Accounting for Managers: Budgeting, Variance, and Analysis Project

VerifiedAdded on 2020/05/04

|16

|2734

|59

Project

AI Summary

This accounting project for managers presents a detailed analysis of budgeting, variance analysis, and financial statement preparation. It includes a sales budget, production budget, direct material, direct labor, and manufacturing overhead budgets. The project calculates the ending finished goods inventory, cost of goods sold, and prepares a budgeted income statement and cash budget. Part B analyzes the impact of a new facility, while Part C examines sales, material price and usage, direct labor rate and efficiency variances. Part D discusses the implications of imposed versus participative budgetary approaches. The student analyzes the impact of a new facility, and provides detailed calculations and variance analyses to evaluate performance. This project provides a comprehensive overview of financial planning and control, and offers valuable insights into managerial accounting practices.

Running head: ACCOUNTING FOR MANAGERS

Accounting for Managers

Student’s Name:

University Name:

Author Note

Accounting for Managers

Student’s Name:

University Name:

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

ACCOUNTING FOR MANAGERS

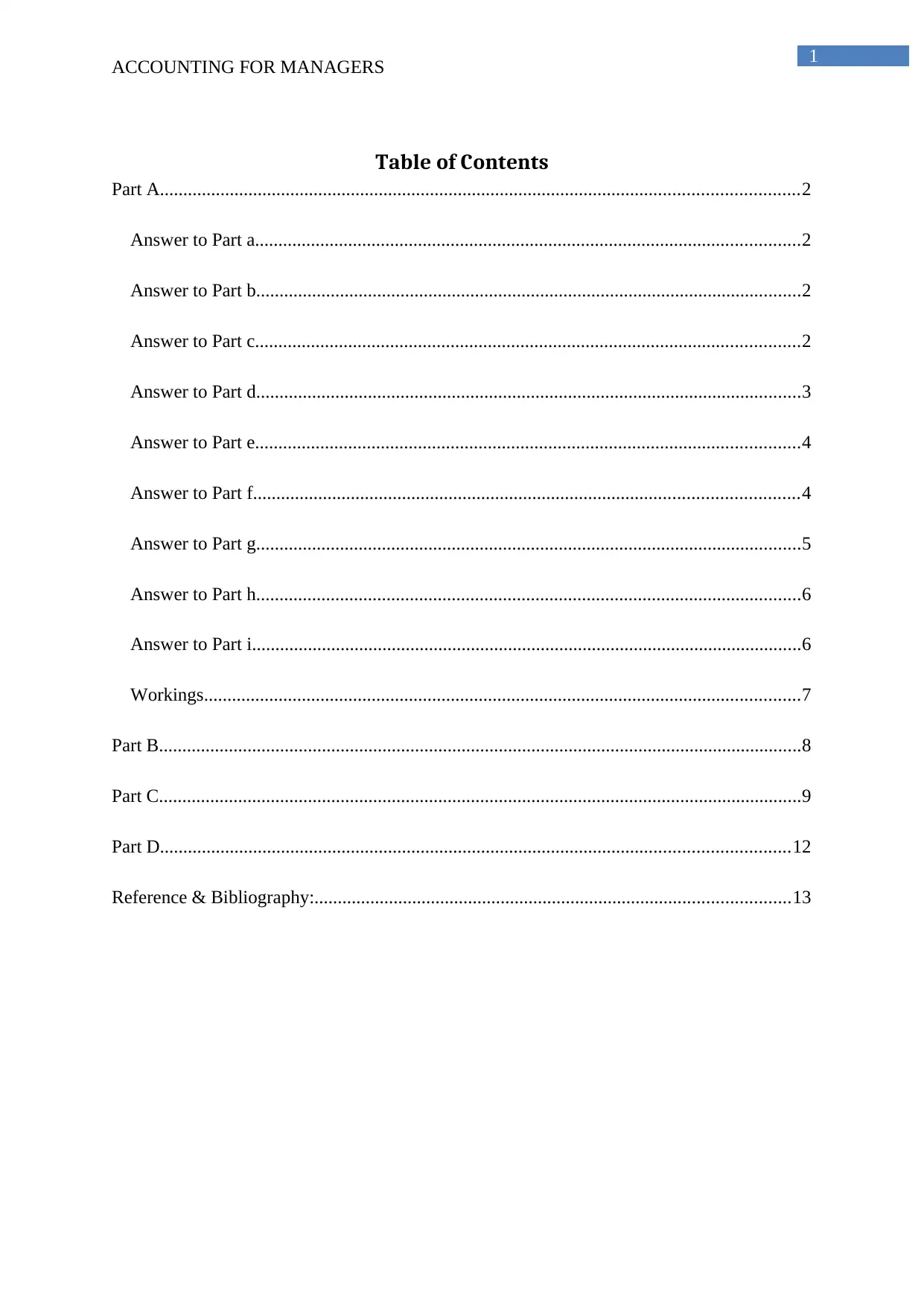

Table of Contents

Part A.........................................................................................................................................2

Answer to Part a.....................................................................................................................2

Answer to Part b.....................................................................................................................2

Answer to Part c.....................................................................................................................2

Answer to Part d.....................................................................................................................3

Answer to Part e.....................................................................................................................4

Answer to Part f.....................................................................................................................4

Answer to Part g.....................................................................................................................5

Answer to Part h.....................................................................................................................6

Answer to Part i......................................................................................................................6

Workings................................................................................................................................7

Part B..........................................................................................................................................8

Part C..........................................................................................................................................9

Part D.......................................................................................................................................12

Reference & Bibliography:......................................................................................................13

ACCOUNTING FOR MANAGERS

Table of Contents

Part A.........................................................................................................................................2

Answer to Part a.....................................................................................................................2

Answer to Part b.....................................................................................................................2

Answer to Part c.....................................................................................................................2

Answer to Part d.....................................................................................................................3

Answer to Part e.....................................................................................................................4

Answer to Part f.....................................................................................................................4

Answer to Part g.....................................................................................................................5

Answer to Part h.....................................................................................................................6

Answer to Part i......................................................................................................................6

Workings................................................................................................................................7

Part B..........................................................................................................................................8

Part C..........................................................................................................................................9

Part D.......................................................................................................................................12

Reference & Bibliography:......................................................................................................13

2

ACCOUNTING FOR MANAGERS

Part A

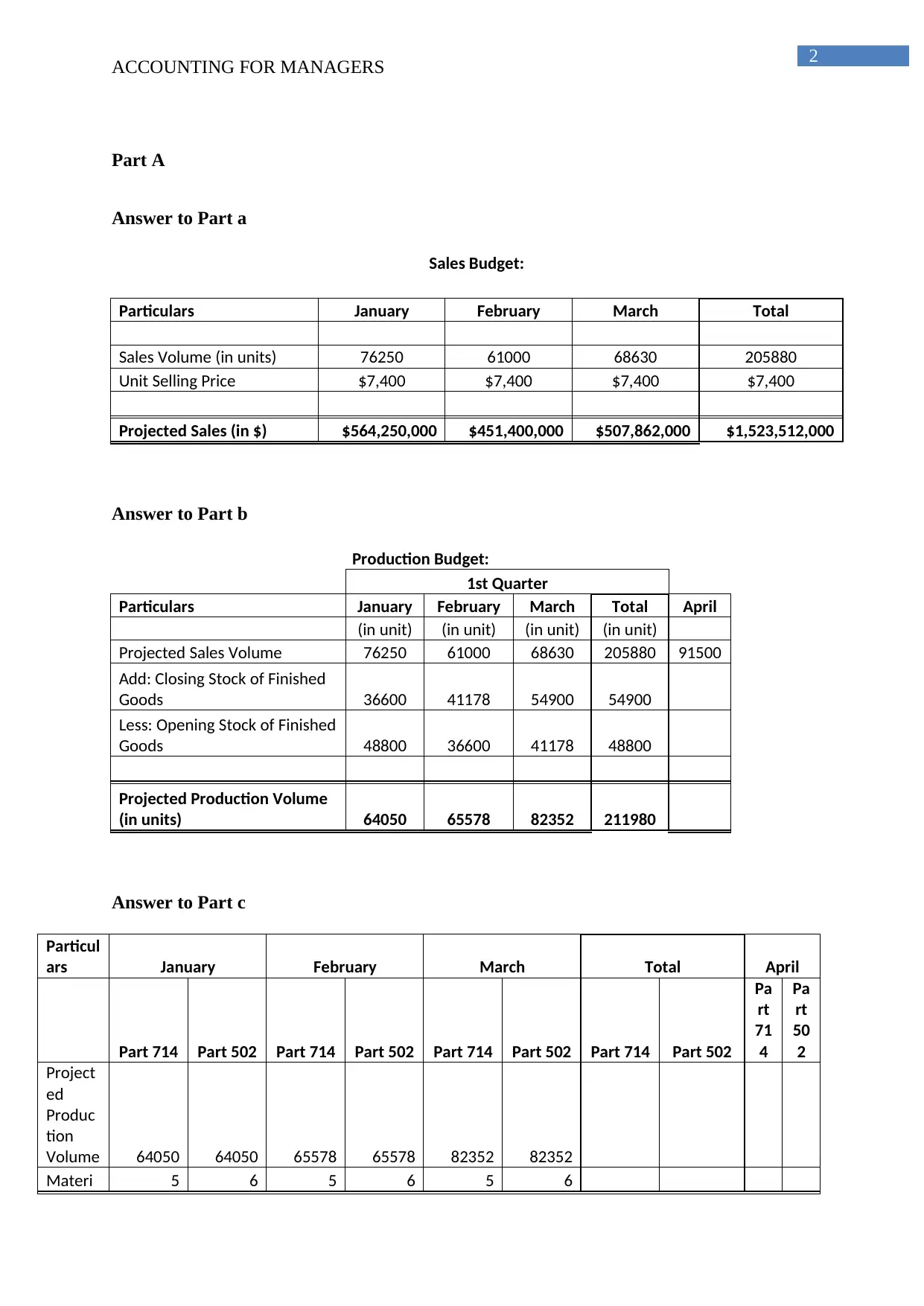

Answer to Part a

Sales Budget:

