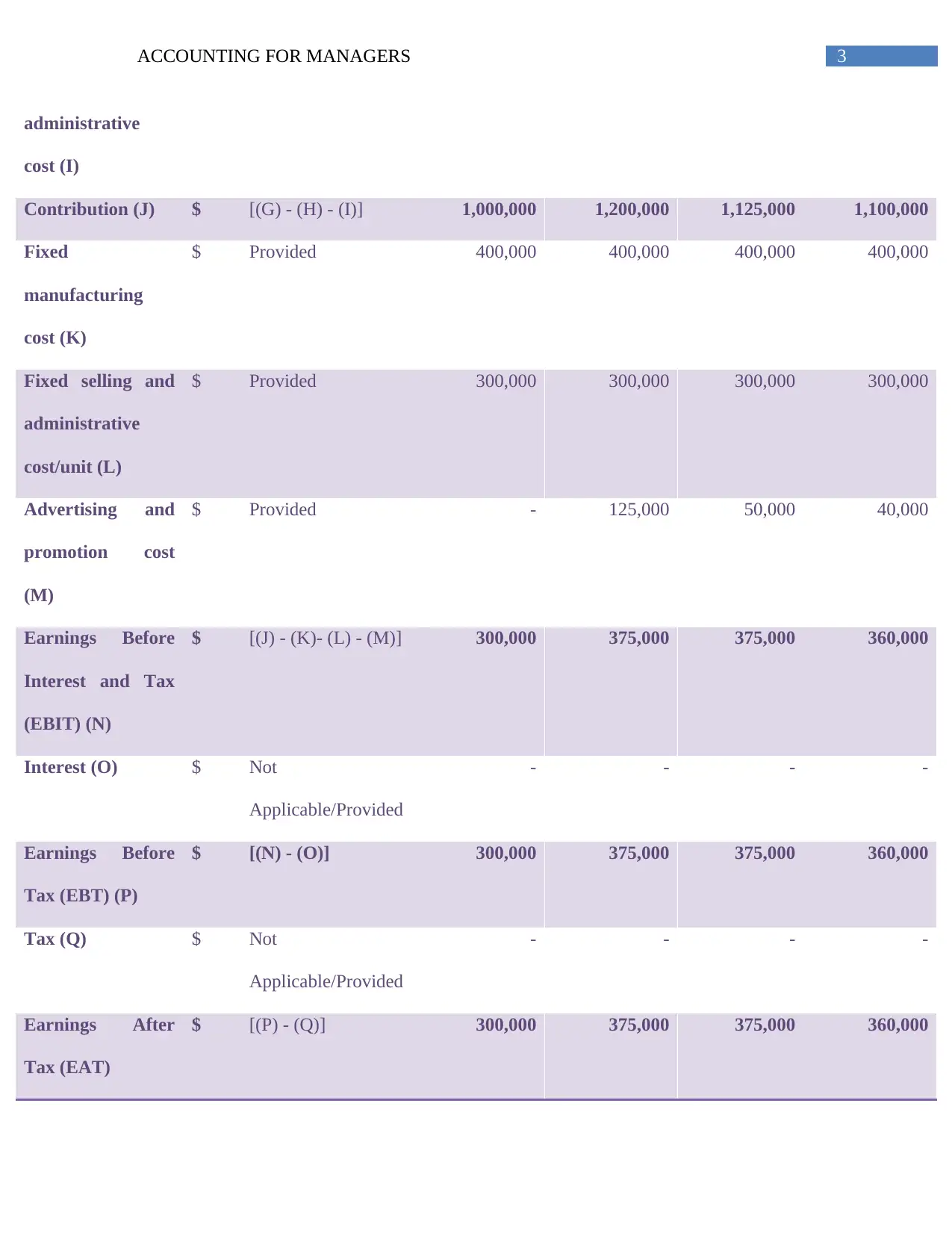

3ACCOUNTING FOR MANAGERS

administrative

cost (I)

Contribution (J) $ [(G) - (H) - (I)] 1,000,000 1,200,000 1,125,000 1,100,000

Fixed

manufacturing

cost (K)

$ Provided 400,000 400,000 400,000 400,000

Fixed selling and

administrative

cost/unit (L)

$ Provided 300,000 300,000 300,000 300,000

Advertising and

promotion cost

(M)

$ Provided - 125,000 50,000 40,000

Earnings Before

Interest and Tax

(EBIT) (N)

$ [(J) - (K)- (L) - (M)] 300,000 375,000 375,000 360,000

Interest (O) $ Not

Applicable/Provided

- - - -

Earnings Before

Tax (EBT) (P)

$ [(N) - (O)] 300,000 375,000 375,000 360,000

Tax (Q) $ Not

Applicable/Provided

- - - -

Earnings After

Tax (EAT)

$ [(P) - (Q)] 300,000 375,000 375,000 360,000

administrative

cost (I)

Contribution (J) $ [(G) - (H) - (I)] 1,000,000 1,200,000 1,125,000 1,100,000

Fixed

manufacturing

cost (K)

$ Provided 400,000 400,000 400,000 400,000

Fixed selling and

administrative

cost/unit (L)

$ Provided 300,000 300,000 300,000 300,000

Advertising and

promotion cost

(M)

$ Provided - 125,000 50,000 40,000

Earnings Before

Interest and Tax

(EBIT) (N)

$ [(J) - (K)- (L) - (M)] 300,000 375,000 375,000 360,000

Interest (O) $ Not

Applicable/Provided

- - - -

Earnings Before

Tax (EBT) (P)

$ [(N) - (O)] 300,000 375,000 375,000 360,000

Tax (Q) $ Not

Applicable/Provided

- - - -

Earnings After

Tax (EAT)

$ [(P) - (Q)] 300,000 375,000 375,000 360,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ACCOUNTING FOR MANAGERS

To,

The Directors of Bonza Handtools Limited

Date: 04.01.2018

Subject: Assessment of the three available proposals

Respected Sir,

After careful consideration of the three available proposals, the report has been developed

by depicting the effect and benefits of the proposals on the organisation. These are demonstrated

briefly as follows:

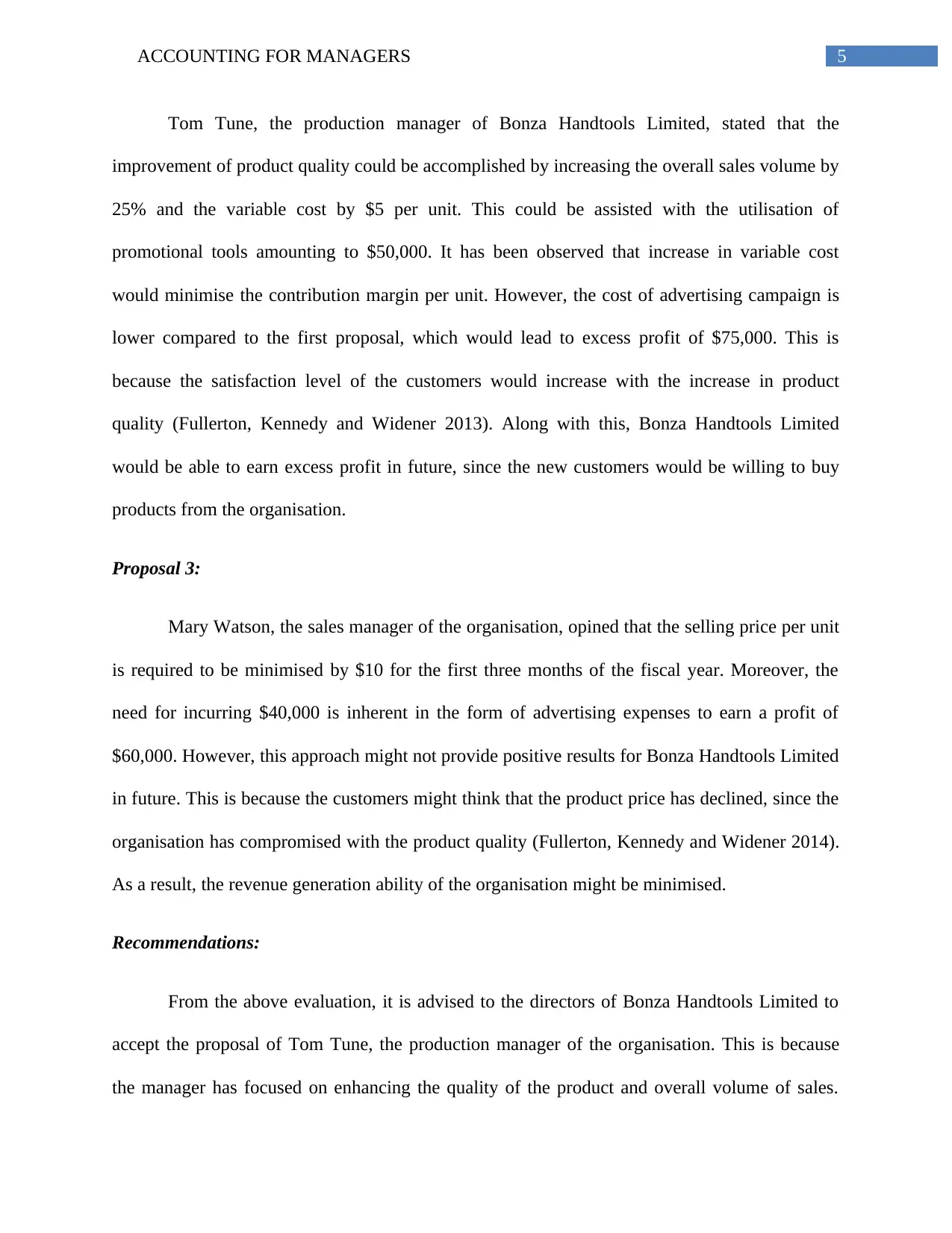

Proposal 1:

In accordance with the proposal of Jan Rossi, the accountant of the organisation, the

selling price needs to be $140 per unit in order to raise its overall profit level. The above table

clearly signifies that the organisation would see a rise in profit level from $300,000 to $375,000

and hence, the amount increased would be $75,000. Such enhanced profit margin could be

accomplished with the help of appropriate advertising campaign, which would cost $125,000.

However, the risk level of the organisation would be increased, if the advertising campaign is not

able to draw the attention of the customers. Due to this, there would be a significant fall in profit

margin of Bonza Handtools Limited along with increased advertising and promotion cost.

Moreover, such fall in profit might lead to loss of customer loyalty with additional burden over

the customers (Bebbington, Unerman and O'Dwyer 2014).

Proposal 2:

To,

The Directors of Bonza Handtools Limited

Date: 04.01.2018

Subject: Assessment of the three available proposals

Respected Sir,

After careful consideration of the three available proposals, the report has been developed

by depicting the effect and benefits of the proposals on the organisation. These are demonstrated

briefly as follows:

Proposal 1:

In accordance with the proposal of Jan Rossi, the accountant of the organisation, the

selling price needs to be $140 per unit in order to raise its overall profit level. The above table

clearly signifies that the organisation would see a rise in profit level from $300,000 to $375,000

and hence, the amount increased would be $75,000. Such enhanced profit margin could be

accomplished with the help of appropriate advertising campaign, which would cost $125,000.

However, the risk level of the organisation would be increased, if the advertising campaign is not

able to draw the attention of the customers. Due to this, there would be a significant fall in profit

margin of Bonza Handtools Limited along with increased advertising and promotion cost.

Moreover, such fall in profit might lead to loss of customer loyalty with additional burden over

the customers (Bebbington, Unerman and O'Dwyer 2014).

Proposal 2:

5ACCOUNTING FOR MANAGERS

Tom Tune, the production manager of Bonza Handtools Limited, stated that the

improvement of product quality could be accomplished by increasing the overall sales volume by

25% and the variable cost by $5 per unit. This could be assisted with the utilisation of

promotional tools amounting to $50,000. It has been observed that increase in variable cost

would minimise the contribution margin per unit. However, the cost of advertising campaign is

lower compared to the first proposal, which would lead to excess profit of $75,000. This is

because the satisfaction level of the customers would increase with the increase in product

quality (Fullerton, Kennedy and Widener 2013). Along with this, Bonza Handtools Limited

would be able to earn excess profit in future, since the new customers would be willing to buy

products from the organisation.