Particulars January February March Total

Sales Volume (in units) 76250 61000 68630 205880

Unit Selling Price $7,400 $7,400 $7,400 $7,400

Projected Sales (in $) $564,250,000 $451,400,000 $507,862,000 $1,523,512,000

Answer to Part b

Production Budget:

1st Quarter

Particulars January February March Total April

(in unit) (in unit) (in unit) (in unit)

Projected Sales Volume 76250 61000 68630 205880 91500

Add: Closing Stock of Finished

Goods 36600 41178 54900 54900

Less: Opening Stock of Finished

Goods 48800 36600 41178 48800

Projected Production Volume

(in units) 64050 65578 82352 211980

Answer to Part c

Particul

ars January February March Total April

Part 714 Part 502 Part 714 Part 502 Part 714 Part 502 Part 714 Part 502

Pa

rt

71

4

Pa

rt

50

2

Project

ed

Produc

tion

Volume 64050 64050 65578 65578 82352 82352

Materi 5 6 5 6 5 6

ACCOUNTING FOR MANAGERS

Part A

Answer to Part a

Sales Budget:

Particulars January February March Total

Sales Volume (in units) 76250 61000 68630 205880

Unit Selling Price $7,400 $7,400 $7,400 $7,400

Projected Sales (in $) $564,250,000 $451,400,000 $507,862,000 $1,523,512,000

Answer to Part b

Production Budget:

1st Quarter

Particulars January February March Total April

(in unit) (in unit) (in unit) (in unit)

Projected Sales Volume 76250 61000 68630 205880 91500

Add: Closing Stock of Finished

Goods 36600 41178 54900 54900

Less: Opening Stock of Finished

Goods 48800 36600 41178 48800

Projected Production Volume

(in units) 64050 65578 82352 211980

Answer to Part c

Particul

ars January February March Total April

Part 714 Part 502 Part 714 Part 502 Part 714 Part 502 Part 714 Part 502

Pa

rt

71

4

Pa

rt

50

2

Project

ed

Produc

tion

Volume 64050 64050 65578 65578 82352 82352

Materi 5 6 5 6 5 6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

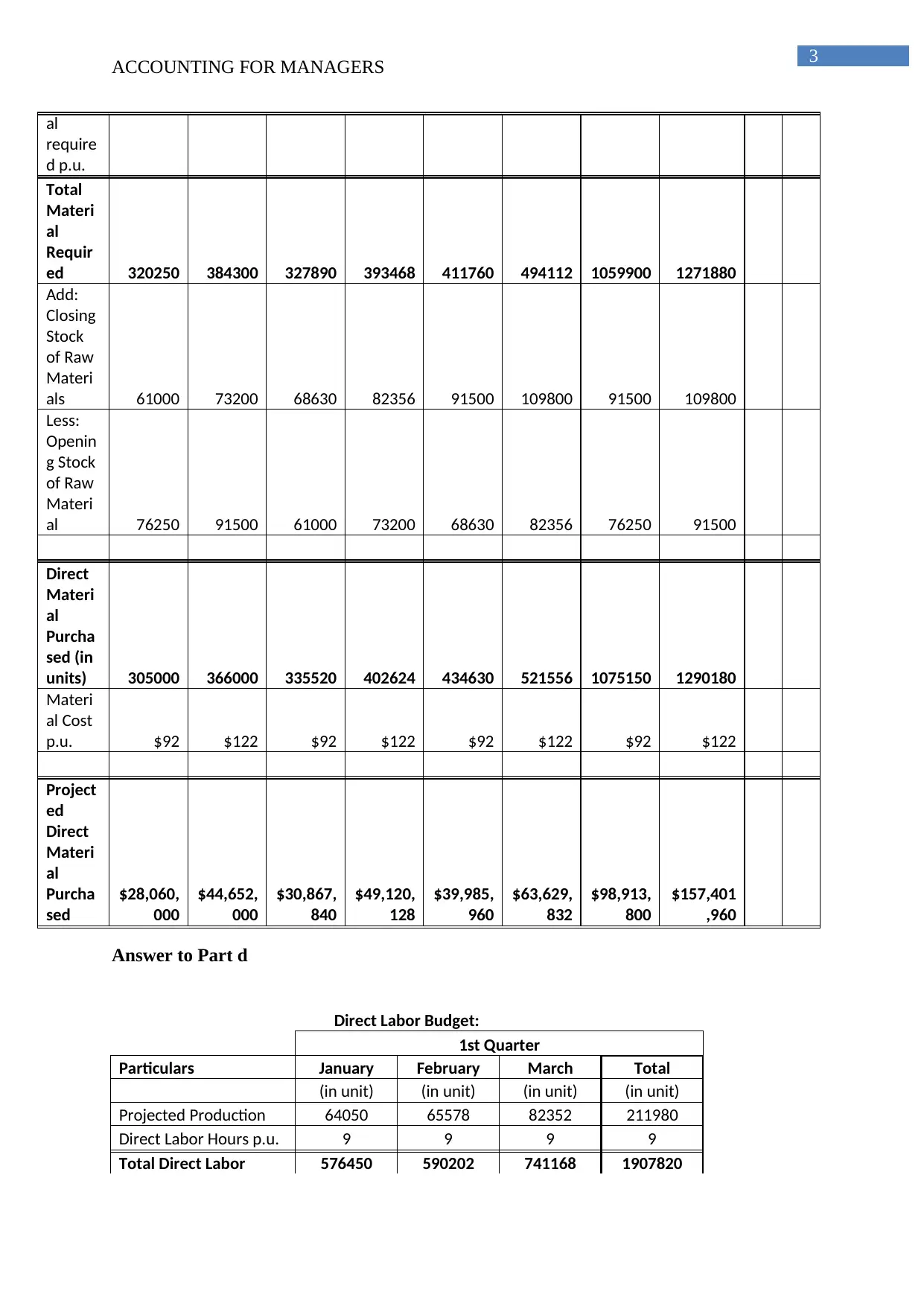

ACCOUNTING FOR MANAGERS

al

require

d p.u.

Total

Materi

al

Requir

ed 320250 384300 327890 393468 411760 494112 1059900 1271880

Add:

Closing

Stock

of Raw

Materi

als 61000 73200 68630 82356 91500 109800 91500 109800

Less:

Openin

g Stock

of Raw

Materi

al 76250 91500 61000 73200 68630 82356 76250 91500

Direct

Materi

al

Purcha

sed (in

units) 305000 366000 335520 402624 434630 521556 1075150 1290180

Materi

al Cost

p.u. $92 $122 $92 $122 $92 $122 $92 $122

Project

ed

Direct

Materi

al

Purcha

sed

$28,060,

000

$44,652,

000

$30,867,

840

$49,120,

128

$39,985,

960

$63,629,

832

$98,913,

800

$157,401

,960

Answer to Part d

Direct Labor Budget:

1st Quarter

Particulars January February March Total

(in unit) (in unit) (in unit) (in unit)

Projected Production 64050 65578 82352 211980

Direct Labor Hours p.u. 9 9 9 9

Total Direct Labor 576450 590202 741168 1907820

ACCOUNTING FOR MANAGERS

al

require

d p.u.

Total

Materi

al

Requir

ed 320250 384300 327890 393468 411760 494112 1059900 1271880

Add:

Closing

Stock

of Raw

Materi

als 61000 73200 68630 82356 91500 109800 91500 109800

Less:

Openin

g Stock

of Raw

Materi

al 76250 91500 61000 73200 68630 82356 76250 91500

Direct

Materi

al

Purcha

sed (in

units) 305000 366000 335520 402624 434630 521556 1075150 1290180

Materi

al Cost

p.u. $92 $122 $92 $122 $92 $122 $92 $122

Project

ed

Direct

Materi

al

Purcha

sed

$28,060,

000

$44,652,

000

$30,867,

840

$49,120,

128

$39,985,

960

$63,629,

832

$98,913,

800

$157,401

,960

Answer to Part d

Direct Labor Budget:

1st Quarter

Particulars January February March Total

(in unit) (in unit) (in unit) (in unit)

Projected Production 64050 65578 82352 211980

Direct Labor Hours p.u. 9 9 9 9

Total Direct Labor 576450 590202 741168 1907820

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

ACCOUNTING FOR MANAGERS

Hours

Direct Labor Cost per

hour $50 $50 $50 $50

Budgeted Direct Labor

Cost

$28,822,50

0

$29,510,10

0

$37,058,40

0

$95,391,00

0

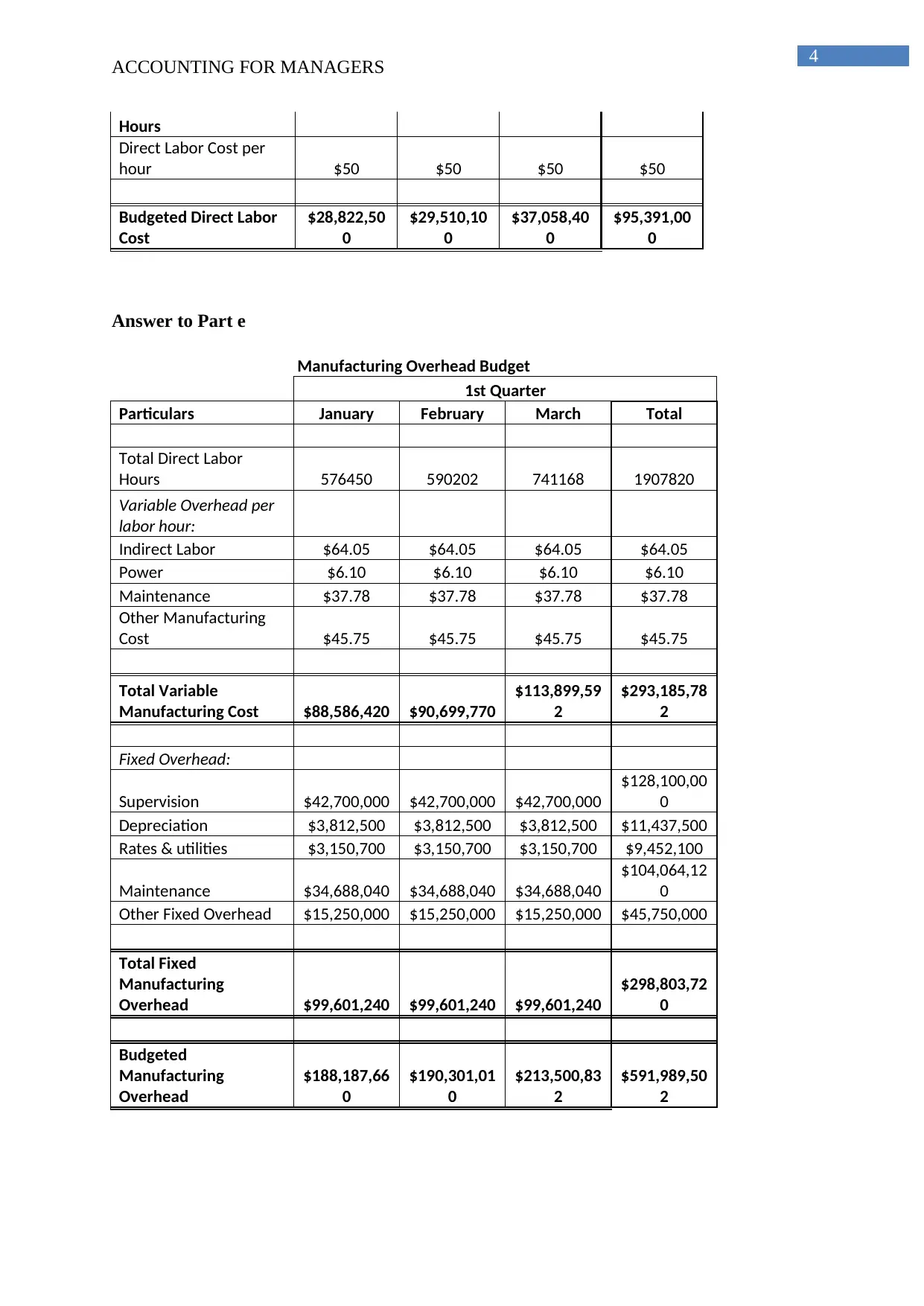

Answer to Part e

Manufacturing Overhead Budget

1st Quarter

Particulars January February March Total

Total Direct Labor

Hours 576450 590202 741168 1907820

Variable Overhead per

labor hour:

Indirect Labor $64.05 $64.05 $64.05 $64.05

Power $6.10 $6.10 $6.10 $6.10

Maintenance $37.78 $37.78 $37.78 $37.78

Other Manufacturing

Cost $45.75 $45.75 $45.75 $45.75

Total Variable

Manufacturing Cost $88,586,420 $90,699,770

$113,899,59

2

$293,185,78

2

Fixed Overhead:

Supervision $42,700,000 $42,700,000 $42,700,000

$128,100,00

0

Depreciation $3,812,500 $3,812,500 $3,812,500 $11,437,500

Rates & utilities $3,150,700 $3,150,700 $3,150,700 $9,452,100

Maintenance $34,688,040 $34,688,040 $34,688,040

$104,064,12

0

Other Fixed Overhead $15,250,000 $15,250,000 $15,250,000 $45,750,000

Total Fixed

Manufacturing

Overhead $99,601,240 $99,601,240 $99,601,240

$298,803,72

0

Budgeted

Manufacturing

Overhead

$188,187,66

0

$190,301,01

0

$213,500,83

2

$591,989,50

2

ACCOUNTING FOR MANAGERS

Hours

Direct Labor Cost per

hour $50 $50 $50 $50

Budgeted Direct Labor

Cost

$28,822,50

0

$29,510,10

0

$37,058,40

0

$95,391,00

0

Answer to Part e

Manufacturing Overhead Budget

1st Quarter

Particulars January February March Total

Total Direct Labor

Hours 576450 590202 741168 1907820

Variable Overhead per

labor hour:

Indirect Labor $64.05 $64.05 $64.05 $64.05

Power $6.10 $6.10 $6.10 $6.10

Maintenance $37.78 $37.78 $37.78 $37.78

Other Manufacturing

Cost $45.75 $45.75 $45.75 $45.75

Total Variable

Manufacturing Cost $88,586,420 $90,699,770

$113,899,59

2

$293,185,78

2

Fixed Overhead:

Supervision $42,700,000 $42,700,000 $42,700,000

$128,100,00

0

Depreciation $3,812,500 $3,812,500 $3,812,500 $11,437,500

Rates & utilities $3,150,700 $3,150,700 $3,150,700 $9,452,100

Maintenance $34,688,040 $34,688,040 $34,688,040

$104,064,12

0

Other Fixed Overhead $15,250,000 $15,250,000 $15,250,000 $45,750,000

Total Fixed

Manufacturing

Overhead $99,601,240 $99,601,240 $99,601,240

$298,803,72

0

Budgeted

Manufacturing

Overhead

$188,187,66

0

$190,301,01

0

$213,500,83

2

$591,989,50

2

5

ACCOUNTING FOR MANAGERS

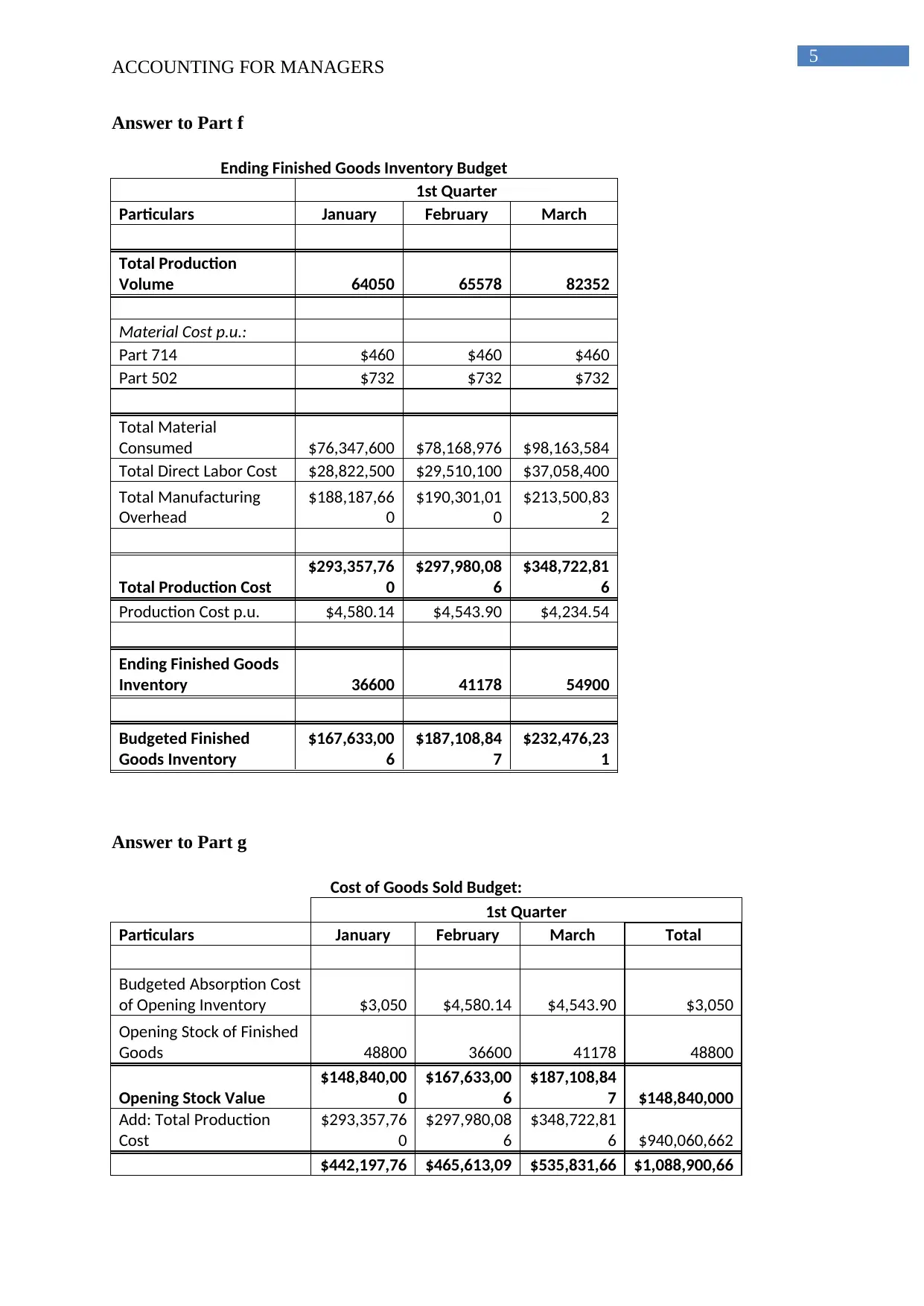

Answer to Part f

Ending Finished Goods Inventory Budget

1st Quarter

Particulars January February March

Total Production

Volume 64050 65578 82352

Material Cost p.u.:

Part 714 $460 $460 $460

Part 502 $732 $732 $732

Total Material

Consumed $76,347,600 $78,168,976 $98,163,584

Total Direct Labor Cost $28,822,500 $29,510,100 $37,058,400

Total Manufacturing

Overhead

$188,187,66

0

$190,301,01

0

$213,500,83

2

Total Production Cost

$293,357,76

0

$297,980,08

6

$348,722,81

6

Production Cost p.u. $4,580.14 $4,543.90 $4,234.54

Ending Finished Goods

Inventory 36600 41178 54900

Budgeted Finished

Goods Inventory

$167,633,00

6

$187,108,84

7

$232,476,23

1

Answer to Part g

Cost of Goods Sold Budget:

1st Quarter

Particulars January February March Total

Budgeted Absorption Cost

of Opening Inventory $3,050 $4,580.14 $4,543.90 $3,050

Opening Stock of Finished

Goods 48800 36600 41178 48800

Opening Stock Value

$148,840,00

0

$167,633,00

6

$187,108,84

7 $148,840,000

Add: Total Production

Cost

$293,357,76

0

$297,980,08

6

$348,722,81

6 $940,060,662

$442,197,76 $465,613,09 $535,831,66 $1,088,900,66

ACCOUNTING FOR MANAGERS

Answer to Part f

Ending Finished Goods Inventory Budget

1st Quarter

Particulars January February March

Total Production

Volume 64050 65578 82352

Material Cost p.u.:

Part 714 $460 $460 $460

Part 502 $732 $732 $732

Total Material

Consumed $76,347,600 $78,168,976 $98,163,584

Total Direct Labor Cost $28,822,500 $29,510,100 $37,058,400

Total Manufacturing

Overhead

$188,187,66

0

$190,301,01

0

$213,500,83

2

Total Production Cost

$293,357,76

0

$297,980,08

6

$348,722,81

6

Production Cost p.u. $4,580.14 $4,543.90 $4,234.54

Ending Finished Goods

Inventory 36600 41178 54900

Budgeted Finished

Goods Inventory

$167,633,00

6

$187,108,84

7

$232,476,23

1

Answer to Part g

Cost of Goods Sold Budget:

1st Quarter

Particulars January February March Total

Budgeted Absorption Cost

of Opening Inventory $3,050 $4,580.14 $4,543.90 $3,050

Opening Stock of Finished

Goods 48800 36600 41178 48800

Opening Stock Value

$148,840,00

0

$167,633,00

6

$187,108,84

7 $148,840,000

Add: Total Production

Cost

$293,357,76

0

$297,980,08

6

$348,722,81

6 $940,060,662

$442,197,76 $465,613,09 $535,831,66 $1,088,900,66

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

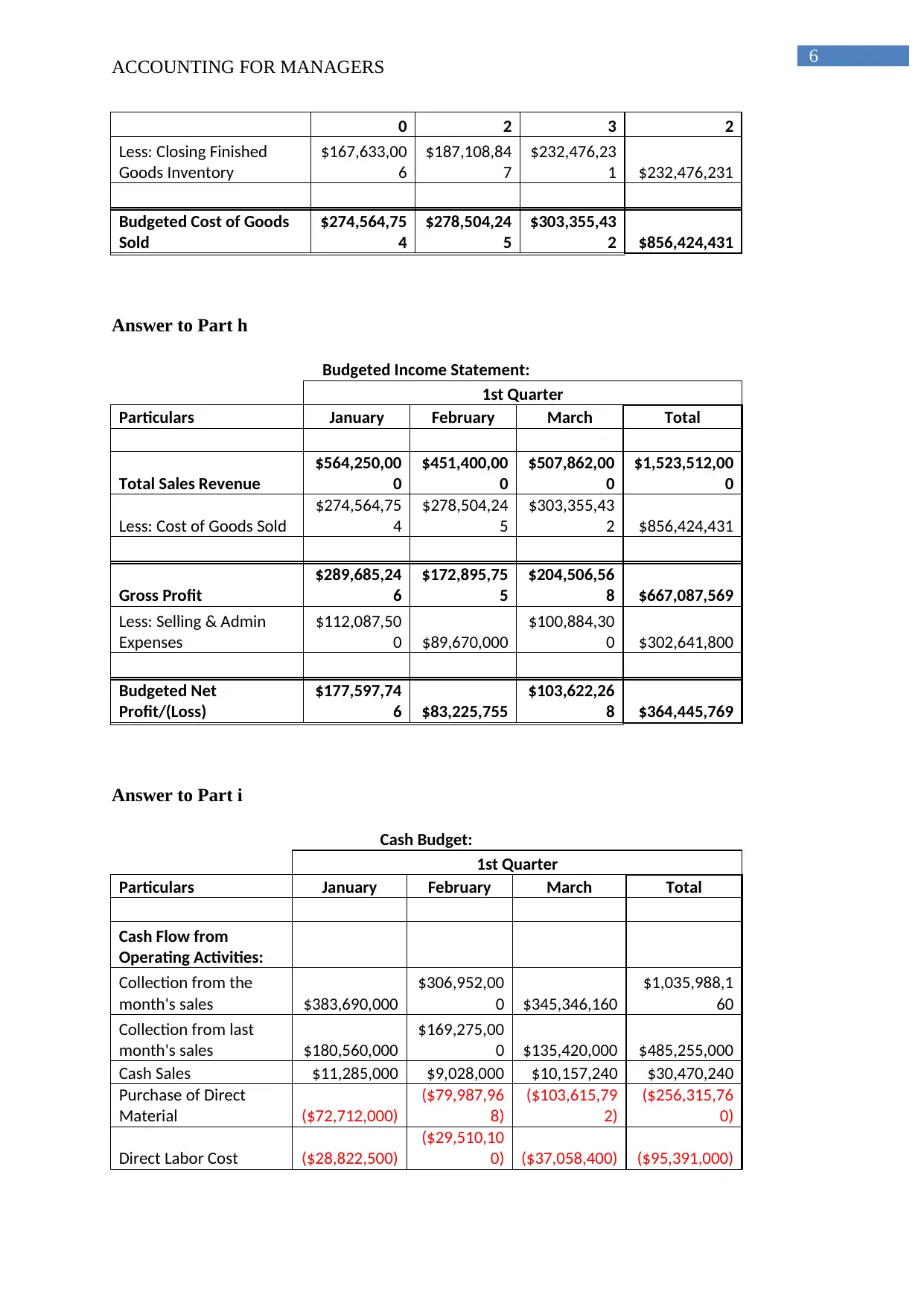

ACCOUNTING FOR MANAGERS

0 2 3 2

Less: Closing Finished

Goods Inventory

$167,633,00

6

$187,108,84

7

$232,476,23

1 $232,476,231

Budgeted Cost of Goods

Sold

$274,564,75

4

$278,504,24

5

$303,355,43

2 $856,424,431

Answer to Part h

Budgeted Income Statement:

1st Quarter

Particulars January February March Total

Total Sales Revenue

$564,250,00

0

$451,400,00

0

$507,862,00

0

$1,523,512,00

0

Less: Cost of Goods Sold

$274,564,75

4

$278,504,24

5

$303,355,43

2 $856,424,431

Gross Profit

$289,685,24

6

$172,895,75

5

$204,506,56

8 $667,087,569

Less: Selling & Admin

Expenses

$112,087,50

0 $89,670,000

$100,884,30

0 $302,641,800

Budgeted Net

Profit/(Loss)

$177,597,74

6 $83,225,755

$103,622,26

8 $364,445,769

Answer to Part i

Cash Budget:

1st Quarter

Particulars January February March Total

Cash Flow from

Operating Activities:

Collection from the

month's sales $383,690,000

$306,952,00

0 $345,346,160

$1,035,988,1

60

Collection from last

month's sales $180,560,000

$169,275,00

0 $135,420,000 $485,255,000

Cash Sales $11,285,000 $9,028,000 $10,157,240 $30,470,240

Purchase of Direct

Material ($72,712,000)

($79,987,96

8)

($103,615,79

2)

($256,315,76

0)

Direct Labor Cost ($28,822,500)

($29,510,10

0) ($37,058,400) ($95,391,000)

ACCOUNTING FOR MANAGERS

0 2 3 2

Less: Closing Finished

Goods Inventory

$167,633,00

6

$187,108,84

7

$232,476,23

1 $232,476,231

Budgeted Cost of Goods

Sold

$274,564,75

4

$278,504,24

5

$303,355,43

2 $856,424,431

Answer to Part h

Budgeted Income Statement:

1st Quarter

Particulars January February March Total

Total Sales Revenue

$564,250,00

0

$451,400,00

0

$507,862,00

0

$1,523,512,00

0

Less: Cost of Goods Sold

$274,564,75

4

$278,504,24

5

$303,355,43

2 $856,424,431

Gross Profit

$289,685,24

6

$172,895,75

5

$204,506,56

8 $667,087,569

Less: Selling & Admin

Expenses

$112,087,50

0 $89,670,000

$100,884,30

0 $302,641,800

Budgeted Net

Profit/(Loss)

$177,597,74

6 $83,225,755

$103,622,26

8 $364,445,769

Answer to Part i

Cash Budget:

1st Quarter

Particulars January February March Total

Cash Flow from

Operating Activities:

Collection from the

month's sales $383,690,000

$306,952,00

0 $345,346,160

$1,035,988,1

60

Collection from last

month's sales $180,560,000

$169,275,00

0 $135,420,000 $485,255,000

Cash Sales $11,285,000 $9,028,000 $10,157,240 $30,470,240

Purchase of Direct

Material ($72,712,000)

($79,987,96

8)

($103,615,79

2)

($256,315,76

0)

Direct Labor Cost ($28,822,500)

($29,510,10

0) ($37,058,400) ($95,391,000)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

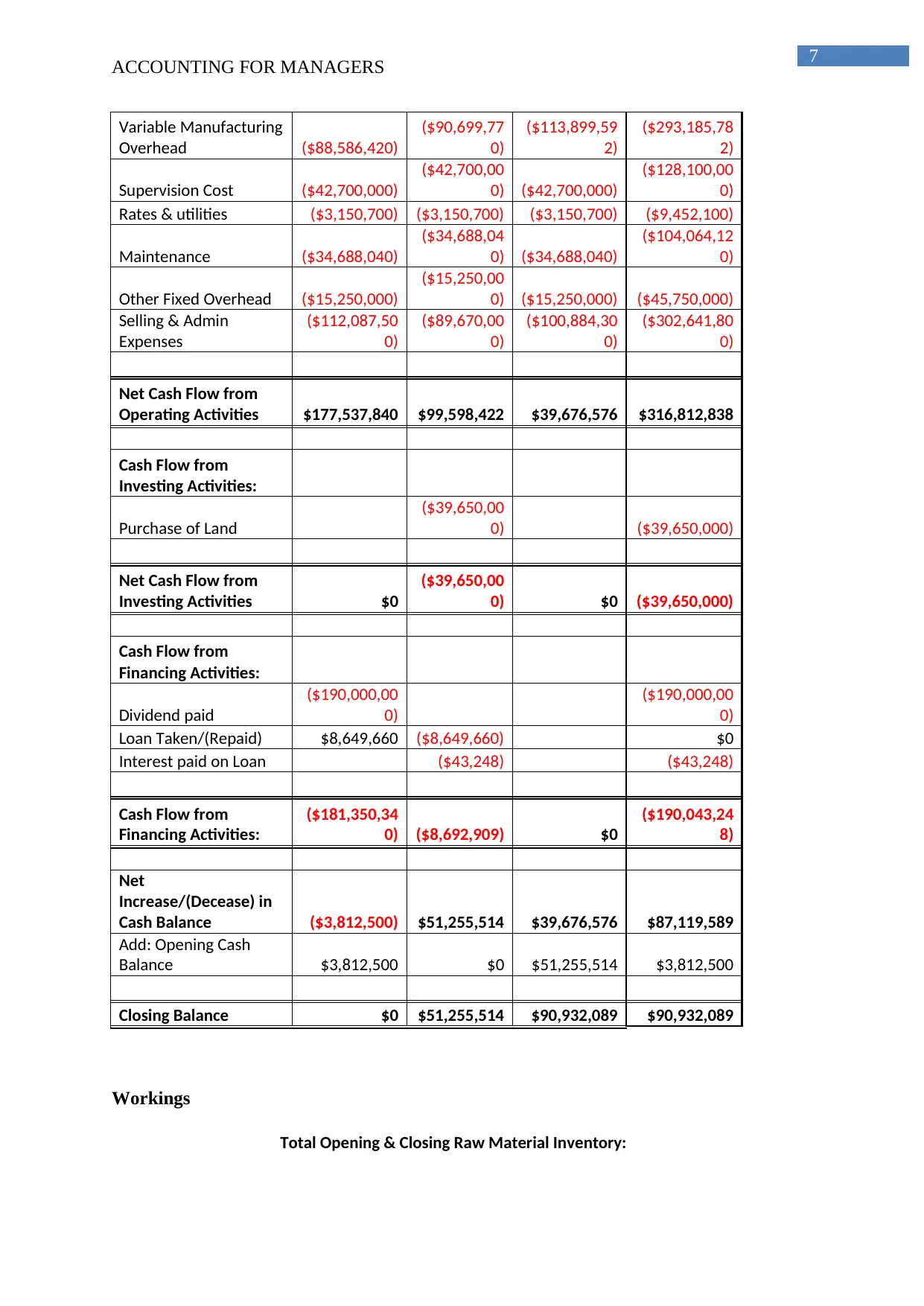

ACCOUNTING FOR MANAGERS

Variable Manufacturing

Overhead ($88,586,420)

($90,699,77

0)

($113,899,59

2)

($293,185,78

2)

Supervision Cost ($42,700,000)

($42,700,00

0) ($42,700,000)

($128,100,00

0)

Rates & utilities ($3,150,700) ($3,150,700) ($3,150,700) ($9,452,100)

Maintenance ($34,688,040)

($34,688,04

0) ($34,688,040)

($104,064,12

0)

Other Fixed Overhead ($15,250,000)

($15,250,00

0) ($15,250,000) ($45,750,000)

Selling & Admin

Expenses

($112,087,50

0)

($89,670,00

0)

($100,884,30

0)

($302,641,80

0)

Net Cash Flow from

Operating Activities $177,537,840 $99,598,422 $39,676,576 $316,812,838

Cash Flow from

Investing Activities:

Purchase of Land

($39,650,00

0) ($39,650,000)

Net Cash Flow from

Investing Activities $0

($39,650,00

0) $0 ($39,650,000)

Cash Flow from

Financing Activities:

Dividend paid

($190,000,00

0)

($190,000,00

0)

Loan Taken/(Repaid) $8,649,660 ($8,649,660) $0

Interest paid on Loan ($43,248) ($43,248)

Cash Flow from

Financing Activities:

($181,350,34

0) ($8,692,909) $0

($190,043,24

8)

Net

Increase/(Decease) in

Cash Balance ($3,812,500) $51,255,514 $39,676,576 $87,119,589

Add: Opening Cash

Balance $3,812,500 $0 $51,255,514 $3,812,500

Closing Balance $0 $51,255,514 $90,932,089 $90,932,089

Workings

Total Opening & Closing Raw Material Inventory:

ACCOUNTING FOR MANAGERS

Variable Manufacturing

Overhead ($88,586,420)

($90,699,77

0)

($113,899,59

2)

($293,185,78

2)

Supervision Cost ($42,700,000)

($42,700,00

0) ($42,700,000)

($128,100,00

0)

Rates & utilities ($3,150,700) ($3,150,700) ($3,150,700) ($9,452,100)

Maintenance ($34,688,040)

($34,688,04

0) ($34,688,040)

($104,064,12

0)

Other Fixed Overhead ($15,250,000)