Proposal 3:

Mary Watson, the sales manager of the organisation, opined that the selling price per unit

is required to be minimised by $10 for the first three months of the fiscal year. Moreover, the

need for incurring $40,000 is inherent in the form of advertising expenses to earn a profit of

$60,000. However, this approach might not provide positive results for Bonza Handtools Limited

in future. This is because the customers might think that the product price has declined, since the

organisation has compromised with the product quality (Fullerton, Kennedy and Widener 2014).

As a result, the revenue generation ability of the organisation might be minimised.

Recommendations:

From the above evaluation, it is advised to the directors of Bonza Handtools Limited to

accept the proposal of Tom Tune, the production manager of the organisation. This is because

the manager has focused on enhancing the quality of the product and overall volume of sales.

Tom Tune, the production manager of Bonza Handtools Limited, stated that the

improvement of product quality could be accomplished by increasing the overall sales volume by

25% and the variable cost by $5 per unit. This could be assisted with the utilisation of

promotional tools amounting to $50,000. It has been observed that increase in variable cost

would minimise the contribution margin per unit. However, the cost of advertising campaign is

lower compared to the first proposal, which would lead to excess profit of $75,000. This is

because the satisfaction level of the customers would increase with the increase in product

quality (Fullerton, Kennedy and Widener 2013). Along with this, Bonza Handtools Limited

would be able to earn excess profit in future, since the new customers would be willing to buy

products from the organisation.

Proposal 3:

Mary Watson, the sales manager of the organisation, opined that the selling price per unit

is required to be minimised by $10 for the first three months of the fiscal year. Moreover, the

need for incurring $40,000 is inherent in the form of advertising expenses to earn a profit of

$60,000. However, this approach might not provide positive results for Bonza Handtools Limited

in future. This is because the customers might think that the product price has declined, since the

organisation has compromised with the product quality (Fullerton, Kennedy and Widener 2014).

As a result, the revenue generation ability of the organisation might be minimised.

Recommendations:

From the above evaluation, it is advised to the directors of Bonza Handtools Limited to

accept the proposal of Tom Tune, the production manager of the organisation. This is because

the manager has focused on enhancing the quality of the product and overall volume of sales.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ACCOUNTING FOR MANAGERS

This would help in generating profit of $75,000. Despite the similar profit level as the proposal

of the accountant, the risk factor is high in the latter proposal because additional concentration

has been placed on promotional and advertising campaign.

The third proposal would lead to additional profit in contrast to the second alternative;

however, the turnover of the customers might increase largely. Therefore, after careful

assessment of the three provided proposals, the organisation could progress ahead with the

proposal of the production manager, Tom Tune.

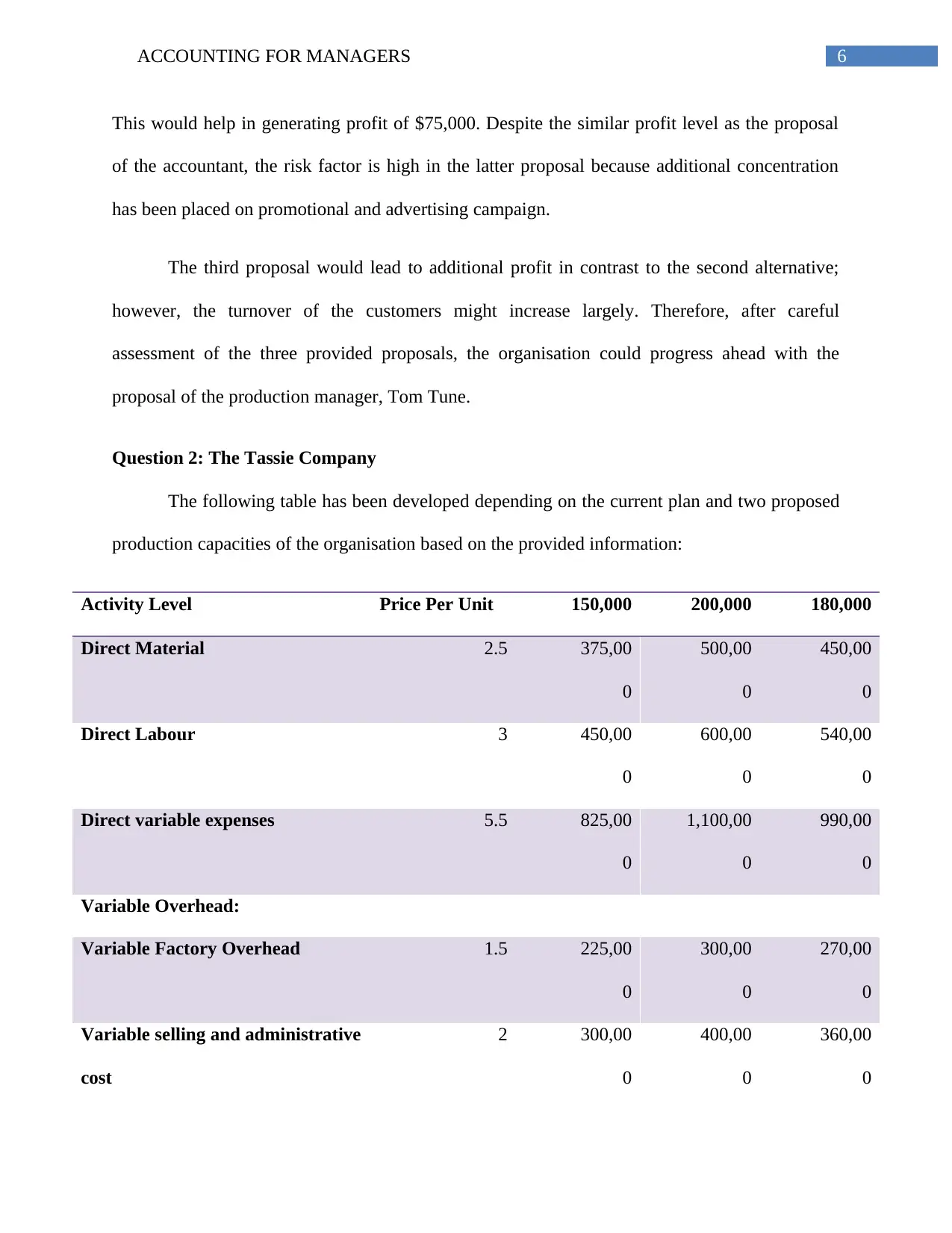

Question 2: The Tassie Company

The following table has been developed depending on the current plan and two proposed

production capacities of the organisation based on the provided information:

Activity Level Price Per Unit 150,000 200,000 180,000

Direct Material 2.5 375,00

0

500,00

0

450,00

0

Direct Labour 3 450,00

0

600,00

0

540,00

0

Direct variable expenses 5.5 825,00

0

1,100,00

0

990,00

0

Variable Overhead:

Variable Factory Overhead 1.5 225,00

0

300,00

0

270,00

0

Variable selling and administrative

cost

2 300,00

0

400,00

0

360,00

0

This would help in generating profit of $75,000. Despite the similar profit level as the proposal

of the accountant, the risk factor is high in the latter proposal because additional concentration

has been placed on promotional and advertising campaign.

The third proposal would lead to additional profit in contrast to the second alternative;

however, the turnover of the customers might increase largely. Therefore, after careful

assessment of the three provided proposals, the organisation could progress ahead with the

proposal of the production manager, Tom Tune.

Question 2: The Tassie Company

The following table has been developed depending on the current plan and two proposed

production capacities of the organisation based on the provided information:

Activity Level Price Per Unit 150,000 200,000 180,000

Direct Material 2.5 375,00

0

500,00

0

450,00

0

Direct Labour 3 450,00

0

600,00

0

540,00

0

Direct variable expenses 5.5 825,00

0

1,100,00

0

990,00

0

Variable Overhead:

Variable Factory Overhead 1.5 225,00

0

300,00

0

270,00

0

Variable selling and administrative

cost

2 300,00

0

400,00

0

360,00

0

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ACCOUNTING FOR MANAGERS

Total cost of production 3.5 525,00

0

700,00

0

630,00

0

Fixed Overhead:

Fixed factory overhead 2 300,00

0

400,00

0

360,00

0

Fixed selling and administrative

cost

1.5 225,00

0

300,00

0

270,00

0

Fixed Cost 3.5 525,00

0

700,00

0

630,00

0

20% Mark Up 2.5 375,00

0

500,00

0

450,00

0

Selling price 15 2,250,00

0

3,000,00

0

2,700,00

0

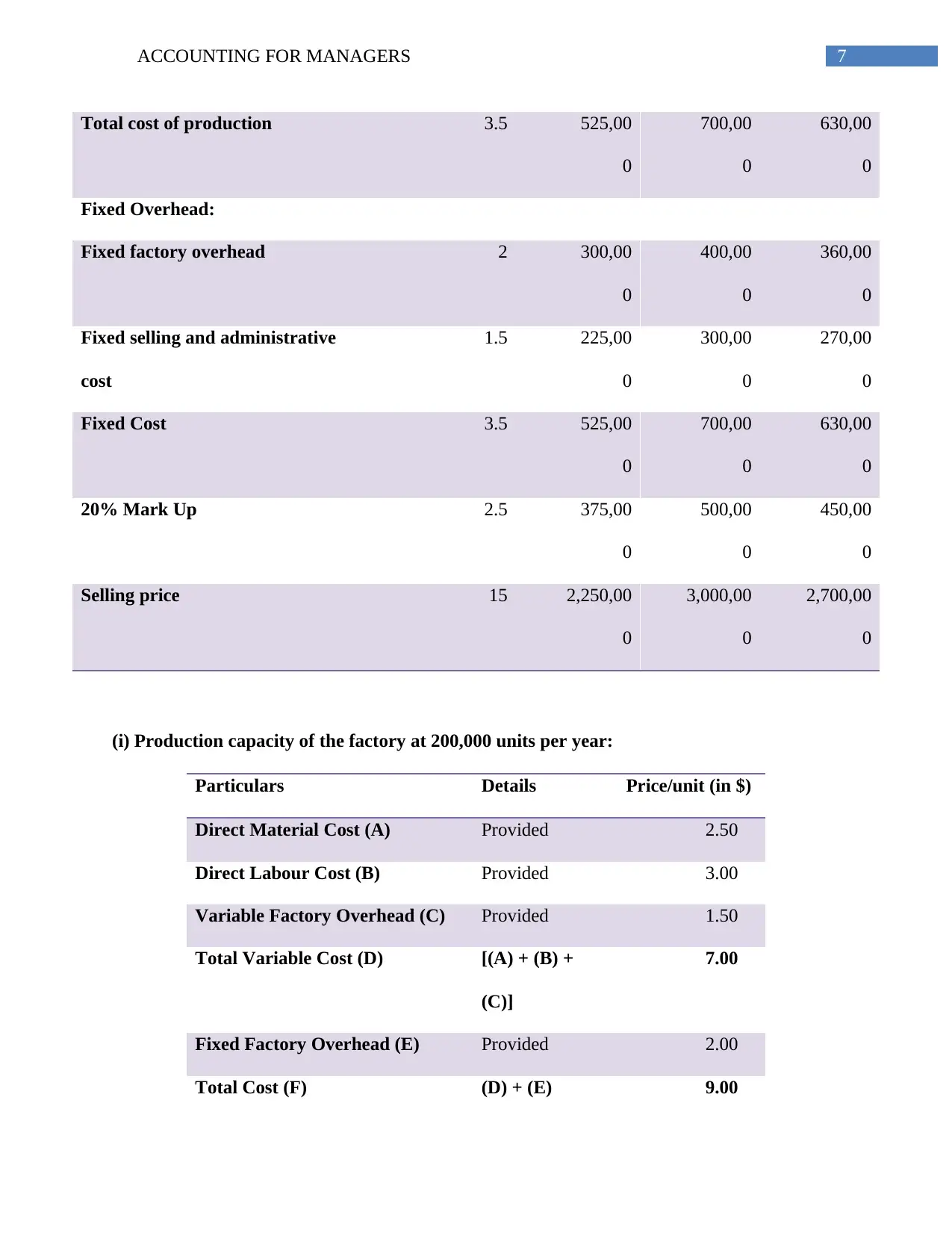

(i) Production capacity of the factory at 200,000 units per year:

Particulars Details Price/unit (in $)

Direct Material Cost (A) Provided 2.50

Direct Labour Cost (B) Provided 3.00

Variable Factory Overhead (C) Provided 1.50

Total Variable Cost (D) [(A) + (B) +

(C)]

7.00

Fixed Factory Overhead (E) Provided 2.00

Total Cost (F) (D) + (E) 9.00

Total cost of production 3.5 525,00

0

700,00

0

630,00

0

Fixed Overhead:

Fixed factory overhead 2 300,00

0

400,00

0

360,00

0

Fixed selling and administrative

cost

1.5 225,00

0

300,00

0

270,00

0

Fixed Cost 3.5 525,00

0

700,00

0

630,00

0

20% Mark Up 2.5 375,00

0

500,00

0

450,00

0

Selling price 15 2,250,00

0

3,000,00

0

2,700,00

0

(i) Production capacity of the factory at 200,000 units per year:

Particulars Details Price/unit (in $)

Direct Material Cost (A) Provided 2.50

Direct Labour Cost (B) Provided 3.00

Variable Factory Overhead (C) Provided 1.50

Total Variable Cost (D) [(A) + (B) +

(C)]

7.00

Fixed Factory Overhead (E) Provided 2.00

Total Cost (F) (D) + (E) 9.00

8ACCOUNTING FOR MANAGERS

20% Mark-up (G) [(F) x 20 %] 1.80

Minimum price (F) + (G) 10.80

From the provided information, it has been identified that the Tassie Company could

manufacture 200,000 units per annum. However, it is involved in manufacturing 150,000 units in

accordance with the current plan. As pointed out by Drury (2013), the sales volume could be

increased by utilising the entire capacity; thus, resulting in enhanced profit margin. On the other

hand, Kim and Sohn (2013) are of the view that in case of low market demand, the rise in

production level might lead to considerable loss for a firm. In this case, the organisation is not

need to compromise its own production level in order to bid for manufacturing 40,000 product

units related to government department. Henceforth, the Tassie Company would be able to sell

the product at $10.8 per unit, which is derived by summing fixed cost, variable cost and 20%

mark-up on cost price (Klychova et al. 2015).

(ii) Production capacity of the factory at 180,000 units per year:

Particulars Details Price/unit (in $)

Selling price (A) Provided 15.00

Cost of Sales (B) Provided 12.50

Profit (A) - (B) 2.50

Price for additional 10,000 units 10.8 +2.5 13.30

Particulars Details Price (in $)

Total price for 40,000 units (30,000 x 10.8) + (10,000 x 457,000

20% Mark-up (G) [(F) x 20 %] 1.80

Minimum price (F) + (G) 10.80

From the provided information, it has been identified that the Tassie Company could

manufacture 200,000 units per annum. However, it is involved in manufacturing 150,000 units in

accordance with the current plan. As pointed out by Drury (2013), the sales volume could be

increased by utilising the entire capacity; thus, resulting in enhanced profit margin. On the other

hand, Kim and Sohn (2013) are of the view that in case of low market demand, the rise in

production level might lead to considerable loss for a firm. In this case, the organisation is not

need to compromise its own production level in order to bid for manufacturing 40,000 product

units related to government department. Henceforth, the Tassie Company would be able to sell

the product at $10.8 per unit, which is derived by summing fixed cost, variable cost and 20%

mark-up on cost price (Klychova et al. 2015).

(ii) Production capacity of the factory at 180,000 units per year:

Particulars Details Price/unit (in $)

Selling price (A) Provided 15.00

Cost of Sales (B) Provided 12.50

Profit (A) - (B) 2.50

Price for additional 10,000 units 10.8 +2.5 13.30

Particulars Details Price (in $)

Total price for 40,000 units (30,000 x 10.8) + (10,000 x 457,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