($15,250,00

0) ($15,250,000) ($45,750,000)

Selling & Admin

Expenses

($112,087,50

0)

($89,670,00

0)

($100,884,30

0)

($302,641,80

0)

Net Cash Flow from

Operating Activities $177,537,840 $99,598,422 $39,676,576 $316,812,838

Cash Flow from

Investing Activities:

Purchase of Land

($39,650,00

0) ($39,650,000)

Net Cash Flow from

Investing Activities $0

($39,650,00

0) $0 ($39,650,000)

Cash Flow from

Financing Activities:

Dividend paid

($190,000,00

0)

($190,000,00

0)

Loan Taken/(Repaid) $8,649,660 ($8,649,660) $0

Interest paid on Loan ($43,248) ($43,248)

Cash Flow from

Financing Activities:

($181,350,34

0) ($8,692,909) $0

($190,043,24

8)

Net

Increase/(Decease) in

Cash Balance ($3,812,500) $51,255,514 $39,676,576 $87,119,589

Add: Opening Cash

Balance $3,812,500 $0 $51,255,514 $3,812,500

Closing Balance $0 $51,255,514 $90,932,089 $90,932,089

Workings

Total Opening & Closing Raw Material Inventory:

8

ACCOUNTING FOR MANAGERS

Particulars January February March April

Part

714

Part

502

Part

714

Part

502

Part

714

Part

502

Part

714

Part

502

Total Sales Volume 76250 76250 61000 61000 68630 68630 91500 91500

Material Required

p.u. 5 6 5 6 5 6 5 6

Stock Maintaining

Level 20% 20% 20% 20% 20% 20% 20% 20%

Opening Stock 76250 91500 61000 73200 68630 82356 91500

10980

0

Closing Stock 61000 73200 68630 82356 91500

10980

0

Fixed & Variable Maintenance Cost:

Direct Labor Hours

Total

Maintenanc

e Cost

1471600 $90,280,000

1677500 $98,057,500

1540300 $92,872,500

1403000 $87,687,500

Variable Maintenance

Cost per hour $37.78

Fixed Maintenance

Cost $34,688,040

Part B

Particulars

Without New

Facility

% of

Total

Cost

With New

Facility

% of

Total

Cost

Varianc

e Remarks

Direct Material Cost $252,680,160 27% $189,510,120 19% 25.00% Favorable

Direct Labor Cost $95,391,000 10% $71,543,250 7% 25.00% Favorable

Variable Manufacturing

Overhead $293,185,782 31% $293,185,782 29% 0.00% Favorable

Fixed Manufacturing

Overhead $298,803,720 32% $448,205,580 45% -50.00% Adverse

ACCOUNTING FOR MANAGERS

Particulars January February March April

Part

714

Part

502

Part

714

Part

502

Part

714

Part

502

Part

714

Part

502

Total Sales Volume 76250 76250 61000 61000 68630 68630 91500 91500

Material Required

p.u. 5 6 5 6 5 6 5 6

Stock Maintaining

Level 20% 20% 20% 20% 20% 20% 20% 20%

Opening Stock 76250 91500 61000 73200 68630 82356 91500

10980

0

Closing Stock 61000 73200 68630 82356 91500

10980

0

Fixed & Variable Maintenance Cost:

Direct Labor Hours

Total

Maintenanc

e Cost

1471600 $90,280,000

1677500 $98,057,500

1540300 $92,872,500

1403000 $87,687,500

Variable Maintenance

Cost per hour $37.78

Fixed Maintenance

Cost $34,688,040

Part B

Particulars

Without New

Facility

% of

Total

Cost

With New

Facility

% of

Total

Cost

Varianc

e Remarks

Direct Material Cost $252,680,160 27% $189,510,120 19% 25.00% Favorable

Direct Labor Cost $95,391,000 10% $71,543,250 7% 25.00% Favorable

Variable Manufacturing

Overhead $293,185,782 31% $293,185,782 29% 0.00% Favorable

Fixed Manufacturing

Overhead $298,803,720 32% $448,205,580 45% -50.00% Adverse

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

ACCOUNTING FOR MANAGERS

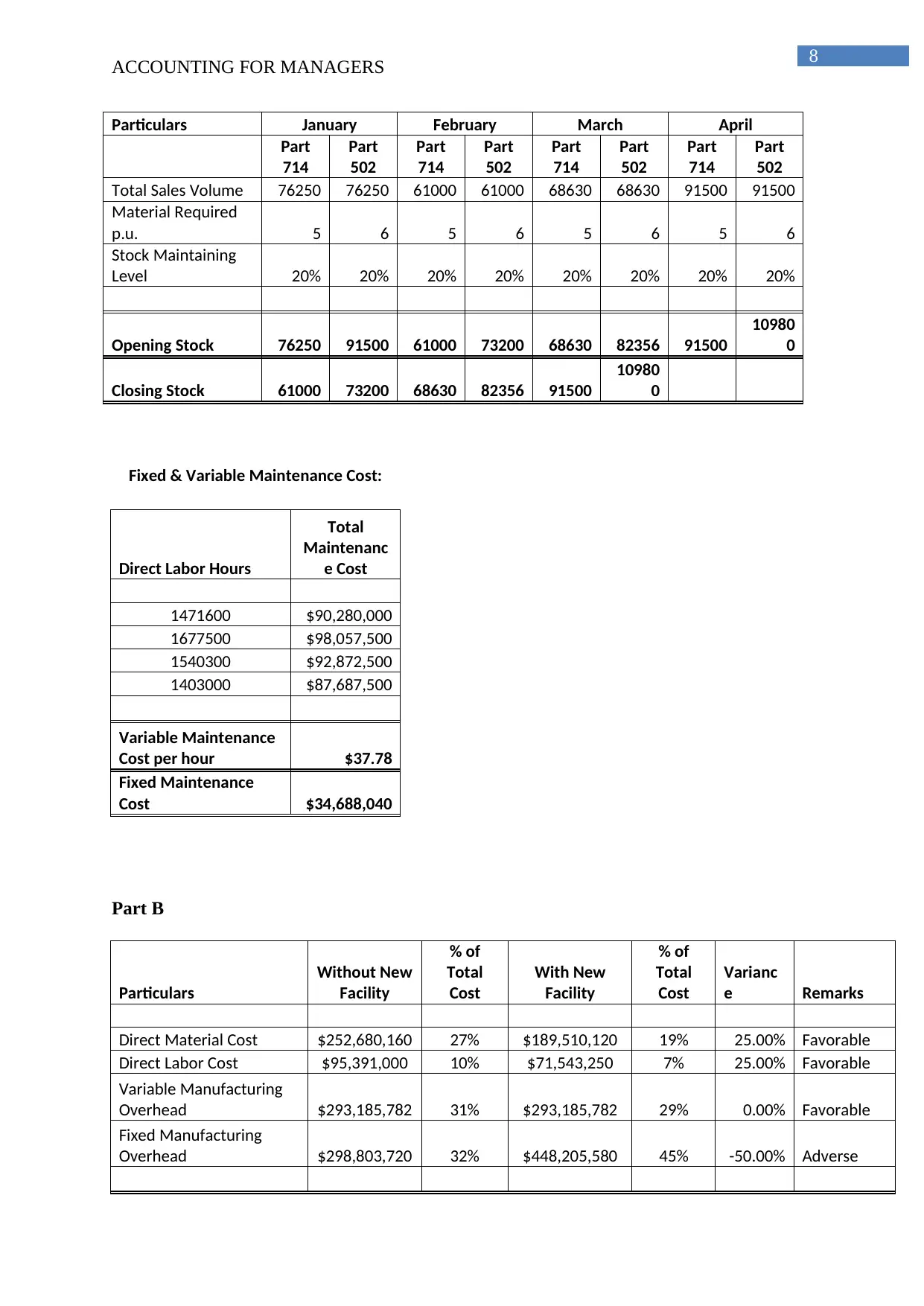

Total Production Cost $940,060,662 100%

$1,002,444,73

2 100% -6.64% Adverse

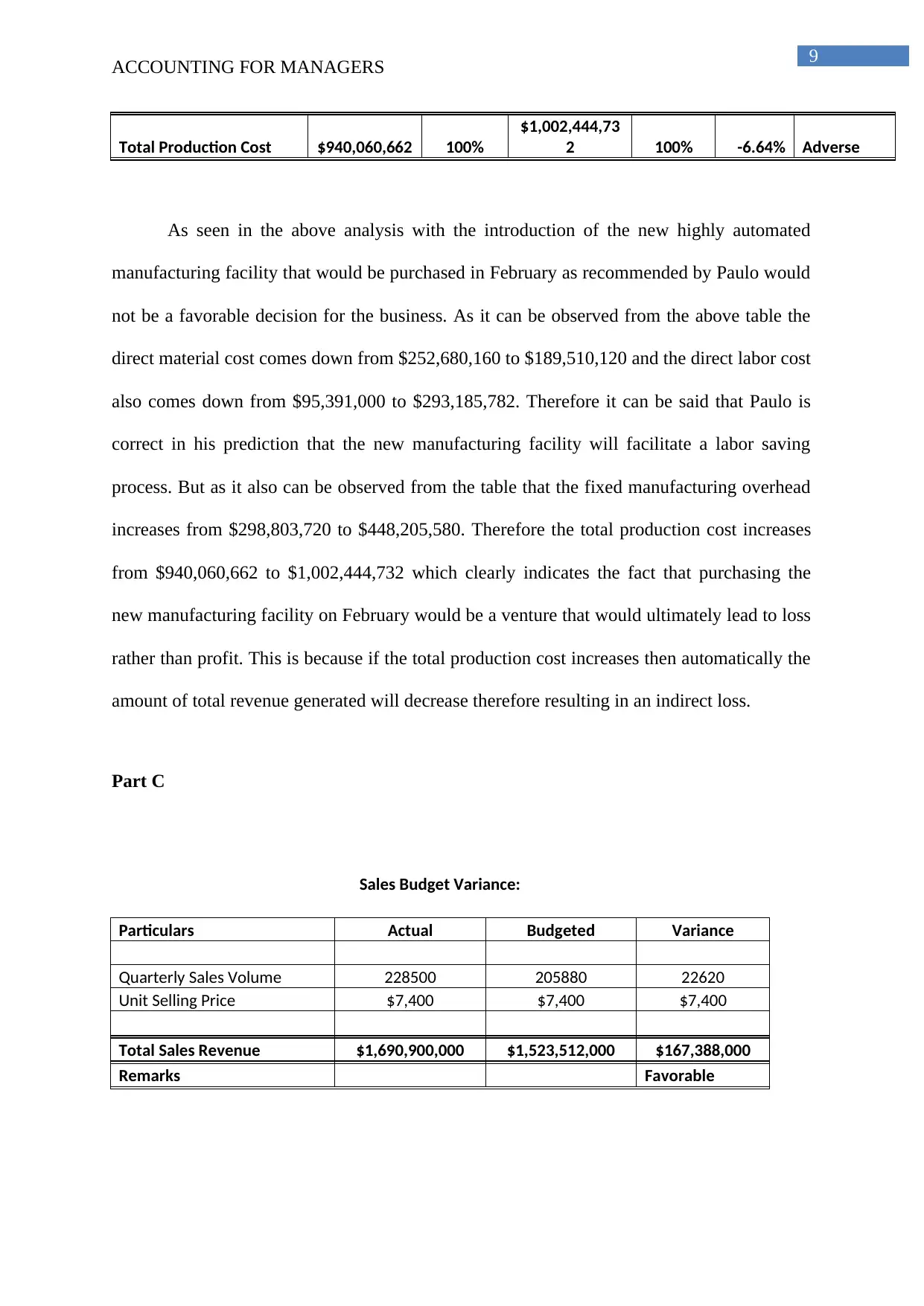

As seen in the above analysis with the introduction of the new highly automated

manufacturing facility that would be purchased in February as recommended by Paulo would

not be a favorable decision for the business. As it can be observed from the above table the

direct material cost comes down from $252,680,160 to $189,510,120 and the direct labor cost

also comes down from $95,391,000 to $293,185,782. Therefore it can be said that Paulo is

correct in his prediction that the new manufacturing facility will facilitate a labor saving

process. But as it also can be observed from the table that the fixed manufacturing overhead

increases from $298,803,720 to $448,205,580. Therefore the total production cost increases

from $940,060,662 to $1,002,444,732 which clearly indicates the fact that purchasing the

new manufacturing facility on February would be a venture that would ultimately lead to loss

rather than profit. This is because if the total production cost increases then automatically the

amount of total revenue generated will decrease therefore resulting in an indirect loss.

Part C

Sales Budget Variance:

Particulars Actual Budgeted Variance

Quarterly Sales Volume 228500 205880 22620

Unit Selling Price $7,400 $7,400 $7,400

Total Sales Revenue $1,690,900,000 $1,523,512,000 $167,388,000

Remarks Favorable

ACCOUNTING FOR MANAGERS

Total Production Cost $940,060,662 100%

$1,002,444,73

2 100% -6.64% Adverse

As seen in the above analysis with the introduction of the new highly automated

manufacturing facility that would be purchased in February as recommended by Paulo would

not be a favorable decision for the business. As it can be observed from the above table the

direct material cost comes down from $252,680,160 to $189,510,120 and the direct labor cost

also comes down from $95,391,000 to $293,185,782. Therefore it can be said that Paulo is

correct in his prediction that the new manufacturing facility will facilitate a labor saving

process. But as it also can be observed from the table that the fixed manufacturing overhead

increases from $298,803,720 to $448,205,580. Therefore the total production cost increases

from $940,060,662 to $1,002,444,732 which clearly indicates the fact that purchasing the

new manufacturing facility on February would be a venture that would ultimately lead to loss

rather than profit. This is because if the total production cost increases then automatically the

amount of total revenue generated will decrease therefore resulting in an indirect loss.

Part C

Sales Budget Variance:

Particulars Actual Budgeted Variance

Quarterly Sales Volume 228500 205880 22620

Unit Selling Price $7,400 $7,400 $7,400

Total Sales Revenue $1,690,900,000 $1,523,512,000 $167,388,000

Remarks Favorable

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

ACCOUNTING FOR MANAGERS

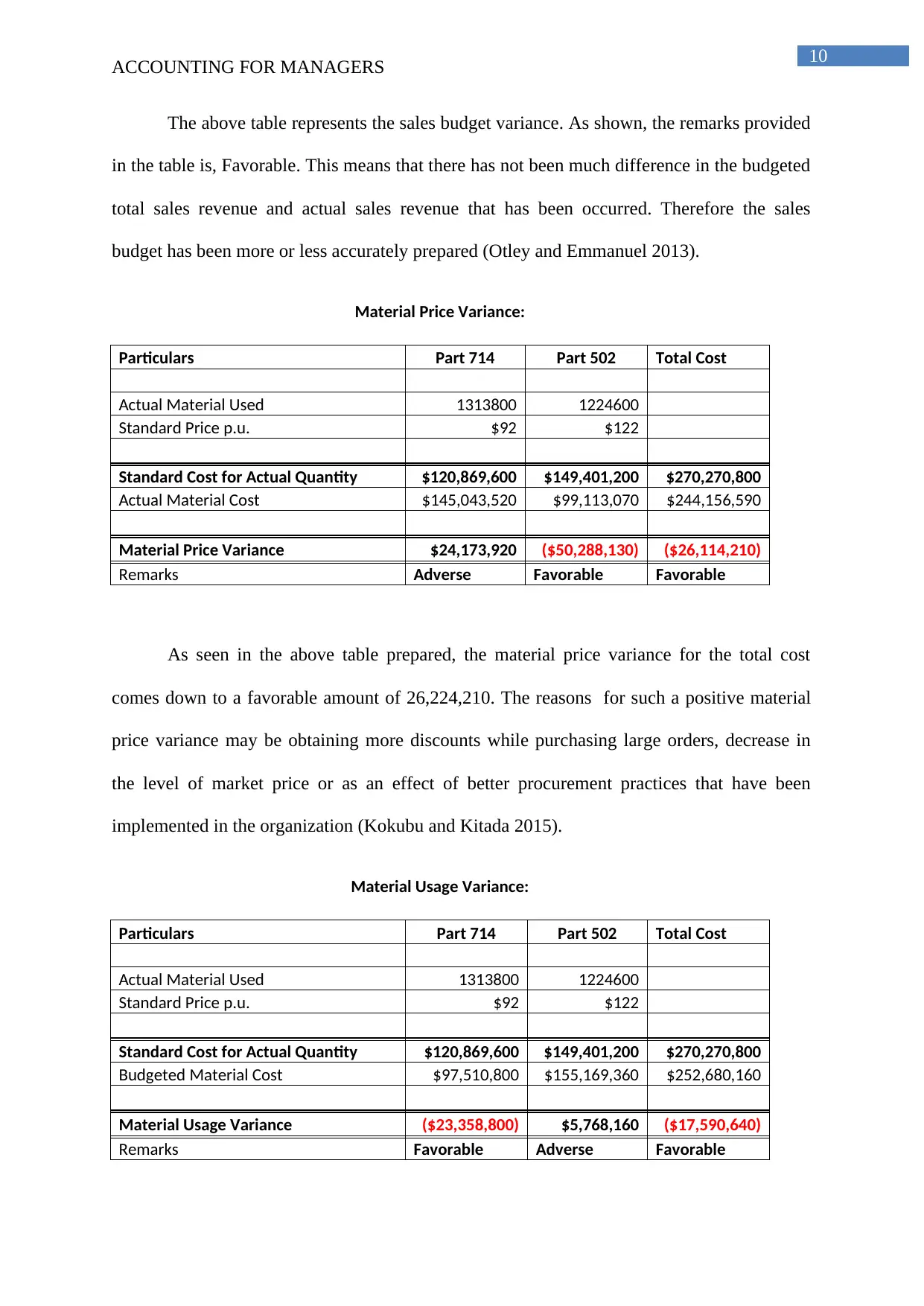

The above table represents the sales budget variance. As shown, the remarks provided

in the table is, Favorable. This means that there has not been much difference in the budgeted

total sales revenue and actual sales revenue that has been occurred. Therefore the sales

budget has been more or less accurately prepared (Otley and Emmanuel 2013).