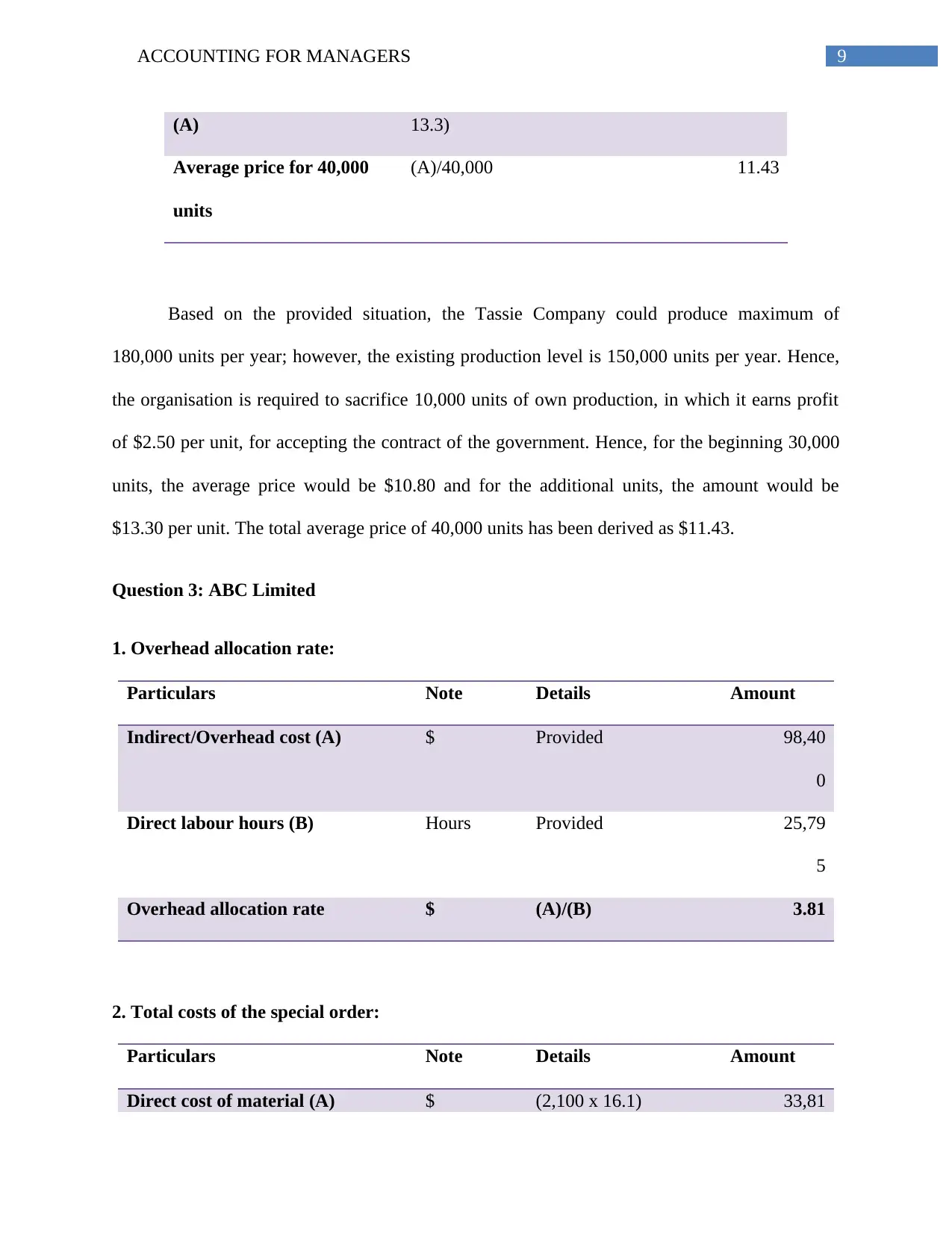

9ACCOUNTING FOR MANAGERS

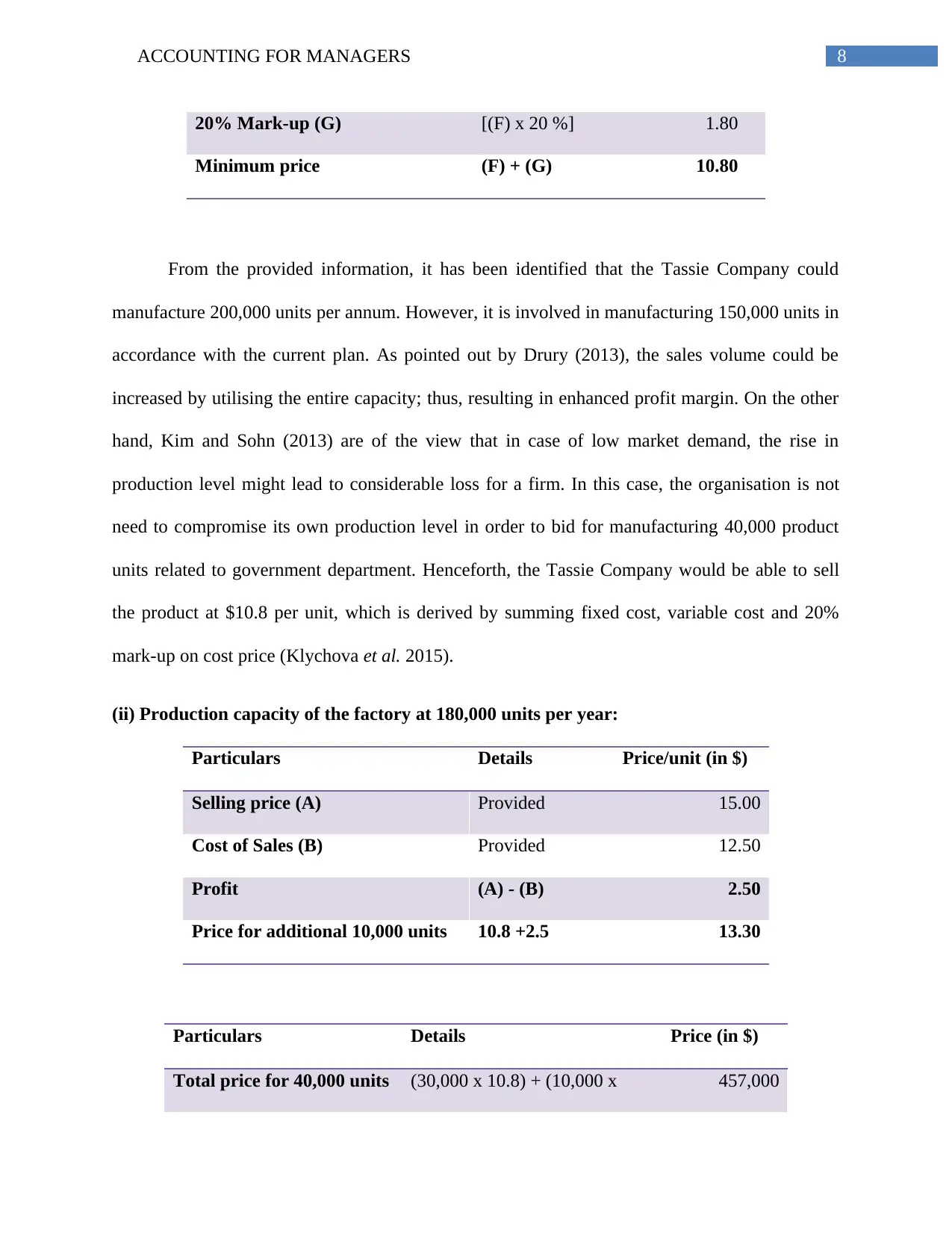

(A) 13.3)

Average price for 40,000

units

(A)/40,000 11.43

Based on the provided situation, the Tassie Company could produce maximum of

180,000 units per year; however, the existing production level is 150,000 units per year. Hence,

the organisation is required to sacrifice 10,000 units of own production, in which it earns profit

of $2.50 per unit, for accepting the contract of the government. Hence, for the beginning 30,000

units, the average price would be $10.80 and for the additional units, the amount would be

$13.30 per unit. The total average price of 40,000 units has been derived as $11.43.

Question 3: ABC Limited

1. Overhead allocation rate:

Particulars Note Details Amount

Indirect/Overhead cost (A) $ Provided 98,40

0

Direct labour hours (B) Hours Provided 25,79

5

Overhead allocation rate $ (A)/(B) 3.81

2. Total costs of the special order:

Particulars Note Details Amount

Direct cost of material (A) $ (2,100 x 16.1) 33,81

(A) 13.3)

Average price for 40,000

units

(A)/40,000 11.43

Based on the provided situation, the Tassie Company could produce maximum of

180,000 units per year; however, the existing production level is 150,000 units per year. Hence,

the organisation is required to sacrifice 10,000 units of own production, in which it earns profit

of $2.50 per unit, for accepting the contract of the government. Hence, for the beginning 30,000

units, the average price would be $10.80 and for the additional units, the amount would be

$13.30 per unit. The total average price of 40,000 units has been derived as $11.43.

Question 3: ABC Limited

1. Overhead allocation rate:

Particulars Note Details Amount

Indirect/Overhead cost (A) $ Provided 98,40

0

Direct labour hours (B) Hours Provided 25,79

5

Overhead allocation rate $ (A)/(B) 3.81

2. Total costs of the special order:

Particulars Note Details Amount

Direct cost of material (A) $ (2,100 x 16.1) 33,81

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ACCOUNTING FOR MANAGERS

0

Direct cost of labour (B) $ (327,600/25,795) x

1400

17,780.1

9

Indirect/overhead cost (C) S (1,400 x 3.81) 5,33

4

Total cost of the special order S (A) + (B) + (C) 56,924.1

9

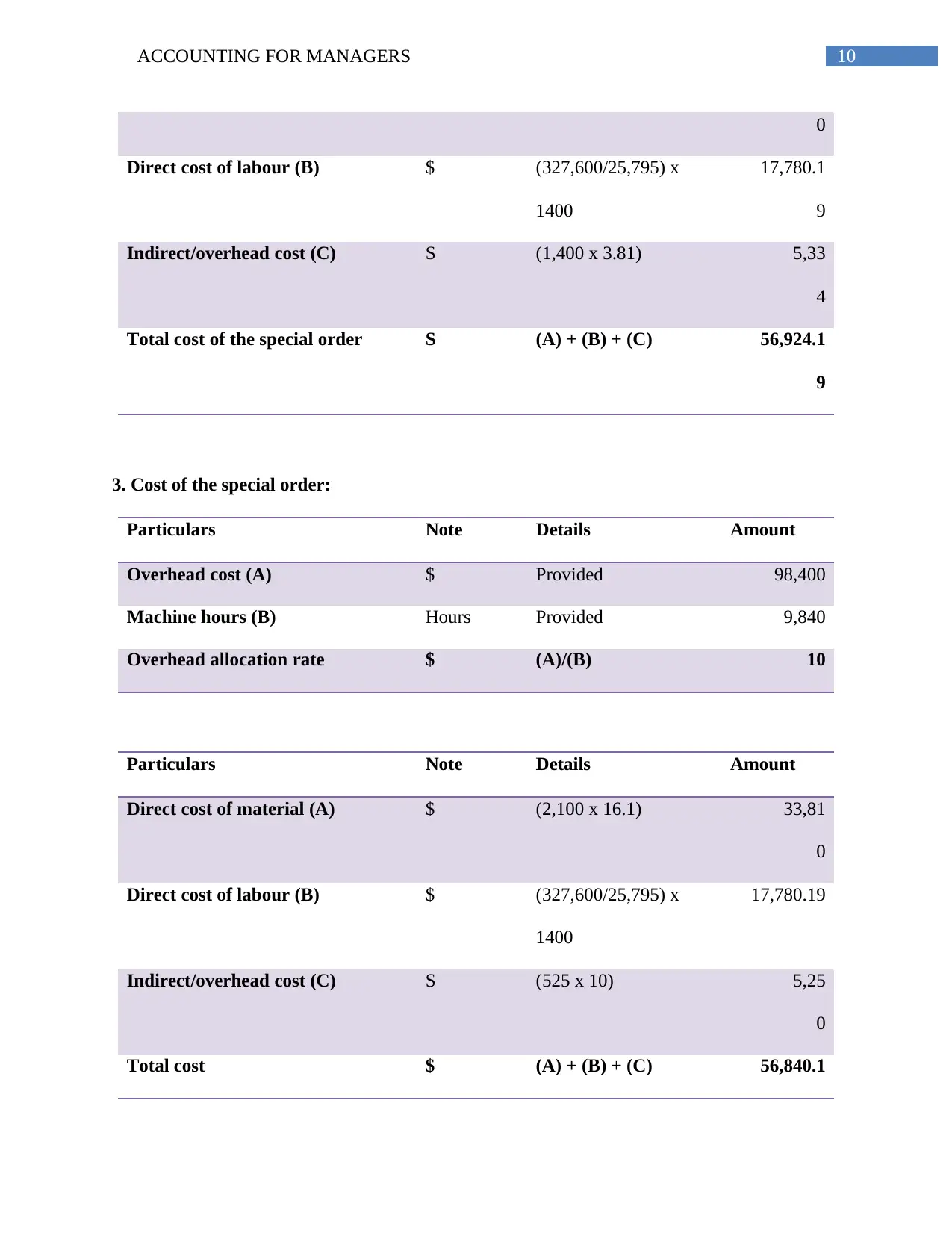

3. Cost of the special order:

Particulars Note Details Amount

Overhead cost (A) $ Provided 98,400

Machine hours (B) Hours Provided 9,840

Overhead allocation rate $ (A)/(B) 10

Particulars Note Details Amount

Direct cost of material (A) $ (2,100 x 16.1) 33,81

0

Direct cost of labour (B) $ (327,600/25,795) x

1400

17,780.19

Indirect/overhead cost (C) S (525 x 10) 5,25

0

Total cost $ (A) + (B) + (C) 56,840.1

0

Direct cost of labour (B) $ (327,600/25,795) x

1400

17,780.1

9

Indirect/overhead cost (C) S (1,400 x 3.81) 5,33

4

Total cost of the special order S (A) + (B) + (C) 56,924.1

9

3. Cost of the special order:

Particulars Note Details Amount

Overhead cost (A) $ Provided 98,400

Machine hours (B) Hours Provided 9,840

Overhead allocation rate $ (A)/(B) 10

Particulars Note Details Amount

Direct cost of material (A) $ (2,100 x 16.1) 33,81

0

Direct cost of labour (B) $ (327,600/25,795) x

1400

17,780.19

Indirect/overhead cost (C) S (525 x 10) 5,25

0

Total cost $ (A) + (B) + (C) 56,840.1

11ACCOUNTING FOR MANAGERS

9

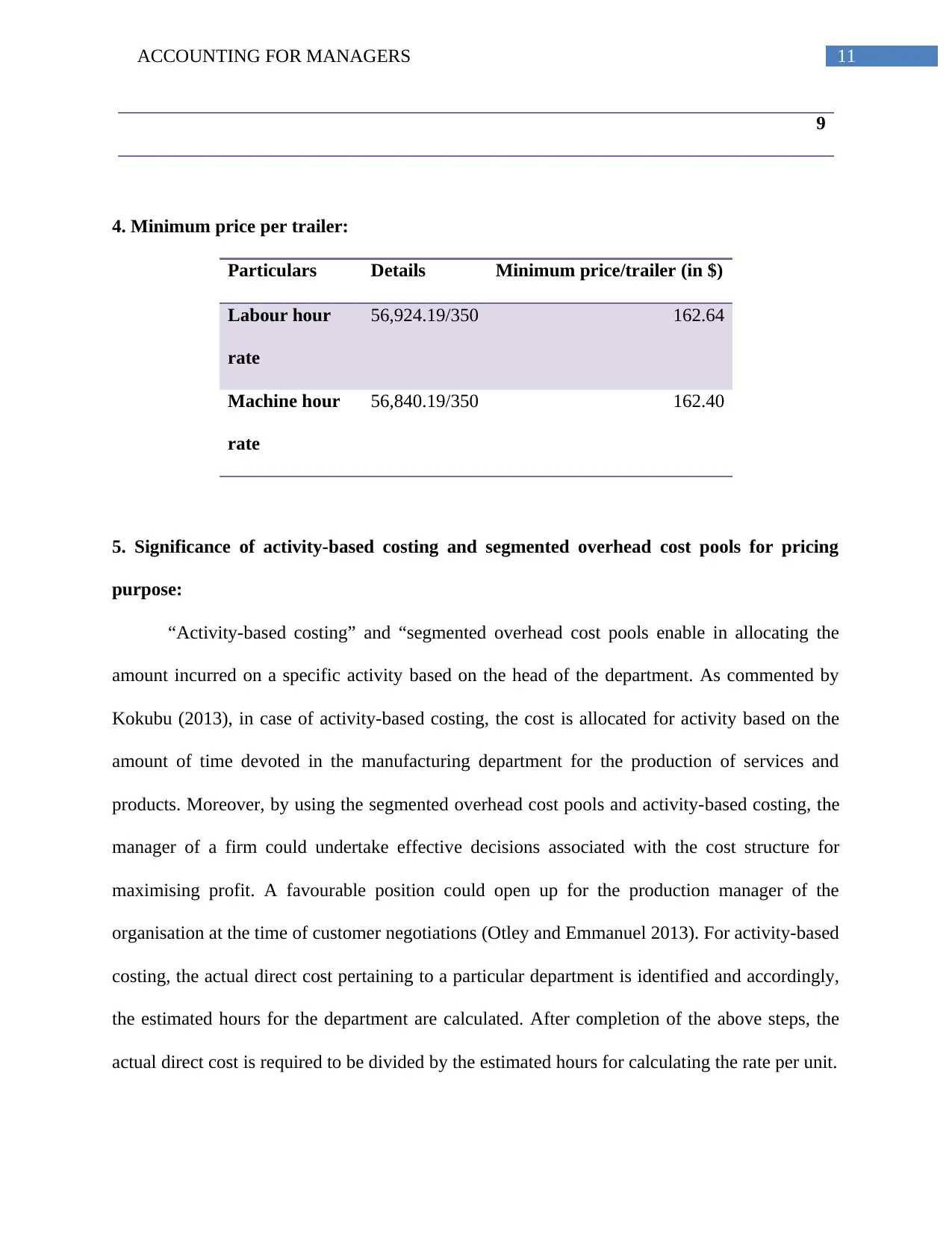