Material Price Variance:

Particulars Part 714 Part 502 Total Cost

Actual Material Used 1313800 1224600

Standard Price p.u. $92 $122

Standard Cost for Actual Quantity $120,869,600 $149,401,200 $270,270,800

Actual Material Cost $145,043,520 $99,113,070 $244,156,590

Material Price Variance $24,173,920 ($50,288,130) ($26,114,210)

Remarks Adverse Favorable Favorable

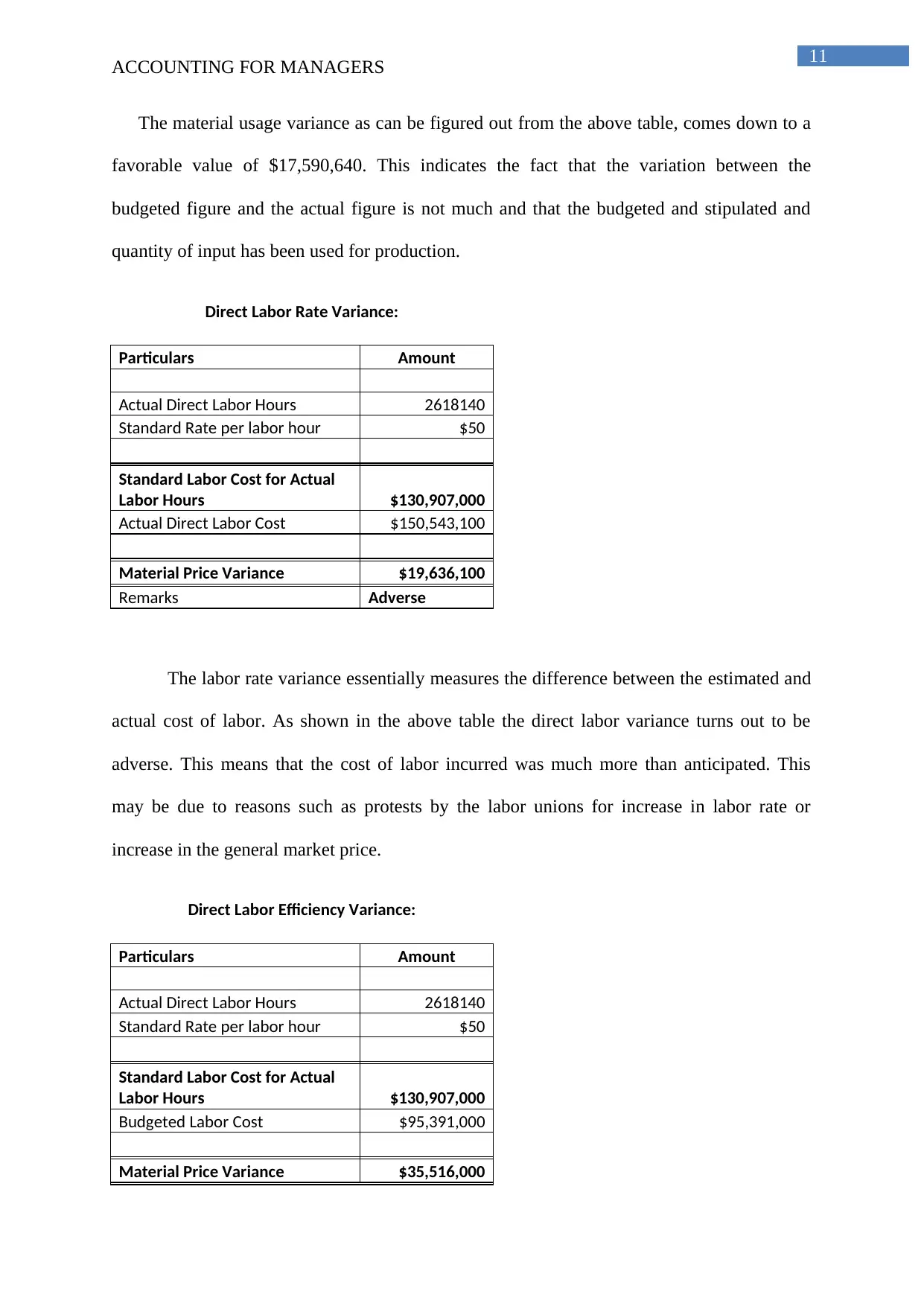

As seen in the above table prepared, the material price variance for the total cost

comes down to a favorable amount of 26,224,210. The reasons for such a positive material

price variance may be obtaining more discounts while purchasing large orders, decrease in

the level of market price or as an effect of better procurement practices that have been

implemented in the organization (Kokubu and Kitada 2015).

Material Usage Variance:

Particulars Part 714 Part 502 Total Cost

Actual Material Used 1313800 1224600

Standard Price p.u. $92 $122

Standard Cost for Actual Quantity $120,869,600 $149,401,200 $270,270,800

Budgeted Material Cost $97,510,800 $155,169,360 $252,680,160

Material Usage Variance ($23,358,800) $5,768,160 ($17,590,640)

Remarks Favorable Adverse Favorable

ACCOUNTING FOR MANAGERS

The above table represents the sales budget variance. As shown, the remarks provided

in the table is, Favorable. This means that there has not been much difference in the budgeted

total sales revenue and actual sales revenue that has been occurred. Therefore the sales

budget has been more or less accurately prepared (Otley and Emmanuel 2013).

Material Price Variance:

Particulars Part 714 Part 502 Total Cost

Actual Material Used 1313800 1224600

Standard Price p.u. $92 $122

Standard Cost for Actual Quantity $120,869,600 $149,401,200 $270,270,800

Actual Material Cost $145,043,520 $99,113,070 $244,156,590

Material Price Variance $24,173,920 ($50,288,130) ($26,114,210)

Remarks Adverse Favorable Favorable

As seen in the above table prepared, the material price variance for the total cost

comes down to a favorable amount of 26,224,210. The reasons for such a positive material

price variance may be obtaining more discounts while purchasing large orders, decrease in

the level of market price or as an effect of better procurement practices that have been

implemented in the organization (Kokubu and Kitada 2015).

Material Usage Variance:

Particulars Part 714 Part 502 Total Cost

Actual Material Used 1313800 1224600

Standard Price p.u. $92 $122

Standard Cost for Actual Quantity $120,869,600 $149,401,200 $270,270,800

Budgeted Material Cost $97,510,800 $155,169,360 $252,680,160

Material Usage Variance ($23,358,800) $5,768,160 ($17,590,640)

Remarks Favorable Adverse Favorable

11

ACCOUNTING FOR MANAGERS

The material usage variance as can be figured out from the above table, comes down to a

favorable value of $17,590,640. This indicates the fact that the variation between the

budgeted figure and the actual figure is not much and that the budgeted and stipulated and

quantity of input has been used for production.

Direct Labor Rate Variance:

Particulars Amount

Actual Direct Labor Hours 2618140

Standard Rate per labor hour $50

Standard Labor Cost for Actual

Labor Hours $130,907,000

Actual Direct Labor Cost $150,543,100

Material Price Variance $19,636,100

Remarks Adverse

The labor rate variance essentially measures the difference between the estimated and

actual cost of labor. As shown in the above table the direct labor variance turns out to be

adverse. This means that the cost of labor incurred was much more than anticipated. This

may be due to reasons such as protests by the labor unions for increase in labor rate or

increase in the general market price.

Direct Labor Efficiency Variance:

Particulars Amount

Actual Direct Labor Hours 2618140

Standard Rate per labor hour $50

Standard Labor Cost for Actual

Labor Hours $130,907,000

Budgeted Labor Cost $95,391,000

Material Price Variance $35,516,000

ACCOUNTING FOR MANAGERS

The material usage variance as can be figured out from the above table, comes down to a

favorable value of $17,590,640. This indicates the fact that the variation between the

budgeted figure and the actual figure is not much and that the budgeted and stipulated and

quantity of input has been used for production.

Direct Labor Rate Variance:

Particulars Amount

Actual Direct Labor Hours 2618140

Standard Rate per labor hour $50

Standard Labor Cost for Actual

Labor Hours $130,907,000

Actual Direct Labor Cost $150,543,100

Material Price Variance $19,636,100

Remarks Adverse

The labor rate variance essentially measures the difference between the estimated and

actual cost of labor. As shown in the above table the direct labor variance turns out to be

adverse. This means that the cost of labor incurred was much more than anticipated. This

may be due to reasons such as protests by the labor unions for increase in labor rate or

increase in the general market price.

Direct Labor Efficiency Variance:

Particulars Amount

Actual Direct Labor Hours 2618140

Standard Rate per labor hour $50

Standard Labor Cost for Actual

Labor Hours $130,907,000

Budgeted Labor Cost $95,391,000

Material Price Variance $35,516,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.