4. Minimum price per trailer:

Particulars Details Minimum price/trailer (in $)

Labour hour

rate

56,924.19/350 162.64

Machine hour

rate

56,840.19/350 162.40

5. Significance of activity-based costing and segmented overhead cost pools for pricing

purpose:

“Activity-based costing” and “segmented overhead cost pools enable in allocating the

amount incurred on a specific activity based on the head of the department. As commented by

Kokubu (2013), in case of activity-based costing, the cost is allocated for activity based on the

amount of time devoted in the manufacturing department for the production of services and

products. Moreover, by using the segmented overhead cost pools and activity-based costing, the

manager of a firm could undertake effective decisions associated with the cost structure for

maximising profit. A favourable position could open up for the production manager of the

organisation at the time of customer negotiations (Otley and Emmanuel 2013). For activity-based

costing, the actual direct cost pertaining to a particular department is identified and accordingly,

the estimated hours for the department are calculated. After completion of the above steps, the

actual direct cost is required to be divided by the estimated hours for calculating the rate per unit.

9

4. Minimum price per trailer:

Particulars Details Minimum price/trailer (in $)

Labour hour

rate

56,924.19/350 162.64

Machine hour

rate

56,840.19/350 162.40

5. Significance of activity-based costing and segmented overhead cost pools for pricing

purpose:

“Activity-based costing” and “segmented overhead cost pools enable in allocating the

amount incurred on a specific activity based on the head of the department. As commented by

Kokubu (2013), in case of activity-based costing, the cost is allocated for activity based on the

amount of time devoted in the manufacturing department for the production of services and

products. Moreover, by using the segmented overhead cost pools and activity-based costing, the

manager of a firm could undertake effective decisions associated with the cost structure for

maximising profit. A favourable position could open up for the production manager of the

organisation at the time of customer negotiations (Otley and Emmanuel 2013). For activity-based

costing, the actual direct cost pertaining to a particular department is identified and accordingly,

the estimated hours for the department are calculated. After completion of the above steps, the

actual direct cost is required to be divided by the estimated hours for calculating the rate per unit.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.